Part 1—Introduction

Division 1—Preliminary

1 Name

This instrument is the Help to Buy Program Directions 2025.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after this instrument is registered. | |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under the Help to Buy Act 2024.

Division 2—Simplified outline of this instrument

4 Simplified outline of this instrument

This instrument gives directions to the Board about the performance of certain functions of Housing Australia under the Act. The Act requires Housing Australia to take all reasonable steps to comply with these directions when performing those functions.

This instrument has 5 Parts. Part 1 deals with preliminary matters, including the definitions of key terms.

Part 2 deals with entry into Help to Buy arrangements. The provisions in Part 2 are relevant to the performance of Housing Australia’s functions in relation to participating States and the Territories. They set out the circumstances in which Housing Australia may enter into a Help to Buy arrangement, including by specifying the individuals and properties in respect of which Housing Australia may enter into such arrangements.

Part 3 deals with participation in the Help to Buy program. The provisions in Part 3 are relevant to the performance of Housing Australia’s functions in relation to both participating and cooperating States and the Territories. Among other things, Part 3 provides for the conditions of participation in Help to Buy arrangements and the consequences of failing to comply with them.

Part 4 sets out how an individual can end a Help to Buy arrangement early. Part 4 is relevant to the performance of Housing Australia’s functions in relation to both participating and cooperating States and the Territories. It provides, among other things, for Housing Australia to accept voluntary early repayments, and for arrangements to end upon the sale of the relevant property (subject to certain exceptions), and covers arrangements for deceased estates of participants.

Part 5 deals with miscellaneous matters, such as Housing Australia’s ability to charge fees in relation to arrangements, the approval of participating lenders, and the making of improvements to relevant properties. Part 5 is relevant to the performance of Housing Australia’s functions in relation to both participating and cooperating States and the Territories.

Division 3—Definitions

5 Definitions

Note: Expressions have the same meaning in this instrument as in the Help to Buy Act 2024 as in force from time to time—see paragraph 13(1)(b) of the Legislation Act 2003.

In this instrument:

adequately insured: see section 6.

administrative costs include legal costs, conveyancing costs and stamp duty, where applicable.

agreed percentage: see section 16.

allocated: a place is allocated where it is made available for use for an arrangement in respect of property in a particular State or Territory under section 48 or 50.

arrangement means a Help to Buy arrangement.

Australian Defence Force has the same meaning as in the Defence Act 1903.

Australian Statistical Geography Standard means the Australian Statistical Geography Standard (ASGS) Edition 3, as published by the Australian Statistician on 20 July 2021.

Note: The Australian Statistical Geography Standard could in 2025 be viewed on the Australian Bureau of Statistics website (https://www.abs.gov.au).

capital city, of a State or the Northern Territory, means the Greater Capital City Statistical Area (within the meaning of the Australian Statistical Geography Standard) in that State or Territory.

committed: a place is committed where:

(a) an applicant or applicants have applied for an arrangement; and

(b) Housing Australia has not yet approved the application under subsection 14(4); and

(c) Housing Australia has decided that it is reasonably likely that the applicant or applicants will satisfy paragraph 14(4)(c) (eligibility), disregarding the financial capacity test; and

(d) the applicant or applicants have obtained mortgage pre‑approval from a participating lender for such funds as they are likely to require in order to purchase the relevant property (when combined with their deposit and the Commonwealth’s contribution).

Commonwealth company has the meaning given by section 89 of the Public Governance, Performance and Accountability Act 2013.

Commonwealth entity has the meaning given by section 10 of the Public Governance, Performance and Accountability Act 2013.

Commonwealth share: see section 25.

Commonwealth share percentage: see paragraph 25(1)(b).

CPI index number: see section 56.

credit activities has the same meaning as in the National Consumer Credit Protection Act 2009.

credit service has the same meaning as in the National Consumer Credit Protection Act 2009.

dependent child: an individual is a dependent child of a second individual (the adult) if:

(a) the adult is a natural or adoptive parent or a legal guardian of the child; and

(b) either:

(i) the individual is a dependent child of the adult within the meaning of subsections 5(2) to (7) of the Social Security Act 1991; or

(ii) the individual lives with the adult and is in receipt of a disability support pension within the meaning of the Social Security Act 1991.

disqualifying property interest: an individual holds a disqualifying property interest if they hold:

(a) a freehold interest in real property in Australia; or

(b) a lease of land in Australia (including a renewal or extension of such a lease) as described in paragraph 104‑115(1)(b) of the Income Tax Assessment Act 1997; or

(c) a company title interest (within the meaning of Part X of the Income Tax Assessment Act 1936) in land in Australia;

including a beneficial interest in any of the above.

eligible applicant: see section 17.

eligible property: see section 21.

financial capacity test, in relation to an applicant for an arrangement: see section 20.

hardship includes financial hardship.

income test, in relation to an applicant for an arrangement: see section 19.

Investment Mandate has the same meaning as in the Housing Australia Act 2018.

joint income threshold: see section 8.

lender means a person who carries on a business of making loans.

mortgage requirements: see section 22.

new home means a dwelling that meets the requirements of paragraph 40‑75(1)(a) of the A New Tax System (Goods and Services Tax) Act 1999, other than a dwelling that, prior to sale, has been rented or leased, or made available for rental or lease, as commercial residential premises or residential premises (as those terms are defined in that Act).

new home contract requirements: see section 23.

participant: see section 10.

participating lender means a lender that has been approved by Housing Australia under section 62, and has not been notified, in writing, that the approval has been revoked.

participation requirements: see section 28 and Schedule 1.

price cap: see section 7.

place means the opportunity to enter into an arrangement.

population of a State or a Territory, or of Australia, for a particular financial year, means the population of the State, Territory, or Australia, as most recently estimated and published by the Australian Statistician as at 30 June of the preceding financial year.

Note: The Australian Statistician’s estimates of population could in 2025 be viewed on the Australian Bureau of Statistics website (https://www.abs.gov.au) in quarterly publications titled National, state and territory population.

purchase price, in relation to:

(a) a house and land package; or

(b) separate arrangements for the purchase of land and the construction of a dwelling on that land;

means the sum of the purchase price for the land and the contract price for the construction of a dwelling on that land.

regional centre: see subsection 7(2).

relevant property means the residential property that is, or is to be, the subject of an arrangement.

repayment means a payment made by a participant in an arrangement to reduce the Commonwealth share in respect of the relevant property.

shared equity scheme means a scheme (other than an arrangement) in relation to a residential property that is an arrangement or contract with one or more individuals under which the Commonwealth, or a State or Territory:

(a) contributes (including by means of a loan) part of the cost of the individual or individuals acquiring the residential property; and

(b) is entitled to a return on that contribution worked out, in whole or in part, by reference to the value of the residential property at one or more times; and

(c) secures that entitlement by means of a mortgage or other right relating to the residential property.

single, in relation to an individual, means an individual that does not have a spouse or de facto partner.

single income threshold: see section 8.

single parent means a single individual who has at least one dependent child.

Note: A single parent includes someone who has legal guardianship of a child: see the definition of “dependent child”.

Statistical Area Level 4 area has the same meaning as in the Australian Statistical Geography Standard.

taxable income has the meaning given by the Income Tax Assessment Act 1997.

the Act means the Help to Buy Act 2024.

timeframe requirements: see section 24.

used: a place is used when Housing Australia approves an application to enter into an arrangement with a participant or joint participants in respect of the place (whether or not the arrangement is actually entered into at that time).

wage price index number, for a quarter, is the Wage Price Index (total hourly rates of pay excluding bonuses/all sectors/all Australia/original) number published by the Australian Statistician in respect of that quarter.

Note: The Wage Price Index could in 2025 be viewed on the Australian Bureau of Statistics website (https://www.abs.gov.au).

6 Definition of adequately insured

Where an arrangement has been entered into in respect of a relevant property, the property is adequately insured at a particular time if:

(a) the arrangement specifies insurance requirements; and

(b) those requirements are met at that time.

Note 1: Housing Australia cannot enter into an arrangement in respect of a relevant property unless it is satisfied that the property, once purchased, will be adequately insured: see paragraph 14(4)(g).

Note 2: A participant must keep the relevant property adequately insured across the life of an arrangement: see section 28 and clause 1.11 of Schedule 1.

7 Price caps

Price caps

- The price cap for the area in which a property is located is the amount set out in the following table.

Note: The price caps are relevant to a number of provisions of this instrument, including paragraph 21(b). Paragraph 21(b) provides that a property is only an ‘eligible property’ for the purposes of a proposed arrangement if the purchase price does not exceed the price cap for the area in which the property is located.

Price cap for an area |

Item | Area | Price cap |

1 | New South Wales—capital city and regional centre | $1,300,000 |

2 | New South Wales—other | $800,000 |

3 | Victoria—capital city and regional centre | $950,000 |

4 | Victoria—other | $650,000 |

5 | Queensland—capital city and regional centre | $1,000,000 |

6 | Queensland—other | $700,000 |

7 | Western Australia—capital city | $850,000 |

8 | Western Australia—other | $600,000 |

9 | South Australia—capital city | $900,000 |

10 | South Australia—other | $500,000 |

11 | Tasmania—capital city | $700,000 |

12 | Tasmania—other | $550,000 |

13 | Australian Capital Territory | $1,000,000 |

14 | Northern Territory | $600,000 |

15 | Jervis Bay Territory and Norfolk Island | $550,000 |

16 | Christmas Island and Cocos (Keeling) Islands | $400,000 |

| | | |

Price caps—meaning of regional centre

(2) A regional centre, for a State specified in an item in the following table, is any of the Statistical Area Level 4 areas specified in that item.

Item | State | Regional Centre |

1 | New South Wales | Newcastle and Lake Macquarie Illawarra Central Coast Mid‑North Coast Coffs Harbour–Grafton Richmond–Tweed |

2 | Victoria | Geelong |

3 | Queensland | Gold Coast Sunshine Coast |

8 Single and joint income thresholds

(1) The single income threshold, for a financial year, is $100,000, as indexed in accordance with section 9.

(2) The joint income threshold, for a financial year, is $160,000, as indexed in accordance with section 9.

9 Indexing the income thresholds

(1) An amount mentioned in section 8 is to be indexed on the first day of each financial year starting on or after 1 July 2026 by multiplying it by its indexation factor for 1 June in the preceding financial year.

(2) The indexation factor for 1 June in a financial year is the number worked out as follows:

Method statement

Step 1. Add:

(a) the wage price index number for the quarter ending on 31 March in that financial year; and

(b) the wage price index numbers for the 3 quarters that immediately preceded that quarter.

(a) the wage price index number for the quarter ending on 31 March in the immediately preceding financial year; and

(b) the wage price index numbers for the 3 quarters that immediately preceded that quarter.

Step 3. The indexation factor for 1 June in the financial year is the amount under step 1 divided by the amount under step 2.

(3) The indexation factor is to be worked out to 3 decimal places, rounding up if the fourth decimal place is 5 or more.

(4) An amount mentioned in section 8, after indexation, must be rounded to the nearest $1,000.

10 References to participants

(1) Participant means an individual who is party to an arrangement.

(2) Where a provision of this instrument applies in respect of an arrangement with joint participants:

(a) in relation to a provision referring to a participant giving notice of a matter—Housing Australia is to allow one of the participants to give notice of the matter on behalf of both participants; and

(b) in relation to a provision referring to a participant taking an action that, in law, both participants would need to take jointly—a reference to a participant is a reference to both participants acting jointly; and

(c) in other cases—a reference to a participant is a reference to each participant in the arrangement.

Example: Clause 1.14 of Schedule 1, read with section 28, requires Housing Australia to ensure that a participant must give notice to Housing Australia before a contract for the construction of a new home is varied. Where the relevant arrangement is with 2 participants jointly, one of the participants may give notice of the matter on behalf of both.

The effect of section 44 is that a participant must be allowed to sell the relevant property. Where the arrangement is with 2 participants who jointly own the property, that property could only be sold by the participants acting jointly.

Part 2—Entering into Help to Buy arrangements

Division 1—Introduction

11 Simplified outline of this Part

This Part contains directions regarding the circumstances in which Housing Australia can enter into arrangements. The directions in this Part are relevant to the performance of Housing Australia’s functions in relation to participating States and the Territories.

Housing Australia may only enter into a Help to Buy arrangement in accordance with this instrument. Division 2 of this Part sets out overarching requirements relating to entry into arrangements, including requirements around the individuals with whom, and properties in respect of which, arrangements can be entered into. It also sets limits on the amount that Housing Australia can contribute, on behalf of the Commonwealth, to the purchase of a relevant property.

Division 3 of this Part defines the class of individuals with whom Housing Australia can enter into arrangements, while Division 4 of this Part defines the class of properties that can be purchased under an arrangement. Division 5 of this Part sets out standards in relation to mortgages, and to contracts and timeframes for the construction of new homes. Finally, Division 6 of this Part deals with the “Commonwealth share” in a relevant property, and the circumstances in which the “Commonwealth share percentage” can be adjusted.

12 Application of this Part

This Part:

(a) applies to the performance of Housing Australia’s functions in relation to the participating States and the Territories (for the purposes of subparagraph 24(1)(a)(i) of the Act); and

(b) does not apply to the performance of Housing Australia’s functions in relation to cooperating States.

Division 2—When can Housing Australia enter into a Help to Buy arrangement?

13 Housing Australia can only enter into arrangements where this instrument permits

(1) Housing Australia must not enter into an arrangement other than in accordance with this instrument.

(2) Housing Australia must ensure that each arrangement contains such terms and conditions as are necessary to enable it to comply with the requirements of this instrument.

(3) This instrument does not limit the terms and conditions that Housing Australia may include in an arrangement, except to the extent that those terms and conditions are directly inconsistent with this instrument.

Example 1: Division 2 of Part 3 deals with the “participation requirements” that Housing Australia must include in arrangements. This does not prevent Housing Australia from also including other participation requirements unless they are directly inconsistent with this instrument.

Example 2: If the effect of a provision of this instrument is that an arrangement must require someone to give notice of a particular matter to Housing Australia, this instrument does not prevent the arrangement from specifying the timeframe within which that notice must be given, or requiring the giving of other kinds of notices to Housing Australia, unless doing so would be inconsistent with this instrument.

14 Housing Australia may enter into arrangements with one or more applicants

When Housing Australia may enter into an arrangement

(1) Housing Australia may enter into an arrangement in relation to a property with an individual, or 2 individuals jointly, where:

(a) the individual (the applicant), or individuals jointly (each being an applicant), apply for the arrangement in accordance with subsection (2); and

(b) Housing Australia has approved the application under subsection (4); and

(c) the approval has not expired or been revoked before the arrangement is entered into; and

(d) entering into the arrangement would not be contrary to Division 2 of Part 5.

Note 1: See section 15 for the circumstances in which Housing Australia may revoke an approval before entering into an arrangement.

Note 2: Division 2 of Part 5 affects when Housing Australia may enter into arrangements in respect of properties in particular jurisdictions. It also provides for the expiry of approvals in certain circumstances.

(2) An application for an arrangement must be:

(a) in writing; and

(b) if Housing Australia has approved, in writing, and published on its website, the manner and form for an application—made in that manner and form; and

(c) accompanied by the information or documents required by any such approved form.

(3) Housing Australia must commence consideration of applications in the order in which Housing Australia receives each application that complies with subsection (2).

When Housing Australia may approve an application to enter into an arrangement

(4) Housing Australia may approve an application to enter into an arrangement if, at the time it decides the application:

(a) Housing Australia is satisfied that the dealings with the vendor of the relevant property will be carried out on an arm’s‑length basis; and

(b) the arrangement would relate to the purchase of the whole of the relevant property, unless subsection 18(1) applies; and

(c) the applicant, or each applicant, is an eligible applicant (see section 17); and

(d) the relevant property is an eligible property (see section 21); and

(e) Housing Australia is satisfied that the mortgage requirements will be met by the settlement date (see section 22); and

(f) where the arrangement relates to the construction of a new home—Housing Australia is satisfied that:

(i) the new home contract requirements will be met by the settlement date (see section 23); and

(ii) the timeframe requirements will be met (see section 24); and

(g) Housing Australia is satisfied that the property, once purchased, will be adequately insured (see section 6); and

(h) approving the application would not be contrary to Division 2 of Part 5.

Note: Division 2 of Part 5 affects when Housing Australia may approve applications in respect of properties in particular jurisdictions.

15 Circumstances in which Housing Australia may revoke approvals

(1) Housing Australia may revoke an approval under subsection 14(4) at a time before the entry into the arrangement to which the approval relates if, at that time, a criterion in that subsection has ceased to be satisfied.

Note 1: See section 53 for the circumstances in which Housing Australia must revoke an approval.

Note 2: This section deals with revoking approvals to enter into arrangements. Approvals stop being relevant once an arrangement is entered into as arrangements are contractual in nature and can only be terminated in accordance with their terms. Division 6 of Part 3 requires Housing Australia to ensure arrangements allow it to terminate the arrangement in certain circumstances.

(2) To avoid doubt:

(a) a purported revocation of an approval after an arrangement has been entered into is of no effect; and

(b) this section does not limit Housing Australia’s power to terminate an arrangement in accordance with the terms of that arrangement.

16 Minimum and maximum contributions to purchase price

(1) The contribution made by Housing Australia, on behalf of the Commonwealth, to the purchase price of a relevant property under an arrangement must fall within the limits set out in the following table.

Commonwealth’s contribution |

Property type | Minimum contribution | Maximum contribution |

Existing dwelling | 5% of purchase price | 30% of purchase price |

New home | 5% of purchase price | 40% of purchase price |

Note: The remainder of the purchase price will be supplied by the participant’s deposit and funding from a participating lender secured by way of a mortgage.

(2) However, Housing Australia must not contribute, on behalf of the Commonwealth, less than the amount required to ensure that its contribution and the participant’s deposit will together equal at least 20% of the value of the property as assessed by the participating lender mentioned in paragraph 21(1)(a).

Note: Where the Commonwealth’s contribution, and the participant’s deposit, together equal at least 20% of the value of the property, the participant will not need to bear the cost of lenders’ mortgage insurance.

Example: If the participant is contributing 5% of the assessed value as a deposit, Housing Australia’s minimum contribution amount would be 15% of the assessed value.

(3) Housing Australia must determine the percentage that the Commonwealth will contribute (the agreed percentage), taking into account:

(a) the percentage (if any) that a participant requested in their application; and

(b) the principle that a participant must contribute as large a deposit as can reasonably be required in light of their personal circumstances and financial capacity.

Note: The agreed percentage must fall within the limits set out in subsection (1) at the time the arrangement is entered into. However, on or after settlement, it is possible to vary the percentage of the value of the relevant property to which the Commonwealth is entitled in accordance with subsections 25(3) and (4). Accordingly, that percentage might subsequently fall outside of the ranges in subsection (1) of this section.

Division 3—Who is an eligible applicant?

17 Who is an eligible applicant?

An applicant is an eligible applicant, at a particular time, if, at that time:

(a) the applicant is an Australian citizen of at least 18 years of age; and

(b) the income test (section 19) and the financial capacity test (section 20) are satisfied in relation to the applicant; and

(c) Housing Australia is satisfied that the applicant will comply with the principal place of residence requirement (clause 1.3 of Schedule 1); and

(d) the applicant is not receiving assistance from one or more of the following:

(i) a home‑buyer guarantee provided by a Commonwealth entity or Commonwealth company;

(ii) a shared equity scheme;

(iii) a loan or guarantee provided by or on behalf of a State or Territory to support home ownership; and

(e) except where Housing Australia is satisfied that section 18 applies—the applicant does not hold a disqualifying property interest; and

(f) Housing Australia is satisfied that the applicant will, either individually or jointly with another applicant:

(i) provide a deposit of at least 2% of the purchase price of the relevant property; and

(ii) cover all additional costs (such as conveyancing costs, legal costs and stamp duty) associated with the purchase of the property; and

(g) Housing Australia is satisfied that the applicant will, either individually or jointly with another applicant, upon settlement, be the only registered owner of the property.

Note: Paragraph (d) does not extend to home buyer assistance in other forms, such as first home owner grants or tax concessions, or the First Home Super Saver scheme.

18 Exception to requirement not to hold interest in real estate

Exception—single parent buying out existing property

(1) This section applies where an applicant for an arrangement:

(a) is a single parent; and

(b) holds a disqualifying property interest as a joint tenant or tenant in common in the relevant property; and

(c) intends to become the sole registered owner of that property with the assistance of the arrangement.

Exception—simultaneous purchase of the property and sale of existing property

(2) This section also applies where an applicant for an arrangement:

(a) is a single parent; and

(b) holds a disqualifying property interest; and

(c) intends to cease to hold that interest within 4 weeks of the applicant becoming the registered owner of the property to be purchased with the assistance of the arrangement.

19 Income test for single and joint applicants

(1) The income test is satisfied in relation to an applicant for an arrangement if:

(a) in the case of an applicant, other than a single parent, who will be the only party to the arrangement—the single income threshold for the financial year in which the applicant applied for the arrangement is greater than or equal to the applicant’s taxable income for the most recent income year (within the meaning of the Income Tax Assessment Act 1936) for which the Commissioner of Taxation has given the applicant a notice of assessment; and

(b) in the case of an applicant who is a single parent and who will be the only party to the arrangement—the joint income threshold for the financial year in which they applied for the arrangement is greater than or equal to the applicant’s taxable income for the most recent income year (within the meaning of the Income Tax Assessment Act 1936) for which the Commissioner of Taxation has given the applicant a notice of assessment; and

(c) in the case of 2 applicants who will be party to the arrangement—the joint income threshold for the financial year in which both applicants applied for the arrangement is greater than or equal to the combined taxable incomes of the applicants, calculated using the taxable income for each of the applicant’s most recent income year (within the meaning of the Income Tax Assessment Act 1936) for which the Commissioner of Taxation has given that applicant a notice of assessment.

20 Financial capacity test for single and joint applicants

The financial capacity test is satisfied in relation to an applicant or applicants for an arrangement if Housing Australia reasonably believes that it is unlikely that the applicant, or both applicants together, could acquire the relevant property at that time without the assistance of the arrangement, having regard to the value of their assets (including assets that either applicant owns jointly with another person), their liabilities, their income, and any other financial assistance, of a material nature, likely to be provided by the Commonwealth, a State or a Territory.

Division 4—What is an eligible property?

21 What is an eligible property?

A property is an eligible property if:

(a) it is an existing dwelling or a new home; and

(b) the purchase price does not exceed the price cap for the area in which the property is located (see section 7).

Division 5—Contract, mortgage and timeframe requirements

22 Requirements relating to mortgages

(1) The mortgage requirements in relation to a proposed arrangement are as follows:

(a) the purchase of the relevant property is financed by a single mortgage with a participating lender (the first mortgage); and

(b) the following requirements will be satisfied in relation to the first mortgage at the time of settlement of the purchase of the relevant property:

(i) the applicant or applicants are the only counterparties to the mortgage agreement; and

(ii) the mortgage is a variable or fixed rate loan, or a combination of both (and not a line of credit); and

(iii) subject to subsections (2) and (3), the mortgage agreement requires scheduled payments of both principal and interest for the full period of the agreement which is a period of not more than 30 years; and

(c) the applicant or applicants have granted a second mortgage over the relevant property in favour of the Commonwealth.

(2) The mortgage agreement may be varied in relation to an applicant who is experiencing hardship.

Example: A participating lender may provide for interest‑only payments to be made while a borrower is experiencing hardship.

(3) Where the arrangement relates to the construction of a new home:

(a) the mortgage agreement may provide for interest-only payments to be made while the home is being constructed; and

(b) the period of the mortgage may exceed 30 years, but only if the period of the mortgage agreement after completion of construction of the home is not more than 30 years.

23 New home contract requirements

The new home contract requirements, in relation to a contract for the construction of a new home that is a relevant property, are that the applicant or applicants for the arrangement have entered into a contract that meets all the following requirements:

(a) the contract is a fixed‑price contract under which the purchase price for the property does not exceed the price cap for the area in which the property is located;

(b) the contract is with a builder who holds all the licences and registrations required by law in order to perform the work required by the contract in the relevant jurisdiction;

(c) insurance policies are in place in relation to the construction of the new home, as required by law;

(d) the contract is entered into on an arm’s‑length basis;

(e) the contract requires the builder to construct a fully completed dwelling on the land, up to and including the point at which the new home is certified as fit for occupation.

24 Timeframe requirements

(1) Subject to subsection (2), the timeframe requirements for an arrangement relating to the construction of a new home are as follows:

(a) if the new home is an off‑the‑plan dwelling:

(i) the construction of the dwelling must commence before the parties enter into the contract of sale; and

(ii) the settlement date must be no later than 90 days after the application to enter into the arrangement is approved;

(b) in all other cases:

(i) the construction of the new home must commence within 12 months of the day on which the applicant becomes the registered owner of the relevant property (the transfer date); and

(ii) the construction must be completed within 36 months of the transfer date.

(2) If Housing Australia is satisfied, in relation to a particular arrangement, that it is necessary or appropriate to adjust the timeframes in subsection (1) in response to the circumstances of the particular case, then the timeframe requirements for that arrangement are the requirements specified by Housing Australia by notice given to the applicant or applicants in writing.

Division 6—Securing Housing Australia’s entitlement to a return

25 The Commonwealth share and Commonwealth share percentage

(1) Housing Australia must ensure that each arrangement provides for the Commonwealth share and Commonwealth share percentage to be determined and adjusted in accordance with this section.

Note: The definition of “shared equity arrangement” in subsection 7(1) of the Act allows return entitlements to be worked out either in whole or in part by reference to the value of the relevant property at one or more times. The effect of this section is that an arrangement must create a return entitlement that is worked out wholly by reference to the value of the relevant property.

(2) The Commonwealth share, in relation to a relevant property:

(a) means the return to which the Commonwealth is entitled under the arrangement in respect of that property; and

(b) is expressed as a percentage of the value of the relevant property from time to time, where the percentage (the Commonwealth share percentage) is:

(i) unless adjusted as set out in subsections (3) and (4)—the agreed percentage (see section 16); and

(ii) if adjusted as set out in subsections (3) and (4)—the agreed percentage as adjusted.

Note: Because the value of the relevant property will change from time to time, the precise monetary value of the Commonwealth share will also vary depending on the time at which it is calculated. This will be the case even if the Commonwealth share percentage itself has not been adjusted.

Example: If the Commonwealth share is 20% of the value of a relevant property, and the property, at a particular time, is valued at $600,000, the monetary value of the Commonwealth share at that time is $120,000.

Adjustments to the Commonwealth share percentage

(3) Housing Australia must ensure that each arrangement must allow Housing Australia, on or after settlement, to increase the Commonwealth share percentage without making further financial contributions:

(a) in the circumstances mentioned in column 1 of an item of the following table; and

(b) as set out in column 2 of that item.

| Column 1 | Column 2 |

Item | Circumstances | Amount by which Commonwealth share percentage may be increased |

1 | Where the value of the relevant property, as assessed by the participating lender for the purpose of settlement, is lower than the purchase price | To a percentage that preserves what would have been the value of the Commonwealth share on the date of settlement, had the value of the property at that date been equal to the purchase price |

2 | Where Housing Australia considers that a participant’s negligence, fraudulent behaviour, or other unreasonable deliberate or reckless act or omission, has reduced, or is likely to reduce, the value of the relevant property | To a percentage that preserves what would have been the value of the Commonwealth share but for the act or omission |

Example: For item 1, the Commonwealth contributes 30% of the purchase price of a relevant property (this being the agreed percentage). The purchase price is $500,000, so the Commonwealth’s contribution is $150,000. The Commonwealth share, immediately before settlement, is 30% of the value of the relevant property at that time.

However, the property is valued at $475,000 for the purpose of settlement. This would reduce the value of the Commonwealth share at that time to $142,500, based on the original percentage return of 30%. The arrangement is to permit the Commonwealth share to be increased to 31.58% of the value of the property at settlement so that, as at the settlement date, the value of the Commonwealth share is preserved at $150,000.

(4) Housing Australia must ensure that each arrangement enables Housing Australia to reduce the Commonwealth share percentage:

(a) to reflect a repayment mentioned in section 37 or 43; or

(b) in the circumstances mentioned in section 60 (home improvements).

Part 3—Participating in the Help to Buy program

Division 1—Introduction

26 Simplified outline of this Part

This Part deals with participation in the Help to Buy program. The provisions in this Part are relevant to the performance of Housing Australia’s functions in relation to the Territories, and participating and cooperating States.

Division 2 of this Part, in combination with Schedule 1, deals with the conditions of participation in an arrangement. Division 3 of this Part requires Housing Australia to take certain steps to monitor compliance with those conditions, and Division 4 of this Part defines how Housing Australia is to respond where an individual ceases to comply with the conditions.

Participants are not bound by the conditions of participation by force of this instrument. Rather, Housing Australia is to ensure that its arrangements with participants enable it to take the steps set out in Division 4 where an individual ceases to meet those conditions.

Division 5 of this Part sets out the circumstances in which Housing Australia may vary an arrangement.

Finally, Division 6 of this Part requires Housing Australia to ensure that it may terminate arrangements in certain circumstances.

27 Application of this Part

This Part applies to the performance of Housing Australia’s functions in relation to:

(a) the participating States, and the Territories (under subparagraph 24(1)(a)(i) of the Act); and

(b) cooperating States (under subparagraph 24(1)(a)(ii) of the Act).

Division 2—Participation requirements

28 Arrangements must require compliance with participation requirements

(1) Housing Australia must ensure that each arrangement requires the participant to comply with the participation requirements specified in Schedule 1 for the duration of the arrangement.

(2) Those requirements, as set out in each arrangement, are the participation requirements for that arrangement.

(3) To avoid doubt, the participation requirements, for an arrangement, are to apply to a participant only during the life of that arrangement and are not to apply where the arrangement has been brought to an end early (for example, because of voluntary early repayment of the Commonwealth share in full or the sale of the relevant property).

Note 1: The participation requirements have legal force by virtue of an arrangement. This instrument does not impose such obligations on participants directly.

Note 2: There is no participation requirement relating to the income thresholds. However, Division 4 of Part 3 requires Housing Australia to take certain actions where a participant exceeds the income threshold at a particular time.

29 Exceptions to sale of existing property requirement

(1) Housing Australia must ensure that each arrangement, where relevant, provides that the participant is not required to comply with the participation requirement outlined in clause 1.1 of Schedule 1 (the sale of existing property requirement) if Housing Australia is satisfied, based on satisfactory evidence provided by the participant, that it is impracticable for the participant to meet that requirement:

(a) because the participant is experiencing hardship; or

(b) on other compassionate grounds.

(2) Housing Australia may, if satisfied as mentioned in subsection (1):

(a) allow the participant not to comply with the sale of existing property requirement for such a period as Housing Australia considers appropriate; and

(b) extend that period, as it considers appropriate.

30 Exceptions to principal place of residence requirement: all properties

(1) Housing Australia must ensure that each arrangement provides that a participant is not required to comply with the participation requirement outlined in clause 1.3 of Schedule 1 (the principal place of residence requirement) if Housing Australia is satisfied, based on satisfactory evidence provided by the participant, that it is impracticable for the participant to meet that requirement:

(a) because of a posting required in the course of the participant performing their duties as a member of the Australian Defence Force, other than as a member of the Naval Reserve, the Army Reserve or the Air Force Reserve (within the meaning of the Defence Act 1903); or

(b) because the participant’s employer has required them to relocate, in circumstances where the participant has been employed by that employer for:

(i) at least 12 months; or

(ii) a lesser period, where Housing Australia is satisfied that a lesser period is appropriate having regard to the nature of the ongoing employment relationship between the parties; or

(c) because the participant, or an individual for whom a participant exercises carer responsibilities, is suffering from a serious illness; or

(d) on other compassionate grounds.

(2) Housing Australia may, if satisfied as mentioned in subsection (1):

(a) allow the participant not to comply with the principal place of residence requirement under paragraph (1)(a) for such a period as Housing Australia considers appropriate; and

(b) extend that period, as it considers appropriate.

(3) The period of allowed non-compliance under paragraph (1)(b), (c) or (d) must not be longer than 12 months. However, Housing Australia may, where it considers it appropriate to do so:

(a) in relation to a situation covered by paragraph (1)(b)—extend the period by up to 2 further 12‑month periods; and

(b) in relation to a situation covered by paragraph (1)(c) or (d)— extend the period by one or more 12‑month periods.

(4) Housing Australia may, at any time during a period of allowed non-compliance, if satisfied that the reasons for which the non‑compliance was allowed no longer apply, require the participant to comply with the principal place of residence requirement.

31 Delayed application of principal place of residence requirement: new homes

Where an arrangement relates to the construction of a new home, Housing Australia must ensure that the arrangement provides that the participant does not breach the participation requirement set out in clause 1.3 of Schedule 1 by failing to treat the relevant property as the participant’s principal place of residence between the commencement of the arrangement and the date mentioned in paragraph (c) of this section, if:

(a) the participant does not occupy the relevant property because construction of the new home is being carried out; and

(b) the participant does not own the property that is their principal place of residence during the construction period; and

(c) the participant begins to treat the relevant property as their principal place of residence within 3 months of the construction being completed.

32 Borrowing additional funds under a mortgage from participating lenders

Housing Australia must ensure that each arrangement provides that the participant may only borrow additional funds from a participating lender:

(a) for the purpose of making a payment to reduce the Commonwealth share in respect of the relevant property; or

(b) for the purpose of maintenance or capital expenditure in respect of the relevant property (including home improvements); or

(c) in accordance with the participating lender’s policies for assisting borrowers who are experiencing hardship.

Note 1: This does not limit a participant’s capacity to take out a new mortgage with a participating lender, or with their current participating lender, if the refinancing does not result in a larger mortgage.

Note 2: For when participants must notify Housing Australia about borrowing additional funds from participating lenders, see clause 1.5 of Schedule 1.

Division 3—Monitoring participants’ compliance

33 Housing Australia must monitor participant compliance

Housing Australia must monitor each participant’s compliance with the participation requirements throughout the life of an arrangement.

34 Housing Australia must conduct 5‑yearly reviews

Without limiting section 33, Housing Australia must, for each arrangement, conduct a review at least every 5 years to determine:

(a) in the case of a participant, other than a single parent, who is a sole participant—whether the participant’s taxable income:

(i) for the most recent income year (within the meaning of the Income Tax Assessment Act 1936) for which the Commissioner of Taxation has given the participant a notice of assessment—exceeded the single income threshold for the financial year in which the review is undertaken; and

(ii) for the income year immediately preceding the most recent income year for which the Commissioner of Taxation has given the participant a notice of assessment—exceeded the single income threshold for the financial year preceding the year in which the review is undertaken; and

(b) in the case of a participant who is a single parent—whether the participant’s taxable income:

(i) for the most recent income year (within the meaning of the Income Tax Assessment Act 1936) for which the Commissioner of Taxation has given the participant a notice of assessment—exceeded the joint income threshold for the financial year in which the review is undertaken; and

(ii) for the income year immediately preceding the most recent income year for which the Commissioner of Taxation has given the participant a notice of assessment—exceeded the income threshold for the financial year preceding the year in which the review is undertaken; and

(c) in the case of joint participants—whether the participants’ combined taxable incomes:

(i) calculated by adding together the taxable income of each participant for the most recent income year for which the Commissioner of Taxation has given each of the participants a notice of assessment—exceeded the joint income threshold for the financial year in which the review is undertaken; and

(ii) calculated by adding together the taxable income of each participant for the income year immediately preceding the most recent income year for which the Commissioner of Taxation has given each of the participants a notice of assessment—exceeded the joint income threshold for the financial year preceding the year in which the review is undertaken; and

(d) whether each participant has met the participation requirements.

35 Housing Australia must review arrangement where mortgage with a participating lender is discharged

(1) Upon a participant discharging their mortgage with a participating lender, Housing Australia must, within a reasonable time, review the arrangement in order to determine:

(a) whether the participant has met the participation requirements; and

(b) whether the participant should be required to undergo the processes set out in section 37.

(2) Subsection (1) does not apply if the participant:

(a) has repaid the Commonwealth share in full at the time of discharging the mortgage; or

(b) has taken out a new mortgage with another participating lender in order to discharge their mortgage with their current participating lender and move their borrowing to the new lender.

Division 4—Managing participants’ compliance

36 How Housing Australia is to respond where review identifies potential non‑compliance

(1) Housing Australia must take action under an arrangement in accordance with section 37 where, after conducting a review mentioned in section 34, Housing Australia is satisfied that:

(a) for a sole participant, other than a single parent—the participant’s taxable income during the periods mentioned in paragraph 34(a) exceeded the thresholds mentioned in that paragraph; and

(b) in the case of a participant who is a single parent— the participant’s taxable income during the periods mentioned in paragraph 34(b) exceeded the thresholds mentioned in that paragraph; and

(c) for joint participants—the participants’ combined taxable income during the periods mentioned in paragraph 34(c) exceeded the thresholds mentioned in that paragraph.

(2) Housing Australia may take action under an arrangement in accordance with section 37 where Housing Australia is satisfied that the participant has, at any time, not met a participation requirement, if it considers it appropriate to do so.

Note: Subsection 13(2) requires Housing Australia to ensure that each arrangement contains such terms and conditions as are necessary to enable Housing Australia to comply with the requirements of this instrument.

(3) This section does not prevent Housing Australia from making provision in an arrangement for the imposition of other measures relating to compliance, except to the extent that those provisions are directly inconsistent with this instrument.

37 Housing Australia may require repayment and terminate arrangement

Assessment of capacity to repay Commonwealth share

(1) Housing Australia must ensure that each arrangement requires the participant to obtain, and provide to Housing Australia, an assessment by the participating lender of the participant’s capacity to repay the Commonwealth share in respect of the relevant property (as valued at the time of the assessment):

(a) where Housing Australia determines, under paragraph 35(1)(b), that the participant should be required to undergo the process set out in this section; or

(b) in the circumstances mentioned in subsection 36(1) or (2); or

(c) where a further assessment is required under subsection (5), (6), (9) or (12) of this section.

(2) An assessment mentioned in subsection (1) must:

(a) if the Commonwealth share is greater than 5% of the value of the property (as at the time of the assessment)—assess whether the participant does, or does not, have the capacity to repay a minimum amount of 5% of that property value; and

(b) if the Commonwealth share is equal to or less than 5% of the property value (as at the time of the assessment)—assess whether the participant does, or does not, have the capacity to repay the Commonwealth share of that property value in full; and

(c) be obtained within the period determined by Housing Australia and notified, in writing, to the participant.

(3) In determining the period under paragraph (2)(c), Housing Australia must:

(a) consider the participant’s personal circumstances and financial capacity; and

(b) consider the reason, or reasons, why the participant was required to obtain the assessment (including, if the assessment is a further assessment, the reason, or reasons, for the previous assessment); and

(c) where the assessment is required because of subsection (5), (6), (9) or (12)—set a start date for the period that is not less than 12 months after the previous assessment.

Example: If Housing Australia has dealt with an arrangement under this section because the participant’s taxable income exceeded the relevant threshold as set out in section 34, Housing Australia must consider the extent to which the participant’s taxable income exceeded that threshold.

Arrangements must allow Housing Australia to require repayment of Commonwealth share

(4) Housing Australia must ensure that each arrangement allows Housing Australia to require the participant to repay the Commonwealth share in full or in part in the circumstances specified in this section.

Commonwealth share greater than 5% of value of property

(5) Where:

(a) Housing Australia receives an assessment mentioned in subsection (1); and

(b) the Commonwealth share in respect of the relevant property is greater than 5% of the value of the property (as at the time of the assessment); and

(c) the participating lender assessed the participant to have the capacity to repay a minimum amount of 5% of that property value; and

(d) Housing Australia is satisfied that the assessment was properly made;

Housing Australia, under the arrangement:

(e) must require the participant to repay that minimum amount (rounded to the nearest $1,000) within 90 days of the date of the assessment; and

(f) may allow the participant to repay more than the minimum amount; and

(g) where the Commonwealth share percentage of the relevant property, re‑calculated by Housing Australia to reflect a payment mentioned in paragraph (e) or (f) (as applicable), is greater than 0%—must require a further assessment under subsection (1) to be undertaken; and

(h) where the Commonwealth share percentage of the relevant property, calculated by Housing Australia to reflect a payment mentioned in paragraph (e) or (f) (as applicable), is 0%—must terminate the arrangement.

(6) Where:

(a) Housing Australia receives an assessment mentioned in subsection (1); and

(b) the participating lender has assessed the participant not to have the capacity to repay a minimum amount of 5% of the property value; and

(c) Housing Australia is satisfied that assessment was properly made;

Housing Australia must require a further assessment under subsection (1).

Example: If Housing Australia is satisfied with an assessment that a participant does not have the capacity to repay the minimum amount, the participant need not make a repayment, but will be required to obtain another assessment at a later time determined by Housing Australia.

(7) Despite anything else in this section, Housing Australia must not require, but may allow, a participant to repay an amount if repayment of that amount would render the participant liable to bear the cost of lenders’ mortgage insurance.

Note: The participant may become liable to bear the cost of lenders’ mortgage insurance if, for example, they borrow further funds from their participating lender in order to repay the Commonwealth share, and this results in them borrowing more than a certain percentage of the property’s value from that lender.

Commonwealth share equal to or less than 5% of value of property

(8) Where:

(a) Housing Australia receives an assessment mentioned in subsection (1); and

(b) the Commonwealth share in respect of the relevant property is equal to or less than 5% of the value of the property (as at the time of the assessment); and

(c) the participating lender has assessed the participant to have the capacity to repay the Commonwealth share of that value in full; and

(d) Housing Australia is satisfied that the assessment was properly made;

Housing Australia, under the arrangement:

(e) must require the participant to repay the Commonwealth share in full within 90 days from the time the assessment is made; and

(f) terminate the arrangement when the repayment in full has been made.

(9) If:

(a) the participating lender has assessed the participant not to have the capacity to repay the Commonwealth share of the value in full as mentioned in paragraph (2)(b); and

(b) Housing Australia is satisfied that the assessment was properly made;

Housing Australia must require a further assessment, as mentioned in subsection (1).

Example: If Housing Australia is satisfied with an assessment that a participant does not have the capacity to repay the Commonwealth share in full, the participant need not make a repayment but will be required to obtain another assessment at a later time determined by Housing Australia.

Note: The participant may repay the Commonwealth share by, for example, borrowing further funds from their participating lender, or using their own savings or assets.

(10) Despite paragraph (8)(e), Housing Australia must not require, but may allow, a participant to repay the Commonwealth share in full even if this would render the participant liable to bear the cost of lenders’ mortgage insurance.

Note: The participant may become liable to bear the cost of lenders’ mortgage insurance if, for example, they borrow further funds from their participating lender in order to repay the Commonwealth share, and this results in them borrowing more than a certain percentage of the property’s value from that lender.

Housing Australia may not seek repayment in certain circumstances

(11) Housing Australia may choose not to enforce a requirement for a participant to repay an amount as set out in this section if Housing Australia considers it reasonable in the circumstances after considering:

(a) the participant’s personal circumstances and financial capacity; and

(b) the reason, or reasons, the participant was required to obtain an assessment of their capacity to repay the Commonwealth share in respect of the relevant property.

Example: If Housing Australia has dealt with an arrangement under this section because the participant’s taxable income exceeded the threshold as set out in section 34, Housing Australia would consider the extent which the participant’s taxable income exceeded the threshold.

(12) Where Housing Australia chooses not to enforce a requirement for a participant to repay an amount as set out in this section, Housing Australia must require a further assessment, as mentioned in subsection (1).

Division 5—Varying arrangements

38 Varying the participants in an arrangement

(1) Housing Australia must not vary an arrangement:

(a) so that there are more than 2 participants; or

(b) to remove all of the original participants.

(2) Housing Australia may only vary an arrangement by adding a participant where Housing Australia is satisfied that:

(a) the new participant is an eligible applicant (see section 17), subject to the following qualifications:

(i) where the variation occurs after the parties enter into the contract of sale, but on or before the settlement date—subparagraph 17(f)(i) need not apply; and

(ii) where the variation occurs after the settlement date—paragraph 17(f) does not apply; and

(b) any transactions with the vendor or builder that involve the new participant would be conducted on an arm’s-length basis.

(3) Housing Australia must not vary an arrangement by removing a participant unless it is satisfied that:

(a) the relevant participating lender has determined that the participant in the arrangement, as varied, would be able to meet their obligations under the mortgage agreement; or

(b) it is necessary to do so to enable or facilitate compliance with a court order.

(4) This section does not apply in the circumstances mentioned in section 45.

Note: Section 45 provides for the alteration of arrangements in circumstances involving the death of a participant.

39 Varying or entering into new construction contracts

(1) Where:

(a) a construction contract for a new home is to be varied, or a replacement contract is to be entered into, in the circumstances mentioned in clause 1.14 of Schedule 1; and

(b) the purchase price under the varied or replacement contract is higher than the original purchase price;

Housing Australia must not increase the Commonwealth’s contribution to the purchase price to more than 40% of the purchase price under the varied or replacement contract.

Example: The original construction contract is for the amount of $500,000 and the Commonwealth contribution is 30% of the purchase price of the property. Under the arrangement, Housing Australia would pay, on behalf of the Commonwealth, 30% of the purchase price of the land at the settlement date, followed by 30% of the value of each progress payment during the course of the construction. During construction, the contract is varied due to higher building costs, resulting in a new amount of $600,000. Housing Australia may provide up to an additional $90,000, on behalf of the Commonwealth, for a total contribution of $240,000 (40% of $600,000). If an additional $90,000 is paid on behalf of the Commonwealth, this would increase the Commonwealth share to 40%.

(2) Subsection (1) applies even if the increase to the purchase price would mean that Housing Australia contributes less than the amount required to ensure that its contribution and applicant’s deposit together equal at least 20% of the new value of the property.

Note: This may mean that the participant has to bear the cost of lenders’ mortgage insurance.

Division 6—Terminating arrangements in specified circumstances

40 Housing Australia must reserve power to terminate arrangements in certain circumstances

(1) Housing Australia must ensure that an arrangement may be terminated if, before the settlement date for the purchase of the relevant property:

(a) due to a change of circumstances, the participant stops being an eligible applicant; or

(b) Housing Australia stops being satisfied that the mortgage requirements or new home contract requirements will be met by the settlement date.

(2) Housing Australia must ensure that an arrangement can be terminated at any time if:

(a) Housing Australia stops being satisfied that the timeframe requirements will be met; or

(b) the timeframe requirements have not been met; or

(c) Division 2 of Part 5 (about allocating Help to Buy places) would require the arrangement to be terminated.

(3) This section does not limit the circumstances in which an arrangement may allow Housing Australia to terminate the arrangement.

Part 4—Exiting the program

Division 1—Introduction

41 Simplified outline of this Part

This Part sets out additional means by which an arrangement is to be able to be brought to an early end, such as voluntary early repayments or sale of the relevant property. It also deals with how Housing Australia may manage arrangements in respect of deceased estates of participants. It is relevant to the performance of Housing Australia’s functions in relation to both participating and cooperating States, and the Territories.

42 Application of this Part

This Part applies to the performance of Housing Australia’s functions in relation to:

(a) the participating States and the Territories (under subparagraph 24(1)(a)(i) of the Act); and

(b) cooperating States (under subparagraph 24(1)(a)(ii) of the Act).

Division 2—Exiting the program

43 Housing Australia must allow voluntary early repayments

(1) Housing Australia must ensure that each arrangement permits a participant to make one or more voluntary repayments, provided that each repayment would:

(a) when rounded to the nearest $1,000, reduce the Commonwealth share percentage by at least 5% of the value of the relevant property as at the time of the repayment; or

(b) repay the Commonwealth share (as valued at that time) in full.

(2) Housing Australia must ensure that each arrangement allows Housing Australia to require the participant to bear the costs of obtaining a valuation, and any other administrative costs, associated with a repayment.

44 Housing Australia must allow the relevant property to be sold

(1) Housing Australia must ensure that each arrangement allows the participant to sell the relevant property at any time, subject to the conditions specified in the arrangement and mentioned in subsection (2).

(2) For the purposes of subsection (1), the conditions are that:

(a) the participant must give Housing Australia written notice of a sale immediately after the parties enter into a contract of sale; and

(b) Housing Australia is satisfied that the contract of sale has been entered into on an arm’s‑length basis; and

(c) the participant must bear the costs of obtaining a valuation, and any other administrative costs, associated with the sale.

45 Options for deceased estates of participants

(1) Housing Australia must ensure that each arrangement provides for Housing Australia to be able to recover the Commonwealth share (as valued at the time it is recovered), in accordance with this section, where:

(a) a sole participant in an arrangement dies; or

(b) 2 joint participants own the relevant property as joint tenants, and both participants die.

Note: Subsection 13(2) requires Housing Australia to ensure that each arrangement contains such terms and conditions as are necessary to enable it to comply with the requirements of this instrument.

(2) However, the arrangement must also provide that Housing Australia need not recover the Commonwealth share where:

(a) the relevant property is inherited by a single beneficiary (or 2 beneficiaries jointly) of the estate of one or both of the deceased participants; and

(b) each beneficiary applies, in the manner and form approved by Housing Australia, to be accepted as a participant in the arrangement; and

(c) the requirements in paragraphs 17(a) to (e) (about eligible applicants) are met in respect of each beneficiary at the time of the application; and

(d) Housing Australia agrees to substitute each beneficiary as a party to, and participant in, the arrangement in respect of the relevant property.

(3) Housing Australia must ensure that each arrangement provides for Housing Australia to be able to recover the Commonwealth share (as valued at the time it is recovered), where:

(a) 2 joint participants own the relevant property as tenants in common; and

(b) one of the participants dies; and

(c) an individual, other than the surviving participant, inherits the deceased participant’s interest in the property.

(4) However, the arrangement must also provide that Housing Australia need not recover the Commonwealth share where:

(a) the deceased participant’s interest in the relevant property is inherited by a beneficiary of the estate of the deceased or by a surviving participant (the successor); and

(b) the successor applies, in the manner and form approved by Housing Australia, to be accepted as a participant in the arrangement; and

(c) the requirements in paragraphs 17(a) to (e) (about eligible applicants) are met in respect of the successor at the time of the application; and

(d) Housing Australia agrees to substitute the successor as a participant in the arrangement in respect of the relevant property.

(5) Where Housing Australia must recover a Commonwealth share under a provision of an arrangement required by this section, Housing Australia must do so within:

(a) 2 years of the date of the deceased participant’s death; or

(b) such longer period as Housing Australia considers reasonable, where a surviving participant or beneficiary is experiencing hardship.

(6) Housing Australia must ensure that an arrangement allows Housing Australia to require a beneficiary to bear any administrative costs associated with a substitution under subsection (2) or (4).

Part 5—Miscellaneous

Division 1—Introduction

46 Simplified outline of this Part

This Part deals with allocation of Help to Buy places across the participating jurisdictions. It also deals with miscellaneous matters relevant to the administration of the program, such as Housing Australia’s ability to charge fees in relation to arrangements, the approval of participating lenders, and the making of improvements to relevant properties.

This Part is relevant to the performance of Housing Australia’s functions in relation to the participating States and the Territories, and, in some respects, the cooperating States.

Division 2—Allocating Help to Buy places

47 Application of this Division

This Division applies to the performance of Housing Australia’s functions in relation to the participating States and the Territories (under subparagraph 24(1)(a)(i) of the Act).

Note: Paragraphs 14(1)(d) and 14(4)(h) of this instrument provide that Housing Australia may only approve applications for arrangements, and enter into arrangements, where this Division allows.

48 Allocating places—first year of the program

10,000 places are available in the first year of program

(1) 10,000 places are to be made available in the period starting on 1 July 2025 and ending on 30 June 2026 (the initial period).

Initial per capita allocation to participating jurisdictions

(2) The places are to be allocated between the participating States and the Territories as follows:

(a) each State, that is a participating State on 1 July 2025, is allocated a number of places on 1 July 2025; and

(b) each State, that is not a participating State on 1 July 2025, but becomes a participating State before 1 March 2026, is allocated a number of places on the day it becomes a participating State; and

(c) each Territory is allocated a number of places on 1 July 2025.

Note: This section operates subject to section 52 (which prevents places from being allocated in certain circumstances once a participating State has given notice of its intention to stop participating).

(3) The number of places to be allocated for a participating State or a Territory for the initial period is the number of places worked out in accordance with the following formula:

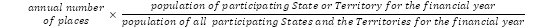

Where the result of the formula is not a whole number, round down to the nearest whole number.

49 Committing and using places—first year of the program

(1) Where a place has been allocated to a particular State or Territory under subsection 48(2), Housing Australia may, on or after the allocation date, commit or use the place for an arrangement in respect of property in that State or Territory at any time before 1 March 2026.

Note 1: Paragraph 14(4)(h) means that Housing Australia cannot approve an application except where this Division allows.

Note 2: This section operates subject to section 52 (which prevents places from being used and arrangements from being entered into in certain circumstances once a participating State has given notice of its intention to cease participating).

Committing and using places from 1 March 2026

(2) Where a place remains unallocated or uncommitted on 1 March 2026, Housing Australia may, on or after that date, commit or use the place for an arrangement in respect of property in any participating State or a Territory at any time before the end of the 2025-26 financial year.

Note: Places will be unallocated on 1 March 2026 if not all States are participating by that date, or, if all States are participating, if rounding under subsection 48(3) results in some places being unallocated.

Uncommitted places at end of year treated as unused for next financial year

(3) If a place has not been committed before the end of 30 June 2026, for the purposes of working out the number of unused places in a financial year, it is to be treated as an unused place for the next financial year.

Where place is committed, arrangement need not be entered into before end of financial year

(4) If a place is committed before the end of 30 June 2026:

(a) Housing Australia may only use the place, and enter into an arrangement in respect of the place, before the end of 30 June 2027; and

(b) after 30 June 2027, for the purposes of working out the number of unused places in a financial year, the place is to be treated as an unused place.

Note 1: This allows the place to be rolled over under subsection 50(1). However, this section applies subject to section 52, which deals with situations where a State gives notice of its intention to stop participating in the program.

Note 2: Paragraph 14(1)(d) provides that Housing Australia may only enter into an arrangement where this Division allows. This section will sometimes prevent Housing Australia from entering into an arrangement in respect of a place even where it had previously approved an application to enter into the arrangement.

50 Allocating places—subsequent years of the program

Number of places available in subsequent years

(1) The annual number of places that are to be made available in a financial year after the 2025-26 financial year is the sum of:

(a) 10,000 places; and

(b) the number of unused places from a previous financial year that are treated as unused places for that financial year.

Initial per‑capita allocation to participating jurisdictions

(2) The places are allocated between the participating States and the Territories for a financial year as follows:

(a) each State, that is a participating State before the start of the financial year, is allocated a number of places on 1 July of that year; and

(b) each Territory is allocated a number of places on 1 July of each financial year starting on or after 1 July 2026.

Note: This section operates subject to section 52 (which prevents places from being allocated in certain circumstances once a participating State has given notice of its intention to withdraw).

(3) The allocated number of places for a participating State or a Territory for a financial year is the number of places worked out in accordance with the following formula:

Where the result of the formula is not a whole number, round down to the nearest whole number.

Maximum number of places that can be allocated under the program

(4) Despite subsection (1), the annual number of places for a financial year is to be reduced so that the total number of used places, for all financial years, does not exceed 40,000. Where this subsection applies, Housing Australia must pro rata each participating State’s and each Territory’s allocation for the financial year.

51 Committing and using places—subsequent years of the program

(1) Where a place has been allocated to a particular State or Territory under subsection 50(2), Housing Australia may, on or after the allocation date, commit or use the place for an arrangement in respect of property in that State or Territory at any time before 1 March of the relevant financial year.

Note 1: Paragraph 14(3)(h) means that Housing Australia cannot approve an application except where this Division allows.

Note 2: This section operates subject to section 52 (which prevents places from being used and arrangements from being entered into in certain circumstances once a participating State has given notice of its intention to withdraw).

(2) Where a place is unallocated following the application of section 50, Housing Australia may, after 1 March of the relevant financial year, commit or use the place for an arrangement in respect of property in any participating State or a Territory at any time before the end of that financial year.

Note: A place may be unallocated because of a rounding under subsection 50(3), because of the operation of section 52 (which prevents places from being allocated in certain circumstances once a participating State has given notice of its intention to withdraw), or because a State is not a participating State.

Uncommitted places after 1 March of the relevant financial year

(3) Where a place remains uncommitted on 1 March of a relevant financial year, Housing Australia may, on or after that date, commit or use the place for an arrangement in respect of property in any participating State or a Territory at any time before the end of that financial year.

Uncommitted places at end of year treated as unused places for next financial year

(4) If a place remains uncommitted on 30 June of a relevant financial year, for the purposes of working out the number of unused places in a financial year, it is to be treated as an unused place for the next financial year.

Where place is committed, arrangement need not be entered into before end of financial year

(5) If a place is committed before the end of 30 June of the relevant financial year:

(a) Housing Australia may use the place, and enter into an arrangement in respect of the place, at any time before the end of 30 June of the next financial year; and

(b) at the end of that next financial year:

(i) subject to subparagraph (ii), the place may no longer be used, and an arrangement may no longer be entered into in respect of the place; and

(ii) for the purposes of working out the number of unused places in a financial year, it is to be treated as an unused place for the next financial year.

Note 1: This allows the place to be rolled over under subsection 50(1). However, this section applies subject to section 52, which deals with situations where a State gives notice of its intention to cease participating.