Financial Sector (Collection of Data) (reporting standard) determination No. 12 of 2025

Reporting Standard SRS 607.0 RSE Business Model

Financial Sector (Collection of Data) Act 2001

I, Andrew Robertson, delegate of APRA, under paragraph 13(1)(a) of the Financial Sector (Collection of Data) Act 2001 (the Act), determine Reporting Standard SRS 607.0 RSE Business Model, in the form set out in the Schedule, which applies to financial sector entities to the extent provided in paragraph 3 of that reporting standard.

Under section 15 of the Act, I declare that Reporting Standard SRS 607.0 RSE Business Model shall begin to apply to those financial sector entities at the start of the day after the day this instrument is registered on the Federal Register of Legislation.

This instrument commences at the start of the day after the day it is registered on the Federal Register of Legislation.

Dated: 30 April 2025

Andrew Robertson

Chief Data Officer

Technology and Data Division

Interpretation

In this instrument:

APRA means the Australian Prudential Regulation Authority.

Federal Register of Legislation means the register established and maintained under section 15A of the Legislation Act 2003.

financial sector entity means financial sector entities of a kind referred to in paragraphs 5(2)(a) to (d) of the Act.

Schedule

Reporting Standard SRS 607.0 RSE Business Model comprises the document commencing on the following page.

Reporting Standard SRS 607.0

RSE Business Model

Objective of this reporting standard

This Reporting Standard sets out requirements for the provision of information to APRA relating to the structure of a registrable superannuation entity (RSE), defined benefit RSE or Pooled Superannuation Trust (PST).

It includes Reporting Form SRF 607.0 RSE Business Model and associated specific instructions.

Authority

- This Reporting Standard is made under section 13 of the Financial Sector (Collection of Data) Act 2001.

Purpose

- Information collected under this Reporting Standard is used by APRA for the purposes of prudential supervision and publication. It may also be used by the Australian Securities and Investments Commission.

Application

- This Reporting Standard applies to each registrable superannuation entity (RSE) licensee (RSE licensee) in respect of each RSE, defined benefit RSE and pooled superannuation trust (PST) within its business operations.

Commencement

- This Reporting Standard commences at the start of the day after the day it is registered on the Federal Register of Legislation.

Reporting periods

- The RSE Licensee must provide the information required by this Reporting Standard for the reporting periods, by the due dates, set out in the table below.

Reporting Form | Reporting Table | Reporting Period | Due date | First reporting period |

Reporting Form SRF 607.0 RSE Business Model (SRF 607.0) | Table 1A – Promoter agreements Table 1B Employer-sponsors Table 2 RSE Composition Table 3.1 PST Redemption Notice Period Table 3.2 PST Investor Information | Each financial year | For the first reporting period: 15 December 2025 for RSE licensees with 30 June financial year end. Within 3 months after the end of the first reporting period for all other RSE licensees. For subsequent reporting periods for all RSE licensees: Within 3 months after the end of the relevant reporting period. | The first financial year ending on or after 30 June 2025 |

Reporting Form SRF 607.0 RSE Business Model (SRF 607.0) | Table 4 MySuper And Choice Lifecycle Stage Factors Table 5 MySuper And Choice Lifecycle Portfolio Mix Design - Dynamic Mix | Each calendar quarter ending 30 September, 31 December, 31 March and 30 June each year | For the first reporting period: 15 December 2025 For subsequent reporting periods: 28 calendar days after the end of the relevant reporting period. | The calendar quarter ending on 30 September 2025 |

Notices

- If, having regard to the particular circumstances of an RSE, defined benefit RSE or PST, APRA considers it necessary or desirable to obtain information more or less frequently than as provided by paragraph 5, APRA may, by notice in writing, change the reporting periods for the particular RSE, defined benefit RSE or PST.

- Where APRA has changed the reporting periods under paragraph 6, the RSE licensee must provide the relevant information within the time specified by the notice in writing.

- APRA may grant, in writing, an RSE licensee an extension of a due date with respect to one or more RSEs, defined benefit RSEs or PSTs within its business operations, in which case the new due date for the provision of the information will be the due date on the specified notice of extension.

Note: For the avoidance of doubt, APRA’s expectation is that if the due date falls on a day other than a usual business day, an RSE licensee will submit the information required no later than the due date.

Form and method of submission

- The information required by this Reporting Standard must be given to APRA in electronic format using an electronic method available on APRA’s website or by a method notified by APRA prior to submission.

Quality control

- The information provided by an RSE licensee under this Reporting Standard must be the product of systems, procedures and internal controls that have been reviewed and tested by the RSE auditor of the RSE, defined benefit RSE or PST to which the information relates. This will require the RSE auditor to review and test the RSE licensee’s systems, procedures and internal controls designed to enable the RSE licensee to report reliable information to APRA. This review and testing must be done on:

- an annual basis or more frequently if necessary to enable the RSE auditor to form an opinion on the reliability and accuracy of information; and

- at least a limited assurance engagement consistent with professional standards and guidance notes issued by the Auditing and Assurance Standards Board as may be amended from time to time, to the extent that they are not inconsistent with the requirements of Prudential Standard SPS 310 Audit and Related Matters (SPS 310).

- All information provided by an RSE licensee under this Reporting Standard must be subject to systems, processes and controls developed by the RSE licensee for the internal review and authorisation of that information. It is the responsibility of the Board and senior management of the RSE licensee to ensure that an appropriate set of policies, procedures and controls for the authorisation of information submitted to APRA is in place.

Authorisation

- When an officer or agent of an RSE licensee provides the information required by this Reporting Standard using an electronic format, the officer or agent must digitally sign the relevant information using a digital certificate acceptable to APRA.

- If the information required by this Reporting Standard is provided by an agent who submits the information on the RSE licensee’s behalf, the RSE licensee must:

- obtain from the agent a copy of the completed form with the information provided to APRA; and

- retain the completed copy.

- An officer or agent of an RSE licensee who submits the information under this Reporting Standard for, or on behalf of, the RSE licensee must be authorised by either:

- the Chief Executive Officer of the RSE licensee; or

- the Chief Financial Officer of the RSE licensee.

Minor alterations to forms and instructions

- APRA may make minor variations to:

- a form that is part of this Reporting Standard, and the instructions to such a form, to correct technical, programming or logical errors, inconsistencies or anomalies; or

- the instructions to a form, to clarify their application to the form,

without changing any substantive requirement in the form or instructions.

- If APRA makes such a variation, it must notify each RSE licensee that is required to report under this Reporting Standard.

Interpretation

- In this Reporting Standard:

APRA means the Australian Prudential Regulation Authority established under the Australian Prudential Regulation Authority Act 1998.

Chief Executive Officer means the chief executive officer of the RSE licensee, by whatever name called, and whether or not he or she is a member of the Board of the RSE licensee.

Chief Financial Officer means the chief financial officer of the RSE licensee, by whatever name called.

defined benefit RSE has the meaning of defined benefit fund in subsection 10(1) of the SIS Act.

due date means the relevant due date under paragraph 5, 7 or, if applicable, paragraph 8 of this Reporting Standard.

financial year means the financial year (within the meaning of the Corporations Act 2001) of the RSE, defined benefit RSE or pooled superannuation trust (PST).

investment option has the meaning given in SRS 101.0.

MySuper product has the meaning given in subsection 10(1) of the SIS Act.

pooled superannuation trust (PST) has the meaning given in subsection 10(1) of the SIS Act.

reporting period means a period mentioned in paragraph 5 or, if applicable, paragraph 6 of this Reporting Standard.

RSE means a registrable superannuation entity as defined in subsection 10(1) of the SIS Act that is not a defined benefit RSE, pooled superannuation trust, small APRA fund or single member approved deposit fund.

RSE auditor means an auditor appointed by the RSE licensee to perform functions under this Reporting Standard.

RSE licensee has the meaning given in subsection 10(1) of the SIS Act.

SIS Act means Superannuation Industry (Supervision) Act 1993.

SRS 101.0 means Reporting Standard SRS 101.0 Definitions for Superannuation Data Collections.

- In this Reporting Standard, unless an instrument is not disallowable or a contrary intention appears, a reference to an Act, Regulation, Prudential Standard, Reporting Standard, Australian Accounting Standard or Auditing Standard is a reference to the instrument as in force or existing from time to time.

- Where this Reporting Standard provides for APRA to exercise a power or discretion, this power or discretion is to be exercised in writing.

Reporting Form SRF 607.0

RSE Business Model

Instruction Guide

This instruction guide is designed to assist in the completion of Reporting Form SRF 607.0 RSE Business Model (SRF 607.0). This form collects information on the structure of each RSE licensee’s business operations.

General directions and notes

Reporting level

SRF 607.0 must be completed for each RSE licensee in respect of each registrable superannuation entity (RSE), defined benefit RSE and pooled superannuation trust (PST), as relevant, within its business operations.

Reporting tables

Tables described in this reporting form list each of the data fields required to be reported. The data fields are listed sequentially in the column order that they will appear in the reported data set. Constraints on the data that can be reported for each field have also been provided.

The Unique identifier column indicates which field or fields form the primary key of the table. Where a field has ‘Y’ in the Unique identifier column, this denotes that this field forms part of the primary key for the table. A blank cell in the Unique identifier column means that the field does not form part of the primary key for the table. Any specific combination of values in the fields that form the primary key of a table must not appear on more than one row in that table when reported.

Reporting basis and units of measurement

Amounts in SRF 607.0 are to be reported as percentages or whole numbers. Percentages are to be reported as an unconverted number to two decimal places. For example, 12.34 per cent is to be reported as 0.1234.

Items on SRF 607.0 must be reported as at the end of the reporting period.

Definitions

Terms highlighted in bold italics indicate that the definition is provided in Reporting Standard SRS 101.0 Definitions for Superannuation Data Collections (SRS 101.0).

Specific instructions

Table 1A: Promoter agreements

Where the RSE licensee has a Promoter agreement in place with respect to the RSE or any Superannuation Product within the RSE, report information on all Promoter agreements in place at any time during the reporting period.

Column | Field name | Unique identifier | Applicable to | Valid values | Description |

1 | Superannuation Product Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | For all superannuation products with a promoter agreement, report the superannuation product identifier. The superannuation product identifier must correspond to a superannuation product identifier reported in Reporting Standard SRS 605.0 RSE Structure (SRS 605.0). Report each superannuation product identifier as a separate line. |

2 | Fees And Costs Arrangement Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | Report the fees and costs arrangement identifier for the fees and costs arrangement for each superannuation product where a promoter agreement exists. The fees and costs arrangement identifier must correspond to a fees and costs arrangement identifier reported in Reporting Standard SRS 605.0 RSE Structure (SRS 605.0). Report each unique combination of superannuation product identifier and fees and costs arrangement identifier on a separate line. |

3 | Service Provider Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | Report the service provider identifier for the promoter. The service provider identifier must correspond to a service provider identifier reported in Reporting Standard SRS 332.0 Expenses. |

4 | Promoter Agreement Start Date | Y | All filers | Date values (dd/mm/yyyy) | Report the Promoter Agreement Start Date. |

5 | Promoter Agreement Term | | All filers | Whole numbers | Where a promoter agreement exists for the superannuation product, report the term of the promoter agreement in years. |

6 | Promoter Agreement Renewal Date | | All filers | Date values (dd/mm/yyyy) | Where a promoter agreement exists for the superannuation product, report the promoter agreement renewal date for the promoter agreement. |

7 | Promoter Agreement End Date | | All filers | Date values (dd/mm/yyyy) | Where the Promoter Agreement ceased during the reporting period, report the Promoter Agreement End Date. Otherwise, leave this field blank. |

8 | Member Accounts Count | | All filers | Whole numbers | Report the number of member accounts for each unique combination of superannuation product identifier, fees and costs arrangement identifier and service provider identifier. |

9 | Member Assets Amount | | All filers | Dollar values | Report the value of member assets for each unique combination of superannuation product identifier, fees and costs arrangement identifier and service provider identifier. |

Table 1B: Employer-sponsors

Where the RSE Licensee has Employer-sponsor arrangements in place with respect to the RSE or any Superannuation Product within the RSE, report information all Employer-sponsors accounting for more than 1% of member accounts of the Superannuation Product; or at a minimum the top 20 Employer-sponsors of the Superannuation Product based on the number of member accounts.

Column | Field name | Unique identifier | Applicable to | Valid values | Description |

1 | Superannuation Product Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | For all superannuation products with employer-sponsor arrangements, report the superannuation product identifier |

2 | Employer-sponsor ABN | Y | All filers | ABN Integer | For each superannuation product with employer-sponsor arrangements, report the ABN of all employer-sponsors accounting for more than 1% of member accounts of the superannuation product; or at a minimum the top 20 employer-sponsors of the superannuation product based on the number of member accounts. Report each employer-sponsor ABN as a separate line. |

3 | Employer-sponsor Name | | All filers | Free text | Report the employer-sponsor business name. |

4 | Fees And Costs Arrangement Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | Report the fees and costs arrangement identifier for the fees and costs arrangement for each superannuation product where employer-sponsor arrangements exist. The fees and costs arrangement identifier must correspond to a fees and costs arrangement identifier reported in SRS605.0. Report each unique combination of superannuation product identifier, employer-sponsor ABN and fees and costs arrangement identifier on a separate line. |

5 | Employer Exit Type | | All filers | - Retain Employer Fees And Costs Arrangement

- Delinked Fees And Costs Arrangement

| Report the fees and costs arrangement that will apply to employees who exit the employer. |

6 | Member Accounts Count | | All filers | Whole numbers | Report the number of member accounts for each unique combination of superannuation product identifier, employer-sponsor ABN and fees and costs arrangement identifier. |

7 | Member Assets Amount | | All filers | Dollar values | Report the value of member assets for each unique combination of superannuation product identifier, employer-sponsor ABN and fees and costs arrangement identifier. |

Table 2: RSE Composition

Report each RSE that was licensed by APRA at any time during the reporting period.

Column | Field name | Unique identifier | Applicable to | Valid values | Description |

1 | RSE ABN | Y | All filers | ABN Integer | Report the RSE ABN/ABNs for all RSEs operated by the RSE Licensee. Report each RSE ABN as a separate line. |

2 | In-house Assets Held By The RSE | | All filers | Dollar values | Report the value of in-house assets held by the RSE. If no in-house assets are held by the RSE, report 0. |

3 | In-house Assets For Which The Entity Has An Exemption By APRA | | All filers | Dollar values | Report the value of in-house assets held by the RSE for which the entity has an exemption from APRA in writing. Otherwise, report 0. |

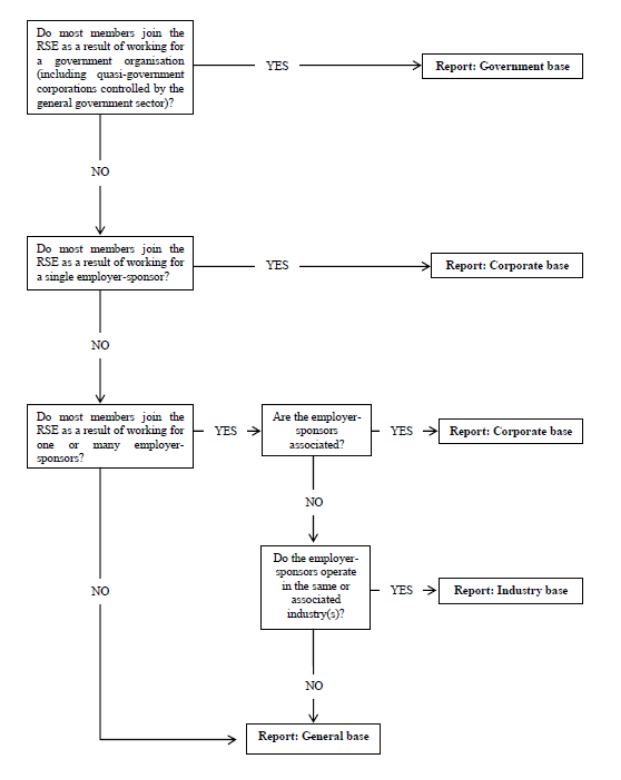

4 | Membership Base Type | | All filers | - Government Base

- Corporate Base

- Industry Base

- General Base

| Report the predominant base of members within the RSE. Where an RSE’s membership base type might be classified as more than one type of membership base type, apply the hierarchy outlined in Attachment A to these instructions when completing this item. |

5 | Member Complaints Received | | All filers | Integer | Report the number of members complaints received from members of the RSE during the reporting period. Where no members complaints were received during the reporting period, report 0. |

Table 3: PST Investor Information

Report as at the end of the reporting period:

- each investor in the PST that is an RSE and that is under the trusteeship of the same RSE licensee as the PST; and/or

- each investor in the PST that is an RSE and is one of the 10 largest investors (by size of investment in the PST), but is under the trusteeship of a different RSE licensee.

Table 3.1 - PST Redemption Notice Period

Column | Field name | Unique identifier | Applicable to | Valid values | Description |

1 | PST Redemption Notice Period | | All filers | Whole numbers | Report the standard notice period in days required by investors for payment of withdrawals. |

Table 3.2 - PST Investor Information

Column | Field name | Unique identifier | Applicable to | Valid values | Description |

1 | PST Investor ABN | Y | All filers | ABN Integer | Report the ABN of the investor in the PST. |

2 | PST Investor Name | | All filers | Free text | Report the name of the investor in the PST. Report each investor as a separate line. |

3 | Associate | | All filers | | Report if the investor is an Associate of the PST. Report for each investor listed. |

4 | Amount Held By PST Investor | | All filers | Dollar values | Report the value of investment in the PST held by the investor. |

5 | Percentage Held By PST Investor | | All filers | Percentage to 2 decimal places | Report the value of investment in the PST held by the investor, as a percentage of the total investment value of the PST. |

Table 4: MySuper And Choice Lifecycle Stage Factors

Report each lifecycle option offered by the RSE and the defining attributes of the lifecycle option.

Column | Field name | Unique identifier | Applicable to | Valid values | Description |

1 | Investment Option Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | Report the investment option identifier. |

2 | Lifecycle Product Design Type | | All filers | - Lifecycle Portfolio Mix Design - Representative Stage

- Lifecycle Portfolio Mix Design – Dynamic Mix

- Lifecycle Cohort Design

| Report the lifecycle product design type. |

3 | Minimum Age | | All filers | Whole numbers | Where age is a factor used to determine allocation to a lifecycle stage, report the minimum allowable age. Where age is not a determinant for membership in a lifecycle stage, leave this field blank. |

4 | Maximum Age | | All filers | Whole numbers | Where age is a factor used to determine allocation to a lifecycle stage, report the maximum allowable age. Where age is not a determinant for membership in a lifecycle stage, leave this field blank. |

5 | Gender | | All filers | - Female

- Male

- Non-binary

- Not Applicable

| Where gender is a factor used to determine allocation to a lifecycle stage, report the gender. Where gender is not a determinant for membership in a lifecycle stage, report ‘Not Applicable’. |

6 | Minimum Account Balance | | All filers | Whole dollars | Where a minimum account balance is set for a lifecycle stage, report the minimum account balance. Where account balance is not a determinant for membership in a lifecycle stage, leave this field blank. |

7 | Maximum Account Balance | | All filers | Whole dollars | Where a maximum account balance is set for a lifecycle stage, report the maximum account balance. Where account balance is not a determinant for membership in a lifecycle stage, leave this field blank. |

8 | Minimum Contribution Rate | | All filers | Percentage to 2 decimal places | Where a minimum contribution rate is set for a lifecycle stage, report the minimum contribution rate. Where contribution rate is not a determinant for membership in a lifecycle stage, leave this field blank. |

9 | Maximum Contribution Rate | | All filers | Percentage to 2 decimal places | Where a maximum contribution rate is set for a lifecycle stage, report the maximum contribution rate. Where contribution rate is not a determinant for membership in a lifecycle stage, leave this field blank. |

10 | Minimum Current Salary | | All filers | Whole dollars | Where salary is used to determine allocation to a lifecycle stage, report the minimum current salary. Where salary is not a determinant for membership in a lifecycle stage, leave this field blank. |

11 | Maximum Current Salary | | All filers | Whole dollars | Where salary is used to determine allocation to a lifecycle stage, report the maximum current salary. Where salary is not a determinant for membership in a lifecycle stage, leave this field blank. |

12 | Minimum Time Remaining To Retirement | | All filers | Whole numbers | Where time remaining to retirement is used to determine allocation to a lifecycle stage, report the minimum time remaining to retirement in years. Where time to retirement is not a determinant for membership in a lifecycle stage, leave this field blank. |

13 | Maximum Time Remaining To Retirement | | All filers | Whole numbers | Where time remaining to retirement is used to determine allocation to a lifecycle stage, report the maximum time remaining to retirement in years. Where time to retirement is not a determinant for membership in a lifecycle stage, leave this field blank. |

14 | Other Factors | | All filers | | Where other factors are used to determine allocation to a lifecycle stage, report the other factors. |

15 | Description Of Other Factors | | All filers | Free text | Where other factors allowable under Regulation 9.47 of SIS Regulations are used to determine allocation to a lifecycle stage, report a description of the other factors. Where other factors are not a determinant for membership in a lifecycle stage, leave this field blank. |

Table 5: MySuper And Choice Lifecycle Portfolio Mix Design - Dynamic Mix

For RSEs offering a 'Lifecycle Portfolio Mix Design - Dynamic Mix' representative stage lifecycle option, report the investment options and respective % allocation that comprise the underlying investment pool for each lifecycle representative stage.

Column | Field name | Unique identifier | Applicable to | Valid values | Description |

1 | Lifecycle Portfolio Mix Design – Dynamic Mix Investment Option Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | Report the investment option identifier for each lifecycle portfolio mix design – dynamic mix. |

2 | Underlying Investment Pool - Investment Option Identifier | Y | All filers | No more than 20 alpha-numeric characters (with no special characters) | Report the investment option identifier for all investment options the lifecycle portfolio mix design – dynamic mix is invested into. The investment option identifier must correspond to an investment option identifier reported in Reporting Form SRF 605.0 RSE Structure in SRS 605.0. |

3 | Percentage Allocation To Investment Pool | | All filers | Percentage to 2 decimal places | For each investment option utilised as part of the underlying investment mix for the lifecycle investment option, report the percentage of allocation to that investment option. |