Contents

1 Name

2 Commencement

3 Authority

4 Schedules

Schedule 1—Travel amendments

Defence Determination 2016/19, Conditions of service

Schedule 2—Domestic miscellaneous amendments

Defence Determination 2016/19, Conditions of service

Schedule 3—Overseas miscellaneous amendments

Defence Determination 2016/19, Conditions of service

Schedule 4—Repayment of rental advance amendments

Defence Determination 2016/19, Conditions of service

Schedule 5—Overseas rates amendments

Defence Determination 2016/19, Conditions of service

Schedule 6—Disturbance allowance amendments

Defence Determination 2016/19, Conditions of service

Schedule 7—Transitional provisions

Schedule 8—Savings provisions

1 Name

This instrument is the Defence Determination, Conditions of service Amendment Determination 2024 (No. 6).

2 Commencement

1. Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. Sections 1 to 4. | The day the instrument is registered | |

2. Schedules 1, 2 and 3 | 6 June 2024 | |

4. Schedules 4 and 5 | 4 July 2024 | |

3. Schedule 6 | 1 August 2024 | |

5. Schedule 7 | 6 June 2024 | |

6. Schedule 8 | 4 July 2024 | |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

2. Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under section 58B of the Defence Act 1903.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Travel amendments

Defence Determination 2016/19, Conditions of service

1 | Before section 9.0.1 |

| Insert: |

Division 1A: General provisions

2 | Section 9.0.1 |

| Repeal the section. |

3 | Section 9.0.3 |

| Repeal the section, substitute: |

| In this Chapter, the following definitions apply. |

| Air travel for travel on duty means air travel booked under the Department of Defence travel contract. |

| Allowable travel time has the meaning given by section 9.1A.2. |

| Contracted service provider refers to CTM PTY LTD, the service provider contracted to provide the Commonwealth with accommodation services for its employees and members of the ADF. |

| Most economical means of travel refers to the means of travel the Commonwealth considers most efficient, practical or appropriate in terms of a range of factors which include, but are not limited to, the following. |

| a. | Cost to the Commonwealth. |

| b. | Availability of transport. |

| c. | Time taken to travel. |

| Normal departmental liability means the amount the Commonwealth would pay for a journey made by a member, their resident family and recognised other persons authorised to travel to a place at Commonwealth expense, which includes the following costs. |

| a. | The cost of travel to the place by the most economical means. |

| b. | The cost of travel to and from the relevant airports, railway stations and coach terminals. |

| c. | Any taxes or levies on the travel. |

| Note: It does not include goods and services tax (GST) on the fare. |

| Travel document means a ticket (including a Miscellaneous Charges Order, travel warrant, movement requisition or other document) that gives a person who holds it travel at Commonwealth expense. |

9.1A.2 Allowable travel time

| Allowable travel time is worked out on the basis of the actual distance in kilometres for the shortest practicable route, divided by one of the following. |

| a. | If a member is towing a towable item — 360. |

| b. | If a member, resident family or recognised other person has a special need — the number of kilometres the CDF believes the person with special needs can travel in a day. |

| c. | In all other cases — 480. |

4 | Subsection 9.2.26.2 |

| Omit “section 9.0.3”, substitute “section 9.1A.1”. |

5 | Subsection 9.4.7.1 |

| Repeal the subsection, substitute: |

1. | Recreation leave travel is the return travel for a member from the location they are performing duty to one of the following. |

| a. | If the member’s nominated family is in Australia — the location where their nominated family live. |

| b. | If the member has no nominated family — one of the following. |

| | i. | The nearest capital city. |

| | ii. | If the member is performing duty in a capital city — the next nearest capital city. |

6 | Section 9.5.18 |

| Repeal the section, substitute: |

1. | A member must not use their travel card to pay for any of the following. |

| a. | If a meal has been provided to the member at no cost during the meal period — a meal. Note 1: An in-flight meal provided by a commercial carrier is not considered a meal for the purposes of this paragraph. Note 2: A member who resides privately with family or friends is still eligible to use their travel card for meals. |

| b. | If any of the following apply — accommodation. |

| | i. | Accommodation is provided to the member at no cost, not including accommodation supplied under section 9.5.16. |

| | ii. | The member's travel continues overnight without a break for accommodation. |

| | iii. | The member is ranked Major or lower, and living-in accommodation is available to them. |

| Note: If living-in accommodation is available but the member chooses to stay off‑base, they are not eligible to use their travel card for meals or accommodation. |

2. | Despite subparagraph 1.b.iii, a member may use their travel card to pay for accommodation if the CDF considers that occupying living‑in accommodation would make the member less efficient in performing their duties. |

3. | For the purposes of accommodation, a member is not eligible for any of the following accommodation costs. |

| a. | The difference between what the member actually paid and the maximum allowable amount if they stay in accommodation that is commercially provided. |

| b. | Any amount if they stay in accommodation that is provided on a non-commercial basis. |

4. | For the purposes of meals, if a member visits more than one location in a day, the location for working out the amount they are eligible for is one of the following. |

| a. | For a meal that is on the last day of their journey — the location they are at, at the beginning of the day. |

| b. | For any other meal — the location they are at, at the end of the day. |

7 | Section 9.5.22 |

| Repeal the section, substitute: |

9.5.22 Travel for more than 21 days

1. | This section applies to a member who meets all of the following. |

| a. | They live continuously in a location for 21 days or more in one of the following circumstances. |

| | i. | During a travel period. Note: The member can occupy living-in accommodation or stay off-base in another type of accommodation, during the travel period. |

| | ii. | They normally live out and are required to occupy living-in accommodation in their housing benefit location. |

| b. | They continue to live at the location for a further travel period after the 21st day. |

2. | The member is eligible for all of the following. |

| a. | Accommodation on each night in the travel period at the rate set out in Annex 9.5.B Part 1. |

| b. | Meals for each meal period at the rate set out in Annex 9.5.B Part 2. |

| c. | Incidentals for the travel period at the rate of $11.50 per day. Note: This item also applies to a member who lives out, if they are required to occupy living‑in accommodation beyond 21 days during a course of training at their primary service location. |

3. | For the purpose of subsection 1, none of the following are counted as days in the travel period. |

| a. | A day on which the member is eligible for field allowance. |

| b. | A day on which the member is required to isolate. |

| Note: A day a member is required to isolate may be included in the travel period under section 9.5.9, but not included for this purpose. |

4. | If the member leaves the location to return to their housing benefit location on one of the following days, their eligibility under this section ends at one of the following times. |

| a. | The 22nd day – midnight on that day. |

| b. | Any later day – midday on the day they leave the location. |

5. | If a member is required to isolate on return to their housing benefit location in a place that is not their residence, they are eligible for the following benefits for their isolation period. |

| a. | Accommodation under section 9.5.16. |

| b. | Meals and incidentals under section 9.5.17. |

8 | Section 9.5.36 |

| Repeal the section, substitute: |

9.5.36 Limits on travelling allowance for meals and accommodation

1. | A member is not eligible for travelling allowance when any of the following conditions are met. |

| a. | For the purpose of meals — if any of the following apply. |

| | i. | A meal is provided to the member at no cost. Note 1: An in-flight meal provided by a commercial carrier is not considered a meal for the purposes of this paragraph. Note 2: A member who resides privately with family or friends is still eligible for meal allowance. |

| | ii. | The meal period begins before the member's journey. |

| | iii. | The meal period begins after the member's journey. |

| b. | For the purpose of accommodation — if any of the following apply. |

| | i. | Accommodation is provided to the member at no cost, not including accommodation supplied under section 9.5.16. |

| | ii. | The member's travel continues overnight without a break for accommodation. |

| | iii. | The member is ranked Major or lower, and living-in accommodation is available to them. |

| Note: If living-in accommodation is available but the member chooses to stay off‑base, they are not eligible for travelling allowance for meals or accommodation. |

2. | Despite subparagraph 1.b.iii, a member may receive travelling allowance for accommodation if the CDF considers that occupying living–in accommodation would make the member less efficient in performing their duties. |

3. | For the purposes of meals, if a member visits more than one location in a day, the location for working out the amount they are eligible for is one of the following. |

| a. | For a meal that is on the last day of their journey — the location they are at, at the beginning of the day. |

| b. | For any other meal — the location they are at, at the end of the day. |

9 | Section 9.5.41 |

| Repeal the section, substitute: |

9.5.41 Travel for more than 21 days

1. | This section applies to a member who meets all of the following. |

| a. | They live continuously in a location for 21 days during a travel period. Note: To avoid doubt, this applies to a member whether they are occupying living-in accommodation or living out. |

| b. | They continue to live at the location for a further travel period after the 21st day. |

2. | For the purpose of calculating the number of days in the member’s travel period, all of the following apply. |

| a. | A day on which the member meets any of the following is not counted towards the travel period. |

| | i. | They are required to isolate in a place that is not their residence. Note: A day a member is required to isolate may be included in the travel period under section 9.5.9, but not included for this purpose. |

| | ii. | They are eligible for field allowance. |

| b. | If paragraph a applies, section 9.5.35 does not apply to the member after midnight on the 21st day, regardless of rank. |

3. | The member is eligible for travelling allowance at the following rate for the travel period. |

| a. | For accommodation on each night in the travel period — the applicable rate in Annex 9.5.B Part 1. |

| b. | For meals for each meal period — the applicable rate in Annex 9.5.B Part 2. |

| c. | For incidentals for the travel period — $11.50 per day. Note: This also applies to a member who lives out, if they are required to occupy living-in accommodation beyond 21 days during a course of training, in their housing benefit location. |

4. | If the member leaves the location to return to their housing benefit location their eligibility under this section ends at one of the following times. |

| a. | If they leave the location on the 22nd day — midnight on that day. |

| b. | If they leave the location on any later day — midday on the day they leave the location. |

10 | Annex 9.5.B Part 2 |

| Omit “weekly”, substitute “daily”. |

11 | Annex 9.5.B Part 2 (table column C) |

| Repeal the column, substitute: |

12 | Section 9.6.28 |

| Repeal the section, substitute: |

9.6.28 Limit to benefit

1. | Travel benefits for a member who has been authorised to travel by private vehicle are limited to the lesser of the following. |

| a. | The sum of the following. |

| | i. | The vehicle allowance the member would get for the journey. |

| | ii. | Travel costs under Part 5 for the actual period of the journey or for the allowable travel time, whichever is the lesser. |

| b. | The sum of the following amounts had the member travelled by the most economical means. |

| | i. | The costs of the fares of the member and any resident family, recognised other persons or other passengers who would otherwise travel at public expense. |

| | ii. | Subject to subsection 2, travel costs. |

| | iii. | Any other charge associated with the journey. |

2. | For the purpose of subparagraph 1.b.ii, travel costs means one of the following. |

| a. | For a member who uses accommodation supplied through the Commonwealth's contracted service provider — the amount provided under Part 5 Division 2. Note: Contracted service provider is defined in section 9.1A.1. |

| a. | For any other member — the amount provided under Annex 9.5.A. |

Schedule 2—Domestic miscellaneous amendments

Defence Determination 2016/19, Conditions of service

1 | Before section 1.3.20 |

| Insert: |

1.3.19A Member this Subdivision does not apply to

| This subdivision does not apply to a member who meets all of the following. |

| a. | The member’s partner is also a member. |

| b. | The member and their partner occupy living-in accommodation at their housing benefit location. |

2 | Paragraph 1.3.20.1.c |

| Repeal the paragraph, substitute: |

| c. | Subject to subsection 1A, the person meets the criteria for a type of unaccompanied resident family in Subdivision 4: Types of unaccompanied resident family. |

1A. | If a person meets all of the following, Subdivision 5: Dual serving members applies and provides who is accompanied resident family and who is unaccompanied resident family. |

| a. | They are part of a dual serving couple. |

| b. | They live in a different housing benefit location to their partner. |

3 | Paragraph 1.3.21.b |

| Repeal the paragraph. |

4 | Paragraph 5.3.11.a |

| Repeal the paragraph, substitute: |

| a. | If a member must travel to an appointment relating to a medical or dental condition for which treatment is provided under section 49 of the Defence Regulation, they may be eligible for their travel costs. Note: The costs are payable as if the trip was duty travel and any means of travel recommended by a health professional were the most economical means of travel. |

5 | Section 5.4.42 (paragraph b. of the definition of annual allowance) |

| Repeal the paragraph. |

6 | Section 6.5.35 |

| Repeal the section, substitute: |

6.5.35 Removal deferred until after posting date

1. | This section applies to a member who has deferred their removal until after the date of posting. |

2. | A member is eligible for a removal if they have 6 months or more to serve on the posting at the time of removal. |

3. | Despite subsection 2, a member who meets all of the following is eligible for a removal. |

| a. | They have less than 6 months to serve on the posting at the time of removal. |

| b. | They are participating in the ADF gap year program. |

| c. | Section 6.5.28 applies. |

7 | Subsection 7.3.14.2 |

| Repeal the subsection, substitute: |

2. | If an eligible person shares ownership with other persons, the HPAS payment is made according to the share of ownership with those other persons. |

3. | For the purpose of subsection 2, the member and their resident family have one share of the home. |

8 | Subsection 7.3.15.1A |

| Repeal the subsection, substitute: |

1A. | Despite subsection 1, the following apply. |

| a. | If service reasons prevent an eligible person from occupying the home within the relevant period, the member does not have to repay the amount. |

| b. | If service reasons prevent the purchase from going ahead, the CDF may decide that the member should be reimbursed their reasonable and unavoidable costs. |

9 | After paragraph 7.3.30.2.b |

| Insert: |

| c. | The member or their resident family lived in the home at the housing benefit location. |

10 | Subsection 7.3.31.3 |

| Omit “or recognised other person”. |

11 | Subsection 7.4.23.1 |

| Repeal the subsection, substitute: |

1. | This section applies to a member who meets all of the following. |

| a. | They occupy living-in accommodation. |

| b. | Subject to subsection 1A, they are deployed for 6 months or longer. |

1A. | This section does not apply to a member who meets all of the following. |

| a. | The member is deployed for a period of less than 6 months. |

| b. | While deployed, the member's deployment is extended. |

| c. | The total period of the member's deployment is 6 months or longer. |

12 | Subsection 7.4.42.3 (exception) |

| Repeal the exception, substitute: |

| Note: The conditions that apply to a licence to live on a ship are those that relate to normal shipboard discipline. |

13 | After subsection 7.6.21.2 |

| Insert: |

3. | Despite subsection 2, if the member is on a flexible service determination (weeks per month pattern of service), the member's rate of contribution is one of the following. |

| a. | If the member’s pattern of service over each 4-week period is 1 week working, 3 weeks’ not working — 150% of the rate that applies to them under Annex 7.4.B. |

| b. | If the member’s pattern of service over each 4-week period is one of the following — 100% of the rate that applies to them under Annex 7.4.B. |

| | i. | 2 weeks’ working, 2 weeks’ not working. |

| | ii. | 3 weeks’ working, 1 week not working. |

14 | Subsection 7.6.33.5 |

| Repeal the subsection, substitute: |

5. | If a member rejects a reasonable offer for reasons not in section 7.6.34, the following apply. |

| a. | If the CDF does not consider the reasons to be sufficient grounds to reject the Service residence, and Defence Housing Australia cannot offer the Service residence to another member within 1 month — the member's name will be removed from the Service residence waiting list. |

| b. | The member will not be eligible for any of the following for the remainder of their posting. |

| | i. | Temporary accommodation allowance. |

| | ii. | Rent allowance. |

| | iii. | Storage. |

15 | Section 7.7.10 |

| Repeal the section, substitute: |

7.7.10 Advances and repayments

1. | A member who accepts an offer for accommodation under this Part is not eligible to be paid the benefits provided under Part 8 Division 6. |

2. | Despite subsection 1, section 7.8.47 applies to a member who accepts an offer for accommodation under this Part. Note: Section 7.8.47 provides reimbursement of rent payable for a home before the home is occupied. |

16 | Subsection 8.7.9.3 |

| Omit “subsection 9.5.41.2 table item 3”, substitute “paragraph 9.5.41.3.c”. |

17 | Paragraph 8.7A.8.2.a |

| Omit “subsection 9.5.41.2 table item 3”, substitute “paragraph 9.5.41.3.c”. |

18 | Amendments of listed provisions – repeals |

| Repeal the following: |

| a. | Paragraph 7.3.15.1.a (exception). |

| b. | Subsection 7.4.42.2. |

| c. | Subsection 7.6.21.2 (exception). |

| d. | Section 7.7.19.3 (exception). |

Schedule 3—Overseas miscellaneous amendments

Defence Determination 2016/19, Conditions of service

1 | Subsection 12.3.5.2 |

| Omit “The CDF may approve another person as a member’s dependants. The following conditions apply.”, substitute “The member may have another person approved as a member’s dependant if the CDF is satisfied it is reasonable, all of the following apply.”. |

2 | Paragraph 14.3.15.3.a |

| Omit “posting location”, substitute “housing benefit location”. |

3 | Subsection 14.3.16.2 |

| Omit “posting location”, substitute “housing benefit location”. |

4 | Subsection 15.2A.15.1 |

| Repeal the subsection, substitute: |

1. | In this section the following apply. |

| Minimum amount means the following. |

| a. | For an accompanied member — 28% of the salary for a Major on pay grade 1 and increment O4-0 in Schedule B.3 Part 1 of DFRT Determination No. 2 of 2017, Salaries. |

| b. | For an unaccompanied member — 18% of the salary for a Major on pay grade 1 and increment O4-0 in Schedule B.3 Part 1 of DFRT Determination No. 2 of 2017, Salaries. |

| Maximum amount means the following. |

| a. | For an accompanied member — 28% of the salary for a Colonel on paygrade 10 and increment O6-1 in Schedule B.3 Part 1 of DFRT Determination No. 2 of 2017, Salaries. |

| b. | For an unaccompanied member — 18% of the salary for a Colonel on paygrade 10 and increment O6-1 in Schedule B.3 Part 1 of DFRT Determination No. 2 of 2017, Salaries. |

5 | Subsection 15.3.8.2 |

| Repeal the subsection, substitute: |

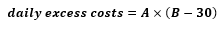

2. | The member may be reimbursed for extra commuting costs, worked out using the following formula on a daily basis in the local currency, for every kilometre over 30 km. |

|

|

| Where: |

| A | is the applicable rate of vehicle allowance payable under section 15.3.21.4 on 1 March in that year. |

| B | is the daily return distance the member travels by private vehicle, in kilometres. |

6 | Section 15.3.9 |

| Repeal the section, substitute: |

| | | |

15.3.9 Use of public transport and private vehicle combined

1. | A member is eligible to be reimbursed excess commuting costs if they travel to their normal place of duty using both public transport and their private vehicle. |

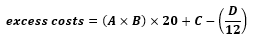

2. | The amount the member is eligible to be reimbursed each month under subsection 1 is calculated using the following formula. |

|

|

| Where: |

| A | is the applicable rate of vehicle allowance payable under section 15.3.21.4 on 1 March in that year. |

| B | is the daily return distance the member travels by private vehicle, in kilometres. |

| C | is the actual cost of the public transport used by the member. |

| D | is the excess fares, as calculated at subsection 15.3.7.2. |

7 | Paragraph 15.5.10.1.a | |

| Omit “recognised dependant with special needs.”, substitute “person with special needs recognised under 1.3.6.”. | |

8 | Subsection 15.8.2.2 (table item 9, column B) | | |

| Repeal the cell, substitute: | | |

| | | | |

Virgin Active Club, Turin |

Schedule 4—Repayment of rental advance amendments

Defence Determination 2016/19, Conditions of service

1 | Subparagraph 7.8.46.1.b.i |

| Omit “26 fortnightly instalments”, substitute “25 fortnightly instalments”. |

2 | Subparagraph 7.8.46.1.b.ii |

| Omit “26 fortnightly instalments”, substitute “25 fortnightly instalments”. |

Schedule 5—Overseas rates amendments

Defence Determination 2016/19, Conditions of service

1 | Subsection 15.2A.20.3 (table, column B) |

| Repeal the column, substitute: |

2 | Subsection 16.2A.5.1 (table, columns B and C) |

| Repeal the columns, substitute: |

| |

Nil | Nil |

Nil | Nil |

18,537 | 27,806 |

24,716 | 37,074 |

30,895 | 46,342 |

37,074 | 55,611 |

Schedule 6—Disturbance allowance amendments

Defence Determination 2016/19, Conditions of service

1 | Section 6.1.6 |

| Repeal the section, substitute: |

6.1.6 Amount of allowance

1. | Disturbance allowance payable for a member who meets any of the following for a removal under column A and the number of the current removal in column B is the amount specified in column C of the same item in the following table. |

| a. | The member has accompanied resident family. |

| b. | The member has recognised other persons and no resident family. |

| Note: The number of the current removals is defined in section 6.1.7. |

| | | |

1. | Removal to a new location. | 1st or 2nd removal | 1,474 |

3rd or 4th removal | 1,965 |

5th or 6th removal | 2,457 |

7th or subsequent removal. | 2,948 |

2. | Removal within the same location. | Each removal | 737 |

3. | Removal from overseas. | 1st or 2nd removal | 295 |

3rd or 4th removal | 590 |

5th or subsequent removal | 884 |

2. | Disturbance allowance payable for a member who meets any of the following for a removal under column A and the number of the current removal in column B is the amount specified in column C of the same item in the following table. |

| a. | The member has unaccompanied resident family. |

| b. | The member has no resident family or recognised other persons. |

| Note: The number of the current removal is defined in section 6.1.7. |

| | | |

1. | Removal to a new location from living out to living out. | 1st or 2nd removal | 737 |

3rd or 4th removal | 983 |

5th or 6th removal | 1,228 |

7th or subsequent removal | 1,474 |

2. | Removal to a new location from living out to living-in accommodation, or from living-in accommodation to living out. | 1st or 2nd removal | 369 |

3rd or 4th removal | 491 |

5th or 6th removal | 615 |

7th or subsequent removal | 737 |

3. | Removal to a new location from living-in accommodation to living-in accommodation. | 1st or 2nd removal | 184 |

3rd or 4th removal | 246 |

5th or 6th removal | 307 |

7th or subsequent removal | 369 |

4. | Removal within the same location and any of the following apply. a. From living-in accommodation to living-in accommodation, between different establishments, units or bases. b. From living out to living-in accommodation, or from living-in accommodation in to living out. | Each removal | 184 |

5. | Removal within the same location from living out to living out. | Each removal | 369 |

6. | Removal from overseas. | 1st or 2nd removal | 147 |

3rd or 4th removal | 295 |

5th or subsequent removal | 442 |

7. | Removal from storage to living-in accommodation, after deployment of more than 6 months. | Each removal | 184 |

8. | Removal from storage to living-out accommodation, after deployment of more than 6 months. | Each removal | 369 |

3. | For the purpose of this section, a removal to or from living out is a single removal, even if temporary accommodation is used during the removal. |

2 | Subsection 6.1.8.1 |

| Omit “section 6.1.6 table item 2”, substitute “subsection 6.1.6.1 table item 2”. |

3 | Section 6.1.9 |

| Omit “section 6.1.6 table item 2”, substitute “subsection 6.1.6.1 table item 2”. |

4 | Subsection 6.1.12.1 |

| Omit “$266”, substitute “$280”. |

Schedule 7—Transitional provisions

| In this Schedule, Defence Determination means Defence Determination 2016/19, Conditions of service, as in force from time to time. |

2 Club membership

1. | This clause applies to a member who was posted to Italy between 18 January 2024 and the commencement of item 9 of Schedule 3 of this Determination. |

2. | The member is eligible for the cost of the club membership they would have been eligible for under sections 15.8.4 and 15.8.5 of the Defence Determination as though the changes made by item 2 of Schedule 4 of this Determination had been in force between 18 January 2024 and the commencement of item 9 of Schedule 3 of this Determination. |

3. | The benefit under subclause 2 is reduced by the amount the member received for the cost of a club membership under section 15.8.4 or 15.8.5 of the Defence Determination between 18 January 2024 and the commencement of item 9 of Schedule 3 of this Determination which has not been repaid. |

Schedule 8—Savings provisions

1 Definition

| In this Schedule, Defence Determination means Defence Determination 2016/19, Conditions of service, as in force on 3 July 2024. |

2 Repayment of rental advance

1. | This clause applies to a member who meets any of the following before the commencement of this Determination and has not completed repayment under section 7.8.46 of the Defence Determination. |

| a. | The member has received a payment under subsection 7.8.41.3. |

| b. | The member has applied for a payment under subsection 7.8.41.3. |

2. | Section 7.8.46 of the Defence Determination remains in force until the day the member completes their repayment of the advance as if the change made by Schedule 4 of this Determination had not been made. |