Reporting Form HRF 601.1 series

Statistical Data by State

Explanatory notes

The HRF 601.1 series includes 9 iterations of Form HRF 601.1 Statistical Data - by State (HRF 601.1) that collect statistical data on a State or Territory basis. The HRF 601.1 series must be completed for each health benefits fund of the private health insurer.

Disclaimer

In the case of any contradiction between these reporting instructions and the relevant legislation, the legislation should be deemed to be the correct interpretation.

Definitions

Definitions for terms used in these reporting instructions can be found in the Attachment to these reporting instructions.

‘The Act’ refers the Private Health Insurance (Prudential Supervision) Act 2015.

Units of measurement

All financial values, quantities and percentages must be reported to no more than two decimal places.

Financial values must be reported in Australian dollars.

Instructions for specific items

The header for HRF 601.1 includes the name of the private health insurer, their Australian business number and the quarter for which the HRF 601.1 series is being submitted.

Note that APRA processing requires the entire file with all states to be submitted. If there are no persons resident in a state, a nil return for that state is required.

Templates are issued with a default setting of zero (0) in all fields, this is a nil return. Funds must fill in all (white) fields before submitting to APRA. Some fields are automatically calculated, these fields are in grey.

The reporting forms are preset for each Risk Equalisation Jurisdiction (state). Policies and insured persons are reported in the state of their principal place of residence as at the end of the quarter. State amounts as zero if there are no such persons in the jurisdiction. If a benefit is paid[4] to or on behalf of an insured person during a quarter and the person changes his or her principal place of residence to another risk equalisation jurisdiction during the quarter, the

person’s principal place of residence is the place at which the person resides at the end of the quarter.

In the case of a policy group with two or more policy holders whose addresses are not in the same risk equalisation jurisdiction the health insurer has 20 days, from the date of notification, to make a determination as to which state/s to report the policy holders and persons. Otherwise the policy holders and dependants should be reported in the state which corresponds to the address of the first person named in the policy records of the health insurer.

Dependants should be reported in the same state as the policy holder. In the case of a dependant residing in a different state to the policy holder/s they should be reported in the state of the first named policy holder unless the health insurer has made a different determination as described in the preceding paragraph.

Insured adults are referred to in the Act as policy holders. Health insurers will be required to keep details of each policy holder.

Part 1 Polices and Insured Persons

The data in this part is to be reported as at the end of the quarter being reported.

- In sections 1 to 7, defined below, report the number of policies and the number of insured persons that are covered by the type of product. These are entered by type of cover and type of policy. It is not expected that health insurers will have to identify policy holders with more than one type of policy. New joins should be reported when the policy commences. This is the date from which the health insurer provides cover, which is not necessarily the same as when the policy becomes financial or when it is entered into the health insurer’s system.

(a) Type of cover includes single, family, single parent, couple, 2+ persons no adults, 3+ adults. These should be reported on the HRF 601.1 according to the Private Health Insurance (Complying Product) Rules 2015 (the Rules):

Description of insured groups from the Rules | Mapped to HRF 601.1 |

(a) for policies other than a non-student policy or a policy referred to in paragraph (c), the insured groups are: |

(i) only one person; | Single |

(ii) 2 adults (and no-one else); | Couple |

(iii) 2 or more people, none of whom is an adult; | 2+ persons no adults |

(iv) 2 or more people, only one of whom is an adult; | Single parent |

(v) 3 or more people, only 2 of whom are adults; | Family |

(vi) 3 or more people, at least 3 of whom are adults; | 3+ adults |

(b) for policies that are a non-student policy (unless the policy is a non-student policy referred to in paragraph (c)), the insured groups are: |

(i) 2 or more people, only one of whom is an adult; | Single parent |

(ii) 3 or more people, only 2 of whom are adults; | Family |

(c) for non-student policies which have as conditions of the policy that the dependent child non-student is not covered for general treatment, other than hospital-substitute treatment, and must have his or her own policy with the same insurer covering general treatment (other than hospital-substitute treatment), the insured groups are: |

(i) 2 or more people, only one of whom is an adult; | Single parent |

(ii) 3 or more people, only 2 of whom are adults. | Family |

(b) Type of policy includes excess and co-payments, no excess and no co-payments, exclusionary and non-exclusionary.

(c) In sections 4 to 7 membership is reported under type of cover only.

2. Sections

Section 1. Total Hospital Treatment (includes Hospital Treatment Only and Hospital Treatment and General Treatment Combined)

Section 2. Hospital Treatment Only (do not include Hospital-linked ambulance cover)

Section 3. Hospital Treatment and General Treatment Combined

Section 4. General Treatment Ambulance Only

Section 5. Total General Treatment Only (includes General Treatment Ambulance Only)

Section 6. General Treatment excluding Hospital-Substitute, CDMP and Hospital-linked Ambulance Treatment

Section 7. Total General Treatment (includes Total General Treatment Only and Hospital Treatment and General Treatment Combined)

3. General guidance

(a) Section 1 is the sum of Section 2 and Section 3.

(b) Hospital-substitute treatment is classed as general treatment but it must be part of a hospital treatment policy. Hospital-substitute treatment is reported under Section 3.

(c) Products that offer CDMP do not require a hospital treatment policy. A policy covering CDMP and no hospital treatment is reported under Section 5.

(d) When the status of dependants (e.g. a student dependant) is temporarily unknown some restricted access funds do not take these dependants off the parent’s policy, although they do not provide cover for them. Due to the restricted nature of the fund, the person may not be able to re-join the fund on a single policy under the rules of the fund if they were taken off the policy. In this case it would not be appropriate to change the policy from Family to 3+Adults.

(e) General Treatment Ambulance Only is a subset of Total General Treatment Only. Total General Treatment is the sum of Hospital Treatment and General Treatment Combined and Total General Treatment Only.

(f) General Treatment excluding Hospital-Substitute, CDMP and Hospital-linked Ambulance Treatment is a subset of Total General Treatment. Total persons in this section should equal the number of persons reported in Part 6. Hospital-linked Ambulance Treatment is defined as ambulance cover provided together with hospital treatment cover without any other general treatment (other than Hospital Substitute or CDMP). The policies and persons in this section are the total policies and persons with ancillary/extras cover and includes Ambulance Only. The policies may cover other general treatment such as CDMP and Hospital-Substitute and may cover hospital treatment but must also cover ancillary/extras.

4. Changes during the quarter

This section reports changes and movement in the membership over the quarter. There should be no negative numbers reported under this section.

(a) For start of quarter policies and insured persons report the number of policies and the number of insured persons that are covered by the type of product, in each of the treatment categories: “Hospital Treatment Only”, “Hospital Treatment and General Treatment” and “General Treatment Only”. The start of quarter should be the same as that reported in the previous quarter for end of quarter policies and persons.

(b) New polices does not include policies being transferred from another fund. In the case of persons transferring from another fund to an existing policy they are reported as new persons only, not new policies. New policies/persons includes reinstated policies and persons, where those policies and person were counted as discontinued in a previous quarter due to their suspension (note that if a policy/person is both suspended and reinstated within the quarter to which this return relates they should not be counted as discontinued or reinstated). Where there are births or deaths within an existing policy this will constitute new persons or discontinued persons but not new or discontinued policies.

(c) When a policy is Transferring to another state and at the same time transferring to another policy. It will be double counted if entered under both headings. It is to be entered:

i) under the policy they are leaving report under Transferring to another state; and

ii) under the policy they are entering report under Transferring from another policy.

(d) Transfers to and from another policy refers to transfers between the treatment types of “Hospital Treatment Only”, “Hospital Treatment and General Treatment” and “General Treatment Only”. Note that a change in the type of cover (e.g. single to couple) does not constitute a change in treatment policy for the purposes of this section.

(e) With the introduction of Lifetime Health Cover and the need for tracking the transferring members to maintain their certified age, health funds are required to report whether a member is joining from another health fund. This should enable funds to split out new membership into new members in the industry as opposed to new members from other funds.

(f) Discontinued represents the balancing item for the aggregate fund policies/persons from one quarter to the next. Included in this category is: deaths (decrease in persons, not necessarily policies) and suspended policies/persons, where they are not included in the count for Risk Equalisation purposes.

(g) End of quarter policies/persons should equal corresponding totals as reported in Part 1 of the return.

Part 2 Total Benefits Paid for Hospital Treatment and General Treatment

The data in this part is to be reported as cumulative totals over the quarter being reported.

5. Report the number of episodes, days and total benefits paid in each hospital category.

6. Report number of and total benefits paid for medical services, medical devices or human tissue products items and CDMP.

7. Report total ineligible hospital benefits. The category Ineligible Benefits is for hospital benefits that are not eligible for Risk Equalisation. They are not reported in any other part of the form.

8. General guidance

(a) Episodes are reported in each category (place where the treatment was provided) in the quarter in which the treatment ceased, this excludes incomplete episodes, see (d). Episodes are to be determined as:

i) hospital treatment provided at a hospital, the period between the insured person's admission to the hospital and discharge from that hospital, including leave periods, as one episode

For:

ii) hospital-substitute treatment, and

iii) hospital treatment that is provided, or arranged, with the direct involvement of a hospital, the continuous period between the commencement and cessation of the treatment as one episode.

(b) Days must reflect the total days related to each episode, including days when no fund benefit is paid.

(c) Leave days from a hospital stay are excluded from reporting days.

(d) Where an episode has not been completed in a quarter (an incomplete episode) but a benefit has been paid in relation to the treatment because of an interim billing arrangement the following applies:

i) the episode should not be reported in the current quarter, the episode is counted as one episode in the quarter in which it is completed.

ii) days and benefits are reported in the quarter they are paid.

It is recognised that this will result in some mismatching of data within quarters.

(e) Days for Day hospital, day only public hospitals, day only private hospitals and day only for hospital-substitute should equal Day only episodes in the respective categories.

(f) Medical benefits should equal the sum of medical benefits reported in Parts 3 and 4, and should equal the total fund benefits reported in Part 11 - Total Hospital Treatment Medical Service Statistics.

(g) Medical devices or human tissue products benefits should equal the sum of medical devices or human tissue products benefits reported in Parts 3 and 4.

(h) Hospital benefits, hospital-substitute benefits and Nursing Home Type Patients benefits reported in this part exclude Medical and medical devices or human tissue products Benefits.

9. High Cost Claimants Pool (HCCP)

Report HCCP benefits in the state in which the person is resident at the end of the quarter, and associated HCCP data in the same state.

(a) Report the number of insured persons with a HCCP claim in the current quarter.

(b) Report the total (gross) benefit paid for HCCP claimants for the current and the preceding three quarters for the insured persons with a HCCP claim in the current quarter.

(c) Report the net benefit paid for HCCP claimants for the current and the preceding three quarters after Age Based Pooling (ABP) has been applied for the insured persons with a HCCP claim in the current quarter.

(d) Report the net benefit paid above the threshold for HCCP claimants for the current and the preceding three quarters after ABP has been applied. This amount will include any amounts already included in the HCCP.

(e) Report the total benefit to be included in HCCP for the current quarter after ABP has been applied, which is the amount from (d) less any amounts already reported in the HRF 601.1 for inclusion in the HCCP.

(f) Threshold in relation to the high cost claimant’s pool means the designated threshold. The threshold is $50,000.

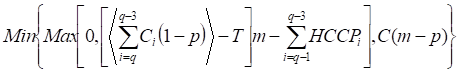

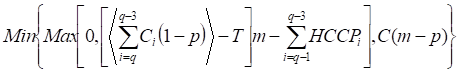

The amount to be notionally allocated to the HCCP is to be calculated in accordance with the formula  , where:

, where:

(a) m is 82 per cent

(b) R is the total gross benefit for the current and the preceding three quarters less the amount notionally allocated to the ABP in the current and preceding three quarters

(c) T is the designated threshold

(d) H is the sum of the amounts notionally allocated to the HCCP in the preceding three quarters.

Subject to a maximum of 82 per cent of gross benefits being included in Risk Equalisation when summing the ABP and HCCP components.

(Part 2, Private Health Insurance (Risk Equalisation Policy) Rules 2015)

It is not intended that the HCCP calculation will deduct amounts or result in negative amounts, for example as a result of an adjustment, through literal application of the above formula in cases where no benefits have been previously allocated to the HCCP for the claimant.

The amount to be notionally allocated to the HCCP is calculated as:

where:

C is gross benefits in the quarter for the claimant

m is 82 per cent

p is percent of gross benefits to be allocated to ABP in the quarter, where p is dependent on the age of the claimant

q is current quarter

T is HCCP Threshold, equal to $50,000

is the residual after age based pooling (ABP)

is the residual after age based pooling (ABP)

C (m-p) is the maximum allowable proportion of gross benefits to be allocated to the HCCP after ABP.

The above formula sums up the residual benefits after ABP for the current and preceding three quarters, takes out the threshold ($50,000), multiplies the result by 82 per cent and from this amount subtracts the sum of benefits that were already included in the HCCP in the preceding three quarters. If this calculation is less than zero (could be as a result of reversal) the formula will return zero and if it is not zero will return the calculated benefit. Further, this calculated benefit undergoes another test to ensure that no more than 82 per cent of the gross benefits are included in Risk Equalisation. The amount to be notionally allocated to the HCCP is taken to be the minimum of the previously calculated benefit or the sum of maximum allowable proportion of gross benefits to be allocated in the HCCP after ABP for the current and the preceding three quarters.

Circular 08/04 of 25 January 2008 provides detailed information to assist health insurers complete the high cost claimants section of the HRF 601.1, with a spreadsheet example attached to the circular.

Parts 3 to 6 Collections by Type of Product and Age Category

The data in these parts is to be reported by age and gender:

- for insured persons in the age cohort that they are in at the end of the quarter; and

- for all other headings as cumulative totals over the quarter being reported.

10. Part 3 and 4 - “Other HT Benefits” and “Other H-ST Benefits” refers to benefits paid for hospital treatment or hospital-substitute treatment respectively and includes hospital charges such as accommodation and theatre fees. Do not include Medical, Medical devices or human tissue products and Ineligible Benefits under this heading.

11. Part 3 and 4 - Total benefits for Part 3 are the sum of “Other HT Benefits”, “Medical benefits”, and “Medical devices or human tissue products benefits”. Total benefits for Part 4 are the sum of “Other H-ST Benefits”, “Medical benefits”, and “Medical devices or human tissue products benefits”. Benefits should be reported:

(a) in the quarter in which they are paid;

(b) against the age of the person as at the date of treatment; and

(c) reversals in benefits should be reported against the age of the person as at the date of treatment if possible, but may be reported against the age of the person as at the time of the reversal.

12. Part 3, 4 and 6 - Services and Episodes are reported under the age at the date of treatment.

13. Part 3 and 4 - Requirements for reporting episodes, days and benefits are the same as reporting requirements in Part 2 (see Part 2 general guidance).

14. All parts - Where an insured person changes age cohort during an episode:

(a) the episode is to be reported in the age cohort that the episode was finalised;

(b) the days and benefits are to be reported for the age cohort in which they were incurred (e.g. a 20 day episode with an accommodation cost of $200 per day, where the insured person turned 50 on day four, is reported as: 1 episode under 50-54, 3 days under 45-49 and 17 days under 50-54, $600 under 45-49 and $3,400 under 50-54). Note that apportionment of benefits by the number of days in each age cohort only relates to the case where the treatment covers more than one age cohort, for example an invoice is received for accommodation for a period where the person had a number of days in one age group and a number of days in another age group. In the case where individual treatments are paid during a single episode where the person moves from one age group to another the benefits paid for those treatments should be reported against the age of the person as at the age of the treatment. (It is not the intent that health insurers should sum all benefits paid over an episode spanning two age groups and then apportion them over the age groups); and

(c) services are reported under the age at the date of treatment.

15. Part 3 and 4 - Medical benefits are reported as benefits paid under all policies only if a Medicare benefit is payable for the service.

16. Part 3 and 4 - Medical devices or human tissue products benefits are reported separately.

17. Part 3 and 4 - Report the fees charged equal to the total amount the patient would have to pay to the provider/s in the absence of any private health insurance, inclusive of hospital, medical and medical devices or human tissue products fees. The amount entered here must exclude the Medicare benefit. The difference between fees charged and benefits paid should be the amount that the patient has to pay (out of pocket payment). If the total fee is not known, e.g. where the provider discounts fee for early payment, enter the invoiced amount. Fees excluding Medicare benefit should be greater than or equal to the sum of other benefits, medical benefits and medical devices or human tissue products benefits.

18. Part 5 - Chronic Disease Management Program (see the section on Guidance for insurers for eligible CDMP benefits for risk equalisation in these reporting instructions for further information on CDMPs).

(a) Programs are reported in the quarter in which the program commenced, in the age category of the participant at the beginning of the program. Programs that run continuously for more than one year are classed as complete at the end of one calendar year after initial commencement. They are reported as a commencing program in the next quarter in which benefits are paid for the program.

i) The commencement date of the program, and thus the first quarter in which the program is deemed to have commenced, should be taken as the date on which benefits were first paid for under the program. The commencement date of the program may be hard to determine due to the different ways benefits can be paid, as well as delays in this information being relayed to health insurers. The first quarter that benefits are paid for a CDMP should be taken as the quarter in which the program commences.

ii) Benefits and fees charged are reported in the quarter in which they are paid in the age category of the participant. Where an insured person changes age cohort during a program, services are reported against the age of the participant at the date benefits were paid for the treatment.

iii) The number of programs does not refer to the particular programs offered by the health insurer, but refers to the number of persons participating in a program.

iv) If a person participates in more than one program, each program they participate in is counted separately.

v) Where an insured person changes age cohort during a program, services are reported against the age of the participant at the date of treatment.

(b) Eligible benefits are reported as the benefit paid for any of the following components of general and/or hospital treatment provided as part of a chronic disease management program:

i) the planning and coordination services described in the definition of chronic disease management program in the Private Health Insurance (Health Insurance Business) Rules 2018 and

ii) allied health services, as defined in the Private Health Insurance (Health Insurance Business) Rules 2018, which are provided as part of the chronic disease management program.

(c) Ineligible benefits report all benefits paid that are not eligible benefits.

(d) Fees excluding Medicare benefits: as health insurers are precluded from paying benefits for out-of-hospital services for which a Medicare benefit is payable (except in the circumstances outlined in General Treatment- services for which Medicare benefit is payable in the Private Health Insurance (Health Insurance Business) Rules 2018 this should be interpreted as “fees” only as no Medicare benefits are payable.

19. Part 6 - General Treatment excluding Hospital-Substitute, CDMP and Hospital-linked Ambulance Treatment

(a) Report the number of persons by age with General Treatment coverage excluding those with Hospital-Substitute, CDMP and Hospital-linked Ambulance Treatment. These persons are those with ancillary or extras cover.

(b) Report the number of General Treatment services, benefits and fees excluding Hospital-Substitute and CDMP.

(c) Services, benefits and fees reported in Part 6 should reconcile with services, benefits and fees reported in Part 9.

i) Services, benefits and fees should include those for ambulance even where these are on behalf of a person with Hospital-linked Ambulance Treatment and the person is not included in this part.

ii) Note that health management programs are reported in each quarter that benefits are paid for the program. The commencement date of the program, and thus the first quarter in which the program is deemed to have commenced, should be taken as the date on which benefits were first paid for under the program. Note that the program would be deemed to be ceased in the case where the participant leaves the program (for example, by choice or other reason such as death). Note that number of programs does not refer to the particular programs offered by the health insurer, but refers to the number of persons participating in a program. If a member participates in more than one program, each program they participate in is counted.

iii) Programs that are similar to, but do not satisfy the criteria for, CDMPs should be reported under Part 9 General Treatment.

Part 7 Total Hospital Treatment Policies by Type of Cover

The intention of Part 7 is to determine contributors by their level of excess.

The data in this part is to be reported as at the end of the quarter being reported.

20. Excess relates to the maximum excess that could be payable in any one year. (An excess may also be referred to as a Front End Deductible.) For consistency in reporting from health insurers it should be noted that the $500/$1,000 relates to the Australian Taxation cut-off, above which there is a Medicare Levy surcharge.

21. Full Cover records the coverage that has no restriction on benefits paid after 12 months of the policy commencing. This could be regarded as a 100 per cent product, with no exclusions. Coverage with a co-payment (and no other restriction) is not defined as having reduced cover. Where a fixed percentage is paid (e.g. 85 per cent benefit of contract fee) the 15 per cent payable by the policy holder should be regarded as a moiety or co-payment, and not reduced cover. Products that pay, for example, 100 per cent on contracted hospitals but a fixed benefit on non-contract hospitals should be regarded as full cover. A Full Cover product may have policies reported at all levels of co-payments.

22. Reduced cover refers to policies that restrict benefits paid after 12 months of membership, e.g. provides some form of default benefits for a period of time. This includes excesses, both day and amount. Products that have a fixed benefit regardless of the fees charged are included in the reduced benefits category. A product that pays fixed benefits will have a nil Excess/Co-payment unless there is an additional moiety attached to the product.

23. Some Lifetime Exclusions refers to polices that provide no benefits for certain occurrences for the life of the membership. (Note that an exclusionary product excludes certain treatments in all settings, for example hip replacement, but does not include the exclusion of services not covered by Medicare, for example cosmetic surgery).

24. Excess relate to the maximum Excess that could be payable in any one year.

25. In the category >$500/$1,000 the intention is for funds to report those policies that are subject to the Medicare Levy Surcharge due to the size of their Excess. Policies that are not subject to the Medicare Levy Surcharge should not be reported on this line.

Part 7 General Treatment claims processing for the state

(excluding Hospital-Substitute Treatment and CDMP)

26. General Treatment claims processing (excluding Hospital-Substitute Treatment and CDMP) - Report the percentage of General Treatment claims processed within five working days. General Treatment claims processing cannot be greater than 100 per cent.

Part 7 National retention index – Hospital Treatment policy holders

27. Retention Index – Hospital Treatment policy holders. The retention index is designed to provide a performance indicator by showing the percentage of policies that have remained active hospital policies of the same fund for two years or more, over all states.

28. If a policy holder changes their coverage from hospital treatment, or hospital treatment and general treatment combined, to general treatment only then they would not be regarded as having retained their hospital treatment policy. A policy which is suspended at the quarter end date is not included in the totals in HRF 601.1. They should not be included in the retention index. If they are re-instated they would then be included as if there had been no lapse in their coverage. The retention index is calculated based on policies as: [Policies at end of reporting quarter less policies joining over the previous eight quarters including the reporting quarter] divided by [policies at end of the quarter nine quarters previously]. The retention index should be reported correct to two decimal points.

Example

The reporting/current quarter is June 2007

As at 30 June 2005 there were 100 policies over all states for the fund

The number of new polices joining after 30 June 2005 is 20

The number of policies over all states for the fund as at 30 June 2007 is 110

The retention index is

As the retention index will provide an indicator for the total fund membership the calculation is not specific to individual states. The number reported should be the same for each state and territory reported in HRF 601.1 for a fund in a quarter.

The Retention index cannot be greater than 100 per cent.

Part 8 Benefits Paid for Chronic Disease Management Programs

(NOTE see the section on Guidance for insurers for eligible CDMP benefits for risk equalisation in these reporting instructions for further information on CDMPs)

The data in this part is to be reported as cumulative totals over the quarter being reported and include both eligible and ineligible benefits. The data reported in this part should only be for programs that satisfy the criteria for CDMP as defined under the Act and associated Rules.

29. Benefits Paid for CDMPs - report the number of services, benefits and fees charged in each of the categories in the quarter they are paid. Note that only Planning, Coordination and Allied Health Services components are eligible for Risk Equalisation so it will be necessary for health insurers to identify “Other” goods and services involved in the delivery of the program.

30. Benefits Paid by Program Type - report the number of programs, benefits and fees charged for each of the program types.

31. Programs are reported in the quarter that they commenced. The commencement date of the program may be hard to determine due to the different ways benefits can be paid, as well as delays in this information being provided to health insurers. The first quarter that benefits are paid for a CDMP should be taken as the quarter in which the program commences.

Programs that run continuously for more than one year are classed as completed at the end of the calendar year from commencement and a new program is reported as commencing in the next quarter that benefits are paid for the program.

(a) The commencement date of the program, and thus the first quarter in which the program is deemed to have commenced, should be taken as the date on which benefits were first paid for under the program.

(b) The number of programs does not refer to the particular programs offered by the health insurer, but refers to the number of persons participating in a program.

(c) If a member participates in more than one program, each program they participate in is counted.

32. Benefits and fees charged are recorded in the quarter in which they are paid.

Part 9 Benefits Paid for General Treatment

The data in this part is to be reported as cumulative totals over the quarter being reported.

33. Report the number of services, benefits paid and fees charged for General Treatment excluding Hospital-Substitute Treatment and CDMP.

34. Include, for example, payments for ambulance, ex-gratia payments and payment for travel in this part under General Treatment. Do not include them as “ineligible hospital benefits”.

(a) Services benefits and fees on behalf of a person with Hospital-linked Ambulance Treatment should be included in this part, even in those cases where the person is not included in Part 6.

(b) Note that health management programs are reported in each quarter that benefits are paid for the program. The commencement date of the program, and thus the first quarter in which the program is deemed to have commenced, should be taken as the date on which benefits were first paid for under the program. Note that the program would be deemed to be ceased in the case where the participant leaves the program (for example, by choice or other reason such as death). Note that number of programs does not refer to the particular programs offered by the health insurer, but refers to the number of persons participating in a program. If a member participates in more than one program, each program they participate in is counted.

(c) Programs that are similar to, but do not satisfy the criteria for, CDMPs should be reported under Part 9 General Treatment.

Part 10 Lifetime Health Cover

The data in this part is to be reported as at the end of the quarter being reported.

35. Report the number of adults with hospital cover by gender at their Lifetime Health Cover certified age at entry.

36. The fields in the columns heading “loading removed” should all have zero reported until 2010. Loadings removed in any other circumstances should not be reported. Report the number of adults with hospital cover by gender at their certified age at entry that have the loading removed. The loading is removed if the adult has held cover:

(a) for a continuous period of 10 years; or

(b) for a period of 10 years that has been interrupted only by permitted days without hospital cover or periods during which the adult was taken to have had hospital cover otherwise than because of paragraph 34-15(2)(a) of the Private Health Insurance Act 2007 (none of which count towards the 10 years).

37. Instructions for completing the HRF 601.1 when an adult has their loading removed.

When an adult paying a loading has had ten continuous years paying the loading and the loading has been removed, that person should be shown as having the loading removed in the quarter in which that occurs. In subsequent quarters, they should be reported as having a certified age at entry of 30.

The following describes the HRF 601.1 reporting requirements with an example using a fictitious female who is initially paying a loading of 4 per cent.

- Initially the health insurer has no adults who have paid the LHC loading for ten years. All adult persons are reported in the first two columns, signifying they are paying a loading or their certified age at entry is 30 and they do not incur a loading.

- In the quarter in which the loading is removed, the person should be reported in the column under “Male LHC loading removed” or “Female LHC loading removed” in the row corresponding to the loading they were previously paying. They should not also be reported in the row corresponding to a certified age at entry of 30 with no loading. There should be no double counting.

- In the quarter after the quarter in which the loading is removed the person should be reported in one of the first two columns, “Male” or “Female”, in the certified age at entry of 30 row.

- If a person ceases to have hospital cover after their loading is removed, for more than the prescribed “Permitted days without hospital cover” as defined in section 34-20 of the Private Health Insurance Act 2007, and they take up hospital insurance again they should be reported in one of the first two columns “Male” or “Female”, in the certified age at entry row corresponding to the loading they incur on rejoining.

Part 11 Total Hospital Treatment Medical Services Statistics

The data in this part is to be reported as cumulative totals over the quarter being reported. Report Medical Services Statistics for hospital-substitute treatment where the treatment includes professional services for which a Medicare benefit is payable as outlined in Private Health Insurance (Health Insurance Business) Rules 2018.

38. Medical service statistics are collected in this section under the different headings of No Gap agreement, Known Gap agreement and No agreement and for different ranges of amount charged in relation to the MBS fee:

(a) amount charged <= MBS Fee

(b) amount charged >MBS to 125% MBS Fee

(c) amount charged >125% to 150% MBS Fee

(d) amount charged >150% to 200% MBS Fee

(e) amount charged >200% MBS Fee.

39. For the amount charged report the amount accepted in full payment (if known), or the invoice amount.

40. Report the amount that Medicare pays for the procedure. The Medicare benefit for in-hospital procedures and hospital-substitute treatment is set at 75 per cent of the schedule fee.

41. Report the amount that the fund pays for the service.

42. The term Agreement is applicable where the health insurer has an agreement with a provider in regard to no gap or known gap.

It is also applicable to the situation where a medical service has no gap or known gap as stipulated under the conditions of the fund’s policy. For example, where the conditions of the policy state there will be no gap where the provider charges no more than a certain amount, regardless of whether there is a formal agreement with the provider.

Guidance for insurers for eligible CDMP benefits for risk equalisation

43. Guidance for insurers completing HRF 601.1 to report eligible benefits for risk equalisation.

The purpose of this section is to provide guidance to health insurers about when and how to complete the sections of the HRF 601.0 series for benefits paid for chronic disease management programs (CDMPs).

The Private Health Insurance (Risk Equalisation Policy) Rules 2015 provide that only benefits paid for planning, coordination and allied health service components of CDMPs are eligible for risk equalisation. Programs must also meet the definition of CDMP set out in the Private Health Insurance (Health Insurance Business) Rules 2018.

The duration of, and diversity of various components of CDMPs mean that health insurers may have varying arrangements for the payment of benefits. Benefits may be paid on a per service basis, on a per program basis (either as a single payment or in instalments) or by directly employing staff to deliver programs.

When to report on CDMPs

Information on CDMPs should be reported in the quarter that benefits were paid for the program, regardless of whether the benefits are paid on a per service, or per program, basis.

In the case where the health insurer employs their own staff to deliver services, benefits should be reported in the quarter that the services were delivered.

How to report the amount of benefits paid for CDMPs

Part 8 of HRF 601.1 calls for benefits paid for planning, coordination and allied health services to be reported separately, as these are the only components of a CDMP that are eligible benefits for risk equalisation.

Part 8 also contains a field for ‘other’ benefits paid for the program that are ineligible for risk equalisation. In the future, this data will inform decisions about extending the risk equalisation arrangements to other costs for CDMPs.

If benefits are paid on a per program basis, or the program is delivered by a salaried employee of the health insurer, the health insurer must attribute specific amounts for planning, coordination, allied health services and ‘other’ so that the amount of benefit paid is accurately reported.

The amount of benefit reported depends upon the way benefits are paid for the CDMP.

1. Benefits paid on a per-service basis for components of a CDMP

If benefits are paid on a per service basis for planning, coordination, and any allied health and/or other goods and services as part of a CDMP on the basis of separate accounts rendered by providers, the completion of HRF 601.1 is straightforward.

2. Benefits paid on a per program basis

If benefits are paid on a per program basis in a single payment, the amount of the benefit must be disaggregated for each of the service components and the number of times services were delivered, and reported against the relevant field in Part 8 of HRF 601.1.

If benefits are paid in instalments, disaggregated benefits should be apportioned to the amount of the instalment.

It is expected that when negotiating the cost of the program with a provider, health insurers would identify the various cost components and the expected frequency of the services to be delivered.

3. Health insurer employs staff to deliver a CDMP

If a health insurer employs staff to deliver CDMPs (e.g. to plan and coordinate programs), the costs that are directly related to the employment of staff can be risk equalised. These costs are the salaries plus on-costs (or overheads).

The fields under the column ‘benefits paid’ should be reported by taking the total cost of employing staff in the quarter and dividing it by the number of services provided in that quarter. For example, a health insurer employs two full time staff at a cost of $30,000 for the quarter. During the quarter 240 planning services and 960 coordination services were delivered. Therefore, the insurer attributes, for example, $65 for each planning service and $15 for each coordination service.

If staff were engaged in other activities, the employment costs should be apportioned according to the actual time spent providing planning and coordination services.

For auditing purposes, health insurers should also be able to demonstrate the costs of employing staff to provide planning and coordination services, and the proportion of time staff spent providing those services.

In this scenario, no fees would be charged as there should be no liability on the health insurer to pay fees or charges for the program. Accordingly, in the fields under the column ‘fees excluding Medicare benefit’ report the same values as the benefits paid. These fields are used as validation checks that the benefit paid is not greater than the fees. Reporting the fees as zero would create an error.

Risk Equalisation Guidelines

Quarterly Return

Part | Heading | Comment |

2. | Total Chronic Disease Management Programs (CDMP) | Number – the total number of chronic disease management programs is the number of individual members who commenced programs during the quarter. Benefits paid – the total benefits paid is the sum of all benefits paid for CDMPs in the quarter. Note: health management programs are not included (these are to be included in Part 6 and 9). |

5. | Chronic Disease Management Program by age category | Details are to be completed separately for males and females. Insured persons – the number of insured persons who hold policies that cover CDMPs, in the age cohort they are in at the end of the quarter. Programs – the number of insured persons commencing CDMPs during the quarter. If one person commenced two CDMPs during the quarter, this should be reported as two. Eligible benefits – eligible benefits are defined in Rule 5 of the Private Health Insurance (Risk Equalisation Policy) Rules 2015. Ineligible benefits – all other benefits paid for CDMPs in the quarter not included in Rule 5 of the Private Health Insurance (Risk Equalisation Policy) Rules 2015. Note: health management programs are not included (these are to be included in Part 6 and 9). Total benefits – sum of eligible plus ineligible benefits paid for CDMPs in the quarter. Fees excluding Medicare benefit – report fees charged by providers, as health insurers are precluded from paying benefits for out-of-hospital services for which a Medicare benefit is payable (except in the circumstances outlined in General treatment – services for which Medicare benefit is payable of the Private Health Insurance (Health Insurance Business) Rules 2018. |

6. | General Treatment by age category | Note: information on health management programs is reported here. |

8. | Benefits paid for CDMPs | Definitions of planning, coordination and allied health services for the delivery of CDMPs are provided in the Private Health Insurance (Health Insurance Business) Rules 2018. Services – the total number of goods and services that benefits were paid for in the quarter. Benefits – the total amount of benefits paid for goods and services in the quarter. Fees charged – the total amount of fees charged by providers for goods and services in the quarter. |

| Benefits paid by Program Type | This is a breakdown of the types of CDMPs that benefits were paid for during the quarter. Programs – the number of insured persons commencing CDMPs that during the quarter. If one person commenced in two CDMPs, this should be reported as two. Benefits – the total amount of benefits paid for goods and services in the quarter. Fees charged – the total amount of fees charged by providers for goods and services in the quarter. |

9. | Benefits paid for General Treatment (excluding Hospital-Substitute Treatment and CDMP) | Note: information on health management programs is reported here. |

—%—

% of services.........................41

—2—

2 + persons, no adults.....................22

—3—

3 + adults...........................22

—A—

Aboriginal Health Workers..................34

ABP..............................28

ABP table...........................29

adult..............................20

Age Based Pool........................28

Allied Health Services.....................33

Amount charged........................41

Amount charged % of MBS..................42

Audiologists..........................34

—B—

Benefits Paid Chronic Disease Management Program....27

Benefits Paid General Treatment...............27

Benefits Paid Hospital Benefits................27

—C—

CDMP...........................25, 32

Chiropractors.........................34

Chronic Disease Management Program..........25, 32

Coordination..........................33

couple.............................22

Cover.............................20

Coverage requirements....................20

—D—

Day Hospital Facilities....................27

Day Only...........................27

Days - Hospital Treatment..................27

Days - Hospital-substitute Treatment.............27

dependent child........................20

Diabetes Educators......................35

Dietitians...........................35

Discontinued.........................25

—E—

Eligible Benefits........................31

End of quarter.........................25

Episode/s...........................26

Excess & Co-payments....................22

Excess/Co-Payments.....................31

Exclusionary Policies.....................23

Exercise Physiologists.....................35

—F—

family.............................22

Fees Charged.........................31

Fees excluding Medicare benefit...............30

Full Cover...........................31

Fund Benefit..........................41

—G—

Gap..............................41

General Treatment.....................26, 36

Accidental Death/Funeral Expenses.37

Acupuncture/Acupressure.........37

Ambulance.....................37

Chiropractic....................37

Community, Home, District Nursing.37

Dental.........................37

Dietetics.......................37

Domestic Assistance.............37

Ex gratia Payments..............37

Hearing Aids and Audiology.......37

Hypnotherapy...................37

Maternity Services...............37

Natural Therapies................38

Occupational Therapy............38

Optical........................38

Orthoptics (Eye Therapy).........38

Osteopathic Services.............38

Overseas.......................38

Pharmacy......................38

Physiotherapy...................38

Podiatry (Chiropody).............38

Preventative health products/Health management programs 37

Medical devices or human tissue products, Aids and Appliances 38

Psych/Group Therapy............38

School........................38

Sickness and Accident............39

Speech Therapy.................39

Theatre Fees....................39

Travel and Accommodation........39

General Treatment Ambulance Only Policies.........26

General Treatment claims processing.............32

General Treatment Only Policies...............26

Gross Benefit.........................29

—H—

HCCP.............................29

HCCP Claimants.......................30

HCCP Net Benefits......................30

HCCP Threshold.......................30

High Cost Claims Pool....................29

holder.............................21

Hospital and General Treatment Combined..........26

Hospital Treatment......................25

Hospital Treatment Only Policies...............26

Hospital-substitute Treatment.................25

Hospital-Substitute Treatment.................28

—I—

Incomplete episode......................27

Ineligible Benefits.....................28, 31

Insured Persons........................21

—K—

Known Gap agreement....................41

—L—

leave days...........................27

leave periods..........................27

Lifetime Health Cover.....................39

base rate.......................40

Certified age of entry.............40

cover age......................40

Loading.......................40

Loading removed................40

—M—

Medical benefits........................28

Medicare benefit........................41

Mental Health Workers....................35

—N—

New Policies/persons.....................24

No Agreement.........................41

No Excess & Co-payments..................23

No Gap Agreement......................40

No of Services.........................41

Non-Exclusionary Policies..................23

Nursing Home Type Patients.................28

—O—

Occupational Therapists....................35

Osteopaths...........................36

Overnight...........................28

—P—

Physiotherapists........................36

Planning............................33

Podiatrists/Chiropodists....................36

Policies............................21

Policy Holder.........................21

private health insurance policy................21

Private Hospitals.......................27

Medical devices or human tissue products Benefits.....28

Psychologists.........................36

Psychologists, occupational therapists and Aboriginal health workers 35

Public Hospitals........................27

—R—

Reduced cover.........................32

Retention index - Hospital Treatment policy holders.....32

Risk Equalisation Levy....................30

Risk Factors for chronic disease................34

—S—

SEU/s.............................21

single.............................22

single equivalent unit/s....................21

single parent..........................22

Some Lifetime Exclusions..................32

Speech Pathologists......................36

Start of quarter.........................23

—T—

Transferring from another Fund................24

Transferring from another policy...............24

Transferring from another state................24

Transferring to another policy.................24

Transferring to another state.................24

Treatment greater than one day................28