Reporting Standard LOLRS 800.1

Policy Data: Public and Product Liability and Professional Indemnity Insurance

Objective of this reporting standard

This Reporting Standard sets out requirements for the provision of information to APRA by Lloyd’s relating to certain public liability, product liability and professional indemnity insurance policies.

It includes Reporting Form LOLRF 800.1 Policy Data: Public and Product Liability and Professional Indemnity Insurance and the associated instructions.

Authority

- This Reporting Standard is made under section 13 of the Financial Sector (Collection of Data) Act 2001.

Purpose

2. Information collected by Reporting Form LOLRF 800.1 Policy Data: Public and Product Liability and Professional Indemnity Insurance (LOLRF 800.1) is used by APRA for the purpose of prudential supervision and publication, including publication in the National Claims and Policies Database (NCPD).

Application

3. This Reporting Standard applies to Lloyd’s.

Commencement

4. This Reporting Standard applies for reporting periods ending on or after 31 December 2021.

Information required

5. Lloyd’s must provide APRA with the information required by LOLRF 800.1 in respect of each reporting period and each reportable policy of a Lloyd’s underwriter in force during the reporting period.

Reporting periods and due dates

6. Subject to paragraph 7 of this Reporting Standard, Lloyd’s must provide the information required by this Reporting Standard in respect of each calendar half-year (i.e. the periods ending 30 June and 31 December each year).

7. APRA may, by notice in writing, change the reporting periods, or specify reporting periods, to require Lloyd’s to provide the information required by this Reporting Standard more frequently, or less frequently, or in respect of reporting periods based upon a Lloyd’s underwriter’s own accounting financial year for that part of the information required by this Reporting Standard relating to that underwriter, having regard to:

(a) the particular circumstances of Lloyd’s or a Lloyd’s underwriter; and

(b) the extent to which the information is required for the purposes of the prudential supervision of Lloyd’s or a Lloyd’s underwriter.

8. The information required by this Reporting Standard must be provided to APRA:

(a) in the case of half-yearly information, by no later than four months after the end of the reporting period; or

(b) in the case of information provided in accordance with paragraph 7, within the time specified by notice in writing,

or such later time as APRA may determine in writing. APRA may determine a later time in writing in relation to the whole of the information required by this Reporting Standard, or in relation to part of the information required by this Reporting Standard to the extent that it relates to a particular class of Lloyd’s underwriters, or in relation to part of the information required by this Reporting Standard to the extent that it relates to one or more Lloyd’s underwriters named in the determination (to the extent that APRA may permit the late submission of part of the information required by this Reporting Standard).

Method of submission

9. The information required by this Reporting Standard must be rendered in comma separated values (CSV) format in accordance with the instructions in

LOLRF 800.1, and must be provided electronically through the web site www.ncpd.apra.gov.au, by logging on using the relevant customer identification number and password provided by Fujitsu Australia (as agent of APRA), and following the instructions on that web site.

10. Despite paragraph 9, APRA may, in writing, make either or both of the following determinations:

(a) a determination that information required by this Reporting Standard must be provided in accordance with alternative information technology requirements specified by APRA in the determination; and

(b) a determination that information required by this Reporting Standard must be provided to APRA or an agent of APRA at an alternative address in accordance with requirements specified in the determination.

Quality control

11. The information provided by Lloyd’s in accordance with this Reporting Standard must be the product of processes and controls developed by Lloyd’s for the internal review and authorisation of the information.

Note: Lloyd’s General Representative in Australia must ensure that an appropriate set of policies and procedures is in place for the authorisation of data provided to APRA.

Authorisation

12. Fujitsu Australia (as agent of APRA) will provide Lloyd’s with a customer identification number. If Lloyd’s proposes to submit information required by this Reporting Standard using the method in paragraph 9 (i.e. via the website), Lloyd’s must apply for a password by viewing the web page referred to in paragraph 9, quoting Lloyd’s customer identification number and following the instructions for applying for a password on that page. Fujitsu Australia will advise Lloyd’s General Representative in Australia of the password for Lloyd’s. When a report is provided using the method in paragraph 9, Lloyd’s will be required to quote its customer identification number and password. Upon successful validation of the customer identification and password a secure session between Lloyd’s and Fujitsu Australia will be created and information will be encrypted before transmission.

13. Despite paragraph 12, or where APRA has made a determination under subparagraphs 10(a) or (b) specifying an alternate method of submission, APRA may also determine in writing that:

(a) a specified person (who need not be Lloyd’s General Representative in Australia or agent);

(b) a person holding a specified position (who need not be Lloyd’s General Representative in Australia or agent); or

(c) a person authorised by Lloyd’s to use Lloyd’s customer identification number and password,

may, or must, authorise (in a manner specified) information provided by Lloyd’s under this Reporting Standard.

Minor alterations to forms and instructions

14. APRA may:

(a) make minor variations to LOLRF 800.1 (either generally, or in relation to a class of Lloyd’s underwriters, or in relation to one or more named Lloyd’s underwriters) to correct technical, programming or logical errors, inconsistencies or anomalies;

(b) vary, omit or substitute (either generally, or in relation to a class of Lloyd’s underwriters, or in relation to one or more named Lloyd’s underwriters) an occupation code or description in Appendix B to LOLRF 800.1, if APRA forms the view that the existing code or description is inappropriate having regard to the circumstances or business of Lloyd’s and any other relevant considerations; or

(c) vary, omit or substitute (either generally, or in relation to a class of Lloyd’s underwriters, or in relation to one or more named Lloyd’s underwriters) a specification in a Table in LOLRF 800.1, if APRA forms the view that the specification is inappropriate having regard to the circumstances or business of Lloyd’s underwriters and any other relevant considerations.

15. If APRA makes such a variation it must notify Lloyd’s in writing.

Interpretation

16. In this Reporting Standard:

agent of APRA means a person appointed under s 47 of the Australian Prudential Regulation Authority Act 1998 to receive data on behalf of APRA.

APRA means the Australian Prudential Regulation Authority established under the Australian Prudential Regulation Authority Act 1998.

Fujitsu Australia means Fujitsu Australia Limited ABN 19 001 011 427.

Lloyd’s has the meaning in the Insurance Act 1973.

Lloyd’s General Representative in Australia means the employee of Lloyd’s or Lloyd’s Australia Ltd who holds the position of Lloyd’s General Representative in Australia, or performs the functions and duties described by that title.

Lloyd’s underwriter has the meaning in the Insurance Act 1973.

product liability insurance includes policies that provide for compensation for loss and or injury caused by, or as a result of, the use of goods.

professional indemnity insurance includes:

(a) insurance that provides cover for a professional for actions taken against that professional in tort, contract or under statute law in respect of advice or services provided as part of their professional practice, including cover in respect of damages and legal expenses;

(b) directors’ and officers’ liability insurance and legal expense insurance; and

(c) medical indemnity insurance.

public liability insurance includes:

(a) insurance covering legal liability to the public in respect of bodily injury or property damage arising out of the operation of the insured’s business; and

(b) insurance in respect of environmental clean-up costs resulting from pollution where not covered by Fire and Industrial Special Risk policies.

reportable policy means an insurance policy, entered into on or after 1 January 2003, of product liability insurance, professional indemnity insurance or public liability insurance, but does not include:

(a) reinsurance or retrocession cover;

(b) marine insurance;

(c) domestic householder’s or owner’s insurance, or tenant’s liability insurance, sold in conjunction with a building or contents policy; or

(d) a policy of insurance solely in relation to an event that could neither occur in Australia nor in relation to an insured resident of Australia.

17. For the purposes of paragraph 8, where information must be provided no later than a particular date, Lloyd’s is required to ensure that the information is received by the person to whom it must be provided (whether APRA or an agent of APRA) no later than that date.

18. Unless the contrary intention appears, any reference to an Act, Regulation, Prudential Standard, Reporting Standard, Australian Accounting Standard or Auditing Standard is a reference to the instrument as in force or existing from time to time.

19. Where this Reporting Standard provides for APRA to exercise a power or discretion, this power or discretion is to be exercised in writing.

Reporting Form LOLRF 800.1

Policy Data: Public and Product Liability and Professional Indemnity Insurance

Instruction Guide

These instructions have been prepared for the purpose of defining the policy information required to be submitted by Lloyd’s in respect of public and product liability and professional indemnity insurance. This information will contribute to a National Claims and Policy Database (NCPD) in respect of these classes of insurance. The intention is to create a database that holds information in respect of claims and policies for public and product liability and professional indemnity on a national basis.

Details of requirements in relation to reporting periods, method of submission and authorisation are set out in the Reporting Standard. The data submitted by Lloyd’s will be validated by APRA at each reporting period. The data validation to be performed is outlined in Appendix A.

Record Layouts and Field Specifications

Policy Data Specifications

Policy Data | Data Item | Public & Products | Professional Risk | Field type1 |

1* | Insurer code | M | M | 6a |

2* | Class of Business | M | M | 2a |

3* | Record type | M | M | 1a |

4* | Policy Basis | M | M | 1a |

5* | Status | O | O | 1a |

6* | Month of end of Reporting Periods | M | M | 8n |

7* | Policy number | M | M | 30a/n |

8* | Risk number | M | M | 30a/n |

9* | Product type | M | M | 3a |

10 | Original Inception Date | O | O | 8n |

11 | Date of commencement / inception (Term Inception Date) | M | M | 8n |

12* | Effective Start Date | M | M | 8n |

13 | Term Expiry Date | M | M | 8n |

14* | Effective End Date | M | M | 8n |

15a | Gross Annualised Premium | T | T | 12n |

15b | Gross Earned Premium | T | T | 12n |

16 | Gross Written Premium | M | M | 12n |

17a | Turnover | O | O | 12n |

17b | Total assets | O | O | 12n |

17c | Professional fees | O | O | 12n |

17d | Total number of staff | O | O | 12n |

17e | Other | O | O | 12n |

17f | Description of “Other” | O | O | 50a |

18 | State | O | O | 3a |

19 | Postcode | O | O | 4n |

20 | Excess/Deductible/Attachment point | M | M | 12n |

21 | Limits of Indemnity | M | M | 12n |

22 | Nature of Insured Organisation/Occupation | O | O | 6a or 4n |

23 | Coinsurance proportion | M | M | 5n |

1 Date must be DDMMYYYY, no delimiter.

Key:

M – mandatory field on all records from 1 July 2004.

O – optional field.

T – at least one of these field must contain a value (i.e. not blank).

a – alpha.

n – numeric.

* Fields so indicated, as a combination, must be unique for each reporting period.

Note: Where a policy is endorsed during the reporting period, separate records should be submitted for the exposure before and after the endorsement showing the relevant factors. See Appendix A, scenario 3 for example exposure records.

Policy Record Data Field Definitions

1. Insurer code

This will be provided by APRA when advised of the method of delivery of the data.

2. Class of Business

• PL = Public & Product

• PI = Professional Risk

3. Record type

• P = Policy record

4. Policy Basis

• C = Claims Made basis

• L = Losses Incurred basis

5. Status

• N = New

• R =Renewal

Where this information is not available, enter a hyphen (“-“).

6. Month of End of Reporting Periods

The data will relate to a six month period. Code the last day of this period in this field as DDMMYYYY, e.g. insert code 30062003 for data relating to the six months ending 30 June 2003.

7. Policy Number

The unique market reference field allocated by the Lloyd’s broker. This information is only used for cross-referencing by APRA – it will not be published except in any individual data reports prepared for the insurer concerned.

8. Risk Number

The broker reference field used to sub-divide accounting entries into different countries.

9. Product Type

Class | Public Products | & | Professional Risk |

Public liability (pure) | PUB | | |

Products liability (pure) and product recall | PRO | | |

Mixed public/products cover ('Broadform' liability) | BRD | | |

Umbrella covers | UMB | | |

Environmental impairment liability | EIL | | |

Construction liability | CON | | |

Cyber Insurance | CYB | | |

Excess Liability | EXL | | |

Excess Umbrella | EXU | | |

Other | PLO | | |

Professional indemnity (not medical malpractice) and errors & omissions | | | PII |

Directors' and Officers' liability | | | D&O |

Employment Practices | | | EPL |

Association Liability | | | ASN |

Superannuation Trustees | | | STL |

Defamation Insurance | | | DFI |

Financial Institutions Policy | | | FIP |

Information & Communication Technology Insurance | | | ICT |

Medical Indemnity/Malpractice | | | MAL |

Management Liability | | | MAN |

Other | | | PIO |

Note that where business is written as part of a package policy, the “Product type” is to be based on the nature of the cover offered, as set out in the above table. The fact that cover is sold in conjunction with other types of insurance is not collected.

10. Original Inception Date

Code the date when a policy providing this cover was first issued to the client in this field as DDMMYYYY. Where this information is not available, enter a hyphen (“-“).

11. Date of Commencement/Inception (Term Inception Date)

Code the inception date of the risk in this field as DDMMYYYY.

12. Effective Start Date (for the purpose of tracking effect of endorsements)

Code the start date of any endorsement which changes the risk in this field as DDMMYYYY. Can be equal to or later than field 11. This field can also be blank if the row reported is not an endorsement record. Where this date is equal to the term expiry date, this signifies a premium adjustment at expiry of the contract.

Where there are multiple endorsements in one reporting period, each endorsement must be reported.

13. Term Expiry Date

Code the date on which the existing policy expires in this field as DDMMYYYY.

14. Effective End Date (for the purpose of tracking endorsements & cancellations)

Code the date on which any endorsement which changes the risk is due to cease in this field as DDMMYYYY.

15. Premium (This field is not used)

This field is to contain either a or b reflecting whether you are providing a value for “Gross Annualised Premium” in field 15a or “Earned Premium” in field 15b.

15a. Gross Annualised Premium

In this field insert the Lloyd’s proportion of the gross annualised premium in force based on the rating factors represented by this record (in whole $, no decimal points) converted to A$ using end of processing month rates of exchange. Exclude all statutory charges (FSL, GST & SD) but include others costs (commissions). If the policy is for a term other than twelve (12) months, pro-rate the premium to a 12month period.

Note that this is NOT the gross written premium – it is the rate of premium for a full 12 months cover based on the rating factors that apply to the policy at the effective start date (field 12).

Also note that the premium for “short term events” cover should not be annualised. “Short Term Events” are defined as those that cover a specific period that is less than one month e.g. a sporting event over a long weekend or an annual festival.

15b. Gross Earned Premium

In this field, insert the Lloyd’s proportion of the earned amount of gross annual premium for the exposure of this policy during the reporting period (in whole $, no decimal points) converted to A$ using end of processing month rates of exchange between the effective start date (field 12) and effective end date (field 14). Include the same components as for gross annualised premium.

For endorsements and cancellations, the gross earned premium should still be the earned amount of gross annual premium for the exposure of this policy during the reporting period (in whole $, no decimal points) between the effective start date of the endorsement or cancellation (field 12) and effective end date of the endorsement or cancellation (field 14).

16. Gross Written Premium

In this field insert Lloyd’s proportion of the gross written premium for the exposure of this policy. Exclude all statutory charges (FSL, GST & SD) but include others costs (commissions) converted to A$ using end of processing month rates of exchange.

For endorsements and cancellations, the updated gross written premium should be stated.

This field should be completed for every reporting period.

17. Risk Factor (This field is not used)

Risk factor is a measure of the relative exposure that the policy represents. Where the information for fields 17a to 17f is not available, enter a hyphen (“-”).

17a. Turnover

Most recently declared annual turnover of the risk represented by this risk record (in whole dollars) converted to A$ using end of processing month rates of exchange. If you collect turnover in bands, show the range of the band in whole dollars e.g. if turnover is up to $5 million, enter “1-5000000”, if between $20 million and $50 million, “20000001-50000000”. Commas must be excluded from all numbers. This should be the total turnover of the organisation, not the insurer’s share of risk (but see note on policy field item 23 below).

17b. Total Assets

Most recent prior year business turnover represented by this risk record (in whole dollars) converted to A$ using end of processing month rates of exchange.

17c. Professional Fees

Most recent prior year annual professional fees represented by this risk record (in whole dollars) converted to A$ using end of processing month rates of exchange.

17d. Total number of staff

Most recent prior year number of full-time equivalent staff members employed in the insured business or practice, whether or not members of a profession.

17e. Other

If any of 17a, 17b, 17c or 17d contains a value, then leave this blank. However if none is applicable then this field should contain a value with a brief description of the risk factor provided in field 17f.

17f. Other Description

If 17e contains a value, this field should contain a brief description of the risk factor of the value provided in field 17e.

18. State

For professional risks, this should be the state (ACT, NSW, NT, QLD, SA, TAS, VIC and WA) where work is done; if multi-state cover is provided, include the state where the majority of work is done. For EPL and D&O, provide the state where the head office is located. This would be expected to be sourced from data for stamp duty split purpose.

Where this information is not available, enter a hyphen (“-“).

19. Postcode

Postcode of location of principal risk. If not available, postcode of head office or postal address of policyholder.

Where this information is not available, enter a hyphen (“-“).

20. Excess/Deductible/Attachment Point

How much of any claim that an insured must bear before the insurer becomes liable (in whole dollars) converted to A$ using end of processing month rates of exchange. Where different levels exist for different causes of claim, enter the excess that is most commonly applied for such policies, or where that is not available, the minimum applied.

21. Limit of Indemnity

Insert the Lloyd’s proportion of the limit of indemnity in whole dollars disregarding any excess payments by the insured converted to A$ using end of processing month rates of exchange. Where different limits exist for different causes of claim, enter the limit that is most commonly applied for such policies.

22. Nature of Insured Organisation/Occupation

For Public and Products Liability, EPL and D&O risks, use the principal classification of the business from the latest edition of Catalogue Number 1292.0 Australian and New Zealand Standard Industrial Classification (ANZSIC), published by the Australian Bureau of Statistics and available on their web site. Provide data at the 4digit ANZSIC code level. Any reports or publications will be aggregated to the 2 digit level ANZSIC.

Residential strata owners’ liability is collected under ANZSIC classification 7711- Residential Property Operators, whereas for Commercial Property Operators it is either 7712 or the occupation code that is most closely aligned with the tenancy of the strata.

For Professional Risks, use the codes provided in Attachment B except for code “OMULTI” which is only for use for facility business.

Where this information is not available, enter a hyphen (“-“).

23. Coinsurance Proportion

This is Lloyd’s overall percentage share of the risk to 2 decimal places (e.g. 66.66 for 66.66%). Where there is a mid-term market change a policy may appear more than once on the file and the gross premium figures may change if the Lloyd’s percentage changes.

Appendix A: Data Validation

The individual policy data submitted by Lloyd’s will be validated by APRA as follows:

Earned premium submitted in information provided by Lloyd’s under Lloyd’s Security Trust Fund Determination No 1, less the premium received for all facilities, is expected to reconcile to within 5% of the total of the earned premium shown in field 15b on the individual policy records submitted by insurers or as calculated by APRA from the gross annualised premium (field 15a). APRA will expect Lloyd’s to explain the source of any greater discrepancy.

While it is appreciated that more extensive reconciliation could be attempted, this could require significant changes to the existing reporting requirements to APRA or the submission of other information (such as management accounts) from insurers that would not be in standard formats.

APRA will expect that Lloyd’s needs to demonstrate the reason for a discrepancy between the individual records submitted to the database and its aggregate data reported to APRA in the above forms, the insurer will share such additional information with APRA as required.

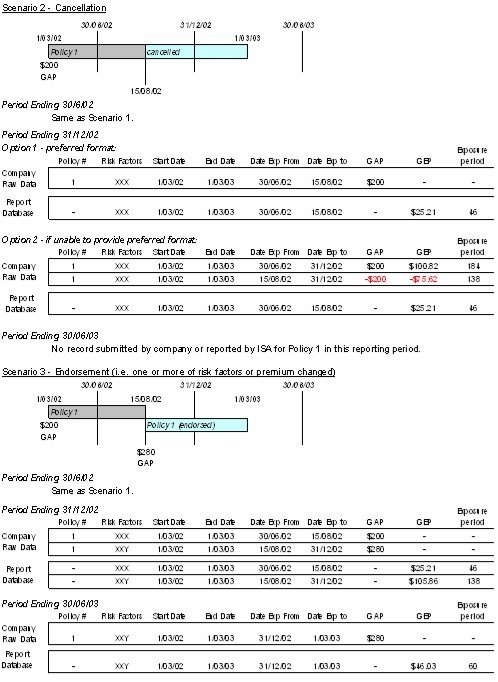

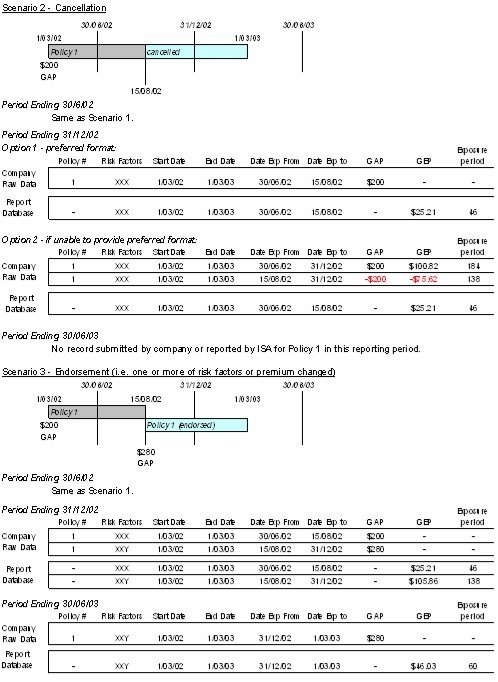

Appendix B: Example Treatment of Exposure Records

Lloyd’s is to provide an initial record for each policy/risk at the start of each period with additional records each time that policy/risk changes in any way in terms of its exposure. The following sets out the expected relationship between Gross Annualised Premium and Gross Earned Premium for your information.

Note: Start date = Term Inception Date (field 11)

Date exp from = Effective Start Date (field 12)

End date = Term Expiry Date (field 13)

Date exp to = Effective End Date (field 14)

GAP = Gross Annualised Premium (field 15a), NOT written premium

GEP = Earned Premium (field 15b)

Appendix C: APRA Occupation Codes for Professional Indemnity

CODE | Occupation Description |

A | Financial Miscellaneous occupations |

AABANK | Bank |

AACCNT | Accountancy - Other |

AACINS | Accountancy - Insolv & Aquis |

AACMAN | Accountancy - Management Service |

AACTAX | Accountancy - Taxation |

AACTUA | Actuarial |

AAUDIT | Accountancy - Audit |

ABLDSO | Building Society |

ABOOKP | Bookkeeping |

ABSCON | IT Business Systems |

ABUSBR | Business Brokers |

ACHCON | Hardware Engineering/Sec/Sales |

ACLHOU | Clearing House |

ACMBRK | Commodity & Futures Broking |

ACMBRK | Futures Broker/Dealer |

ACMCON | Computer Consultants |

ACOMAU | Computer Systems Auditor |

ACOMPR | Computer Programmer |

ACOMSB | Computer Service Bureau |

ACRMAN | Credit Management Services |

ACRUNI | Credit Union |

ACTCON | IT Education & training |

ACUSTO | Custodian |

ACWCON | Web Design |

ADBTCL | Debt Collection & Mercantile Agents |

AFINCO | Financial Counsellors |

AFNADV | Finance Adviser |

AFNBRK | Finance Broking |

AFNMGR | Financial Risk Management |

AFPCON | Financial Planning Consultancy |

AFRANC | Franchisor |

AFRIEN | Friendly Society |

AFUNDM | Fund Manager |

AINCON | Investment Consultancy |

AINDEA | Licenced Security Dealer |

AINSUR | Insurance Company |

AMANIN | Managed Investment Scheme |

AMERBA | Merchant Bank |

AMORBR | Mortgage Broker |

AMORMA | Mortgage Manager |

CODE | Occupation Description |

AMOROR | Mortgage Originator |

APFCON | Financial Planners |

ASTBRK | Stock & Share Broking |

ASUPAD | Superannuation fund administrator |

ASUPTR | Superannuation Trustee |

ATAXAG | Taxation Agency |

ATSTCO | Trustee & Executor Company |

ATSTSU | Trustee Services |

B | General Consultants - Miscellaneous occupations |

BAGCON | Air Cargo Consultancy |

BARCON | Air Pollution Consultancy |

BAVCON | Aviation Consultancy |

BCMCON | Communication (PR) Consultancy |

BCNCON | Corrosion Consultancy |

BCONCO | Convention Coordinator |

BCRIMI | Criminologist |

BECONO | Economist |

BENCON | Environment & Pollution Consultancy |

BEVMAN | Event Managers & Co-Ordinators |

BFOCON | Forestry Services & Consultancy |

BFOODC | Food Consultant |

BHRCON | Human Resource Consulting |

BIRCON | Industrial Relations Consultant |

BLTCON | Telecommunication Consultants |

BMANAG | Management Consultancy |

BMELON | Meteorological Consultancy |

BMGCON | Migration Consultancy |

BMHCON | Materials Handling Consultancy |

BMNCON | Marine Consultancy |

BMOCON | Marketing Consultancy |

BMRCON | Market Research Consultancy |

BMTCON | Materials Testing Consultancy |

BNTCON | Natural Resource Consultancy |

BOCCON | Oceanographic Consultancy |

BODCON | Odour pollution Consultancy |

BPCCON | Pest Control Consultancy |

BPNCON | Personnel Consultancy |

BPRCON | Public Relations Consultancy |

BQUALC | Quality Assurance Consultant |

BRSCON | Research Industry & Scientific |

BSECON | Security Consultancy |

BSOCIO | Sociologist |

BSOCON | Solar Energy Consultancy |

BTACON | Travel Agency &/or Consultancy |

CODE | Occupation Description |

BTCCON | Technical Consultancy |

BTESTS | Inspection & Testing Services |

BTLCON | Telecommunication Consultants |

BTOCON | Tourism Consultancy |

BTOOPP | Tour Operator |

BTPCON | Transportation Consultancy |

BTRANS | Translator / Interpreter |

BTTCON | Textile Consultancy |

BWCCON | Water Conservation Consultancy |

BWNCON | Wine Industry Consultancy |

BWPCON | Water Pollution Consultancy |

C | Medical & Paramedical Miscellaneous occupations |

CACUPT | Acupuncturists |

CALCON | Allergy and asthma consultant |

CALTHE | Alternative health services |

CANAGE | Anaesthetics - general |

CANAIC | Anaesthetics-intensive care |

CAUDIO | Audiologist |

CAUDIM | Audiometrist |

CCARDI | Cardiology |

CCARTH | Cardio-thoracic surgery |

CCHIRP | Chiropodists |

CCHIRO | Chiropractics |

CCLCGN | Clinical genetics |

CCLCHA | Clinical haematology |

CCLCIM | Clinical immunology |

CCLCPH | Clinical pharmacology |

CCOLSU | Colorectal surgery |

CCOSSU | Cosmetic surgery |

CDENTI | Dentistry - oral surgery |

CDENTO | Dentistry -other |

CDERMI | Dermatology |

CRADOL | Diagnostic radiology |

CRADOG | Diagnostic radiology - Practitioner |

CDIETI | Dietician |

CDGALC | Drug and alcohol counselling |

CENTHR | Ear, nose and throat (ENT) |

CEMERG | Emergency medicine |

CENDOC | Endocrinology |

CENDOS | Endoscopy |

CFAMSU | Facio-Maxillary surgery |

CGASTR | Gastroenterology |

CGENME | General and internal medicine |

CGENPN | General practice - no procedure |

CODE | Occupation Description |

CGENPY | General Practice - procedural |

CGENSU | General Surgery |

CGERIA | Geriatrics |

CGYNAE | Gynaecology only |

CHYGCO | Hygiene consultant |

CINFDS | Infectious diseases |

CINTCR | Intensive care |

CMEDON | Medical oncology |

CMIDWI | Midwifery |

CNATUR | Naturopaths |

CNEONA | Neonatology |

CNEURO | Neurology |

CNEUSU | Neurosurgery |

CNUCLR | Nuclear Medicine |

CNURSS | Nursing -general |

CNURSE | Nursing—nurse practitioner |

CNUTRI | Nutrition |

COBSGY | Obstetrics & Gynaecology |

COBSTO | Obstetrics only |

COCTHE | Occupational medicine |

COHSCO | OHS Practitioner |

COPTHA | Ophthalmology |

COPTOM | Optometrist |

CORALM | Oral surgery—medical |

CORTSU | Orthopaedic surgery |

COSTEO | Osteopathy |

COTHER | Other hospital-based medical practitioner |

CPAEDM | Paediatric medicine |

CPAEDS | Paediatric surgery |

CAMBOF | Paramedical and ambulance staff |

CPATHO | Pathology |

CPCHEM | Pharmacy |

CPHYSI | Physiotherapy |

CPLAST | Plastic surgery |

CPODTS | Podiatry |

CPSYCH | Psychiatry |

CPSYCO | Psychology |

CPHPRM | Public health/preventive medicine |

CREHSV | Rehabilitation medicine |

CRENAL | Renal medicine |

CRESPM | Respiratory medicine |

CRHEUM | Rheumatology |

CSONOG | Sonographer |

CSPEEC | Speech Pathologists |

CODE | Occupation Description |

CSPTHE | Speech therapist |

CSPINE | Spinal surgery |

CSPORT | Sports medicine |

CTHMAS | Therapeutic Masseur |

CRADTH | Therapeutic radiology |

CTHORA | Thoracic medicine |

CUROLO | Urology |

CVASCU | Vascular surgery |

D | Legal & Para Legal - Miscellaneous occupations |

DBARIS | Barristers |

DCONSV | Conveyancing Services |

DJPEAC | Justice of the Peace |

DLGLCS | Legal Costing Services |

DLNDBR | Land Broking |

DMARCE | Marriage Celebrant |

DPATNT | Patent Attorneys |

DPRSER | Process Servers |

DPTTMA | Patent & Trade Mark Attorney |

DSHARR | Share Registry |

DSOLIC | Solicitors |

DTITLE | Title Searching |

DTMCON | Trademark Development &/or Investment |

E | Real Estate Miscellaneous occupations |

EANVAL | Valuer - fine art |

EAUCTN | Auctioneering |

EBDCOR | Body Corporate Management Services |

EHOTBR | Hotel & Motel Broking |

ELECON | Electrical Contracting |

EMTCON | Motel Management Consultancy |

EPTCON | Property Consultants |

EPTRPT | Property & Inspection Reports |

EREACT | Real Estate Agency- Commercial |

EREAGT | Real Estate Agency- Domestic |

EREAHT | Real Estate Agency- Hotels |

EREAIT | Real Estate Agency- Industrial |

EREAPM | Property Management Services |

EREVAL | Real Estate Agent & Valuations |

ESTMGR | Strata Title Management |

F | Agricultural, Horticultural miscellaneous occupations |

FAGCON | Agricultural Consultancy |

FAGRON | Agronomy |

FANBRE | Animal Breeders |

FAQCON | Aquaculture Consultants |

FARTBD | Artificial Breeding Services |

CODE | Occupation Description |

FBSKAG | Bloodstock Agency |

FEXPLS | Export Livestock Veterinary Consultant |

FFMADV | Farm Management Advisory Service |

FFMCON | Farm & Agricultural Consultant |

FHTCON | Horticultural Consultancy |

FMOROR | Mortgage Originator |

FPPORG | Primary Production Organisation |

FSSAGT | Stock & Station Agency |

FVALUR | Valuer - real estate |

FVETBS | Veterinary Surgeons Bloodstock |

FVETEQ | Veterinary Surgeons- Equine |

FVETGH | Veterinary Surgeons- Greyhound |

FVETLS | Veterinary Surgeon Livestock |

FVETSM | Veterinary Surgeons-Small/Pets |

FVTLAB | Veterinary Laboratories |

FWLBRK | Wool Broking |

G | Schools, Colleges - Miscellaneous occupations |

GBALSH | Ballet School & Dance Tuition |

GCUBAS | Scuba Diving Instruction - COMMERCIAL |

GEDCON | Education Consultancy |

GKINDA | Kindergartens |

GPSCHL | Private School |

GSCHOL | Primary Schools |

GSCUBA | Scuba Diving Instructor - recreational |

GSECOL | Secondary Schools/Colleges |

GTEACH | Teacher |

GTRCON | Training & Development Consultants |

GUNVER | Universities |

H | Insurance - miscellaneous occupations |

HARGEN | Authorised Representatives (general insurance products) |

HARLIF | Authorised Representatives (life insurance products) |

HININV | Insurance Investigation |

HINSAG | Insurance Agency |

HINSBK | Insurance Broking |

HINSLA | Insurance Assessors & Loss Adjusters |

HINSUR | Insurance Surveyor |

HLASAG | Life Assurance Agents |

HLOSSA | Loss Assessor |

HLSCON | Loss Control & Management Control |

HRMCON | Risk Management Consultants |

HUWAGT | Underwriting Agent |

I | Local Government - Miscellaneous occupations |

IADVOR | Govt. Advisory Organization |

ILGTAT | Local Government Authority |

CODE | Occupation Description |

IMUNCL | Municipal / Shire Councils |

J | Miscellaneous occupations |

JADVAG | Advertising Agency |

JANTHE | Anthropologist |

JARBIT | Mediation & Arbitration |

JARCHE | Archaeology |

JBEAUT | Beauty Therapy |

JBTBKR | Boat & Yacht Broking |

JBTDES | Boat & Yacht Designing |

JCARGO | Cargo & Marine Surveying |

JCMADV | Community Advice Centres |

JCOACH | Sports Coach |

JCOASS | Association - Community |

JCOURI | Courier Service |

JCSFAG | Customs Shipping & Forwarding |

JCUSTA | Customs Agency |

JDIASS | Association - Disability |

JDIVSE | Diving Services |

JENASS | Association - Environmental |

JFAMWL | Family Welfare Organization |

JFUNRL | Funeral Directing |

JGPDES | Graphic design |

JINVES | Investigators |

JMARRC | Marriage, Family, Personal Councillor |

JMNENG | Marine Engineers |

JMNSUR | Marine Surveying |

JNVARC | Naval Architecture |

JPHOTO | Photographer / Cameraman |

JPIDES | Product & Industrial Design |

JPRASS | Association - Professional |

JRELIG | Religious Organisation |

JRESER | Research & Development Corp |

JSECRE | Secretariat Services |

JSHPCH | Ship & Boat Chandelling |

JSPASS | Association - Sporting |

JTDASS | Association - Trade |

JTECHW | Technical Writers |

JTELAN | Telephone Answering / telemarketing |

JTRAUN | Trade Union |

JWEASS | Association - Welfare |

JWTCON | Writers Consultant &/or Service |

K | Architects Miscellaneous occupations |

KACHTS | Architects |

KARCDR | Architectural Draughtspersons |

CODE | Occupation Description |

KINTDE | Interior Designers & Fit out Consultant |

KLACHS | Landscape Architecture |

KLACTP | Town Planning |

KPLUMB | Plumbing Consultants |

L | Engineering - miscellaneous occupations |

LACENG | Engineer – acoustic |

LAEENG | Engineer – aeronautical |

LAGENG | Engineer – agricultural |

LBCERT | Building Certifiers |

LBHENG | Building Hydraulic Design Engineer |

LBIENG | Engineer – biomedical |

LBINSP | Building Inspectors |

LBLCON | Building Consultants |

LBLDES | Building Designer |

LBLDIN | Building Inspector - Victorian Building Act activities only |

LCHENG | Engineer – chemical |

LCHSCI | Chemical Scientist |

LCIENG | Engineer – civil |

LCONMG | Construction Management |

LCONTE | Concrete Testing & Investigation |

LDSCON | Drainage Sewerage & Water Supplies |

LELENG | Engineer – electrical |

LELINS | Electrical Inspectors |

LENAUD | Environmental Auditor |

LENGDT | Engineering Draftspersons |

LENVEN | Engineer – environmental |

LETENG | Engineer – electronic |

LFPENG | Engineer - fire protection / safety |

LFSENG | Foundation & Structural Engineer |

LGEEON | Engineer - geo-technical - soil testing |

LGEOLO | Engineer – geological |

LHAENG | Engineer – harbour |

LHDENG | Hydro Electric Engineering |

LHMENG | Materials Handling, Process Engineer |

LHVENG | Heating/Ventilation/Air-Con |

LHYENG | Engineer – hydraulic |

LMAENG | Engineer – marine |

LMCENG | Engineer – Metallurgical |

LMEENG | Engineer – Mechanical |

LMIENG | Engineer - mining / minerals processing |

LNDCST | Non Destructive Testing Consul |

LPCCST | Petrochem,Chemical,Natural Gas,Env Con |

LPEENG | Power & Energy Engineering |

LPREIN | Pre-purchase Inspection Services |

CODE | Occupation Description |

LPRMGR | Project Managers |

LRFENG | Engineer – Refrigeration |

LSFENG | Safety Engineering |

LSTENG | Engineer – structural |

CODE | Occupation Description |

LTELEC | Engineer – telecommunications |

LTNPNR | Town Planners |

LTRENG | Engineer – Traffic |

LWASTE | Waste Management Consultants |

LWWENG | Engineer - water treatment / sewage |

M | Surveying Miscellaneous |

MBLSUV | Building Surveyor |

MCARTO | Cartographer |

MCMSUV | Surveyors - Cargo and/or Marine |

MCOSTE | Cost Estimators |

MHYSUV | Surveyors – Hydrographic |

MLDSUV | Land Surveyors |

MQTSUV | Surveyor – quantity |

MSUREN | Surveyor – Engineering |

MSURMI | Surveyor – Mining |

N | Defamation – misc |

NFPROD | Film Producer |

NJOURN | Journalist |

NPUBLI | Publishers |

NRADIO | Radio Broadcasters |

NTVBRO | Televisions Broadcasters |