Department of Finance

(Commercial & Government Services)

Copyright Notice

Content

© Commonwealth of Australia 2020

ISBN: 978-1-925537-45-1

With the exception of the Commonwealth Coat of Arms, any material protected by a trade mark, and when otherwise noted, this work is licensed under a Creative Commons Attribution 3.0 Australia licence (http://creativecommons.org/licenses/by/3.0/au/).

![]()

The details of the relevant licence conditions are available on the Creative Commons website (accessible using the links provided) as is the full legal code for the CC BY 3 AU licence.

Use of the Coat of Arms

The terms under which the Coat of Arms can be used are detailed on the following website: http://www.itsanhonour.gov.au/coat-arms/.

Content from this website should be attributed as the Department of Finance.

I am pleased to release the Commonwealth Procurement Rules to reflect the Australian Government’s policies and expectations of procuring officials.

The Australian Government is committed to building a stronger, more prosperous and resilient economy where Australian businesses can be competitive on a domestic and international level. With this in mind, we are focussed on reducing the cost of doing business with the Commonwealth by cutting red tape and enhancing government engagement with business, including small and medium business.

I have made these Commonwealth Procurement Rules under section 105B(1) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act). The previous Commonwealth Procurement Rules - 20 April 2019 (F2019L00536) are repealed when this instrument commences on 14 December 2020.

The Commonwealth Procurement Rules are the keystone of the Government’s procurement policy framework. They are supported by a range of tools including the AusTender system, guidance material and templates developed and maintained by the Department of Finance to ensure accountability and transparency, and reduce the costs and complexity of conducting business with the Australian Government.

Achieving value for money is the core rule of the Commonwealth Procurement Rules as it is critical to ensuring that public resources are used in the most efficient, effective, ethical and economic manner. However, it is important to remember that price is not the only factor when assessing value for money, and officials are required to consider all relevant financial and non-financial costs and benefits, including environmental sustainability, associated with a procurement.

The Australian Government considers it is important to understand the economic implications of major contracts and therefore requires agencies to examine the value offered by different suppliers. Suppliers are encouraged to demonstrate the economic benefits of their proposals in procurements valued above $4 million (or $7.5 million for construction services).

There is sufficient flexibility in these rules to provide opportunities for innovation and for officials to design processes that appropriately reflect the size, scope and risk of the procurement. The framework reflects officials’ responsibilities, including under the PGPA Act and Australia’s international obligations, and factors that must be considered in meeting the core rule of achieving value for money.

Simon Birmingham

Minister for Finance

Contents

Section Paragraph(s) Page

2. Procurement framework 2.1 - 2.15

Resource Management Framework 2.11 - 2.14

International obligations 2.15

3. How to use the Commonwealth Procurement Rules 3.1 - 3.9

Compliance with the two divisions of the CPRs 3.5 - 3.8

Using Appendix A exemptions 3.9

Division 1: Rules for all procurements

Considering value for money 4.1 - 4.3

Achieving value for money 4.4 - 4.6

Broader benefits to the Australian economy 4.7 - 4.8

Procurement-connected policies 4.9 - 4.10

Coordinated procurement 4.11 - 4.12

Cooperative procurement 4.13 - 4.15

Third-party procurement 4.17 - 4.18

5. Encouraging competition 5.1 - 5.8

Small and Medium Enterprises 5.5 - 5.8

6. Efficient, effective, economical and ethical procurement 6.1 - 6.10

Commonwealth Contracting Suite 6.10

7. Accountability and transparency 7.1 - 7.27

Annual procurement plans 7.8 - 7.9

Notifications to the market 7.10 - 7.15

Providing information 7.16 - 7.17

Reporting arrangements 7.18 - 7.20

Treatment of confidential information 7.22 - 7.25

Contract management/Standard verification 7.26

9. Procurement method 9.1 - 9.13

Requirement to estimate value of procurement 9.2 - 9.6

Procurement methods 9.8 - 9.11

Procurement from existing arrangements 9.12 - 9.13

Division 2: Additional rules for procurements at or above the relevant

procurement threshold

10. Additional rules 10.1 - 10.36

Conditions for limited tender 10.3 - 10.5

Request documentation 10.6 - 10.8

Modification of evaluation criteria or specifications 10.14

Conditions for participation 10.15 - 10.19

Minimum time limits 10.20 - 10.27

Late submissions 10.28 - 10.31

Receipt and opening of submissions 10.32 - 10.34

Awarding contracts 10.35 - 10.36

2.1 The Commonwealth Procurement Rules (CPRs) are issued by the Minister for Finance (Finance Minister) under section 105B(1) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

2.2 Officials from non-corporate Commonwealth entities and prescribed corporate Commonwealth entities listed in section 30 of the Public Governance, Performance and Accountability Rule 2014 must comply with the CPRs when performing duties related to procurement. These entities will collectively be referred to as relevant entities throughout the CPRs.

2.3 Rules that must be complied with in undertaking procurement are denoted by the term ‘must’. Non-corporate Commonwealth entities must report non-compliance with the rules of the CPRs through the Commonwealth’s compliance reporting process. The term ‘should’ indicates good practice.

2.4 The CPRs are the core of the procurement framework, which also includes:

- web-based guidance, developed by the Department of Finance (Finance) to assist entities to implement the procurement framework;

- Resource Management Guides, which advise of key changes and developments in the procurement framework; and

- templates, such as the Commonwealth Contracting Suite, which simplify and streamline processes, creating uniformity across Commonwealth contracts to reduce the burden on businesses when contracting with the Commonwealth.

2.5 An Accountable Authority may use Accountable Authority Instructions to set out

entity-specific operational rules to ensure compliance with the rules of the procurement framework.

2.6 These CPRs do not apply to the extent that an official applies measures determined by their Accountable Authority to be necessary for the maintenance or restoration of international peace and security, to protect human health, for the protection of essential security interests, or to protect national treasures of artistic, historic or archaeological value.[1]

Procurement

2.7 Procurement is the process of acquiring goods and services. It begins when a need has been identified and a decision has been made on the procurement requirement. Procurement continues through the processes of risk assessment, seeking and evaluating alternative solutions, and the awarding and reporting of a contract.

2.8 In addition to the acquisition of goods and services by a relevant entity for its own use, procurement includes the acquisition of goods and services on behalf of another relevant entity or a third party.

2.9 Procurement does not include:

- grants (whether in the form of a contract, conditional gift or deed)[2];

b. investments (or divestments);

c. sales by tender;

d. loans;

e. procurement of goods and services for resale or procurement of goods and services used in the production of goods for resale;

f. any property right not acquired through the expenditure of relevant money (for example, a right to pursue a legal claim for negligence);

g. statutory appointments;

h. appointments made by a Minister using the executive power (for example, the appointment of a person to an advisory board);

i. the engagement of employees, such as under the Public Service Act 1999, the Parliamentary Services Act 1999, a relevant entity’s enabling legislation or the common law concept of employment; or

j. arrangements between non-corporate Commonwealth entities where no other suppliers were approached.

2.10 Following the awarding of the contract, the delivery of and payment for the goods and services and, where relevant, the ongoing management of the contract and consideration of disposal of goods, are important elements in achieving the objectives of the procurement.

Resource Management Framework

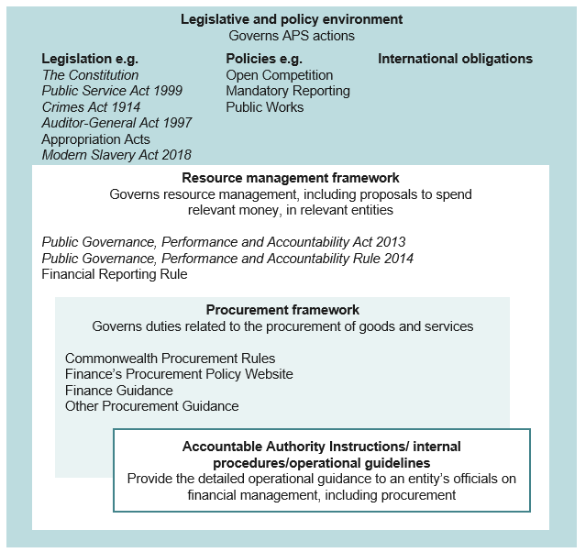

2.11 Relevant entities and officials operate in an environment of legislation and Commonwealth policy. Within that broad context, the Resource Management Framework consists of the legislation and policy governing the management of the Commonwealth’s resources. Figure 1 sets out the main elements of this environment related to procurement.

Figure 1: Legislation and policy

2.12 The procurement framework is a subset of the Resource Management Framework related to the procurement of goods and services.

2.13 Section 16 of the PGPA Act outlines an Accountable Authority's duty to establish appropriate internal control systems for their relevant entity. The CPRs provide the necessary framework for Accountable Authorities when issuing Accountable Authority Instructions and operational requirements in relation to procurement. In the area of procurement, an Accountable Authority should provide a mechanism to:

- apply the principles and requirements of the resource management and procurement frameworks, focusing on the relevant entity's operations; and

b. provide primary operational instructions to relevant entity officials in carrying out their duties related to procurement, in a way that is tailored to a relevant entity's particular circumstances and needs.

2.14 Non-compliance with the requirements of the Resource Management Framework, including in relation to procurement, may attract a range of criminal, civil or administrative remedies including under the Public Service Act 1999 and the

Crimes Act 1914.

International obligations

2.15 Australia is party to a range of free trade arrangements. These arrangements are implemented domestically by legislation and/or Commonwealth policy. Relevant international obligations have been incorporated in these CPRs. Therefore, an official undertaking a procurement is not required to refer directly to international agreements.

3. How to use the Commonwealth Procurement Rules

3.1 The CPRs set out the rules that officials must comply with when they procure goods and services. The CPRs also indicate good practice. The CPRs have been designed to provide officials with flexibility in developing and implementing procurement processes that reflect their relevant entity’s needs.

3.2 Achieving value for money is the core rule of the CPRs. This requires the consideration of the financial and non-financial costs and benefits associated with procurement.

3.3 Further information and guidance on applying the CPRs are available on Finance’s procurement policy website at www.finance.gov.au/procurement.

3.4 Relevant entities may have additional rules, guidance, templates or tools that apply when conducting procurements.

Compliance with the two divisions of the CPRs

3.5 Officials of non-corporate Commonwealth entities must comply with the ‘rules for all procurements’ listed in Division 1, regardless of the procurement value. Officials must also comply with the ‘additional rules’ listed in Division 2 when the estimated value of the procurement is at or above the relevant procurement threshold and when an Appendix A exemption does not apply.

3.6 Officials of corporate Commonwealth entities prescribed in section 30 of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) as having to comply with the CPRs must comply with the ‘rules for all procurements’ listed in Division 1 and the ‘additional rules’ listed in Division 2 when the expected value of the procurement is at or above the relevant procurement threshold and when an Appendix A exemption does not apply.

3.7 Despite being prescribed corporate Commonwealth entities, Australian Digital Health Agency, Australian Human Rights Commission, National Portrait Gallery of Australia, Old Parliament House, and Regional Investment Corporation, must apply a procurement threshold and reporting threshold of $80,000 for procurements other than the procurement of construction services. They may opt-in to coordinated procurements and must only comply with those policies of the Commonwealth that specify compliance by corporate Commonwealth entities.

3.8 Despite being a corporate Commonwealth entity, the Commonwealth Superannuation Corporation, in regards to its administrative functions only, must apply a procurement threshold of $80,000 and a reporting threshold of $10,000 for procurements other than the procurement of construction services. They may opt-in to coordinated procurements and must only comply with those policies of the Commonwealth that specify compliance by corporate Commonwealth entities.

Using Appendix A exemptions

3.9 When an Appendix A exemption applies, the additional rules of Division 2 for procurements at or above the relevant procurement threshold do not apply to the procurement, but the relevant entity must still comply with the rules for all procurements (Division 1), excluding paragraphs 4.7, 4.8 and 7.26. This does not prevent a relevant entity from voluntarily conducting the procurement for goods or services covered by an Appendix A exemption in accordance with some or all of the processes and principles of Division 2.

Division 1: Rules for all procurements

Considering value for money

4.1 A thorough consideration of value for money begins by officials clearly understanding and expressing the goals and purpose of the procurement.

4.2 When a business requirement arises, officials should consider whether a procurement will deliver the best value for money. It is important to take into consideration:

- stakeholder input;

b. the scale and scope of the business requirement;

c. the relevant entity’s resourcing and budget;

d. obligations and opportunities under other existing arrangements;

e. relevant Commonwealth policies; and

f. the market’s capacity to competitively respond to a procurement.

4.3 When a relevant entity determines that procurement represents the best value for money, these considerations will inform the development and implementation of the procurement.

Achieving value for money

4.4 Achieving value for money is the core rule of the CPRs. Officials responsible for a procurement must be satisfied, after reasonable enquires, that the procurement achieves a value for money outcome. Procurements should:

- encourage competition and be non-discriminatory;

b. use public resources in an efficient, effective, economical and ethical manner that is not inconsistent with the policies of the Commonwealth[3];

c. facilitate accountable and transparent decision making;

d. encourage appropriate engagement with risk; and

e. be commensurate with the scale and scope of the business requirement.

4.5 Price is not the sole factor when assessing value for money. When conducting a procurement, an official must consider the relevant financial and non-financial costs and benefits of each submission including, but not limited to the:

- quality of the goods and services;

b. fitness for purpose of the proposal;

c. potential supplier’s relevant experience and performance history;

d. flexibility of the proposal (including innovation and adaptability over the lifecycle of the procurement);

e. environmental sustainability of the proposed goods and services (such as energy efficiency, environmental impact and the use of recycled products)

- recognising the Australian Government’s commitment to sustainable procurement practices, entities are required to consider the Australian Government’s Sustainable Procurement Guide where there is opportunity for sustainability or use of recycled content[4];

- the Sustainable Procurement Guide is available from the Department of Agriculture, Water and the Environment’s website; and

f. whole-of-life costs.

4.6 Whole-of-life costs could include:

- the initial purchase price of the goods and services;

b. maintenance and operating costs;

c. transition out costs;

d. licensing costs (when applicable);

e. the cost of additional features procured after the initial procurement;

f. consumable costs, including the environmental sustainability of consumables; and

g. decommissioning, remediation and disposal costs (including waste disposal).

Broader benefits to the Australian economy

4.7 In addition to the value for money considerations at paragraphs 4.4 – 4.6, for procurements above $4 million (or $7.5 million for construction services) (except procurements covered by Appendix A and procurements from standing offers), officials are required to consider the economic benefit of the procurement to the Australian economy.

4.8 The policy operates within the context of relevant national and international agreements and procurement policies to which Australia is a signatory, including free trade agreements and the Australia and New Zealand Government Procurement Agreement.

Procurement-connected policies

4.9 Procurement-connected policies are policies of the Commonwealth for which procurement has been identified as a means of delivery. To assist relevant entities in complying with policies of the Commonwealth, Finance maintains a list of procurement-connected policies, which can be found at www.finance.gov.au/procurement.

4.10 Generally, procurement-connected policies are the responsibility of entities other than Finance. The relevant policy-owning entity is responsible for administering, reviewing and providing information on the policy as required.

Coordinated procurement

4.11 Coordinated procurement refers to whole-of-government arrangements for procuring goods and services. A list of coordinated procurements can be found at www.finance.gov.au/procurement.

4.12 Non-corporate Commonwealth entities must use coordinated procurements. Exemptions from coordinated procurements can only be granted jointly by the requesting non-corporate Commonwealth entity’s Portfolio Minister and the

Finance Minister when a non-corporate Commonwealth entity can demonstrate a special need for an alternative arrangement[5]. Prescribed corporate Commonwealth entities may opt-in to coordinated procurements.

Cooperative procurement

4.13 Cooperative procurements involve more than one relevant entity as the buyer. Relevant entities can procure cooperatively by approaching the market together or by joining an existing contract of another relevant entity.

4.14 If a relevant entity intends to join an existing contract of another relevant entity, the initial request documentation and the contract must have already specified potential use by other relevant entities.

4.15 Relevant entities joining an existing contract must ensure that:

- value for money is achieved;

b. the goods and services being procured are the same as provided for within the contract; and

c. the terms and conditions of the contract are not being materially altered.

Contract end dates

4.16 When a contract does not specify an end date it must allow for periodic review and subsequent termination of the contract by the relevant entity, if the relevant entity determines that it does not continue to represent value for money.

Third-party procurement

4.17 Procurement by third parties on behalf of a relevant entity can be a valid way to procure goods and services, provided it achieves value for money.

4.18 Relevant entities must not use third-party arrangements to avoid the rules in the CPRs when procuring goods and services.

5.1 Competition is a key element of the Australian Government’s procurement framework. Effective competition requires non-discrimination and the use of competitive procurement processes.

5.2 Participation in procurement imposes costs on relevant entities and potential suppliers. Those costs should be considered when designing a process that is commensurate with the scale, scope and risk of the proposed procurement.

Non-discrimination

5.3 The Australian Government’s procurement framework is non-discriminatory.

5.4 All potential suppliers to government must, subject to these CPRs, be treated equitably based on their commercial, legal, technical and financial abilities and not be discriminated against due to their size, degree of foreign affiliation or ownership, location, or the origin of their goods and services.

Small and Medium Enterprises

5.5 To ensure that Small and Medium Enterprises (SMEs) can engage in fair competition for Australian Government business, officials should apply procurement practices that do not unfairly discriminate against SMEs and provide appropriate opportunities for SMEs to compete. Officials should consider, in the context of value for money:

- the benefits of doing business with competitive SMEs when specifying requirements and evaluating value for money;

b. barriers to entry, such as costly preparation of submissions, that may prevent SMEs from competing;

c. SMEs’ capabilities and their commitment to local or regional markets; and

d. the potential benefits of having a larger, more competitive supplier base.

5.6 The Australian Government is committed to non-corporate Commonwealth entities sourcing at least 10 per cent of procurement by value from SMEs.

5.7 In addition, the Government has a target of non-corporate Commonwealth entities procuring 35 per cent of contracts, by value, with a value of up to $20 million from SMEs.

5.8 The Australian Government recognises the importance of paying suppliers on time, particularly small and medium businesses. Non-corporate Commonwealth entities must make all payments to a supplier under a contract valued up to A$1 million (GST inclusive) within the maximum payment terms, following the acknowledgement of the satisfactory delivery of goods or services and the receipt of a correctly rendered invoice[6].

6. Efficient, effective, economical and ethical procurement

6.1 The Australian Government promotes the proper use and management of public resources. Proper means efficient, effective, economical and ethical. For

non-corporate Commonwealth entities, this would also include being not inconsistent with the policies of the Commonwealth[7].

6.2 Efficient relates to the achievement of the maximum value for the resources used. In procurement, it includes the selection of a procurement method that is the most appropriate for the procurement activity, given the scale, scope and risk of the procurement.

6.3 Effective relates to the extent to which intended outcomes or results are achieved. It concerns the immediate characteristics, especially price, quality and quantity, and the degree to which these contribute to specified outcomes.

6.4 Economical relates to minimising cost. It emphasises the requirement to avoid waste and sharpens the focus on the level of resources that the Commonwealth applies to achieve outcomes.

6.5 Ethical relates to honesty, integrity, probity, diligence, fairness and consistency. Ethical behaviour identifies and manages conflicts of interests, and does not make improper use of an individual’s position.

Ethical behaviour

6.6 In particular, officials undertaking procurement must act ethically throughout the procurement. Ethical behaviour includes:

- recognising and dealing with actual, potential and perceived conflicts of interest;

b. dealing with potential suppliers, tenderers and suppliers equitably, including by

- seeking appropriate internal or external advice when probity issues arise, and

- not accepting inappropriate gifts or hospitality;

c. carefully considering the use of public resources; and

d. complying with all directions, including relevant entity requirements, in relation to gifts or hospitality, the Australian Privacy Principles of the Privacy Act 1988 and the security provisions of the Crimes Act 1914.

6.7 Relevant entities must not seek to benefit from supplier practices that may be dishonest, unethical or unsafe. This includes not entering into contracts with tenderers who have had a judicial decision against them (not including decisions under appeal) relating to employee entitlements and who have not satisfied any resulting order. Officials should seek declarations from all tenderers confirming that they have no such unsettled orders against them.

6.8 If a complaint about procurement is received, relevant entities must apply timely, equitable and non-discriminatory complaint-handling procedures, including providing acknowledgement soon after the complaint has been received. Relevant entities should aim to manage the complaint process internally, when possible, through communication and conciliation.

Judicial Review

6.9 For the purposes of paragraph (a) of the definition of relevant Commonwealth Procurement Rules in section 4 of the Government Procurement (Judicial Review) Act 2018, the following paragraphs of Division 1 of these CPRs are declared to be relevant provisions: paragraphs 4.18, 5.4, 7.2, 7.10, 7.13 – 7.18, 7.20, and 9.3 – 9.6.

Commonwealth Contracting Suite

6.10 Non-corporate Commonwealth entities must use the Commonwealth Contracting Suite for contracts under $200,000. Corporate Commonwealth entities are encouraged to apply the suite of templates[8].

7. Accountability and transparency

7.1 The Australian Government is committed to ensuring accountability and transparency in its procurement activities. Accountability means that officials are responsible for the actions and decisions that they take in relation to procurement and for the resulting outcomes. Transparency involves relevant entities taking steps to enable appropriate scrutiny of their procurement activity. The fundamental elements of accountability and transparency in procurement are outlined in this section.

Records

7.2 Officials must maintain for each procurement a level of documentation commensurate with the scale, scope and risk of the procurement.

7.3 Documentation should provide accurate and concise information on:

- the requirement for the procurement;

b. the process that was followed;

c. how value for money was considered and achieved;

d. relevant approvals; and

e. relevant decisions and the basis of those decisions.

7.4 Relevant entities must have access to evidence of agreements with suppliers, in the form of one or a combination of the following documents: a written contract, a purchase order, an invoice or a receipt.

7.5 Documentation must be retained in accordance with the Archives Act 1983.

AusTender

7.6 AusTender[9], the Australian Government’s procurement information system, is a centralised web-based facility that publishes a range of information, including relevant entities’ planned procurements, open tenders and key details of contracts awarded. It also supports secure electronic tendering to deliver integrity and efficiency for relevant entities and potential suppliers.

7.7 AusTender is the system used to enable relevant entities to meet their publishing obligations under the CPRs. It also enables relevant entities to monitor and review their AusTender-based procurements, including approaches to market, publication of contracts, and amendments to contracts.

Annual procurement plans

7.8 In order to draw the market’s early attention to potential procurement opportunities, each relevant entity must maintain on AusTender a current procurement plan containing a short strategic procurement outlook.

7.9 The annual procurement plan should include the subject matter of any significant planned procurement and the estimated publication date of the approach to market. Relevant entities should update their plans regularly throughout the year.

Notifications to the market

7.10 Relevant entities must use AusTender to publish open tenders and, to the extent practicable, to make relevant request documentation available.

7.11 Relevant entities may use AusTender to publish limited tender approaches to market and make relevant request documentation available.

7.12 Relevant entities should include relevant evaluation criteria in request documentation to enable the proper identification, assessment and comparison of submissions on a fair, common and appropriately transparent basis.

7.13 In any additional notification through other avenues, such as printed media, the details selected for inclusion in the notification must be the same as those published on AusTender.

7.14 When a relevant entity provides request documentation or any other document, already published on AusTender in any other form (for example, a printed version) that documentation must be the same as that published on AusTender.

7.15 The initial approach to market for a multi-stage procurement must include, for every stage, the criteria that will be used to select potential suppliers, and if applicable, any limitation on the number of potential suppliers that will be invited to make submissions.

Providing information

7.16 Officials must, on request, promptly provide, to eligible potential suppliers, request documentation that includes all information necessary to permit the potential supplier to prepare and lodge submissions.

7.17 Following the rejection of a submission or the award of a contract, officials must promptly inform affected tenderers of the decision. Debriefings must be made available, on request, to unsuccessful tenderers outlining the reasons the submission was unsuccessful. Debriefings must also be made available, on request, to the successful supplier(s).

Reporting arrangements

7.18 Relevant entities must report contracts and amendments on AusTender within 42 days of entering into (or amending) a contract if they are valued at or above the reporting threshold.

7.19 The reporting thresholds (including GST) are:

- $10,000 for non-corporate Commonwealth entities; and

b. for prescribed corporate Commonwealth entities,

- $400,000 for procurements other than procurement of construction services, or

- $7.5 million for procurement of construction services.

7.20 Regardless of value, standing offers must be reported on AusTender within 42 days of the relevant entity entering into or amending such arrangements. Relevant details in the standing offer notice, such as supplier details and the names of other relevant entities participating in the arrangement, must be reported and kept current.

Subcontractors

7.21 Relevant entities must make available on request, the names of any subcontractor(s) engaged by a contractor in respect of a contract.

- Relevant entities must require contractors to agree to the public disclosure of the names of any subcontractors engaged to perform services in relation to a contract.

b. Contractors must be required to inform relevant subcontractors that the subcontractor’s participation in fulfilling a contract may be publicly disclosed.

Treatment of confidential information

7.22 When conducting a procurement and awarding a contract, relevant entities should take appropriate steps to protect the Commonwealth’s confidential information. This includes observing legal obligations, such as those under the Privacy Act 1988, and statutory secrecy provisions.

7.23 Submissions must be treated as confidential before and after the award of a contract. Once a contract has been awarded, the terms of the contract, including parts of the contract drawn from the supplier’s submission, are not confidential unless the relevant entity has determined and identified in the contract that specific information is to be kept confidential in accordance with the ‘confidentiality test’ set out in the guidance on Confidentiality Throughout the Procurement Cycle at https://www.finance.gov.au/procurement.

7.24 The need to maintain the confidentiality of information should always be balanced against the public accountability and transparency requirements of the Australian Government. It is therefore important for officials to plan for, and facilitate, appropriate disclosure of procurement information. In particular, officials should:

- include provisions in request documentation and contracts that alert potential suppliers to the public accountability requirements of the Australian Government, including disclosure to the Parliament and its committees;

b. when relevant, include a provision in contracts to enable the Australian National Audit Office to access contractors’ records and premises to carry out appropriate audits; and

c. consider, on a case-by-case basis, any request by a supplier for material to be treated confidentially after the award of a contract, and enter into commitments to maintain confidentiality only when such commitments are appropriate.

7.25 When confidential information is required to be disclosed, for example following a request from a parliamentary committee, reasonable notice in writing must be given to the party from whom the information originated.

Contract management/Standard verification

7.26 For procurements valued at or above the relevant procurement threshold, where applying a standard for goods or services, relevant entities must make reasonable enquiries to determine compliance with that standard, including:

- gathering evidence of relevant certifications; and

- periodic auditing of compliance by an independent assessor.

Other obligations

7.27 Other reporting and disclosure obligations apply to officials undertaking procurement, including:

- disclosure of procurement information for relevant entity annual reporting purposes;

b. disclosure of non-compliance with the CPRs through the Commonwealth’s compliance reporting process;

c. disclosure to the Parliament and its committees, as appropriate, in line with the Government Guidelines for Official Witnesses before Parliamentary Committees and Related Matters;

d. disclosure of information consistent with the Freedom of Information Act 1982;

e. disclosure of discoverable information that is relevant to a case before a court; and

f. reporting requirements under the Modern Slavery Act 2018.

8.1 Risk management comprises the activities and actions taken by a relevant entity to ensure that it is mindful of the risks it faces, that it makes informed decisions in managing these risks, and identifies and harnesses potential opportunities[10].

8.2 Relevant entities must establish processes to identify, analyse, allocate and treat risk when conducting a procurement. The effort directed to risk assessment and management should be commensurate with the scale, scope and risk of the procurement. Relevant entities should consider risks and their potential impact when making decisions relating to value for money assessments, approvals of proposals to spend relevant money and the terms of the contract.

8.3 Relevant entities should consider and manage their procurement security risk, including in relation to cyber security risk, in accordance with the Australian Government’s Protective Security Policy Framework.

8.4 As a general principle, risks should be borne by the party best placed to manage them; that is, relevant entities should generally not accept risk which another party is better placed to manage. Similarly, when a relevant entity is best placed to manage a particular risk, it should not seek to inappropriately transfer that risk to the supplier.

9.1 Australian Government procurement is conducted by open tender or limited tender. These methods are detailed in this section.

Requirement to estimate value of procurement

9.2 The expected value of a procurement must be estimated before a decision on the procurement method is made. The expected value is the maximum value (including GST) of the proposed contract, including options, extensions, renewals or other mechanisms that may be executed over the life of the contract.

9.3 The maximum value of the goods and services being procured must include:

- all forms of remuneration, including any premiums, fees, commissions, interest, allowances and other revenue streams that may be provided for in the proposed contract;

b. the value of the goods and services being procured, including the value of any options in the proposed contract; and

c. any taxes or charges.

9.4 When a procurement is to be conducted in multiple parts with contracts awarded either at the same time or over a period of time, with one or more suppliers, the expected value of the goods and services being procured must include the maximum value of all of the contracts.

9.5 A procurement must not be divided into separate parts solely for the purpose of avoiding a relevant procurement threshold.

9.6 When the maximum value of a procurement over its entire duration cannot be estimated the procurement must be treated as being valued above the relevant procurement threshold.

Procurement thresholds

9.7 When the expected value of a procurement is at or above the relevant procurement threshold and an exemption in Appendix A is not applied, the rules in Division 2 must also be followed. The procurement thresholds (including GST) are:

- for non-corporate Commonwealth entities, other than for procurements of construction services, the procurement threshold is $80,000;

b. for prescribed corporate Commonwealth entities, other than for procurements of construction services, the procurement threshold is $400,000; or

c. for procurements of construction services by relevant entities, the procurement threshold is $7.5 million.

Procurement methods

Method 1 – Open tender

9.8 Open tender involves publishing an open approach to market and inviting submissions. This includes multi-stage procurements, provided the first stage is an open approach to market.

Method 2 – Limited tender

9.9 Limited tender involves a relevant entity approaching one or more potential suppliers to make submissions, when the process does not meet the rules for open tender.

9.10 For procurements at or above the relevant procurement threshold, limited tender can only be conducted in accordance with paragraph 10.3, or when a procurement is exempt as detailed in Appendix A.

9.11 When conducting a limited tender in accordance with paragraph 9.10, the relevant exemption or limited tender condition must be reported on AusTender.