1 Name

This instrument is the Export Control (Sheepmeat and Goatmeat Export to the European Union Tariff Rate Quotas) Amendment (Brexit Transition Period) Order 2020.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | The day after this instrument is registered. | 24 October 2020 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under section 23A of the Export Control Act 1982.

4 Schedules

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments

Export Control (Sheepmeat and Goatmeat Export to the European Union Tariff Rate Quotas) Order 2019

1 Section 1

Omit “(Sheepmeat and Goatmeat Export to the European Union Tariff Rate Quotas)”, substitute “(Tariff Rate Quotas—Sheepmeat and Goatmeat Export to the European Union and United Kingdom)”.

2 Section 5

Repeal the section, substitute:

5 Purpose of this instrument

This instrument provides for, and in relation to, the establishment and administration of a system of tariff rate quotas for the export of sheepmeat and goatmeat to the European Union and the United Kingdom.

3 Section 6 (definition of access amount)

Repeal the definition, substitute:

access amount means:

(a) for the EU and a quota year—the total carcase equivalent weight of eligible meat for the EU that may, under the import tariff quota for CN code 0204 that is specified for Australia in the Annex to Commission Implementing Regulation (EU) No 1354/2011, be exported from Australia to the EU in the quota year at a reduced tariff rate; or

(b) for the UK and a quota year—15,349,000 kilograms.

Note: The Regulation mentioned in paragraph (a) could in 2020 be viewed on the EUR‑Lex website (https://eur‑lex.europa.eu).

4 Section 6 (definition of Australian tariff rate quota)

Repeal the definition.

5 Section 6 (paragraph (a) of the definition of carcase equivalent weight)

Omit “eligible”.

6 Section 6 (definition of consignment)

Omit “of eligible meat”.

7 Section 6 (definition of eligible meat)

After “eligible meat”, insert “, for a quota destination,”.

8 Section 6 (paragraph (d) of the definition of eligible meat)

Omit “EU”, substitute “quota destination”.

9 Section 6 (definition of EU)

Omit “during any UK withdrawal transition period”, substitute “in relation to the quota year starting on 1 January 2020”.

10 Section 6 (definition of exporter)

Omit “to the EU”.

11 Section 6

Insert:

quota destination means the EU or the UK.

UK means the United Kingdom.

12 Section 6 (definition of UK withdrawal transition period)

Repeal the definition.

13 Part 2 (heading)

Repeal the heading, substitute:

Part 2—Use of access amounts

14 Section 7

Omit all the words after “the export”, substitute “of eligible meat to a quota destination within the access amount for the quota destination and a quota year.”.

15 Section 8

After “exporter’s tariff rate quota entitlement,”, insert “for a quota destination”.

16 Section 8

Omit “allocated or transferred to the exporter in relation to the quota year”, substitute “for the quota destination and quota year allocated or transferred to the exporter”.

17 Paragraph 8(a)

After “entitlement”, insert “for the quota destination and quota year”.

18 Paragraph 8(b)

Repeal the paragraph, substitute:

(b) amounts of the exporter’s tariff rate quota entitlement for the quota destination and quota year cancelled under section 14, 15, 16 or 18;

19 Paragraphs 8(c) and (d)

Omit “in the quota year”, substitute “for the quota destination and quota year”.

20 Subsection 9(1)

Omit “under subsection 10(1) for a quota year”, substitute “for a quota destination and a quota year under subsection 10(1)”.

21 Subsection 9(2)

After “entitlement”, insert “for the quota destination and quota year”.

22 Subsection 10(1)

Omit “to be allocated to each applicant under section 9 for a quota year”, substitute “for a quota destination and a quota year to be allocated to each applicant under section 9”.

23 Subsection 10(1) (method statement, step 2)

After “for the”, insert “quota destination and”.

24 Subsection 10(1) (method statement, paragraph (b) of step 4)

After “for the”, insert “quota destination and”.

25 Subsection 10(1) (method statement, step 6)

After “for the”, insert “quota destination and”.

26 Paragraph 10(2)(a)

Omit “under this section for the quota year”, substitute “for the quota destination and quota year under this section”.

27 Section 11

Repeal the section, substitute:

11 Penalty amount

(1) For the purposes of step 2 of the method statement in subsection 10(1), an applicant is subject to a penalty for a quota destination and a quota year if the applicant’s certified exports for the quota destination and the previous quota year (as worked out under subsection (2)) are less than 90% of the applicant’s annual entitlement for the quota destination and the previous quota year (as worked out under subsection (3)).

(2) The applicant’s certified exports for the quota destination and the previous quota year are the sum of:

(a) the amounts stated in certificates (if any) issued to the applicant under section 19, before the end of 30 November in the previous quota year, for export of consignments to the quota destination in the previous quota year; and

(b) the entitlement‑based amounts stated in certificates (if any) issued to the applicant under section 20, before the end of 30 November in the previous quota year, for export of consignments to the quota destination in the previous quota year.

Note: The amount stated in a certificate is disregarded if the certificate is cancelled (see subsection 23(4)). See also section 24 for the effect of annotations of certificates.

(3) The applicant’s annual entitlement for the quota destination and the previous quota year is the total of the amounts of tariff rate quota entitlement for the quota destination and previous quota year allocated or transferred to the applicant under sections 10, 13 and 17, reduced by the sum of:

(a) amounts (if any) of tariff rate quota entitlement for the quota destination and the previous quota year transferred by the applicant under section 13; and

(b) amounts (if any) of the applicant’s tariff rate quota entitlement for the quota destination and the previous quota year cancelled under section 14, 15 or 16.

(4) If the applicant is subject to a penalty, the applicant’s penalty amount for the quota destination and the quota year is half the amount by which the applicant’s annual entitlement for the quota destination and the previous quota year exceeds the applicant’s certified exports for the quota destination and the previous quota year.

28 Section 12 (definition of AA)

After “access amount for”, insert “the quota destination and”.

29 Section 12 (definition of applicant’s accredited exports)

After “eligible meat”, insert “for the quota destination”.

30 Section 12 (at the end of the definition of applicant’s quota exports)

Add “for export of consignments to the quota destination”.

31 Section 12 (definition of total accredited exports)

After “eligible meat”, insert “for the quota destination”.

32 Section 13 (at the end of the heading)

Add “before 1 November”.

33 Subsections 13(1) and 14(1)

After “entitlement”, insert “for a quota destination and the quota year”.

34 Paragraph 15(1)(a)

After “entitlement”, insert “for a quota destination and the quota year”.

35 Paragraph 15(1)(b)

Repeal the paragraph, substitute:

(b) the balance of the exporter’s tariff rate quota entitlement for a quota destination and the quota year was greater than zero at any time in the quota year, and the exporter wants to apply for an additional amount of tariff rate quota entitlement for the quota destination and quota year.

36 Section 16

After “in a quota year”, insert “in relation to the balance of the exporter’s tariff rate quota entitlement for a quota destination and the quota year,”.

37 Section 16

After “entitlement”, insert “for the quota destination and quota year”.

38 Subsection 17(1)

After “entitlement”, insert “for a quota destination and the quota year”.

39 Paragraph 17(1)(a)

Omit “cancelled in the quota year”, substitute “for the quota destination and quota year cancelled”.

40 Paragraph 17(2)(a)

Omit “under this section for the quota year”, substitute “for the quota destination and quota year under this section”.

41 Subsection 18(1)

After “entitlement”, insert “for a quota destination and the quota year”.

42 Subsection 19(1)

Repeal the subsection (not including the note), substitute:

(1) At any time before the Secretary allocates amounts under section 17 in relation to a quota destination and a quota year (additional allocations after 1 November), an exporter may apply to the Secretary for a tariff rate quota certificate for the export of a consignment of eligible meat to the quota destination in the quota year within the access amount for the quota destination and the quota year.

43 Subsection 19(2)

After “entitlement for”, insert “the quota destination and”.

44 Paragraph 19(4)(b)

Omit “goods”, substitute “consignment”.

45 Subsection 19(5)

After “eligible meat”, insert “to a quota destination”.

46 Paragraph 19(5)(b)

Omit “EU”, insert “quota destination”.

47 Subsection 20(1)

Repeal the subsection (not including the note), substitute:

(1) At any time between when the Secretary allocates amounts under section 17 in relation to a quota destination and a quota year (additional allocations after 1 November) and the end of the quota year, an exporter may apply to the Secretary for a tariff rate quota certificate for the export of a consignment of eligible meat to the quota destination in the quota year within the access amount for the quota destination and the quota year.

48 Subsection 20(3)

Omit “to subsection (6)”, substitute “to subsection (7)”.

49 Paragraph 20(3)(a)

After “entitlement”, insert “for the quota destination and quota year”.

50 Paragraph 20(3)(b)

After “amount”, insert “for the quota destination and quota year”.

51 Subsection 20(6)

Repeal the subsection, substitute:

(6) The uncommitted access amount, for a quota destination and a quota year at a particular time, is the sum of:

(a) the amount (if any) that remained unallocated after the Secretary allocated amounts for the quota destination and quota year under section 17; and

(b) any amounts of tariff rate quota entitlement for the quota destination and quota year cancelled under section 18 before that time;

reduced in accordance with paragraph (5)(b) for certificates issued to applicants under this section before that time.

52 Paragraph 20(7)(b)

Omit “goods”, substitute “consignment”.

53 Subsection 20(8)

After “eligible meat”, insert “to a quota destination”.

54 Subsection 20(8)

Omit “EU”, substitute “quota destination”.

55 Subsection 21(1)

Omit “of eligible meat”.

56 Subsection 23(1)

Omit “to the EU”, substitute “to a quota destination”.

57 Paragraph 23(1)(a)

Omit “EU’, substitute “quota destination”.

58 Subsection 23(2)

Omit “to the EU”, substitute “to a quota destination”.

59 Paragraph 23(2)(a)

Omit “EU”, substitute “quota destination”.

60 Subparagraph 23(2)(b)(iv)

Omit “goods”, substitute “consignment”.

61 Paragraph 24(1)(a)

Omit “an appropriate EU authority annotates a tariff rate quota certificate”, substitute “a quota destination authority annotates a tariff rate quota certificate for export of a consignment to the quota destination”.

62 Subsection 24(4)

Repeal the subsection, substitute:

(4) An annotation of a certificate issued under section 20 affects the applicant’s entitlement‑based amount (if any) for the quota destination and quota year before it affects the uncommitted access amount for the quota destination and quota year.

63 Subsection 25(1)

Omit “eligible meat”, substitute “mutton, lamb or goatmeat”.

64 At the end of subsection 25(1)

Omit “under the Australian tariff rate quota”, substitute “for which a certificate was issued under section 19 or 20”.

65 Subsection 32(1)

After “section 20 to the uncommitted access amount”, insert “for a quota destination and a quota year”.

66 Subsection 32(2)

After “entitlement”, insert “for a quota destination and a quota year”.

67 Subsection 34(1)

Repeal the subsection, substitute:

(1) The Secretary may arrange for the use, under the Secretary’s control, of computer programs for any purposes for which the Secretary may, or must, under this instrument:

(a) make a decision; or

(b) exercise any power or comply with any obligation; or

(c) do anything else related to making a decision referred to in paragraph (a), or related to exercising a power or complying with an obligation referred to in paragraph (b).

(1A) However, subsection (1) does not apply in relation to:

(a) making a decision for which an application for reconsideration may be made under section 29; or

(b) reconsidering such a decision under subsection 30(1).

68 Subsection 34(3)

Repeal the subsection, substitute:

(3) The Secretary is taken to have:

(a) made a decision; or

(b) exercised a power or complied with an obligation; or

(c) done something else related to the making of a decision or exercise of a power or compliance with an obligation;

that was made, exercised, complied with or done by the operation of a computer program under an arrangement made under subsection (1).

69 Subsection 34(4)

Omit “subsection (3)”, substitute “paragraph (3)(a)”.

70 Subsection 37(1)

Repeal the subsection, substitute:

(1) This instrument applies:

(a) in relation to exports of eligible meat to the EU in the quota year starting on 1 January 2020 and later quota years; and

(b) in relation to exports of eligible meat to the UK in the quota year starting on 1 January 2021 and later quota years.

Note: In relation to the quota year starting on 1 January 2020, EU is defined to include the UK (see section 6).

71 Sections 40 and 41

Repeal the sections, substitute:

40 Application for tariff rate quota entitlements for 2021 quota year

For the quota year starting on 1 January 2021, section 9 applies as if:

(a) the reference to a quota destination in subsection 9(1) were a reference to both the EU and the UK; and

(b) the reference in subsection 9(2) to an amount of tariff rate quota entitlement for the quota destination and quota year were a reference to amounts of tariff rate quota entitlement for the EU and quota year and the UK and quota year.

41 Determining initial allocations for 2021 quota year

(1) For the quota year starting on 1 January 2021, subsection 10(1) is taken to have been replaced by subsection (2) of this section.

(2) The Secretary must determine the amount of tariff rate quota entitlement for the EU and the UK and a quota year to be allocated to each applicant under section 9, using the following method statement.

Method statement

Step 1. Use the formula in section 42 to work out the step 1 amount for each applicant.

Step 2. If the step 1 amount for an applicant is less than 12,000 kg:

(a) the amount is excluded; and

(b) the applicant is excluded and is not allocated an amount of tariff rate quota entitlement for either the EU or the UK and the quota year under this section.

Step 3. Use the formula in section 42 to distribute the total of the amounts excluded under step 2 among the applicants who were not excluded, and add the amount distributed to each such applicant’s step 1 amount to reach the applicant’s step 3 amount. For this purpose:

(a) replace references in the formula to CAA with references to the total of the amounts excluded; and

(b) replace references to all applicants with references to applicants who were not excluded.

Step 4. Apportion the step 3 amount for each of the remaining applicants as follows:

(a) 20% for the EU; and

(b) 80% for the UK.

Step 5. Round the amounts to the nearest kilogram, with 0.5 of a kilogram to be rounded up. If after this the sum of the amounts apportioned for a quota destination exceeds the access amount for that quota destination, round all the amounts apportioned for the quota destination down to the nearest kilogram instead.

Step 6. For an applicant not excluded at step 2:

(a) the amount of tariff rate quota entitlement for the EU and the quota year allocated to the applicant is the amount apportioned for the EU at step 4, rounded in accordance with step 5; and

(b) the amount of tariff rate quota entitlement for the UK and the quota year allocated to the applicant is the amount apportioned for the UK at step 4, rounded in accordance with step 5.

42 Formula for determining initial allocation for 2021 quota year

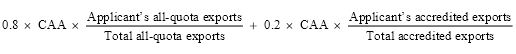

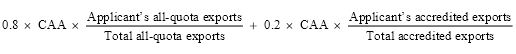

(1) For the purposes of the method statement in section 41, the formula is the following:

where:

where:

applicant’s accredited exports is the carcase equivalent weight of all the applicant’s exports of EU‑eligible meat from an EU‑accredited establishment to any foreign country in the performance period for the quota year, including amounts exported by another exporter in the performance period that have been transferred to the applicant under section 25.

applicant’s all‑quota exports is the total of the amounts stated in certificates issued to the applicant under section 19 or 20 in the performance period for the quota year.

CAA means the sum of:

(a) the access amount for the EU and the quota year; and

(b) the access amount for the UK and the quota year.

total accredited exports is the carcase equivalent weight of all applicants’ exports of EU‑eligible meat from an EU‑accredited establishment to any foreign country in the performance period for the quota year, including amounts exported by another exporter in the performance period that have been transferred to an applicant under section 25.

total all‑quota exports is the total amount of applicant’s all‑quota exports for all applicants.

(2) In subsection (1):

EU‑eligible meat means eligible meat for the EU.

(3) In using the formula in subsection (1), a reference to certificates issued under section 19 or 20 in the performance period for the quota year is taken to include a reference to certificates issued under section 15 or 16 of the old Order in the period starting on 1 November 2019 and ending on 31 December 2019.

43 Repeal of this Part

This Part is repealed at the start of 1 January 2022.