EXPLANATORY STATEMENT

Issued by the Authority of the Minister for Energy and Emissions Reduction

Carbon Credits (Carbon Farming Initiative) Act 2011

Carbon Credits (Carbon Farming Initiative—Animal Effluent Management) Methodology Determination 2019

Purpose

The Carbon Credits (Carbon Farming Initiative—Animal Effluent Management) Methodology Determination 2019 (this Determination) sets out the primary rules for crediting, calculating and reporting on projects to reduce greenhouse gas emissions from the management of animal effluent generated from treatment facilities.

Background

Emissions Reduction Fund

The Carbon Credits (Carbon Farming Initiative) Act 2011 (the Act) enables the crediting of greenhouse gas abatement from emissions reduction activities across the economy. Greenhouse gas abatement is achieved either by reducing or avoiding emissions or by removing carbon dioxide from the atmosphere and sequestering carbon in soil or vegetation.

In 2014, the Australian Parliament passed the Carbon Farming Initiative Amendment Act 2014, which established the Emissions Reduction Fund (ERF). The ERF has three elements: crediting emissions reductions, purchasing emissions reductions and safeguarding emissions reductions.

Emissions reduction activities are undertaken as offsets projects. The process involved in establishing an offsets project is set out in Part 3 of the Act. An offsets project must be covered by, and undertaken in accordance with, a methodology determination.

Subsection 106(1) of the Act empowers the Minister to make, by legislative instrument, a methodology determination. The purpose of a methodology determination is to establish procedures for estimating abatement (emissions reduction and sequestration) from eligible projects and rules for monitoring, record-keeping and reporting. These methodologies will ensure that emissions reductions are genuine—that they are both real and additional to business as usual.

In deciding to make a methodology determination the Minister must have regard to the advice of the Emissions Reduction Assurance Committee (ERAC), an independent expert panel established to advise the Minister on proposals for methodology determinations. The Minister must not make or vary a methodology if the ERAC considers it inconsistent with the offsets integrity standards, which are set out in section 133 of the Act. The Minister will also consider any adverse environmental, economic or social impacts likely to arise as a result of projects to which the determination applies.

Offsets projects that are undertaken in accordance with the methodology determination and approved by the Clean Energy Regulator (the Regulator) can generate Australian carbon credit units (ACCUs), representing emissions reductions from the project. Project proponents can receive funding from the ERF by participating in a competitive auction run by the Regulator. The Government will enter into contracts with successful proponents, which will guarantee the price and payment for the future delivery of emissions reductions.

Further information on the ERF is available on the Department of the Environment and Energy’s website at: http://www.environment.gov.au/emissions-reduction-fund.

Background: Animal Effluent Management Methodology Determination

The Determination provides an incentive for proponents to reduce greenhouse gas emissions from the management of animal effluent generated primarily from piggeries and dairies. This Determination applies to an offsets project in which animal effluent, with or without other organic effluent, is processed in a treatment facility at a piggery or dairy in a way that can be reasonably expected to result in eligible carbon abatement. These are animal effluent management projects, as defined in section 7 of this Determination.

Emissions destruction

An emissions destruction offsets project facility is one that treats animal effluent in one or more anaerobic digesters. These anaerobic biodigesters generate and capture the biogas. Emissions destruction offsets project facilities must also use one or more combustion devices to destroy the proportion of the biogas that is methane (See section 13 of this Determination). Ineligible material can be used in an emissions destruction facility (See section 16 of this Determination).

Emissions avoidance

An emissions avoidance offsets project facility is one that treats animal effluent in a way that reduces the total emissions compared to if the effluent had been treated in an anaerobic pond. When using solids separation devices to avoid emissions, proponents must divert or remove volatile solids from animal effluent and treat the volatile solids in a way that results in fewer emissions of methane than would occur if the volatile solids were only treated in an anaerobic pond. The Determination specifies that these facilities must use a solids separation method of diversion and apply a post-diversion treatment, in accordance with the Supplement. The post-diversion treatment must store the material in stockpiles (solid storage) or as compost that can be used for field application (e.g. windrows) (See section 14 of this Determination). Ineligible material cannot be used in an emissions avoidance facility (See section 16 of this Determination).

It is recognised that both type of projects will be ‘emissions avoidance offsets projects’ under the Act.

Calculation of net abatement from emissions avoidance

To determine the net abatement amount for an animal effluent project under this Determination, the project proponent sums the net abatement amounts from each project facility included in the project.

According to this Determination, the gross abatement amount from each project facility is calculated from emissions resulting from emissions avoided and emissions destroyed. The net abatement amount is determined by deducting from the gross abatement the emissions generated from the combustion of ineligible material and the emissions resulting from the operation of the project. Project emissions include emissions resulting from fuel use, electricity use, and methane and nitrogen emissions arising from the post-diversion treatment of material diverted from the project facility.

Under this Determination, project proponents must complete calculations in accordance with Part 4 of this Determination.

Transferring projects and revocation of existing determinations

Proponents can transition projects eligible under earlier determinations to this Determination in accordance with section 10 of this Determination. Projects that can be transitioned include projects registered under:

- The Carbon Farming (Destruction of Methane Generated from Manure in Piggeries) Methodology Determination 2012;

- The Carbon Credits (Carbon Farming Initiative) (Destruction of Methane Generated from Manure in Piggeries—1.1) Methodology Determination 2013;

- The Carbon Credits (Carbon Farming Initiative) (Destruction of Methane from Piggeries Using Engineered Biodigesters) Methodology Determination 2013; or

- The Carbon Credits (Carbon Farming Initiative - Destruction of Methane Generated from Dairy Manure in Covered Anaerobic Ponds) Methodology Determination 2012.

The first of these four methods was revoked in 2015. The remaining three methods will be revoked once this new method is made.

Project aggregation

The Emissions Reduction Fund permits projects to aggregate. This allows projects at multiple sites and owned by different people to be brought together and managed as a single project by a project aggregator. More information on aggregating projects can be found at www.environment.gov.au/climate-change/government/emissions-reduction-fund/aggregation-agreement

Other emissions avoidance technologies

A number of technologies exist that could be used to avoid emissions from animal effluent. Of these only solids separation devices are included in the Determination. Both pH modification and hydraulic retention tanks were considered when developing this method. A decision was made to include additional technologies at a later stage, as these activities still required some work to incorporate them into a method and needed an assessment as to their viability as an activity under the Emissions Reduction Fund.

Application of the determination

The Determination sets out a method for estimating abatement from eligible animal effluent management projects. The project activity will result in a net reduction of greenhouse gas emissions from the management of animal effluent that results in either emissions avoidance or emissions destruction. The Determination sets out the detailed rules for implementing and monitoring animal effluent management offsets projects.

Proponents are encouraged to read this Determination in combination with the Supplement, the Carbon Credits (Carbon Farming Initiative) Act 2011 (the Act), the Carbon Credits (Carbon Farming Initiative) Rule 2015 and the Carbon Credits (Carbon Farming Initiative) Regulations 2011 (the Regulations).

This Determination reflects the requirements of the Act’s offsets integrity standards, which aim to ensure carbon abatement is real and additional to business as usual. The offsets integrity standards require that an eligible project results in carbon abatement that is unlikely to occur in the ordinary course of events and is eligible carbon abatement under the Act. In summary, the offsets integrity standards require that:

- activities are additional to those that would normally occur;

- abatement contributes to meeting Australia’s international mitigation obligations;

- amounts resulting from undertaking the project activity are measurable and capable of being verified;

- the methods used are supported by clear and convincing evidence;

- material emissions, which are a direct consequence of the project, are deducted; and

- estimates, assumptions and projections used in a methodology determination are conservative.

Project proponents wishing to implement projects under this Determination must make an application to the Regulator under section 22 of the Act. Project proponents wishing to transfer their project to this Determination can do so by applying to the Regulator under section 128 of the Act. Proponents must also meet the general eligibility requirements for an offsets project set out in subsection 27(4) of the Act, which include compliance with any additional requirements set out in this Determination, and the additionality requirements in subsection 27(4A) of the Act. The additionality requirements are:

- the newness requirement;

- the regulatory additionality requirement; and

- the government program requirement.

Public consultation

The determination has been developed by the Department in consultation with the Regulator and in accordance with advice from technical experts in the field of animal effluent management and carbon dynamics.

The Department held two Technical Working Group (TWG) meetings between June, 2017 and January, 2019 to provide scientific and technical advice on key aspects of the method, and review draft versions of the determination. In addition, the Department contracted experts to provide ongoing technical advice during method development.

Submissions will assist ERAC in providing advice to the Minister for the Environment on whether the draft method meets the Offsets Integrity Standards.

Determination details

Details of this Determination are at Attachment A. Numbered sections in this Explanatory Statement align with the relevant sections of this Determination.

This Determination, once made, will be a legislative instrument for the purposes of the Legislation Act 2003. This Determination would commence on the day after it is registered on the Federal Register of Legislation.

For the purpose of subsections 106(4), (4A) and (4B) of the Act, in making the Determination the Minister has had regard to, and agrees with, the advice of the Emissions Reduction Assurance Committee that the Determination complies with the offsets integrity standards and that the Determination should be made. The Minister is satisfied that the carbon abatement used in ascertaining the carbon dioxide equivalent net abatement amount for a project is eligible carbon abatement from the project. The Minister also had regard to whether any adverse environmental, economic or social impacts are likely to arise from the carrying out of the kind of project to which the Determination applies and other relevant considerations.

Details of the operation of the Supplement to the Determination are at Attachment B. The Supplement sets out input data and measurement approaches required by the Determination. It also provides additional detail of requirements as set out in the Determination. The most current version of the Supplement available at the end of the reporting period must be used by proponents when estimating abatement for the entire reporting period.

A Statement of Compatibility with Human Rights prepared in accordance with the Human Rights (Parliamentary Scrutiny) Act 2011 is at Attachment C to this Explanatory Statement.

This Determination expires when it is either revoked under section 123 of the Act, or on the day before it would otherwise be repealed under the Legislation Act 2003, whichever happens first. Under subsection 50(1) of that Act, a legislative instrument such as the Determination is repealed on the first 1 April or 1 October falling on or after the tenth anniversary of registration of the instrument. For example, if the Determination is registered on a day in the month of February 2019, it would expire on 31 March 2029.

Attachment A

Details of the Methodology Determination

Part 1 - Preliminary

1 Name

Section 1 sets out the full name of this Determination, which is the Carbon Credits (Carbon Farming Initiative – Animal Effluent Management) Methodology Determination 2019)

2 Commencement

Section 2 provides that the determination commences on the day after it is registered on the Federal Register of Legislation.

3 Authority

Section 3 provides that the determination is made under subsection 106(1) of the Carbon Credits (Carbon Farming Initiative) Act 2011 (the Act).

Subsection 106(1) of the Act provides that the Minister may, by legislative instrument, make a certain type of determination. Subsection 106(2) of the Act specifies that the determination is to be known as a methodology determination. Subsection 106(8) of the Act allows the instrument to incorporate other instruments or writing as in force from time to time.

4 Duration

Under subparagraph 122(1)(b)(i) of the Act, a methodology determination remains in force for the period specified in the Determination.

This section provides that this Determination would remain in force from commencement until the day before it would otherwise be repealed under subsection 50(1) of the Legislation Act 2003.

Instruments are repealed under that provision on either 1 April or 1 October following the tenth anniversary of registration on the Federal Register of Legislation. Paragraph 4(b) ensures that this Determination, once made, would expire in accordance with subparagraph 122(1)(b)(i) of the Act.

If the Determination expires in accordance with section 122 of the Act or is revoked in accordance with section 123 during a crediting period for a project to which the Determination applies, it will continue to apply to the project during the remainder of the crediting period under subsections 125(2) and 127(2) of the Act. Project proponents may apply to the Regulator during a reporting period to have a different methodology determination apply to their projects from the start of that reporting period (see subsection 128(1) of the Act).

Under section 27A of the Act, the ERAC may also suspend the processing of applications under a determination if there is reasonable evidence that the methodology determination does not comply with one or more of the offsets integrity standards. This does not impact applications for declaration already received by the Regulator before such a suspension or declared eligible offsets projects which apply the determination.

5 Definitions

Section 5 defines a number of terms used in the Determination. A number of terms not defined in section 5 (but used in this Determination) are defined in the Act.

Under paragraph 13(1)(b) of the Legislation Act 2003 and section 23 of the Acts Interpretation Act 1901, unless the contrary intention appears, words in this Determination in the singular number include the plural and words in the plural number include the singular.

The following should be noted about certain defined terms in the Determination:

In section 5 of this Determination, a project facility is defined as a treatment facility that has been registered under the project. An eligible animal facility is defined as being either a piggery or a dairy. Treatment facilities are defined in section 7 of this Determination as any animal effluent waste facility that treats organic effluent by emissions destruction, emissions avoidance or both. Accordingly, the boundary of the ‘treatment facility’ which becomes a ‘project facility’ when part of the project may not include the eligible animal facilities which supply effluent to be treated.

The Supplement to the Carbon Credits (Carbon Farming Initiative—Animal Effluent Management) Methodology Determination 2019 (The Supplement) accompanies this Determination. This document must be used by proponents when estimating abatement. This document includes:

- further definitions of factors and parameters referred to in the Determination;

- details of how to calculate input parameters referred to in the Determination;

- requirements for measuring factors relevant to the estimation of the net abatement amount;

- details of record-keeping and monitoring requirements;

- default methane-producing capacities for different types of eligible and ineligible material;

- information on solids separation technologies; and

- the process for updating the Supplement.

Project proponents must ensure they always use the latest version of the Supplement document, as in force at the end of the offsets reporting period, in accordance with section 6 of the Determination, subsection 106(8) of the Act and subsection 14(2) of the Legislation Act 2003. The Supplement can be accessed at http://environment.gov.au.

The determination also incorporates the National Inventory Report and NGA Factors document as in force from time to time similar to other methodology determinations. These are available on the Department’s website http://www.environment.gov.au and are explained further in section 6.

The National Greenhouse and Energy Reporting (Measurement) Determination 2008 and National Greenhouse and Energy Reporting Regulations 2008 are also incorporated from time to time and available from http://www.legislation.gov.au.

6 References to factors and parameters from external sources

Subsection 6(1) provides that factors and parameters referred to in the Determination and the Supplement accompanying the Determination that are required to be sourced from external documents, must be taken from the version of the relevant external document that is in force on the last day of the relevant offsets reporting period for the project. At the time of publication this included the version of the Supplement, National Inventory Report, the NGA Factors document, National Greenhouse and Energy Reporting (Measurement) Determination 2008 and National Greenhouse and Energy Reporting Regulations 2008 that are in force at that time. The latter two are available from the Federal Register of Legislation, the first three from the Department’s website.

The effect of subsection 6(1) is that if those instruments are amended during a project’s offsets reporting period, then the project proponent will be required to use the factor or parameter prescribed in the instrument that is in force at the end of the reporting period.

Subsection 6(2) states that subsection 6(1) does not apply if this Determination stipulates otherwise, or if it is not possible to define or calculate these parameters by reference to the relevant external documents. An example of circumstances where this may occur is where the measurement approach defined in an external source is amended to require additional or different measurement practices after the reporting period has commenced. In this circumstance it is not possible to undertake measurement activities retrospectively in accordance with the new requirement.

As provided for by section 10 of the Acts Interpretation Act 1901 and section 13 of the Legislation Act 2003, references to external documents which are legislative instruments (such as the National Greenhouse and Energy Reporting Regulations 2008) are to versions of those instruments as in force from time to time. In circumstances where paragraph 6(2)(b) of the determination applies, it is expected that project proponents will use the version of instruments in force at the time at which measurement or other actions were conducted.

Part 2 Animal effluent management projects

7 Animal effluent management projects

Paragraph 27(4)(b) of the Act provides that the Regulator must not declare that an offsets project is an eligible offsets project unless satisfied that it is covered by a methodology determination. Paragraph 106(1)(a) of the Act provides for methodology determinations to specify the kind of offsets projects to which they apply.

Subsection 7(5) provides that the Determination applies to an offsets project that satisfies each of subsections 7(1), (2), (3) and (4). An offsets project that satisfies each of these is an animal effluent management project.

Subsection 7(1) provides that the Determination applies to an offsets project in which animal effluent, with or without other organic effluent, is processed in a treatment facility at a piggery or dairy (eligible animal facility) in a way that can be reasonably expected to result in eligible carbon abatement. The project may include more than one treatment facility and more than one eligible animal facility.

Subsection 7(2) defines a treatment facility as a facility that treats organic effluent either by emissions destruction, emissions avoidance or through both these mechanisms. A treatment facility must undertake one or both of these activities. Accordingly, it is possible for a facility to combine emissions avoidance and emissions destruction. Each treatment facility must treat animal effluent and may also treat other effluent consistent with the requirements of the Determination.

A note to this subsection explains that when a treatment facility is used to fulfil an eligible activity under an animal effluent management project the facility becomes known as a project facility, as defined in section 5.

Subsection 7(3) specifies that emissions destruction treatment facilities must generate biogas from animal effluent and capture and destroy the methane present in the biogas.

Subsection 7(4) specifies that emissions avoidance treatment facilities must divert or remove volatile solids from animal effluent and treat the volatile solids aerobically in a way that results in materially fewer emissions of methane and nitrous oxide than would occur if the volatile solids were only treated in an anaerobic pond (a post-diversion treatment). Accordingly, if the post diversion treatment, such as composting by passive windrow, is conducted in a way that results in anaerobic creation of methane it would not be eligible under the Determination. It is expected that the change in emissions from anaerobic to aerobic treatment would reflect the change in emissions calculated under the Determination in relation to the diverted material.

Part 3 – Project requirements

8 Operation of this Part

The effect of paragraph 106(1)(b) of the Act is that a methodology determination must set out requirements that must be met for a project to be an eligible offsets project. Under paragraph 27(4)(c) of the Act, the Regulator must not declare that a project is an eligible offsets project unless the Regulator is satisfied that the project meets these requirements. Section 8 provides that Part 3 of this Determination sets out requirements for the purpose of paragraph 106(1)(b) of the Act.

9 Project facility must be identified in section 22 application

Section 9 specifies details regarding the project facility that are required for the section 22 application. Provisions in this section do not apply to projects that are transferring, and have used a section 128 application to transfer to this Determination.

The section 22 application must specify one or more facilities to be included as eligible project facilities (see section 5) under the project.

Details of each facility that must be included in the section 22 application include:

Paragraph 9(a) requires a brief description of each facility. This must include the type of facility and details of how animal effluent is treated at the facility to either avoid emissions or destroy emissions.

Paragraph 9(b) requires that the geographic location of each facility must be provided.

Paragraph 9(c) requires that the capacity of each facility must be provided, including any metrics related to the facility. The Supplement provides details of the metrics that must be used and how to define the capacity of different facilities.

Paragraph 9(d) provides that the project proponent also must include any known proposals for the expansion of the facility over the course of the project in their section 22 application.

Paragraph 9(e) requires the proponent to describe how they expect that the use of the facility during the project period will comply with the requirements under this Determination. This provision demonstrates to the Regulator that the proponent is able to comply with the requirements of this Determination.

Paragraph 9(f) requires avoidance projects to describe the proposed solid separation devices to be used and the post-diversion treatments to be applied. This will allow the Regulator to assess whether such approaches are likely to comply with subsection 7(4).

Paragraph 9(g) requires a description of how the project, taken as a whole, is expected to result in eligible carbon abatement as calculated in accordance with the Determination.

A note to this section clarifies that after the project has commenced, it is possible to add further project facilities during the project period. Any project facilities added after the commencement of the project must meet the eligibility requirements set out in Part 3 of this Determination, and must comply with the provisions in Part 5 of this Determination. Abatement generated from project facilities added after the commencement of the project will only be credited from the date on which the facility was declared as having been added to the project.

10 Project facilities must not be pre-existing

Subsection 10(1) precludes pre-existing projects from being eligible under this Determination. Subsection 10(1) requires that each project facility included in the project must not have been operating prior to the date of the section 22 application. This provision ensures that net abatement calculated from projects under this Determination is only crediting new abatement that has occurred as a result of undertaking the project.

A note under this subsection provides that each project facility in the project must meet the newness requirements as specified in subparagraph 27(4A)(a)(i) of the Act as varied by section 11.

Exceptions to this provision are provided for in subsections 10(2) and 10(3).

Subsection 10(2) provides an exception to the provision in subsection 10(1).

Paragraph 10(2)(a) permits the inclusion in a project of a facility, or parts of a facility, that was operational prior to the date on the section 22 application, only if it formed part of a pilot or trial project. This includes a facility that treats material by emissions avoidance or emissions destruction.

Paragraph 10(2)(b) provides for some circumstances when a facility or part of a facility can be considered as eligible, if it uses pre-existing solids separation devices. Paragraph 10(2)(b)(i) requires that, to be eligible, the provisions in both subparagraphs 10(2)(b)(i) and 10(2)(b)(ii) must have been met. Subparagraph 10(2)(b)(i) requires that pre-existing solids separation devices cannot have been used at any time during the three years prior to the date that the section 22 application was made. Subparagraph 10(2)(b)(ii) requires that any pre-existing solids separation devices cannot have been used since 1 January 2019.

Subsection 10(3) sets out requirements that must be fulfilled as part of the section 22 application if the project facility includes pre-existing solids separation devices. If the facility was added after the project commenced, then this information must be provided in the first offsets report after the facility was added to the project. In these situations, subsection 10(3) requires that a signed statement from the owner of the device must be provided that verifies that the device has not been used during the 3 years before the date the section 22 application was made (subparagraph 10(3)(b)(i)) and since 1 January 2019 (subparagraph 10(3)(b)(ii)). The device must also have been present at the site of the project on 1 January 2019 (paragraph 10(3)(a)). The owner must also provide a statement that, in the absence of the project, the device would continue to be unused (paragraph 10(3)(c)). Paragraph 10(3)(d) requires that this statement must also set out the reasons as to why the solids separation device has not been used and why, in the absence of the project, the solids separation device would continue to be unused during the project’s anticipated crediting period. Owners making such statements should be aware of the potential consequences of making false or misleading statements and documents under sections 137.1 and 137.2 of the Criminal Code which are in addition to the consequences for the project proponent of providing false or misleading information under section 88 of the Act.

These provisions do not allow proponents to purchase solids separation devices prior to project application and after 1 January 2019, as provisions in the method will make these projects ineligible.

Subsection 10(4) sets out requirements for projects that are transitioning from a former determination to this Determination. In this situation, subsection 10(1) does not apply, and a transferring project that was undertaking an animal effluent activity and was declared an eligible offsets project under a former determination may be an eligible offsets project under this determination if the Regulator approves an application of this Determination to the project under section 130 of the Act. If one or both of the provisions in subsection 10(4) is not met, then the transitioning project is not an eligible offsets project.

11 Requirements in lieu of newness for certain projects

Section 11 specifies a requirement in lieu of newness for emissions avoidance project facilities that operate one or more solids separation devices that pre-existed prior to a section 22 application. These project facilities are considered new, provided that the solids separation device has not been used during the three years prior to the section 22 application (subparagraph 10(3)(a)(i)) and since 1 January 2019 (subparagraph 10(3)(a)(ii)). These devices must also have been present at the site of the project on 1 January 2019. Note that projects can include both emissions avoidance and emissions destruction and this section applies to any project including emissions avoidance (whether or not it also does emissions destruction).

12 Project source must be identified in section 22 or 128 application

Section 12 specifies that the section 22 application or the section 128 application must provide details regarding each of the eligible animal facilities that are anticipated to provide eligible material for the project. Effluent may be sourced from the facility that is treating the effluent by emissions destruction or emissions avoidance, or be sourced from a different facility.

Section 12 requires the following information be provided in either the section 22 application or the section 128 application regarding the facility from which material has been sourced and used in the project.

Paragraph 12(a) requires that the section 22 or section 128 application include the address and a brief description of each facility from which material will be sourced and used in the project facility. The brief description of the source facility should include the type of facility and the nature of the organic material that is being sourced from the facility and being treated in the project facility. The source may be located at the same facility as the project facility, or may be a facility remote from the project facility.

Paragraph 12(b) requires that the section 22 or section 128 application must include sufficient detail that demonstrates that the organic material from the source facility is expected to be eligible material that meets the eligibility requirements as set out in section 15 of the Determination. Evidence as defined in subsection 15(2) must be supplied with the application.

Paragraph 12(c) requires that the anticipated quantities of eligible organic material that will be provided to each project facility over the duration of the project be provided in the section 22 or section 128 application.

A note to this section clarifies that effluent may be added from additional eligible animal facilities at any time during the project, provided that the provisions set out in this section and in Part 5 of this Determination have all been met.

13 Treatment facility—emissions destruction

Section 13 sets out the requirements for undertaking eligible emissions destruction activities for animal effluent management projects. These requirements ensure that project proponents undertake the eligible management activity as intended.

Projects should adhere to existing WHS, biohazard and other legislation, industry Codes of Practice and Guidelines when handling and transporting effluent in order to minimise the occurrence of adverse environmental impacts.

Subsection 13(1) provides that each emissions destruction project facility must use one or more anaerobic digesters to generate and capture the biogas. In addition, subsection 13(1) requires that these project facilities must use one or more combustion devices to destroy the portion of the biogas that is methane.

Emissions destroyed are calculated in Part 4 of this Determination, and are determined from the amount of biogas that is methane that has been captured and destroyed, or the amount of electricity generated as a result of the destruction of methane.

Section 5 of the Determination provides a definition for combustion devices that includes boilers, flares and other devices that destroy methane. This definition requires the combustion device to be operated in accordance with the manufacturer’s instructions. Complete combustion is defined in section 5 as the combustion of 98% or more of the methane that is captured, or any other threshold specified in the Supplement.

Section 5 of the Determination provides a definition for an anaerobic digester. An anaerobic digester is a system that consists of a closed unit, or a set of closed units which may include equipment for heating and stirring. This definition provides that the system must anaerobically digest organic matter to generate biogas that is then collected and transferred to a combustion device. The definition of an anaerobic digester only includes a covered anaerobic pond that may or may not have heating or stirring equipment.

Subsection 13(2) requires that there must be complete combustion of methane in each combustion device that is operated as part of the project. That is, combustion devices used at the facility to perform the eligible project activity must be operated in accordance to the determination

Section 5 of the Determination defines complete combustion as 98% or more of the methane; or a lower percentage if specified by the Supplement.

Subsection 13(3) defines the requirements for a combustion device that include a flare. These requirements ensure that the device is operated in a manner that results in the combustion of methane to the extent assumed by the abatement calculations.

Paragraph 13(3)(a) requires that the design of the flare, when operational, must ensure the continuous destruction of methane in the project facility.

Paragraph 13(3)(b) requires that the flare includes a system, consistent with the Supplement, that detects and records when the flare is operational. Projects are required to monitor the use of flares consistent with section 41 of this Determination.

These provisions discourage ineligible emissions that may result from non-operational combustion devices. Combustion devices must result in complete combustion of methane when they are operating. Further, monitoring of devices detects period of non-operation, and does not credit abatement for these periods. The Supplement specifies the minimum period of non-operation of combustion devices that will result in no abatement being credited.

14 Treatment facility—emissions avoidance

Section 14 sets out the requirements for undertaking eligible emissions avoidance activities for animal effluent management projects. These requirements ensure that project proponents undertake the eligible management activities as intended.

Projects should adhere to existing WHS, biohazard and other legislation, industry Codes of Practice and Guidelines when handling and transporting effluent and solids that have been separated in order to minimise the impact of adverse environmental impacts.

Subsection 14(1) provides the requirements for treatment of animal effluent by emissions avoidance.

Paragraph 14(1)(a) requires that a solids separation method of diversion must be used to divert the solids from the organic effluent stream in emissions avoidance projects. The method used to separate the solids from the effluent stream must be consistent with the requirements defined in the Supplement.

There are various methods used for separating solids from organic effluent that generally rely on a gravitational process and/or a mechanical device. These methods can be grouped according to their basic removal mechanism:

Gravitational settling

Perforated screens and presses

Centrifugal separation

Dissolved Air Flotation

Chemical flocculation

Combined systems

The efficiency of each system depends on the flow rate of the animal effluent, its solids concentration, the shape and size distribution of the particles, and their chemical nature.

Paragraph 14(1)(b) requires that a post-diversion treatment is applied that involves either storage of solid effluent in stockpiles (subparagraph 14(1)(b)(i)) or composting the solid effluent by field application (subparagraph 14(1)(b)(ii)). The terms ‘stockpiles (solid storage)’ and ‘composting (passive windrow)’ are defined in section 5. In particular:

stockpiles (solid storage) requires the storage of solid material diverted as part of an animal effluent management project in a heaped pile that is not turned.

composting (passive windrow) requires the treatment of solid material diverted as part of an animal effluent management project aerobically in a pile or windrow (a line of heaped material) that is passively managed with infrequent turning for mixing and aeration.

Active (mechanical) composting is not permitted in section 14 of the Determination, as it is not listed in the National Inventory Report. In addition, the IPCC indicates that this process could possibly produce higher nitrous oxide emissions. This would limit the net carbon abatement potential under the method.

As active (mechanical) composting is not listed in the National Inventory Report there are no appropriate input values that can be used in the method. Therefore the method does not allow active (mechanical) composting as the net abatement amount cannot be estimated robustly.

The use of active (mechanical) composting is not common practice for treating solids from these facilities in Australia.

Treatment of organic effluent in accordance with subsection 14(1) is defined as a treatment method (subsection 14(2)).

The Supplement includes requirements for post-diversion treatment to ensure that the intent of subsection 7(4) is achieved, namely that the activity deals with the diverted material aerobically in a way that produces fewer emissions than would be produced by treatment in an anaerobic pond. The post-diversion treatment must:

- take into account industry best practice to ensure the treatment facility complies with subsection 7(4) of the Determination; and

- ensure that stockpiles do not become large or compacted so as to create significant emissions of methane; and

- be carried out consistently with the definitions of composting (passive windrow) or stockpiles (solid storage) in the Determination.

To achieve these requirements the storage of solids is expected to typically be in small stockpiles (approximately 5m diameter x 2m high) or windrows (approximately 3m wide and 2m high) so as to reduce the amount of methane produced. The dimensions of the relevant stockpiles or windrows must be included in offsets reports under paragraph 34(1)(b). The Department will continue to review the performance of projects in this area to ensure that appropriately sized and maintained stockpiles and windrows are used. Should issues arise with the implementation of the method, the Supplement may be updated to include more prescriptive requirements, which would apply to both existing and new projects.

15 Eligible material

Subsection 15(1) defines eligible material for the purposes of the Determination. Eligible material is defined as organic effluent that meets a number of requirements.

Paragraph 15(1)(a) defines how the eligible material must be produced.

The eligible material must be produced by either an eligible animal facility (subparagraph 15(1)(a)(i)), as defined by section 5 of the Determination, or a facility that produces materials of one or more listed types as a waste stream (subparagraph 15(1)(a)(ii)). Listed types are defined in section 5 of this Determination as a type of material whose default methane-producing capacity is specified in the Supplement. These are found in Schedule 1 of the Supplement.

Listed types in the Supplement include eligible material being treated in an emissions destruction and an emissions avoidance project. The methane-producing capacities of these listed types are used to estimate the gross emissions avoided (see section 25 of this Determination).

For emissions destruction projects, emissions destroyed from eligible material are calculated from the amount of biogas produced or the amount of electricity generated as a result of the combustion of methane (see section 24 of this Determination). For these activities, materials of listed types are relevant for calculating emissions resulting from the combustion of ineligible material (see section 26 of this Determination), which are deducted from the gross abatement.

Paragraph 15(1)(b) defines what the eligible material must consist of.

Subparagraph 15(1)(b)(i) requires that eligible material must consist of animal effluent.

Alternatively, subparagraph 15(1)(b)(ii) provides that eligible material must satisfy three conditions. These conditions are:

- the eligible material must predominantly consist of materials of one or more listed types;

- if the eligible material contains material of another (i.e. non-listed) type, then this material must contribute no more than 2% of the methane avoided or combusted by the project facility; and

- the eligible material must not have been diverted from a facility that is part of an eligible offsets project related to the avoidance of methane emissions. The intent of this provision is that effluent management credited for emissions reduction under another Emissions Reduction Fund project cannot be included in projects under this Determination, thus preventing the abatement being considered twice.

All three defined criteria in subparagraph 15(1)(b)(ii) must be met for the organic material to be defined as eligible material under this section.

Paragraph 15(1)(c) requires that the eligible material would have been produced and treated in an anaerobic pond if the project did not occur. The intent of this provision is to ensure that abatement resulting from undertaking the project activity is additional to that which would have occurred in the absence of the project. Accordingly, the same type of material, such as piggery effluent, coming to a project could be eligible whether it was ordinarily going into an anaerobic pond at the site of origin, but ineligible when sourced from an animal facility at another site that already treated the effluent in a digester.

Subsection 15(2) provides additional requirements to demonstrate evidence that the eligible material would have been treated in an anaerobic pond in the absence of the project. This evidence must include one or more of the following:

- evidence that for the 12 months prior to being part of the project, the organic effluent was treated in an anaerobic pond; or

- if the Supplement specifies a particular effluent type—evidence that the material would have been treated in an anaerobic pond consistent with the requirements of the Supplement, and that satisfies the Regulator. It is intended that without a history of material going to an anaerobic pond, only a limited range of effluent streams could provide sufficient evidence that an anaerobic pond would be used. Proponents are encouraged to provide evidence that a new facility treating other types of waste would also install an anaerobic pond.

This Determination permits solids to be separated from an effluent stream and treated consistent with the requirements for eligible emissions avoidance projects. The solids removed when undertaking an eligible emissions avoidance activity cannot be diverted into an emissions destruction facility. In contrast, the liquid waste resulting from this separation can be diverted into an emissions destruction facility that produces biogas and combusts the methane in the biogas. The liquid waste has not contributed to the net abatement amount as a result of undergoing an eligible emissions avoidance activity. This process accounts for removal of methane by both emissions avoidance and emissions destruction.

There are three notes that provide further information regarding the provisions in section 15.

Note 1 confirms that ineligible material can be processed in emissions destruction project facilities. The methane-producing capacity of the ineligible material are subtracted from the gross abatement determined from undertaking the activity using equation 2 in section 22 of this Determination. Section 22 provides a high estimate of methane emissions from ineligible material. This ensures that when they are subtracted from gross abatement, a conservative estimate of net abatement is achieved. The exclusion of methane destruction from ineligible material from the net abatement amount means that credits are only received for the emissions destroyed from eligible material.

In practice, it is expected that ineligible material will be included in project facilities only in small quantities, and where the cost or inconvenience of separating it from the eligible material would outweigh the likely loss of abatement credits.

Note 2 confirms that the material in a waste stream from a project source is only eligible if it is produced by the normal operation of the eligible animal facility as defined by section 5 of this Determination. Therefore, this eligible material would only include incidental amounts of ineligible material such as feed waste.

Note 3 further clarifies the evidence required to satisfy the Regulator that material that would have been treated in an anaerobic pond in the absence of the project, may differ between new project facilities and treatment facilities that are changing their approach to treating effluent as a result of undertaking the project. For instance, where a pond does not exist evidence is likely to be required that a pond would be built should the project not go ahead. This is dealt with in the Supplement.

16 Restrictions on treatment of ineligible material

Section 16 contains a number of restrictions on the use of ineligible material that are relevant to whether the project is an eligible offsets project and also whether credits are issued for a reporting period. Importantly, subsection 21(2) has the effect that non-compliance with this section can result in no credits being issued for a reporting period.

Subsection 16(1) defines ineligible material as material that is not defined as eligible material in accordance with section 15. Importantly, all of the requirements under section 15 need to be met for the material to be eligible, which means that same type of material might be eligible in some cases, but ineligible in others.

A note under subsection 16(1) further clarifies ineligible material as being either organic material that does not satisfy the definition of eligible material in section 15, or other organic material. Ineligible material must not affect the treatment ability of the project facility.

Subsection 16(2) requires that project facilities that treat material by emissions avoidance cannot include ineligible material in the effluent stream entering the project facility. This applies whether or not the project facility also does emissions destruction.

A different proportion of volatile solids is separated from different materials using solids separation devices. It is not possible to determine the amount of volatile solids produced from each type of material entering the solids separation device. For example, ineligible material may only represent 10% of the combined material that enters the project facility and is treated in the diversion device. However 50% of the volatile solids diverted may come from ineligible material. Therefore, this means that it is not possible to determine the proportion of volatile solids that should be attributed to eligible and ineligible material if both enter an emissions avoidance project facility. For this reason, ineligible material is excluded from emissions avoidance projects, as the net abatement amount cannot be reliably estimated.

Subsection 16(3) requires that ineligible material can only be combined with eligible material under the Determination if all four provisions are applicable.

- Paragraph 16(3)(a) provides that ineligible material can only be included in a waste stream entering an emissions destruction project facility;

- Paragraph 16(3)(b) requires that the inclusion of ineligible material with the eligible material has no significant adverse effect on the operation and performance of the project facility. The operation of projects cannot result in adverse environmental impacts, such as excessive odour or environmental hazards. The intent of this provision is to ensure that abatement estimates remain robust and are consistent with the calculations required by the Determination, and that the Determination continues to meet the offsets integrity standards.

A note under this paragraph clarifies that a significant adverse effect includes increasing emissions or results in adverse secondary environmental effects such as producing undesirable odours. The inclusion of paragraph 16(3)(b) also serves to exclude project facilities that are deemed to have adverse environmental impacts because of the use of ineligible material. This paragraph would exclude the inclusion of ineligible material if it causes the performance of the equipment to be reduced such that it no longer meets the requirements in the method – for example, if it causes the combustion of methane to fall below 98%. The Regulator is expected to take into account the extent of the adverse impact and how it relates to compliance with other obligations on the facilities under Commonwealth, State or Territory law.

- Paragraph 16(3)(c) requires that the quantity of ineligible material must be determined before it is combined with the eligible material. In addition, the methane-producing capacity of the measured ineligible material must be determined by either reference to the listed types defined in the Supplement (subparagraph 16(2)(c)(i)), or measured prior to being combined with the eligible material in accordance with the Supplement (subparagraph 16(2)(c)(ii)); and

- Paragraph 16(3)(d) requires that the volume of methane of all ‘inconsistent material’ is less than 5% of the volume of methane attributable to all eligible and ineligible material that enters the project facility.

All four of these provisions must be met for ineligible material to be included in a waste stream that contains eligible material and is being treated by the project facility.

Subsection 16(4) defines ineligible material as being inconsistent material if its methane-producing capacity, when measured in accordance with the Supplement, varies by more than 40% between each measurement. The intent of this provision is to make sure that net abatement estimates remain robust, credible and conservative – consistent with the offsets integrity standards defined in section 133 of the Act. The subsection also clarifies that the methane attributable to material in paragraph 16(3)(d) is to be calculated using equation 8 (although the use of the γ value is unnecessary).

A note under this subsection requires that under section 9 of the section 22 application, proponents must explain the basis upon which this requirement is expected to be met when the project is operational.

The method does not include a cap on the amount of ineligible material that can be added to an emissions destruction project. This is because methane emissions from ineligible material are deducted from the gross abatement. Section 26 estimates the methane emissions from ineligible material assuming that the methane-producing capacity of volatile solids is equal to one. Equation 8 – that calculates the emissions from ineligible material – does not include a factor to account for the methane-producing capacity of the ineligible material. Rather it assumes that the methane-producing capacity is one, and the equation is multiplied by one. This contrasts to estimations of emissions for eligible material that consider the methane-producing capacity of each eligible material type. The methane-producing capacity of most materials is generally a value less than one. Assuming that the methane-producing capacity is equal to one for ineligible material results in a high estimate of methane emissions from ineligible material. As this value is deducted from the gross abatement, it results in a conservative estimate of the net abatement amount. The higher the proportion of ineligible material in the waste stream, the more conservative will be the estimate of the net abatement amount. This means that when ineligible emissions reach 50% of gross abatement, the net abatement amount approaches zero and no credits can be claimed.

If projects choose to include high amounts of ineligible material in their waste stream to increase the production of electricity, then they will receive only a small number or no carbon credits.

17 Crediting period for certain projects

Subsection 17(1) identifies the parts of the Act that allow method determinations to define an alternate length for the crediting period rather than use the default. For this Determination, eligible projects that do not generate electricity for more than 7 years since their declaration (a cumulative total of 84 calendar months) have a crediting period length of 12 years. These could be emissions avoidance projects or projects that only flare without generating electricity. It also allows for projects to start with flaring and move to generating electricity when they have more information on the quality of the gas flow from the project. This recognises the common practice of testing the gas supply by flaring before installing generation equipment.

This builds on the findings of the Emissions Reduction Assurance Committee in their review of the landfill gas method. It reflects the fact that without electricity generation there is no direct revenue stream from the activity to support its continued implementation.

Subsection 17(2) provides for the crediting period of projects to end when they enter the 85th calendar month of electricity generation. For instance, a project may flare for 24 months and then generate electricity for 84 consecutive months (ie 9 years in total). The crediting period would end at the start of the 85th month of generation, which is immediately after the end of the 9th year of the crediting period. If the same project had a 12 month break from generation due to the need to replace equipment, the crediting period would end a year later.

Subsection 17(3) clarifies that if any electricity is generated during 3 or more days in a calendar month, that month is treated as a month of electricity generation. This means that short outages or maintenance will not extend the crediting period, but that one or two days of testing will not count as generation. It will also simplify the assessment of when the 7 years of generation has been completed. Paragraph 17(3)(b) makes clear that the calendar months of generation do not need to be consecutive. Paragraph 17(3)(c) introduces a presumption of generation after it has commenced where there is no evidence to the contrary. It is expected that calendar months without generation would be evidenced by maintenance records or electricity metering data. The consideration of this evidence would be undertaken at the end of each reporting period as part of the offsets reporting requirement under paragraph 34(1)(i).

For projects transitioning into the method, the calculation of the months of generation includes the calendar months that were part of the project’s crediting period or periods on earlier methods. For instance, if a project had a first crediting period from 1 July 2010 to 13 December 2014 and a second crediting period from 14 December 2014, all of the calendar months since 1 July 2010 with 3 days or more of generation would count towards the 84 months. If the project already has 84 months of generation before it transfers or exceeds 84 months before the end of its standard 7 year crediting period (due 14 December 2021), then subsection 17(1) would not apply and the 7 year crediting period in the Act would remain. However, if by 14 December 2021 it only had a total of 80 cumulative months of generation, its crediting period would continue. If the project never generated again it would have a 12 year crediting period (ending 14 December 2026). If it continued to generate every month in 2022, the crediting period would end on 1 May 2022 as that would be the start of the 85th cumulative month of generation.

A summary of the crediting periods is set out in the table below.

Transitioning Projects

Activity | Crediting Period | From |

Flaring only | Balance of 12 years | Start of current crediting period |

Heat Generation | Balance of 12 years | Start of current crediting period |

Electricity Generation | Balance of 84 months of generation (but not shorter than 7 years or longer than 12 from start of current crediting period) | Start of first crediting period OR first demonstrated date of generation# |

New Projects

Activity | Crediting Period | From |

Flaring only | 12 years | Start of crediting period |

Heat Generation | 12 years | Start of crediting period |

Avoidance (composting) only | 12 years | Start of crediting period |

Electricity Generation | 84 months of generation; up to 12 years* | Start of crediting period |

Combined activities with Electricity Generation | 84 months of generation; up to 12 years* | Start of crediting period |

# Electricity generation is deemed to occur from first instance unless evidence is provided otherwise.

* The 84 months of generation is cumulative, not consecutive.

Part 4 Net abatement amounts

Division 1 Operation of this Part

18 Operation of this Part

For paragraph 106(1)(c) of the Act, this Part specifies the method for working out the net abatement amount for a reporting period for an animal effluent management project that is an eligible offsets project.

19 Overview of gases accounted for in abatement calculations

Section 19 describes the emissions sources that need to be assessed in order to determine the total net abatement amount resulting from the project activity.

The gases that need to be taken into account when calculating abatement are:

- methane emissions resulting that are either destroyed by the collection and combustion of methane, or avoided by the diversion of volatile solids from an anaerobic pond in accordance with this Determination;

- methane emissions from the destruction of ineligible material in the waste stream;

- methane, nitrous oxide and carbon dioxide emissions from the use of fuel in activities required to undertake the project activity. This will include emissions from transporting material to the project facility, and fuel used for other parts of the application of the eligible project activity;

- methane, nitrous oxide and carbon dioxide emissions from the consumption of electricity to conduct activities required to undertake the project activity; and

- methane and nitrous oxide emissions arising from the post-diversion treatment of material diverted in an emissions avoidance project facility.

A number of emissions sources are excluded from the estimation of the net abatement amount in the Determination for the following reasons:

• In calculating gross abatement, nitrous oxide emissions from the treatment of organic effluent in an anaerobic digester are excluded for reasons of both immateriality and simplicity.

• Nitrous oxide emissions from the combustion of biogas and the post treatment of ineligible material in methane destruction projects are excluded as they are considered immaterial.

• Carbon dioxide emissions from the treatment of organic effluent and the combustion of biogas from eligible and ineligible material are excluded. These emissions have a biogenic origin (originate from organic material) and so are not counted towards Australia’s national greenhouse gas accounts as they originate from organic material.

• Emissions from the construction and transport of building materials, the demolition of the deep uncovered anaerobic pond and emissions associated with the construction of project facilities are excluded as they are outside the emissions boundary for the eligible activities in this Determination.

Division 2 Method for calculating net abatement amount

This section provides a simplified outline of this Part. While simplified outlines are included to assist readers to understand the substantive provisions, the outlines are not intended to be comprehensive. It is intended that readers should rely on the substantive provisions.

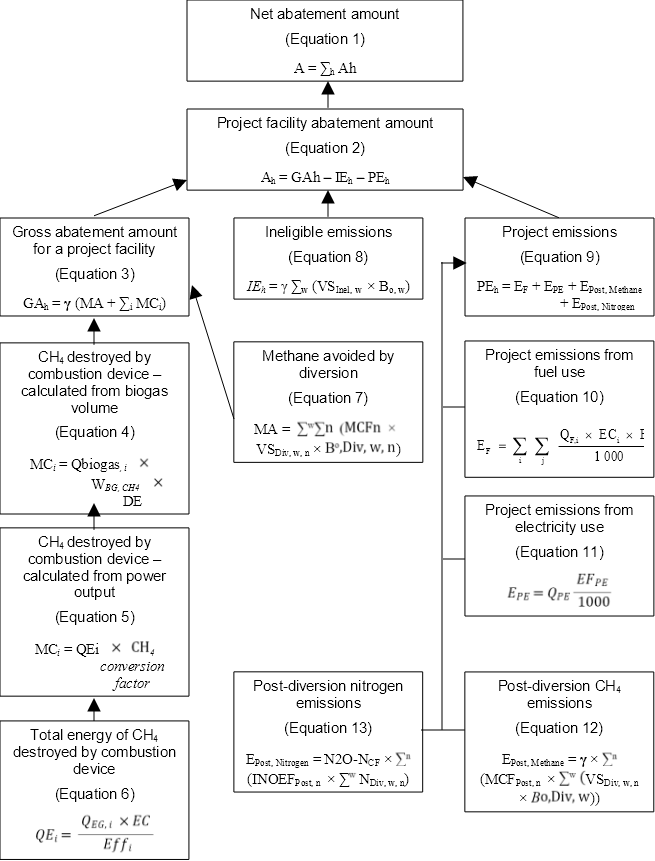

The carbon dioxide equivalent net abatement amount is estimated by summing the net abatement that have been estimated separately for each project facility included in the project (See Figure 1 and Table 1).

For each project facility, the gross abatement amount is calculated as the methane that was either destroyed by the combustion of methane in generated biogas or avoided by the diversion of volatile solids from an anaerobic pond.

For each project facility, the net abatement amount is estimated by deducting from the gross abatement amount all methane emissions resulting from the combustion of methane emitted from the anaerobic digestion of ineligible material (for emissions destruction projects only) and all project emissions of methane, nitrous oxide and carbon dioxide from fuel use and electricity use resulting from undertaking the project, and from methane and nitrous oxide produced as a result of the post-diversion treatment of material in emissions avoidance projects.

Table 1: Description of parameter symbols for Figure 1

Parameter | Equation | Description |

A | 1 | Net abatement amount |

Ah | 1, 2 | Project facility net abatement amount |

GAh | 2, 3 | Gross abatement amount for project facility |

IEh | 2, 8 | Ineligible emissions for project facility |

PEh | 2 | Project emissions for project facility |

MA | 3, 7 | Volume of methane avoided in the project facility by diversion of material |

MCi | 3, 4, 5 | Volume of methane destroyed by combustion device |

Qbiogas, i | 4 | Total volume of biogas sent to combustion device |

WBG, CH4 | 4 | Proportion of Qbiogas, i that is methane |

DEi | 4 | Methane destruction efficiency for combustion device |

QEi i | 5, 6 | Total energy content of the methane destroyed by combustion device |

CH4 conversion factor | 5 | Methane conversion factor to convert gigajoules of energy into volume of methane in cubic metres |

QEG, i | 6 | Total amount of electricity produced by combustion device |

EC | 6 | Energy content per megawatt hour of electricity |

Effi | 6 | Electrical efficiency of the combustion device |

MCF | 7 | Methane conversion factor for the source material region and material type |

VSDiv, w, n | 7 | Amount of volatile solids in eligible material |

Bo,Div, w, n | 7 | Methane-producing capacity for the volatile solids in eligible material |

γ | 3, 8, 12 | Factor that converts cubic metres of methane to tonnes CO2‑e |

VSInel, w | 8 | Amount of volatile solids in the ineligible material |

Bo, w | 8 | Methane-producing capacity of volatile solids in ineligible material |

PEh | 9 | Project emissions from operation of project facility |

EF | 9, 10 | Emissions from fuel that is specifically attributable to the operation of the project facility |

EPE | 9, 11 | Emissions from purchased electricity that is specifically attributable to the operation of the project facility |

EPost, Methane | 9, 12 | Emissions due to methane arising from the post-diversion treatment of material diverted in the project facility |

EPost, Nitrogen | 9, 13 | Emissions due to nitrogen arising from the post-diversion treatment of material diverted in the project facility |

QF, i | 10 | Amount of fuel type that is specifically attributable to the operation of the project facility |

ECi | 10 | Energy content factor for fuel type |

EFij | 10 | Emission factor for greenhouse gas type and fuel type |

QPE | 11 | Amount of purchased electricity that is specifically attributable to the operation of the project facility |

EFPE | 11 | Emissions factor for electricity obtained from an electricity grid |

MCFPost, n | 12 | Post-diversion methane conversion factor |

VSDiv, w, n | 12 | Amount of volatile solids that is diverted in the project facility, in tonnes of volatile solids. |

Bo,Div, w | 12 | Methane-producing capacity for the volatile solids |

N2O-NCF | 13 | Nitrous oxide conversion factor, converts tonnes of N2O-N into tonnes CO2-e |

INOEFPost, n | 13 | Post-diversion integrated nitrous oxide emission factor |

NDiv, w, n | 13 | Amount of nitrogen that is diverted in the project facility |

21 Net abatement amount

Section 21 sets out in equation 1 the calculation for determining the carbon dioxide equivalent total net abatement amount for an animal effluent management project for the reporting period. This equation is used to calculate net abatement resulting from eligible emissions avoidance and emissions destruction activities under the Determination

The net abatement amount, A, for a reporting period is the sum of the net abatement amounts for each project facility in the project, Ah, during the reporting period. The net abatement amount for each project facility is calculated using equation 2 in section 22.

Subsection 21(2) provides that if, during the reporting period, a project facility does not comply in all material respects with regard to the requirements for the use of ineligible material (section 16), then the net abatement is taken to equal zero. The risk of having no credits for a reporting period should be considered by any destruction project using ineligible material in a way likely to breach section 16. Emissions avoidance projects are not allowed to use any ineligible material and so should be aware of the impact of this section if they do use ineligible material in a reporting period. Proponents should endeavour to comply with section 16 at all times, even if minor and unintentional incidents may result in a breach that would be material enough to result in zero credits. The intention of the reference to ‘all material respects’ is to ensure that minor or trivial breaches of section 16, such as breaches only for a short period of time during the crediting period or by an insignificant amount of ineligible material in an avoidance project, do not unfairly impact on the project’s viability. Proponents would be expected to explain to the Regulator what actions they are taking to avoid breaching section 16 in the future.

Examples of when subsection 21(2) would apply include:

- A project facility treats 100 cubic metres of material by emissions avoidance over a reporting period and combines 6 cubic metres of ineligible material in breach of subsection 16(2);

- A project facility using emissions destruction combines ineligible material that results in significant odour for over half of the reporting period in breach of paragraph 16(3)(b);

- A project facility using emissions destruction does not meet the measurement requirements of paragraph 16(3)(c) for a period of greater than 2 months within the reporting period;

- The volume of methane from inconsistent material is 9 cubic metres compared to 100 cubic metres of methane from all material over the reporting period in breach of paragraph 16(3)(d).

These examples are not intended to limit the circumstances when subsection 21(2) could apply.

The net abatement amount will only be negative when the sum of the ineligible abatement, IAh, and the project emissions, PEh , is greater than the gross abatement, GAh (See equation 2). As the Determination estimates high values for ineligible abatement, the use of high amounts of ineligible material could result in no net abatement.

22 Project facility net abatement amount

The net abatement amount for each project facility is determined by subtracting the maximum methane-producing capacity of ineligible material processed by the facility, IAh, (calculated in accordance with section 26) and all project emissions, PEh , (calculated in accordance with section 29) from the gross abatement amount, GAh (calculated in accordance with section 23).

Division 3 Gross abatement amount

23 Gross abatement amount for a project facility

Section 23 sets out in equation 3 the calculation for determining the gross abatement amount for each project facility in tonnes CO2‑e. The gross abatement amount in the reporting period for each project facility is the sum of the volume of emissions avoided and the volume of emissions destroyed, multiplied by the factor, γ, that converts cubic metres of methane to tonnes CO2‑e under standard conditions.

This factor γ is defined in the NGER (Measurement) Determination. The value in the version of that determination current at the end of the reporting period must be used in accordance with section 6 of this Determination. In 2019, γ equalled 6.784 x 10-4 x 25.

The emissions avoided, MA, is the volume of methane avoided by diverting volatile solids using a solids separation device and post-diversion treatment in accordance with section 14 of the Determination. The value for MA is calculated in accordance with section 25 of the Determination.

The emissions destroyed, MCi, is the volume of methane combusted in accordance with section 13 of the Determination. Emissions destruction must use one or more anaerobic digesters to generate and capture the biogas, and one or more combustion devices to destroy the proportion of the biogas that is methane. The value for MCi is calculated in accordance with section 24.

24 Methane destroyed by combustion devices

Section 24 sets out two methods for calculating the volume (in cubic metres) of methane destroyed by a combustion device for each project facility. For emissions avoidance activities there is no methane sent to a combustion device, so the value for MCi is equal to zero, and these calculations are not applicable.

Subsection 24(1) defines when each approach for calculating the amount of methane destroyed by a combustion device must be used. Paragraph 24(1)(a) provides that either Method A or Method B can be used for a combustion device that is an internal combustion engine used to generate electricity. Paragraph 24(1)(b) provides that only Method A can be used in all other circumstances – that is, when electricity is not being generated. The method used to calculate the amount of methane destroyed can vary between devices and reporting periods.

Subsection 24(2) defines how to calculate the volume of methane destroyed by a combustion device in accordance with Method A. In these circumstances, equation 4 must be used to estimate the volume of biogas sent to the combustion device. Equation 4 multiplies the total volume of biogas, Qbiogas, I, by the proportion of the biogas that is methane, WBG, CH4, and the methane destruction efficiency of the combustion device, DEi.

The volume of biogas, Qbiogas, I, sent to the combustion device is determined in accordance with the Supplement.

The proportion of the biogas that is methane, WBG, CH4, and the methane destruction efficiency of the combustion device, DEi, are both expressed as fractions and determined in accordance with the Supplement.

Subsections 24(3) and 24(4) define how to calculate the volume of methane destroyed by a combustion device in accordance with Method B. Method B can only be used for a combustion device that is an internal combustion engine used to generate electricity.

Equation 5 (subsection 24(3)) must be used to calculate the volume of methane destroyed by a combustion device. Equation 5 multiplies the total energy content of the methane destroyed by the combustion device, QEi, by a conversion factor that converts the gigajoules of energy into the volume of methane in cubic metres. This conversion factor is equal to 26.52.

Equation 6 (subsection 24(4)) estimates the total energy content of the methane destroyed by a combustion device, QEi. This equation multiplies the total amount of electricity produced by the combustion device, QEG, in megawatt hours, by the energy content per megawatt hour, EC, equal to 3.6, and then divides this value by the electrical efficiency of the combustion device, Effi. Both QEG and Effi are determined in accordance with the Supplement.

25 Methane avoided by diversion

Section 25 sets out in equation 7 the calculation for estimating the volume of methane avoided in a project facility by the diversion of material that includes volatile solids. For emissions destruction activities there is no methane avoided by diversion, so the value for MA is equal to zero, and these calculations are not applicable.

Equation 7 multiplies the amount of each volatile solid from each material, VSDiv, w, n, by the methane-producing capacity for each volatile solid, B0,Div, w, n and the methane conversion factor, MCFn, for the source material region and type set in the National Inventory Report, . These values are then summed across all types of material and relevant region. All these input values are determined in accordance with the Supplement.

Division 4 Ineligible emissions

A note to Division 4 provides that this Division is only applicable for a project facility that treats material using an emissions destruction approach. Subsection 16(2) requires that ineligible material must only be included in a project facility that does not treat material by emissions avoidance. For emissions avoidance projects which cannot use ineligible material, this value is equal to zero.

26 Ineligible emissions for a project facility

Section 26 sets out in equation 8 the calculation for estimating the ineligible emissions for a project facility. These emissions are deducted from the gross abatement, in accordance with equation 2 in section 22. As emissions from ineligible material are deducted from the gross abatement amount, this reduces the net abatement amount.

Equation 8 multiplies the amount of each volatile solid in the ineligible material, VSInel,w, by the methane-producing capacity for each ineligible material, B0, w. Equation 8 then sums these values across all types of ineligible material, and then multiplies this value by the factor γ as defined in the NGER (Measurement) Determination. The value for γ in the version of that determination current at the end of the reporting period must be used in accordance with section 6 of this Determination. In 2019, γ equalled 6.784 x 10-4 x 25.

The ineligible emissions are a measure of how much methane the ineligible material is able to emit. These values are determined in accordance with section 27 of the Determination.