AASB Standard | AASB 2019-4 |

This Standard is available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

Website: www.aasb.gov.au

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

© Commonwealth of Australia 2019

This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission. Requests and enquiries concerning reproduction and rights should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

ISSN 1036-4803

PREFACE

ACCOUNTING STANDARD

AASB 2019-4 AMENDMENTS TO AUSTRALIAN ACCOUNTING STANDARDS – DISCLOSURE IN SPECIAL PURPOSE FINANCIAL STATEMENTS OF NOT-FOR-PROFIT PRIVATE SECTOR ENTITIES ON COMPLIANCE WITH RECOGNITION AND MEASUREMENT REQUIREMENTS

from paragraph

APPLICATION 2

AMENDMENTS TO AASB 1054 6

COMMENCEMENT OF THE LEGISLATIVE INSTRUMENT 8

IMPLEMENTATION GUIDANCE AND ILLUSTRATIVE EXAMPLES FOR NOT-FOR-PROFIT PRIVATE SECTOR ENTITIES

BASIS FOR CONCLUSIONS

Australian Accounting Standard AASB 2019-4 Amendments to Australian Accounting Standards – Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement Requirements is set out in paragraphs 1 – 8. All the paragraphs have equal authority.

This Standard makes amendments to AASB 1054 Australian Additional Disclosures (May 2011).

Main requirements

This Standard amends AASB 1054 to require not-for-profit private sector entities that are required to apply AASB 1054 (including those required by legislation to do so) and are preparing special purpose financial statements to disclose information about those financial statements, including information that enables users of the financial statements to understand whether or not the material accounting policies applied in the financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards.

In particular, the amendments to AASB 1054 require a not-for-profit private sector entity to:

(a) disclose the basis on which the decision to prepare special purpose financial statements was made;

(b) where the entity has interests in other entities – disclose either:

(i) whether or not its subsidiaries and investments in associates or joint ventures have been consolidated or equity accounted in a manner consistent with the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures, as appropriate. If the entity has not consolidated its subsidiaries or equity accounted its investments in associates or joint ventures consistently with those requirements, it shall disclose that fact, and the reasons why; or

(ii) that the entity has not assessed whether its interests in other entities give rise to interests in subsidiaries, associates or joint ventures, provided it is not required by legislation to make such an assessment for financial reporting purposes and has not made such an assessment;

(c) for each material accounting policy applied and disclosed in the financial statements that does not comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), disclose an indication of how it does not comply; or if such an assessment has not been made, disclose that fact; and

(d) disclose whether or not the financial statements overall comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) or that such an assessment has not been made.

Application date

This Standard applies to annual reporting periods ending on or after 30 June 2020, with earlier application permitted.

The Australian Accounting Standards Board makes Accounting Standard AASB 2019-4 Amendments to Australian Accounting Standards – Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement Requirements under section 334 of the Corporations Act 2001.

| Kris Peach |

Dated 21 November 2019 | Chair – AASB |

Amendments to Australian Accounting Standards – Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement Requirements

1 This Standard amends AASB 1054 Australian Additional Disclosures (May 2011) to add requirements for not‑for‑profit private sector entities that are required to apply AASB 1054 and are preparing special purpose financial statements to disclose information about those financial statements, including information that enables users of the financial statements to understand whether or not the accounting policies applied in the financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards.

2 The amendments set out in this Standard apply to entities and financial statements in accordance with the application of AASB 1054 set out in AASB 1057 Application of Australian Accounting Standards.

3 This Standard applies to annual reporting periods ending on or after 30 June 2020.

4 This Standard may be applied to annual reporting periods ending before 30 June 2020. When an entity applies this Standard to such an annual period, it shall disclose that fact.

5 This Standard uses underlining, striking out and other typographical material to identify some of the amendments to a Standard, in order to make the amendments more understandable. However, the amendments made by this Standard do not include that underlining, striking out or other typographical material. Ellipses (…) are used to help provide the context within which amendments are made and also to indicate text that is not amended.

6 Paragraphs 9A and 9B, and a related heading, are added as follows (new text is underlined):

…

Information about special purpose financial statements

9A A not-for-profit private sector entity that prepares special purpose financial statements shall:

(a) disclose the basis on which the decision to prepare special purpose financial statements was made;

(b) where the entity has interests in other entities – disclose either:

(i) whether or not its subsidiaries and investments in associates or joint ventures have been consolidated or equity accounted in a manner consistent with the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures, as appropriate. If the entity has not consolidated its subsidiaries or equity accounted its investments in associates or joint ventures consistently with those requirements, it shall disclose that fact, and the reasons why; or

(c) for each material accounting policy applied and disclosed in the financial statements that does not comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), disclose an indication of how it does not comply; or if such an assessment has not been made, disclose that fact; and

(d) disclose whether or not the financial statements overall comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) or that such an assessment has not been made.

9B Implementation guidance and illustrative examples for not-for-profit private sector entities accompanies this Standard. It illustrates the application of the requirements in paragraph 9A and their relationship to the requirements in AASB 101 Presentation of Financial Statements for the disclosure of an entity’s significant accounting policies.

7 Implementation guidance and illustrative examples for not-for-profit private sector entities is attached to accompany AASB 1054 as set out on pages 7 to 14.

8 For legal purposes, this legislative instrument commences on 29 June 2020.

Implementation guidance and illustrative examples for not-for-profit private sector entities

The following implementation guidance and illustrative examples accompany, but are not part of, AASB 1054 Australian Additional Disclosures. They illustrate aspects of AASB 1054 but are not intended to provide interpretative guidance.

IG1 The AASB has prepared this guidance and examples to explain and illustrate the application of the requirements in paragraph 9A of this Standard and their relationship to the requirements in AASB 101 Presentation of Financial Statements for the disclosure of a not-for-profit private sector entity’s significant accounting policies. These requirements apply to entities applying this Standard, including those required by legislation to comply. An entity preparing special purpose financial statements that is not specifically required to comply with AASB 1054 may elect not to comply with these requirements, however, is encouraged to do so.

IG2 The table below has been provided for ease of reference to illustrate the types of entities that would be generally within the scope of the requirements in paragraph 9A of this Standard, but some entities may have different specific requirements.

# | Entity | In scope/out of scope |

1 | For-profit private and for-profit public sector entities preparing special purpose financial statements | Not in scope |

2 | Not-for-profit private sector entities |

|

| Charities registered with the Australian Charities and Not-for-profits Commission (ACNC) |

|

| - that have annual revenue of $250,000 or more (ie medium and large charities), preparing special purpose financial statements and required to comply with the ACNC reporting requirements for such financial statements | In scope, must comply with AASB 1054 |

| - that have annual revenue of less than $250,000 (ie small charities) | Not in scope |

| - that have annual revenue of $250,000 or more, preparing special purpose financial statements and not required to comply with the ACNC reporting requirements for such financial statements | Not in scope |

| Not-for-profit entities not registered with ACNC |

|

| - lodging special purpose financial statements with the Australian Securities and Investments Commission (ASIC) under the Corporations Act 2001 (eg companies limited by guarantee) | In scope, must comply with AASB 1054 |

| - required by Federal or State/Territory legislation to prepare financial statements in accordance with Australian Accounting Standards or accounting standards (eg incorporated associations, co-operatives and charitable fundraising organisations), that are preparing special purpose financial statements and not specifically required to comply with AASB 1054 | Not in scope |

3 | Other not-for-profit entities, including not-for-profit public sector entities, entities not specified above and entities not required to comply with AASB 1054 by legislation or otherwise | Not in scope |

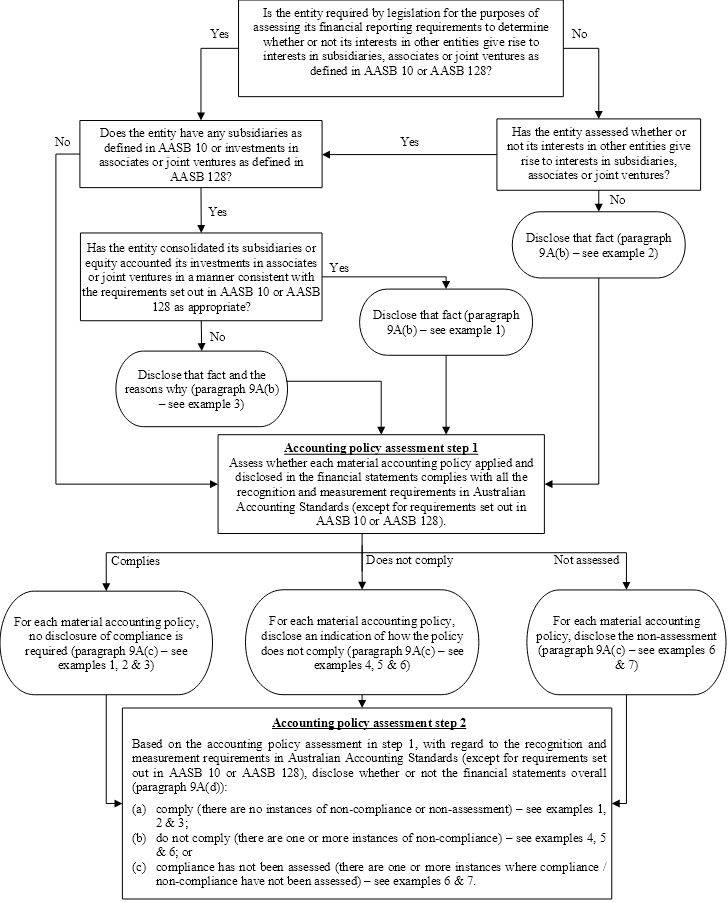

IG3 The following flowchart summarises some of the key decisions in determining how to apply the disclosure requirements in paragraph 9A of this Standard in relation to special purpose financial statements.

IG4 In disclosing the information required by paragraph 9A of this Standard, entities are not expected to provide quantitative information, or reconciliations, where accounting policies do not comply with all the recognition and measurement requirements in Australian Accounting Standards.

Chart 1 – Not-for-profit private sector entities preparing special purpose financial statements

Chart 1 – Not-for-profit private sector entities preparing special purpose financial statements

(a) paragraph 15 of AASB 101, which requires the fair presentation of financial statements;

(b) paragraphs 10-12 of AASB 108, which address the selection of accounting policies in the absence of an Australian Accounting Standard that specifically applies to a transaction, other event or condition; and

(c) paragraph 117 of AASB 101, which requires disclosure of significant accounting policies comprising the measurement basis (or bases) and the other accounting policies used that are relevant to an understanding of the financial statements.

As a result, sufficient information to enable users of special purpose financial statements to obtain an understanding of the accounting policies adopted is required to be disclosed. This includes where an entity has selected and applied accounting policies that differ from the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 Consolidated Financial statements or AASB 128 Investments in Associates and Joint Ventures).

(a) an entity discloses for those policies not complying with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) or not assessed for compliance, an indication of how it does not comply or that such an assessment has not been made; or

(b) if the material accounting policies applied and disclosed in the financial statements comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) no additional disclosures are required.

(a) an entity may choose to disclose which Australian Accounting Standards they have not complied with and provide details of the non-compliance in one place for example within the basis of preparation note, where the instance of non-compliance are not extensive (see Example 4 below); or alternatively

(b) where the instances of non-compliance are extensive, details of the non-compliance may be provided within the relevant accounting policy note (see Example 5 below).

IG9 Based on the assessment in paragraph 9A(c), paragraph 9A(d) then requires an entity to disclose whether or not overall the material accounting policies applied and disclosed in the financial statements comply (that is there are no instances of non-compliance or non-assessment) (see Examples 1, 2 and 3 below) or do not comply (there are one or more instances of non-compliance) with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) (see Examples 4, 5 and 6 below), or that an assessment has not been made (there are one or more instances of compliance / non-compliance not having been assessed) (see Examples 6 and 7 below).

IG10 Based on the AASB’s research, some of the most frequent examples of non-compliance with recognition and measurement requirements in Australian Accounting Standards include:

(a) in accounting for income, recognition of grant income for a specified time period, or which has no conditions that need to be met, is deferred until the related expenses are incurred, or all grant income is deferred, without assessing whether a performance obligation exists, which does not comply with AASB 15 Revenue from Contracts with Customers or AASB 1058 Income of Not-for-Profit Entities;

(b) in accounting for property, plant and equipment, assets were not depreciated based on their useful lives, which does not comply with AASB 116 Property, Plant and Equipment;

(c) in accounting for impairments, the recoverable amount for impairment testing was calculated on an undiscounted basis, which does not comply with AASB 136 Impairment of Assets; and

(d) in accounting for employee benefits, the long-term provision for long service leave is not recognised, or not discounted, which does not comply with AASB 119 Employee Benefits.

IG11 In relation to paragraph 9A(b) of this Standard, information about the accounting for subsidiaries and investments in associates and joint ventures is fundamental for a user’s understanding of the scope of the financial statements. Some entities are required to determine their financial reporting requirements based on the application of recognition and measurement requirements in Australian Accounting Standards, including consolidation, for example a proprietary company subject to section 45A of the Corporations Act 2001 is required to determine whether it is a small or large proprietary company on a consolidated basis (ie the parent and the entities it controls (subsidiaries)) in accordance with the accounting standards even if the standards do not otherwise apply to some or all of the companies concerned. Other entities, typically lodging financial reports with the ACNC, make their assessments based on individual entity circumstances only. In instances where legislation does not require assessment on a consolidated basis, and an entity has not made an assessment of whether its interests in other entities are subsidiaries, associates or joint ventures, an entity shall make a statement that they have not been assessed (see Example 2 below).

IG12 Exemptions from consolidation of subsidiaries are provided in AASB 10, paragraphs 4(a) and Aus4.1 (as modified by paragraph Aus4.2), including when the entity is a wholly-owned subsidiary and its ultimate parent produces consolidated financial statements that are available for public use and comply with accounting standards. Directors preparing special purpose financial statements might have other reasons for non-consolidation of some or all of an entity’s subsidiaries, and paragraph 9A(b) requires these reasons to be disclosed (see Example 3 below).

IG13 The following illustrative examples are provided:

Scenario/Example | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Reporting Framework | ACNC | | | |

| |

| |

Corporations Act 2001 |

|

|

| |

| |

| |

Subsidiaries | Yes | | Not assessed | |

|

|

|

|

No |

|

| | | | | ||

Consolidated | Yes | | n/a |

| n/a | n/a | n/a | n/a |

No |

|

| ||||||

Partially |

|

| | |||||

Associates / Joint Ventures | Yes | | Not assessed | |

|

|

|

|

No |

|

| | | | | ||

Equity accounted | Yes | |

|

| n/a | n/a | n/a | n/a |

No |

| |

| |||||

Partially |

|

| | |||||

Material accounting policies comply with all recognition and measurement requirements (except for AASB 10 or AASB 128) | Yes | | | |

|

|

|

|

No |

|

|

| | | |

| |

Not assessed |

|

|

|

|

| | | |

Financial statements overall comply with all recognition and measurement requirements (except for AASB 10 or AASB 128) | Yes | | | |

|

|

|

|

No |

|

|

| | | |

| |

Not assessed |

|

|

|

|

|

| | |

IG14 The following examples illustrate how an entity might apply the disclosure requirements in paragraph 9A of this Standard within the context of the requirements in AASB 101 and AASB 108 referred to in paragraph IG5 above to the special purpose financial statements they prepare, on the basis of the limited facts presented. Although some aspects of the examples might be present in actual fact patterns, all relevant facts and circumstances of a particular fact pattern need to be evaluated when applying disclosure requirements of this Standard.

# | Example | Illustrative disclosure |

1 | Compliance with all recognition and measurement requirements in Australian Accounting Standards including AASB 10 and AASB 128 Charity A Inc, a not-for-profit parent, prepares consolidated special purpose financial statements that:

| Charity A Inc is a not-for-profit entity. The Members of the Governing / Management Committee are of the opinion that the Association is not a reporting entity as users may obtain the financial information they require upon request. These special purpose financial statements have therefore been prepared in order to meet the requirements of the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. Charity A Inc has consolidated all its subsidiaries consistent with the requirements set out in AASB 10 Consolidated Financial Statements and equity accounted for its investments in associates and joint ventures in a manner consistent with the requirements set out in AASB 128 Investments in Associates and Joint Ventures. These consolidated special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards. |

2 | Compliance with all recognition and measurement requirements in Australian Accounting Standards except for AASB 10 and AASB 128 (interests in other entities not assessed) Charity B Inc, a not-for-profit entity, prepares special purpose financial statements that:

The legislative framework in which Charity B Inc operates does not require it to identify subsidiaries, associates or joint ventures to determine its financial reporting requirements. | Charity B Inc is a not-for-profit entity. In the opinion of the Management Committee, Charity B Inc is not a reporting entity as its users may request the financial information they need. These special purpose financial statements have been prepared for distribution to members and for the purposes of fulfilling the reporting requirements under the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. Charity B Inc has not assessed whether it has relationships with other entities which, for financial reporting purposes, might be considered subsidiaries, associates or joint ventures as it is not required by the [Australian Charities and Not-for-profits Commission Act 2012] to do so. These special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards (except for the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures). |

Compliance with all recognition and measurement requirements in Australian Accounting Standards except for AASB 10 and AASB 128 (some subsidiaries not consolidated and some associates and joint ventures not equity accounted) MNO Ltd, a parent that is a charity, prepares partially consolidated special purpose financial statements that:

| MNO Ltd, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Directors, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Directors’ reporting requirements under the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. These financial statements do not consolidate all of MNO Ltd’s subsidiaries or equity account all its investments in associates and investments in joint ventures as the Directors [did not perform a detailed assessment of all of MNO Ltd’s relationships with other entities, and instead elected to only consolidate those entities MNO Ltd has a 100% ownership interest in / insert an explanation of why some subsidiaries, associates and joint ventures are not consolidated / equity accounted.] MNO Ltd’s partially consolidated special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards (except for the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures). | |

4 | Known non-compliance with all recognition and measurement requirements in Australian Accounting Standards that is not extensive XYZ Ltd, a not-for-profit entity that is not a charity, determined that it does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply material accounting policies that do not comply with all the recognition and measurement requirements in Australian Accounting Standards. The differences are not extensive. | XYZ Ltd, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Directors, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Directors’ reporting requirements under the Corporations Act 2001. These special purpose financial statements do not comply with all the recognition and measurement requirements in Australian Accounting Standards. The recognition and measurement requirements that have not been complied with are those specified in AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities as, in accounting for income, recognition of all grant income has been deferred [[until the related expenses are incurred without assessing whether there are enforceable performance obligations to transfer a good or service to a third party which are sufficiently specific to know when the performance obligation has been satisfied] / [where the grant is for multi-years without assessing whether there is a performance obligation or the grantor retains control of the remainder of the grant at the end of each year] / insert further details including an indication of how material recognition and measurement requirements in Australian Accounting Standards have not been complied with]. |

5 | Known non-compliance with all recognition and measurement requirements in Australian Accounting Standards that is extensive Charity D Inc, a not-for-profit entity, does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply material accounting policies that do not comply with all the recognition and measurement requirements in Australian Accounting Standards. Although the differences have not been quantified, they are extensive and an indication of the differences are presented with the appropriate note disclosing the accounting policy. | Charity D Inc, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Management Committee, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Management Committee’s reporting requirements under the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. These special purpose financial statements do not comply with all the recognition and measurement requirements in Australian Accounting Standards. [The material accounting policies adopted in the special purpose financial statements are set out in notes X-Y and indicate how the recognition and measurement requirements in Australian Accounting Standards have not been complied with. … Note X: Revenue … All grant income has been deferred upon receipt and not recognised as revenue until the related expenses are incurred, without assessing whether enforceable performance obligations exist. This does not comply with AASB 15 Revenue from Contracts with Customers or AASB 1058 Income of Not-for-Profit Entities. … Note Y: Employee Benefits … Long-term provision recognised for long service leave has been measured on the undiscounted basis which does not comply with AASB 119 Employee Benefits. …] |

6 | At least one material accounting policy not assessed for compliance with recognition and measurement requirements in Australian Accounting Standards (combined with known non-compliance with recognition and measurement requirements in Australian Accounting Standards) MLK Ltd, a not-for-profit entity, does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply some material accounting policies that do not comply with the recognition and measurement requirements in Australian Accounting Standards and some material accounting policies that have not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. | MLK Ltd is a not-for-profit entity. In the opinion of the Directors Charity E Ltd is not a reporting entity as its users may request the financial information they need. These special purpose financial statements have been prepared for distribution to members and for the purposes of fulfilling the requirements of the Corporations Act 2001. These special purpose financial statements do not comply with all the recognition and measurement requirements in Australian Accounting Standards. The material accounting policies adopted in the special purpose financial statements include: - [deferring all grant income upon receipt and not recognising as revenue until the related expenses are incurred, without assessing whether enforceable performance obligations exist, which does not comply with AASB 15 Revenue from Contracts with Customers or AASB 1058 Income of Not-for-Profit Entities; - insert further details including an indication of how material recognition and measurement requirements in Australian Accounting Standards have not been complied with]. The material accounting policies disclosed in note X that have not been assessed for compliance with the recognition and measurement requirements of Australian Accounting Standards include: - Long-service leave; and - Impairment of assets. |

7 | At least one material accounting policy not assessed for compliance with recognition and measurement requirements in Australian Accounting Standards (all other material accounting policies comply with recognition and measurement requirements in Australian Accounting Standards) Charity F Inc, a not-for-profit entity, does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply some material accounting policies that have not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. All other material accounting policies comply with the recognition and measurement requirements in Australian Accounting Standards. | Charity F Inc, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Management Committee, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Management Committee’s reporting requirements under [the Australian Charities and Not-for-profits Commission Act 2012 / insert details of the not-for-profit reporting framework under which the financial statements are prepared]. Charity F Inc has not assessed whether these special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards. [The material accounting policies disclosed in note X that have not been assessed for compliance with Australian Accounting Standards include: - Recognition of income; and - Long-service leave.] OR [The material accounting policies adopted in the special purpose financial statements are set out in notes X-Y and indicate how they have not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. … Note X: Revenue All grant income has been deferred upon receipt and not recognised as revenue until the related expenses are incurred, and has not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. … Note Y: Employee Benefits … Long-term provision recognised for long service leave has been measured to reflect the directors best estimate of the amounts payable for those employees expected to achieve seven years of service at the reporting date, and has not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards.] |

Basis for Conclusions

This Basis for Conclusions accompanies, but is not part of, AASB 2019-4 Amendments to Australian Accounting Standards – Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement Requirements.

Introduction

BC1 This Basis for Conclusions summarises the Australian Accounting Standards Board’s considerations in reaching the conclusions in this Standard. It sets out the reasons why the Board developed the Standard, the approach taken to developing the Standard and the bases for the key decisions made. In making decisions, individual Board members gave greater weight to some factors than to others.

Background

BC2 Australia is the only jurisdiction with a ‘reporting entity’ concept that effectively permits entities to self-assess what type of financial reporting they do when they are required by legislation or otherwise (such as by a constitutional document) to prepare financial statements in accordance with Australian Accounting Standards (issued by the Australian Accounting Standards Board). Therefore, unlike other jurisdictions, in Australia two similar entities might prepare very different sets of financial statements, one preparing general purpose financial statements using a robust and consistent framework, and the other preparing special purpose financial statements with self-selected requirements. The Board notes that the self-selection is subject to some constraints, imposed by paragraphs 7 and 10 to 12 of AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors.

BC3 Appendix A of AASB 1053 Application of Tiers of Australian Accounting Standards defines what a reporting entity is,[1] and Statement of Accounting Concepts SAC 1 Definition of the Reporting Entity also sets out the reporting entity concept. Paragraph 41 of SAC 1 states that “Reporting entities shall prepare general purpose financial reports.” [2] In relation to a group, SAC 1 states in paragraph 17 that “the group, which may be termed an economic entity, will be a reporting entity where there exist users dependent on general purpose financial reports for making and evaluating resource allocation decisions regarding the collective operations of the group of entities”.

BC4 An entity that assesses itself to be a non-reporting entity can therefore prepare special purpose financial statements, which are not necessarily consistent, comparable, transparent or enforceable. In particular, special purpose financial statements do not always comply with the recognition and measurement requirements[3] in Australian Accounting Standards and nor do they always disclose that fact. The Board is aware of the view of some, that this situation is acceptable because, by inference, users of special purpose financial statements can demand any information they need. However, the Board has received feedback that in practice that is often not the case. The Board determined that users should be provided with adequate information to enable them to confidently assess an entity’s level of compliance with the recognition and measurement requirements in Australian Accounting Standards in special purpose financial statements or be alerted to areas where this has not been assessed, and is therefore unclear. Such disclosures are expected to better support users in identifying where additional information is required.

BC5 In developing this Standard, the Board considered the findings of AASB Research Report 11 Review of Special Purpose Financial Statements: Large and Medium Sized Australian Charities and feedback obtained from the not-for-profit private sector regarding the public interest nature of the sector and the needs of financial statement users with regard to the consistency and transparency of special purpose financial statements.

BC6 The research examining the reporting practices of large and medium charities lodging financial statements with the ACNC in 2016 estimates that approximately 36% of those charities declared that they were preparing special purpose financial statements based on data obtained from the 2016 Annual Information Statements lodged with the ACNC. It is estimated that, of those charities preparing and lodging special purpose financial statements, approximately 26% state compliance with recognition and measurement requirements in Australian Accounting Standards. 30% state non-compliance with the recognition and measurements requirements in Australian Accounting Standards. It is not clear for the remaining 44% whether or not they complied with the recognition and measurement requirements in Australian Accounting Standards.[4] Research also indicates that there are issues with the accuracy of charities stating they are preparing general purpose financial statements.[5]

BC7 In addition to it being difficult for the researchers to understand the extent of alignment of an entity’s accounting policies to the recognition and measurement requirements in Australian Accounting Standards, the researchers were also unable to ascertain whether or not an entity had fully consolidated its subsidiaries or equity accounted all its investments in associates and joint ventures.

BC8 The Board discussed the results of the research outlined above and also feedback obtained from respondents to user surveys, along with evidence supporting the existence of users of financial statements, including special purpose financial statements.[6] The Board also noted the importance of consistency, comparability, transparency and enforceability in financial reporting to special purpose financial statement users, and that at times users and other stakeholders were unaware that some special purpose financial statements (where the preparation of financial statements in compliance with Australian Accounting Standards is required by legislation or otherwise) did not comply with all the recognition and measurement requirements in Australian Accounting Standards including consolidation. Adoption of the new disclosures in this Standard helps address these issues.

BC9 The Board was also particularly concerned that the quality of disclosures in a significant number of special purpose financial statements is not adequate to enable a user to determine what additional information they might need. As noted in paragraph BC6 above research indicated that, for 44% of medium and large charities lodging special purpose financial statements with the ACNC, it was unclear to the academics conducting the research whether or not the entities in question complied with the recognition and measurement requirements in Australian Accounting Standards. The Board considers this to be unacceptable given the feedback received from users regarding consistency and transparency of special purpose financial statements including comparability of the recognition and measurement requirements (refer paragraph BC5 above).

BC10 In light of the Board’s current broader project proposing to remove the ability for certain entities to prepare special purpose financial statements when they are required to comply with Australian Accounting Standards,[7] the Board considered whether it was necessary and timely to require an entity preparing special purpose financial statements to disclose whether or not the accounting policies applied in the financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards. These new disclosures are an interim measure aimed at addressing these concerns given the project proposing to remove special purpose financial statements will take some time, particularly for the not-for-profit entities.

BC11 In considering whether such disclosure was necessary, the Board also considered whether any existing disclosure requirements in Australian Accounting Standards or other pronouncements required the disclosure of similar information.

BC12 The Board noted that paragraph 117 of AASB 101 Presentation of Financial Statements, which applies not only to general purpose financial statements but also directly to the special purpose financial statements of entities required to prepare financial reports in accordance with the Corporations Act 2001,[8] requires an entity to disclose its significant accounting policies. The Board also noted that, where it applies, paragraph 6.1 of Accounting Professional and Ethical Standard APES 205 Conformity with Accounting Standards (October 2015) issued by the Accounting Professional and Ethical Standards Board (APESB) also requires that an entity’s special purpose financial statements clearly identify “the significant accounting policies adopted in the preparation of the special purpose financial statements”.[9] The Board however noted that while these disclosures provide information about an entity’s accounting policies, they would not necessarily provide users with sufficient information about an entity’s compliance with all the recognition and measurement requirements in Australian Accounting Standards.

BC13 On the basis of the considerations outlined in paragraphs BC2-BC12 above, the Board decided that an amendment to Australian Accounting Standards to require entities to disclose an explicit statement as to whether or not the accounting policies applied in the financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards was urgently needed to provide greater transparency to users of publicly lodged special purpose financial statements and to improve the comparability of special purpose financial statements. The Board also acknowledged that disclosure of this information is not sufficient to address the problems of special purpose financial reporting, however it provides a practical interim means of improving the quality of information provided to users of special purpose financial statements.

BC14 The Board noted that, when preparing the required disclosure, entities would need to consider how their existing accounting policies compare with all the recognition and measurement requirements in Australian Accounting Standards. While the Board confirmed that the amendment would not require an entity to change its existing accounting policies, understanding how closely the entity’s existing accounting policies are aligned to the recognition and measurement requirements in Australian Accounting Standards would also help entities assess the impact of any future transition from special purpose financial statements to general purpose financial statements.

Issue of Exposure Draft ED 293

BC15 The Board’s proposals with respect to the disclosures in special purpose financial statements finalised in this Standard were exposed for public comment in July 2019 as part of Exposure Draft ED 293 Amendments to Australian Accounting Standards – Disclosure in Special Purpose Financial Statements of Compliance with Recognition and Measurement Requirements (ED 293).

BC16 The significant issues considered by the Board in developing ED 293 are addressed in the following section.

BC17 In deciding who should be required to make the disclosures proposed in ED 293, the Board considered The AASB’s For-Profit Entity Standard-Setting Framework and The AASB’s Not-for-Profit Entity Standard-Setting Framework, and decided the proposals would be consistent with both frameworks and therefore ED 293 proposed that they should apply to for-profit and not-for-profit entities.

BC18 In making this decision, the Board had particular regard to the following factors:

(a) the uncertainty about whether or not the accounting policies applied in the financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards described in paragraph BC6 above, coupled with the findings of AASB Research Report 12 Financial Reporting Practices of For-Profit Entities Lodging Special Purpose Financial Statements (August 2019)[10] significantly adversely impacts financial statement users in both the for-profit and not-for-profit sectors;

(b) financial statement users have noted during AASB outreach to date[11] the lack of, and need to improve, comparability, consistency, transparency and enforceability in special purpose financial statements;

(c) the evidence of diversity in the application of, and compliance with, the recognition and measurement requirements in Australian Accounting Standards in special purpose financial statements noted in Research Report 11 (refer to paragraph BC6 above) and Research Report 12;[12]

(d) the significant number of charities preparing special purpose financial statements and the low levels of explicit statements of compliance with the recognition and measurement requirements in Australian Accounting Standards therein (refer paragraph BC6 above); and

(e) the requirements of Australian Auditing Standards as they relate to special purpose financial statements (refer to paragraph BC26 below).

(a) all entities preparing special purpose financial statements (including those preparing financial statements voluntarily); or

(c) only those entities preparing special purpose financial statements that are directly subject to AASB 101 and AASB 1054 Australian Additional Disclosures[13], as set out in paragraph 2 of AASB 1054 and paragraph 7 of AASB 1057 Application of Australian Accounting Standards, (and, indirectly, any entities required through legislation to comply with AASB 101 and AASB 1054, such as entities lodging special purpose financial statements with the ACNC as they are required by legislation to comply with AASB 101 and AASB 1054 (as noted in footnote 8 to paragraph BC12 above)).

BC21 The Board did acknowledge that if the disclosures were required only by entities subject to AASB 101 and AASB 1054, there may be a large number of entities preparing special purpose financial statements when required to comply with Australian Accounting Standards that would not be required to make the disclosures (eg entities outside the scope of the Corporations Act 2001 and entities not required to comply with the ACNC’s reporting requirements applying to special purpose financial statements). The Board however made the observation that many of these entities are expected to fall within the scope of APES 205, as the intention of APES 205 is to set requirements for members[14] who are involved in the preparation, presentation, audit, review or compilation of financial statements for entities that are outside the scope of the Corporations Act 2001. Therefore, to possibly mitigate (albeit not eliminate) concerns about entities outside the scope of AASB 101 and AASB 1054 not being required to make the disclosures, the matter was raised with staff of the APESB as to whether the APESB might consider, following its own due process, making any consequential amendments to APES 205 consistent with the amendments to the affected Australian Accounting Standard proposed in ED 293. Subsequent to the issue of ED 293, the Board noted that the matter was considered by the APESB, and that the APESB were not proposing amendments to APES 205 (of a nature consistent with those proposed in ED 293) at that time, however they did consider it an important issue to seek stakeholder views on. Accordingly, the Explanatory Memorandum to Exposure Draft 03/19 Proposed revisions to APESB Pronouncements included commentary on this matter and sought specific feedback from their stakeholders. After considering this feedback, the APESB decided not to amend APES 205.

BC22 For the reasons outlined in paragraph BC20-BC21 above, the Board decided it was not necessary to broaden the application paragraphs of AASB 101 or AASB 1054, and therefore ED 293 proposed the amendment should apply in the manner described in paragraph BC19(c) above.

BC25 In making this decision, the Board noted that APES 205 contains a requirement for entities to identify “the purpose for which the Special Purpose Financial Statements have been prepared”[15] and therefore entities within the scope of APES 205 should already be including this information in special purpose financial statements, however mandating it in an Australian Accounting Standard would help ensure users are provided with useful information.

BC26 The Board also noted the requirements of Australian Auditing Standards and the existing responsibilities of those charged with governance and auditors with respect to the selection and application of an entity’s financial reporting framework. In particular, the Board noted the requirements in ASA 800 Special Considerations-Audits of Financial Reports Prepared in Accordance with Special Purpose Frameworks which for example require that “the auditor shall obtain an understanding of the steps undertaken by management to determine that the applicable financial reporting framework is acceptable in the circumstances”[16] and also ASA 700 Forming an Opinion and Reporting on a Financial Report which for example requires that “the auditor shall evaluate whether the financial report adequately refers to or describes the applicable financial reporting framework”.[17]

Option | Information to be disclosed |

Option 1 | Contextual information about the entity, being where the entity has subsidiaries, investments in associates or investments in joint ventures, and whether or not they have been consolidated or equity accounted in a manner consistent with the requirements set out in Australian Accounting Standards. If the entity has not consolidated its subsidiaries or equity accounted its investments in associates or joint ventures in a manner consistent with the requirements set out in Australian Accounting Standards, the entity shall disclose that fact and the reasons why. If the entity is a not-for-profit entity, and it has not determined whether or not its interests in other entities give rise to interests in subsidiaries, associates or joint ventures, the entity shall instead disclose that fact. |

Option 2 | An explicit statement as to whether or not the financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards and, if not, an indication of where they do not comply. |

Option 3 | Merely a binary statement regarding compliance or non-compliance with all the recognition and measurement requirements in Australian Accounting Standards, for example either that “the entity has complied with all the recognition and measurement requirements in Australian Accounting Standards” or “the entity has not complied with all the recognition and measurement requirements in Australian Accounting Standards”. |

Option 4 | Merely a statement of compliance with all the recognition and measurement requirements in Australian Accounting Standards that is, no statement would be required if an entity did not comply with all the recognition and measurement requirements in Australian Accounting Standards. |

BC30 The Board considered whether an explicit statement that an entity does not have subsidiaries, or investments in associates or joint ventures was required. The Board noted that entities preparing either Tier 1 or Tier 2 general purpose financial statements[18] are not required to make these statements and accordingly an explicit statement in these circumstances should not be required.

BC32 The Board also considered whether to require these entities to identify those subsidiaries that have not been consolidated. Whilst the Board acknowledged that this information might be useful to users of the financial statements, the Board noted that for some entities, particularly those in the not-for-profit private sector, this disclosure might be unduly burdensome, such as where entities are not required to determine whether they have subsidiaries in accordance with AASB 10 to assess their financial reporting requirements. Thus, on balance, the Board decided that ED 293 would not require entities to disclose the identity of subsidiaries that have not been consolidated.

BC33 The Board noted the general requirement in paragraph 117 of AASB 101 to disclose accounting policies provides financial statement users with an explanation of the basis upon which the financial statements have been prepared, but does not provide information regarding how those accounting policies compare with all the recognition and measurement requirements in Australian Accounting Standards. Accordingly, the transparency of special purpose financial reporting is compromised. The Board therefore decided that it was necessary for an entity to explicitly disclose whether or not it complied with all the recognition and measurement requirements in Australian Accounting Standards and to supplement that disclosure with an indication of where they do not comply.

BC35 The Board did however confirm, that in disclosing the required information, the Board did not expect entities to provide quantitative information or reconciliations where their accounting policies do not comply with all the recognition and measurement requirements in Australian Accounting Standards.

BC38 While Options 3 and 4 in the table in paragraph BC27 above were not without their advantages, the Board decided they were not the most appropriate alternatives for a number of reasons including:

(a) a binary disclosure stating only ‘non-compliance’ as suggested in Option 3 would not be useful as users would not be able to discern an indication of the extent of recognition and measurement compliance or non-compliance; and

(b) Option 4 was not appropriate as, if an entity did not make the disclosure, users would also not be able discern the reason for non-compliance, that is, whether it was a recognition and measurement non-compliance or the omission of a disclosure requirement for example.

Accordingly, any costs that would be saved by adopting Options 3 or 4 relative to Option 2, including that they would result in less voluminous disclosure, would be clearly outweighed by the benefits to users of Option 2.

BC40 Notwithstanding this, “as part of moving legacy regulations out of legislation and into Australian Accounting Standards …”,[19] and as noted in paragraph BC19(c) above, Australian Accounting Standards AASB 101, AASB 107, AASB 108, AASB 1048 and AASB 1054 apply to special purpose financial statements. The Board considered that this, especially the requirement in paragraph 9 of AASB 1054,[20] together with the needs of users noted in paragraph BC18 above, provided a sufficient basis for requiring the disclosures in special purpose financial statements proposed in ED 293. The Board was particularly concerned that a significant number of special purpose financial statements do not provide adequate disclosures to enable a user to determine whether they do need additional information to meet their needs.

Finalisation of ED 293 proposals

BC41 Following the consultation period, and after considering constituent comments received, the Board decided to proceed with issuing this Standard, however in doing so the Board made a number of decisions regarding the final proposals.

BC42 The Board received 14 formal comment letters on ED 293, and undertook targeted outreach with key stakeholders including professional bodies and regulators.

BC45 The Board decided that the requirements of this Standard should apply only to not-for-profit private sector entities required by legislation or otherwise to comply with AASB 1054, such as medium and large charities with revenue greater than $250,000, registered with the ACNC and required to comply with the ACNC’s reporting requirements relating to special purpose financial statements and companies limited by guarantee lodging financial reports with ASIC. The Board noted the ACNC expressed support for increased transparency of financial reporting in the charities sector with the additional disclosure requirements being viewed as a positive step towards greater transparency, accountability and good governance.

BC46 As noted in paragraph BC44 above, the disclosure requirements were amended (refer paragraphs BC48-BC57 below) to not require not-for-profit private sector entities to undertake more effort than they already have in regards to assessing compliance or otherwise with the recognition and measurement requirements in Australian Accounting Standards, as they could state that they have not made an assessment of compliance with the recognition and measurement requirements in Australian Accounting Standards (refer paragraph BC49) if they wish to. The Board acknowledged that there is less clarity regarding compliance with the recognition and measurement requirements in Australian Accounting Standards in the special purpose financial statements of charities and considered that the new disclosures provide appropriate information for users without these entities incurring undue costs. The Board also confirmed the new disclosures should apply to not-for-profit private sector entities for annual reporting periods ending on or after 30 June 2020.

BC47 When deciding to limit the application of this Standard to not-for-profit private sector entities only, the Board noted feedback from respondents to ED 293 (refer paragraph BC43 above) that if the proposals in ED 297 Removal of Special Purpose Financial Statements for Certain For-Profit Private Sector Entities to remove the ability for certain for-profit private sector entities to prepare special purpose financial statements are finalised as proposed, so that they are effective for annual reporting periods beginning on or after 1 July 2020, the requirements of this Standard would only be relevant for a short period of time for these for-profit private sector entities. The Board therefore considered that the costs to prepare the disclosures in this Standard for these for-profit private sector entities would arguably outweigh the benefits. If however the proposals in ED 297 are not finalised as proposed, the Board will reconsider the application of the requirements in this Standard for for-profit private sector entities.

BC48 In order to simplify the new disclosures and minimise any possible burden associated with preparing the new disclosures, the Board decided to amend the disclosure requirements to adopt a two-step approach to assessing and disclosing compliance with the recognition and measurement requirements in Australian Accounting Standards and also clarified a number of other aspects of the disclosure requirements.

BC49 The Board decided that not-for-profit private sector entities required to apply this Standard should assess, for each material accounting policy applied and disclosed in the special purpose financial statements, whether the policy does not comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128 Investments in Associates and Joint Ventures). If a material accounting policy does not comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), that fact shall be disclosed with an indication of how it does not comply. Alternatively, if a not-for-profit private sector entity has not made this assessment, it should disclose that fact.

BC50 After making the disclosures noted in paragraph BC49, the not-for-profit private sector entity will then disclose, whether the financial statements overall:

(a) comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) - that is there are no material accounting policies disclosed in the special purpose financial statements that would not comply and have not been assessed in respect of the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128);

(b) do not comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) - that is there are one or more instances of material accounting policies disclosed in the special purpose financial statements that do not comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128); or

(c) compliance with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) has not been assessed - that is there are one or more instances where the not-for-profit private sector entity has not assessed whether or not the material accounting policies disclosed in the special purpose financial statements comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128).

BC51 The Board decided to include an option for a not-for-profit private sector entity to disclose that they have not assessed whether or not the accounting policies disclosed in the special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), because allowing an entity to make such a disclosure would require minimal additional effort (as entities would not be required to complete additional assessment of compliance with the recognition and measurement requirements in Australian Accounting Standards but merely make the disclosures based on their existing understanding of the entity’s accounting policies). This disclosure, however, would highlight potential instances of non-compliance with the recognition and measurement requirements in Australian Accounting Standards to users of the special purpose financial statements, as well as potential governance issues, and would also allow users of the special purpose financial statements to seek additional information if required.

BC52 The Board confirmed that it is their expectation that the new disclosures are intended to identify instances of non-compliance with the recognition and measurement requirements in Australian Accounting Standards that are material to the special purpose financial statements. The Board considered whether an entity that has disclosed non-compliance with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) for an accounting policy that is not material to the entity, could still claim that its financial statements overall complied with the recognition and measurement requirements in Australian Accounting Standards. The Board confirmed if there is one instance of a material accounting policy applied and disclosed in the special purpose financial statements not complying with the recognition and measurement requirements in Australian Accounting Standards or not being assessed, the entity cannot claim that its financial statements overall comply with all the recognition and measurement requirements in Australian Accounting Standards.

BC53 The Board acknowledged the diversity in views regarding whether or not consolidation and the equity method of accounting are recognition and measurement requirements, presentation and disclosure requirements, neither or both, and the effect this diversity in views may have on the ability of an entity to determine whether or not they have complied with all the recognition and measurement requirements in Australian Accounting Standards.

BC54 The Board considered whether the recent amendment to paragraph 9 of AASB 1053 made via AASB 2019-1 Amendments to Australian Accounting Standards – References to the Conceptual Framework clarified that consolidation and the equity method of accounting are recognition and measurement requirements, however noted that the intention of this amendment was to provide certainty that an entity not consolidating or equity accounting must apply the transitional provisions in AASB 1 or AASB 108, and the Board had determined to not make a conclusive decision on it.

BC55 For the avoidance of doubt the Board decided to make it clear that for the purposes of the disclosures in paragraphs 9A(c) and 9A(d) of this Standard, recognition and measurement requirements exclude consolidation and the equity method of accounting as the application of consolidation and the equity method of accounting are the subject of separate disclosure requirements in this Standard.

BC56 The Board also reconsidered the proposal in ED 293 to relieve a not-for-profit entity from the requirement to determine whether or not its interests in other entities give rise to interests in subsidiaries, associates or joint ventures. The Board acknowledged that there may be some instances where a not-for-profit private sector entity may be required by legislation to make this determination to assess their financial reporting requirements, and therefore decided that this relief should only be available where there is no legislative requirement for a not-for-profit entity to make this determination. For example, and as noted in paragraph BC29, section 45A of the Corporations Act 2001 requires the assessment of thresholds for small and large proprietary companies to be determined on a consolidated basis (ie the parent and the entities it controls (subsidiaries)) in accordance with the accounting standards even if the standards do not otherwise apply to some or all of the companies concerned. While it is not common, it is possible for a not-for-profit entity to be structured using a proprietary company structure and the entity would therefore be subject to section 45A of the Corporations Act 2001.

BC58 In responding to the specific feedback from respondents to ED 293 regarding the costs of the proposed disclosures exceeding any benefits and the short term nature of the proposals, particularly for for-profit private sector entities, the Board considered that as the disclosures required by this Standard apply only to not-for-profit private sector entities and are less burdensome than those proposed in ED 293 (while still providing users with useful information regarding whether or not an entity has complied with the recognition and measurement requirements in Australian Accounting Standards), there was no need to undertake further due process and re-expose the requirements of this Standard.

BC59 The Board also decided that notwithstanding its decision to limit the scope of the requirements in this Standard to not-for-profit private sector entities, issuing a fatal-flaw review version of this Standard for public comment was not required as the Board did not make any other major changes to the proposals in ED 293.

BC60 The Board also informed other regulators of the outcome of ED 293, to help them identify whether there are any regulatory consequences of the proposed disclosure requirements.

BC61 The Board confirmed that the narrow scope amendment in this Standard is an interim measure, until the broader project proposing to remove the ability for certain entities to prepare special purpose financial statements is completed (which would take some time for not-for-profit entities), and confirmed, as outlined in this Basis for Conclusions, that the amendment is urgently needed to provide more transparency to the users of publicly lodged special purpose financial statements of not-for-profit private sector entities and to increase the comparability of special purpose financial statements with other special purpose financial statements and general purpose financial statements.

BC62 As noted in paragraph BC37 above, the amendments do not require entities to change their existing accounting policies or perform additional assessment of compliance with the recognition and measurement requirements in Australian Accounting Standards, and therefore the information required to be disclosed is based on an entity’s existing financial reporting policies and practices. Accordingly, it is not necessary to provide an extended operative date.

BC63 Based on the above, the Board decided this Standard should be effective for annual periods ending on or after 30 June 2020, with early voluntary disclosure allowed.

[1] “Reporting entity means an entity in respect of which it is reasonable to expect the existence of users who rely on the entity’s general purpose financial statements for information that will be useful to them for making and evaluating decisions about the allocation of resources. A reporting entity can be a single entity or a group comprising a parent and all of its subsidiaries.” AASB 1053, Appendix A.

[2] A “ ‘general purpose financial report’ means a financial report intended to meet the information needs common to users who are unable to command the preparation of reports tailored so as to satisfy, specifically, all of their information needs”. SAC 1, paragraph 6.

[3] For those entities that are required to prepare and lodge financial statements with the Australian Securities and Investments Commission (ASIC) by Part 2M.3 of the Corporations Act 2001, and who are preparing special purpose financial statements, paragraph 2 of ASIC Regulatory Guide 85 Reporting requirements for non-reporting entities states “… ASIC believes that non-reporting entities, which are required to prepare financial reports in accordance with Chapter 2M of the Corporations Act 2001 (Act), should comply with the recognition and measurement requirements of accounting standards”. For those entities that are required to prepare and lodge financial statements with the Australian Charities and Not-for-profits Commission (ACNC), “section 60.10(3) of ACNC Regulations requires financial statements and notes give a ‘true and fair view’, and the determination is required by the charity as well as the auditors in their audit report.

[4] Research Report 11.

[5] Appendix 2, Research Report 11.

[6] Financial statements lodged with the ACNC are available from the ACNC’s website for no cost, therefore it is reasonable to expect that financial statements are being accessed by public users. Research Report 11 noted that of the approximately 16,000 charities lodging financial statements with the ACNC in 2016, approximately one third declared that they were preparing special purpose financial statements.

[7] This project proposes to remove ability for certain entities to prepare special purpose financial statements when they are required to comply with Australian Accounting Standards via a phased approach, firstly in relation to for-profit entities and, in due course, in relation to not-for-profit entities.

[8] And indirectly through other legislation that imposes the application of AASB 101 in the preparation of special purpose financial statements. For example, the Australian Charities and Not-for-profits Commission Act 2012, through section 60.30 of the Australian Charities and Not‑for‑profits Commission Regulation 2013, requires charities lodging special purpose financial statements with the ACNC to comply with AASB 101, despite the fact that the application paragraph of that Standard does not directly encompass them.

[9] Paragraph 6.1(c) of APES 205.

[10] Research Report 12 examined the financial reporting practices of for-profit entities, including large proprietary companies, small foreign-controlled proprietary companies, for-profit unlisted public companies and other small proprietary companies, lodging financial statements with ASIC. Research Report 12 noted that when performing their initial assessment as to whether or not the accounting policies applied in the special purpose financial statements complied with the recognition and measurement requirements in Australian Accounting Standards, it was initially unclear to the researchers whether or not 34% of the entities in question complied with the recognition and measurement requirements in Australian Accounting Standards.

[11] Such outreach included responses received on ITC 39, user surveys, participation of stakeholders at ITC 39 roundtable events and targeted outreach with not-for-profit private sector stakeholders.

[12] Research Report 12 estimated that of those for-profit non-disclosing entities preparing and lodging special purpose financial statements 66% explicitly stated that they followed the recognition and measurement requirements in Australian Accounting Standards, 10% were assessed to have complied with the recognition and measurement requirements in Australian Accounting Standards based on a qualitative review of the accounting policies, despite the absence of an explicit statement to that effect, 10% did not comply with the recognition and measurement requirements in Australian Accounting Standards (of which only 0.5% clearly stated so), and the extent of compliance (or otherwise) with the recognition and measurement requirements in Australian Accounting Standards of the remaining 14% was unclear.

[13] And AASB 107 Statement of Cash Flows, AASB 108 and AASB 1048 Interpretation of Standards, although they were not considered appropriate candidates to give effect to the amendments proposed in ED 293, as noted in paragraph BC23 below.

[14] APES 205 defines a member as “a member of a professional body that has adopted this Standard as applicable to their membership as defined by that professional body”. APES 205 is therefore applicable, to and mandatory for, accounting professionals who are members of CPA Australia, Chartered Accountants Australia and New Zealand or the Institute of Public Accountants. This includes accountants working in accounting firms (of all sizes), the corporate sector and in government. Therefore, although its reach is limited, it is broader than that of AASB 1054.

[15] Paragraph 6.1(c) of APES 205.

[16] Paragraph 8 of ASA 800.

[17] Paragraph 15 of ASA 700.

[18] “Australian Accounting Standards consist of two Tiers of reporting requirements for preparing general purpose financial statements:

(a) Tier 1: Australian Accounting Standards; and

(b) Tier 2: Australian Accounting Standards – Reduced Disclosure Requirements.” Paragraph 7 of AASB 1053.

[19] Paragraph 14 of both The AASB’s For-Profit Entity Standard-Setting Framework and The AASB’s Not-for-Profit Entity Standard-Setting Framework.

[20] Paragraph 9 of AASB 1054 requires an entity to disclose whether the financial statements are general purpose financial statements or special purpose financial statements.