Part 1—Preliminary

Division 1—Preliminary

1 Name

These Rules are the Child Care Subsidy Minister’s Rules 2017.

2 Commencement

(1) Each provision of these Rules specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. All provisions except section 41 | Immediately after Schedule 1 to the Family Assistance Legislation Amendment (Jobs for Families Child Care Package) Act 2017 commences. | 2 July 2018 |

2. Section 41 | The day after these Rules are registered. | |

Note: This table relates only to the provisions of these Rules as originally made. It will not be amended to deal with any later amendments of these Rules.

(2) Any information in column 3 of the table is not part of these Rules. Information may be inserted in this column, or information in it may be edited, in any published version of these Rules.

3 Authority

These Rules are made under the following:

(a) subsection 85GB(1) of the A New Tax System (Family Assistance) Act 1999;

(b) subsection 194(5) of the A New Tax System (Family Assistance) (Administration) Act 1999 (as in force before 2 July 2018);

(c) item 12 of Schedule 4 to the Family Assistance Legislation Amendment (Jobs for Families Child Care Package) Act 2017.

4 Definitions

In these Rules:

at risk has the meaning given by section 9 (Circumstances in which a child is taken to be at risk of serious abuse or neglect—child at risk of suffering harm).

attends school has the meaning given by section 16 (Determining hourly rate cap that applies for a session of care).

business continuity payment has the meaning given by section 57 (Method of determining payment amount).

commencement day means the same day as Schedule 1 to the Jobs for Families Act commences.

customer reference number (or CRN) means the unique identifier given to an individual by the Department administering the Human Services (Centrelink) Act 1997 to identify the individual for the purposes of social security and family assistance payments.

Education and Care Services National Law, in relation to an entity or service in a State or Territory except Western Australia, means the law of that name set out in the Schedule to the Education and Care Services National Law Act 2010 (Vic), as adopted in that State or Territory, and in relation to an entity or service in Western Australia, means the Education and Care Services National Law (WA) Act 2012.

Education and Care Services National Regulations, in relation to an entity or service in a State or Territory except in Western Australia, means the Education and Care Services National Regulations (NSW), as adopted in that State or Territory, and in relation to an entity or service in Western Australia, means the regulations made under the Education and Care Services National Law (WA) Act 2012.

educator, in relation to a child care service in a State or Territory, means an educator within the meaning of the Education and Care Services National Law or, to the extent that the context permits reference to an individual who provides child care at an IHC service, an IHC educator.

eligible disability child has the meaning given by section 8.

eligible ISP child has the meaning given by section 8.

estimated number of children in care for the week has the meaning given by section 60 (Weekly amount where service has not previously received a fee reduction amount).

Family Assistance Act means the A New Tax System (Family Assistance) Act 1999.

Family Assistance Administration Act means the A New Tax System (Family Assistance) (Administration) Act 1999.

FDC educator, in relation to an FDC service in a State or Territory, means a family day care educator within the meaning of the Education and Care Services National Law.

FDC service, in a State or Territory, means a family day care service within the meaning of the Education and Care Services National Law.

harm has the meaning given by section 9 (Circumstances in which a child is taken to be at risk of serious abuse or neglect—child at risk of suffering harm).

IHC educator means an individual employed, contracted or otherwise engaged by an approved provider for the purposes of providing child care by an IHC service.

IHC service means an in home care service as prescribed by section 15B for item 4 of the table in subclause 2(3) of Schedule 2 to the Family Assistance Act.

IHC Support Agency has the same meaning as In Home Care Support Agency given by subsection 49B(2).

immediate family member has the meaning given by section 20.

Jobs for Families Act means the Family Assistance Legislation Amendment (Jobs for Families Child Care Package) Act 2017.

neglect has the meaning given by section 9 (Circumstances in which a child is taken to be at risk of serious abuse or neglect—child at risk of suffering harm).

period of local emergency has the meaning given by section 6 (Reasons for additional absences).

remote area child has the meaning given by section 8.

registered training organisation has the same meaning as in the National Vocational Education and Training Regulator Act 2011.

Note: A term used in these Rules that is defined in the Family Assistance Act or the Family Assistance Administration Act has the same meaning as it has in the relevant Act (see subsection 3(2) of each of those Acts and paragraph 13(1)(b) of the Legislation Act 2003).

Division 2—Interpretative matters

5 Determining that an individual is taken to be an Australian resident

(1) Under subsection 8(3) of the Family Assistance Act, for paragraph 8(1)(a) of that Act, the Secretary must have regard to the following matters in considering whether hardship would be caused to an individual if the individual were not treated as an Australian resident:

(a) whether the individual has, since arriving in Australia, experienced an event which was not reasonably foreseeable and which has substantially reduced her or his ability to pay child care fees; and

(b) if so:

(i) how long ago that event occurred; and

(ii) the continuing effect of the event in causing hardship if the individual were not treated as an Australian resident; and

(iii) whether it is in the best interests of the child to attend child care.

(2) However, for paragraph (1)(a), the following events are not to be considered:

(a) currency fluctuations;

(b) an increase in fees charged by an approved child care service;

(c) a reduction in an individual’s available income due to routine or unnecessary expenditure.

6 Reasons for additional absences

(1) For paragraph 10(4)(e) of the Family Assistance Act, a child care service is taken to have provided a session of care to a child on a day in a financial year where the absence on that day is directly due to one of the following reasons:

(a) where:

(i) the child has not been immunised against a particular infectious disease; and

(ii) the absence occurs during an immunisation grace period in respect of the child (see subsection 67CD(9) of the Family Assistance Administration Act); and

(iii) the provider of the service holds a written statement given by a medical practitioner which certifies that exposure to the infectious disease would pose a health risk to the child;

(b) where:

(i) the provider of the service holds a copy of a court order (including a parenting order within the meaning of section 64B of the Family Law Act 1975), a registered parenting plan or a parenting plan in relation to the child; and

(ii) that order or plan requires the child to spend time with a person other than the individual in whose care the child usually is; and

(iii) the absence occurs because the child spends time with that other person;

(c) where the service is closed as a direct result of a period of local emergency;

(d) where the child cannot attend as a direct result of a period of local emergency (for example, because they are unable to travel to the service), if:

(i) the period is still underway; or

(ii) the period ended not more than 28 days before the absence;

(e) where the absence is due to the individual in whose care the child is, deciding the child should not attend the service for up to seven days immediately following the end of a period of local emergency.

(2) In these Rules:

period of local emergency means a period in respect of which :

(a) an event has occurred which:

(i) affects a widespread area; and

(ii) has a severe impact on the lives of a significant number of the inhabitants of the area; and

(iii) prevents, or may prevent, children from attending the service, or may make such attendance hazardous; or

(b) a disaster declaration (however described) is made by a state emergency service, the police, or another Commonwealth, State or Territory agency and the disaster prevents, or may prevent, children from attending the service, or may make attendance hazardous.

7 Child care service payments

For paragraph (b) of the definition of child care service payment in subsection 3(1) of the Family Assistance Administration Act, any payments made under a funding agreement associated with the following grant programs are prescribed:

(a) the Community Child Care Fund (under item 110 in Part 4 of Schedule 1AB to the Financial Framework (Supplementary Powers) Regulations 1997);

(b) the Inclusion Support Programme (under item 109 in Part 4 of Schedule 1AB to the Financial Framework (Supplementary Powers) Regulations 1997);

(c) the Interim Home Based Carer Subsidy Pilot Programme (under item 108 in Part 4 of Schedule 1AB to the Financial Framework (Supplementary Powers) Regulations 1997);

(d) In Home Care Support (under item 267 in Part 4 of Schedule 1AB to the Financial Framework (Supplementary Powers) Regulations 1997).

Part 2—Eligibility for child care subsidy and additional child care subsidy

Division 1—Circumstances where no one is eligible for a session of care

8 Prescribed circumstances where no eligibility for a session of care

(1) For subparagraph 85BA(1)(c)(iii) of the Family Assistance Act, the following are circumstances in which a session of care is provided for which there is no eligibility for CCS:

(a) where the care is provided aboard a transportation vehicle (such as a bus), unless the transport is merely incidental to a session of care being provided (such as to take children on an outing);

(b) except for care provided by an IHC service, where the care is provided in a domestic living arrangement on residential premises where:

(i) the care is provided in the child’s own home; or

(ii) an individual for whom the child is an FTB child or a regular care child (including a parent of the child) remains present at the location where the care is being provided, whilst the care is taking place;

(c) where the session of care is provided by an individual as referred to in section 195D of the Family Assistance Administration Act (individuals in relation to whom providers must notify the Secretary of working with children card details), in circumstances where the provider is in breach of the condition for continued approval in that provision by either:

(i) not holding a required working with children card; or

(ii) if the session of care is provided within the first 7 days after a required working with children card is issued—not providing details of the card within those 7 days; or

(iii) if the session of care is provided 7 or more days after a required working with children card is issued—not providing details of the card before the session of care;

(d) where the session of care is provided by an FDC service to a child who is an FTB child or regular care child of an FDC educator, or a partner of an FDC educator, and where the session occurs on a day that the FDC educator provides care at an FDC service, unless one of the circumstances in subsection (2) apply;

(da) where the session of care is provided by an IHC service to a child who is an FTB child or regular care child of an IHC educator, or a partner of an IHC educator, and where the session occurs on a day that the IHC educator provides care at an IHC service;

(e) where the session of care is provided to children who are in the relationships with an FDC educator of the service, or their partner, as set out in subsection (3), who provides the care at an FDC service;

(ea) except where subsection (4A) applies, where the session of care is provided by an IHC educator to children who are in one of the relationships, as set out below, with the IHC educator, or their partner:

(i) FTB child;

(ii) regular care child;

(iii) foster care child;

(iv) biological or adopted child;

(v) brother, sister, half-brother, half-sister, step-brother or step-sister;

(vi) grandchild or great-grandchild;

(vii) nephew, niece or cousin;

(viii) a child (not mentioned in subparagraphs (i) to (vii)) for whom the IHC educator or their partner has legal responsibility, as described in paragraph 22(5)(a) or (b) of the Family Assistance Act;

(f) where, during any part of the session, the child is attending school, or engaged in a formal schooling program (including a home schooling or distance education program);

(g) where the session of care is provided in breach of the condition for continued approval in subsection 48A(6) of these Rules (about numbers of children who can be cared for by an IHC educator).

(2) The circumstances for paragraph (1)(d) are:

(a) the child is an eligible disability child of the individual; or

(b) the child is an eligible ISP child of the individual; or

(c) the child is a remote area child of the individual; or

(d) the FDC educator:

(i) is required to work for at least 2 hours on the care day in paid work which is not for an approved FDC service; and

(ii) has provided documentary evidence, in accordance with subsection (4), to the provider of the FDC service that the FDC educator is usually required to work at the time the session of care is provided; or

(e) the FDC educator:

(i) is enrolled in a program or course of education or training towards a recognised qualification (at Certificate III level or above) provided by a registered training organisation; and

(ii) is engaged in scheduled activities for the purposes of the program or course on the care day that overlap with the session of care; and

(iii) has provided documentary evidence, in accordance with subsection (4), to the provider of the FDC service that the FDC educator usually studies at the time the session of care is provided.

(3) The relationships for paragraph (1)(e) are where the child is one (or more) of the following with respect to the FDC educator or the partner of the FDC educator:

(a) FTB child;

(b) regular care child;

(c) foster care child;

(d) biological or adopted child;

(e) brother, sister, half‑brother, half‑sister, step‑brother or step‑sister;

(f) a child (not mentioned in paragraphs (a) to (e)) for whom the FDC educator or partner has legal responsibility, as described in paragraph 22(5)(a) or (b) of the Family Assistance Act.

(4) Documentary evidence is provided in accordance with this subsection where:

(a) it has been provided by the time that the provider is required to submit an attendance report under section 204B of the Family Assistance Administration Act for the first session of care to which the evidence relates; and

(b) the provider has met the requirements to keep a register, as set out in section 56 of these Rules, in relation to the evidence; and

(c) if the evidence relates to the requirement to work referred to in subparagraph 8(2)(d)(ii), the evidence is an employment contract or a payslip, showing usual hours of work (but where the contract or payslip does not show usual hours of work, a letter signed by the relevant employer is required stating usual hours of work); and

(d) if the evidence relates to the study referred to in subparagraph 8(2)(e)(iii), the evidence is a copy of an enrolment form detailing the times that the individual is usually required to study (but where the form does not provide such details, it must be supplemented with additional documentary evidence, such as an official course timetable).

(4A) This subsection applies where:

(a) an IHC Support Agency has made a recommendation that the session of care should be one in respect to which an individual is eligible;

(b) the premises at which the session of care is provided is in an area designated as ‘very remote Australia’ in accordance with the Australian Statistical Geography Standard (ASGS) Volume 5 – Remoteness Structure, July 2016 (cat. no. 1270.0.55.005), as published by the Australian Bureau of Statistics;

(c) there is no IHC educator reasonably available who is not in the relationships with children described in paragraph (1)(ea); and

(d) the child is the grandchild, great-grandchild, nephew, niece or cousin of the IHC educator or their partner.

(5) In this section:

eligible disability child of an individual means:

(a) a child of the individual who has been diagnosed by a medical practitioner as suffering from one or more of the conditions listed in Schedule 1; or

(b) a child of the individual who has been diagnosed as suffering from one or more of the conditions listed in Schedule 2 by a psychologist who:

(i) is registered with a Board established under a law of a State or Territory that registers psychologists in that State or Territory; and

(ii) has qualifications or experience in assessing impairment in children;

and where:

(c) documentary evidence of the diagnosis has been provided to the provider of the service providing care to the child in accordance with subsection (4); and

(d) the diagnosis was obtained within a period of 24 months prior to the provision of the documentary evidence to the provider of the service, unless the diagnosis is, or is likely to be, permanent.

eligible ISP child of an individual means a child of the individual in respect of whom an approved child care service that is an FDC service is receiving funding, under a funding agreement entered into under the auspices of the Commonwealth Inclusion Support Programme, of IDF Family Day Care Top Up (as referred to in the Inclusion Support Programme Guidelines 2016‑2017 to 2018‑2019), but only if:

(a) the child is undergoing assessment for disability (including an ongoing or continuous assessment, as described in those Guidelines); and

(b) documentary evidence has been provided to the provider of the service providing care to the child in accordance with subsection (3).

engaged in scheduled activities means:

(a) the individual is engaged in an activity on the care day that is part of a formal timetable of activities provided by the registered training organisation, and where participation in that activity can only reasonably occur at a set time on the care day; and

(b) without limitation, could involve attending a lecture (in person, or online) or undertaking an exam, which is only scheduled at a set time on the day during which the session of care occurs;

however does not mean:

(c) engaging in activities that are outside of the individual’s formal timetable, such as where the individual is engaged in homework, group activity, viewing a pre‑recorded lecture or assessment work; or

(d) engaging in activity on a day that is not the day during which the session of care occurs and during a time that would not usually overlap or conflict with the session of care.

remote area child of an individual means an FTB child or regular child of the individual, if:

(a) the child resides in an area designated as ‘remote Australia’ or ‘very remote Australia’ in accordance with the Australian Statistical Geography Standard (ASGS) Volume 5 – Remoteness Structure, July 2016 (cat. no. 1270.0.55.005), as published by the Australian Bureau of Statistics; and

(b) documentary evidence of the child’s residence has been provided to the provider of the approved FDC service providing care to the child in accordance with subsection (4).

Note: Documentary evidence of a child’s residence could include a copy of the individual’s (in relation to whom the child is an FTB child or a regular care child) current driver’s licence, or a recent utility bill sent to the address where the individual and child reside, or a statutory declaration.

Division 1A—Prescribed classes of children for eligibility for CCS or ACCS

8A Purpose of prescribing classes of children in this Division

Classes of children are prescribed in this Division so that an individual may be able to be eligible for CCS or ACCS, or that an approved provider of an approved child care service may be able to be eligible for ACCS (child wellbeing), for a session of care in relation to such children, notwithstanding the restriction in subparagraphs 85BA(1)(a)(ii) and 85CA(2)(b)(ii) of the Family Assistance Act (which limits CCS and ACCS eligibility in relation to children who are 13 or under and who do not attend secondary school).

8B Children 13 years or under who are attending secondary school who do not have a prescribed disability or prescribed medical condition

For paragraphs 85BA(2)(a) and 85CA(3)(a) of the Family Assistance Act, the following class of children is prescribed:

(a) children who do not meet the medical or disability requirements set out in subsection 8C(2); and

(b) are 13 years or under and are attending secondary school; and

(c) who cannot reasonably be left alone; and

(d) are children for whom no one aged 18 years or older is able to provide suitable care outside of an approved child care service.

8C Children who have a prescribed disability or prescribed medical condition

(1) For paragraphs 85BA(2)(a) and 85CA(3)(a) of the Family Assistance Act, the following class of children is prescribed:

(a) children who:

(i) are 14 years or older; or

(ii) are 13 years or under and are attending secondary school; and

(b) who meet the medical or disability requirements set out in subsection (2); and

(c) who cannot reasonably be left alone; and

(d) are children for whom no one aged 18 years or older is able to provide suitable care outside of an approved child care service; and

(e) where the child is 16, 17 or 18 years old, the Secretary is satisfied that there are exceptional circumstances that justify CCS or ACCS eligibility.

(2) The disability or medical requirements as referred to in paragraph (1)(b) and paragraph 8B(a) are as follows:

(a) the child has been diagnosed with, or is undergoing an assessment for, one or more of the conditions listed in Schedule 1 by a medical practitioner; or

(b) the child has been diagnosed with, or is undergoing an assessment for, one or more of the conditions listed in Schedule 2 by a psychologist who:

(i) is registered with a Board established under a law of a State or Territory that registers psychologists in that State or Territory; and

(ii) has qualifications or experience in assessing impairment in children; or

(c) the child has been diagnosed with, or is undergoing assessment for, a condition that is referred to in Part 2 of Schedule 3 to the Disability Care Load Assessment (Child) Determination 2010 by a medical practitioner; or

(d) the child has become a participant in the National Disability Insurance Scheme launch under section 28 of the National Disability Insurance Scheme Act 2013; or

(e) the Secretary is otherwise satisfied that the child has, or is being assessed for, a disability and makes a determination to that effect.

8D Conditions in relation to the classes of children prescribed in sections 8B and 8C

For paragraphs 85BA(2)(b) and 85CA(3)(b) of the Family Assistance Act, the following conditions are prescribed, as applicable:

(a) in relation to all prescribed children—an individual, in respect of eligibility for CCS or ACCS, or an approved provider, in respect of eligibility for ACCS (child wellbeing), as applicable, must provide a statutory declaration to the Secretary in the form prescribed under the Statutory Declarations Act 1959 (Cth) that attests to the matters referred to in paragraphs 8B(c) and (d) and 8C(1)(c) and (d) (being that the child cannot be left alone and that there is no adult able to provide suitable care) and provides an explanation as to why those matters are the case;

(b) where the child meets the disability or medical requirements referred to in paragraphs 8C(2)(a), (b), (c) or (e), and where a diagnosis has been made in relation to a permanent condition—documentary evidence has been provided of the diagnosis to the satisfaction of the Secretary;

(c) where the child meets the disability or medical requirements referred to in paragraphs 8C(2)(a), (b), (c) or (e), and where a diagnosis has been made in relation to a condition that is not permanent or where the child is still undergoing assessment—documentary evidence of the diagnosis or assessment has been provided to the Secretary that was obtained within a period of 24 months prior to its provision and is to the satisfaction of the Secretary;

(d) where the child meets the disability or medical requirements referred to in paragraph 8C(2)(d)—evidence that the child is a participant in the National Disability Insurance Scheme launch has been provided to the Secretary;

(e) where the child is one that the Secretary is otherwise satisfied as referred to in paragraph 8C(2)(e)—the Secretary has provided a notice to that effect to the individual or provider that is eligible for CCS or ACCS in relation to the child.

Division 2—When children are at risk of serious abuse or neglect for ACCS (child wellbeing)

9 Circumstances in which a child is taken to be at risk of serious abuse or neglect—child at risk of suffering harm

(1) For subsection 85CA(4) of the Family Assistance Act, a child is taken to be at risk of serious abuse or neglect if the child is at risk of suffering harm as a result of being subject to, or exposed to, one or more of the following events:

(a) serious physical, emotional or psychological abuse;

(b) sexual abuse;

(c) domestic or family violence;

(d) neglect.

(2) For subsection (1), a child is at risk if:

(a) the child is currently experiencing one or more of the events set out in subsection (1); or

(b) the risk of the child experiencing one or more of the events in the future is real and apparent.

(3) A child may be taken to be at risk of suffering harm in relation to an event mentioned in subsection (1) even if the event occurred before:

(a) a certificate in relation to the child was given under section 85CB of the Family Assistance Act; or

(b) an application in relation to the child was made under subsection 85CE(1) of that Act.

(4) In this section:

harm means any detriment to the child’s wellbeing.

neglect means a failure to be provided with the basic needs that are essential for the child’s physical and emotional wellbeing.

10 Circumstances in which a child is taken to be at risk of serious abuse or neglect—child in need of care etc. under State or Territory law

For subsection 85CA(4) of the Family Assistance Act, a child is taken to be at risk of serious abuse or neglect if:

(a) where the child is a resident of the Australian Capital Territory at the time the session of care is provided—the child is in need of care and protection under the Children and Young People Act 2008 (ACT); or

(b) where the child is a resident of New South Wales at the time the session of care is provided—the child is at risk of significant harm under the Children and Young Persons (Care and Protection) Act 1998 (NSW); or

(c) where the child is a resident of the Northern Territory at the time the session of care is provided—the child is in need of care and protection under the Care and Protection of Children Act (NT); or

(d) where the child is a resident of Queensland at the time the session of care is provided—the child is in need of protection under the Child Protection Act 1999 (Qld); or

(e) where the child is a resident of South Australia at the time the session of care is provided—the child is at risk under the Children’s Protection Act 1993 (SA); or

(f) where the child is a resident of Tasmania at the time the session of care is provided—the child is at risk under the Children, Young Persons and Their Families Act 1997 (Tas); or

(g) where the child is a resident of Victoria at the time the session of care is provided—the child is in need of protection under the Children, Youth and Families Act 2005 (Vic); or

(h) where the child is a resident of Western Australia at the time the session of care is provided—the child is in need of protection under the Children and Community Services Act 2004 (WA).

11 Circumstances in which a child is not taken to be at risk of serious abuse or neglect

(1) Subject to subsection (2), a child is not taken to be at risk of serious abuse or neglect solely because:

(a) of the income of the individual or individuals with respect to whom the child is an FTB child or regular care child; or

(b) of the ethnic, cultural, religious or racial background of the child or the child’s immediate family; or

(c) of the geographical location in which the child and the child’s immediate family resides; or

(d) the child’s place of residence is, statistically, an area of socio‑economic disadvantage; or

(e) the child is likely to benefit from early childhood education and care programs; or

(f) the child has a disability; or

(g) the child is in a foster care or kinship care arrangement.

(2) Where a circumstance listed in subsection (1) applies in relation to a child, that circumstance may only be considered:

(a) in conjunction with other circumstances or matters; and

(b) only to the extent that it is relevant to determining whether a child is taken to be at risk of serious abuse or neglect in accordance with section 9.

Division 3—Temporary financial hardship

12 Circumstances in which an individual is taken to be experiencing temporary financial hardship

(1) For subsection 85CG(2) of the Family Assistance Act, an individual is taken to be experiencing temporary financial hardship if:

(a) the individual has had a substantial reduction in her or his ability to pay child care fees as a result of any of the circumstances described in subsection (2) of this section; and

(b) the circumstance described in subsection (2) occurred in relation to the individual on a day that is no earlier than 6 months before the day the application for ACCS (temporary financial hardship) was made.

(2) For subsection (1), the circumstances are as follows:

(a) the death of a partner or child of the individual;

(b) a loss of employment of the individual, or a partner of the individual, other than due to resignation or retirement;

(c) a loss of income or business failure of the individual, or a partner of the individual, due to circumstances outside of the control of the individual or of the partner (such as serious illness);

(d) a loss of income of the individual, due to the death of a former partner, where the former partner was providing ongoing financial assistance in relation to the child under child support arrangements;

(e) the individual, or a partner of the individual, being adversely affected by a major disaster event;

(f) the destruction of, or severe damage to, the home of the individual, or of a partner of the individual;

(g) the individual having to leave home, and not being able to return because of an extreme circumstance (such as domestic violence);

(h) the individual still living at home after being subjected to domestic violence by a family member who has left or has been removed from the home.

Division 4—Transition to work

13 Additional eligibility requirements for ACCS (transition to work)

(1) For paragraph 85CK(1)(c) of the Family Assistance Act, the prescribed requirements that must be met by an individual at the start of a CCS fortnight to which a session of care relates are:

(a) the requirements (the activity requirements) set out in subsection (2); and

(b) the requirements (the income requirements) set out in subsection (3); and

(c) where applicable, the requirements (the job plan requirements) set out in subsections (4) and (5); and

(d) where the individual is in receipt of special benefit, the requirement in subsection (17).

(2) In order for an individual to meet the activity requirements, the individual must meet at least one of the following during the period provided by subsections (12) and (13):

(a) the requirements (the study requirements) set out in subsections (7) and (8);

(b) the requirements (the job search requirements) set out in subsection (10);

(c) the requirements (the work/training requirements) set out in subsection (11).

Income requirements

(3) An individual meets the income requirements where the estimate of the individual’s adjusted taxable income that would be used to determine the individual’s entitlement to CCS for the week to which the session of care relates, including as determined by Division 4 of Part 3A of the Family Assistance Administration Act, is equal to or lower than the lower income threshold (as referred to in clause 3 of Schedule 2 to the Family Assistance Act).

Note: Adjusted taxable income is defined in Schedule 3 to the Family Assistance Act to include the income of any partner of the individual as set out in that Schedule.

Job plan requirements

(4) The job plan requirements are applicable to individuals who are in receipt of a transition to work payment referred to in paragraph 85CK(3)(b) of the Family Assistance Act, as prescribed by paragraph 15(a), (b), (e), (f), (g) or (h) of these Rules.

(5) An individual meets the job plan requirements if a job plan is in effect in relation to the individual at the start of the CCS fortnight in which the session of care is provided.

Note: Individuals in receipt of the transition to work payments referred to in paragraph 85CK(3)(a) of the Family Assistance Act (parenting payment, newstart allowance, disability support pension and youth allowance) must have an employment pathway plan or participation plan in effect, as referred to in subparagraph 85CK(1)(b)(ii) of that Act.

(6) For this section, a job plan is:

(a) an employment pathway plan within the meaning of the Social Security Act 1991, or a plan by that name entered into on a voluntary basis through the Department of Human Services; or

Note: An employment pathway plan is defined in section 23 of the Social Security Act 1991 to include a Parenting Payment Employment Pathway Plan, a Youth Allowance Employment Pathway Plan, a Newstart Employment Pathway Plan, or a Special Benefit Employment Pathway Plan.

(b) for an individual in receipt of a disability support pension—a participation plan entered into under section 94B of the Social Security Act 1991, or a plan by that name entered into on a voluntary basis by the individual with a service provider that is approved by an agency of the Commonwealth to provide employment services to such individuals.

Study requirements

(7) An individual meets the study requirements in relation to an approved course of education or study if:

(a) the course is of the following type or of the following level:

(i) a secondary course within the meaning of Schedule 1 to the Student Assistance (Education Institutions and Courses) Determination 2009 (No. 2);

(ii) a preparatory course within the meaning of the Student Assistance (Education Institutions and Courses) Determination 2009 (No. 2);

(iii) level 2 (Certificate II) through to level 8 (up to Graduate Diploma) of the Australian Qualifications Framework; and

Note: For approved course of education or study, see subsection 541B(5) of the Social Security Act 1991 and subsection 3(1) of the Family Assistance Act.

(b) the individual is making satisfactory progress in that course of education or study; and

(c) where the course of education or study is of a kind described in subparagraph (a)(iii), the study occurs at a level that is above any level that the individual has already studied at within the last 10 years, unless:

(i) on a single occasion, the individual studied a course of education or study at a higher level than the level at which they are currently studying for a period of less than 6 weeks; or

(ii) the individual has, only once, begun studying at a level below a qualification already achieved, where the study (if completed) will qualify the individual for an occupation listed on the Skill Shortage List as modified on 28 March 2018 and as maintained by the Department administering the Fair Work Act 2009 (the Skill Shortage List could in 2018 be viewed on that Department’s website at https://docs.jobs.gov.au/documents/skill‑shortage‑list‑australia), and the study involves progression towards a qualification that the individual has not already studied towards; or

(iii) on 1 July 2018, the individual is in receipt of the payment known as Jobs Education and Training (JET) Child Care Fee Assistance that is paid by the Commonwealth in respect of a course of education or study and the individual was engaged in that course of education or study on that day.

(8) The exception in subparagraph (7)(c)(iii) only applies to the individual for that course of education or study referred to in that subparagraph.

(9) For this section, the Australian Qualifications Framework is the second edition of the publication of that name (which could in 2017 be viewed on the Australian Qualifications Framework Council website at http://www.aqf.edu.au/).

Job search requirements

(10) An individual meets the job search requirements where the individual is actively looking for work and can provide evidence to the Secretary that he or she is looking for work.

Work/training requirements

(11) An individual meets the work/training requirements where he or she is participating in any of the following activities:

(a) paid work;

(b) actively setting up a business;

(c) unpaid work (including a work experience placement or an internship);

(d) a vocational training or other program which, in the opinion of the Secretary, has a reasonable likelihood of improving the individual’s employment prospects.

Time limits

(12) Subject to subsections (15) and (16), the period during which an individual is eligible for ACCS (transition to work) under subsection 85CK(1) of the Assistance Act is limited to the period set out in the table below, unless subsections (13) and (14) apply:

Item | Where the individual is meeting the following requirements: | The individual is only eligible during the following period: |

1 | The study requirements | (a) where the course is at level 2 (Certificate II) to 6 (Advanced Diploma, Associate Degree) (inclusive) and level 8 (Bachelor Honours Degree, Graduate Certificate, Graduate Diploma) of the Australian Qualifications Framework—104 weeks for each course studied on a full‑time basis or 208 weeks for each course studied on a part‑time basis; or (b) where the course is at level 7 (Bachelor Degree) of the Australian Qualifications Framework—156 weeks for each course studied on a full‑time basis or 312 weeks for each course studied on a part‑time basis; or (c) where the course is a secondary course within the meaning of Schedule 1 of the Student Assistance (Education Institutions and Courses) Determination 2009 (No. 2) or a preparatory course within the meaning of that Determination, 104 weeks for full‑time study, or 208 weeks for part‑time study |

2 | The job search requirements | 26 weeks |

3 | The work/training requirements set out in paragraphs (11)(a), (b) or (c) | 26 weeks |

4 | The work/training requirement relating to training set out in paragraph (11)(d) | 52 weeks full‑time or 104 weeks part‑time |

5 | The work/training requirement relating to employment prospects set out in paragraph (11)(d) | 52 weeks |

(13) This subsection applies if, on 1 July 2018:

(a) the individual was engaged in a course of education or study for the purposes of meeting the study requirements; and

(b) the individual was in receipt of the payment, known as Jobs Education and Training (JET) Child Care Fee Assistance that is paid by the Commonwealth.

(14) Where subsection (13) applies to an individual, the maximum period during which the individual is eligible for ACCS (transition to work) is worked out as follows:

the applicable number of weeks set out in the right hand column of item 1 of the table in subsection (12) minus the number of weeks the individual has already engaged in the study requirements referred to in that item.

(15) The period referred to in item 1 of the table in subsection (12) relates to each new course of education or study that the individual studies.

Example: Lyndal completes a Certificate II level qualification and, once completed, begins a Bachelor Degree—when she begins study towards the Bachelor Degree, she has a new period of 156 weeks (full‑time) during which she can remain eligible for ACCS (transition to work).

(16) The periods referred to in items 2 to 5 of the table in subsection (12) apply to an individual only once in their lifetime, so that the period accrues as an aggregate for each activity.

Example: Michelle trains for 52 weeks, full‑time, as described in item 4 of that table—following that period she is unable to remain eligible for ACCS (transition to work) where she continues to train beyond those 52 weeks. However, she could be eligible if she subsequently begins a course of education or study referred to in item 1, or if she begins another activity referred to in items 2, 3 or 5.

Additional requirement for recipients of special benefit

(17) Where the individual is in receipt of special benefit under the Social Security Act 1991, in addition to meeting the other eligibility requirements for ACCS (transition to work), the individual is only eligible where the individual would qualify for parenting payment or newstart allowance but for a requirement relating to residency that applies in relation to that payment or allowance under that Act.

14 Additional eligibility requirements for individuals who ceased receiving transition to work payment fewer than 12 weeks ago

For paragraph 85CK(2)(c) of the Family Assistance Act, the requirements are that:

(a) the individual was eligible for ACCS (transition to work) under subsection 85CK(1) for one or more sessions of care in the CCS fortnight preceding the CCS fortnight in which the session of care was provided; and

(b) the individual was engaged in paid work in the CCS fortnight in which the session of care was provided and the individual is able to provide evidence of that engagement; and

(c) the individual did not stop receiving a transition to work payment solely because he or she became a member of a couple (including a member of a new couple) resulting in the person no longer being qualified for, or meeting the income or assets test requirements to be paid, the payment.

15 Transition to work payments

For paragraph 85CK(3)(b) of the Family Assistance Act, the payments are as follows:

(a) carer payment under the Social Security Act 1991;

(b) special benefit under the Social Security Act 1991;

(c) austudy payment under the Social Security Act 1991;

(d) a payment made under the ABSTUDY Scheme to the extent that it provides means tested allowances;

(e) farm household allowance under the Farm Household Support Act 2014;

(f) parenting payment under the Social Security Act 1991, as paid to individuals who are not subject to participation requirements under section 500A of that Act;

Note: Paragraphs 500(1)(c) and (ca) of the Social Security Act 1991 set out when an individual is subject to participation requirements to qualify for the parenting payment.

(g) disability support pension under the Social Security Act 1991, as paid to individuals who are not subject to the participation requirements under section 94A of that Act;

Note: Paragraph 94(1)(da) of the Social Security Act 1991 sets out when an individual is subject to participation requirements to qualify for the disability support pension.

(h) youth allowance under the Social Security Act 1991, as paid to individuals who are not required, under Subdivision E of Division 1 of Part 2.11 of that Act, to have an employment pathway plan in effect.

Note: Section 544A of the Social Security Act 1991 sets out when an individual is not required to have a youth allowance employment pathway plan in effect.

Division 5—Certain classes of children for whom no one is eligible for CCS or ACCS

15A Children in respect of whom no one is eligible—where multiple children being cared for by an in home care service in the same home

Where 1 to 5 children are in care

(1) For paragraph 85ED(1)(b) of the Family Assistance Act, no individual is eligible for CCS or ACCS for a session of care provided by an in home care service to a child where:

(a) the child is one of no more than five children being cared for by the service at the same home during the same session of care; and

(b) of those children, the child is not the only child who the individual or the approved provider of the in home care service has nominated in respect of the session of care for the purposes of the individual’s eligibility for CCS or ACCS.

Where 6 to 10 children are in care

(2) For paragraph 85ED(1)(b) of the Family Assistance Act, no individual is eligible for CCS or ACCS for a session of care provided by an in home care service to a child where:

(a) the child is one of between six and ten children being cared for by the service at the same home during the same session of care; and

(b) of those children, the child is not one of only two children who the individual or the approved provider of the in home care service has nominated in respect of the session of care for the purposes of the individual’s eligibility for CCS or ACCS.

Note: This provision is intended to ensure that the $25 hourly rate cap specified in section 15B for in home care services applies in respect of a maximum of only one child among any group of up to five children (to a total of ten) being cared for during the same session of care in the same home in line with the examples set out below.

Example 1: The McEnroe family has four children in in-home care on one day, during the same period of time. Mrs McEnroe nominates her eldest son Ralph as the child referred to in paragraph 15A(1)(b) (as the one child who she wishes to be eligible for in relation to the relevant session of care). Mrs McEnroe is only eligible for CCS in relation to Ralph (not the other children in care) and the hourly rate cap that applies to fees charged by the approved provider is $25. Mrs McEnroe’s applicable percentage as worked out under clause 3 of the CCS calculator in Schedule 2 of the Family Assistance Act is 85% and so the total maximum hourly rate of CCS payable in relation to the relevant session of care is 85% of $25, which is $21.25 for each hour in the session.

Example 2: The Borg family has eight children in in-home care on one day, during the same period of time. The approved provider of the relevant in-home care service nominates Mr Borg’s eldest daughter Martina and his eldest son Patrick as the children referred to in paragraph 15A(2)(b) (as the two children who Mr Borg may be eligible for in relation to the relevant session of care). Mr Borg is only eligible for CCS in relation to Martina and Patrick (not the other children in care) and the hourly rate cap that applies to fees charged by the approved provider is $25 for Martina and $25 for Patrick. Mr Borg’s applicable percentage as worked out under clause 3 of the CCS calculator in Schedule 2 of the Family Assistance Act is 50% and so the total maximum hourly rate of CCS payable in relation to the relevant session of care is 50% of $25 for Martina and 50% of $25 for Patrick, which is $25 in total for each hour in the session.

Part 3—Amount of child care subsidy and additional child care subsidy

Division 1—Hourly rate of child care subsidy

15B In Home Care Services

(1) For item 4 of the table in subclause 2(3) of Schedule 2 to the Family Assistance Act, a type of service is: “an in home care service”.

(2) The CCS hourly rate cap for an in home care service is: “$25”.

Note: This provision, together with section 15A, is intended to ensure that the prescribed hourly rate cap for in home care services applies in respect of a maximum of only one child among any group of up to five children being cared for during the same session of care in the same home in line with the examples set out at the end of section 15A.

16 Determining hourly rate cap that applies for a session of care

(1) For subclause 2(4) of Schedule 2 to the Family Assistance Act, the type of service that applies to a session of care is the same type of service that is:

(a) specified in the notice of approval that the Secretary gives to a provider under subsection 194B(4) of the Family Assistance Administration Act; or

(b) determined by the Secretary under subitem 9(2) of Schedule 4 to the Jobs for Families Act.

(2) Despite subsection (1), a session of care provided by a service specified or determined as a centre‑based day care service is taken to be provided by an outside school hours care service for the purposes of determining the applicable CCS hourly rate cap where the session is provided to a child who attends school.

(3) Despite subsection (1), a session of care provided by a service specified or determined as an outside school hours care service is taken to be provided by a centre‑based day care service for the purposes of determining the applicable CCS hourly rate cap where the session is provided to a child who does not yet attend school.

(4) For these Rules, a child attends school on a day that is or follows the first day of scheduled physical attendance, and where any of the following apply:

(a) the child has turned 6;

(b) the child attends the year of school before grade 1;

(c) the child attends primary or secondary school;

(d) the child is subject to home schooling as recognised in the State or Territory in which the child resides;

(e) the child would be attending school as referred to in paragraph (b) or (c), except that the child is absent from school, or is on holidays.

Division 2—Circumstances for election

17 Election of allocation of claimant’s fortnightly entitlement between services attended by the child

For subclause 4(3) of Schedule 2 to the Family Assistance Act, an individual may give the Secretary a written election in relation to a child for a CCS fortnight if:

(a) the child is enrolled at more than one child care service during the fortnight; and

(b) the individual’s activity test result in relation to the child is greater than zero.

Division 3—Recognised activities

Subdivision A—General

18 Application—unlawful purposes

(1) This Division does not apply in relation to paid or unpaid work or other activity, if undertaken:

(a) for an unlawful purpose; or

(b) for an employer, business or other person or organisation that has an unlawful purpose.

(2) Without limiting subsection (1), work or other activity includes the following:

(a) work experience or an internship;

(b) employment or contract work;

(c) voluntary work;

(d) self‑employed activity;

(e) setting up a business.

Subdivision B—Additional activities

19 Unpaid work experience

(1) For the purposes of paragraph 12(2)(d) of Schedule 2 to the Family Assistance Act, an individual engages in recognised activity during a CCS fortnight if he or she engages in either of the following activities during the fortnight:

(a) unpaid work experience;

(b) an unpaid internship.

(2) However, the individual does not engage in recognised activity under subsection (1) of this section if the activity is engaged in during the course of an activity mentioned in paragraph 12(2)(b) or (c) of that Schedule.

Note: Paragraph 12(2)(b) of that Schedule covers training courses for improving work skills or employment prospects. Paragraph 12(2)(c) of that Schedule covers an approved course of education or study.

20 Unpaid work in a family business

(1) For the purposes of paragraph 12(2)(d) of Schedule 2 to the Family Assistance Act, an individual engages in recognised activity if he or she engages in unpaid work for a family business owned by a member of the individual’s immediate family.

(2) Each of the following is a member of the individual’s immediate family:

(a) a parent of the individual;

(b) a partner of a parent of the individual;

(c) a partner of the individual;

(d) a sibling of the individual, including any person (other than the individual) who is a child of a parent of the individual;

(e) a child of the individual;

(f) a partner of a child of the individual;

(g) another particular member of the individual’s family determined by the Secretary to be a member of the individual’s immediate family for the purposes of this section.

(3) Without limiting who is a child of another person, each of the following is a child of the other person:

(a) an adopted child, or step‑child, of the other person, within the meaning of the Social Security Act 1991;

(b) a foster‑child or ward of the other person, including someone who was the ward of the other person when the ward was under 18 years of age;

(c) someone who is a child of the other person within the meaning of the Family Law Act 1975.

(4) Without limiting who is a parent, if someone is, within the meaning of this section, a child of another person, the other person is a parent of the child.

21 Voluntary work

(1) For the purposes of paragraph 12(2)(d) of Schedule 2 to the Family Assistance Act, an individual engages in recognised activity during a CCS fortnight if he or she engages in any of the following activities during the fortnight:

(a) voluntary work which could reasonably be expected to improve the individual’s work skills or employment prospects, or both;

(b) voluntary work for a charitable, welfare or community organisation;

(c) voluntary work for a school, preschool or a centre‑based day care service, if the work directly supports the learning and development of the children at the school, preschool or service.

Example: For paragraphs (b) and (c), examples include reading to children or providing support for other learning or development activities, and could include involvement in a school parents and citizens committee.

(2) For the purposes of paragraph 12(4)(b) of that Schedule, if the individual, in a CCS fortnight, does not engage in any recognised activity except the activity prescribed under this section, the maximum number of hours that are to be counted towards the prescribed activity in that fortnight is 16 hours.

22 Actively looking for work

(1) For the purposes of paragraph 12(2)(d) of Schedule 2 to the Family Assistance Act, an individual engages in recognised activity during a CCS fortnight if he or she is actively looking for work.

(2) An individual is actively looking for work if the individual engages in one or more of the following activities during the fortnight:

(a) looking for job vacancies;

(b) preparing résumés and job applications;

(c) contacting potential employers;

(d) preparing for, and attending, job interviews.

Note: The individual need not be unemployed to be actively looking for work. Her or his overall activity test result may also take into account hours engaged in other activities (such as paid work) mentioned in subclause 12(2) of Schedule 2 to the Family Assistance Act, including other activities prescribed under this Division.

(3) For the purposes of paragraph 12(4)(b) of that Schedule, if the individual, in a CCS fortnight, does not engage in any recognised activity except the activity prescribed under this section, the maximum number of hours that are to be counted towards the prescribed activity in that fortnight is 16 hours.

23 Actively setting up a business

(1) For the purposes of paragraph 12(2)(d) of Schedule 2 to the Family Assistance Act, an individual engages in recognised activity during a CCS fortnight if, during the fortnight, the individual engages in the activity of actively setting up a business that has not yet started to operate, including engaging in one or more of the following activities in relation to the proposed business:

(a) obtaining finance, advice and support;

(b) attending and organising events, including meetings, networks and seminars;

(c) developing business, marketing or other plans.

(2) However, an individual only engages in recognised activity under subsection (1) in relation to a CCS fortnight if, during the period of 12 months immediately before the CCS fortnight, determinations have been made under subsection 67CD(2) of the Family Assistance Administration Act that the individual is entitled to a payment of CCS worked out on the basis of the application of subsection (1) of this section in relation to fewer than 13 CCS fortnights:

(a) whether or not occurring consecutively; and

(b) whenever occurring during that period; and

(c) in relation to that proposed business, or any other.

Subdivision C—Associated activities

24 Preparing for paid work

(1) This section applies to an individual who starts engaging in a recognised activity consisting of paid work, or starts to engage in such an activity for an increased number of hours, for the purposes of paragraph 12(2)(a) of Schedule 2 to the Family Assistance Act during a CCS fortnight (the start fortnight).

(2) For the purposes of paragraph 12(3)(b) of that Schedule, the individual is taken also to engage in recognised activity of the same kind, or for that increased number of hours, during the period:

(a) starting on the first day of the CCS fortnight immediately before the start fortnight; and

(b) ending at the end of the start fortnight.

(3) For the purposes of paragraph 12(4)(a) of that Schedule, the number of hours of recognised activity engaged in by the individual to which subsection (2) of this section applies, during the period covered by that subsection, is taken to be the same number of hours as the number of hours of paid work, or the increased number of hours of paid work, that the individual is to start to engage in.

25 Leave from paid work

(1) This section applies if:

(a) an individual engages in a recognised activity consisting of paid work for the purposes of paragraph 12(2)(a) of Schedule 2 to the Family Assistance Act; and

(b) during a CCS fortnight, the individual takes paid or unpaid leave from that work; and

(c) in the case of an individual taking unpaid leave:

(i) the leave is for a continuous period of 6 months or less; or

(ii) the leave is parental leave (or of the nature of parental leave); and

(d) as at the time immediately before the individual takes the leave, he or she was normally engaged in recognised activity for 8 or more hours each fortnight.

(2) For the purposes of paragraph 12(3)(b) of that Schedule, the individual is taken also to engage in recognised activity of the same kind for the purposes of paragraph 12(2)(a) of that Schedule during the period of paid or unpaid leave.

(3) For the purposes of paragraph 12(4)(a) of that Schedule, the number of hours of recognised activity engaged in by the individual to which subsection (2) of this section applies during a period of paid or unpaid leave is taken to be the same number of hours as the number of hours of paid work normally engaged in by the individual during a period of the same length.

(4) Paid or unpaid leave, for an individual, means:

(a) if the individual engages in paid work as an employee, or under a contract—paid or unpaid leave granted under the terms or conditions of the individual’s employment or contract; or

(b) in any other case—paid or unpaid leave taken by the individual that, if the individual were an employee, would be of the nature of any of the following:

(i) annual leave;

(ii) long service leave;

(iii) leave for illness or injury;

(iv) carer’s leave for family or household members, or for household emergencies;

(v) leave (parental leave) for the birth of a child to the individual or the individual’s partner, or for the adoption of a child by the individual or the individual’s partner, including such leave taken in preparation for birth or adoption and to care for a child after birth or adoption.

26 Training course—self‑directed study

(1) This section applies if, during a CCS fortnight:

(a) an individual engages in a recognised activity consisting of a training course for the purposes of paragraph 12(2)(b) of Schedule 2 to the Family Assistance Act; and

(b) the individual engages in additional self‑directed study in relation to the course, outside the scheduled hours of the course.

Note: The individual may also be taken to engage in the recognised activity mentioned in paragraph (a) during a break in the course: see section 27.

(2) For the purposes of paragraph 12(3)(a) of that Schedule, the individual is taken also to engage in recognised activity of the same kind for the purposes of paragraph 12(2)(b) of that Schedule while being engaged in that additional self‑directed study.

27 Training course—break in course

(1) This section applies if:

(a) an individual engages in a recognised activity consisting of a training course for the purposes of paragraph 12(2)(b) of Schedule 2 to the Family Assistance Act; and

(b) a scheduled semester or vacation break during the training course includes a CCS fortnight, or any part of a CCS fortnight.

(2) For the purposes of paragraph 12(3)(b) of that Schedule, the individual is taken also to engage in recognised activity of the same kind for the purposes of paragraph 12(2)(b) of that Schedule during the period of the scheduled semester or vacation break that occurs during the CCS fortnight.

(3) However, an individual is not taken under subsection (2) also to engage in recognised activity in relation to a break that:

(a) occurs at the start or end of a course mentioned in paragraph (1)(a); or

(b) arises because the individual defers starting or continuing such a course.

(4) For the purposes of paragraph 12(4)(a) of that Schedule, the number of hours of recognised activity engaged in by the individual to which subsection (2) of this section applies during a scheduled semester or vacation break is taken to be the same number of hours as the number of hours of that training course normally scheduled during a period of the same length.

28 Approved course of education or study—self‑directed study

(1) This section applies if, during a CCS fortnight:

(a) an individual engages in a recognised activity consisting of an approved course of education or study for the purposes of paragraph 12(2)(c) of Schedule 2 to the Family Assistance Act; and

(b) the individual engages in additional self‑directed study in relation to the course, outside the scheduled hours of the course.

Note: The individual may also be taken to engage in the recognised activity mentioned in paragraph (a) during a break in the course: see section 29.

(2) For the purposes of paragraph 12(3)(a) of that Schedule, the individual is taken also to engage in recognised activity of the same kind for the purposes of paragraph 12(2)(b) of that Schedule while being engaged in that additional self‑directed study.

29 Approved course of education or study—break in course

(1) This section applies if:

(a) an individual engages in a recognised activity consisting of an approved course of education or study for the purposes of paragraph 12(2)(c) of Schedule 2 to the Family Assistance Act; and

(b) a scheduled semester or vacation break during the course includes a CCS fortnight, or any part of a CCS fortnight.

(2) For the purposes of paragraph 12(3)(b) of that Schedule, the individual is taken also to engage in recognised activity of the same kind for the purposes of paragraph 12(2)(c) of that Schedule during the period of the scheduled semester or vacation break that occurs during the CCS fortnight.

(3) However, an individual is not taken under subsection (2) also to engage in recognised activity in relation to a break that:

(a) occurs at the start or end of a course mentioned in paragraph (1)(a); or

(b) arises because the individual defers starting or continuing such a course.

(4) For the purposes of paragraph 12(4)(a) of that Schedule, the number of hours of recognised activity engaged in by the individual to which subsection (3) of this section applies during a scheduled semester or vacation break is taken to be the same number of hours as the number of hours of that course normally scheduled during a period of the same length.

Subdivision D—Hours during which activities are engaged in

30 Individual engages in paid work over variable hours

(1) This section applies if:

(a) an individual engages in recognised activity during a CCS fortnight consisting of paid work for the purposes of paragraph 12(2)(a) of Schedule 2 to the Family Assistance Act; and

(b) the individual’s total number of hours of paid work (under one or more work arrangements) varies unpredictably from fortnight to fortnight.

(2) For the purposes of paragraph 12(4)(a) of that Schedule, the total number of hours of that recognised activity (under one or more work arrangements) engaged in by the individual in any particular CCS fortnight during which this section applies is taken to be the largest number of such hours engaged in by the individual during any CCS fortnight over any continuous period of 6 CCS fortnights, as reasonably estimated by the individual, during which the individual engages in recognised activity to which this section applies.

Example 1: Suzie is eligible for CCS. She works at a supermarket. She works shifts that vary unpredictably from CCS fortnight to CCS fortnight. She reasonably estimates that her hours of work per CCS fortnight, over a period of 6 CCS fortnights, can vary from 15 hours per CCS fortnight to a maximum of 45 hours per CCS fortnight.

Under this section, she is taken to engage in the recognised activity of paid work for the estimated maximum of 45 hours in each CCS fortnight while she continues to work on the same basis, until the circumstances of her work change significantly.

Example 2: Patrick is eligible for CCS. He has 3 casual jobs for different employers. His total number of hours of work for all of these jobs, taken together, varies unpredictably from CCS fortnight to CCS fortnight. He reasonably estimates that his total hours of work per fortnight, over a period of 6 CCS fortnights, can vary from 8 hours per CCS fortnight to a maximum of 50 hours per CCS fortnight.

Under this section, he is taken to engage in the recognised activity of paid work for the estimated maximum of 50 hours in each CCS fortnight while he continues to work on the same basis, until the circumstances of his work change significantly.

Division 4—Minister’s rules result

31 Scope

This Division prescribes rules for the purposes of clause 14 of Schedule 2 to the Family Assistance Act.

32 Individuals with disabilities or impairments

There is a Minister’s rules result of 100 for an individual for a CCS fortnight, in relation to any child, if, on the first day of the fortnight, the individual is a disabled person, and as a result of the individual’s disability or impairment, the individual:

(a) is unable to engage in recognised activity to any significant degree; or

(b) would be unable to adequately care for the child if the child did not attend sessions of care at a child care service.

Note: For the meaning of disabled person, see subsection 3(1) of the Family Assistance Act.

33 Individual temporarily outside Australia

There is a Minister’s rules result of 100 for an individual for a CCS fortnight, in relation to any child, if, on the first day of the fortnight, the individual is temporarily absent from Australia.

Note: Section 85EE of the Family Assistance Act sets out the maximum period of CCS (or ACCS) eligibility for an individual who is absent from Australia.

34 Individual in gaol or psychiatric confinement

There is a Minister’s rules result of 100 for an individual for a CCS fortnight, in relation to any child, if, on the first day of the fortnight, the individual is in gaol (within the meaning of the Social Security Act 1991), or in psychiatric confinement that starts because he or she has been charged with an offence.

35 Individual or an individual’s partner is a grandparent or great‑grandparent

There is a Minister’s rules result of 100 for an individual, or the partner of an individual, for a CCS fortnight, in relation to any child, if the individual would, on the first day of the fortnight, but for paragraph 85CJ(1)(d) of the Family Assistance Act, be eligible for ACCS (grandparent) for the child.

Note: Paragraph 85CJ(1)(d) of the Family Assistance Act provides as an eligibility condition for ACCS (grandparent) that an individual, or the individual’s partner, must be receiving a social security or veterans’ pension or benefit of a specified kind.

36 Individual receiving a carer payment

There is a Minister’s rules result of 100 for an individual for a CCS fortnight, in relation to any child, if, on the first day of the fortnight, the individual receives a carer payment under the Social Security Act 1991.

37 Individual providing constant care

(1) There is a Minister’s rules result of 100 for an individual for a CCS fortnight, in relation to any child, if, on the first day of the fortnight, the individual would, but for an income test or asset test requirement, qualify for a carer payment under the Social Security Act 1991.

(2) An income test or asset test requirement is a requirement under Part 2.5 of the Social Security Act 1991 that, in order to qualify for a carer payment, a person must pass the income test or the assets test under that Act.

38 Individual receiving a carer allowance

(1) There is a Minister’s rules result under this section for an individual for a CCS fortnight, in relation to any child, if, on the first day of the fortnight, the individual receives a carer allowance under the Social Security Act 1991.

(2) The Minister’s rules result for the individual for the fortnight, in relation to any child, is the higher of the following:

(a) 72;

(b) the recognised activity result that would apply for the fortnight if the individual engaged in recognised activity for the number of hours worked out as follows:

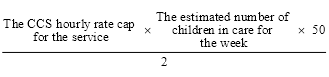

where:

hours of caring activity, in relation to caring activity consisting of the provision of care and attention on a daily basis to a care receiver (or care receivers) for the purpose of qualifying for the carer allowance, means the actual number of hours in the fortnight the individual engages in such caring activity.

hours of recognised activity is the number of hours the individual engages in recognised activities that would (apart from this section) count towards the individual’s recognised activity result for the fortnight.

(3) This section does not apply to an individual in relation to a CCS fortnight if section 36 or 37 applies to the individual in relation to the fortnight.

39 Individual receiving a newstart allowance, youth allowance, parenting payment or special benefit

(1) There is a Minister’s rules result under this section for an individual for a CCS fortnight, in relation to any child, if, on the first day of the fortnight, the individual receives one of the benefits under the Social Security Act 1991 covered by subsection (2).

(2) The benefits covered by this subsection are each of the following, if receipt of the benefit is subject to participation requirements requiring the individual to engage in particular activities (qualifying activities) during the fortnight, or would be so subject if the individual were not exempt from those requirements under that Act:

(a) a parenting payment;

(b) a youth allowance;

(c) a newstart allowance;

(d) a special benefit (subject to subsection (3)).

(3) There is a Minister’s rules result under this section for an individual who receives a special benefit only if the individual would qualify for one of the other benefits covered by subsection (2) but for a requirement relating to residence that applies in relation to the other benefit under the Social Security Act 1991.

(4) The Minister’s rules result for the individual for the fortnight, in relation to any child, is the higher of the following:

(a) 36;

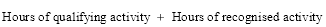

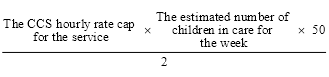

(b) the recognised activity result that would apply for the fortnight if the individual engaged in recognised activity for the number of hours worked out as follows:

where:

hours of qualifying activity is the actual number of hours the individual engages in qualifying activities for the receipt of the relevant benefit during the fortnight.

hours of recognised activity, in relation to activities other than qualifying activities, if the other activities are recognised activities, is the number of hours the individual engages in those recognised activities that would (apart from this section) count towards the individual’s recognised activity result for the fortnight.

Note: Some activities may be both qualifying activities and recognised activities (for example, looking for paid work, for an individual receiving a newstart allowance). Hours engaged in those activities are covered by the definition of hours of qualified activity.

(5) Despite subsection (4), the Minister’s rules result for the individual for the fortnight, in relation to any child, is 100 if:

(a) the individual is exempt under the Social Security Act 1991 from the requirement to engage in qualifying activities; and

(b) the exemption is not because the individual is a home educator or a distance educator, or because of the number of children for whom the individual is the principal carer or main supporter.

Note: For exemptions on the grounds mentioned in this paragraph, see sections 502D (parenting payment), 542FA (youth allowance), 602C (newstart allowance) and 731DB (special benefit) of the Social Security Act 1991.

40 Child attending early educational program at a centre‑based day care service

There is a Minister’s rules result of 36 for an individual for a CCS fortnight, in relation to a particular child, if, at any time during the CCS fortnight, the child attends an early educational program (such as a preschool or kindergarten program), in the year that is 2 years before grade 1 of school, offered at a centre‑based day care service.

Part 3A—Withholding Amount

40A Prescribed percentage

The prescribed percentage for paragraph 67EB(3)(b) of the Family Assistance Administration Act is 5%.

Part 4—Approval of provider of child care services

Division 1—Application for approval

41 Cut‑off date for applications for approval under the family assistance law before the commencement day

(1) For subsection 194(5) of the Family Assistance Administration Act (as in force before the commencement day), an application for approval of a child care service for the purposes of the family assistance law as in force before that day is taken not to have been made if the application is made on or after 1 April 2018.

Note: The commencement day is 2 July 2018 (the day Schedule 1 to the Jobs for Families Act commences).

(2) However, subsection (1) does not apply in relation to a particular application if the Secretary:

(a) considers that exceptional circumstances exist in relation to the application that justify treating it as being made; and

(b) so determines in writing.

42 Who may apply for approval

For paragraph 194A(1)(d) of the Family Assistance Administration Act, the following entities and bodies are prescribed:

(a) an eligible association or a prescribed entity within the meaning of the Education and Care Services National Law and the Education and Care Services National Regulations;

(b) an unincorporated body or entity that has a governing body as referred to in section 230B of the Family Assistance Administration Act (application of family assistance law to providers that are unincorporated).

Division 2—Provider eligibility rules

43 Additional rules for provider eligibility

(1) For paragraph 194C(f) of the Family Assistance Administration Act, this section prescribes criteria in relation to a provider of a child care service.

(2) The provider must ensure that each of the following checks is carried out for each person who has management or control of the provider (other than a person who is responsible for the day‑to‑day operation of the service), and be able to provide a written record of each check upon any request:

(a) a national police check from the State or Territory police service, or an agency accredited by the Australian Criminal Intelligence Commission, no more than 6 months before the date of the application;

(b) a check in relation to the issue of a working with children card within the meaning of section 195D of the Family Assistance Administration Act;