Reporting Standard RRS 391.0

Commercial Finance

Objective of this reporting standard

This reporting standard is made under section 13 of the Financial Sector (Collection of Data) Act 2000. It applies to relevant registered entities. In general terms these are entities described in the Schedule to this reporting standard.

Subject to what follows, this reporting standard requires a relevant registered entity to give APRA monthly statements in relation to commercial finance.

However, if there are two or more relevant registered entities of the same category[1] in a group of related bodies corporate (e.g. two or more money market corporations in the group), then only one of them is required to give APRA a statement in relation to commercial finance in any given month. That statement must cover all relevant registered entities of the same category in the group.

This reporting standard outlines the overall requirements for the provision of the required information to APRA. It should be read in conjunction with:

- Form RRF 391.0.1 Commercial Finance in NSW;

- Form RRF 391.0.2 Commercial Finance in VIC;

- Form RRF 391.0.3 Commercial Finance in QLD;

- Form RRF 391.0.4 Commercial Finance in SA;

- Form RRF 391.0.5 Commercial Finance in WA;

- Form RRF 391.0.6 Commercial Finance in TAS;

- Form RRF 391.0.7 Commercial Finance in the NT;

- Form RRF 391.0.8 Commercial Finance in the ACT; and

the instructions to those forms, all of which are attached and form part of this reporting standard.

Purpose

- Data collected in Forms RRF 391.0.1 to RRF 391.0.8 is used for the purposes of the Reserve Bank of Australia. It may also be used by APRA, for the purpose of prudential supervision, and the Australian Bureau of Statistics.

Application

2. This reporting standard applies to all relevant registered entities.

Information required

3. Subject to paragraph 4, a relevant registered entity must provide APRA with the information required by Forms RRF 391.0.1 to RRF 391.0.8 in respect of a reporting period.

4. However, a relevant registered entity is not required to report in respect of a particular reporting period if another relevant registered entity has reported under this reporting standard in respect of that reporting period, and that other entity is both:

(a) a related body corporate of the first-mentioned registered entity; and

(b) of the same category as the first-mentioned registered entity.

Reporting periods and due dates

5. Subject to paragraph 6, a relevant registered entity must provide the information required by this reporting standard for each calendar month.

6. APRA may, by notice in writing to a particular relevant registered entity, vary the timing of a reporting period for the relevant registered entity or vary the duration of a relevant reporting period for the registered entity.

7. The information required by this reporting standard must be provided to APRA within 10 business days after the end of the reporting period to which it relates.

8. APRA may grant a relevant registered entity an extension of a due date in writing, in which case the new due date for the provision of the information will be the date on the notice of extension.

Forms and method of submission

9. The information required by this reporting standard must be given to APRA either:

(a) in electronic form, using one of the electronic submission mechanisms provided by the 'Direct to APRA' (also known as 'D2A') application; or

(b) manually completed on paper, which must be faxed or mailed to APRA's head office.

Note: the Direct to APRA application software and paper forms may be obtained from APRA.

Authorisation

10. All information provided by a relevant registered entity under this reporting standard must be subject to processes and controls developed by the relevant registered entity for the internal review and authorisation of that information. It is the responsibility of the board and senior management of the relevant registered entity to ensure that an appropriate set of policies and procedures for the authorisation of data submitted to APRA is in place.

11. If a relevant registered entity submits information under this reporting standard using the ‘Direct to APRA’ software, it will be necessary for an officer of the registered entity to digitally sign, authorise and encrypt the relevant data. For this purpose APRA’s certificate authority will issue 'digital certificates', for use with the software, to officers of the relevant registered entity who have authority from the relevant registered entity to transmit the data to APRA.

12. If information under this reporting standard is provided in paper form, it must be signed on the front page of the relevant completed form by either:

(a) the Principal Executive Officer of the registered entity; or

(b) the Chief Financial Officer of the registered entity (whatever his or her official title may be).

Minor alterations to forms and instructions

13. APRA may make minor variations to:

(a) a form that is part of this reporting standard, and the instructions to such a form, to correct technical, programming or logical errors, inconsistencies or anomalies; or

(b) the instructions, to clarify their application to the form

without changing any substantive requirement in the form or instructions.

14. If APRA makes such a variation it must notify in writing each relevant registered entity that is required to report under this reporting standard.

Transitional

15. A registered entity must report under the old reporting standard in respect of a transitional reporting period. For these purposes:

old reporting standard means the reporting standard revoked in the determination making this reporting standard (being the reporting standard which this reporting standard replaces).

transitional reporting period means a reporting period under the old reporting standard:

(a) which ended before the date of revocation of the old reporting standard; and

(b) in relation to which the registered entity was required, under the old reporting standard, to report by a date on or after the date of revocation of the old reporting standard.

Interpretation

16. In this reporting standard:

business days means ordinary business days, exclusive of Saturdays, Sundays and public holidays.

category means a category to which a registered entity has been allocated under section 11 of the Financial Sector (Collection of Data) Act 2001.

Principal Executive Officer means the principal executive officer of the registered entity for the time being, by whatever name called, and whether or not he or she is a member of the governing board of the entity.

registered entity has the meaning given in the Financial Sector (Collection of Data) Act 2001 (that is, a corporation whose name is entered in the Register of Entities kept by APRA under section 8 of that Act).

Note: references to registered financial corporations in the forms and instructions that form part of this reporting standard are taken to have the same meaning as registered entity.

related body corporate has the meaning given in section 50 of the Corporations Act 2001.

relevant registered entity means:

(a) a registered entity listed in Part 1 of the Schedule, unless APRA has made a determination, under clause 1 of Part 2 of the Schedule, that the entity is not a relevant registered entity; or

(b) a registered entity that APRA has determined, under clause 2 of Part 2 of the Schedule, is a relevant registered entity.

Note: references to a reporting entity in the forms and instructions that form part of this reporting standard are taken to have the same meaning as relevant registered entity.

reporting period means a period defined in paragraph 5 or, if applicable, paragraph 6.

Schedule

Part 1: Relevant registered entities

• AAA Capital Markets Limited

• ABN AMRO Australia Limited

• ABN AMRO Facilities Australia Limited

• Adelaide Equity Finance Pty Ltd

• AMP Finance Limited

• AMRO Australia Limited

• Avco Access Pty Ltd

• BMW Australia Finance Limited

• BOQ Equipment Finance Limited

• Boston Australia Limited

• BT Securities Ltd

• Calyon Australia Limited

• Capital Finance Australia Limited

• Capital Motor Finance Limited

• CBFC Leasing Pty Limited

• CBFC Limited

• DaimlerChrysler Capital Services (Debis) Australia Pty Ltd

• DaimlerChrysler Financial Services Australia Pty Ltd

• Deutsche Australia Limited

• Deutsche Capital Markets Australia Limited

• Ford Credit Australia Limited

• Fortis Clearing Sydney Pty Ltd

• Galanthus Leasing Pty Limited

• GE (Finance) Pty Ltd

• GE Automotive Financial Services

• GE Commercial Corporation (Australia) Pty Ltd

• GE Mortgage Solutions Limited

• GE Personal Finance Pty Ltd

• Leveraged Equities Limited

• Macquarie Acceptances Limited

• Macquarie Australia International Ltd

• Macquarie Australia Pty Limited

• Macquarie Commercial Leasing Vic Pty Limited

• Macquarie Finance Ltd

• Macquarie Leasing NSW Pty Ltd

• Macquarie Leasing Pty Ltd

• Mizuho Corporate Australia Ltd.

• Orix Australia Corporation Limited

• PRIMUS Automotive Financial Services Australia Limited

• Rabo Australia Limited

• SPAL Limited

• TFA (Wholesale) Pty Ltd

• Toronto Dominion Australia Limited

• Toyota Finance Australia Ltd

Part 2

- APRA may determine in writing that a registered entity listed in Part 1 of this Schedule is not a relevant registered entity if APRA considers that the entity is not a substantial provider of commercial finance in Australia.

- APRA may determine in writing that a registered entity that is not listed in Part 1 of the Schedule is a relevant registered entity if APRA considers that the entity is a substantial provider of commercial finance in Australia.

- In considering, for the purposes of clause 1 or 2, whether a registered entity is a substantial provider of commercial finance in Australia, APRA shall have regard to whether the amount of commercial finance provided in Australia by the entity is comparable to the registered entities, or other registered entities, listed in the Schedule.

Reporting Form RRF 391.0

Commercial Finance

Instruction Guide

The purpose of this survey is to provide monthly statistics on finance provided to private and public sector businesses. The statistics are used by APRA for regulatory purposes, and may be provided to the Reserve Bank of Australia (RBA) and the Australian Bureau of Statistics (ABS) for policy and statistical purposes. Published aggregate statistics from this collection are used for research and policy formulation by economists, State and Federal Governments, and leasing associations.

A separate form for commercial finance in all eight states should be completed:

• RRF 391.0.1 Commercial Finance in NSW;

• RRF 391.0.2 Commercial Finance in VIC;

• RRF 391.0.3 Commercial Finance in QLD;

• RRF 391.0.4 Commercial Finance in SA;

• RRF 391.0.5 Commercial Finance in WA;

• RRF 391.0.6 Commercial Finance in TAS;

• RRF 391.0.7 Commercial Finance in NT; and

• RRF 391.0.8 Commercial Finance in ACT.

General directions and notes

Reporting entity

This form is to be completed for the Domestic books reporting entity. For corporations registered under the Financial Sector (Collection of Data) Act 2001 (e.g. money market corporations, finance companies, general financiers), report consolidated figures for all related corporations within the same Registered Financial Corporation (RFC) category.

Reporting period

The information provided should be for the calendar month up to and including the last day of the month. This form is to be reported as at the last day of the reporting period. All RFCs should submit the completed form to APRA within 10 business days of the end of the month.

Unit of measurement

All RFCs are asked to complete the form in thousands of Australian dollars rounded to the nearest whole number (no decimal place).

Amounts denominated in foreign currency are to be converted to AUD using the spot exchange rate effective as at the reporting date.

Basis of preparation

Unless otherwise specifically stated, information reported on this form should comply with Australian accounting standards.

Definitions

A separate form for commercial finance in all eight states should be completed. Where the entity has no activity in any state, check the “nil form” box. The form requests details of new commitments to provide commercial finance to private and public enterprises. Only the Australian activities of the business should be included on the form. If exact figures are not available please provide careful estimates. Please note that the items listed under ‘Include’ and ‘Exclude’ are examples and should not be taken as a complete list of items to be included or excluded.

What is a “commitment”?

A commitment is a firm offer to provide finance which has been accepted by the client. A commitment generally exists once the loan application has been approved, and a loan contract or letter of offer has been issued to the borrower.

Include:

• commitments to related corporations except to those related corporations within the same Financial Sector (Collection of Data) Act 2001 category or Australian and New Zealand Standard Industrial Classification (ANZSIC) class;

• commitments for hire purchase agreements for commercial finance;

• commitments for debt participation in leveraged lease agreements;

• commitments that involve or make provision for the issue of bills of exchange to be accepted, discounted or drawn by you;

• new commitments which have also been cancelled during the month;

• commitments for standby agreements; and

• commitments for revolving credit loans to individuals secured by mortgage (mortgage backed overdrafts) on residential properties where the stated purpose at application is as a commercial line of credit.

Exclude:

• commitments to non-residents;

• commitments for lease agreements (other than hire purchase agreements and debt participation in leveraged lease agreements), these should be reported on RRF 393.0 Lease Finance;

• deposits with financial institutions;

• the purchase of securities unless it involves a direct commitment to a client;

• bills of exchange and promissory notes purchased and held;

• commitments contingent on some specified eventuality (e.g. bill endorsement, guarantees, letter of credit) unless and until that eventuality occurs;

• commitments for discounts which exists as options under acceptance commitments; and

• commitments for personal investment loans – these should be reported on RRF 394.0 Personal Finance.

What is a “dwelling”?

A dwelling is a place of residence which is:

• contained in a building which is an immobile structure;

• private (i.e. not generally accessible to the public); and

• self contained (i.e. includes bathing and cooking facilities).

How to consolidate

• For corporations registered under the Financial Sector (Collection of Data) Act 2001, report consolidated figures for all related corporations within the same RFC category.

• For other corporations, report consolidated figures for all related corporations within the same ANZSIC industry.

Specific instructions

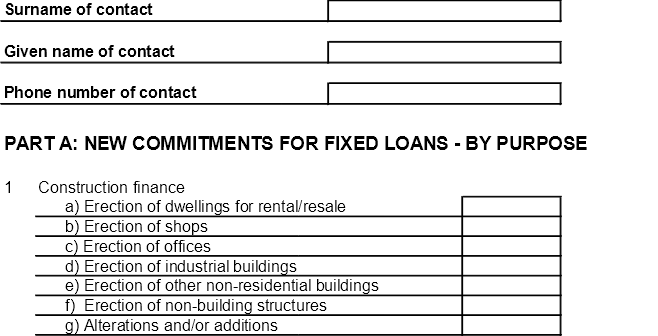

Part A: New commitments for fixed loans – By purpose

The purpose of the loan is that specified by the borrower. Multi-purpose loans should be split and each component reported in the appropriate purpose classification. Where this is not possible the whole loan should be classified to the major purpose.

Fixed loans generally involve a commitment for a fixed period for a specific purpose and repayments over that fixed period which reduce the loan, but do not make further finance available.

1. Construction finance

1a. Erection of dwellings for rental/resale Include:

• only dwellings that will be occupied by persons other than the owner(s).

1d. Erection of industrial buildings

Include:

• factories, automotive repair facilities etc.

1e. Erection of other non-residential buildings

Include:

• hotels, buildings for educational, religious, health, entertainment and recreational purposes.

1f. Erection of non-building structures Include:

• roads, bridges, railways, harbours, telecommunication towers, dams, powerlines, pipelines, sewers.

1g. Alteration and/or additions

Include:

• all structural and non-structural changes to existing buildings.

Exclude:

• maintenance and repairs (include in Question 7); and

• improvements which do not involve building work (include in Question 7).

2. Finance for the purchase of land and buildings

Include such things as are considered by law to be part of land (e.g. fencing).

2a. Purchase of dwellings for rental/resale Include:

• only dwellings that will be occupied by persons other than the owner(s).

2d. Purchase of industrial buildings

Include:

• factories, automotive repair facilities etc.

2e. Purchase of non-residential buildings

Include:

• hotels, buildings for educational, religious, health, entertainment and recreational purposes.

2f. Purchase of rural property

Include:

• all property used for agricultural or pastoral purposes.

2h. Other land purchases

Include:

• land not elsewhere included.

3. Wholesale finance

Wholesale finance is finance for the purchase of goods by wholesalers and retailers.

Include:

• traders' stocks held under bailment or floorplan schemes.

4. Purchase of plant and equipment

4a. Motor vehicles

Include:

• cars, station wagons, utilities, trucks, ambulances and passenger vehicles such as buses.

Exclude:

• motorcycles, trailers, caravans, trains, boats and planes (include in ‘Other transport equipment’ below).

4b. Other transport equipment

Include:

• motorcycles, trailers, caravans, trains, boats and planes.

4c. Other plant and equipment

Include:

• construction and earthmoving equipments;

• agricultural machinery; and

• EDP and office equipment.

6. Refinancing

Include:

• commitments where the principal purpose is to pay out (refinance) existing commercial loans.

7. Other

Include:

• maintenance and repairs, and other improvements to property not involving building work.

9. Of the new commitments for fixed loans (Question 1 to 7) how much was debt participation in leveraged leases

The amount of debt participation in leveraged leases should be included in fixed loans (Question 1 to 7).

Part B: New commitments for revolving credit loans

Revolving credit facilities involve a commitment for a credit or borrowing limit and where the extent of the borrowings used at any one time may be for any amount up to the authorised limit. Repayments (other than of charges and interest) reduce the borrowings thereby increasing the amount of unused credit available. For example, overdrafts limits (mortgage backed overdrafts).

14. Cancellations of and reductions in previously approved credit limits

Include:

• the actual value of credit limits cancelled and the value by which existing credit limits were reduced during the month.

Exclude:

• amounts used as balancing or adjustment items (such as adjustments between states). These should be reported in Question 15; and

• repayments which reduce the used portion of the credit facility but not the total credit available. These should be excluded from the form altogether.

15. Balancing item (+/-)

If the previous month's 'total credit limits available' (Q12 last month) plus (+) 'total new limits approved' (Q11) minus (-) 'cancellations' (Q14) does not equal the current month's 'total credit limits available' (Q12), please provide the amount and a reason for this discrepancy.

Part C: New commitments – By industry

Industry is the business the client is mainly engaged in. The industry groupings are according to the ANZSIC. Include businesses that provide related or supporting services.

17. Agriculture, forestry and fishing

Include:

• borrowers engaged in providing related services such as sheep shearing, aerial agricultural services, harvesting or forest protection.

18. Mining

Include:

• borrowers engaged in mineral exploration, in the provision of services to mining or mineral exploration, and mining enterprises under development.

19. Manufacturing

Include:

• borrowers engaged in manufacturing products, where 'manufacturing is related to the physical or chemical transformation of materials or components into new products'.

20. Construction

Include:

• borrowers engaged in special trade construction such as plumbing, earthmoving and dredging, painting etc.

21. Wholesale trade

Include:

• borrowers engaged in the resale of new or used goods to businesses or to institutional (including government) users.

22. Retail trade

Include:

• borrowers engaged in the resale of goods to final consumers for personal or household consumption; and

• borrowers engaged in the reselling their own goods by auction.

23. Transport and storage

Include:

• borrowers engaged in providing terminal and storage facilities; services related to transport; booking, travel, forwarding, materials handling etc.

24. Finance and insurance

Include:

• borrowers engaged in the provision of finance, investments in financial assets and in providing services to lenders, borrowers and investors; and

• borrowers engaged in the provision of insurance and superannuation, and in providing services to insurers.

25. Property and business services

Include:

• borrowers engaged in valuing, purchasing, selling, renting, leasing or managing

real estate;

• borrowers engaged in developing or subdividing land;

• borrowers engaged in scientific research and meteorological services;

• borrowers engaged in providing technical, legal, accounting and other business services; and

• borrowers engaged in renting and hiring equipment (except cars, trucks, and other transport equipment).

26. Cultural, recreational, personal and other services

Include:

• borrowers engaged in providing entertainment, recreational, library, museum, accommodation, and catering services;

• borrowers engaged in personal services such as laundries, hairdressing, photography, funerals;

• private households employing staff; and

• borrowers engaged in the provision of public order and safety services (such as police, prison and fire-brigade).

27. Government administration and defense

Include:

• borrowers engaged in Federal, State and local government enterprises engaged in public administration and regulatory activities;

• judicial authorities and commissions; and

• Army, Navy and Air Force establishments.

28. Health and community services

Include:

• borrowers engaged in providing health, welfare and employment services; and

• certain non-profit organisations such as religious organisations, business, professional and labour organisations, and political parties and associations formed to promote community or sectional aims.

29. Other industries

Include:

• borrowers not elsewhere classified, such as those involved in the production or distribution of gas or electricity, the storage or supply of water, and the provision of education and communication services.

30. Total (sum of Questions 17 to 29)

The total of fixed loans in Question 30 should equal the total of fixed loans in Question 8. The total of revolving credit in Question 30 should equal the total of new revolving credit in Question 11.

Part D: Comments

31. Please provide comments

• on any of the information you have supplied on this form;

• on any questions which caused problems; and

• if you would like to suggest improvements to this form.