Part 1—Preliminary

1 Name

This is the Cocos (Keeling) Islands Utilities and Services (Water, Sewerage and Building Application Services Fees) Determination 2016.

2 Commencement

(1) Each provision of this instrument specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this instrument | 1 July 2016. | 1 July 2016 |

Note: This table relates only to the provisions of this instrument as originally made. It will not be amended to deal with any later amendments of this instrument.

(2) Any information in column 3 of the table is not part of this instrument. Information may be inserted in this column, or information in it may be edited, in any published version of this instrument.

3 Authority

This instrument is made under paragraph 7(2)(a) of the Cocos (Keeling) Islands Utilities and Services Ordinance 2016.

4 Definitions

In this instrument:

charitable purposes land: see subsection 5(8).

commercial land: see subsection 5(3).

discharge factor, for a property: see clause 3 of Schedule 3.

eligible pensioner has the same meaning as in subsection 3(1) of the Rates and Charges (Rebates and Deferments) Act 1992 (WA) (CKI).

eligible senior has the same meaning as in subsection 3(1) of the Rates and Charges (Rebates and Deferments) Act 1992 (WA) (CKI).

fire service means a water supply connection provided for fire‑fighting purposes.

government land: see subsection 5(6).

gross rental value, of land, has the same meaning as in subsection 4(1) of the Valuation of Land Act 1978 (WA) (CKI).

holiday accommodation, of an owner or occupier, means accommodation that is:

(a) held out as being available, or made available, by the owner or occupier for occupation for holiday purposes by persons other than the owner or occupier; and

(b) not held out, or made available, substantially:

(i) by way of trade or business; or

(ii) for the purpose of any trade or business.

industrial land: see subsection 5(4).

institutional/public land: see subsection 5(7).

local government land: see subsection 5(9).

major fixture means any of the following:

(a) a water closet;

(b) each urinal outlet contained within a floor‑mounted urinal;

(c) each stand of wall‑hung urinals contained within a separate ablution area;

(d) a pan washer.

occupier, in relation to land, means the person in occupation of the land or, if there is no person in occupation, the person entitled to possession of the land.

owner, in relation to land, has the same meaning as in section 1.4 of the Local Government Act 1995 (WA) (CKI).

residence means a private dwelling house, home unit or flat, including any yard, garden, outhouse or appurtenance belonging to, or usually enjoyed with, the private dwelling house, home unit or flat.

residential land: see subsection 5(2).

vacant land: see subsection 5(5).

5 Categories of land

(1) This section defines categories of land for the purposes of this instrument.

(2) Land is residential land if:

(a) the land is used wholly or primarily for the purpose of providing a residence for one or more of the following:

(i) the owner or occupier of the land;

(ii) the family of the owner or occupier of the land;

(iii) the employees of the owner or occupier of the land; and

(b) the land is not used, in whole or in part, for the purpose of providing holiday accommodation.

(3) Land is commercial land if:

(a) the land is used for one or more of the following purposes:

(i) conducting a business;

(ii) the practice of a profession;

(iii) holiday accommodation;

(iv) any other commercial purpose; and

(b) the land is not used for any other purpose mentioned in this section.

(4) Land is industrial land if:

(a) the land is used for manufacturing or processing; and

(b) the manufacturing or processing cannot be conducted without the use of water; and

(c) the land is not used for any other purpose mentioned in this section.

(5) Land is vacant land if:

(a) there is no building on the land; and

(b) the land is not used for any other purpose mentioned in this section.

(6) Land is government land if:

(a) the land is used by the Commonwealth Government or the government of a State for business, professional, commercial, or office purposes, or as a power station; and

(b) the land is not used for any other purpose mentioned in this section.

(7) Land is institutional/public land if:

(a) the land is used for a club, institutional or public purpose that has been approved by the Administrator by notice in writing given to the owner or occupier of the land; and

(b) the land is not used for any other purpose mentioned in this section.

(8) Land is charitable purposes land if the land is used for one of the following purposes:

(a) providing relief or assistance to persons who are sick, aged, disadvantaged, unemployed or young;

(b) the conduct of activities:

(i) by a private organisation that is not operated for the purpose of profit or gain to individual members, shareholders or owners; and

(ii) for the benefit of the public or in the interests of social welfare.

(9) Land is local government land if:

(a) the land is used by a local government for business or office purposes; and

(b) the land is not used for any other purpose mentioned in this section.

Part 2—Fees

6 Fees

Determination of fees that may be charged for the supply of services

(1) This instrument determines fees that may be charged for the supply of water and sewerage services, and the supply of building application services that relate to water and sewerage services, for the financial year commencing on 1 July 2016.

(2) The fees determined by this instrument apply from and including 1 July 2016.

(3) The fees that may be charged are the following:

(a) fixed fees for the supply of water services as set out in Schedule 1;

(b) fixed fees for the supply of sewerage services as set out in Schedule 2;

(c) quantity fees for the supply of water and sewerage services as set out in Schedule 3;

(d) fees for the supply of other water and sewerage services as set out in Schedule 4;

(e) fees for the supply of building application services that relate to water and sewerage services as set out in Schedule 5.

(4) Despite paragraph (3)(c), if, in relation to particular land, the Administrator agrees, in writing, with the owner or occupier of the land on an amount of quantity fees that is lower than the amount of quantity fees for the land as set out in Schedule 3, the amount of quantity fees for the land is determined to be the amount agreed.

Method of charging fees—notice to owner or occupier of land

(5) If the Administrator charges a fee for the supply of a service mentioned in this instrument, the Administrator must do so by sending a notice to the owner or occupier of the land:

(a) to which the service is supplied (for a service mentioned in any of Schedules 1 to 4); or

(b) to which the service relates (for a service mentioned in Schedule 5).

Note: The fee must also be notified in the Gazette—see section 8 of the Cocos (Keeling) Islands Utilities and Services Ordinance 2016.

(6) The notice must specify:

(a) the amount of the fee payable; and

(b) the day by which the fee must be paid.

(7) The day specified in the notice must be at least 16 days after the day the notice is sent to the owner or occupier.

Liability to pay fee and payment of fee

(8) If the Administrator sends the notice under subsection (5) to the owner or occupier:

(a) the owner or occupier is liable to pay the fee specified in the notice; and

(b) the fee is payable to the Administrator on behalf of the Commonwealth.

7 Concessions for eligible pensioners and eligible seniors

Fixed fees for water or sewerage services—eligible pensioners

(1) Despite paragraphs 6(3)(a) and (b), an eligible pensioner may pay a fee mentioned in Schedule 1 or 2 at the pensioner rate if:

(a) the pensioner is the owner and occupier of residential land; and

(b) the fee applies in relation to the land.

Quantity fees for water and sewerage services—eligible pensioners

(2) Despite paragraph 6(3)(c), an eligible pensioner may pay a fee mentioned in Schedule 3 at the pensioner rate, for up to 600 kilolitres of water used, if:

(a) the pensioner is the occupier of residential land; and

(b) the fee applies in relation to the land.

Fixed fees for water or sewerage services—eligible seniors

(3) Despite paragraphs 6(3)(a) and (b), an eligible senior may pay a fee mentioned in Schedule 1 or 2 at the senior rate if:

(a) the senior is the owner and occupier of residential land; and

(b) the fee applies in relation to the land.

Definitions

(4) In this section:

pensioner rate means a fee mentioned in Schedule 1, 2 or 3, reduced by 50%.

senior rate means a fee mentioned in Schedule 1 or 2, reduced by 25%.

8 Payment of fees

Subject to section 10, a fee that applies to an owner or occupier of land in accordance with this instrument is due for payment on or before the day specified in a notice under subsection 6(5).

9 When a fee is not paid

(1) This section applies if:

(a) an owner or occupier of land has not paid a fee for the supply of a service to, or in relation to, the land, in accordance with a notice under subsection 6(5); and

(b) at least 14 days have elapsed after the day specified in the notice as the day by which the fee must be paid; and

(c) a special payment arrangement under section 10 is not in force between the Administrator and the owner or occupier in relation to the fee.

(2) The Administrator must send a reminder notice to the owner or occupier advising the owner or occupier that the Administrator may restrict access to the service if the fee is not paid within 10 days of the date of the reminder notice.

(3) If the fee is not paid within 10 days of the date of the reminder notice, the Administrator may send the owner or occupier a notice to restrict.

(4) The notice to restrict must tell the owner or occupier that, unless the fee is paid within the period stated in the notice to restrict, action may be taken to restrict access to the service.

(5) The period mentioned in subsection (4) must not be less than 7 days.

(6) If the owner or occupier does not pay the fee within the period stated in the notice to restrict, the Administrator may restrict the supply of the service to the land until:

(a) the owner or occupier has paid:

(i) the fee; and

(ii) if the Administrator charges a fee for restoring the service after the restriction—that fee; or

(b) a special payment arrangement under section 10 is in force between the Administrator and the owner or occupier in relation to the fee.

10 Special payment arrangements

(1) The Administrator may agree, in writing, to a special payment arrangement with an owner or occupier of land if:

(a) the owner or occupier is experiencing difficulties in paying a fee mentioned in this instrument for the supply of a service to, or in relation to, the land; and

(b) the owner or occupier notifies the Administrator of the difficulties.

(2) If a special payment arrangement under this section is in force between the Administrator and the owner or occupier in relation to a fee, the fee is due for payment in accordance with the arrangement.

Schedule 1—Fixed fees for the supply of water services

Note: See paragraph 6(3)(a).

1 Fixed fees for the supply of water services

(1) The table in this clause sets out fixed fees for the supply of water services.

Note: An eligible pensioner or eligible senior may pay a fee at a reduced rate—see subsections 7(1) and (3).

(2) If an additional water service is required, the fees mentioned in the table also apply to that additional service.

Fixed fees for the supply of water services |

Item | Supply of water services to ... | Fixed fee |

1 | residential land | $236.22 |

2 | commercial land or industrial land (other than land mentioned in item 5) or government land, or shipping (supply of water services to land for the purpose of water being taken on board a ship in a port), with: | |

(a) no meter or a 15 or 20 mm meter | $236.22 |

(b) a 25 mm meter | $369.11 |

(c) a 30 mm meter | $531.49 |

(d) a 35, 38 or 40 mm meter | $944.93 |

(e) a 50 mm meter | $1,476.44 |

(f) a 70, 75 or 80 mm meter | $3,779.68 |

(g) a 100 mm meter | $5,905.75 |

(h) a 140 or 150 mm meter | $13,287.95 |

3 | institutional/public land, charitable purposes land or local government land | Nil |

4 | vacant land | $236.22 |

5 | strata‑titled commercial land or industrial land, if sharing a water service | $236.22 |

6 | any land, for the supply of a fire service | $236.22 |

Schedule 2—Fixed fees for the supply of sewerage services

Note: See paragraph 6(3)(b).

1 Fixed fees for the supply of sewerage services

The table in this clause sets out fixed fees for the supply of sewerage services.

Note: An eligible pensioner or eligible senior may pay a fee at a reduced rate—see subsections 7(1) and (3).

Fixed fees for the supply of sewerage services |

Item | Supply of sewerage services to … | Fixed fee |

1 | residential land: | |

(a) rate in the dollar | $0.1254 per $1 of gross rental value |

(b) minimum annual fee | $381.26 |

(c) maximum annual fee | $1,040.89 |

2 | commercial land or industrial land (other than land mentioned in item 6): | |

(a) first major fixture | $886.68 |

(b) second major fixture | $379.55 |

(c) third major fixture | $506.88 |

(d) each subsequent major fixture | $551.20 |

(e) minimum annual fee | $886.68 |

3 | vacant land: | |

(a) rate in the dollar | $0.1254 per $1 of gross rental value |

(b) minimum annual fee | $250.88 |

(c) maximum annual fee (if zoned for future residential use) | $1,040.89 |

4 | institutional/public land, charitable purposes land or local government land: | |

(a) first major fixture | $238.23 |

(b) each subsequent major fixture | $104.81 |

5 | government land: | |

(a) first major fixture | $886.68 |

(b) second major fixture | $379.55 |

(c) third major fixture | $506.88 |

(d) each subsequent major fixture | $551.20 |

6 | strata‑titled commercial land or industrial land, if sharing a major fixture | $551.20 |

Schedule 3—Quantity fees for the supply of water and sewerage services

Note: See paragraph 6(3)(c).

1 Quantity fees for the supply of water and sewerage services

The table in this clause sets out quantity fees for the supply of water and sewerage services.

Note: An eligible pensioner may pay a fee at a reduced rate—see subsection 7(2).

Quantity fees for the supply of water and sewerage services |

Item | Supply of water and sewerage services to ... | Quantity fee (per kL of water used) |

1 | residential land or vacant land that has been zoned for residential purposes: | |

(a) 0 to 350 kL | $1.586 |

(b) 351 to 500 kL | $2.114 |

(c) 501 to 750 kL | $4.324 |

(d) over 750 kL | $7.434 |

2 | vacant land not mentioned in item 1 | $7.434 |

3 | institutional/public land used for non‑government schools, churches or community facilities, charitable purposes land or local government land | $2.256 |

4 | commercial land, government land or industrial land | $7.434 |

5 | commercial land, government land or industrial land—discharge to sewer: | |

(a) 0 to 200 kL per property (allowance) | Nil |

(b) over 200 kL | $3.258 |

2 Calculation of kilolitres of water used—quantity fee for discharge to sewer for commercial, government or industrial land

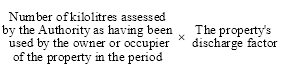

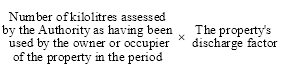

For item 5 of the table in clause 1, the number of kilolitres of water used in a period for a property is worked out using the following formula:

3 Discharge factor

The discharge factor, for calculating the number of kilolitres of water used in a period for a property, is the following percentage of the water supplied to the property in the period:

(a) if paragraph (b) does not apply—95%;

(b) if the Administrator agrees, in writing, with the owner or occupier of the property on a percentage that is lower than 95%—the agreed percentage.

Schedule 4—Fees for the supply of other water and sewerage services

Note: See paragraph 6(3)(d).

1 Fees for the supply of other water and sewerage services

(1) The table in this clause sets out fees for the supply of water and sewerage services other than those mentioned in Schedules 1 to 3.

Fees for the supply of other water and sewerage services |

Item | Type of service | Fee |

1 | Relocation of service | quoted cost |

2 | Disconnection or reconnection of water service | quoted cost |

3 | Special meter readings for change of owner/occupier: | |

(a) within 7 days of being requested | $16.78 |

(b) within 2 days of being requested | $56.37 |

4 | Advice of sale requests: | |

(a) electronic advice—standard | $44.55 |

(b) electronic advice—urgent | $84.04 |

(c) manual advice—standard | $76.44 |

(d) manual advice—urgent | $115.61 |

5 | Meter tests: | |

(a) 20 to 25 mm meters | $107.68 |

(b) over 25 mm meters | actual cost |

6 | Restoration of service after restriction: | |

(a) between 7 am and 4 pm any day except Saturday, Sunday or a public holiday | $154.15 |

(b) any other time | $244.95 |

7 | Sewer connection | quoted cost |

8 | Installation of sewer junction | quoted cost |

(2) In the table:

actual cost, for a meter test, is the cost incurred in removing the meter and sending it for testing.

quoted cost, for a service, means the cost quoted by a contractor engaged to perform the service.

Schedule 5—Fees for the supply of building application services that relate to water and sewerage services

Note: See paragraph 6(3)(e).

1 Fees for the supply of building application services that relate to water and sewerage services

The table in this clause sets out fees for the supply of building application services that relate to water and sewerage services.

Fees for the supply of building application services that relate to water and sewerage services |

Item | Supply of the building application service of dealing with a notice to construct or alter … | Fee |

1 | a residential building | $124.37 per residential unit |

2 | an outbuilding to a single residential building, including pools, garages and pergolas (in sewered areas only) | $36.31 |

3 | a multi‑residential unit building | $124.37 per residential unit |

4 | a building other than a residential building or a multi‑residential unit building at a cost of: | |

(a) not more than $22,500 (sewered area only) | $25.00 |

(b) more than $22,500 but not more than $200,000 | $85.00 |

(c) more than $200,000 but not more than $500,000 | $330.00 |

(d) more than $500,000 but not more than $1 million | $550.00 |

5 | a building other than a residential building or a multi‑residential unit building at a cost of more than $1 million but not more than $10 million | $0.90 per $1,000 of the building cost |

6 | a building other than a residential building or a multi‑residential unit building at a cost of more than $10 million | The sum of: (a) $9,000.00; and (b) $0.25 per $1,000 of the building cost over $10 million |