Compiled AASB Standard | AASB 16 |

Leases

This compiled Standard applies to annual periods beginning on or after 1 July 2021. Earlier application is permitted for annual periods beginning before 1 July 2021. It incorporates relevant amendments made up to and including 21 April 2021.

Prepared on 21 July 2021 by the staff of the Australian Accounting Standards Board.

Compilation no. 6

Compilation date: 30 June 2021

Obtaining copies of Accounting Standards

Compiled versions of Standards, original Standards and amending Standards (see Compilation Details) are available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

Website: www.aasb.gov.au

Other enquiries

Phone: (03) 9617 7600

E-mail: standard@aasb.gov.au

COPYRIGHT

© Commonwealth of Australia 2021

This compiled AASB Standard contains IFRS Foundation copyright material. Reproduction within Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use subject to the inclusion of an acknowledgment of the source. Requests and enquiries concerning reproduction and rights for commercial purposes within Australia should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

All existing rights in this material are reserved outside Australia. Reproduction outside Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use only. Further information and requests for authorisation to reproduce for commercial purposes outside Australia should be addressed to the IFRS Foundation at www.ifrs.org.

Contents

COMPARISON WITH IFRS 16

ACCOUNTING STANDARD

AASB 16 LEASES

from paragraph

Objective 1

Scope 3

Recognition exemptions 5

Identifying a lease 9

Separating components of a contract 12

Lessee 13

Lessor 17

Lease term 18

Lessee

Recognition 22

Measurement

Initial measurement

Initial measurement of the right-of-use asset 23

Initial measurement of the lease liability 26

Subsequent measurement

Subsequent measurement of the right-of-use asset 29

Subsequent measurement of the lease liability 36

Lease modifications 44

Presentation 47

Disclosure 51

Lessor

Classification of leases 61

Finance leases

Recognition and measurement 67

Initial measurement 68

Subsequent measurement 75

Operating leases

Recognition and measurement 81

Lease modifications 87

Presentation 88

Disclosure 89

Finance leases 93

Operating leases 95

Sale and leaseback transactions 98

Assessing whether the transfer of the asset is a sale 99

Transfer of the asset is a sale 100

Transfer of the asset is not a sale 103

Commencement of the legislative instrument

Temporary exception arising from interest rate benchmark reform 104

Appendices

A Defined terms

B Application guidance

C Effective date and transition

D Amendments to other Standards

E Australian simplified disclosures for Tier 2 entities

COMPILATION DETAILS

Deleted IFRS 16 text

basis for conclusions on AASB 2018-8

basis for conclusions on AASB 2019-8

Available on the AASB website

Illustrative examples for IFRS 16

Basis for Conclusions on IFRS 16

Australian Accounting Standard AASB 16 Leases (as amended) is set out in paragraphs 1 – 106 and Appendices A – E. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. Terms defined in Appendix A are in italics the first time they appear in the Standard. AASB 16 is to be read in the context of other Australian Accounting Standards, including AASB 1048 Interpretation of Standards, which identifies the Australian Accounting Interpretations, and AASB 1057 Application of Australian Accounting Standards. In the absence of explicit guidance, AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies.

Comparison with IFRS 16

AASB 16 Leases as amended incorporates IFRS 16 Leases as issued and amended by the International Accounting Standards Board (IASB). Australian‑specific paragraphs (which are not included in IFRS 16) are identified with the prefix “Aus”. Paragraphs that apply only to not-for-profit entities begin by identifying their limited applicability.

Tier 1

For-profit entities complying with AASB 16 also comply with IFRS 16.

Not-for-profit entities’ compliance with IFRS 16 will depend on whether any “Aus” paragraphs that specifically apply to not-for-profit entities provide additional guidance or contain applicable requirements that are inconsistent with IFRS 16.

Tier 2

Entities preparing general purpose financial statements under Australian Accounting Standards – Simplified Disclosures (Tier 2) will not be in compliance with IFRS Standards.

AASB 1053 Application of Tiers of Australian Accounting Standards explains the two tiers of reporting requirements.

Accounting Standard AASB 16

The Australian Accounting Standards Board made Accounting Standard AASB 16 Leases under section 334 of the Corporations Act 2001 on 23 February 2016.

This compiled version of AASB 16 applies to annual periods beginning on or after 1 July 2021. It incorporates relevant amendments contained in other AASB Standards made by the AASB up to and including 21 April 2021 (see Compilation Details).

Accounting Standard AASB 16

Leases

Objective

1 This Standard sets out the principles for the recognition, measurement, presentation and disclosure of leases. The objective is to ensure that lessees and lessors provide relevant information in a manner that faithfully represents those transactions. This information gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of an entity.

2 An entity shall consider the terms and conditions of contracts and all relevant facts and circumstances when applying this Standard. An entity shall apply this Standard consistently to contracts with similar characteristics and in similar circumstances.

Scope

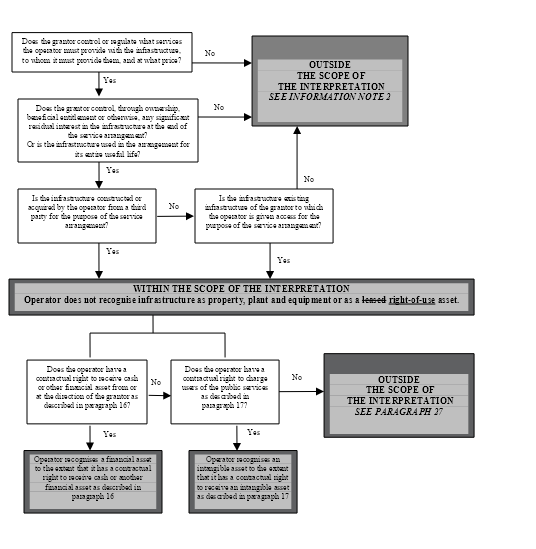

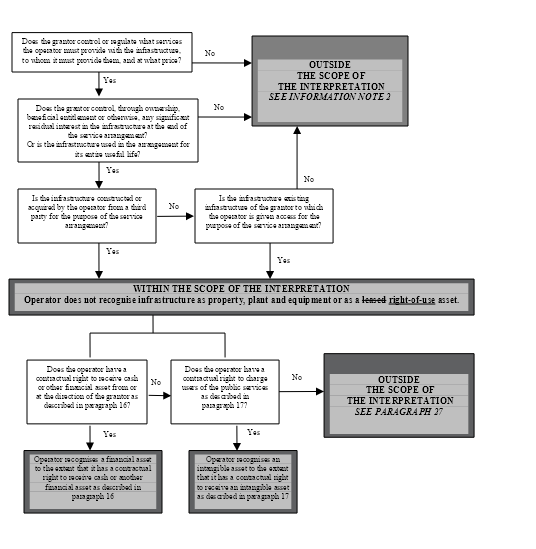

3 An entity shall apply this Standard to all leases, including leases of right-of-use assets in a sublease, except for:

(a) leases to explore for or use minerals, oil, natural gas and similar non-regenerative resources;

(b) leases of biological assets within the scope of AASB 141 Agriculture held by a lessee;

(c) service concession arrangements within the scope of Interpretation 12 Service Concession Arrangements;

(d) licences of intellectual property granted by a lessor within the scope of AASB 15 Revenue from Contracts with Customers; and

(e) rights held by a lessee under licensing agreements within the scope of AASB 138 Intangible Assets for such items as motion picture films, video recordings, plays, manuscripts, patents and copyrights.

Aus3.1 This Standard does not apply to service concession assets recognised in accordance with AASB 1059 Service Concession Arrangements: Grantors.

Aus3.1 Notwithstanding paragraph 3, in respect of not-for-profit public sector licensors, this Standard also applies to licences that are in substance leases or contain leases, excluding licences of intellectual property. AASB 15 applies to licences of intellectual property. AASB 15 also applies to licences of non-intellectual property that, in substance, are not leases or do not contain leases.

4 A lessee may, but is not required to, apply this Standard to leases of intangible assets other than those described in paragraph 3(e).

Recognition exemptions (paragraphs B3–B8)

5 A lessee may elect not to apply the requirements in paragraphs 22–49 to:

(a) short-term leases; and

(b) leases for which the underlying asset is of low value (as described in paragraphs B3–B8).

6 If a lessee elects not to apply the requirements in paragraphs 22–49 to either short-term leases or leases for which the underlying asset is of low value, the lessee shall recognise the lease payments associated with those leases as an expense on either a straight-line basis over the lease term or another systematic basis. The lessee shall apply another systematic basis if that basis is more representative of the pattern of the lessee’s benefit.

7 If a lessee accounts for short-term leases applying paragraph 6, the lessee shall consider the lease to be a new lease for the purposes of this Standard if:

(a) there is a lease modification; or

(b) there is any change in the lease term (for example, the lessee exercises an option not previously included in its determination of the lease term).

8 The election for short-term leases shall be made by class of underlying asset to which the right of use relates. A class of underlying asset is a grouping of underlying assets of a similar nature and use in an entity’s operations. The election for leases for which the underlying asset is of low value can be made on a lease-by-lease basis.

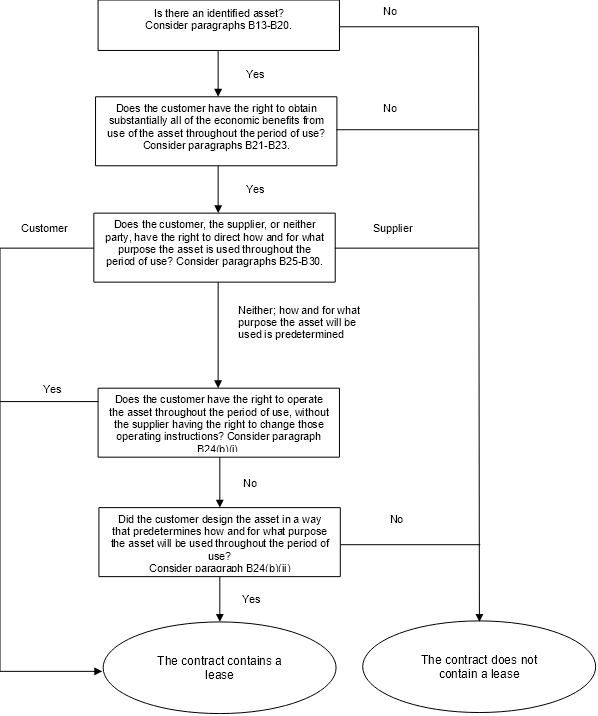

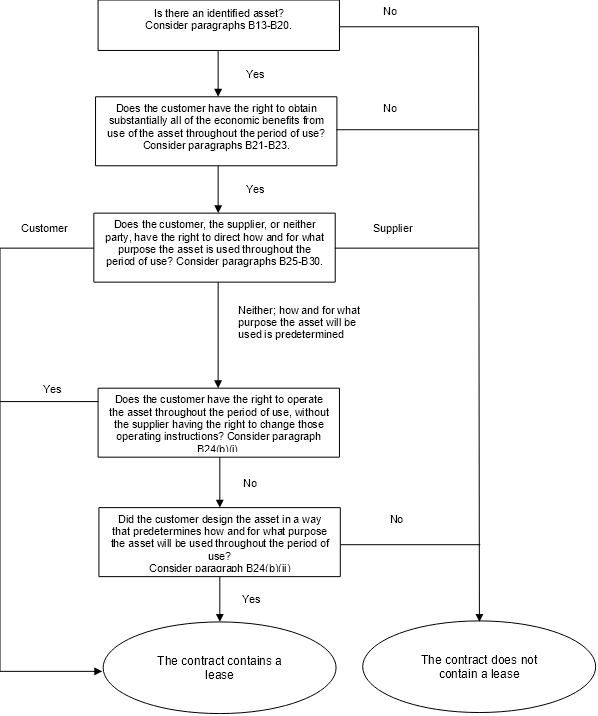

Identifying a lease (paragraphs B9–B33)

9 At inception of a contract, an entity shall assess whether the contract is, or contains, a lease. A contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. Paragraphs B9–B31 set out guidance on the assessment of whether a contract is, or contains, a lease.

10 A period of time may be described in terms of the amount of use of an identified asset (for example, the number of production units that an item of equipment will be used to produce).

11 An entity shall reassess whether a contract is, or contains, a lease only if the terms and conditions of the contract are changed.

Separating components of a contract

12 For a contract that is, or contains, a lease, an entity shall account for each lease component within the contract as a lease separately from non-lease components of the contract, unless the entity applies the practical expedient in paragraph 15. Paragraphs B32–B33 set out guidance on separating components of a contract.

Lessee

13 For a contract that contains a lease component and one or more additional lease or non-lease components, a lessee shall allocate the consideration in the contract to each lease component on the basis of the relative stand-alone price of the lease component and the aggregate stand-alone price of the non-lease components.

14 The relative stand-alone price of lease and non-lease components shall be determined on the basis of the price the lessor, or a similar supplier, would charge an entity for that component, or a similar component, separately. If an observable stand-alone price is not readily available, the lessee shall estimate the stand-alone price, maximising the use of observable information.

15 As a practical expedient, a lessee may elect, by class of underlying asset, not to separate non-lease components from lease components, and instead account for each lease component and any associated non-lease components as a single lease component. A lessee shall not apply this practical expedient to embedded derivatives that meet the criteria in paragraph 4.3.3 of AASB 9 Financial Instruments.

16 Unless the practical expedient in paragraph 15 is applied, a lessee shall account for non-lease components applying other applicable Standards.

Lessor

17 For a contract that contains a lease component and one or more additional lease or non-lease components, a lessor shall allocate the consideration in the contract applying paragraphs 73–90 of AASB 15.

Lease term (paragraphs B34–B41)

18 An entity shall determine the lease term as the non-cancellable period of a lease, together with both:

(a) periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option; and

(b) periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option.

19 In assessing whether a lessee is reasonably certain to exercise an option to extend a lease, or not to exercise an option to terminate a lease, an entity shall consider all relevant facts and circumstances that create an economic incentive for the lessee to exercise the option to extend the lease, or not to exercise the option to terminate the lease, as described in paragraphs B37–B40.

20 A lessee shall reassess whether it is reasonably certain to exercise an extension option, or not to exercise a termination option, upon the occurrence of either a significant event or a significant change in circumstances that:

(a) is within the control of the lessee; and

(b) affects whether the lessee is reasonably certain to exercise an option not previously included in its determination of the lease term, or not to exercise an option previously included in its determination of the lease term (as described in paragraph B41).

21 An entity shall revise the lease term if there is a change in the non-cancellable period of a lease. For example, the non-cancellable period of a lease will change if:

(a) the lessee exercises an option not previously included in the entity’s determination of the lease term;

(b) the lessee does not exercise an option previously included in the entity’s determination of the lease term;

(c) an event occurs that contractually obliges the lessee to exercise an option not previously included in the entity’s determination of the lease term; or

(d) an event occurs that contractually prohibits the lessee from exercising an option previously included in the entity’s determination of the lease term.

Lessee

Recognition

22 At the commencement date, a lessee shall recognise a right-of-use asset and a lease liability.

Measurement

Initial measurement

Initial measurement of the right-of-use asset

23 At the commencement date, a lessee shall measure the right-of-use asset at cost.

24 The cost of the right-of-use asset shall comprise:

(a) the amount of the initial measurement of the lease liability, as described in paragraph 26;

(b) any lease payments made at or before the commencement date, less any lease incentives received;

(c) any initial direct costs incurred by the lessee; and

(d) an estimate of costs to be incurred by the lessee in dismantling and removing the underlying asset, restoring the site on which it is located or restoring the underlying asset to the condition required by the terms and conditions of the lease, unless those costs are incurred to produce inventories. The lessee incurs the obligation for those costs either at the commencement date or as a consequence of having used the underlying asset during a particular period.

25 A lessee shall recognise the costs described in paragraph 24(d) as part of the cost of the right-of-use asset when it incurs an obligation for those costs. A lessee applies AASB 102 Inventories to costs that are incurred during a particular period as a consequence of having used the right-of-use asset to produce inventories during that period. The obligations for such costs accounted for applying this Standard or AASB 102 are recognised and measured applying AASB 137 Provisions, Contingent Liabilities and Contingent Assets.

Aus25.1 Notwithstanding paragraphs 23–25, where the lessee is a not-for-profit entity, the lessee may elect to measure right-of-use assets on a class‑by‑class basis at initial recognition at fair value in accordance with AASB 13 Fair Value Measurement for leases that have significantly below-market terms and conditions principally to enable the entity to further its objectives. AASB 1058 Income of Not-for-Profit Entities addresses the recognition of related amounts.

Aus25.2 Right-of-use assets arising under leases that have significantly below-market terms and conditions principally to enable a not-for-profit entity to further its objectives may be treated as a separate class of right-of-use assets to right-of-use assets arising under other leases, despite their similar nature and use in the entity’s operations. Identifying separate classes of right-of-use assets despite their similar nature and use in the entity’s operations applies for the purposes of this Standard and other Standards that refer to classes of assets. However, this approach shall not be applied by analogy to distinguish sub-classes of other assets as separate classes of assets.

Initial measurement of the lease liability

26 At the commencement date, a lessee shall measure the lease liability at the present value of the lease payments that are not paid at that date. The lease payments shall be discounted using the interest rate implicit in the lease, if that rate can be readily determined. If that rate cannot be readily determined, the lessee shall use the lessee’s incremental borrowing rate.

27 At the commencement date, the lease payments included in the measurement of the lease liability comprise the following payments for the right to use the underlying asset during the lease term that are not paid at the commencement date:

(a) fixed payments (including in-substance fixed payments as described in paragraph B42), less any lease incentives receivable;

(b) variable lease payments that depend on an index or a rate, initially measured using the index or rate as at the commencement date (as described in paragraph 28);

(c) amounts expected to be payable by the lessee under residual value guarantees;

(d) the exercise price of a purchase option if the lessee is reasonably certain to exercise that option (assessed considering the factors described in paragraphs B37–B40); and

(e) payments of penalties for terminating the lease, if the lease term reflects the lessee exercising an option to terminate the lease.

28 Variable lease payments that depend on an index or a rate described in paragraph 27(b) include, for example, payments linked to a consumer price index, payments linked to a benchmark interest rate (such as LIBOR) or payments that vary to reflect changes in market rental rates.

Subsequent measurement

Subsequent measurement of the right-of-use asset

29 After the commencement date, a lessee shall measure the right-of-use asset applying a cost model, unless it applies either of the measurement models described in paragraphs 34 and 35.

Cost model

30 To apply a cost model, a lessee shall measure the right-of-use asset at cost:

(a) less any accumulated depreciation and any accumulated impairment losses; and

(b) adjusted for any remeasurement of the lease liability specified in paragraph 36(c).

31 A lessee shall apply the depreciation requirements in AASB 116 Property, Plant and Equipment in depreciating the right-of-use asset, subject to the requirements in paragraph 32.

32 If the lease transfers ownership of the underlying asset to the lessee by the end of the lease term or if the cost of the right-of-use asset reflects that the lessee will exercise a purchase option, the lessee shall depreciate the right-of-use asset from the commencement date to the end of the useful life of the underlying asset. Otherwise, the lessee shall depreciate the right-of-use asset from the commencement date to the earlier of the end of the useful life of the right-of-use asset or the end of the lease term.

33 A lessee shall apply AASB 136 Impairment of Assets to determine whether the right-of-use asset is impaired and to account for any impairment loss identified.

Other measurement models

34 If a lessee applies the fair value model in AASB 140 Investment Property to its investment property, the lessee shall also apply that fair value model to right-of-use assets that meet the definition of investment property in AASB 140.

35 If right-of-use assets relate to a class of property, plant and equipment to which the lessee applies the revaluation model in AASB 116, a lessee may elect to apply that revaluation model to all of the right-of-use assets that relate to that class of property, plant and equipment.

Aus35.1 Notwithstanding paragraph 35, a not-for-profit public sector entity may elect to measure a class of right-of-use assets at cost or at fair value if the entity applies the revaluation model in AASB 116 to the related class of property, plant and equipment.

Subsequent measurement of the lease liability

36 After the commencement date, a lessee shall measure the lease liability by:

(a) increasing the carrying amount to reflect interest on the lease liability;

(b) reducing the carrying amount to reflect the lease payments made; and

(c) remeasuring the carrying amount to reflect any reassessment or lease modifications specified in paragraphs 39–46, or to reflect revised in-substance fixed lease payments (see paragraph B42).

37 Interest on the lease liability in each period during the lease term shall be the amount that produces a constant periodic rate of interest on the remaining balance of the lease liability. The periodic rate of interest is the discount rate described in paragraph 26, or if applicable the revised discount rate described in paragraph 41, paragraph 43 or paragraph 45(c).

38 After the commencement date, a lessee shall recognise in profit or loss, unless the costs are included in the carrying amount of another asset applying other applicable Standards, both:

(a) interest on the lease liability; and

(b) variable lease payments not included in the measurement of the lease liability in the period in which the event or condition that triggers those payments occurs.

Reassessment of the lease liability

39 After the commencement date, a lessee shall apply paragraphs 40–43 to remeasure the lease liability to reflect changes to the lease payments. A lessee shall recognise the amount of the remeasurement of the lease liability as an adjustment to the right-of-use asset. However, if the carrying amount of the right-of-use asset is reduced to zero and there is a further reduction in the measurement of the lease liability, a lessee shall recognise any remaining amount of the remeasurement in profit or loss.

40 A lessee shall remeasure the lease liability by discounting the revised lease payments using a revised discount rate, if either:

(a) there is a change in the lease term, as described in paragraphs 20–21. A lessee shall determine the revised lease payments on the basis of the revised lease term; or

(b) there is a change in the assessment of an option to purchase the underlying asset, assessed considering the events and circumstances described in paragraphs 20–21 in the context of a purchase option. A lessee shall determine the revised lease payments to reflect the change in amounts payable under the purchase option.

41 In applying paragraph 40, a lessee shall determine the revised discount rate as the interest rate implicit in the lease for the remainder of the lease term, if that rate can be readily determined, or the lessee’s incremental borrowing rate at the date of reassessment, if the interest rate implicit in the lease cannot be readily determined.

42 A lessee shall remeasure the lease liability by discounting the revised lease payments, if either:

(a) there is a change in the amounts expected to be payable under a residual value guarantee. A lessee shall determine the revised lease payments to reflect the change in amounts expected to be payable under the residual value guarantee.

(b) there is a change in future lease payments resulting from a change in an index or a rate used to determine those payments, including for example a change to reflect changes in market rental rates following a market rent review. The lessee shall remeasure the lease liability to reflect those revised lease payments only when there is a change in the cash flows (ie when the adjustment to the lease payments takes effect). A lessee shall determine the revised lease payments for the remainder of the lease term based on the revised contractual payments.

43 In applying paragraph 42, a lessee shall use an unchanged discount rate, unless the change in lease payments results from a change in floating interest rates. In that case, the lessee shall use a revised discount rate that reflects changes in the interest rate.

Lease modifications

44 A lessee shall account for a lease modification as a separate lease if both:

(a) the modification increases the scope of the lease by adding the right to use one or more underlying assets; and

(b) the consideration for the lease increases by an amount commensurate with the stand-alone price for the increase in scope and any appropriate adjustments to that stand-alone price to reflect the circumstances of the particular contract.

45 For a lease modification that is not accounted for as a separate lease, at the effective date of the lease modification a lessee shall:

(a) allocate the consideration in the modified contract applying paragraphs 13–16;

(b) determine the lease term of the modified lease applying paragraphs 18–19; and

(c) remeasure the lease liability by discounting the revised lease payments using a revised discount rate. The revised discount rate is determined as the interest rate implicit in the lease for the remainder of the lease term, if that rate can be readily determined, or the lessee’s incremental borrowing rate at the effective date of the modification, if the interest rate implicit in the lease cannot be readily determined.

46 For a lease modification that is not accounted for as a separate lease, the lessee shall account for the remeasurement of the lease liability by:

(a) decreasing the carrying amount of the right-of-use asset to reflect the partial or full termination of the lease for lease modifications that decrease the scope of the lease. The lessee shall recognise in profit or loss any gain or loss relating to the partial or full termination of the lease.

(b) making a corresponding adjustment to the right-of-use asset for all other lease modifications.

46A As a practical expedient, a lessee may elect not to assess whether a rent concession that meets the conditions in paragraph 46B is a lease modification. A lessee that makes this election shall account for any change in lease payments resulting from the rent concession the same way it would account for the change applying this Standard if the change were not a lease modification.

46B The practical expedient in paragraph 46A applies only to rent concessions occurring as a direct consequence of the covid-19 pandemic and only if all of the following conditions are met:

(a) the change in lease payments results in revised consideration for the lease that is substantially the same as, or less than, the consideration for the lease immediately preceding the change;

(b) any reduction in lease payments affects only payments originally due on or before 30 June 2022 (for example, a rent concession would meet this condition if it results in reduced lease payments on or before 30 June 2022 and increased lease payments that extend beyond 30 June 2022); and

(c) there is no substantive change to other terms and conditions of the lease.

Presentation

47 A lessee shall either present in the statement of financial position, or disclose in the notes:

(a) right-of-use assets separately from other assets. If a lessee does not present right-of-use assets separately in the statement of financial position, the lessee shall:

(i) include right-of-use assets within the same line item as that within which the corresponding underlying assets would be presented if they were owned; and

(ii) disclose which line items in the statement of financial position include those right-of-use assets.

(b) lease liabilities separately from other liabilities. If the lessee does not present lease liabilities separately in the statement of financial position, the lessee shall disclose which line items in the statement of financial position include those liabilities.

48 The requirement in paragraph 47(a) does not apply to right-of-use assets that meet the definition of investment property, which shall be presented in the statement of financial position as investment property.

49 In the statement of profit or loss and other comprehensive income, a lessee shall present interest expense on the lease liability separately from the depreciation charge for the right-of-use asset. Interest expense on the lease liability is a component of finance costs, which paragraph 82(b) of AASB 101 Presentation of Financial Statements requires to be presented separately in the statement of profit or loss and other comprehensive income.

50 In the statement of cash flows, a lessee shall classify:

(a) cash payments for the principal portion of the lease liability within financing activities;

(b) cash payments for the interest portion of the lease liability applying the requirements in AASB 107 Statement of Cash Flows for interest paid; and

(c) short-term lease payments, payments for leases of low-value assets and variable lease payments not included in the measurement of the lease liability within operating activities.

Disclosure

51 The objective of the disclosures is for lessees to disclose information in the notes that, together with the information provided in the statement of financial position, statement of profit or loss and statement of cash flows, gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of the lessee. Paragraphs 52–60 specify requirements on how to meet this objective.

52 A lessee shall disclose information about its leases for which it is a lessee in a single note or separate section in its financial statements. However, a lessee need not duplicate information that is already presented elsewhere in the financial statements, provided that the information is incorporated by cross-reference in the single note or separate section about leases.

53 A lessee shall disclose the following amounts for the reporting period:

(a) depreciation charge for right-of-use assets by class of underlying asset;

(b) interest expense on lease liabilities;

(c) the expense relating to short-term leases accounted for applying paragraph 6. This expense need not include the expense relating to leases with a lease term of one month or less;

(d) the expense relating to leases of low-value assets accounted for applying paragraph 6. This expense shall not include the expense relating to short-term leases of low-value assets included in paragraph 53(c);

(e) the expense relating to variable lease payments not included in the measurement of lease liabilities;

(f) income from subleasing right-of-use assets;

(g) total cash outflow for leases;

(h) additions to right-of-use assets;

(i) gains or losses arising from sale and leaseback transactions; and

(j) the carrying amount of right-of-use assets at the end of the reporting period by class of underlying asset.

54 A lessee shall provide the disclosures specified in paragraph 53 in a tabular format, unless another format is more appropriate. The amounts disclosed shall include costs that a lessee has included in the carrying amount of another asset during the reporting period.

55 A lessee shall disclose the amount of its lease commitments for short-term leases accounted for applying paragraph 6 if the portfolio of short-term leases to which it is committed at the end of the reporting period is dissimilar to the portfolio of short-term leases to which the short-term lease expense disclosed applying paragraph 53(c) relates.

56 If right-of-use assets meet the definition of investment property, a lessee shall apply the disclosure requirements in AASB 140. In that case, a lessee is not required to provide the disclosures in paragraph 53(a), (f), (h) or (j) for those right-of-use assets.

57 If a lessee measures right-of-use assets at revalued amounts applying AASB 116, the lessee shall disclose the information required by paragraph 77 of AASB 116 for those right-of-use assets.

58 A lessee shall disclose a maturity analysis of lease liabilities applying paragraphs 39 and B11 of AASB 7 Financial Instruments: Disclosures separately from the maturity analyses of other financial liabilities.

59 In addition to the disclosures required in paragraphs 53–58, a lessee shall disclose additional qualitative and quantitative information about its leasing activities necessary to meet the disclosure objective in paragraph 51 (as described in paragraph B48). This additional information may include, but is not limited to, information that helps users of financial statements to assess:

(a) the nature of the lessee’s leasing activities;

(b) future cash outflows to which the lessee is potentially exposed that are not reflected in the measurement of lease liabilities. This includes exposure arising from:

(i) variable lease payments (as described in paragraph B49);

(ii) extension options and termination options (as described in paragraph B50);

(iii) residual value guarantees (as described in paragraph B51); and

(iv) leases not yet commenced to which the lessee is committed.

(c) restrictions or covenants imposed by leases; and

(d) sale and leaseback transactions (as described in paragraph B52).

Aus59.1 In addition to the disclosures required in paragraphs 53–59, where a lessee is a not-for-profit entity and elects to measure a class or classes of right-of-use assets at initial recognition at cost in accordance with paragraphs 23–25 for leases that have significantly below-market terms and conditions principally to enable the entity to further its objectives, the lessee shall disclose additional qualitative and quantitative information about those leases necessary to meet the disclosure objective in paragraph 51. This additional information shall include, but is not limited to, information that helps users of financial statements to assess:

(a) the entity’s dependence on leases that have significantly below-market terms and conditions principally to enable the entity to further its objectives; and

(b) the nature and terms of the leases, including:

(i) the lease payments;

(ii) the lease term;

(iii) a description of the underlying assets; and

(iv) restrictions on the use of the underlying assets specific to the entity.

Aus59.2 The disclosures provided by a not‑for‑profit entity in accordance with paragraph Aus59.1 shall be provided individually for each material lease that has significantly below-market terms and conditions principally to enable the entity to further its objectives or in aggregate for leases involving right-of-use assets of a similar nature. An entity shall consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the various requirements. An entity shall aggregate or disaggregate disclosures so that useful information is not obscured by either the inclusion of a large amount of insignificant detail or the aggregation of items that have substantially different characteristics.

60 A lessee that accounts for short-term leases or leases of low-value assets applying paragraph 6 shall disclose that fact.

60A If a lessee applies the practical expedient in paragraph 46A, the lessee shall disclose:

(a) that it has applied the practical expedient to all rent concessions that meet the conditions in paragraph 46B or, if not applied to all such rent concessions, information about the nature of the contracts to which it has applied the practical expedient (see paragraph 2); and

(b) the amount recognised in profit or loss for the reporting period to reflect changes in lease payments that arise from rent concessions to which the lessee has applied the practical expedient in paragraph 46A.

Lessor

Classification of leases (paragraphs B53–B58)

61 A lessor shall classify each of its leases as either an operating lease or a finance lease.

62 A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership of an underlying asset. A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset.

63 Whether a lease is a finance lease or an operating lease depends on the substance of the transaction rather than the form of the contract. Examples of situations that individually or in combination would normally lead to a lease being classified as a finance lease are:

(a) the lease transfers ownership of the underlying asset to the lessee by the end of the lease term;

(b) the lessee has the option to purchase the underlying asset at a price that is expected to be sufficiently lower than the fair value at the date the option becomes exercisable for it to be reasonably certain, at the inception date, that the option will be exercised;

(c) the lease term is for the major part of the economic life of the underlying asset even if title is not transferred;

(d) at the inception date, the present value of the lease payments amounts to at least substantially all of the fair value of the underlying asset; and

(e) the underlying asset is of such a specialised nature that only the lessee can use it without major modifications.

64 Indicators of situations that individually or in combination could also lead to a lease being classified as a finance lease are:

(a) if the lessee can cancel the lease, the lessor’s losses associated with the cancellation are borne by the lessee;

(b) gains or losses from the fluctuation in the fair value of the residual accrue to the lessee (for example, in the form of a rent rebate equaling most of the sales proceeds at the end of the lease); and

(c) the lessee has the ability to continue the lease for a secondary period at a rent that is substantially lower than market rent.

65 The examples and indicators in paragraphs 63–64 are not always conclusive. If it is clear from other features that the lease does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset, the lease is classified as an operating lease. For example, this may be the case if ownership of the underlying asset transfers at the end of the lease for a variable payment equal to its then fair value, or if there are variable lease payments, as a result of which the lessor does not transfer substantially all such risks and rewards.

66 Lease classification is made at the inception date and is reassessed only if there is a lease modification. Changes in estimates (for example, changes in estimates of the economic life or of the residual value of the underlying asset), or changes in circumstances (for example, default by the lessee), do not give rise to a new classification of a lease for accounting purposes.

Finance leases

Recognition and measurement

67 At the commencement date, a lessor shall recognise assets held under a finance lease in its statement of financial position and present them as a receivable at an amount equal to the net investment in the lease.

Initial measurement

68 The lessor shall use the interest rate implicit in the lease to measure the net investment in the lease. In the case of a sublease, if the interest rate implicit in the sublease cannot be readily determined, an intermediate lessor may use the discount rate used for the head lease (adjusted for any initial direct costs associated with the sublease) to measure the net investment in the sublease.

69 Initial direct costs, other than those incurred by manufacturer or dealer lessors, are included in the initial measurement of the net investment in the lease and reduce the amount of income recognised over the lease term. The interest rate implicit in the lease is defined in such a way that the initial direct costs are included automatically in the net investment in the lease; there is no need to add them separately.

Initial measurement of the lease payments included in the net investment in the lease

70 At the commencement date, the lease payments included in the measurement of the net investment in the lease comprise the following payments for the right to use the underlying asset during the lease term that are not received at the commencement date:

(a) fixed payments (including in-substance fixed payments as described in paragraph B42), less any lease incentives payable;

(b) variable lease payments that depend on an index or a rate, initially measured using the index or rate as at the commencement date;

(c) any residual value guarantees provided to the lessor by the lessee, a party related to the lessee or a third party unrelated to the lessor that is financially capable of discharging the obligations under the guarantee;

(d) the exercise price of a purchase option if the lessee is reasonably certain to exercise that option (assessed considering the factors described in paragraph B37); and

(e) payments of penalties for terminating the lease, if the lease term reflects the lessee exercising an option to terminate the lease.

Manufacturer or dealer lessors

71 At the commencement date, a manufacturer or dealer lessor shall recognise the following for each of its finance leases:

(a) revenue being the fair value of the underlying asset, or, if lower, the present value of the lease payments accruing to the lessor, discounted using a market rate of interest;

(b) the cost of sale being the cost, or carrying amount if different, of the underlying asset less the present value of the unguaranteed residual value; and

(c) selling profit or loss (being the difference between revenue and the cost of sale) in accordance with its policy for outright sales to which AASB 15 applies. A manufacturer or dealer lessor shall recognise selling profit or loss on a finance lease at the commencement date, regardless of whether the lessor transfers the underlying asset as described in AASB 15.

72 Manufacturers or dealers often offer to customers the choice of either buying or leasing an asset. A finance lease of an asset by a manufacturer or dealer lessor gives rise to profit or loss equivalent to the profit or loss resulting from an outright sale of the underlying asset, at normal selling prices, reflecting any applicable volume or trade discounts.

73 Manufacturer or dealer lessors sometimes quote artificially low rates of interest in order to attract customers. The use of such a rate would result in a lessor recognising an excessive portion of the total income from the transaction at the commencement date. If artificially low rates of interest are quoted, a manufacturer or dealer lessor shall restrict selling profit to that which would apply if a market rate of interest were charged.

74 A manufacturer or dealer lessor shall recognise as an expense costs incurred in connection with obtaining a finance lease at the commencement date because they are mainly related to earning the manufacturer or dealer’s selling profit. Costs incurred by manufacturer or dealer lessors in connection with obtaining a finance lease are excluded from the definition of initial direct costs and, thus, are excluded from the net investment in the lease.

Subsequent measurement

75 A lessor shall recognise finance income over the lease term, based on a pattern reflecting a constant periodic rate of return on the lessor’s net investment in the lease.

76 A lessor aims to allocate finance income over the lease term on a systematic and rational basis. A lessor shall apply the lease payments relating to the period against the gross investment in the lease to reduce both the principal and the unearned finance income.

77 A lessor shall apply the derecognition and impairment requirements in AASB 9 to the net investment in the lease. A lessor shall review regularly estimated unguaranteed residual values used in computing the gross investment in the lease. If there has been a reduction in the estimated unguaranteed residual value, the lessor shall revise the income allocation over the lease term and recognise immediately any reduction in respect of amounts accrued.

78 A lessor that classifies an asset under a finance lease as held for sale (or includes it in a disposal group that is classified as held for sale) applying AASB 5 Non-current Assets Held for Sale and Discontinued Operations shall account for the asset in accordance with that Standard.

Lease modifications

79 A lessor shall account for a modification to a finance lease as a separate lease if both:

(a) the modification increases the scope of the lease by adding the right to use one or more underlying assets; and

(b) the consideration for the lease increases by an amount commensurate with the stand-alone price for the increase in scope and any appropriate adjustments to that stand-alone price to reflect the circumstances of the particular contract.

80 For a modification to a finance lease that is not accounted for as a separate lease, a lessor shall account for the modification as follows:

(a) if the lease would have been classified as an operating lease had the modification been in effect at the inception date, the lessor shall:

(i) account for the lease modification as a new lease from the effective date of the modification; and

(ii) measure the carrying amount of the underlying asset as the net investment in the lease immediately before the effective date of the lease modification.

(b) otherwise, the lessor shall apply the requirements of AASB 9.

Operating leases

Recognition and measurement

81 A lessor shall recognise lease payments from operating leases as income on either a straight-line basis or another systematic basis. The lessor shall apply another systematic basis if that basis is more representative of the pattern in which benefit from the use of the underlying asset is diminished.

82 A lessor shall recognise costs, including depreciation, incurred in earning the lease income as an expense.

83 A lessor shall add initial direct costs incurred in obtaining an operating lease to the carrying amount of the underlying asset and recognise those costs as an expense over the lease term on the same basis as the lease income.

84 The depreciation policy for depreciable underlying assets subject to operating leases shall be consistent with the lessor’s normal depreciation policy for similar assets. A lessor shall calculate depreciation in accordance with AASB 116 and AASB 138.

85 A lessor shall apply AASB 136 to determine whether an underlying asset subject to an operating lease is impaired and to account for any impairment loss identified.

86 A manufacturer or dealer lessor does not recognise any selling profit on entering into an operating lease because it is not the equivalent of a sale.

Lease modifications

87 A lessor shall account for a modification to an operating lease as a new lease from the effective date of the modification, considering any prepaid or accrued lease payments relating to the original lease as part of the lease payments for the new lease.

Presentation

88 A lessor shall present underlying assets subject to operating leases in its statement of financial position according to the nature of the underlying asset.

Disclosure

89 The objective of the disclosures is for lessors to disclose information in the notes that, together with the information provided in the statement of financial position, statement of profit or loss and statement of cash flows, gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of the lessor. Paragraphs 90–97 specify requirements on how to meet this objective.

90 A lessor shall disclose the following amounts for the reporting period:

(a) for finance leases:

(i) selling profit or loss;

(ii) finance income on the net investment in the lease; and

(iii) income relating to variable lease payments not included in the measurement of the net investment in the lease.

(b) for operating leases, lease income, separately disclosing income relating to variable lease payments that do not depend on an index or a rate.

91 A lessor shall provide the disclosures specified in paragraph 90 in a tabular format, unless another format is more appropriate.

92 A lessor shall disclose additional qualitative and quantitative information about its leasing activities necessary to meet the disclosure objective in paragraph 89. This additional information includes, but is not limited to, information that helps users of financial statements to assess:

(a) the nature of the lessor’s leasing activities; and

(b) how the lessor manages the risk associated with any rights it retains in underlying assets. In particular, a lessor shall disclose its risk management strategy for the rights it retains in underlying assets, including any means by which the lessor reduces that risk. Such means may include, for example, buy-back agreements, residual value guarantees or variable lease payments for use in excess of specified limits.

Finance leases

93 A lessor shall provide a qualitative and quantitative explanation of the significant changes in the carrying amount of the net investment in finance leases.

94 A lessor shall disclose a maturity analysis of the lease payments receivable, showing the undiscounted lease payments to be received on an annual basis for a minimum of each of the first five years and a total of the amounts for the remaining years. A lessor shall reconcile the undiscounted lease payments to the net investment in the lease. The reconciliation shall identify the unearned finance income relating to the lease payments receivable and any discounted unguaranteed residual value.

Operating leases

95 For items of property, plant and equipment subject to an operating lease, a lessor shall apply the disclosure requirements of AASB 116. In applying the disclosure requirements in AASB 116, a lessor shall disaggregate each class of property, plant and equipment into assets subject to operating leases and assets not subject to operating leases. Accordingly, a lessor shall provide the disclosures required by AASB 116 for assets subject to an operating lease (by class of underlying asset) separately from owned assets held and used by the lessor.

96 A lessor shall apply the disclosure requirements in AASB 136, AASB 138, AASB 140 and AASB 141 for assets subject to operating leases.

97 A lessor shall disclose a maturity analysis of lease payments, showing the undiscounted lease payments to be received on an annual basis for a minimum of each of the first five years and a total of the amounts for the remaining years.

Sale and leaseback transactions

98 If an entity (the seller-lessee) transfers an asset to another entity (the buyer-lessor) and leases that asset back from the buyer-lessor, both the seller-lessee and the buyer-lessor shall account for the transfer contract and the lease applying paragraphs 99–103.

Assessing whether the transfer of the asset is a sale

99 An entity shall apply the requirements for determining when a performance obligation is satisfied in AASB 15 to determine whether the transfer of an asset is accounted for as a sale of that asset.

Transfer of the asset is a sale

100 If the transfer of an asset by the seller-lessee satisfies the requirements of AASB 15 to be accounted for as a sale of the asset:

(a) the seller-lessee shall measure the right-of-use asset arising from the leaseback at the proportion of the previous carrying amount of the asset that relates to the right of use retained by the seller-lessee. Accordingly, the seller-lessee shall recognise only the amount of any gain or loss that relates to the rights transferred to the buyer-lessor.

(b) the buyer-lessor shall account for the purchase of the asset applying applicable Standards, and for the lease applying the lessor accounting requirements in this Standard.

101 If the fair value of the consideration for the sale of an asset does not equal the fair value of the asset, or if the payments for the lease are not at market rates, an entity shall make the following adjustments to measure the sale proceeds at fair value:

(a) any below-market terms shall be accounted for as a prepayment of lease payments; and

(b) any above-market terms shall be accounted for as additional financing provided by the buyer-lessor to the seller-lessee.

102 The entity shall measure any potential adjustment required by paragraph 101 on the basis of the more readily determinable of:

(a) the difference between the fair value of the consideration for the sale and the fair value of the asset; and

(b) the difference between the present value of the contractual payments for the lease and the present value of payments for the lease at market rates.

Transfer of the asset is not a sale

103 If the transfer of an asset by the seller-lessee does not satisfy the requirements of AASB 15 to be accounted for as a sale of the asset:

(a) the seller-lessee shall continue to recognise the transferred asset and shall recognise a financial liability equal to the transfer proceeds. It shall account for the financial liability applying AASB 9.

(b) the buyer-lessor shall not recognise the transferred asset and shall recognise a financial asset equal to the transfer proceeds. It shall account for the financial asset applying AASB 9.

Commencement of the legislative instrument

Aus103.1 [Repealed]

Temporary exception arising from interest rate benchmark reform

104 A lessee shall apply paragraphs 105–106 to all lease modifications that change the basis for determining future lease payments as a result of interest rate benchmark reform (see paragraphs 5.4.6 and 5.4.8 of AASB 9). These paragraphs apply only to such lease modifications. For this purpose, the term ‘interest rate benchmark reform’ refers to the market-wide reform of an interest rate benchmark as described in paragraph 6.8.2 of AASB 9.

105 As a practical expedient, a lessee shall apply paragraph 42 to account for a lease modification required by interest rate benchmark reform. This practical expedient applies only to such modifications. For this purpose, a lease modification is required by interest rate benchmark reform if, and only if, both of these conditions are met:

(a) the modification is necessary as a direct consequence of interest rate benchmark reform; and

(b) the new basis for determining the lease payments is economically equivalent to the previous basis (ie the basis immediately preceding the modification).

106 However, if lease modifications are made in addition to those lease modifications required by interest rate benchmark reform, a lessee shall apply the applicable requirements in this Standard to account for all lease modifications made at the same time, including those required by interest rate benchmark reform.

Appendix A

Defined terms

This appendix is an integral part of the Standard.

commencement date of the lease (commencement date) | The date on which a lessor makes an underlying asset available for use by a lessee. |

economic life | Either the period over which an asset is expected to be economically usable by one or more users or the number of production or similar units expected to be obtained from an asset by one or more users. |

effective date of the modification | The date when both parties agree to a lease modification. |

fair value | For the purpose of applying the lessor accounting requirements in this Standard, the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction. |

finance lease | A lease that transfers substantially all the risks and rewards incidental to ownership of an underlying asset. |

fixed payments | Payments made by a lessee to a lessor for the right to use an underlying asset during the lease term, excluding variable lease payments. |

gross investment in the lease | The sum of: (a) the lease payments receivable by a lessor under a finance lease; and (b) any unguaranteed residual value accruing to the lessor. |

inception date of the lease (inception date) | The earlier of the date of a lease agreement and the date of commitment by the parties to the principal terms and conditions of the lease. |

initial direct costs | Incremental costs of obtaining a lease that would not have been incurred if the lease had not been obtained, except for such costs incurred by a manufacturer or dealer lessor in connection with a finance lease. |

interest rate implicit in the lease | The rate of interest that causes the present value of (a) the lease payments and (b) the unguaranteed residual value to equal the sum of (i) the fair value of the underlying asset and (ii) any initial direct costs of the lessor. |

lease | A contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration. |

lease incentives | Payments made by a lessor to a lessee associated with a lease, or the reimbursement or assumption by a lessor of costs of a lessee. |

lease modification | A change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease (for example, adding or terminating the right to use one or more underlying assets, or extending or shortening the contractual lease term). |

lease payments | Payments made by a lessee to a lessor relating to the right to use an underlying asset during the lease term, comprising the following: (a) fixed payments (including in-substance fixed payments), less any lease incentives; (b) variable lease payments that depend on an index or a rate; (c) the exercise price of a purchase option if the lessee is reasonably certain to exercise that option; and (d) payments of penalties for terminating the lease, if the lease term reflects the lessee exercising an option to terminate the lease. For the lessee, lease payments also include amounts expected to be payable by the lessee under residual value guarantees. Lease payments do not include payments allocated to non-lease components of a contract, unless the lessee elects to combine non-lease components with a lease component and to account for them as a single lease component. For the lessor, lease payments also include any residual value guarantees provided to the lessor by the lessee, a party related to the lessee or a third party unrelated to the lessor that is financially capable of discharging the obligations under the guarantee. Lease payments do not include payments allocated to non-lease components. |

lease term | The non-cancellable period for which a lessee has the right to use an underlying asset, together with both: (a) periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option; and (b) periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option. |

lessee | An entity that obtains the right to use an underlying asset for a period of time in exchange for consideration. |

lessee’s incremental borrowing rate | The rate of interest that a lessee would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of a similar value to the right-of-use asset in a similar economic environment. |

lessor | An entity that provides the right to use an underlying asset for a period of time in exchange for consideration. |

net investment in the lease | The gross investment in the lease discounted at the interest rate implicit in the lease. |

operating lease | A lease that does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset. |

optional lease payments | Payments to be made by a lessee to a lessor for the right to use an underlying asset during periods covered by an option to extend or terminate a lease that are not included in the lease term. |

period of use | The total period of time that an asset is used to fulfil a contract with a customer (including any non-consecutive periods of time). |

residual value guarantee | A guarantee made to a lessor by a party unrelated to the lessor that the value (or part of the value) of an underlying asset at the end of a lease will be at least a specified amount. |

right-of-use asset | An asset that represents a lessee’s right to use an underlying asset for the lease term. |

short-term lease | A lease that, at the commencement date, has a lease term of 12 months or less. A lease that contains a purchase option is not a short-term lease. |

sublease | A transaction for which an underlying asset is re-leased by a lessee (‘intermediate lessor’) to a third party, and the lease (‘head lease’) between the head lessor and lessee remains in effect. |

underlying asset | An asset that is the subject of a lease, for which the right to use that asset has been provided by a lessor to a lessee. |

unearned finance income | The difference between: (a) the gross investment in the lease; and (b) the net investment in the lease. |

unguaranteed residual value | That portion of the residual value of the underlying asset, the realisation of which by a lessor is not assured or is guaranteed solely by a party related to the lessor. |

variable lease payments | The portion of payments made by a lessee to a lessor for the right to use an underlying asset during the lease term that varies because of changes in facts or circumstances occurring after the commencement date, other than the passage of time. |

Terms defined in other Standards and used in this Standard with the same meaning

contract | An agreement between two or more parties that creates enforceable rights and obligations. |

useful life | The period over which an asset is expected to be available for use by an entity; or the number of production or similar units expected to be obtained from an asset by an entity. |

Appendix B

Application guidance

This appendix is an integral part of the Standard. It describes the application of paragraphs 1–103 and has the same authority as the other parts of the Standard.

Portfolio application

B1 This Standard specifies the accounting for an individual lease. However, as a practical expedient, an entity may apply this Standard to a portfolio of leases with similar characteristics if the entity reasonably expects that the effects on the financial statements of applying this Standard to the portfolio would not differ materially from applying this Standard to the individual leases within that portfolio. If accounting for a portfolio, an entity shall use estimates and assumptions that reflect the size and composition of the portfolio.

Combination of contracts

B2 In applying this Standard, an entity shall combine two or more contracts entered into at or near the same time with the same counterparty (or related parties of the counterparty), and account for the contracts as a single contract if one or more of the following criteria are met:

(a) the contracts are negotiated as a package with an overall commercial objective that cannot be understood without considering the contracts together;

(b) the amount of consideration to be paid in one contract depends on the price or performance of the other contract; or

(c) the rights to use underlying assets conveyed in the contracts (or some rights to use underlying assets conveyed in each of the contracts) form a single lease component as described in paragraph B32.

Recognition exemption: leases for which the underlying asset is of low value (paragraphs 5–8)

B3 Except as specified in paragraph B7, this Standard permits a lessee to apply paragraph 6 to account for leases for which the underlying asset is of low value. A lessee shall assess the value of an underlying asset based on the value of the asset when it is new, regardless of the age of the asset being leased.

B4 The assessment of whether an underlying asset is of low value is performed on an absolute basis. Leases of low-value assets qualify for the accounting treatment in paragraph 6 regardless of whether those leases are material to the lessee. The assessment is not affected by the size, nature or circumstances of the lessee. Accordingly, different lessees are expected to reach the same conclusions about whether a particular underlying asset is of low value.

B5 An underlying asset can be of low value only if:

(a) the lessee can benefit from use of the underlying asset on its own or together with other resources that are readily available to the lessee; and

(b) the underlying asset is not highly dependent on, or highly interrelated with, other assets.

B6 A lease of an underlying asset does not qualify as a lease of a low-value asset if the nature of the asset is such that, when new, the asset is typically not of low value. For example, leases of cars would not qualify as leases of low-value assets because a new car would typically not be of low value.

B7 If a lessee subleases an asset, or expects to sublease an asset, the head lease does not qualify as a lease of a low-value asset.

B8 Examples of low-value underlying assets can include tablet and personal computers, small items of office furniture and telephones.

Identifying a lease (paragraphs 9–11)

B9 To assess whether a contract conveys the right to control the use of an identified asset (see paragraphs B13–B20) for a period of time, an entity shall assess whether, throughout the period of use, the customer has both of the following:

(a) the right to obtain substantially all of the economic benefits from use of the identified asset (as described in paragraphs B21–B23); and

(b) the right to direct the use of the identified asset (as described in paragraphs B24–B30).

B10 If the customer has the right to control the use of an identified asset for only a portion of the term of the contract, the contract contains a lease for that portion of the term.

B11 A contract to receive goods or services may be entered into by a joint arrangement, or on behalf of a joint arrangement, as defined in AASB 11 Joint Arrangements. In this case, the joint arrangement is considered to be the customer in the contract. Accordingly, in assessing whether such a contract contains a lease, an entity shall assess whether the joint arrangement has the right to control the use of an identified asset throughout the period of use.

B12 An entity shall assess whether a contract contains a lease for each potential separate lease component. Refer to paragraph B32 for guidance on separate lease components.

Identified asset

B13 An asset is typically identified by being explicitly specified in a contract. However, an asset can also be identified by being implicitly specified at the time that the asset is made available for use by the customer.

Substantive substitution rights

B14 Even if an asset is specified, a customer does not have the right to use an identified asset if the supplier has the substantive right to substitute the asset throughout the period of use. A supplier’s right to substitute an asset is substantive only if both of the following conditions exist:

(a) the supplier has the practical ability to substitute alternative assets throughout the period of use (for example, the customer cannot prevent the supplier from substituting the asset and alternative assets are readily available to the supplier or could be sourced by the supplier within a reasonable period of time); and

(b) the supplier would benefit economically from the exercise of its right to substitute the asset (ie the economic benefits associated with substituting the asset are expected to exceed the costs associated with substituting the asset).

B15 If the supplier has a right or an obligation to substitute the asset only on or after either a particular date or the occurrence of a specified event, the supplier’s substitution right is not substantive because the supplier does not have the practical ability to substitute alternative assets throughout the period of use.

B16 An entity’s evaluation of whether a supplier’s substitution right is substantive is based on facts and circumstances at inception of the contract and shall exclude consideration of future events that, at inception of the contract, are not considered likely to occur. Examples of future events that, at inception of the contract, would not be considered likely to occur and, thus, should be excluded from the evaluation include:

(a) an agreement by a future customer to pay an above market rate for use of the asset;

(b) the introduction of new technology that is not substantially developed at inception of the contract;

(c) a substantial difference between the customer’s use of the asset, or the performance of the asset, and the use or performance considered likely at inception of the contract; and

(d) a substantial difference between the market price of the asset during the period of use, and the market price considered likely at inception of the contract.

B17 If the asset is located at the customer’s premises or elsewhere, the costs associated with substitution are generally higher than when located at the supplier’s premises and, therefore, are more likely to exceed the benefits associated with substituting the asset.

B18 The supplier’s right or obligation to substitute the asset for repairs and maintenance, if the asset is not operating properly or if a technical upgrade becomes available does not preclude the customer from having the right to use an identified asset.

B19 If the customer cannot readily determine whether the supplier has a substantive substitution right, the customer shall presume that any substitution right is not substantive.

Portions of assets

B20 A capacity portion of an asset is an identified asset if it is physically distinct (for example, a floor of a building). A capacity or other portion of an asset that is not physically distinct (for example, a capacity portion of a fibre optic cable) is not an identified asset, unless it represents substantially all of the capacity of the asset and thereby provides the customer with the right to obtain substantially all of the economic benefits from use of the asset.

Right to obtain economic benefits from use

B21 To control the use of an identified asset, a customer is required to have the right to obtain substantially all of the economic benefits from use of the asset throughout the period of use (for example, by having exclusive use of the asset throughout that period). A customer can obtain economic benefits from use of an asset directly or indirectly in many ways, such as by using, holding or sub-leasing the asset. The economic benefits from use of an asset include its primary output and by-products (including potential cash flows derived from these items), and other economic benefits from using the asset that could be realised from a commercial transaction with a third party.

B22 When assessing the right to obtain substantially all of the economic benefits from use of an asset, an entity shall consider the economic benefits that result from use of the asset within the defined scope of a customer’s right to use the asset (see paragraph B30). For example:

(a) if a contract limits the use of a motor vehicle to only one particular territory during the period of use, an entity shall consider only the economic benefits from use of the motor vehicle within that territory, and not beyond.

(b) if a contract specifies that a customer can drive a motor vehicle only up to a particular number of miles during the period of use, an entity shall consider only the economic benefits from use of the motor vehicle for the permitted mileage, and not beyond.

B23 If a contract requires a customer to pay the supplier or another party a portion of the cash flows derived from use of an asset as consideration, those cash flows paid as consideration shall be considered to be part of the economic benefits that the customer obtains from use of the asset. For example, if the customer is required to pay the supplier a percentage of sales from use of retail space as consideration for that use, that requirement does not prevent the customer from having the right to obtain substantially all of the economic benefits from use of the retail space. This is because the cash flows arising from those sales are considered to be economic benefits that the customer obtains from use of the retail space, a portion of which it then pays to the supplier as consideration for the right to use that space.

Right to direct the use

B24 A customer has the right to direct the use of an identified asset throughout the period of use only if either:

(a) the customer has the right to direct how and for what purpose the asset is used throughout the period of use (as described in paragraphs B25–B30); or

(b) the relevant decisions about how and for what purpose the asset is used are predetermined and:

(i) the customer has the right to operate the asset (or to direct others to operate the asset in a manner that it determines) throughout the period of use, without the supplier having the right to change those operating instructions; or

(ii) the customer designed the asset (or specific aspects of the asset) in a way that predetermines how and for what purpose the asset will be used throughout the period of use.

How and for what purpose the asset is used

B25 A customer has the right to direct how and for what purpose the asset is used if, within the scope of its right of use defined in the contract, it can change how and for what purpose the asset is used throughout the period of use. In making this assessment, an entity considers the decision-making rights that are most relevant to changing how and for what purpose the asset is used throughout the period of use. Decision-making rights are relevant when they affect the economic benefits to be derived from use. The decision-making rights that are most relevant are likely to be different for different contracts, depending on the nature of the asset and the terms and conditions of the contract.

B26 Examples of decision-making rights that, depending on the circumstances, grant the right to change how and for what purpose the asset is used, within the defined scope of the customer’s right of use, include:

(a) rights to change the type of output that is produced by the asset (for example, to decide whether to use a shipping container to transport goods or for storage, or to decide upon the mix of products sold from retail space);

(b) rights to change when the output is produced (for example, to decide when an item of machinery or a power plant will be used);

(c) rights to change where the output is produced (for example, to decide upon the destination of a truck or a ship, or to decide where an item of equipment is used); and

(d) rights to change whether the output is produced, and the quantity of that output (for example, to decide whether to produce energy from a power plant and how much energy to produce from that power plant).

B27 Examples of decision-making rights that do not grant the right to change how and for what purpose the asset is used include rights that are limited to operating or maintaining the asset. Such rights can be held by the customer or the supplier. Although rights such as those to operate or maintain an asset are often essential to the efficient use of an asset, they are not rights to direct how and for what purpose the asset is used and are often dependent on the decisions about how and for what purpose the asset is used. However, rights to operate an asset may grant the customer the right to direct the use of the asset if the relevant decisions about how and for what purpose the asset is used are predetermined (see paragraph B24(b)(i)).

Decisions determined during and before the period of use

B28 The relevant decisions about how and for what purpose the asset is used can be predetermined in a number of ways. For example, the relevant decisions can be predetermined by the design of the asset or by contractual restrictions on the use of the asset.

B29 In assessing whether a customer has the right to direct the use of an asset, an entity shall consider only rights to make decisions about the use of the asset during the period of use, unless the customer designed the asset (or specific aspects of the asset) as described in paragraph B24(b)(ii). Consequently, unless the conditions in paragraph B24(b)(ii) exist, an entity shall not consider decisions that are predetermined before the period of use. For example, if a customer is able only to specify the output of an asset before the period of use, the customer does not have the right to direct the use of that asset. The ability to specify the output in a contract before the period of use, without any other decision-making rights relating to the use of the asset, gives a customer the same rights as any customer that purchases goods or services.

Protective rights