National Greenhouse and Energy Reporting (Safeguard Mechanism) Rule 2015

made under section 22XS of the

National Greenhouse and Energy Reporting Act 2007

Compilation No. 13

Compilation date: 31 August 2024

Includes amendments: National Greenhouse and Energy Reporting Legislation Amendment (Best Practice Emissions Intensities Update) Instrument 2024 (F2024L01063)

About this compilation

This compilation

This is a compilation of the National Greenhouse and Energy Reporting (Safeguard Mechanism) Rule 2015 that shows the text of the law as amended and in force on 31 August 2024 (the compilation date).

The notes at the end of this compilation (the endnotes) include information about amending laws and the amendment history of provisions of the compiled law.

Uncommenced amendments

The effect of uncommenced amendments is not shown in the text of the compiled law. Any uncommenced amendments affecting the law are accessible on the Register (www.legislation.gov.au). The details of amendments made up to, but not commenced at, the compilation date are underlined in the endnotes. For more information on any uncommenced amendments, see the Register for the compiled law.

Application, saving and transitional provisions for provisions and amendments

If the operation of a provision or amendment of the compiled law is affected by an application, saving or transitional provision that is not included in this compilation, details are included in the endnotes.

Editorial changes

For more information about any editorial changes made in this compilation, see the endnotes.

Modifications

If the compiled law is modified by another law, the compiled law operates as modified but the modification does not amend the text of the law. Accordingly, this compilation does not show the text of the compiled law as modified. For more information on any modifications, see the Register for the compiled law.

Self‑repealing provisions

If a provision of the compiled law has been repealed in accordance with a provision of the law, details are included in the endnotes.

Contents

Part 1—Preliminary

1 Name

3 Authority

4 Definitions

Part 2—Coverage

7 Covered emissions

8 Designated large facility threshold

Part 3—Baseline emissions number

Division 1—General

9 Baseline emissions number—main rule

10 Baseline emissions number—special rules

Division 2—Existing facilities

Subdivision A—Baseline emissions number for existing facility

11 Baseline emissions number for existing facility

12 Meaning of existing facility

Subdivision B—Transition proportion

13 Transition proportion

Subdivision C—Emissions intensity determination

14 Application for emissions intensity determination

14A Application specifying primary steel as production variable may specify steelmaking production variables as historical production variables

15 Calculating an amount of covered emissions

16 Covered emissions relevantly associated with a historical production variable

17 Application must be accompanied by safeguard audit report

18 Consideration of application

19 Emissions intensity determination

19A Emissions intensity determination in relation to application specifying steelmaking production variables as historical production variables

20 Facility‑specific emissions intensity number

Subdivision D—Related production variables

21 Statement about related production variable when emissions intensity determination is made

22 Statement about related production variable when emissions intensity determination is already in force

23 Requirements for statement about related production variable

Subdivision E—Successor determination

24 Successor determination for restructured facility

25 Process for making successor determination

Subdivision F—Variation by Regulator of emissions intensity determination

26 Variation by Regulator of emissions intensity determination

27 Request for information relevant to possible variation

28 Process for making variation

Division 3—New facilities

29 Baseline emissions number for new facility

Division 4—Landfill facilities

30 Baseline emissions number for landfill facility

Division 5—Emissions reduction contribution

Subdivision A—Default values

31 Default emissions reduction contribution

32 Default decline rate

Subdivision B—Regular facilities

33 Emissions reduction contribution for regular facility

Subdivision C—Trade‑exposed baseline‑adjusted facilities

34 Emissions reduction contribution for trade‑exposed baseline‑adjusted facility

35 Ratio of cost impacts

36 Assessed cost impact

37 Earnings before interest and tax

38 Safeguard Mechanism default prescribed unit price

Subdivision D—Determination that a facility is a trade‑exposed baseline‑adjusted facility

39 Application for determination that a facility is a trade‑exposed baseline‑adjusted facility

40 Application must be accompanied by safeguard audit report

41 Consideration of application

42 Determination that a facility is a trade‑exposed baseline‑adjusted facility

43 Determination where another determination is already in force

Subdivision E—Variation and revocation of determination that a facility is a trade‑exposed baseline‑adjusted facility

44 Variation on Regulator’s initiative

45 Revocation at request of responsible emitter

46 Consequence of revocation at request of responsible emitter

Division 6—Borrowing adjustment

47 Borrowing adjustment

48 Application for borrowing adjustment determination

49 Consideration of application

50 Borrowing adjustment determination

51 No borrowing adjustment for year included in multi‑year period declaration

Division 7—Miscellaneous

Subdivision A—Applications under this Part

52 Due date and decision date for applications

53 Withdrawal of applications

Subdivision B—Shale gas extraction facilities

54 Meaning of shale gas extraction facility

Part 3A—Safeguard mechanism credit units

Division 1—General

55 Purpose and application of Part

Division 2—Issuing safeguard mechanism credit units

56 Issuing safeguard mechanism credit units for a financial year

57 Issuing safeguard mechanism credit units for a declared multi‑year period

58 Application requirements

Division 3—Timing etc. of issue of safeguard mechanism credit units

58A Identifying safeguard mechanism credit units with a financial year etc.

Division 4—Eligible facilities

58B Meaning of eligible facility

Part 4—Compliance

Division 1—Exemption declarations

59 Operation of this Division

60 Application

61 Further information

62 Issue of exemption declaration

63 Revocation of exemption declaration because of false or misleading information

Division 2—Declared multi‑year periods

64 Operation of this Division

65 Application

66 Further information

67 Making of multi‑year period declaration

68 Variation or revocation of multi‑year period declaration on request

69 Revocation of multi‑year period declaration because of false or misleading information

69A Explanation of performance against plan for avoiding an excess emissions situation at end of declared multi‑year period

69B Variation of multi‑year period declaration where emissions are not being reduced

Division 3—Notification and publication requirements

70 Operation of this Division

71 Advisory notices

72 Publication

Division 4—Net emissions number

72A Excess surrender situation

72B Circumstances in which subsection 22XK(4) of the Act does not apply

Division 5—Surrender of prescribed carbon units

72C Requirements for surrender of prescribed carbon units

72D Requirements for period for which net emissions number is reduced by surrendering units

72E Circumstances in which subsection 22XN(6) of the Act does not apply

Part 5—Registration, reporting and record‑keeping

Division 1A—Voluntary registration

72F Registration of eligible facilities

Division 1—Registration applications

73 Operation of this Division

74 Application requirements

Division 2—Reporting

75 Operation of this Division

76 Required information

77 Reporting a change in principal activity for facility

Division 3—Record‑keeping

78 Form of records

Division 4—Other information about the safeguard mechanism

78A Audit of regulatory reports for facilities with high emissions

Part 6—Application and transitional provisions

Division 1—Application and transitional provisions relating to the National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment Rule (No. 1) 2019

79 Applications for calculated‑emissions baseline determination before commencement

80 Applications for declared multi‑year period before commencement

Division 2—Application and transitional provisions relating to the National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment (Extended Transition) Rule 2020

81 Baseline emissions number if calculated‑emissions baseline determination expired on 30 June 2019

Division 3—Application and transitional provisions relating to the National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment (Additional Prescribed Production Variables) Rule 2020

82 Default emissions intensities for financial year beginning on 1 July 2019

83 Default emissions intensities and calculated‑emissions baseline determinations for financial year beginning on 1 July 2020

84 Calculated‑emissions baseline determinations applying from 1 July 2019

Division 4—Application and transitional provisions relating to the National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment (Prescribed Production Variables Update) Rule 2021

85 Determination of estimated emission intensity and production variable

86 Updated emissions intensity for certain changes to NGER (Measurement) Determination

Division 5—Application, saving and transitional provisions relating to the National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment (Reforms) Rules 2023

87 Application provisions

88 Saving provisions

89 Updated end date for declared multi‑year periods ending after 30 June 2024

90 Regulator must not extend multi‑year period declaration in force before 1 July 2023

Division 6—Application, saving and transitional provisions relating to the National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment (Production Variables Update) Rules 2023

91 Application and transitional provisions

Division 7—Application, saving and transitional provisions relating to the National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment (Production Variables Update) Rules 2024

92 Application and transitional provisions

Division 8—Application, saving and transitional provisions relating to the National Greenhouse and Energy Reporting Legislation Amendment (Best Practice Emissions Intensities Update) Instrument 2024

93 Application and transitional provisions

Schedule 1—Production variables

Part 1—Preliminary

1 Purpose

2 Structure

3 Definitions

4 Meaning of saleable quality

Part 2—Bulk flat glass

5 Bulk flat glass

Part 3—Glass containers

6 Glass containers

Part 4—Aluminium

7 Aluminium

Part 5—Alumina

8 Alumina

Part 6—Ammonia production

9 Ammonia production

Part 7—Ammonium nitrate production

10 Ammonium nitrate

Part 8—Urea production

11 Carbamide (urea)

Part 9—Ammonium phosphate production

12 Monoammonium phosphate

12A Diammonium phosphate

Part 9A—Phosphoric acid

12B Phosphoric acid

Part 10— Sodium cyanide

13 Sodium cyanide

Part 11—Synthetic rutile

14 Synthetic rutile

Part 12—White titanium dioxide pigment

15 White titanium dioxide pigment

Part 13—Production variables related to coal mining

Division 1—Definitions

16 Definitions

Division 2— Run‑of‑mine coal

17 Run‑of‑mine coal

Division 3—Decommissioned underground mines

19 Fugitive emissions from decommissioned underground mines

Part 14—Iron ore

20 Iron ore

Part 15—Manganese ore

21 Manganese ore

Part 16—Bauxite

22 Bauxite

Part 17—Heavy metal concentrate (mineral sands mining)

23 Heavy metal concentrate

Part 17A—Lithium ore

23A Lithium ore

Part 18—Run‑of‑mine metal ore

24 Run‑of‑mine metal ore

Part 19—Production variables related to the oil and gas industry

Division 1—Definitions

25 Definitions

Division 2—Oil and gas extraction

26 Extracted oil and gas

Division 3—Stabilisation of crude oil and condensates

27 Stabilised crude oil or condensate (stabilisation only)

Division 4—Integrated extraction and stabilisation of crude oil

28 Stabilised crude oil (integrated extraction and stabilisation)

Division 5—Natural gas processing

29 Processed natural gas (processing only)

Division 6—Integrated natural gas extraction and processing

30 Processed natural gas (integrated extraction and processing)

Division 7—Liquefied natural gas from unprocessed natural gas

31 Liquefied natural gas (from unprocessed natural gas)

Division 8—Liquefied natural gas from processed natural gas

32 Liquefied natural gas (from processed natural gas)

Division 9—Ethane

33 Ethane

Division 10—Liquefied petroleum gas

34 Liquefied petroleum gas

Division 11—Reservoir carbon dioxide

35 Reservoir carbon dioxide from existing gas fields

35A Reservoir carbon dioxide from new gas fields

Part 20—Production variables related to steel manufacturing

Division 1—Definitions

36 Definitions

Division 2—Coke oven coke

37 Coke oven coke

Division 3—Lime manufacturing

38 Lime (steel manufacturing)

Division 4—Primary iron

39 Primary iron

Division 4A—Primary iron (steelmaking)

39A Primary iron (steelmaking)

Division 5—Iron ore pellets

40 Iron ore pellets

Division 6—Continuously cast carbon steel products and ingots of carbon steel from primary steel manufacturing

41 Primary Steel

Division 7—Hot‑rolled long products produced at primary steel manufacturing facilities

42 Hot‑rolled long products produced at primary steel manufacturing facilities

Division 8—Hot‑rolled flat products produced at primary steel manufacturing facilities

43 Hot‑rolled flat products produced at primary steel manufacturing facilities

Division 9—Continuously cast carbon steel products and ingots of carbon steel from manufacture of carbon steel from cold ferrous feed

44 Continuously cast carbon steel products and ingots of carbon steel (manufacture of carbon steel from cold ferrous feed)

Division 9A—ferrous feed (steelmaking)

44A Ferrous feed (steelmaking)

Division 10—Hot‑rolled long products (cold ferrous feed)

45 Hot‑rolled long products (cold ferrous feed)

Division 11—Hot‑rolled flat products (cold ferrous feed)

46 Hot‑rolled flat products (cold ferrous feed)

Division 13—Treated steel flat products

47A Treated steel flat products

Part 21—Production variables related to rail transport

Division 1—Definitions

48 Definitions

Division 2—Rail transport of bulk freight on a dedicated line

49 Net‑tonne‑kilometres of bulk freight on a dedicated line

Division 3—Rail transport of bulk freight on a non‑dedicated line

50 Net‑tonne‑kilometres of bulk freight on a non‑dedicated line

Division 4—Rail transport of non‑bulk freight

51 Net‑tonne‑kilometres of non‑bulk freight

Division 5—Rail passenger transport

52 Passenger‑kilometres of rail passenger transport

Part 22—Air transport

53 Revenue‑tonne‑kilometres of air transport

Part 23—Production variables related to road transport

Division 1AA—Definitions

53A Definitions

Division 1—Passenger road transport

54 Vehicle‑kilometres of passenger road transport

Division 2—Non‑bulk freight road transport

54A Cubic‑tonne‑kilometres of non‑bulk freight

Division 3—Non‑bulk (temperature controlled) freight road transport

54B Cubic‑tonne‑kilometres of non‑bulk freight

Division 4—Specialised and heavy haulage road transport

54C Deadweight‑tonne‑kilometres of specialised and heavy haulage

Division 5—Bulk freight road transport

54D Net‑tonne‑kilometres of bulk freight

Part 24—Production variables related to water transport

Division 1—Mixed passenger and freight water transport

55 Deadweight‑tonne‑kilometres of mixed passenger and freight water transport

Division 2—Bulk freight water transport

55A Net‑tonne‑kilometres of bulk freight water transport

Part 25—Wastewater handling (domestic and commercial)

56 COD removed from wastewater (domestic and commercial)

56A Nitrogen removed from wastewater (domestic and commercial)

Part 26—Electricity generation

57 Electricity generation

Part 27—Natural gas distribution

58 Petajoule‑kilometres of natural gas distribution

Part 28—Natural gas transmission

Division 1—Definitions

59 Definitions

Division 2—Natural gas transmission production variables

60 Kilometres of natural gas transmission pipelines

61 Natural gas throughput

Part 29—Clinker, lime and cement production

Division 1—Definitions

62 Definitions

Division 2—Clinker and cement production variables

63 Clinker not used by facility to make cement

64 Cement produced from clinker and supplementary cementitious material

Division 3—Lime

65 Lime

Part 30—Non‑metallic mineral quarrying

66 Quarried rock

Part 31—Silicon

67 Silicon

Part 32—Lead bullion

68 Lead bullion

Part 33—Refined lead

69 Refined lead

Part 34—Zinc in fume

70 Zinc in fume

Part 35—Caustic calcined magnesia

71 Caustic calcined magnesia

Part 36—Copper anode

72 Copper anode

Part 37—Manganese sinter

73 Manganese sinter

Part 38—Ferromanganese alloy

74 Ferromanganese alloy

Part 39—Silicomanganese alloy

75 Silicomanganese alloy

Part 40—Nickel manufacturing

Division 1—Definitions

76 Definitions

Division 2—Nickel production variables

77 Primary nickel products from nickel bearing inputs

78 Primary nickel products from imported intermediate nickel products

79 Intermediate nickel products from nickel bearing inputs

Part 41—Pulp and paper production

Division 1—Definitions

80 Definitions

Division 2—Tissue paper

81 Tissue paper

Division 3—Packaging and industrial paper

82 Packaging and industrial paper

Division 4—Printing and writing paper

83 Printing and writing paper

Division 5—Newsprint

84 Newsprint

Division 6—Pulp

85 Pulp

Part 42—Ethylene and polyethylene production

86 Ethene (ethylene)

87 Polyethylene

87A Exported steam related to the ethene production activity

Part 43—Wheat based products

88 Wheat protein products (dried gluten)

89 Dried wheat starch

90 Wheat based glucose

91 Wheat based dried distillers grain

Part 44—Ethanol

92 Ethanol—95

93 Ethanol—absolute

94 Beverage grade ethanol

Part 45—Production variables related to sugar production

95 Raw sugar

96 Exported steam related to the raw sugar manufacturing activity

Part 46—Petroleum refining

97 Petroleum refinery feedstocks

Part 47—Lithium hydroxide

98 Lithium hydroxide

Part 48—Hydrogen

99 Gaseous hydrogen

100 Liquefied hydrogen

Part 49—Mine rehabilitation

101 Mine rehabilitation

Part 50—Biofuels

102 Definitions

103 Renewable aviation kerosene

104 Renewable diesel

Part 51—Rare earth processing

105 Definitions

106 Rare earth processing

Schedule 2—Trade‑exposed production variables and manufacturing production variables

1 Trade‑exposed production variables that are also manufacturing production variables

2 Trade‑exposed production variables that are not manufacturing production variables

Endnotes

Endnote 1—About the endnotes

Endnote 2—Abbreviation key

Endnote 3—Legislation history

Endnote 4—Amendment history

Part 1—Preliminary

1 Name

This is the National Greenhouse and Energy Reporting (Safeguard Mechanism) Rule 2015.

3 Authority

This instrument is made under subsection 22XS(1) of the National Greenhouse and Energy Reporting Act 2007.

4 Definitions

In this instrument:

accelerated depreciation factor has the meaning given by subsection 37(6).

Act means the National Greenhouse and Energy Reporting Act 2007.

adverse conclusion has the meaning given by the National Greenhouse and Energy Reporting (Audit) Determination 2009.

amount includes a nil amount.

askm means available seat kilometres.

assessed cost impact, for a facility for a financial year, has the meaning given by section 36.

Australian accounting standards means the accounting standards in force under section 334 of the Corporations Act 2001.

Note: In 2023, the Australian accounting standards were accessible at http://www.aasb.gov.au.

best practice emissions intensity, for a production variable for a financial year, means the best practice emissions intensity (if any) specified, in t CO2‑e per unit of the production variable, in relation to the production variable in Schedule 1 as in force at:

(a) if the financial year is the financial year beginning on 1 July 2023—the end of the financial year; or

(b) otherwise—the start of the financial year.

best practice emissions intensity number, for a production variable for a financial year, means the number that is equal to the best practice emissions intensity for the production variable for that financial year.

Example: If the best practice emissions intensity for a tonne of glass in the financial year beginning on 1 July 2024 is 0.6 t CO2‑e per tonne of glass, the best practice emissions intensity number for a tonne of glass in that financial year is 0.6.

borrowing adjustment, for a facility for a financial year, has the meaning given by section 47.

borrowing adjustment determination means a determination made under section 50.

borrowing adjustment number, for a facility for a financial year: see subsection 50(3).

by‑product means a saleable output or other product that:

(a) results from a chemical or physical process undertaken by a facility other than for the purpose of producing the output; and

(b) will be disposed of, by sale or gift, without any further processing by the facility (other than further processing in accordance with standard industry practice); and

(c) contributes less than 10% of the facility’s revenue.

comparative production variable, for a related production variable, has the meaning given by paragraph 19(4)(b).

criminal activity means any activity that the Regulator has reasonable cause to believe involves the commission of an offence by one or more persons.

Darwin to Katherine network means the local distribution systems in items 1, 2 and 5 of Schedule 2 to the National Electricity (Northern Territory) (National Uniform Legislation) Act 2015 (NT) and any transmission or distribution system which is connected to those local distribution systems.

decision date, for an application under Part 3, has the meaning given by subsection 52(2).

default decline rate, for a financial year, has the meaning given by section 32.

default emissions intensity, for a production variable for a financial year, means the default emissions intensity specified, in t CO2‑e per unit of the production variable, in relation to the production variable in Schedule 1 as in force at the start of that financial year.

default emissions intensity number, for a production variable for a financial year, means the number that is equal to the default emissions intensity of the production variable.

Example: If the default emissions intensity for a tonne of glass in the financial year beginning on 1 July 2024 is 0.8 t CO2‑e per tonne of glass, the default emissions intensity number for a tonne of glass in that financial year is 0.8.

default emissions reduction contribution, for a financial year, has the meaning given by section 31.

designated electricity network means one of the following electricity networks:

(a) the interconnected national electricity system within the meaning of the National Electricity Law set out in the Schedule to the National Electricity (South Australia) Act 1996 (SA);

(b) the South West interconnected system within the meaning of section 3 of the Electricity Industry Act 2004 (WA);

(c) the North West interconnected system within the meaning of section 2 of the Electricity Transmission and Distribution Systems (Access) Act 1994 (WA);

(d) the Darwin to Katherine network;

(e) the Mount Isa–Cloncurry supply network within the meaning of section 10 of the Electricity—National Scheme (Queensland) Act 1997 (Qld).

designated historical information, about a historical production variable for a facility, has the meaning given by subsection 14(5).

details, in relation to a declaration under this instrument, includes:

(a) the type of declaration; and

(b) the facility to which the declaration relates; and

(c) the responsible emitter for the facility to which the declaration relates; and

(d) the start and any end date of the declaration; and

(e) if the declaration is being varied—the nature of that variation.

due date, for an application under Part 3, has the meaning given by subsection 52(1).

dwtnmi means dead weight tonne nautical miles.

EBIT Guidelines has the meaning given by subsection 37(7).

eligible facility, for a financial year, has the meaning given by section 58B.

emissions intensity determination means:

(a) a determination made under section 19; or

(b) a successor determination.

emissions reduction contribution:

(a) for a regular facility for a financial year—has the meaning given by section 33; or

(b) for a trade‑exposed baseline‑adjusted facility for a financial year—has the meaning given by section 34.

existing facility has the meaning given by subsection 12(1).

facility‑specific emissions intensity number:

(a) of a historical production variable for a facility—has the meaning given by subsection 20(1); or

(b) of a related production variable for a facility—has the meaning given by subsection 20(5); or

(c) of a transitional production variable for a facility—has the meaning given by subsection 20(6).

first adjusted financial year, for a facility, has the meaning given by subsection 36(6).

grid‑connected electricity generator means a designated generation facility connected to a designated electricity network at any time during a financial year.

historical financial year has the meaning given by subsection 12(3).

historical production variable, for a facility, has the meaning given by subsection 12(2).

hypothetical baseline, of a facility for a financial year, has the meaning given by subsection 36(7).

identifying details has the meaning given by the NGER Regulations.

identifying information has the meaning given by the NGER Regulations.

input means:

(a) if the input relates to a landfill facility—a tonne of waste received by a landfill facility; and

(b) otherwise—anything that undergoes a chemical or physical process to produce an intermediate product or an output.

intermediate product means a product that:

(a) results from a chemical or physical process undertaken by a facility using one or more inputs; and

(b) is then used as an input for the production of an output at the same facility.

landfill facility means a facility for the disposal of solid waste as landfill, and includes a facility that is closed for the acceptance of waste.

legacy emissions has the meaning given by subsection 7(2).

limited assurance conclusion has the meaning given by the National Greenhouse and Energy Reporting (Audit) Determination 2009.

manufacturing facility: a facility is a manufacturing facility in a financial year if the primary production variable for the facility in the financial year is a manufacturing production variable.

manufacturing production variable means a production variable that is listed in the table in section 1 of Schedule 2.

multi‑year period declaration has the meaning given by subsection 65(1).

m3km means metres cubed kilometres.

national facility definition means the requirements for a transport facility applying as a result of a nomination under subregulation 2.19A(2) of the NGER Regulations.

new facility has the meaning given by subsection 29(2).

NGER (Measurement) Determination means the National Greenhouse and Energy Reporting (Measurement) Determination 2008.

NGER Regulations means the National Greenhouse and Energy Reporting Regulations 2008.

non‑commercial production variable, for a facility for a financial year, has the meaning given by subsection 12(5).

output means a product that is:

(a) if the output is from a transport facility—a transport service measured by service units; or

(b) if more than 25,000 megawatt hours of electricity is, or is to be, generated at the facility in a financial year—electricity generated at the facility; or

(c) otherwise—the last product resulting from a chemical or physical process undertaken by a facility using one or more inputs or intermediate products.

pkm means passenger kilometres.

pnmi means passenger nautical miles.

primary production variable, for a facility, means:

(a) if there is only one production variable for the facility—that production variable; or

(b) if there are 2 or more production variables for the facility—the production variable that is most significant for the operation of the facility, having primary regard to the share of revenue and covered emissions directly or indirectly attributable to that production variable.

production variable, for a facility, means a production variable that is applicable to the facility in accordance with Schedule 1.

production variable means a metric that is set out in a Part of Schedule 1.

qualified limited assurance conclusion has the meaning given by the National Greenhouse and Energy Reporting (Audit) Determination 2009.

qualified reasonable assurance conclusion has the meaning given by the National Greenhouse and Energy Reporting (Audit) Determination 2009.

quantity, of a production variable for a facility for a financial year, means the number of units of the production variable for the facility for that financial year.

Example: If a facility produces 500 tonnes of glass in a financial year, the quantity of tonnes of glass for that financial year is 500.

ratio of cost impacts, for a facility for a financial year, has the meaning given by section 35.

reasonable assurance conclusion has the meaning given by the National Greenhouse and Energy Reporting (Audit) Determination 2009.

regular facility: a facility that is not a trade‑exposed baseline‑adjusted facility in a financial year is a regular facility in that financial year.

related production variable, for a facility, has the meaning given by paragraph 19(4)(a).

relevant historical financial year, for a production variable, has the meaning given by subsection 20(3).

relevantly associated with has the meaning given by section 16.

responsible financial officer, of a responsible emitter for a facility, means any of the following:

(a) if the person with operational control of the facility is an individual—that person;

(b) a person who holds or performs the duties of the position of the chief executive officer, chief financial officer or chief operating officer for the person with operational control of the facility;

(c) a person who holds or performs the duties of a position with equivalent or similar responsibilities to a person with a position in paragraph (b);

(d) an individual employed by the person with operational control of the facility who:

(i) makes, or participates in making, decisions that affect the whole, or a substantial part, of the business or affairs of the person; or

(ii) has the capacity to significantly affect the person’s financial standing.

Safeguard Mechanism default prescribed unit price, for a financial year, has the meaning given by section 38.

Safeguard Mechanism document means the document of that name published on the Department’s website, as in force from time to time.

Note: In 2023, the document could be accessed from http://www.dcceew.gov.au.

sectoral‑baseline financial year means every financial year before the financial year beginning on the first 1 July after the Regulator has published a statement on its website that the total reported scope 1 emissions of all grid‑connected electricity generators exceeded 198,000,000 t CO2‑e emissions in the previous financial year based upon reports submitted to the Regulator at the time of the statement. The Regulator must take all reasonable steps to publish the statement at least 4 months before the start of the financial year which is not a sectoral‑baseline financial year.

Example: If the sum of reported emissions from each grid‑connected electricity generator was 210,000,000 t CO2‑e in 2020‑21, by 28 February 2022 the Regulator would publish a statement on its website and the financial year beginning 1 July 2022 would not be a sectoral‑baseline financial year and emissions of grid‑connected electricity generators would be covered emissions in that year.

service unit means a unit of measure related to a transport facility (such as askm, dwtnmi, m3km, pkm, pnmi, tkm, tnmi or vkt) determined and measured by the responsible emitter for the facility taking into account:

(a) standard industry practice; and

(b) existing measurement systems used by the responsible emitter.

shale gas extraction facility has the meaning given by section 54.

significant cost impact threshold, for a facility, has the meaning given by subsection 35(4).

successor determination means a determination made under section 24.

t CO2‑e means tonnes of carbon dioxide equivalence.

tkm means tonne kilometres.

tnmi means tonne nautical miles.

trade‑exposed baseline‑adjusted facility: a facility is a trade‑exposed baseline‑adjusted facility in a financial year if it is determined to be a trade‑exposed baseline‑adjusted facility in that financial year under section 42.

trade‑exposed production variable means a production variable that is listed in a table in Schedule 2.

transitional production variable, for a facility, has the meaning given by subsection 12(4).

transition proportion, for a financial year, has the meaning given by section 13.

vkt means vehicle kilometres travelled.

waste product means an output or other product that:

(a) results from a chemical or physical process undertaken by a facility other than for the purpose of producing the output; and

(b) will be disposed of without any further processing by the facility (other than further processing in accordance with standard industry practice); and

(c) is not a by‑product.

Part 2—Coverage

7 Covered emissions

(1) For section 22XI of the Act, the following scope 1 emissions of one or more greenhouse gases are not covered emissions for the purposes of the safeguard mechanism:

(a) emissions of one or more greenhouse gases in circumstances where the Minister has not determined, under subsection 10(3) of the Act:

(i) methods by which the amounts of the scope 1 emissions of the greenhouse gas are to be measured; or

(ii) criteria for methods by which the amounts of the scope 1 emissions of the greenhouse gas are to be measured;

(b) legacy emissions from the operation of a landfill facility;

(c) emissions of one or more greenhouse gases from the operation of a grid‑connected electricity generator in respect of a sectoral‑baseline financial year;

(d) if a facility is partly in Australia and partly in the Greater Sunrise special regime area—scope 1 emissions of greenhouse gases which occurred in the Greater Sunrise special regime area.

Note: A facility wholly in the Greater Sunrise special regime area is not subject to the safeguard provisions in accordance with subsection 6A(4) of the Act.

Legacy emissions

(2) For the purposes of subsection (1), if:

(a) an amount of greenhouse gas was emitted from the operation of a landfill facility; and

(b) waste was accepted by the landfill facility before 1 July 2016;

so much of the amount mentioned in paragraph (a) as is, under a determination under subsection 10(3) of the Act, taken to be attributable to waste accepted by the facility before 1 July 2016 is a legacy emission from the operation of the landfill facility.

Emissions not included as emissions from grid‑connected electricity generators

(3) For the purposes of paragraph (1)(c), emissions of one or more greenhouse gases from the operation of a grid‑connected electricity generator in respect of a sectoral‑baseline financial year do not include:

(a) fugitive emissions from coal mining (within the meaning of the NGER (Measurement) Determination); or

(b) emissions from fuel combustion for the purposes of coal mining; or

(c) emissions covered by Chapter 2 (fuel combustion) of the NGER (Measurement) Determination that are not for electricity generation or cogeneration.

8 Designated large facility threshold

For paragraph 22XJ(1)(b) of the Act, the specified number is 100,000.

Part 3—Baseline emissions number

Division 1—General

9 Baseline emissions number—main rule

(1) Unless otherwise provided, the provisions of this Part are made for the purposes of subsection 22XL(1) of the Act.

(2) The baseline emissions number for a facility for a financial year is ascertained in relation to the facility in accordance with Divisions 2 to 7 of this Part.

(3) Subsection (2) has effect subject to section 10.

10 Baseline emissions number—special rules

Minimum baseline

(1) The baseline emissions number for a facility for a financial year is 100,000 if:

(a) the baseline emissions number for the facility for the financial year that is ascertained in accordance with Divisions 2 to 7 of this Part is a number less than 100,000; and

(b) that number is not less than 100,000 merely because of a borrowing adjustment for the facility for the financial year.

Note: This means that the baseline emissions number for a facility for a financial year can be less than 100,000 if there is a sufficiently large borrowing adjustment for the facility for that financial year.

Zero baseline for shale gas extraction facilities

(2) The baseline emissions number for a facility for a financial year is zero if the facility is a shale gas extraction facility.

Zero baseline from 2050

(3) The baseline emissions number for a facility for a financial year that begins after 30 June 2049 is zero.

Division 2—Existing facilities

Subdivision A—Baseline emissions number for existing facility

11 Baseline emissions number for existing facility

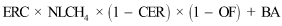

(1) The baseline emissions number for an existing facility (other than a landfill facility) for a financial year is the number worked out using the following formula:

where:

ERC is the emissions reduction contribution for the facility for the financial year.

p is a production variable for the facility for the financial year.

h is the transition proportion for the financial year.

EI, in relation to a production variable for the facility for the financial year, is the default emissions intensity number of the production variable for the financial year.

Note: The default emissions intensity number of tonnes of reservoir carbon dioxide from new gas fields is zero (see section 35A of Schedule 1).

EIF, in relation to a production variable for the facility for the financial year, is:

(a) if an emissions intensity determination that applies in relation to the facility for the financial year specifies a facility‑specific emissions intensity number of the production variable—that number; or

(b) otherwise—0.

Q, in relation to a production variable for the facility for the financial year, is:

(a) if an emissions intensity determination that applies in relation to the facility for the financial year specifies a facility‑specific emissions intensity number of the production variable—the quantity of the production variable for the facility for the financial year; or

(b) otherwise—0.

EIB, in relation to a production variable for the facility for the financial year, is:

(a) if there is a best practice emissions intensity number for the production variable for the financial year—that number; or

(b) if there is no best practice emissions intensity number for the production variable for the financial year, and the production variable is a historical production variable for the facility—zero; or

(c) otherwise—the default emissions intensity number for the production variable for the financial year.

Note: The best practice emissions intensity number of tonnes of reservoir carbon dioxide from new gas fields is zero (see section 35A of Schedule 1).

QB, in relation to a production variable for the facility for the financial year, is:

(a) if an emissions intensity determination that applies in relation to the facility for the financial year specifies a facility‑specific emissions intensity number of the production variable—0; or

(b) otherwise—the quantity of the production variable for the facility for the financial year.

BA is the borrowing adjustment for the facility for the financial year.

(2) The number worked out using the formula in subsection (1) is to be rounded to the nearest whole number (rounding up if the first decimal place is 5 or more).

12 Meaning of existing facility

(1) A facility is an existing facility if there are one or more historical production variables or transitional production variables for the facility.

(2) A historical production variable, for a facility, is a production variable that:

(a) was applicable to the facility, in accordance with Schedule 1, at any time during a historical financial year; and

(b) was not a non‑commercial production variable for the facility for the historical financial year.

(3) A historical financial year is:

(a) the financial year beginning on 1 July 2017; or

(b) the financial year beginning on 1 July 2018; or

(c) the financial year beginning on 1 July 2019; or

(d) the financial year beginning on 1 July 2020; or

(e) the financial year beginning on 1 July 2021.

(4) A transitional production variable, for a facility, is a production variable that:

(a) was not applicable to the facility, in accordance with Schedule 1, at any time during a historical financial year; and

(b) was applicable to the facility, in accordance with Schedule 1, at a time during the financial year beginning on 1 July 2022; and

(c) was not a non‑commercial production variable for the facility for the financial year beginning on 1 July 2022.

(5) A non‑commercial production variable, for a facility for a financial year, is a production variable that, at a time during the financial year, was applicable to the facility, in accordance with Schedule 1, merely because of testing or piloting activities undertaken at the facility.

Subdivision B—Transition proportion

13 Transition proportion

The transition proportion for a financial year beginning on a day specified in column 1 of an item of the following table is the number specified in column 2 of that item.

Transition proportion |

Item | Column 1 Financial year | Column 2 Transition proportion |

1 | 1 July 2023 | 0.1 |

2 | 1 July 2024 | 0.2 |

3 | 1 July 2025 | 0.3 |

4 | 1 July 2026 | 0.4 |

5 | 1 July 2027 | 0.6 |

6 | 1 July 2028 | 0.8 |

7 | 1 July 2029 or a later 1 July | 1 |

Subdivision C—Emissions intensity determination

14 Application for emissions intensity determination

(1) The responsible emitter for an existing facility may apply to the Regulator for an emissions intensity determination.

(2) The application must be made:

(a) in a manner and form approved, in writing, by the Regulator; and

(b) before the end of the due date for the application, unless the Regulator agrees to accept the application after that date.

Note 1: For the due date for the application, see section 52.

Note 2: For withdrawal of the application, see section 53.

(3) The application must specify:

(a) the first financial year in relation to which the determination would apply; and

(b) the historical production variables (if any) for the facility; and

(c) for each historical financial year—a calculation, in accordance with section 15, of the amount of covered emissions of greenhouse gases (in t CO2‑e) from the operation of the facility during the historical financial year; and

(d) the estimates and assumptions (if any) made in accordance with subsection 15(3); and

(e) the transitional production variables (if any) for the facility.

(4) For each historical production variable for the facility, the application must, to the extent reasonably practicable, include the designated historical information about the production variable.

(5) The following information is the designated historical information about a historical production variable for a facility:

(a) the quantity of the production variable in each historical financial year that is measured in accordance with any measurement requirements or procedures specified in Schedule 1 in relation to the production variable;

(b) the amount of covered emissions of greenhouse gases (in t CO2‑e) relevantly associated with the production variable in each historical financial year.

Note: See the definition of relevantly associated with in section 16.

(6) If the application does not include the designated historical information about a historical production variable for the facility, the application must include an explanation of why such information has not been included.

(7) If a greenhouse gas other than carbon dioxide comprises more than 1% of the covered emissions relevantly associated with a production variable for the facility in a particular historical financial year, the application must specify the amount of that gas (in t CO2‑e).

(8) The application may include a request for the determination to include a statement that:

(a) a particular production variable for the facility is a related production variable for the facility; and

(b) another specified production variable for the facility is the comparative production variable for that related production variable.

14A Application specifying primary steel as production variable may specify steelmaking production variables as historical production variables

(1) An application under section 14 for an emissions intensity determination that specifies primary steel as a production variable may also specify the following production variables (the steelmaking production variables) as historical production variables for the facility:

(a) the primary iron (steelmaking) production variable; and

(b) the ferrous feed (steelmaking) production variable.

Note: Section 19A applies to an application which specifies the steelmaking production variables as historical production variables.

(2) Despite paragraph 12(2)(b), the steelmaking production variables may be specified as historical production variables for a facility even if one or both of them was a non‑commercial production variable for the facility for a historical financial year.

(3) Despite paragraph 16(2)(b), covered emissions of greenhouse gases from the operation of a facility during a particular historical financial year that are of a particular kind may be attributed to both a steelmaking production variable and to the primary steel production variable.

(4) Despite paragraph 16(3)(d), covered emissions of greenhouse gases from the operation of a facility during a particular historical financial year may be attributed to both a steelmaking production variable and to the primary steel production variable.

Note: Emissions associated with the production of primary iron and continuously cast carbon steel products and ingots of carbon steel would also be relevantly associated with primary steel.

(5) In this Part:

continuously cast carbon steel products and ingots of carbon steel (manufacture of carbon steel from cold ferrous feed) production variable means the production variable in section 44 of Schedule 1.

ferrous feed (steelmaking) production variable means the production variable in section 44A of Schedule 1.

primary iron (steelmaking) production variable means the production variable in section 39A of Schedule 1.

primary iron production variable means the production variable in section 39 of Schedule 1.

primary steel production variable means the production variable in section 41 of Schedule 1.

steelmaking production variables has the meaning given by subsection (1).

15 Calculating an amount of covered emissions

(1) This section specifies requirements for the purposes of calculating an amount of covered emissions of greenhouse gases from the operation of a facility during a historical financial year.

(2) The amount must be calculated:

(a) in accordance with the NGER (Measurement) Determination; and

(b) using the Global Warming Potentials specified for the relevant greenhouse gas in regulation 2.02 of the NGER Regulations; and

(c) using the same method as the method (the most recent method) that was used in the most recent report provided to the Regulator relating to the greenhouse gas emissions from the operation of the facility.

(3) For the purposes of paragraph (2)(c), if:

(a) a report was provided to the Regulator relating to the greenhouse gas emissions from the operation of the facility during the historical financial year; and

(b) the report used a method other than the most recent method;

estimates and assumptions may be made for the purposes of using the most recent method to calculate the amount.

(4) In this section:

method has the same meaning as in the NGER (Measurement) Determination.

16 Covered emissions relevantly associated with a historical production variable

(1) Covered emissions of greenhouse gases from the operation of a facility during a particular historical financial year are relevantly associated with a historical production variable for the facility in that financial year if those emissions are attributed to the production variable for the financial year in accordance with subsection (2) or (3).

Emissions relevant to default emissions intensity

(2) Covered emissions of greenhouse gases from the operation of a facility during a particular historical financial year that are of a particular kind are attributed to a production variable for the facility for that financial year if:

(a) having regard to the Safeguard Mechanism document, covered emissions of that kind are relevant to the default emissions intensity of that production variable for that financial year; and

(b) those emissions are not attributed to another production variable in accordance with this section.

(2A) To avoid doubt, the Safeguard Mechanism document may specify that a particular kind of covered emissions is relevant to the default emissions intensity of a production variable notwithstanding that the specified kind of covered emissions was not taken into account when the default emissions intensity was calculated.

Emissions from minor emissions sources

(3) Covered emissions of greenhouse gases from the operation of a facility during a particular historical financial year are attributed to a production variable for the facility for that financial year if:

(a) the emissions come from a minor emissions source for the facility for the historical financial year; and

(b) the emissions fairly represent the actual emissions from the production of the production variable; and

(c) the emissions are apportioned to the production variable consistently with the NGER (Measurement) Determination; and

(d) the emissions are not apportioned to another production variable for the facility for that financial year.

(4) In this section, a source of emissions is a minor emissions source for a facility in a historical financial year if the sum of the emissions from that source, and every other minor emissions source for the facility in that historical financial year, is less than 10% of the facility’s total covered emissions in that financial year.

17 Application must be accompanied by safeguard audit report

(1) This section is made for the purposes of subsection 22XQ(3) of the Act.

(2) An application for an emissions intensity determination by the responsible emitter for an existing facility must be accompanied by an audit report that meets the requirements of this section.

Note: Under subsection 75(1) of the Act, the Minister may determine requirements to be met by registered greenhouse and energy auditors in preparing for and carrying out safeguard audits.

Reasonable assurance matters

(3) The audit report must include a conclusion in relation to each of the following matters:

(a) whether, in all material respects, the application correctly specifies the historical production variables (if any) for the facility;

(b) if the application includes the designated historical information about a historical production variable for the facility for a historical financial year—whether, in all material respects, the application correctly specifies the quantity of the historical production variable in the historical financial year;

(c) whether, in all material respects, the application correctly specifies the amount of covered emissions for the facility in each historical financial year;

(d) whether, in all material respects, the application correctly specifies the transitional production variables (if any) for the facility.

Limited assurance matters

(4) The audit report must include a conclusion in relation to each of the following matters:

(a) if the application specifies one or more historical production variables for the facility—whether, in all material respects, the application correctly specifies the amount of covered emissions of greenhouse gases from the operation of the facility that are relevantly associated with each of those production variables;

(b) whether, in all material respects, calculations of amounts of covered emissions of greenhouse gases from the operation of the facility that are included in the application meet the requirements specified in section 15;

(c) if the application includes estimates and assumptions made in accordance with subsection 15(3)—whether, in all material respects, those estimates and assumptions are reasonable.

Previously audited matters

(5) Despite subsections (3) and (4), the audit report does not need to include a conclusion:

(a) about a matter in subsection (3) if the responsible emitter has previously given the Regulator an audit report that includes a reasonable assurance conclusion in relation to the matter; or

(b) about a matter in subsection (4) if the responsible emitter has previously given the Regulator an audit report that includes a limited assurance conclusion in relation to the matter.

(6) An audit report under this section must be the result of an audit which:

(a) was conducted in accordance with the relevant requirements for reasonable assurance engagements under the National Greenhouse and Energy Reporting (Audit) Determination 2009; and

(b) had an audit team leader who is registered as a Category 2 auditor under subregulation 6.25(3) of the NGER Regulations.

18 Consideration of application

(1) This section applies if the responsible emitter for an existing facility applies for an emissions intensity determination in accordance with this Subdivision.

(2) Subject to subsection (4), the Regulator must take all reasonable steps to decide the application under section 19 before the end of the decision date for the application.

Note: For the decision date for the application, see section 52.

(3) The Regulator may, by notice in writing, require the applicant to give the Regulator, within the period specified in the notice, such further information in relation to the application as the Regulator requires.

(4) The Regulator is not required to decide the application, and may cease considering whether to decide the application, if the applicant does not provide the required information within the period specified in the notice.

19 Emissions intensity determination

(1) If the responsible emitter for an existing facility applies for an emissions intensity determination in accordance with this Subdivision, the Regulator must decide to:

(a) make the determination; or

(b) refuse to make the determination.

(2) The Regulator must not make the determination unless:

(a) the audit report that accompanies the application includes:

(i) a reasonable assurance conclusion, or a qualified reasonable assurance conclusion, in relation to each of the matters specified in subsection 17(3); and

(ii) a limited assurance conclusion, or a qualified limited assurance conclusion, in relation to each of the matters specified in subsection 17(4); and

(b) the Regulator is reasonably satisfied, having regard to any matter the Regulator considers relevant, that:

(i) the information included in the application is correct; and

(ii) any explanation in the application of why the designated historical information about a historical production variable for the facility has not been included in the application is reasonable; and

(iii) calculations of amounts of covered emissions of greenhouse gases from the operation of the facility that are included in the application meet the requirements specified in section 15; and

(iv) any estimates and assumptions made in accordance with subsection 15(3) and included in the application are reasonable.

(3) The determination must be in writing and must specify:

(a) the facility‑specific emissions intensity number of:

(i) any historical production variable for the facility; and

(ii) any transitional production variable for the facility; and

(iii) any related production variable for the facility; and

(b) the first financial year in relation to which the determination applies.

(4) The determination may state that:

(a) a particular production variable for the facility is a related production variable for the facility; and

(b) another specified production variable for the facility is the comparative production variable for that related production variable.

Note: See Subdivision D (related production variables).

(5) The determination:

(a) comes into force on the first day of the financial year specified for the purposes of paragraph (3)(b); and

(b) applies in relation to the facility for that financial year and each subsequent financial year.

Note: See subsection 22XQ(2) of the Act (commencement of determination).

(6) If the Regulator makes the determination, the Regulator must:

(a) notify the applicant for the determination that the Regulator has made the determination; and

(b) publish the determination on the Regulator’s website.

(7) If the Regulator decides to refuse to make the determination, the Regulator must give the applicant for the determination a written notice of the decision that includes the Regulator’s reasons for the decision.

19A Emissions intensity determination in relation to application specifying steelmaking production variables as historical production variables

(1) This section applies if an application under section 14 for an emissions intensity determination specifies the steelmaking production variables as historical production variables, and the Regulator decides under subsection 19(1) to make the determination.

(2) The following production variables are taken to be historical production variables for the facility:

(a) the primary iron production variable; and

(b) the continuously cast carbon steel products and ingots of carbon steel (manufacture of carbon steel from cold ferrous feed) production variable.

(3) Subparagraph 19(3)(a)(i) applies to the production variables mentioned in subsection (2) instead of the steelmaking production variables.

Note: Subparagraph 19(3)(a)(i) requires a determination to specify the facility‑specific emissions intensity number of any historical production variable for the facility.

(4) For the purpose of subsection 19(3)(a)(i), the Regulator must consider the designated historical information included in the application:

(a) in relation to the primary iron (steelmaking) production variable—as if that information was instead in relation to the primary iron production variable; and

(b) in relation to the ferrous feed (steelmaking) production variable—as if that information was instead in relation to the continuously cast carbon steel products and ingots of carbon steel (manufacture of carbon steel from cold ferrous feed) production variable.

20 Facility‑specific emissions intensity number

Historical production variables

(1) The facility‑specific emissions intensity number, of a historical production variable for a facility, is the number that is ascertained by dividing the total number of tonnes of carbon dioxide equivalence of covered emissions relevantly associated with the production variable in the relevant historical financial years for the production variable by the total quantity of the production variable in those financial years.

(2) The Regulator may round the facility‑specific emissions intensity number of a historical production variable for a facility to 4 or more significant figures if the Regulator considers it appropriate to do so.

(3) If the condition specified in column 1 of an item of the following table is satisfied in relation to a historical production variable specified in an application for an emissions intensity determination, each of the historical financial years specified in column 2 of that item is a relevant historical financial year for that production variable.

Relevant historical financial year |

Item | Column 1 Condition | Column 2 Relevant historical financial year |

1 | The application includes the designated historical information about all 5 historical financial years for the historical production variable | Each of the 3 historical financial years that is not: (a) the historical financial year with the highest emissions intensity for the historical production variable; or (b) the historical financial year with the lowest emissions intensity for the historical production variable |

2 | The application includes the designated historical information about only 4 historical financial years for the historical production variable | Each of the 2 historical financial years that is not: (a) the historical financial year with the highest emissions intensity for the historical production variable; or (b) the historical financial year with the lowest emissions intensity for the historical production variable |

3 | The application includes the designated historical information about only 3 historical financial years for the historical production variable | Each of the 2 historical financial years that is not the historical financial year with the highest emissions intensity for the historical production variable |

4 | The application includes the designated historical information about only 2 historical financial years for the historical production variable | The historical financial year with the lowest emissions intensity for the historical production variable |

5 | The application includes the designated historical information about only 1 historical financial year for the historical production variable | That historical financial year |

(4) For the purposes of items 1, 2, 3 and 4 of the table in subsection (3), the emissions intensity of a historical production variable for a historical financial year is ascertained by dividing the emissions relevantly associated with the production variable in the historical financial year by the quantity of the production variable in that financial year.

Related production variables

(5) The facility‑specific emissions intensity number, of a related production variable for a facility, is:

(a) if the related production variable is tonnes of reservoir carbon dioxide from new gas fields—zero; or

(b) otherwise—the same as the facility‑specific emissions intensity number of the comparative production variable for the related production variable.

Transitional production variables

(6) The facility‑specific emissions intensity number, of a transitional production variable for a facility, is the number that is equal to the default emissions intensity number of the production variable:

(a) if the production variable was applicable to the facility at any time during a historical financial year—for that financial year; or

(b) otherwise—for the financial year beginning on 1 July 2022.

Note: Subsections 91(2) and 92(2) modify the operation of this provision where the transitional production variable for the facility is run‑of‑mine coal, reservoir carbon dioxide from existing gas fields, natural gas throughput, or lithium hydroxide.

Subdivision D—Related production variables

21 Statement about related production variable when emissions intensity determination is made

(1) This section applies if:

(a) the Regulator decides to make an emissions intensity determination in relation to a facility; and

(b) the application for the determination includes a request for the determination to state that:

(i) a particular production variable for the facility is a related production variable for the facility; and

(ii) another specified production variable for the facility is the comparative production variable for that related production variable.

(2) The Regulator must decide to:

(a) include the statement in the determination; or

(b) refuse to include the statement in the determination.

(3) The Regulator must not include the statement in the determination unless satisfied that the particular production variable and the other production variable meet the requirements of section 23.

22 Statement about related production variable when emissions intensity determination is already in force

(1) If an emissions intensity determination is in force in relation to a facility, the responsible emitter for the facility may apply, in writing, to the Regulator to vary the determination to include a statement that:

(a) a particular production variable for the facility is a related production variable for the facility; and

(b) another specified production variable for the facility is the comparative production variable for that related production variable.

(2) The Regulator must decide to:

(a) make the variation; or

(b) refuse to make the variation.

(3) The Regulator must not make the variation unless satisfied that the particular production variable and the other production variable meet the requirements of section 23.

Notification of decision etc.

(4) If the Regulator makes the variation, the Regulator must notify the applicant of the variation and publish the emissions intensity determination, as varied, on the Regulator’s website.

(5) If the Regulator decides not to make the variation, the Regulator must give the applicant a written notice of the decision that includes the Regulator’s reasons for the decision.

When variation applies

(6) A variation under this section applies in relation to the financial year in which the application for the variation was made and each subsequent financial year.

23 Requirements for statement about related production variable

(1) A particular production variable for a facility and another production variable for the facility meet the requirements of this section if any of subsections (2), (3) or (4) apply.

(2) This subsection applies if:

(a) the particular production variable:

(i) is not a historical production variable for the facility; or

(ii) is a historical production variable for the facility but it was not reasonably practicable for the application for the determination to include the designated historical information about that production variable; and

(b) the particular production variable is substantially similar to the other production variable; and

(c) the particular production variable and the other production variable are measured using the same units or mutually convertible units; and

(d) the facility’s production of the particular production variable does not involve the installation of new equipment that is likely to increase the facility’s capacity to increase the total quantity of the particular production variable and the other production variable by more than 20% (relative to that quantity in the last financial year before the equipment is installed) in any of the years to which the determination is to apply.

(3) This subsection applies if:

(a) the particular production variable:

(i) is not a historical production variable for the facility; or

(ii) is a historical production variable for the facility but it was not reasonably practicable for the application for the determination to include the designated historical information about that production variable; and

(b) the particular production variable is the hot‑rolled long products (cold ferrous feed) production variable and the other production variable is the hot‑rolled long products produced at primary steel manufacturing facilities production variable.

(4) This subsection applies if:

(a) the particular production variable:

(i) is not a historical production variable for the facility; or

(ii) is a historical production variable for the facility but it was not reasonably practicable for the application for the determination to include the designated historical information about that production variable; and

(b) the particular production variable is the hot‑rolled flat products (cold ferrous feed) production variable and the other production variable is the hot‑rolled flat products produced at primary steel manufacturing facilities production variable.

(5) In this section:

hot‑rolled flat products (cold ferrous feed) production variable means the production variable in section 46 of Schedule 1.

hot‑rolled flat products produced at primary steel manufacturing facilities production variable means the production variable in section 43 of Schedule 1.

hot‑rolled long products (cold ferrous feed) production variable means the production variable in section 45 of Schedule 1.

hot‑rolled long products produced at primary steel manufacturing facilities production variable means the production variable in section 42 of Schedule 1.

Subdivision E—Successor determination

24 Successor determination for restructured facility

(1) This section applies if an activity, or a series of activities, that constitutes a facility (the original facility) in relation to which an emissions intensity determination is in force:

(a) ceases to constitute the original facility; and

(b) either:

(i) begins to constitute one or more other facilities; or

(ii) becomes included in the activity, or series of activities, that constitutes another facility.

Note: See the definition of facility in section 9 of the Act.

(2) The Regulator may make a determination in relation to a facility covered by paragraph (1)(b) (a successor facility) in accordance with the process set out in section 25.

(3) The determination must be in writing and must specify:

(a) the facility‑specific emissions intensity number of:

(i) any historical production variable for the successor facility that was also a historical production variable for the original facility; and

(ii) any related production variable for the successor facility that was also a related production variable for the original facility; and

(iii) any transitional production variable for the successor facility that was also a transitional production variable for the original facility; and

(b) the first financial year in relation to which the determination applies.

(4) In making the determination, the Regulator may have regard to any matter the Regulator considers relevant.

(5) The determination:

(a) comes into force on the first day of the financial year specified for the purposes of paragraph (3)(b); and

(b) applies in relation to the successor facility for that financial year and each subsequent financial year.

Note: See subsection 22XQ(2) of the Act (commencement of determination).

25 Process for making successor determination

(1) If the Regulator proposes to make a successor determination in relation to a facility, the Regulator must notify the responsible emitter for the facility in writing that the Regulator proposes to do so.

(2) The notice must:

(a) specify:

(i) the facility‑specific emissions intensity number of any production variable for the facility that would be specified in the determination; and

(ii) the first financial year in relation to which the determination would apply; and

(b) invite the responsible emitter to provide a written response to the proposed determination within the period specified in the notice.

(3) The notice may request that the responsible emitter provide the Regulator with specified information that the Regulator considers relevant to the proposed determination.

(4) Within 30 days after the end of the period specified in the notice, the Regulator must consider the responsible emitter’s response (if any) to the proposed determination and decide to:

(a) make the determination; or

(b) not make the determination.

(5) If the Regulator makes the determination, the Regulator must:

(a) notify the responsible emitter that the Regulator has made the determination; and

(b) publish the determination on the Regulator’s website.

Subdivision F—Variation by Regulator of emissions intensity determination

26 Variation by Regulator of emissions intensity determination

(1) Subject to subsection (4), if an emissions intensity determination is in force in relation to a facility, the Regulator may vary, in accordance with the process set out in section 28, a facility‑specific emissions intensity number specified in the determination if satisfied that:

(a) the amount of covered emissions of greenhouse gases from the operation of the facility during a historical financial year differs by at least 1% from the amount specified in the application for the determination; and

(b) the difference is due to:

(i) a relevant regulatory change that came into force after the determination was made; or

(ii) a different method being used, after the determination was made, to report the facility’s emissions in accordance with the Act; or

(iii) a change of activities at the facility after the determination was made.

(2) The variation:

(a) comes into force on the first day of the first financial year in which:

(i) the relevant regulatory change came into force; or

(ii) the different method was used; or

(iii) the change of activities occurred; and

(b) applies in relation to the facility for that financial year and each subsequent financial year.

Note: See subsection 22XQ(2) of the Act (commencement of determination).

(3) If, under this section, the Regulator varies an emissions intensity determination that is in force in relation to a facility, the Regulator must:

(a) notify the responsible emitter for the facility of the variation; and

(b) publish the determination, as varied, on the Regulator’s website.

(4) The Regulator must not vary the determination if the difference referred to in paragraph (1)(a) is due to an increase in the emissions intensity of a production variable for the facility resulting from a lower method being used instead of a higher method, after the determination was made, to report the facility’s emissions in accordance with the Act.

(5) This section does not limit subsection 33(3) of the Acts Interpretation Act 1901.

(6) In this section:

higher method has the same meaning as in the NGER (Measurement) Determination.

lower method has the same meaning as in the NGER (Measurement) Determination.

method has the same meaning as in the NGER (Measurement) Determination.

relevant regulatory change means:

(a) an amendment to the NGER Regulations, including a change to the Global Warming Potentials specified for a greenhouse gas in regulation 2.02 of the NGER Regulations; or