1 Name of regulation

This regulation is the Product Stewardship (Televisions and Computers) Amendment (Single Product Class) Regulation 2013.

2 Commencement

Each provision of this regulation specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 4 and anything in this regulation not elsewhere covered by this table | The day after this regulation is registered. | |

2. Schedule 1 | The day after this regulation is registered. | |

3. Schedule 2 | 1 July 2013 | 1 July 2013 |

3 Authority

This regulation is made under the Product Stewardship Act 2011.

4 Schedule(s)

Each instrument that is specified in a Schedule to this instrument is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this instrument has effect according to its terms.

Schedule 1—Amendments commencing day after registration

Product Stewardship (Televisions and Computers) Regulations 2011

1 Subregulations 3.04(5) and (6)

Repeal the subregulations.

2 After regulation 3.04

Insert:

3.04A Import or manufacture share—no co‑regulatory membership on 30 June

(1) This regulation applies if a person:

(a) is a liable party in a financial year because of television or computer products that were imported or manufactured before the financial year; and

(b) is not a member of a co‑regulatory arrangement on 30 June of the financial year; and

(c) becomes a member of a co‑regulatory arrangement at a later time.

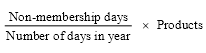

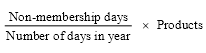

(2) For subregulation 3.04(4), a proportion of the products are taken to have been imported or manufactured in the financial year immediately before the year in which the person becomes a member of the co‑regulatory arrangement, as worked out according to the following formula:

where:

non‑membership days means the number of days in the financial year, immediately before 30 June, for which the liable party was not a member of a co‑regulatory arrangement.

number of days in year means the number of days in the financial year.

products means the television or computer products mentioned in paragraph (1)(a).

(3) Regulation 3.04B (which allows proportioning of the products) does not apply to those products.

Example 1: A person imports 20 000 web cameras in the 2013/2014 financial year, and therefore is a liable party in the 2014/2015 financial year. The person is not a member of a co‑regulatory arrangement in the 2014/2015 financial year, and does not become a member of a co‑regulatory arrangement until the 2015/2016 financial year.

The co‑regulatory arrangement must count all of the 20 000 web cameras as if the web cameras had been imported in the 2014/2015 financial year, even if the liable party is not a member of the co‑regulatory arrangement for the whole of the 2015/2016 financial year.

Example 2: A person imports 36 500 web cameras in the 2013/2014 financial year, and therefore is a liable party in the 2014/2015 financial year. The person is a member of a co‑regulatory arrangement for the first 265 days of the 365 days in the financial year, but is not a member for the last 100 days, including on 30 June.

The co‑regulatory arrangement must count 10 000 web cameras (10 000 = 36 500 ÷ 365 x 100) as if the web cameras had been imported in the 2014/2015 financial year, even if the liable party is not a member of the co‑regulatory arrangement for the whole of the 2015/2016 financial year.

(4) Subregulation (2) does not affect the import of manufacture share of co‑regulatory arrangements in the financial year mentioned in paragraph (1)(a).

3.04B Import or manufacture share—co‑regulatory membership for part of year

(1) This regulation applies if:

(a) a co‑regulatory arrangement is working out its import or manufacture share of a kind of television or computer products, for a financial year; and

(b) a liable party was a member of the co‑regulatory arrangement for only part of the financial year.

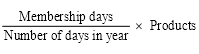

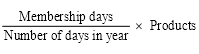

(2) For subregulation 3.04(4), the co‑regulatory arrangement must count only a proportion of the kind of television or computer products that were imported or manufactured by the member, as worked out using the following formula:

where:

membership days means the number of days in the financial year that the liable party was a member of the co‑regulatory arrangement.

number of days in year means the number of days in the financial year.

products means the number of that kind of television or computer product that was imported or manufactured in the year before the financial year.

Example: A liable party imported 36 500 web cameras in the year before the financial year. The liable party was a member of a co‑regulatory arrangement for 100 days of the financial year.

The co‑regulatory arrangement must count only 10 000 of the web cameras (i.e. 10 000 = 36 500 x 100 ÷ 365) when working out its import or manufacture share for the financial year.

(3) For subregulation (2), if the liable party:

(a) becomes a member of a co‑regulatory arrangement after 1 July in a financial year; and

(b) has not previously been a member of another co‑regulatory arrangement in the financial year;

the liable party is taken to be a member of the co‑regulatory arrangement from 1 July of the financial year.

Example: A liable party is not a member of a co‑regulatory arrangement between 1 July 2014 and 31 August 2014, when the liable party becomes a member of co‑regulatory arrangement ABC. The liable party remains a member of co‑regulatory arrangement ABC until 30 June 2015.

The liable party is taken to have been a member of co‑regulatory arrangement ABC from 1 July 2014 to 30 June 2015.

(4) For subregulation (2), if a liable party:

(a) becomes a member of a co‑regulatory arrangement (the previous co‑regulatory arrangement) in a financial year; and

(b) becomes a member of another co‑regulatory arrangement (the later co‑regulatory arrangement) later that financial year;

the liable party is taken to be a member of the later co‑regulatory arrangement from the day after the liable party stopped being a member of the previous co‑regulatory arrangement.

Example 1: A liable party was a member of co‑regulatory arrangement ABC from 1 July until 31 August 2013. The liable party becomes a member of co‑regulatory arrangement XYZ on 1 December 2013 and remains a member until 30 June 2014.

For subregulation (2), the liable party is taken to be a member of co‑regulatory arrangement XYZ between 1 September 2013 and 30 June 2014.

Example 2: A liable party became a member of co‑regulatory arrangement ABC on 1 July, and stopped being a member on 31 August 2013. The liable party becomes a member of co regulatory arrangement XYZ on 1 August 2013, (i.e. before the liable party stopped being a member of co‑regulatory arrangement ABC) and remains a member until 30 June 2014.

For subregulation (2), the liable party is taken to be a member of co‑regulatory arrangement XYZ between 1 September 2013 and 30 June 2014.

Schedule 2—Amendments commencing 1 July 2013

Product Stewardship (Televisions and Computers) Regulations 2011

1 Subregulation 1.03(1)

Omit “(1) In”, substitute “In”.

2 Subregulation 1.03(1) (definition of class of products)

Repeal the definition.

3 Subregulation 1.03(1)

Insert:

computer means a product with a product code mentioned in Part 2 of Schedule 1, 1A or 1B.

4 Subregulation 1.03(1) (definition of computer class)

Repeal the definition.

5 Subregulation 1.03(1)

Insert:

computer part or peripheral means a product with a product code mentioned in Part 4 of Schedule 1, 1A or 1B.

6 Subregulation 1.03(1) (definition of converted weight)

Repeal the definition, substitute:

converted weight, in relation to a number of units of a kind of television or computer product, means the number obtained by multiplying the number of units by the conversion factor mentioned for the product in column 3 of the relevant Schedule.

7 Subregulation 1.03(1) (definition of import or manufacture share of a co‑regulatory arrangement)

Repeal the definition.

8 Subregulation 1.03(1)

Insert:

import or manufacture share: see regulation 3.04.

kind of television or computer product means a television or computer product with a distinct product code.

Example: Plasma televisions with a screen size less than 76cm have the distinct product code 8528.72.00.23. They are a kind of television or computer product.

9 Subregulation 1.03(1) (definition of material recovery target)

Omit “products in a class of products”, substitute “television or computer products.

10 Subregulation 1.03(1) (definition of percentage target)

Repeal the definition, substitute:

percentage target, in relation to a television or computer product for a financial year, means the percentage target set out in Schedule 2 for the television or computer product for the financial year.

11 Subregulation 1.03(1)

Insert:

printer means a product with a product code mentioned in Part 3 of Schedule 1, 1A or 1B.

12 Subregulation 1.03(1) (definition of product code)

Repeal the definition, substitute:

product code, for a television or computer product, means the code mentioned for the product in the document called the Combined Australian Customs Tariff Nomenclature and Statistical Classification.

Note: In 2013, the Combined Australian Customs Tariff Nomenclature and Statistical Classification was accessible on the Australian Customs and Border Protection Service website (www.customs.gov.au).

13 Subregulation 1.03(1) (definition of recycle)

Omit “a product,”, substitute “a television or computer product,”.

14 Subregulation 1.03(1) (definition of recycling target)

Repeal the definition, substitute:

recycling target: see regulation 3.04.

15 Subregulation 1.03(1)

Insert:

relevant Schedule, for a unit of a television or computer product, means:

(a) for a unit imported or manufactured before 1 January 2012—Schedule 1; and

(b) for a unit imported or manufactured on or after 1 January 2012 and before 1 July 2012—Schedule 1A; and

(c) for a unit imported or manufactured on or after 1 July 2012—Schedule 1B.

16 Subregulation 1.03(1) (definition of scheme target)

Repeal the definition, substitute:

scheme target: see regulation 3.04.

17 Subregulation 1.03(1)

Insert:

television means a product with a product code mentioned in Part 1 of Schedules 1, 1A and 1B.

18 Subregulation 1.03(1) (definition of television class)

Repeal the definition.

19 Subregulation 1.03(1)

Insert:

television or computer product: see subregulation 1.04(2).

20 Subregulation 1.03(1) (definition of waste arising)

Repeal the definition, substitute:

waste arising: see regulation 3.04.

21 Subregulation 1.03(1) (definition of whole unit)

Omit “a product” (wherever occurring), substitute “a television or computer product,”.

22 Subregulation 1.03(2)

Repeal the subregulation.

23 Regulation 1.04

Repeal the regulation, substitute:

1.04 Application

(1) These Regulations apply to television or computer products.

(2) A television or computer product is:

(a) a television; or

(b) a computer that was manufactured outside Australia; or

(c) a printer; or

(d) a computer part or peripheral.

24 Regulation 1.05 (note)

Repeal the note.

25 Regulations 2.01 to 2.03

Repeal the regulations, substitute:

2.01 What this Division does

(1) This Division specifies the class of persons who are liable parties in relation to television or computer products; and

(2) This Division is made for subsection 19(1) of the Act.

2.02 Liable parties

Televisions

(1) A person is a liable party, for a financial year, if:

(a) the person is a constitutional corporation in that financial year; and

(b) in the previous financial year:

(i) the person imported or manufactured more than 5 000 televisions; or

(ii) the person, and a related body corporate, imported or manufactured more than 5 000 televisions, of which more than 1 000 were imported or manufactured by the person.

Note 1: An example of subparagraph (1)(b)(i) is a person who imported 4 000 televisions and manufactured 2 000 televisions.

Note 2: An example of subparagraph (1)(b)(ii) is a person who imported 2 000 televisions when a related body corporate imported 4 000 televisions.

Computers or printers

(2) A person is a liable party, for a financial year, if:

(a) the person is a constitutional corporation in that financial year; and

(b) in the previous financial year:

(i) the person imported or manufactured more than 5 000 computers or printers; or

(ii) the person, and a related body corporate, imported or manufactured more than 5 000 computers or printers, of which more than 1 000 were imported or manufactured by the person.

Note 1: An example of subparagraph (2)(b)(i) is a person who imported 4 000 computers and manufactured 2 000 printers.

Note 2: An example of subparagraph (2)(b)(ii) is a person who imported 2 000 computers when a related body corporate manufactured 4 000 printers.

Computer parts or peripherals

(3) A person is a liable party, for a financial year, if:

(a) the person is a constitutional corporation in that financial year; and

(b) in the previous financial year, the person imported or manufactured more than 15 000 computer parts or peripherals.

Obligation as liable party continues

(4) If:

(a) a person is a liable party for television or computer products in a financial year; and

(b) the person is not a member of a co‑regulatory arrangement on 30 June of that financial year;

the person continues to be a liable party, for those products, until the end of the financial year in which the person becomes a member of a co‑regulatory arrangement, regardless of whether the person would have been a liable party in that financial year but for this subregulation.

Definitions for regulation

(5) In this regulation:

imported, in relation to a product, means:

(a) the product is the subject of an import declaration under section 71A of the Customs Act 1901; and

(b) the product has been entered for home consumption under subsection 68(3A) of that Act.

manufactured means manufactured in Australia.

26 Subregulation 3.01(1)

Omit “a class of products”, substitute “television or computer products”.

27 Paragraph 3.01(1)(a)

Repeal the paragraph, substitute:

(a) reasonable access to collection services in metropolitan, inner regional, outer regional and remote areas must be provided in accordance with regulation 3.03 before the later of:

(i) 31 December 2013; and

(ii) the end of 12 months after the co‑regulatory arrangement was approved;

28 Subregulation 3.01(2)

Omit “a class of products”, substitute “television or computer products”.

29 Paragraph 3.01(2)(a)

Omit “a product”, substitute “a television or computer product”.

30 Paragraph 3.01(2)(b)

Omit “a product in the class of products”, substitute “television or computer products”.

31 Paragraphs 3.02(a) to (e)

Omit “products”, substitute “television or computer products”.

32 Regulation 3.04

Repeal the regulation, substitute:

3.04 Working out recycling target

(1) The recycling target of a co‑regulatory arrangement, for a financial year, is the scheme target for that year multiplied by the co‑regulatory arrangement’s import or manufacture share for that year.

(2) The scheme target is the percentage target for a financial year (see Schedule 2) multiplied by the waste arising.

(3) Waste arising is worked out as follows:

Method statement

Step 1 Identify the total converted weight of all television or computer products imported or manufactured in the last 3 financial years.

Step 2 Work out the annual average converted weight of products by dividing the result of step 1 by 3.

Step 3 Multiply the result of step 2 by 0.9

Note: In 2013, the total converted weight was accessible on the department’s website (http://www.environment.gov.au/).

(4) The import or manufacture share, of a co‑regulatory arrangement, for a financial year (the current financial year), is worked out using the following steps:

Method statement

Step 1A For each kind of television or computer product, identify the total number of units imported or manufactured, in the previous financial year, by all liable parties who are members of the co‑regulatory arrangement during the current financial year.

Step 1B Multiply that number by the conversion factor for that kind of product (as set out in column 3 of the relevant Schedule).

Step 2A For each kind of television or computer product, identify the total number of units exported, in the previous financial year, by all liable parties who are members of the co‑regulatory arrangement on 15 September of the current financial year.

Step 2B Multiply that number by the conversion factor for that kind of product (as set out in column 3 of the relevant Schedule).

Step 3 For each kind of television or computer product, take the result of step 1B and subtract the result of step 2B.

Step 4 Add together each result of step 3.

Step 5A Identify the total converted weight of all television or computer products imported or manufactured by all liable parties in the previous financial year.

Note: In 2013, the total converted weight of each kind of television or computer product was accessible on the department’s website (http://www.environment.gov.au/).

Step 5B From that number, deduct the total converted weight of the exported products reported under regulation 3.04C.

Step 6 Divide the result of step 4 by the result of step 5B.

(5) For subregulation (4), the co‑regulatory arrangement:

(a) must use the same conversion factor for steps 1B and 2B; and

(b) may only count products of a kind for which the requirements of subregulation 2.02(1), (2) or (3) are satisfied.

Example: If a person imports 6 000 televisions and 6 000 computers in a financial year, the televisions and the computers must be taken into account when working out the import share.

However, if a person imports 6 000 televisions and 2 000 computers (i.e. less than the number of computers required in subregulation 2.02(2)) in a financial year, only the televisions must be counted when working out the import or manufacture share.

33 After regulation 3.04B

Insert:

3.04C Import or manufacture share—counting exported products

(1) This regulation applies if:

(a) a liable party was a member of a co‑regulatory arrangement on 15 September of a financial year (the current financial year); and

(b) the liable party exported television or computer products in the previous financial year.

(2) The co‑regulatory arrangement, when working out its import or manufacture share for the current financial year, may count the exported products only if the administrator of the arrangement, on or before 15 September of the current financial year, gives the Minister:

(a) a report that states:

(i) the total number of units of each kind of television or computer product (identified by product code) exported by members in the previous financial year; and

(ii) the total converted weight of each kind of kind of television or computer product exported by members in the previous financial year; and

(iii) evidence that each product was imported or manufactured no more than 1 year before the product was exported; and

(b) a report, prepared by an auditor, that states the report mentioned in paragraph (a) is accurate.

(3) In this regulation:

auditor means:

(a) a person that is a registered company auditor under section 1280 of the Corporations Act 2001; or

(b) a company that is an authorised audit company under section 1299C of the Corporations Act 2001.

34 Subregulation 3.05(1)

Omit “A product in a class of products”, substitute “A television or computer product”.

35 Regulation 3.06

Omit “the products in a class of products”, substitute “television or computer products”.

36 Paragraph 4.01(e)

Omit “products”, substitute “television or computer products”.

37 Subregulation 5.08(1)

Omit “a class of products”, substitute “television or computer products”.

38 Subregulation 5.09(1)

Omit “(1) The liable party in relation to a class of products”, substitute “The liable party in relation to television or computer products”.

39 Subregulation 5.09(2)

Repeal the subregulation.

40 Subregulation 5.10(1)

Omit from “(1) The liable party” to “year:”, substitute:

(1) This regulation applies if a related body corporate, of a liable party, imported or manufactured televisions, computers or printers in a financial year.

(1A) The liable party must give the Minister, before 1 September of the following financial year, the following information about the related body corporate:

41 Subregulation 5.10(2)

Repeal the subregulation.

42 Subregulation 5.11(1)

Omit “a class of products must give the Minister any information relating to products in that class”, substitute “television or computer products must give the Minister any information relating to those products”.

43 Paragraph 5.14(1)(a)

Repeal the paragraph.

44 Paragraph 5.14(2)(b)

Omit “if the co‑regulatory arrangement covers more than one class of products—the class of”, substitute “the kinds of television or computer”.

45 Subregulation 5.14(3)

Omit “storage of products”, substitute “storage of television or computer products”.

46 Paragraphs 5.14(3)(b) and (c)

Omit “products in a class of products”, substitute “television or computer products”.

47 Subregulation 5.14(4)

Omit “recycling of products under”, substitute “recycling of television or computer products under”.

48 Paragraphs 5.14(4)(a) to (f)

Omit “products in a class of”, substitute “the”.

49 Subregulation 5.14(5)

Omit “products exported”, substitute “television or computer products exported”.

50 Paragraph 5.14(5)(a)

Omit “products in a class of”, substitute “the”.

51 Subregulation 5.14(6)

Omit “each class of products”, substitute “television or computer products”.

52 Paragraphs 5.14(6)(c) and (7)(a)

Omit “products”, substitute “the products”.

53 Subregulation 5.14(8)

Omit “products in a class of products”, substitute “television or computer products”.

54 Paragraphs 5.14(10)(a), (c) and (d)

Omit “products in a class of products”, substitute “television or computer products”.

55 After Part 5

Insert:

Part 6—Transitional provisions

Division 1—Transition to Product Stewardship (Televisions and Computers) Amendment (Single Product Class) Regulation 2013

6.01 Approving co‑regulatory arrangements

(1) This regulation applies if, immediately before the commencement of this regulation, a co‑regulatory arrangement was approved under section 26 of the Act in relation to both the television class and the computer class.

(2) On and from the commencement of this regulation, the co‑regulatory arrangement is taken to be approved for television and computer products.

56 Schedule 1 (heading)

Repeal the heading, substitute:

Schedule 1—Television or computer products, product codes and conversion factors until 31 December 2011

Note: See regulations 1.03 and 1.04.

57 Part 2 of Schedule 1 (heading)

Repeal the heading, substitute:

Part 2—Computers

58 Division 1 of Part 2 of Schedule 1 (heading)

Repeal the heading.

59 Division 2 of Part 2 of Schedule 1 (heading)

Repeal the heading, substitute:

Part 3—Printers

60 Division 3 of Part 2 of Schedule 1 (heading)

Repeal the heading, substitute:

Part 4—Computer parts and peripherals

61 Division 3 of Part 2 of Schedule 1 (table item 6.2)

Omit “6.1”, substitute “4.1”.

62 Schedule 1A (heading)

Repeal the heading, substitute:

Schedule 1A—Television or computer products, product codes and conversion factors from 1 January 2012 to 30 June 2012

Note: See regulations 1.03 and 1.04.

63 Part 2 of Schedule 1A (heading)

Repeal the heading, substitute:

Part 2—Computers

64 Division 1 of Part 2 of Schedule 1A (heading)

Repeal the heading.

65 Division 2 of Part 2 of Schedule 1A (heading)

Repeal the heading, substitute:

Part 3—Printers

66 Division 3 of Part 2 of Schedule 1A (heading)

Repeal the heading, substitute:

Part 4—Computer parts and peripherals

67 Division 3 of Part 2 of Schedule 1A (table item 6.2)

Omit “6.1”, substitute “4.1”.

68 After Schedule 1A

Insert:

Schedule 1B—Television or computer products, product codes and conversion factors from 1 July 2012

Note: See regulations 1.03 and 1.04.

Part 1—Televisions

Division 1—Colour

Colour televisions—product codes and conversion factors |

Item | Column 1 Description | Column 2 Product code | Column 3 Conversion factor (kg) |

1.1 | Plasma: | | |

| (a) screen size less than 76cm | 8528.72.00.23 | 25.7 |

| (b) screen size 76cm or more but less than 111cm | 8528.72.00.24 | 25.7 |

| (c) screen size 111cm or more but less than 137cm | 8528.72.00.25 | 32.7 |

| (d) screen size 137cm or more | 8528.72.00.26 | 38.6 |

1.2 | LCD and LED: | | |

| (a) screen size less than 35cm | 8528.72.00.81 | 2.5 |

| (b) screen size 35cm or more but less than 43cm | 8528.72.00.82 | 2.6 |

| (c) screen size 43cm or more but less than 51cm | 8528.72.00.83 | 3.4 |

| (d) screen size 51cm or more but less than 59cm | 8528.72.00.84 | 3.9 |

| (e) screen size 59cm or more but less than 74cm | 8528.72.00.85 | 4.8 |

| (f) screen size 74cm or more but less than 84cm | 8528.72.00.86 | 10.9 |

| (g) screen size 84cm or more but less than 99cm | 8528.72.00.87 | 13.7 |

| (h) screen size 99cm or more but less than 109cm | 8528.72.00.88 | 15.9 |

| (i) screen size 109cm or more but less than 125cm | 8528.72.00.89 | 18.0 |

| (j) screen size 125cm or more but less than 135cm | 8528.72.00.90 | 25.5 |

| (k) screen size 135cm or more but less than 150cm | 8528.72.00.91 | 28.7 |

| (l) screen size 150cm or more | 8528.72.00.92 | 37.7 |

1.3 | Other | 8528.72.00.93 | 37.7 |

Division 2—Black and white or other monochrome

Other televisions—product codes and conversion factors |

Item | Column 1 Description | Column 2 Product code | Column 3 Conversion factor (kg) |

2.1 | Black and white or other monochrome | 8528.73.00.35 | 1.0 |

Part 2—Computers

Computers—product codes and conversion factors |

Item | Column 1 Description | Column 2 Product code | Column 3 Conversion factor (kg) |

3.1 | Automatic data processing machines and units, magnetic or optical readers, machines for transcribing data onto data media in coded form, and machines for processing the data: | | |

| (a) portable automatic data processing machines, weighing not more than 10kg, consisting of at least a central processing unit, a keyboard and a display: | | |

| (i) laptops, notebooks and palmtops weighing: | | |

| (A) not more than 1kg | 8471.30.00.31 | 0.6 |

| (B) more than 1kg but not more than 3kg | 8471.30.00.33 | 2.3 |

| (C) more than 3kg but not more than 10kg | 8471.30.00.34 | 3.4 |

| (ii) other | 8471.30.00.90 | 3.0 |

| (b) other automatic data processing machines, comprising in the same housing at least a central processing unit and an input and output unit, whether or not combined: | | |

| (i) personal computers | 8471.41.00.21 | 10.7 |

| (ii) other | 8471.41.00.91 | 10.0 |

| (c) other automatic data processing machines, presented in the form of systems: | | |

| (i) personal computers | 8471.49.00.22 | 13.5 |

| (ii) other | 8471.49.00.92 | 13.5 |

| (d) processing units other than those mentioned in paragraphs (b) and (c), whether or not containing in the same housing one or 2 storage units, input units or output units: | | |

| (i) central processing units for personal computers | 8471.50.00.23 | 10.4 |

| (ii) other | 8471.50.00.93 | 13.2 |

3.2 | Monitors and projectors, not incorporating television reception apparatus, reception apparatus for television, whether or not incorporating radio‑broadcast receivers or sound or video recording or reproducing apparatus: | | |

| (a) cathode‑ray tube monitors of a kind solely or principally used in an automatic data processing system mentioned in item 3.1 | 8528.41.00.10 | 11.4 |

| (b) other monitors of a kind solely or principally used in an automatic data processing system mentioned in item 3.1: | | |

| (i) flat screen monitors | 8528.51.00.32 | 6.4 |

| (ii) other | 8528.51.00.33 | 6.3 |

Part 3—Printers

Printers—product codes and conversion factors |

Item | Column 1 Description | Column 2 Product code | Column 3 Conversion factor (kg) |

4.1 | Machines which perform 2 or more of the functions of printing, copying or fax transmission (with printing or copying as the principal function) capable of connecting to an automatic data processing machine or to a network, weighing: | | |

| (a) not more than 10kg | 8443.31.00.20 | 5.3 |

| (b) more than 10kg but not more than 20kg | 8443.31.00.21 | 11.7 |

| (c) more than 20kg but not more than 50kg | 8443.31.00.22 | 23.6 |

| (d) more than 50kg but not more than 100kg | 8443.31.00.23 | 81.6 |

| (e) more than 100kg but not more than 150kg | 8443.31.00.24 | 122.0 |

| (f) more than 150kg but not more than 200kg | 8443.31.00.25 | 152.0 |

| (g) more than 200kg but not more than 300kg | 8443.31.00.26 | 238.3 |

| (h) more than 300kg but not more than 500kg | 8443.31.00.27 | 304.0 |

| (i) more than 500kg | 8443.31.00.28 | 617.2 |

4.2 | Other printers capable of connecting to an automatic data processing machine or to a network, weighing: | | |

| (a) not more than 10kg | 8443.32.00.31 | 6.3 |

| (b) more than 10kg but not more than 20kg | 8443.32.00.32 | 12.4 |

| (c) more than 20kg but not more than 50kg | 8443.32.00.33 | 22.5 |

| (d) more than 50kg but not more than 100kg | 8443.32.00.34 | 75.1 |

| (e) more than 100kg but not more than 150kg | 8443.32.00.35 | 116.0 |

| (f) more than 150kg but not more than 200kg | 8443.32.00.36 | 157.7 |

| (g) more than 200kg but not more than 300kg | 8443.32.00.37 | 239.2 |

| (h) more than 300kg but not more than 500kg | 8443.32.00.38 | 384.2 |

| (i) more than 500kg | 8443.32.00.39 | 551.0 |

| | | | | |

Part 4—Computer parts and peripherals

Computer parts and peripherals—product codes and conversion factors |

Item | Column 1 Description | Column 2 Product code | Column 3 Conversion factor (kg) |

5.1 | Automatic data processing machines and units, magnetic or optical readers, machines for transcribing data onto data media in coded form, and machines for processing the data: | | |

| (a) input or output units, whether or not containing storage units in the same housing: | | |

| (i) keyboards | 8471.60.00.55 | 0.8 |

| (ii) joysticks and game pads | 8471.60.00.91 | 0.6 |

| (iii) mouses and trackballs | 8471.60.00.92 | 0.3 |

| (iv) scanners: | | |

| (A) not more than 1kg | 8471.60.00.65 | 0.4 |

| (B) more than 1kg but not more than 5kg | 8471.60.00.66 | 2.2 |

| (C) more than 5 kg | 8471.60.00.67 | 7.0 |

| (v) other | 8471.60.00.98 | 0.6 |

| (b) storage units: | | |

| (i) compact disc drives (including burners) | 8471.70.00.20 | 1.0 |

| (ii) digital video disc drives (including burners) | 8471.70.00.25 | 0.6 |

| (iii) hard drives | 8471.70.00.74 | 0.6 |

| (iv) other | 8471.70.00.44 | 0.04 |

5.2 | Parts and accessories for machines mentioned in item 3.1: | | |

| (a) cards (including network, sound, video, IDE, SCSI, and other similar cards) | 8473.30.00.62 | 0.5 |

| (b) motherboards | 8473.30.00.68 | 0.8 |

| (c) other | 8473.30.00.70 | 1.0 |

5.3 | Electrical transformers, static converters (for example, rectifiers and inductors)—static converters—separately housed units, designed to be housed in the same cabinet as the central processing unit of machines mentioned in item 3.1 | 8504.40.30.59 | 4.5 |

5.4 | Web cameras | 8525.80.10.15 | 0.1 |

69 Schedule 2 (heading)

Repeal the heading, substitute:

Schedule 2—Percentage targets

Note: See regulation 1.03, definition of percentage target

70 Part 1 of Schedule 2 (heading)

Repeal the heading.

71 Part 2 of Schedule 2

Repeal the Part.