Schedule 1 Amendments

(section 3)

[1] Part I, heading

substitute

Part 1 Preliminary

[2] Subregulation 2 (1)

insert

home buildings insurance contract means a contract referred to in regulation 9.

home contents insurance contract means a contract referred to in regulation 13.

[3] After regulation 2A

insert

Part 4 Disclosures and misrepresentations

Division 1 Insured’s duty of disclosure

[4] After regulation 3

insert

Division 3 Remedies for non‑disclosure and misrepresentations by insured

[5] After regulation 4

insert

Division 4 Key Facts Sheets

4A Application of Division

(1) This regulation is made for section 33A of the Act.

(2) Each of the following class of contracts of insurance is declared to be a class of contracts in relation to which Division 4 of Part IV of the Act applies:

(a) a home buildings insurance contract;

(b) a home contents insurance contract.

(3) In this Division, a reference to a contract includes a reference to a proposed or possible contract.

4B What is a Key Facts Sheet?

(1) This regulation:

(a) is made for section 33B of the Act; and

(b) prescribes:

(i) the information required to be contained in a Key Facts Sheet for a contract; and

(ii) requirements that a Key Facts Sheet must comply with.

(2) A Key Facts Sheet must:

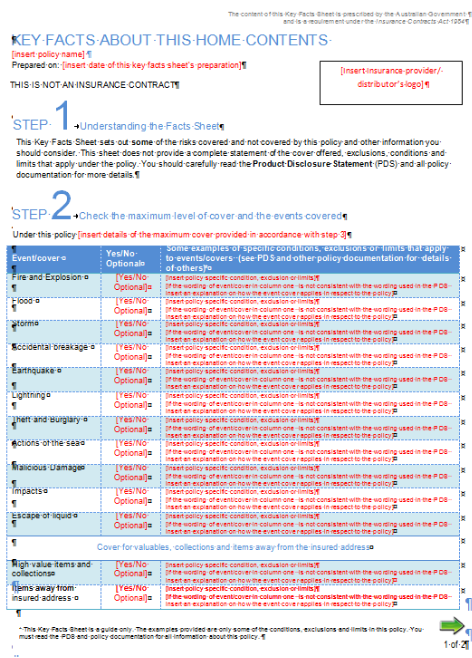

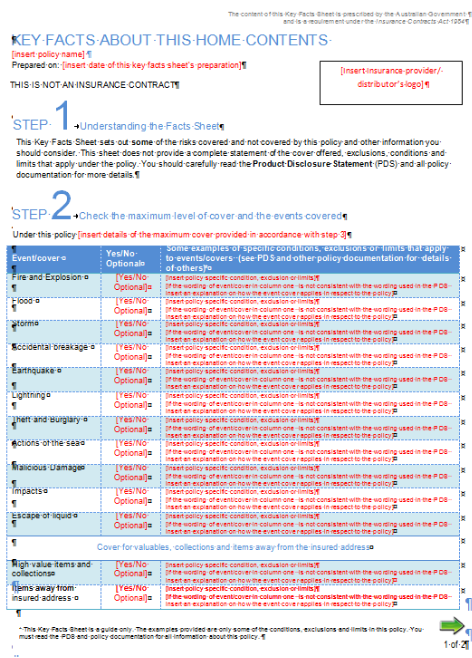

(a) contain the information, and be completed in the way, specified in the following form:

(i) for a home buildings insurance contract—Form 1 in Schedule 3;

(ii) for a home contents insurance contract—Form 2 in Schedule 3; and

(b) be A4 in size; and

(c) be set out in Arial font, in the following sizes:

(i) the heading at the top of the first page that starts with the words ‘KEY FACTS’ must be in size 18 font;

(ii) the word ‘STEP’ must be in size 16 font;

(iii) the number after the word ‘STEP’ must be in size 48 font;

(iv) the footnote after step 2 must be in size 8 font;

(v) the rest of the document must be in size 10 font; and

(d) be set out in the following colours, with sufficient contrast in the colours to allow the text to be easily read:

(i) the headings, subheadings, and policy name, must be in blue type on a white background;

(ii) the top box in step 2 must be in white type on a blue background;

(iii) the remaining boxes in step 2 must alternate between black type on a white background, and black type on a light blue background;

(iv) the box in step 3 must be in white type on a blue background;

(v) the rest of the document must be in black type on a white background.

4C Insurer’s obligation to provide Key Facts Sheet

(1) This regulation:

(a) is made for section 33C of the Act; and

(b) prescribes:

(i) the circumstances, and manner, in which an insurer must provide a Key Facts Sheet for a contract; and

(ii) the circumstances in which an insurer may or must provide a Key Facts Sheet for a contract by electronic means; and

(iii) exceptions to the requirement in subsection 33C (1) of the Act.

(2) An insurer must provide a person (a consumer) with a Key Facts Sheet for a contract:

(a) if the consumer requests information about the contract—as soon as reasonably practicable, but not later than 14 days, after the consumer first requests information about the contract; and

(b) if the consumer enters into the contract with the insurer (other than by an agreement to extend or vary the contract or a reinstatement of the contract)—as soon as reasonably practicable, but not later than 14 days, after the consumer enters into the contract.

(3) The insurer may provide the Key Facts Sheet by electronic means at the consumer’s request.

(4) If an insurer has a website that is accessible by members of the public, the insurer must keep the most current copy of each Key Facts Sheet for a contract on the website, in a format that may be downloaded by members of the public.

(5) An insurer is not required to provide a consumer with a Key Facts Sheet for a contract:

(a) if:

(i) the insurer has already provided the consumer with the Key Facts Sheet; and

(ii) the Key Facts Sheet has not changed since then, other than a change to the date of the Key Facts Sheet; or

(b) if:

(i) the insurer believes, on reasonable grounds, that someone else has already provided the consumer with the Key Facts Sheet; and

(ii) the Key Facts Sheet has not changed since then, other than a change to the date of the Key Facts Sheet; or

(c) if the consumer:

(i) requests information about the contract from an insurance broker; or

(ii) enters into the contract through an insurance broker who is not acting as an agent of the insurer in relation to the contract; or

(d) if the consumer does not provide the insurer with the consumer’s address (postal or electronic) to which the Key Facts Sheet is to be sent; or

(e) if the consumer informs the insurer that the consumer does not want the Key Facts Sheet.

[6] Part II, heading

substitute

Part 5 The contract—standard cover

[7] Subregulation 29C (2)

substitute

(2) However, subregulation (1) does not apply to a contract that is arranged by an insurance broker who is acting as an agent of the insured.

[8] Part III, heading

substitute

Part 10 Miscellaneous

[9] Part 4, heading

substitute

Part 11 Transitional arrangements

[10] Regulation 40, heading

substitute

40 Purpose of Part

[11] Subregulation 41 (1), note

omit

Part II

insert

Part 5

[12] After Schedule 2

insert

Schedule 3 Key Facts Sheets

(regulation 4B)

Form 1 Home buildings insurance contract

Form 2 Home contents insurance contract