1 Name of determination

This determination is the Family Law (Superannuation) (Interest Rate for Adjustment Period) Determination 2012.

2 Commencement

This determination commences on 1 July 2012.

3 Definition

In this determination:

regulations means the Family Law (Superannuation) Regulations 2001.

4 Adjustment period—financial year

For subregulation 45D (3) of the regulations, the interest rate for the adjustment period, being the financial year beginning on 1 July 2012, is 0.069.

5 Adjustment period—less than 12 months within financial year

(1) This section applies to an adjustment period of less than 12 months that begins and ends in the financial year beginning on 1 July 2012.

(2) For subregulation 45D (4) of the regulations, the method for working out the interest rate for the adjustment period is by using the formula:

where:

d is the number of days in the adjustment period.

6 Adjustment period—12 months not within financial year

(1) This section applies to an adjustment period of 12 months that begins in the financial year beginning on 1 July 2011 and ends in the financial year beginning on 1 July 2012.

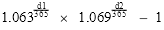

(2) For subregulation 45D (6) of the regulations, the method for working out the interest rate for the adjustment period is by using the formula:

where:

d1 is the number of days in the adjustment period in the financial year beginning on 1 July 2011.

d2 is the number of days in the adjustment period in the financial year beginning on 1 July 2012.

7 Adjustment period—less than 12 months not within financial year

(1) This section applies to an adjustment period of less than 12 months that begins in the financial year beginning on 1 July 2011 and ends in the financial year beginning on 1 July 2012.

(2) For subregulation 45D (6) of the regulations, the method for working out the interest rate for the adjustment period is by using the formula:

where:

d1 is the number of days in the adjustment period in the financial year beginning on 1 July 2011.

d2 is the number of days in the adjustment period in the financial year beginning on 1 July 2012.