Nation Building Program (National Land Transport) Act 2009

DETERMINATION of Conditions Applying to Payments under Part 8 of the Act

As amended.

Made under section 90(1) of the Nation Building Program (National Land Transport) Act 2009

This compilation was prepared on 11 April 2013 taking into account amendments to the determination of 9 September 2009 up to and including the Nation Building Program Roads to Recovery Program Conditions Variation FC2013/1 dated 18 March 2013.

Prepared by the South East Roads Branch, Nation Building - Infrastructure Investment Division, Department of Infrastructure and Transport, Canberra

Nation Building Program (National Land Transport) Act 2009

determination of conditions applying to payments under part 8

Preliminary

Definitions

1. (1) In this Determination, unless the contrary intention appears:

AusLink conditions means the conditions made under s90(1) of the AusLink (National Land Transport) Act 2005 as in force immediately before the commencement of this instrument.

Chief Executive Officer in relation to a funding recipient means the Chief Executive Officer or equivalent office holder of the funding recipient;

funded project means a project in respect of which a Roads to Recovery fpayment has been received;

funding recipient means a person or body that is to receive or has received a Roads to Recovery payment;

own source funds in respect of a funding recipient means funds available to the funding recipient other than funds provided by the Commonwealth, a State or Territory government or by the private sector for specific projects;

own source expenditure means the amount spent from a funding recipient’s own source funds;

relevant documents means, in relation to a funding recipient, documents relating to Roads to Recovery payments received by the funding recipient, including documents relating to projects in respect of which Roads to Recovery payments were spent and documents relating to expenditure by the funding recipient on the construction or maintenance of roads, whether out of Roads to Recovery payments or otherwise;

reference amount applicable to a funding recipient means the lesser of the following three amounts:

(i) the average financial year expenditure of own source funds by the funding recipient on the construction or maintenance of roads during the reference period; or

(ii) the average financial year expenditure of own source funds by the funding recipient on the construction or maintenance of roads for three of the financial years during the reference period, excluding the financial year in which the funding recipient’s expenditure of own source funds was highest and the financial year in which the funding recipient’s expenditure of own source funds was lowest; or

(iii) the reference amount applicable to the funding recipient on 30 June 2009 (in respect of payments made to the funding recipient during the funding period 1 July 2005 to 30 June 2009) plus 11.5%.

reference period is the period commencing on 1 July 2004 and ending on 30 June 2009;

Roads to Recovery payment means a payment of Commonwealth funds provided under the Roads to Recovery Program under Part 8 of the Act during the funding period 1 July 2009 to 30 June 2014;

small funded project means a project relating to the construction or maintenance of roads, the total cost of which is, or is expected to be, less than $10 000;

the Act means the Nation Building Program (National Land Transport) Act 2009.

(2) Terms that are defined in the Act have the same meaning in this Determination.

Part 2: Conditions relating to expenditure of payments

2.1. A funding recipient must ensure that Roads to Recovery payments are:

(a) spent only on the construction or maintenance of roads;

(b) spent only on projects which are identified in the works schedule submitted by the funding recipient in accordance with clause 5;

(c) spent only on work on projects which are in progress on or after 1 July 2009 and for which payment is required on or after 1 July 2009; and

(d) not spent on meeting any part of a price paid by the funding recipient for a supply acquired by the funding recipient where:

(i) the supply is a supply within the meaning of the A New Tax System (Goods and Services Tax) Act 1999; and

(ii) the part of the price represents the amount of GST payable on the supply by the entity which is making or which made, the supply.

Note: the terms ‘road’; ‘construction’ and ‘maintenance’ are defined in section 4 of the Act. The Department has issued Guidelines which give a more detailed explanation of these terms.

2.2. If:

(a) a Roads to Recovery payment is provided for a particular project specified by the Commonwealth; and

(b) that project costs the funding recipient less than the total Roads to Recovery payments provided in respect of that project or that project does not proceed at all; and

(c) the funding recipient wishes to spend the unspent Roads to Recovery payment on another project relating to the construction or maintenance of roads;

the funding recipient must first obtain the approval of the Department of the expenditure of those payments on that other project.

2.3. Subclause 2.2 only applies where the Commonwealth has specified that a Roads to Recovery payment is to be spent in relation to:

(a) a particular project in Western Australia involving the construction or maintenance of bridges; or

(b) a particular project in Western Australia involving the construction or maintenance of Aboriginal access roads.

2.4. A funding recipient must ensure that Roads to Recovery payments are spent within six months of receipt of the payment.

Note: The Minister has power under s.91 of the Act to waive a condition.

2.5 A funding recipient must spend all Roads to Recovery payments it receives by 31 December 2014.

2.6 If a funding recipient receives an amount as interest in respect of a Roads to Recovery payment in one financial year, the recipient must spend an amount equal to that amount on the construction or maintenance of roads in the next financial year and must be able to demonstrate that it has done so. This condition does not apply to councils which are to receive total funding of less than $1.25 million according to the list determined by the Minister under section 87(1) of the Act in relation to the funding period starting on 1 July 2009 and ending on 30 June 2014.

Note: Interest earned in respect of a Roads to Recovery payment is own source funds for the purposes of Part 3 of these conditions.

2.7 If a funding recipient distributes Roads to Recovery payments which it receives to local government authorities for expenditure by those authorities on the construction or maintenance of roads, the funding recipient must ensure that the authorities are subject to the same obligations in respect of those payments as those to which the funding recipient is subject to under subclause 5.8 and clause 6.

Part 3: Own source roads expenditure obligation

3.1 Subject to subclauses 3.2 and 3.3, for each financial year in which a funding recipient receives a Roads to Recovery payment, the funding recipient must spend on the construction or maintenance of roads an amount of own source funds equal to or greater than the reference amount applicable to the funding recipient.

3.2 If, in any particular financial year, a funding recipient does not satisfy cl.3.1, but the average expenditure of its own source funds in that year and the previous financial year, or in that year and the two previous financial years, exceeds the reference amount applicable to it, the funding recipient is taken to have met its obligations under subclause 3.1 in respect of the first mentioned financial year.

3.3. If, in a particular year, a funding recipient does not satisfy the requirements of clauses 3.1 or 3.2, and it can demonstrate that its own source funds in that year fell below its average annual own source funds for the period 1 July 2005 to 30 June 2009, then that funding recipient is taken to have met its obligations under clause 3.1 in respect of that financial year if its expenditure of own source funds has not declined proportionately more than the decline in its own source revenue.

Part 4: Public Information conditions

4.1 In all formal public statements, media releases or statements, displays, publications and advertising generated by a funding recipient relating to a funded project, the funding recipient must acknowledge and give appropriate recognition to the contribution of the Australian Government to that project.

4.2 If a funding recipient proposes to issue any media release relating to a funded project, the funding recipient must consult with and obtain approval of the proposed release from the Department.

4.3 Subject to subclause 4.4, a funding recipient must ensure that signs in the form specified in Schedule 2 are erected for each funded project, other than projects which are estimated to cost under $10,000, at the time work on the project commences, as follows:

(a) except where the funded project relates to a cul-de-sac or a one-way road, one sign must be erected at the place where the funded project starts, and one sign must be erected at the place where the funded project ends. Where the funded project relates to a cul-de-sac, one sign must be erected at the entrance to the cul-de-sac. Where the funded project relates to a one-way road, one sign must be erected at the place where the project begins.

(b) all signs must be erected in a prominent but safe position facing oncoming traffic, in any event so that they are plainly visible to passing motorists;

(c) signs erected as required by this clause must have greater prominence, in size and frequency and visibility, than any other signs which relate to the funded project or which are erected in the immediate vicinity of the funded project.

4.4 Signs should be as specified in figures 1 and 2 of Schedule 2 except that, where a funded project is undertaken on a road where the usual speed limit is 80km per hour or less, the signs may be as specified in figures 3 and 4 of that Schedule.

4.5 A funding recipient must ensure that all signs erected as required by these conditions remain in place for the duration of the project to which they relate and for a minimum period of one year commencing on the day on which the project is completed.

4.6 If a funding recipient proposes to hold an opening ceremony in relation to a funded project, the funding recipient must inform the Department of the proposed ceremony at least two weeks before the proposed ceremony is to be held, and provide details of the proposed ceremony, including proposed invitees and order of proceedings. If requested by the Department, the funding recipient must arrange a joint Australian Government/funding recipient opening ceremony.

4.7 If requested by the Minister’s office or the Department, a funding recipient must arrange for an Australian Government representative to attend any opening ceremony which the funding recipient proposes to hold in relation to a funded project.

Part 5: Conditions relating to planning and reporting

5.1. A funding recipient must prepare and submit, as soon as practical after 1 July 2009, but in any event prior to the time the recipient submits its first quarterly report under subclause 5.7 or subclause 5.8, a works schedule to the Department in the manner and form specified by the Department.

5.2 Subject to cl.5.3, a funding recipient must ensure that its works schedule;

(a) specifies each project on which the funding recipient proposes to spend, on or after 1 July 2009, Roads to Recovery payments received by the funding recipient;

(b) specifies each project which has been completed and for which Roads to Recovery payments were received;

(c) specifies the location of each project (other than small funded projects) specified in the works schedule by means including data for use in a Geographical Information System in the manner and form required by the Department;

(d) includes a description of the project and the funding recipient’s reason for undertaking each project specified in the works schedule;

(e) specifies the estimated start and completion date for each project specified in the works schedule;

(f) specifies the estimated total amount of Roads to Recovery payments to be spent on each project specified in the works schedule; and

(g) in relation to projects specified in the works schedule not funded wholly from Roads to Recovery payments or other Australian Government payments, specifies the estimated total cost of the project, excluding GST.

5.3 Funding recipients may group a series of small funded projects of the same or similar nature in their work schedules as one ‘group project’. In these circumstances, the funding recipient must ensure that its works schedule includes the following details:

(a) a general description of each group project;

(b) the location and cost (excluding GST) of each small funded project in each group;

(c) the amount of Roads to Recovery payments to be expended on each group project;

(d) in relation to each group project, the estimated start date of the first of the small funded projects in the group project to begin and the scheduled completion date of the small funded project in the group expected to be completed last.

5.4 Only projects in respect of which the funding recipient proposes to expend Roads to Recovery payments on or after 1 July 2009 may be included in the work schedule.

5.5 If the Department provides details of, and access to, the Department’s secure Roads to Recovery website, a funding recipient must submit its works schedule to the Department electronically by using that website. However, if a funding recipient is not able to access the website, it may submit its works schedule in some other form agreed by the Department.

5.6 A funding recipient must keep its work schedule current.

5.7 A funding recipient may, for each project in its works schedule, submit a report in the form specified by the Department by 31 July 2009 which specifies the amount of Roads to Recovery payments which the funding recipient intends to spend on the project in the quarter 1 July 2009 to 30 September 2009.

5.8 Where a funding recipient wishes to receive a Roads to Recovery payment in a particular quarter (other than the first quarter in the funding period), it must submit a quarterly report in the form specified by the Department:

(a) in respect of the quarter 1 January to 31 March: by the following 30 April;

(b) in respect of the quarter 1 April to 30 June: by the following 31 July;

(c) in respect of the quarter 1 July to 30 September: by the following 31 October;

(d) in respect of the quarter 1 October to 31 December : by the following 15 February.

For example: Where a funding recipient wants to receive a Roads to Recovery payment in the quarter 1 October to 31 December 2010, it must submit a quarterly report in respect of the previous quarter (1 July to 30 September 2010) and that report must be submitted by 31 October 2010.

Note: Where a funding recipient does not wish to receive a Roads to Recovery payment during a particular quarter, it is not required to provide a quarterly report in respect of the previous quarter. However, it is strongly encouraged to do so, to enable the Department to monitor progress on individual projects.

5.9 The funding recipient must in each quarterly report submitted specify in respect of each project:

(a) the amount of Roads to Recovery payments spent during the period commencing on 1 July 2009 and ending on the last day of the quarter to which the quarterly report relates; and

(b) the amount of Roads to Recovery payments which the funding recipient intends to spend on that project in the following quarter.

Note: The figures in the quarterly reports can be prepared on a cash or an accrual basis.

Part 6: Accountability

6.1 A funding recipient must properly account for Roads to Recovery payments.

Annual report

6.2 For each financial year in which a funding recipient receives, spends or retains any Roads to Recovery payment, the Chief Executive Officer of the funding recipient must give to the Department by 31 October after the end of the financial year:

(a) a written financial statement in the form set out in Schedule 1 as to:

(i) the amount of Roads to Recovery payments which remained unspent from the previous financial year;

Note: This amount is to be shown in column 1 of the Chief Executive Officer’s financial statement as ‘Amount brought forward from the previous financial year’.

(ii) the amount of Roads to Recovery payments received by the funding recipient in the year to which the report relates;

(iii) the amount of Roads to Recovery payments available for expenditure by the funding recipient on the construction or maintenance of roads in the financial year to which the statement relates;

(iv) the amount spent by the funding recipient during that year out of Roads to Recovery payments available for expenditure by the funding recipient during that year;

(v) the amount (if any) retained at the end of the year by the funding recipient out of Roads to Recovery payments available for expenditure by the funding recipient during that year and which remain unspent at the end of that year; and

Note to clause 6.2(a)(v): This amount is to be shown in column 5 of the Chief Executive Officer’s financial statement as ‘Amount carried forward to next financial year;

(vi) the amount of own sources expenditure on roads expended during the year to which the statement relates.

Note on subclause 6.2(a): The amounts should be prepared on a cash basis

(b) a report in writing and signed by the appropriate auditor stating whether, in the auditor’s opinion:

(i) the Chief Executive Officer's financial statement is based on proper accounts and records; and

(ii) the Chief Executive Officer's financial statement is in agreement with the accounts and records;

(iii) the expenditure referred to in subparagraph (a)(iv) has been on the construction or maintenance of roads; and

Note: By way of example, see the auditor’s report set out in Part 1 of Schedule 1 to the conditions.

(iv) the amount certified by the Chief Executive Officer in the Chief Executive Officer’s financial statement as the funding recipient’s own source expenditure is based on, and in agreement with, proper accounts and records.

Other annual report requirements

6.3 For each financial year in which a funding recipient receives, spends or retains any Roads to Recovery payment, the Chief Executive Officer of the funding recipient must give to the Department by 31 October after the end of the financial year a report in the form set out in Schedule 1 which includes a statement that:

(a) Roads to Recovery payments received during the financial year which have been spent by the funding recipient have been spent on the construction or maintenance of roads;

(b) the funding recipient has fulfilled its obligations under subclause 3.2, 3.3 or 3.4 (whichever is applicable) of these conditions arising during the financial year (the own source funding obligation);

(c) the funding recipient has fulfilled its obligations under Part 4 of these conditions arising during the financial year (the public information obligation);

(d) these conditions have, in other respects, been complied with by the funding recipient during the financial year;

(e) summarises and describes the outcomes achieved during the financial year with those Roads to Recovery payments received during the financial year; and

(f) gives details of the funding recipient’s own source expenditure on roads for each financial year from 2004-05 to 2008-09.

Part 7: Other accountability requirements

7.1 A funding recipient must create and keep accurate and comprehensive documentation relating to Roads to Recovery payments it has received after 1 July 2009 and retain those documents for a minimum of seven years.

7.2 A funding recipient must allow Australian Public Service employees or persons nominated by the Commonwealth to inspect:

(a) work on projects being undertaken by the funding recipient which are funded by Roads to Recovery payments; and

(b) relevant documents.

7.3 A funding recipient must, when requested to do so by the Department, provide:

(a) copies of relevant documents; and

(b) photographs of projects completed using Roads to Recovery payments, in the manner and form required by the Department.

Part 8: Non-compliance with conditions

8.1 If the Secretary or delegate of the Secretary notifies a funding recipient in writing that the Secretary is satisfied that the funding recipient has, in relation to a Roads to Recovery payment, failed to comply with the Act or to fulfil any of these conditions, the funding recipient must repay to the Commonwealth an amount equal to so much of the payment that the Secretary or delegate specifies in the notice.

Part 9 AusLink conditions

9.1 The definition of ‘AusLink Roads to Recovery Payment’ in clause 1(1) of the AusLink conditions is amended as follows:

After ‘Act’, insert the words ‘for the funding period starting on 1 July 2005 and ending on 30 June 2009’.

Part 10 Compliance with other laws

10.1 Funding recipients are required to comply with all other relevant laws, including those identified below.

10.2 The National Code of Practice for the Construction Industry (the Construction Code) is the standard of practice for building and construction work, setting out the responsibilities of all parties on construction projects funded by the Australian Government. The Australian Government Implementation Guidelines for the National Code of Practice for the Construction Industry (the Implementation Guidelines) outlines the process for complying with the Construction Code.

The Construction Code and the Implementation Guidelines apply to all construction projects indirectly funded by the Australian Government through grant or other programs where:

- the Australian Government funding contribution is at least $5 million and represents at least 50 per cent of the total construction value; and

- the Australian Government contribution to the project is $10 million or more irrespective of the proportion of Australian Government funding.

For further information, and copies of the Construction Code and Implementation Guidelines, refer to: http://www.deewr.gov.au/WorkplaceRelations/Policies/BuildingandConstruction/Pages/NationalCodeandGuidelines.aspx or contact the National Code Hotline on 1300 731 293.

10.3 Under the Building and Construction Industry Improvement Act (2005), Australian Government agencies can only fund “building work” when, subject to thresholds, an accredited builder is engaged.

The Australian Government Building and Construction OHS Accreditation Scheme (the Scheme) operates such that, subject to certain thresholds, only head contractors who are accredited under the Scheme can enter into contracts for building work that is funded directly or indirectly by the Australian Government.

Roads to Recovery projects are considered indirectly funded.

The Scheme applies to projects that are indirectly funded by the Australian Government and where:

- the value of the Australian Government contribution to the project is at least $5 million and represents at least 50 per cent of the total construction project value; or

- the Australian Government contribution to a project is $10 million or more, irrespective of the proportion of Australian Government funding.

If a project meets the above thresholds, the requirement that accredited builders carry out the building work only applies to head contracts for building work valued at $3 million or more.

For further information on the Scheme, refer to the Australian Government Building and Construction OHS Accreditation Scheme: Guidance for Government Agencies and Funding Recipients, available on the Federal Safety Commissioner (FSC) website at http://www.fsc.gov.au/ofsc/Theaccreditationscheme/ or contact the FSC Assist Line on 1800 652 500.

10.4 Projects must adhere to Australian Government environment and heritage legislation eg the Environment Protection and Biodiversity Conservation Act 1999. Construction cannot start unless the relevant obligations are met.

The Department strongly recommends that, before starting an environmental study for a project, Proponents contact the Australian Government Department of Environment, Water, Heritage and the Arts http://www.environment.gov.au/epbc/index.html. They can provide advice about Australian Government requirements and ensure that the Australian Government’s legislative requirements are properly addressed by the study. This will reduce the likelihood of cost and time delays before construction can commence.

10.5 Other statutory requirements

Funding recipients must also meet other statutory requirements where relevant. These may include, but are not limited to:

- Native title legislation;

- State government legislation - for example, environment and heritage; and

- Local government planning approvals’

schedule 1

Nation building program (National Land Transport) Act 2009, Part 8

Roads to Recovery Program Annual Report Proforma

PART 1 - CHIEF EXECUTIVE OFFICER’S FINANCIAL STATEMENT and auditor’s REPORT

Chief Executive Officer’s financial statement

(see subclause 6.2(a) of the funding conditions)

The following financial statement is a true statement of the receipts and expenditure of the Roads to Recovery payments received by …(name of funding recipient) … under Part 8 of the Nation Building Program (National Land Transport) Act 2009 in the financial year 20xy-1z.

[1] | [2] | [3] | [4] | [5] |

Amount brought forward from previous financial year | Amount received in report year

| Total amount available for expenditure in report year | Amount expended in report year | Amount carried forward to next financial year |

$ | $ | $ | $ | $ |

|

| [1]+[2] |

| [3]-[4] |

|

|

|

|

|

The own source expenditure for (name of funding recipient) in 20xy-1z was: $.....

……………………………………(signature of Chief Executive Officer/General Manager)

…./…./201x

……………………………………….(name of Chief Executive Officer/General Manager)

Auditor’s report

(Conditions cl.6.2(b))

In my opinion:

(i) the financial statement above is based on proper accounts and records; and

(ii) the financial statement above is in agreement with proper accounts and records;

(iii) the amount reported as expended during the year was used solely for expenditure on the maintenance or construction of roads; and

(iv) the amount certified by the Chief Executive Officer in the Chief Executive Officer’s financial statement above as the funding recipient’s own source expenditure on roads during the year is based on, and in agreement with, proper accounts and records.

I am an “appropriate auditor” as defined in section 4 of the Nation Building Program (National Land Transport) Act 2009.

………………………………………(signature of auditor)

………./…...../201x

………………………………………(name of auditor)

..……………………………………..(name of auditor’s company)

Note: Under s.4 of the Act, “appropriate auditor” means:

(a) in relation to a funding recipient whose accounts are required by law to be audited by the Auditor-General of a State — the Auditor‑General of the State; or

(b) in relation to a person or body whose accounts are required by law to be audited by the Auditor-General of the Commonwealth — the Auditor‑General of the Commonwealth; or

(c) in relation to any other funding recipient — a person (other than an officer or employee of the person or body) who is:

(i) registered as a company auditor or a public accountant under a law in force in a State; or

(ii) a member of the Institute of Chartered Accountants in Australia or of the Australian Society of Accountants.

Roads to Recovery Program Annual Report Proforma

PART 2 - STATEMENT OF ACCOUNTABILITY BY CHIEF EXECUTIVE OFFICER

(see subclauses 6.3(a), (c) and (d) of the funding conditions)

I, ………(name)…………….., Chief Executive Officer or General Manager, of ……(name of funding recipient) ……, hereby certify, in accordance with the funding conditions determined under section 90 of the Nation Building Program (National Land Transport) Act 2009 (the Act), that:

(a) Roads to Recovery funds received by [name of funding recipient] during the year [insert financial year] which have been spent, have been spent on the construction or maintenance of roads;

(b) [Name of funding recipient] complied with the signage and other public information requirements as set out in Part 3 of the funding conditions; and

(c) during the financial year [name of funding recipient] complied with other conditions of the grant as set out in clause 6.3(d) of the funding conditions.

…………………………………(signature of Chief Executive Officer/General Manager)

…./…./201x

Roads to Recovery Program Annual Report Proforma

PART 3 – STATEMENT on expenditure maintenance by Chief Executive Officer

(see subclause 6.3(b) of the funding conditions)

I, ………(name)…………….., Chief Executive Officer/General Manager of …(name of funding recipient)..........., state that, in accordance with the funding conditions determined under section 90 of the Nation Building Program (National Land Transport) Act 2009:

1(a) expenditure on the construction or maintenance of roads by [insert name of funding recipient] using its own sources funds in the year to which this report refers was $……....………………..

1(b) the reference amount for [insert name of funding recipient] is $………….....…………..

Note: the figure at 1(b) should be taken from Part 5 of the report.

The following information need only be provided if the expenditure shown in 1(a) is less than the reference amount as shown in 1(b) above:

2(a) expenditure on the construction or maintenance of roads by [insert name of funding recipient] using its own sources funds for the year prior to the year to which this report refers was $…………....…………..

2(b) the average of expenditure on the construction or maintenance of roads by [insert name of funding recipient] using its own source funds for the year to which this report refers and the previous year was $………..…………….

The following information need only be provided if the expenditure shown in 2(b) is less than the reference amount as shown in 1(b) above:

3(a) expenditure on the construction or maintenance of roads by [insert name of funding recipient] using its own sources funds in the year two years before the year to which this report refers was $……....………….

3(b) the average of expenditure on the construction and maintenance of roads by [insert name of this funding recipient] using its own source funds for the year to which this report refers and the previous two years was $……..………………

The following information need only be provided if the expenditure shown at 3(b) is less than the reference amount as shown in 1(b) above:

4(a) the funding recipient’s average own source revenue (See Notes 1 and 2 below) during the reference period was $..............................

4(b) the funding recipient’s own source revenue during the year to which this report refers was $.....................................

4(c) please express the amount at 4(b) as a percentage of 4(a) ..................%.

4(d) please calculate the adjusted reference amount by multiplying the reference amount (from 1(b)) by the percentage at 4(c) ....................%.

Note 1: The average own source revenue for the reference period is either the average of the own source revenue for each of the years during the reference period (see clause 1.(1)) or the average of three of those five years except for the years where the revenue was highest and lowest.

Note 2: The definition of ‘own source revenue’ corresponds to the definition of ‘own source funds’ in clause 1.(1).

…………………………………(signature of Chief Executive Officer/General Manager)

…./…./201x

Roads to Recovery Program Annual Report Proforma

PART 4 - STATEMENT OF OUTCOMES BY CHIEF EXECUTIVE OFFICER

(see subclause 6.3(e) of the funding conditions)

…(name of funding recipient) … has achieved the following outcomes under the Roads to Recovery Program in 201x-1y:

|

Key outcomes

Outcome | Estimated % of Roads to Recovery Expenditure (all projects) |

|

|

2. Regional economic development |

|

3. Achievement of asset maintenance strategy |

|

4. Improved access for heavy vehicles |

|

5. Promotion of tourism |

|

6. Improvements of school bus routes |

|

7. Access to remote communities |

|

8. Access to intermodal facilities |

|

9. Traffic management |

|

10. Improved recreational opportunities |

|

11. Amenity of nearby residents |

|

12. Equity of access (remote areas) |

|

13. Other |

|

TOTAL | 100.0 |

…………………………………(signature of Chief Executive Officer/General Manager)

…./…./201x

Roads to Recovery Program Annual Report Proforma

part 5 - reference amount

(see clause 6.3(f) of the funding conditions)

I, ………(name)…………….., Chief Executive Officer/General Manager of ……(name of funding recipient) ……, hereby state that, for the purposes of the funding conditions determined under section 90 of the Nation Building Program (National Land Transport) Act 2009, expenditure on the construction and maintenance of roads by [insert name of funding recipient] using its own sources funds were

for 2004/05: $ …………………….(fill in amount)

for 2005/06: $ …………………….(fill in amount)

for 2006/07: $ …………………….(fill in amount)

for 2007/08: $ …………………….(fill in amount)

for 2008/09: $ …………………….(fill in amount)

The average of these amounts is: $ ………… (fill in amount) – this is Amount A

The average of these amounts excluding the highest and lowest amounts is: $ …………. (fill in amount) – this is Amount B

The reference amount for the funding recipient as at 30 June 2009 was $................(fill in amount). This amount plus 11.5% is $.............. (fill in amount) – this is Amount C

The lesser of Amounts A, B and C is $.............. (fill in amount) – this is the reference amount for the funding recipient for the period 1 July 2009 to 30 June 2014.

…………………………………(signature of Chief Executive Officer/General Manager)

…./…./201x

Schedule 2

signage Requirements

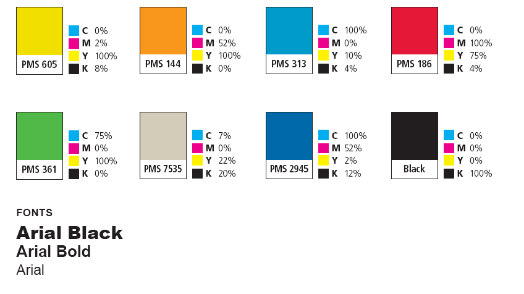

Colour

Colour for all reproduction methods must be matched as closely as possible to the Pantone standards. Allowances should be made for variations between materials.

Colour for all reproduction methods must be matched as closely as possible to the Pantone standards. Allowances should be made for variations between materials.

![]()

![]()

Notes to Determination of Conditions Applying to Payments under Part 8 of the Act

Note 1

The Determination of the Conditions Applying to Payments under Part 8 of the Act (in force under subsection 9(1) of the Nation Building Program (National Land Transport) Act 2009) as shown in this compilation is amended as indicated in the Tables below.

The Roads to Recovery funding conditions pursuant to section 90 of the Act apply to payments under Part 8 of the Act for the funding period 1 July 2009 to 30 June 2014.

Table of Instruments

Title | Date of registration on FRLI | Date of | Application, saving or |

Determination of Conditions Applying to Payments under Part 8 of the Act | 1 October 2009 (see F2009L03617) | 2 October 2009 |

|

Nation Building Program Roads to Recovery Program Conditions Variation 2010/1 | 7 Jan 2011 (see F2011L00003) | 8 Jan 2011 | — |

Nation Building Program Roads to Recovery Program Conditions Variation 2011/1 | 28 April 2011 (see F2011L00651) | 29 April 2011 | — |

Nation Building Program Roads to Recovery Program Conditions Variation FC2013/1 | 28 March 2013 (see F2013L00574) | 29 March 2013 | — |

Table of Amendments

ad. = added or inserted am. = amended rep.= repealed rs. = repealed and substituted | |

Provision affected | How affected |

Clause 3(1) | am. F2013L00574 |

Clause 3(2) | am F2013L00574 |

Clause 3(3) | am F2013L00574 |

Clause 6(2) | am. F2011L00003 |

Part 10 | ad. F2011L00651 |

Schedule 1, Part 1 | am. F2011L00003 |

Schedule 1, Part 3 | am. F2011L00003 |