ARF 231 International Exposures

Instruction Guide

ARF 231 International Exposures has two purposes:

- to provide information on the international exposures of Australian-resident banks; and

- to satisfy Australia’s obligation to the Bank for International Settlements (BIS) in providing aggregate international banking statistics for Australia. These are available, along with statistics from other countries, on its website (http://www.bis.org/statistics/index.htm).

The return has three parts:

- ARF 231.1 Locational Data Part 1 (ARF 231.1): collects data on international assets and liabilities broken down by currency, sector, and debtor country. This consists of 2 forms, ARF 231.1a Locational Data Part 1a: Assets (ARF 231.1a) and ARF 231.1b Locational Data Part 1b: Liabilities (ARF 231.1b);

- ARF 231.2 Locational Data Part 2 (ARF 231.2): collects a similar range of information as above, but regroups the data differently; and

- ARF 231.3 Consolidated Data (ARF 231.3): covers consolidated international assets broken down by maturity, sector and debtor country. This consists of 2 forms, ARF 231.3a Consolidated Data - Domestic Entity: Immediate and Ultimate Risk Exposures (ARF 231.3a) and ARF 231.3b Immediate and Ultimate Risk Exposures – Foreign Entity (ARF 231.3b).

This Instruction Guide is intended to assist in the completion of the ARF 231 series and is based on the BIS “Guide to the international banking statistics” July 2000. Reporting entities are encouraged to consult the BIS Guide for a fuller discussion of the rationale for, and uses of, the international banking statistics (http://www.bis.org/publ/meth07.htm).

General directions and notes

Reporting entity

These forms are to be completed by all locally incorporated banks and foreign authorised deposit-taking institutions (ADIs).

The basis of consolidation required in ARF 231.3 is in accordance with the accounting consolidated group. The accounting consolidated group is to be determined in accordance with the requirements of the Australian accounting standards, notably AASB 127 Consolidated and Separate Financial Statements (AASB 127) and AASB 3 Business Combinations (AASB 3).

Exclude from the accounting consolidated group special purpose vehicles (SPVs) whose assets have satisfied the clean sale requirements set down in Prudential Standard APS 120 Securitisation (APS 120) (refer to Securitisation deconsolidation principle).

Securitisation deconsolidation principle

Except as otherwise specified in these instructions, the following applies:

- Where an ADI (or a member of its Level 2 consolidated group) participates in a securitisation that meets APRA’s operational requirements for regulatory capital relief under APS 120:

(a) special purpose vehicles (SPVs) holding securitised assets may be treated as non-consolidated independent third parties for regulatory reporting purposes, irrespective of whether the SPVs (or their assets) are consolidated for accounting purposes;

(b) the assets, liabilities, revenues and expenses of the relevant SPVs may be excluded from the ADI’s reported amounts in APRA’s regulatory reporting returns; and

(c) the underlying exposures (i.e. the pool) under such a securitisation may be excluded from the calculation of the ADI’s regulatory capital (refer to APS 120). However, the ADI must still hold regulatory capital for the securitisation exposures that it retains or acquires and such exposures are to be reported in Form ARF 120.0 Standardised – Securitisation or Forms ARF 120.1A to ARF 120.1C IRB – Securitisation (as appropriate). The RWA relating to such securitisation exposures must also be reported in Form ARF 110.0 Capital Adequacy (ARF 110.0).

2. Where an ADI (or a member of its Level 2 consolidated group) participates in a securitisation that does not meet APRA’s operational requirements for regulatory capital relief under APS 120, or the ADI elects to treat the securitised assets as on-balance sheet assets under Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk or Prudential Standard APS 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk, such exposures are to be reported as on-balance sheet assets in APRA’s regulatory reporting returns. In addition, these exposures must also be reported as a part of the ADI’s total securitised assets within Form ARF 120.2 Securitisation – Supplementary Items.

Reporting period

The three parts of the return should be completed jointly as at the last day of the stated quarter (i.e. March, June, September and December). Locally incorporated banks and foreign ADIs should submit the completed return to APRA within 20 business days after the end of the relevant reporting quarter.

Unit of measurement

All banks are to complete the return in AUD millions to three (3) decimal places (with the data formatted to the nearest million).

Valuation and currency conversion

Assets and liabilities denominated in currencies other than AUD are to be converted to AUD using the mid-point rate (of market buying and selling spot quotations) effective as at the close of reporting date.

Reporting entities are free to use those AUD exchange rates that it judges to be a representative closing mid‑market rate as at the reporting date. However, to ensure consistency across related returns and to assist in the reconciliation between these returns, reporting entities should attempt to use the same exchange rates across all returns to APRA and the Australian Bureau of Statistics (ABS). Particular attention should be given to the following returns:

- ABS Form 90 Survey of International Investment

- ARF 231.1/2/3 International Exposures

- ARF 320.0 Statement of Financial Position

- ARF 321.0 Statement of Financial Position (Offshore Operations)

- ARF 325.0 International Operations

- ARF 326.0 Offshore Banking Unit

The main AUD exchange rates that are used throughout the ARF 231 series are to be reported in ARF 231.2 (refer to section 3.6.1).

Note: for the major currencies, reporting entities may want to use the exchange rates available in the Reserve Bank of Australia (RBA) Bulletin (Table F.11), which are also available on the RBA website: http://www.rba.gov.au/Statistics/Bulletin/F11hist.xls

Prior to the June 2002 Bulletin, refer to Table F10 for exchange rates.

- TABLE OF CONTENTS

1 ARF 231 International Exposures

1.1 Background

1.2 Country listing

1.3 Resident/Non-resident

1.4 Unallocated amounts

1.5 Zero and null values

1.6 Colour-coded fields

2 ARF 231.1 Locational Data Part 1

2.1 Background

2.2 How to update the return

2.3 Which entities are to report locational data

2.4 Business to be reported

2.4.1 Foreign trade-related credit

2.4.2 Trustee business

2.4.3 Holdings of debt securities

2.4.4 Own issues of international debt securities

2.4.5 Derivative contracts

2.4.6 Other assets and liabilities

2.5 Sectoral breakdown

2.6 Netting of assets and liabilities

2.7 Valuation

2.8 Memo ltems

2.8.1 Valuation changes due to revaluations at market prices

2.8.2 Arrears of interest and principal

2.8.3 Write-offs of claims and debt forgiveness

2.9 Column descriptions

3 ARF 231.2 Locational Data Part 2

3.1 Background

3.2 How to update the return

3.3 Consistency with ARF 231.1

3.4 Nationality classification

3.5 Data to be reported

3.6 Memo items

3.6.1 Exchange rates

3.7 Column descriptions

4 ARF 231.3 Consolidated Data

4.1 Background

4.2 How to update the return

4.3 Which entities are to report consolidated data

4.4 Domestic entities (Australian-owned)

4.4.1 Treatment of subsidiaries

4.5 Foreign entities (Foreign-owned)

4.6 Risk transfers

4.7 Positions vis-à-vis Australia

4.8 Positions on an ultimate risk basis

4.8.1 On-balance sheet financial claims

4.8.2 Derivative contracts

4.8.3 Guarantees and credit commitments

4.9 Maturity breakdown

4.10 Sectoral breakdown

4.11 Netting of assets and liabilities

4.12 Valuation

4.13 Memo items

4.14 Column descriptions

5 Consistency with other returns

5.1 Internal consistency within each return

5.2 Consistency with other APRA and ABS returns

6 Glossary

APPENDIX 1 -BIS International Banking Statistics: Country Listing

APPENDIX 2 - International Organisations

- General instructions

The BIS publishes two different sets of quarterly international banking data, both based on information provided by creditor banks. They are the locational and consolidated banking statistics. The key features of the two data sets are below.

- The locational banking statistics (i.e. ARF 231.1 and ARF 231.2) collect data on the gross (i.e. unconsolidated) international financial claims (assets) and liabilities of the banks resident in a given country. The key concept here is the residence (or “location”) of the reporting entity. The main purpose of the statistics is to provide information on the role of banks and financial centres in the intermediation of international capital flows. The key organisational criteria are:

the country of residence of the reporting entities and their counterparties; and

the recording of all positions on a gross basis, including those vis-a-vis own affiliates.

This methodology is consistent with the principles underlying the compilation of national accounts, balance of payments and external debt statistics.

- The consolidated banking statistics (i.e. ARF 231.3) collects data on international on‑balance sheet (and selected off-balance sheet) financial claims (i.e. contractual lending) of banks vis-à-vis the rest of the world and provides a measure of the risk exposure of lenders’ national banking systems. The data mainly cover contractual lending by the head office and all its branches and subsidiaries on a global consolidated basis, net of inter-office accounts. Presenting lending in this way allows the allocation of claims to the reporting entity that would bear the losses as a result of default by borrowers. These statistics also provide information on the maturity (i.e. liquidity) and sector risk distribution of reporting entities’ contractual lending.

Further, to reflect the fact that reporting entities’ country risk exposures can differ substantially from that of contractual lending due to the use of risk mitigants, such as guarantees and collateral, reporting countries also provide information on claims on an ultimate risk basis (i.e. contractual claims net of guarantees and collateral).

The key difference between the two sets of BIS banking data is based upon the concept of residency. Locational data show the claims and liabilities of all reporting entities located in a reporting country vis-à-vis entities located in other countries. Consolidated data show the total claims of a reporting entity groups’ global offices (domestic and foreign) on entities located in foreign countries. Claims between offices of the same entity group are netted out.

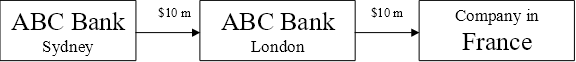

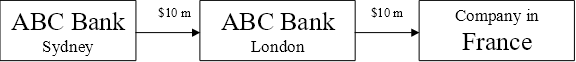

These differences are highlighted in an example (Figure 1). ABC Bank (headquartered in Sydney) has lent $10 million to a company located in France routed via its branch office in London.

Figure 1: Flow of funds and BIS locational and consolidated banking data

The implications of this transaction for the BIS data are as follows:

Locational data:

- Australian resident reporting entities (i.e. ABC Bank, Sydney) will report $10 million increase in locational claims on UK resident banks (i.e. ABC Bank, London)

- UK resident banks (i.e. ABC Bank, London) will report $10 million increase in locational claims on a non-bank entity resident in France.

Consolidated data:

- Australian resident reporting entities (i.e. ABC Bank, Sydney) will report $10 million increase in consolidated claims on a non-bank entity resident in France.

Each of the three returns contains an alphabetical listing of countries that allows a reporting entity’s claims (assets) and liabilities to be allocated to the respective country.

Also listed are several regional residual entries (e.g. “Residual Asia”, “Residual Europe” etc). If a reporting entity has an exposure or liability to a country not already listed, allocate the data to the relevant “Residual” entry. If this is not possible either, the data should be assigned to the “Unallocated” item.

Note that “United Kingdom U1” refers to the United Kingdom excluding Jersey, Guernsey and the Isle of Man. As Jersey, Guernsey and the Isle of Man appear as separate entries in the country listing, reporting entities should provide UK data on the “United Kingdom U1” basis to avoid double counting (i.e. list exposures to United Kingdom U1 and to each of the three islands). A reporting entity unable to provide separate data (for United Kingdom U1 and each of the three islands) should still allocate the sum of these exposures to “United Kingdom U1”. Reporting entities should not enter any data in the memo item “United Kingdom GB” as this is automatically calculated as United Kingdom U1 plus Jersey plus Guernsey plus the Isle of Man.

Appendix 1 contains a list of countries with information as to the extra jurisdictions/territories covered by each country name. For example, claims vis‑à‑vis France should also include data for Monaco.

The criterion for residency is whether a banking, non-bank or official monetary sector entity is permanently located, physically and/or by way of law or registration, inside or outside a country's borders.

Foreign branches or subsidiaries of Australian institutions are classified as “non-residents” (making them residents of the country in which they operate), while branches or subsidiaries of foreign institutions operating in Australia are classified as “residents”.

If a detailed vis-à-vis breakdown for a return is not available, but a figure for the grand total can be reported, this figure should instead be allocated in the relevant return under “Unallocated – 5M” (which in turn feeds into “Total – 3P”). For example, to report only one figure for issues of debt securities (liabilities), allocate this figure to 5M in the worksheet “international issues of debt securities”. Note that this figure will also automatically be included in 5M (and therefore 3P) for “total international liabilities”.

Relevant cells should be left blank if data are zero or unavailable.

Grey areas:

- These fields are not to be updated manually. They sum data from other columns/rows of the return and hence will update automatically once the underlying data are updated.

Black areas:

- These fields are not to be updated. For example, in ARF 231.1, Australia appears in the country listing. However, areas relating to AUD data for Australia have been blacked-out as such positions are not international exposures.

2. ARF 231.1 Locational Data Part 1

ARF 231.1 captures a reporting entity’s non-consolidated (i.e. gross) on-balance sheet international assets and liabilities plus off-balance sheet trustee business.

For each column not shaded grey, enter the entity’s exposure or liability to each country in the country listing, in AUD amounts. Particular sections that may be of guidance are listed below:

- for a discussion of the concept of “locational” data, refer to section 1.1;

- regarding which entities are to report, refer to section 2.3;

- regarding the type of data to be included, refer to section 2.4;

- regarding exchange rates and the conversion of non-AUD positions into AUD, refer to page 2 ‘valuation and currency conversion’;

- regarding the memo items to be reported, refer to section 2.8; and

- for a description of the columns in the return, refer to section 2.9.

ARF 231.1 and ARF 231.2 are to be completed by all banks resident in Australia, i.e. both domestic and foreign-owned banks in Australia are to record their positions on a gross (unconsolidated) basis, including those vis-à-vis own affiliates (branches, subsidiaries, joint ventures).

Data are to be supplied on the positions on the Australian books of the Australian reporting entity (i.e. whereby the accounts of related foreign institutions are not consolidated). Reporting entities should include transactions between any branches in Australia to the extent that these transactions are denominated in non-AUD currencies.

The main items, to be reported separately, are

- loans and deposits, securities and other assets and liabilities vis-à-vis non‑residents in all currencies (i.e. AUD and foreign currencies); and

- loans and deposits, securities and other assets and liabilities vis-à-vis residents in foreign currency.

The principal balance sheet items to be included as claims (i.e. assets) are deposits and balances placed with banks, loans and advances to banks and non-banks and holdings of securities.

On the liabilities side, the data should mainly relate to deposits and loans received from banks and non-banks. Also, funds received and invested on a trust basis in reporting entities’ own names (even if they are booked off-balance sheet, refer to also section 2.4.2) and the reporting entities’ own issues of securities in the international markets (even if they are not booked as foreign liabilities) should be reported as international banking business (refer to also section 2.4.4).

Loans should comprise those financial assets that are created through the lending of funds by a creditor (lender) to a debtor (borrower) and that are not represented by negotiable securities. Deposits should comprise all claims reflecting evidence of deposit - including non-negotiable certificates of deposit - that are not represented by negotiable securities. Thus, loans and deposits should include interbank borrowings, loans and inter-office balances.

Special types of loans to be classified in the category “loans and deposits” are foreign trade‑related credits (refer to section 2.4.1 below) and international loans received and granted and deposits received and made on a trust basis (refer to section 2.4.2 below).

Sale and repurchase transactions (repos) involving the sale of assets (e.g. securities and gold) with a commitment to repurchase the same or similar assets, financial leases, promissory notes, non-negotiable debt securities, endorsement liabilities arising from bills rediscounted abroad and subordinated loans (including subordinated non-negotiable debt securities) should also be included as loans and deposits. Borrowing and lending of securities and gold without cash collateral should not be reported as international banking business. The reporting of negative positions is accepted in those cases where it is the result of the short selling of securities acquired in the context of repo or bond lending transactions.

Reporting entities’ holdings of international notes and coin that are in circulation and commonly used to make payments should be recorded as claims in the form of loans and deposits. Loans that have become negotiable de facto should be classified under debt securities consistent with SNA (UN System of National Accounts) guidelines.

Note: Multi-currency loans should be classified according to the currency in which the repayment obligation exists. This would normally be the same currency in which the drawings are made.

Foreign trade-related credits mainly occur in one of two forms: as buyers’ credits or as suppliers’ credits. A buyer’s credit is granted directly by a reporting entity to a foreign importer and therefore represents an external asset that should be included in the locational statistics.

In contrast, a supplier’s credit is granted directly by a reporting entity to a domestic exporter. However, this credit may be extended on the basis of a trade bill that is drawn by the exporter on the importer and subsequently acquired by the reporting entity. These credits may therefore be treated as external or domestic assets depending on whether the residency of the drawee (who is the final debtor) or of the presenter of the bill (who has guaranteed payment by endorsing the bill) is used as the criterion for geographical allocation.

For the purposes of the locational banking statistics, it is recommended that suppliers’ credits be allocated according to the residence of the drawee of the relevant trade bills, as the drawee is the final recipient of the credit extended.

Reporting entities may acquire external trade bills “à forfait” and “en pension”. An “à forfait” purchase is an outright purchase that absolves the seller/presenter of the bills from any obligation should the drawee fail to honour the bill when it matures. When the drawee is a non‑resident, such bills should similarly be considered to be external assets, irrespective of the residence of the presenter.

An “en pension” acquisition involves a reporting entity purchasing a foreign trade bill under a sale and repurchase agreement with the domestic exporter whereby the reporting entity must or may return the bill to the exporter on, or prior to, the maturity date. If the return of the bill is optional, the bill is recorded in the balance sheet of the purchaser as a claim on the drawee. If the bill must be returned, the instrument remains in the balance sheet of the seller and the transaction can be regarded as an advance to the domestic exporter that should not be included in the locational statistics as a foreign asset.

Funds received by reporting entities from non-residents in any currency or from residents in foreign currency on a trust basis represent international liabilities that fall into the category of loans and deposits. Funds on-lent or deposited on a trust basis in reporting entities’ own name, but on behalf of third parties, with non-residents in any currency or with residents in foreign currency, represent international assets which also fall into the category of loans and deposits. In addition, international securities issued by reporting entities in their own name but on behalf of third parties, or funds invested on a trust basis in international securities and held in the reporting entities’ own name but on behalf of third parties, represent international assets and liabilities that should be included in the categories of “debt securities” and “other” assets and liabilities as described below.

Note: Trustee business does not refer to unit trusts.

Reporting entities’ holdings of international debt securities are defined as comprising:

- all negotiable short- and long-term debt instruments (including negotiable certificates of deposit, but excluding equity shares, investment fund units and warrants) in AUD and foreign currency issued by non-residents; and

- all such instruments in foreign currency issued by residents.

Also included are those international debt securities held in their own name but on behalf of third parties as part of trustee business. Debt securities held on a purely custodial basis for customers and debt securities acquired in the context of securities lending transactions without cash collateral should not be included in the data on holdings of debt securities. It is recognised that the borrowing of securities that are subsequently sold to third parties may result in negative holdings of securities.

Reporting entities’ own issues of international debt securities are defined as comprising all negotiable short - and long-term debt securities (including subordinated issues and issues in their own name but on behalf of third parties) in AUD issued abroad and all issues in foreign currency. The classification as international debt securities is determined by the place, currency and method of issue rather than the residence of the issuer as in the case of reporting entities’ holdings of debt securities. The reason for using such a criterion is the difficulty of determining the residence of the current holder of a negotiable instrument.

Data on reporting entities’ own issues of international debt securities should be included in their geographically allocated international liabilities if the residence of current holders of own issues of securities is known to the issuing entity.

Include all derivatives entered into after adoption of International Financial Reporting Standards (IFRS) consistent with the classification and measurement basis used for derivatives by institutions in accordance with AASB 132 Financial Instruments: Disclosure and Presentation, AASB 7 Financial Instruments: Disclosures and AASB 139 Financial Instruments: Recognition and Measurement (AASB 139). Derivative financial instruments in existence prior to adoption of IFRS are to be reported in accordance with AASB 1 First-time Adoption of Australian Equivalents to International Financial Reporting Standards.

Derivative contracts are reflected in the on‑balance sheet positions of reporting entities under IFRS (e.g. assets and liabilities arising from currency swaps, cash margins in connection with futures and fair values of option contracts). For the purposes of this return (as well as ARF 231.2) derivatives that are recorded on-balance sheet be included at fair values under “other assets and liabilities” as appropriate (refer to also Section 4.8.2, which applies to ARF 231.3).

Other international assets and liabilities mainly comprise, on the assets side, equity shares (including mutual and investment fund units and holdings of shares in a reporting entity’s own name but on behalf of third parties), participations, derivative contracts and working capital supplied by head offices to their branches abroad.

On the liabilities side they include derivative contracts and working capital received by local branches from their head offices abroad. Accrued interest and items in the course of collection also fall into this category.

International positions in ARF 231.1 are to be reported vis-à-vis “All” counterparties and vis-à-vis “Non‑bank” counterparties. The two are therefore not additive but rather the latter is a “of which” component of the former. International positions vis-à-vis “bank” counterparties are to be reported in ARF 231.2.

Reporting entities should use the definition used in the country where the counterparty is located (home country) to determine whether a counterparty is a bank or not. If this is not possible, reporting entities should use their own knowledge and readily available works of reference (e.g. banking almanacs).

Table 1 lists certain bank and non-bank entities and their treatment in ARF 231.1 (and ARF 231.2).

Table 1: ARF 231.1/2 Locational Data – reporting basis

Entity | Bank | Non-Bank |

Official Monetary Authorities

(e.g. RBA, the Fed, BOJ) | | - |

International Organisations | Either bank or non-bank depending on the organisation; refer to Appendix 2 for details |

Publicly Trading Enterprises

(other than banks) | - | |

All positions (AUD and foreign currency-denominated) vis-a-vis a country's official monetary authority should be listed under the country itself as a claim/liability on a bank, and again listed and aggregated under the memo item "official monetary authorities". For example, a claim vis-a-vis the Bank of Japan should be included with claims on Japan and again under official monetary authorities (together with all other claims on official monetary authorities).

Non-AUD positions vis-a-vis the RBA should be similarly treated (with the data, of course, listed under “Australia”). AUD positions vis‑à‑vis the RBA are not to be reported.

The BIS and the ECB (European Central Bank) are classed as official monetary authorities and positions vis-à-vis these banks should be listed under Switzerland and Germany, respectively.

All international organisations should be aggregated and listed under the "international organisations" entry in the country listing; they should not be assigned to the country of residence of the institution. With respect to international organisations, consult Appendix 2; all organisations shown in italics (e.g. the International Monetary Fund (IMF)) should be classified as banks, all others should be classified as non-banks. (ARF 231.3 has a different treatment, refer to section 4.10).

International assets and liabilities should in principle be reported on a gross basis in the locational banking statistics. In other words, reporting entities assets and liabilities vis-à-vis the same counterparty should be reported separately, not netted one against the other.

Assets and liabilities should be measured in accordance with Australian accounting standards.

Note: International financial claims should be reported gross of specific provisions and General Reserve for Credit Losses as defined by Prudential Standard APS 220 Credit Quality. Provisions and reserves are not to be included in the ARF 231 series.

When reporting the data, reporting entities should also ensure that all figures be prepared in accordance with applicable Australian accounting principles.

While not included in the actual return, information is requested from reporting entities on several memo items (refer to below). Reporting entities are requested to provide such information only if the data is readily available. Reporting entities are free to provide the data to APRA in any form/design they choose (Excel, Word, etc) and they should be submitted at the same time as the ARF 231 series is submitted.

Additional information is needed if adequate proxies for flows are to be calculated from data on changes of amounts outstanding at market prices. For this reason, valuation changes due to revaluations at market prices are to be reported separately as memorandum items, with the currency, sector and country being given, even if only partial information is available.

Until they are written off, interest in arrears on international claims and principal in arrears (including capitalised interest) should be included in the data on international assets. If they are not, i.e. if interest or principal in arrears is placed in special (suspense) accounts which are not included in the reported data on international assets and liabilities, the relevant amounts should be reported separately as memorandum items, with the currency, sector and country being given, even if only partial information is available.

Although an asset that has been written off may still be a legally enforceable claim, it is recommended that items that have been written off be excluded from the reported data. This is because the process of writing-off can be seen as reflecting the judgment that the current or prospective price of the claim is zero. Write-offs of international claims (including capitalised interest and interest booked on special suspense accounts) should be reported separately as memorandum items, with the currency, sector and country being given, even if only partial information is available. The same reporting is recommended for reductions in claims due to debt forgiveness, i.e. cancellations of claims via contractual arrangements between debtors and creditors.

As data on international banking flows are generally derived from changes in amounts outstanding, the above-mentioned memorandum items are needed to compute valuation adjusted changes either by adding amounts that represent additional bank lending (arrears of interest) or by eliminating reductions that do not represent repayments of bank lending (provisions and write-offs of capital).

Part 1 of the locational data are reported in ARF 231.1a for claims (assets) and ARF 231.1b for liabilities. There are eight worksheets where claims and liabilities should be reported by the currency in which they are denominated. These worksheets are titled: AUD, USD, EUR, JPY, GBP, CHF, NZD, and Other. There is also another worksheet titled Total, which sums data from other sections of the return and should not be updated manually.

Note: non-AUD foreign currency-denominated amounts should be converted to AUD amounts using the appropriate exchange rate.

General column descriptions are below:

Column 1 – Country listing

This column is an alphabetical listing of countries. Claims and liabilities should be allocated to the respective country. If there is an exposure or liability to a country not already listed, refer to section 1.2 for further instructions.

Only foreign currency assets and liabilities to Australian residents should be allocated next to “Australia”. Do not report any AUD positions vis-à-vis “Australia” as these are not international/foreign in nature; the relevant areas have been shaded black accordingly.

Column 2 to 7 – Claims

Columns 2 to 7 in the worksheets in ARF 231.1a relate to international claims, classified either as ‘loans and advances’, ‘holdings of debt securities’, or ‘other assets’. These claims are further broken down into ‘claims on all counter parties’ and ‘claims on non-bank counter parties’.

Column 2 to 7 – Liabilities

Columns 2 to 7 in the worksheets in ARF 231.1b relate to international liabilities, classified either as ‘deposits’, ‘own issues of debt securities’, or ‘other liabilities’. These liabilities are further broken down into ‘liabilities to all counter parties’ and ‘liabilities to non-bank counter parties’.

Column 8 to 9 – Claims

Columns 8 to 9 in the worksheets in ARF 231.1a relate to total international claims, classified as claims on all counter parties and claims on non-bank counter parties. Do not manually update these columns as they contain formulas that sum data from the previous 2 to 7 columns.

Column 8 to 9 – Liabilities

Columns 8 to 9 in the worksheets in ARF 231.1b relate to total international liabilities, classified as liabilities to all counter parties and liabilities to non-bank counter parties. Do not manually update these columns as they contain formulas that sum data from the previous 2 to 7 columns.

3. ARF 231.2 Locational Data Part 2

In ARF 231.2, reporting entities are asked to regroup the locational assets and liabilities data reported in ARF 231.1, providing a different sectoral breakdown.

When preparing Australia-wide data to provide to the BIS, data from individual reporting entities will be allocated to the country of incorporation or charter of the parent (refer to 3.4 below). For this reason, reporting entities are asked to provide information on the nationality of their parent.

For each column not shaded in grey, enter the exposure or liability to each country in the country listing, in AUD amounts. Particular sections that may be of guidance are listed below:

- regarding which entities have to report and the basis of reporting, refer to section 2.3;

- regarding the type of data to be included, refer to section 2.4;

- regarding the treatment of bank and non-bank entities, refer to section 2.5;

- regarding exchange rates and the conversion of non-AUD positions into AUD, refer to page 2 ‘valuation and currency conversion’;

- regarding the memo items to be reported, refer to section 3.6; and

- for a description of the columns in the return, refer to section 3.7.

In ARF 231.2, reporting entities are asked to regroup the locational assets and liabilities data reported in ARF 231.1, by presenting positions vis-à-vis banks, rather than non-banks and all counter parties.

As with ARF 231.1, data is to be reported in ARF 231.2 on the positions on the Australian books of the Australian resident entity (i.e. whereby the accounts of related foreign institutions are not consolidated). Reporting entities should include transactions between any branches in Australia to the extent that these transactions are denominated in non-AUD currencies.

In the return, reporting entities are asked to select the country in which its ultimate parent entity is incorporated or chartered. For this purpose, a controlling interest may be assumed to exist if a participation exceeds 50 per cent of the subscribed capital of a reporting entity. In the case of indirect ownership it is recommended that foreign-owned reporting entities be classified by nationality of the final owner.

If the reporting entity is the ultimate parent entity, then for the purposes of ARF 231.2, the country of parent entity is Australia.

Consortiums are joint ventures in which no single owner has a controlling interest and, as such, no clear sole ultimate parent entity. In such cases, the consortium’s “parent” is to be allocated to their own separate ‘country’ group (Country: “Consortium bank”).

The types of assets and liabilities to be included in this return should be the same as those in the ordinary locational statistics (ARF 231.1, refer to section 2.4).

While not included in the return (except for the memo item relating to exchange rates, refer to section 3.6.1), information is requested on several memo items (refer to below). Reporting entities are requested to provide such information only if the data is readily available. Reporting entities are free to provide the data to APRA in any form/design they choose (Excel, Word, etc) and they should be submitted at the same time as ARF 231 is submitted.

As with ARF 231.1, data are requested for several memo items relating to:

- valuation changes due to revaluations at market prices;

- arrears of interest and principal; and

- write-offs & debt forgiveness.

Refer to section 2.8 for further information on these memo items.

The major exchange rates used to convert non-AUD amounts to AUD in the ARF 231 series are to be reported in this memo item.

This information is used to assess the variability in the major exchange rates used by different reporting entities.

Note: Report exchange rates as units of foreign currency per 1 Australian dollar. For example, 0.5555 US dollars buys 1 Australian dollar).

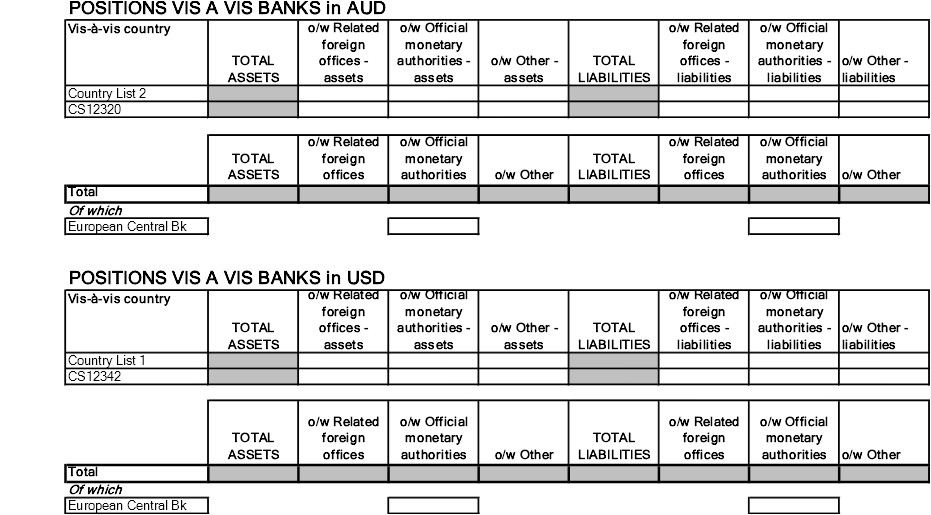

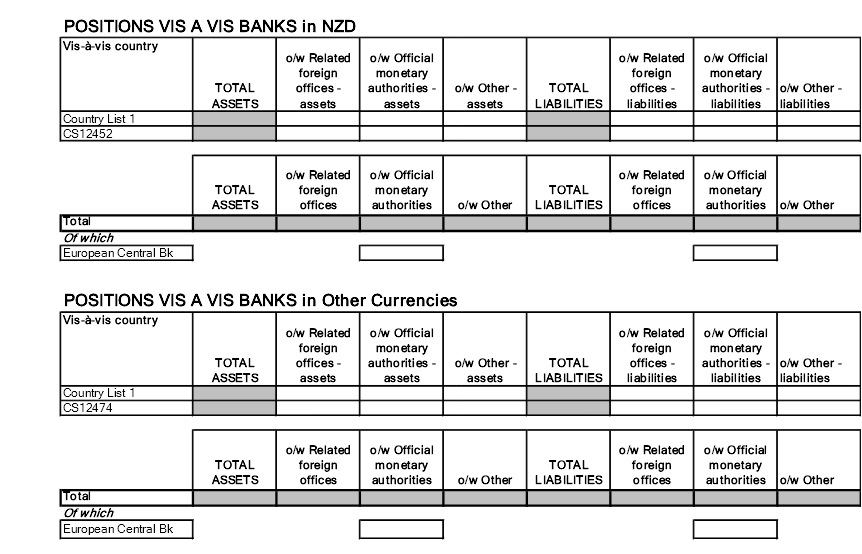

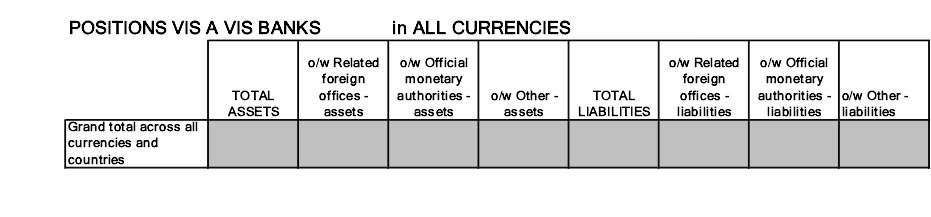

Part 2 of the locational data are reported in ARF 231.2. There are eight worksheets where claims and liabilities should be reported by the currency in which they are denominated. These worksheets are titled: AUD, USD, EUR, JPY, GBP, CHF, NZD, and Other. There is also another worksheet titled Total, which sums data from other sections of the return and should not be updated manually.

Note: Non-AUD foreign currency-denominated amounts should be converted to AUD amounts using the appropriate exchange rate.

General column descriptions are below:

Columns 1 – Country listing

This column is an alphabetical listing of countries. Your claims and liabilities should be allocated to the respective country. If you have an exposure or liability to a country not already listed refer to section 1.2 for further instructions.

Only foreign currency assets and liabilities to Australian residents should be allocated next to “Australia”. Do not report any AUD positions vis-à-vis “Australia” as these are not international/foreign in nature; the relevant areas have been shaded black accordingly.

Columns 2 to 5 – Assets

Columns 2 to 5 in the worksheets in ARF 231.2 relate to international assets of the reporting entity vis-à-vis banks. The columns in each worksheet report assets in the following way:

- Positions vis-à-vis banks – total assets (column 2);

- Positions vis-à-vis banks – of which related foreign offices (column 3);

- Positions vis-à-vis banks – of which official monetary authorities (column 4); and

- Positions vis-à-vis banks – of which other (column 5).

Do not manually update column 2 (total assets) as this is the sum of data from the following 3 columns.

Column 6 to 9 – Liabilities

Columns 6 to 9 in the worksheets in ARF 231.2 relate to international liabilities of the reporting entity vis-à-vis banks. The columns in each worksheet report liabilities in the following way:

- Positions vis-à-vis banks – total liabilities (column 6);

- Positions vis-à-vis banks – of which related foreign offices (column 7);

- Positions vis-à-vis banks – of which official monetary authorities (column 8);

- Positions vis-à-vis banks – of which other (column 9).

Do not manually update column 6 (total liabilities) as this is the sum of data from the following 3 columns.

4. ARF 231.3 Consolidated Data

ARF 231.3 captures a reporting entity’s consolidated international financial claims broken down by the remaining maturity and the sector of borrower. In addition, they include information on exposures by country of immediate borrower and on the reallocation of claims (i.e. risk transfers) to the country of ultimate risk. The latter is defined as the country where the guarantor of a claim resides (refer to section 4.8.1 below).

The data mainly cover claims reported by domestic entity head offices, including the exposures of their foreign affiliates, and are collected on a global consolidated basis (i.e. with inter-office positions being netted out).

The above paragraphs relate to domestic reporting entities. They are also applicable to foreign reporting entities except that data sought from foreign reporting entities is on an unconsolidated basis.

For each column in the return not shaded grey, enter your consolidated exposure to each country in the country listing, in AUD amounts. Particular sections that may be of guidance are listed below:

- For a discussion of the concept of “consolidated” data, refer to section 1.1;

- regarding which entities have to report, refer to section 4.3;

- regarding the type of data to be included, refer to section 2.4 except that no positions on an immediate borrower basis vis-à-vis Australia are to be reported (refer to section 4.7);

- regarding exchange rates and the conversion of non-AUD positions into AUD, refer to page 2 ‘valuations and currency conversion’;

- regarding the memo items to be updated, refer to section 4.13; and

- for a description of the columns in the return, refer to section 4.14.

As with the locational data, ARF 231.3 is to be completed by all reporting entities operating in Australia (i.e. Australian residents). However, reporting entities will report different parts of ARF 231.3 depending on whether they are domestic (i.e. Australian-owned) or whether they are a subsidiary or branch of a foreign institution (i.e. foreign-owned). “Domestic” entities report in ARF 231.3a, while “foreign” entities report in ARF 231.3b.

Table 2 summarises the reporting requirements for each different entity type.

Table 2: ARF 231.3 – Reporting basis

Entity Type

|

Consolidated

or

Non-Consolidated

| Claims on an Immediate Borrower Basis | Claims on an Ultimate Risk Basis |

Risk Transfers

| Local Currency Positions of Foreign Affiliates with local residents |

1. Domestic owned | Consolidated | | | | |

2. Foreign owned | Non-Consolidated | | | | - |

Data should be provided by reporting entities on their on-balance sheet financial claims on an:

- immediate borrower basis (i.e. allocated to the country where the original risk lies). This is done in the worksheets ‘By maturity’, ‘By sector’, and ‘Risk transfer’.

- country of ultimate risk basis (i.e. allocated to the country where the guarantor of a claim resides). This is done in the worksheets ‘Ultimate risk, and ‘Derivative contracts’.

Data are also sought on risk transfers, where claims are reallocated from the country of immediate borrower to the country of ultimate risk.

Reporting basis:

Types of business to report:

- Report consolidated data on cross-border on‑balance sheet financial claims of their offices worldwide and the claims of their foreign affiliates on residents of the countries where the affiliates are located.

- As in the locational banking statistics, the principal items are deposits and balances placed with banks, loans and advances to banks and non‑banks, and holdings of securities and other assets.

The data should be reported in ARF 231.3a on a consolidated immediate borrower basis in the worksheets: ‘By maturity’; ‘By sector’; and ‘Risk transfers’. The data should be reported on a consolidated ultimate risk basis in the worksheets: ‘Ultimate risk’; and ‘Derivative contracts’. That is, claims between different offices of the same institution (e.g. between a reporting entity that is the Australian head office and its subsidiary in New Zealand) should be netted out, and the positions should be allocated to the country where the final risk lies.

Australian-owned reporting entities should also provide a breakdown between cross-border claims of all their offices on the one hand (column 7 in the worksheet ‘Ultimate risk’) and local claims of their foreign offices on the other (column 8 in the same worksheet). If reporting entities face difficulties reporting this distinction it is recommended that it be estimated on a best effort basis.

The return should cover the activities of all offices and certain subsidiaries (refer to section 4.4.1, below) of the reporting entity, whether within or outside Australia and should comprise all balance sheet items, which represent claims on other individual countries.

The consolidated reporting should capture the following types of claims:

- Australian offices’ claims on non-residents in AUD or other currencies.

For example, any claim of the Sydney office of an Australian reporting entity on a borrower resident in New Zealand.

B. Offshore offices’ claims on non-residents in local and non-local currency, excluding claims on Australian residents.

For example, a claim of the Wellington subsidiary of an Australian entity on a borrower resident in the US.

C. Offshore offices’ claims in non-local currencies on local residents.

For example, a USD claim of the Wellington subsidiary of an Australian entity on a borrower resident in New Zealand.

D. Offshore offices’ gross claims and liabilities in local currency on local residents.

For example, include the NZD business of the Wellington subsidiary of an Australian entity with a customer resident in New Zealand.

These data are sought as these reflect, in addition to cross-border claims, a source of country transfer risk for the reporting entity if the assets are funded abroad.

While A-C claim types should be reported on a consolidated basis, report D-type claims on a gross (i.e. non-consolidated) basis.

Reporting entities should refer to AASB 127 and AASB 3 regarding definitions of controlled entity and parent entity.

Note: Domestic entities may find that much of the data needed for consolidating their offshore operations is already available. This is because any offshore branches and subsidiaries most likely already submit the bulk of this data to their regulator/central bank in their host country who in turn forward the data to the BIS.

Australian-owned reporting entities should report the consolidated activities of the whole group. The return should consolidate all Australian and foreign subsidiaries whose business is financial and whose prime function is to grant credit or whose assets are largely of types that are captured in the return. This includes subsidiaries involved in banking, hire‑purchase, factoring, bank-funded "warehousing", leasing, bond trading and those which trade in or underwrite securities. Insurance broking and similar companies should be excluded.

There may be cases in which an Australian-owned bank or a merchant bank or a finance company is a subsidiary of another Australian‑owned reporting entity. In such cases the parent reporting entity and the subsidiary must still separately complete all parts of the return, with the parent consolidating the activities of the subsidiary in ARF 231.3 Consolidated Data. Even though its activities have been consolidated, the subsidiary is still required to complete ARF 231.3 separately.

Reporting basis:

- Unconsolidated (i.e. gross).

Types of business to report:

- Report unconsolidated (i.e. gross) worldwide cross‑border claims on all other countries including their home country on an immediate borrower basis and on an ultimate risk basis. Include any positions vis-à-vis own affiliates or head offices in other countries.

- As in the locational banking statistics, the principal items are deposits and balances placed with banks, loans and advances to banks and non‑banks, and holdings of securities and other assets.

The data should be reported on an immediate borrower basis (worksheets: ‘By maturity’; ‘By sector’; and ‘Risk transfers‘) and on an ultimate risk basis (worksheets: ‘Ultimate risk’; and ‘Derivative contracts‘).

Note: Foreign owned reporting entities may find that much of the data needed for completing ARF 231.3 is already available. This is because they most likely already submit the bulk of this data to their headquarters in their parent country (who would consolidate it with other data and provide it to the regulator/central bank in their country who in turn forward the data to the BIS).

Reporting entities are requested to provide information on the volume of their cross‑border financial claims and the local claims of their foreign affiliates in any currency that has been reallocated from the country of the immediate borrower to the country of ultimate risk as a result of guarantees, collateral, and credit derivatives, which are part of the ‘banking book’. The risk reallocation should also include those between different economic sectors (banks, public sector and non-bank private sector) in the same country. The information on the reallocation of claims should be reported as net risk transfers i.e. the difference of reallocated claims that increase the exposure (inward risk transfers) and those, which reduce the exposure (outward risk transfers) vis-à-vis a given country. All outward and inward risk transfers should add up to the same total.

The risk reallocation should also cover loans to domestic borrowers that are guaranteed by foreign entities and therefore represent inward risk transfers, which increase the exposure to the country of the guarantor. Equally foreign lending that is guaranteed by Australian entities (e.g. a domestic export credit agency such as EFIC, the Export Finance and Insurance Corporation) should be reported as an outward risk transfer, which reduces the exposure to the country of the foreign borrower.

In summary, there are four potential forms of risk reallocation:

- Lending to a non-resident that is guaranteed by a non-resident third party.

In this case both the outward risk transfer from the original borrower and the risk transfer to the guarantor have to be reported.

ii. Lending to a non-resident that is guaranteed by an Australian resident third party.

In this case both the outward risk transfer from the original non-resident borrower has to be reported as well as the inward risk transfer to Australia.

iii. Lending to a resident that is guaranteed by a non-resident third party.

In this case, report the outward risk transfer from Australia as well as the inward risk transfer to the non-resident guarantor.

iv. Lending to a non-resident where the exposure is extinguished by receiving a cash collateral.

In this case only the outward risk transfer from the original non-resident borrower has to be reported (but no inward risk transfer to Australia).

Example 1

A bank in Australia has granted a loan of AUD 10 million to a manufacturer in Hong Kong, which is guaranteed by a bank in Japan. The Australian bank should report the claim as an outward risk transfer from Hong Kong and an inward risk transfer to Japan. Using the title of the worksheets and the column numbers in ARF 231.3a, this example will look as follows:

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

Hong Kong | 10 | 10 | | -10 |

Japan | | | 10 | 10 |

Column 8 in the worksheet ‘By maturity’ reports total cross-boarder claims in all currencies and foreign affiliates local claims in non-local currencies on an immediate borrower basis. This “total” is also reported in column 6 in the worksheet ‘By sector’. In the ‘Risk transfers’ worksheet, column 2 reports outward risk transfers, column 3 reports inward risk transfers, and column 4 reports net risk transfers to the ultimate borrower.

Example 2

If in example 1, a bank in Australia guarantees the claim instead, the claim should be reported as an outward risk transfer from Hong Kong and an inward risk transfer to Australia.

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

Australia | | | 10 | 10 |

Hong Kong | 10 | 10 | | -10 |

Example 3

If in example 1, the manufacturer were resident in Australia, the claim would have to be reported as an outward risk transfer from Australia and an inward risk transfer to Japan. Note that no immediate claim is reported for Australia, refer to section 4.7.

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

Australia | | 10 | | -10 |

Japan | | | 10 | 10 |

Example 4

If in example 1, the manufacturer were resident in Japan, the claim would have to be reported as an outward risk transfer from the non-bank private sector in Japan and an inward risk transfer to the banking sector in Japan.

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

Australia | | | | |

Japan | | 10 | 10 | 0 |

As a result, the data in column 2 in the ‘Ultimate risk’ worksheet should be $10 million higher than the amount in column 2 in the ‘By sector’ worksheet (on an immediate basis), and column 4 in the ‘Ultimate risk’ worksheet should be $10 million lower than the amount in column 4 in the ‘By sector’ worksheet (on an immediate basis) for Japan.

Example 5

If in example 4, the loan were granted by a subsidiary of an Australian bank in Hong Kong, the claim would have to be reported as an outward risk transfer from Hong Kong and an inward risk transfer to Japan (remembering that the loan is guaranteed by a bank in Japan).

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

Hong Kong | | 10 | | -10 |

Japan | | | 10 | +10 |

As a result, the data in columns 2 and 7 in the ‘Ultimate risk’ worksheet for Japan will be $10 million higher than in columns 2 or 7 in the ‘By sector’ worksheet, depending on whether the claim was denominated in Hong Kong dollars (column 7) or any other currency (column 2). In addition, the data in columns 4 and 8 in the ‘Ultimate risk’ worksheet for Hong Kong would be $10 million lower than in columns 4 or 7 in the ‘By sector’ worksheet (immediate risk, non-bank private sector), depending on whether the claim was denominated in Hong Kong dollars (column 7) or any other foreign currency (column 4).

Example 6

An Australian bank makes a AUD 10 million loan to the Wellington branch of a US bank. The loan should be reported as a claim against New Zealand in column 8 in the ‘By maturity’ worksheet, as an outward risk transfer from New Zealand in column 2 in the ‘Risk transfers’ worksheet and as an inward risk transfer to USA in column 3 in the ‘Risk transfers’ worksheet.

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

New Zealand | 10 | 10 | | -10 |

USA | | | 10 | 10 |

Example 7

If in example 6, the loan to the Wellington branch of the US bank is made by a New Zealand office of the bank and is in NZD, it should be reported in column 7 in the ‘By sector’ worksheet as well as an outward risk transfer from New Zealand (column 2 in the ‘Risk transfers’ worksheet) and an equivalent inward risk transfer to the USA (column 3 in the ‘Risk transfers’ worksheet).

| ‘By maturity’ Col. 8 | ‘By sector’ Col. 7 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

New Zealand | | 10 | 10 | | -10 |

USA | | | | 10 | 10 |

Note: For any individual country (except Australia, refer to section 4.7 below), the entry in column 2 in the ‘Risk transfers’ worksheet should normally not be more than (and usually less than) the sum of columns 8 in the ‘By maturity worksheet and 7 in the ‘By sector worksheet’ (the exception is where the sum of these columns is less than column 2 in the ‘Risk transfers’ worksheet because of short positions in investments). The counterpart of each outward risk transfer included in column 2 in the ‘Risk transfers’ worksheet is an equal inward risk transfer reported in column 3 in the same worksheet against the country of residence of the person or institution responsible for repayment of the claim if the original borrower fails to do so.

Example 8

For example, a AUD 10 million claim on the Wellington branch of another Australian‑incorporated bank should be included against New Zealand in columns 8 in the ‘By maturity’ worksheet and 2 in the ‘Risk transfers’ worksheet and against Australia in column 3 in the ‘Risk transfers’ worksheet. However, if the loan to the Wellington branch of the Australian-incorporated bank is made by a Wellington office of the reporting bank and is in NZD, it should be reported only in column 7 in the ‘By sector' worksheet (refer to example 7 above).

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

Australia | | | 10 | 10 |

New Zealand | 10 | 10 | | -10 |

Example 9

A claim in AUD or any other currency on the Sydney office of a US bank (or on a Australian company with a US guarantor) will not be included in column 8 in the ‘By maturity’ worksheet. However, an outward risk transfer in respect of such a claim should be reported against Australia in column 2 in the ‘Risk transfers’ worksheet and an inward risk transfer to USA in column 3 in the same worksheet. Included in this way are all claims that would qualify for inclusion in column 8.

| ‘By maturity’ Col. 8 | ‘Risk transfers’ Col. 2 | ‘Risk transfers’ Col. 3 | ‘Risk transfers’ Col. 4 |

Australia | | 10 | | -10 |

USA | | | 10 | 10 |

4.7 Positions vis-à-vis Australia

The locational data collected in ARF 231.1 and ARF 231.2 captured:

- non-AUD denominated claims on Australian residents; and

- all AUD and non-AUD denominated claims on non-residents.

ARF 231.3, however, only relates to B-type claims; therefore do not include A-type claims, i.e. claims on Australian residents (either AUD or non-AUD denominated) should be excluded as these do not represent country risk. The only exception is in terms of risk transfers as Australians may have guaranteed a claim by a third-party on a non‑resident.

Accordingly, reporting entities are asked to provide some limited ultimate risk data vis-à-vis Australia. Data on reporting entities’ risk transfers in/out of Australia are sought for two reasons:

- It is used as a data validity check for both the reporting entities and APRA. By showing risk transfers into and out of Australia, total (i.e. for the world) outward risk transfers should always equal inward risk transfers. While it could be surmised that any difference between the two is a net transfer either in or out of Australia, if this balancing check was not there, there is the possibility that misreporting could appear. This works as a useful check.

There is one qualification to this point. The issuer (or protection buyer) of credit linked notes and other collateral debt obligations and asset backed securities should only report an outward risk transfer and no inward risk transfer because the issuer is perceived to have received a cash collateral which extinguishes the exposure to his original claim. So in this limited case, total outward risk transfers may not match total inward risk transfers.

- It provides an indication of the magnitude of gross risk transfer into and out of Australia, and given the definition of risk transfer it provides a "ball park" figure for possible foreign-owned banks branch business in Australia (and by Australian‑owned banks branches outside Australia), with Australian-owned banks.

Reporting entities are requested to provide data on their cross-border on-balance sheet financial claims of their offices worldwide and, for Australian-owned reporting entities, the claims of their foreign affiliates on residents of the countries where the affiliates are located. For Australian-owned reporting entities, the data should be reported on a consolidated immediate borrower basis (in worksheets ‘By maturity’, ‘By sector’, and ‘Risk transfers’) and on a consolidated ultimate risk basis (in worksheets ‘Ultimate risk’ and ‘Derivative contracts’), i.e. inter-office positions should be netted out and the positions should be allocated to the country where the final risk lies. For foreign reporting entities, both immediate borrower and ultimate risk data should be on an unconsolidated basis.

In line with the risk reallocation principle for measuring country exposure recommended by the Basel Committee on Banking Supervision, the country of ultimate risk, or where the final risk lies is defined as the country in which the guarantor of a financial claim resides and/or the country in which the head office of a legally dependent branch is located. Collateral may be considered as an indicator of where the final risk lies to the extent that is recognised as a risk mitigant under the Basel Capital Accord.

Similarly, if credit derivatives are used to cover for the counterparty risk of financial claims in the banking book, the country of ultimate risk of these positions is defined as the country in which the counterparty to the credit derivative contract resides. In addition, in case of holdings of credit linked notes and other collateral debt obligations and asset-backed securities a “look-through” approach should be adopted and the country of ultimate risk is defined as the country where the debtor of the underlying credit, security or derivative contract resides. However, it is recognised that this “look-through” approach might not always be possible for practical reasons. Accordingly, reporting entities might only be able to provide estimates for the allocation of claims to the country where the debtor of the underlying resides or to allocate the claims to the country of the immediate borrower that is the country where the issuer of the securities resides. Furthermore, the issuer (or protection buyer) of credit linked notes and other collateral debt obligations and asset backed securities should regard the issuance of a security backed by financial claims and sale to investors as a cash collateral which therefore extinguishes the exposure of the issuer to the underlying claim.

Claims on separately capitalised subsidiaries can only be considered as being guaranteed by the head office if the parent has provided an explicit guarantee. In contrast, any claims on non-incorporated branches should for the purposes of the consolidated banking statistics always be considered as guaranteed by the respective head office, even if there is no legal guarantee.

The data on financial claims should comprise all those balance sheet items, which represent claims on residents in other individual countries or economies. As in the locational banking statistics, the principal items are deposits and balances placed with banks, loans and advances to banks and non-banks, holdings of securities (including credit linked notes and other collateral debt obligations and asset-backed securities) and participations. If derivatives are booked as on-balance sheet items, they should not be reported as part of the item “On-balance sheet financial claims”, but separately under the 'Derivative Contracts' item.

Domestic (Australian-owned) reporting entities are required to provide consolidated data on the cross-border financial claims (i.e. positive fair values) resulting from derivative contracts of all their offices worldwide and the financial claims from derivative contracts of their foreign affiliates vis-à-vis residents of the countries where the offices are located, independent of whether the derivative contracts are booked as off- or on-balance sheet items. The data should be reported on a consolidated and ultimate risk basis i.e. inter-office positions should be netted out and the positions should be allocated to the country where the final risk lies.

Foreign reporting entities are required to provide unconsolidated derivatives data.

The data should cover in principle all derivative contracts that are reported in the context of the triennial central bank survey of foreign exchange and derivatives market activity, which is coordinated by the BIS and reported to the RBA. The data thus mainly comprise forwards, swaps and options relating to foreign exchange, interest rate, equity, commodity and credit derivative contracts. However, credit derivatives, such as credit default swaps and total return swaps, should only be reported under the “derivative contracts” item if they belong to the ‘trading book’ of a protection buying reporting entity. Credit derivatives which belong to the ‘banking book’ should be reported as “risk transfers” by the protection buyer and, all credit derivatives should be reported as “guarantees” by the protection seller (refer to below).

Financial claims resulting from derivative contracts should be valued at fair values (i.e. current credit exposure calculated as the sum of all positive fair values of derivative contracts outstanding after taking account of legally enforceable bilateral netting agreements) as this ensures consistency not only with the BIS OTC derivatives statistics but also with the valuation principles for all other on- and off-balance sheet items in the BIS international financial statistics. Negative fair values of derivative contracts are considered to represent financial liabilities and are therefore by definition excluded from the reporting of financial claims.

The following examples indicate how to calculate the market or fair value of various derivative instruments.

- For a forward, a contract to purchase USD against Euro at a forward rate of 1.00 when initiated has a positive fair value if the EUR/USD forward rate at the time of reporting for the same settlement date is lower than 1.00. It has a negative fair value if the forward rate at the time of reporting is higher than 1.00, and it has a zero fair value if the forward rate at the time of reporting is equal to 1.00.

- For swaps, which involve multiple (and sometimes two-way) payments, the fair value is the net present value of the payments to be exchanged between the counterparties between the reporting date and the contract's maturity, where the discount factor to be applied would normally reflect the market interest rate for the period of the contract's remaining maturity. Thus, a fixed/floating swap which at the interest rates prevailing at the reporting date involves net annual receipts by the reporter of e.g. 2% of the notional principal amount for the next three years has a positive marked-to-market (or replacement) value equal to the sum of three net payments (each 2% of the notional amount), discounted by the market interest rate prevailing at the reporting date. If the contract is not in the reporter's favour (i.e. the reporter would have to make net annual payments), the contract has a negative net present value.

- Unlike forwards or swaps, OTC options have a fair value at initiation that is equal to the premium paid to the writer of the option. Throughout their life, option contracts can only have a positive fair value for the buyer and a negative fair value for the seller. If a quoted market price is available for a contract, the fair value to be reported for that contract is the product of the number of trading units of the contract multiplied by that market price. If a quoted market price is not available, the fair value of an outstanding option contract at the time of reporting can be determined on the basis of secondary market prices for options with the same strike prices and remaining maturities as the options being valued, or by using option pricing models. In an option pricing model, current quotes of forward prices for the underlying (spot prices for American options) and the implied volatility and market interest rate relevant to the option's maturity would normally be used to calculate the “market” values. Options sold and purchased with the same counterparty should not be netted against each other, nor should offsetting bought and sold options on the same underlying.

Reporting entities are requested to provide data on guarantees outstanding vis‑à‑vis non-residents of all their offices worldwide and the exposures of their foreign affiliates from guarantees vis-à-vis residents of the countries where the affiliates are located. Similar data is also requested separately for credit commitments outstanding. For domestic reporting entities, the data should be reported on a consolidated and ultimate risk basis i.e. inter-office positions should be netted out and, in case of secondary guarantees, collateral, and guarantees and credit commitments vis-à-vis non-incorporated branches of banks, the positions should be allocated to the country where the final risk lies. For foreign reporting entities, the data should be on an unconsolidated and ultimate risk basis.

Guarantees and credit commitments should be reported to the extent that they represent the unutilised portions of both binding contractual obligations and any other irrevocable commitments. They should only cover those obligations, which, if utilised, would be reported in total cross-border claims and local claims of foreign affiliates in any currency. Performance bonds and other forms of guarantee should only be reported if, in the event of the contingency occurring, the resulting claim would have an impact on total cross-border claims and local claims of foreign affiliates in any currency.

A more detailed definition of guarantees and credit commitments and a non-exhaustive list of typical instruments that qualify as guarantees and credit commitments is provided below:

Guarantees

- Represent contingent liabilities arising from an irrevocable obligation to pay to a third party beneficiary when a client fails to perform some contractual obligations. They include secured, bid and performance bonds, warranties and indemnities, confirmed documentary credits, irrevocable and stand-by letters of credits, acceptances and endorsements. Guarantees also include the contingent liabilities of the protection seller of credit derivative contracts.

Credit commitments

- Represent arrangements that irrevocably obligate an institution, at a client’s request, to extend credit in the form of loans, participation in loans, lease financing receivables, mortgages, overdrafts or other loan substitutes or commitments to extend credit in the form of the purchase of loans, securities or other assets, such as back-up facilities including those under note issuance facilities (NIFs) and revolving underwriting facilities (RUFs).

Reporting entities are to provide a maturity breakdown of their on-balance sheet international claims on an immediate borrower basis.

- Claims are to be entered according to their remaining maturity.

- Deposits that are repayable on demand should be allocated to the shortest maturity bracket.

- Overdue items should be allocated to the shortest maturity bracket (i.e. “< 3 mths”).

- Claims that cannot be classified by maturity, such as equity and participations, should be assigned to a residual category “unallocated”.

- Remaining maturities should be defined on the basis of the time to final payment of the relevant claim.

- The maturity classification of revolving credit facilities should be based on the term to loan rollover, which would typically be in the “< 3 mths” maturity bracket.

- Overdrafts should be allocated to the shortest maturity bracket (i.e. “< 3 mths”).

Table 3 details the treatment of claims according to different types of sector. Claims that cannot be classified by sector should be assigned to a residual category “unallocated”.

Table 3: Sector breakdown for ARF 231.3

Claims vis-à-vis

| Bank Sector | Public Sector | Non-Bank Private Sector |

General Government

(Federal, state and local governments) | - | | - |

Banks

(i.e. institutions which receive deposits and/or close substitutes for deposits and grant credit or invest in securities on their own account) | | - | - |

Central Banks

(e.g. RBA, the Fed, BOJ) | - | | - |

Bank for International Settlements

(included in Switzerland) | - | | - |

European Central Bank

(included in Germany) | - | | - |

Multilateral development banks

(e.g. the World Bank and the Asian Development Bank) | - | | - |

International Organisations | - | | - |

Publicly owned enterprises

(other than banks) | - | - | |

Residual Claims to non-bank private sector | - | - | |

Note

- The treatment of certain institutions in ARF 231.3 (e.g. official monetary authorities) differs from their treatment in ARF 231.1 and ARF 231.2. This reflects the differing purposes of the locational (ARF 231.1 and ARF 231.2) and consolidated (ARF 231.3) statistics; and

- In the consolidated statistics (ARF 231.3) all international organisations should be included in “public sector”.

As in the locational statistics (refer to section 2.6), international financial claims should generally be reported on a gross basis. However, reporting entities that are head offices exclude their claims on affiliates in any other country (as the data is reported on a consolidated basis).

As a general rule it is recommended that financial claims belonging to the banking book be valued at face values or cost prices and financial claims belonging to the trading book be valued at market or fair values which is largely consistent with AASB 139.

Financial claims resulting from derivative contracts should be valued at fair values (i.e. current credit exposure calculated as the sum of all positive fair values of derivative contracts outstanding after taking account of legally enforceable bilateral netting agreements) as this ensures consistency not only with the BIS OTC derivatives statistics but also with the valuation principles for all other on- and off-balance sheet items in the BIS international financial statistics. Negative fair values of derivative contracts are considered to represent financial liabilities and are therefore by definition excluded from the reporting of financial claims.

Contingent liabilities resulting from guarantees and credit commitments should be valued at face values or the maximum possible exposure.

While not included in the actual return, information is requested from reporting entities on several memo items (refer to below). Reporting entities are requested to provide such information only if the data is readily available. Reporting entities are free to provide the data to APRA in any form/design they choose (Excel, Word, etc) and they should be submitted at the same time as the ARF 231 series is submitted.

As with ARF 231.1 and ARF 231.2, data are requested for several memo items relating to:

- valuation changes due to revaluations at market prices;

- arrears of interest and principal; and

- write-offs & debt forgiveness.

Refer to section 2.8 for further information on these memo items.

Domestic reporting entities report consolidated data in ARF 231.3a. Foreign reporting entities report data in ARF 231.3 Immediate and Ultimate Risk Exposures – Foreign Entity.

General column descriptions are below:

Columns 1 – Country listing

This column is an alphabetical listing of countries. Claims and liabilities should be allocated to the respective country. If there is an exposure or liability to a country not already listed refer to section 1.2 for further instructions.

Only foreign currency assets and liabilities to Australian residents should be allocated next to “Australia”. Do not report any AUD positions vis-à-vis “Australia” as these are not international/foreign in nature; the relevant areas have been shaded black accordingly.

Columns 2 to 7 – Maturity breakdown of claims (worksheet ‘By maturity’)

In worksheet ‘By maturity’, enter each claim in the appropriate maturity bucket on the basis of its remaining maturity (refer to section 4.9).

Column 8 – Total claims on an immediate borrower basis (worksheet ‘By maturity’)

Column 8 in the worksheet ‘By maturity’ reports total consolidated cross-border claims in all currencies and local claims in foreign currencies on an immediate borrower basis (refer to sections 4.4 and 4.5). Do not update manually as this column sums data from other sections of the return.

Note: Column 8 in the worksheet ‘By maturity’ should equal column 6 in the ‘By sector worksheet’.

Columns 2 to 5 – Sectoral breakdown of outstanding claims (worksheet ‘By sector’)

Report consolidated cross-boarder claims in all currencies and foreign affiliates’ local claims in non-local currencies, by sector of borrower, in columns 2 to 5 in the ‘By sector’ worksheet. Enter each claim in the appropriate sector (refer to section 4.10).

Column 6 – Total claims on an immediate borrower basis (worksheet ‘By Sector’)

Column 6 in the worksheet ‘By sector’ reports total consolidated cross-border claims in all currencies and local claims in foreign currencies on an immediate borrower basis (refer to sections 4.4 and 4.5). Do not update manually as this column sums data from other sections of the return.

Note: Column 6 in the worksheet ‘By sector’ equals column 8 in the ‘By maturity’ worksheet.

Columns 7 to 8 – Activities of foreign affiliates (worksheet ‘By sector’)

Report local currency positions of reporting banks’ foreign affiliates with local residents in columns 7 to 8 in the worksheet ‘By sector’. Claims are reported in column 7 and liabilities in column 8.