Prudential Rules No. 26

Collection of Statistics

Life Insurance Act 1995 (ss 117(2)(d), 117(3), 244(1) and 244(2))

These Prudential Rules are made under subsection 252(1) of the Life Insurance Act 1995 (the Act) for the purposes of paragraph 117(2)(d) and subsections 117(3), 244(1) and 244(2) of the Act and apply to life companies registered under the Act (other than friendly societies).

Application

- These rules apply as follows:

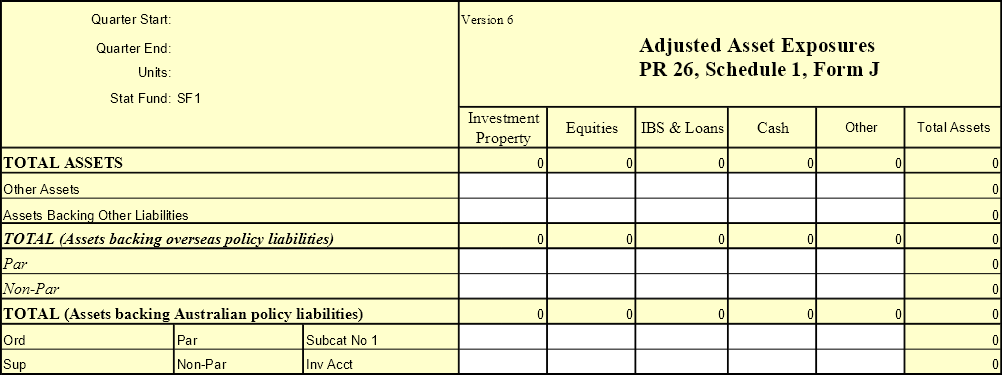

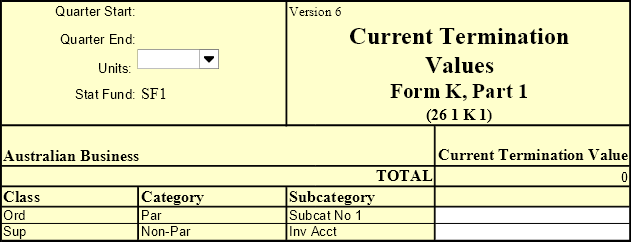

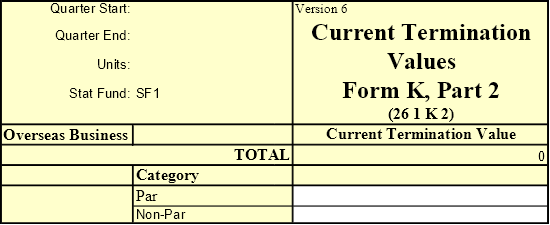

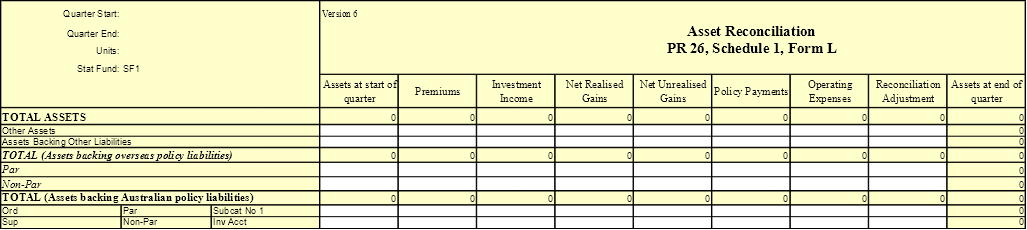

(a) Schedule 1 Forms A to H and J to L apply to a quarter ending on or after 31 December 2005;

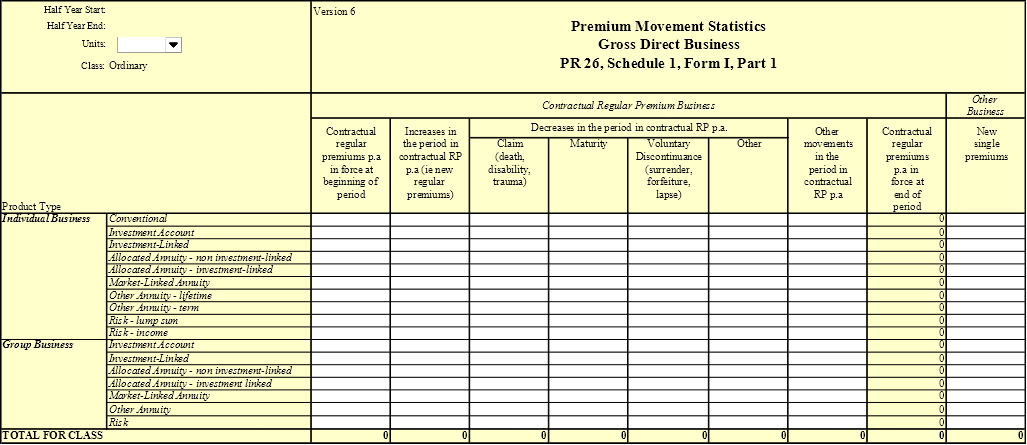

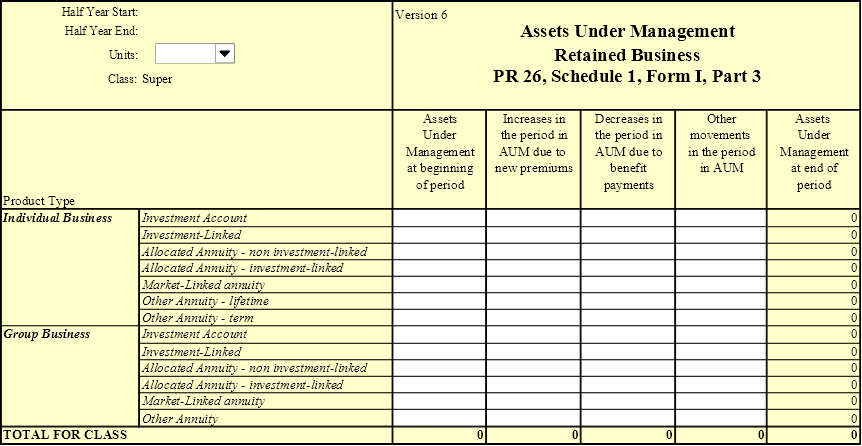

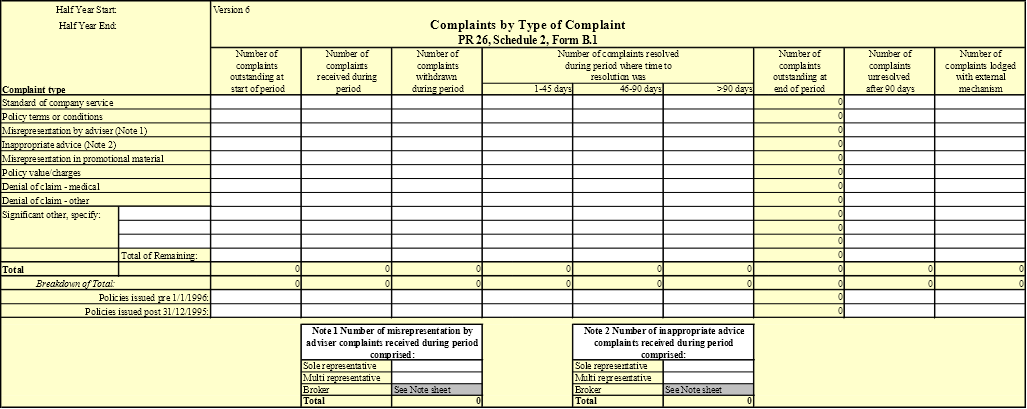

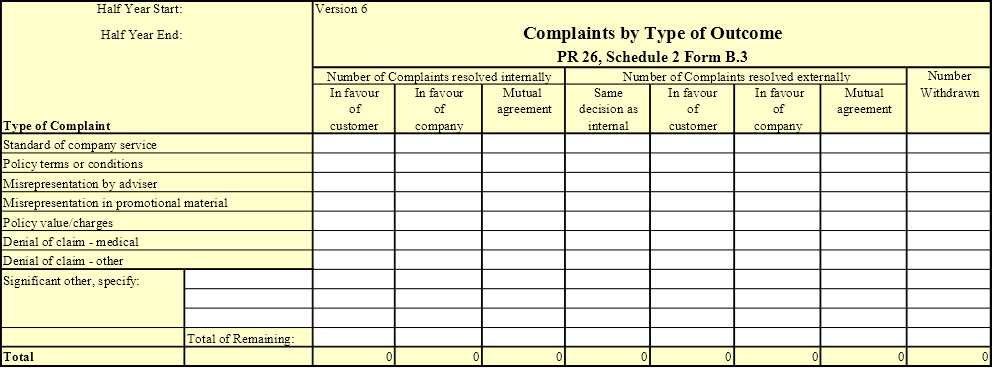

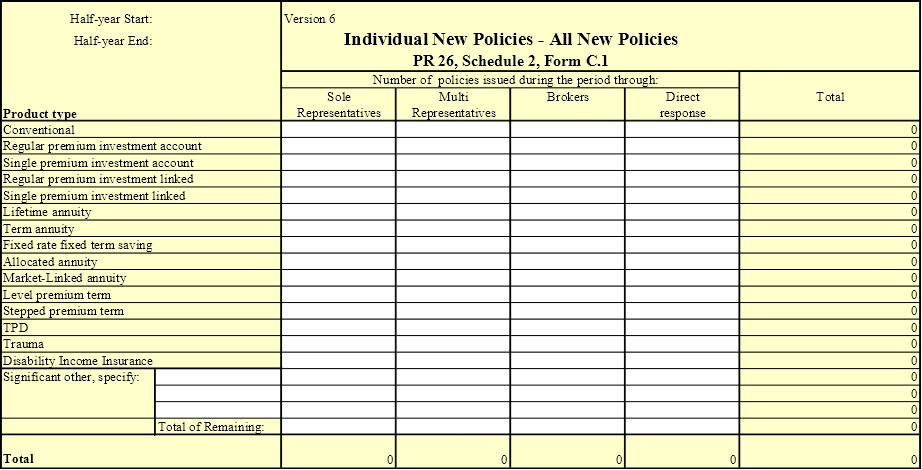

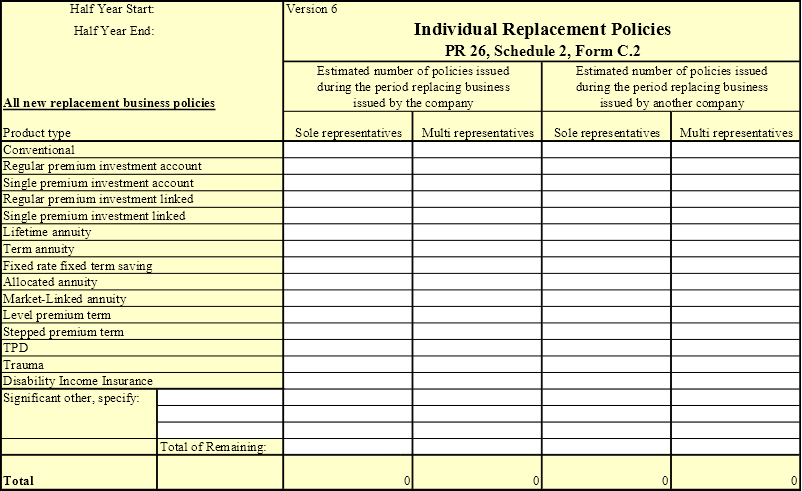

(b) Schedule 1 Form I and Schedule 2 apply to a half-year ending on or after 31 December 2005;

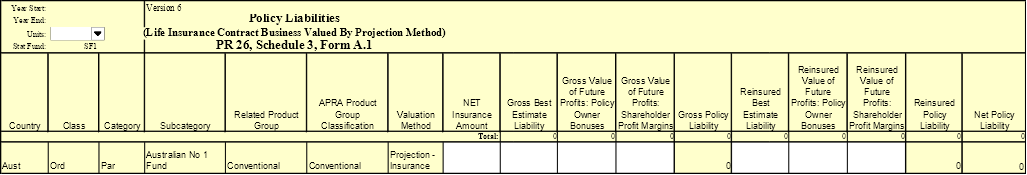

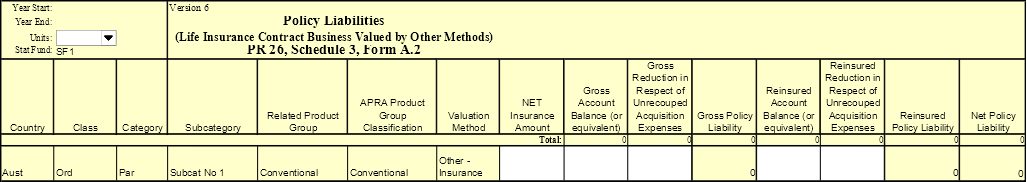

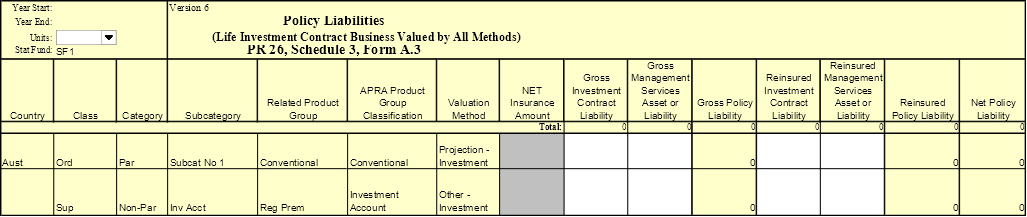

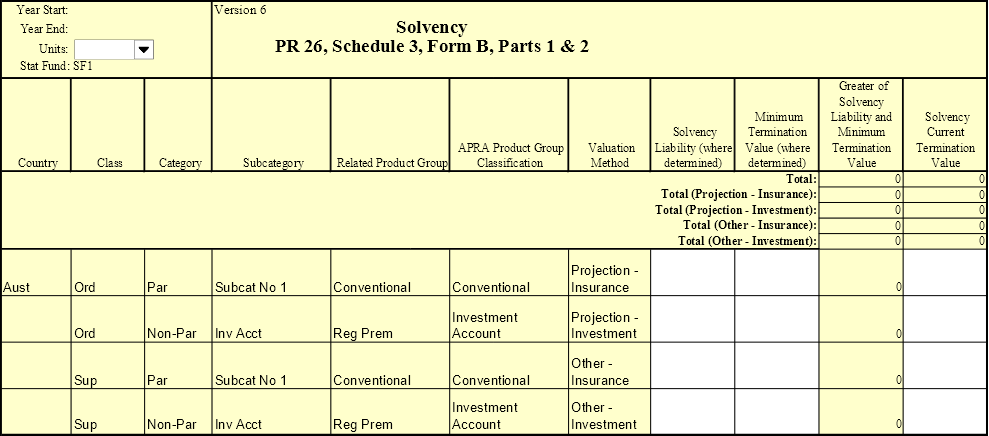

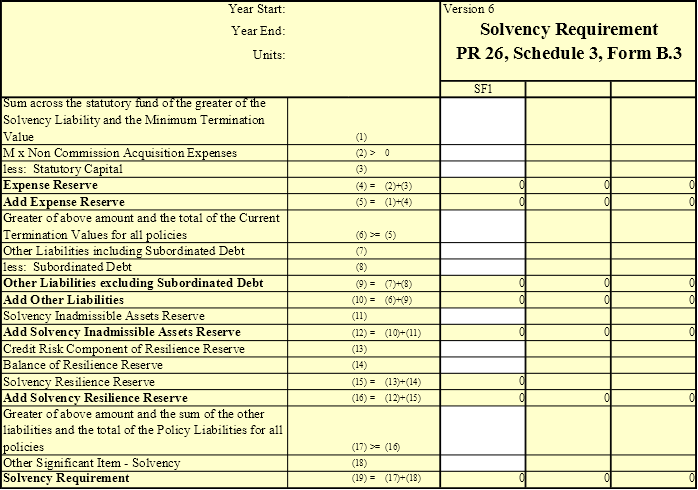

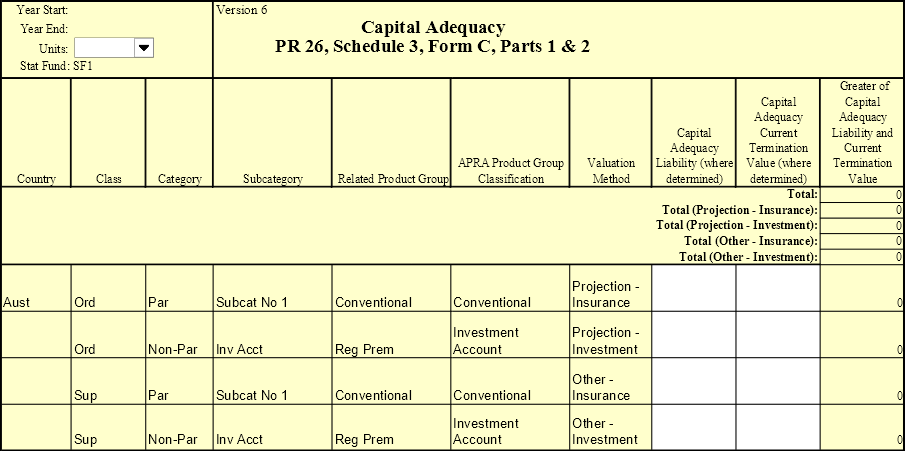

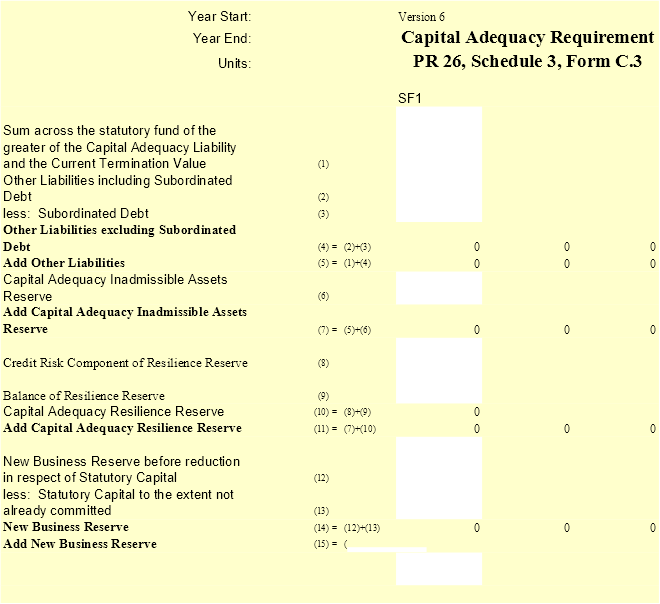

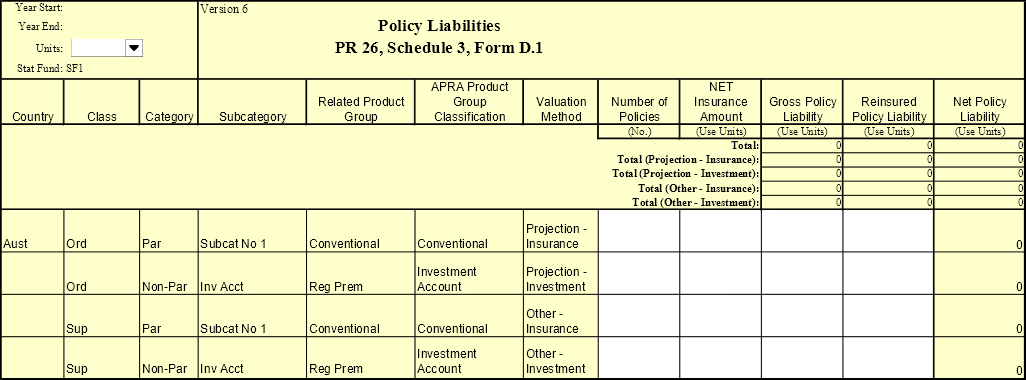

(c) Schedule 3 applies to a financial year of a life company ending on or after 31 December 2005;

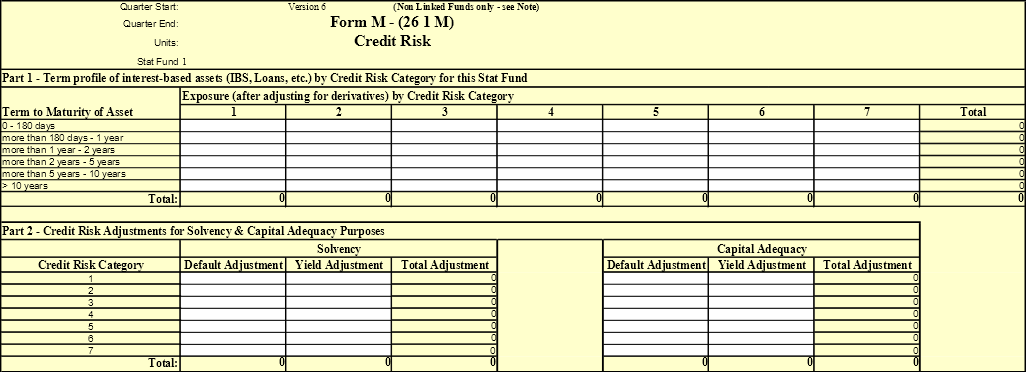

(d) Schedule 1 Form M applies to a quarter ending on or after 30 June 2006.

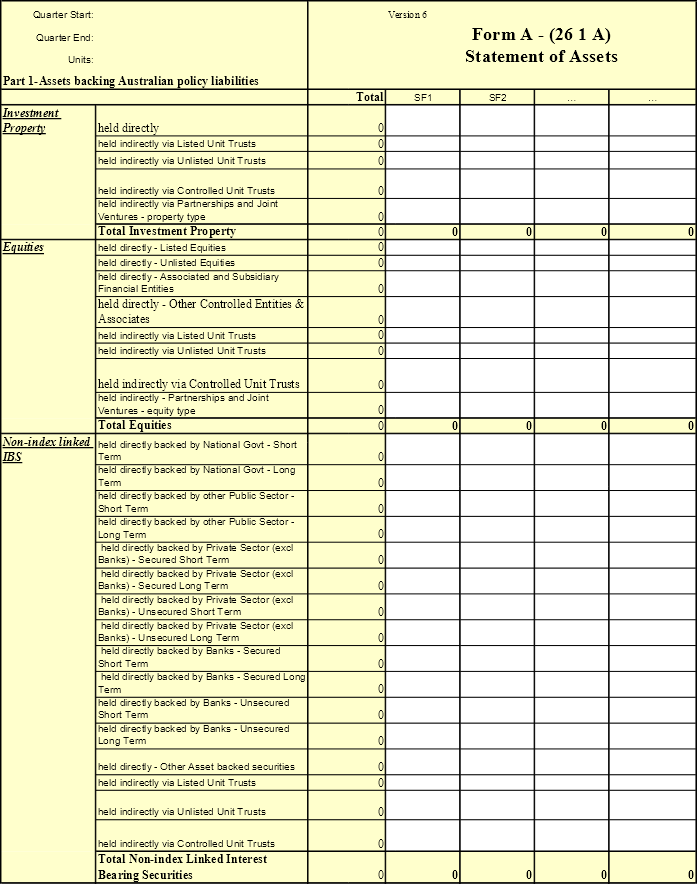

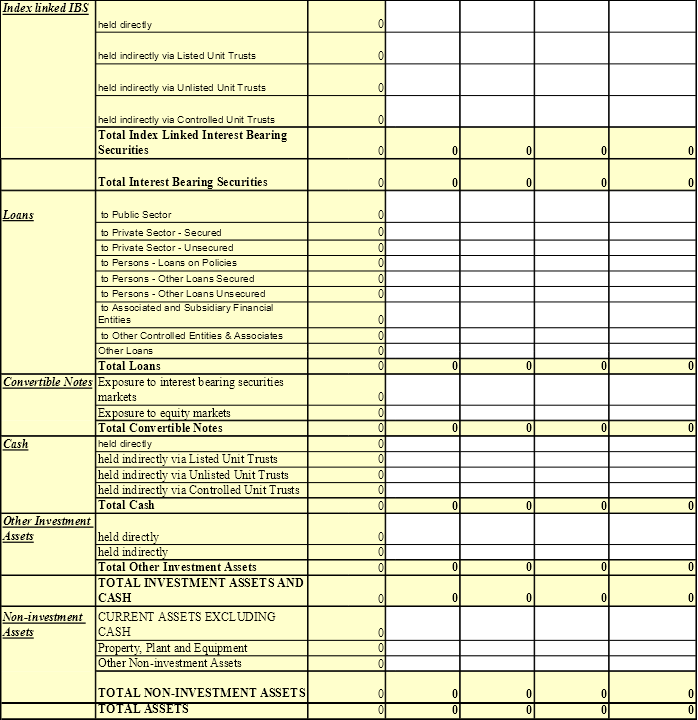

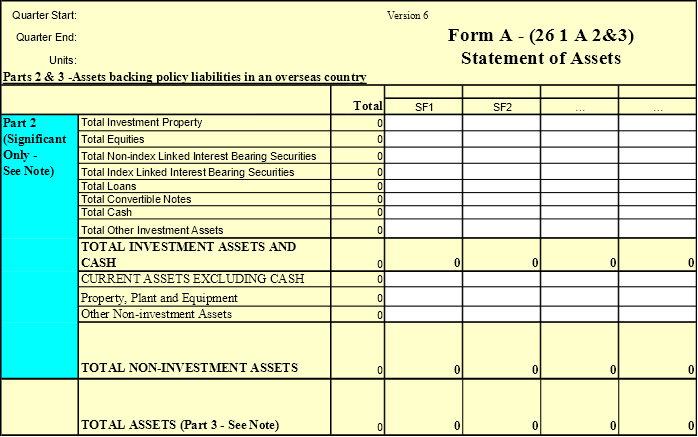

2. In rule 1:

(a) “quarter” means:

(i) the period comprising:

(A) January, February and March; or

(B) April, May and June; or

(C) July, August and September; or

(D) October, November and December; or

(ii) a period approved by APRA in relation to a particular life company;

(b) “half-year” means:

(i) the period comprising:

(A) January to June (both inclusive); or

(B) July to December (both inclusive); or

(ii) a period approved by APRA in relation to a particular life company.

APRA must collect statistics

3. APRA must collect the statistics to which the Forms in the Schedules relate, at such times and in such manner as prescribed in these rules.

When the statistics must be collected

4. Subject to rule 5, a life company must provide to APRA:

(a) the statistics in Schedules 1 and 2 within 6 weeks after the end of the period to which they relate; and

(b) the statistics in Schedule 3 within 3 months after the end of the period to which they relate.

5. APRA may in its discretion from time to time and by notice in writing to one or more life companies extend any of the deadlines in rule 4 for the period and on the conditions (if any) specified in the notice.

6. If the statistics in any of Schedule 1 Forms A to H and M have not been audited in accordance with rule 14 by the end of the time within which rules 4 and 5 require them to be to be provided to APRA:

(a) they must still be provided to APRA by the end of that time; and

(b) audited versions of them must be provided to APRA within 3 months after the end of the period to which they relate or within such extended period as may apply under rule 5.

Actuarial valuations and calculations must be in accordance with actuarial standards

7. Actuarial valuations and calculations included in, or used in the preparation of, the statistics must be in accordance with actuarial standards made by the Life Insurance Actuarial Standards Board, as in force from time to time.

Statistics must be expressed in Australian dollars

8. Amounts of money in the statistics must be expressed in units of one, one thousand or one million Australian dollars. (All Forms relating to a particular statutory fund must use the same units.)

9. A foreign currency amount must be converted to Australian dollars at the market exchange rate prevailing at the end of the period to which the statistics in which the amount is included relate.

Statistics must be consistent with financial statements

10. The statistics in Schedule 1 Form A and Schedule 3 Forms A, B and D must be consistent with, and prepared on the same basis as, the life company’s regulatory financial statements prepared in accordance with Prudential Rules No 35 (as amended), except to the extent that compliance with these Prudential Rules No 26 or with the requirements of specific Forms necessitates deviation from such regulatory financial statements. In particular:

(a) class, category and subcategory classifications; and

(b) policy liability valuations;

must be consistent with the regulatory financial statements.

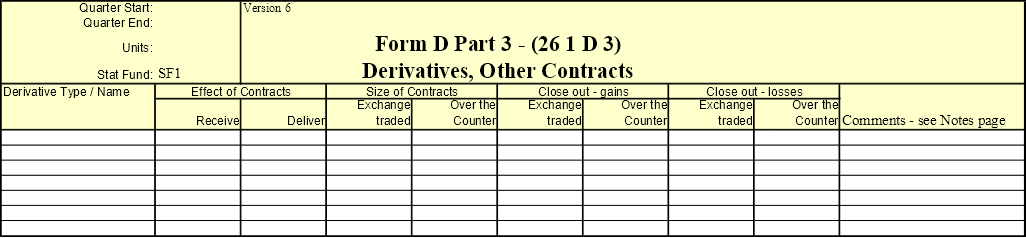

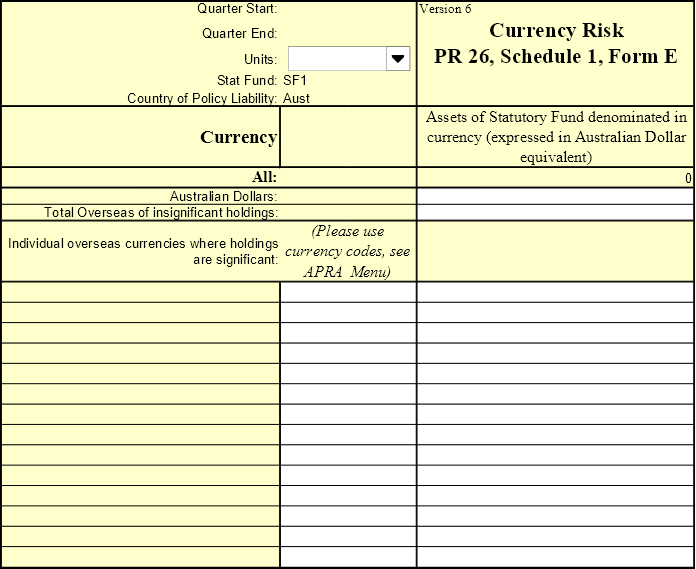

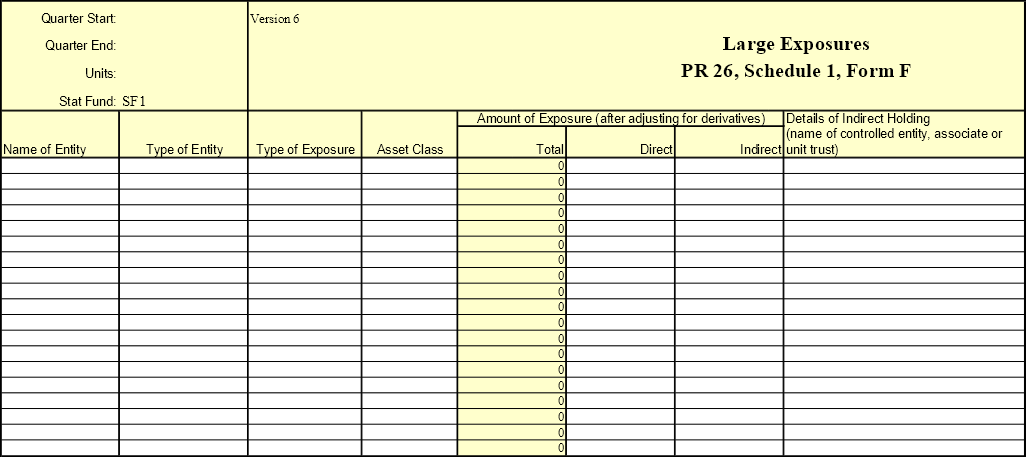

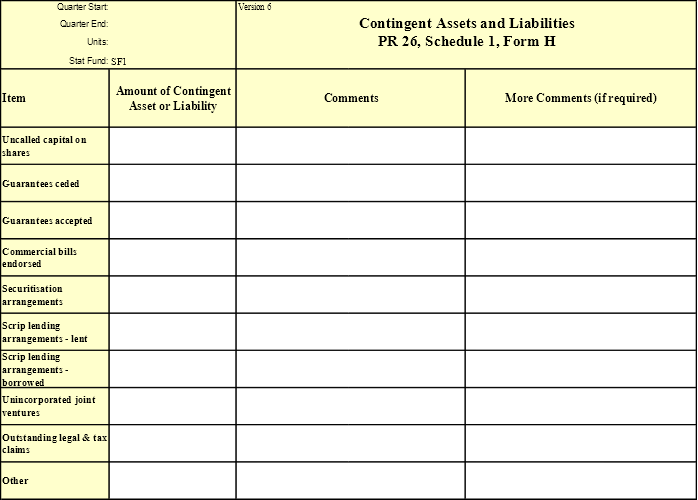

Statistics in Schedule 1 Forms B to H and M must be consistent with Schedule 1 Form A

11. The statistics in Schedule 1 Forms B to H and M must be consistent with, and prepared on the same basis as, the statistics in Schedule 1 Form A, except to the extent that compliance with these rules or with the specific requirements of Schedule 1 Forms B to H and M necessitates deviation from the basis for preparing the statistics in Schedule 1 Form A.

Statistics must be prepared on a look-through basis where this basis is applied under Solvency and Capital Adequacy Standards

12. Where a look-through basis is adopted in calculating solvency and capital adequacy under actuarial standards made by the Life Insurance Actuarial Standards Board, the statistics must be prepared on the same basis.

References to controlled entities

13. For the purposes of the Schedules, whether one entity controls another entity is to be determined in the same way as under the Corporations Act 2001.

Certain statistics must be audited

14. The statistics in Schedule 1 Forms A to H and M that relate to a period the end of which coincides with the end of a financial year of the life company must be audited by the auditor of the life company.

15. Those statistics must be accompanied by a report signed by the auditor stating:

(a) that they have been prepared in accordance with these rules; and

(b) that the records of the life company on which they are based properly record the affairs and transactions of the life company; and

(c) that they truly represent the financial position of the life company prepared in accordance with these rules.

How the statistics must be signed or approved on behalf of the life company

16. If the statistics are given to APRA in paper form they must be signed by, and if the statistics are given to APRA in electronic form they must include a statement stating that they have been approved by:

(a) in the case of the statistics in Schedule 1 - Forms A to H and J to M - the principal executive officer or the chief financial officer;

(b) in the case of the statistics in Schedule 2 - the principal executive officer or the compliance manager;

(c) in the case of the statistics in Schedule 3 and Schedule 1 – Form I - the principal executive officer or the appointed actuary.

Review of APRA’s decisions concerning approval of quarters and half-years

17. In rules 18 to 21, “financial period decision” means a decision by APRA approving, or refusing to approve, a period under subparagraph 2(a)(ii) or 2(b)(ii) of these rules.

18. Subsections 236(2) to (10) and section 237 of the Act apply in relation to a request for reconsideration and application for review of a financial period decision as if, in those provisions of the Act:

(a) “person affected by a reviewable decision” means a life company in relation to which a financial period decision has been made; and

(b) “reviewable decision” means a financial period decision.

19. When APRA notifies a life company of a financial period decision, APRA must inform the company in writing that:

(a) the company may, if dissatisfied with the decision, seek a reconsideration of the financial period decision by APRA in accordance with rule 18; and

(b) the company may, if dissatisfied with the reconsideration of the financial period decision, apply to the Administrative Appeals Tribunal for review of the reconsideration in accordance with rule 18.

20. When APRA notifies a life company of the reconsideration of a financial period decision, APRA must inform the company in writing that the company may, if dissatisfied with the reconsideration, apply to the Administrative Appeals Tribunal for review of the reconsideration in accordance with rule 18.

21. A failure by APRA to comply with rule 19 or 20 does not affect the validity of the financial period decision or of any reconsideration of the financial period decision concerned.

Note about the publication of the statistics

22. Subsection 244(5) of the Act authorizes APRA to publish, in such form as APRA thinks appropriate, the statistics collected under these rules.

APRA :

(a) will publish the statistics in Schedule 1 Forms A, B and I and Schedule 2; and

(b) will not publish the statistics in Schedule 3 Form C; and

(c) may publish the other statistics in the Schedules, but only in an aggregated form which will not identify individual life companies or amounts or figures relating to individual life companies.

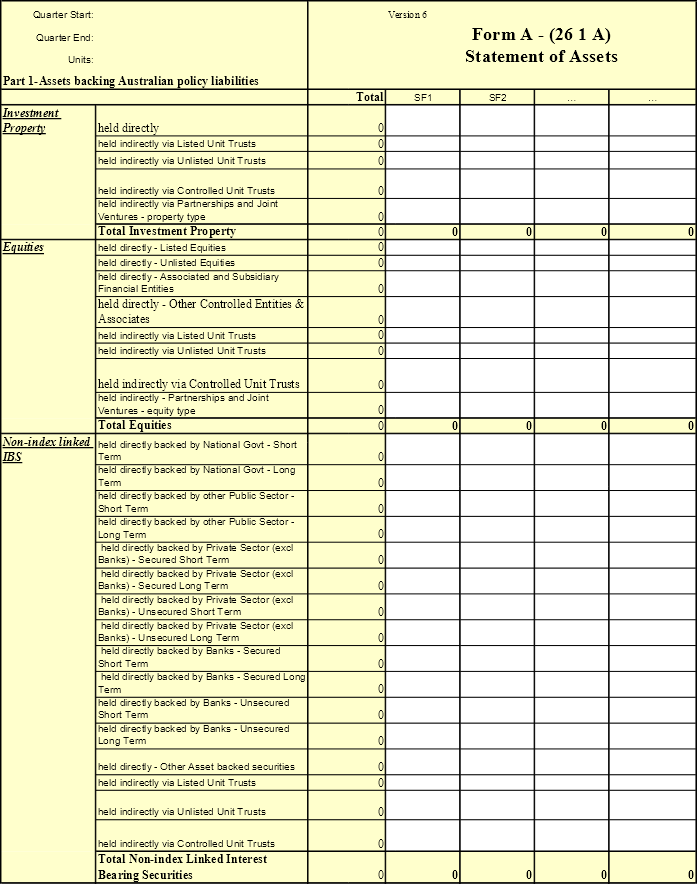

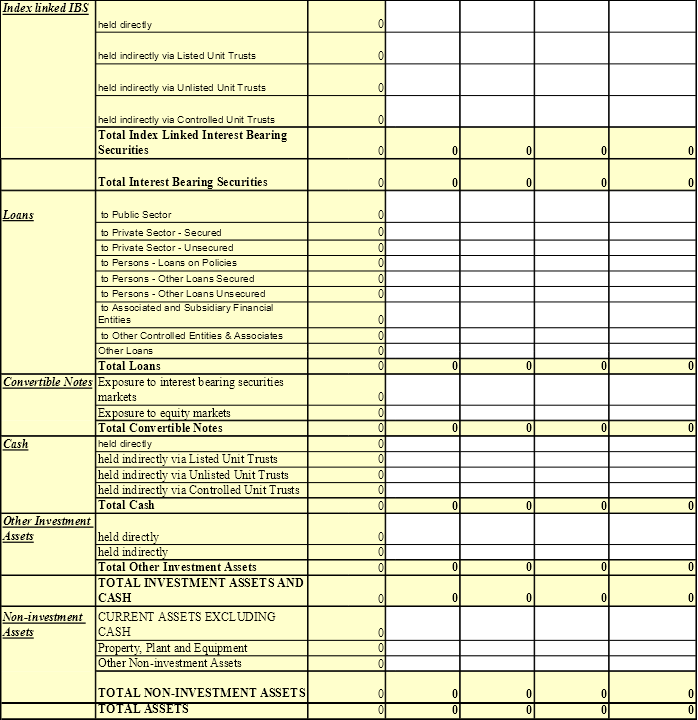

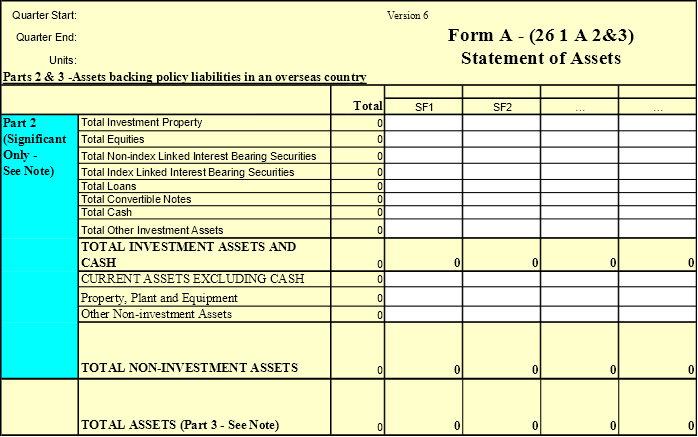

Schedule 1 – Form A

Statement of Assets

Statement of Assets

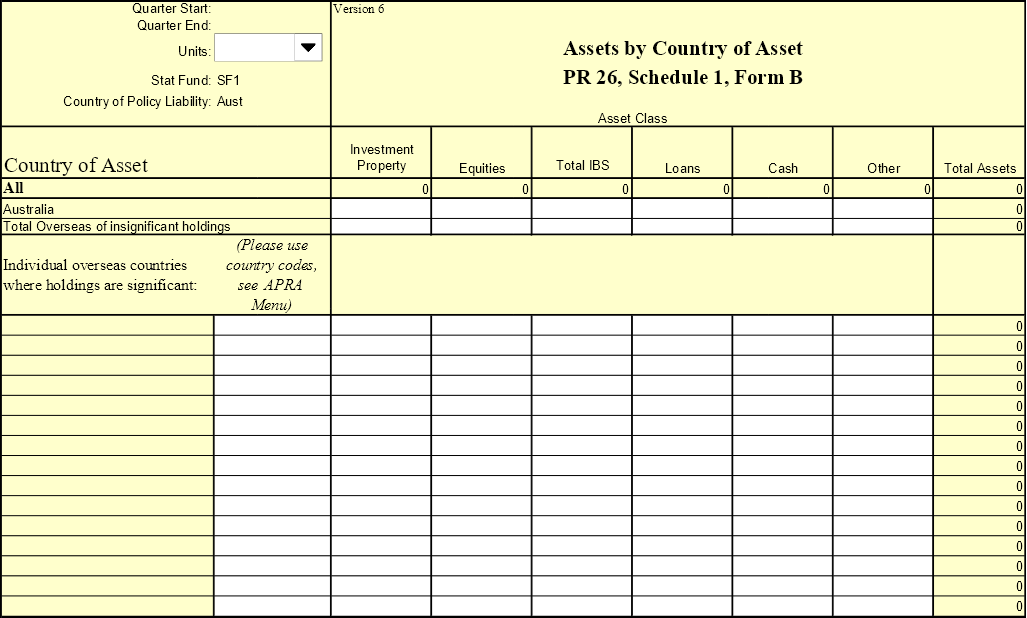

Schedule 1 – Form B

Assets by Country of Asset