The Schedule

RULES FOR THE ADMINISTRATION OF THE PUBLIC SECTOR SUPERANNUATION ACCUMULATION PLAN (PSSAP)

(THE RULES)

PART 1 – INTRODUCTION

|

Division 1 | Understanding the Rules |

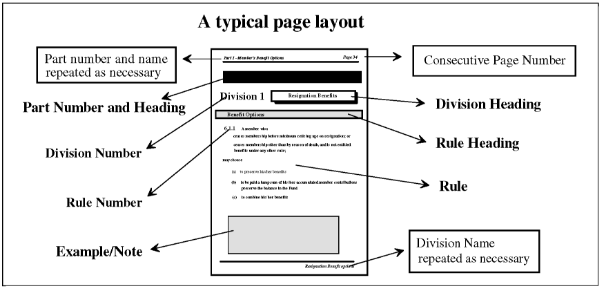

Structure of the Rules

1.1.1 These Rules are divided into 7 Parts, each dealing with a major aspect of the operation of PSSAP. The Parts and a general guide to each Part are set out below.

Guide to the 7 Parts of the Rules | ||

Part | Title | Deals With |

1 | Introduction | The structure of the Rules and defines special terms and phrases, and some concepts, used in the Rules. |

2 | Membership and contributions | How you become a member of PSSAP. Also covers the payment to the Board of contributions and transfer amounts in respect of an ordinary employer-sponsored member of PSSAP by designated employers and by or on behalf of employees and the transfer of amounts to the plan from other superannuation entities. |

3 | Benefits and payments | Payment of benefits, roll-over of amounts from PSSAP, invalidity benefits, income protection benefits, transition to retirement products and retirement income products. |

4 | Insurance | Provision of basic death and invalidity cover, supplementary death and invalidity cover, basic income protection cover and supplementary income protection cover. |

5 | Other matters | Personal accumulation accounts, investment earnings and losses, superannuation surcharge and member investment choice. |

6 | Review of decisions | The internal review mechanisms available to have a decision of the Board or its delegate reconsidered in relation to PSSAP. |

7 | Family Law Superannuation Splitting | Splitting of superannuation between a member spouse and a non-member spouse following a splitting agreement or splitting order under the Family Law Act 1975. |

1.1.2 Each Part is further divided into Divisions addressing unique groupings within the Part and each Division is made up of Rules containing specific provisions. Rules do not necessarily have their own Rule headings.

1.1.3 The Rules have been numbered so that the first number refers to the Part, the second number refers to the Division number within that Part and the third to the Rule number within that Division. For example, Rule 2.3.1 is the first Rule in Division 3 of Part 2 of the Rules.

1.1.4 There are several notes within the Rules to help readers understand the more complicated superannuation concepts or to inform them of the need to refer to another area of the Rules. However, these aids (including Part, Division and Rule headings) do not form part of the Rules.

Division 2 | Words and phrases used in the Rules |

Explanations of certain words and phrases

1.2.1 Because some words and phrases have a special meaning when used in the Rules they have been explained below or in the Trust Deed. They appear throughout the Rules in bold print to remind the reader that they have a special meaning.

accumulated member contributions | in relation to a PSSAP member, means the amount equal to the total of the following amounts: (a) employee contributions that have been paid by the PSSAP member; (b) eligible spouse contributions accepted by the Board under Rule 2.3.4 paid on behalf of the PSSAP member; (c) the interest credited (if any) in respect of fund earnings on the person’s accumulated member contributions as decided by the Board under Rule 5.2.1

less the total of the following amounts:

(d) any insurance premium payable under Rule 4.1.6, 4.2.12, 4.3.5 and 4.4.10 paid from the person’s accumulated member contributions; (e) the interest debited (if any) in respect of fund losses on the person’s accumulated member contributions under Rule 5.2.1; (f) any benefit paid to or in respect of the PSSAP member from their accumulated member contributions, including a benefit paid as a roll-over; (g) any administration costs under Rule 5.4.3 paid from the person’s accumulated member contributions.

|

accumulation amount | in relation to a PSSAP member means the amount specified in Rule 5.1.4.

|

additional employer contributions | means, in respect of an ordinary employer-sponsored member, contributions made by the designated employer of that member under Rule 2.2.4.

|

APS Agency | means an Agency within the meaning of the Public Service Act 1999.

|

assessment | has the same meaning as in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

|

AWA | means an Australian workplace agreement within the meaning of the Workplace Relations Act 1996.

|

basic death and invalidity cover | means insurance coverage provided in respect of an ordinary employer-sponsored member under Division 1 of Part 4 of the Rules for death and permanent invalidity.

|

basic employer contributions | means, in respect of an ordinary employer-sponsored member, contributions paid by the designated employer of that member under Rule 2.2.1.

|

basic income protection cover | means insurance cover provided in respect of an ordinary employer-sponsored member under Division 3 of Part 4 of the Rules.

|

benefit application | means a written application to the Board requesting the Board to pay a benefit under these Rules.

|

binding member nomination | means a notice in such form and manner as the Board specifies from time to time that meets the requirements of the SIS Act, given by a PSSAP member to the Board requiring the Board to pay some or all of a PSSAP member’s benefit on or after their death to the person or persons mentioned in the notice.

|

cashed | has the same meaning as in the SIS Act.

|

certified agreement | means an agreement certified under Division 4 of Part VIB of the Workplace Relations Act 1996.

|

compensation leave | means any period during which a person is absent full-time from his/her employment due to an incapacity for work resulting from an injury in respect of which compensation is payable under section 19 or 22 of the Safety, Rehabilitation and Compensation Act 1988 or any period in respect of which persons not covered by that Act are receiving similar compensation payments.

|

CSS | means the superannuation scheme established by the Superannuation Act 1976, known as the Commonwealth Superannuation Scheme. |

decision | for the purposes of reconsidering decisions of the Board under Part 6 of the Rules, includes: (a) making, suspending, revoking or refusing to make an order or determination; (b) giving, suspending, revoking or refusing to give a certificate, direction, approval, consent or permission; (c) issuing, suspending, revoking or refusing to issue an authority or other instrument; (d) imposing a condition or restriction; (e) making a declaration, demand or requirement; (f) retaining, or refusing to deliver up, an article; and (g) doing or refusing to do any other act or thing; under the Rules.

|

dependant | has the same meaning as in the SIS Act.

|

designated employer | in relation to an ordinary employer-sponsored member, has the same meaning as in the Act.

|

eligible roll-over fund | has the same meaning as in the SIS Act.

|

eligible spouse contributions | has the same meaning as in the Income Tax Assessment Act 1936 or the Income Tax Assessment Act 1997.

|

eligible termination payment | has the same meaning as in the Income Tax Assessment Act 1936 or the Income Tax Assessment Act 1997.

|

employee contributions | means contributions paid by an ordinary employer-sponsored member under Rule 2.3.1.

|

employer contribution shortfall

| means the amount, if any, reported under Rule 2.2.10.

|

income protection benefits

| means benefits payable under Division 4 of Part 3. |

income protection cover | means insurance cover provided in respect of an ordinary employer-sponsored member under Division 3 and Division 4 of Part 4 of the Rules.

|

insurance premium | means any amounts payable in respect of an ordinary employer-sponsored member for insurance coverage under Part 4 of the Rules.

|

invalidity retirement | means the termination of the employment of an ordinary employer-sponsored member on the ground that they are unable to perform their duties because of any mental or physical condition.

|

legal personal representative

| has the same meaning as in the SIS Act. |

life insurance company | has the same meaning as in the Income Tax Assessment Act 1997.

|

maternity or parental leave | in relation to an ordinary employer-sponsored member means leave of absence taken: (a) in relation to the birth of a child of the person; or (b) because the person’s pregnancy ended for reasons other than birth; or (c) in relation to the adoption of a child by the person.

|

member-financed benefits | has the same meaning as in the SIS Act.

|

member spouse | in relation to a superannuation interest in the PSSAP Fund, means the spouse who has the superannuation interest.

|

non-commutable allocated annuity

| has the same meaning as in the SIS Act. |

non-commutable allocated pension

| has the same meaning as in the SIS Act. |

non-commutable annuity

| has the same meaning as in the SIS Act. |

non-commutable income stream

| has the same meaning as in the SIS Act. |

non-commutable pension | has the same meaning as in the SIS Act.

|

non-member spouse | in relation to a superannuation interest in the PSSAP Fund, means the spouse who is not the member spouse in relation to that interest.

|

non-member spouse interest | means an interest created in the PSSAP Fund for the non-member spouse under Part 7 of the Rules

|

non-member spouse interest account

| means an account created by the Board in respect of a non-member spouse interest under Rule 7.2.1. |

ordinary employer- sponsored member

| means a person who is an ordinary employer-sponsored member of PSSAP in accordance with Part 4 of the Act.

Note: Where an ordinary employer-sponsored member, who is employed by two or more designated employers, ceases to be the employee of one or more, but not all, of those designated employers, the person does not cease to be an ordinary employer-sponsored member. Also, where a person is an ordinary employer-sponsored member with one designated employer and, upon ceasing to be the employee of that designated employer, immediately becomes the employee of another designated employer, the person does not cease to be an ordinary employer-sponsored member. See Rule 2.1.2.

|

ordinary time earnings | has the same meaning as in the Superannuation Guarantee (Administration) Act 1992.

|

other approved employment | means: (a) employment with an organization registered under the Workplace Relations Act 1996, the membership of which includes people who are members of the CSS or the PSS or PSSAP or a body consisting of such organizations; (b) if the person is employed in an APS Agency – employment that is approved by the Agency Head (within the meaning of the Public Service Act 1999) of the Agency on the basis that the engagement of the person in the other employment is in the interests of the Australian Public Service; or (c) if the person is not employed in an APS Agency – employment that is approved by the person’s designated employer on the basis that the engagement of the person in the other employment is in the interests of the designated employer; provided the temporary employer agrees to reimburse the designated employer for the cost of making basic employer contributions.

|

pay advice document | means a pay-slip or other document advising an employee about the amount of salary or wages paid for a period of time and includes a document in electronic form.

|

pay day | means the day on which a regular salary payment is made by a designated employer to an ordinary employer-sponsored member and, in the case of an ordinary employer-sponsored member who: (a) is referred to in Rule 2.2.2(b); and (b) does not receive a salary payment from a designated employer due to a period of: (i) unpaid leave of 12 weeks or less; or (ii) maternity or parental leave; or (iii) sick leave without pay; or (iv) a period of compensation leave; or (v) a period of leave of absence for the purposes of also means the day that the ordinary employer-sponsored member would otherwise have received a salary payment from the designated employer.

|

permanent incapacity | has the same meaning as in the SIS Act.

|

personal accumulation account | means the account kept by the Board for each PSSAP member under Division 1 of Part 5 of the Rules.

|

preservation age | has the same meaning as in the SIS Act.

|

PSS defined benefits plan | means the plan of the PSS governed by the provisions of section B of the Rules of the Trust Deed, as amended from time to time, made under the 1990 Act.

|

PSS member | means a person who is a member of the PSS due to the operation of Part 3 of the 1990 Act.

|

PSS | means the superannuation scheme established by the Trust Deed, as amended from time to time, referred to in section 4 of the 1990 Act.

|

quarter | has the same meaning as in the Superannuation Guarantee (Administration) Act 1992.

|

remuneration determination | means: (a) any determination made under the Remuneration Tribunal Act 1973; or (b) any determination made under another Act or a law of a Territory in respect of remuneration for a person holding a statutory office or appointed under an Act or law of a Territory, not being a determination of remuneration made under section 24 of the Public Service Act 1999 or section 24 of the Parliamentary Service Act 1999.

|

roll-over | has the same meaning as in the SIS Act.

|

roll-over application | means a written application to the Board requesting the Board to roll-over or transfer benefits from the PSSAP to a superannuation entity, an RSA or a life insurance company.

|

RSA | has the same meaning as in the SIS Act.

|

shortfall component | means the shortfall component within the meaning of section 64A or 64B of the Superannuation Guarantee (Administration) Act 1992.

|

SIS Act | means the Superannuation Industry (Supervision) Act 1993 and the regulations in force under that Act.

|

SIS Regulations | means the Superannuation Industry (Supervision) Regulations 1994.

|

standard risk | in relation to an ordinary employer-sponsored member being assessed by a life office for the provision of supplementary death and invalidity cover or income protection cover under Part 4 of the Rules, means an ordinary employer-sponsored member who does not: (a) suffer from any physical or mental incapacity or condition; or (b) engage in any hazardous occupation or pursuit.

|

superannuation entity | has the same meaning as in the SIS Act.

|

superannuation salary | has the meaning given in Rule 2.2.2.

|

supplementary death and invalidity cover | means insurance cover provided in respect of an ordinary employer-sponsored member under Division 2 of Part 4 of the Rules.

|

supplementary income protection cover | means insurance cover provided in respect of an ordinary employer-sponsored member under Division 4 of Part 4 of the Rules.

|

surcharge | has the same meaning as in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

|

surchargeable contributions | has the same meaning as in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

|

temporary incapacity | has the same meaning as in the SIS Act.

|

total benefit | in relation to a PSSAP member, means the balance of the member’s personal accumulation account at the end of the day before the benefit is paid.

|

transfer | has the same meaning as in the SIS Act.

|

transfer amount | means an amount transferred in respect of an ordinary employer-sponsored member to the Board under Rule 2.4.1 less income tax payable by the PSSAP Fund in relation to that amount.

|

transitional member | means an ordinary employer-sponsored member who has attained their preservation age.

|

trustee | has the same meaning as in the 1990 Act.

|

|

|

|

|

PART 2 – MEMBERSHIP AND CONTRIBUTIONS

|

Division 1 | Membership |

Becoming a PSSAP member

Note:

A person becomes a PSSAP member under Part 3 of the Act, which also specifies the duration of the person’s PSSAP membership. As well as specifying when a person is eligible to become a member of PSSAP, that Part empowers the Minister to either declare that a particular person is eligible to become a PSSAP member or is not eligible to become a PSSAP member.

A designated employer is required to pay contributions only in respect of ordinary employer-sponsored members. Part 4 of the Act sets out the situations in which a PSSAP member is an ordinary employer-sponsored member of PSSAP.

Concurrent memberships

2.1.1 A person may be an ordinary employer-sponsored member in respect of two or more concurrent employments.

2.1.2 Where an ordinary employer-sponsored member, who is employed by two or more designated employers at the same time, ceases to be an employee of one or more but not all of those designated employers, the person will not cease to be an ordinary employer-sponsored member. Also, where an ordinary employer-sponsored member ceases to be employed by one designated employer but immediately afterwards becomes an employee of another designated employer, the person does not cease to be an ordinary employer-sponsored member.

2.1.3 Where a person is an ordinary employer-sponsored member in respect of two or more concurrent employments, the Board may maintain one personal accumulation account for the member.

Note: The Board must keep a personal accumulation account for each PSSAP member. (See Rule 5.1.1.)

Division 2 | Contributions by employers |

Basic contributions by designated employers

2.2.1 Each pay day the designated employer of an ordinary employer-sponsored member must pay as contributions to the Board an amount equal to 15.4% of the superannuation salary of the member on that day. However, the Board must reject any contributions paid under this Rule if the SIS Act would prevent the PSSAP Fund from accepting the contributions or if acceptance of the contributions by the Board may jeopardise the status of the PSSAP Fund as a complying superannuation fund.

Superannuation salary

2.2.2 The superannuation salary of an ordinary employer-sponsored member is:

(a) where the circumstances referred to in Rule 2.2.3 apply – the ordinary time earnings of the person; and

(b) in all other cases the amount that would have been the person’s “fortnightly contribution salary” if they were a PSS member who is a member of the PSS defined benefits plan.

2.2.3 The superannuation salary of an ordinary employer-sponsored member will be the person’s ordinary time earnings if this is specified in:

(a) a certified agreement that applies to the ordinary employer-sponsored member;

(b) an AWA that applies to the ordinary employer-sponsored member;

(c) a remuneration determination that applies to the ordinary employer-sponsored member; or

(d) an agreement in writing between the ordinary employer-sponsored member and their designated employer in the case of an ordinary employer-sponsored member not covered by an AWA, a certified agreement or a remuneration determination.

Additional employer contributions

2.2.4 In addition to the amounts required to be paid by the designated employer under Rule 2.2.1, the designated employer of an ordinary employer-sponsored member may pay additional contributions to the Board in respect of that member. However, the Board must reject any contributions paid under this Rule if the SIS Act would prevent the PSSAP Fund from accepting the contributions or if acceptance of the contributions by the Board may jeopardise the status of the PSSAP Fund as a complying superannuation fund.

Note: This Rule allows employers to make contributions for or on behalf of an employee in addition to any amounts the employer is required to pay as basic employer contributions. Circumstances where an employer may make additional contributions include, but are not limited to:

-as a result of salary sacrifice arrangements with an employee;

-to avoid an employer contribution shortfall;

-to provide additional superannuation cover as specified in an Australian workplace agreement or a certified agreement;

-to provide superannuation contributions in circumstances where contributions would otherwise not be required to be paid. These circumstances differ depending upon whether the ordinary employer-sponsored member has their superannuation salary based on ordinary time earnings or on fortnightly contribution salary. See Rule 2.2.2.

Method of payment of employer contributions

2.2.5 The Board may from time to time determine the way in which basic employer contributions and additional employer contributions must be paid to the Board.

2.2.6 The designated employer of an ordinary employer-sponsored member must pay basic employer contributions and any additional employer contributions in accordance with any determination of the Board under Rule 2.2.5.

Payments to be paid into the PSSAP Fund

2.2.7 The Board must pay any basic employer contributions and any additional employer contributions into the PSSAP Fund.

Reporting of employer contributions

2.2.8 Each designated employer, in respect of an ordinary employer-sponsored member to whom Rule 2.2.2(a) applies, must inform the member in writing, at least quarterly, of the amount of basic employer contributions and additional employer contributions paid to the PSSAP Fund.

2.2.9 Within one month of the end of each quarter, each designated employer must, in respect of an ordinary employer-sponsored member to whom Rule 2.2.2(b) applies or has applied at any time during the quarter, inform the member and the Board in writing of the total amount of basic employer contributions and additional employer contributions paid to the PSSAP Fund in the quarter expressed:

(a) in dollars and cents; and

(b) as a percentage of the ordinary time earnings of the ordinary employer-sponsored member for the quarter.

2.2.10 If the percentage reported under Rule 2.2.9(b) is less than 9%, the designated employer is required to notify in writing the ordinary employer-sponsored member and the Board of an employer contribution shortfall. The amount of the employer contribution shortfall to be notified is the amount, expressed in dollars and cents, by which the reported amount falls short of 9% of the ordinary time earnings of the ordinary employer-sponsored member.

2.2.11 For the purposes of Rules 2.2.8 and 2.2.9 an ordinary employer-sponsored member is taken to have been informed in writing if the information is included in a pay advice document issued to the member.

Division 3 | Contributions by members |

When employee contributions can be made

2.3.1 An ordinary employer-sponsored member may pay contributions to the Board at any time and in any amount:

(a) except that the Board must reject any contributions paid under this Rule if the SIS Act would prevent the PSSAP Fund from accepting the contributions or if acceptance of the contributions by the Board may jeopardise the status of the PSSAP Fund as a complying superannuation fund; and

(b) where the method of payment complies with any Board determination under Rule 2.3.5.

2.3.2 An ordinary employer-sponsored member is not required to make employee contributions.

2.3.3 A PSSAP member who is not an ordinary employer-sponsored member may not make employee contributions to the PSSAP Fund.

Eligible spouse contributions

2.3.4 Eligible spouse contributions may be made on behalf of an ordinary employer-sponsored member at any time and in any amount:

(a) except that the Board must reject any contributions paid under this Rule if the SIS Act would prevent the PSSAP Fund from accepting the contributions or if acceptance of the contributions by the Board may jeopardise the status of the PSSAP Fund as a complying superannuation fund; and

(b) where the method of payment complies with any Board determination under Rule 2.3.5.

Method of payment of employee contributions and eligible spouse contributions

2.3.5 The Board may determine the way in which employee contributions and eligible spouse contributions must be paid to the Board.

Payments to be paid into the PSSAP Fund

2.3.6 The Board must pay any employee contributions and eligible spouse contributions into the PSSAP Fund.

Division 4 | Transfer amounts |

Amounts that may be transferred or rolled-over into the PSSAP Fund

2.4.1 An ordinary employer-sponsored member may transfer or roll-over any or all of the following amounts to the Board as a transfer amount:

(a) an amount payable to, or in respect of, the member by a superannuation entity, an RSA or a life insurance company, other than an amount payable because of physical or mental incapacity to perform their duties;

(b) the amount of any eligible termination payment payable to, or in respect of, the person;

(c) an amount of shortfall component payable to, or in respect of, the person in accordance with the Superannuation Guarantee (Administration) Act 1992; and

(d) an amount payable in respect of the person under the Superannuation (Government Co-contribution for Low Income Earners) Act 2003,

provided the method of payment complies with Rule 2.4.2.

Method of payment of transfer amounts

2.4.2 The Board may determine the way in which transfer amounts must be paid to the Board.

Payments to be paid into the PSSAP Fund

2.4.3 The Board must pay any transfer amount into the PSSAP Fund.

PART 3 – BENEFITS

|

Division 1 | Benefits |

Applications for payment of benefits

3.1.1 A benefit application may be made to the Board by:

(a) an ordinary employer-sponsored member who:

(i) intends to cease to be an ordinary employer-sponsored member within one month of making the benefit application;

(ii) has applied for approval of their invalidity retirement under Rule 3.3.1;

(iii) is applying for income protection benefits under Rule 3.4.1;

(iv) is a transitional member who is applying for an amount of benefits to be cashed as an income product which may be a non-commutable allocated annuity, a non-commutable allocated pension, a non-commutable annuity or a non-commutable pension;

(b) a PSSAP member who, at any time, has ceased to be an ordinary employer-sponsored member;

(c) a PSSAP member who is applying for the payment of benefits on compassionate grounds or due to severe financial hardship;

(d) the legal personal representative of a PSSAP member; or

(e) a person claiming to be entitled to the benefit of a deceased PSSAP member.

3.1.2 A benefit application must be made in a form acceptable to the Board and must include any supporting evidence of entitlement to the benefit required by the Board.

Payment of benefits to a PSSAP member who has ceased to be an ordinary employer-sponsored member

3.1.3 If the Board receives a benefit application from or on behalf of an ordinary employer-sponsored member pursuant to Rule 3.1.1(a)(i), the Board must, as soon as possible after the person ceases to be an ordinary employer-sponsored member, pay to or in respect of the person a lump sum amount of such part of their total benefit as requested in the benefit application, subject to the SIS Act.

3.1.4 On receiving a benefit application from or on behalf of a PSSAP member pursuant to Rule 3.1.1(b), the Board must pay to or in respect of the member a lump sum amount of such part of their total benefit as requested in the benefit application, subject to the SIS Act.

Note: Where part of a benefit is paid to a person under Rule 3.1.3 or Rule 3.1.4, the remainder of the benefit must be retained in the personal accumulation account of the PSSAP member or rolled-over or transferred to another superannuation entity. See Rule 3.1.12.

Compulsory payment of benefits

3.1.5 Where the SIS Act requires a benefit to be paid to a PSSAP member, the Board must pay as a lump sum the total benefit or such part of the total benefit as the SIS Act requires to or in respect of the person, even if no benefit application has been made.

Note: This rule only applies where the PSSAP member is not deceased. See Rule 3.1.11 for payment of benefits in respect of deceased members.

Payment of benefits to a PSSAP member on compassionate and financial hardship grounds

3.1.6 If the Board receives a benefit application from a PSSAP member pursuant to Rule 3.1.1(c), the Board may pay the person such part of their total benefit as requested in the benefit application, subject to the SIS Act:

(a) on a compassionate ground in accordance with a determination of the Australian Prudential Regulatory Authority under the SIS Act; or

(b) on grounds of severe financial hardship in accordance with the SIS Act.

Payment of benefits to ordinary employer-sponsored members

3.1.7 If the Board receives or is taken to have received a benefit application from or on behalf of an ordinary employer-sponsored member pursuant to Rule 3.1.1(a)(ii) and the Board approves the invalidity retirement of the ordinary employer-sponsored member, the Board must, if the person ceases to be an ordinary employer-sponsored member following approval of their invalidity retirement, pay the person as a lump sum such part of their total benefit as the SIS Act permits as soon as possible.

3.1.8 If the Board receives a benefit application from or on behalf of an ordinary employer-sponsored member pursuant to Rule 3.1.1(a)(iii), the member, subject to Rules 3.4.2 and 3.4.5, is entitled to income protection benefits in accordance with Rule 3.4.3.

3.1.9 If the Board receives a benefit application from a transitional member pursuant to Rule 3.1.1(a)(iv) and the Board has in place arrangements for members to purchase the income product requested in the application, the Board, in accordance with Rule 3.5.1, must, on behalf of the transitional member, arrange for the purchase by the member of an income product of the type so requested costing an amount equal to the total benefit set out in the benefit application.

Payment of benefits to a legal personal representative where member not deceased

3.1.10 On receiving a benefit application from the legal personal representative of a PSSAP member under Rule 3.1.1(d), the Board may pay to the legal personal representative such part of the total benefit as the SIS Act permits if the Board is satisfied that:

(a) the PSSAP member is under a legal disability; and

(b) the PSSAP member is entitled to the payment of a benefit under the Rules.

Payment of death benefits

3.1.11 When the Board:

(a) receives an application for benefits from a person claiming to be entitled to the benefit of a person who is a deceased PSSAP member; or

(b) otherwise becomes aware that a PSSAP member has died;

the Board must determine who is entitled to be paid the death benefits in accordance with Division 2 of this Part and pay the total benefit to the person or persons so entitled in such shares as the Board determines.

Preservation of benefits not paid

3.1.12 Where a part of the total benefit is paid to or in respect of a PSSAP member under this Division, the remainder of the benefit is retained in the personal accumulation account of the PSSAP member unless a roll-over application or benefit application is made in relation to the remainder of the benefit.

Applications for roll-over or transfer of benefits

3.1.13 A roll-over application may be made to the Board by:

(a) an ordinary employer-sponsored member who intends to cease to be an ordinary employer-sponsored member within one month of making the roll-over application;

(b) a PSSAP member who, at any time, has ceased to be an ordinary employer-sponsored member;

(c) an ordinary employer-sponsored member whose personal accumulation account contains accumulated member contributions or a transfer amount; or

(d) a transitional member who has applied for an amount of benefits to be cashed as an income product which may be a non-commutable allocated annuity, a non-commutable allocated pension, a non-commutable annuity or a non-commutable pension.

3.1.14 A roll-over application must be made in a form acceptable to the Board and must include any supporting evidence of entitlement to the benefit required by the Board.

Preservation or transfer of benefits

3.1.15 If the Board receives a roll-over application from an ordinary employer-sponsored member who meets the requirements of Rule 3.1.13(a), the Board must roll-over or transfer so much of the person’s total benefit as requested in the roll-over application to a superannuation entity, RSA or life insurance company as soon as possible after the person ceases to be an ordinary employer-sponsored member.

3.1.16 On receiving a roll-over application from a PSSAP member who meets the requirements of Rule 3.1.13(b), the Board must roll-over or transfer so much of the person’s total benefit as requested in the roll-over application to a superannuation entity, RSA or life insurance company.

3.1.17 On receiving a roll-over application from an ordinary employer-sponsored member who meets the requirements of Rule 3.1.13(c), the Board must roll-over or transfer such part of the person’s total benefit as requested in the roll-over application to a superannuation entity, RSA or life insurance company provided the amount rolled-over or transferred does not exceed the sum of the person’s accumulated member contributions and any transfer amount, adjusted for interest credited (if any) or interest debited (if any) in respect of fund earnings or fund losses on those amounts, respectively, as decided by the Board.

Note: This Rule allows ordinary employer-sponsored members to transfer out any transfer amounts paid to the Board as well as any accumulated member contributions, but not employer contributions, made to PSSAP.

3.1.18 On receiving a roll-over application from a transitional member under Rule 3.1.13(d), the Board must roll-over or transfer such part of the person’s total benefit as requested in the roll-over application to a superannuation entity or life insurance company.

3.1.19 If no benefit application or roll-over application is received upon a PSSAP member ceasing to be an ordinary employer-sponsored member and Rule 3.1.20 does not apply, the total benefit is retained in the personal accumulation account of the PSSAP member.

Payment of benefits to eligible roll-over fund

3.1.20 The Board may pay a benefit to an eligible roll-over fund if:

(a) a benefit has become payable under Rule 3.1.5 and

(i) 90 days have passed since the benefit became payable; and

(ii) the person in relation to whom the benefit is payable has not informed the Board in writing how he/she wishes the benefit to be paid; or

(e) the Board is unable to locate a PSSAP member and the SIS Act permits the Board to pay the benefit to an eligible roll-over fund.

Division 2 | Death benefits |

Who is entitled to be paid death benefits

3.2.1 If, upon the death of a PSSAP member, the Board is in receipt of a current valid binding member nomination in relation to the deceased PSSAP member, then the member’s total benefit will be paid by the Board to the person or persons specified in the binding member nomination.

3.2.2 Subject to Rule 3.2.1, in the event of the death of a PSSAP member, the Board must pay or apply the deceased member’s total benefit to or for the benefit of one or more, as determined by the Board, of the following:

(a) one or more dependants of the deceased PSSAP member;

(b) the legal personal representative of the deceased PSSAP member.

3.2.3 If, after making reasonable enquiries, the Board upon the death of a PSSAP member has not found either a legal personal representative or a dependant of the deceased PSSAP member, the Board will pay or apply the deceased member’s total benefit to or for the benefit of such one or more individuals as determined by the Board.

Division 3 | Permanent invalidity |

Application for approval of invalidity retirement

3.3.1 An application for approval of the invalidity retirement of an ordinary employer-sponsored member may be made to the Board by:

(a) the ordinary employer-sponsored member ; or

(b) the designated employer of the ordinary employer-sponsored member.

3.3.2 An ordinary employer-sponsored member in respect of whom an application under Rule 3.3.1 is made is taken to have also made a benefit application.

Invalidity retirement process

3.3.3 Following receipt of an application to approve the invalidity retirement of an ordinary employer-sponsored member, the Board may approve the person’s invalidity retirement if it is satisfied that the person has a permanent incapacity.

3.3.4 The Board may determine the process it will follow before approving the invalidity retirement of an ordinary employer-sponsored member.

3.3.5 The Board must advise its decision under Rule 3.3.3 to the ordinary employer-sponsored member and the designated employer of the ordinary employer-sponsored member. The advice is to include a statement of the reasons for the decision.

Division 4 | Income protection benefits |

Income protection benefits

3.4.1 An ordinary employer-sponsored member may apply to the Board for income protection benefits if the ordinary employer-sponsored member:

(a) is unable to work due to a temporary incapacity; and

(b) holds income protection cover.

Assessment of applications for income protection benefits

3.4.2 Following receipt of an application for income protection benefits that meets the requirements of Rule 3.4.1 the Board must make a claim against the policy or policies providing the income protection cover.

Payment of income protection benefits

3.4.3 Subject to the SIS Act, any amount paid by a life insurance company in response to a claim against a policy providing income protection cover:

(a) must be paid into the PSSAP Fund and paid from the PSSAP Fund to the ordinary employer-sponsored member as a non-commutable income stream; or

(b) must be paid directly to the ordinary employer-sponsored member as a non-commutable income stream.

3.4.4 Any amount paid into the PSSAP Fund or directly to an ordinary employer-sponsored member under Rule 3.4.3 does not form part of the personal accumulation account of the ordinary employer-sponsored member.

3.4.5 Nothing in this Deed requires the Board to pay income protection benefits where:

(a) an ordinary employer-sponsored member does not hold income protection cover; or

(b) a life insurance company does not pay any amount in response to a claim by the Board.

Division 5 | Retirement income products |

Board must arrange retirement income products

3.5.1 The Board:

(a) before 1 July 2006 may; and

(b) from 1 July 2006 must

enter into arrangements with a life insurance company to offer income products, including retirement income products, for purchase by persons in receipt of benefits under the Rules.

3.5.2 A person in receipt of benefits under Division 1 of this Part may use the benefits to purchase income products arranged by the Board.

PART 4 – INSURANCE

|

Division 1 | Basic death and invalidity cover |

Board to arrange policy

4.1.1 The Board must take out a policy or policies with a life insurance company or companies in its name to provide basic death and invalidity cover for ordinary employer-sponsored members. A basic death and invalidity cover policy is to be on the terms and conditions, including the circumstances, agreed between the Board and the relevant life insurance company.

Provision of basic death and invalidity cover

4.1.2 An ordinary employer-sponsored member will be provided with basic death and invalidity cover on and subject to the terms and conditions of the policy taken out pursuant to Rule 4.1.1, unless the life insurance company does not provide cover in respect of the member under that policy.

Claims by the Board

4.1.3 Where an ordinary employer-sponsored member dies or an application for approval of their invalidity retirement is made under Rule 3.3.1, the Board must make a claim against the policy providing the basic death and invalidity cover, unless the life insurance company does not provide cover in respect of the member under that policy.

4.1.4 Any amount paid by a life insurance company to the Board in response to a claim under Rule 4.1.3 against a policy providing basic death and invalidity cover must be paid into the PSSAP Fund and is credited to the personal accumulation account of the ordinary employer-sponsored member.

Basic death and invalidity cover premiums

4.1.5 All premiums for basic death and invalidity cover are to be paid by the Board from the PSSAP Fund.

4.1.6 Subject to Rule 4.1.7, the premium for basic death and invalidity cover provided in respect of an ordinary employer-sponsored member is the amount determined by the Board, being the same amount as the amount of premium specified in the basic death and invalidity cover policy, and must be deducted from the personal accumulation account of the ordinary employer-sponsored member.

4.1.7 Where a premium payable for basic death and invalidity cover is more than the amount in the personal accumulation account of the ordinary employer-sponsored member, Rule 4.1.6 shall not apply.

Cessation of basic death and invalidity cover

4.1.8 The basic death and invalidity cover of an ordinary employer-sponsored member ceases on the earliest of:

(a) the day, or a day after the day, that the ordinary employer-sponsored member ceases to be an ordinary employer-sponsored member, that is specified in the basic death and invalidity cover policy for the purpose of this paragraph;

(b) the death or invalidity retirement of the ordinary employer-sponsored member;

(c) where, under Rule 4.1.7, a premium payable for basic death and invalidity cover has not been paid on the day on which the premium became payable and the terms of the basic death and invalidity cover policy provide for cover to end if the premiums cease, the day after the day on which the cover ends due to non-payment of the premiums; and

(d) the date the insurer ceases to provide basic death and invalidity cover in respect of the ordinary employer-sponsored member.

Division 2 | Supplementary death and invalidity cover |

Board to arrange policy

4.2.1 Subject to the requirements of the SIS Act, the Board may take out a policy or policies with a life insurance company or companies in its name to provide supplementary death and invalidity cover for ordinary employer-sponsored members. A supplementary death and invalidity cover policy is to be on the terms and conditions, including the circumstances, agreed between the Board and the relevant life insurance company.

Applying for supplementary death and invalidity cover

4.2.2 An ordinary employer-sponsored member may apply to the Board for supplementary death and invalidity cover at any time.

4.2.3 The Board may allow the ordinary employer-sponsored member to choose the policy providing the supplementary death and invalidity cover if the Board has taken out more than one policy.

4.2.4 An ordinary employer-sponsored member who applies for supplementary death and invalidity cover must provide any information and undergo any medical examinations the relevant life insurance company requires for it to determine whether it is prepared to provide the supplementary death and invalidity cover.

Advice to Board and ordinary employer-sponsored member

4.2.5 If an ordinary employer-sponsored member applies to the Board for supplementary death and invalidity cover, or applies to vary existing cover, the Board must ask the relevant life insurance company:

(a) whether it is prepared to provide the cover for that ordinary employer-sponsored member ; and

(b) if so, the cost of the premium, including any extra cost where the ordinary employer-sponsored member was assessed as not being a standard risk, on:

(i) the date the cover commenced; and

(ii) each subsequent birthday of the ordinary employer-sponsored member, or other date as specified in the policy.

The Board must provide the responses to the questions in paragraphs (a) and (b) from the life insurance company to the ordinary employer-sponsored member.

Variation of supplementary death and invalidity cover

4.2.6 An ordinary employer-sponsored member may vary the amount of supplementary death and invalidity cover at any time before the cover ceases to be applicable, provided the relevant life insurance company is prepared to provide the varied cover.

4.2.7 Variations in the amount of supplementary death and invalidity cover take effect from:

(a) the date specified in the policy; or

(b) otherwise, the date determined by the Board.

Cessation of supplementary death and invalidity cover

4.2.8 The supplementary death and invalidity cover of an ordinary employer-sponsored member ceases on the earliest of:

(a) the day, or a day after the day, that the ordinary employer-sponsored member ceases to be an ordinary employer-sponsored member, that is specified in the supplementary death and invalidity cover policy for the purpose of this paragraph;

(b) the date the ordinary employer-sponsored member notifies the Board that they no longer wish to have supplementary death and invalidity cover;

(c) the death or invalidity retirement of the ordinary employer-sponsored member;

(d) where, under Rule 4.2.13, a premium payable for supplementary death and invalidity cover has not been paid on the day on which the premium became payable and the terms of the supplementary death and invalidity cover policy provide for cover to end if the premiums cease, the day after the day on which the cover ends due to non-payment of premiums; and

(e) the date the insurer ceases to provide supplementary death and invalidity cover in respect of the ordinary employer-sponsored member.

Claims by the Board

4.2.9 Where an ordinary employer-sponsored member with supplementary death and invalidity cover dies or an application for approval of their invalidity retirement is made under Rule 3.3.1, the Board must make a claim against the policy providing the supplementary death and invalidity cover.

4.2.10 Any amount paid by a life insurance company to the Board in response to a claim against a policy providing supplementary death and invalidity cover must be paid into the PSSAP Fund and is credited to the person’s personal accumulation account.

Supplementary death and invalidity cover premiums

4.2.11 All premiums for supplementary death and invalidity cover are to be paid by the Board from the PSSAP Fund.

4.2.12 Subject to Rule 4.2.13, the cost of the premium for supplementary death and invalidity cover provided in respect of an ordinary employer-sponsored member must be deducted from the personal accumulation account of the ordinary employer-sponsored member.

4.2.13 Where a premium payable for supplementary death and invalidity cover is more than the amount in the personal accumulation account of an ordinary employer-sponsored member, Rule 4.2.12 shall not apply.

Division 3 | Basic income protection cover |

Board to arrange policy

4.3.1 The Board must take out a policy or policies with a life insurance company or companies in its name to provide basic income protection cover for ordinary employer-sponsored members. A basic income protection cover policy is to be on the terms and conditions, including the circumstances, agreed between the Board and the relevant life insurance company but subject to the requirements of the SIS Act.

Provision of basic income protection cover

4.3.2 Subject to the terms of the basic income protection cover policy taken out pursuant to Rule 4.3.1, ordinary employer-sponsored members will be provided with basic income protection cover in accordance with arrangements made under Rule 4.3.1 unless:

(a) the ordinary employer-sponsored member has notified the Board in writing that they do not wish to be provided with basic income protection cover; or

(b) in accordance with the policy between the Board and the life insurance company, the company refuses to provide cover in respect of the ordinary employer-sponsored member.

Cessation of basic income protection cover

4.3.3 The basic income protection cover of an ordinary employer-sponsored member ceases on the earliest of:

(a) the day, or a day after the day, that the ordinary employer-sponsored member ceases to be an ordinary employer-sponsored member, that is specified in the basic income protection cover policy for the purpose of this paragraph;

(b) the date the ordinary employer-sponsored member notifies the Board that they no longer wish to have basic income protection cover;

(c) the death or invalidity retirement of the ordinary employer-sponsored member;

(d) where, under Rule 4.3.6, a premium payable for basic income protection cover has not been paid on the day on which the premium became payable and the terms of the basic income protection cover policy provide for cover to end when premiums cease, the day after the day on which the cover ends due to non-payment of premiums; and

(e) the date the insurer ceases to provide basic income protection cover in respect of the ordinary employer-sponsored member.

Basic income protection cover premiums

4.3.4 All premiums for basic income protection cover are to be paid by the Board from the PSSAP Fund.

4.3.5 Subject to Rule 4.3.6, the premium for basic income protection cover provided in respect of an ordinary employer-sponsored member is the amount determined by the Board, being the same amount as the amount of premium specified in the basic income protection cover policy, and must be deducted from the personal accumulation account of the ordinary employer-sponsored member.

Note: The Board may make a claim against a policy providing income protection cover. See Rule 3.4.2.

Amounts paid by an insurer in response to a claim are paid to the PSSAP Fund for payment to the ordinary employer-sponsored member or directly to the ordinary employer-sponsored member but are not credited to their personal accumulation account. See Rules 3.4.3 and 3.4.4.

4.3.6 Where a premium payable for basic income protection cover is more than the amount in the personal accumulation account of the ordinary employer-sponsored member, Rule 4.3.5 shall not apply.

Division 4 | Supplementary income protection cover |

Board to arrange policy

4.4.1 The Board may take out a policy or policies with a life insurance company or companies in its name to provide supplementary income protection cover for ordinary employer-sponsored members. A supplementary income protection cover policy is to be on the terms and conditions, including the circumstances, agreed between the Board and the relevant life insurance company but subject to the requirements of the SIS Act.

Applying for supplementary income protection cover

4.4.2 An ordinary employer-sponsored member may apply to the Board for supplementary income protection cover at any time.

4.4.3 The Board may allow the ordinary employer-sponsored member to choose the policy providing the supplementary income protection cover if the Board has taken out more than one policy.

4.4.4 An ordinary employer-sponsored member who applies for supplementary income protection cover must provide any information and undergo any medical examinations the relevant life insurance company requires for it to determine whether it is prepared to provide the supplementary income protection cover.

Advice to Board and ordinary employer-sponsored member

4.4.5 If an ordinary employer-sponsored member applies to the Board for supplementary income protection cover, or applies to vary existing cover, the Board must ask the relevant life insurance company:

(a) whether it is prepared to provide the cover for that ordinary employer-sponsored member; and

(b) if so, the cost of the premium, including any extra cost where the ordinary employer-sponsored member was assessed as not being a standard risk, on:

(i) the date the cover commenced; and

(ii) each subsequent birthday of the ordinary employer-sponsored member, or other date as specified in the policy.

The Board must provide the responses to the questions in paragraphs (a) and (b) from the life insurance company to the ordinary employer-sponsored member.

Variation of supplementary income protection cover

4.4.6 The ordinary employer-sponsored member may vary the amount of supplementary income protection cover at any time before the cover ceases to be applicable, provided the relevant life insurance company is prepared to provide the varied cover.

4.4.7 Variations in the amount of supplementary income protection cover take effect from:

(a) the date specified in the policy; or

(b) otherwise, the date determined by the Board.

Cessation of supplementary income protection cover

4.4.8 The supplementary income protection cover of an ordinary employer-sponsored member ceases on the earliest of:

(a) the day, or a day after the day, that the ordinary employer-sponsored member ceases to be an ordinary employer-sponsored member, that is specified in the supplementary income protection cover policy for the purpose of this paragraph;

(b) the date the ordinary employer-sponsored member notifies the Board that they no longer wish to have supplementary income protection cover;

(c) the death or invalidity retirement of the ordinary employer-sponsored member;

(d) where, under Rule 4.4.11, a premium payable for supplementary income protection cover has not been paid on the day on which the premium became payable and the terms of the supplementary income protection cover policy provide for cover to end if the premiums cease, the day after the day on which the cover ends due to non-payment of premiums; and

(e) the date the insurer ceases to provide supplementary income protection cover in respect of the ordinary employer-sponsored member.

Supplementary income protection cover premiums

4.4.9 All premiums for supplementary income protection cover are to be paid by the Board from the PSSAP Fund.

4.4.10 Subject to Rule 4.4.11, the cost of the premium for supplementary income protection cover provided in respect of an ordinary employer-sponsored member must be deducted from the personal accumulation account of the ordinary employer-sponsored member.

Note: The Board may make a claim against a policy providing income protection cover. See Rule 3.4.2.

Amounts paid by an insurer in response to a claim are paid to the PSSAP Fund for payment to the ordinary employer-sponsored member but are not credited to their personal accumulation account. See Rules 3.4.3 and 3.4.4.

4.4.11 Where a premium payable for supplementary income protection cover is more than the amount in the personal accumulation account of the ordinary employer-sponsored member, Rule 4.4.10 shall not apply.

PART 5 – OTHER MATTERS

|

Division 1 | Personal accumulation account |

Board must keep personal accumulation accounts

5.1.1 The Board must keep a personal accumulation account for each PSSAP member.

Note: A PSSAP member includes an ordinary employer-sponsored member.

5.1.2 The Board may keep only one personal accumulation account for each PSSAP member.

5.1.3 The personal accumulation account records the accumulation amount of a PSSAP member.

Accumulation amount

5.1.4 The accumulation amount of a PSSAP member is equal to the total of the amounts credited to the personal accumulation account of the PSSAP member under Rule 5.1.5 less the total of the amounts debited to the personal accumulation account under Rule 5.1.6.

5.1.5 If any or all of the following amounts are paid to the PSSAP Fund in respect of a PSSAP member, the amounts must be credited to the person’s personal accumulation account:

(a) basic employer contributions;

(b) any additional employer contributions;

(c) employee contributions that have been paid by the ordinary employer-sponsored member;

(d) eligible spouse contributions accepted by the Board under Rule 2.3.4 paid on behalf of the ordinary employer-sponsored member;

(e) the interest credited (if any) in respect of fund earnings on the person’s accumulation amount as decided by the Board under Rule 5.2.1;

(f) any amount paid by a life insurance company to the Board in respect of the person in response to a claim against a life policy unless the amount is an amount referred to in Rule 3.4.3;

(g) any transfer amounts;

(h) any amount credited to the person’s personal accumulation account under Rule 7.2.2.

5.1.6 If any or all of the following amounts are paid from the PSSAP Fund or are payable by or in respect of a PSSAP member the amounts must be debited from the person’s personal accumulation account:

(a) income tax as determined by the Board;

(b) any insurance premium payable under Rule 4.1.6, 4.2.12, 4.3.5 and 4.4.10 paid from the person’s accumulation amount;

(c) the interest debited (if any) in respect of fund losses on the person’s accumulation amount as decided by the Board under Rule 5.2.1;

(d) any benefit paid to or in respect of the PSSAP member from their accumulation amount including any benefit paid as a roll-over or transfer;

(e) any fees, costs and expenses paid from the person’s personal accumulation account under Rule 5.4.3;

(f) any surcharge payable by the Board under Rule 5.3.1 in respect of the PSSAP member.

Division 2 | Crediting of fund earnings and debiting of fund losses |

Crediting of earnings and debiting of losses

5.2.1 The Board may determine:

(a) the amounts to be credited or debited to a person’s personal accumulation account under Rule 5.1.5(e) and 5.1.6(c) that reasonably reflects the after tax earnings or losses derived from the investment of the amount in the account; and

(b) how much of each amount determined under (a) is in respect of fund earnings or losses on the person’s accumulated member contributions.

5.2.2 In determining the amount referred to in Rule 5.2.1 the Board must have regard to:

(a) the charges, costs and expenses incurred in the investment of amounts in all personal accumulation accounts; and

(b) if, under Rule 5.4.1, a PSSAP member may choose between two or more investment strategies – the investment strategies chosen by the PSSAP member for their personal accumulation account.

Note: The PSSAP is subject to provisions relating to financial management of funds (including solvency and winding up of accumulation funds) set out at Part 9 of the SIS Regulations.

Division 3 | Superannuation surcharge |

Application of the Superannuation Contributions Tax

5.3.1 The Board must pay from the PSSAP Fund any amount of surcharge payable in respect of an assessment of surcharge on surchargeable contributions for a PSSAP member held in the PSSAP Fund.

Note: As well as covering possible surcharge assessments received in respect of surchargeable contributions made on or after 1 July2005 (legislation has been introduced in Parliament to abolish the surcharge from 1 July 2005), Rule 5.3.1 will cover surcharge assessments received in relation to surchargeable contributions made before 1 July 2005 and transferred by PSSAP members to the PSSAP Fund.

Division 4 | Member investment choice |

Member Investment Choice

5.4.1 The Board may offer PSSAP members the opportunity to elect to have amounts held in their personal accumulation account invested in accordance with a particular investment strategy.

5.4.2 The Board may determine when and how a PSSAP member may make or change an election about their choice of investment strategy.

5.4.3 The Board may determine, in relation to choice of investment strategy, the fees, costs and expenses to be paid from a person’s personal accumulation account, including, fees, costs and expenses in connection with the investment of contributions, the realisation of those investments, the choice of an investment strategy and changes to an investment strategy.

Division 5 | Incorrectly paid amounts |

Board must redirect incorrectly paid amounts and correct the PSSAP Fund

5.5.1 If any moneys paid to or withdrawn from the PSSAP Fund, in the opinion of the Board, have been paid to or withdrawn from the PSSAP Fund by mistake (whether of law or of fact), the Board must take steps to correct the mistake, including:

(a) in the case of moneys paid by mistake - refunding those moneys to the person who paid them to the PSSAP Fund and doing all things necessary to correct the records of the PSSAP Fund to reflect such refunding;

(b) in the case of moneys withdrawn by mistake – taking all reasonable steps to recover the moneys and doing all things necessary to correct the records of the PSSAP Fund to reflect such recovery.

Note: Among other things, Rule 5.5.1 covers the situation where an amount transferred to the Board by the Australian Taxation Office under Rule 2.4.1(c) or (d) has been found, upon reassessment by the Commissioner of Taxation, to be more than the correct amount.

Board must redirect incorrectly paid amounts and correct personal accumulation accounts

5.5.2 If any moneys paid to or withdrawn from the personal accumulation account of a PSSAP member were, in the opinion of the Board, paid into or withdrawn from the personal accumulation account by mistake (whether of law or of fact), the Board must take steps to correct the mistake, including:

(a) withdrawing an amount from the personal accumulation account or paying an amount to the personal accumulation account; and

(b) doing all things necessary to correct the records of the PSSAP Fund to reflect action taken under paragraph (a).

PART 6 – REVIEW OF DECISIONS

|

Division 1 | Reconsideration Advisory Committees |

Establishing Reconsideration Advisory Committees

6.1.1 The Board will establish one or more Reconsideration Advisory Committees comprising people with such qualifications as the Board determines and may refer a decision of the Board, or of a delegate of the Board, in relation to PSSAP to be reconsidered by a Reconsideration Advisory Committee. A member of a Reconsideration Advisory Committee may be a trustee.

6.1.2 Subject to any Board directions, a Reconsideration Advisory Committee will regulate its own affairs.

Board responsibilities to Reconsideration Advisory Committees

6.1.3 Where the Board has referred a decision in relation to PSSAP to a Reconsideration Advisory Committee, the Board is to provide the Committee with all relevant evidence and information.

Recommendation by Reconsideration Advisory Committees

6.1.4 Where the Board has referred a decision in relation to PSSAP to a Reconsideration Advisory Committee for review and to make a recommendation to the Board, the Committee is to review the decision and make a recommendation to the Board whether the decision should be affirmed, varied, substituted or set aside.

Division 2 | Reconsidering delegate’s decisions |

Request for reconsideration

6.2.1 A person affected by a decision in relation to PSSAP made by a delegate of the Board may request the Board to reconsider the original decision.

6.2.2 A request for reconsideration must be made in writing, or any other form acceptable to the Board, and must set out the particulars of the decision to be reconsidered.

Reconsideration of decision of delegate

6.2.3 Where the Board accepts a request to reconsider a decision of a delegate of the Board in relation to PSSAP, the Board must:

(a) if the Board has delegated to a Reconsideration Advisory Committee the Board’s power to determine the matter, refer the request to the Committee for review and to exercise that power and in that event the Committee must review the decision and determine the matter in accordance with the delegated power by:

(i) affirming the decision under review;

(ii) varying the decision;

(iii) substituting another decision; or

(iv) setting the decision aside; or

(b) itself review the decision and decide whether to affirm the decision, vary the decision, substitute another decision or set the decision aside, after considering the recommendation of a Reconsideration Advisory Committee, if any, if, at its discretion, it has referred the request to the Committee for review and to make a recommendation in relation to the decision.

Decision to be notified to affected person

6.2.4 The decision of the Board or the Reconsideration Advisory Committee under Rule 6.2.3 on a reconsideration must be notified to the person requesting reconsideration of the original decision. The notification is to include a statement of reasons for the decision.

Division 3 | Reconsidering Board Decisions |

Request for reconsideration

6.3.1 A person affected by a decision of the Board in relation to PSSAP, including a decision under Division 2 or 4 of this Part, may request the Board to reconsider that decision.

6.3.2 A request for reconsideration of a decision of the Board in relation to PSSAP must be made in writing and:

(a) set out the particulars of the decision to be reconsidered;

(b) specify the grounds for the request;

(c) include new evidence, being evidence not previously known to the Board, supporting the grounds for the request; and

(d) be accompanied by the fee prescribed under the Act.

6.3.3 The Board must not proceed with a request for reconsideration of a decision of the Board in relation to PSSAP:

(a) that does not include new evidence; or

(b) if in the opinion of the Board, the evidence included in the request does not support the grounds specified for the request;

and the Board may refund the fee paid. The Board may subsequently proceed with the request if sufficient new evidence is provided.

Clear decision in favour of person

6.3.4 If the Board accepts a request to reconsider a decision of the Board in relation to PSSAP, the Board may decide in favour of the person seeking reconsideration without referring the request to a Reconsideration Advisory Committee or to an Assessment Panel if, after considering:

(a) the new evidence provided with the request; and

(b) any other evidence the Board considers relevant;

it is satisfied there is no reasonable doubt it should decide in favour of the person.

Reconsideration of decision of Board

6.3.5 Where the Board accepts a request to reconsider one of its decisions in relation to PSSAP, the Board, unless under Rule 6.3.4 it has decided in favour of the person seeking reconsideration, must:

(a) if the Board has delegated to a Reconsideration Advisory Committee the Board’s power to determine the matter, refer the request to the Committee for review and to exercise that power and in that event the Committee must review the decision and determine the matter in accordance with the delegated power by:

(i) affirming the decision under review;

(ii) varying the decision;

(iii) substituting another decision; or

(iv) setting the decision aside; or

(b) itself review the decision and decide whether to affirm the decision, vary the decision, substitute another decision or set the decision aside, after considering the recommendation of a Reconsideration Advisory Committee, if any, if, at its discretion, it has referred the request to the Committee for review and to make a recommendation in relation to the decision;

after first obtaining, if appropriate, the recommendation of an Assessment Panel, and the Committee or the Board, as the case requires, may, at its discretion, refund the fee paid.

Decision to be notified to affected person

6.3.6 The decision of the Board or the Reconsideration Advisory Committee under Rule 6.3.5 must be notified to the person requesting reconsideration of the original decision. The notification is to include a statement of reasons for the decision.

Division 4 | Board initiated reconsiderations |

Board may initiate a reconsideration of a decision

6.4.1 The Board, on its own motion, may initiate the reconsideration of a delegate's decision or a decision of the Board in relation to PSSAP and may vary the decision, substitute another decision or set the decision aside. The Board will advise the person affected of that reconsideration and any changed decision.

PART 7 – FAMILY LAW SUPERANNUATION SPLITTING |

Division 1 | Board powers and duties: superannuation interests subject to payment split |

Powers and duties of the Board: adoption of SIS Regulations

7.1.1 Subject to this Part, where an interest in the PSSAP Fund becomes subject to a payment split under the Family Law Act 1975:

(a) the Board shall have the same powers and duties in relation to the interest as a trustee has under Part 7A of the SIS Regulations in relation to a relevant accumulation interest;

(b) a non-member spouse in relation to the interest has the same rights in relation to benefits connected with the interest as the non-member spouse would have in relation to benefits connected with the interest if Part 7A of the SIS Regulations applied in relation to the interest; and

(c) a member spouse in relation to the interest has the same rights in relation to reduction of benefits connected with the interest as the member spouse would have in relation to such reduction if Part 7A of the SIS Regulations applied in relation to the interest.

Division 2 | Board to establish a non-member spouse interest account where a non-member spouse interest is created |

Board to establish a non-member spouse interest account

7.2.1 Where the Board creates a non-member spouse interest, the Board must create an account to which the value of the non-member spouse interest is credited (non-member spouse interest account).

Note: Regulation 7A.20 of the SIS Regulations governs the apportionment of the non-member spouse interest among unrestricted non-preserved benefits, restricted non-preserved benefits and preserved benefits.

Board to consolidate non-member spouse interest account and personal accumulation account

7.2.2 Where the non-member spouse is a PSSAP member with both a personal accumulation account and a non-member spouse interest account, the Board shall, within 28 days after being requested to do so by the non-member spouse:

(a) increase the amount credited to the personal accumulation account of the PSSAP member by the amount credited to the non-member spouse interest account; and

(b) thereafter and on the same day reduce to zero the value of the non-member spouse interest account and then close the non-member spouse interest account.

Division 3 | Rights and restrictions applying to a non-member spouse interest |

Board may determine terms and conditions for non member spouse interest

7.3.1 Subject to the provisions of this Division, the Board may, in creating a non-member spouse interest, determine terms and conditions for the non-member spouse interest.

Right of non-member spouse to benefits

7.3.2 Subject to the SIS Act, the rights of a non-member spouse or their legal personal representative applying for benefits or the roll-over of benefits in relation to their non-member spouse interest are the same as those of a PSSAP member who has ceased to be an ordinary employer-sponsored member - or their legal personal representative - applying for benefits or the roll-over of benefits in relation to an interest in the PSSAP Fund of the PSSAP member.

Right of person claiming death benefits

7.3.3 Subject to the SIS Act, the rights of persons claiming death benefits upon the death of a non-member spouse in relation to their non-member spouse interest are the same as the rights of persons claiming death benefits upon the death of a PSSAP member in relation to the interest in the PSSAP Fund of the deceased PSSAP member.

Board may offer non-member spouse choice of investment strategy

7.3.4 The Board may offer a non-member spouse the opportunity to elect to have amounts held in his or her non-member spouse interest account invested in accordance with a particular investment strategy.

7.3.5 The Board may determine when and how a non-member spouse may make or change an election about their choice of investment strategy.

7.3.6 The Board may determine the administration fees to be paid from a person’s non-member spouse interest account for changing elections about choice of investment strategy.

Board may not take out insurance policy for a non-member spouse

7.3.7 The Board may not take out policies to provide insurance, including insurance of the kind referred to in Part 4, for a non-member spouse.

Employee contributions not able to be credited to non-member spouse interest account

7.3.8 The Board shall not accept employee contributions, contributions by an employer or transfer amounts, including those referred to at Rule 2.4.1, for the purpose of them being credited to the non-member spouse interest account.