Schedule 1 Interpretation Standard

(section 3)

Part 1 Preliminary

Division 1.1 Introduction

1.1.1 This Standard

(1) This Interpretation Standard is established by the Private Health Insurance Administration Council (PHIAC) to have application in terms of:

(a) being a component part of other standards under the National Health Act 1953 (the Act), such as the Solvency and Capital Adequacy Standards; and

(b) other relevant industry applications as appropriate.

(2) This Standard sets out:

(a) the requirements for determining the various components of the Solvency Requirement and Capital Adequacy Requirement of a health benefits fund under the Act; and

(b) the terminology used in the Solvency Standard and the Capital Adequacy Standard.

1.1.2 How to Use & Interpret This Standard

(1) In this Standard the following conventions apply:

(a) the requirements prescribed in this Standard are shown in bold type;

(b) commentary is shown in normal print directly following the prescriptive sections to which it relates;

(c) some sections of the Standard are also preceded by an overview — shown in normal print — intended as a plain English introduction to the principles which are developed in greater detail in the relevant section;

(d) the Standard also adopts a Please Note facility as a means of emphasising special messages to the practitioner readers.

(2) The commentary, overview and Please Note facility can be used as an aid to interpretation, and to the intent of the Standard. In addition, circulars and other advice released periodically by PHIAC will provide further background and an insight to its considerations in the development of this Standard.

1.1.3 Application of the Interpretation Standard

This Standard applies:

(a) in respect of all health insurance business of a registered health benefits organization; and

(b) on and from 1 July 2003.

Commentary The Standard has been through a due process of exposure and consultation established and managed by PHIAC, and has been the subject of consultation with the Australian Government Actuary. The Standard is a disallowable instrument and will, accordingly, have been through the Parliamentary processes, and not disallowed.

Division 1.2 Materiality

1.2.1 Overview

(1) In many cases in practice, the calculation processes outlined in this Standard will be able to be simplified by the Organization as it becomes apparent that certain components in the required calculations dominate for certain Funds in certain circumstances. It is not the intention of this Standard to require expensive calculations to be undertaken which have a negligible impact on the overall results.

(2) However, equally, items that have a material impact on the results should not be understated.

(3) Particular values or components are considered material to the overall result of a calculation when their misstatement or omission would cause the result to be misleading to the users of the information.

(4) Materiality tests assess the significance of the particular value/component by relating it to the amount of the overall result to which it contributes.

(5) The amounts determined in accordance with this Standard are subject to materiality standards applied at a Fund level.

(6) In determining the Solvency Requirement, the base amount for materiality purposes is the Health Benefits Fund Solvency Requirement (HBFSR) of the Fund.

(7) In determining the Capital Adequacy Requirement the base amount for materiality purposes is the Health Benefits Fund Capital Adequacy Requirement (HBFCAR) of the Fund.

(8) In applying the materiality standard described above, the materiality must be considered relative to the base amount of both:

(a) the major individual components of the base amount; and

(b) the overall cumulative effect of those individual components.

(9) It is appropriate that in any circumstances where the base amount approaches zero, alternative key indicators be used in establishing materiality.

(10) Materiality relative to the base amount may be based on the following:

(a) variations in amounts of 10% or more of the base amount are to be presumed material;

(b) variations in amounts of 5% or less of the base amount may be presumed immaterial.

(11) Materiality applies to all aspects of the determination of the base amount and covers the acceptability of grouped data, modelled projections and approximate valuation methods.

PLEASE NOTE

Judgment is generally needed in the application of the materiality provisions to a Fund. However, such judgment should not result in the Fund being inappropriately exposed to technical insolvency.

It also needs to be considered, at each reporting date, whether detailed valuations need to be performed to demonstrate the continued appropriateness of any approximate methods.

Division 1.3 Definitions

1.3.1 Definitions

For the purposes of this Standard, the Solvency Standard and the Capital Adequacy Standard, the terms set out below have the specific meaning assigned:

Actuary

Fellow of the Institute of Actuaries of Australia or an Accredited Member of the Institute of Actuaries of Australia.

Authorised Deposit-taking Institution

Means a body corporate in relation to which an authority under subsection 9 (3) of the Banking Act 1959 is in force.

Average Deficit Per SEU

For each quarter, the Average Deficit Per SEU is determined for each state by PHIAC as the Gross Deficit for the state for that quarter divided by the average number of SEUs for the state for that quarter.

Calculated Deficit

The Calculated Deficit for a Fund is determined as the state Average Deficit Per SEU multiplied by the Organization’s average membership in SEUs over the relevant period.

Capital Adequacy Standard

Means the Health Benefits Organizations — Capital Adequacy Standard 2003.

Fund

The health benefits fund of an Organization established in accordance with the provisions of the National Health Act 1953.

Gross Deficit

The Gross Deficit is the amount of the benefits paid by an Organization that can be recovered from the Reinsurance Trust Fund.

Organization

An Organization registered under the National Health Act 1953 (as amended) as a health benefits organization to carry on health insurance business.

Reinsurance

Refers to the statutory pooling arrangements under the Health Benefits Reinsurance Trust Fund (Reinsurance Trust Fund).

Related Party

In relation to an Organization, a Related Party includes:

(a) any entity that has control or significant influence over the Organization; or

(b) any entity that is subject to control or significant influence by the Organization; or

(c) any entity that is controlled by the same entity that controls the Organization — referred to as a situation in which entities are subject to common control; or

(d) any entity that is controlled by the same entity that significantly influences the Organization; or

(e) any entity that is significantly influenced by the same entity that controls the Organization; or

(f) any director of the Organization or any of their director-related entities; or

(g) any director of any entity identified as a related party under any of paragraphs (a) to (e), or any of their director-related entities.

Reported Liabilities

The value of the liabilities of the Health Benefits Fund as set out in the Financial Statements of the Fund at the valuation date.

SEU

Single equivalent unit, and is determined in accordance with the requirements of the Reinsurance Trust Fund.

Solvency Standard

Means the Health Benefits Organizations — Solvency Standard 2003.

Part 2 Components

Division 2.1 Solvency liability

2.1.1 Overview

(1) The Solvency Liability is an intermediate component in the determination of the Health Benefits Fund Solvency Requirement (HBFSR), which reflects the assessed liabilities of the Fund on the basis of assumptions which are more conservative (anticipate a more adverse experience) than best estimate assumptions.

| | | | Health Benefits Fund Solvency Requirement | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Solvency Liability | | Expense Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

(2) The risks pertaining to each element include the risk of mis-estimation of the mean, the risk of deterioration of the assumed mean, the risk of adverse statistical fluctuations about the mean and the risk of unexpected changes in the underlying distribution of experience.

(3) In essence, the Solvency Liability has a minimum value equal to the liabilities determined in accordance with the requirements of this Standard, plus a loading of 10% as a risk margin for those elements of the liability assessment that contain uncertainty.

2.1.2 The Solvency Liability must make provision for the risks pertaining to elements in respect of which an assumption is required in valuing the accrued liabilities of the Fund.

2.1.3 The Solvency Liability of a Fund is to be determined as the sum of three components:

(a) Solvency Net Claims Liability; plus

(b) Solvency Reinsurance Accrued Liability; plus

(c) Solvency Other Liabilities.

| | | Solvency Liability | | | |

| | | | | | | |

| | | | | | | |

Solvency Net Claims Liability | | Solvency Reinsurance Accrued Liability | | Solvency Other Liabilities |

2.1.4 Solvency Net Claims Liability

The Solvency Net Claims Liability is determined as the greater of:

(a) the sum of:

(i) 1.1 times the value of the best estimate Outstanding Claims Liability determined in accordance with Division 2.10 of this Standard; plus

(ii) 1.1 times the value of the Reinsurance Outstanding Claims Liability determined in accordance with Division 2.12 of this Standard; plus

(iii) the greater of:

(A) 1.1 times the value of the Unexpired Risk Reserve determined in accordance with Division 2.11 of this Standard; and

(B) the value of the Contributions in Advance determined in accordance with Division 2.11 of this Standard; and

(b) the net value of these liability components reflected in the Reported Liabilities of the Fund.

2.1.5 Solvency Reinsurance Accrued Liability

(1) The Solvency Reinsurance Accrued Liability is based on the Calculated Deficit and the Gross Deficit determined in accordance with Division 2.13 of this Standard.

(2) The value of the Solvency Reinsurance Accrued Liability is determined as:

(a) 1.1 times Calculated Deficit; minus

(b) Gross Deficit.

2.1.6 Solvency Other Liabilities

(1) The Solvency Other Liabilities is the value of the Other Liabilities determined in accordance with Division 2.14 of this Standard.

(2) Where the determination of the liabilities of the Fund in accordance with this standard would have the effect of changing the Other Liabilities assessment of the Fund, then such change should be reflected in the Other Liabilities amount considered under subsection (1).

(3) The primary adjustment that may be relevant to the Other Liabilities under subsection (2) would be in respect of any deferred tax liability held where the Fund was subject to income tax. To the extent that any increase in the Fund’s liability provisions would generate a corresponding tax benefit, it may be appropriate to allow for the tax benefit in respect of the cost of the solvency margin held via an adjustment to any deferred tax liability within the Other Liabilities.

Division 2.2 Expense Reserve

2.2.1 Overview

(1) The Expense Reserve is an intermediate component in the determination of the Health Benefits Fund Solvency Requirement (HBFSR) which reflects the provision for expenses needed to be funded in a run-off situation in respect of the Fund.

| | | | Health Benefits Fund Solvency Requirement | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Solvency Liability | | Expense Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

(2) The calculation basis and assumptions adopted in respect of the Solvency Liability do not cover the risk of the expenses eroding the asset value of the Fund under conditions of the Fund being closed to new members and in run-off and where future contribution income into the Fund has discontinued. Hence an explicit reserve is established.

(3) The risk is concerned with a Fund forced to operate as a fund closed to new members and in run-off, which incurs delays or unavoidable expenses in implementing the significant change to its expense structure that such a change in status would require. In particular non-contracted expenses that cannot be immediately terminated without cost to the Fund may continue to be incurred for a period, or incur the associated termination penalties, without the benefit of ongoing contribution income to fund them. There is also likely to be a need to meet special additional costs such as staff retrenchment and redundancy payments, and the appointment of an external administrator and/or liquidator. It is inappropriate that existing members’ benefit entitlements be reduced as a consequence of the Fund bearing such expenses.

2.2.2 The Expense Reserve (ER) is to be determined as:

ER | = | 0.4 x Total Non-Claim Expenses |

2.2.3 Total Non-Claim Expenses, for the purposes of the above calculation, is to be determined as the total actual non-claims expenses of the Fund reflected in the financial statements of the Fund for the twelve months prior to the valuation date.

2.2.4 The Expense Reserve must not be less than zero.

Division 2.3 Inadmissible Assets Reserve

2.3.1 Overview

(1) The Inadmissible Assets Reserve is an intermediate component in the determination of the Health Benefits Fund Solvency Requirement (HBFSR) and the Health Benefits Fund Capital Adequacy Requirement (HBFCAR), which reflects certain asset risks.

| | | | Health Benefits Fund Solvency Requirement | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Solvency Liability | | Expense Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | | | | | | | | | | |

(2) The risks reflected in the Inadmissible Assets Reserve are as follows:

Asset Contagion Risks/Liquidity/Realisation

(a) Certain assets are disclosed in the financial statements at a value which may be dependent on the ongoing operation of the business. On the cessation of business, the value of those assets would likely be less. A reserve needs to be held for solvency against that part of the value of such assets which would not be realisable in the adverse circumstance of a wind-down of the business of the Organization.

Holdings in Associated Entities which are Prudentially Regulated

(b) The value at which an associated entity is held in the Fund should not have the effect of double counting the legislated capital requirement of the associated entity (ie. using the same capital for both entities).

Asset Concentration & Non-Systemic Risks

(c) Diversification is an important principle of prudent investment. To the extent the asset exposure of a Fund is excessively concentrated in a particular asset, or with a particular obligor, a reserve should be established against the part of the value of that exposure considered excessive.

General Credit/Liquidity Risks

(d) While no explicit provision is made for general credit and liquidity risk, it is considered that the fair value or net market value of the assets shown in the balance sheet would reflect appropriate consideration of default and marketability/liquidity risks for particular individual assets, and the allowance for adverse systemic market movements under the Resilience Reserve (Division 2.4) makes implicit allowance for these risks at a macro level.

(e) Beyond this it is noted that the Board of each Organization in implementing the Fund’s investment policy and discharging its responsibilities in the financial operations of the Organization and the Fund would include consideration of credit and liquidity risks. It is not the intention of these reserves to limit the investment practices of Organizations. Rather it is to ensure that the risks associated with particular investment strategies are appropriately assessed and provided for.

2.3.2 Asset Exposure

(1) In assessing the asset risks, the Organization must:

(a) take account of the effective exposure of the Fund to various asset classes, regardless of the physical asset holdings of the Fund; and

(b) consider exposure to counterparty risks including, but not limited to, futures and options contracts, swaps, hedges, warrants, forward rate and repurchase agreements.

(2) In the case of investment entities, it is the exposure of the Fund to the underlying assets of the entity, determined by adopting a ‘look through’ approach, that is relevant. For this purpose, an investment entity is an entity whose assets are solely investments, where the sole purpose of the entity is investment activities and where the investor investing in that entity has security directly linked to those assets.

(3) As an example of the asset exposure to be adopted in assessing asset risks, an unlisted unit trust or securitised mortgage instrument would generally be considered an investment entity and the assessment of asset risks should be based on the underlying assets of the trust/instrument. However, in practice, examples exist of arrangements where the security of the investor is not directly linked to the underlying assets, but is subordinated to the interests of a third party. In this case, it would not be appropriate to base the assessment on the underlying assets.

2.3.3 Solvency Requirement

In determining the Health Benefit Fund Solvency Requirement (HBFSR), the Inadmissible Assets Reserve for the Fund is determined as the sum of:

(a) the reserve prescribed in respect of Assets Used for the Conduct of Business (section 2.3.6); plus

(b) the reserve prescribed in respect of Holdings in Associated and Subsidiary Entities which are Prudentially Regulated Institutions (section 2.3.7); plus

(c) the reserve prescribed in respect of Asset Concentration Risks (section 2.3.8).

2.3.4 Capital Adequacy Requirement

In determining the Health Benefit Fund Capital Adequacy Requirement (HBFCAR), the Inadmissible Assets Reserve for the Fund is determined as the sum of:

(a) the reserve prescribed in respect of Holdings in Associated and Subsidiary Entities which are Prudentially Regulated Institutions (section 2.3.7); plus

(b) the reserve prescribed in respect of Asset Concentration Risks (section 2.3.8).

2.3.5 Where the Inadmissible Assets Reserve is reduced by deferred tax provisions or other liabilities relevant to the inadmissible portion of the assets, the reduction must only be to the extent those provisions/liabilities are assessed as likely to be realised.

PLEASE NOTE

The value of an asset is the value as determined in accordance with the Fund reporting standards and requirements under the National Health Act 1953; that is, the net realisable market value.

2.3.6 Assets Used for the Conduct of Business

Overview

(1) The closure of a Fund to new members may require the downsizing of infrastructure and the rearrangement of assets to match the expected run-off of liabilities. The value of an asset in this context should be determined based on:

(a) the ability to realise the reported value of the asset in the process of this rearrangement; or

(b) the ability to turn the asset into an equivalent amount of cash to meet the liabilities of the Fund as they become due.

(2) Assets that need to be examined include:

(a) operational equipment held in the Fund; and

(b) loans to and receivables from directors, employees, intermediaries and related parties; and

(c) outstanding contributions; and

(d) equipment and computer software; and

(e) future income tax benefits; and

(f) holdings in associated entities whose value is dependent upon the continuation of the operation of the Fund or the Organization; and

(g) pre-paid expenses; and

(h) intangible assets.

(3) The HBFSR must establish a reserve to provide for the risk that, in the context of the run-off of the business of a Fund closed to new members, the value realised for the operational assets will differ from their value disclosed in the financial statements.

(4) The prescribed reserve for assets used in the conduct of business is determined as the amount by which the stated value of the asset in the financial statements exceeds the value the asset would have in a run-off situation.

(5) For the purpose of the above, the value to be ascribed to certain assets is subject to the following specific requirements:

(a) Loans to Directors, Employees, Advisers and Related Parties:

(i) In respect of money loaned or advanced on an unsecured basis, no value is to be ascribed to the debt.

(ii) In respect of money loaned or advanced on a secured basis, the value to be ascribed to the debt must not exceed the amount of the security available to extinguish the debt.

(iii) Where the loan to a related party is the provision of subordinated debt, the party is a prudentially regulated financial institution, and the subordinated debt qualifies as capital within that institution, the value to be ascribed is to be determined in accordance with section 2.3.7.

(b) Contributions in Arrears:

(i) Where the amount of the contributions has been collected by a third party and is in effect ‘in transit’ from the third party to the Fund, the value ascribed to the contributions must not be greater than the value of the contributions.

(ii) In any other circumstances a nil value must be adopted.

(c) Equipment (other than Computer Software):

The value of equipment (other than computer software) owned by the Organization must not exceed the net realisable value of that asset.

(d) Computer Software:

The value of computer software owned by the Organization must not exceed the known resale value of that asset. If the resale value is not known, then a zero value must be assumed.

(e) Future Income Tax Benefits:

The value of any future income tax benefit due to the Organization must not exceed the value of any income tax benefit that would accrue and be realised on ceasing business.

(f) Holdings in Associated and Subsidiary Entities:

(i) Where the entity is financially and operationally interdependent, directly or indirectly, with the Organization, the value placed on the entity must not exceed the value of net tangible assets.

(ii) Otherwise, (that is, where the entity is a self sustaining operation), the value placed on the entity must not exceed its fair value or net market value.

(g) Pre-paid expenses:

The value of any pre-payment must not exceed the value of the recoverable amount.

(h) Intangible assets:

Nil value.

2.3.7 Holdings in Associated and Subsidiary Entities which are Prudentially Regulated Institutions

Overview

(1) It is the intention that the integrity of the capital requirements of separate entities be maintained. It is not appropriate that assets being held in respect of one institution’s capital requirements are counted in meeting the capital requirements of another.

(2) It is recognised that the methods for valuing financial entities, in particular the minimum capital requirements thereof, vary depending on the nature of the financial institution, the assets backing its capital requirement and the circumstances of the association. Accordingly, the responsibility for appropriate reserving in this respect is placed with the Board.

(3) Where the entity is a financial institution or a private health insurance institution subject to prudential regulation which requires the maintenance of minimum capital levels, it is not appropriate that, in determining the HBFSR and HBFCAR of the Fund, credit be taken for the capital already securing those minimum capital requirements.

(4) Where a part of the capital requirement of the entity is externally sourced, for example, by a subordinated debt arrangement, the fair value or net market value of the entity should not recognise this debt as a net asset, and accordingly it is not necessary to further reduce that market value in respect of that part of the capital requirement.

(5) Where the associated entity is a financial institution subject to prudential regulation which requires the maintenance of minimum capital, the HBFSR and the HBFCAR must each include a reserve to the extent that the value of the asset in the financial statements includes some value in respect of that capital.

(6) The prescribed additional reserve in respect of holdings in associated and subsidiary entities which are prudentially regulated is to be determined as the extent to which the value placed on the entity in accordance with paragraph 2.3.6 (5) (f) includes a component of value in respect of the prudential capital requirement of the entity.

2.3.8 Asset Concentration Risks

(1) The HBFSR and the HBFCAR must each establish a reserve against the adverse impact of a concentration of investment in a particular asset, with a particular obligor or with a Related Party.

(2) Notwithstanding the prescribed limits, if in the opinion of the Board the overall portfolio of assets of the Fund has too little diversification, is too illiquid or has too great an exposure to one obligor of low credit standing, the Organization should add to the reserve for inadmissible assets an amount considered necessary to adequately protect the interests of the members of the Fund.

(3) Except for those assets described in subsection (4), the prescribed reserve for asset concentration risks is determined as the amount by which the value of any single asset or credit exposure (with a particular obligor or related party) exceeds 10% of the value of the assets of the Fund.

(4) For those assets set out below, the prescribed reserve for asset concentration risks is determined as the amount by which the value of any single asset or credit exposure (with a particular obligor or related party) exceeds:

(a) 100% of the value of the assets of the Fund, where the asset or credit exposure concerned is:

(i) guaranteed by a national government, being the national government of the country in whose currency the liabilities of the Fund are denominated; or

(ii) guaranteed by an Australian State government;

(b) the greater of 50% of the value of the assets of the Fund and $5 million, where the asset or credit exposure concerned is:

(i) guaranteed by a local government or public sector entity; or

(ii) secured by banks bills or deposits with an Authorised Deposit-taking Institution which is regulated by the Australian Prudential Regulation Authority and which has net assets of at least $50 million;

(c) the greater of 25% of the value of the assets of the Fund and $5 million, where the asset or credit exposure concerned is secured by deposits with an Authorised Deposit-taking Institution which is regulated by the Australian Prudential Regulation Authority and has net assets of less than $50 million and which is not a Related Party.

(5) In respect of banks bills and deposits with Authorised Deposit-taking Institutions, the standards permit the following maximum concentrations of assets:

(a) for bank bills and deposits with an Authorised Deposit-taking Institution that has at least $50 million in net assets, the greater of 50% of total assets and $5 million;

(b) for deposits with an Authorised Deposit-taking Institution that has net assets less than $50 million and is not a Related Party, the greater of 25% of total assets and $5 million;

(c) for deposits with an Authorised Deposit-taking Institution that has net assets less than $50 million and is a Related Party, 10% of total assets.

PLEASE NOTE

In assessing the Inadmissible Asset Reserve requirements, asset risks should be assessed on the basis of effective asset exposures and adopting a ‘look through’.

Division 2.4 Resilience Reserve

2.4.1 Overview

(1) The Resilience Reserve is an intermediate component in the determination of the Health Benefits Fund Solvency Requirement (HBFSR) and the Health Benefits Fund Capital Adequacy Requirement (HBFCAR), which reflects the risks of the Fund in respect of any mismatching of asset and liability exposures.

| | | | Health Benefits Fund Solvency Requirement | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Solvency Liability | | Expense Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | Health Benefits Fund Capital Adequacy Requirement | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Capital Adequacy Liability | | Renewal Option Reserve | | Business Funding Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | | | | | | | | | | | | | | |

(2) To the extent that the value of liabilities is not directly linked to the value of the underlying assets, an adverse movement in the day to day value of the assets effectively reduces the level of reserves supporting the liabilities. It is prudent that an Organization recognise the risk associated with such asset valuation volatility and hold sufficient reserves such that the obligation of each Fund would still be able to be met following an adverse systemic market movement.

2.4.2 Asset Exposure

(1) In assessing the asset risks, the Organization must:

(a) take account of the effective exposure of the Fund to various asset classes, regardless of the physical asset holdings of the Fund; and

(b) consider exposure to counterparty risks including, but not limited to, futures and options contracts, swaps, hedges, warrants, forward rate and repurchase agreements.

(2) In the case of investment entities, it is the exposure of the Fund to the underlying assets of the entity, determined by adopting a ‘look through’ approach, that is relevant. For this purpose, an investment entity is an entity whose assets are solely investments, where the sole purpose of the entity is investment activities and where the investor investing in that entity has security directly linked to those assets.

(3) As an example of the asset exposure to be adopted in assessing asset risks, an unlisted unit trust or securitised mortgage instrument would generally be considered an investment entity and the assessment of asset risks should be based on the underlying assets of the trust/instrument. However, in practice, examples exist of arrangements where the security of the investor is not directly linked to the underlying assets, but is subordinated to the interests of a third party. In this case, it would not be appropriate to base the assessment on the underlying assets.

2.4.3 Resilience Reserve

(1) The Organization must assess the resilience of the Fund and provide for an appropriate reserve — the Resilience Reserve.

(2) In this context, resilience is assessed as the ability of the Fund to sustain shocks to the economic environment in which it operates and which are likely to result in an adverse movement in the value of its assets relative to the value of its liabilities.

(3) An assessment of the resilience of the Fund, while targeting the assessment of an asset related risk, theoretically involves consideration of the movements in both the value of assets and the value of liabilities under the prescribed scenario of adverse market movement.

(4) While this will often not be a significant concern in the circumstances of the generally short term liabilities and renewal option risks of a health insurer, it is important that this position is verified, and appropriate allowance be made where relevant.

2.4.4 The Resilience Reserve is determined as the additional amount that needs to be held before the happening of a prescribed set of changes in the economic environment, such that after the changes in the assets of the Fund exceed its liabilities, including the assessed liability risks in accordance with this Standard.

2.4.5 The Resilience Reserve is determined by reference to the Admissible Assets of the Fund.

2.4.6 Determination of Resilience Reserve

(1) The Resilience Reserve is determined in accordance with the following formula:

where

RR | = | Resilience Reserve. |

L | = | The liability held for the Fund for solvency purposes to reflect the liability risks prior to the prescribed economic change. That is: (a) in determining the Solvency Requirement, L is equal to the Solvency Liability plus the Expense Reserve; and |

| | (b) in determining the Capital Adequacy Requirement, L is equal to the Capital Adequacy Liability plus the Renewal Option Reserve plus the Business Funding Reserve. |

L’ | = | The value of the liabilities after the prescribed economic change. |

f | = | A / A’. |

A | = | Value of the admissible assets of the Fund prior to the prescribed economic change. |

A’ | = | Value of those assets after the prescribed economic change. |

(2) The Resilience Reserve must not be less than zero.

2.4.7 For the determination of A’, the prescribed changes to the economic environment are:

| | Change FOR CAPITAL ADEQUACY |

Equities | Fall in Capital Value of (25% x DF) | Fall in Capital Value of (35% x DF) |

Property (other than listed property trusts) | Fall in Capital Value of (25% x DF) | Fall in Capital Value of (25% x DF) |

Listed property trusts | Fall in Capital Value of (15% x DF) | Fall in Capital Value of (25% x DF) |

Interest Bearing | Rise in Yield of (1.5% x DF) | Rise in Yield of (2.5% x DF) |

Indexed Bonds | Rise in Yield of (0.50% x DF) | Rise in Yield of (1.0% x DF) |

| | |

All | 10% reduction in value of assets exposed to a denomination other than that of the liabilities. | 15% reduction in value of assets exposed to a denomination other than that of the liabilities. |

2.4.8 Diversification Factor

(1) DF in the above table is the diversification factor.

(2) Unless the Fund has a reasonable spread of investments across the equity, property and cash/fixed interest sectors, the diversification factor will be close to a value of 1.0. Consequently for many funds DF can be set equal to 1.0 without the need to perform the additional calculation set out below.

(3) DF is determined in accordance with the following formula:

DF = { (E2 + P2 + F2) } / (E + P + F)

where

E = | the proportionate holding of admissible assets in the equity sector times 30%. |

P = | the proportionate holding of admissible assets in the property sector times 20%. |

F = | the proportionate holding of admissible assets in the cash and fixed interest sector times 1.5% times the average term to maturity for the sector. |

2.4.9 Determination of Yield

Yield, as referred to in the above table, should be taken to mean:

(a) for interest bearing securities, redemption yield (running yield in the case of irredeemable securities); and

(b) for indexed bonds, real yield.

2.4.10 Determination of L’

(1) The required Resilience Reserve is determined by assuming changes in the economic environment which cause asset values to vary. In certain circumstances, these changes also cause the bases of determining liabilities to vary. Such changes to the value of the liabilities should be allowed for in determining the overall impact of the changes.

(2) Two particular examples are:

(a) The Renewal Option Reserve component of the Capital Adequacy Liability is based on a present value calculation. The interest and discount rate used in its determination may be increased consistently with the above interest rate environment scenario.

(b) Where there is a provision for deferred taxation. This should be adjusted in a manner consistent with the change in associated asset values. Note however, that any resulting net future income tax benefit arising would not normally be counted as an asset as it would be subject to the inadmissible asset considerations.

2.4.11 Currency Movements

The prescribed exchange rate movement would normally be applied to the value of the assets following the application of the prescribed economic change and not to the gross value of assets prior to the application of the prescribed economic change.

PLEASE NOTE

In assessing the Resilience Reserve requirements, asset risks should be assessed on the basis of effective asset exposures and adopting a ‘look through’ approach in accordance with the principles set out in section 2.4.2.

Division 2.5 Management Capital Amount

2.5.1 Overview

(1) The Management Capital Amount is an intermediate component in the determination of the Health Benefits Fund Solvency Requirement (HBFSR) and the Health Benefits Fund Capital Adequacy Requirement (HBFCAR), which reflects the need for a minimum dollar amount in respect of the business risks that are not proportional to the size of an operation.

| | | | Health Benefits Fund Solvency Requirement | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Solvency Liability | | Expense Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | | | | | | | | | | |

| | | | | Health Benefits Fund Capital Adequacy Requirement | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Capital Adequacy Liability | | Renewal Option Reserve | | Business Funding Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | | | | | | | | | | | | | | |

(2) As noted elsewhere in the Standards, the components of the HBFSR and the HBFCAR (excluding the Management Capital component) consider risks that essentially relate to the size of the Fund in question, and the Fund is basically considered as a discrete entity.

(3) However, it is acknowledged that some business risks are not proportional to the size of an operation and some risks, if crystallised, are likely to be incurred in amounts of at least a minimum practical dollar amount per event.

(4) As a practical matter, these risks are addressed under the Solvency Standard and Capital Adequacy Standard by requiring the application of a fixed dollar minimum Solvency Requirement and Capital Adequacy Requirement.

(5) Consequently, where an Organization comprises one health benefits fund, with no other business funds directly within the Organization entity, then these minimums apply to the HBFSR amount under the Solvency Standard and the HBFCAR amount under the Capital Adequacy Standard.

(6) However, where an Organization maintains a management, shareholders’ or members’ fund (or similar) outside the health benefits fund, but available within the Organization to support the obligations of the Fund, then it may be appropriate to offset some or all of the minimum reserve requirements of the Fund by the net assets available within these other funds. In this case any offset would need to be subject to the business risks reflected in these other funds being properly reserved against.

(7) Where the Organization has net assets in a management, shareholders’, members’ or other similar fund (a Management Fund) outside the health benefits fund, then the Management Capital Amount may be reduced for the risk adjusted value of the net assets available in the Management Fund.

(8) For this purpose, the risk adjusted net assets available in the Management Fund are assessed on the basis of the net assets held in excess of the ‘Management Fund Capital Requirement’ as would be calculated under the Life Insurance Actuarial Standards Board’s Actuarial Standard (Friendly Societies) 6.01 Management Capital Standard.

(9) The amount of the excess that counts is adjusted depending on whether the excess is comprised of Tier 1 or Tier 2 capital under that standard.

2.5.2 The Management Capital Amount is determined as the Default Management Capital Amount less the Management Capital Offset.

2.5.3 The Management Capital Amount has a minimum value of zero.

2.5.4 In determining the Health Benefits Fund Solvency Requirement the Default Management Capital Amount is determined according to the following formula:

Default Management Capital Amount =

$1.0 million minus the value of:

(a) Solvency Liability; plus

(b) Expense Reserve; plus

(c) Inadmissible Assets Reserve; plus

(d) Resilience Reserve; less

(e) Reported Liabilities.

2.5.5 In determining the Health Benefits Fund Capital Adequacy Requirement the Default Management Capital Amount is determined according to the following formula:

Default Management Capital Amount =

$1.5 million minus the value of the following:

(a) Capital Adequacy Liability; plus

(b) Renewal Option Reserve; plus

(c) Business Funding Reserve; plus

(d) Inadmissible Assets Reserve; plus

(e) Resilience Reserve; less

(f) Reported Liabilities.

2.5.6 Where the Organization maintains a Management Fund that is not a health benefits Fund or a Statutory Fund under the Life Insurance Act 1995, then a Management Capital Offset may be determined in accordance with section 2.5.7. In all other cases the Management Capital Offset shall be nil.

2.5.7 Where applicable, the Management Capital Offset shall be determined as follows:

(a) The Management Fund Capital Requirement (MFCR) for the Management Fund is to be determined in accordance with the requirements set out in the Actuarial Standard (Friendly Societies) 6.01 Management Capital Standard (ASFS 6.01) issued by the Life Insurance Actuarial Standards Board under the Life Insurance Act 1995.

(b) The amounts of ‘Tier 1 Capital’ and ‘Tier 2 Capital’ are to be determined in accordance with section 10 of ASFS 6.01.

(c) The quantities are to be determined as follows:

MFCR | = | The Management Fund Capital Requirement. |

T1C | = | The Tier 1 Capital amount. |

T2C | = | The Tier 2 Capital amount. |

T2E | = | The greater of { T2C – 50% MFCR } and zero. |

T2U | = | T2C – T2E. |

T1E | = | The greater of { T1C – (MFCR – T2U) } and zero. |

MCO | = | T1E + 0.50 x T2E. |

2.5.8 The Management Capital Offset is equal to MCO, above.

Division 2.6 Capital Adequacy Liability

2.6.1 Overview

(1) The Capital Adequacy Liability is an intermediate component in the determination of the Health Benefits Fund Capital Adequacy Requirement (HBFCAR), which reflects the assessed liabilities of the Fund on the basis of assumptions which are more conservative (anticipate a more adverse experience) than best estimate assumptions.

| | | | | Health Benefits Fund Capital Adequacy Requirement | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Capital Adequacy Liability | | Renewal Option Reserve | | Business Funding Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | | | | | | | | | | | | | | |

(2) The risks pertaining to each element include the risk of mis-estimation of the mean, the risk of deterioration of the assumed mean, the risk of adverse statistical fluctuations about the mean and the risk of unexpected changes in the underlying distribution of experience.

(3) In essence the Capital Adequacy Liability has a minimum value equal to the liabilities determined in accordance with the requirements of this Standard plus a loading of ‘margin’ as a risk margin for those elements of the liability assessment that contain uncertainty.

2.6.2 The margin for risk to be included in the Capital Adequacy Liability is to be determined in accordance with the provisions of Division 2.7 of this Standard.

2.6.3 The Capital Adequacy Liability of a Fund is to be determined as the sum of 3 components:

(a) Capital Adequacy Net Claims Liability; plus

(b) Capital Adequacy Reinsurance Accrued Liability; plus

(c) Capital Adequacy Other Liabilities.

| | | Capital Adequacy Liability | | | |

| | | | | | | |

| | | | | | | |

Capital Adequacy Net Claims Liability | | Capital Adequacy Reinsurance Accrued Liability | | Capital Adequacy Other Liabilities |

2.6.4 Capital Adequacy Net Claims Liability

The Capital Adequacy Net Claims Liability is determined as the greater of:

(a) the sum of:

(i) {1 + Margin} times the value of the best estimate Outstanding Claims Liability determined in accordance with Division 2.10 of this Standard; plus

(ii) {1 + Margin} times the value of the Reinsurance Outstanding Claims Liability determined in accordance with Division 2.12 of this Standard; plus

(iii) the greater of:

(A) the value of the Unexpired Risk Reserve determined in accordance with Division 2.11 of this Standard; and

(B) the value of the Contributions in Advance determined in accordance with Division 2.11 of this Standard; and

(b) the net value of these liability components reflected in the Reported Liabilities of the Fund.

2.6.5 Capital Adequacy Reinsurance Accrued Liability

(1) The Capital Adequacy Reinsurance Accrued Liability is based on the Reinsurance Liability determined in accordance with Division 2.13 of this Standard.

(2) The value of the Capital Adequacy Accrued Reinsurance Liability is determined as:

(a) {1 + Margin} times Calculated Deficit; minus

(b) Gross Deficit.

2.6.6 Capital Adequacy Other Liabilities

(1) The Capital Adequacy Other Liabilities is the value of the Other Liabilities determined in accordance with the provisions of Division 2.14 of this Standard.

(2) Where the determination of the liabilities of the Fund in accordance with this Standard would have the effect of changing the Other Liabilities assessment of the Fund, then such change should be reflected in the Other Liabilities amount considered under subsection (1).

(3) The primary adjustment that may be relevant to the Other Liabilities under subsection (1) would be in respect of any deferred tax liability held where the Fund was subject to income tax. To the extent that any increase in the Fund’s liabilities provisions would generate a corresponding tax benefit, it may be appropriate to allow for the tax benefit in respect of the cost of the capital adequacy margins held via an adjustment to any deferred tax liability within the Other Liabilities.

Division 2.7 Capital Adequacy Margin

2.7.1 The margin for risk to be included in the Capital Adequacy Liability (Division 2.6) and the Renewal Option Reserve (Division 2.8) is to be determined by the Board as the appropriate level within the quantitative range prescribed in this Standard. The Board is to determine the appropriate margin after consideration of the qualitative factors specified.

2.7.2 The margins adopted must not be less than the minimum value specified in the prescribed range, but may be greater than the high value specified in the prescribed range.

2.7.3 The Margin specified under the Capital Adequacy Liability and the Renewal Option Reserve has the following prescribed quantitative range:

Minimum Value: 12.5%

High Value: 25.0%.

2.7.4 The qualitative factors to be considered in selecting the Margin with regard to the above range is the reliability and stability of the relevant components of the HBFCAR:

(a) A Fund with a large membership base and with a history of stable membership, stable utilisation rates and stable unit costs, could adopt a factor close to or at the Minimum Value above.

(b) A Fund with a small membership base and with a history of variable membership, variable utilisation rates and variable unit costs would adopt a factor close to or at the High Value above.

2.7.5 The following table is intended to give a general guide to the assessment of the appropriate Margin required under Capital Adequacy Liability and the Renewal Option Reserve. The suggested approach follows a process of adding to the Minimum Value for the various factors indicated:

Factor | Margin |

Starting Point (Minimum Value) | +12.5% |

Fund Size, defined as the Fund’s total number of hospital single equivalent units (SEU). | |

Greater than 199,999 | +0% |

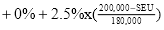

Less than 200,000 and greater than 19,999 |

|

Less than 20,000 and greater than 3,999 |

|

Less than 4,000 | +7.5% |

Fund Membership and Claims Experience Stability: Minimum margin High margin | +0% +5% |

2.7.6 Fund Membership and Claims Experience Stability

(1) The more the following conditions exist, the closer the margin should be to the minimum margin:

(a) Membership numbers have been stable over a number of years.

(b) Utilisation rates and unit costs (allowing for expected seasonal fluctuations) have been stable over a number of years.

(c) Loss ratios have been stable or falling over a number of years.

(2) The more the following conditions exist, the closer the margin should be to the high margin:

(a) Membership numbers have been significantly variable over recent years.

(b) Utilisation rates and unit costs (allowing for expected seasonal fluctuations) have been significantly variable over recent years.

(c) Loss ratios have been increasing over a number of years.

(d) A new product has been introduced which is expected to materially impact the finances of the fund but about which little credible experience is available in respect of utilisation rates and units costs, and where the overall impact of the product on the fund has a high degree of uncertainty.

Division 2.8 Renewal Option Reserve

2.8.1 Overview

(1) The Renewal Option Reserve is an intermediate component in the determination of the Health Benefits Fund Capital Adequacy Requirement (HBFCAR), which reflects the risks associated with the ability of the Fund to accept new members with an appropriate degree of contribution rate stability.

| | | | | Health Benefits Fund Capital Adequacy Requirement | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Capital Adequacy Liability | | Renewal Option Reserve | | Business Funding Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | | | | | | | | | | | | | | |

(2) Members of a Fund have an expectation to maintain and renew their membership of the Fund in the future. To the extent that current contribution rates may prove inadequate to cover future benefits and related Fund expenses, some prospective renewal option reserve is needed. This would reflect the time taken to identify any adverse emerging experience trends and for appropriate corrective action to be taken.

(3) The risks pertaining to each element include the risk of mis-estimation of the mean, the risk of deterioration of the assumed mean, the risk of adverse statistical fluctuations about the mean and the risk of unexpected changes in the underlying distribution of experience.

(4) The Renewal Option Reserve will generate a reserve requirement to the extent that the profit margin contained within the prospective contribution rates is insufficient to cover any contribution rate shortfall, plus the value of the risks evaluated.

2.8.2 The Renewal Option Reserve must make provision for the risks and potential costs in providing the right of renewal to members of the Fund. This reserve is to be assessed via a projection of future contributions, claims and expense experience of the Fund over the prescribed period.

2.8.3 The margin for risk to be included in the Renewal Option Reserve is to be determined in accordance with the provisions of Division 2.7 of this Standard.

2.8.4 The Renewal Option Reserve for a Fund must not be less than zero.

2.8.5 The Renewal Option Reserve is determined based on a conservative business projection of the Fund over the twelve month period subsequent to the valuation date.

2.8.6 Fund Business Projection

(1) Except for those circumstances described in subsection (2), the required Fund business projection is the Fund’s current business plan, with an appropriate margin for risk included in the projection.

(2) Where the Fund’s current business plan has not been determined on a best estimate basis, the Fund business projection adopted for the purposes of the Renewal Option Reserve should be a best estimate projection, with an appropriate margin for risk included in the projection.

(3) The Fund Business Projection may be determined either:

(a) as detailed in sections 2.8.7 to 2.8.14; or

(b) by an Actuary.

2.8.7 The required Fund business projection must allow for the following:

(a) Earned contribution income allowing for:

(i) The contribution rates reflected in the current business plan.

(ii) The contributions projected to be paid during the projection period.

(iii) The Contribution in Advance liability held at the start of the projection period as income, and the corresponding liability at the end of the period as outgo.

(iv) The Contribution in Arrears asset held at the start of the projection period as outgo, and the corresponding asset at the end of the period as income.

(b) Incurred claims allowing for:

(i) Benefit claims outgo based on the claims assumption specified in section 2.8.10.

(ii) The benefits projected to be paid during the projection period.

(iii) The Outstanding Claims liability held at the start of the projection period as outgo, and the corresponding liability at the end of the period as income.

(c) Administration and all other expense outgo on the expense assumptions specified in section 2.8.12.

(d) Reinsurance income and outgo as specified in section 2.8.11.

(e) Investment income at the rate specified in section 2.8.13. This is to be based on the Contributions in Advance and Outstanding Claims liabilities at the start of the period and projected net cashflows during the period. Investment income on Fund surplus at the start of the projection period is to be excluded.

2.8.8 The Renewal Option Reserve is determined as the net present value of the cash outflows less the cash inflows. The rate of interest used for the present value calculation is to be the same as that used under section 2.8.13. If the net present value result is less than zero (projected income exceeds outgo), the result is to be taken as zero.

2.8.9 Contribution Income

(1) The projection specifies reference to the contribution rates in the current business plan. To the extent that the current business plan makes no allowance for future contribution rate increases, then the existing contribution rates should be used in the projection. Note that to the extent that current or any future increased contribution rates are not immediately applicable to all contributors, the resulting contribution income shortfall is to be allowed for in the projection.

(2) However, benefit claims are to be based on the full contribution rate irrespective of any actual contribution shortfall as this is the basis on which the claims ratios adopted have been specified and determined.

2.8.10 Benefit Claims

(1) The projected gross benefit claims are to be determined via the application of a claims ratio to the membership and the effective contribution rate over the projection period. The claims ratio used is to be {1 + Margin} times the greater of:

(a) the equivalent claims ratio used for the purpose of the last contribution rate application made in respect of the Fund; and

(b) the equivalent best estimate claims ratio underlying the current business plans of the Organization in respect of the Fund; and

(c) the best estimate claims ratio used to determine the outstanding claims liability in accordance with Division 2.10 of this Standard.

(2) The cost of any additional options provided to members must also be allowed for based on {1 + Margin} times the best estimate cost of these.

(3) The Margin specified above is to be the Margin determined in accordance with the provisions of Division 2.7 of this Standard.

2.8.11 Reinsurance

(1) Reinsurance outgo and reinsurance income are to be assessed explicitly and separately.

(2) In the case of the Reinsurance Trust Fund:

(a) Income related to actual claims experience is to be determined based on the relevant component of the benefit claims projected and the lesser of the best estimate ratio of claims recoveries to gross claims, and the actual ratio observed over the previous twelve month period.

(b) Payments related to membership profiles, are to be based on the best estimate Average Deficit Per SEU for each quarter of the twelve month period.

(3) In the case of the base amounts determined under subsection (2):

(a) The amount determined under paragraph (2) (a) is to be increased by the same Margin as applies under section 2.8.10.

(b) The amount determined under paragraph (2) (b) is to be increased by the same Margin as applies under section 2.8.10.

2.8.12 Administration and Other Expenses

(1) These are to based on the greater of:

(a) the best estimate non-claim expenses ratio of the Fund over the next 12 months; and

(b) the actual non-claims expense ratio (adjusted to the projected contribution rate) over the previous 12 month period.

(2) The amount determined under subsection (1) is to be increased by a margin equal to 50% of the margin applicable under section 2.8.10.

(3) The non-claims expense ratio is the ratio of all expense outgoings of a Fund, excluding claims and reinsurance amounts, to the gross contribution income of the Fund.

2.8.13 Investment Earnings Rate

The rate of investment earnings to be adopted is to be taken as the market yield available on one year Commonwealth Government Treasury Bonds as at the start date of the projection, less 0.01 (1%).

2.8.14 Taxation

Where an Organization is subject to taxation, appropriate allowance should be made for taxation in the determination of the Renewal Option Reserve. To the extent that any increase in the Fund’s liability provisions would generate a corresponding tax benefit, it may be appropriate to allow for the tax benefit in respect of the cost of the capital adequacy margins held via an adjustment to any deferred tax liability within Other Liabilities.

2.8.15 Where the Renewal Option Reserve is determined by an actuary, the actuary must take into account the requirements of this section in respect of the individual components of the projection.

Division 2.9 Business Funding Reserve

2.9.1 Overview

(1) The Business Funding Reserve is an intermediate component in the determination of the Health Benefits Fund Capital Adequacy Requirement (HBFCAR) which allows for the planned business growth or other relevant business development strategies that are likely to require increased capital reserving or otherwise absorb existing capital resources.

| | | | | Health Benefits Fund Capital Adequacy Requirement | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Capital Adequacy Liability | | Renewal Option Reserve | | Business Funding Reserve | | Inadmissible Assets Reserve | | Resilience Reserve | | Management Capital |

| | | | | | | | | | | | | | | | | | |

(2) The Capital Adequacy Liability and Renewal Option Reserve secure the Fund’s obligations in respect of the general level of membership of the Fund and the basic operation of the Fund. However, in the context of an ongoing operation, it is appropriate to also allow for the impact of anticipated levels of business growth and the impact of related or other relevant business development strategies and plans.

(3) A significant increase in the membership of a Fund will at least require the establishment of related Solvency and Capital Adequacy Requirements, and may involve the incidence of material acquisition costs in terms of items such as advertising expenses and ‘special offers’. Major systems or business redevelopment and restructuring projects are another item of potential capital strain on an Organization and its Fund.

(4) It is inappropriate that the drain on capital involved in these circumstances be borne at the expense of the security of existing members’ entitlements.

(5) A Fund should not be considered capital adequate where a projection of the business of that fund over the next three years, assuming future experience during that period in accordance with best estimate assumptions, and reflecting realistic (best estimate) planned levels of growth in the business, reveals a breach of the Solvency Standard.

(6) It can be argued that it is onerous to require the advance commitment of capital to a Fund, where the actual need for that capital may not emerge for a number of years. However, as the required capital is a consequence of the business plans of the Organization, it is appropriate that the source of that capital be identified. Accordingly it is appropriate to recognise internally sourced capital (shareholders’/members’ capital, existing and/or emerging profits) to the extent that the capital is available to meet the business requirements of the Fund. It is appropriate to recognise externally sourced capital to the extent that the capital has been committed to the business requirements of the Fund.

(7) It is considered appropriate to count, for this purpose, capital residing in, or emerging from, the business of other funds of the Organization, to the extent it is excess to the Capital Adequacy Requirement of those funds and can be transferred into the Fund.

(8) In considering the future (3 year) viability of the fund, it is appropriate to assume that the experience of the fund over that period will be in line with the Board’s best estimates underlying its business plans at the reporting date. The Solvency Requirement which it is necessary to meet into the future is, however, determined in accordance with the Solvency Standard, with appropriate allowance for experience more adverse than best estimate.

PLEASE NOTE

The Business Funding Reserve, in ensuring the Fund’s ability to meet the Solvency Requirement over the next three years, must by implication secure the Solvency Requirement as at the reporting date.

Although some items of prospective capital expense may be intended to be capitalised and amortised over time, to the extent the related assets are not admissible for Solvency purposes, their capital cost cannot be ignored in the Business Funding Reserve.

2.9.2 The HBFCAR must provide for a reserve in respect of any additional capital likely to be required to ensure that, if experience during the next three years is in accordance with the intended business plans of the Organization, the Fund will be able to meet the Solvency Requirement (in accordance with the Solvency Standard) over those three years.

2.9.3 The Business Funding Reserve is determined as:

(a) the additional amount required to ensure that the Solvency Requirement of the Fund will be able to be met over the next three years, allowing for any capital released over that period from the existing business of the Fund; less

(b) New Business Capital.

2.9.4 New Business Capital is the aggregate of:

(a) existing, binding arrangements for the external raising of capital specific to the growth of business within the Fund; and

(b) available capital (existing or emerging) in any other health or other insurance fund of the Organization which is in excess of the Capital Adequacy Requirements of that fund at that time.

2.9.5 The Business Funding Reserve must not be less than zero.

Division 2.10 Outstanding Claims Liability

2.10.1 Overview

(1) The Outstanding Claims Liability is a best estimate liability in respect of the accrued but not admitted claims, and related expense, liabilities of the Fund at the valuation date.

(2) The Outstanding Claims Liability forms the basis for the relevant intermediate component in the determination of the Solvency Liability and the Capital Adequacy Liability.

2.10.2 The Outstanding Claims Liability is to be a best estimate of the value of the outstanding claims liability of the Fund as at the valuation date. This includes an allowance for claims handling expenses. Outstanding claims relate to claims that have been reported and have not yet been settled, claims which have been incurred but not yet reported (IBNR) and claims which have been administratively finalised and which may be reopened.

2.10.3 The Outstanding Claims Liability is to be determined gross of recoveries from the Reinsurance Trust Fund.

2.10.4 The valuation method to be adopted to determine the Outstanding Claims Liability must take appropriate account of:

(a) the historical pattern, over a minimum period of the 12 months immediately prior to the valuation date, of the rate of reporting of claims, the rate of settlement of claims, the development of benefit payments and the impact of refunds; and

(b) trends in utilisation rates and unit costs, especially regarding seasonality and other factors which may influence claims lodgement or processing trends; and

(c) any special features or changes to the experience such as changes in benefit design, claims handling procedures and the mix of products and members.

2.10.5 Chain Ladder Method

(1) An example of a method that could be adopted to determine the Outstanding Claims Liability is a ‘chain ladder’ method specified as follows:

(a) The claims incurred and admitted over the previous 3 years are tabulated by calendar month of incidence (down) and by calendar month of payment delay (across).

(b) For each calendar month of incidence, the cumulative payment totals are to be determined (across).

(c) From this cumulative payments table, average cumulative payment ratios by development month may be determined.

(d) From these ratios the outstanding cumulative payments by calendar month of incidence may be projected, with the results differenced to determine the projected outstanding claims payments by calendar month of incidence.

(e) The sum of the projected outstanding claims payments from paragraph (d), plus an allowance for claims handling expenses, gives an outstanding claims liability.

(2) The calculation under subsection (1) is to be undertaken based on amounts gross of recoveries from the Reinsurance Trust Fund.

(3) Where the historic claims data to be used in the above specified process has been affected by one-off events or distortions, the data used is to be suitably adjusted for these effects. Whilst this adjustment may be to adjust the timing of payments, it should not generally reduce the total quantum of the historic payments applying over time.

(4) A separate calculation is required under subsection (1) for each material Claims Group that displays, or is expected to display a different claims development pattern.

(5) A Claims Group relates to Claims that display, or are expected to display, similar benefit payment run-off patterns. For example, the separation of the overall claims run-off analysis between benefit tables with different annual benefit ‘excesses’ may be appropriate where there are material volumes of claims with more than one category of ‘excess’ applicable.

(6) The result of the above calculation is then to be grossed up by an appropriate factor to allow for associated claims handling expenses. The allowance for claims handling expenses made should be based on an analysis of the ratio of historic claims handling expenses to historic claims payment amounts.

(7) It is important to ensure the historic claims payment run-off gives a meaningful indication of likely future run-off patterns. Where it is known that the historic data contains features, such as temporary claims payment delays, the data should be adjusted for these effects. This may include increasing the most recent period payment amount where it is expected to be understated. In this case, the upward adjustment amount should be added to the projected outstanding claims result.

(8) In some cases the portfolio Claims Group mix of business may be changing but historic claims run-off data for the newer Claims Groups is insufficient for a reliable analysis as set out in subsection (1). In this case some suitable conservative adjustment to a macro analysis could be made based on the best judgement of the Board. The adjustment should not generally reduce the macro result otherwise obtained.

Division 2.11 Contributions in Advance & Unexpired Risk Reserve

2.11.1 Overview

(1) The liability for Contributions in Advance is the amount of contributions actually received prior to the valuation date for insurance cover to be provided for periods after the valuation date.

(2) The Unexpired Risk Reserve is a calculation of the value of future claims, reinsurance and expense liability of the Fund arising in respect of the amount of Contributions in Advance.

(3) The Contributions in Advance and Unexpired Risk Reserve liabilities form the basis for the relevant intermediate component in the determination of the Solvency Liability and the Capital Adequacy Liability.

2.11.2 Contributions in Advance

(1) The Contributions in Advance amount is to be determined in respect of contributions paid in advance, that is contributions paid prior to the date of valuation which provide cover to members in respect of some period beyond the valuation date. The Contributions in Advance amount is the pro rata amount of a contribution in respect of the period of cover after the valuation date relative to the total period originally covered by the contribution paid.

(2) The pro rata calculation required of subsection (1) is to be determined on a precise number of days basis for each contribution amount.

2.11.3 Unexpired Risk Reserve

(1) The Unexpired Risk Reserve is determined as the Contributions in Advance times the Loss Ratio specified below.

(2) The Loss Ratio is ordinarily to be determined as the sum of the Claims Ratio and the Expense Ratio. Where the Board believes that this may no longer be a best estimate measure of the prospective annualised loss ratio for the Fund on the current contribution rates, a suitable alternative ratio is to be adopted.

(3) The Claims Ratio is determined as the ratio of the Fund’s expected claims, reinsurance payments and reinsurance recoveries to earned contributions underlying the effective contribution rate of the Fund.

(4) The Expense Ratio is determined as the ratio of the Fund’s expenses to earned contributions underlying the effective contribution rate of the Fund.

(5) It is noted that the onus is on the Board to adopt a realistic and genuine best estimate of the Loss Ratio. This should have regard to the most recent rate review for the Fund, recent actual experience of the Fund (adjusted for changes in underlying contribution rates) and the effect of cyclical changes in this ratio over the year.

(6) The Unexpired Risk Reserve would normally be calculated at an aggregate level for the Fund.

(7) The prospective annualised loss ratio should be determined on the basis of the 12 month period following the valuation and would normally be expected to reconcile to that used in determining the Renewal Option Reserve.

Division 2.12 Reinsurance Outstanding Claims Liability

2.12.1 Overview

(1) In this Standard, Reinsurance refers to the statutory pooling arrangement under the Health Benefits Reinsurance Trust Fund.

(2) At any point in time a Fund needs to allow for the two components of reinsurance, namely:

(a) the net amount in respect of recoveries from and payments to the Reinsurance Trust Fund in respect of unpresented and outstanding claims (Reinsurance Outstanding Claims Liability); and

(b) the net amount in respect of recoveries from and payments to the Reinsurance Trust Fund in respect of the period just ended (Reinsurance Accrued Liability).

(3) The Reinsurance Outstanding Claims Liability reflects the best estimate reinsurance liability in respect of the Outstanding Claims Liability of the Fund. The net amount is determined as the difference between the relevant Calculated Deficit and the relevant Gross Deficit.

2.12.2 In determining the Solvency Liability and the Capital Adequacy Liability, proper allowance for the statutory pooling reinsurance arrangements must be made. It is the liabilities net of reinsurance costs and benefits which must be determined in accordance with this Standard.

2.12.3 In this context it is noted that reinsurance can involve both asset and liability components (both recoveries into and payments out of the Fund). This Standard covers the assessment of all component impacts of reinsurance irrespective of whether the net results of the reinsurance is, or is anticipated to be, an asset or liability of the Fund.

2.12.4 Anticipated recoveries from the Reinsurance Trust Fund are to be treated as a deduction from the liabilities, and not an asset, of a Fund.

2.12.5 The Reinsurance Outstanding Claims Liability relates to the net reinsurance liability, determined as the Calculated Deficit minus the Gross Deficit, in respect of the Outstanding Claims Liability determined under Division 2.10 of this Standard.

2.12.6 Calculated Deficit

(1) The Calculated Deficit in respect of the outstanding claims liability is to be determined on a basis consistent with the quarterly determination of the Calculated Deficit required under the Reinsurance Trust Fund.

(2) The Calculated Deficit is to be determined from a best estimate of the membership profile of the Fund and a best estimate Average Deficit Per SEU for the relevant period.

(3) The best estimate Average Deficit Per SEU is to be determined taking into account the Average Deficit Per SEU for previous quarters, historical seasonal trends in the Average Deficit Per SEU, reasonable assumptions in respect of the claims experience of all Funds at State level and reasonable assumptions in respect of the total membership of all Funds at State level.

2.12.7 Gross Deficit

(1) The Gross Deficit is the amount in respect of the outstanding claims liability that can be recovered from the Reinsurance Trust.

(2) The Gross Deficit is to be based on the underlying determination of the Outstanding Claims Liability with the estimated recoveries to be based on the historic relationship of the gross claims and recoveries experience.

2.12.8 The statutory reinsurance recoveries would be determined on the same method as specified for the associated Outstanding Claims Liability, but based on reinsurance recovery amounts rather than gross claim payments made. Where the reinsurance recovery does not vary by claims delay duration, the reinsurance recovery amount may be estimated via a uniform proportion of the gross projected claims amount, where the uniform proportion is based on historic experience.

Division 2.13 Reinsurance Accrued Liability

2.13.1 Overview

(1) In this Standard, Reinsurance refers to the statutory pooling arrangement under the Health Benefits Reinsurance Trust Fund.

(2) At any point in time a Fund needs to allow for the two components of reinsurance, namely:

(a) the net amount in respect of recoveries from and payments to the Reinsurance Trust Fund in respect of unpresented and outstanding claims (Reinsurance Outstanding Claims Liability); and

(b) the net amount in respect of recoveries from and payments to the Reinsurance Trust Fund in respect of the period just ended (Reinsurance Accrued Liability).

(3) The Reinsurance Accrued Liability reflects the best estimate net reinsurance liability in respect of the period ending at the valuation date and not payable until after the balance date. The net amount is determined as the difference between the relevant Calculated Deficit and the relevant Gross Deficit.

2.13.2 In determining the Solvency Liability and the Capital Adequacy Liability, proper allowance for the statutory pooling reinsurance arrangements must be made. It is the liabilities net of reinsurance costs and benefits which must be determined in accordance with this Standard.

2.13.3 In this context it is noted that reinsurance can involve both asset and liability components (both recoveries into and payments out of the Fund). This Standard covers the assessment of all component impacts of reinsurance irrespective of whether the net results of the reinsurance is, or is anticipated to be, an asset or liability of the Fund.

2.13.4 Anticipated recoveries from the Reinsurance Trust Fund are to be treated as a deduction from the liabilities, and not an asset, of a Fund.

2.13.5 The Reinsurance Accrued Liability relates to the net reinsurance liability, determined as the Calculated Deficit minus the Gross Deficit, that has accrued under the Reinsurance Trust Fund, in respect of the period ending at the valuation date.

2.13.6 Calculated Deficit

(1) The Calculated Deficit is to be determined from the actual relevant historic membership profile of the Fund and a best estimate Average Deficit Per SEU for the period concerned.

(2) The best estimate Average Deficit Per SEU is to be determined taking into account the Average Deficit Per SEU for previous quarters, historical seasonal trends in the Average Deficit Per SEU, reasonable assumptions in respect of the claims experience of all Funds at State level and reasonable assumptions in respect of the total membership of all Funds at State level.

2.13.7 Gross Deficit

The Gross Deficit is to be determined on the basis of the actual benefits paid during the period that can be recovered from the Reinsurance Trust Fund.

Division 2.14 Other Liabilities

2.14.1 Overview