1 Name of Determination [see Note 1]

This Determination is the Radiocommunications (Spectrum Licence Tax) Determination 1999.

2 Commencement

This Determination commences on 11 October 1999.

3 Initial holding date (Act s 4)

(1) For a spectrum licence in force on 11 October 1999, that day is the initial holding date for the licence.

(2) For a spectrum licence that comes into force on 11 October in a year after 1999, that day is the initial holding date for the licence.

(3) For any other spectrum licence, the initial holding date for the licence is the first 11 October that happens after the licence comes into force.

4 Working out spectrum licence tax (Act s 7)

The amount of tax on a spectrum licence is worked out using Schedule 1.

Schedule 1 Working out spectrum licence tax

(section 4)

Part 1 Base amounts

The base amount for the frequency range mentioned in an item in table 1 is the base amount specified in the item in relation to the frequency range.

Table 1

Item | Frequency range | Total specified spectrum | Base amount ($) |

101 | 500.99375–504.99375 MHz | 8 MHz | 5 126 |

| 510.99375–514.99375 MHz | | |

102 | 825–845 MHz | 40 MHz | 19 527 |

| 870–890 MHz | | |

103 | 1710–1755 MHz | 90 MHz | 60 929 |

| 1805–1850 MHz | | |

104 | 1755–1785 MHz | 60 MHz | 60 929 |

| 1850–1880 MHz | | |

105 | 1900–1980 MHz | 155 MHz | 60 929 |

| 2010–2025 MHz | | |

| 2110–2170 MHz | | |

106 | 3425–3492.5 MHz | 100 MHz | 60 862 |

| 3542.5–3575 MHz | | |

107 | 26.5–27.5 GHz | 1 000 MHz | 87 326 |

108 | 27.5–28.35 GHz | 1 150 MHz | 48 753 |

| 31–31.3 GHz | | |

Note 1 Each frequency range in Table 1 comprises 1 or more of the following:

(a) spectrum designated in a written notice under s 36 of the Radiocommunications Act 1992 to be allocated by issuing spectrum licences with respect to a particular area;

(b) spectrum specified in a spectrum re-allocation declaration made by the Minister under subs 153B (1) of the Radiocommunications Act 1992;

(c) spectrum being considered for specification in a spectrum re-allocation declaration made under subs 153B (1) of the Radiocommunications Act 1992.

Note 2 The base amount for a frequency range mentioned in an item in Table 1 will generally, but not always, be equal to the SMC component of the annual amount of tax payable for spectrum access relating to an Australia-wide transmitter licence involving:

(a) spectrum within the lower and upper limits of the frequency range; and

(b) a bandwidth equal to the total amount of spectrum in the frequency range.

Transmitter licence tax has 2 components: a spectrum access tax (SAT) and a spectrum maintenance charge (SMC). Each is a percentage of the total amount of transmitter licence tax.

Part 2 Method statement

Step 1A Step 1A is to be used when working out spectrum licence tax for the initial holding date for the licence, and for each anniversary of the initial holding date except the last anniversary.

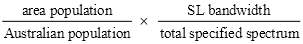

For each relevant frequency range in relation to a licence, take the base amount for that frequency range and multiply it by:

Step 1B Step 1B is to be used only when working out spectrum licence tax for the last anniversary of the initial holding date for the licence.

For each relevant frequency range in relation to the licence, take the base amount for that frequency range and multiply it by:

Step 2 Add together the amounts worked out in step 1A or 1B for each relevant frequency range and round the result to the nearest dollar (an amount ending in 50 cents is to be rounded up).

Step 3 The amount of spectrum licence tax payable for the spectrum licence is the greater of:

(a) the amount worked out in step 2; and

(b) $7.

Part 3 Definitions

area population, for a spectrum licence, means the population of the area covered by the spectrum licence, as reported in the 2001 census.

Australian population means the population of Australia, as reported in the 2001 census.

days, for step 1B, means the number of days in the period:

(a) starting on the last anniversary of the initial holding date for a spectrum licence; and

(b) ending when the licence ends.

relevant frequency range, for a spectrum licence, means a frequency range mentioned in an item in Table 1 which includes some or all of the spectrum covered by the licence.

SL bandwidth, for a relevant frequency range in relation to a spectrum licence, means the actual amount of the spectrum covered by the spectrum licence falling within that range.

total specified spectrum, for a frequency range mentioned in an item in Table 1, means the amount of spectrum specified in that way in the item.