Family Law (Superannuation) (Methods and Factors for Valuing Particular Superannuation Interests) Approval 2003

as amended

made under regulations 38 and 43A of the

Family Law (Superannuation) Regulations 2001

This compilation was prepared on 20 April 2006

taking into account amendments up to Family Law (Superannuation)

(Methods and Factors for Valuing Particular Superannuation Interests)

Amendment Approval 2006 (No. 2)

This document has been split into four volumes

Volume 1 contains Sections 1 to 4 and Schedule 1 (Parts 1 and 2),

Volume 2 contains Schedule 1 (Parts 3 and 4),

Volume 3 contains Schedule 1 (Part 5), and

Volume 4 contains Schedules 2 to 10 and the Notes

Each volume has its own Table of Contents

Prepared by the Office of Legislative Drafting and Publishing,

Attorney-General’s Department, Canberra

Contents

Schedule 2 Public sector superannuation plans — New South Wales

Part 1 Local Government Superannuation Scheme

Part 5 New South Wales Police Superannuation Scheme

Division 5.1 Definitions

Division 5.2 Interests in the growth phase

Division 5.3 Interests in the payment phase

Division 5.4 Factors

Part 6 Police Association Superannuation Scheme

Division 6.1 Definitions

Division 6.2 Interests in the growth phase

Division 6.3 Interests in the payment phase

Division 6.4 Factors

Part 7 New South Wales State Authorities Superannuation Scheme

Division 7.1 Definitions

Division 7.2 Interests in the growth phase

Division 7.3 Interests in the payment phase

Division 7.4 Factors

Part 9 NSW State Authorities Non‑contributory Superannuation Scheme

Schedule 3 Public sector superannuation plans — Victoria

Part 1 Superannuation scheme established by the State Superannuation Act 1988 (Vic) — new scheme members

Division 1.1 Definitions

Division 1.2 Interests in the growth phase

Division 1.3 Interests in the payment phase

Part 2 Superannuation scheme established by the State Superannuation Act 1988 (Vic) — revised scheme members

Part 3 Victorian State Employees Retirement Benefits Scheme

Part 4 Benefits provided under the Superannuation Benefits Act 1977 (Vic)

Part 5 Victorian Transport Superannuation Fund

Division 5.1 Definitions

Division 5.2 Interests in the growth phase

Division 5.3 Interests in the payment phase

Part 6 State Parliamentary Contributory Superannuation Fund

Division 6.1 Definitions

Division 6.2 Interests in the growth phase

Division 6.3 Interests in the payment phase

Division 6.4 Factors

Schedule 4 Public sector superannuation plans — Queensland

Part 1 Superannuation scheme established by the Superannuation (State Public Sector) Deed 1990 (Qld)

Part 2 Parliamentary Contributory Superannuation Fund

Part 3 Local Government Superannuation Scheme

Schedule 5 Public sector superannuation plans — Western Australia

Part 1 Gold State Super Scheme

Schedule 6 Public sector superannuation plans — South Australia

Part 1 South Australian Superannuation Fund

Division 1.1 Definitions

Division 1.2 Interests in the growth phase

Division 1.3 Interests in the payment phase

Division 1.4 Factors

Part 2 South Australian Local Government Superannuation Scheme

Part 3 South Australian Police Superannuation Scheme

Division 3.1 Definitions

Division 3.2 Interests in the growth phase

Division 3.3 Interests in the payment phase

Division 3.4 Factors

Part 4 South Australian Parliamentary Superannuation Scheme

Part 5 South Australian Judges’ Pension Scheme

Division 5.1 Definitions

Division 5.2 Interests in the growth phase

Division 5.3 Interests in the payment phase

Division 5.4 Factors

Schedule 7 Public sector superannuation plans — Tasmania

Schedule 8 Public sector superannuation plans — Australian Capital Territory

Schedule 9 Public sector superannuation plans — Northern Territory

Schedule 10 Other superannuation plans

Part 22 Energy Industries Superannuation Scheme

Part 30 Ford superannuation plans

Part 35 GlaxoSmithKline Superannuation Fund

Part 40 Hanson Australia Pty Limited as a participating employer in Sunsuper

Part 90 RACV superannuation fund

Part 105 UniSuper superannuation fund

Division 105.1 Definitions

Division 105.2 Interests in the growth phase

Division 105.3 Interests in the payment phase

Division 105.4 Factors for interests in the payment phase

Part 110 Victorian Racing Industry Superannuation Fund

Part 115 Woodside Superannuation Fund

Part 116 Woolworths Group Superannuation Scheme

Notes

Schedule 2 Public sector superannuation plans — New South Wales

(section 4)

Part 1 Local Government Superannuation Scheme

1 Definitions

In this Part:

Early Retirement Age has the meaning given by rule 1.1 of the Rules.

LGSS means the Local Government Superannuation Scheme established by the Trust Deed.

Rules means the rules set out in Schedule 2 to the Trust Deed.

Trust Deed means the Trust Deed dated 30 June 1997, entered into by the Treasurer of New South Wales and LGSS Pty Limited, as amended and in force on the commencement of this Part.

2 Methods and factors for interests of members in the LGSS

For an interest that:

(a) is in the growth phase in the LGSS; and

(b) is mentioned in an item in the following table;

the method or factor mentioned in the item is approved for section 4 of this instrument.

Item | Interest in the growth phase | Method or factor |

1 | An interest that a person has in the LGSS if the person has elected to make provision for a benefit provided by rule 5.10 of the Rules. | CFB + EFB × Fy+m where: CFB is the amount of the contributor‑financed benefit that would have been payable to the person under paragraph 5.10.8 (a) of the Rules if the person had been eligible to receive that benefit on the relevant date. |

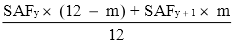

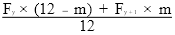

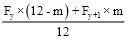

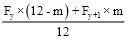

| | EFB is the amount of the employer‑financed benefits that would have been payable to the person under paragraph 5.10.8 (b) of the Rules if the person had been eligible to receive that benefit on the relevant date. Fy+m is the factor calculated in accordance with the following formula:. |

| |

where: Fy is the valuation factor mentioned in Table 1 of this Part that applies to the period in completed years (y) commencing on the relevant date and ending on the date when the person will reach the person’s Early Retirement Age. m is the number of complete months commencing on the relevant date and ending on the date when the person will reach the person’s Early Retirement Age that are not included in the completed years mentioned in the definition of the factor Fy. Fy+1 is the valuation factor mentioned in Table 1 of this Part that applies to the period in completed years (y) commencing on the relevant date and ending 1 year after the date when the person will reach the person’s Early Retirement Age. |

Table 1 Valuation factors

Number of completed years until Early Retirement Age | Factor |

37 | 0.716 |

36 | 0.722 |

35 | 0.729 |

34 | 0.735 |

33 | 0.742 |

32 | 0.749 |

31 | 0.756 |

30 | 0.762 |

29 | 0.769 |

28 | 0.776 |

27 | 0.783 |

26 | 0.791 |

25 | 0.798 |

24 | 0.805 |

23 | 0.812 |

22 | 0.820 |

21 | 0.827 |

20 | 0.835 |

19 | 0.842 |

18 | 0.850 |

17 | 0.858 |

16 | 0.865 |

15 | 0.873 |

14 | 0.881 |

13 | 0.889 |

12 | 0.897 |

11 | 0.905 |

10 | 0.914 |

9 | 0.922 |

8 | 0.930 |

7 | 0.939 |

6 | 0.947 |

5 | 0.956 |

4 | 0.964 |

3 | 0.973 |

2 | 0.982 |

1 | 0.991 |

0 | 1.000 |

Part 5 New South Wales Police Superannuation Scheme

Division 5.1 Definitions

1 Definitions

(1) In this Part:

age at entry means the age, in completed years, when a person became a contributor.

Police Superannuation Scheme means the superannuation scheme constituted by the PRS Act.

Police Superannuation Regulation means the Police Superannuation Regulation 2005 (NSW).

PRS Act means the Police Regulation (Superannuation) Act 1906 (NSW).

(2) A reference in this Part to the requirements of Division 2.2 of the Regulations being satisfied does not include a reference to the requirements of that Division being satisfied by making a payment of the kind mentioned in regulation 14H of the Regulations.

(3) An expression used in this Part and in the PRS Act or in a provision of that Act has the same meaning in this Part as it has in the PRS Act or the provision of that Act.

Note 1 The following expressions are defined in subsection 1 (2) of the PRS Act:

attributed salary of office

contributor

executive officer

member of the police force

STC.

Note 2 Equivalent service ratio is defined in section 6 of the PRS Act.

Division 5.2 Interests in the growth phase

2 Method for interests in Police Superannuation Scheme

For an interest:

(a) that is held by a member of the police force other than an executive officer who elected to make provision for a benefit in accordance with paragraph 5B (1) (b) of the PRS Act; and

(b) that is in the growth phase in the Police Superannuation Scheme;

the method set out in the following table is approved for section 4 of this instrument.

Method |

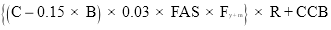

where: AS, ESR, NEA, B and C have the meanings given by subclause 3 (1). Fae,y+m has the meaning given by subclause 3 (2). R is the reduction factor under clause 4. |

3 Definition of terms and expressions

(1) In clause 2 and, unless expressly modified, in any other provision in this Part:

AS is the attributed salary of office of the person at the relevant date.

B is the total number of days, in the period commencing on 1 July 1988 and ending at the end of the relevant date, for which:

(a) contributions were deducted from the person’s salary of office under subsection 5 (1) of the PRS Act; or

(b) amounts were paid by the person under section 5A of the PRS Act, being amounts that are deemed, under subsection 5A (6) of that Act, to have been deducted from the person’s salary of office.

C is the total number of days, as at the relevant date (including, if applicable, that date) for which:

(a) contributions were deducted from the person’s salary of office under subsection 5 (1) of the PRS Act; or

(b) amounts were paid by the person under section 5A of the PRS Act, being amounts that are deemed, under subsection 5A (6) of that Act, to have been deducted from the person’s salary of office.

ESR is the person’s equivalent service ratio at the relevant date.

NEA is the person’s notional employee account, being the sum of the amounts referred to in paragraphs 10 (1) (a), (b) and (c) of the Police Superannuation Regulation if STC were required to reduce the amount of the person’s benefit under subsection 14AA (1) of the PRS Act, at the relevant date.

(2) In clause 2 and, unless expressly modified, in any other provision in this Part:

Fae,y+m is calculated in accordance with the formula:

where:

Fae,y is the valuation factor in whichever of Table 1 or 2 of Division 5.4 is applicable, given:

(a) the person’s gender; and

(b) the person’s age in completed years at the relevant date (y); and

(c) the person’s age at entry (ae).

m is the number of complete months of the person’s age that are not included in the person’s age in completed years at the relevant date.

Fae,y+1 is the valuation factor mentioned in whichever of Table 1 or 2 of Division 5.4 is applicable to the person if the person’s age in completed years at the relevant date were 1 year more than it is.

4 Reduction factor

(1) Reduction factor is:

(a) if the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlement of only one spouse of the person, being an entitlement arising under a particular superannuation agreement, flag lifting agreement or splitting order that applies in respect of the interest — the amount calculated in accordance with the formula set out in subclause (2); or

(b) if the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlements of 2 or more spouses of the person, being entitlements each arising under a superannuation agreement, flag lifting agreement or splitting order that applies to the interest — the product of the amounts calculated in accordance with the formula set out in subclause (2) in respect of each entitlement; or

(c) in any other case — 1.

(2) For paragraphs (1) (a) and (b), each amount is calculated in accordance with the formula:

where:

NMProp is the quotient of:

(a) the value of the spouse’s entitlement under the agreement or order immediately before the time when the requirements of Division 2.2 of the Regulations were satisfied; and

(b) the gross value of the person’s interest, immediately before those requirements were satisfied, determined in accordance with the method set out in the table following clause 2.

BenProp is the quotient of:

(a) the product of Cs and TAs; and

(b) the product of C and TArd;

where:

Cs is the total number of days, as at the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse of the person under the superannuation agreement, flag lifting agreement or splitting order (including, if applicable, that date), for which:

(a) contributions were deducted from the person’s salary of office under subsection 5 (1) of the PRS Act; or

(b) amounts were paid by the person under section 5A of the PRS Act, being amounts that are deemed, under subsection 5A (6) of that Act, to have been deducted from the person’s salary of office.

TAs is the amount of tax adjustment in respect of the person immediately before the time when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse under the superannuation agreement, flag lifting agreement or splitting order, calculated in accordance with the formula set out in subclause 5 (1).

C has the meaning given by subclause 3 (1).

TArd is the amount of tax adjustment in respect of the person at the relevant date, calculated in accordance with the formula set out in subclause 5 (2).

5 Tax adjustment

(1) TAs is calculated in accordance with the formula:

where:

EFBProps is the quotient of:

(a) EFBs, being the value of the person’s employer‑financed benefit, immediately before the time when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse under the superannuation agreement, flag lifting agreement or splitting order, calculated in accordance with the formula:

where:

AS, ESR, NEA, B and C have the meanings given by subclause 3 (1), modified so that a reference to ‘the relevant date’ in relation to each of those terms is a reference to ‘the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse under the superannuation agreement, flag lifting agreement or splitting order’.

Fae,y+m has the meaning given by subclause 3 (2), modified so that a reference to ‘the relevant date’ in relation to that term is a reference to ‘the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse under the superannuation agreement, flag lifting agreement or splitting order’.

; and

(b) the person’s total benefit at the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse of the person under the superannuation agreement, flag lifting agreement or splitting order, being the sum of:

(i) EFBs calculated in accordance with the formula set out in paragraph (a); and

(ii) NEA as defined in subclause 3 (1) but modified so that the reference to ‘the relevant date’ in that definition is a reference to ‘the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse under the superannuation agreement, flag lifting agreement or splitting order’.

CSProps is the quotient of:

(a) the total number of days, in the period commencing on 1 July 1988 and ending on the day immediately before the time when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse of the person under the superannuation agreement, flag lifting agreement or splitting order, for which:

(i) contributions were deducted from the person’s salary of office under subsection 5 (1) of the PRS Act; or

(ii) amounts were paid by the person under section 5A of the PRS Act, being amounts that are deemed, under subsection 5A (6) of that Act, to have been deducted from the person’s salary of office; and

(b) Cs (as defined in subclause 4 (2)).

(2) TArd is calculated in accordance with the formula:

where:

EFBProp is the quotient of:

(a) EFBrd calculated in accordance with the formula:

where:

AS, ESR, NEA, B and C have the meanings given by subclause 3 (1).

Fae,y+m has the meaning given by subclause 3 (2).

; and

(b) the person’s total benefit at the relevant date, being the sum of:

(i) EFBrd calculated in accordance with the formula set out in paragraph (a); and

(ii) NEA (as defined in subclause 3 (1)).

CSProp is the quotient of B and C (as defined in subclause 3 (1)).

Division 5.3 Interests in the payment phase

6 Method for interests in Police Superannuation Scheme

For an interest that:

(a) is held by a person:

(i) who was a member of the police force; or

(ii) who was, at the time of the death of a person who was or who had been a member of the police force, a spouse, or de facto partner within the meaning given by subsection 1 (2) of the PRS Act, of that deceased person; and

(b) in respect of which a superannuation allowance is payable under the PRS Act; and

(c) is in the payment phase in the Police Superannuation Scheme;

the method set out in the following table is approved for section 4 of this instrument.

Method |

where: SA is the amount of annual superannuation allowance payable to the person in respect of the interest at the relevant date. SAFy+m is the amount calculated in accordance with the formula:

where: SAFy is the valuation factor mentioned in whichever of Table 3 or 4 of Division 5.4 is applicable, given: (a) the person’s gender; and (b) the person’s age in completed years at the relevant date (y); and (c) the type of superannuation allowance. m is the number of complete months of the person’s age that are not included in the person’s age in completed years at the relevant date. SAFy+1 is the valuation factor mentioned in whichever of Table 3 or 4 of Division 5.4 is applicable if the person’s age in completed years at the relevant date were 1 year more than it is. |

Division 5.4 Factors

Table 1 Police Superannuation Scheme — male members of the Police Force |

Age at relevant date | Age at Entry |

19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 |

34 | 3.4 | | | | | | | | | | | | | | | |

35 | 3.6 | 3.5 | | | | | | | | | | | | | | |

36 | 3.8 | 3.7 | 3.6 | | | | | | | | | | | | | |

37 | 4.1 | 4.0 | 3.8 | 3.7 | | | | | | | | | | | | |

38 | 4.3 | 4.2 | 4.1 | 3.9 | 3.9 | | | | | | | | | | | |

39 | 4.7 | 4.5 | 4.4 | 4.2 | 4.1 | 4.0 | | | | | | | | | | |

40 | 5.0 | 4.8 | 4.6 | 4.5 | 4.4 | 4.2 | 4.1 | | | | | | | | | |

41 | 5.2 | 5.1 | 5.0 | 4.8 | 4.7 | 4.5 | 4.4 | 4.3 | | | | | | | | |

42 | 5.5 | 5.3 | 5.3 | 5.2 | 4.9 | 4.8 | 4.7 | 4.5 | 4.3 | | | | | | | |

43 | 5.7 | 5.6 | 5.5 | 5.4 | 5.3 | 5.1 | 5.0 | 4.8 | 4.6 | 4.4 | | | | | | |

44 | 6.0 | 5.9 | 5.8 | 5.7 | 5.6 | 5.4 | 5.3 | 5.1 | 4.9 | 4.7 | 4.5 | | | | | |

45 | 6.2 | 6.1 | 6.0 | 5.9 | 5.8 | 5.7 | 5.6 | 5.4 | 5.2 | 4.9 | 4.7 | 4.6 | | | | |

46 | 6.4 | 6.3 | 6.3 | 6.2 | 6.1 | 6.0 | 5.9 | 5.8 | 5.5 | 5.3 | 5.0 | 4.8 | 4.7 | | | |

47 | 6.7 | 6.6 | 6.5 | 6.5 | 6.4 | 6.3 | 6.2 | 6.0 | 5.8 | 5.6 | 5.3 | 5.1 | 4.9 | 4.7 | | |

48 | 6.9 | 6.8 | 6.7 | 6.7 | 6.6 | 6.6 | 6.5 | 6.3 | 6.2 | 6.0 | 5.7 | 5.4 | 5.1 | 4.9 | 4.7 | |

49 | 7.1 | 7.1 | 7.0 | 6.9 | 6.9 | 6.8 | 6.7 | 6.6 | 6.4 | 6.2 | 6.1 | 5.8 | 5.5 | 5.2 | 4.9 | 4.8 |

50 | 7.3 | 7.3 | 7.2 | 7.2 | 7.2 | 7.1 | 7.0 | 6.9 | 6.7 | 6.5 | 6.3 | 6.1 | 5.8 | 5.6 | 5.2 | 5.0 |

51 | 7.5 | 7.5 | 7.4 | 7.4 | 7.4 | 7.3 | 7.2 | 7.1 | 6.9 | 6.8 | 6.5 | 6.3 | 6.1 | 5.7 | 5.5 | 5.2 |

52 | 7.7 | 7.6 | 7.6 | 7.6 | 7.6 | 7.5 | 7.5 | 7.3 | 7.2 | 7.0 | 6.8 | 6.5 | 6.3 | 6.0 | 5.7 | 5.6 |

53 | 7.9 | 7.9 | 7.8 | 7.8 | 7.8 | 7.8 | 7.7 | 7.6 | 7.4 | 7.2 | 7.0 | 6.8 | 6.6 | 6.4 | 6.1 | 5.8 |

54 | 8.1 | 8.1 | 8.0 | 8.0 | 8.0 | 8.0 | 8.0 | 7.9 | 7.6 | 7.5 | 7.2 | 7.1 | 6.9 | 6.5 | 6.4 | 6.0 |

55 | 8.3 | 8.3 | 8.3 | 8.2 | 8.2 | 8.2 | 8.2 | 8.1 | 7.9 | 7.7 | 7.5 | 7.3 | 7.1 | 6.8 | 6.5 | 6.2 |

56 | 8.4 | 8.4 | 8.4 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.2 | 8.1 | 7.9 | 7.7 | 7.4 | 7.2 | 6.8 | 6.5 |

57 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.5 | 8.4 | 8.4 | 8.4 | 8.3 | 8.2 | 8.0 | 7.8 | 7.3 | 7.1 | 7.0 |

58 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.5 | 8.5 | 8.5 | 8.5 | 8.4 | 8.2 | 7.9 | 7.7 | 7.4 | 7.2 |

59 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.6 | 8.6 | 8.6 | 8.7 | 8.6 | 8.6 | 8.4 | 8.2 | 8.0 | 7.7 | 7.4 |

60 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.4 | 8.2 | 8.0 | 7.7 |

61 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.4 | 8.3 | 8.0 |

62 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.5 | 8.2 |

63 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.3 |

64 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 |

65 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 |

Table 2 Police Superannuation Scheme — female members of the Police Force |

Age at relevant date | Age at Entry |

19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 |

34 | 3.1 | | | | | | | | | | | | | | | |

35 | 3.3 | 3.2 | | | | | | | | | | | | | | |

36 | 3.6 | 3.4 | 3.4 | | | | | | | | | | | | | |

37 | 3.8 | 3.7 | 3.6 | 3.5 | | | | | | | | | | | | |

38 | 4.1 | 4.0 | 3.8 | 3.7 | 3.6 | | | | | | | | | | | |

39 | 4.4 | 4.2 | 4.1 | 4.0 | 3.8 | 3.7 | | | | | | | | | | |

40 | 4.7 | 4.6 | 4.4 | 4.3 | 4.1 | 4.0 | 3.9 | | | | | | | | | |

41 | 4.9 | 4.8 | 4.7 | 4.6 | 4.4 | 4.3 | 4.1 | 4.0 | | | | | | | | |

42 | 5.2 | 5.1 | 5.0 | 4.9 | 4.7 | 4.6 | 4.4 | 4.3 | 4.1 | | | | | | | |

43 | 5.5 | 5.4 | 5.3 | 5.2 | 5.1 | 4.9 | 4.8 | 4.6 | 4.4 | 4.2 | | | | | | |

44 | 5.7 | 5.7 | 5.6 | 5.4 | 5.3 | 5.2 | 5.1 | 4.9 | 4.7 | 4.5 | 4.3 | | | | | |

45 | 6.0 | 5.9 | 5.8 | 5.7 | 5.6 | 5.5 | 5.4 | 5.2 | 5.0 | 4.7 | 4.6 | 4.4 | | | | |

46 | 6.3 | 6.2 | 6.1 | 6.0 | 5.9 | 5.8 | 5.7 | 5.6 | 5.4 | 5.1 | 4.9 | 4.6 | 4.5 | | | |

47 | 6.5 | 6.5 | 6.3 | 6.3 | 6.2 | 6.1 | 6.0 | 5.9 | 5.7 | 5.4 | 5.1 | 4.9 | 4.7 | 4.5 | | |

48 | 6.8 | 6.7 | 6.6 | 6.6 | 6.5 | 6.5 | 6.3 | 6.2 | 6.0 | 5.8 | 5.6 | 5.3 | 5.0 | 4.8 | 4.6 | |

49 | 7.0 | 7.0 | 6.9 | 6.8 | 6.8 | 6.7 | 6.6 | 6.5 | 6.3 | 6.1 | 6.0 | 5.7 | 5.4 | 5.1 | 4.8 | 4.6 |

50 | 7.2 | 7.2 | 7.2 | 7.1 | 7.1 | 7.0 | 6.9 | 6.8 | 6.6 | 6.4 | 6.2 | 6.0 | 5.7 | 5.5 | 5.1 | 4.9 |

51 | 7.5 | 7.4 | 7.4 | 7.3 | 7.3 | 7.2 | 7.1 | 7.0 | 6.8 | 6.7 | 6.4 | 6.3 | 6.0 | 5.7 | 5.4 | 5.1 |

52 | 7.7 | 7.6 | 7.6 | 7.6 | 7.6 | 7.5 | 7.5 | 7.3 | 7.2 | 7.0 | 6.8 | 6.5 | 6.3 | 6.0 | 5.7 | 5.6 |

53 | 7.9 | 7.9 | 7.9 | 7.9 | 7.8 | 7.8 | 7.8 | 7.6 | 7.5 | 7.3 | 7.1 | 6.8 | 6.6 | 6.4 | 6.1 | 5.8 |

54 | 8.2 | 8.2 | 8.1 | 8.1 | 8.1 | 8.1 | 8.1 | 7.9 | 7.7 | 7.6 | 7.3 | 7.2 | 7.0 | 6.6 | 6.4 | 6.0 |

55 | 8.4 | 8.4 | 8.4 | 8.4 | 8.3 | 8.3 | 8.3 | 8.2 | 8.0 | 7.8 | 7.6 | 7.4 | 7.2 | 6.9 | 6.6 | 6.2 |

56 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.4 | 8.4 | 8.3 | 8.2 | 8.0 | 7.8 | 7.5 | 7.3 | 7.0 | 6.6 |

57 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.5 | 8.4 | 8.3 | 8.1 | 7.9 | 7.5 | 7.3 | 7.1 |

58 | 8.8 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.6 | 8.4 | 8.0 | 7.8 | 7.5 | 7.3 |

59 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.91 | 8.9 | 8.7 | 8.4 | 8.2 | 7.9 | 7.6 |

60 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 8.7 | 8.4 | 8.1 | 7.8 |

61 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 8.6 | 8.4 | 8.1 |

62 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 9.0 | 8.6 | 8.4 |

63 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.7 | 8.6 |

64 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.6 |

65 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 |

Table 3 Police Superannuation Scheme — Payment phase — males |

Age in

Completed Years | Age Retirement Superannuation Allowance (ss 7 and 7AA) | Invalid Superannuation Allowance | Reversionary Superannuation Allowance (ss 11, 11AA, 11A, 11B, 11C, 11D and 12) |

Hurt on Duty (s 10) | Not Hurt on Duty (s 7 with certification under s 8) |

25 | 23.53 | 22.88 | 22.02 | 23.24 |

26 | 23.43 | 22.78 | 21.90 | 23.13 |

27 | 23.32 | 22.67 | 21.78 | 23.01 |

28 | 23.22 | 22.56 | 21.66 | 22.89 |

29 | 23.10 | 22.44 | 21.53 | 22.76 |

30 | 22.99 | 22.32 | 21.39 | 22.63 |

31 | 22.86 | 22.19 | 21.25 | 22.49 |

32 | 22.74 | 22.06 | 21.10 | 22.34 |

33 | 22.61 | 21.93 | 20.96 | 22.19 |

34 | 22.47 | 21.80 | 20.81 | 22.04 |

35 | 22.33 | 21.65 | 20.65 | 21.88 |

36 | 22.18 | 21.51 | 20.49 | 21.72 |

37 | 22.03 | 21.35 | 20.32 | 21.54 |

38 | 21.87 | 21.19 | 20.14 | 21.36 |

39 | 21.70 | 21.03 | 19.96 | 21.18 |

40 | 21.53 | 20.86 | 19.78 | 20.99 |

41 | 21.33 | 20.66 | 19.55 | 20.79 |

42 | 21.13 | 20.46 | 19.33 | 20.59 |

43 | 20.92 | 20.25 | 19.09 | 20.37 |

44 | 20.70 | 20.04 | 18.85 | 20.15 |

45 | 20.47 | 19.82 | 18.60 | 19.92 |

46 | 20.16 | 19.50 | 18.21 | 19.69 |

47 | 19.84 | 19.18 | 17.83 | 19.44 |

48 | 19.51 | 18.85 | 17.44 | 19.19 |

49 | 19.17 | 18.52 | 17.06 | 18.93 |

50 | 18.83 | 18.19 | 16.68 | 18.66 |

51 | 18.47 | 17.85 | 16.31 | 18.39 |

52 | 18.19 | 17.59 | 16.05 | 18.10 |

53 | 17.89 | 17.32 | 15.79 | 17.81 |

54 | 17.58 | 17.04 | 15.52 | 17.50 |

55 | 17.27 | 16.74 | 15.25 | 17.19 |

56 | 16.94 | 16.44 | 14.97 | 16.87 |

57 | 16.61 | 16.13 | 14.68 | 16.53 |

58 | 16.26 | 15.80 | 14.38 | 16.19 |

59 | 15.90 | 15.47 | 14.08 | 15.83 |

60 | 15.53 | 15.13 | 13.77 | 15.47 |

61 | 15.16 | 14.78 | 13.45 | 15.10 |

62 | 14.77 | 14.42 | 13.12 | 14.72 |

63 | 14.38 | 14.05 | 12.78 | 14.33 |

64 | 13.98 | 13.68 | 12.44 | 13.93 |

65 | 13.57 | 13.30 | 12.10 | 13.52 |

66 | 13.15 | 12.91 | 11.74 | 13.11 |

67 | 12.72 | 12.52 | 11.38 | 12.69 |

68 | 12.28 | 12.12 | 11.01 | 12.26 |

69 | 11.83 | 11.71 | 10.63 | 11.81 |

70 | 11.38 | 11.30 | 10.26 | 11.36 |

71 | 10.91 | 10.89 | 9.88 | 10.90 |

72 | 10.43 | 10.48 | 9.51 | 10.43 |

73 | 9.95 | 10.07 | 9.13 | 9.96 |

74 | 9.47 | 9.67 | 8.75 | 9.48 |

75 | 8.98 | 9.26 | 8.37 | 8.99 |

76 | 8.48 | 8.86 | 7.99 | 8.50 |

77 | 8.00 | 8.46 | 7.61 | 8.03 |

78 | 7.54 | 8.08 | 7.24 | 7.57 |

79 | 7.09 | 7.70 | 6.87 | 7.12 |

80 | 6.67 | 7.33 | 6.51 | 6.70 |

81 | 6.28 | 6.97 | 6.16 | 6.31 |

82 | 5.91 | 6.61 | 5.82 | 5.94 |

83 | 5.57 | 6.27 | 5.49 | 5.60 |

84 | 5.25 | 5.95 | 5.18 | 5.28 |

85 | 4.95 | 5.63 | 4.89 | 4.98 |

86 | 4.66 | 5.33 | 4.61 | 4.69 |

87 | 4.38 | 5.04 | 4.33 | 4.41 |

88 | 4.11 | 4.75 | 4.07 | 4.14 |

89 | 3.86 | 4.48 | 3.82 | 3.89 |

90 | 3.61 | 4.22 | 3.57 | 3.64 |

91 | 3.37 | 3.96 | 3.34 | 3.40 |

92 | 3.15 | 3.72 | 3.11 | 3.17 |

93 | 2.93 | 3.50 | 2.91 | 2.96 |

94 | 2.74 | 3.29 | 2.72 | 2.76 |

95 | 2.56 | 3.09 | 2.54 | 2.58 |

96 | 2.40 | 2.92 | 2.38 | 2.42 |

97 | 2.25 | 2.75 | 2.24 | 2.27 |

98 | 2.12 | 2.59 | 2.10 | 2.13 |

99 or more | 1.99 | 2.44 | 1.97 | 2.00 |

Table 4 Police Superannuation Scheme — Payment phase — females |

Age in

Completed Years | Age Retirement Superannuation Allowance (ss 7 and 7AA) | Invalid Superannuation Allowance (s 7 with certification under s 8, s10) | Reversionary Superannuation Allowance (ss 11, 11AA, 11A, 11B, 11C, 11D and 12) |

25 | 23.84 | 22.19 | 23.80 |

26 | 23.75 | 22.05 | 23.70 |

27 | 23.65 | 21.91 | 23.60 |

28 | 23.55 | 21.76 | 23.49 |

29 | 23.44 | 21.61 | 23.38 |

30 | 23.33 | 21.45 | 23.26 |

31 | 23.22 | 21.29 | 23.14 |

32 | 23.10 | 21.13 | 23.02 |

33 | 22.98 | 20.96 | 22.89 |

34 | 22.85 | 20.79 | 22.75 |

35 | 22.72 | 20.61 | 22.61 |

36 | 22.58 | 20.43 | 22.47 |

37 | 22.44 | 20.24 | 22.32 |

38 | 22.29 | 20.05 | 22.17 |

39 | 22.14 | 19.85 | 22.01 |

40 | 21.98 | 19.65 | 21.84 |

41 | 21.78 | 19.32 | 21.67 |

42 | 21.58 | 18.99 | 21.49 |

43 | 21.40 | 18.77 | 21.31 |

44 | 21.21 | 18.54 | 21.12 |

45 | 21.02 | 18.30 | 20.92 |

46 | 20.82 | 18.07 | 20.71 |

47 | 20.61 | 17.83 | 20.50 |

48 | 20.39 | 17.59 | 20.28 |

49 | 20.17 | 17.35 | 20.06 |

50 | 19.94 | 17.11 | 19.83 |

51 | 19.69 | 16.84 | 19.59 |

52 | 19.45 | 16.60 | 19.34 |

53 | 19.19 | 16.35 | 19.08 |

54 | 18.93 | 16.10 | 18.82 |

55 | 18.66 | 15.85 | 18.54 |

56 | 18.37 | 15.60 | 18.26 |

57 | 18.08 | 15.34 | 17.97 |

58 | 17.78 | 15.08 | 17.67 |

59 | 17.48 | 14.82 | 17.37 |

60 | 17.17 | 14.55 | 17.06 |

61 | 16.85 | 14.28 | 16.74 |

62 | 16.52 | 14.01 | 16.41 |

63 | 16.19 | 13.73 | 16.08 |

64 | 15.85 | 13.44 | 15.74 |

65 | 15.49 | 13.14 | 15.39 |

66 | 15.13 | 12.84 | 15.03 |

67 | 14.77 | 12.53 | 14.67 |

68 | 14.39 | 12.21 | 14.30 |

69 | 14.00 | 11.89 | 13.91 |

70 | 13.61 | 11.57 | 13.53 |

71 | 13.21 | 11.24 | 13.13 |

72 | 12.80 | 10.90 | 12.73 |

73 | 12.38 | 10.56 | 12.32 |

74 | 11.96 | 10.22 | 11.90 |

75 | 11.53 | 9.86 | 11.48 |

76 | 11.10 | 9.51 | 11.06 |

77 | 10.67 | 9.14 | 10.63 |

78 | 10.23 | 8.76 | 10.21 |

79 | 9.80 | 8.36 | 9.78 |

80 | 9.37 | 7.96 | 9.35 |

81 | 8.94 | 7.55 | 8.93 |

82 | 8.51 | 7.15 | 8.51 |

83 | 8.09 | 6.75 | 8.09 |

84 | 7.66 | 6.35 | 7.67 |

85 | 7.25 | 5.97 | 7.27 |

86 | 6.85 | 5.60 | 6.87 |

87 | 6.47 | 5.25 | 6.49 |

88 | 6.11 | 4.91 | 6.13 |

89 | 5.76 | 4.60 | 5.79 |

90 | 5.43 | 4.31 | 5.46 |

91 | 5.13 | 4.05 | 5.16 |

92 | 4.84 | 3.80 | 4.87 |

93 | 4.57 | 3.57 | 4.60 |

94 | 4.30 | 3.35 | 4.33 |

95 | 4.04 | 3.14 | 4.07 |

96 | 3.78 | 2.93 | 3.81 |

97 | 3.52 | 2.72 | 3.55 |

98 | 3.26 | 2.50 | 3.28 |

99 or more | 2.97 | 2.26 | 2.99 |

Part 6 Police Association Superannuation Scheme

Division 6.1 Definitions

1 Definitions

(1) In this Part:

age at entry means the age, in completed years, when a person became a contributor.

contributor has the meaning given by subsection 1 (2) of the PRS Act.

equivalent service ratio has the meaning given by section 6 of the PRS Act.

PAES Act means the Police Association Employees (Superannuation) Act 1969 (NSW).

Police Association Superannuation Scheme means the superannuation scheme constituted by the PAES Act.

Police Superannuation Scheme means the superannuation scheme constituted by the PRS Act.

PRS Act means the Police Regulation (Superannuation) Act 1906 (NSW).

(2) A reference in this Part to the requirements of Division 2.2 of the Regulations being satisfied does not include a reference to the requirements of that Division being satisfied by making a payment of the kind mentioned in regulation 14H of the Regulations.

(3) An expression used in this Part and in the PAES Act or in a provision of that Act has the same meaning in this Part as it has in the PAES Act or the provision of that Act.

Note The following expressions are defined in subsection 2 (1) of the PAES Act:

Association

member of the police force

STC.

Division 6.2 Interests in the growth phase

2 Method for interests in Police Association Superannuation Scheme

(1) For an interest that:

(a) is held by a person who:

(i) was a member of the police force; and

(ii) resigned office as a member of the police force and immediately became an employee of the Association or become such an employee on the working day of the Association next following the date on which his or her resignation took effect; and

(iii) was a contributor to the Police Superannuation Scheme immediately before transferring to the employment of the Association; and

(b) is in the growth phase in the Police Association Superannuation Scheme;

the method set out in the following table is approved for section 4 of this instrument.

Method |

where: AS, ESR, NEA, B and C have the meanings given by subclause 3 (1). Fae,y+m has the meaning given by subclause 3 (2). R is the reduction factor under clause 4. |

3 Definition of terms and expressions

(1) In clause 2:

AS is the annual rate of the salary of the person as an employee of the Association that STC would consider if, at the relevant date, STC had approved the payment of an annual superannuation allowance to the person under subsection 3 (2) of the PAES Act.

B is the total number of days, in the period commencing on the day when section 3 of the PAES Act commenced to have effect in respect of the person and ending at the end of the relevant date, for which the person has paid:

(a) an amount or amounts equivalent to contributions that would have been deducted from his or her salary of office under section 5 of the PRS Act if he or she had not resigned office as a member of the police force; or

(b) an amount or amounts that he or she would have been required to pay under section 5A of the PRS Act, in respect of one or more periods of leave without pay or special leave without pay, if he or she had not resigned office as a member of the police force.

C is the total number of days, as at the relevant date (including, if applicable, that date) for which the person has paid:

(a) an amount or amounts equivalent to contributions that would have been deducted from his or her salary of office under section 5 of the PRS Act if he or she had not resigned office as a member of the police force; or

(b) an amount or amounts that he or she would have been required to pay under section 5A of the PRS Act, in respect of one or more periods of leave without pay or special leave without pay, if he or she had not resigned office as a member of the police force.

ESR is the equivalent service ratio of the person, at the relevant date, that is based on the service of the person as:

(a) an employee of the Association; and

(b) a former member of the police force.

NEA is the person’s notional employee account, being the sum of the amounts referred to in paragraphs 10 (1) (a), (b) and (c) of the Police Superannuation Regulation if STC were required to reduce the amount of the person’s benefit under subsection 14AA (1) of the PRS Act, at the relevant date.

(2) In clause 2:

Fae,y+m is calculated in accordance with the formula:

where:

Fae,y is the valuation factor mentioned in whichever of Table 1 or 2 of Division 6.4 is applicable, given:

(i) the person’s gender; and

(ii) the person’s age in completed years (y) at the relevant date; and

(iii) the person’s age at entry (ae).

m is the number of complete months of the person’s age that are not included in the person’s age in completed years at the relevant date.

Fae,y+1 is the valuation factor mentioned in whichever of Table 1 or 2 of Division 6.4 is applicable to the person if the person’s age in completed years at the relevant date were 1 year more than it is.

4 Reduction Factor

(1) Reduction factor is the amount worked out in accordance with clause 4 (the reduction clause) and clause 5 (the adjustment clause) of Division 5.2 of Part 5, subject to the following:

(a) AS, B, ESR and NEA have the meanings given by subclause 3 (1), unless required to be modified under the adjustment clause;

(b) C has the meaning given by subclause 3 (1) unless required to be modified under the reduction or adjustment clause;

(c) Fae,y+m has the meaning given by subclause 3 (2), unless required to be modified under the adjustment clause;

(d) if required to be modified under the reduction or adjustment clause, AS, B, C, ESR, NEA and Fae,y+m have the meanings given by subclause 3 (1) or (2) modified so that a reference to ‘the relevant date’ in relation to each of those terms is a reference to ‘the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse under the superannuation agreement, flag lifting agreement or splitting order’;

(e) Cs is the total number of days, as at the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse of the person under the superannuation agreement, flag lifting agreement or splitting order (including, if applicable, that date), for which the person has paid:

(i) an amount or amounts equivalent to contributions that would have been deducted from his or her salary of office under section 5 of the PRS Act if he or she had not resigned office as a member of the police force; or

(ii) an amount or amounts that he or she would have been required to pay under section 5A of the PRS Act, in respect of one or more periods of leave without pay or special leave without pay, if he or she had not resigned as a member of the police force.

Division 6.3 Interests in the payment phase

5 Method for interests in Police Association Superannuation Scheme

For an interest that is held by a person in the Police Association Superannuation Scheme as a result of being paid an annual superannuation allowance under the PAES Act, the method set out in the following table is approved for section 4 of this instrument.

Method |

where: SA is the amount of annual superannuation allowance payable to the person in respect of the interest at the relevant date. SAFy+m is the amount calculated in accordance with the formula:

where: SAFy is the valuation factor mentioned in whichever of Table 3 or 4 of Division 6.4 is applicable, given: (a) the person’s gender; and (b) the person’s age in completed years at the relevant date (y); and (c) the type of superannuation allowance. m is the number of complete months of the person’s age that are not included in the person’s age in completed years at the relevant date. SAFy+1 is the valuation factor mentioned in whichever of Table 3 or 4 of Division 6.4 is applicable if the person’s age in completed years at the relevant date were 1 year more than it is. |

Division 6.4 Factors

Table 1 Police Association Superannuation Scheme — male employees |

Age at relevant date | Age at Entry |

19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 |

34 | 2.1 | | | | | | | | | | | | | | | |

35 | 2.3 | 2.2 | | | | | | | | | | | | | | |

36 | 2.5 | 2.4 | 2.3 | | | | | | | | | | | | | |

37 | 2.7 | 2.6 | 2.5 | 2.4 | | | | | | | | | | | | |

38 | 3.0 | 2.9 | 2.7 | 2.6 | 2.5 | | | | | | | | | | | |

39 | 3.3 | 3.1 | 3.0 | 2.9 | 2.8 | 2.7 | | | | | | | | | | |

40 | 3.6 | 3.4 | 3.2 | 3.2 | 3.0 | 2.9 | 2.8 | | | | | | | | | |

41 | 3.8 | 3.7 | 3.6 | 3.4 | 3.3 | 3.1 | 3.0 | 2.9 | | | | | | | | |

42 | 4.0 | 3.9 | 3.9 | 3.8 | 3.6 | 3.5 | 3.3 | 3.1 | 3.0 | | | | | | | |

43 | 4.3 | 4.2 | 4.1 | 4.0 | 3.9 | 3.7 | 3.6 | 3.4 | 3.2 | 3.1 | | | | | | |

44 | 4.6 | 4.5 | 4.4 | 4.3 | 4.2 | 4.1 | 3.9 | 3.7 | 3.6 | 3.3 | 3.1 | | | | | |

45 | 4.8 | 4.7 | 4.7 | 4.6 | 4.5 | 4.4 | 4.3 | 4.0 | 3.8 | 3.6 | 3.4 | 3.2 | | | | |

46 | 5.1 | 5.0 | 4.9 | 4.9 | 4.8 | 4.7 | 4.6 | 4.5 | 4.2 | 3.9 | 3.7 | 3.4 | 3.3 | | | |

47 | 5.4 | 5.3 | 5.2 | 5.2 | 5.1 | 5.0 | 4.9 | 4.7 | 4.5 | 4.3 | 4.0 | 3.7 | 3.5 | 3.3 | | |

48 | 5.6 | 5.6 | 5.5 | 5.5 | 5.4 | 5.3 | 5.2 | 5.1 | 4.9 | 4.7 | 4.4 | 4.1 | 3.8 | 3.6 | 3.4 | |

49 | 5.9 | 5.9 | 5.8 | 5.8 | 5.7 | 5.6 | 5.5 | 5.4 | 5.2 | 5.0 | 4.8 | 4.5 | 4.2 | 3.9 | 3.6 | 3.4 |

50 | 6.2 | 6.2 | 6.1 | 6.1 | 6.0 | 6.0 | 5.9 | 5.8 | 5.6 | 5.3 | 5.1 | 4.9 | 4.6 | 4.3 | 3.9 | 3.7 |

51 | 6.5 | 6.5 | 6.4 | 6.4 | 6.4 | 6.3 | 6.2 | 6.1 | 5.9 | 5.8 | 5.4 | 5.3 | 5.0 | 4.6 | 4.3 | 4.0 |

52 | 6.8 | 6.8 | 6.7 | 6.7 | 6.7 | 6.6 | 6.6 | 6.4 | 6.3 | 6.1 | 5.8 | 5.6 | 5.3 | 5.0 | 4.7 | 4.5 |

53 | 7.1 | 7.1 | 7.1 | 7.1 | 7.0 | 7.0 | 6.9 | 6.8 | 6.6 | 6.4 | 6.2 | 6.0 | 5.7 | 5.5 | 5.2 | 4.8 |

54 | 7.4 | 7.4 | 7.4 | 7.4 | 7.4 | 7.4 | 7.4 | 7.2 | 7.0 | 6.9 | 6.5 | 6.5 | 6.2 | 5.8 | 5.6 | 5.2 |

55 | 7.8 | 7.8 | 7.8 | 7.8 | 7.7 | 7.7 | 7.7 | 7.6 | 7.4 | 7.2 | 7.0 | 6.8 | 6.5 | 6.2 | 6.0 | 5.6 |

56 | 7.9 | 7.9 | 7.9 | 7.9 | 7.9 | 7.8 | 7.8 | 7.8 | 7.7 | 7.6 | 7.4 | 7.2 | 6.9 | 6.6 | 6.3 | 5.9 |

57 | 8.0 | 8.0 | 8.0 | 8.0 | 8.0 | 8.0 | 8.0 | 8.0 | 8.0 | 7.9 | 7.7 | 7.5 | 7.3 | 6.9 | 6.7 | 6.5 |

58 | 8.3 | 8.2 | 8.2 | 8.2 | 8.2 | 8.2 | 8.2 | 8.2 | 8.2 | 8.2 | 8.1 | 7.9 | 7.5 | 7.3 | 7.0 | 6.8 |

59 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.2 | 8.0 | 7.8 | 7.5 | 7.2 |

60 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.4 | 8.2 | 8.0 | 7.7 |

61 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.4 | 8.3 | 8.0 |

62 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.5 | 8.2 |

63 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.3 |

64 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 | 8.4 |

65 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 |

Table 2 Police Association Superannuation Scheme — female employees |

Age at relevant date | Age at Entry |

19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 |

34 | 2.1 | | | | | | | | | | | | | | | |

35 | 2.2 | 2.2 | | | | | | | | | | | | | | |

36 | 2.4 | 2.3 | 2.3 | | | | | | | | | | | | | |

37 | 2.7 | 2.6 | 2.4 | 2.4 | | | | | | | | | | | | |

38 | 2.9 | 2.8 | 2.7 | 2.6 | 2.5 | | | | | | | | | | | |

39 | 3.2 | 3.1 | 3.0 | 2.8 | 2.7 | 2.6 | | | | | | | | | | |

40 | 3.5 | 3.4 | 3.2 | 3.1 | 3.0 | 2.8 | 2.8 | | | | | | | | | |

41 | 3.7 | 3.6 | 3.5 | 3.4 | 3.3 | 3.1 | 3.0 | 2.9 | | | | | | | | |

42 | 4.0 | 3.9 | 3.8 | 3.7 | 3.5 | 3.4 | 3.3 | 3.1 | 3.0 | | | | | | | |

43 | 4.3 | 4.2 | 4.1 | 4.0 | 3.9 | 3.7 | 3.6 | 3.4 | 3.2 | 3.1 | | | | | | |

44 | 4.5 | 4.5 | 4.4 | 4.3 | 4.2 | 4.1 | 3.9 | 3.7 | 3.6 | 3.3 | 3.1 | | | | | |

45 | 4.8 | 4.7 | 4.7 | 4.6 | 4.5 | 4.4 | 4.3 | 4.0 | 3.8 | 3.6 | 3.4 | 3.2 | | | | |

46 | 5.1 | 5.0 | 5.0 | 4.9 | 4.8 | 4.7 | 4.6 | 4.5 | 4.2 | 4.0 | 3.7 | 3.4 | 3.3 | | | |

47 | 5.4 | 5.4 | 5.2 | 5.2 | 5.1 | 5.0 | 4.9 | 4.8 | 4.6 | 4.3 | 4.0 | 3.8 | 3.6 | 3.3 | | |

48 | 5.7 | 5.6 | 5.6 | 5.5 | 5.5 | 5.4 | 5.3 | 5.1 | 5.0 | 4.8 | 4.5 | 4.2 | 3.9 | 3.6 | 3.4 | |

49 | 6.0 | 6.0 | 5.9 | 5.8 | 5.8 | 5.7 | 5.6 | 5.5 | 5.3 | 5.1 | 4.9 | 4.6 | 4.3 | 3.9 | 3.7 | 3.5 |

50 | 6.3 | 6.3 | 6.2 | 6.2 | 6.1 | 6.1 | 6.0 | 5.9 | 5.7 | 5.4 | 5.2 | 5.0 | 4.7 | 4.4 | 4.0 | 3.7 |

51 | 6.6 | 6.6 | 6.5 | 6.5 | 6.5 | 6.4 | 6.3 | 6.2 | 6.0 | 5.9 | 5.5 | 5.4 | 5.1 | 4.7 | 4.4 | 4.1 |

52 | 6.9 | 6.9 | 6.9 | 6.9 | 6.8 | 6.8 | 6.7 | 6.6 | 6.4 | 6.2 | 6.0 | 5.7 | 5.4 | 5.1 | 4.8 | 4.6 |

53 | 7.3 | 7.3 | 7.2 | 7.2 | 7.2 | 7.2 | 7.1 | 7.0 | 6.8 | 6.6 | 6.4 | 6.1 | 5.9 | 5.6 | 5.3 | 4.9 |

54 | 7.6 | 7.6 | 7.6 | 7.6 | 7.6 | 7.5 | 7.5 | 7.4 | 7.2 | 7.1 | 6.7 | 6.6 | 6.4 | 5.9 | 5.8 | 5.3 |

55 | 8.0 | 8.0 | 8.0 | 8.0 | 7.9 | 8.0 | 7.9 | 7.8 | 7.6 | 7.4 | 7.2 | 7.0 | 6.7 | 6.4 | 6.1 | 5.7 |

56 | 8.1 | 8.1 | 8.1 | 8.1 | 8.1 | 8.1 | 8.0 | 8.0 | 7.9 | 7.8 | 7.6 | 7.4 | 7.1 | 6.8 | 6.5 | 6.1 |

57 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.3 | 8.2 | 8.2 | 8.1 | 8.0 | 7.8 | 7.6 | 7.1 | 6.9 | 6.7 |

58 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.5 | 8.4 | 8.3 | 8.2 | 7.8 | 7.5 | 7.2 | 7.0 |

59 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.5 | 8.2 | 8.1 | 7.6 | 7.4 |

60 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 8.7 | 8.4 | 8.1 | 7.8 |

61 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 | 8.9 | 8.5 | 8.4 | 8.1 |

62 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 8.9 | 9.0 | 8.6 | 8.4 |

63 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.8 | 8.7 | 8.6 |

64 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 | 8.6 |

65 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 |

Table 3 Police Association Superannuation Scheme — Payment phase — males |

Age in

Completed Years | Age Retirement Superannuation Allowance (s 3 (2)) | Invalid Superannuation Allowance (s 3 (2) with certification under s. 8 of PRS Act) | Reversionary Superannuation Allowance (ss 3 (9), (10) and (10AA)) |

25 | 23.53 | 22.02 | 23.24 |

26 | 23.43 | 21.90 | 23.13 |

27 | 23.32 | 21.78 | 23.01 |

28 | 23.22 | 21.66 | 22.89 |

29 | 23.10 | 21.53 | 22.76 |

30 | 22.99 | 21.39 | 22.63 |

31 | 22.86 | 21.25 | 22.49 |

32 | 22.74 | 21.10 | 22.34 |

33 | 22.61 | 20.96 | 22.19 |

34 | 22.47 | 20.81 | 22.04 |

35 | 22.33 | 20.65 | 21.88 |

36 | 22.18 | 20.49 | 21.72 |

37 | 22.03 | 20.32 | 21.54 |

38 | 21.87 | 20.14 | 21.36 |

39 | 21.70 | 19.96 | 21.18 |

40 | 21.53 | 19.78 | 20.99 |

41 | 21.33 | 19.55 | 20.79 |

42 | 21.13 | 19.33 | 20.59 |

43 | 20.92 | 19.09 | 20.37 |

44 | 20.70 | 18.85 | 20.15 |

45 | 20.47 | 18.60 | 19.92 |

46 | 20.16 | 18.21 | 19.69 |

47 | 19.84 | 17.83 | 19.44 |

48 | 19.51 | 17.44 | 19.19 |

49 | 19.17 | 17.06 | 18.93 |

50 | 18.83 | 16.68 | 18.66 |

51 | 18.47 | 16.31 | 18.39 |

52 | 18.19 | 16.05 | 18.10 |

53 | 17.89 | 15.79 | 17.81 |

54 | 17.58 | 15.52 | 17.50 |

55 | 17.27 | 15.25 | 17.19 |

56 | 16.94 | 14.97 | 16.87 |

57 | 16.61 | 14.68 | 16.53 |

58 | 16.26 | 14.38 | 16.19 |

59 | 15.90 | 14.08 | 15.83 |

60 | 15.53 | 13.77 | 15.47 |

61 | 15.16 | 13.45 | 15.10 |

62 | 14.77 | 13.12 | 14.72 |

63 | 14.38 | 12.78 | 14.33 |

64 | 13.98 | 12.44 | 13.93 |

65 | 13.57 | 12.10 | 13.52 |

66 | 13.15 | 11.74 | 13.11 |

67 | 12.72 | 11.38 | 12.69 |

68 | 12.28 | 11.01 | 12.26 |

69 | 11.83 | 10.63 | 11.81 |

70 | 11.38 | 10.26 | 11.36 |

71 | 10.91 | 9.88 | 10.90 |

72 | 10.43 | 9.51 | 10.43 |

73 | 9.95 | 9.13 | 9.96 |

74 | 9.47 | 8.75 | 9.48 |

75 | 8.98 | 8.37 | 8.99 |

76 | 8.48 | 7.99 | 8.50 |

77 | 8.00 | 7.61 | 8.03 |

78 | 7.54 | 7.24 | 7.57 |

79 | 7.09 | 6.87 | 7.12 |

80 | 6.67 | 6.51 | 6.70 |

81 | 6.28 | 6.16 | 6.31 |

82 | 5.91 | 5.82 | 5.94 |

83 | 5.57 | 5.49 | 5.60 |

84 | 5.25 | 5.18 | 5.28 |

85 | 4.95 | 4.89 | 4.98 |

86 | 4.66 | 4.61 | 4.69 |

87 | 4.38 | 4.33 | 4.41 |

88 | 4.11 | 4.07 | 4.14 |

89 | 3.86 | 3.82 | 3.89 |

90 | 3.61 | 3.57 | 3.64 |

91 | 3.37 | 3.34 | 3.40 |

92 | 3.15 | 3.11 | 3.17 |

93 | 2.93 | 2.91 | 2.96 |

94 | 2.74 | 2.72 | 2.76 |

95 | 2.56 | 2.54 | 2.58 |

96 | 2.40 | 2.38 | 2.42 |

97 | 2.25 | 2.24 | 2.27 |

98 | 2.12 | 2.10 | 2.13 |

99 or more | 1.99 | 1.97 | 2.00 |

Table 4 Police Association Superannuation Scheme — Payment phase — females |

Age in

Completed Years | Age Retirement Superannuation Allowance (s 3 (2)) | Invalid Superannuation Allowance (s 3 (2) with certification under s 8 of PRS Act) | Reversionary Superannuation Allowance (ss 3 (9), (10) and (10AA)) |

25 | 23.84 | 22.19 | 23.80 |

26 | 23.75 | 22.05 | 23.70 |

27 | 23.65 | 21.91 | 23.60 |

28 | 23.55 | 21.76 | 23.49 |

29 | 23.44 | 21.61 | 23.38 |

30 | 23.33 | 21.45 | 23.26 |

31 | 23.22 | 21.29 | 23.14 |

32 | 23.10 | 21.13 | 23.02 |

33 | 22.98 | 20.96 | 22.89 |

34 | 22.85 | 20.79 | 22.75 |

35 | 22.72 | 20.61 | 22.61 |

36 | 22.58 | 20.43 | 22.47 |

37 | 22.44 | 20.24 | 22.32 |

38 | 22.29 | 20.05 | 22.17 |

39 | 22.14 | 19.85 | 22.01 |

40 | 21.98 | 19.65 | 21.84 |

41 | 21.78 | 19.32 | 21.67 |

42 | 21.58 | 18.99 | 21.49 |

43 | 21.40 | 18.77 | 21.31 |

44 | 21.21 | 18.54 | 21.12 |

45 | 21.02 | 18.30 | 20.92 |

46 | 20.82 | 18.07 | 20.71 |

47 | 20.61 | 17.83 | 20.50 |

48 | 20.39 | 17.59 | 20.28 |

49 | 20.17 | 17.35 | 20.06 |

50 | 19.94 | 17.11 | 19.83 |

51 | 19.69 | 16.84 | 19.59 |

52 | 19.45 | 16.60 | 19.34 |

53 | 19.19 | 16.35 | 19.08 |

54 | 18.93 | 16.10 | 18.82 |

55 | 18.66 | 15.85 | 18.54 |

56 | 18.37 | 15.60 | 18.26 |

57 | 18.08 | 15.34 | 17.97 |

58 | 17.78 | 15.08 | 17.67 |

59 | 17.48 | 14.82 | 17.37 |

60 | 17.17 | 14.55 | 17.06 |

61 | 16.85 | 14.28 | 16.74 |

62 | 16.52 | 14.01 | 16.41 |

63 | 16.19 | 13.73 | 16.08 |

64 | 15.85 | 13.44 | 15.74 |

65 | 15.49 | 13.14 | 15.39 |

66 | 15.13 | 12.84 | 15.03 |

67 | 14.77 | 12.53 | 14.67 |

68 | 14.39 | 12.21 | 14.30 |

69 | 14.00 | 11.89 | 13.91 |

70 | 13.61 | 11.57 | 13.53 |

71 | 13.21 | 11.24 | 13.13 |

72 | 12.80 | 10.90 | 12.73 |

73 | 12.38 | 10.56 | 12.32 |

74 | 11.96 | 10.22 | 11.90 |

75 | 11.53 | 9.86 | 11.48 |

76 | 11.10 | 9.51 | 11.06 |

77 | 10.67 | 9.14 | 10.63 |

78 | 10.23 | 8.76 | 10.21 |

79 | 9.80 | 8.36 | 9.78 |

80 | 9.37 | 7.96 | 9.35 |

81 | 8.94 | 7.55 | 8.93 |

82 | 8.51 | 7.15 | 8.51 |

83 | 8.09 | 6.75 | 8.09 |

84 | 7.66 | 6.35 | 7.67 |

85 | 7.25 | 5.97 | 7.27 |

86 | 6.85 | 5.60 | 6.87 |

87 | 6.47 | 5.25 | 6.49 |

88 | 6.11 | 4.91 | 6.13 |

89 | 5.76 | 4.60 | 5.79 |

90 | 5.43 | 4.31 | 5.46 |

91 | 5.13 | 4.05 | 5.16 |

92 | 4.84 | 3.80 | 4.87 |

93 | 4.57 | 3.57 | 4.60 |

94 | 4.30 | 3.35 | 4.33 |

95 | 4.04 | 3.14 | 4.07 |

96 | 3.78 | 2.93 | 3.81 |

97 | 3.52 | 2.72 | 3.55 |

98 | 3.26 | 2.50 | 3.28 |

99 or more | 2.97 | 2.26 | 2.99 |

Part 7 New South Wales State Authorities Superannuation Scheme

Division 7.1 Definitions

1 Definitions

(1) In this Part:

1927 Act means the Local Government and Other Authorities (Superannuation) Act 1927 (NSW).

current insurance policy has the meaning given by clause 3 of the State Authorities Superannuation (Closed Local Government Schemes Transfer) (Savings and Transitional) Regulation 1990 (NSW).

SAS Act means the State Authorities Superannuation Act 1987 (NSW).

SAS Scheme means the superannuation scheme constituted by the SAS Act.

transferred contributor has the meaning given by the State Authorities Superannuation (State Public Service Superannuation Scheme Transfer) (Savings and Transitional) Regulation 1989 (NSW).

(2) A reference in this Part to the requirements of Division 2.2 of the Regulations being satisfied does not include a reference to the requirements of that Division being satisfied by making a payment of the kind mentioned in regulation 14H of the Regulations.

(3) An expression used in this Part and in the SAS Act or in a provision of that Act has the same meaning in this Part as it has in the SAS Act or a provision of that Act.

Note 1 The following expressions are defined in subsection 3 (1) of the SAS Act:

benefit

contributor‑financed benefit

contributor’s account

early retirement age

employee

employer‑financed benefit

entry date

executive officer

Fund

STC.

Note 2 The following expression is defined in subsection 29 (1) of the SAS Act:

leave without pay.

Note 3 The following expressions are defined in section 36 of the SAS Act:

accrued benefit points

final average salary.

(4) An expression used in this Part and in the 1927 Act or in a provision of that Act has the same meaning in this Part as it has in the 1927 Act or in a provision of that Act.

Note The following expressions are defined in section 3 of the 1927 Act:

Benefits Fund

Provident Fund.

Division 7.2 Interests in the growth phase

Subdivision 7.2.1 Employees (general)

2 Method for interests in SAS Scheme

For an interest that is in the growth phase in the SAS Scheme and that is held by an employee other than:

(a) an employee who is a former holder of a current insurance policy; or

(b) an employee who is a former contributor to the Provident Fund; or

(c) an employee who is a former contributor to the Benefits Fund; or

(d) an employee who is an executive officer who elected to make provision for a benefit in accordance with paragraph 30A (1) (b) of the SAS Act; or

(e) an employee to whom Part 1 of Schedule 5 to the SAS Act applies; or

(f) an employee who, at 55 years or over, has elected to make provision for a benefit in accordance with Part 2 of Schedule 5 to the SAS Act;

the method set out in the following table is approved for section 4 of this instrument.

Method |

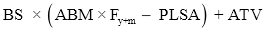

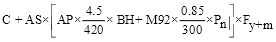

where: CFB is the person’s contributor‑financed benefit that would be payable from the contributor’s account of the person if the person were to receive a benefit under Part 5 of the SAS Act at the relevant date. ABP is a person’s accrued benefit points at the relevant date. PAF has the meaning given by subclause 3 (1). B is the number of days in the period: (a) commencing on the later of a person’s entry date and 1 July 1988; and (b) ending at the end of the relevant date; other than any day when the person was not required to make contributions to the SAS Scheme because the person was on leave without pay. C is the number of the days in the period: (a) commencing on the person’s entry date; and (b) ending at the end of the relevant date; other than any day when the person was not required to make contributions to the SAS Scheme because the person was on leave without pay. AR is a person’s rate of accrual, being whichever of the following is applicable: (a) if the person is a transferred contributor — 0.03; (b) in any other case — 0.025. FAS is the person’s final average salary at the relevant date. Fy+m has the meaning given by subclause 3 (2). R is the reduction factor under clause 4. |

3 Definitions of PAF and Fy+m

(1) In clause 2:

PAF is the person’s accrued benefit points adjustment factor, being the lesser of:

(a) 1; and

(b) the factor calculated in accordance with the formula:

;

;

where:

age at entry is the person’s age in years, including any fraction of a year, at that person’s entry date.

fraction of a year means the quotient of the number of days in the period commencing on the person’s last birthday and ending at the person’s entry date, and:

(a) if the date ‘29 February’ has occurred in that period or will occur before the person’s next birthday — 366; or

(b) in any other case — 365.

(2) In clause 2:

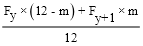

Fy+m is the factor calculated in accordance with the formula:

where:

Fy is the valuation factor mentioned in whichever of Table 1 to 7 of Division 7.4 is applicable, given:

(a) the person’s gender; and

(b) the person’s age in completed years at the relevant date (y); and

(c) the person’s age at the person’s entry date; and

(d) if the person was under 28 years at the person’s entry date, the average rate at which that person has accumulated accrued benefit points calculated in accordance with the formula:

where:

ABP and C have the meanings given by clause 2.

m is the number of complete months of the person’s age that are not included in the person’s age in completed years at the relevant date.

Fy+1 is the valuation factor in whichever of Table 1 to 7 of Division 7.4 is applicable to the person if the person’s age in completed years at the relevant date were 1 year more than it is.

4 Reduction factor

(1) Reduction factor is:

(a) if the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlement of only one spouse of the person, being an entitlement arising under a particular superannuation agreement, flag lifting agreement or splitting order that applies in respect of the interest — the amount calculated in accordance with the formula set out in subclause (2); or

(b) if the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlement of 2 or more spouses of the person, being entitlements each arising under a superannuation agreement, flag lifting agreement or splitting order that applies to the interest — the product of the amounts calculated in accordance with the formula set out in subclause (2) in respect of each entitlement; or

(c) in any other case — 1.

(2) For paragraphs (1) (a) and (b), each amount is calculated in accordance with the formula:

where:

NMProp is the quotient of:

(a) the value of the spouse’s entitlement under the agreement or order immediately before the time when the requirements of Division 2.2 of the Regulations were satisfied; and

(b) the gross value of the person’s interest, immediately before those requirements were satisfied, determined in accordance with the method set out in the table following clause 2.

ABPs is a person’s accrued benefit points at the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse of the person under the superannuation agreement, flag lifting agreement or splitting order.

Bs is the number of days in the period:

(a) commencing on the later of the person’s entry date and 1 July 1988; and

(b) ending on the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse of the person under the superannuation agreement, flag lifting agreement or splitting order (including, if applicable, that date);

other than any day when the person was not required to make contributions to the SAS Scheme because the person was on leave without pay.

Cs is the number of the days in the period:

(a) commencing on the person’s entry date; and

(b) ending on the date when the requirements of Division 2.2 of the Regulations were satisfied in respect of the entitlement of the spouse of the person under the superannuation agreement, flag lifting agreement or splitting order (including, if applicable, that date);

other than any day when the person was not required to make contributions to the SAS Scheme because the person was on leave without pay.

ABP, B and C have the meanings given by clause 2.

Subdivision 7.2.2 Employees (Closed Local Government Schemes)

5 Method for interests in SAS Scheme

(1) For an interest that is in the growth phase in the SAS Scheme and that is held by an employee:

(a) who has not elected to make provision for a benefit in accordance with Part 2 of Schedule 5 to the SAS Act; and

(b) who is not an employee to whom Part 1 of Schedule 5 to the SAS Act applies; and

(c) who is:

(i) a former holder of a current insurance policy; or

(ii) a former contributor to the Provident Fund; or

(iii) a former contributor to the Benefits Fund;

the method set out in the following table is approved for section 4 of this instrument.

Method |

Step 1 Calculate the gross value of the interest in accordance with the method set out in clause 2. |

Step 2 Calculate the gross value of the interest in accordance with the following formula: CFB + NA – NMSA where: CFB is the person’s contributor‑financed benefit that would be payable from the contributor’s account of the person if the person were to receive a benefit under Part 5 of the SAS Act at the relevant date. NA is the person’s notional accumulation at the relevant date, being: (a) for a person who was a holder of a current insurance policy or a contributor to the Provident Fund — the person’s notional accumulation determined in accordance with clause 10 of the State Authorities Superannuation (Closed Local Government Schemes Transfer) (Savings and Transitional) Regulation 1990 (NSW); or (b) for a person who was a contributor to the Benefits Fund — the person’s notional accumulation determined in accordance with clause 17 of that Regulation. NMSA has the meaning given by subclause (2). |

Step 3 Compare the gross values calculated in accordance with steps 1 and 2. The greater of those values is the value of the interest. |

(2) In subclause (1):

NMSA is:

(a) if the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlement of only one spouse of the person, being an entitlement arising under a particular superannuation agreement, flag lifting agreement or splitting order that applies in respect of the interest, the sum of:

(i) the value of the entitlement of the spouse to the interest immediately before the time when the Division 2.2 requirements were satisfied; and

(ii) the amount of the adjustment (if any) that STC would make under section 16 of the SAS Act if:

(A) STC were to pay to the person the balance of his or her contributor’s account at the relevant date; and

(B) the balance of that account had remained equal to the value of the spouse’s entitlement in the period commencing at the time when the Division 2.2 requirements were satisfied and ending at the relevant date; or

(b) if the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlement of 2 or more spouses of the person, being entitlements each arising under a particular superannuation agreement, flag lifting agreement or splitting order that applies in respect of the interest, the sum of:

(i) the value of the entitlement of each spouse under the agreement or order immediately before the time when the Division 2.2 requirements were satisfied in respect of that agreement or order; and

(ii) the amount of the adjustment (if any) that STC would make under section 16 of the SAS Act in respect of the entitlement of each spouse, if:

(A) STC were to pay to the person the balance of his or her contributor’s account had the person applied for payment of a benefit under Part 5 of that Act at the relevant date; and

(B) the balance of that account had remained equal to the value of each spouse’s entitlement under the agreement or order in the period commencing at the time when the Division 2.2 requirements were satisfied and ending at the relevant date in respect of each interest; or

(c) in any other case — nil.

Subdivision 7.2.3 Deferred beneficiaries

6 Method for interests in SAS Scheme

For an interest:

(a) that is held by a person who is entitled, in the event of death, to the benefit provided by subsection 43 (6) of the SAS Act; and

(b) that is in the growth phase in the SAS Scheme;

the method set out in the following table is approved for section 4 of this instrument.

Note This method applies to former employees and to employees:

(a) who are taken to have made provision for a deferred benefit in accordance with Part 1 of Schedule 5 to the SAS Act because they transferred their superannuation coverage and became contributors to another superannuation scheme; and

(b) who, after a salary reduction when they turned 55 years or more, elected to make provision for a benefit in accordance with Part 2 of Schedule 5 to the SAS Act; and

(c) who are executive officers who elected to make provision for a benefit in accordance with paragraph 30A (1) (b) of the SAS Act.

Method |

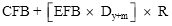

where: CFB is the amount that would be payable from the contributor’s account of the person if the person had applied for payment of a benefit at the relevant date. EFB is the person’s employer‑financed benefit calculated in accordance with paragraph 43 (6) (b) of the SAS Act if the person had died on the relevant date. Dy+m has the meaning given by clause 7. R is the reduction factor under clause 8. |

7 Definition of Dy+m

(1) In clause 6:

Dy+m is:

(a) if subsection (2) applies — 1; or

(b) otherwise — the factor calculated in accordance with the formula set out in subclause (3).

(2) For paragraph (a) of the definition of Dy+m in subsection (1), this subsection applies if:

(a) the person has reached the person’s early retirement age; or

(b) the person elected to make provision for a benefit in accordance with paragraph 30A (1) (b) of the SAS Act; or

(c) the person elected to make provision for a benefit in accordance with Part 2 of Schedule 5 to the SAS Act when the person was at least 55 years.

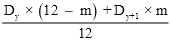

(3) For paragraph (1) (b), the factor calculated in accordance with the formula:

where:

Dy is the valuation factor mentioned in Table 8 of Division 7.4 that is applicable given the number of complete years (y) in the period commencing on the relevant date and ending on the date when the person reaches the person’s early retirement age.

m is the number of complete months that are not included in the number of complete years in the period commencing on the relevant date and ending on the date when the person reaches the person’s early retirement age.

Dy+1 is the valuation factor mentioned in Table 8 of Division 7.4 that is applicable to the person if the number of complete years (y) in the period commencing on the relevant date and ending on the date when the person reaches the person’s early retirement age were 1 year more than it is.

8 Reduction factor

(1) Reduction factor is:

(a) if paragraphs (b), (c) and (d) do not apply — 1; or

(b) if:

(i) the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlement of only one spouse of the person, being an entitlement arising under a superannuation agreement, flag lifting agreement or splitting order that applies in respect of the interest; and

(ii) the requirements mentioned in subparagraph (i) were satisfied after the person became entitled, in the event of death, to the benefit provided in accordance with subsection 43 (6) of the SAS Act;

the amount calculated in accordance with the formula set out in subclause (2); or

(c) if:

(i) the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlement of only one spouse of the person, being an entitlement arising under a superannuation agreement, flag lifting agreement or splitting order that applies in respect of the interest; and

(ii) the requirements mentioned in subparagraph (i) were satisfied before the person became entitled, in the event of death, to the benefit provided in accordance with subsection 43 (6) of the SAS Act;

the amount calculated in accordance with the formula set out in subclause (3); or

(d) if the requirements of Division 2.2 of the Regulations have been satisfied in respect of the entitlements of 2 or more spouses of the person, being entitlements each arising under a superannuation agreement, flag lifting agreement or splitting order that applies in respect of the interest — the product of the amounts calculated in accordance with whichever of paragraph (b) or (c) is applicable, in respect of each entitlement.

(2) For paragraph (1) (b), the amount is to be calculated in accordance with the formula:

where:

NMProp is the quotient of:

(a) the value of the spouse’s entitlement to the interest under the agreement or order immediately before the time when the requirements of Division 2.2 of the Regulations were satisfied; and

(b) the gross value of the person’s interest, immediately before those requirements were satisfied, determined in accordance with the method set out in the table following clause 6.

(3) For paragraph (1) (c), the amount is to be calculated in accordance with the formula:

where:

NMProp has the meaning given by subclause (2).

ABPs, Bs, and Cs have the meanings given by subclause 4 (2).

ABPe is a person’s accrued benefit points as at the date when the person became entitled, in the event of death, to the benefit provided in accordance with subsection 43 (6) of the SAS Act.

Be is the number of days in the period:

(a) commencing on the later of the person’s entry date and 1 July 1988; and

(b) ending at the end of the date when the person became entitled, in the event of death, to the benefit provided in accordance with subsection 43 (6) of the SAS Act;

other than any day when the person was not required to make contributions to the SAS Scheme because the person was on leave without pay.

Ce is the total number of days in the period:

(a) commencing on the person’s entry date; and

(b) ending at the end of the date when the person became entitled, in the event of death, to the benefit provided in accordance with subsection 43 (6) of the SAS Act;

other than any day when the person was not required to make contributions to the SAS Scheme because the person was on leave without pay.

Division 7.3 Interests in the payment phase

9 Method for interests in SAS Scheme

For an interest:

(a) that is held by a person who is entitled to be paid a pension under the SAS scheme; and

(b) that is in the payment phase in the SAS Scheme;

the method set out in the following table is approved for section 4 of this instrument.

Method |

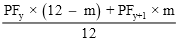

where: P is the amount of person’s annual pension at the relevant date. PFy+m is the factor calculated in accordance with the formula:

where: PFy is the valuation factor mentioned in whichever of Table 9 or 10 of Division 7.4 is applicable given: (a) the person’s gender; and (b) the person’s age in completed years (y) at the relevant date; and (c) the type of pension. m is the number of complete months of the person’s age that are not included in the person’s age in completed years at the relevant date. PFy+1 is the valuation factor mentioned in whichever of Table 9 or 10 of Division 7.4 is applicable if the person’s age in completed years at the relevant date were 1 year more than it is. |

Division 7.4 Factors

Table 1 Valuation factors — females who are under 18 years on entry to SAS Scheme |

Employee’s age in completed years | Average rate of benefit point accrual (abpa) |

abpa 0.04 | 0.04< abpa <0.045 | 0.045abpa< 0.05 | 0.05abpa< 0.055 | 0.055abpa< 0.06 | abpa=0.06 |

26 | 0.4285 | 0.4237 | 0.4048 | 0.3862 | 0.3687 | 0.3604 |

27 | 0.4414 | 0.4363 | 0.4162 | 0.3964 | 0.3777 | 0.3689 |

28 | 0.4547 | 0.4492 | 0.4279 | 0.4067 | 0.3868 | 0.3775 |

29 | 0.4683 | 0.4626 | 0.4398 | 0.4173 | 0.3961 | 0.3861 |

30 | 0.4825 | 0.4763 | 0.4520 | 0.4280 | 0.4055 | 0.3949 |

31 | 0.4969 | 0.4904 | 0.4646 | 0.4390 | 0.4150 | 0.4037 |

32 | 0.5105 | 0.5035 | 0.4762 | 0.4491 | 0.4235 | 0.4116 |

33 | 0.5243 | 0.5169 | 0.4880 | 0.4593 | 0.4323 | 0.4197 |

34 | 0.5383 | 0.5305 | 0.4999 | 0.4697 | 0.4413 | 0.4279 |

35 | 0.5524 | 0.5442 | 0.5121 | 0.4803 | 0.4504 | 0.4363 |

36 | 0.5667 | 0.5581 | 0.5244 | 0.4910 | 0.4596 | 0.4449 |

37 | 0.5812 | 0.5722 | 0.5370 | 0.5021 | 0.4692 | 0.4538 |

38 | 0.5960 | 0.5866 | 0.5498 | 0.5133 | 0.4789 | 0.4628 |

39 | 0.6110 | 0.6012 | 0.5628 | 0.5248 | 0.4890 | 0.4722 |

40 | 0.6263 | 0.6161 | 0.5761 | 0.5364 | 0.4991 | 0.4816 |

41 | 0.6416 | 0.6310 | 0.5893 | 0.5480 | 0.5092 | 0.4910 |

42 | 0.6571 | 0.6460 | 0.6026 | 0.5597 | 0.5193 | 0.5003 |

43 | 0.6727 | 0.6612 | 0.6160 | 0.5713 | 0.5292 | 0.5095 |

44 | 0.6886 | 0.6766 | 0.6295 | 0.5829 | 0.5390 | 0.5184 |

45 | 0.7047 | 0.6922 | 0.6431 | 0.5944 | 0.5487 | 0.5272 |

46 | 0.7210 | 0.7079 | 0.6566 | 0.6058 | 0.5580 | 0.5356 |

47 | 0.7375 | 0.7238 | 0.6701 | 0.6170 | 0.5670 | 0.5617 |

48 | 0.7541 | 0.7398 | 0.6835 | 0.6278 | 0.5882 | 0.5882 |

49 | 0.7708 | 0.7558 | 0.6967 | 0.6383 | 0.6154 | 0.6154 |

50 | 0.7877 | 0.7719 | 0.7098 | 0.6483 | 0.6431 | 0.6431 |

51 | 0.8047 | 0.7880 | 0.7226 | 0.6715 | 0.6715 | 0.6715 |

52 | 0.8216 | 0.8040 | 0.7348 | 0.7003 | 0.7003 | 0.7003 |

53 | 0.8385 | 0.8199 | 0.7466 | 0.7298 | 0.7298 | 0.7298 |

54 | 0.8555 | 0.8357 | 0.7600 | 0.7600 | 0.7600 | 0.7600 |

55 | 0.8726 | 0.8515 | 0.7913 | 0.7913 | 0.7913 | 0.7913 |

56 | 0.8898 | 0.8674 | 0.8239 | 0.8239 | 0.8239 | 0.8239 |

57 | 0.9072 | 0.8833 | 0.8577 | 0.8577 | 0.8577 | 0.8577 |

58 | 0.9252 | 0.8996 | 0.8935 | 0.8935 | 0.8935 | 0.8935 |

59 | 0.9316 | 0.9136 | 0.9136 | 0.9136 | 0.9136 | 0.9136 |

60 | 0.9424 | 0.9424 | 0.9424 | 0.9424 | 0.9424 | 0.9424 |

61 | 0.9501 | 0.9501 | 0.9501 | 0.9501 | 0.9501 | 0.9501 |

62 | 0.9576 | 0.9576 | 0.9576 | 0.9576 | 0.9576 | 0.9576 |

63 | 0.9681 | 0.9681 | 0.9681 | 0.9681 | 0.9681 | 0.9681 |

64 | 0.9836 | 0.9836 | 0.9836 | 0.9836 | 0.9836 | 0.9836 |

65 or more | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

Table 2 Valuation factors — males who are under 18 years on entry to SAS Scheme |

Employee’s age in completed years | Average rate of benefit point accrual (abpa) |

abpa 0.04 | 0.04< abpa <0.045 | 0.045abpa< 0.05 | 0.05abpa< 0.055 | 0.055abpa< 0.06 | abpa=0.06 |

26 | 0.4398 | 0.4337 | 0.4095 | 0.3868 | 0.3661 | 0.3565 |

27 | 0.4521 | 0.4457 | 0.4204 | 0.3965 | 0.3748 | 0.3648 |

28 | 0.4647 | 0.4579 | 0.4314 | 0.4064 | 0.3836 | 0.3731 |

29 | 0.4775 | 0.4705 | 0.4426 | 0.4164 | 0.3926 | 0.3816 |

30 | 0.4906 | 0.4832 | 0.4540 | 0.4266 | 0.4016 | 0.3900 |

31 | 0.5040 | 0.4963 | 0.4657 | 0.4370 | 0.4108 | 0.3987 |

32 | 0.5174 | 0.5093 | 0.4773 | 0.4472 | 0.4198 | 0.4071 |

33 | 0.5308 | 0.5223 | 0.4889 | 0.4574 | 0.4288 | 0.4155 |

34 | 0.5441 | 0.5353 | 0.5004 | 0.4676 | 0.4376 | 0.4238 |

35 | 0.5576 | 0.5484 | 0.5120 | 0.4777 | 0.4465 | 0.4321 |

36 | 0.5712 | 0.5616 | 0.5236 | 0.4879 | 0.4554 | 0.4404 |

37 | 0.5850 | 0.5750 | 0.5354 | 0.4983 | 0.4644 | 0.4487 |

38 | 0.5989 | 0.5884 | 0.5473 | 0.5086 | 0.4733 | 0.4570 |

39 | 0.6129 | 0.6021 | 0.5593 | 0.5190 | 0.4823 | 0.4654 |

40 | 0.6272 | 0.6159 | 0.5714 | 0.5296 | 0.4914 | 0.4738 |

41 | 0.6417 | 0.6300 | 0.5837 | 0.5403 | 0.5007 | 0.4824 |

42 | 0.6565 | 0.6443 | 0.5963 | 0.5511 | 0.5100 | 0.4910 |

43 | 0.6715 | 0.6589 | 0.6090 | 0.5621 | 0.5194 | 0.4996 |

44 | 0.6868 | 0.6737 | 0.6219 | 0.5731 | 0.5287 | 0.5082 |

45 | 0.7024 | 0.6887 | 0.6349 | 0.5842 | 0.5381 | 0.5168 |

46 | 0.7183 | 0.7040 | 0.6481 | 0.5954 | 0.5474 | 0.5252 |

47 | 0.7344 | 0.7196 | 0.6614 | 0.6066 | 0.5567 | 0.5514 |

48 | 0.7508 | 0.7354 | 0.6747 | 0.6176 | 0.5781 | 0.5781 |

49 | 0.7674 | 0.7513 | 0.6880 | 0.6284 | 0.6056 | 0.6056 |

50 | 0.7843 | 0.7675 | 0.7013 | 0.6391 | 0.6339 | 0.6339 |

51 | 0.8012 | 0.7836 | 0.7145 | 0.6629 | 0.6629 | 0.6629 |

52 | 0.8183 | 0.7999 | 0.7275 | 0.6927 | 0.6927 | 0.6927 |

53 | 0.8357 | 0.8164 | 0.7404 | 0.7235 | 0.7235 | 0.7235 |

54 | 0.8533 | 0.8330 | 0.7553 | 0.7553 | 0.7553 | 0.7553 |

55 | 0.8712 | 0.8499 | 0.7883 | 0.7883 | 0.7883 | 0.7883 |

56 | 0.8895 | 0.8670 | 0.8226 | 0.8226 | 0.8226 | 0.8226 |

57 | 0.9081 | 0.8844 | 0.8585 | 0.8585 | 0.8585 | 0.8585 |

58 | 0.9272 | 0.9021 | 0.8960 | 0.8960 | 0.8960 | 0.8960 |

59 | 0.9339 | 0.9166 | 0.9166 | 0.9166 | 0.9166 | 0.9166 |

60 | 0.9422 | 0.9422 | 0.9422 | 0.9422 | 0.9422 | 0.9422 |

61 | 0.9515 | 0.9515 | 0.9515 | 0.9515 | 0.9515 | 0.9515 |

62 | 0.9592 | 0.9592 | 0.9592 | 0.9592 | 0.9592 | 0.9592 |

63 | 0.9715 | 0.9715 | 0.9715 | 0.9715 | 0.9715 | 0.9715 |

64 | 0.9853 | 0.9853 | 0.9853 | 0.9853 | 0.9853 | 0.9853 |

65 or more | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

Table 3 Valuation factors — females who are 18 to 22 years on entry to SAS Scheme | |

Employee’s age in completed years | Average rate of benefit point accrual (abpa) | |

abpa 0.045 | 0.045<abpa< 0.05 | 0.05abpa< 0.055 | 0.055abpa< 0.06 | abpa=0.06 |

26 | 0.4098 | 0.4028 | 0.3858 | 0.3693 | 0.3615 |

27 | 0.4243 | 0.4168 | 0.3987 | 0.3812 | 0.3728 |

28 | 0.4396 | 0.4317 | 0.4124 | 0.3937 | 0.3848 |

29 | 0.4557 | 0.4473 | 0.4267 | 0.4068 | 0.3973 |

30 | 0.4729 | 0.4638 | 0.4419 | 0.4207 | 0.4107 |

31 | 0.4881 | 0.4784 | 0.4551 | 0.4325 | 0.4218 |

32 | 0.5022 | 0.4919 | 0.4672 | 0.4432 | 0.4319 |

33 | 0.5165 | 0.5057 | 0.4795 | 0.4542 | 0.4421 |

34 | 0.5309 | 0.5195 | 0.4919 | 0.4652 | 0.4525 |

35 | 0.5455 | 0.5335 | 0.5045 | 0.4764 | 0.4631 |