Part 1—Preliminary

1 Name of Regulations

These Regulations are the Renewable Energy (Electricity) Regulations 2001.

3 Definitions

(1) In these Regulations:

accredited body means a body accredited under the Joint Accreditation System of Australia and New Zealand to give product certification or component certification of solar water heaters.

Act means the Renewable Energy (Electricity) Act 2000.

AS, AS/NZS or Australian Standard followed by a number (for example, AS/NZS 3000:2007) means a standard of that number issued by Standards Australia Limited and, if a date is included, of that date.

auxiliary loss has the meaning given in regulation 3B.

bioenergy means the energy derived from the biomass components of an energy source mentioned in any of paragraphs (i) to (s) of the definition of eligible renewable energy source in subsection 17(1) of the Act.

biomass means organic matter other than fossilised biomass.

Examples of fossilised biomass: Coal, lignite.

business day means a day that is not:

(a) a Saturday or a Sunday; or

(b) a public holiday or a bank holiday in the Australian Capital Territory.

Clean Energy Council means Clean Energy Council Limited, ACN 127 102 443.

cogeneration means a power generation process that provides electricity and process heat as outputs.

commercial meter means a meter that is used to record the consumption of electricity for the purposes of a financial transaction between unrelated parties in relation to the consumption of electricity.

component certification, of a solar water heater, means certification by an accredited body in relation to specified components of the solar water heater.

digital identity of an individual means a distinct electronic representation of the individual that enables the individual to be sufficiently distinguished when interacting online with services.

document verification service means the service known as the Australian Government Document Verification Service, or that service continuing in existence with a different name.

identity evidence, for a person: see subregulation 20Q(1).

identity service provider means an accredited participant in the system known as the Australian Government Digital Identity System, or that system continuing in existence with a different name, that provides a service that generates, manages, maintains or verifies information relating to the identity of an individual.

interconnected hydro‑electric system means a hydro‑electric system in which water can be directed from a common storage down different watercourses so that water can be diverted from 1 power station to another, altering the amount of electricity that can be generated by each power station.

Jobs and Competitiveness Program means the Jobs and Competitiveness Program that was in force under the Clean Energy Act 2011 immediately before the repeal of that Act by item 1 of Schedule 1 to the Clean Energy Legislation (Carbon Tax Repeal) Act 2014.

national electricity market means the interconnected electricity grids in the participating jurisdictions in the National Electricity Rules.

National Electricity (NT) Rules has the same meaning as in the National Electricity (Northern Territory) (National Uniform Legislation) Act 2015 (NT), as in force from time to time.

native forest means a local indigenous plant community:

(a) the dominant species of which are trees; and

(b) containing throughout its growth the complement of native species and habitats normally associated with that forest type or having the potential to develop those characteristics; and

(c) including a forest with those characteristics that has been regenerated with human assistance following disturbance; and

(d) excluding a plantation of native species or previously logged native forest that has been regenerated with non‑endemic native species.

NEM standard metering means the standard of metering mentioned in the National Electricity Rules.

network control ancillary services, for a power station, has the same meaning as in the National Electricity Rules.

NTESMO has the same meaning as in the National Electricity (NT) Rules.

Note: See item 99A of Schedule 2 to the National Electricity (Northern Territory) (National Uniform Legislation) (Modification) Regulations 2016 (NT), as in force from time to time.

plantation means an intensively managed stand of trees of native or exotic species, created by the regular placement of seedlings or seed.

product certification, of a solar water heater, means certification by an accredited body in relation to the design and manufacture of the solar water heater.

quarter means a period of 3 months commencing on 1 January, 1 April, 1 July or 1 October of a year.

regional forest agreement means a Regional Forest Agreement within the meaning of the Regional Forest Agreements Act 2002.

registered for GST means registered under the A New Tax System (Goods and Services Tax) Act 1999.

Register of solar water heaters means the Register of solar water heaters kept by the Regulator under regulation 19C.

required to be registered for GST means required to be registered under the A New Tax System (Goods and Services Tax) Act 1999.

territorial sea has the meaning given by section 3 of the Seas and Submerged Lands Act 1973.

thinnings means the selective removal of trees and branches from a forest during the growing stage and at harvest.

true‑up report means a true‑up report that is required to be given to the Regulator under section 5 of the Clean Energy Legislation (Carbon Tax Repeal) (Jobs and Competitiveness Program) Rules 2014.

(2) For the definition of small generation unit in subsection 5(1) of the Act:

(a) a device whose energy source is hydro is a small generation unit if:

(i) it has a kW rating of no more than 6.4 kW; and

(ii) it generates no more than 25 MWh of electricity each year; and

(b) a device whose energy source is wind is a small generation unit if:

(i) it has a kW rating of no more than 10 kW; and

(ii) it generates no more than 25 MWh of electricity each year; and

(c) a device whose energy source is solar (photovoltaic) is a small generation unit if:

(i) it has a kW rating of no more than 100 kW; and

(ii) it generates no more than 250 MWh of electricity each year.

(2A) Without limiting paragraph (2)(c), 2 or more systems whose energy source is solar (photovoltaic) are taken to be a device for the purposes of that paragraph if any of the following apply:

(a) the systems are connected to a grid at one or more connection points and not installed behind a commercial meter subsidiary to any of the connection points;

(b) both:

(i) the systems are connected to a grid at one or more connection points and installed behind a single commercial meter subsidiary to one or more of the connection points; and

(ii) there is no connection subsidiary to the commercial meter that allows electricity to flow between the commercial meter and any other commercial meter or to another connection point;

(c) both:

(i) the systems are connected to a grid at one or more connection points and installed behind more than one commercial meter subsidiary to one or more of the connection points; and

(ii) a connection subsidiary to the commercial meters allows electricity to flow between the commercial meters but not between any other commercial meter or to any other connection point;

(d) at least 3 of the following apply:

(i) the systems are located at a single site or multiple adjoining sites in the same area;

(ii) the systems are installed for the primary purpose of generating electricity for export to a grid;

(iii) electrical infrastructure (other than metering equipment) is needed to connect the systems to a grid;

(iv) more than 50% of the total kW rating of all systems is from ground mounted systems.

3A Conditions for solar water heater

(1) For the definition of solar water heater in subsection 5(1) of the Act, a device that heats water using solar energy is a solar water heater during the period specified in the Register for the device if the device:

(a) is entered in the Register of solar water heaters; and

(b) satisfies subregulation (2) or (3).

Note: Certificates cannot be created for a solar water heater that is an air source heat pump water heater if it has a volumetric capacity of more than 425 L—see subsection 21(4) of the Act.

(1A) However, a device is not a solar water heater if the number of certificates that could be created over a 10‑year period for the installation of the device in any one or more of the zones, worked out in accordance with the method mentioned in subregulation 19B(1) or 19BA(3), would be more than 2,500, unless the device was entered into the Register of solar water heaters before 1 December 2018.

Solar water heaters—capacity not more than 700 L

(2) A device satisfies this subregulation if:

(a) the device has a capacity of not more than 700 L; and

(b) an accredited body has given the device product certification to AS/NZS 2712:2007, Solar and heat pump water heaters—Design and construction, as in force at the time the certification is given.

Solar water heaters—capacity more than 700 L

(3) A device satisfies this subregulation if:

(a) the device has a capacity of more than 700 L; and

(b) an accredited body has given the device component certification to each of the following Australian Standards that applies to the device:

(i) AS/NZS 2712:2007 Solar and heat pump water heaters—Design and construction, as in force at the time the certification is given;

(ii) the Australian Standards mentioned in clause 1.4 of AS/NZS 2712:2007 Solar and heat pump water heaters—Design and construction, as in force at the time the certification is given; and

(c) the storage tank of the device meets the requirements of:

(i) both:

(A) AS/NZS 4692.1:2005, Electric water heaters, Part 1: Energy consumption, performance and general requirements, as in force at the time the certification mentioned in paragraph (b) is given; and

(B) AS/NZS 4692.2:2005, Electric water heaters, Part 2: Minimum Energy Performance Standard (MEPS) requirements and energy labelling, as in force at the time the certification mentioned in paragraph (b) is given; or

(ii) the document called Heat Loss Test Procedure for Solar Water Heaters with a Hot Water Storage Tank Greater than 700 L, first published by the Regulator on 29 May 2003, as in force at the time the certification mentioned in paragraph (b) is given.

Note: A copy of the document mentioned in subparagraph (3)(c)(ii) is available by post from the Regulator, GPO Box 621, Canberra ACT 2601. The document can be viewed on and downloaded from the Regulator’s website: www.cleanenergyregulator.gov.au.

3B Definition of auxiliary loss

(1) For a power station, auxiliary loss means the amount of electricity used in generating electricity, and operating and maintaining the power station, but does not include any electricity used for network control ancillary services.

(2) For a hydro‑electric power station, auxiliary loss also includes the amount of electricity that is used to pump or to raise water before its release for hydro‑electric generation.

Part 2—Renewable energy certificates

Division 2.1A—Registration

3L Determining fit and proper person

(1) For subsection 11(2A) of the Act, in determining whether the applicant is a fit and proper person, the Regulator must have regard to the following matters:

(a) whether the applicant has been convicted of an offence against any of the following:

(i) a law of the Commonwealth, a State or a Territory, that relates to dishonest conduct;

(ii) a law of the Commonwealth, a State or a Territory, that relates to the conduct of a business;

(iii) section 136.1, 137.1 or 137.2 of the Criminal Code;

(iv) a foreign law that corresponds to a law mentioned in subparagraphs (i) to (iii) or subparagraphs (b)(i) to (iv);

(b) whether the applicant has breached any of the following:

(i) this Act or these Regulations;

(ii) the Australian National Registry of Emissions Units Act 2011 or regulations under that Act;

(iii) the Carbon Credits (Carbon Farming Initiative) Act 2011 or regulations under that Act;

(iv) the National Greenhouse and Energy Reporting Act 2007 or regulations under that Act;

(c) whether an order has been made against the applicant under:

(i) section 76 of the Competition and Consumer Act 2010; or

(ii) section 224 of Schedule 2 to the Competition and Consumer Act 2010, as that section applies as a law of the Commonwealth, a State or a Territory; or

(iii) a foreign law that corresponds to a law mentioned in subparagraphs (i) or (ii);

(d) whether the applicant has been refused registration by, de‑registered by, or suspended from participating in, a State or Territory energy efficiency scheme, such as the following:

(i) the Energy Savings Scheme in New South Wales;

(ii) the Victorian Energy Efficiency Target scheme;

(e) whether the applicant has:

(i) sought or been granted accreditation by, or membership of, a clean energy organisation; or

(ii) been refused accreditation by, or membership of, a clean energy organisation; or

(iii) had the applicant’s accreditation by, or membership of, a clean energy organisation suspended or revoked;

(f) whether the applicant is:

(i) for an applicant that is an individual—an insolvent under administration within the meaning of the Corporations Act 2001; and

(ii) for an applicant that is a body corporate—a Chapter 5 body corporate within the meaning of the Corporations Act 2001;

(g) for an applicant that is a body corporate—whether overseas or under a foreign law:

(i) the body corporate is being wound up; or

(ii) a receiver, or a receiver and manager, has been appointed (whether or not by a court) in respect of the property of the body corporate and is acting; or

(iii) the body corporate is under administration; or

(iv) the body corporate has executed a deed of company arrangement that has not yet terminated; or

(v) the body corporate is under restructuring; or

(vi) the body corporate has made a restructuring plan that has not yet terminated; or

(vii) the body corporate has entered into a compromise or arrangement with another person and the administration of which has not been concluded.

(2) If the applicant is a body corporate, the Regulator must also have regard to the following matters:

(a) whether an executive officer of the body corporate has been convicted of an offence against any of the following:

(i) a law of the Commonwealth, a State or a Territory, that relates to dishonest conduct;

(ii) a law of the Commonwealth, a State or a Territory, that relates to the conduct of a business;

(iii) section 136.1, 137.1 or 137.2 of the Criminal Code;

(iv) a foreign law that corresponds to a law mentioned in subparagraphs (i) to (iii) or subparagraphs (b)(i) to (iv);

(b) whether an executive officer of the body corporate has breached any of the following:

(i) this Act or these Regulations;

(ii) the Australian National Registry of Emissions Units Act 2011 or regulations under that Act;

(iii) the Carbon Credits (Carbon Farming Initiative) Act 2011 or regulations under that Act;

(iv) the National Greenhouse and Energy Reporting Act 2007 or regulations under that Act;

(c) whether an order has been made against an executive officer of the body corporate:

(i) under section 76 of the Competition and Consumer Act 2010; or

(ii) under section 224 of Schedule 2 to the Competition and Consumer Act 2010, as that section applies as a law of the Commonwealth, a State or a Territory; or

(iii) under a foreign law that corresponds to a law mentioned in subparagraph (i) or (ii); or

(iv) by a foreign court, disqualifying the executive officer from:

(A) being a director of a body corporate; or

(B) being concerned in the management of a body corporate;

(d) whether an executive officer of the body corporate has been refused registration, de‑registered or suspended from participating in a State or Territory energy efficiency scheme, such as the following:

(i) the Energy Savings Scheme in New South Wales;

(ii) the Victorian Energy Efficiency Target scheme;

(e) whether an executive officer of the body corporate has:

(i) sought or been granted accreditation by, or membership of, a clean energy organisation; or

(ii) been refused accreditation by, or membership of, a clean energy organisation; or

(iii) had the executive officer’s accreditation by, or membership of, a clean energy organisation suspended or revoked.

(3) For paragraphs (1)(e) and (2)(e), a clean energy organisation means an organisation that has a constitution and operates a scheme that:

(a) accredits, or provides membership to, persons who do one or more of the following:

(i) install small generation units or solar water heaters;

(ii) supply small generation units or solar water heaters;

(iii) create or trade in small‑scale technology certificates; and

(b) has a code of conduct that is binding on persons who are accredited by, or members of, the organisation; and

(c) monitors compliance with the code of conduct and is able to take action against a person who is accredited by, or a member of, the organisation for a breach of the code (such as by suspending the person’s accreditation or membership).

Examples:

1 Clean Energy Council

2 REC Agents Association Incorporated (ABN 950 64 032 965).

Division 2.1—Accreditation

3S Final day for including eligible WCMG in application

For subsection 13(2A) of the Act, 1 April 2012 is prescribed as the day after which an application that lists eligible WCMG as an eligible energy source cannot be made.

4 Eligibility for accreditation

(1) For paragraph 14(2)(b) of the Act:

(a) a power station that is in the national electricity market must use NEM standard metering; and

(b) a power station that is not in the national electricity market must use metering that enables the Regulator to determine the amount of electricity generated by the power station; and

(c) the power station must be operated in accordance with any relevant Commonwealth, State, Territory or local government planning and approval requirements.

(2) For subsection 14(4) of the Act, the guidelines are set out in Schedule 1.

5 1997 eligible renewable power baselines

For subsection 14(4) of the Act, the guidelines for determining the 1997 eligible renewable power baseline for a power station are set out in Schedule 3.

Note: See section 30F of the Act and Division 2.6 of these Regulations in relation to varying the 1997 eligible renewable power baseline for an accredited power station.

5A 2008 WCMG limit

For subsection 14(4) of the Act, the guidelines for determining the 2008 WCMG limit for a power station are set out in Schedule 3A.

Note: See section 30G of the Act and Division 2.7 of these Regulations in relation to varying the 2008 WCMG limit for an accredited power station.

Division 2.2—Eligible renewable energy sources

6 Meaning of certain energy sources that are eligible renewable energy sources (Act s 17)

For subsections 17(3) and (4) of the Act:

agricultural waste means the putrescible biomass wastes produced during agricultural operations, including livestock husbandry.

biomass‑based components of municipal solid waste means the biomass‑based components of wastes that are directly sourced from, or eligible to be disposed of in, landfill or a waste transfer station that is licensed by a State or Territory government body or by a local government authority, but does not include biomass‑based components of wastes originating from:

(a) forestry or broadacre land clearing for agriculture, silviculture and horticulture operations; or

(b) fossil fuels.

black liquor means the mixture arising from the chemical wood pulping process.

hot dry rock includes hot fractured rock.

landfill gas means the gas produced by the breaking down of the organic part of municipal landfills.

sewage gas means gas produced by the decomposition of domestic and commercial wastes that are collected from sewerage systems and treated by sewage treatment plants.

waste from processing of agricultural products means the biomass waste produced from processing agricultural products.

7 Meaning of certain energy sources that are not eligible renewable energy sources (Act s 17)

For subsection 17(3) of the Act:

fossil fuels means any of the following:

(a) coal, oil, natural gas or other petroleum‑based products;

(b) products, by‑products and wastes associated with, or produced from, extracting and processing coal, oil, natural gas or other petroleum‑based products.

Examples: Condensate liquids, coal seam methane, coal mine methane.

waste products derived from fossil fuels means the components of waste streams that:

(a) are made using, as raw materials, any material that is a fossil fuel for the Act; and

(b) are products or by‑products of manufacturing operations, including plastics, tyres, disposable nappies, synthetic carpets and synthetic textiles.

8 Meaning of wood waste

For the purposes of section 17 of the Act, wood waste means:

(a) biomass:

(i) produced from non‑native environmental weed species; and

(ii) harvested for the control or eradication of the species, from a harvesting operation that is approved under relevant Commonwealth, State or Territory planning and approval processes; and

(b) a manufactured wood product or a by‑product from a manufacturing process; and

(c) waste products from the construction of buildings or furniture, including timber off‑cuts and timber from demolished buildings; and

(d) sawmill residue.

Examples for paragraph (b): Packing case, pallet, recycled timber, engineered wood product (including one manufactured by binding wood strands, wood particles, wood fibres or wood veneers with adhesives to form a composite).

9 Energy crops (Act s 17)

(1) For section 17 of the Act, biomass from a plantation is not an energy crop unless all of the following apply to it:

(a) it must be a product of a harvesting operation (including thinnings and coppicing) approved under relevant Commonwealth, State or Territory planning and approval processes;

(b) it must be biomass from a plantation that is managed in accordance with:

(i) a code of practice approved for a State under the Export Control (Wood and Woodchips) Rules 2021; or

(ii) if a code of practice has not been approved for a State as required under subparagraph (i), Australian Standard AS 4708—2007—The Australian Forestry Standard;

(c) it must be taken from land that was not cleared of native vegetation after 31 December 1989 to establish the plantation.

(2) For section 17 of the Act, biomass from a native forest is not an energy crop.

10 Special requirements—ocean, wave and tide

Electricity generated from an ocean, wave or tide energy source must be generated within the territorial sea of Australia.

Division 2.2A—Eligible WCMG

10A Eligible WCMG starting day

(1) For subparagraph 17A(1)(a)(i) of the Act, 1 July 2012 is prescribed as the starting day.

(2) However, subregulation (1) does not take effect if section 3 of the Clean Energy Act 2011 does not commence on or before 1 July 2012.

10B Meaning of waste coal mine gas

(1) This regulation is made for subsection 17A(2) of the Act.

(2) For the purposes of the Act, waste coal mine gas means either of the following:

(a) coal seam gas that, as part of a coal mining operation, is drained from a coal mine that is covered by a coal mining lease (however called) that authorises coal mining;

(b) coal seam gas that is drained from a closed coal mine that is, or was, covered by a coal mining lease (however called) that authorises coal mining.

10C Limitations on eligible WCMG

For subsection 17A(3) of the Act, waste coal mine gas is not eligible WCMG if:

(a) an abatement certificate under the Electricity Supply Act 1995 (NSW); or

(b) a gas electricity certificate under the Electricity Act 1994 (Qld); or

(c) an abatement certificate under the Electricity (Greenhouse Gas Emissions) Act 2004 (ACT);

is created in relation to electricity generated using the waste coal mine gas.

Division 2.3—Eligible electricity generation

Subdivision 2.3.1—Accredited power stations

13 Working out electricity generation for a power station

For subsection 18(3) of the Act, the amount of electricity generated by an accredited power station is worked out in accordance with regulations 14 to 16.

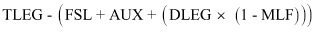

14 General formula

(1) The amount of electricity generated by an accredited power station in a year is:

where:

TLEG is the total amount of electricity, in MWh, generated by the power station in the year, as measured at all generator terminals of the power station in the year.

FSL is the amount (if any) of electricity, in MWh, generated by the power station in the year using energy sources that are not eligible energy sources, worked out under regulation 15.

AUX is the auxiliary loss, in MWh, for the power station for the year.

Note: See regulation 16 in relation to working out the auxiliary loss if some of the electricity generated by the power station in the year was generated using energy sources that are not eligible energy sources.

DLEG is the amount of electricity, in MWh, transmitted or distributed by the power station in the year, measured:

(a) if the power station is part of the national electricity market—at the point determined under the National Electricity Rules; or

(b) in any other case—at the point determined by an authority of the State or Territory where the power station is.

MLF is the marginal loss factor, to allow for the amount of electricity losses in transmission networks, as determined by:

(a) if the power station is part of the national electricity market—AEMO; or

(b) in any other case—an authority of the State or Territory where the power station is.

(2) If all the electricity generated by the accredited power station is used in the power station, or in the local distribution network, or in both the power station and the local distribution network, the marginal loss factor (MLF) for subregulation (1) is taken to be 1.

(3) If the amount calculated using the formula in subregulation (1) exceeds 1 MWh and results in an amount that is not a whole MWh, the amount must be rounded down to the nearest MWh.

15 Ineligible fuel component

For the purpose of regulation 14, the amount (FSL) of electricity generated by an accredited power station attributable to energy sources that are not eligible energy sources is the amount worked out by converting the energy content of those energy sources into the equivalent number of MWh of electricity.

15A Electricity omitted from calculation

When determining the amount of electricity generated by an accredited power station, the following electricity is to be omitted from all calculations under regulation 14:

(a) electricity that was generated by using an eligible renewable energy source that is not ecologically sustainable;

(b) electricity that was not used to directly meet demand for electricity;

(c) electricity generated in a power station where an approval to use an eligible energy source:

(i) is required by a Commonwealth, State, Territory or local government authority; and

(ii) the nominated person for the power station is unable to give evidence of that approval;

(d) if certificates have been created in relation to a small generation unit under section 23A of the Act—electricity that was generated by the small generation unit.

Note: Ecologically sustainable is defined in subsection 5(1) of the Act.

16 Supplementary generation

For electricity generated by the power station from an energy source that is not an eligible energy source, auxiliary losses from the system that are attributable to that source are to be deducted from the total auxiliary loss proportionately to the proportion of electricity generated from that source.

18 Electricity generation returns for accredited power stations (Act s 20)

(1) For paragraph 20(2)(d) of the Act, an electricity generation return for an accredited power station for a year must include the following:

(a) the year to which the return relates;

(b) the nominated person’s registration number;

(c) the identification code given to the power station;

(d) the telephone number, fax number and e‑mail address (if any) of the power station;

(e) for each eligible energy source used by the power station to generate electricity in the year:

(i) the amount of electricity generated; and

(ii) the number of certificates created by the nominated person for that electricity;

(f) any changes to information already given to the Regulator or the Renewable Energy Regulator about the following matters in relation to the power station:

(i) ownership;

(ii) company mergers involving the owner or the operator;

(iii) street address, telephone number, fax number and e‑mail address (if any);

(iv) electricity supply arrangements;

(v) generation capacity;

(g) the 1997 eligible renewable power baseline that applied to the power station for the year;

(h) the date when the power station became an accredited power station;

(i) if the power station was not an accredited power station for all of the year:

(i) the amount of electricity generated by the power station since it became accredited; and

(ii) the number of certificates created by the nominated person for that amount of electricity;

(j) if a certificate was created in the year for an amount of electricity generated by the power station in a previous year:

(i) the number of certificates created by the nominated person for the amount of electricity generated in each previous year; and

(ii) each eligible energy source used to generate that electricity;

(k) information about any electricity that was imported into the power station in the year and how it was used;

(l) details of any breach of the conditions of a permit, or conviction for an offence, under any Commonwealth, State, Territory or local government law related to the operation of the power station during the year, or, if there was no breach or conviction during the year, a declaration to that effect.

(2) The first return for an accredited power station after commencement of this regulation must also include the following:

(a) for the years since gaining any accreditation under the Act, details of any breach of the conditions of a permit, or conviction for an offence, under any Commonwealth, State, Territory or local government law related to operation of the power station;

(b) if there was no breach or conviction for those years, a declaration to that effect.

Note: See subsection 20(2) of the Act for other information that must be included in an electricity generation return.

Subdivision 2.3.2—Solar water heaters

19 Creation of certificates for solar water heaters (Act s 21)

(1) For subsection 21(3) of the Act, the time at which a solar water heater is taken to have been installed is the day the heater is first able to produce and deliver hot water heated by solar energy.

(2) To avoid doubt, a solar water heater is taken to have been installed once only during the life of the unit.

Note: Certificates may only be created within 12 months after the installation of the solar water heater (see subsection 21(2) of the Act).

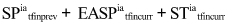

19A Number of certificates

(1) For subsection 22(1) of the Act, the number of certificates that may be created for a particular installation of a model of solar water heater in a particular zone and installation period is:

(a) for a solar water heater with a volumetric storage capacity up to and including 700 litres—the number set out in the Register of solar water heaters that is applicable to the model, zone and period; and

(b) for a solar water heater with a volumetric storage capacity over 700 litres—either:

(i) if the person who is entitled to create the certificates complies with subregulation (2)—the number set out in the Register of solar water heaters that is applicable to the model, zone and period; or

(ii) if the person who is entitled to create the certificates does not comply with subregulation (2)—0.

Note: Certificates cannot be created for a solar water heater that is an air source heat pump water heater if it has a volumetric capacity of more than 425 L—see subsection 21(4) of the Act.

(2) For paragraph (1)(b), the person who is entitled to create the certificates complies with this subregulation if, before the person creates any certificates in relation to the solar water heater, the person:

(a) obtains a statutory declaration that states the matters set out in subregulation (3); and

(b) obtains a further statutory declaration from the owner of the heater at the time it is installed stating that the owner intends that the solar water heater will remain installed in its original configuration and location for the life of the heater; and

(c) gives a copy of both statutory declarations to the Regulator.

(3) For subregulation (2) the statutory declaration must state:

(a) the model of the solar water heater; and

(b) the volumetric storage capacity of the heater; and

(c) the premises at which the heater is to be installed and used; and

(d) the purposes for which the heater, and the hot water produced by the heater, are to be used; and

(e) that the volumetric storage capacity of the heater is appropriate for the premises at which the heater is to be installed and the purposes for which the heater, and the hot water produced by the heater, are to be used; and

(f) the expertise or experience of the person signing the declaration in relation to a heater of the kind covered by the declaration.

19B Determination of method for determining number of certificates

(1) For subsection 22(1) of the Act, the Regulator may determine, by legislative instrument, the method to be used to determine the number of certificates that may be created for a particular model of solar water heater.

(2) The determination must provide that the number of certificates that may be created is to be worked out by reference to the difference, over the number of years specified for the solar water heater in regulation 19BE, between:

(a) the energy, other than solar energy or energy collected from the latent and sensible heat of the atmosphere, to be used by the solar water heater; and

(b) the electrical energy that would be used by an equivalent electric water heater.

(3) For subregulation (2), an electric water heater is an equivalent electric water heater if it:

(a) supplies the same, or a similar, hot water load as the solar water heater mentioned in paragraph (2)(a); and

(b) is not a heat pump.

(4) In making the determination, the Regulator must have regard to the method set out in the Australian Standard, set out in Schedule 4, as in force at the time the determination is made that applies to the solar water heater.

(5) In making the first determination under subregulation (1), the Regulator must have regard to:

(a) the guidelines known as REC calculation methodology for solar water heaters and heat pump water heaters with a volumetric capacity up to and including 700 litres, published by the Regulator on its website, as in force at the time the determination is made; and

(b) the guidelines known as REC calculation methodology for solar water heaters and heat pump water heaters with a volumetric capacity over 700 litres, published by the Regulator on its website, as in force at the time the determination is made.

19BA Determination of number of certificates

(1) For subsection 22(1) of the Act, the Regulator may determine the number of certificates that may be created for a particular model of solar water heater in each of the zones mentioned in paragraph 19C(3)(b).

(2) In making the determination, the Regulator must:

(a) if a determination under subregulation 19B(1) is in force—make the determination in accordance with that determination; and

(b) if there is no determination under subregulation 19B(1) in force—determine the number of certificates using the method in subregulation (3).

(3) For paragraph (2)(b), the number of certificates that may be created is to be worked out:

(a) by reference to the difference, over the number of years specified for the solar water heater in regulation 19BE, between:

(i) the energy, other than solar energy or energy collected from the latent and sensible heat of the atmosphere, to be used by the solar water heater; and

(ii) the electrical energy that would be used by an equivalent electric water heater; and

(b) having regard to the following, as in force at the time of the determination:

(i) AS/NZS 2535.1:2007, Test methods for solar collectors, Part 1: Thermal performance of glazed liquid heating collectors including pressure drop; and

(ii) AS 4234—1994, Solar water heaters—Domestic and heat pump—Calculation of energy consumption; and

(iii) AS/NZS 4692.1:2005, Electric water heaters, Part 1: Energy consumption, performance and general requirements; and

(c) if the solar water heater has a volumetric capacity up to and including 700 litres—having regard to the guidelines known as REC calculation methodology for solar water heaters and heat pump water heaters with a volumetric capacity up to and including 700 litres, published by the Regulator on its website, as in force at the time the determination is made; and

(d) if the solar water heater has a volumetric capacity over 700 litres—having regard to the guidelines known as REC calculation methodology for solar water heaters and heat pump water heaters with a volumetric capacity over 700 litres, published by the Regulator on its website, as in force at the time the determination is made.

(4) For subregulation (3), an electric water heater is an equivalent electric water heater if it:

(a) supplies the same, or a similar, hot water load as the solar water heater mentioned in subparagraph (3)(a)(i); and

(b) is not a heat pump.

19BB Variation of determination

(1) This regulation applies if the Regulator proposes to make a determination under regulation 19BA which would vary the information contained in the Register of solar water heaters.

(2) Before making the determination, the Regulator must:

(a) tell the manufacturer of the solar water heater, in writing:

(i) what information the Regulator proposes to vary and how it would be varied; and

(ii) the reason for the proposed variation; and

(b) invite the manufacturer to make written submissions about the proposed variation; and

(c) take into account any submissions received from the manufacturer when deciding whether to make the determination.

(3) The Regulator must not make a determination that would vary the information contained in the Register of solar water heaters in relation to a device entered into the Register before 1 December 2018, if the effect of the determination would be:

(a) to increase, to more than 2,500 from a number less than or equal to 2,500, the number of certificates that could be created over a 10‑year period for the installation of the device in any one or more of the zones; or

(b) to increase, from a number more than 2,500, the number of certificates that could be created over a 10‑year period for the installation of the device in any one or more of the zones.

19BC Requests for determination

(1) A person may request the Regulator to make a determination under regulation 19BA.

(2) The request must:

(a) be in writing in a form approved by the Regulator; and

(b) contain, or be accompanied by, any information or document required by the approved form; and

(c) be given to the Regulator within the 30 day period mentioned in paragraph 19BD(2)(b).

(3) The Regulator may, by written notice given to the person, request the person to give the Regulator, within the period specified in the notice, additional information and documents in connection with the request.

(4) If the person does not provide the additional information and documents within the specified period, the Regulator may, by written notice to the person:

(a) refuse to consider the request; or

(b) refuse to take any action, or further action, in relation to the request.

(5) The Regulator must consult with the person making the request if the Regulator proposes:

(a) not to make the requested determination; or

(b) to include information in the determination that is different to the information contained in the request.

(6) The Regulator must tell the person about the Regulator’s decision on the request:

(a) in writing; and

(b) not later than 180 days after the expiry of 30 day period mentioned in paragraph (2)(c).

19BD Invitation for requests for determination

(1) The Regulator must, at intervals of not more than 6 months, invite persons to make requests under subregulation 19BC(1).

(2) The invitation must:

(a) be published on the Regulator’s website; and

(b) include a 30 day period in which requests are to be made.

19BE Working out number of certificates that may be created

For subregulation 19B(2) and paragraph 19BA(3)(a), the number of years specified is:

(a) for a solar water heater installed on or before 31 December 2021—10 years; and

(b) for a solar water heater installed during a year mentioned in column 1 of the following table, the number of years specified in column 2 for the item.

Period certificates may be created |

Item | Column 1 | Column 2 |

| Year solar water heater installed | Number of years |

1 | 2022 | 9 |

2 | 2023 | 8 |

3 | 2024 | 7 |

4 | 2025 | 6 |

5 | 2026 | 5 |

6 | 2027 | 4 |

7 | 2028 | 3 |

8 | 2029 | 2 |

9 | 2030 | 1 |

19C Register of solar water heaters (Act s 23AA)

(1) The Regulator must establish and keep a register to be known as the Register of solar water heaters.

(2) The Regulator must keep the Register in electronic form.

(3) The Regulator must include the following information in the Register:

(a) the brand name and the model name of each solar water heater for which certificates may be created (an eligible solar water heater);

(b) zones in Australia determined by the Regulator:

(i) on the basis of climate and solar radiation levels; and

(ii) by reference to a range of postcodes, taking account of each postcode area in Australia;

(c) the number of certificates that may be created for each eligible solar water heater in each zone;

(d) the installation periods in which certificates may be created for each eligible solar water heater.

(3A) The Regulator may remove a device from the Register if satisfied that:

(a) the device is not a solar water heater; or

(b) a certification that was given to the device as mentioned in subregulation 3A(2) or (3) has expired; or

(c) the device poses a safety risk.

(3B) Before removing a device from the Register under paragraph (3A)(a) or (b), the Regulator must:

(a) give written notice of the proposed removal, specifying the date proposed for the removal, to:

(i) the manufacturer of the device; and

(ii) any person who made a request in relation to the device under subregulation 19BC(1); and

(b) consider any submissions made in response to the proposed removal.

(4) The Register must be accessible on a website kept by the Regulator.

Subdivision 2.3.3—Small generation units

19D Creation of certificates for small generation units (Act s 23A)

(1) For subsection 23A(2) of the Act, the time at which a small generation unit is taken to have been installed is the day the unit is first able to produce and deliver electricity.

(2) For subsection 23A(3) of the Act, a right to create certificates for a small generation unit arises:

(a) for a unit installed during a year mentioned in column 1 of the following table, within 12 months of installation and for a period mentioned in column 2 for the item; or

Period certificates may be created |

Item | Column 1 | Column 2 |

| Year unit installed | Period |

1 | before 2026 | 1 or 5 years |

2 | 2026 | 1 or 5 years |

3 | 2027 | 1 or 4 years |

4 | 2028 | 1 or 3 years |

5 | 2029 | 1 or 2 years |

6 | 2030 | 1 year |

(b) if a right was previously exercised for a 1 year period under paragraph (a), the start of each subsequent 1 year period after installation that begins during a year mentioned in column 1 of the table in paragraph (a) for the additional period mentioned in column 2 for the item; or

(c) if:

(i) a right was previously exercised for a 5 year period under paragraph (a); and

(ii) the Regulator is satisfied that the unit is still installed and likely to remain functional for a further 5 years;

the start of each subsequent 5 year period that begins on or before 31 December 2025 for a further 5 year period; or

(d) if:

(i) the unit is a solar (photovoltaic) system; and

(ii) no certificate has been created for the unit under paragraph (a), (b) or (c);

for a unit installed during a year mentioned in column 1 of the following table, within 12 months of installation and for the period mentioned in column 2 for the item.

Period certificates may be created |

Item | Column 1 | Column 2 |

| Year solar (photovoltaic) system installed | Period in years |

1 | before 2016 | 15 |

2 | 2016 | 15 |

3 | 2017 | 14 |

4 | 2018 | 13 |

5 | 2019 | 12 |

6 | 2020 | 11 |

7 | 2021 | 10 |

8 | 2022 | 9 |

9 | 2023 | 8 |

10 | 2024 | 7 |

11 | 2025 | 6 |

12 | 2026 | 5 |

13 | 2027 | 4 |

14 | 2028 | 3 |

15 | 2029 | 2 |

16 | 2030 | 1 |

(3) Where a right to create certificates has been exercised under the period specified for the unit in paragraph (2)(d), no additional right to create certificates arises.

20 Number of certificates that may be created (Act s 23B)

(1) For subsection 23B(1) of the Act, the number of certificates that may be created for a small generation unit is the number that may be created:

(a) for a hydro‑electric system—for the amount calculated by multiplying 0.00095 by the rated power output of the system, measured in kW, multiplied by:

(i) 4 000; or

(ii) the number of hours each year of hydro resource availability if those hours are greater than 4 000.

(b) for a solar (photovoltaic) system—for the amount calculated by multiplying the zone rating of the system at the time of installation (worked out in accordance with an instrument made under subregulation (4) as existing from time to time) by the rated power output of the system measured in kilowatts‑peak (kWp); or

(c) for a wind turbine—for the amount calculated by multiplying 0.00095 by the rated power output of the system, measured in kW, multiplied by:

(i) 2 000; or

(ii) the number of hours each year of wind resource availability if those hours are greater than 2 000.

Note: Small generation unit is defined in subregulation 3(2). For certificates in relation to installations other than small generation units, see Divisions 2 and 3 of Part 2 of the Act.

(2) For subregulation (1), the number of certificates worked out for an installation is:

(a) if the amount of electricity generated that is in excess of the 1997 renewable energy baseline for the small generation unit is at least 0.5 MWh but less than 1 MWh—1; and

(b) in any other case—the number calculated under subregulations (2A) and (2B).

(2A) If a small generation unit has a rated power output of more than 1.5kW (output power), and is not a unit to which subregulation (2C) or (2E) applies, the number of certificates created for the unit is to be calculated as follows:

(a) by first adding together:

(i) the number of certificates created for the first 1.5 kW of the unit’s output power (as multiplied in accordance with regulation 20AA); and

(ii) the number of certificates created for the remainder of the unit’s output power; and

(b) then by rounding down the number of certificates arrived at under paragraph (a) to the nearest whole number.

(2B) If the small generation unit has a rated power output of 1.5kW or less, and is not a unit to which subregulation (2E) applies, the number of certificates created for the unit is to be calculated as follows:

(a) by first multiplying the number of certificates in accordance with regulation 20AA; and

(b) then by rounding down the number of certificates arrived at under paragraph (a) to the nearest whole number.

(2C) This subregulation applies to a small generation unit if:

(a) the unit:

(i) has a rated power output of more than 20 kW (output power); and

(ii) is an off‑grid small generation unit; and

(iii) was installed after 28 June 2010 and before 1 July 2013; and

(b) at the time the certificates are created, the number of multiplier certificates created for off‑grid small generation units installed in the period in which the unit is installed does not equal or exceed the maximum number mentioned in subregulation (2G) for the period; and

(c) the creation of certificates for the unit will not cause the number of multiplier certificates created for off‑grid small generation units installed in the period in which the unit was installed to exceed the maximum number mentioned in subregulation (2G) for the period.

(2D) The number of certificates created for a unit to which subregulation (2C) applies is to be worked out:

(a) by adding together:

(i) the number of certificates created for the first 20 kW of the unit’s output power (as multiplied in accordance with regulation 20AA); and

(ii) the number of certificates created for the remainder of the unit’s output power; and

(b) by rounding down the number of certificates worked out under paragraph (a) to the nearest whole number.

(2E) This subregulation applies to a small generation unit if:

(a) the unit:

(i) has a rated power output of 20 kW or less; and

(ii) is an off‑grid small generation unit; and

(iii) was installed after 28 June 2010 and before 1 July 2013; and

(b) at the time the certificates are created, the number of multiplier certificates created for off‑grid small generation units installed in the period in which the unit is installed does not equal or exceed the maximum number mentioned in subregulation (2G) for the period; and

(c) the creation of certificates for the unit will not cause the number of multiplier certificates created for off‑grid small generation units installed in the period in which the unit is installed to exceed the maximum number mentioned in subregulation (2G) for the period.

(2F) The number of certificates created for a unit to which subregulation (2E) applies is to be worked out:

(a) by multiplying the number of certificates in accordance with regulation 20AA; and

(b) by rounding down the number of certificates worked out under paragraph (a) to the nearest whole number.

(2G) For paragraphs (2C)(b) and (2E)(b), the maximum number of multiplier certificates that may be created for off‑grid small generation units installed in a period is the number mentioned in the following table for the period.

Item | Period | Number |

1 | 1 July 2010 to 30 June 2011 | 250 000 |

2 | 1 July 2011 to 30 June 2012 | 250 000 |

3 | 1 July 2012 to 30 June 2013 | 200 000 |

(2H) If subregulation (2C) or (2E) does not apply to a small generation unit only because paragraph (2C)(c) or (2E)(c) does not apply to the unit, the number of certificates that may be created for the unit is the sum of:

(a) the number that may be created for the unit under paragraph (2A) or (2B); and

(b) the number of certificates that would cause the number of multiplier certificates created for off‑grid small generation units installed in the period in which the unit was installed to equal the maximum number mentioned in subregulation (2G) for the period.

(2I) For paragraphs (2C)(b) and (c) and (2E)(b) and (c), a certificate that the Regulator determines is not eligible for registration is not to be included in the number of multiplier certificates created for the period for off‑grid small generation units installed in the period.

(2J) For this regulation:

multiplier certificates, for off‑grid small generation units installed in a period mentioned in the table in subregulation (2G), means the certificates created for units using the multiplier in subregulation 20AA(2), other than the certificates that would have been created were the multiplier applied only to the first 1.5 kW of the rated power output for those units.

(3) For subparagraph (1)(a)(ii), hydro resource availability of more than 4 000 hours each year must be demonstrated by a site‑specific assessment.

(4) The Regulator may, by legislative instrument, prescribe zone ratings of solar (photovoltaic) systems, and zones, for the purposes of paragraph (1)(b).

(5) For paragraph (1)(c)(ii), wind resource availability of more than 2 000 hours each year must be demonstrated by a site‑specific wind audit.

20AA Multiplying number of certificates (Act s 23B)

(1) For subsections 23B(2) and (3) of the Act, subregulation (2) sets out the multiplier for certificates that may be created for a small generation unit in the circumstances set out in subregulation (3).

(2) Subject to subregulation (3), the number of certificates that may be created in relation to a small generation unit that is installed during a period specified in column 1 of an item in the following table is to be multiplied by the number in column 2 of the item.

Multiplier for certificates for small generation units

Item | Column 1

Period | Column 2

Number |

1 | 9 June 2009 to 30 June 2010 | 5 |

2 | 1 July 2010 to 30 June 2011 | 5 |

3 | 1 July 2011 to 30 June 2012 | 3 |

4 | 1 July 2012 to 30 June 2013 | 2 |

Note: The certificates are created in accordance with regulations 19D and 20.

(3) The number of certificates is to be multiplied in accordance with subregulation (2):

(a) only if:

(i) the small generation unit in respect of which the certificates are created is installed at eligible premises:

(A) during a period mentioned in the table in subregulation (2); and

(B) in the circumstances mentioned in regulation 20AAA; and

(ii) at the time the small generation unit is installed at the eligible premises, there is no pre‑approval or funding agreement in force in respect of the unit under the SHCP, the RRPGP or the NSSP and no financial assistance has been provided in respect of the unit under the SHCP, the RRPGP or the NSSP; and

(iii) at the time the small generation unit is installed at the eligible premises, financial assistance under the SHCP, the PVRP, the RRPGP or the NSSP has not been approved or provided in respect of any other small generation unit at the eligible premises; and

(iv) the small generation unit is a new and complete unit; and

(v) at the time the small generation unit is installed at eligible premises, certificates have not been multiplied under subregulation (2) in respect of any small generation unit at the premises; and

(b) on 1 occasion only, irrespective of whether the certificates are created for a 1‑year period, a 5‑year period or a 15‑year period; and

(c) only if the certificates relate to:

(i) for a unit to which subregulation 20(2C) or (2E) applies—the first 20 kW of the rated power output of the unit; or

(ii) for any other unit—the first 1.5 kW of the rated power output of the unit.

(4) For subparagraph (3)(a)(iv), a small generation unit is a complete unit if:

(a) the unit is capable of generating electricity in a form that is usable at the eligible premises where it is installed without the need for an additional part or parts to be added to or incorporated into the unit; and

(b) either:

(i) the unit is wired directly to the eligible premises where the unit is installed so that its output is capable of being metered at those premises; or

(ii) the unit includes a meter that is dedicated to measuring the electricity output of the unit.

(5) In this regulation:

eligible premises means any of the following:

(a) a house (including the land on which the house is located and any outbuildings on the land);

(b) a townhouse;

(c) a residential apartment;

(d) a shop (including the land on which the shop is located and any outbuildings on the land);

(e) premises, other than premises mentioned in paragraphs (a) to (d), that are located at an address.

NSSP means the program known as the National Solar Schools Program administered by the Department administered by the Minister administering the Environment Protection and Biodiversity Conservation Act 1999.

PVRP means the program known as the Photovoltaic Rebate Program administered by the Australian Greenhouse Office.

RRPGP means the program known as the Renewable Remote Power Generation Program administered by the Department administered by the Minister administering the Environment Protection and Biodiversity Conservation Act 1999.

SHCP means the program known as the Solar Homes and Communities Plan administered by the Department administered by the Minister administering the Environment Protection and Biodiversity Conservation Act 1999.

20AAA Further circumstances for multiplying number of certificates

(1) For subparagraph 20AA(3)(a)(i), the small generation unit must be installed:

(a) before 1 January 2013; or

(b) on or after 1 January 2013 but before 1 July 2013 and in the circumstances mentioned in subregulation (2).

(2) For paragraph (1)(b), the circumstances are:

(a) the unit is installed under a contract entered into before 16 November 2012; and

(b) the parties to the contract are legally bound to proceed with the contract on and after 16 November 2012; and

(c) if the contract is conditional on any event happening, the event happened before 16 November 2012; and

(d) the person who becomes the owner of the unit following its installation is a party to the contract; and

(e) the contract documentation identifies:

(i) the date the contract was entered into; and

(ii) the identity of each party to the contract; and

(iii) the address at which the unit is to be installed; and

(iv) the size, make and model of the unit; and

(f) the person entitled to create certificates for the unit (the entitled person) meets the requirements of subregulation (3) before creating certificates for the unit.

(3) For paragraph (2)(f), the entitled person must:

(a) possess contract documentation identifying the matters mentioned in paragraph (2)(e); and

(b) provide to the Regulator a statutory declaration made by the entitled person:

(i) describing the contract documentation; and

(ii) stating that the entitled person can provide the contract documentation to the Regulator if requested by the Regulator; and

(iii) stating that the contract meets the requirements of paragraphs (2)(a) to (d); and

(iv) stating:

(A) the date on which the contract was entered into; and

(B) the identity of each party to the contract; and

(C) the address at which the unit was installed; and

(D) the size, make and model of the unit; and

(v) stating that the contract documentation in the entitled person’s possession identifies the matters mentioned in subparagraph (iv); and

(c) if the contract is an oral contract—provide to the Regulator a statutory declaration made by each party to the contract stating:

(i) the date on which the contract was entered into; and

(ii) the identity of each party to the contract; and

(iii) the address at which the unit was installed; and

(iv) the size, make and model of the unit; and

(d) provide to the Regulator any other information or documents requested by the Regulator.

(4) An entitled person may provide one statutory declaration under paragraph (3)(b) setting out the information required by that paragraph for more than one unit, including where:

(a) the units were installed under different contracts; or

(b) the contracts for the installations of the units involve different parties; or

(c) the units were installed at different addresses.

(5) However a statutory declaration provided under paragraph (3)(c) must relate to one unit only.

(6) For paragraph (3)(c), if the entitled person is a party to the contract, he or she only needs to provide statutory declarations from the other parties to the contract.

(7) In this regulation:

contract documentation means:

(a) for a written contract—the written documents setting out the terms and conditions of the contract and evidencing the offer and acceptance of those terms and conditions; and

(b) for an oral contract—written documentation that was created and dated before 22 December 2012, evidencing the existence of the contract.

20AB Regulator may make determinations about particular premises

(1) For the purposes of paragraph (e) of the definition of eligible premises in subregulation 20AA(5), the Regulator may, by legislative instrument, determine that:

(a) specified premises are premises located at an address; or

(b) specified premises are not premises that are located at an address.

(2) The Regulator must publish details of any determination made by the Regulator on the Regulator’s website.

20AC Conditions for creation of certificates (Act s 23A)

(1) For the purposes of subsection 23A(1A) of the Act, certificates cannot be created in relation to a small generation unit unless the conditions in this regulation are satisfied in relation to the unit or its installation.

Condition—design and installation

(2) The unit was designed and installed by a person or persons:

(a) if the unit is a stand‑alone power system—accredited for stand‑alone power systems under an accreditation scheme approved by the Regulator under Subdivision 2.3.4; and

(b) if the unit is a grid‑connected power system—accredited for grid‑connected power systems under an accreditation scheme approved by the Regulator under Subdivision 2.3.4; and

(c) if the unit is a wind system—endorsed for wind systems under an accreditation scheme approved by the Regulator under Subdivision 2.3.4; and

(d) if the unit is a hydro system—endorsed for hydro systems under an accreditation scheme approved by the Regulator under Subdivision 2.3.4; and

(e) in relation to whom, or none of whom, a declaration was not in effect under regulation 20AG or 47 on:

(i) if the installation of the unit was completed in a single day—that day; or

(ii) in any other case—the day the installation began.

Condition—installer on site (solar (photovoltaic) systems)

(2A) If the unit is a solar (photovoltaic) system, the person mentioned in paragraph (2)(a) or (b) who installed the unit was on site to install, or supervise the installation of, the unit in accordance with the accreditation scheme under which the person is accredited.

Condition—inverters

(2B) If the unit uses an inverter, regulation 20AD has been complied with in relation to the inverter used in the installation of the unit.

Condition—photovoltaic modules (solar (photovoltaic) systems)

(2C) If the unit is a solar (photovoltaic) system, regulation 20AD has been complied with in relation to the photovoltaic module used in the installation of the unit.

Condition—electrical wiring

(3) The electrical wiring associated with the installation of the unit was undertaken by an electrical worker holding an unrestricted license for electrical work issued by the State or Territory authority for the place where the unit was installed.

Condition—local and State or Territory government requirements

(4) All local and State or Territory government requirements have been met for the installation of the unit.

Condition—written statements, documents and evidence

(5) The person who is entitled to create the certificates for the unit has obtained:

(aa) a written statement by the designer of the unit (or, if the installer of the unit is accredited for the design of the unit, the installer of the unit) stating:

(i) the name of the designer of the unit; and

(ii) the accreditation scheme type or classification, and accreditation number, of the designer of the unit; and

(iii) that the designer complied with all relevant requirements of the accreditation scheme for the design of the unit; and

(a) a written statement by the installer of the unit stating:

(i) the name of the installer of the unit; and

(ii) the accreditation scheme type or classification, and accreditation number, of the installer of the unit; and

(iii) that the installer complied with all relevant requirements of the accreditation scheme for the installation of the unit; and

(b) a written statement by the installer of the unit that all local and State or Territory government requirements have been met for the installation of the unit; and

(c) a copy of any documentation required, by the laws of the jurisdiction in which the unit was installed, to be provided to the owner of the unit certifying that the electrical installation of the unit complies with laws relating to safety and technical standards; and

(d) a written statement by the installer of the unit stating:

(i) that the installer has a copy of the design of the unit; and

(ii) if the design was not modified during the installation of the unit—that the unit was installed, in all material respects, in accordance with the design; and

(iii) if the design was modified during the installation of the unit—that the modifications were consistent with all relevant requirements of the accreditation scheme for the design of the unit, and that the unit was installed, in all material respects, in accordance with the modified design; and

(iv) that the unit will perform consistently with the design or modified design (as applicable); and

(e) if the system uses an inverter:

(i) a written statement by the installer of the unit that the model of inverter used in the installation was, when the unit was installed, an approved eligible model of inverter; and

(ii) if the system is a grid‑connected power system—a written statement by the installer of the unit that, when the unit was installed, the model of inverter used in the installation complied with Australian/New Zealand Standard AS/NZS 4777.2:2020, Grid connection of energy systems via inverters, Part 2: Inverter requirements, published jointly by, or on behalf of, Standards Australia and Standards New Zealand (as existing from time to time); and

(f) for a unit that is a solar (photovoltaic) system—the following:

(i) a written statement by the installer of the unit that the model of photovoltaic module used in the installation was, when the unit was installed, an approved eligible model of a photovoltaic module;

(ii) a written statement by the installer of the unit that the installer was on site as mentioned in subregulation (2A);

(iii) evidence from the installer of the unit that the installer was on site as mentioned in subregulation (2A).

Condition—written statement from solar retailer (solar (photovoltaic) systems)

(5A) If the unit is a solar (photovoltaic) system, the person who is entitled to create the certificates for the unit has obtained a written statement by the person (the solar retailer) who sold the unit to the owner of the unit stating the following:

(a) the name of the installer of the unit;

(b) whether or not the installer is an employee or a subcontractor of the solar retailer;

(c) that the unit will perform in accordance with the contract (or the quote accepted) for the sale of the unit to the owner of the unit, except to the extent that that performance is prevented by circumstances outside the solar retailer’s control;

(d) that the unit is:

(i) complete; and

(ii) generating electricity or capable of generating electricity;

(e) if the unit is a grid‑connected power system—that:

(i) the unit is connected to the grid; or

(ii) the solar retailer has completed the solar retailer’s obligations under the contract (or the quote accepted) relating to the connection of the unit to the grid;

(f) that the solar retailer has provided information in writing to the owner of the unit about the feed in tariffs and export limits for the unit; and

(g) that the solar retailer has provided information in writing to the owner of the unit about one or more of the following for the unit:

(i) the expected payback period;

(ii) the expected energy savings;

(iii) the expected cost savings;

(h) that the information provided as mentioned in paragraphs (f) and (g) is true, correct and complete;

(i) that any actual or potential conflicts of interest of the solar retailer relating to the sale or installation of the unit, or the creation of certificates for the unit, including any conflicts of interest in relation to persons or entities related to the solar retailer, have been:

(i) disclosed to the owner of the unit; and

(ii) managed appropriately;

(j) that a declaration under regulation 20AH is not in effect in relation to the solar retailer on the day the statement is given.

(5B) Subsection (5A) does not apply in relation to a unit if:

(a) the unit was installed by the owner of the unit; or

(b) the installation of the unit was sold to the owner of the unit by a person other than the solar retailer or a person related to the solar retailer.

Electrical wiring to which subregulation (3) does not apply

(6) Subregulation (3) does not apply to electrical wiring if:

(a) the unit is not grid‑connected; and

(b) the wiring does not involve alternating current of 50 or more volts; and

(c) the wiring does not involve direct current of 120 or more volts; and

(d) before any certificates are created for the unit, the person who is entitled to create the certificates for the unit obtains a written statement by the installer of the unit that:

(i) the unit is not grid‑connected; and

(ii) an electrical worker holding an unrestricted license for electrical work issued by the State or Territory authority for the place where the unit was installed undertook all wiring of the unit that involves:

(A) alternating current of 50 or more volts; or

(B) direct current of 120 or more volts.

Condition—statements to include statement of truth, correctness and completeness

(7) Each statement obtained for the purposes of subregulation (5) or (5A) includes a statement that the information in the statement is true, correct and complete.

Condition—information not to be false or misleading

(8) None of the documents, statements or evidence obtained for the purposes of subregulation (5) or (5A) contain information that:

(a) is false or misleading in a material particular; or

(b) omits a matter or thing without which the information is misleading in a material particular.

Note: See also section 24B of the Act (which relates to civil penalties for giving false or misleading information in relation to the installation of small generation units that results in the improper creation of certificates in relation to the units).

Approved eligible models of inverters

(9) For the purposes of subparagraph (5)(e)(i), a model of an inverter is an approved eligible model at a particular time if, at the time:

(a) the model is included in the list of approved inverters (as existing from time to time) that is published by the person to whom regulation 20AE applies; and

(b) a declaration under regulation 20AF is not in effect in relation to the model; and

(c) a recall notice has not been issued for the model under subsection 122(1) of the Australian Consumer Law (compulsory recall of consumer goods); and

(d) section 128 of the Australian Consumer Law (voluntary recall of consumer goods) does not apply in relation to the model.

Note: The reference to the Australian Consumer Law is a reference to Schedule 2 to the Competition and Consumer Act 2010 as it applies as a law of the Commonwealth, States and Territories: see section 140K of that Act and corresponding provisions of Acts of States and Territories applying that Schedule.

Approved eligible models of photovoltaic modules

(10) For the purposes of subparagraph (5)(f)(i), a model of a photovoltaic module is an approved eligible model at a particular time if, at the time:

(a) the model complies with:

(i) if the time is before 19 May 2022—Australian/New Zealand Standard AS/NZS 5033:2014, Installation and safety requirements for photovoltaic (PV) arrays, published jointly by, or on behalf of, Standards Australia and Standards New Zealand (as existing from time to time); or

(ii) if the time is on or after 19 May 2022—Australian/New Zealand Standard AS/NZS 5033:2021, Installation and safety requirements for photovoltaic (PV) arrays, published jointly by, or on behalf of, Standards Australia and Standards New Zealand (as existing from time to time); and

(b) the model is included in the list of approved photovoltaic modules (as existing from time to time) that is published by the person to whom regulation 20AE applies; and

(c) a declaration under regulation 20AF is not in effect in relation to the model; and

(d) a recall notice has not been issued for the model under subsection 122(1) of the Australian Consumer Law (compulsory recall of consumer goods); and

(e) section 128 of the Australian Consumer Law (voluntary recall of consumer goods) does not apply in relation to the model.

Note: The reference to the Australian Consumer Law is a reference to Schedule 2 to the Competition and Consumer Act 2010 as it applies as a law of the Commonwealth, States and Territories: see section 140K of that Act and corresponding provisions of Acts of States and Territories applying that Schedule.

20AD Provision of serial numbers for inverters and photovoltaic modules

(1) For the purposes of subregulations 20AC(2B) and (2C), the responsible person for an inverter or photovoltaic module used in the installation of a small generation unit must give the serial number for the inverter or photovoltaic module to:

(a) a person in relation to whom a nomination is in effect under subregulation (2) of this regulation; or

(b) if no nomination is in effect under subregulation (2) of this regulation—the Regulator.

Note: The responsible person may commit an offence if the person provides false or misleading information or documents (see sections 137.1 and 137.2 of the Criminal Code).

(2) The Regulator may, in writing, nominate a person for the purposes of paragraph (1)(a) if the Regulator is reasonably satisfied that the person:

(a) will, if nominated, receive, store and disseminate serial numbers for inverters and photovoltaic modules to facilitate the creation of certificates in relation to small generation units in accordance with the Act and these Regulations; and

(b) has, or will have, appropriate arrangements for receiving, storing and disseminating the serial numbers.

(3) If the Regulator nominates a person under subregulation (2), the Regulator must publish the person’s contact details on the Regulator’s website.

(4) In this regulation:

responsible person, for an inverter or photovoltaic module used in the installation of a small generation unit, means:

(a) if the inverter or photovoltaic module was not imported into Australia—the manufacturer of the inverter or photovoltaic module; or

(b) if the inverter or photovoltaic module was imported into Australia—the person who imported the inverter or photovoltaic module.

20AE Publisher of lists of approved inverters and photovoltaic modules

(1) For the purposes of paragraphs 20AC(9)(a) and (10)(b), this regulation applies to:

(a) a person in relation to whom a nomination is in effect under subregulation (2) of this regulation; or

(b) if no nomination is in effect under subregulation (2) of this regulation—the Clean Energy Council.

(2) The Regulator may, in writing, nominate a person for the purposes of paragraph (1)(a).

Public consultation about whether any person should be nominated

(3) The Regulator must, before 1 January 2023, undertake public consultation about whether any person should be nominated under subregulation (2).

Process for nominating a particular person

(4) In deciding whether to nominate a person under subregulation (2), the Regulator must consider the following matters:

(a) the efficiency, integrity and effectiveness of the person’s proposed processes, including testing and verification processes, for including a model of an inverter or photovoltaic module on the person’s list of approved inverters or approved photovoltaic modules;

(b) the person’s capacity to publish the person’s lists of approved inverters and approved photovoltaic modules and keep them updated;