Part 1—Preliminary

1 Name of regulations

These Regulations are the Income Tax Regulations 1936.

2 Interpretation

(1) In these Regulations, unless the contrary intention appears:

ABN (Australian Business Number) has the meaning given by section 41 of the A New Tax System (Australian Business Number) Act 1999.

effective, in relation to an address, means that the person to whom the address relates will receive documents delivered to the address.

ESS interest has the meaning given by susbsection 83A‑10(1) of the Income Tax Assessment Act 1997.

preferred address for service has the meaning given by regulation 36.

tax file number, in relation to an employee, means the number that is the employee’s tax file number for the purposes of Part VA of the Act.

the Act means the Income Tax Assessment Act 1936.

(3) If:

(a) a provision of these Regulations requires the number of cents in an amount to be worked out to the nearest 5 cents; and

(b) an amount to which the provision applies is not a whole number that ends in a 0 or a 5;

the provision is satisfied if the amount is rounded to the nearest number of whole cents ending in a 0 or a 5, and if the amount to be rounded ends in 2.5 or 7.5, rounded up.

Part 3—Liability to taxation

6 Prescribed classes of persons (Act, subsection 23AB(2))

(1) For subsection 23AB(2) of the Act, the following classes of persons are prescribed:

(a) members of the Australian Federal Police who are members of the force, created by the United Nations, for keeping peace in Cyprus;

(b) Australian residents serving with UNMIT in Timor‑Leste on or after 25 August 2006.

(2) For paragraph (1)(b):

UNMIT means the United Nations Integrated Mission in Timor‑Leste, established by the United Nations Security Council on 25 August 2006.

7 Termination dates of operational areas (Act, subsection 23AC(7))

For the purposes of paragraph (b) of the definition of termination date in subsection 23AC(7) of the Act:

(a) 7 October 1993 is the termination date in respect of Cambodia (being the operational area specified in subsection 23AC(6B) of the Act); and

(b) 30 November 1994 is the termination date in respect of Somalia (being the operational area specified in subsection 23AC(6D) of the Act); and

(c) 23 January 1997 is the termination date in respect of the former Yugoslavia (being the operational area specified in subsection 23AC(6C) of the Act).

7A Declaration of eligible duty (Act, subsection 23AD(2))

For subsection 23AD(2) of the Act, each of the following is eligible duty:

(aa) duty with Operation Slipper starting on 20 February 2012 and ending at the end of 30 June 2014 in the area bounded by the following geographical coordinates:

(i) 39° 00´ N 32° 00´ E;

(ii) 39° 00´ N 78° 00´ E;

(iii) 23° 00´ N 78° 00´ E;

(iv) 23° 00´ N 68° 00´ E;

(v) 11° 00´ S 68° 00´ E;

(vi) 11° 00´ S 38° 00´ E;

(vii) 17° 00´ N 38° 00´ E;

(viii) 17° 00´ N 32° 00´ E;

(ab) duty with Operation Slipper in Afghanistan, including within the land territory, internal waters, airspace and superjacent airspace of Afghanistan, starting on 1 July 2014 and ending on 31 December 2014;

(b) duty with the United Nations Assistance Mission in Afghanistan, including within the land territory, internal waters, airspace and superjacent airspace of Afghanistan, starting on or after 27 June 2005 and ending at the end of 31 December 2014 (Operation Palate II);

(c) duty with Operation OKRA in Iraq, including within the land territory, internal waters, territorial sea, airspace and superjacent airspace of Iraq, starting on 9 August 2014 and ending on 30 June 2015;

(d) duty with the Defence Force on Operation Highroad in Afghanistan, including within the land territory, internal waters, airspace and superjacent airspace of Afghanistan, after 31 December 2014 and before the end of 30 June 2015.

9 Prescribed Life Tables—subsection 27H(4) of the Act

For the purposes of the definition of life expectation factor in subsection 27H(4) of the Act, the following Australian Life Tables published by the Australian Government Actuary are prescribed:

(a) for an annuity first commencing to be payable before 1 September 1988—the Australian Life Tables 1975–1977;

(b) for an annuity first commencing to be payable on or after 1 September 1988 but before 1 May 1993—the Australian Life Tables 1980–1982;

(c) for an annuity first commencing to be payable on or after 1 May 1993 but before 1 July 1993—the Australian Life Tables 1985–1987;

(d) for an annuity first commencing to be payable on or after 1 July 1993—the Australian Life Tables that are most recently published before the year in which the annuity first commences to be payable.

12 Excluded car parking facilities

(1) For the purposes of paragraph 51AGA(1)(e) of the Act, the provision of car parking facilities for a car during a period referred to in section 51AGA of the Act is taken to be excluded from that section if:

(a) the facilities are provided to an employee who:

(i) is entitled under the law of a State or Territory to the use of a disabled persons’ car parking space; and

(ii) is the driver of, or is a passenger in, the car; and

(b) a valid disabled persons’ car parking permit is displayed on the car.

(1A) For the purposes of paragraph 51AGB(1)(h) of the Act, the provision of car parking facilities for a car during a period referred to in section 51AGB of the Act is taken to be excluded from that section if:

(a) the facilities are provided to a taxpayer who:

(i) is entitled under the law of a State or Territory to the use of a disabled persons’ car parking space; and

(ii) is the driver of, or is a passenger in, the car; and

(b) a valid disabled persons’ car parking permit is displayed on the car.

(2) In this regulation:

disabled persons’ car parking space means a car parking space:

(a) in a public car parking area; and

(b) designated for the exclusive use of disabled persons.

disabled persons’ car parking permit means a permit, label or other document:

(a) issued by the appropriate authority in a State or Territory; and

(b) authorising the parking of a car in a disabled persons’ car parking space.

13 Prescribed stock exchanges

(1) The following stock exchanges are specified as prescribed stock exchanges for the purposes of Division 3A of Part III of the Act:

Brisbane Stock Exchange

Hobart Stock Exchange

Stock Exchange of Adelaide

Stock Exchange of Melbourne

Stock Exchange of Perth

Sydney Stock Exchange.

(2) The stock exchanges specified in subregulation (1) are declared to have been prescribed stock exchanges for the purposes of Division 3A of Part III of the Act during the period from and including 16 June 1970, to and including the day immediately before the commencement of these Regulations.

14AA Debentures issued on overseas capital market (subsection 128F(8))

The United States of America is a country specified under paragraph 128F(8)(c) of the Act.

Part 4—Returns and assessments

19 Statement to be furnished by employers

(1) Every employer of labour shall, when called upon by the Commissioner either by general notice published in the Gazette or by direct notice to the employer, give to the Commissioner, at an address mentioned in subregulation (3), a statement showing:

(a) the names and addresses of all persons employed by him during the period mentioned in the notice;

(b) the capacity in which each person was employed;

(c) the total amount of remuneration paid to each person during that period; and

(d) the value of board, residence, or other allowance made to each person during that period.

Penalty: 5 penalty units.

(2) The employer shall include in the statement, in relation to each employee who has, for the purposes of Part VA of the Act, quoted his or her tax file number in a TFN declaration given to the employer:

(a) the employee’s tax file number; or

(b) where the employee is, because of the application of subsection 202CB(2) or (4) of the Act, to be taken to have so quoted the number—a notice to that effect.

Penalty: 5 penalty units.

(3) For subregulation (1), the addresses are:

(a) a place directed by the Commissioner; or

(b) if the Commissioner does not give a direction, a place where, under these Regulations, the return of the employer may be furnished.

(4) An offence under subregulation (1) or (2) is an offence of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code.

20 Amendment of assessments for an income year

For a provision of subsection 170(1) of the Act mentioned in an item of the table, the circumstances set out in the item are prescribed.

Note: If a circumstance in an item of the table exists, the Commissioner of Taxation may amend an assessment of the taxpayer within 4 years after the day on which the Commissioner gives notice of the assessment to the taxpayer, unless a longer amendment period applies to the taxpayer.

Item | Provision | Circumstance |

1 | Paragraph (f) of item 1 of the table in subsection 170(1) Paragraph (e) of item 2 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | All of the following exist: (a) there has been a transaction involving associates (within the meaning of section 318 of the Act), that has income tax consequences, in the year of income mentioned in the item; (b) the parties were not dealing with each other at arm’s length in relation to the transaction; (c) the period during which the Commissioner may amend an assessment in relation to one of the parties is at least 4 years. |

2 | Paragraph (f) of item 1 of the table in subsection 170(1) Paragraph (e) of item 2 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | All of the following exist: (a) a private company is taken to have paid a dividend to an entity, as described in section 109C, 109D, 109E or 109F of the Act, in the year of income mentioned in the item; (b) the entity is: (i) a shareholder of the company; or (ii) an associate of a shareholder of the company; or (iii) a former shareholder of the company; or (iv) an associate of a former shareholder of the company; (c) the period during which the Commissioner may amend an assessment in relation to the company is at least 4 years. |

3 | Paragraph (f) of item 1 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | All of the following exist: (a) the effect of section 109XB of the Act is that an amount is included as a dividend in the assessable income of a taxpayer as described in subsection 109XA(1), (2) or (3) of the Act in the year of income mentioned in the item; (b) the matter involves a taxpayer who is: (i) a shareholder of a company; or (ii) an associate of a shareholder of a company; (c) the period during which the Commissioner may amend an assessment in relation to both the trust and the company is at least 4 years. |

4 | Paragraph (f) of item 1 of the table in subsection 170(1) Paragraph (e) of item 2 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | All of the following exist in the year of income mentioned in the item: (a) a taxpayer has acquired an ESS interest; (b) subsection 83A‑35(5) of the Income Tax Assessment Act 1997 (integrity rule about share trading and investment companies) did not apply to the ESS interest; (c) the entity that provided the ESS interest to the taxpayer is not a small business entity in relation to which item 2 or 3 of the table in subsection 170(1) of the Act applies. |

5 | Paragraph (f) of item 1 of the table in subsection 170(1) Paragraph (e) of item 2 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | Both of the following exist in the year of income mentioned in the item: (a) the taxpayer has not identified income (ordinary or statutory) from one or more foreign transactions for the purposes of, or in the course of, an assessment; (b) the income has not been received from a resident investment vehicle within the meaning of the Income Tax Assessment Act 1997. |

6 | Paragraph (f) of item 1 of the table in subsection 170(1) Paragraph (e) of item 2 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | Both of the following exist in the year of income mentioned in the item: (a) subsection 345(5) of the Act (transfer under a scheme) may be applicable to the taxpayer; (b) not all of the relevant information regarding the application of that subsection can be obtained from a resident investment vehicle within the meaning of the Income Tax Assessment Act 1997. |

7 | Paragraph (f) of item 1 of the table in subsection 170(1) | Both of the following exist in the year of income mentioned in the item: (a) paragraph 448(1A)(f) of the Act (provision of services under a scheme) may be applicable to the taxpayer; |

| Paragraph (e) of item 2 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | (b) not all of the relevant information regarding the application of that paragraph can be obtained from a resident investment vehicle within the meaning of the Income Tax Assessment Act 1997. |

8 | Paragraph (f) of item 1 of the table in subsection 170(1) Paragraph (e) of item 2 of the table in subsection 170(1) Paragraph (d) of item 3 of the table in subsection 170(1) | Any of the following provisions applies in relation to the taxpayer in the year of income mentioned in the item: (a) section 45A of the Act (streaming of dividends and capital benefits); (b) section 45B of the Act (schemes to provide certain benefits); (c) subsection 102AE(7) of the Act (excluded income for minors); (d) section 177E of the Act (stripping of company profits); (e) section 177EA of the Act (franking debit creation and franking credit cancellation schemes); (f) Division 270 of Schedule 2F to the Act (scheme to take advantage of deductions); |

| | (g) subsection 26‑50(7) of the Income Tax Assessment Act 1997 (expenses for a leisure facility or boat); (h) any of sections 165‑180 to 165‑205 (rules affecting the operation of tests for changing ownership of a company), and Division 175 (use of a company’s tax losses or deductions to avoid income tax), of the Income Tax Assessment Act 1997; (i) Subdivision 207‑F of the Income Tax Assessment Act 1997 (cancellation of gross‑up or tax offset where the imputation system has been manipulated). |

Part 4A—Preferred address for service and service of documents

35 References to Act include references to 1997 Act

In this Part, unless the contrary intention appears:

(a) a reference to the Act includes a reference to the Income Tax Assessment Act 1997; and

(b) a reference to these Regulations includes a reference to Regulations made under the Income Tax Assessment Act 1936 or the Income Tax Assessment Act 1997.

36 Preferred address for service

(1) An address in Australia used by or associated with a person is a preferred address for service of the person if:

(a) it is of one of the following kinds of address:

(i) a physical address;

(ii) a postal address;

(iii) an electronic address; and

Note 1: An address may be both a physical address and a postal address (eg. a street address).

Note 2: The following are examples of an electronic address:

(a) an e‑mail address;

(b) a secure website that the person can access to obtain a document.

(b) the person has given it to the Commissioner as an address for the service of documents by the Commissioner under the Act or these Regulations; and

(c) the designation of the address or other circumstances indicate that the person wishes the address to be used by the Commissioner in preference to other addresses of the person, whether generally or in specific circumstances.

(2) The designation of an address in a form or correspondence as an ‘address for service’, a ‘preferred address’, an ‘address for correspondence’ or similar term satisfies paragraph (1)(c).

37 Change or withdrawal of preferred address for service

(1) A person may change or withdraw a preferred address for service only by giving the Commissioner notice in accordance with this regulation.

(2) The notice must state whether or not the former address is still effective.

(3) The notice must be given to the Commissioner in one of the following ways:

(a) orally, including by telephone;

(b) in writing, including electronically;

(c) any other way approved by the Commissioner in writing.

(4) If the person is required to maintain a preferred address for service under the Act or these Regulations, the person may withdraw a preferred address for service only if another effective preferred address for service that is a postal address remains.

(5) If the person is required to maintain a preferred address for service under the Act or these Regulations, and a preferred address for service becomes ineffective, the person must change or withdraw the ineffective address within 28 days.

37A Requirement to maintain a preferred address for service

If a person is required to give the Commissioner a preferred address for service for a purpose (for example, by the approved form for a return), the person must subsequently maintain a preferred address for service for the purpose.

38 Substitute preferred address for service

(1) This regulation applies if:

(a) a person has not given the Commissioner a preferred address for service; or

(b) the Commissioner is satisfied that none of a person’s preferred addresses for service is effective.

(2) If the Commissioner has a record of another address relating to the person (whether or not a physical address), and it appears to the Commissioner that it is likely that the address is effective, the Commissioner may treat that address as the person’s preferred address for service for all purposes under the Act and these Regulations.

39 Failure to notify change of address

A person whose preferred address for service is no longer effective, and who has not changed or withdrawn the address under regulation 37, may not plead the fact that the address was not effective as a defence in any proceedings instituted against the person under the Act or these Regulations.

40 Service of documents

(1) The Commissioner may serve a document on a person for the purposes of the Act and these Regulations by:

(a) if the person has given a preferred address for service that is a physical address—leaving a copy of the document at that address; or

(b) if the person has given a preferred address for service that is a postal address—posting a copy of the document to that address; or

(c) if the person has given a preferred address for service that is an electronic address—delivering an electronic copy of the document to that address.

(2) This regulation also applies to the service of a notice:

(a) for the purposes of section 451 of the Act—by an attributable taxpayer upon a company that is a CFC within the meaning of Part X; and

(b) for the purposes of section 452 of the Act—by a company that is a CFC within the meaning of that Part upon a partnership;

in the same way as it applies to the Commissioner serving a document on a person.

(3) This regulation does not affect the operation of any other law of the Commonwealth, or any law of a State or Territory, that deals with the service of documents.

Note: For an example of another law that deals with the service of documents, see sections 28A and 29 of the Acts Interpretation Act 1901.

Part 6—Tax file numbers

54 Interpretation

In this Part:

investment body means an investment body as defined in section 202D of the Act.

investment reference number, in relation to an investment of a kind mentioned in section 202D of the Act, means the number used by the investment body in its records for the purpose of identifying the investments of investors.

investor means an investor as defined in section 202D of the Act.

phasing‑in period means the phasing‑in period mentioned in section 202DA of the Act.

quarter means a period of 3 months commencing on 1 January, 1 April, 1 July or 1 October.

55 File number reports

(1) Each person who is an investment body in relation to any investments mentioned in section 202D of the Act in connection with which an investor’s tax file number is quoted under Part VA of the Act, or ABN is quoted under section 12‑155 of Schedule 1 to the Taxation Administration Act 1953, during a particular reporting period shall give to the Commissioner in a form approved by the Commissioner a written report of all such investments.

(2) Subregulation (1) does not apply to an investment body in relation to a reporting period in respect of which:

(a) there is in force an agreement between the investment body and the Commonwealth relating to the reporting of tax file numbers or ABNs; and

(b) the investment body has complied with the provisions of the agreement.

(3) Subregulation (1) does not apply to a reporting period that ended before the beginning of the phasing‑in period.

(4) The report shall be given to the Commissioner within one month after the end of the reporting period to which it relates, or within such further time as the Commissioner, by written notice given to the investment body, allows.

(5) The report shall state, in relation to each investment referred to in subregulation (1):

(a) the investor’s full name and address;

(b) the investor’s tax file number or ABN; and

(c) the investment reference number (if any) in relation to the investment.

(6) In this regulation, reporting period means:

(a) a quarter; or

(b) in respect of an investment body to which a notice has been given under subregulation (7), the period specified in the notice.

(7) The Commissioner may, by notice in writing given to an investment body, inform the body that, for the purposes of this regulation, the period specified in the notice (being a period greater than 3 months) is to be the reporting period in respect of the body.

56 Annual investment income reports

(1) A person who at any time during a financial year is an investment body that accepted any investments mentioned in section 202D of the Act must give to the Commissioner a written report relating to those investments in the following form:

(a) for a report in respect of a financial year beginning on or before 1 July 2008—a form approved by the Commissioner;

(b) for a report in respect of a financial year beginning on or after 1 July 2009—the approved form.

Note: For the meaning of approved form, see subsection 6(1) of the Act and section 388‑50 of Schedule 1 to the Taxation Administration Act 1953.

(2) Subregulation (1) does not apply to a financial year that ended at or before the end of the phasing‑in period.

(3) The report shall be given to the Commissioner within 4 months after the end of the financial year to which it relates, or within such further time as the Commissioner, by written notice given to the investment body, allows.

(4) Subject to subregulation (4A), the report must state, in relation to each investment, in respect of the financial year:

(a) the full name of:

(i) the investor; or

(ii) each of 2 investors; or

(iii) 2 of 3 or more investors;

as the case requires; and

(b) the address of:

(i) the investor; or

(ii) 1 of 2 or more investors;

as the case requires; and

(c) where there were more than 2 investors—that fact; and

(d) the tax file number (if any) quoted, for the purpose of Part VA of the Act, or the ABN (if any) quoted under section 12‑155 of Schedule 1 to the Taxation Administration Act 1953, by:

(i) the investor; or

(ii) each of 2 investors; or

(iii) 2 of 3 or more investors;

as the case requires; and

(e) where an investor is to be taken to have quoted his or her tax file number because of the application of a provision of Division 5 of that Part—the code approved by the Commissioner; and

(f) unless paragraph (fa) applies—the total amount of income paid by the investment body; and

(fa) if income is paid under an eligible deferred interest investment entered into on or after 1 February 1992:

(i) so much of the payment as is a periodic interest payment within the meaning of Division 16E of Part III of the Act; and

(ii) if the income became payable at the end of the term of the investment—so much of the amount of the payment as does not exceed the amount that would have been included in the investor’s assessable income for the year of income in which the term ended if section 159GQ and paragraph 159GR(2)(c) of the Act applied to the investor; and

(iii) any amount that is taken under section 159GQ of the Act to be included in the investor’s assessable income for the year of income, excluding any amount of that kind for the year of income in which the end of the term of the investment occurred; and

(g) the total amount of:

(ii) any amounts withheld under sections 12‑140 and 12‑145 of Schedule 1 to the Taxation Administration Act 1953; and

(iii) any payments made under Division 14 of Schedule 1 to that Act because of the operation of sections 12‑140 and 12‑145; and

(ga) the amount of any TFN withholding tax paid by the investment body; and

(h) where the investment body has paid an amount of income to a non‑resident:

(i) the overseas address of the non‑resident; and

(ii) the overseas address code applicable to that address, being one of the codes specified by the Commissioner; and

(iii) the total of any amount withheld under Subdivision 12‑F of Schedule 1 to the Taxation Administration Act 1953 and any payment made under Division 14 of that Schedule because of the operation of Subdivision 12‑F; and

(iv) the total of any amounts withheld from fund payments under Subdivision 12‑H of Schedule 1 of the Taxation Administration Act 1953; and

(j) the investment reference number (if any).

(4A) In relation to each secondary investment to which section 202DDB of the Act applies, the report must state in respect of the financial year:

(a) the full name of the interposed entity; and

(b) the full name of each of the primary investors identified in the descriptive title of the investment in accordance with regulation 56A; and

(c) the address of the interposed entity; and

(d) the tax file number (if any) quoted, or taken to have been quoted, for the purpose of Part VA of the Act, and the ABN (if any) quoted under section 12‑155 of Schedule 1 to the Taxation Administration Act 1953, by the interposed entity; and

(e) where the interposed entity is taken to have quoted the interposed entity’s tax file number because of the application of a provision of Division 5 of that Part—the code approved by the Commissioner; and

(f) the total amount of income paid by the secondary investment body, excluding any amount that is taken to be included in the income of an investor under section 159GQ or paragraph 159GR(2)(c) of the Act; and

(fa) in respect of an investment entered into on or after 1 February 1992—the total amount that is taken to be included in the income of the investor, or each of the investors, under section 159GQ of the Act excluding income that has already been included in a report under this subregulation; and

(fb) in respect of an investment entered into on or after 1 February 1992—any amount that is taken to be included in the income of an investor under paragraph 159GR(2)(c) of the Act; and

(g) the total amount of:

(ii) any amounts withheld under section 12‑140 or 12‑145 of Schedule 1 to the Taxation Administration Act 1953; and

(iii) any payments made under Division 14 of Schedule 1 to that Act because of the operation of sections 12‑140 and 12‑145; and

(ga) the amount of any TFN withholding tax paid by the investment body; and

(h) the investment reference number (if any).

(5) Subject to subregulation (5B), subregulation (1) does not apply to an investment in relation to a financial year if the total amount of income paid on the investment is less than $1.

(5A) Subject to subregulation (5B), subregulation (1) does not apply to a person who at any time during a financial year is an investment body that accepted an investment if the total number of the investments that the person accepted during the financial year is less than 10.

(5B) Subregulation (1) applies to an investment in relation to a financial year if a person who at any time in the financial year is the investment body that accepted the investment is required:

(a) to withhold under section 12‑140 or 12‑145 of Schedule 1 to the Taxation Administration Act 1953 an amount from any income that an investor is entitled to receive in the financial year in respect of the investment; or

(b) to pay an amount to the Commissioner under Division 14 of Schedule 1 to that Act because of the operation of those sections.

(5C) For the purposes of paragraph (4)(fa), any accounting period, other than a year of income, that is adopted in relation to the income is to be ignored.

(6) For the purposes of paragraphs (4)(f) and (h), (4A)(f) and subregulation (5):

(a) where income is not actually paid to a person but is reinvested, accumulated, capitalised or otherwise dealt with on behalf of the person, or as the person directs, the income shall be taken to be paid to the person when it is so reinvested, accumulated, capitalised or otherwise dealt with;

(b) where a person becomes presently entitled, as an investor in relation to an investment of the kind mentioned in item 5 in the table in subsection 202D(1) of the Act, to a share of income in respect of the investment, that share of the income shall be taken to be paid to the person as income in respect of the investment when the person becomes so entitled.

(9) In this regulation investor, in relation to an investment in relation to a financial year, means a person who was, at any time during the financial year, an investor, as defined in section 202D of the Act, in relation to the investment.

56A Paragraph 202DDB(1)(b) of the Act: condition

For the purposes of paragraph 202DDB(1)(b) of the Act, the condition is that the secondary investment must have a descriptive title which identifies all the primary investors.

57 Reviewable decisions

For the purposes of section 202F of the Act, the following decisions of the Commissioner, being decisions made following an application by the investment body concerned, are reviewable decisions:

(a) a decision refusing to extend, or extending, the time referred to in subregulation 55(4);

(b) a decision refusing to give, or giving, a notice under subregulation 55(7);

(c) a decision refusing to extend, or extending, the time referred to in subregulation 56(3);

(d) a decision varying or revoking a notice given under subregulation 55(4), 55(7) or 56(3).

Part 8—Rebate for low income aged persons and pensioners and rebate in respect of certain benefits

Division 1—General

148 Interpretation

In this Part:

lowest marginal tax rate, in relation to a year of income, means the rate that is:

(a) the lowest rate specified in the table in Part 1 of Schedule 7 to the Income Tax Rates Act 1986, in the application of the table to that year of income; and

(b) expressed as a decimal fraction.

rebatable benefit has the same meaning as in subsection 160AAA(1) of the Act.

tax‑free threshold, in relation to a year of income, has the meaning given by subsection 3(1) of the Income Tax Rates Act 1986.

149 Amount of rebate of tax

(1) For sections 160AAAA and 160AAAB of the Act, the amount of an entitlement to a rebate of tax is ascertained in accordance with Division 1A of this Part.

(2) For section 160AAA of the Act, the amount of an entitlement to a rebate of tax is ascertained in accordance with Division 3 of this Part.

Division 1A—Rebate under sections 160AAAA and 160AAAB of the Act

150AA Definitions

In this Division:

rebate threshold has the meaning given by subregulations 150AB(3) and (3A).

relevant income‑recipient means the beneficiary of a trust, if the trustee in relation to the trust:

(a) is the taxpayer; and

(b) is liable to be assessed under section 98 of the Act in respect of the beneficiary’s share of the net income of the trust estate.

150AB Eligibility—amount of rebate income

(1) For subsection 160AAAA(3) or 160AAAB(3) of the Act, the amount mentioned is:

(2) A taxpayer’s rebate amount for a year of income is the amount in the relevant item in the following table:

Item | Class of person | Rebate amount |

1 | Single person | $2 230 |

2 | Member of a couple | $1 602 |

3 | Member of an illness‑separated couple | $2 040 |

(2B) If, in a year of income, more than one item in the table in subregulation (2) applies to a taxpayer, the taxpayer’s rebate amount is the amount that gives the taxpayer the greatest rebate entitlement.

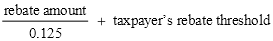

(3) If subregulation (3A) does not apply, a taxpayer’s rebate threshold for a year of income is the amount calculated using the formula:

where:

D is the tax‑free threshold.

E is the maximum amount of rebate allowable under section 159N of the Act.

F is the taxpayer’s rebate amount for the year of income.

Note: The rebate amount is worked out in accordance with subregulations (2) and (2B), but may then be affected by regulation 150AE or 150AF.

C is the lowest marginal tax rate.

Note: For lowest marginal tax rate and tax‑free threshold—see regulation 148.

(3A) If the taxpayer’s rebate threshold, if it were calculated using the formula in subregulation (3), would be an amount that is greater than the amount at which the rebate of tax under section 159N of the Act is reduced, the taxpayer’s rebate threshold for a year of income is the amount calculated using the formula:

where:

C is the lowest marginal tax rate.

D is the tax‑free threshold.

E is the maximum amount of rebate allowable under section 159N of the Act.

F is the taxpayer’s rebate amount for the year of income.

Note: The rebate amount is worked out in accordance with subregulations (2) and (2B), but may then be affected by regulation 150AE or 150AF.

G is the amount at which the rebate of tax under section 159N of the Act is reduced.

H is the rate at which the rebate of tax under subsection 159N(2) of the Act is reduced, expressed as a decimal fraction.

I is the second lowest marginal tax rate, expressed as a decimal fraction.

Note: For lowest marginal tax rate and tax‑free threshold—see regulation 148.

(4) If an amount worked out under subregulation (1), (2), (3) or (3A) is not an amount of whole dollars, the amount must be rounded up to the nearest whole dollar.

(5) In this regulation:

illness separated couple has the same meaning as in subsection 4(7) of the Social Security Act 1991.

member of a couple has the same meaning as in:

(a) the Social Security Act 1991; or

(b) the Veteran’s Entitlements Act 1986.

single person means a person who, at any time in the year of income, is not the spouse of another person.

150AD Rebate for low income aged persons and pensioners

Subject to regulations 150AE and 150AF, a taxpayer who, under section 160AAAA or 160AAAB of the Act, is eligible, in a year of income, for a rebate of tax is entitled, in respect of income, or trust income, of the year of income, to a rebate of tax amounting to:

(b) for a year of income ending after 30 June 1997 and before 1 July 2009:

(i) if the relevant income‑recipient’s taxable income of the year of income does not exceed his or her rebate threshold—the taxpayer’s rebate amount; or

(ii) if the relevant income‑recipient’s taxable income of the year of income exceeds his or her rebate threshold—the taxpayer’s rebate amount, reduced by 12.5 cents for each $1 of the amount of the excess; and

(c) for a later year of income:

(i) if the relevant income‑recipient’s rebate income of the year of income does not exceed his or her rebate threshold—the taxpayer’s rebate amount; or

(ii) if the relevant income‑recipient’s rebate income of the year of income exceeds his or her rebate threshold—the taxpayer’s rebate amount, reduced by 12.5 cents for each $1 of the amount of the excess.

150AE Transfer of unused rebate from taxpayer other than trustee

(1) Regulation 150AD is affected by subregulation (2) if, in relation to a year of income:

(a) a taxpayer (TP1) is entitled to a rebate of tax under section 160AAAA of the Act; and

(aa) a person (TP2) who is, at any time in that year of income, TP1’s spouse, is entitled to a rebate of tax under section 160AAAA of the Act; and

(b) TP1’s rebate amount for the year of income, worked out under this regulation, exceeds the tax payable by TP1 in respect of income of that year (disregarding any credits or rebates); and

(c) the amount of the rebate to which, apart from this subregulation, TP2 is entitled under section 160AAAA of the Act for the year of income is less than TP2’s rebate amount for that year.

(2) In the circumstances mentioned in subregulation (1):

(a) TP1’s rebate amount for the year of income is the amount ascertained under subregulation 150AB(2) reduced by the amount of the excess rebate amount mentioned in paragraph (1)(b); and

(b) TP2’s rebate amount for the year of income is the amount ascertained under subregulation 150AB(2) increased by the amount of excess rebate ascertained under subregulation (11).

(3) Regulation 150AD is affected by subregulation (4) if, in relation to a year of income:

(a) a taxpayer (TP1) is, under section 160AAAA of the Act, entitled to a rebate of tax; and

(b) TP1 is, at any time in that year of income, the spouse of a person who is a relevant income‑recipient in relation to a taxpayer (TP2) who is entitled under section 160AAAB to a rebate of tax; and

(c) TP1’s rebate amount for the year of income worked out under this regulation exceeds the tax payable by TP1 in respect of income of that year (disregarding any credits or rebates); and

(d) the amount of the rebate to which, apart from this subregulation, TP2 is entitled under section 160AAAB for the year of income in relation to TP1’s spouse is less than TP2’s rebate amount for that year in relation to TP1’s spouse.

(4) In the circumstances mentioned in subregulation (3), the rebate amount for the year of income is:

(a) for TP1—the amount ascertained under subregulation 150AB(2) or 151(3) reduced by the amount of the excess rebate amount mentioned in paragraph (3)(c); and

(b) for TP2—the amount ascertained under subregulation 150AB(2) increased by the amount of the excess rebate amount ascertained under subregulation (11).

(7) This regulation applies whether TP1 is, or is not, the same person as TP2.

(8) For this regulation, if:

(a) TP1 received, at any time in the year of income, a pension under:

(i) Part 2.3, 2.4 or 2.5 of the Social Security Act 1991; or

(ii) Division 4 or 5 of Part III of the Veterans’ Entitlements Act 1986; and

(b) the pension payments were exempt payments under Subdivision 52‑A or 52‑B of the Income Tax Assessment Act 1997;

the amount of TP1’s assessable income of that year is to be calculated as if that pension were assessable income.

(11) In the circumstances mentioned in paragraphs (2)(b) and (4)(b), if TP1’s taxable income for the year is $6 000 or less, the amount of excess rebate is the excess rebate amount mentioned in paragraph (1)(b).

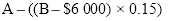

(12) In the circumstances mentioned in paragraphs (2)(b) and (4)(b), if TP1’s taxable income for the year is greater than $6 000, and each rate of tax payable by TP1 is a rate set out in Part I of Schedule 7 to the Income Tax Rates Act 1986:

(a) the amount of excess rebate is calculated using the formula:

where:

A is TP1’s rebate amount for the year of income, worked out under this regulation.

B is TP1’s taxable income for the year; but

(b) if the amount calculated in paragraph (a) is less than zero, the amount of excess rebate is zero.

(13) In the circumstances mentioned in paragraphs (2)(b) and (4)(b), if TP1’s taxable income for the year is greater than $6 000, and each rate of tax payable by TP1 is a rate set out in Part II of Schedule 7 to the Income Tax Rates Act 1986, the amount of excess rebate is the excess rebate amount mentioned in paragraph (1)(b).

150AF Transfer of unused rebate from taxpayer who is trustee

(1) Regulation 150AD is affected by subregulation (2) if, in relation to a year of income:

(a) a taxpayer (TP1) is entitled to a rebate under section 160AAAB of the Act; and

(b) the relevant income‑recipient in relation to that rebate is, at any time in that year of income, the spouse of a taxpayer (TP2) who is entitled to a rebate of tax under section 160AAAA of the Act; and

(c) TP1’s rebate amount in relation to the relevant income‑ recipient mentioned in paragraph (b) exceeds the tax payable by TP1 in relation to that relevant income‑ recipient for income of that year (disregarding any credits or rebates); and

(d) the amount of the rebate to which, apart from this subregulation, TP2 is entitled under section 160AAAA of the Act for the year of income is less than TP2’s rebate amount for that year.

(2) In the circumstances mentioned in subregulation (1), the rebate amount for the year of income is:

(a) for TP1—the amount ascertained under subregulation 150AB(2) reduced by the amount of the excess rebate amount mentioned in paragraph (1)(c); and

(b) for TP2—the amount ascertained under subregulation 150AB(2) increased by the amount of the excess rebate amount ascertained under subregulation (8) or (9).

(3) Regulation 150AD is affected by subregulation (4) if, in relation to a year of income:

(a) a taxpayer (TP1) is entitled to a rebate under section 160AAAB of the Act; and

(b) the relevant income‑recipient in relation to TP1 (RIR1) is, at any time in that year of income, the spouse of a person (RIR2) who is the relevant income‑recipient in relation to a taxpayer (TP2) who is entitled to a rebate of tax under section 160AAAB of the Act; and

(c) TP1’s rebate amount in relation to RIR1 exceeds the tax payable by TP1 in relation to RIR1 for income of that year (disregarding any credits or rebates); and

(d) the amount of the rebate to which, apart from this subregulation, TP2 is entitled under section 160AAAB of the Act for the year of income in relation to RIR2 is less than TP2’s rebate amount for that year in relation to RIR2.

(4) In the circumstances mentioned in subregulation (3), the rebate amount for the year of income:

(a) for TP1—is the amount ascertained under subregulation 150AB(2) reduced by the amount of the excess rebate amount mentioned in paragraph (3)(c); and

(b) for TP2—is the amount ascertained under subregulation 150AB(2) increased by the amount of the excess rebate amount ascertained under subregulation (8) or (9).

(7) This regulation applies whether TP1 is, or is not, the same person as TP2.

(7A) For this regulation, if:

(a) TP1 received, at any time in the year of income, a pension under:

(i) Part 2.3, 2.4 or 2.5 of the Social Security Act 1991; or

(ii) Division 4 or 5 of Part III of the Veterans’ Entitlements Act 1986; and

(b) the pension payments were exempt payments under Subdivision 52‑A or 52‑B of the Income Tax Assessment Act 1997;

the amount of TP1’s assessable income for that year is to be calculated as if that pension were assessable income.

(8) In the circumstances mentioned in paragraphs (2)(b) and (4)(b), if TP1’s taxable income in relation to the relevant income‑recipient for the year is $6 000 or less, the amount of excess rebate is the excess rebate amount mentioned in paragraph (1)(b).

(9) In the circumstances mentioned in paragraphs (2)(b) and (4)(b), if TP1’s taxable income in relation to the relevant income‑recipient for the year is greater than $6 000, and each rate of tax payable by TP1 is a rate set out in Part I of Schedule 7 to the Income Tax Rates Act 1986:

(a) the amount of excess rebate is calculated using the formula:

where:

A is TP1’s rebate amount for the year of income, worked out under this regulation.

B is TP1’s taxable income for the year; but

(b) if the amount calculated in paragraph (a) is less than zero, the amount of excess rebate is zero.

(10) In the circumstances mentioned in paragraphs (2)(b) and (4)(b), if TP1’s taxable income for the year is greater than $6 000, and each rate of tax payable by TP1 is a rate set out in Part II of Schedule 7 to the Income Tax Rates Act 1986, the amount of excess rebate is the excess rebate amount mentioned in paragraph (1)(c).

Division 3—Rebate under section 160AAA of the Act

152 Rebate of tax in respect of rebatable benefits

(1) If the assessable income of a taxpayer of a year of income commencing on or after 1 July 2003 includes an amount of rebatable benefit, the taxpayer is entitled in the taxpayer’s assessment in respect of income of that year of income to a rebate of tax of the amount calculated using the formula in subregulation (2) or (3).

(2) If the taxpayer’s benefit amount is less than or equal to the threshold at the upper conclusion of the lowest marginal tax rate, the formula is:

where:

A is the taxpayer’s benefit amount, being the amount of rebatable benefit received by the taxpayer during the year of income, rounded down to the nearest whole dollar.

Note: For lowest marginal tax rate and tax‑free threshold—see regulation 148.

(3) If the taxpayer’s benefit amount is greater than the threshold at the upper conclusion of the lowest marginal tax rate, the formula is:

where:

A is the taxpayer’s benefit amount, being the amount of rebatable benefit received by the taxpayer during the year of income, rounded down to the nearest whole dollar.

B is the threshold at the upper conclusion of the lowest marginal tax rate.

Note: For lowest marginal tax rate and tax‑free threshold—see regulation 148.

(4) If the amount worked out under subregulation (2) or (3) is not an amount of whole dollars, the amount must be rounded up to the nearest whole dollar.

Part 8A—Foreign income

Division 1—General

152A Interpretation

(1) In this Part, unless the contrary intention appears, words and phrases have the same meanings as they have in Part X of the Act.

(2) In this Part, unless the contrary intention appears:

CGT asset has the meaning given by section 108‑5 of the Income Tax Assessment Act 1997.

Compulsory acquisition, in relation to a CGT asset, means the compulsory acquisition of that asset by:

(a) the government of a country, whether a federal, State or municipal government (however described); or

(b) an authority of such a government.

permanent establishment, in relation to an entity that carries on business in a listed country:

(a) if there is a double tax agreement in relation to the country and section 23AH of the Act applies to the entity—has the same meaning as in the agreement; or

(b) in any other case—has the meaning given by subsection 6(1) of the Act.

wholly‑owned group has the meaning given by section 975‑500 of the Income Tax Assessment Act 1997.

(3) In this Part (other than in regulation 152D):

capital gains means gains or profits of a capital nature that arise from the sale or disposal of all or part of a CGT asset, other than gains or profits that would not be capital gains but for a provision of Australian tax law.

(4) In this Part:

passive income means passive income described in section 446 of the Act, subject to the following modifications:

(a) omit paragraph 446(1)(k) and insert the following paragraph:

‘(k) capital gains in respect of tainted assets;’;

(b) if it is necessary to identify the designated concession income of an entity to which Division 6AAA of Part III of the Act applies, as part of using Schedule 9:

(i) read each reference, as appropriate, in Part X to a company as a reference to the entity; and

(ii) read each reference, as appropriate, in Part X to a statutory accounting period as a reference to a year of income;

(c) if it is necessary to identify the designated concession income of an entity to which section 23AH of Part III of the Act applies, as part of using Schedule 9, read each reference, as appropriate, in Part X to a statutory accounting period as a reference to a year of income.

Division 2—Controlled foreign companies

152B Income or profits as designated concession income

(1) For the definition of designated concession income in section 317 of the Act, if:

(a) a listed country is mentioned in column 2 of an item in Part 2 of Schedule 9; and

(b) an entity mentioned in column 3 of the item derived income or profits that are:

(i) of a kind specified in column 4 of the item; and

(ii) further described in column 5 of the item;

the income or profits are designated concession income.

(2) For subregulation (1), the income or profits of an entity include:

(a) the entity’s interest in the income or profits of a partnership in which the entity is a partner; and

(b) the entity’s beneficial interest in the income or profits of a trust estate in which the entity is a beneficiary.

152C Listed countries and section 404 countries

(1) For the definition of listed country in subsection 320(1) of the Act, a foreign country or a part of a foreign country listed in Part 1 of Schedule 10 is declared to be a listed country for the purposes of Part X of the Act.

(2) For the definition of section 404 country in subsection 320(1) of the Act, a foreign country or a part of a foreign country listed in Part 2 of Schedule 10 is declared to be a section 404 country for the purposes of Part X of the Act.

152D Capital gains regarded as subject to tax

(1) In this regulation:

capital gains means gains or profits or other amounts of a capital nature.

roll‑over relief, in relation to a particular tax accounting period in relation to a listed country, means the deferral of tax liability in the tax accounting period under a tax law of the listed country because of a circumstance specified in regulation 152E.

(2) For section 324 of the Act, if:

(a) capital gains that are derived by an entity are not subject to tax in a listed country in a particular tax accounting period; and

(b) apart from the availability of roll‑over relief, the capital gains would have been subject to tax in the listed country in the tax accounting period;

the capital gains are to be treated as if they were subject to tax in the listed country in the tax accounting period.

152E Circumstances specified for the definition of roll‑over relief in regulation 152D

For the definition of roll‑over relief in subregulation 152D(1), each of the following circumstances is specified:

(a) an entity:

(i) is taken to have disposed of all or part of a CGT asset because of an act, transaction or event as a result of which the entity has received an amount of money or a replacement CGT asset:

(A) by way of compensation for the compulsory acquisition, or for the loss or destruction, of the original CGT asset; or

(B) under a policy of insurance against the risk of loss or destruction of the original CGT asset; and

(ii) after receiving an amount of money mentioned in subparagraph (i), in order to achieve a deferral of tax liability under the tax law of the listed country, is required:

(A) to incur expenditure in acquiring a CGT asset in place of the original CGT asset; or

(B) to incur expenditure of a capital nature in repairing or restoring the original CGT asset;

(b) a company disposes of a CGT asset to another company, and the transferee is a member of the same wholly‑owned group as the transferor;

(c) a company redeems or cancels all the shares of a particular class in the company, and:

(i) an entity holds shares of that class in the company; and

(ii) the company issues to the entity other shares in the company in substitution for the redeemed or cancelled shares; and

(iii) the market value of the new shares immediately after they were issued is not less than the market value of the redeemed or cancelled shares immediately before the redemption or cancellation; and

(iv) the entity did not receive any consideration (other than the new shares) in respect of the redemption or cancellation;

(d) an entity owns an option to acquire shares in a company or a right, issued by a company, to acquire shares in the company or to acquire an option to acquire shares in the company, and:

(i) any of the shares:

(A) are consolidated and divided into new shares of a larger amount; or

(B) are subdivided into shares of a smaller amount; and

(ii) as a result of the consolidation or subdivision:

(A) the original option is cancelled; or

(B) the original right is cancelled; and

(iii) the company issues to the entity:

(A) another option relating to the new shares in substitution for the original option; or

(B) another right relating to the new shares, in substitution for the original right; and

(iv) the market value of the new option or the new right, immediately after it was issued, is not less than the market value of the original option or original right immediately before its cancellation; and

(v) the entity did not receive any consideration in respect of the cancellation, other than the new option or right.

152F Accruals tax laws

For the purposes of the definition of accruals tax law in section 317 of the Act, each of the following laws of a broad‑exemption listed country is declared to be an accruals tax law:

(a) sections 91 to 95 (inclusive) of the Income Tax Act of Canada;

(b) article 209B of the General Tax Code of France;

(c) sections 7 to 14 (inclusive) of the External Tax Law of the Federal Republic of Germany;

(d) articles 40‑4 to 40‑6 (inclusive) and 66‑6 to 66‑9 (inclusive) of the Special Taxation Measures Law of Japan;

(e) sections 245C to 245Q (inclusive) of the Income Tax Act 1976 of New Zealand;

(ea) paragraph CG 1(a) and sections CG 2 to CG 13 (inclusive) of the Income Tax Act 1994 of New Zealand;

(g) Chapter IV of Part XVII of the Income and Corporation Taxes Act 1988 of the United Kingdom;

(h) subpart F of Part III of subchapter N of Chapter 1 of the Internal Revenue Code of the United States of America.

152G State foreign taxes that are treated as federal foreign taxes

For the purposes of Part X of the Act, a foreign tax imposed in Switzerland that is a cantonal tax on income referred to in paragraph 1(b) of Article 2 of the Swiss agreement within the meaning of the Income Tax (International Agreements) Act 1953 is to be treated as if it were an additional federal foreign tax of Switzerland.

Part 10—Miscellaneous

171 Signatures

(1) Any notice to be given by the Commissioner may be given by any officer of the Commissioner duly authorized in that behalf; and any notice purporting to be signed by the authority of the Commissioner shall be as valid and effectual for all purposes as if signed by the Commissioner in person.

(2) In this regulation, notice to be given by the Commissioner includes a notice to be given by the Commissioner under Income Tax Assessment Act 1997 or Regulations made under that Act.

172 Presumption as to signatures

(1) Judicial notice shall be taken of the names and signatures of the persons who are, or were at any time, the Commissioner, a Second Commissioner, a Deputy Commissioner or a delegate of the Commissioner.

(2) A certificate, notice or other document bearing the written, printed or stamped name (including a facsimile of the signature) of a person who is, or was at any time, the Commissioner, a Second Commissioner, a Deputy Commissioner or a delegate of the Commissioner in lieu of that person’s signature shall, unless it is proved that the document was issued without authority, be deemed to have been duly signed by that person.

(3) In this regulation, certificate, notice or other document includes a certificate, notice or other document under the Income Tax Assessment Act 1997 or Regulations made under that Act.

173 Appointment of Public Officer

Whenever the position of Public Officer of a company becomes vacant, and it is necessary for a new Public Officer to be appointed, the notice of appointment by the company of a new Public Officer shall be given to the Commissioner at the place where, under these Regulations, the return of the company is to be furnished.

174 Scale of expenses in respect of persons required to attend before Commissioner etc under section 264 of the Act

For the purposes of subsection 264(3) of the Act, the scale set out in Schedule 5 is prescribed in respect of expenses to be allowed to persons (other than persons giving evidence in respect of their own income or assessment or the income or assessment of persons whose representatives they are) required under that section to attend and give evidence before the Commissioner or an officer.

175 Oath or affirmation for purposes of section 265

(1) In this regulation, designated person means a person designated for the purposes of section 265 of the Act.

(2) For the purposes of examining a person upon oath or affirmation for the purposes of section 265 of the Act, a designated person may administer an oath or take an affirmation.

Part 15—Application and transitional provisions

200 Transitional arrangements arising out of the Income Tax Amendment Regulation 2013 (No. 1)

The amendments made by Schedule 1 to the Income Tax Amendment Regulation 2013 (No. 1) apply in relation to assessments of income for the 2012‑2013 income year and later income years.

201 Transitional arrangements arising out of the Tax Laws Amendment (2013 Measures No. 1) Regulation 2013

The amendments made by items 1 to 5 of Schedule 1 to the Tax Laws Amendment (2013 Measures No. 1) Regulation 2013 apply in relation to assessments of income for the 2013‑2014 income year and later income years.