Part 1—Preliminary

1 Name of regulations

These regulations are the Insurance Contracts Regulations 1985.

2 Interpretation

(1) In these Regulations, unless the contrary intention appears:

accidental damage, in relation to a thing, means damage that occurs to the thing fortuitously in relation to the insured.

accidental injury means an injury that occurs fortuitously to the insured person but does not include an injury that is caused by or results from a sickness or disease.

the Act means the Insurance Contracts Act 1984.

contents, in relation to a residential building, means:

(a) furniture, furnishings and carpets (whether fixed or unfixed);

(b) household goods;

(c) clothing and other personal effects;

(d) any of the following:

(i) a picture;

(ii) a work of art;

(iii) a fur;

(iv) a piece of jewellery;

(v) a gold or silver article;

(vi) a document of any kind;

(vii) a collection of any kind;

the value of all of which at the time when the relevant contract of insurance is entered into does not exceed $500; and

(e) swimming pools that are not fixtures, that are owned by the insured or by a member of the insured’s family ordinarily residing with the insured, but does not include an article or thing to which the expression residential building extends.

eligible contract of insurance has the meaning given in regulation 2B.

expropriation, in relation to property, means the lawful seizure, confiscation, nationalization or requisition of the property.

home building means:

(a) a building used principally and primarily as a place of residence; and

(b) out‑buildings, fixtures and structural improvements used for domestic purposes, being purposes related to the use of the principal residence;

on the site and, without limiting the generality of the expression, includes:

(c) fixed wall coverings, fixed ceiling coverings and fixed floor coverings (other than carpets);

(d) services (whether underground or not) that are the property of the insured or that the insured is liable to repair or replace or pay the cost of repairing and replacing; and

(e) fences and gates wholly or partly on the site;

but does not include:

(f) a hotel;

(g) a motel;

(h) a boarding house;

(j) a building that is in the course of construction;

(k) a temporary building or structure or a demountable or moveable structure;

(m) a caravan (whether fixed to the site or not); or

(n) a building that is let or rented by the insured, as lessor, as a business and is not the principal residence of the insured.

home buildings insurance contract means a contract referred to in regulation 9.

home contents insurance contract means a contract referred to in regulation 13.

insured person, in relation to a contract of insurance, means a person specified in the contract as a person in respect of whose death, sickness, disease, injury or unemployment insurance cover is provided under the contract.

member of the insured person’s travelling party means a member of the family of the insured person, or a person specified in the contract of insurance, travelling or intending to travel with the insured person on the specified journey.

motor vehicle means a vehicle that is designed:

(a) to travel by road;

(b) to use volatile spirit, steam, gas, oil, electricity or any other power (not being human power or animal power) as its principal means of propulsion; and

(c) to carry passengers;

and includes a motor cycle but does not include an omnibus or a tram or a motor vehicle the carrying capacity of which exceeds 2 tonnes.

personal belongings means baggage and other personal effects (including tickets, credit cards, travellers cheques, travel documents and passports) that accompany the insured person on the specified journey (whether acquired before or during the journey) or have been collected from the insured person by a carrier in order to be taken on the specified journey, but does not include:

(a) currency notes, bank notes or coins; or

(b) goods so taken that are intended for trade.

residential building means:

(a) a building used principally and primarily as a place of residence; and

(b) out‑buildings used for domestic purposes, being purposes related to the use of the principal residence;

on the site but does not include:

(c) a hotel;

(d) a motel;

(e) a boarding house;

(f) a building that is in the course of construction;

(g) a temporary building or structure or a demountable or moveable structure;

(h) a caravan (whether fixed to the site or not); or

(j) a building that is let or rented by the insured, as lessor, as a business and is not the principal residence of the insured.

site, in relation to a building, means the site specified in the relevant contract of insurance as the site on which the building is situated.

specified journey means a journey in relation to which insurance cover is provided by the relevant contract of insurance.

warlike activities means invasion, act of foreign enemy, hostilities (whether war is declared or not), civil war, rebellion, revolution, insurrection, military or usurped power, looting, sacking or pillage following any of these.

(2) Where a residential building is a part of a building that has been subdivided under a law of a State or Territory that relates to the subdivision of buildings into strata (however described), a reference in these Regulations to the contents of the residential building includes a reference to such of the fixtures and structural improvements in the part of the building as are not insured under a contract of insurance that provides insurance cover in respect of the destruction of, or damage occurring to, the building, being a contract under which the body corporate established by or under that law is the insured.

(3) A reference in these Regulations to a period during which a person is disabled is a reference to a period specified in a certificate given by a duly qualified medical practitioner that certifies that the person is disabled during that period.

2A Definition of consumer credit insurance

For the purposes of paragraph (b) of the definition of consumer credit insurance in subsection 11(1) of the Act, the class of contracts referred to in regulation 21 is identified as consumer credit insurance.

Note: For the purposes of paragraph (a) of the definition of consumer credit insurance (a class of contracts declared to be a class of contracts to which Division 1 of Part V of the Act applies), see regulation 21.

Part 4—Disclosures and misrepresentations

Division 1—Insured’s duty of disclosure

2B Eligible contracts of insurance (Act s 21A(9))

(1) A contract of insurance is an eligible contract of insurance if it:

(a) is for new business; and

(b) is wholly in a class of contracts that is declared to be a class of contracts in relation to which Division 1 of Part V of the Act applies.

Note: The following regulations declare certain classes of insurance contracts for Division 1 of Part V of the Act:

- regulation 5 (motor vehicle insurance)

- regulation 9 (home buildings insurance)

- regulation 13 (home contents insurance)

- regulation 17 (sickness and accident insurance)

- regulation 21 (consumer credit insurance)

- regulation 25 (travel insurance)

(2) A contract of insurance is an eligible contract of insurance if:

(a) it is not mentioned in subregulation (1); and

(b) it is for new business; and

(c) the insurer, before the contract is entered into, gives to the insured:

(i) a written notice in accordance with the form set out in Part 3 of Schedule 1; or

(ii) an oral notice in accordance with the words set out in Schedule 2; or

(iii) a notice otherwise complying with subsection 22(1) of the Act clearly informing the insured of the general nature and effect of the duty of disclosure and the general nature and effect of section 21A of the Act.

(3) However, a contract of insurance mentioned in subregulation (2) is not an eligible contract of insurance if:

(a) the insurer gave the insured a notice mentioned in paragraph (2)(c) before 28 December 2015; and

(b) the contract is subsequently renewed before 28 December 2016; and

(c) before that renewal, the insurer gives the insured a notice under section 22 of the Act; and

(d) in that notice, the insurer clearly indicates that contract of insurance is no longer an eligible contract of insurance.

3 Notice of duty of disclosure

(1) The form of writing that may be used to inform an insured of the matters mentioned in subsection 22(1) of the Act is:

(a) for a contract of general insurance that is not an eligible contract of insurance—the form set out in Part 1 of Schedule 1; and

(b) for a contract of life insurance—the form set out in Part 2 of Schedule 1; and

(c) for an eligible contract of insurance—the form set out in Part 3 of Schedule 1; and

(d) for the renewal of an eligible contract of insurance—the form set out in Part 4 of Schedule 1.

(2) The words that may be used to inform an insured orally of the matters mentioned in subsection 22(1) of the Act for an eligible contract of insurance are set out in Schedule 2.

Note: Section 69 of the Act provides for the circumstances in which information that is required by other provisions of the Act to be given in writing may be given orally.

Division 3—Remedies for non‑disclosure and misrepresentations by insured

4 Prescribed rate of interest—subparagraph 30(2)(b)(i) of the Act

For the purposes of subparagraph 30(2)(b)(i) of the Act, the rate of 11 per cent per annum is prescribed.

Division 4—Key Facts Sheets

4A Application of Division

(1) This regulation is made for section 33A of the Act.

(2) Each of the following class of contracts of insurance is declared to be a class of contracts in relation to which Division 4 of Part IV of the Act applies:

(a) a home buildings insurance contract;

(b) a home contents insurance contract.

(3) In this Division, a reference to a contract includes a reference to a proposed or possible contract.

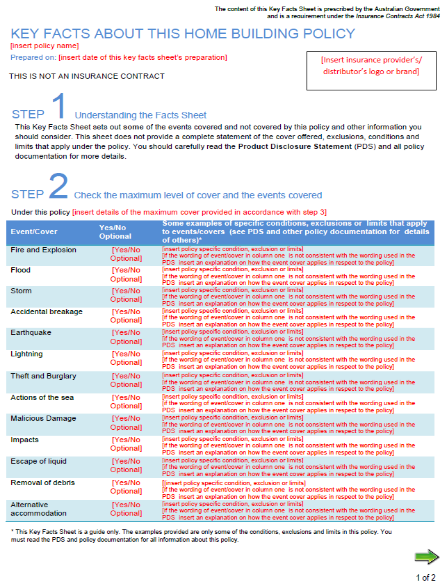

4B What is a Key Facts Sheet?

(1) This regulation:

(a) is made for section 33B of the Act; and

(b) prescribes:

(i) the information required to be contained in a Key Facts Sheet for a contract; and

(ii) requirements that a Key Facts Sheet must comply with.

(2) A Key Facts Sheet must:

(a) contain the information, and be completed in the way, specified in the following form:

(i) for a home buildings insurance contract—Form 1 in Schedule 3;

(ii) for a home contents insurance contract—Form 2 in Schedule 3; and

(b) be A4 in size; and

(c) be set out in Arial font, in the following sizes:

(i) the heading at the top of the first page that starts with the words ‘KEY FACTS’ must be in size 18 font;

(ii) the word ‘STEP’ must be in size 16 font;

(iii) the number after the word ‘STEP’ must be in size 48 font;

(iv) the footnote after step 2 must be in size 8 font;

(v) the rest of the document must be in size 10 font; and

(d) be set out in the following colours, with sufficient contrast in the colours to allow the text to be easily read:

(i) the headings, subheadings, and policy name, must be in blue type on a white background;

(ii) the top box in step 2 must be in white type on a blue background;

(iii) the remaining boxes in step 2 must alternate between black type on a white background, and black type on a light blue background;

(iv) the box in step 3 must be in white type on a blue background;

(v) the rest of the document must be in black type on a white background.

4C Insurer’s obligation to provide Key Facts Sheet

(1) This regulation:

(a) is made for section 33C of the Act; and

(b) prescribes:

(i) the circumstances, and manner, in which an insurer must provide a Key Facts Sheet for a contract; and

(ii) the circumstances in which an insurer may or must provide a Key Facts Sheet for a contract by electronic means; and

(iii) exceptions to the requirement in subsection 33C(1) of the Act.

(2) An insurer must provide a person (a consumer) with a Key Facts Sheet for a contract:

(a) if the consumer requests information about the contract—as soon as reasonably practicable, but not later than 14 days, after the consumer first requests information about the contract; and

(b) if the consumer enters into the contract with the insurer (other than by an agreement to extend or vary the contract or a reinstatement of the contract)—as soon as reasonably practicable, but not later than 14 days, after the consumer enters into the contract.

(3) The insurer may provide the Key Facts Sheet by electronic means at the consumer’s request.

(4) If an insurer has a website that is accessible by members of the public, the insurer must keep the most current copy of each Key Facts Sheet for a contract on the website, in a format that may be downloaded by members of the public.

(5) An insurer is not required to provide a consumer with a Key Facts Sheet for a contract:

(a) if:

(i) the insurer has already provided the consumer with the Key Facts Sheet; and

(ii) the Key Facts Sheet has not changed since then, other than a change to the date of the Key Facts Sheet; or

(b) if:

(i) the insurer believes, on reasonable grounds, that someone else has already provided the consumer with the Key Facts Sheet; and

(ii) the Key Facts Sheet has not changed since then, other than a change to the date of the Key Facts Sheet; or

(c) if the consumer:

(i) requests information about the contract from an insurance broker; or

(ii) enters into the contract through an insurance broker who is not acting as an agent of the insurer in relation to the contract; or

(d) if the consumer does not provide the insurer with the consumer’s address (postal or electronic) to which the Key Facts Sheet is to be sent; or

(e) if the consumer informs the insurer that the consumer does not want the Key Facts Sheet.

42 Amendments made by the Insurance Contracts Amendment Regulation 2014 (No. 1)

(1) Despite the repeal and substitution of Schedules 1 and 2 by the Insurance Contracts Amendment Regulation 2014 (No. 1), either the repealed or substituted Parts 1, 2 and 3 of Schedule 1, and either the repealed or substituted Schedule 2, may be used for the purposes of regulation 3 in relation to a contract of insurance entered into before 28 December 2015.

(2) Paragraph 3(1)(d) and Part 4 of Schedule 1 apply only in relation to an eligible contract of insurance that is proposed to be renewed on or after 28 December 2015.

(3) This regulation is repealed on 28 December 2015.

Part 5—The contract—standard cover

Division 1—Motor vehicle insurance

5 Prescribed contracts

The following class of contracts of insurance is declared to be a class of contracts in relation to which Division 1 of Part V of the Act applies, namely, contracts that provide insurance cover (whether or not the cover is limited or restricted in any way) in respect of one or more of the following:

(a) loss of, or damage to, a motor vehicle;

(b) liability for loss of, or damage to, property caused by or resulting from impact of a motor vehicle with some other thing;

where the insured or one of the insureds is a natural person.

6 Prescribed events

The following, except insofar as they are excluded by regulation 7, are declared to be prescribed events in relation to a contract referred to in regulation 5:

(a) the occurrence within Australia of the destruction or, theft of, or accidental damage to, the motor vehicle specified in the contract;

(b) the occurrence within Australia of accidental damage to, or the theft of:

(i) a tool or appliance that is standard equipment for the motor vehicle specified in the contract; or

(ii) an accessory that forms part of that motor vehicle;

at a time when the tool, appliance or accessory is attached to or within the motor vehicle;

(c) the insured or a person:

(i) who, with the express or implied consent of the insured, was driving, using or in charge of the motor vehicle at the relevant time; or

(ii) who, at the relevant time, was an authorized passenger in the motor vehicle or, if the motor vehicle is a motor cycle, who, at the relevant time, was an authorized passenger on the motor vehicle;

incurring a liability (otherwise than under a contract) to pay compensation or damages in respect of loss of, or damage occurring to, property (not being the motor vehicle or a tool, appliance or accessory as mentioned in paragraph (b)) in Australia, being loss or damage that occurs as a result of the use of:

(iii) the motor vehicle; or

(iv) a trailer or caravan attached to the motor vehicle;

(d) a person who, at the relevant time, was an employer, principal or partner of the insured, incurring a liability (otherwise than under a contract) as employer, principal or partner, respectively, to pay compensation or damages in respect of loss of, or damage occurring to, property (not being the motor vehicle or a tool, appliance or accessory as mentioned in paragraph (b)) in Australia, being loss or damage that occurs as a result of the use of:

(i) the motor vehicle; or

(ii) a trailer or caravan attached to the motor vehicle.

7 Exclusions

The following are excluded:

(a) depreciation;

(b) wear and tear, rust or corrosion;

(c) structural failure or mechanical or electrical breakdown or failure;

(d) the tyres of the motor vehicle being damaged by application of brakes or by road punctures, cuts or bursting;

(e) destruction or damage, or the incurring of a liability as mentioned in paragraph 6(c) or (d), at a time when:

(i) the motor vehicle is being used in, or tested in preparation for, racing, pacemaking, a reliability trial or a speed or hill‑climbing test by the insured or by some other person with the express or implied consent of the insured;

(ii) the motor vehicle, trailer or caravan is being used:

(A) in an experiment, test, trial or demonstration; or

(B) in the case of a motor vehicle, to tow some other vehicle;

in connection with the motor trade by the insured or by some other person with the express or implied consent of the insured;

(iii) the motor vehicle, trailer or caravan:

(A) is let on hire by the insured as lessor; or

(B) is being used in the course of the business of carrying passengers or goods for hire or reward by the insured or by some other person with the express or implied consent of the insured;

(iv) the motor vehicle, trailer or caravan is in the possession of a person as part of the person’s stock in trade;

(v) the motor vehicle, trailer or caravan is being used for an unlawful purpose by the insured or is being so used by some other person with the express or implied consent of the insured;

(vi) the insured is driving the motor vehicle and is not authorized under the law in force in the State or Territory in which the motor vehicle is being driven, being a law with respect to the licensing of drivers of motor vehicles, to drive the motor vehicle;

(vii) a person other than the insured:

(A) is driving the motor vehicle with the express or implied consent of the insured; and

(B) is not authorized under the law in force in the State or Territory in which the motor vehicle is being driven, being a law with respect to the licensing of drivers of motor vehicles, to drive the motor vehicle;

and the insured knew or should reasonably have known, at the time when the consent was given or impliedly given, that that person was not so authorized;

(viii) the insured is driving the motor vehicle and is under the influence of intoxicating liquor or of a drug; or

(ix) a person other than the insured:

(A) is driving the motor vehicle with the express or implied consent of the insured; and

(B) is under the influence of intoxicating liquor or of a drug;

and the insured knew or should reasonably have known, at the time when the consent was given or impliedly given, that that person was or was to be at the relevant time under that influence;

(f) destruction or damage, or the incurring of a liability as mentioned in paragraph 6(c) or (d), as a result of:

(i) the expropriation of the motor vehicle, trailer or caravan;

(ii) war or warlike activities;

(iii) the use, existence or escape of nuclear weapons material, or ionizing radiation from, or contamination by radioactivity from, any nuclear fuel or nuclear waste from the combustion of nuclear fuel; or

(iv) the unroadworthy or unsafe condition of the motor vehicle, caravan or trailer concerned, being a condition that was known to the insured, or should reasonably have been known to the insured, at the time of the occurrence of the loss or damage or the incurring of the liability;

(g) destruction or damage intentionally caused by, or a liability as mentioned in paragraph 6(c) or (d) intentionally incurred by, the insured or a person acting with the express or implied consent of the insured;

(h) destruction or damage occurring as a result of the insured failing to take steps that are, in the circumstances, reasonable for the security of the motor vehicle after accidental damage has occurred to it;

(j) the incurring of a liability as mentioned in paragraph 6(c) or (d) (whether to the insured or to some other person) in respect of damage to property that belongs to, or is in the custody of, the person so liable;

(k) the incurring of a liability as mentioned in paragraph 6(c) or (d) by a person other than the insured at a time when that person is driving the motor vehicle and:

(i) is not authorized under the law in force in the State or Territory in which the motor vehicle is being driven, being a law with respect to the licensing of drivers of motor vehicles, to drive the motor vehicle; or

(ii) is under the influence of intoxicating liquor or of a drug;

(m) the incurring of a liability to pay compensation or damages in respect of loss or damage, where:

(i) the loss or damage occurred as a result of the use of a trailer or caravan attached to the motor vehicle; and

(ii) there were, at the time the loss or damage occurred, two or more trailers or caravans, or one or more trailers and one or more caravans, attached to the motor vehicle.

8 Minimum amounts

(1) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 5, being a claim arising out of an event referred to in paragraph 6(a) or (b), is declared to be the amount sufficient to indemnify the person who made the claim.

(2) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 5, being a claim that arises out of an event referred to in paragraph 6(c) or (d), is declared to be the amount, not exceeding $5,000,000, sufficient to indemnify the person who made the claim in respect of his or her liability.

(3) Where there is more than one such claim arising out of the same event, being an event referred to in paragraph 6(c) or (d), then, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made after the first of those claims has been made is declared to be the amount sufficient to indemnify the person who made the claim or the amount ascertained by subtracting from $5,000,000 the amount or the sum of the amounts, as the case may be, that the insurer has paid, or is liable to pay, in respect of the claim or claims arising out of that event that have already been made, whichever is the lesser.

Division 2—Home buildings insurance

9 Prescribed contracts

The following class of contracts of insurance is declared to be a class of contracts in relation to which Division 1 of Part V of the Act applies, namely, contracts that provide insurance cover (whether or not the cover is limited or restricted in any way) in respect of destruction of or damage to a home building, where the insured or one of the insureds is a natural person.

10 Prescribed events

The following, except in so far as they are excluded by regulation 11, are declared to be prescribed events in relation to a contract referred to in regulation 9:

(a) the destruction of, or damage occurring to, the home building on the site, being destruction or damage that is caused by or results from:

(i) fire or explosion;

(ii) lightning or thunderbolt;

(iii) earthquake;

(iv) theft, burglary or housebreaking or an attempt to commit theft, burglary or housebreaking;

(v) a deliberate or intentional act;

(vi) bursting, leaking, discharging or overflowing of fixed apparatus, fixed tanks or fixed pipes used to hold or carry liquid of any kind;

(vii) riot or civil commotion;

(viii) an action of a person acting maliciously;

(ix) impact by or arising out of the use of a vehicle (including an aircraft or a water‑borne craft);

(x) impact by:

(A) space debris or debris from an aircraft, rocket or satellite;

(B) an animal (other than an animal kept on the site or a domestic animal);

(C) a falling tree or part of a tree; or

(D) a television or radio aerial that has broken or collapsed; or

(xi) storm, tempest, flood (within the meaning given by regulation 29D), (the action of the sea, high water, tsunami, erosion or land slide or subsidence;

(b) accidental damage that is breakage of any fixed glass, fixed shower base, fixed basin, fixed sink, fixed bath, fixed lavatory pan or fixed cistern;

(c) loss by theft, burglary or housebreaking;

(d) the insured or a member of the insured’s family ordinarily residing with the insured incurring a liability as owner or occupier of the home building to pay compensation or damages to some other person.

11 Exclusions

The following are excluded:

(a) depreciation;

(b) wear and tear, rust or corrosion;

(c) the action of insects or vermin;

(d) destruction or damage, or the incurring of a liability as mentioned in paragraph 10 (d), as a result of:

(i) the expropriation of the home building;

(ii) war or warlike activities;

(iii) the use, existence or escape of nuclear weapons material, or ionizing radiation from, or contamination by radioactivity from, any nuclear fuel or nuclear waste from the combustion of nuclear fuel;

(iv) the use of the home building for the purposes of a business, trade or profession; or

(v) tree lopping or felling by the insured or a person acting with the express or implied consent of the insured; or

(e) destruction or damage intentionally caused, or a liability as mentioned in paragraph 10(d) intentionally incurred, by:

(i) the insured; or

(ii) a member of the insured’s family ordinarily residing with the insured;

or a person acting with the express or implied consent of any of them;

(f) where the home building is unoccupied and has been unoccupied for a continuous period of more than 60 days—destruction or damage occurring otherwise than as mentioned in subparagraph 10(a)(ii) or (iii) or (vii) to (xi) (inclusive), or the incurring of liability as mentioned in paragraph 10(d);

(g) destruction of, or damage occurring to:

(i) a free‑standing or retaining wall (whether or not part of the home building), or to a gate or fence, as a result of a storm or tempest;

(ii) an electrical machine or apparatus as a result of the electric current therein; or

(iii) any property as a result of it undergoing a process necessarily involving the application of heat;

(h) theft by a person ordinarily residing with the insured at the time of the theft;

(j) in the case of destruction or damage that is caused by or results from bursting, leaking, discharging or overflowing of fixed apparatus, fixed tanks or fixed pipes used to hold or carry liquid of any kind or impact by a television or radio aerial that has broken or collapsed—damage to the apparatus, tanks or pipes or the television or radio aerial, respectively;

(k) the incurring of a liability as mentioned in paragraph 10(d):

(i) to the insured or a member of the insured’s family ordinarily residing with the insured; or

(ii) as a result of:

(A) the insured; or

(B) a member of the insured’s family ordinarily residing with the insured;

or a person acting with the express or implied consent of any of them, using a vehicle (including an aircraft or water‑borne craft) on the site.

12 Minimum amounts

(1) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 9, being a claim arising out of an event referred to in paragraph 10(a), (b) or (c), is declared to be the amount sufficient to indemnify the person who made the claim reduced, in respect of destruction or damage occurring as a result of and within 48 hours after an earthquake, by $200.

(2) The amount declared by subregulation (1) to be the minimum amount in respect of a claim shall be taken to include the reasonable cost of:

(a) identifying and locating the cause of destruction or damage concerned if it is necessary to do so to effect a repair;

(b) demolition and removal of debris; and

(c) emergency accommodation.

(3) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 9, being a claim that arises out of an event referred to in paragraph 10(d), is declared to be the amount, not exceeding $2,000,000, sufficient to indemnify the person who made the claim in respect of his or her liability.

(4) Where there is more than one such claim arising out of the same event, being an event referred to in paragraph 10(d), then, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made after the first of those claims has been made is declared to be the amount sufficient to indemnify the person who made the claim or the amount ascertained by subtracting from $2,000,000 the amount or the sum of the amounts, as the case may be, that the insurer has paid, or is liable to pay, in respect of the claim or claims arising out of that event that have already been made, whichever is the lesser.

Division 3—Home contents insurance

13 Prescribed contracts

The following class of contracts of insurance is declared to be a class of contracts in relation to which Division 1 of Part V of the Act applies, namely, contracts that provide insurance cover (whether or not the cover is limited or restricted in any way) in respect of loss of or damage to the contents of a residential building where the insured or one of the insureds is a natural person, but does not include a contract that provides insurance cover only or primarily in respect of specified personal effects.

14 Prescribed events

The following, except in so far as they are excluded by regulation 15, are declared to be prescribed events in relation to a contract referred to in regulation 13:

(a) destruction of, or damage occurring to, the contents of the residential building which is specified in the contract, at a time when they are in the residential building or on the site of the residential building, being destruction or damage that is caused by or results from:

(i) fire or explosion;

(ii) lightning or thunderbolt;

(iii) earthquake;

(iv) theft, burglary or housebreaking or an attempt to commit theft, burglary or housebreaking;

(v) a deliberate or intentional act;

(vi) bursting, leaking, discharging or overflowing of fixed apparatus, fixed tanks or fixed pipes used to hold or carry liquid of any kind;

(vii) riot or civil commotion;

(viii) an action of a person acting maliciously;

(ix) impact by or arising out of the use of a vehicle (including an aircraft or water‑borne craft);

(x) impact by:

(A) space debris or debris from an aircraft, a rocket or a satellite;

(B) an animal (other than an animal kept on the site or a domestic animal);

(C) a falling tree or part of a tree; or

(D) a television or radio aerial that has broken or collapsed; or

(xi) storm, tempest, flood (within the meaning given by regulation 29D), the action of the sea, high water, tsunami, erosion or land slide or subsidence;

(b) accidental damage that is breakage of glass forming part of an item of furniture (including fixed or unfixed glass table tops), at a time when it is in the residential building or on the site of the residential building;

(c) loss by theft, burglary or housebreaking of contents while in the residential building on the site;

(d) where:

(i) the insured is a tenant or lessee of the residential building; or

(ii) the residential building is a unit (however described) created by the subdivision of strata (however described) in a building and the insured is the owner of the unit;

the insured or a member of the insured’s family ordinarily residing with the insured incurring a liability as occupier of the home building to pay compensation or damages to some other person.

15 Exclusions

The following are excluded:

(a) depreciation;

(b) wear and tear, rust or corrosion;

(c) the action of insects or vermin;

(d) destruction or damage, or the incurring of a liability as mentioned in paragraph 14(d), as a result of:

(i) the expropriation of the contents;

(ii) war or warlike activities;

(iii) the use, existence or escape of nuclear weapons material, or ionizing radiation from, or contamination by radioactivity from, any nuclear fuel or nuclear waste from the combustion of nuclear fuel;

(iv) the use of the residential building for the purposes of a business, trade or profession; or

(v) tree lopping or felling by the insured or a person acting with the express or implied consent of the insured;

(e) destruction or damage intentionally caused, or a liability as mentioned in paragraph 14(d) intentionally incurred, by:

(i) the insured; or

(ii) a member of the insured’s family ordinarily residing with the insured;

or a person acting with the express or implied consent of any of them;

(f) where the residential building is unoccupied and has been unoccupied for a continuous period of more than 60 days—destruction or damage occurring otherwise than as mentioned in subparagraph 14(a)(ii) or (iii) or (vii) to (ix) (inclusive), or the incurring of liability as mentioned in paragraph 14(d);

(g) destruction of, or damage occurring to:

(i) an electrical machine or apparatus as a result of the electric current in it; or

(ii) any property as a result of it undergoing a process necessarily involving the application of heat;

(h) accidental breakage of:

(i) a television picture tube or screen;

(ii) the picture tube or screen of an electronic visual display unit;

(iii) a ceramic or glass cooking top of a stove;

(iv) glass in a picture frame, a radio set or a clock;

(j) theft by a person ordinarily residing with the insured at the time of the theft;

(k) in the case of destruction or damage that is caused by or results from bursting, leaking, discharging or overflowing of fixed apparatus, fixed tanks or fixed pipes used to hold or carry liquid of any kind or impact by a television or radio aerial that has broken or collapsed—damage to the apparatus, tanks or pipes or the television or radio aerial, respectively;

(m) the incurring of a liability as mentioned in paragraph 14(d):

(i) to the insured or a member of the insured’s family ordinarily residing with the insured; or

(ii) as a result of:

(A) the insured; or

(B) a member of the insured’s family ordinarily residing with the insured;

or a person acting with the express or implied consent of any of them, using a vehicle (including an aircraft or water‑borne craft) on the site.

16 Minimum amounts

(1) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 13, being a claim arising out of an event referred to in paragraph 14(a), (b) or (c), is declared to be the amount sufficient to indemnify the person who made the claim, reduced, in the case of destruction or damage occurring as a result of an earthquake, by $200.

(2) For the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 13, being a claim that arises out of an event referred to in paragraph 14(d), is declared to be the amount, not exceeding $2,000,000, sufficient to indemnify the person who made the claim in respect of his or her liability.

(3) Where there is more than one such claim arising out of the same event, being an event referred to in paragraph 14(d), then, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made after the first of those claims has been made is declared to be the amount sufficient to indemnify the person who made the claim or the amount ascertained by subtracting from $2,000,000 the amount or the sum of the amounts, as the case may be, that the insurer has paid, or is liable to pay, in respect of the claim or claims arising out of that event that have already been made, whichever is the lesser.

Division 4—Sickness and accident insurance

17 Prescribed contracts

The following class of contracts of insurance is declared to be a class of contracts in relation to which Division 1 of Part V of the Act applies, namely, contracts that provide insurance cover (whether the cover is limited or restricted in any way) in respect of the insured person contracting a sickness or disease or a specified sickness or disease or sustaining an injury or a specified injury, where the insured or one of the insureds is a natural person, other than:

(a) a life policy within the meaning of the Life Insurance Act 1995;

(b) a continuous disability insurance contract incorporated within a life policy within the meaning of the Life Insurance Act 1995;

(c) sickness and accident policies which are guaranteed ‘renewable’ at the option of the insured or where the insurer guarantees not to cancel the policy in response to a change in the risk where such a policy has been effected for a predetermined period of years in excess of one year; or

(d) a contract that is included in a class of contracts that is declared by some other regulation to be a class of contracts in relation to which that Division applies.

18 Prescribed events

The following, except in so far as they are excluded by regulation 19, are declared to be prescribed events in relation to a contract referred to in regulation 17:

(a) where the contract provides insurance cover (whether the cover is limited or restricted in any way) in respect of the insured person contracting a specified sickness or disease:

(i) the death of the insured person; or

(ii) the total disablement of the insured person from carrying out all the normal duties of his or her usual occupation;

being death or disablement that results from the insured person contracting that sickness or disease;

(b) where the contract (not being a contract referred to in paragraph (a)) provides insurance cover (whether the cover is limited or restricted in any way) in respect of the insured person contracting a sickness or disease—the total disablement of the insured person from carrying out all the normal duties of his or her usual occupation, being disablement that results from the person contracting a sickness or disease;

(c) the death of the insured person, or the total disablement of the insured person from carrying out all the normal duties of his or her usual occupation, as a result of the insured person sustaining an accidental injury, being death or disablement that occurs within 12 months after the insured person sustains the injury;

(d) the partial disablement of the insured person from carrying out the normal duties of his or her usual occupation as a result of the insured person sustaining an accidental injury, being disablement that occurs within 12 months after the insured person sustains the injury.

19 Exclusions

The following are excluded:

(a) death or disablement that results from:

(i) a deliberately self‑inflicted injury;

(ii) war or warlike activities;

(iii) the use, existence or escape of nuclear weapons material, or ionizing radiation from, or contamination by radioactivity from, any nuclear fuel or nuclear waste from the combustion of nuclear fuel;

(iv) the insured person:

(A) being under the influence of intoxicating liquor or of a drug, other than a drug taken or administered by or in accordance with the advice of a duly qualified medical practitioner;

(B) being addicted to intoxicating liquor or to a drug;

(C) taking part in a riot or civil commotion;

(D) acting maliciously; or

(E) engaging in professional sporting activities;

(b) death or disablement occurring at a time when the insured person is flying, or engaging in aerial activities, otherwise than as a passenger in an aircraft that is authorised to fly under a law that relates to the safety of aircraft.

20 Minimum amounts

(1) Where the insured has expressly agreed that no amount is to be payable under the contract of insurance in particular circumstances, then, for the purposes of this regulation, the contract shall be read as though it specified an amount to be payable in those circumstances.

(2) Where a contract of insurance provides that an amount is payable by reference to a period other than a day, then, for the purposes of this regulation, the contract shall be read as though it specified as the daily amount an amount ascertained by dividing the amount payable for that period by the number of days in that period.

(3) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 17, being a claim that arises as mentioned in Column 1 of the following Table, is declared to be the amount ascertained in accordance with Column 2 of the Table in relation to that claim, reduced by an amount equal to the amount so payable in respect of the first 14 days of the period during which the insured person is disabled.

Table

Column 1 Description of claim | Column 2 Minimum amount |

1 | A claim that arises out of the death of the insured person | The amount specified in the contract as the amount payable under the contract in respect of the death of the insured person or, where no amount is so specified, $25,000 |

2 | A claim that arises out of the total disablement of the insured person | Where: (a) a daily amount is specified in the contract in respect of the total disablement of the insured person—that amount multiplied by the number of days during which the insured person is so disabled; or (b) where no amount is so specified—an amount equal to the amount of income lost by the insured person by reason of the disablement |

3 | A claim that arises out of the partial disablement of the insured person | Where: (a) a daily amount is specified in the contract in respect of the partial disablement of the insured person—that amount multiplied by the number of days during which the insured person is so disabled; or (b) where no amount is so specified—an amount equal to the amount of income lost by the insured person by reason of the disablement |

Division 5—Consumer credit insurance

21 Prescribed contracts

The following class of contracts of insurance is declared to be a class of contracts to which Division 1 of Part V of the Act applies, namely, contracts that provide insurance cover (whether the cover is limited or restricted in any way) in respect of:

(a) the death of the insured; or

(b) the insured:

(i) contracting a sickness or disease;

(ii) sustaining an injury; or

(iii) becoming unemployed;

where:

(c) the insured or one of the insureds is a natural person; and

(d) the amount of the liability of the insurer under the contract is to be ascertained by reference to a liability of the insured under a specified agreement to which the insured is a party.

22 Prescribed events

The following, except in so far as they are excluded by regulation 23, are declared to be prescribed events in relation to a contract referred to in regulation 21:

(a) the total disablement of the insured person from carrying out all the normal duties of his or her usual occupation as a result of the insured person contracting a sickness or disease, being disablement that occurs within 12 months after the insured person contracted the sickness or disease;

(b) the death of the insured person, or the total disablement of the insured person from carrying out all the normal duties of his or her usual occupation, as a result of the insured person sustaining an accidental injury, being death or disablement that occurs within 12 months after the insured person sustains the injury;

(c) the insured person becoming unemployed.

23 Exclusions

The following are excluded:

(a) death, disablement or unemployment resulting from:

(i) a deliberately self‑inflicted injury;

(ii) war or warlike activities;

(iii) expropriation of any property;

(iv) the use, existence or escape of nuclear weapons material, or ionizing radiation from, or contamination by radioactivity from, any nuclear fuel or nuclear waste from the combustion of nuclear fuel; or

(v) the insured person:

(A) being under the influence of intoxicating liquor or of a drug, other than a drug taken or administered by or in accordance with the advice of a duly qualified medical practitioner;

(B) being addicted to intoxicating liquor or to a drug;

(C) taking part in a riot or civil commotion;

(D) acting maliciously; or

(E) engaging in professional sporting activities;

(b) death or disablement occurring at a time when the insured person is flying, or engaging in aerial activities, otherwise than as a passenger in an aircraft that is authorised to fly under a law that relates to the safety of aircraft;

(c) the insured person becoming voluntarily unemployed;

(d) where the insured person is employed for a specified period or by reference to specified work—the insured person becoming unemployed at the expiration of the period or on the completion of the work.

24 Minimum amounts

(1) A reference in this regulation to the amount falling due under an agreement in respect of a day is a reference to the amount ascertained by dividing the amount of the payment that next falls due after that day under the agreement (excluding any arrears) by the number of days in the period commencing on the day on which the immediately previous payment under the agreement fell due and ending on the day on which that next payment falls due.

(2) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 21, being a claim that arises as mentioned in Column 1 of the following Table, is declared to be the amount ascertained in accordance with Column 2 of the Table in relation to that claim, reduced by an amount equal to the amount so payable in respect of the first 14 days of the period during which the insured person is disabled.

Table

Column 1 Description of claim | Column 2 Minimum amount |

1 | A claim that arises out of the death of the insured person | The amount due at the date of death (excluding any arrears) under the agreement specified in the contract |

2 | A claim that arises out of the total disablement of the insured person | The sum of the amounts falling due under the agreement specified in the contract in respect of each day during the period during which the insured person is so disabled |

3 | A claim that arises out of the insured person becoming unemployed | The sum of the amounts falling due under the agreement specified in the contract in respect of each day during the period during which the insured person is unemployed |

Division 6—Travel insurance

25 Prescribed contracts

The following class of contracts of insurance is declared to be a class of contracts in relation to which Division 1 of Part V of the Act applies, namely, contracts that provide insurance cover (whether or not the cover is limited or restricted in any way) in respect of one or more of the following:

(a) financial loss in respect of:

(i) fares for any form of transport to be used; or

(ii) accommodation to be used;

in the course of the specified journey in the event that the insured person does not commence or complete the specified journey;

(b) loss of or damage to personal belongings that occurs while the insured person is on the specified journey;

(c) a sickness or disease contracted or an injury sustained by the insured person while on the specified journey;

where the insured or one of the insureds is a natural person.

26 Prescribed events

The following, except in so far as they are excluded by regulation 27, are declared to be prescribed events in relation to a contract referred to in regulation 25:

(a) financial loss on account of:

(i) fares for any form of transport to be used; or

(ii) accommodation to be used;

in the course of the specified journey in the event that the insured person or a member of the insured person’s travelling party, through unforeseen circumstances beyond the control of the insured person or member, respectively, cannot reasonably be expected to commence or complete the journey;

(b) loss of or damage occurring to personal belongings of the insured person during the course of the specified journey;

(c) the death of the insured person or a member of the insured’s travelling party while on the specified journey;

(d) the insured person or a member of the insured’s travelling party contracting a sickness or disease or sustaining an injury while on the specified journey.

27 Exclusions

The following are excluded:

(a) financial loss, loss of or damage to personal belongings or death, sickness or injury, occurring as a result of:

(i) war or warlike activities;

(ii) expropriation of any thing;

(iii) the use, existence or escape of nuclear weapons material, or ionizing radiation from, or contamination by radioactivity from, any nuclear fuel or nuclear waste from the combustion of nuclear fuel; or

(iv) the insured person or a member of the insured person’s travelling party:

(A) being under the influence of intoxicating liquor or of a drug, other than a drug taken or administered by or in accordance with the advice of a duly qualified medical practitioner;

(B) being addicted to intoxicating liquor or to a drug;

(C) taking part in a riot or civil commotion;

(D) acting maliciously; or

(E) engaging in professional sporting activities;

(b) financial loss, loss of or damage to personal belongings or death, sickness or injury, intentionally caused by:

(i) the insured person; or

(ii) a member of the insured person’s travelling party;

or by a person acting with the express or implied consent of any of them;

(c) financial loss as a result of:

(i) the insured person failing to commence or complete the journey:

(A) for financial, business or contractual reasons, being reasons related to the insured person or to a member of the insured person’s travelling party; or

(B) because of a sickness, disease or disability to which a person was subject at any time during the period of six months before the contract was entered into and continues to be subject to after that time;

(ii) the insured person or a member of the insured person’s travelling party being disinclined to travel; or

(iii) contravention of, or failure to comply with, a law (including the law of a foreign country) by the insured person or a member of the insured person’s travelling party;

(d) loss of or damage occurring to personal belongings as a result of:

(i) depreciation;

(ii) wear and tear, mildew, rust or corrosion;

(iii) the action of insects or vermin;

(iv) mechanical or electrical breakdown or failure of the personal belongings;

(v) the personal belongings being cleaned, dyed, altered or repaired; or

(vi) in the case of personal belongings that are fragile or brittle—the negligence of the insured;

(e) death occurring or injury sustained as a result of a sickness or disability to which the person concerned was subject at any time during the period of 6 months before the contract was entered into and continues to be subject to after that time;

(f) death occurring or injury sustained at a time when the person concerned is flying, or engaging in aerial activities, otherwise than as a passenger in an aircraft that is authorised to fly under a law that relates to the safety of aircraft;

(g) the insured person or a member of the insured’s travelling party sustaining a deliberately self‑inflicted injury.

28 Minimum amounts

(1) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 25, being a claim that arises out of an event referred to in paragraph 26(a) or (b), is declared to be the amount sufficient to indemnify the person who made the claim in respect of his or her loss or damage.

(2) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 25, being a claim that arises out of an event referred to in paragraph 26(c), is declared to be the amount sufficient to indemnify the person who made the claim in respect of the reasonable cost of:

(a) the funeral or cremation; or

(b) transporting the remains of the deceased person to the deceased’s former place of residence.

(3) Subject to these Regulations, for the purposes of section 34 of the Act, the minimum amount in respect of a claim made under a contract referred to in regulation 25, being a claim that arises out of an event referred to in paragraph 26(d), is declared to be the amount sufficient to indemnify the person who made the claim in respect of the reasonable cost of:

(a) medical, surgical, hospital, ambulance and nursing home charges; and

(b) other medical treatment;

incurred during the specified journey as a result of the sickness, disease or injury.

Division 7—Limits on minimum amounts

29 Limits on minimum amounts

Where the insured knew, or a reasonable person in the circumstances would have known, that a particular amount is the maximum amount that would be payable by the insurer under the contract of insurance whatever the circumstances, then, in relation to a claim under that contract, the minimum amount for the purposes of section 34 of the Act shall be the first‑mentioned amount or the amount declared by the relevant provision of these Regulations to be the minimum amount in respect of the claim, whichever is the less.

Division 8—Flood insurance

29A Definition for Division 8

In this Division:

strata title residence means a residence to which the following apply:

(a) the portion of land on which the residence is located exists as the result of the subdivision of the title to a larger portion of land into separate titles for use for residential purposes;

(b) property that is common between the residence and one or more other portions of land is managed by a single body corporate (however described);

Example

An ‘owners corporation’.

(c) the title to the portion of land on which the residence is located is regulated under the law of the State or Territory in which the land is located as a ‘strata title’, a ‘community title’ or another description that refers to the title being created as described in paragraphs (a) and (b).

29B Small businesses

(1) This regulation explains whether a business is a small business for this Division.

(2) If the business has operated in the last completed financial year, and its turnover in the last completed financial year is known, the business is a small business if:

(a) its turnover in the last completed financial year was less than $1 000 000; and

(b) the total number of hours worked each week by the employees of the business is no more than 190 hours (whether or not the employees are employed on a full‑time, part‑time or casual basis).

Note: 190 hours is the equivalent of 5 employees each working a 38 hour week.

(3) If:

(a) the business did not operate in the last completed financial year; or

(b) the turnover of the business in the last completed financial year is unknown;

the business is a small business only if the number of hours worked each week by the employees of the business is no more than 190 hours (whether or not the employees are employed on a full‑time, part‑time or casual basis).

Note: 190 hours is the equivalent of 5 employees each working a 38 hour week.

29C Prescribed contracts

(1) For section 37A of the Act, the following classes of contracts of insurance are declared to be classes of contracts in relation to which Division 1A of Part V of the Act applies:

(a) home building insurance contracts described in regulation 9;

(b) home contents insurance contracts described in regulation 13;

(c) insurance contracts that combine home building insurance and home contents insurance;

(d) contracts that provide insurance cover (whether or not the cover is limited or restricted in any way) in respect of destruction of or damage to a strata title residence;

(e) contracts that provide insurance cover (whether or not the cover is limited or restricted in any way) in respect of the loss of the equipment, stock, inventory or premises of a small business;

(f) contracts that provide insurance cover (whether or not the cover is limited or restricted in any way) in respect of damage to the equipment, stock, inventory or premises of a small business.

Note: Division 1A of Part V of the Act refers to these contracts as prescribed contracts.

(2) However, subregulation (1) does not apply to a contract that is arranged by an insurance broker who is acting as an agent of the insured.

29D Meaning of ‘flood’ in prescribed contracts etc

(1) For paragraph 37B(2)(a) of the Act, the word ‘flood’ means the covering of normally dry land by water that has escaped or been released from the normal confines of any of the following:

(a) a lake (whether or not it has been altered or modified);

(b) a river (whether or not it has been altered or modified);

(c) a creek (whether or not it has been altered or modified);

(d) another natural watercourse (whether or not it has been altered or modified);

(e) a reservoir;

(f) a canal;

(g) a dam.

Note: Under subsection 37B(3) of the Act, the meaning of ‘flood’ set out in subregulation (1) will apply in the prescribed contract even if the meaning of the word provided by the prescribed contract (or by a notice or other document or information given by the insurer in relation to the prescribed contract) is different from the meaning set out in subregulation (1).

(2) For the purposes of entering into a contract that provides insurance cover (whether or not the cover is limited or restricted in any way) in respect of loss caused to a business, if an insurer proposes to:

(a) use the word ‘flood’ in the contract; and

(b) give the word a meaning other than the meaning set out in subregulation (1);

the insurer must take reasonable steps to ensure that the contract is not a prescribed contract in respect of loss caused to a business that would, at that time, be a small business.

Note: The insurer is likely to rely on information provided by the insured to assess whether the business is a small business. The provision of false or misleading information is a serious matter.

(3) Subregulation (2) does not apply to:

(a) the making of an agreement to renew, extend or vary the contract; or

(b) the reinstatement of any previous contract of insurance.

Note: See subsection 11(9) of the Act.

Part 10—Miscellaneous

30 Classes of contracts of insurance in relation to which section 46 of the Act does not apply

For the purposes of section 46 of the Act, each of the following classes of contracts is declared to be a class of contracts in relation to which that section does not apply:

(a) contracts of insurance commonly known as construction risks insurance contracts;

(b) contracts of insurance commonly known as industrial special risks insurance contracts or commercial risks insurance contracts;

(c) contracts of insurance under which the insurer agrees to indemnify the insured, in relation to a business undertaking, against loss resulting from a breakdown of, or malfunction in, machinery (including electronic equipment) or plant of the insured, being:

(a) loss in respect of the repair or replacement of that machinery or plant; or

(b) any further loss resulting from that breakdown or malfunction;

or both, but not against any other loss;

(d) contracts of insurance commonly known as products liability insurance contracts;

(e) contracts of insurance commonly known as ‘broad form’ accidental loss and damage insurance contracts.

31 Classes of contracts of insurance in relation to which section 53 of the Act does not apply

(1) For section 53 of the Act, each of the following classes of contracts is declared to be a class of contracts in relation to which that section does not apply:

(a) each of the classes of contracts referred to in regulation 30;

(b) contracts of insurance under which the insurer agrees to indemnify the insured against loss in respect of failure by a debtor to pay a debt due to the insured, but not against any other loss;

(c) contracts of life insurance;

(d) superannuation contracts, including individual superannuation contracts and blanket superannuation contracts;

(e) sickness and accident insurance contracts to which paragraph 17(c) applies;

(f) export payments insurance contracts within the meaning of subsection 14(2) of the Export Finance and Insurance Corporation Act 1991;

(g) aviation liability indemnity contracts.

(2) For this regulation, aviation liability indemnity contracts are contracts under which the Commonwealth provides indemnities to airlines, airports or other aviation service providers for claims against them by third parties, for property damage or bodily injury or both (other than injury to aircraft passengers and employees of the insured travelling as passengers in the course of their duties) arising as a consequence of:

(a) war, invasion, acts of foreign enemies, hostilities (whether war has been declared or not), civil war, rebellion, revolution, insurrection, martial law, military law, military or usurped power or attempts at usurpation of power; or

(b) strikes, riots, civil commotions or labour disturbances; or

(c) an act of one or more persons (whether or not as agent of a sovereign power) for political or terrorist purposes (whether the resulting loss or damage is accidental or intentional); or

(d) a malicious act or act of sabotage; or

(e) hi‑jacking or an unlawful seizure or wrongful exercise of control of the aircraft or crew in flight (including an attempt at such seizure or control) made by any person acting without the consent of the insured; or

(f) confiscation, nationalisation, seizure, restraint, detention, appropriation, requisition or use by or under the order of a government (civil, military or de facto) or public or local authority.

32 Rate of interest on withheld payment—section 57 of Act

(1) For subsection 57(3) of the Act, the rate applicable to a day in respect of which interest is payable by an insurer, is the rate worked out under the following formula:

Y + 3%

where:

Y is the rate of:

(a) 10‑year Treasury Bond yield at the end of the half‑financial year ending in the period that, in relation to the withheld amount, is mentioned in subsection 57(2) of the Act, or:

(b) if more than one half‑financial year has ended during that period—the mean of the rates of the 10‑year Treasury Bond yield at the end of each of those half‑financial years; or

(c) if no half‑financial year has ended during that period—the 10‑year Treasury Bond yield at the end of the half‑financial year immediately preceding the commencement of that period.

(2) In subregulation (1), 10‑year Treasury Bond yield means the rate known as the 10‑year Treasury Bond yield, published by the Reserve Bank of Australia.

(3) In subregulation (1), mean, in relation to rates, means, if the mean of the rates is not a whole number, or does not end in .75, .50 or .25, the mean rate rounded to the nearest lower quarter of 1%.

33 Insurance for risks related to war and terrorism

For paragraph 9(4)(b) of the Act, a provision of a contract, or proposed contract, for extended coverage endorsement (aviation liabilities) is prescribed if it provides one or more of the following:

(a) the insurers may give notice in writing to review the premium or geographical limits, and the notice becomes effective after a period of 6 days 23 hours and 59 minutes after the day on which notice is given;

(b) following a hostile detonation of any weapon of war employing atomic or nuclear fission or fusion or other like reaction or radioactive force or matter, regardless of the place or time of the detonation and whether or not the insured aircraft may be involved—the insurers may give notice, in writing, of the cancellation of one or more parts of the cover provided by the endorsement, and the notice becomes effective after a period of 47 hours and 59 minutes after the day on which notice is given;

(c) the cover provided by the endorsement may be cancelled by either the insurer or the insured giving notice in writing, and the notice becomes effective after a period of 6 days 23 hours and 59 minutes after the day on which notice is given.

Note: Section 9 of the Act allows an insurer to vary or cancel a provision of a contract or proposed contract of insurance only to the extent that the provision covers risks related to war or terrorism.

Part 11—Transitional arrangements

40 Purpose of Part

This Part makes transitional arrangements in relation to amendments of these Regulations.

41 Amendments made by Insurance Contracts Amendment Regulation 2012 (No. 1)

(1) The amendments of these Regulations made by Schedule 1 to the Insurance Contracts Amendment Regulation 2012 (No. 1) do not apply for the period of 2 years commencing when this regulation commences.

Note: Schedule 1 to the Insurance Contracts Amendment Regulation 2012 (No. 1) inserted Division 8 of Part 5, which, among other things:

(a) identifies certain contracts that provide insurance cover in respect of loss caused to a business; and

(b) deals with the use of the word ‘flood’ in those contracts; and

(c) explains whether a business is a small business.

(2) However, if, during that period, an insurer decides to rely on these Regulations, as amended by Schedule 1 to the Insurance Contracts Amendment Regulation 2012 (No. 1), in relation to a contract that provides insurance cover, these Regulations, as amended by that Schedule, apply in relation to:

(a) the insurer; and

(b) the contract.