Schedule 1AAA—Approved auditors—professional organisations

(subregulation 1.04(2))

Item | Professional Organisation | Manner of Association |

1. | CPA Australia Limited | Member |

2. | The Institute of Chartered Accountants in Australia | Member |

3. | Institute of Public Accountants | Member or Fellow |

4. | Association of Taxation and Management Accountants | Member or Fellow |

5. | National Tax and Accountants Association Ltd | Fellow |

6. | SMSF Professionals’ Association of Australia Limited | SMSF Specialist Auditor |

Schedule 1AA

(subregulation 1.04(4A))

Part 1—Exempt public sector superannuation schemes (1994‑95 and 1995‑96 years of income)

Commonwealth

Schemes established by or operated under:

Defence Act 1903

Defence Force Retirement and Death Benefits Act 1973

Governor‑General Act 1974

Judges’ Pensions Act 1968

Parliamentary Contributory Superannuation Act 1948

New South Wales

Schemes established by or operated under:

First State Superannuation Act 1992

Judges’ Pensions Act 1953

Local Government and other Authorities (Superannuation) Act 1927

New South Wales Retirement Benefits Act 1972

Parliamentary Contributory Superannuation Act 1971

Police Regulation (Superannuation) Act 1906

Public Authorities Superannuation Act 1985

Public Sector Executives Superannuation Act 1989

State Authorities Non‑contributory Superannuation Act 1987

State Authorities Superannuation Act 1987

State Public Service Superannuation Act 1985

Superannuation Act 1916

Superannuation Administration Act 1991

Transport Employees Retirement Benefits Act 1967

Victoria

Schemes established by or operated under:

Attorney‑General and Solicitor General Act 1972

Coal Mines (Pensions) Act 1958

Constitution Act 1975

County Court Act 1958

Judicial Remuneration Tribunal Act 1995

Justices Act 1958

Magistrates Courts Act 1989

Magistrates (Summary Proceedings) Act 1975

Mint Act 1958

Ombudsman Act 1973

Public Prosecutions Act 1994

Supreme Court Act 1986

Schemes established under trust deeds:

City of Melbourne Superannuation Fund

County Court Associates Superannuation Scheme

Emergency Services Superannuation Scheme

Gas and Fuel Superannuation Fund

Holmesglen Construction Superannuation Plan

Hospitals Superannuation Fund

Local Authorities Superannuation Fund

Melbourne Water Corporation Employees’ Superannuation Fund

Parliamentary Contributory Superannuation Fund

Pharmaceutical Organisations Superannuation Fund

Port of Geelong Authority Superannuation Fund

Port of Melbourne Authority Superannuation Scheme

State Casual Employees Superannuation Fund

State Employees Retirement Benefits Fund

State Superannuation Fund

Supreme Court Associates Superannuation Scheme

Transport Superannuation Fund

Victorian Electricity Industry Superannuation Fund

Victorian Superannuation Fund

Zoological Board of Victoria Superannuation Fund

Queensland

Schemes established by or operated under:

Fire Service Act 1990

Governors’ Pensions Act 1977

Judges (Pensions and Long Leave) Act 1957

Parliamentary Contributory Superannuation Act 1970

Police Superannuation Act 1974

State Service Superannuation Act 1972

Superannuation (Government and Other Employees) Act 1988

Superannuation (State Public Sector) Act 1990

South Australia

Schemes established by or operated under:

Electricity Corporations Act 1994

Governors’ Pensions Act 1976

Judges’ Pensions Act 1971

Parliamentary Superannuation Act 1974

Police Superannuation Act 1990

Southern State Superannuation Act 1994

Superannuation Act 1988

Superannuation (Benefit Scheme) Act 1992

Schemes established under trust deeds

Lyell McEwen Health Service Incorporated Superannuation Fund

Police Occupational Superannuation Scheme

Western Australia

Schemes established by or operated under:

Government Employees Superannuation Act 1987

Judges’ Salaries and Pensions Act 1950

Parliamentary Superannuation Act 1970

Superannuation and Family Benefits Act 1938

Tasmania

Schemes established by or operated under:

Judges’ Contributory Pensions Act 1968

Parliamentary Retiring Benefits Act 1985

Parliamentary Superannuation Act 1973

Retirement Benefits Act 1993

Solicitor‑General Act 1983

Australian Capital Territory

Schemes established by or operated under:

Superannuation (Legislative Assembly Members) Act 1991

Northern Territory

Schemes established by or operated under:

Administrators Pension Act 1981

Legislative Assembly Members’ Superannuation Act 1979

Superannuation Act 1986

Supreme Court (Judges Pensions) Act 1980

Schemes established under trust deeds or other means

Northern Territory Police Supplementary Benefit Scheme

Northern Territory Supplementary Superannuation Scheme

Part 2—Exempt public sector superannuation schemes (1996‑97 year of income)

Commonwealth

Schemes established by or operated under:

Defence Act 1903

Defence Force Retirement and Death Benefits Act 1973

Governor‑General Act 1974

Judges’ Pensions Act 1968

Parliamentary Contributory Superannuation Act 1948

New South Wales

Schemes established by or operated under:

First State Superannuation Act 1992

Judges’ Pensions Act 1953

Local Government and Other Authorities (Superannuation) Act 1927

New South Wales Retirement Benefits Act 1972

Parliamentary Contributory Superannuation Act 1971

Police Regulation (Superannuation) Act 1906

Public Authorities Superannuation Act 1985

Public Sector Executives Superannuation Act 1989

State Authorities Non‑contributory Superannuation Act 1987

State Authorities Superannuation Act 1987

State Public Service Superannuation Act 1985

Superannuation Act 1916

Superannuation Administration Act 1996

Transport Employees Retirement Benefits Act 1967

Victoria

Schemes established by or operated under:

Attorney General and Solicitor General Act 1972

Coal Mines (Pensions) Act 1958

Constitution Act 1975

County Court Act 1958

County Court (Jurisdictions) Act 1968

Emergency Services Superannuation Act 1986

Hospitals Superannuation Act 1988

Justices Act 1958

Local Authorities Superannuation Act 1988

Magistrates (Summary Proceedings) Act 1975

Mint Act 1958

Ombudsman Act 1973

Parliamentary Salaries and Superannuation Act 1968

Port of Geelong Authority Act 1958

Port of Melbourne Authority Act 1958

Public Prosecutions Act 1994

Public Sector Superannuation (Administration) Act 1993

State Superannuation Act 1988

Supreme Court Act 1986

Queensland

Government Officers’ Superannuation Scheme (GoSuper)

Governors’ Pension Scheme

Judges Pension Scheme

Parliamentary Contributory Superannuation Fund

Police Superannuation Fund (Police Super)

Queensland Fire Service Superannuation Plan

State Service Superannuation Fund (State Super)

South Australia

Schemes established by or operated under:

Electricity Corporations Act 1994

Governors’ Pensions Act 1976

Judges’ Pensions Act 1971

Parliamentary Superannuation Act 1974

Police Superannuation Act 1990

Southern State Superannuation Act 1994

Superannuation Act 1988

Superannuation (Benefit Scheme) Act 1992

Schemes established by or under trust deeds

Lyell McEwen Health Service Incorporated Superannuation Fund

Police Occupational Superannuation Scheme

Western Australia

Schemes established by or operated under:

Government Employees Superannuation Act 1987

Judges’ Salaries and Pensions Act 1950

Parliamentary Superannuation Act 1970

Superannuation and Family Benefits Act 1938

Tasmania

Schemes established by or operated under:

Governor of Tasmania Act 1982

Judges’ Contributory Pensions Act 1968

Parliamentary Retiring Benefits Act 1985

Parliamentary Superannuation Act 1973

Retirement Benefits Act 1993

Solicitor‑General Act 1983

Australian Capital Territory

Schemes established by or operated under:

Superannuation (Legislative Assembly Members) Act 1991

Northern Territory

Schemes established by or operated under:

Administrators Pension Act 1981

Legislative Assembly Members’ Superannuation Act 1979

Superannuation Act 1986

Supreme Court (Judges Pensions) Act 1980

Other schemes

Northern Territory Police Supplementary Benefit Scheme

Northern Territory Supplementary Superannuation Scheme

Part 3—Exempt public sector superannuation schemes (1997‑98 year of income and subsequent years of income)

Commonwealth

Schemes established by or operated under:

Defence Act 1903

Defence Force Retirement and Death Benefits Act 1973

Defence Forces Retirement Benefits Act 1948

Federal Magistrates Act 1999

Governor‑General Act 1974

Judges’ Pensions Act 1968

Papua New Guinea (Staffing Assistance) Act 1973

Parliamentary Contributory Superannuation Act 1948

Superannuation Act 1922

New South Wales

Schemes established by or operated under:

Judges’ Pensions Act 1953

Local Government and Other Authorities (Superannuation) Act 1927

New South Wales Retirement Benefits Act 1972

Parliamentary Contributory Superannuation Act 1971

Police Regulation (Superannuation) Act 1906

Public Authorities Superannuation Act 1985

State Authorities Non‑contributory Superannuation Act 1987

State Authorities Superannuation Act 1987

State Public Service Superannuation Act 1985

Superannuation Act 1916

Superannuation Administration Act 1996

Transport Employees Retirement Benefits Act 1967

Victoria

Schemes established by or operated under:

Attorney General and Solicitor General Act 1972

Constitution Act 1975

County Court Act 1958

Emergency Services Superannuation Act 1986

Magistrates’ Court Act 1989

Ombudsman Act 1973

Parliamentary Salaries and Superannuation Act 1968

Police Regulation Act 1958

Public Prosecutions Act 1994

State Employees Retirement Benefits Act 1979

State Superannuation Act 1988

Supreme Court Act 1986

Transport Superannuation Act 1988

Queensland

Governors’ Pension Scheme

Judges Pension Scheme

South Australia

Schemes established by or operated under:

Electricity Corporations Act 1994

Governors’ Pensions Act 1976

Judges’ Pensions Act 1971

Parliamentary Superannuation Act 1974

Police Superannuation Act 1990

Southern State Superannuation Act 2009

Superannuation Act 1988

Other schemes

Super SA Select

Western Australia

Schemes established by or operated under:

Judges’ Salaries and Pensions Act 1950

Parliamentary Superannuation Act 1970

State Superannuation Act 2000

Tasmania

Schemes established by or operated under:

Judges’ Contributory Pensions Act 1968

Public Sector Superannuation Reform Act 1999

Retirement Benefits Act 1993

Retirement Benefits (Parliamentary Superannuation) Regulations 2012

Australian Capital Territory

Schemes established by or operated under:

Legislative Assembly (Members’ Superannuation) Act 1991

Supreme Court Act 1933

Northern Territory

Schemes established by or operated under:

Administrators Pension Act 1981

Legislative Assembly Members’ Superannuation Act 1979

Superannuation Act 1986

Supreme Court (Judges Pensions) Act 1980

Other schemes

Northern Territory Police Supplementary Benefit Scheme

Northern Territory Supplementary Superannuation Scheme

Schedule 1A—Payment limits for annuities and pensions with a commencement day before 1 January 2006

(subregulations 1.05(4) and 1.06(4))

1. Subject to clauses 3, 4 and 5, the maximum limits mentioned in paragraph 1.05(4)(f) or 1.06(4)(e) are determined under the formula:

where:

AB means the amount of the annuity account balance, or pension account balance, as the case requires:

(a) on 1 July in the financial year in which the payments are made; or

(b) if that year is the year in which the annuity payments, or pension payments, commence—on the commencement day; and

PVF means the maximum pension valuation factor set out in Column 3 in the Table in this Schedule in relation to the item in the Table that represents the age of the beneficiary on:

(a) 1 July in the financial year in which the payments are made; or

(b) if that is the year in which the annuity payments, or pension payments, commence—the commencement day.

2. Subject to clauses 3, 3A, 3B and 4, the minimum limits mentioned in paragraph 1.05(4)(f) or 1.06(4)(e) are determined under the formula:

where:

AB means the amount of the annuity account balance, or pension account balance, as the case requires:

(a) on 1 July in the financial year in which the payments are made; or

(b) if that year is the year in which the annuity payments, or pension payments, commence—on the commencement day; and

PVF means the minimum pension valuation factor set out in Column 4 in the Table to this Schedule in relation to the item in the Table that represents the age of the beneficiary on:

(a) 1 July in the financial year in which the payments are made; or

(b) if that is the year in which the annuity payments, or pension payments, commence—the commencement day.

3. For a calculation of the maximum or minimum limit in the year in which the commencement day of the pension or annuity occurs if that day is a day other than 1 July, the appropriate value set out in Column 3 or Column 4 must be applied proportionally to the number of days in the financial year that include and follow the commencement day.

3A. For the financial years commencing on 1 July 2008, 1 July 2009 and 1 July 2010, the minimum limit is half of the amount determined under the formula in clause 2.

3B. For the financial years commencing on 1 July 2011 and 1 July 2012, the minimum limit is 75% of the amount determined under the formula in clause 2.

4. An amount determined under the formula in clause 1 or clause 2, is rounded to the nearest 10 whole dollars.

Table

Column 1 Item | Column 2 Age of Beneficiary | Column 3 Maximum Pension Valuation Factor | Column 4 Minimum Pension Valuation Factor |

1 | 20 or less | 10 | 28.6 |

2 | 21 | 10 | 28.5 |

3 | 22 | 10 | 28.3 |

4 | 23 | 10 | 28.1 |

5 | 24 | 10 | 28.0 |

6 | 25 | 10 | 27.8 |

7 | 26 | 10 | 27.6 |

8 | 27 | 10 | 27.5 |

9 | 28 | 10 | 27.3 |

10 | 29 | 10 | 27.1 |

11 | 30 | 10 | 26.9 |

12 | 31 | 10 | 26.7 |

13 | 32 | 10 | 26.5 |

14 | 33 | 10 | 26.3 |

15 | 34 | 10 | 26.0 |

16 | 35 | 10 | 25.8 |

17 | 36 | 10 | 25.6 |

18 | 37 | 10 | 25.3 |

19 | 38 | 10 | 25.1 |

20 | 39 | 10 | 24.8 |

21 | 40 | 10 | 24.6 |

22 | 41 | 10 | 24.3 |

23 | 42 | 10 | 24.0 |

24 | 43 | 10 | 23.7 |

25 | 44 | 10 | 23.4 |

26 | 45 | 10 | 23.1 |

27 | 46 | 10 | 22.8 |

28 | 47 | 10 | 22.5 |

29 | 48 | 10 | 22.2 |

30 | 49 | 10 | 21.9 |

31 | 50 | 9.9 | 21.5 |

32 | 51 | 9.9 | 21.2 |

33 | 52 | 9.8 | 20.9 |

34 | 53 | 9.7 | 20.5 |

35 | 54 | 9.7 | 20.1 |

36 | 55 | 9.6 | 19.8 |

37 | 56 | 9.5 | 19.4 |

38 | 57 | 9.4 | 19.0 |

39 | 58 | 9.3 | 18.6 |

40 | 59 | 9.1 | 18.2 |

41 | 60 | 9.0 | 17.8 |

42 | 61 | 8.9 | 17.4 |

43 | 62 | 8.7 | 17.0 |

44 | 63 | 8.5 | 16.6 |

45 | 64 | 8.3 | 16.2 |

46 | 65 | 8.1 | 15.7 |

47 | 66 | 7.9 | 15.3 |

48 | 67 | 7.6 | 14.9 |

49 | 68 | 7.3 | 14.4 |

50 | 69 | 7.0 | 14.0 |

51 | 70 | 6.6 | 13.5 |

52 | 71 | 6.2 | 13.1 |

53 | 72 | 5.8 | 12.6 |

54 | 73 | 5.4 | 12.2 |

55 | 74 | 4.8 | 11.7 |

56 | 75 | 4.3 | 11.3 |

57 | 76 | 3.7 | 10.8 |

58 | 77 | 3.0 | 10.4 |

59 | 78 | 2.2 | 10.0 |

60 | 79 | 1.4 | 9.5 |

61 | 80 | 1 | 9.1 |

62 | 81 | 1 | 8.7 |

63 | 82 | 1 | 8.3 |

64 | 83 | 1 | 7.9 |

65 | 84 | 1 | 7.5 |

66 | 85 | 1 | 7.1 |

67 | 86 | 1 | 6.8 |

68 | 87 | 1 | 6.4 |

69 | 88 | 1 | 6.1 |

70 | 89 | 1 | 5.8 |

71 | 90 | 1 | 5.5 |

72 | 91 | 1 | 5.3 |

73 | 92 | 1 | 5.0 |

74 | 93 | 1 | 4.8 |

75 | 94 | 1 | 4.6 |

76 | 95 | 1 | 4.4 |

77 | 96 | 1 | 4.2 |

78 | 97 | 1 | 4.0 |

79 | 98 | 1 | 3.8 |

80 | 99 | 1 | 3.7 |

81 | 100 or more | 1 | 3.5 |

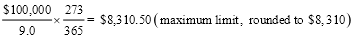

Example:

Iva Fortune, who turns 60 on 5 September 1994, invests $100,000 in an allocated pension fund on 1 October 1994. The date of the first payment to Ms Fortune is 1 January 1995.

Assume a fund earning rate of 7%.

1994/95: The maximum and minimum payments for 1994/95 are based on:

(a) the account balance on the day of purchase; and

(b) the beneficiary’s age of 60 on the day of purchase:

Assume that total payments to Ms Fortune at 30 June 1995 are $6,000.

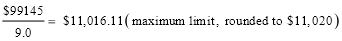

1995/96: The maximum and minimum payments for the year 1995/96 are based on:

(a) the account balance on 1 July 1995 which is $99,145 (residue $94,000 + interest of $5,145); and

(b) the beneficiary’s age of 60 on 1 July 1995:

5. In a year in which a PVF of 1 is used in calculating the maximum limit under clause 1, payment of the full account balance may be made at any time during the year.

Schedule 1AAB—Payment limits for annuities and pensions with a commencement day on and after 1 January 2006

(subregulations 1.05(4) and 1.06(4))

1. Subject to clauses 3, 4 and 5, the maximum limits mentioned in paragraph 1.05(4)(f) or 1.06(4)(e) are determined under the formula:

where:

AB means the amount of the annuity account balance, or pension account balance, as the case requires:

(a) on 1 July in the financial year in which the payments are made; or

(b) if that year is the year in which the annuity payments, or pension payments, commence—on the commencement day.

PVF means the maximum pension valuation factor set out in Column 3 of the Table in this Schedule in relation to the item in the Table that represents the age of the beneficiary on:

(a) 1 July in the financial year in which the payments are made; or

(b) if that is the year in which the annuity payments, or pension payments, commence—the commencement day.

2. Subject to clauses 3, 3A, 3B and 4, the minimum limits mentioned in paragraph 1.05(4)(f) or 1.06(4)(e) are determined under the formula:

where:

AB means the amount of the annuity account balance, or pension account balance, as the case requires:

(a) on 1 July in the financial year in which the payments are made; or

(b) if that year is the year in which the annuity payments, or pension payments, commence—on the commencement day.

PVF means the minimum pension valuation factor set out in Column 4 of the Table in this Schedule in relation to the item in the Table that represents the age of the beneficiary on:

(a) 1 July in the financial year in which the payments are made; or

(b) if that is the year in which the annuity payments, or pension payments, commence—the commencement day.

3. For a calculation of the maximum or minimum limit in the year in which the commencement day of the pension or annuity occurs if that day is a day other than 1 July, the appropriate value set out in Column 3 or Column 4 of the Table in this Schedule as the case requires, must be applied proportionally to the number of days in the financial year that include and follow the commencement day.

3A. For the financial years commencing on 1 July 2008, 1 July 2009 and 1 July 2010, the minimum limit is half of the amount determined under the formula in clause 2.

3B. For the financial years commencing on 1 July 2011 and 1 July 2012, the minimum limit is 75% of the amount determined under the formula in clause 2.

4. An amount determined under the formula in clause 1 or clause 2, is rounded to the nearest 10 whole dollars.

5. In a year in which a PVF of 1 is used in calculating the maximum limit under clause 1, payment of the full account balance may be made at any time during the year.

Table

Column 1 Item | Column 2 Age of Beneficiary | Column 3 Maximum Pension Valuation Factor | Column 4 Minimum Pension Valuation Factor |

1 | 20 or less | 12.0 | 29.2 |

2 | 21 | 12.0 | 29.0 |

3 | 22 | 12.0 | 28.9 |

4 | 23 | 12.0 | 28.7 |

5 | 24 | 12.0 | 28.6 |

6 | 25 | 12.0 | 28.4 |

7 | 26 | 12.0 | 28.3 |

8 | 27 | 12.0 | 28.1 |

9 | 28 | 12.0 | 27.9 |

10 | 29 | 12.0 | 27.8 |

11 | 30 | 12.0 | 27.6 |

12 | 31 | 12.0 | 27.4 |

13 | 32 | 12.0 | 27.2 |

14 | 33 | 12.0 | 27.0 |

15 | 34 | 12.0 | 26.8 |

16 | 35 | 12.0 | 26.6 |

17 | 36 | 12.0 | 26.4 |

18 | 37 | 12.0 | 26.2 |

19 | 38 | 12.0 | 26.0 |

20 | 39 | 12.0 | 25.8 |

21 | 40 | 12.0 | 25.5 |

22 | 41 | 12.0 | 25.3 |

23 | 42 | 12.0 | 25.0 |

24 | 43 | 12.0 | 24.8 |

25 | 44 | 12.0 | 24.5 |

26 | 45 | 12.0 | 24.2 |

27 | 46 | 12.0 | 24.0 |

28 | 47 | 12.0 | 23.7 |

29 | 48 | 12.0 | 23.4 |

30 | 49 | 12.0 | 23.1 |

31 | 50 | 12.0 | 22.8 |

32 | 51 | 11.9 | 22.5 |

33 | 52 | 11.8 | 22.2 |

34 | 53 | 11.8 | 21.8 |

35 | 54 | 11.7 | 21.5 |

36 | 55 | 11.5 | 21.1 |

37 | 56 | 11.4 | 20.8 |

38 | 57 | 11.3 | 20.4 |

39 | 58 | 11.2 | 20.1 |

40 | 59 | 11.0 | 19.7 |

41 | 60 | 10.9 | 19.3 |

42 | 61 | 10.7 | 18.9 |

43 | 62 | 10.5 | 18.5 |

44 | 63 | 10.3 | 18.1 |

45 | 64 | 10.1 | 17.7 |

46 | 65 | 9.9 | 17.3 |

47 | 66 | 9.6 | 16.8 |

48 | 67 | 9.3 | 16.4 |

49 | 68 | 9.1 | 16.0 |

50 | 69 | 8.7 | 15.5 |

51 | 70 | 8.4 | 15.1 |

52 | 71 | 8.0 | 14.6 |

53 | 72 | 7.6 | 14.2 |

54 | 73 | 7.2 | 13.7 |

55 | 74 | 6.7 | 13.3 |

56 | 75 | 6.2 | 12.8 |

57 | 76 | 5.7 | 12.3 |

58 | 77 | 5.1 | 11.9 |

59 | 78 | 4.5 | 11.4 |

60 | 79 | 3.8 | 10.9 |

61 | 80 | 3.1 | 10.5 |

62 | 81 | 2.3 | 10.0 |

63 | 82 | 1.4 | 9.6 |

64 | 83 | 1 | 9.1 |

65 | 84 | 1 | 8.7 |

66 | 85 | 1 | 8.3 |

67 | 86 | 1 | 7.9 |

68 | 87 | 1 | 7.5 |

69 | 88 | 1 | 7.2 |

70 | 89 | 1 | 6.9 |

71 | 90 | 1 | 6.6 |

72 | 91 | 1 | 6.3 |

73 | 92 | 1 | 6.0 |

74 | 93 | 1 | 5.8 |

75 | 94 | 1 | 5.5 |

76 | 95 | 1 | 5.3 |

77 | 96 | 1 | 5.1 |

78 | 97 | 1 | 4.9 |

79 | 98 | 1 | 4.7 |

80 | 99 | 1 | 4.5 |

81 | 100 or more | 1 | 4.4 |

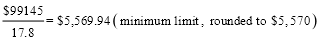

Example:

Clive Long, who turns 65 on 8 February 2006, invests $100,000 in an allocated pension fund on 1 March 2006. The date of the first payment to Mr Long is 1 April 2006.

2005/06: The maximum and minimum payments for 2005/06 are based on:

(a) the account balance on the day of purchase; and

(b) the beneficiary’s age of 65 on the day of purchase:

Assume that total payments to Mr Long at 30 June 2006 are $3,000.

2006/07: The maximum and minimum payments for 2006/07 are based on:

(a) the account balance on 1 July 2006 which is $99,300 (residue $97,000 + earnings of $2,300); and

(b) the beneficiary’s age of 65 on 1 July 2006:

Schedule 1B—Pension valuation factors

(paragraph 1.06(6)(g) and subregulation 1.08(1))

1. The pension valuation factor for:

(a) a pension that is to be indexed at a rate greater than 8% each year; or

(b) a pension that is included in a class of pensions that are to be indexed at a rate that is greater than 8% each year;

is the factor determined in writing by the Regulator, on a case‑by‑case basis, in relation to that pension or class of pensions.

2. The pension valuation factor for any other pension is the factor applicable to the pension under the following tables.

3. A reference in the tables to Age is a reference to the age of the recipient on the commencement day of the relevant pension. If the age of a person on that day falls between 2 of the ages specified in a table, the pension valuation factor is to be determined by reference to the factors specified under the next greater age group in the table.

4. If a pension has no reversion, the pension valuation factor for the pension is to be the relevant factor specified in the relevant table in the Below 50% group.

5. If the rules of a superannuation fund provide that a pension is indexed to movements in salary, the pension valuation factor for the pension is the relevant factor specified in the table relating to an indexation rate of 8%.

6. If a pension is indexed by reference to movements in a price index published by the Australian Statistician, the pension valuation factor for the pension is the relevant factor applicable under the table into which the standard indexation rate falls.

7. Subject to clause 8, if the governing rules of a superannuation fund provide for a pension to be indexed at the discretion of the trustees of the fund, the pension valuation factor is to be determined as if the indexation rate were a rate worked out by:

(a) adding together the indexation rates determined by the trustees for pensions of same kind as that pension in respect of each year in the period of 5 years of which the year of income in which the pension commences to be paid is the last year; and

(b) dividing the result by 5.

8. If a superannuation fund to which clause 7 applies has been in existence, or making pension payments, for less than a continuous period of 5 years, the pension valuation factor is to be the relevant factor specified in the table that relates to the standard indexation rate.

Tables

Indexation rate of 8%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 33 | 31 | 29 | 27 | 25 | 23 | 21 | 18 | 16 | 14 | 12 | 10 | 9 | 9 |

50%‑75% | 34 | 33 | 31 | 29 | 27 | 25 | 22 | 20 | 18 | 15 | 13 | 11 | 10 | 9 |

Above 75% | 35 | 34 | 32 | 30 | 28 | 26 | 24 | 21 | 19 | 16 | 14 | 12 | 10 | 10 |

Indexation rate of at least 7% but less than 8%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 26 | 25 | 24 | 23 | 21 | 20 | 18 | 16 | 14 | 13 | 11 | 10 | 9 | 8 |

50%‑75% | 27 | 26 | 25 | 24 | 23 | 21 | 19 | 18 | 16 | 14 | 12 | 10 | 9 | 9 |

Above 75% | 28 | 27 | 26 | 25 | 24 | 22 | 20 | 19 | 17 | 15 | 13 | 11 | 10 | 9 |

Indexation rate of least 6% but less than 7%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 22 | 21 | 20 | 19 | 18 | 17 | 16 | 14 | 13 | 12 | 10 | 9 | 8 | 8 |

50%‑75% | 22 | 22 | 21 | 20 | 19 | 18 | 17 | 16 | 14 | 13 | 11 | 10 | 9 | 8 |

Above 75% | 23 | 22 | 22 | 21 | 20 | 19 | 18 | 16 | 15 | 13 | 12 | 10 | 9 | 8 |

Indexation rate of at least 5% but less than 6%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 18 | 18 | 17 | 17 | 16 | 15 | 14 | 13 | 12 | 11 | 10 | 9 | 8 | 8 |

50%‑75% | 19 | 18 | 18 | 17 | 17 | 16 | 15 | 14 | 13 | 12 | 10 | 9 | 8 | 8 |

Above 75% | 19 | 19 | 18 | 18 | 17 | 17 | 16 | 15 | 13 | 12 | 11 | 9 | 8 | 8 |

Indexation rate of at least 4% but less than 5%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 16 | 15 | 15 | 15 | 14 | 13 | 13 | 12 | 11 | 10 | 9 | 8 | 8 | 7 |

50%‑75% | 16 | 16 | 15 | 15 | 15 | 14 | 13 | 13 | 12 | 11 | 10 | 9 | 8 | 7 |

Above 75% | 16 | 16 | 16 | 15 | 15 | 15 | 14 | 13 | 12 | 11 | 10 | 9 | 8 | 7 |

Indexation rate of at least 3% but less than 4%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 14 | 14 | 13 | 13 | 13 | 12 | 11 | 11 | 10 | 9 | 8 | 8 | 7 | 7 |

50%‑75% | 14 | 14 | 14 | 13 | 13 | 13 | 12 | 11 | 11 | 10 | 9 | 8 | 7 | 7 |

Above 75% | 14 | 14 | 14 | 14 | 13 | 13 | 12 | 12 | 11 | 10 | 9 | 8 | 8 | 7 |

Indexation rate of at least 2% but less than 3%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 12 | 12 | 12 | 12 | 11 | 11 | 10 | 10 | 9 | 9 | 8 | 7 | 7 | 7 |

50%‑75% | 12 | 12 | 12 | 12 | 12 | 11 | 11 | 10 | 10 | 9 | 8 | 8 | 7 | 7 |

Above 75% | 12 | 12 | 12 | 12 | 12 | 12 | 11 | 11 | 10 | 9 | 9 | 8 | 7 | 7 |

Indexation rate of at least 1% but less than 2%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 11 | 11 | 11 | 11 | 10 | 10 | 10 | 10 | 9 | 8 | 7 | 7 | 7 | 6 |

50%‑75% | 11 | 11 | 11 | 11 | 11 | 10 | 10 | 10 | 9 | 8 | 8 | 7 | 7 | 6 |

Above 75% | 11 | 11 | 11 | 11 | 11 | 10 | 10 | 10 | 9 | 9 | 8 | 7 | 7 | 6 |

Indexation rate less that 1%

Reversion | Age next birthday of recipient on commencement day of pension |

20 or less | 21 to 25 | 26 to 30 | 31 to 35 | 36 to 40 | 41 to 45 | 46 to 50 | 51 to 55 | 56 to 60 | 61 to 65 | 66 to 70 | 71 to 75 | 76 to 80 | 81 or more |

Below 50% | 10 | 10 | 10 | 10 | 9 | 9 | 9 | 8 | 8 | 8 | 7 | 7 | 6 | 6 |

50%‑75% | 10 | 10 | 10 | 10 | 10 | 9 | 9 | 9 | 8 | 8 | 7 | 7 | 6 | 6 |

Above 75% | 10 | 10 | 10 | 10 | 10 | 10 | 9 | 9 | 9 | 8 | 8 | 7 | 7 | 6 |

Schedule 1—Conditions of release of benefits

(Subregulations 1.03AB(2) and 6.01(2), regulation 6.01A, paragraphs 6.15A(1)(a) and (b), (2)(b), (3)(b), (4)(c) and (5)(c), subparagraph 6.16(3)(b)(ii) and paragraphs 6.18(3)(a), 6.19(3)(a), 6.23(3)(a) and 7A.01A(a) and (c))

Part 1—Regulated superannuation funds

Column 1 Item | Column 2 Conditions of release | Column 3 Cashing restrictions |

101 | Retirement | Nil |

102 | Death | Nil |

102A | Terminal medical condition | Nil |

103 | Permanent incapacity | Nil |

103A | Former temporary resident to whom regulation 6.20A or 6.20B applies, requesting in writing the release of his or her benefits | Amount that is at least the amount of the temporary resident’s withdrawal benefit in the fund, paid: (a) as a single lump sum; or |

| | (b) if the fund receives any combination of contributions, transfers and rollovers after cashing the benefits—in a way that ensures that the amount is cashed |

103B | The trustee is required to pay an amount to the Commissioner of Taxation under the Superannuation (Unclaimed Money and Lost Members) Act 1999 for the person’s superannuation interest in the fund | Amount that the trustee is required to pay to the Commissioner of Taxation under the Superannuation (Unclaimed Money and Lost Members) Act 1999 for the person’s superannuation interest in the fund, paid as a lump sum to the Commissioner |

104 | Termination of gainful employment with a standard employer‑sponsor of the regulated superannuation fund on or after 1 July 1997 (where the member’s preserved benefits in the fund at the time of the termination are less than $200) | Nil |

105 | Severe financial hardship | For a person taken to be in severe financial hardship under paragraph 6.01(5)(a)—in each 12 month period (beginning on the date of first payment), a single lump sum not less than $1,000 (except if the amount of the person’s preserved benefits and restricted non‑preserved benefits is less than that amount) and not more than $10,000 |

| | For a person taken to be in severe financial hardship under paragraph 6.01(5)(b)—Nil. |

106 | Attaining age 65 | Nil |

107 | Compassionate ground | A single lump sum, not exceeding an amount determined, in writing, by the Regulator, being an amount that: |

| | (a) taking account of the ground and of the person’s financial capacity, is reasonably required; and |

| | (b) in the case of the ground mentioned in paragraph 6.19A (1)(b)—in each 12 month period (beginning on the date of first payment), does not exceed an amount equal to the sum of: (i) 3 months’ repayments; and (ii) 12 months’ interest on the outstanding balance of the loan |

108 | Termination of gainful employment with an employer who had, or any of whose associates had, at any time, contributed to the regulated superannuation fund in relation to the member | 1. Preserved benefits: Non‑commutable life pension or non‑commutable life annuity 2. Restricted non‑preserved benefits: Nil |

109 | Temporary incapacity | A non‑commutable income stream cashed from the regulated superannuation fund for: |

| | (a) the purpose of continuing (in whole or part) the gain or reward which the member was receiving before the temporary incapacity; and |

| | (b) a period not exceeding the period of incapacity from employment of the kind engaged in immediately before the temporary incapacity |

110 | Attaining preservation age | Any of the following: (a) a transition to retirement income stream; (b) a non‑commutable allocated annuity; (c) a non‑commutable allocated pension; (d) a non‑commutable annuity; (e) a non‑commutable pension |

111 | Being a lost member who is found, and the value of whose benefit in the fund, when released, is less than $200 | Nil |

111A | The Commissioner of Taxation gives a superannuation provider a release authority under subsection 96‑10(1) or 96‑12(1) in Schedule 1 to the Taxation Administration Act 1953 | The restrictions contained in sections 96‑20 and 96‑25 in Schedule 1 to the Taxation Administration Act 1953 |

111B | A person gives a superannuation provider a release authority under section 135‑40 in Schedule 1 to the Taxation Administration Act 1953 | The restrictions contained in sections 135‑75 and 135‑85 in Schedule 1 to the Taxation Administration Act 1953 |

111C | The Commissioner of Taxation gives a superannuation provider a release authority under section 135‑45 in Schedule 1 to the Taxation Administration Act 1953 | The restrictions contained in sections 135‑75 and 135‑85 in Schedule 1 to the Taxation Administration Act 1953 |

112 | Either: (a) a person gives a release authority to a superannuation provider under subsection 292‑410(1) of the Income Tax Assessment Act 1997; or | Restrictions contained in subsections 292‑415(1) and (2) of the Income Tax Assessment Act 1997 |

| (b) the Commissioner of Taxation gives a release authority to a superannuation provider under subsection 292‑410(4) of the Income Tax Assessment Act 1997 | |

112A | The Commissioner of Taxation issues a release authority to a superannuation provider under subsection 292‑420(1) of the Income Tax Assessment Act 1997 | Restrictions contained in subsections 292‑420(4), (5) and (7) of the Income Tax Assessment Act 1997 |

113 | A person gives a transitional release authority to a superannuation provider under section 292‑80B of the Income Tax (Transitional Provisions) Act 1997 | Restrictions contained in subsections 292‑80C (1) and (2) of the Income Tax (Transitional Provisions) Act 1997 |

113A | A former resident of Australia has: (a) moved permanently to New Zealand; and (b) nominated a provider of a KiwiSaver Scheme for the purposes of this item | Amount that is at least the amount of the former resident’s withdrawal benefit in the fund, paid: (a) as a single lump sum; or (b) if the fund receives any combination of contributions, transfers and rollovers after cashing the benefits—in a way that ensures that the amount is cashed |

114 | Any other condition, if expressed to be a condition of release, in an approval under subparagraph 62(1)(b)(v) of the Act | Restrictions expressed in the approval to be cashing restrictions applying to the condition of release |

Part 2—Approved deposit funds

Column 1 Item no. | Column 2 Conditions of release | Column 3 Cashing restrictions |

201 | Retirement | Nil |

202 | Death | Nil |

202A | Terminal medical condition | Nil |

203 | Permanent incapacity | Nil |

204 | Former temporary resident to whom regulation 6.24A applies, requesting in writing the release of his or her benefits | Amount that is at least the amount of the temporary resident’s withdrawal benefit in the fund, paid: (a) as a single lump sum; or |

| | (b) if the fund receives any combination of contributions, transfers and rollovers after cashing the benefits—in a way that ensures that the amount is cashed |

204A | The trustee is required to pay an amount to the Commissioner of Taxation under the Superannuation (Unclaimed Money and Lost Members) Act 1999 for the person’s superannuation interest in the fund | Amount that the trustee is required to pay to the Commissioner of Taxation under the Superannuation (Unclaimed Money and Lost Members) Act 1999 for the person’s superannuation interest in the fund, paid as a lump sum to the Commissioner |

205 | Severe financial hardship | For a person taken to be in severe financial hardship under paragraph 6.01(5)(a)—in each 12 month period (beginning on the date of first payment), a single lump sum not less than $1,000 (except if the amount of the person’s preserved benefits and restricted non‑preserved benefits is less than that amount) and not more than $10,000 |

| | For a person taken to be in severe financial hardship under paragraph 6.01(5)(b)—Nil |

206 | Attaining age 65 | Nil |

207 | Compassionate ground | A single lump sum, not exceeding an amount determined, in writing, by APRA, being an amount that: |

| | (a) taking account of the ground and of the person’s financial capacity, is reasonably required; and |

| | (b) in the case of the ground mentioned in paragraph 6.19A(1)(b)—in each 12 month period (beginning on the date of first payment), does not exceed an amount equal to the sum of: (i) 3 months’ repayments; and |

| | (ii) 12 months’ interest on the outstanding balance of the loan |

208 | Attaining preservation age | Any of the following: (a) a transition to retirement income stream; |

| | (b) a non‑commutable allocated annuity; (c) a non‑commutable allocated pension; (d) a non‑commutable annuity; (e) a non‑commutable pension |

208A | The Commissioner of Taxation gives a superannuation provider a release authority under subsection 96‑10(1) or 96‑12(1) in Schedule 1 to the Taxation Administration Act 1953 | The restrictions contained in sections 96‑20 and 96‑25 in Schedule 1 to the Taxation Administration Act 1953 |

208B | A person gives a superannuation provider a release authority under section 135‑40 in Schedule 1 to the Taxation Administration Act 1953 | The restrictions contained in sections 135‑75 and 135‑85 in Schedule 1 to the Taxation Administration Act 1953 |

208C | The Commissioner of Taxation gives a superannuation provider a release authority under section 135‑45 in Schedule 1 to the Taxation Administration Act 1953 | The restrictions contained in sections 135‑75 and 135‑85 in Schedule 1 to the Taxation Administration Act 1953 |

209 | Either: (a) a person gives a release authority to a superannuation provider under subsection 292‑410(1) of the Income Tax Assessment Act 1997; or | Restrictions contained in subsections 292‑415(1) and (2) of the Income Tax Assessment Act 1997 |

| (b) the Commissioner of Taxation gives a release authority to a superannuation provider under subsection 292‑410(4) of the Income Tax Assessment Act 1997 | |

209A | The Commissioner of Taxation issues a release authority to a superannuation provider under subsection 292‑420(1) of the Income Tax Assessment Act 1997 | Restrictions contained in subsections 292‑420(4), (5) and (7) of the Income Tax Assessment Act 1997 |

210 | A person gives a transitional release authority to a superannuation provider under section 292‑80B of the Income Tax (Transitional Provisions) Act 1997 | Restrictions contained in subsections 292‑80C(1) and (2) of the Income Tax (Transitional Provisions) Act 1997 |

211 | Being a lost member who is found, and the value of whose benefit in the fund, when released, is less than $200 | Nil |

Note: The definitions set out in subregulation 6.01(2) apply, unless they are in material or expressed not to apply, to Schedule 1; see that subregulation.

Schedule 2—Modifications of the OSS laws in relation to preserved benefits in regulated superannuation funds

(subregulation 6.02(2))

Part 1—Modifications of the Occupational Superannuation Standards Act 1987

101. Section 7 (Operating standards for superannuation funds)

101.1 After subsection 7(3), insert:

‘(4) Despite any other provision of this Act, superannuation funds must comply with the standards prescribed for the purposes of this section.’.

Part 2—Modifications of the Occupational Superannuation Standards Regulations

201. Regulation 3 (Interpretation)

201.1 Paragraph 3(2)(a):

Omit the paragraph.

201A. Regulation 8 (Vesting standards)

201A.1 After subregulation 8(1A), insert:

‘(1B) Paragraph (1A)(a) does not apply in relation to contributions made in accordance with a prescribed agreement or award’

202. Regulation 9 (Preservation standards)

201.1A Subparagraph 9(1)(a)(i):

Omit ‘subject to regulation 10,’.

202.1 Paragraph 9(1)(b):

After ‘the fund’, insert ‘before the commencement day’.

202.2 Paragraph 9(1)(c):

Omit the paragraph, substitute:

‘(c) member‑financed benefits must be preserved if they arise from contributions made by a member to a superannuation fund during any period during which the member did not have employer support in the fund, being a period that:

(i) commenced on or after 13 March 1989 (in the case of a private sector fund) or 1 July 1990 (in the case of a public sector fund); and

(ii) ended before the commencement day;

‘(d) member‑financed benefits must be preserved if they arise from contributions (other than undeducted contributions) made to a superannuation fund in relation to the member on or after the commencement day;

‘(e) benefits must be preserved if they arise from payments from the Superannuation Holding Accounts Special Account;

‘(f) benefits must be preserved if they arise from eligible spouse contributions within the meaning of section 159TC of the Tax Act;

‘(g) benefits must be preserved if they arise from a capital gains tax exempt component rolled over to the fund because of subsection 160ZZPZF(1), 160ZZPZH(7) or 160ZZPZI(5) of the Tax Act.’.

202.3 Subregulation 9(3):

After ‘arising’, insert ‘before the commencement day,’.

202.4 Add at the end:

‘(5) In paragraphs (1)(b), (c) and (d) and subregulation (3):

commencement day has the same meaning as in Part 6 of the Superannuation Industry (Supervision) Regulations.

undeducted contributions has the same meaning as in Part 6 of the Superannuation Industry (Supervision) Regulations.’

202A. New regulation 10A

202A.1 After regulation 10, insert:

10A. Preservation standard—interaction of subparagraph 9(1)(a)(i) and regulation 10

‘Where, apart from this regulations, a fund must preserve, in respect of a member:

(a) the amount of benefits in compliance with subparagraph 9(1)(a)(i); and

(b) an amount of benefits in compliance with regulation 10;

it is sufficient compliance with those provisions if the fund preserves the greater of those amounts.’.

203. Regulation 11 (Preservation and portability standards)

203.1 Omit the regulation.

204. Regulation 12 (Preservation standards not to apply in certain cases)

204.1 Omit the regulation.