Universities Accord (Cutting Student Debt by 20 Per Cent) Act 2025

No. 30, 2025

An Act to amend the law relating to Australian apprenticeship support loans, the Higher Education Loan Program, student start‑up loans, vocational education and training student loans and the Student Financial Supplement Scheme, and for related purposes

[Assented to 2 August 2025]

The Parliament of Australia enacts:

1 Short title

This Act is the Universities Accord (Cutting Student Debt by 20 Per Cent) Act 2025.

2 Commencement

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information |

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. The whole of this Act | The day after this Act receives the Royal Assent. | 3 August 2025 |

Note: This table relates only to the provisions of this Act as originally enacted. It will not be amended to deal with any later amendments of this Act.

(2) Any information in column 3 of the table is not part of this Act. Information may be inserted in this column, or information in it may be edited, in any published version of this Act.

3 Schedules

Legislation that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Schedule 1—Debt reduction

Part 1—Amendments

Australian Apprenticeship Support Loans Act 2014

1 Subsection 27(1)

Omit “on the day the instalment is paid”, substitute “on the relevant day”.

2 After subsection 27(1)

Insert:

(1A) For the purposes of subsection (1), the relevant day is:

(a) unless paragraph (b) applies—the day the instalment is paid; or

(b) if the instalment should have been paid on or before 1 June 2025 but was paid after 1 June 2025 as a result of an administrative error—1 June 2025.

3 After section 27

Insert:

27A Reduction in AASL debts incurred between 1 January and 1 June 2025

(1) This section applies if a person incurs an AASL debt during the period beginning on 1 January 2025 and ending on 1 June 2025.

Note: Certain AASL debts are taken to have been incurred on 1 June 2025 (see paragraph 27(1A)(b)).

(2) For the purposes of this Act, and despite anything in section 27, the amount of the AASL debt is the amount worked out under that section reduced by 20%.

4 At the end of subsection 31(1)

Add:

Note: This method statement is modified for the purposes of working out a person’s former accumulated AASL debt in relation to the financial year starting on 1 July 2024: see section 35A.

5 At the end of subsection 35(1)

Add:

Note: The formula in this subsection is modified for the purposes of working out a person’s accumulated AASL debt for the financial year starting on 1 July 2024: see section 35A.

6 After section 35

Insert:

35A Reduction in AASL debts incurred before 1 January 2025

(1) For the purposes of working out a person’s former accumulated AASL debt in relation to the person’s accumulated AASL debt for the financial year starting on 1 July 2024, section 31 has effect as if the method statement in subsection (1) of that section included the following step after step 7:

Step 8. Reduce the amount worked out under step 7 by 20%.

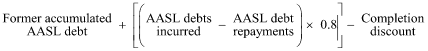

(2) For the purposes of working out a person’s accumulated AASL debt for the financial year starting on 1 July 2024, section 35 has effect as if the formula in subsection (1) of that section were omitted and substituted with the following:

7 Subsection 37(2)

Omit “sections 31 and 35”, substitute “sections 31, 35 and 35A”.

Higher Education Support Act 2003

8 Subsection 79‑20(1)

Omit “with an amount equal to the amount”, substitute “in relation to the amount”.

9 Section 97‑23

Omit “with an amount equal to”, substitute “in relation to”.

10 Subsection 97‑25(1)

Omit “with an amount equal to”, substitute “in relation to”.

11 At the end of subsection 97‑25(2)

Add:

Note: For certain HECS‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 97‑55.

12 At the end of subsection 97‑27(1)

Add:

Note: For certain HECS‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 97‑55.

13 Subsection 97‑42(1) (note)

Omit “Note”, substitute “Note 1”.

14 At the end of subsection 97‑42(1)

Add:

Note 2: For certain HECS‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 97‑55.

15 Subsection 97‑45(1) (note)

Omit “Note”, substitute “Note 1”.

16 At the end of subsection 97‑45(1)

Add:

Note 2: For certain HECS‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 97‑55.

17 At the end of subsection 97‑50(1)

Add:

Note 4: For certain HECS‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 97‑55.

18 At the end of the Division 97

Add:

97‑55 Re‑crediting a person’s HELP balance in relation to HECS‑HELP debts incurred on or before 1 June 2025

If:

(a) section 97‑25, 97‑27, 97‑42, 97‑45 or 97‑50 applies to re‑credit a person’s *HELP balance in relation to the amounts of *HECS‑HELP assistance that the person received for a *unit of study; and

(b) on or before 1 June 2025, the person incurred a *HECS‑HELP debt relating to the unit of study;

then, despite anything in that section, the amount to be re‑credited to the person’s HELP balance under that section is an amount equal to 80% of the amounts of HECS‑HELP assistance that the person received for the unit of study.

19 Subsection 104‑25(1A)

Omit “with an amount equal to”, substitute “in relation to”.

20 Subsection 104‑25(2) (note)

Omit “Note”, substitute “Note 1”.

21 At the end of subsection 104‑25(2)

Add:

Note 2: For certain FEE‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 104‑44A.

22 Subsection 104‑27(2) (note)

Omit “Note”, substitute “Note 1”.

23 At the end of subsection 104‑27(2)

Add:

Note 2: For certain FEE‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 104‑44A.

24 Subsection 104‑42(1) (note)

Omit “Note”, substitute “Note 1”.

25 At the end of subsection 104‑42(1)

Add:

Note 2: For certain FEE‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 104‑44A.

26 Subsection 104‑43(1) (note)

Omit “Note”, substitute “Note 1”.

27 At the end of subsection 104‑43(1)

Add:

Note 2: For certain FEE‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 104‑44A.

28 Subsection 104‑44(1) (note)

Omit “Note”, substitute “Note 1”.

29 At the end of subsection 104‑44(1)

Add:

Note 2: For certain FEE‑HELP debts relating to a unit of study, the amount to be re‑credited under this section in relation to the unit may be reduced: see section 104‑44A.

30 At the end of Subdivision 104‑B

Add:

104‑44A Re‑crediting a person’s HELP balance in relation to FEE‑HELP debts incurred on or before 1 June 2025

If:

(a) section 104‑25, 104‑27, 104‑42, 104‑43 or 104‑44 applies to re‑credit a person’s *HELP balance in relation to the amounts of *FEE‑HELP assistance that the person received for a *unit of study; and

(b) on or before 1 June 2025, the person incurred a *FEE‑HELP debt relating to the unit of study;

then, despite anything in that section, the amount to be re‑credited to the person’s HELP balance under that section is an amount equal to 80% of the amounts of FEE‑HELP assistance that the person received for the unit of study.

31 Before subsection 128‑25(1)

Insert:

Payment made in discharge of HELP debt

32 After subsection 128‑25(2)

Insert:

Reduction in certain HELP debts etc.

(2A) If an amount is reduced from:

(a) a person’s *HELP debt because of the operation of section 137‑19A; or

(b) a person’s *accumulated HELP debt or *former accumulated HELP debt because of the operation of section 140‑26;

the *Commissioner must notify the amount reduced to the *Secretary as soon as practicable.

(2B) If the *Secretary is so notified, the Secretary must re‑credit the person’s *HELP balance with an amount equal to the amount reduced.

Reduction in accumulated HELP debt—special measures for location‑preferred HELP debtors

33 After section 137‑19

Insert:

137‑19A Reduction in HELP debts incurred between 1 January and 1 June 2025

(1) This section applies if, under a section of this Division, a person incurs a *HELP debt during the period beginning on 1 January 2025 and ending on 1 June 2025.

(2) For the purposes of this Act, and despite anything in that section, the amount of the *HELP debt is the amount worked out under that section reduced by 20%.

34 Subsection 140‑5(1) (after step 2B of the method statement)

Insert:

35 At the end of subsection 140‑5(1) (before the example)

Add:

Note: This method statement is modified for the purposes of working out a person’s former accumulated HELP debt in relation to the financial year starting on 1 July 2024: see section 140‑26.

36 At the end of subsection 140‑25(1) (before the example)

Add:

Note: The formula in this subsection is modified for the purposes of working out a person’s accumulated HELP debt for the financial year starting on 1 July 2024: see section 140‑26.

37 After section 140‑25

Insert:

140‑26 Reduction in HELP debts incurred before 1 January 2025

(1) For the purposes of working out a person’s *former accumulated HELP debt in relation to the person’s *accumulated HELP debt for the financial year starting on 1 July 2024, section 140‑5 has effect as if the method statement in subsection (1) of that section included the following step after step 6:

Step 7. Reduce the amount worked out under step 6 by 20%.

(2) For the purposes of working out a person’s *accumulated HELP debt for the financial year starting on 1 July 2024, section 140‑25 has effect as if the first formula in subsection (1) of that section were omitted and substituted with the following:

38 Subsection 140‑35(2)

Omit “or section 140‑25”, substitute “or section 140‑25 or 140‑26”.

39 Subclause 46(1) of Schedule 1A

Omit “with an amount equal to”, substitute “in relation to”.

40 Subclause 46(2) of Schedule 1A (note)

Omit “Note”, substitute “Note 1”.

41 At the end of subclause 46(2) of Schedule 1A

Add:

Note 2: For certain VET FEE‑HELP debts relating to a VET unit of study, the amount to be re‑credited under this clause in relation to the unit may be reduced: see clause 51AA.

42 Subclause 46A(1) of Schedule 1A (note)

Omit “Note”, substitute “Note 1”.

43 At the end of subclause 46A(1) of Schedule 1A

Add:

Note 2: For certain VET FEE‑HELP debts relating to a VET unit of study, the amount to be re‑credited under this clause in relation to the unit may be reduced: see clause 51AA.

44 At the end of subclause 46AA(1) of Schedule 1A

Add:

Note 3: For certain VET FEE‑HELP debts relating to a VET unit of study, the amount to be re‑credited under this clause in relation to the unit may be reduced: see clause 51AA.

45 Subclause 47(1) of Schedule 1A (note)

Omit “Note”, substitute “Note 1”.

46 At the end of subclause 47(1) of Schedule 1A

Add:

Note 2: For certain VET FEE‑HELP debts relating to a VET unit of study, the amount to be re‑credited under this clause in relation to the unit may be reduced: see clause 51AA.

47 Subclause 51(1) of Schedule 1A (note)

Omit “Note”, substitute “Note 1”.

48 At the end of subclause 51(1) of Schedule 1A

Add:

Note 2: For certain VET FEE‑HELP debts relating to a VET unit of study, the amount to be re‑credited under this clause in relation to the unit may be reduced: see clause 51AA.

49 After clause 51 of Schedule 1A

Insert:

51AA Re‑crediting a person’s HELP balance in relation to VET FEE‑HELP debts incurred on or before 1 June 2025

If:

(a) clause 46, 46A, 46AA, 47 or 51 applies to re‑credit a person’s *HELP balance in relation to the amounts of *VET FEE‑HELP assistance that the person received for a *VET unit of study; and

(b) on or before 1 June 2025, the person incurred a *VET FEE‑HELP debt relating to the VET unit of study;

then, despite anything in that clause, the amount to be re‑credited to the person’s HELP balance under that clause is an amount equal to 80% of the amounts of VET FEE‑HELP assistance that the person received for the VET unit of study.

Social Security Act 1991

50 After section 1061ZVDA

Insert:

1061ZVDAA Reduction in SSL debts incurred between 1 January and 1 June 2025

(1) This section applies if a person incurs an SSL debt during the period beginning on 1 January 2025 and ending on 1 June 2025.

(2) For the purposes of this Act, and despite subsection 1061ZVDA(3), the amount of the SSL debt is the amount worked out under that subsection reduced by 20%.

51 At the end of subsection 1061ZVEB(1)

Add:

Note: This method statement is modified for the purposes of working out a person’s former accumulated SSL debt in relation to the financial year starting on 1 July 2024: see section 1061ZVECA.

52 At the end of subsection 1061ZVEC(1)

Add:

Note: The formula in this subsection is modified for the purposes of working out a person’s accumulated SSL debt for the financial year starting on 1 July 2024: see section 1061ZVECA.

53 After section 1061ZVEC

Insert:

1061ZVECA Reduction in SSL debts incurred before 1 January 2025

(1) For the purposes of working out a person’s former accumulated SSL debt in relation to the person’s accumulated SSL debt for the financial year starting on 1 July 2024, section 1061ZVEB has effect as if the method statement in subsection (1) of that section included the following step after step 6:

Step 7. Reduce the amount worked out under step 6 by 20%.

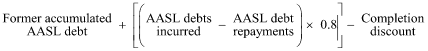

(2) For the purposes of working out a person’s accumulated SSL debt for the financial year starting on 1 July 2024, section 1061ZVEC has effect as if the formula in subsection (1) of that section were omitted and substituted with the following:

54 Subsection 1061ZVEE(2)

Omit “sections 1061ZVEB and 1061ZVEC”, substitute “sections 1061ZVEB, 1061ZVEC and 1061ZVECA”.

55 At the end of subsection 1061ZZER(2)

Add:

Note: This formula is modified for the purposes of working out the accumulated FS debt incurred by a person on 1 June 2025: see section 1061ZZESA.

56 After section 1061ZZES

Insert:

1061ZZESA Reduction in accumulated FS debt on 1 June 2025

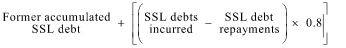

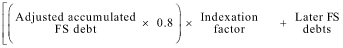

For the purposes of working out the accumulated FS debt incurred by a person on 1 June 2025, section 1061ZZER has effect as if the formula in subsection (2) of that section were omitted and substituted with the following:

Student Assistance Act 1973

57 After section 8B

Insert:

8BA Reduction in ABSTUDY SSL debts incurred between 1 January and 1 June 2025

(1) This section applies if a person incurs an ABSTUDY SSL debt during the period beginning on 1 January 2025 and ending on 1 June 2025.

(2) For the purposes of this Act, and despite subsection 8B(3), the amount of the ABSTUDY SSL debt is the amount worked out under that subsection reduced by 20%.

58 Subsection 9B(1)

Omit “ABSTUDY accumulated”, substitute “accumulated ABSTUDY”.

59 At the end of subsection 9B(1)

Add:

Note: This method statement is modified for the purposes of working out a person’s former accumulated ABSTUDY SSL debt in relation to the financial year starting on 1 July 2024: see section 9CA.

60 At the end of subsection 9C(1)

Add:

Note: The formula in this subsection is modified for the purposes of working out a person’s accumulated ABSTUDY SSL debt for the financial year starting on 1 July 2024: see section 9CA.

61 After section 9C

Insert:

9CA Reduction in ABSTUDY SSL debts incurred before 1 January 2025

(1) For the purposes of working out a person’s former accumulated ABSTUDY SSL debt in relation to the person’s accumulated ABSTUDY SSL debt for the financial year starting on 1 July 2024, section 9B has effect as if the method statement in subsection (1) of that section included the following step after step 6:

Step 7. Reduce the amount worked out under step 6 by 20%.

(2) For the purposes of working out a person’s accumulated ABSTUDY SSL debt for the financial year starting on 1 July 2024, section 9C has effect as if the formula in subsection (1) of that section were omitted and substituted with the following:

62 Subsection 9E(2)

Omit “section 8B, 8C, 9B or 9C”, substitute “section 8B, 8BA, 8C, 9B, 9C or 9CA”.

63 At the end of subsection 12ZF(3)

Add:

Note: The formula in this subsection is modified for the purposes of working out the accumulated FS debt incurred by a person on 1 June 2025: see section 12ZFA.

64 After section 12ZF

Insert:

12ZFA Reduction in accumulated FS debt on 1 June 2025

For the purposes of working out the accumulated FS debt incurred by a person on 1 June 2025, section 12ZF has effect as if the formula in subsection (3) of that section were omitted and substituted with the following:

65 Subsection 12ZG(2)

Omit “section 12ZF”, substitute “sections 12ZF and 12ZFA”.

VET Student Loans Act 2016

66 Subsection 23BA(3)

Omit “on the day that the Secretary pays the loan amount”, substitute “on the relevant day”.

67 After subsection 23BA(3)

Insert:

(3A) For the purposes of subsection (3), the relevant day is:

(a) unless paragraph (b) applies—the day the Secretary pays the loan amount; or

(b) if subsection (3B) applies to the loan amount—1 June 2025.

(3B) This subsection applies to a loan amount if:

(a) the loan amount should have been paid on or before 1 June 2025 but was paid after 1 June 2025 as a result of an administrative error; or

(b) the loan amount:

(i) was paid during the period of 6 months beginning immediately after 1 June 2025; and

(ii) was used to pay tuition fees for a course, or a part of a course, for which the census day was on or before 1 June 2025.

68 After section 23BA

Insert:

23BAA Reduction in VETSL debts incurred between 1 January and 1 June 2025

(1) This section applies if, under section 23BA, a person incurs a VETSL debt during the period beginning on 1 January 2025 and ending on 1 June 2025.

Note: Certain VETSL debts are taken to have been incurred on 1 June 2025: see paragraph 23BA(3A)(b).

(2) For the purposes of this Act, and despite subsection 23BA(2), the amount of the VETSL debt is the amount worked out under that subsection reduced by 20%.

69 At the end of subsection 23CB(1) (before the example)

Add:

Note: This method statement is modified for the purposes of working out a person’s former accumulated VETSL debt in relation to the financial year starting on 1 July 2024: see section 23CCA.

70 At the end of subsection 23CC(1) (before the example)

Add:

Note: The formula in this subsection is modified for the purposes of working out a person’s accumulated VETSL debt for the financial year starting on 1 July 2024: see section 23CCA.

71 After section 23CC

Insert:

23CCA Reduction in VETSL debts incurred before 1 January 2025

(1) For the purposes of working out a person’s former accumulated VETSL debt in relation to the person’s accumulated VETSL debt for the financial year starting on 1 July 2024, section 23CB has effect as if the method statement in subsection (1) of that section included the following step after step 6:

Step 7. Reduce the amount worked out under step 6 by 20%.

(2) For the purposes of working out a person’s accumulated VETSL debt for the financial year starting on 1 July 2024, section 23CC has effect as if the first formula in subsection (1) of that section were omitted and the following formula substituted:

72 Subsection 23CE(2)

Omit “section 23CB or 23CC”, substitute “section 23CB, 23CC or 23CCA”.

73 Paragraph 66E(3)(g)

Omit “an amount equal to”, substitute “an amount in relation to”.

74 Paragraph 66E(4)(d)

Omit “an amount equal to”, substitute “an amount in relation to”.

75 Paragraph 66H(3)(a)

Omit “an amount equal to”, substitute “an amount in relation to”.

76 Subsection 68(4)

Omit “The”, substitute “Subject to subsection (4A), the”.

77 After subsection 68(4)

Insert:

(4A) If:

(a) this section applies to re‑credit a student’s HELP balance in relation to an amount of a VET student loan that has been used to pay tuition fees for the student for a course, or a part of a course; and

(b) on or before 1 June 2025, the person incurred a VETSL debt relating to the amount of the VET student loan;

then the amount to be re‑credited to the student’s HELP balance under this section is an amount equal to 80% of the amount of the VET student loan.

78 Subsection 72A(2)

Omit “The”, substitute “Subject to subsection (2A), the”.

79 After subsection 72A(2)

Insert:

(2A) If:

(a) this section applies to re‑credit a student’s HELP balance in relation to a loan amount that has been used to pay tuition fees for the student for an affected part; and

(b) on or before 1 June 2025, the person incurred a VETSL debt relating to the loan amount;

then the amount to be re‑credited to the student’s HELP balance under this section is an amount equal to 80% of the loan amount.

80 Subsection 72A(3)

Omit “subsection (2)”, substitute “subsection (2) or (2A)”.

81 Division 4 of Part 6 (heading)

After “discharge”, insert “or reduction”.

82 Section 73A (heading)

After “discharge”, insert “or reduction”.

83 Before subsection 73A(1)

Insert:

Payment made in discharge of VETSL debt

84 After subsection 73A(2) (before the note)

Insert:

Reduction in certain VETSL debts etc.

(3) If an amount is reduced from:

(a) a person’s VETSL debt because of the operation of section 23BAA; or

(b) a person’s accumulated VETSL debt or former accumulated VETSL debt because of the operation of section 23CCA;

the Commissioner must notify the amount reduced to the Secretary as soon as practicable.

(4) If the Secretary is so notified, the Secretary must re‑credit the person’s HELP balance with an amount equal to the amount reduced.

Part 2—Modification and transitional rules

Division 1—Modification rules

85 Modification rules

(1) The Minister may, by legislative instrument, make rules modifying the operation of a provision specified in subitem (2) by providing that the provision applies as if a reference in the provision to 1 June 2025 were a reference to a later day specified by those rules (which must be no later than 2 calendar days after 1 June 2025).

(2) The following provisions are specified:

(a) a provision of the Australian Apprenticeship Support Loans Act 2014, as amended by this Schedule, that refers to 1 June 2025;

(b) a provision of the Higher Education Support Act 2003, as amended by this Schedule, that refers to 1 June 2025;

(c) a provision of the Social Security Act 1991, as amended by this Schedule, that refers to 1 June 2025;

(d) a provision of the Student Assistance Act 1973, as amended by this Schedule, that refers to 1 June 2025;

(e) a provision of the VET Student Loans Act 2016, as amended by this Schedule, that refers to 1 June 2025.

86 Requirements for making modification rules

Agreement of administering Minister

(1) The Minister must not make rules under subitem 85(1) that modify the operation of a provision of an Act without the written agreement of a Minister administering the Act.

(2) Subitem (1) does not apply in relation to a provision of the Higher Education Support Act 2003.

Time limit on making rules

(3) Rules under subitem 85(1) may only be made before the later of:

(a) 1 January 2026; and

(b) the day after the end of the period of 3 months beginning on the day this item commences.

Rules must not do certain things

(4) To avoid doubt, rules made under subitem 85(1) may not do the following:

(a) create an offence or civil penalty;

(b) provide powers of:

(i) arrest or detention; or

(ii) entry, search or seizure;

(c) impose a tax;

(d) set an amount to be appropriated from the Consolidated Revenue Fund under an appropriation in this Act;

(e) directly amend the text of an Act.

Division 2—Transitional rules

87 Transitional rules

(1) The Minister may, by legislative instrument, make rules prescribing matters of a transitional nature (including prescribing any saving or application provisions) relating to the amendments or repeals made by this Schedule.

(2) To avoid doubt, rules made under subitem (1) may not do the following:

(a) create an offence or civil penalty;

(b) provide powers of:

(i) arrest or detention; or

(ii) entry, search or seizure;

(c) impose a tax;

(d) set an amount to be appropriated from the Consolidated Revenue Fund under an appropriation in this Act;

(e) directly amend the text of an Act.

(3) This Schedule (other than subitem (2)) does not limit the rules that may be made under subitem (1).

Schedule 2—Fairer repayment system

Part 1—Amendments

Australian Apprenticeship Support Loans Act 2014

1 Subsection 46(1)

Omit “so much of the person’s repayable AASL debt for the income year as does not exceed the amount worked out by the formula”, substitute “the amount worked out using the following formula in reduction of the person’s repayable AASL debt”.

2 Subsection 46(1) (formula)

Repeal the formula, substitute:

3 Subsection 46(1) (definition of applicable percentage of repayment income)

Repeal the definition.

4 Subsection 46(1)

Insert:

applicable repayable amount means the amount that is the least of the following:

(a) the amount worked out under subsection 154‑20(2) of the Higher Education Support Act 2003 for the income year, as if:

(i) references in that subsection to the person’s repayment income were references to the person’s repayment income within the meaning of this Act; and

(ii) references in that subsection to the person’s minimum repayment income were references to the person’s minimum repayment income within the meaning of this Act;

(b) the amount equal to 10% of the person’s repayment income for the income year;

(c) the amount of the person’s repayable AASL debt for the income year.

Higher Education Support Act 2003

5 Section 154‑10

Repeal the section, substitute:

154‑10 Minimum repayment income

The minimum repayment income for an *income year is $67,000.

Note: The minimum repayment income is indexed under section 154‑25.

6 Sections 154‑20, 154‑25 and 154‑30

Repeal the sections, substitute:

154‑20 Amounts payable to the Commonwealth

(1) The amount that a person is liable to pay under section 154‑1, in respect of an *income year, is the amount that is the least of the following:

(a) the amount worked out under subsection (2);

(b) the amount equal to 10% of the person’s *repayment income for the income year;

(c) the amount of the person’s *repayable debt for the income year.

(2) For the purposes of paragraph (1)(a), the amount is the sum of the following amounts:

(a) 15% of the part of the person’s *repayment income that exceeds the *minimum repayment income but does not exceed $125,000;

(b) 17% of the part of the person’s repayment income that exceeds $125,000.

Note: The amount of $125,000 mentioned in paragraphs (a) and (b) is indexed under section 154‑25.

154‑25 Indexation of HELP repayment thresholds

(1) This section applies in relation to the following amounts (each of which is an indexable amount):

(a) the *minimum repayment income;

(b) the amount mentioned in paragraphs 154‑20(2)(a) and (b).

(2) At the start of each *income year (an indexation year) after the 2025‑26 income year, each indexable amount is replaced by the amount worked out using the following formula:

where:

AWE, for an income year, is the number of dollars in the sum of:

(a) the average weekly earnings for all employees (total earnings) for the reference period in the *quarter ending on 31 December immediately before the income year, as published by the *Australian Statistician; and

(b) the average weekly earnings for all employees (total earnings) for the reference period in the quarter ending on 30 June that is immediately before the quarter referred to in paragraph (a), as published by the Australian Statistician.

(3) If an amount worked out under subsection (2) is an amount made up of dollars and cents, round the amount down to the nearest dollar.

Publication of indexation amounts

(4) The Minister must cause to be published in the Gazette, before the start of an indexation year, the replacement indexable amount for the indexation year. However, a failure by the Minister to do so does not invalidate the indexation.

Definitions

(5) In this section:

reference period, in a *quarter, is the period described by the *Australian Statistician as the pay period ending on or before a specified day that is the third Friday of the middle month of that quarter.

7 Paragraph 238‑8(a)

Omit “except section 154‑30”, substitute “except subsection 154‑25(4)”.

Social Security Act 1991

8 Subsection 19AB(2) (definition of minimum repayment income)

Repeal the definition, substitute:

minimum repayment income has the same meaning as in the Higher Education Support Act 2003.

9 Subsection 1061ZVHA(1)

Omit “so much of the person’s repayable SSL debt for the income year as does not exceed the amount worked out using the formula”, substitute “the amount worked out using the following formula in reduction of the person’s repayable SSL debt”.

10 Subsection 1061ZVHA(1) (formula)

Repeal the formula, substitute:

11 Subsection 1061ZVHA(1) (definition of applicable percentage of repayment income)

Repeal the definition.

12 Subsection 1061ZVHA(1)

Insert:

applicable repayable amount means the amount that is the least of the following:

(a) the amount worked out under subsection 154‑20(2) of the Higher Education Support Act 2003 for the income year, as if:

(i) references in that subsection to the person’s repayment income were references to the person’s HELP repayment income; and

(ii) references in that subsection to the person’s minimum repayment income were references to the person’s minimum HELP repayment income;

(b) the amount equal to 10% of the person’s HELP repayment income for the income year;

(c) the amount of the person’s repayable SSL debt for the income year.

13 Section 1061ZZFB

Repeal the section.

14 Subsection 1061ZZFD(1) (formula)

Repeal the formula, substitute:

15 Subsection 1061ZZFD(1) (definition of applicable percentage of repayment income)

Repeal the definition.

16 Subsection 1061ZZFD(1)

Insert:

applicable repayable amount means the amount that is the least of the following:

(a) the amount worked out under subsection 154‑20(2) of the Higher Education Support Act 2003 for the income year, as if:

(i) references in that subsection to the person’s repayment income were references to the person’s repayment income within the meaning of this Chapter; and

(ii) references in that subsection to the person’s minimum repayment income were references to the person’s minimum repayment income within the meaning of this Chapter;

(b) the amount equal to 10% of the person’s repayment income for the income year;

(c) the amount of the person’s repayable debt for the income year.

17 Subsection 1061ZZFD(2)

Repeal the subsection.

Student Assistance Act 1973

18 Subsection 3(1) (definition of minimum repayment income)

Repeal the definition, substitute:

minimum repayment income has the same meaning as in the Higher Education Support Act 2003.

19 Subsection 10F(1)

Omit “so much of the person’s repayable ABSTUDY SSL debt for the income year as does not exceed the amount worked out by the formula”, substitute “the amount worked out using the following formula in reduction of the person’s repayable ABSTUDY SSL debt”.

20 Subsection 10F(1) (formula)

Repeal the formula, substitute:

21 Subsection 10F(1) (definition of applicable percentage of HELP repayment income)

Repeal the definition.

22 Subsection 10F(1)

Insert:

applicable repayable amount means the amount that is the least of the following:

(a) the amount worked out under subsection 154‑20(2) of the Higher Education Support Act 2003 for the income year, as if:

(i) references in that subsection to the person’s repayment income were references to the person’s HELP repayment income; and

(ii) references in that subsection to the person’s minimum repayment income were references to the person’s minimum HELP repayment income;

(b) the amount equal to 10% of the person’s HELP repayment income for the income year;

(c) the amount of the person’s repayable ABSTUDY SSL debt for the income year.

23 Section 12ZLA

Repeal the section.

24 Subsection 12ZLC(1) (formula)

Repeal the formula, substitute:

25 Subsection 12ZLC(1) (definition of applicable percentage of repayment income)

Repeal the definition.

26 Subsection 12ZLC(1)

Insert:

applicable repayable amount means the amount that is the least of the following:

(a) the amount worked out under subsection 154‑20(2) of the Higher Education Support Act 2003 for the income year, as if:

(i) references in that subsection to the person’s repayment income were references to the person’s repayment income within the meaning of this Act; and

(ii) references in that subsection to the person’s minimum repayment income were references to the person’s minimum repayment income within the meaning of this Act;

(b) the amount equal to 10% of the person’s repayment income for the income year;

(c) the amount of the person’s repayable debt for the income year.

27 Subsection 12ZLC(2)

Repeal the subsection.

Taxation Administration Act 1953

28 Paragraphs 15‑30(ca) to (db) in Schedule 1

Repeal the paragraphs, substitute:

(c) the methods for working out, for any financial year starting on or after 1 July 2025, the following:

(i) the amounts referred to in paragraphs (a) and (b) of the definition of applicable repayable amount for the purposes of subsection 46(1) (about repayments of accumulated AASL debt) of the Australian Apprenticeship Support Loans Act 2014;

(ii) the amounts referred to in paragraphs 154‑20(1)(a) and (b) (about repayments of accumulated HELP debt) of the Higher Education Support Act 2003;

(iii) the amounts referred to in paragraphs (a) and (b) of the definition of applicable repayable amount for the purposes of subsection 1061ZVHA(1) (about repayments of accumulated SSL debt) of the Social Security Act 1991;

(iv) the amounts referred to in paragraphs (a) and (b) of the definition of applicable repayable amount for the purposes of subsection 1061ZZFD(1) (about repayments of accumulated FS debts) of the Social Security Act 1991;

(v) the amounts referred to in paragraphs (a) and (b) of the definition of applicable repayable amount for the purposes of subsection 10F(1) (about repayments of accumulated ABSTUDY SSL debt) of the Student Assistance Act 1973;

(vi) the amounts referred to in paragraphs (a) and (b) of the definition of applicable repayable amount for the purposes of subsection 12ZLC(1) (about repayments of accumulated FS debts) of the Student Assistance Act 1973;

(vii) the amounts referred to in paragraphs (a) and (b) of the definition of applicable repayable amount for the purposes of subsection 23EA(1) (about repayments of accumulated VETSL debts) of the VET Student Loans Act 2016;

VET Student Loans Act 2016

29 Subsection 23EA(1)

Omit “so much of the person’s repayable VETSL debt for the income year as does not exceed the amount worked out using the formula”, substitute “the amount worked out using the following formula in reduction of the person’s repayable VETSL debt”.

30 Subsection 23EA(1) (formula)

Repeal the formula, substitute:

31 Subsection 23EA(1) (definition of applicable percentage of repayment income)

Repeal the definition.

32 Subsection 23EA(1)

Insert:

applicable repayable amount means the amount that is the least of the following:

(a) the amount worked out under subsection 154‑20(2) of the Higher Education Support Act 2003 for the income year, as if:

(i) references in that subsection to the person’s repayment income were references to the person’s repayment income within the meaning of this Act; and

(ii) references in that subsection to the person’s minimum repayment income were references to the person’s minimum repayment income within the meaning of this Act;

(b) the amount equal to 10% of the person’s repayment income for the income year;

(c) the amount of the person’s repayable VETSL debt for the income year.

Part 2—Application and transitional provisions

33 Application of amendments of the Higher Education Support Act 2003

(1) Sections 154‑10 and 154‑20 of the Higher Education Support Act 2003, as substituted by this Schedule, apply in relation to the 2025‑26 income year and later income years.

(2) Section 154‑25 of the Higher Education Support Act 2003, as substituted by this Schedule, applies in relation to the 2026‑27 income year and later income years.

34 Transitional—indexation

Despite anything in subsection 154‑25(1) of the Higher Education Support Act 2003 (as in force immediately before the commencement of this item), the minimum repayment income is not to be indexed for the 2025‑26 income year.

35 Application of amendments of other Acts

The amendments of the following Acts made by this Schedule apply in relation to the 2025‑26 income year and later income years:

(a) the Australian Apprenticeship Support Loans Act 2014;

(b) the Social Security Act 1991;

(c) the Student Assistance Act 1973;

(d) the Taxation Administration Act 1953;

(e) the VET Student Loans Act 2016.