Treasury Laws Amendment (2019 Tax Integrity and Other Measures No. 1) Act 2019

No. 95, 2019

An Act to amend the law relating to taxation, and for other purposes

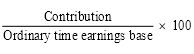

Treasury Laws Amendment (2019 Tax Integrity and Other Measures No. 1) Act 2019

No. 95, 2019

An Act to amend the law relating to taxation, and for other purposes

Contents

1 Short title

2 Commencement

3 Schedules

Schedule 1—Tax treatment of concessional loans involving tax exempt entities

Income Tax Assessment Act 1936

Schedule 2—Enhancing the integrity of the small business CGT concessions in relation to partnerships

Income Tax Assessment Act 1997

Schedule 3—Limiting deductions for vacant land

Income Tax Assessment Act 1997

Schedule 4—Extending anti‑avoidance rules for circular trust distributions

Income Tax Assessment Act 1936

Taxation Administration Act 1953

Schedule 5—Disclosure of business tax debts

Income Tax Assessment Act 1997

Taxation Administration Act 1953

Schedule 6—Electronic invoicing

Taxation Administration Act 1953

Schedule 7—Salary sacrifice integrity

Superannuation Guarantee (Administration) Act 1992

Treasury Laws Amendment (2019 Tax Integrity and Other Measures No. 1) Act 2019

No. 95, 2019

An Act to amend the law relating to taxation, and for other purposes

[Assented to 28 October 2019]

The Parliament of Australia enacts:

This Act is the Treasury Laws Amendment (2019 Tax Integrity and Other Measures No. 1) Act 2019.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provisions | Commencement | Date/Details |

1. Sections 1 to 3 and anything in this Act not elsewhere covered by this table | The day this Act receives the Royal Assent. | 28 October 2019 |

2. Schedules 1 to 4 | The first 1 January, 1 April, 1 July or 1 October to occur after the day this Act receives the Royal Assent. | 1 January 2020 |

3. Schedules 5 to 7 | The day after this Act receives the Royal Assent. | 29 October 2019 |

Note: This table relates only to the provisions of this Act as originally enacted. It will not be amended to deal with any later amendments of this Act.

(2) Any information in column 3 of the table is not part of this Act. Information may be inserted in this column, or information in it may be edited, in any published version of this Act.

Legislation that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 At the end of subsection 57‑25(3) in Schedule 2D

Add:

Note: If the asset is, or is part of, a Division 230 financial arrangement, section 57‑32 may affect how the market value of the asset is worked out.

2 At the end of subsection 57‑30(2) in Schedule 2D

Add:

Note: If the liability is, or is part of, a Division 230 financial arrangement, section 57‑32 may affect how the market value of the corresponding right or other asset is worked out.

3 After section 57‑30 in Schedule 2D

Insert:

(1) This section applies in relation to an asset (the subject asset) held by an entity (the holder) if:

(a) the subject asset is:

(i) covered by subsection 57‑25(1); or

(ii) a right, or other asset, corresponding to a liability covered by subsection 57‑30(1); and

(b) the subject asset, or the corresponding liability for the subject asset, is or is part of a Division 230 financial arrangement at the transition time; and

(c) when the arrangement was entered into:

(i) the parties to the arrangement were not dealing at arm’s length (within the meaning of the Income Tax Assessment Act 1997) in relation to the subject asset; or

(ii) if the subject asset gives rise to an interest that is not an equity interest in an entity—the return on the interest would reasonably be expected to be less than the benchmark rate of return (within the meaning of that Act) for the interest.

(2) For the purposes mentioned in subsection (3), assume at the transition time that the market value of the subject asset is the total amount (the initial amount) of the financial benefits (within the meaning of the Income Tax Assessment Act 1997) that the holder provided in relation to the subject asset before the transition time:

(a) reduced by:

(i) repayments of principal made in relation to the subject asset before the transition time; and

(ii) the amount of any impairment (within the meaning of the accounting principles (within the meaning of that Act)) of the subject asset at the transition time; and

(b) increased by the amount of the cumulative amortisation (worked out using the effective interest method recognised by the accounting principles (within the meaning of that Act)) of any difference at the transition time between:

(i) the initial amount; and

(ii) the amount payable on the maturity of the subject asset.

(3) Subsection (2) has effect for the purposes of working out the subject asset’s adjusted market value under section 57‑25 or 57‑30 for use when applying Division 230 of the Income Tax Assessment Act 1997 to the subject asset or the corresponding liability for the subject asset.

(1) This section applies in relation to the following:

(a) an asset covered by subsection 57‑25(1) to which section 57‑32 applies;

(b) the corresponding liability for a right, or other asset, covered by subsection 57‑30(1) to which section 57‑32 applies.

Note: Section 57‑32 applies if the asset or liability is or is part of a Division 230 financial arrangement.

(2) For the purposes of section 230‑60 of the Income Tax Assessment Act 1997, assume the following:

(a) in the case of an asset—that the transition taxpayer acquired the asset at the transition time in return for the transition taxpayer starting to have an obligation to provide one or more financial benefits in relation to the Division 230 financial arrangement;

(b) in the case of a liability—that the transition taxpayer started to have the liability at the transition time in return for the transition taxpayer starting to have a right to receive one or more financial benefits under the Division 230 financial arrangement.

4 At the end of Division 57 in Schedule 2D

Add:

(1) This section applies if:

(a) section 57‑32 was applied to work out the market value of an asset (the subject asset); and

(b) the transition taxpayer is a party to the Division 230 financial arrangement (the financial arrangement) to which the subject asset, or the corresponding liability for the subject asset, is or is part of; and

(c) a balancing adjustment is made under Subdivision 230‑G of the Income Tax Assessment Act 1997, after the transition time, in relation to the financial arrangement.

(2) For the purposes of making the balancing adjustment under Subdivision 230‑G of the Income Tax Assessment Act 1997 in relation to the financial arrangement, adjust the amount worked out using the method statement (the method statement) in subsection 230‑445(1) of that Act by:

(a) if the transition taxpayer is the holder of the subject asset—increasing any gain or reducing any loss by the amount worked out under subsection (4) of this section; or

(b) if the transition taxpayer is the holder of the corresponding liability for the subject asset—reducing any gain or increasing any loss by the amount worked out under subsection (4) of this section.

(3) Despite subsection (2):

(a) if the amount worked out under subsection (4) exceeds the amount of the loss to be reduced under paragraph (2)(a)—the transition taxpayer is taken, for the purposes of making the balancing adjustment, to have made a gain equal to the amount of the excess; or

(b) if the amount worked out under subsection (4) exceeds the amount of the gain to be reduced under paragraph (2)(b)—the transition taxpayer is taken, for the purposes of making the balancing adjustment, to have made a loss equal to the amount of the excess; or

(c) if when applying the method statement no balancing adjustment is made in relation to the financial arrangement—the transition taxpayer is taken, for the purposes of making the balancing adjustment, to have:

(i) if the transition taxpayer is the holder of the subject asset—made a gain equal to the amount worked out under subsection (4); or

(ii) if the transition taxpayer is the holder of the corresponding liability for the subject asset—made a loss equal to the amount worked out under subsection (4).

(4) For the purposes of subsections (2) and (3), the amount is the difference between:

(a) the amount that the transition taxpayer would need to receive or pay under the financial arrangement without an amount being assessable income of, or deductible to, the transition taxpayer if the subject asset, or the corresponding liability for the subject asset, were disposed of at the time the balancing adjustment is made; and

(b) the amount that the transition taxpayer would need to receive or pay under the financial arrangement without an amount being assessable income of, or deductible to, the transition taxpayer if:

(i) the subject asset, or the corresponding liability for the subject asset, were disposed of at the time the balancing adjustment is made; and

(ii) the assumptions in subsection (5) were made.

(5) The assumptions referred to in subparagraph (4)(b)(ii) are that, when the financial arrangement was entered into:

(a) the parties to the arrangement were dealing with each other at arm’s length (within the meaning of the Income Tax Assessment Act 1997) in relation to the arrangement; and

(b) if the arrangement gives rise to an interest that is not an equity interest in an entity—the return on the interest would reasonably be expected to be equal to the benchmark rate of return (within the meaning of the Income Tax Assessment Act 1997) for the interest.

(6) This section applies despite section 230‑510 of the Income Tax Assessment Act 1997.

5 Application of amendments

The amendments made by this Schedule apply if the transition time is at or after 7.30 pm, by legal time in the Australian Capital Territory, on 8 May 2018.

1 Section 152‑5

Omit:

Additional basic conditions must be satisfied if the CGT asset is a share in a company or an interest in a trust.

substitute:

Additional basic conditions must be satisfied in the following circumstances:

(a) the CGT asset is a share in a company or an interest in a trust;

(b) the CGT event involves certain rights or interests in relation to the income or capital of a partnership.

2 After subsection 152‑10(2B)

Insert:

Additional basic condition for CGT events involving certain rights or interests in relation to the income or capital of a partnership

(2C) If the *CGT event involves the creation, transfer, variation or cessation of a right or interest that would entitle an entity to:

(a) an amount of the income or capital of a partnership; or

(b) an amount calculated by reference to a partner’s entitlement to an amount of income or capital of a partnership;

it is an additional basic condition that the right or interest is a *membership interest of the entity in the partnership:

(c) immediately after the CGT event happens; or

(d) if the CGT event involved the cessation of the right or interest—immediately before the CGT event happens.

3 Application

The amendments made by this Schedule apply in relation to CGT events happening after 7.30 pm, by legal time in the Australian Capital Territory, on 8 May 2018.

1 Section 12‑5 (before table item headed “land degradation”)

Insert:

land |

|

land degradation, see primary production |

|

vacant land, limit on deduction.................. | 26‑102 |

2 Section 12‑5 (table item headed “land degradation”)

Repeal the item.

3 After section 26‑100

Insert:

Limit on deduction

(1) If:

(a) at a particular time, you incur a loss or outgoing relating to holding land (including interest or any other ongoing costs of borrowing to acquire the land); and

(b) at the earlier of the following (the critical time):

(i) that time;

(ii) if you have ceased to hold the land—the time just before you ceased to hold the land;

there is no substantial and permanent structure in use or available for use on the land having a purpose that is independent of, and not incidental to, the purpose of any other structure or proposed structure;

you can only deduct under this Act the loss or outgoing to the extent that the land is in use, or available for use, in carrying on a business covered by subsection (2) at the time applying under subsection (3).

Note 1: The ordinary meaning of structure includes a building and anything else built or constructed.

Note 2: The land need not be all of the land under a land title.

(2) A *business is covered by this subsection if the business is carried on for the purpose of gaining or producing the assessable income of one or more of the following entities:

(a) you;

(b) your *affiliate, or an entity of which you are an affiliate;

(c) if you are an individual—your *spouse, or any of your *children who is under 18 years of age;

(d) an entity *connected with you.

(3) The time applying under this subsection is the critical time unless:

(a) the business referred to in subsection (1) ceases before the critical time; and

(b) the loss or outgoing is otherwise deductible because of the use or availability for use of the land at an earlier time or during an earlier period; and

(c) at that earlier time or during that earlier period the land was in use or available for use in carrying on that business;

in which case the time applying under this subsection is that earlier time or the end of that earlier period.

Disregard certain residential premises if not rented etc.

(4) For the purposes of paragraph (1)(b), treat a building as not being a substantial and permanent structure if it is *residential premises constructed, or *substantially renovated, while you hold the land unless:

(a) the residential premises are lawfully able to be occupied; and

(b) the residential premises are:

(i) leased, hired or licensed; or

(ii) available for lease, hire or licence.

Note: If all of the structures on the land are disregarded under this subsection, then subsection (1) may deny you a deduction for a loss or outgoing relating to the land.

Exception—kind of entity

(5) Subsection (1) does not stop you deducting a loss or outgoing if, at any time during the income year in which the loss or outgoing is incurred, you are:

(a) a *corporate tax entity; or

(b) a *superannuation plan that is not a *self managed superannuation fund; or

(c) a *managed investment trust; or

(d) a public unit trust (within the meaning of section 102P of the Income Tax Assessment Act 1936); or

(e) a unit trust or partnership, if each *member of the trust or partnership is covered by a paragraph of this subsection at that time during the income year.

Exception—structures affected by natural disasters or other exceptional circumstances

(6) Subsection (1) does not stop you deducting a loss or outgoing relating to holding land if:

(a) had an earlier time been the critical time (see paragraph (1)(b)), paragraph (1)(b) would not have applied to you for the land because of the existence at that earlier time of a substantial and permanent structure on the land; and

(b) after that earlier time, paragraph (1)(b):

(i) began to apply to you for the land wholly or mainly because of a circumstance affecting that structure; and

(ii) continued to do so at the critical time; and

(c) the circumstance was exceptional and beyond the reasonable control of you, and of all the entities referred to in paragraphs (2)(b), (c) and (d); and

(d) the critical time happened before:

(i) the third anniversary of the time paragraph (1)(b) began to apply to you for the land as described in subparagraph (b)(i) of this subsection; or

(ii) such later time as the Commissioner allows.

(7) If subsection (6) applies to you and you deduct the loss or outgoing, you must keep written records of:

(a) the circumstance; and

(b) the circumstance’s effect on the affected structure;

until the fifth anniversary of the end of the income year in which you incurred the loss or outgoing.

Note: There is an administrative penalty if you fail to keep these records (see section 288‑25 in Schedule 1 to the Taxation Administration Act 1953).

Exception—land held by primary producers

(8) Subsection (1) does not stop you deducting a loss or outgoing relating to holding land if, at the critical time (see paragraph (1)(b)):

(a) the land is under lease, hire or licence to another entity; and

(b) you are, or an entity referred to in paragraph (2)(b), (c) or (d) is, carrying on a *primary production business; and

(c) the land does not contain *residential premises; and

(d) residential premises are not being constructed on the land.

Exception—land in use or available for use in carrying on a business

(9) Subsection (1) does not stop you deducting a loss or outgoing relating to holding land if, at the critical time (see paragraph (1)(b)):

(a) the land is under lease, hire or licence to another entity as a result of a dealing at *arm’s length; and

(b) the land is in use, or available for use, in carrying on a *business; and

(c) the land does not contain *residential premises; and

(d) residential premises are not being constructed on the land.

4 Application of amendments

The amendments made by this Schedule apply in relation to losses or outgoings incurred on or after 1 July 2019 (whether the applicable land is acquired before, on or after 1 July 2019).

1 Subsection 102UC(4) (paragraph (b) of the definition of excluded trust)

Omit “Limited; or”, substitute “Limited.”.

2 Subsection 102UC(4) (paragraphs (c), (d) and (e) of the definition of excluded trust)

Repeal the paragraphs.

3 After paragraph 102UK(1)(c)

Insert:

(ca) the closely held trust is none of the following:

(i) a family trust (within the meaning of section 272‑75 in Schedule 2F);

(ii) a trust in relation to which an interposed entity election has been made and is in force in accordance with section 272‑85 in Schedule 2F;

(iii) a trust covered by subsection 272‑90(5) in Schedule 2F; and

4 After paragraph 102UT(1)(b)

Insert:

and (c) the closely held trust is none of the following:

(i) a family trust (within the meaning of section 272‑75 in Schedule 2F);

(ii) a trust in relation to which an interposed entity election has been made and is in force in accordance with section 272‑85 in Schedule 2F;

(iii) a trust covered by subsection 272‑90(5) in Schedule 2F;

5 Subparagraph 12‑175(1)(c)(ii) in Schedule 1

Omit “, disregarding paragraphs (c), (d) and (e) of the definition of excluded trust in subsection (4) of that section”.

6 Application of amendments

The amendments made by this Schedule apply in relation to years of income starting on or after 1 July 2019.

1 Subsection 995‑1(1)

Insert:

credit reporting bureau has the meaning given by subsection 355‑72(7) in Schedule 1 to the Taxation Administration Act 1953.

2 After section 355‑70 in Schedule 1

Insert:

Exception—entities in declared class of entities

(1) Section 355‑25 does not apply if:

(a) the entity is a *taxation officer; and

(b) the record is made for, or the disclosure is to, a *credit reporting bureau; and

(c) the record or disclosure is of information that relates to the *tax debts of an entity (the primary entity) that is included in a class of entities declared under subsection (5) of this section; and

(d) the record or disclosure is for the purpose of enabling the credit reporting bureau to prepare, issue, update, correct or confirm credit worthiness reports in relation to the primary entity; and

(e) in the case of a disclosure of information other than for the purposes of updating, correcting or confirming information previously disclosed under this exception—both:

(i) the Inspector‑General of Taxation has been consulted on the disclosure; and

(ii) 28 days have passed after a notice under subsection (2) of this section was given to the primary entity for the disclosure.

Note: A defendant bears an evidential burden in relation to the matters in this subsection: see subsection 13.3(3) of the Criminal Code.

Notice of disclosure

(2) The Commissioner must notify a primary entity if:

(a) information that relates to the primary entity is to be disclosed to a *credit reporting bureau under this section; and

(b) the information is not information that updates, corrects or confirms the information previously disclosed under the exception in subsection (1).

(3) The notice must:

(a) be in writing; and

(b) explain the type of information that is to be disclosed to the *credit reporting bureau; and

(ba) explain:

(i) why the primary entity is included in a class of entities declared under subsection (5); and

(ii) the steps (if any) the primary entity may take to no longer be included in that class before the disclosure occurs; and

(c) set out the amount of any *tax debts payable by the primary entity at the time the notice is given by the Commissioner; and

(d) explain how the primary entity may make a complaint in relation to the proposed disclosure of the entity’s information; and

(e) be served on the primary entity.

Exception—entities no longer in declared class of entities

(4) Section 355‑25 does not apply if:

(a) the entity is a *taxation officer; and

(b) the record is made for, or the disclosure is to, a *credit reporting bureau; and

(c) the record or disclosure is of information that relates to the *tax debts of an entity that:

(i) has had information previously disclosed under the exception in subsection (1) of this section; and

(ii) is no longer an entity that is included in a class of entities declared under subsection (5) of this section; and

(d) the record or disclosure is of information that relates to why the entity to which the information relates is no longer included in a class of entities declared under subsection (5) of this section; and

(e) the record or disclosure is for the purpose of enabling the credit reporting bureau to update or correct credit worthiness reports in relation to the entity to which the information relates.

Note: A defendant bears an evidential burden in relation to the matters in this subsection: see subsection 13.3(3) of the Criminal Code.

Class of entities

(5) The Minister may, by legislative instrument, declare one or more classes of entities for the purposes of this section.

(5A) Before making an instrument under subsection (5), the Minister must:

(a) consult the Inspector‑General of Taxation; and

(b) consider any submissions made by the Inspector‑General of Taxation because of that consultation.

(6) Before making an instrument under subsection (5), the Minister must:

(a) consult the Information Commissioner in relation to matters that relate to the privacy functions (within the meaning of the Australian Information Commissioner Act 2010) and would be affected by the proposed instrument; and

(b) consider any submissions made by the Information Commissioner because of that consultation.

Credit reporting bureau

(7) An entity is a credit reporting bureau if the entity is recognised by the Commissioner as an entity that prepares and issues credit worthiness reports in relation to other entities.

(8) The Commissioner must keep and publish a list of credit reporting bureaus on the Australian Taxation Office website.

(9) The list of credit reporting bureaus is not a legislative instrument.

3 At the end of Subdivision 355‑C in Schedule 1

Add:

Section 355‑155 does not apply if:

(a) the information was originally disclosed under the exception in subsection 355‑72(1) or (4); and

(b) the information was acquired by the entity under that exception or the exception in section 355‑175; and

(c) when making the record, or disclosing the information, the entity is not:

(i) a *credit reporting bureau; or

(ii) an entity appointed or employed by, or otherwise performing services for, a credit reporting bureau.

Note: A defendant bears an evidential burden in relation to the matters in this section: see subsection 13.3(3) of the Criminal Code.

4 Application of amendments

The amendments made by this Schedule apply in relation to records and disclosures of information made on or after the commencement of this Schedule, regardless of when the information was acquired.

1 Title

Omit “purposes connected therewith”, substitute “other purposes”.

2 At the end of Part IA

Add:

(1) The Commissioner’s functions include the function of developing and/or administering a framework or system for electronic invoicing.

(2) Without limiting subsection (1), the Commissioner may develop the framework or system by adopting (with appropriate modifications) a framework or system for electronic invoicing operating outside Australia.

(3) The Commissioner has power to do all things that are necessary or convenient to be done for or in connection with the performance of the Commissioner’s functions under this section.

(4) Without limiting subsection (3), the Commissioner’s powers under that subsection include:

(a) entering into agreements for integrating the framework or system for electronic invoicing mentioned in subsection (1) with frameworks or systems for electronic invoicing that operate outside Australia; and

(b) entering into agreements for accessing the framework or system for electronic invoicing mentioned in subsection (1); and

(c) liaising with:

(i) foreign countries; and

(ii) agencies, and other entities, of foreign countries;

to develop common approaches to electronic invoices between countries.

(5) This section does not limit any functions or powers the Commissioner has apart from this section.

1 Subsection 6(1)

Insert:

quarterly salary or wages base, for an employer in respect of an employee, for a quarter has the meaning given by subsection 19(1).

sacrificed contribution means a contribution to a complying superannuation fund or an RSA made under a salary sacrifice arrangement.

sacrificed ordinary time earnings amount has the meaning given by subsection 15A(2).

sacrificed salary or wages amount has the meaning given by subsection 15A(2).

salary sacrifice arrangement has the meaning given by subsection 15A(1).

2 At the end of Part 2

Add:

Salary sacrifice arrangement

(1) An arrangement under which a contribution is, or is to be, made to a complying superannuation fund or an RSA by an employer for the benefit of an employee is a salary sacrifice arrangement if the employee agreed:

(a) for the contribution to be made; and

(b) in return, for either or both of the following amounts to be reduced (including to nil):

(i) the ordinary time earnings of the employee;

(ii) the salary or wages of the employee.

Sacrificed amounts

(2) If an amount mentioned in subparagraph (1)(b)(i) or (ii) is reduced under a salary sacrifice arrangement, the amount of that reduction is:

(a) if ordinary time earnings for a quarter are reduced—a sacrificed ordinary time earnings amount of the employee for the quarter in respect of the employer; and

(b) if salary or wages for a quarter are reduced—a sacrificed salary or wages amount of the employee for the quarter in respect of the employer.

Excluded salary or wages

(3) In working out the amount of a reduction for the purposes of subsection (2), disregard any amounts that, had they been paid to the employee (instead of being reduced), would have been excluded salary or wages.

(4) For the purposes of this section, excluded salary or wages are salary or wages that, under section 27 or 28, are not to be taken into account for the purpose of making a calculation under section 19.

3 Subsection 19(1) (formula)

Repeal the formula, substitute:

4 At the end of subsection 19(1)

Add:

quarterly salary or wages base, for an employer in respect of an employee, for a quarter means the sum of:

(a) the total salary or wages paid by the employer to the employee for the quarter; and

(b) any sacrificed salary or wages amounts of the employee for the quarter in respect of the employer.

5 Subsection 19(3)

Repeal the subsection, substitute:

(3) For the purposes of the definition of quarterly salary or wages base in subsection (1), disregard an amount in a quarter if:

(a) the amount would be covered by paragraph (a) of that definition for the quarter (about amounts paid to the employee); but

(b) the amount is taken into account under paragraph (b) of that definition (about sacrificed salary or wages amounts) for any quarter.

Note: This prevents double counting if a sacrificed salary or wages amount is later paid as salary or wages, instead of being contributed to superannuation.

(4) If the quarterly salary or wages base, for an employer in respect of an employee, for a quarter exceeds the maximum contribution base for the quarter, the employer’s quarterly salary or wages base to be taken into account for the purposes of the application of subsection (1) in relation to the quarter is the amount equal to the maximum contribution base.

6 Subsection 23(2)

Omit “contributes”, substitute “makes a contribution (other than a sacrificed contribution)”.

7 Subsection 23(2) (formula)

Repeal the formula, substitute:

8 Subsection 23(2) (definition of ordinary time earnings)

Repeal the definition (including the example).

9 Subsection 23(2)

Insert:

ordinary time earnings base is the number of dollars in the sum of:

(a) the ordinary time earnings of the employee for the quarter in respect of the employer; and

(b) any sacrificed ordinary time earnings amounts, of the employee for the quarter in respect of the employer.

10 After subsection 23(7)

Insert:

Sacrificed ordinary time earnings amounts taken into account in a quarter not to be taken into account for any other quarter

(7A) For the purposes of the definition of ordinary time earnings base in subsection (2), disregard an amount in a quarter if:

(a) the amount would be covered by paragraph (a) of that definition for the quarter (about ordinary time earnings of the employee); but

(b) the amount is taken into account under paragraph (b) of that definition (about sacrificed ordinary time earnings amounts) for any quarter.

Note: This prevents double counting if a sacrificed ordinary time earnings amount is later paid as ordinary time earnings, instead of being contributed to superannuation.

11 Subsection 23(12) (heading)

Repeal the heading, substitute:

Reduction of ordinary time earnings base if amount excluded from employee’s salary or wages

12 Subsection 23(12)

After “ordinary time earnings”, insert “base”.

13 Subsection 23(12)

Omit “are”, substitute “is”.

14 Subsection 23A(1)

After “A contribution”, insert “(other than a sacrificed contribution)”.

15 Section 23B

Before “For”, insert “(1)”.

16 Section 23B

Omit “sections 23 and 23A”, substitute “a provision covered by subsection (2)”.

17 At the end of section 23B

Add:

(2) The provisions are as follows:

(a) section 15A (which deals with salary sacrifice arrangements);

(b) section 23 (which deals with reduction of charge percentage);

(c) section 23A (which deals with offsetting late payments against an employer’s liability to pay superannuation guarantee charge).

18 Application

The amendments made by this Schedule apply in relation to working out an employer’s superannuation guarantee shortfall for quarters beginning on or after 1 January 2020.

[Minister’s second reading speech made in—

House of Representatives on 24 July 2019

Senate on 1 August 2019]

(129/19)