An Act about fuel tax and fuel tax credits, and for related purposes

Chapter 1—Introduction

Part 1‑1—Preliminary

Division 1—Preliminary

Table of Subdivisions

1‑A Preliminary

Subdivision 1‑A—Preliminary

Table of Sections

1‑5 Short title

1‑10 Commencement

1‑15 States and Territories are bound by the fuel tax law

1‑5 Short title

This Act may be cited as the Fuel Tax Act 2006.

1‑10 Commencement

This Act commences on 1 July 2006.

1‑15 States and Territories are bound by the fuel tax law

The *fuel tax law binds the Crown in right of each of the States, of the Australian Capital Territory and of the Northern Territory. However, it does not make the Crown liable to be prosecuted for an offence.

Note: For the application of this Act to the Commonwealth, see section 95‑10.

Part 1‑2—Using this Act

Division 2—Overview and purpose of the fuel tax law

Table of Subdivisions

2‑A Overview and purpose of the fuel tax law

Subdivision 2‑A—Overview and purpose of the fuel tax law

Table of Sections

2‑1 Overview and purpose of the fuel tax law

2‑1 Overview and purpose of the fuel tax law

This Act provides a single system of fuel tax credits. Fuel tax credits are paid to reduce the incidence of fuel tax levied on taxable fuels, ensuring that, generally, fuel tax is effectively only applied to:

(a) fuel used in private vehicles and for certain other private purposes; and

(b) fuel used on‑road in light vehicles for business purposes.

For fuel that is not *covered by the Opt‑in Scheme, the fuel tax credit entitlement is (with some exceptions) reduced by an amount equivalent to what the carbon price on the fuel emissions would be (if those emissions were subject to a carbon price). For fuel that is covered by that Scheme, the entitlement is not so reduced.

Fuel tax credits are also provided for fuel for use in aircraft if the fuel is covered by the Opt‑in Scheme. The amount of the credit is limited to the carbon component rate that was factored into the rate of fuel tax.

Fuel tax credits are also provided for gaseous fuel that is subject to the carbon pricing mechanism if the fuel is for use in agriculture, fishing operations or forestry. The amount of the credit is the amount of the carbon charge that is embedded in the price of the fuel.

Liability for fuel tax currently arises under the Excise Act 1901, the Excise Tariff Act 1921, the Customs Act 1901 and the Customs Tariff Act 1995.

The administrative aspects of this Act (such as your rights, obligations and payment arrangements) are aligned as closely as possible to the administrative aspects of other indirect taxes (primarily, the GST), and other taxes administered by the Commissioner, to reduce your compliance costs.

Division 3—Explanation of the use of defined terms

Table of Subdivisions

3‑A Explanation of the use of defined terms

Subdivision 3‑A—Explanation of the use of defined terms

Table of Sections

3‑1 When defined terms are identified

3‑5 When terms are not identified

3‑10 Identifying the defined term in a definition

3‑1 When defined terms are identified

(1) Many of the terms used in the *fuel tax law are defined.

(2) Most defined terms in this Act are identified by an asterisk appearing at the start of the term: as in “*enterprise”. The footnote that goes with the asterisk contains a signpost to the Dictionary definitions at section 110‑5.

3‑5 When terms are not identified

(1) Once a defined term has been identified by an asterisk, later occurrences of the term in the same subsection are not usually asterisked.

(2) Terms are not asterisked in the non‑operative material contained in this Act.

Note: The non‑operative material is described in Division 4.

(3) The following basic terms used throughout the Act are not identified with an asterisk.

Common definitions that are not asterisked |

Item | This term: |

1 | Australia |

2 | Commissioner |

3 | entity |

4 | fuel tax |

5 | fuel tax credit |

6 | taxable fuel |

7 | you |

3‑10 Identifying the defined term in a definition

Within a definition, the defined term is identified by bold italics.

Division 4—Status of Guides and other non‑operative material

Table of Subdivisions

4‑A Status of Guides and other non‑operative material

Subdivision 4‑A—Status of Guides and other non‑operative material

Table of Sections

4‑1 Non‑operative material

4‑5 Guides

4‑10 Other material

4‑1 Non‑operative material

In addition to the operative provisions themselves, this Act contains other material to help you identify accurately and quickly the provisions that are relevant to you and to help you understand them.

This other material falls into 2 main categories.

4‑5 Guides

The first is the “Guides”. A *Guide consists of sections under a heading indicating that what follows is a Guide to a particular Subdivision, Division etc.

*Guides form part of this Act but are kept separate from the operative provisions. In interpreting an operative provision, a Guide may only be considered for limited purposes. These are set out in section 105‑10.

4‑10 Other material

The other category consists of material such as notes and examples. These also form part of the Act. Generally, they are distinguished by type size from the operative provisions, but are not kept separate from them.

Chapter 3—Fuel tax credits

Part 3‑1—Basic rules

Division 40—Object of this Chapter

Table of Subdivisions

40‑A Object of this Chapter

Subdivision 40‑A—Object of this Chapter

Table of Sections

40‑5 Object of this Chapter

40‑5 Object of this Chapter

(1) The object of this Chapter is to provide a single system of fuel tax credits to ensure that, generally, fuel tax is effectively only applied to:

(a) fuel used in private vehicles and for certain other private purposes; and

(b) fuel used on‑road in light vehicles for business purposes.

(2) To do this, a fuel tax credit is provided to reduce the incidence of fuel tax applied to:

(a) fuel used in *carrying on your *enterprise (other than fuel used on‑road in light vehicles); and

(b) fuel used for domestic heating and domestic electricity generation; and

(c) fuel packaged for use other than in an internal combustion engine; and

(d) fuel supplied into certain kinds of tanks.

Note: However, other provisions of this Act might affect your entitlement to a fuel tax credit.

(3) For fuel that is not *covered by the Opt‑in Scheme, your fuel tax credit entitlement is (with some exceptions) reduced by an amount equivalent to what the carbon price on the fuel emissions would be (if those emissions were subject to a carbon price). For fuel that is covered by that Scheme, your entitlement is not so reduced.

(4) Fuel tax credits are also provided for fuel for use in aircraft if the fuel is *covered by the Opt‑in Scheme. The amount of the credit is limited to the carbon component rate that was factored into the rate of fuel tax.

Division 41—Fuel tax credits for business taxpayers and non‑profit bodies

Table of Subdivisions

Guide to Division 41

41‑A Entitlement rules for fuel tax credits

41‑B Disentitlement rules for fuel tax credits

Guide to Division 41

41‑1 What this Division is about

Fuel tax credits are provided under Subdivision 41‑A to business taxpayers who are registered, or required to be registered, for GST (and to some non‑profit bodies) in 2 situations.

The first situation is where you acquire, manufacture or import fuel to use in carrying on your enterprise (whether the fuel is used as fuel or otherwise).

The second situation is where you acquire, manufacture or import fuel to:

(a) make a taxable supply to a private user for domestic heating; or

(b) package the fuel for the purpose of making a taxable supply of it for use other than in an internal combustion engine; or

(c) make a taxable supply of LPG into certain kinds of tanks.

However, fuel tax credits are denied under Subdivision 41‑B if:

(a) another person is already entitled to a fuel tax credit in respect of the fuel; or

(b) the fuel is for use on‑road in light vehicles; or

(c) the fuel is for use in vehicles that do not meet certain environmental criteria; or

(d) the fuel is for use in aircraft, and is not covered by the Opt‑in Scheme.

Subdivision 41‑A—Entitlement rules for fuel tax credits

Table of Sections

41‑5 Fuel tax credit for fuel to be used in carrying on your enterprise

41‑10 Fuel tax credit for fuel supplied for domestic heating, packaged for supply or transferred into tanks

41‑5 Fuel tax credit for fuel to be used in carrying on your enterprise

(1) You are entitled to a fuel tax credit for taxable fuel that you acquire or manufacture in, or import into, Australia to the extent that you do so for use in *carrying on your *enterprise.

Note 1: Other provisions can affect your entitlement to the credit. (For example, see Subdivision 41‑B.)

Note 2: Fuel is taken to have been used if it is blended as specified in a determination made under section 95‑5.

Registration for GST

(2) However, you are only entitled to the fuel tax credit if, at the time you acquire, manufacture or import the fuel, you are *registered for GST, or *required to be registered for GST.

(3) Subsection (2) does not apply if, at the time you acquire, manufacture or import the fuel:

(a) you are a non‑profit body; and

(b) you acquire, manufacture or import the fuel for use in a vehicle, vessel or aircraft that:

(i) provides emergency services; and

(ii) is clearly identifiable as such.

41‑10 Fuel tax credit for fuel supplied for domestic heating, packaged for supply or transferred into tanks

Certain fuels supplied for domestic heating

(1) You are entitled to a fuel tax credit for taxable fuel that you acquire or manufacture in, or import into, Australia to the extent that:

(a) you do so to make a *taxable supply of the fuel to an entity; and

(b) the fuel is kerosene, heating oil or any other fuel prescribed by the regulations; and

(c) you have a reasonable belief that the entity:

(i) will not use the fuel in *carrying on an *enterprise; but

(ii) will use the fuel for domestic heating.

Certain fuels packaged for supply

(2) You are entitled to a fuel tax credit for taxable fuel that you acquire or manufacture in, or import into, Australia to the extent that:

(a) you do so to package the fuel, in accordance with the regulations, for the purpose of making a *taxable supply of the fuel for use other than in an internal combustion engine; and

(b) the fuel is kerosene, mineral turpentine, white spirit or any other fuel prescribed by the regulations.

LPG supplied into certain kinds of tanks

(3) You are entitled to a fuel tax credit for taxable fuel that is *LPG that you acquire or manufacture in, or import into, Australia to the extent that:

(a) you do so for making a *taxable supply of the LPG; and

(b) the supply involves transferring the LPG to a tank; and

(c) the tank is not for use in a system for supplying fuel to an internal combustion engine of either a *motor vehicle or a vessel, either directly or by filling another tank connected to such an engine; and

(d) any of the following apply to the tank:

(i) the tank has a capacity of not more than 210 kilograms of LPG;

(ii) the tank is at *residential premises and is not for use in *carrying on an *enterprise;

(iii) the tank is for use in a system for supplying fuel to at least 2 residential premises (whether or not the system also supplies fuel to premises other than residential premises).

(4) Paragraph (3)(c) does not apply to a *motor vehicle that:

(a) is designed merely to move goods with a forklift and is for use primarily off public roads; or

(b) is of a kind prescribed by the regulations for the purposes of this paragraph.

Subdivision 41‑B—Disentitlement rules for fuel tax credits

Table of Sections

41‑15 No fuel tax credit if another entity was previously entitled to a credit

41‑20 No fuel tax credit for fuel to be used in light vehicles on a public road

41‑25 No fuel tax credit for fuel to be used in motor vehicles that do not meet environmental criteria

41‑30 No fuel tax credit for fuel to be used in aircraft, unless the fuel is covered by the Opt‑in Scheme

41‑35 No fuel tax credit under this Division or Division 42 for gaseous fuel that is subject to the carbon pricing mechanism

41‑15 No fuel tax credit if another entity was previously entitled to a credit

(1) You are not entitled to a fuel tax credit (under this Division, Division 42 or Division 42A) for taxable fuel if it is reasonable to conclude that another entity has previously been entitled to a fuel tax credit (under this Division, Division 42 or Division 42A), or a *decreasing fuel tax adjustment, for the fuel.

(2) However, subsection (1) does not apply if it is also reasonable to conclude that another entity had, in respect of the credit, an *increasing fuel tax adjustment of the *amount of the credit.

41‑20 No fuel tax credit for fuel to be used in light vehicles on a public road

You are not entitled to a fuel tax credit for taxable fuel to the extent that you acquire, manufacture or import the fuel for use in a vehicle with a gross vehicle mass of 4.5 tonnes or less travelling on a public road.

41‑25 No fuel tax credit for fuel to be used in motor vehicles that do not meet environmental criteria

(1) You are not entitled to a fuel tax credit for taxable fuel to the extent that you acquire, manufacture or import the fuel for use in a *motor vehicle, unless the vehicle meets one of the following criteria:

(a) it is manufactured on or after 1 January 1996;

(b) it is registered in an audited maintenance program that is accredited by the *Transport Secretary;

(c) it meets Rule 147A of the Australian Vehicle Standards Rules 1999;

(d) it complies with a maintenance schedule that is endorsed by the Transport Secretary.

(2) Subsection (1) does not apply to a *motor vehicle:

(a) that is used:

(i) in carrying on a *primary production business; and

(ii) primarily on an *agricultural property; or

(b) that is not powered by a diesel engine; or

(c) that is not used on a public road.

41‑30 No fuel tax credit for fuel to be used in aircraft, unless the fuel is covered by the Opt‑in Scheme

(1) You are not entitled to a fuel tax credit for taxable fuel that you acquire, manufacture or import for use as fuel in aircraft if the fuel was entered for home consumption for that use (within the meaning of the Excise Act 1901 or the Customs Act 1901, as the case requires).

(2) However, subsection (1) does not apply if the fuel is *covered by the Opt‑in Scheme.

41‑35 No fuel tax credit under this Division or Division 42 for gaseous fuel that is subject to the carbon pricing mechanism

(1) You are not entitled to a fuel tax credit (under this Division or Division 42) for taxable fuel if:

(a) the fuel is compressed natural gas, liquefied petroleum gas or liquefied natural gas; and

(b) the fuel is subject to the carbon pricing mechanism (within the meaning of subsection 42A‑5(3) or (4)).

(2) For the purposes of this section, compressed natural gas, liquefied petroleum gas and liquefied natural gas have the same respective meanings as in the Clean Energy Act 2011.

Division 42—Fuel tax credit for non‑business taxpayers

Table of Subdivisions

Guide to Division 42

42‑A Fuel tax credit for non‑business taxpayers

Guide to Division 42

42‑1 What this Division is about

Fuel tax credits are provided under this Division to non‑business taxpayers. Currently, a credit is only provided for fuel to be used by you for generating electricity for domestic use.

Subdivision 42‑A—Fuel tax credit for non‑business taxpayers

Table of Sections

42‑5 Fuel tax credit for fuel to be used in generating electricity for domestic use

42‑5 Fuel tax credit for fuel to be used in generating electricity for domestic use

You are entitled to a fuel tax credit for taxable fuel that you acquire or manufacture in, or import into, Australia to the extent that you do so for use by you in generating electricity for domestic use.

Note: If you are carrying on an enterprise, you might be entitled to a credit under section 41‑5.

Division 42A—Fuel tax credit for gaseous fuel that is subject to the carbon pricing mechanism

Table of Subdivisions

Guide to Division 42A

42A‑A Fuel tax credit for gaseous fuel that is subject to the carbon pricing mechanism

Guide to Division 42A

42A‑1 What this Division is about

Fuel tax credits are provided under this Division for gaseous fuel that is subject to the carbon pricing mechanism if the fuel is for use in agriculture, fishing operations or forestry.

Subdivision 42A‑A—Fuel tax credit for gaseous fuel that is subject to the carbon pricing mechanism

Table of Sections

42A‑5 Fuel tax credit for gaseous fuel that is subject to the carbon pricing mechanism

42A‑5 Fuel tax credit for gaseous fuel subject to the carbon pricing mechanism

(1) You are entitled to a fuel tax credit for taxable fuel that you acquire or manufacture in, or import into, Australia to the extent that:

(a) the fuel is compressed natural gas, liquefied petroleum gas or liquefied natural gas; and

(b) you acquire, manufacture or import the fuel for use in:

(i) *agriculture; or

(ii) *fishing operations; or

(iii) *forestry; and

(c) the fuel is subject to the carbon pricing mechanism (within the meaning of subsection (3) or (4)); and

(d) you acquire, manufacture or import the fuel for use in *carrying on your *enterprise.

Registration for GST

(2) However, you are only entitled to the fuel tax credit if, at the time you acquire, manufacture or import the fuel, you are *registered for GST, or *required to be registered for GST.

When fuel is subject to the carbon pricing mechanism

(3) Compressed natural gas is subject to the carbon pricing mechanism if:

(a) a person has, under section 33 or 35 of the Clean Energy Act 2011, a preliminary emissions number for an eligible financial year; and

(b) the preliminary emissions number is attributable to the supply of the natural gas that was used to manufacture or produce the compressed natural gas.

(4) Liquefied petroleum gas or liquefied natural gas is subject to the carbon pricing mechanism if:

(a) a person has, under section 36B or 36C of the Clean Energy Act 2011, a preliminary emissions number for an eligible financial year; and

(b) the preliminary emissions number is attributable to the import, manufacture or production of the liquefied petroleum gas or liquefied natural gas.

Definitions

(5) For the purposes of this section, compressed natural gas, liquefied petroleum gas, liquefied natural gas, preliminary emissions number, eligible financial year, natural gas, person and supply have the same respective meanings as in the Clean Energy Act 2011.

Division 43—Working out your fuel tax credit

Table of Subdivisions

Guide to Division 43

43‑A Working out your fuel tax credit

43‑B Definitions of agriculture, fishing operations, forestry and related expressions

Guide to Division 43

43‑1 What this Division is about

The amount of your credit for taxable fuel is the amount of fuel tax that was payable on the fuel:

(a) reduced to take account of certain grants and subsidies that were payable in respect of the fuel (as the grants or subsidies reduced the amount of fuel tax that effectively applied to the fuel); and

(b) for fuel that is not covered by the Opt‑in Scheme—reduced (with some exceptions) to take account of what the carbon price on the fuel emissions would be (if those emissions were subject to a carbon price).

For fuel for use in aircraft that is covered by the Opt‑in Scheme, the amount of the credit is reduced so that it is limited to the carbon component rate that was factored into the rate of fuel tax.

For gaseous fuel that is subject to the carbon pricing mechanism, the amount of the credit is the amount of the carbon charge that is embedded in the price of the fuel.

For taxable fuel that is a blend of fuels, there are additional rules for working out the amount of your credit.

In some cases, the credit is reduced so that some of the fuel tax can be retained to fund cleaner fuel grants and as a road user charge.

Subdivision 43‑A—Working out your fuel tax credit

Table of Sections

43‑5 Working out your fuel tax credit

43‑7 Working out the effective fuel tax for fuel blends

43‑8 Working out amount of carbon reduction

43‑10 Reducing the amount of your fuel tax credit: fuel other than for use in aircraft

43‑11 Reducing the amount of your fuel tax credit: fuel for use in aircraft

43‑5 Working out your fuel tax credit

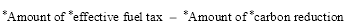

(1) The *amount of your fuel tax credit for taxable fuel (other than a fuel tax credit to which you are entitled under Division 42A) is the amount (but not below nil) worked out using the following formula:

Note: The amount of the credit might be reduced under section 43‑10 or 43‑11.

Amount of effective fuel tax

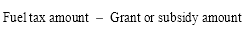

(2) The *amount of effective fuel tax that is payable on the fuel is the amount (but not less than nil) worked out using the formula:

where:

fuel tax amount means the *amount of fuel tax that was or would be payable on the fuel at the rate in force on the day worked out using the table in subsection (2A).

grant or subsidy amount means the *amount of any grant or subsidy, except a grant specified in subsection (3), that was or would be payable in respect of the fuel by the Commonwealth at the rate in force on the day worked out using the table in subsection (2A).

Note: Section 43‑7 affects how this subsection applies to blends.

Day for rate of fuel tax, grant or subsidy

(2A) Work out the day using the table:

Day for rate of fuel tax, grant or subsidy |

| If: | The day is: |

1 | You: (a) acquired or imported the fuel after 30 November 2011 and before 1 July 2015; and (b) are *registered for GST or *required to be registered for GST | The day you acquired or imported the fuel |

2 | You: (a) manufactured the fuel; and (b) entered the fuel for home consumption (within the meaning of the Excise Act 1901) after 30 November 2011 and before 1 July 2015; and (c) are *registered for GST or *required to be registered for GST | The day you entered the fuel for home consumption (within the meaning of the Excise Act 1901) |

3 | You: (a) acquired, manufactured or imported the fuel after 30 June 2015; and (b) are *registered for GST or *required to be registered for GST | The first day of the *tax period to which the credit is attributable |

4 | You are neither *registered for GST nor *required to be registered for GST | The day the Commissioner receives your return relating to the fuel |

Note: Division 65 sets out which tax period a credit is attributable to.

Exclusions from grant or subsidy amount

(3) In applying subsection (2), the following grants are disregarded:

(a) a grant under the Biofuels Capital Grants Program;

(c) a grant for petrol or diesel under the Energy Grants (Cleaner Fuels) Scheme Act 2004;

(d) a benefit under the Product Stewardship (Oil) Act 2000.

Fuel tax credit to which you are entitled under Division 42A

(4) If you are entitled to a fuel tax credit under Division 42A for taxable fuel, the amount of the fuel tax credit is the amount of *carbon reduction that applies to the fuel that you acquired, manufactured or imported.

(5) For the purposes of subsection (4), disregard paragraph 43‑8(4)(b).

43‑7 Working out the effective fuel tax for fuel blends

Certain blends containing ethanol

(1) The effective fuel tax for taxable fuel that:

(a) is a blend of ethanol and one or more other kinds of fuel; and

(b) meets the requirements prescribed by the regulations;

is worked out under subsection 43‑5(2) as if the fuel were entirely petrol.

Certain blends containing biodiesel

(2) The effective fuel tax for taxable fuel that:

(a) is a blend of biodiesel and one or more other kinds of fuel; and

(b) meets the requirements prescribed by the regulations;

is worked out under subsection 43‑5(2) as if the fuel were entirely diesel.

Other blends for which there is evidence of fuel proportions

(3) The effective fuel tax for taxable fuel:

(a) that is a blend of more than one kind of fuel; and

(b) to which neither subsection (1) nor (2) applies; and

(c) for which you have documentary evidence that satisfies the Commissioner of the actual proportions of the kinds of fuel in the blend;

is worked out under subsection 43‑5(2) in accordance with those proportions.

(4) The Commissioner may determine, by legislative instrument, the kinds of documentary evidence that are able to satisfy the Commissioner for the purposes of paragraph (3)(c).

(5) If:

(a) you acquire or manufacture in, or import into, Australia a taxable fuel that is a blend of either of the following (whether or not the blend includes other substances other than fuel):

(i) petrol and one other kind of fuel;

(ii) diesel and one other kind of fuel; and

(b) none of subsections (1), (2) or (3) apply to the fuel; and

(c) you acquire, manufacture or import the fuel on terms and conditions that specify or require that the blend contains a minimum percentage by volume of petrol or diesel (as the case requires);

then the effective fuel tax for the fuel is worked out under subsection 43‑5(2) as if:

(d) the fuel contains that minimum percentage of petrol or diesel (as the case requires); and

(e) the remaining percentage by volume of the fuel consists of the other kind of fuel contained in the blend.

Rules for working out fuel tax in other cases of blends

(6) For the purposes of working out under subsection 43‑5(2) the *effective fuel tax payable on taxable fuels that are blends other than blends to which any of subsections (1), (2), (3) or (5) of this section apply, the Commissioner may determine, by legislative instrument, rules for working out the proportions of one or more of the constituents of the blends.

Note: The rules may make different provision for different blends or different classes of blends (see subsection 33(3A) of the Acts Interpretation Act 1901).

Working out the fuel tax for certain fuels containing ethanol

(7) Work out the *effective fuel tax under subsection 43‑5(2) for taxable fuel:

(a) that you acquired, manufactured or imported; and

(b) that is a blend containing ethanol; and

(c) to which neither subsection (1) nor (2) of this section applies;

as if a grant under a funding agreement with the Commonwealth connected with a program called the Ethanol Production Grants Program was payable for all the ethanol.

Note: As you may not know whether the ethanol contained in the blend is imported or produced domestically, subsection (7) requires you to work out the effective fuel tax assuming that the ethanol was produced domestically and had attracted the payment of a grant.

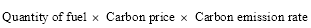

43‑8 Working out amount of carbon reduction

Amount of carbon reduction: general rule

(1) Subject to subsections (3) and (4), the *amount of carbon reduction that applies to a particular quantity of taxable fuel you acquire, manufacture or import is worked out using the following formula:

where:

carbon emission rate means:

(a) if the fuel is gasoline—0.0024; or

(b) if the fuel is LPG—0.0016; or

(c) if the fuel is LNG—0.0029; or

(d) if the fuel is CNG—0.0029; or

(e) if the fuel is denatured ethanol for use in an internal combustion engine—nil; or

(f) if the fuel is biodiesel or renewable diesel—nil; or

(g) for any other taxable fuel (other than a blend of taxable fuels)—0.0027.

Note: If the fuel is a blend, see subsection (3).

carbon price means:

(a) if you acquire, manufacture or import the fuel in the financial year starting on 1 July 2012—2,300 cents; or

(b) if you acquire, manufacture or import the fuel in the financial year starting on 1 July 2013—2,415 cents; or

(c) if you acquire, manufacture or import the fuel in the financial year starting on 1 July 2014—2,540 cents; or

(d) if you acquire, manufacture or import the fuel in the *half‑year starting on 1 July 2015 or a later half‑year—the amount that applies to that half‑year under subsection (2).

quantity of fuel means:

(a) unless paragraph (b) applies—the number of litres of the fuel; or

(b) if the fuel is LNG or CNG—the number of kilograms of the fuel.

(1A) In applying the formula in subsection (1):

(a) first, calculate, to 3 decimal places (rounding up if the fourth decimal place is 5 or more), the product of:

(i) the factor known as carbon price; and

(ii) the factor known as carbon emission rate; and

(b) second, multiply the result of that calculation by the factor known as quantity of fuel.

Carbon price for half‑years starting on or after 1 July 2015

(2) For the purpose of paragraph (d) of the definition of carbon price in subsection (1), the amount that applies to a *half‑year is the amount that:

(a) is the per‑tonne carbon price equivalent worked out under section 196A of the Clean Energy Act 2011 for the 6‑month period ending at the end of:

(i) the last May before the start of the half‑year, if the half‑year starts on 1 July (in 2015 or a later year); or

(ii) the last November before the start of the half‑year, if the half‑year starts on 1 January (in 2016 or a later year); and

(b) is the first per‑tonne carbon price equivalent that is worked out under that section for that 6‑month period and published under that section.

Amount of carbon reduction: blends

(3) If the fuel is a blend of 2 or more kinds of taxable fuel (the constituent fuels), the *amount of carbon reduction that applies to the blend is to be worked out as follows:

(a) work out the quantity of each of the constituent fuels that is included in the blend;

(b) work out the amount of carbon reduction that would apply to each of those quantities of the constituent fuels;

(c) the amount of carbon reduction that applies to the blend is the sum of the amounts worked out under paragraph (b).

Situations in which no carbon reduction applies

(4) The *amount of carbon reduction that applies to the fuel is nil to the extent that:

(a) the fuel is *covered by the Opt‑in Scheme; or

(b) you acquire, manufacture or import the fuel for use in:

(i) *agriculture; or

(ii) *fishing operations; or

(iii) *forestry; or

(c) you acquire, manufacture or import the fuel for use in a vehicle with a gross vehicle mass of more than 4.5 tonnes travelling on a public road; or

(d) you acquire, manufacture or import the fuel for use otherwise than by combustion of the fuel.

43‑10 Reducing the amount of your fuel tax credit: fuel other than for use in aircraft

Fuel to which this section applies

(1A) This section applies to taxable fuel other than fuel that you acquire, manufacture or import for use in aircraft.

Cleaner fuel grants

(1) The *amount of your fuel tax credit for taxable fuel is reduced to the extent, determined by the Minister, that fuel tax is imposed on the fuel to fund a cleaner fuel grant.

(2) For the purposes of subsection (1), the Minister must determine, by legislative instrument, the *amount of the fuel tax imposed that will fund a cleaner fuel grant.

Road user charge

(3) To the extent that you acquire, manufacture or import taxable fuel to use, in a vehicle, for travelling on a public road, the *amount of your fuel tax credit for the fuel is reduced by the amount of the road user charge for the fuel.

Note: Only certain motor vehicles whose gross vehicle mass is more than 4.5 tonnes are entitled to any credit (see sections 41‑20 and 41‑25).

(4) However, the *amount is not reduced under subsection (3) if the vehicle’s travel on a public road is incidental to the vehicle’s main use.

Working out the amount of the reduction

(6) The *amount by which a fuel tax credit for taxable fuel is reduced under subsection (1) or (3) is worked out by reference to the rate of fuel tax or road user charge in force:

(a) if you are *registered for GST, or *required to be registered for GST—at the beginning of the *tax period to which the credit is attributable; and

(b) if you are not registered for GST, nor required to be registered for GST—on the day on which the Commissioner receives your return relating to the fuel.

Note: Division 65 sets out which tax period a credit is attributable to.

Determining the rate of road user charge

(7) The *amount of road user charge for taxable fuel is worked out using the following rate:

(a) if no rate has been determined by the *Transport Minister—21 cents for each litre of the fuel;

(b) otherwise—the rate determined by the Transport Minister.

(8) For the purposes of subsection (7), the *Transport Minister may determine, by legislative instrument, the rate of the road user charge.

(9) Before the *Transport Minister determines an increased rate of road user charge, the Transport Minister must:

(a) make the following publicly available for at least 60 days:

(i) the proposed increased rate of road user charge;

(ii) any information that was relied on in determining the proposed increased rate; and

(b) consider any comments received, within the period specified by the Transport Minister, from the public in relation to the proposed increased rate.

(10) However, the *Transport Minister may, as a result of considering any comments received from the public in accordance with subsection (9), determine a rate of road user charge that is different from the proposed rate that was made publicly available without making that different rate publicly available in accordance with that subsection.

(11) In determining the road user charge, the *Transport Minister must not apply a method for indexing the charge.

(12) The *Transport Minister must not make more than one determination in a financial year if the effect of the determination would be to increase the road user charge more than once in that financial year.

43‑11 Reducing the amount of your fuel tax credit: fuel for use in aircraft

Fuel to which this section applies

(1) This section applies to taxable fuel that you acquire, manufacture or import for use in aircraft if the fuel is *covered by the Opt‑in Scheme.

Reduction so that credits only cover carbon component rate of fuel tax

(2) The *amount of your fuel tax credit for the taxable fuel is reduced by the amount of fuel tax that would have been payable by you on the fuel if the carbon component rate that applied under whichever of sections 6FA and 6FB of the Excise Tariff Act 1921 affected the rate of fuel tax on the fuel had instead been nil.

Note: The reference to sections 6FA and 6FB of the Excise Tariff Act 1921 includes a reference to those sections as they have effect in relation to rates of duties of customs because of section 19A of the Customs Tariff Act 1995.

Subdivision 43‑B—Definitions of agriculture, fishing operations, forestry and related expressions

43‑15 Agriculture

(1) Subject to subsection (2), the expression agriculture means:

(a) the cultivation of the soil; or

(b) the cultivation or gathering in of crops; or

(c) the rearing of *livestock; or

(d) viticulture, *horticulture, pasturage or apiculture;

and includes:

(e) a *livestock activity; and

(f) an *agricultural soil/water activity; and

(g) an *agricultural construction activity; and

(h) an *agricultural waste activity; and

(i) a *sundry agricultural activity.

(2) The expression agriculture does not include:

(a) *fishing operations or *forestry; or

(b) an activity referred to in subsection (1) (other than hunting or trapping that is conducted for the purposes of a business, including the storage of any carcasses or skins obtained from the hunting or trapping) unless the activity is conducted for the purposes of, or for purposes that will directly benefit, a business conducted to obtain produce for sale.

43‑20 Livestock activity and livestock

Livestock activity

(1) The expression livestock activity means:

(a) the shearing or cutting of hair or fleece of *livestock, or the milking of livestock, on an *agricultural property; or

(b) the transporting of livestock to an agricultural property:

(i) for the purpose of rearing; or

(ii) for the purpose of agistment; or

(c) the return journey from a place referred to in paragraph (b) of the vehicles or equipment used in transporting the livestock, if that journey is for the purpose of:

(i) a further transportation of livestock as mentioned in paragraph (b); or

(ii) backloading raw materials or consumables for use in a *core agricultural activity; or

(d) the mustering of livestock:

(i) by a person who conducts a core agricultural activity; or

(ii) by a person contracted by that person to conduct the mustering;

on the agricultural property where the core agricultural activity is conducted.

Note: The agricultural activities referred to in paragraph (d) are given an expanded meaning by subsection 43‑45(2).

Livestock

(2) The expression livestock includes any animal reared for the production of food, fibres, skins, fur or feathers, or for its use in the farming of land.

43‑25 Agricultural soil/water activity

The expression agricultural soil/water activity means:

(a) any activity conducted for the purpose of soil or water conservation:

(i) by a person who conducts a *core agricultural activity; or

(ii) by a person contracted by that person to conduct the first‑mentioned activity;

on the *agricultural property where the core agricultural activity is conducted; or

(b) searching for ground water solely for use in an *agricultural activity, or the construction or maintenance of facilities for the extraction of such water, solely for that use, if the searching, construction or maintenance:

(i) is conducted on an agricultural property where a core agricultural activity is conducted, or at a place adjacent to that property; and

(ii) is conducted by the person who conducts the first‑mentioned agricultural activity or by a person contracted by that person to conduct the searching, construction or maintenance; or

(c) any activity conducted for the purposes of soil or water conservation:

(i) by a person who conducts a core agricultural activity within an *approved catchment area; or

(ii) by a person contracted by that person to conduct the first‑mentioned activity;

within the approved catchment area; or

(d) the pumping of water solely for use in an agricultural activity if the pumping is conducted:

(i) on an agricultural property where a core agricultural activity is conducted, or at a place adjacent to that property; and

(ii) by the person who conducts the first‑mentioned agricultural activity or by a person contracted by that person to conduct the pumping, other than a person so contracted that is a *public authority; or

(e) the supply of water solely for use in an agricultural activity if:

(i) the supply is to an agricultural property where a core agricultural activity is conducted; and

(ii) the water comes from that property or a place adjacent to that property; and

(iii) the supply is conducted by the person who conducts the first‑mentioned agricultural activity or by a person contracted by that person to conduct the supply, other than a person so contracted that is a public authority.

Note: The agricultural activities referred to in the above paragraphs are given an expanded meaning by subsection 43‑45(2).

43‑30 Agricultural construction activity

The expression agricultural construction activity means:

(a) the construction or maintenance of fences:

(i) by a person who conducts a *core agricultural activity; or

(ii) by a person contracted by that person to conduct the construction or maintenance;

on the *agricultural property where the core agricultural activity is conducted; or

(b) the construction or maintenance of firebreaks:

(i) by a person who conducts a core agricultural activity; or

(ii) by a person contracted by that person to conduct the construction or maintenance;

on the agricultural property where the core agricultural activity is conducted or at a place adjacent to that property; or

(c) the construction or maintenance of sheds, pens, silos or silage pits for use in an *agricultural activity if the construction or maintenance is conducted:

(i) on an agricultural property where a core agricultural activity is conducted; and

(ii) by the person who conducts the first‑mentioned agricultural activity or by a person contracted by that person to conduct the construction or maintenance; or

(d) the construction or maintenance of dams, water tanks, water troughs, water channels, irrigation systems or drainage systems, including (but not limited to) water pipes and water piping, for use in a core agricultural activity if the construction or maintenance is conducted:

(i) on the agricultural property where the core agricultural activity is conducted; and

(ii) by the person who conducts the core agricultural activity or by a person contracted by that person to conduct the construction or maintenance; or

(e) the conducting of *earthworks for use in a core agricultural activity if the earthworks are conducted:

(i) on the agricultural property where the core agricultural activity is conducted; and

(ii) by the person who conducts the core agricultural activity or by a person contracted by that person to conduct the earthworks.

Note: The agricultural activities referred to in the above paragraphs are given an expanded meaning by subsection 43‑45(2).

43‑35 Agricultural waste activity

The expression agricultural waste activity means:

(a) the removal of waste products of an *agricultural activity from the *agricultural property where the activity is conducted; or

(b) the disposal of waste products of an agricultural activity on the agricultural property where the activity is conducted.

43‑40 Sundry agricultural activity

The expression sundry agricultural activity means:

(a) frost abatement on an *agricultural property; or

(b) hay baling on the agricultural property where the hay was cultivated; or

(c) the planting or tending of trees on an agricultural property otherwise than for the purpose of felling; or

(d) firefighting activities conducted:

(i) by a person who conducts a *core agricultural activity; or

(ii) by a person contracted by that person to conduct the firefighting activities;

on the agricultural property where the core agricultural activity is conducted or at a place adjacent to that property; or

(e) the service, maintenance or repair of vehicles or equipment for use in an *agricultural activity if the service, maintenance or repair is conducted:

(i) on an agricultural property where a core agricultural activity is conducted; and

(ii) by the person who conducts the first‑mentioned agricultural activity or by a person contracted by that person to conduct the service, maintenance or repair; or

(f) the storage of produce of a core agricultural activity on an agricultural property where a core agricultural activity is conducted; or

(g) the packing, or the prevention of deterioration, of the produce of a core agricultural activity if:

(i) the packing, or the prevention of deterioration, of the produce is conducted on an agricultural property where a core agricultural activity is conducted; and

(ii) there is no physical change to the produce; and

(iii) the packing, or the prevention of deterioration, of the produce does not constitute a processing of the produce; or

(h) weed, pest or disease control conducted:

(i) by a person who conducts a core agricultural activity; or

(ii) by a person contracted by that person to conduct the weed, pest or disease control;

on the agricultural property where the core agricultural activity is conducted; or

(i) hunting or trapping that is conducted for the purposes of a business, including the storage of any carcasses or skins obtained from the hunting or trapping; or

(j) the *use of taxable fuel at *residential premises in:

(i) providing food and drink for; or

(ii) providing lighting, heating, air‑conditioning, hot water or similar amenities for; or

(iii) meeting other domestic requirements of;

residents of the premises if:

(iv) the use is by a person who conducts a core agricultural activity; and

(v) the residential premises are situated on the agricultural property where that activity is conducted.

Note: The agricultural activities referred to in paragraphs (d), (e) and (h) are given an expanded meaning by subsection 43‑45(2).

43‑45 Agricultural activity

(1) The expression agricultural activity means an activity referred to in any one of the paragraphs of the definition of agriculture in subsection 43‑15(1) (other than an activity referred to in paragraph (i) or (j) of the definition of sundry agricultural activity in section 43‑40) if that activity is conducted for the purposes of, or for purposes that will directly benefit, a business conducted to obtain produce for sale.

(2) For the purposes of determining whether an activity is an agricultural activity, the activity referred to in:

(a) paragraph (d) of the definition of livestock activity in subsection 43‑20(1); or

(b) any of the paragraphs of the definition of agricultural soil/water activity in section 43‑25; or

(c) any of the paragraphs of the definition of agricultural construction activity in section 43‑30; or

(d) paragraph (d), (e) or (h) of the definition of sundry agricultural activity in section 43‑40;

includes such an activity when it is conducted by a subcontractor of a person contracted to conduct the activity.

43‑50 Approved catchment area

The expression approved catchment area means an area:

(a) in respect of which a soil or water conservation plan has been adopted by the persons who conduct *core agricultural activities within that area; or

(b) in respect of which a soil or water conservation agreement has been made between the persons who conduct core agricultural activities within that area.

43‑55 Core agricultural activity

The expression core agricultural activity means an activity referred to in paragraph (a), (b), (c) or (d) of the definition of agriculture in subsection 43‑15(1) if that activity is conducted for the purposes of, or for purposes that will directly benefit, a business conducted to obtain produce for sale.

43‑60 Earthworks

The expression earthworks means:

(a) the forming or maintenance of levee banks or windbreaks; or

(b) contour banking; or

(c) land levelling or land grading.

43‑65 Horticulture

The expression horticulture includes:

(a) the cultivation or gathering in of fruit, vegetables, herbs, edible fungi, nuts, flowers, trees, shrubs or plants; or

(b) the propagation of trees, shrubs or plants; or

(c) the production of seeds, bulbs, corms, tubers or rhizomes.

43‑70 Fishing operations and related definitions

Fishing operations

(1) The expression fishing operations means:

(a) the taking, catching or capturing of *fish; or

(b) the farming of fish; or

(c) the construction of ponds, tanks or other structures to contain fish that are to be farmed, where the construction is conducted by:

(i) the person who will do the farming; or

(ii) a person contracted by that person to conduct the construction; or

(iii) a subcontractor of a person so contracted; or

(d) the *processing of fish on board vessels; or

(e) *pearling operations; or

(f) the operation of a dedicated mother vessel in connection with an activity referred to in paragraphs (a), (b), (d) or (e); or

(g) the conducting of:

(i) voyages to or from a *port by a vessel for the purposes of refitting or repairing the vessel, or its equipment, for purposes that are integral to the performance of an activity referred to in any of the preceding paragraphs; or

(ii) trials in connection with such a refit or repair of a vessel or of its equipment;

but does not include any activity referred to in any of the preceding paragraphs that is conducted, in whole or in part:

(h) otherwise than for the purposes of a business; or

(i) for business purposes connected with recreation, sport or tourism.

Fish

(2) The expression fish means freshwater or saltwater fish, and includes crustacea, molluscs or any other living resources, whether of the sea or seabed or of fresh water or the bed below fresh water.

Pearling operations

(3) The expression pearling operations means:

(a) the taking of pearl shell; or

(b) the culture of pearls or pearl shell;

and includes the taking or capturing of trochus, beche‑de‑mer or green snails.

Processing of fish

(4) The expression processing of fish includes:

(a) the cutting up, dismembering, cleaning, sorting or packing of *fish; or

(b) the preserving or preparing of fish; or

(c) the producing of any substance or article from fish.

43‑75 Forestry

The expression forestry means:

(a) the planting or tending, in a forest or plantation, of trees intended for felling; or

(b) the thinning or felling, in a forest or plantation, of standing timber;

and includes:

(c) the transporting, milling or processing, in a forest or plantation, of timber felled in the forest or plantation; and

(d) the milling of timber at a sawmill or chipmill that is not situated in the forest or plantation in which the timber was felled; and

(e) if timber is milled at a sawmill or chipmill that is not situated in the forest or plantation in which the timber was felled—the transporting of the timber from the forest or plantation in which it was felled to the sawmill or chipmill; and

(f) the making and maintaining in a forest or plantation referred to in paragraph (a) or (b) of a road that is integral to the activities referred to in paragraph (a), (b) or (c).

Division 44—Increasing and decreasing fuel tax adjustments

Table of Subdivisions

Guide to Division 44

44‑A Increasing and decreasing fuel tax adjustments

Guide to Division 44

44‑1 What this Division is about

Your entitlement to a fuel tax credit for taxable fuel is worked out on the basis of what the fuel is intended for when you acquire, manufacture or import the fuel.

If you use or supply the fuel differently, or you do not use or supply the fuel at all, you have an increasing or decreasing fuel tax adjustment.

Fuel tax adjustments are included in working out your net fuel amount under Division 60. (Your assessed net fuel amount determines how much you owe the Commissioner or the Commissioner owes you.)

Subdivision 44‑A—Increasing and decreasing fuel tax adjustments

Table of Sections

44‑5 Increasing and decreasing fuel tax adjustments for change of circumstances

44‑10 Increasing fuel tax adjustment for failure to use or make a taxable supply of fuel

44‑5 Increasing and decreasing fuel tax adjustments for change of circumstances

(1) You have a *fuel tax adjustment if you use fuel, or make a *taxable supply of fuel, in circumstances where, if you had originally acquired, manufactured or imported the fuel to use or make a taxable supply in those circumstances, the *amount of the fuel tax credit to which you would have been entitled would have been different from the amount to which you are or were entitled.

(2) The *amount of the adjustment is the difference between the 2 amounts.

Note: Division 65 sets out which tax period or fuel tax return period the fuel tax adjustment is attributable to.

Decreasing fuel tax adjustments

(3) The *fuel tax adjustment is a decreasing fuel tax adjustment if the *amount to which you would have been entitled is greater than the amount to which you are or were entitled.

Increasing fuel tax adjustments

(4) The *fuel tax adjustment is an increasing fuel tax adjustment if the *amount to which you are or were entitled is greater than the amount to which you would have been entitled.

Example: You acquire taxable fuel to use in a harvester in carrying on your farming enterprise, so you are paid a fuel tax credit for the fuel. Later on, you use the fuel to transport wheat in a vehicle of more than 4.5 tonnes travelling on a public road. As your fuel tax credit would have been reduced by the amount of the road user charge, you have an increasing fuel tax adjustment of the difference between the 2 amounts.

44‑10 Increasing fuel tax adjustment for failure to use or make a taxable supply of fuel

You have an increasing fuel tax adjustment if:

(a) you are or were entitled to a fuel tax credit for taxable fuel; and

(b) you have no reasonable prospect of using, or making a *taxable supply of, the fuel.

The *amount of the adjustment is the amount of the credit that you are or were entitled to.

Example: You acquire taxable fuel to use in a harvester in carrying on your farming enterprise, so you are paid a fuel tax credit for the fuel. Later on, the fuel is stolen. You have an increasing fuel tax adjustment of the amount of the credit.

Note: Division 65 sets out which tax period or fuel tax return period the fuel tax adjustment is attributable to.

Part 3‑3—Special rules

Division 46—Instalment taxpayers

Table of Subdivisions

Guide to Division 46

46‑A Instalment taxpayers

Guide to Division 46

46‑1 What this Division is about

If you are a GST instalment taxpayer, you work out and claim your fuel tax credits for GST instalment quarters, instead of the annual tax period you use for the GST. However, you can choose not to give a return for the first 3 GST instalment quarters in a financial year (but if you have an increasing fuel tax adjustment, you must give a return for the last quarter in the year).

Subdivision 46‑A—Instalment taxpayers

Table of Sections

46‑5 Instalment taxpayers

46‑5 Instalment taxpayers

(1) If you are a *GST instalment payer, you must treat each *GST instalment quarter as if it were a *tax period.

GST instalment quarters to be treated as tax periods

(2) For the purposes of working out under subsection 65‑5(1) which *GST instalment quarter a fuel tax credit is attributable to, you must treat each GST instalment quarter as if, in the *GST Act, the quarter were a *tax period.

Choice to give a return for first 3 quarters

(3) You may choose whether to give the Commissioner a return for any of the first 3 *GST instalment quarters in a *financial year. If you do so, you must give the Commissioner your return on or before the day on which you are, or would be, required to pay your *GST instalment to the Commissioner for the quarter (disregarding section 162‑80 of the *GST Act).

Note: Section 162‑80 of the GST Act allows certain entities to pay only 2 GST instalments for a financial year.

(4) If you choose not to give a return for any of those quarters, then any fuel tax credit or *fuel tax adjustment that is attributable to that quarter:

(a) ceases to be attributable to that quarter; and

(b) becomes attributable to the first quarter for which you give the Commissioner a return.

Note: See subsection 65‑5(4) if your return for a quarter does not include a fuel tax credit that is attributable, under this subsection, to the quarter.

Requirement to give a return for final quarter

(5) If you have an *increasing fuel tax adjustment that is (or, under subsection (4), would be) attributable to the last *GST instalment quarter in the *financial year, you must give the Commissioner a return for that quarter on or before the day on which you are, or would be, required to pay your *GST instalment to the Commissioner for the quarter (disregarding section 162‑80 of the *GST Act).

Division 47—Time limit on entitlements to fuel tax credits

Table of Subdivisions

Guide to Division 47

47‑A Time limit on entitlements to fuel tax credits

Guide to Division 47

47‑1 What this Division is about

Your entitlements to fuel tax credits cease unless they are included in your assessed net fuel amounts within a limited period (generally 4 years).

However, this time limit does not apply in certain limited cases.

Subdivision 47‑A—Time limit on entitlements to fuel tax credits

Table of Sections

47‑5 Time limit on entitlements to fuel tax credits

47‑10 Exceptions to time limit on entitlements to fuel tax credits

47‑5 Time limit on entitlements to fuel tax credits

(1) You cease to be entitled to a fuel tax credit to the extent that it has not been taken into account, in an *assessment of a *net fuel amount of yours, during the period of 4 years after the day on which you were required to give to the Commissioner a return for the tax period or fuel tax return period to which the fuel tax credit would be attributable under subsection 65‑5(1), (2) or (3).

(2) Without limiting subsection (1), you also cease to be entitled to a fuel tax credit for taxable fuel you acquire, manufacture or import, to the extent that you did not give to the Commissioner under section 61‑15 during the period of 4 years after the day on which the acquisition, manufacture or importation occurred a return that takes the fuel tax credit into account.

Note: Section 47‑10 sets out circumstances in which your entitlement to the fuel tax credit does not cease under this section.

47‑10 Exceptions to time limit on entitlements to fuel tax credits

Commissioner has notified you of excess or refund etc.

(1) You do not cease under section 47‑5 to be entitled to a fuel tax credit to the extent that:

(a) the fuel tax credit arises out of circumstances that also gave rise to the whole or a part of:

(i) an amount, or an amount of an excess, in relation to which paragraph 105‑50(3)(a) in Schedule 1 to the Taxation Administration Act 1953 applies; or

(ii) a refund, other payment or credit in relation to which paragraph 105‑55(1)(b) or (3)(b) in Schedule 1 to that Act applies; and

(b) the Commissioner gave to you the notice referred to in that paragraph not later than 4 years after the end of the *tax period, or *fuel tax return period, to which the credit would be attributable under subsection 65‑5(1), (2) or (3) of this Act.

Note 1: Section 105‑50 in Schedule 1 to the Taxation Administration Act 1953 deals with the time limit within which the Commissioner can recover indirect tax amounts, and section 105‑55 in Schedule 1 to that Act deals with the time limit within which you can claim amounts relating to indirect tax.

Note 2: Sections 105‑50 and 105‑55 in Schedule 1 to the Taxation Administration Act 1953 only apply in relation to tax periods and fuel tax return periods starting before 1 July 2012.

Note 3: This subsection will be repealed on 1 January 2017 (see Part 2 of Schedule 1 to the Indirect Tax Laws Amendment (Assessment) Act 2012).

Excess relates to amount avoided by fraud or evaded

(2) You do not cease under section 47‑5 to be entitled to a fuel tax credit to the extent that the fuel tax credit arises out of circumstances that also gave rise to:

(a) the whole or a part of an amount in relation to which paragraph 105‑50(3)(b) in Schedule 1 to the Taxation Administration Act 1953 applies; or

(b) an amount of an excess, in relation to which that paragraph applies.

Note 1: Section 105‑50 in Schedule 1 to the Taxation Administration Act 1953 deals with the time limit within which the Commissioner can recover indirect tax amounts.

Note 2: Section 105‑50 in Schedule 1 to the Taxation Administration Act 1953 only applies in relation to tax periods and fuel tax return periods starting before 1 July 2012.

Note 3: This subsection will be repealed on 1 January 2017 (see Part 2 of Schedule 1 to the Indirect Tax Laws Amendment (Assessment) Act 2012).

You have notified the Commissioner of refund etc.

(3) You do not cease under section 47‑5 to be entitled to a fuel tax credit to the extent that:

(a) the fuel tax credit arises out of circumstances that also gave rise to the whole or a part of a refund, other payment or credit in relation to which paragraph 105‑55(1)(a) or (3)(a) in Schedule 1 to the Taxation Administration Act 1953 applies; and

(b) you gave to the Commissioner the notice referred to in that paragraph not later than 4 years after the end of the *tax period, or *fuel tax return period, to which the credit would be attributable under subsection 65‑5(1), (2) or (3) of this Act.

Note 1: Section 105‑55 in Schedule 1 to the Taxation Administration Act 1953 deals with the time limit within which you can claim amounts relating to indirect tax.

Note 2: Section 105‑55 in Schedule 1 to the Taxation Administration Act 1953 only applies in relation to tax periods and fuel tax return periods starting before 1 July 2012.

Note 3: This subsection will be repealed on 1 January 2017 (see Part 2 of Schedule 1 to the Indirect Tax Laws Amendment (Assessment) Act 2012).

Request to treat document as tax invoice

(4) If:

(a) you requested the Commissioner to treat a document under subsection 29‑70(1B) of the *GST Act as a tax invoice (within the meaning of that Act) for the purposes of attributing an *input tax credit for fuel to a *tax period; and

(b) you made the request before the end of the 4‑year period mentioned in subsection 47‑5(1) of this Act in relation to the tax period; and

(c) the Commissioner agrees to the request after the end of the 4‑year period;

you do not cease under subsection 47‑5(1) to be entitled to a fuel tax credit for the fuel to the extent that, had the Commissioner agreed to the request before the end of the 4‑year period, you would not cease under that subsection to be entitled to the credit.

Chapter 4—Common rules

Part 4‑1—Net fuel amounts

Division 60—Net fuel amounts

Table of Subdivisions

Guide to Division 60

60‑A Net fuel amounts

Guide to Division 60

60‑1 What this Division is about

Your net fuel amount reflects how much you or the Commissioner must pay. A positive net fuel amount reflects how much you must pay the Commissioner. A negative net fuel amount reflects how much the Commissioner must pay you.

Your net fuel amount is worked out for each tax period (or fuel tax return period if you are not registered, nor required to be registered, for GST).

Subdivision 60‑A—Net fuel amounts

Table of Sections

60‑5 Working out your net fuel amount

60‑10 Determinations relating to how to work out net fuel amounts

60‑5 Working out your net fuel amount

Your net fuel amount for a *tax period or a *fuel tax return period is worked out using the following formula:

where:

total decreasing fuel tax adjustments is the sum of all *decreasing fuel tax adjustments that are attributable to the period.

Note: Division 65 sets out which tax periods or fuel tax return periods fuel tax adjustments are attributable to.

total fuel tax is nil.

Note: Fuel tax is currently assessed under the Excise Act 1901, the Excise Tariff Act 1921, the Customs Act 1901 and the Customs Tariff Act 1995.

total fuel tax credits is the sum of all fuel tax credits to which you are entitled that are attributable to the period.

Note: Division 65 sets out which tax periods or fuel tax return periods fuel tax credits are attributable to.

total increasing fuel tax adjustments is the sum of all *increasing fuel tax adjustments that are attributable to the period.

Note: Division 65 sets out which tax periods or fuel tax return periods fuel tax adjustments are attributable to.

60‑10 Determinations relating to how to work out net fuel amounts

(1) The Commissioner may make a determination that, in the circumstances specified in the determination, a *net fuel amount for a *tax period or a *fuel tax return period may be worked out to take account of other matters in the way specified in the determination.

(2) The matters must relate to correction of errors:

(a) that were made in working out *net fuel amounts to which subsection (3) or (4) applies; and

(b) that do not relate to amounts:

(i) that have ceased to be payable by you because of section 105‑50 in Schedule 1 to the Taxation Administration Act 1953; or

(ii) to which, because of section 105‑55 in that Schedule, you are not entitled.

Note: Paragraph (2)(b) will be repealed on 1 January 2017 (see Part 2 of Schedule 1 to the Indirect Tax Laws Amendment (Assessment) Act 2012).

(3) This subsection applies to a *net fuel amount for a *tax period (the earlier tax period) if:

(a) the earlier tax period precedes the tax period mentioned in subsection (1); and

(b) if the earlier tax period started on or after 1 July 2012—the tax period mentioned in subsection (1) starts during the *period of review for the *assessment of the net fuel amount.

(4) This subsection applies to a *net fuel amount for a *fuel tax return period (the earlier fuel tax return period) if:

(a) the earlier fuel tax return period precedes the fuel tax return period mentioned in subsection (1); and

(b) if the earlier fuel tax return period started on or after 1 July 2012—the fuel tax return period mentioned in subsection (1) starts during the *period of review for the *assessment of the net fuel amount.

(5) If the circumstances mentioned in subsection (1) apply in relation to a *tax period or a *fuel tax return period applying to you, you may work out your *net fuel amount for the tax period or fuel tax return period in that way.

Division 61—Returns, refunds and payments

Table of Subdivisions

Guide to Division 61

61‑A Returns, refunds and payments

Guide to Division 61

61‑1 What this Division is about

You must give the Commissioner a return for each tax period (or fuel tax return period if you are not registered, nor required to be registered, for GST) by a specified time.

If the Commissioner assesses you as having a positive net fuel amount, you must pay the Commissioner that amount. If the Commissioner assesses you as having a negative net fuel amount, the Commissioner must pay you that amount.

Note: For the assessment of the net fuel amount (including self‑assessment), see Division 155 in Schedule 1 to the Taxation Administration Act 1953.

Subdivision 61‑A—Returns, refunds and payments

Table of Sections

61‑5 Entitlement to a refund

61‑7 When entitlement arises

61‑10 Requirement to pay an assessed net fuel amount

61‑15 When you must give the Commissioner your return

61‑17 Returns treated as being duly made

61‑20 Fuel tax return periods

61‑5 Entitlement to a refund

(1) If your *assessed net fuel amount for a *tax period or *fuel tax return period is less than zero, the Commissioner must, on behalf of the Commonwealth, pay that *amount (expressed as a positive amount) to you.

Note 1: See Division 3A of Part IIB of the Taxation Administration Act 1953 for the rules about how the Commissioner must pay you. Division 3 of Part IIB of that Act allows the Commissioner to apply the amount owing as a credit against tax debts that you owe to the Commonwealth.

Note 2: Interest is payable under the Taxation (Interest on Overpayments and Early Payments) Act 1983 if the Commissioner is late in paying the amount.

(2) However, if:

(a) the Commissioner amends the *assessment of your *net fuel amount for a *tax period or *fuel tax return period; and

(b) your *assessed net fuel amount before the amendment was less than zero; and

(c) the *amount that, because of the assessment, was:

(i) paid; or

(ii) applied under the Taxation Administration Act 1953;

exceeded the amount (including a nil amount) that would have been payable or applicable had your assessed net fuel amount always been the later assessed net fuel amount;

you must pay the excess to the Commissioner as if:

(d) the excess were an assessed net fuel amount for that period; and

(e) that assessed net fuel amount were an amount greater than zero and equal to the amount of the excess; and

(f) despite section 61‑10, that assessed net fuel amount became payable, and due for payment, by you at the time when the amount was paid or applied.

Note: Treating the excess as if it were an assessed net fuel amount has the effect of applying the collection and recovery rules in Part 3‑10 in Schedule 1 to the Taxation Administration Act 1953, such as a liability to pay the general interest charge under section 105‑80 in that Schedule.

61‑7 When entitlement arises

Your entitlement to be paid an *amount under section 61‑5 arises when the Commissioner gives you notice of the *assessment of your *net fuel amount for the *tax period or *fuel tax return period.

Note: In certain circumstances, the Commissioner is treated as having given you notice of the assessment when you give to the Commissioner your return (see section 155‑15 in Schedule 1 to the Taxation Administration Act 1953).

61‑10 Requirement to pay an assessed net fuel amount

You must pay your *assessed net fuel amount for a *tax period to the Commissioner by the day on which you are required under section 46‑5 or 61‑15 to give to the Commissioner your return for the tax period, if your assessed net fuel amount is greater than zero.

61‑15 When you must give the Commissioner your return

(1) If you are *registered for GST, or *required to be registered for GST, you must give the Commissioner your return for a *tax period on or before the day on which you are required to give the Commissioner your *GST return for the tax period.

Note 1: For the penalties for failing to comply with these obligations, see the Taxation Administration Act 1953.

Note 2: If you lodge your GST return electronically, you must also electronically notify the Commissioner of your net fuel amount (see section 388‑80 in Schedule 1 to the Taxation Administration Act 1953).

Note 3: Instalment taxpayers may give their returns on a different day (see section 46‑5).

(2) If you are neither *registered for GST, nor *required to be registered for GST, you must give the Commissioner your return for a *fuel tax return period by the 21st day after the end of the fuel tax return period.

(2A) You must, if required by the Commissioner, whether before or after the end of a *tax period or *fuel tax return period, give to the Commissioner, within the time required, a return or a further or fuller return for the tax period or fuel tax return period or a specified period, whether or not you have given the Commissioner a return for the tax period or fuel tax return period under subsection (1) or (2).

(3) You must give the Commissioner your return for a *tax period or a *fuel tax return period in the *approved form.

61‑17 Returns treated as being duly made

A return purporting to be made or signed by or on behalf of an entity is treated as having been duly made by the entity or with the entity’s authority until the contrary is proved.

61‑20 Fuel tax return periods

(1) If you are neither *registered for GST, nor *required to be registered for GST, your fuel tax return period is the period specified in the return.

(2) However, you must end a *fuel tax return period within 90 days, or any longer period allowed by the Commissioner, after you become aware of an *increasing fuel tax adjustment under Division 44. If you do not do so, your fuel tax return period ends at the end of the 90 days, or the longer period allowed by the Commissioner.

Note: You must give your return to the Commissioner by the 21st day after the end of the fuel tax return period (see section 61‑15).

Part 4‑2—Attribution rules

Division 65—Attribution rules

Table of Subdivisions

Guide to Division 65

65‑A Attribution rules

Guide to Division 65

65‑1 What this Division is about

Fuel tax credits and fuel tax adjustments are attributed to tax periods (or fuel tax return periods).

Generally, if you are a business taxpayer, your fuel tax credit for taxable fuel is attributed to the same period as your input tax credit for the fuel (to reduce compliance costs). If you are a non‑business taxpayer, your fuel tax credit for taxable fuel is attributed to the fuel tax return period in which you acquire, manufacture or import the fuel.

Fuel tax adjustments are attributed to the tax period (or fuel tax return period) in which you become aware of the adjustment.

Subdivision 65‑A—Attribution rules

Table of Sections

65‑5 Attribution rules for fuel tax credits

65‑10 Attribution rules for fuel tax adjustments

65‑5 Attribution rules for fuel tax credits

Attribution rules for fuel you acquire or import

(1) If you are *registered for GST, or *required to be registered for GST, your fuel tax credit for taxable fuel that you acquire or import is attributable to:

(a) the same *tax period that your *input tax credit for the fuel is attributable to under the *GST Act; or

(b) the same tax period that an input tax credit would have been attributable to under that Act if the fuel had been a *creditable acquisition or a *creditable importation.

(2) If you are neither *registered for GST, nor *required to be registered for GST, your fuel tax credit for taxable fuel that you acquire or import is attributable to the *fuel tax return period in which you acquire or import the fuel.

Attribution rule for fuel you manufacture

(3) Your fuel tax credit for taxable fuel that you manufacture is attributable to the *tax period or *fuel tax return period in which the fuel was entered for home consumption (within the meaning of the Excise Act 1901).

Later attribution rule for fuel tax credits

(4) If your return for a *tax period or *fuel tax return period does not take into account a fuel tax credit that is attributable to the period mentioned in subsection (1), (2) or (3), then the credit:

(a) ceases to be attributable to that period; and

(b) becomes attributable to the first period for which you give the Commissioner a return that does take it into account.

Note: For another attribution rule for fuel tax credits, see subsection 46‑5(4) (GST instalment taxpayers).

65‑10 Attribution rules for fuel tax adjustments

A *fuel tax adjustment under Division 44 is attributable to the *tax period or *fuel tax return period in which you become aware of the adjustment.

Note: For another attribution rule for fuel tax adjustments, see subsection 46‑5(4) (GST instalment taxpayers).

Part 4‑3—Special rules about entities

Division 70—Special rules about entities

Table of Subdivisions

Guide to Division 70

70‑A Special rules about entities and how they are organised

70‑B Government entities

Guide to Division 70

70‑1 What this Division is about

This Act applies to GST groups, joint ventures, religious practitioners, incapacitated entities, branches, resident agents and non‑profit sub‑entities in a similar way to the way in which the GST Act applies to those entities.

Government entities that are registered for GST are treated as if they are carrying on an enterprise.

Subdivision 70‑A—Special rules about entities and how they are organised

Table of Sections

70‑5 Application of fuel tax law to GST groups and joint ventures

70‑10 Entry and exit history rules

70‑15 Consolidating joint venture returns

70‑20 Application of fuel tax law to religious practitioners

70‑25 Application of fuel tax law to incapacitated entities

70‑30 Application of fuel tax law to GST branches, resident agents and non‑profit sub‑entities

70‑5 Application of fuel tax law to GST groups and joint ventures

(1) The entities in column 1 of the table are treated as a single entity for the purposes of the *fuel tax law.

(2) The entity in column 2 of the table has all the rights, powers and obligations of the single entity under the *fuel tax law (instead of each entity in column 1 having those rights, powers and obligations).

Application of fuel tax law to GST groups and joint ventures |

Item | Column 1 These entities are treated as a single entity for the purposes of the fuel tax law | Column 2 This entity has all the rights, powers and obligations of the single entity under the fuel tax law |

1 | The members of a *GST group | The representative member of the group |

2 | The *participants in a *GST joint venture (to the extent that any relevant fuel is acquired, manufactured or imported in the course of activities for which the joint venture was entered into) | The *joint venture operator of the joint venture |

Note: Sections 444‑80 and 444‑90 in Schedule 1 to the Taxation Administration Act 1953 affect the operation of this section.

70‑10 Entry and exit history rules

Entry history rule