An Act to impose a superannuation contributions tax and to declare the rate of the tax

1 Short title [see Note 1]

This Act may be cited as the Superannuation Contributions Tax Imposition Act 1997.

2 Commencement [see Note 1]

This Act commences on the day on which it receives the Royal Assent.

3 Interpretation

Expressions used in this Act that are defined by the Superannuation Contributions Tax (Assessment and Collection) Act 1997 have the same meanings as in that Act.

4 Imposition of superannuation contributions surcharge

The superannuation contributions surcharge that is payable on a member’s surchargeable contributions for a financial year under the Superannuation Contributions Tax (Assessment and Collection) Act 1997 is imposed by this Act.

Note: Surcharge is not payable for the financial year that began on 1 July 2005 or a later financial year—see subsection 7(1) of the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

5 Rate of superannuation contributions surcharge

(1AA) In this section:

higher income amount means:

(a) for the 2003‑2004 financial year—$114,981; and

(b) for the 2004‑2005 financial year—that amount as indexed under section 7.

lower income amount means:

(a) for the 2003‑2004 financial year—$94,691; and

(b) for the 2004‑2005 financial year—that amount as indexed under section 7.

maximum surcharge percentage means:

(a) for the 2003‑2004 financial year—14.5%; and

(b) for the 2004‑2005 financial year—12.5%.

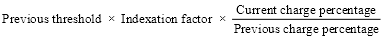

(1) Unless subsection (3) applies, if the member’s adjusted taxable income for a financial year (relevant adjusted taxable income) is not less than the lower income amount but is less than the higher income amount, the rate of the superannuation contributions surcharge that applies to the member for that year is the percentage (calculated to 5 decimal places) of the member’s surchargeable contributions for that year worked out using the formula:

where:

A is:

(1A) If the percentage calculated under subsection (1) for a financial year would, if it were worked out to 6 decimal places, end with a number greater than 4, the number so calculated is increased by 0.00001.

(2) If the member’s adjusted taxable income for a financial year is equal to, or greater than, the higher income amount, the rate of the superannuation contributions surcharge that applies to the member for that year is the maximum surcharge percentage of the member’s surchargeable contributions for that year.

(3) If:

(a) the member has not quoted his or her tax file number in connection with the operation or the possible future operation of the Superannuation Contributions Tax (Collection and Assessment) Act 1997 to the superannuation provider, or one of the superannuation providers, who, at the end of a financial year, held any of the member’s surchargeable contributions for that year; and

(b) the Commissioner has not, after taking all reasonable steps, found out the member’s tax file number; and

(c) the Commissioner has written a letter to the member at the member’s last‑known address telling the member that, if the member does not quote his or her tax file number, the rate of surcharge that will apply to the member for a financial year (the relevant financial year) may be the maximum surcharge percentage of the member’s surchargeable contributions for the relevant financial year;

the following provisions have effect:

(d) if contributed amounts in respect of contributions began to be paid for or by the member to a superannuation provider before 7 May 1997 and the member’s surchargeable contributions for the relevant financial year exceed the surchargeable contributions threshold—the rate of surcharge that applies in respect of the member’s surchargeable contributions for the relevant financial year is the maximum surcharge percentage of those contributions;

(e) if contributed amounts in respect of contributions began to be paid for or by the member to a superannuation provider before 7 May 1997 and the member’s surchargeable contributions for the relevant financial year do not exceed the surchargeable contributions threshold—the rate of surcharge that applies in respect of the member’s surchargeable contributions for the relevant financial year is nil;

(f) subject to subsection (4), if no contributed amounts in respect of contributions began to be paid for or by the member to a superannuation provider before 7 May 1997—the rate of surcharge that applies in respect of the member’s surchargeable contributions for the relevant financial year is the maximum surcharge percentage of those contributions.

(4) If:

(a) the Commissioner has written a letter to a member as mentioned in paragraph (3)(c); and

(b) the member has not quoted his or her tax file number as mentioned in paragraph (3)(a) within 3 months after the letter was sent;

paragraph (3)(f) does not apply in respect of the member unless the Commissioner has, after that period, written a further letter to the member:

(c) to an address determined by the Commissioner as most appropriate for the letter to reach the member; and

(d) in the same terms as the earlier letter.

6 Surchargeable contributions threshold

Surchargeable contributions threshold for the 1996‑97 financial year

(1) The surchargeable contributions threshold for the 1996‑97 financial year is $2,000.

Surchargeable contributions for a later financial year

(2) The surchargeable contributions threshold for a financial year (the relevant financial year) after the 1996‑97 financial year is the amount worked out using the formula:

where:

previous threshold means the surchargeable contributions threshold for the financial year immediately before the relevant financial year.

indexation factor means the number worked out under subsections 9(4) and (5) of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 for the relevant financial year.

current charge percentage means the number that is specified in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992 for the quarter beginning on 1 July of the relevant financial year.

previous charge percentage means the number that is specified in subsection 19(2) of the Superannuation Guarantee (Administration) Act 1992 for the quarter beginning on 1 July of the financial year immediately before the relevant financial year.

7 Indexation

Indexation of certain amounts for 2004‑05 financial year

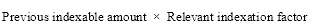

(1) Section 5 applies in relation to an indexing financial year as if each indexable amount were replaced by the amount worked out using the formula:

where:

previous indexable amount means the indexable amount for the financial year immediately before the indexing financial year.

relevant indexation factor means the indexation factor for the indexing financial year.

Rounding off of indexed amounts

(2) If an amount worked out under subsection (1) is an amount of dollars and cents:

(a) if the number of cents is less than 50—the amount is to be rounded down to the nearest whole dollar; or

(b) otherwise—the amount is to be rounded up to the nearest whole dollar.

Indexation factor

(3) The indexation factor for an indexing financial year is the number calculated, to 3 decimal places, using the formula:

where:

current March year means the period of 12 months ending on 31 March immediately before the indexing financial year.

previous March year means the period of 12 months immediately before the current March year.

Rounding up of indexation factor

(4) If the number calculated under subsection (3) for a financial year would, if it were worked out to 4 decimal places, end with a number greater than 4, the number so calculated is increased by 0.001.

Change in index numbers

(5) If, at any time, whether before or after the commencement of this Act, the Australian Statistician has published or publishes an index number for a quarter in substitution for an index number previously published for the quarter, the publication of the later index number is to be disregarded.

Indexable amounts to be published

(6) The Commissioner must publish before, or as soon as practicable after, the start of the 2004‑05 financial year the indexable amounts as replaced under subsection (1) for that year.

Definitions

(7) In this section:

indexable amount means:

(a) an amount stated in section 5; or

(b) if that amount has previously been altered under this section—the altered amount.

indexing financial year means the 2004‑05 financial year.

index number, for a quarter, means the estimate of full‑time adult average weekly ordinary time earnings for the middle month of the quarter published by the Australian Statistician.

Note: For the purposes of this section, Australian Statistician means the Australian Statistician referred to in subsection 5(2) of the Australian Bureau of Statistics Act 1975.

8 Severability

If, apart from this section, section 4 would impose in relation to a State, or an authority or officer of a State, a superannuation contributions surcharge the imposition of which in relation to the State, authority or officer would exceed the legislative power of the Commonwealth, section 4 has effect as if it did not impose that surcharge in relation to the State, authority or officer, as the case may be.

9 Act does not impose tax on property of State

(1) Without limiting section 7, this Act does not impose a tax on property of any kind belonging to a State.

(2) In this section:

property of any kind belonging to a State has the same meaning as in section 114 of the Constitution.