Income Tax Assessment Act 1997

No. 38, 1997

An Act about income tax and related matters

Income Tax Assessment Act 1997

No. 38, 1997

An Act about income tax and related matters

Contents

Chapter 1—Introduction and core provisions

Part 1-1—Preliminary

Division 1—Preliminary

1-1 Short title......................................

1-2 Commencement..................................

1-3 Differences in style not to affect meaning...................

Part 1-2—A Guide to this Act

Division 2—How to use this Act

Subdivision 2-A—How to find your way around

2-1 The design.....................................

Subdivision 2-B—How the Act is arranged

2-5 The pyramid....................................

Subdivision 2-C—How to identify defined terms and find the definitions

2-10 When defined terms are identified.......................

2-15 When terms are not identified.........................

2-20 Identifying the defined term in a definition..................

Subdivision 2-D—The numbering system

2-25 Purposes......................................

2-30 Gaps in the numbering.............................

Subdivision 2-E—Status of Guides and other non-operative material

2-35 Non-operative material.............................

2-40 Guides.......................................

2-45 Other material..................................

Division 3—What this Act is about

Table of sections....................................

3-1 What this Act is about..............................

3-5 Annual income tax................................

3-10 Your other obligations as a taxpayer.....................

3-15 Your obligations other than as a taxpayer..................

Part 1-3—Core provisions

Division 4—How to work out the income tax payable on your taxable income

4-1 Who must pay income tax............................

4-5 Meaning of you

4-10 How to work out how much income tax you must pay...........

4-15 How to work out your taxable income....................

Division 6—Assessable income and exempt income

Guide to Division 6

6-1 Diagram showing relationships among concepts in this Division......

Operative provisions

6-5 Income according to ordinary concepts (ordinary income).........

6-10 Other assessable income (statutory income).................

6-15 What is not assessable income.........................

6-20 Exempt income..................................

6-25 Relationships among various rules about ordinary income.........

Division 8—Deductions

8-1 General deductions................................

8-5 Specific deductions................................

8-10 No double deductions..............................

Part 1-4—Checklists of what is covered by concepts used in the core provisions

Division 9—Entities that must pay income tax

9-1 List of entities...................................

9-5 Entities that work out their income tax by reference to something other than taxable income

Division 10—Particular kinds of assessable income

10-5 List of provisions about assessable income..................

Division 11—Lists of classes of exempt income

11-1 Overview.....................................

11-5 Entities that are exempt, no matter what kind of ordinary or statutory income they have

11-10 Ordinary or statutory income which is exempt, no matter whose it is..

11-15 Ordinary or statutory income which is exempt only if it is derived by certain entities

Division 12—Particular kinds of deductions

12-5 List of provisions about deductions......................

Division 13—Tax offsets

13-1 List of tax offsets.................................

Chapter 2—Liability rules of general application

Part 2-5—Rules about deductibility of particular kinds of amounts

Division 26—Some amounts you cannot deduct, or cannot deduct in full

26-55 Limit on deductions..............................

Division 28—Car expenses

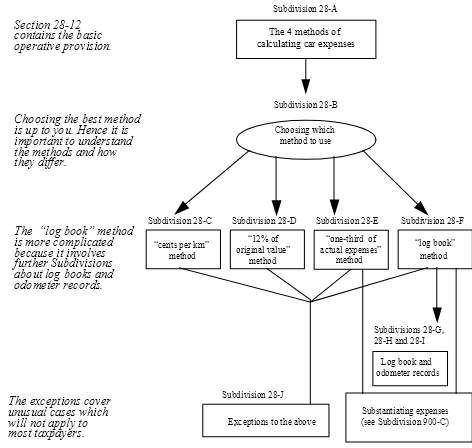

Guide to Division 28

28-1 What this Division is about...........................

28-5 Map of this Division...............................

Subdivision 28-A—Deductions for car expenses

28-10 Application of Division 28..........................

28-12 Car expenses..................................

28-13 Meaning of car expense

Subdivision 28-B—Choosing which method to use

Guide to Subdivision 28-B

28-14 What this Subdivision is about........................

28-15 Choosing among the 4 methods.......................

Operative provision

28-20 Rules governing choice of method......................

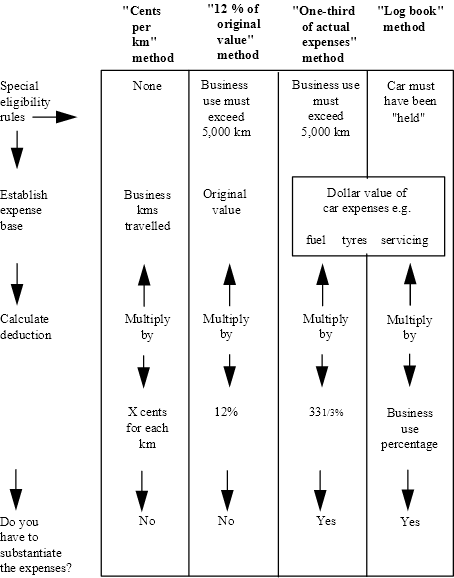

Subdivision 28-C—The “cents per kilometre” method

28-25 How to calculate your deduction.......................

28-30 Depreciation...................................

28-35 Substantiation..................................

Subdivision 28-D—The “12% of original value” method

28-45 How to calculate your deduction.......................

28-50 Eligibility....................................

28-55 Depreciation...................................

28-60 Substantiation..................................

Subdivision 28-E—The “one-third of actual expenses” method

28-70 How to calculate your deduction.......................

28-75 Eligibility....................................

28-80 Substantiation..................................

Subdivision 28-F—The “log book” method

28-90 How to calculate your deduction.......................

28-95 Eligibility....................................

28-100 Substantiation.................................

Subdivision 28-G—Keeping a log book

Guide to Subdivision 28-G

28-105 What this Subdivision is about.......................

28-110 Steps for keeping a log book........................

Operative provisions

28-115 Income years for which you need to keep a log book..........

28-120 Choosing the 12 week period for a log book...............

28-125 How to keep a log book...........................

28-130 Replacing one car with another.......................

Subdivision 28-H—Odometer records for a period

Guide to Subdivision 28-H

28-135 What this Subdivision is about.......................

Operative provision

28-140 How to keep odometer records for a car for a period..........

Subdivision 28-I—Retaining the log book and odometer records

28-150 Retaining the log book for the retention period..............

28-155 Retaining odometer records.........................

Subdivision 28-J—Situations where you cannot use, or don’t need to use, one of the 4 methods

Guide to Subdivision 28-J

28-160 What this Subdivision is about.......................

Operative provisions

28-165 Exception for particular cars taken on hire................

28-170 Exception for particular cars used in particular ways..........

28-175 Further miscellaneous exceptions......................

28-180 Car expenses related to award transport payments............

28-185 Application of Subdivision 28-J to PAYE earners and the entities that pay them

Division 36—Tax losses of earlier income years

Guide to Division 36

36-1 What this Division is about...........................

Subdivision 36-A—Deductions for tax losses of earlier income years

36-10 How to calculate a tax loss for an income year...............

36-15 How to deduct tax losses...........................

36-20 Net exempt income...............................

36-25 Special rules about tax losses.........................

Subdivision 36-B—Effect of you becoming bankrupt

Guide to Subdivision 36-B

36-30 What this Subdivision is about........................

Operative provisions

36-35 No deduction for tax loss incurred before bankruptcy...........

36-40 Deduction for amounts paid for debts incurred before bankruptcy...

36-45 Limit on deductions for amounts paid....................

Part 2-10—Capital allowances: rules about deductibility of capital expenditure

Division 40—Overview of capital allowances

Guide to Division 40

40-1 What this Division is about...........................

40-5 Map of Divisions 40 and 41..........................

Subdivision 40-A—What a capital allowance is

40-7 Effect of this Division..............................

40-10 What expenditure qualifies?.........................

40-15 Who may deduct?...............................

40-20 How to work out the deduction........................

40-25 Disposal, loss, destruction or termination of use: balancing adjustment

Subdivision 40-B—Summary and finding table

40-30 Table of capital allowances..........................

Division 41—Common rules for capital allowances

Guide to Division 41

41-1 What this Division is about...........................

41-5 Summary and finding table...........................

Subdivision 41-A—Common rule 1 (Roll-over relief for related entities)

Guide to Common rule 1

41-10 What this Common rule is about.......................

Operative provisions

41-15 When is roll-over relief available?......................

41-20 Disposals of property.............................

41-25 How are the balancing adjustment provisions affected?.........

41-30 What is the effect of the roll-over on the transferor’s and transferee’s entitlement to a deduction?

41-35 Subsequent applications of this Common rule—relief available even if subsequent transferor got no deduction

41-40 Subsequent disposal—modify the balancing adjustment accordingly..

41-45 Commissioner may amend assessment after recoupment despite section 170 of the Income Tax Assessment Act 1936

Subdivision 41-B—Common rule 2 (Non-arm’s length transactions)

41-65 Non-arm’s length transactions........................

Subdivision 41-C—Common rule 3 (Anti-avoidance provisions relating to the ownership of property)

41-85 You are taken to be owner of property for purposes of certain anti-avoidance provisions

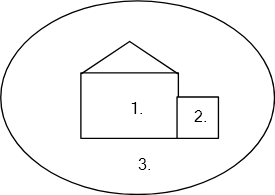

Division 43—Deductions for capital works

Guide to Division 43

43-1 What this Division is about...........................

43-2 Key concepts used in this Division......................

Subdivision 43-A—Key operative provisions

Guide to Subdivision 43-A

43-5 What this Subdivision is about.........................

Operative provisions

43-10 Deductions for capital works.........................

43-15 Amount you can deduct............................

43-20 Capital works to which this Division applies..............

43-25 Rate of deduction................................

43-30 No deduction until construction is complete................

43-35 Requirement for body corporate to be registered under the Industry Research and Development Act

43-40 Deduction for destruction of capital works................

43-45 Application of Division 41 common rules.................

43-50 Links and signposts to other parts of the Act................

43-55 Anti-avoidance—arrangement etc. with tax-exempt entity........

Subdivision 43-B—Establishing the deduction base

Guide to Subdivision 43-B

43-60 What this Subdivision is about........................

43-65 Explanatory material..............................

Operative provisions

43-70 What is construction expenditure?......................

43-75 Construction expenditure area........................

43-80 When capital works begin...........................

43-85 Pools of construction expenditure......................

43-90 Table of intended use at time of completion of construction.....

43-95 Meaning of hotel building and apartment building

43-100 Certificates by Industry Research and Development Board.......

Subdivision 43-C—Your area and your construction expenditure

Guide to Subdivision 43-C

43-105 What this Subdivision is about.......................

43-110 Explanatory material.............................

Operative provisions

43-115 Your area and your construction expenditure—owners.........

43-120 Your area and your construction expenditure—lessees and quasi-ownership right holders

43-125 Lessees’ or right holders’ pools can revert to owner...........

43-130 Identifying your area on acquisition or disposal.............

Subdivision 43-D—Deductible uses of capital works

Guide to Subdivision 43-D

43-135 What this Subdivision is about.......................

Operative provisions

43-140 Using your area in a deductible way....................

43-145 Using your area in the 4% manner.....................

43-150 Meaning of industrial activities

Subdivision 43-E—Special rules about uses

Guide to Subdivision 43-E

43-155 What this Subdivision is about.......................

Operative provisions

43-160 Your area is used for a purpose if it is maintained ready for use for the purpose

43-165 Temporary cessation of use........................

43-170 Own use—capital works other than hotel and apartment buildings..

43-175 Own use—hotel and apartment buildings.................

43-180 Special rules for hotel and apartment buildings..............

43-185 Residential or display use..........................

43-190 Use of facilities not commonly provided, and of certain buildings used to operate a hotel, motel or guest house

43-195 Use for research and development activities must be in connection with a business

Subdivision 43-F—Calculation of deduction

Guide to Subdivision 43-F

43-200 What this Subdivision is about.......................

43-205 Explanatory material.............................

Operative provisions

43-210 Deduction for capital works begun after 26 February 1992.......

43-215 Deduction for capital works begun before 27 February 1992......

43-220 Capital works taken to have begun earlier for certain purposes....

Subdivision 43-G—Undeducted construction expenditure

Guide to Subdivision 43-G

43-225 What this Subdivision is about.......................

Operative provisions

43-230 Calculating undeducted construction expenditure—common step...

43-235 Post‑26 February 1992 undeducted construction expenditure

43-240 Pre‑27 February 1992 undeducted construction expenditure

Subdivision 43-H—Balancing deduction on destruction of capital works

Guide to Subdivision 43-H

43-245 What this Subdivision is about.......................

Operative provisions

43-250 The amount of the balancing deduction..................

43-255 Amounts received or receivable.......................

43-260 Apportioning amounts received for destruction..............

Chapter 3—Specialist liability rules

Part 3-5—Corporate taxpayers and corporate distributions

Division 165—Income tax consequences of changing ownership or control of a company

Guide to Division 165

165-1 What this Division is about..........................

Subdivision 165-A—Deducting tax losses of earlier income years

Guide to Subdivision 165-A

165-5 What this Subdivision is about........................

Operative provisions

165-10 To deduct a tax loss..............................

165-12 Company must maintain the same owners.................

165-13 Alternatively, company must carry on same business..........

165-15 Same people must control the voting power, or company must carry on same business

165-20 When company can deduct part of a tax loss...............

Subdivision 165-B—Working out the taxable income and tax loss for the income year of the change

Guide to Subdivision 165-B

165-23 What this Subdivision is about.......................

165-25 Summary of this Subdivision........................

165-30 Flow chart showing the application of this Subdivision.........

When a company must work out its taxable income and tax loss under this Subdivision

165-35 On a change of ownership, unless the company carries on the same business

165-37 Who has more than a 50% stake in the company during a period...

165-40 On a change of control of voting power in the company, unless the company carries on the same business

Working out the company’s taxable income

165-45 First, divide the income year into periods.................

165-50 Next, calculate the notional loss or notional taxable income for each period

165-55 How to attribute deductions to periods...................

165-60 How to attribute assessable income to periods..............

165-65 How to calculate the company’s taxable income for the income year.

Working out the company’s tax loss

165-70 How to calculate the company’s tax loss for the income year.....

165-75 How to calculate the company’s notional loss or notional taxable income for a period when the company was a partner

165-80 How to calculate the company’s share of a partnership’s notional loss or notional net income for a period if both entities have the same income year

165-85 How to calculate the company’s share of a partnership’s notional loss or notional net income for a period if the entities have different income years

165-90 Company’s full year deductions include a share of partnership’s full year deductions

Subdivision 165-D—Tests for finding out whether the company has maintained the same owners

The primary and alternative tests

165-150 Who has more than 50% of the voting power in the company during a period

165-155 Who has rights to more than 50% of the company’s dividends during a period

165-160 Who has rights to more than 50% of the company’s capital distributions during a period

165-165 Rules about the primary test for a condition...............

165-175 Tests can be satisfied by a single person.................

Rules affecting the operation of the tests

165-180 Arrangements affecting beneficial ownership of shares........

165-185 Shares treated as never having carried rights..............

165-190 Shares treated as always having carried rights..............

165-195 Disregard redeemable shares........................

165-200 Rules do not affect totals of shares or rights...............

165-205 Death of beneficial owner.........................

Subdivision 165-E—The same business test

165-210 The test....................................

Division 166—Income tax consequences of changing ownership or control of a listed public company

Guide to Division 166

166-1 What this Division is about..........................

Subdivision 166-A—Deducting tax losses of earlier income years

166-5 How Subdivision 165-A applies to a listed public company.......

166-10 How Subdivision 165-A applies to a 100% subsidiary of a listed public company

166-15 Companies can choose that this Subdivision is not to apply to them.

Subdivision 166-B—Working out the taxable income and tax loss for the income year of the change

166-20 How Subdivision 165-B applies to a listed public company......

166-25 How to work out the taxable income and tax loss............

166-30 How Subdivision 165-B applies to 100% subsidiary of a listed public company

166-35 Companies can choose that this Subdivision is not to apply to them.

Subdivision 166-D—Tests for finding out whether the listed public company has maintained the same owners

Guide to Subdivision 166-D

166-140 What this Subdivision is about......................

Substantial continuity of ownership

166-145 Substantial continuity of ownership....................

The ownership tests

166-150 Who has more than 50% of the voting power in the listed public company at a particular time

166-155 Who has rights to more than 50% of the listed public company’s dividends at a particular time

166-160 Who has rights to more than 50% of the listed public company’s capital distributions at a particular time

Rules affecting the operation of the ownership tests

166-165 Rules in Division 165 apply........................

Subdivision 166-F—How to treat shareholdings of less than 1%

Guide to Subdivision 166-F

166-215 What this Subdivision is about......................

Special tracing rules for listed public companies

166-220 Shareholdings of less than 1% in the listed public company.....

166-225 Shareholdings of less than 1% in an interposed listed public company

166-230 Notional shareholder............................

166-235 Notional shareholder taken to have minimum voting control, dividend rights and capital rights

166-240 Voting, dividend and capital shareholding of less than 1%......

166-245 Shares that are part of a substantial shareholding............

When the rules in this Subdivision do not apply

166-250 Limit on listed public company splitting its shares into different classes

166-255 If listed public company would not have otherwise passed the ownership tests

Subdivision 166-G—How to treat interposed superannuation funds, approved deposit funds and special companies

Guide to this Subdivision

166-260 What this Subdivision is about......................

Special tracing rules for listed public companies

166-265 When fund or special company is taken to control voting power...

166-270 When fund or special company is taken to have rights to dividends and capital

Division 170—Treatment of company groups for income tax purposes

Subdivision 170-A—Transfer of tax losses within wholly-owned groups of companies

Guide to Subdivision 170-A

170-1 What this Subdivision is about........................

170-5 Basic principles for transferring tax losses.................

170-10 When a company can transfer a tax loss..................

170-15 Income company is taken to have incurred transferred loss.......

170-20 Who can deduct transferred loss......................

170-25 Tax treatment of payment for transferred tax loss............

170-30 Companies must be in existence and members of the same wholly-owned group

170-35 The loss company...............................

170-40 The income company.............................

170-45 Maximum amount that can be transferred.................

170-50 Transfer by written agreement.......................

170-55 Losses must be transferred in order they are incurred..........

170-60 Income company cannot transfer transferred tax loss..........

170-65 Agreement transfers as much as can be transferred...........

170-70 Amendment of assessments.........................

Division 175—Use of a company’s tax losses or deductions to avoid income tax

Guide to Division 175

175-1 What this Division is about..........................

Subdivision 175-A—Tax benefits from unused tax losses

175-5 When Commissioner can disallow deduction for tax loss.........

175-10 First case: income injected into company because of available tax loss

175-15 Second case: someone else obtains a tax benefit because of tax loss available to company

Subdivision 175-B—Tax benefits from unused deductions

175-20 Income injected into company because of available deductions....

175-25 Deduction injected into company because of available income....

175-30 Someone else obtains a tax benefit because of a deduction or income available to company

175-35 Tax loss resulting from disallowed deductions..............

Subdivision 175-D—Shareholding interest in the company

175-65 When a person has a shareholding interest in the company.......

Division 195—Special types of company

Subdivision 195-A—Pooled development funds (PDFs)

Guide to Subdivision 195-A

195-1 What this Subdivision is about........................

Working out a PDF’s taxable income and tax loss

195-5 Deductibility of PDF tax losses........................

195-10 PDF cannot transfer tax loss.........................

195-15 Tax loss for year in which company becomes a PDF..........

Part 3-45—Rules for particular industries and occupations

Division 330—Mining and quarrying

Guide to Division 330

330-1 What this Division is about

330-5 How petroleum mining is treated

330-10 Diagram—the stages of mining

Subdivision 330-A—Exploration and prospecting

330-15 Deduction for exploration or prospecting expenditure

330-20 Meaning of exploration or prospecting

330-25 Meaning of minerals, petroleum and quarry materials

330-30 Meaning of eligible mining or quarrying operations

330-35 No deduction for amount “transferred” by seller of right or information

330-40 Election that section 330-15 not apply to plant

Subdivision 330-B—Exempt income from the sale of rights to mine

330-60 Genuine prospector exemption for ordinary income derived from the sale of rights to mine

Subdivision 330-C—Development and operation of a mine or quarry

330-80 Allowable capital expenditure is deductible

330-85 What is allowable capital expenditure?

330-90 Housing and welfare in mining

330-95 Expenditure that is not allowable capital expenditure

330-100 How much is deductible over how long?

330-105 Meaning of unrecouped expenditure

330-110 Expenditure that does not relate to a mining property, quarrying property or petroleum field

330-115 Apportioning between mining and quarrying

330-120 Resuming use of property for qualifying purposes

330-125 Each mining property, quarrying property or petroleum field is separate from any other

Subdivision 330-D—Cash bidding

Guide to Subdivision 330-D

330-145 What this Subdivision is about

Operative provisions

330-150 Mining cash bidding payments

330-155 Meaning of mining cash bidding payment and mining authority

330-160 Exploration or prospecting cash bidding payments made when mining authority has been granted

330-165 Meaning of exploration or prospecting cash bidding payment and exploration or prospecting authority

330-170 Exploration or prospecting cash bidding payments made before mining authority has been granted

330-175 Meaning of entitlement to an eligible cash bidding amount

330-180 Transfer of entitlement to an eligible cash bidding amount

330-185 Limit on amount

330-190 Time limit on agreement

330-195 Agreement must be in writing and signed

330-200 When a mining authority is related to an exploration or prospecting authority

330-205 Meaning of retention authority

330-210 When a retention authority is related to an exploration or prospecting authority

330-215 Effect of renewal of authority

Subdivision 330-E—Selling a right or information

330-235 Buyer and seller may agree to include allowable capital expenditure

330-240 Meaning of mining, quarrying or prospecting right and mining, quarrying or prospecting information

330-245 Limit on amount that can be included in the agreement

330-250 Capital expenditure on buildings or other improvements only counts toward the limit if buyer gets rights to them

330-255 Time limit on agreement

330-260 Agreement must be signed and in writing

330-265 Election under subsection 88B(5) of the Income Tax Assessment Act 1936 voids agreement

330-270 Agreement results in seller giving up further deductions

330-275 Apportionment between mining and quarrying

Subdivision 330-F—Excess deductions

Guide to Subdivision 330-F

330-295 What this Subdivision is about

Operative provisions

330-300 Limit on amounts deductible under Subdivision 330-C for the income year

330-305 Limit on amounts deductible under Subdivision 330-A for the income year

330-310 Excess amount deductible for the next income year

330-315 Election not to limit amounts deductible under Subdivision 330-A or 330-C

330-320 Excess amount not deductible for certain property

330-325 Excess amount not deductible if specified in a section 330‑235 agreement

330-330 Excess amount set off against income exempt under section 330-60

Subdivision 330-G—Petroleum resource rent tax payments

330-350 Payments of petroleum resource rent tax

Subdivision 330-H—Transporting the product

330-370 Transport capital expenditure is deductible

330-375 Meaning of transport capital expenditure

330-380 Meaning of transport facility and public body

330-385 Meaning of mining or quarrying transport

330-390 Meaning of processed materials, treatment and concentration

330-395 How much is deductible over how long?

330-400 What if you stop using property for mining or quarrying transport?

330-405 Resuming use of property for mining or quarrying transport

330-410 Apportionment between mining and quarrying

330-415 No double deductions for port or other ship facility

Subdivision 330-I—Rehabilitating the site

330-435 Deduction for expenditure on rehabilitation

330-440 Meaning of rehabilitation

330-445 Meaning of ancillary activities and eligible building site

330-450 No deduction for certain expenditure

330-455 Property used for rehabilitation taken to be used for the purpose of producing assessable income

Subdivision 330-J—Balancing adjustment

Guide to Subdivision 330-J

330-475 What this Subdivision is about

Operative provisions

330-480 When a balancing adjustment is required

330-485 How to do the adjustment

330-490 Meaning of termination value

330-495 Meaning of written down value

330-500 What if there is a disposal of part of an interest in property?

Subdivision 330-K—Partial change of ownership

330-520 Partial change of ownership

Subdivision 330-L—Modification of Common rules

330-540 Which Common rules apply

330-545 Modification to Common rule 1 (Roll-over relief for related entities)

330-547 Roll-over relief

330-550 Transferee inherits certain characteristics from transferor

330-555 Leases: subsection 88B(5) of the Income Tax Assessment Act 1936 election has no effect

330-560 Modification to Common rule 2 (Non-arm’s length transactions)

Subdivision 330-M—Special situations

Guide to Subdivision 330-M

330-580 What this Subdivision is about

Operative provisions

330-585 Recoupment of capital expenditure

330-590 Deductions under this Division take priority over other deductions

330-595 Mining, quarrying or prospecting—getting someone else to do the work

330-600 No deduction for petroleum income sharing

330-605 No deduction for paying transferees or sub-lessees of mining, quarrying or prospecting rights

Division 375—Australian films

Subdivision 375-G—Film losses

Guide to Subdivision 375-G

375-800 What this Subdivision is about......................

Operative provisions

375-805 Does your tax loss have a film component?...............

375-810 What is a film loss?.............................

375-815 Deductibility of film losses.........................

375-820 Order in which tax losses are to be deducted..............

Chapter 4—Collection and recovery of income tax (and some other taxes)

Part 4-5—Collection of income tax instalments

Division 750—Guide to Part 4-5

750-1 What this Part is about...........................

750-5 What instalments of income tax do you have to pay?...........

750-10 Instalments collected periodically.....................

750-15 Instalments collected in respect of particular transactions........

750-20 What happens if your income tax is less than the instalments you have paid? How do you get a refund?

Part 4-10—Withholding taxes: liability and collection provisions

Division 765—Withholding tax on dividends, interest and royalties

Guide to Division 765

765-1 What this Division is about..........................

765-5 Where to find the rules about the withholding tax.............

Division 766—Withholding tax on payments for mining operations on Aboriginal land

Guide to Division 766

766-1 What this Division is about..........................

766-5 Where to find the rules about the withholding tax.............

Division 767—Interest paid by companies on bearer debentures

Guide to Division 767

767-1 What this Division is about..........................

767-5 Where to find the rules about the tax....................

Division 768—Withholding tax on income notionally accruing under certain deferred interest investments

Guide to Division 768

768-1 What this Division is about..........................

768-5 Where to find the rules about the withholding tax.............

Part 4-30—Collecting Medicare levy and HECS with income tax

Division 785—Medicare levy

Guide to Division 785

785-1 What this Division is about..........................

785-5 Where to find the rules about Medicare levy................

Division 786—HECS (Higher Education Contribution Scheme)

Guide to Division 786

786-1 What this Division is about..........................

786-5 Where to find the rules about repaying HECS contributions.......

Chapter 5—Administration

Part 5-30—Record-keeping and other obligations

Division 900—Substantiation rules

Guide to Division 900

900-1 What this Division is about..........................

Subdivision 900-A—Application of Division

900-5 Application of the requirements of Division 900..............

900-10 Substantiation requirement.........................

900-12 Application of Division 900 to PAYE earners and the entities that pay them

Subdivision 900-B—Substantiating work expenses

900-15 Getting written evidence...........................

900-20 Keeping travel records............................

900-25 Retaining the written evidence and travel records............

900-30 Meaning of work expense

900-35 Exception for small total of expenses...................

900-40 Exception for laundry expenses below a certain limit..........

900-45 Exception for work expense related to award transport payment....

900-50 Exception for domestic travel allowance expenses............

900-55 Exception for overseas travel allowance expenses............

900-60 Exception for reasonable overtime meal allowance...........

900-65 Crew members on international flights need not keep travel records.

Subdivision 900-C—Substantiating car expenses

900-70 Getting written evidence...........................

900-75 Retaining the written evidence and odometer records..........

Subdivision 900-D—Substantiating business travel expenses

900-80 Getting written evidence...........................

900-85 Keeping travel records............................

900-90 Retaining the written evidence and travel records............

900-95 Meaning of business travel expense

Subdivision 900-E—Written evidence

Guide to Subdivision 900-E

900-100 What this Subdivision is about......................

Operative provisions

900-105 Ways of getting written evidence.....................

900-110 Time limits..................................

900-115 Written evidence from supplier......................

900-120 Written evidence of depreciation expense................

900-125 Evidence of small expenses........................

900-130 Evidence of expenses considered otherwise too hard to substantiate.

900-135 Evidence on a group certificate......................

Subdivision 900-F—Travel records

Guide to Subdivision 900-F

900-140 What this Subdivision is about......................

900-145 Purpose of a travel record.........................

Operative provisions

900-150 Recording activities in travel records...................

900-155 Showing which of your activities were income-producing activities.

Subdivision 900-G—Retaining and producing records

Guide to Subdivision 900-G

900-160 What this Subdivision is about......................

900-165 The retention period.............................

Operative provisions

900-170 Extending the retention period if an expense is disputed........

900-175 Commissioner may tell you to produce your records..........

900-180 How to comply with a notice.......................

900-185 What happens if you don’t comply....................

Subdivision 900-H—Relief from effects of failing to substantiate

900-195 Commissioner’s discretion to review failure to substantiate......

900-200 Reasonable expectation that substantiation would not be required..

900-205 What if your documents are lost or destroyed?.............

Subdivision 900-I—Award transport payments

Guide to Subdivision 900-I

900-210 What this Subdivision is about......................

Operative provisions

900-215 Deducting an expense related to an award transport payment.....

900-220 Definition of award transport payment

900-225 Substituted industrial instruments.....................

900-230 Changes to industrial instruments applied for before 29 October 1986

900-235 Changes to industrial instruments solely referable to matters in the instrument

900-240 Deducting in anticipation of receiving award transport payment...

900-245 Effect of exception in this Subdivision on exception for small total of expenses

900-250 Effect of exception in this Subdivision on methods of calculating car expense deductions

Part 5-35—Miscellaneous

Division 909—Regulations

909-1 Regulations...................................

Chapter 6—The Dictionary

Part 6-1—Concepts and topics

Division 950—Rules for interpreting this Act

950-100 What forms part of this Act........................

950-105 What does not form part of this Act....................

950-150 Guides, and their role in interpreting this Act..............

Division 960—General

Subdivision 960-E—Entities

960-100 Entities....................................

Subdivision 960-H—Abnormal trading in shares or units

960-220 Meaning of trading

960-225 Abnormal trading..............................

960-230 Abnormal trading—5% of shares or units in one transaction.....

960-235 Abnormal trading—suspected 5% of shares or units in a series of transactions

960-240 Abnormal trading—suspected acquisition or merger..........

960-245 Abnormal trading—20% of shares or units traded over 60 day period

Division 975—Concepts about companies

Subdivision 975-A—General

975-100 When a company is in existence

975-150 Position to affect rights in relation to a company............

Subdivision 975-W—Wholly-owned groups of companies

975-500 Wholly-owned groups...........................

975-505 What is a 100% subsidiary?........................

Part 6-5—Dictionary definitions

Division 995—Definitions

995-1 Definitions....................................

Income Tax Assessment Act 1997

No. 38, 1997

An Act about income tax and related matters

The Parliament of Australia enacts:

Table of sections

1-1 Short title

1-2 Commencement

1-3 Differences in style not to affect meaning

This Act may be cited as the Income Tax Assessment Act 1997.

This Act commences on 1 July 1997.

(1) This Act contains provisions of the Income Tax Assessment Act 1936 in a rewritten form.

(2) If:

(a) that Act expressed an idea in a particular form of words; and

(b) this Act appears to have expressed the same idea in a different form of words in order to use a clearer or simpler style;

the ideas are not to be taken to be different just because different forms of words were used.

Note: A public or private ruling about a provision of the Income Tax Assessment Act 1936 is taken also to be a ruling about the corresponding provision of this Act, so far as the 2 provisions express the same ideas: see sections 14ZAAM and 14ZAXA of the Taxation Administration Act 1953.

Table of Subdivisions

2-A How to find your way around

2-B How the Act is arranged

2-C How to identify defined terms and find the definitions

2-D The numbering system

2-E Status of Guides and other non-operative material

This Act is designed to help you identify accurately and quickly the provisions that are relevant to your purpose in reading the income tax law.

The Act contains tables, diagrams and signposts to help you navigate your way.

You can start at Division 3 (What this Act is about) and follow the signposts as far into the Act as you need to go. You may also encounter signposts to several areas of the law that are relevant to you. Each one should be followed.

Sometimes they will lead down through several levels of detail. At each successive level, the rules are structured in a similar way. They will often be preceded by a Guide to the rules at that level. The rules themselves will usually deal first with the general or most common case and then with the more particular or special cases.

This Act is arranged in a way that reflects the principle of moving from the general case to the particular.

In this respect, the conceptual structure of the Act is something like a pyramid. The pyramid shape illustrates the way the income tax law is organised, moving down from the central or core provisions at the top of the pyramid, to general rules of wide application and then to the more specialised topics.

Table of sections

2-10 When defined terms are identified

2-15 When terms are not identified

2-20 Identifying the defined term in a definition

(1) Many of the terms used in the income tax law are defined.

(2) Most defined terms in this Act are identified by an asterisk appearing at the start of the term: as in “*business”. The footnote that goes with the asterisk contains a signpost to the Dictionary definitions starting at section 995‑1.

(1) Once a defined term has been identified by an asterisk, later occurrences of the term in the same subsection are not usually asterisked.

(2) Terms are not asterisked in the non-operative material contained in this Act.

Note: The non-operative material is described in Subdivision 2-E.

(3) The following basic terms used throughout the Act are not identified with an asterisk. They fall into 2 groups:

Key participants in the income tax system

Item | This term: | is defined in: |

1. | Australian resident | section 995-1 |

2. | Commissioner | section 995-1 |

3. | company | section 995-1 |

4. | entity | section 960-100 |

5. | individual | section 995-1 |

6. | partnership | section 995-1 |

7. | person | section 995-1 |

8. | trustee | section 995-1 |

9. | you | section 4-5 |

Core concepts

Item | This term: | is defined in: |

1. | amount | section 995-1 |

2. | assessable income | Division 6 |

3. | assessment | section 995-1 |

4. | deduct, deduction | Division 8 |

5. | income tax | section 995-1 |

6. | income year | section 995-1 |

7. | taxable income | section 4-15 |

8. | this Act | section 995-1 |

Within a definition, the defined term is identified by bold italics.

Table of sections

2-25 Purposes

2-30 Gaps in the numbering

Two main purposes of the numbering system in this Act are:

To indicate the relationship between units at different levels.

For example, the number of Part 2-15 indicates that the Part is in Chapter 2. Similarly, the number of section 165-70 indicates that the section is in Division 165.

To allow for future expansion of the Act. The main technique here is leaving gaps between numbers.

There are gaps in the numbering system to allow for the insertion of new Divisions and sections.

Except where the gaps follow a regular pattern, notes are included at the end of one group of units to indicate the number of the next unit.

Table of sections

2-35 Non-operative material

2-40 Guides

2-45 Other material

In addition to the operative provisions themselves, this Act contains other material to help you identify accurately and quickly the provisions that are relevant to you and to help you understand them.

This other material falls into 2 main categories.

The first is the “Guides”. A Guide consists of sections under a heading indicating that what follows is a Guide to a particular Subdivision, Division etc.

Guides form part of this Act but are kept separate from the operative provisions. In interpreting an operative provision, a Guide may only be considered for limited purposes. These are set out in section 950-150.

The other category consists of material such as notes and examples. These also form part of the Act. They are distinguished by type size from the operative provisions, but are not kept separate from them.

3-1 What this Act is about

3-5 Annual income tax

3-10 Your other obligations as a taxpayer

3-15 Your obligations other than as a taxpayer

This Act is mainly about income tax, and this Division is concerned only with income tax.

However, this Act also deals with a variety of other topics that may affect you:

Item | For a guide to this topic: | See: |

1. | Medicare levy | Division 785 |

2. | HECS (Higher Education Contribution Scheme) | Division 786 |

3. | Withholding taxes |

|

| on dividends, interest and royalties | Division 765 |

| on payments for mining operations on Aboriginal land | Division 766 |

| on interest paid by companies on bearer debentures | Division 767 |

| on certain income notionally accruing under deferred interest investments | Division 768 |

(1) Income tax is payable for each year by each individual and company, and by some other entities.

Note 1: Individuals who are Australian residents, and some trustees, are also liable to pay Medicare levy for each year. See Division 785.

Note 2: Income tax is imposed by the Income Tax Act 1986 and the other Acts referred to in the definition of income tax in section 995-1.

(2) Most entities have to pay instalments of income tax before the income tax they actually have to pay can be worked out.

(3) This Act answers these questions:

1. What instalments of income tax do you have to pay? When and how do you pay them?

See section 750-1.

2. How do you work out how much income tax you must pay?

See Division 4, starting at section 4-1.

3. What happens if your income tax is more than the instalments you have paid? When and how must you pay the rest?

See Division 1 (sections 204 to 220) of Part VI of the Income Tax Assessment Act 1936.

4. What happens if your income tax is less than the instalments you have paid? How do you get a refund?

See section 750-20.

5. What are your other obligations as a taxpayer, besides paying instalments and the rest of your income tax?

See section 3-10.

6. Do you have any other obligations under the income tax law?

See section 3-15.

7. If a dispute between you and the Commissioner of Taxation cannot be settled by agreement, what procedures for objection, review and appeal are available?

See Part IVC (sections 14ZL to 14ZZS) of the Taxation Administration Act 1953.

(1) Besides paying instalments and the rest of your income tax, your main obligations as a taxpayer are:

(a) to keep records and provide information as required by:

the Income Tax Assessment Act 1936; and

Division 900 (which sets out substantiation rules) of this Act; and

(b) to lodge returns as required by:

the Income Tax Assessment Act 1936.

Tax file numbers

(2) Under Part VA of the Income Tax Assessment Act 1936, a tax file number can be issued to you. You are not obliged to apply for a tax file number. However, if you do not quote one in certain situations:

you may become liable for instalments of income tax that would not otherwise have been payable;

the amount of certain of your instalments of income tax may be increased.

Your main obligations under the income tax law, other than as a taxpayer are:

in certain situations, to deduct from money you owe to another person, and to remit to the Commissioner, instalments of income tax payable by that person.

See Part 4-5 (Collection of income tax instalments),

starting at section 750-1.

4-1 Who must pay income tax

4-5 Meaning of you

4-10 How to work out how much income tax you must pay

4-15 How to work out your taxable income

Income tax is payable by each individual and company, and by some other entities.

Note: The actual amount of income tax payable may be nil.

For a list of the entities that must pay income tax,

see Division 9, starting at section 9-1.

If a provision of this Act uses the expression you, it applies to entities generally, unless its application is expressly limited.

Note: The expression you is not used in provisions that apply only to entities that are not individuals.

(1) You must pay income tax for each year ending on 30 June, called the financial year.

(2) Your income tax is worked out by reference to your taxable income for the income year. The income year is the same as the *financial year, except in these cases:

(a) for a company, the income year is the previous financial year;

(b) if you adopt an accounting period ending on a day other than 30 June, the income year is the accounting period adopted in place of the financial year or previous financial year, as appropriate.

Note: The Commissioner can allow you to adopt an accounting period ending on a day other than 30 June. See section 18 of the Income Tax Assessment Act 1936.

(3) Work out your income tax for the *financial year as follows:

![]()

Method statement

Step 1. Work out your taxable income for the income year.

To do this, see section 4-15.

Step 2. Work out your basic income tax liability on your taxable income using:

(a) the income tax rate or rates that apply to you for the income year; and

(b) any special provisions that apply to working out that liability.

See the Income Tax Rates Act 1986.

Step 3. Work out your tax offsets for the income year. A tax offset reduces the amount of income tax you have to pay.

For the list of tax offsets, see section 13-1.

Step 4. Subtract your *tax offsets from your basic income tax liability. The result is how much income tax you owe for the *financial year. (If your total tax offsets exceed your basic income tax liability, you are not entitled to a refund, or to offset the excess against any other liability.)

Note: Some tax offsets can be carried forward to a later year. See, for example, section 160AFE of the Income Tax Assessment Act 1936, which deals with the carry forward of excess foreign tax credits.

(4) For some entities, some or all of their income tax for the *financial year is worked out by reference to something other than taxable income for the income year.

See section 9-5.

(1) Work out your taxable income for the income year like this:

![]()

Method statement

Step 1. Add up all your assessable income for the income year.

To find out about your assessable income, see Division 6.

Step 2. Add up your deductions for the income year.

To find out what you can deduct, see Division 8.

Step 3. Subtract your deductions from your assessable income (unless they exceed it). The result is your taxable income. (If the deductions equal or exceed the assessable income, you don’t have a taxable income.)

Note: If the deductions exceed the assessable income, you may have a tax loss which you may be able to deduct in a later income year: see Division 36.

(2) There are cases where taxable income is worked out in a special way:

Item | For this case ... | See: |

1. | A company does not maintain continuity of ownership and control during the income year and does not continue to carry on the same business | Subdivision 165‑B |

2. | A company becomes a PDF (pooled development fund) during the income year, and the PDF component for the income year is a nil amount | section 124ZTA of the Income Tax Assessment Act 1936 |

3. | A shipowner or charterer: has its principal place of business outside Australia; and carries passengers, freight or mail shipped in Australia | section 129 of the Income Tax Assessment Act 1936 |

4. | An insurer who is not an Australian resident enters into insurance contracts connected with Australia | sections 142 and 143 of the Income Tax Assessment Act 1936 |

5. | The Commissioner makes a default or special assessment of taxable income | sections 167 and 168 of the Income Tax Assessment Act 1936 |

Table of sections

6-1 Diagram showing relationships among concepts in this Division

Operative provisions

6-5 Income according to ordinary concepts (ordinary income)

6-10 Other assessable income (statutory income)

6-15 What is not assessable income

6-20 Exempt income

6-25 Relationships among various rules about ordinary income

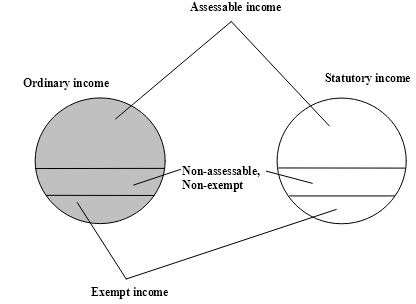

(1) Assessable income consists of *ordinary income and *statutory income.

(2) Some *ordinary income, and some *statutory income, is *exempt income.

(3) *Exempt income is not assessable income.

(4) Some *ordinary income, and some *statutory income, is neither assessable income nor *exempt income.

(1) Your assessable income includes income according to ordinary concepts, which is called ordinary income.

Note: Some of the provisions about assessable income listed in section 10-5 may affect the treatment of ordinary income.

(2) If you are an Australian resident, your assessable income includes the *ordinary income you *derived directly or indirectly from all sources, whether in or out of Australia, during the income year.

(3) If you are not an Australian resident, your assessable income includes:

(a) the *ordinary income you *derived directly or indirectly from all *Australian sources during the income year; and

(b) other *ordinary income that a provision includes in your assessable income for the income year on some basis other than having an *Australian source.

(4) In working out whether you have derived an amount of *ordinary income, and (if so) when you derived it, you are taken to have received the amount as soon as it is applied or dealt with in any way on your behalf or as you direct.

(1) Your assessable income also includes some amounts that are not *ordinary income.

Note: These are included by provisions about assessable income.

For a summary list of these provisions, see section 10-5.

(2) Amounts that are not *ordinary income, but are included in your assessable income by provisions about assessable income, are called statutory income.

Note: Many provisions in the summary list in section 10-5 contain rules about ordinary income. These rules do not change its character as ordinary income.

(3) If an amount would be *statutory income apart from the fact that you have not received it, it becomes statutory income as soon as it is applied or dealt with in any way on your behalf or as you direct.

(4) If you are an Australian resident, your assessable income includes your *statutory income from all sources, whether in or out of Australia.

(5) If you are not an Australian resident, your assessable income includes:

(a) your *statutory income from all *Australian sources; and

(b) other *statutory income that a provision includes in your assessable income on some basis other than having an *Australian source.

(1) If an amount is not *ordinary income, and is not *statutory income, it is not assessable income (so you do not have to pay income tax on it).

(2) If an amount is *exempt income, it is not assessable income.

Note: If an amount is exempt income, there are other consequences besides it being exempt from income tax. For example:

the amount may be taken into account in working out the amount of a tax loss (see section 36‑10);

you cannot deduct as a general deduction a loss or outgoing incurred in deriving the amount (see Division 8).

To find out about exempt income, see section 6-20.

(1) An amount of *ordinary income or *statutory income is exempt income if it is made exempt from income tax by a provision of this Act.

For summary lists of provisions about exempt income,

see sections 11-5, 11-10 and 11-15.

(2) *Ordinary income is also exempt income to the extent that this Act excludes it (expressly or by implication) from being assessable income.

Note: Some express provisions result in ordinary income being neither assessable income nor exempt income. See, for example, section 121EG of the Income Tax Assessment Act 1936, dealing with offshore banking units.

(3) By contrast, an amount of *statutory income is exempt income only if it is made exempt from income tax by a provision of this Act outside this Division.

(1) Sometimes more than one rule includes an amount in your assessable income:

the same amount may be *ordinary income and may also be included in your assessable income by one or more provisions about assessable income; or

the same amount may be included in your assessable income by more than one provision about assessable income.

For a summary list of the provisions about assessable income,

see section 10-5.

However, the amount is included only once in your assessable income for an income year, and is then not included in your assessable income for any other income year.

(2) Unless the contrary intention appears, the provisions of this Act (outside this Part) prevail over the rules about *ordinary income.

Note: This Act contains some specific provisions about how far the rules about ordinary income prevail over the other provisions of this Act.

Table of sections

8-1 General deductions

8-5 Specific deductions

8-10 No double deductions

(1) You can deduct from your assessable income any loss or outgoing to the extent that:

(a) it is incurred in gaining or producing your assessable income; or

(b) it is necessarily incurred in carrying on a *business for the purpose of gaining or producing your assessable income.

(2) However, you cannot deduct a loss or outgoing under this section to the extent that:

(a) it is a loss or outgoing of capital, or of a capital nature; or

(b) it is a loss or outgoing of a private or domestic nature; or

(c) it is incurred in relation to gaining or producing your *exempt income; or

(d) a provision of this Act prevents you from deducting it.

For a summary list of provisions about deductions, see section 12-5.

(3) A loss or outgoing that you can deduct under this section is called a general deduction.

(1) You can also deduct from your assessable income an amount that a provision of this Act (outside this Division) allows you to deduct.

(2) Some provisions of this Act prevent you from deducting an amount that you could otherwise deduct, or limit the amount you can deduct.

(3) An amount that you can deduct under a provision of this Act (outside this Division) is called a specific deduction.

For a summary list of provisions about deductions, see section 12-5.

If 2 or more provisions of this Act allow you deductions in respect of the same amount (whether for the same income year or different income years), you can deduct only under the provision that is most appropriate.

Table of sections

9-1 List of entities

9-5 Entities that work out their income tax by reference to something other than taxable income

Income tax is payable by the entities listed in the table.

Provisions of the Income Tax Assessment Act 1997 are identified in normal text. The other provisions, in bold, are provisions of the Income Tax Assessment Act 1936.

Item | Income tax is payable by this kind of entity: | because of this provision: |

1. | An individual | section 4-1 |

2. | A company, that is:

| section 4-1 |

3. | A corporate limited partnership (as defined in section 94D) | section 94J |

4. | A mutual insurance association (as described in section 121) | section 121 |

5. | A trustee (except one covered by a later item in this table), but only in respect of some kinds of income of the trust | sections 98, 99, 99A and 102 |

6. | The trustee of a corporate unit trust | section 102K |

7. | The trustee of a public trading trust | section 102S |

8. | The trustee of a complying superannuation fund | section 278 |

9. | The trustee of a non-complying superannuation fund | section 286 |

10. | The trustee of a complying approved deposit fund | section 289 |

11. | The trustee of a non-complying approved deposit fund | section 294 |

12. | The trustee of a pooled superannuation trust | section 296 |

(1) For some entities, some or all of their income tax for the *financial year is worked out as described in the table.

Provisions of the Income Tax Assessment Act 1997 are identified in normal text. The other provisions, in bold, are provisions of the Income Tax Assessment Act 1936.

Item | This kind of entity is liable to pay income tax worked out by reference to: | See: |

1. | A trustee covered by item 5 in the table in section 9-1 is liable to pay income tax worked out by reference to the net income of the trust for the income year. | sections 98, 99 and 99A |

2. | The trustee of a corporate unit trust is liable to pay income tax worked out by reference to the net income of the trust for the income year. | section 102K |

3. | The trustee of a public trading trust is liable to pay income tax worked out by reference to the net income of the trust for the income year. | section 102S |

4. | An entity that is liable to pay income tax (worked out by reference to taxable income or otherwise) is also liable to pay income tax worked out by reference to diverted income or diverted trust income for the income year. | section 121H |

5. | An Australian insurer that re-insures overseas can elect to pay, as agent for the re-insurer, income tax worked out by reference to the amount of the re-insurance premiums. | section 148 |

(2) For entities covered by an item in the table in subsection (1), the income year is the same as the *financial year, except in these cases:

(a) for a company, or an entity covered by item 2 or 3 in the table, the income year is the previous financial year;

(b) if an entity adopts an accounting period ending on a day other than 30 June, the income year is the accounting period adopted in place of the financial year or previous financial year, as appropriate.

Note: The Commissioner can allow an entity to adopt an accounting period ending on a day other than 30 June. See section 18 of the Income Tax Assessment Act 1936.

The provisions set out in the table:

include in your assessable income amounts that are not *ordinary income; and

vary or replace the rules that would otherwise apply for certain kinds of *ordinary income.

Provisions of the Income Tax Assessment Act 1997 are identified in normal text. The other provisions, in bold, are provisions of the Income Tax Assessment Act 1936.

accrued leave transfer payments |

|

............................................ | 26(ec) |

allowances |

|

see employment |

|

annual leave |

|

see leave payments |

|

annuities |

|

............................................ | 27H |

approved deposit fund (ADFs) |

|

see superannuation |

|

attributable income |

|

see controlled foreign corporations and foreign investment funds

|

|

avoidance of tax |

|

general ................................. | 177F |

diversion of income ......................... | 121H |

profits shifted out of Australia .................. | 136AD, 136AE |

see also transfers of income |

|

bad debt |

|

debt recovered after a deduction allowed for a bad debt . | 63(3) |

balancing adjustment |

|

see depreciation, industrial property, investments, mining, research & development, scientific research and timber |

|

banking |

|

offshore banking activities, income from ........... | 121EG(1) |

offshore banking unit, deemed interest on payments to by owner .. |

|

barter transactions |

|

............................................ | 21, 21A, 26(e) |

beneficiaries |

|

see trusts |

|

benefits |

|

business, non-cash ......................... | 21A |

consideration, non-cash ...................... | 21 |

meals you provide in an in-house dining facility ...... | 26AAAC |

see also employment and superannuation |

|

bonus shares |

|

see shares |

|

bounties |

|

............................................ | 26(g) |

capital gains |

|

............................................ | 160ZO |

see also insurance |

|

car expenses |

|

cents per kilometres reimbursement of ............ | 26(eaa) |

CFCs |

|

see controlled foreign corporations |

|

charters |

|

see shipping |

|

child |

|

non-trust income of, unearned .................. | 102AE |

trust income of, unearned ..................... | 102AG |

company |

|

see controlled foreign corporations, co-operative company, directors, dividends, liquidation, shareholders and shares |

|

compensation |

|

deductible loss or outgoing, insurance or indemnity for . | 26(j) |

lessee pays for non-compliance with covenant to repair . | 26(l) |

live stock or trees, recoveries for loss of ........... | 26B |

profit or income, insurance or indemnity for loss of .... | 26(j) |

trading stock, insurance or indemnity for loss of ...... | 26(j) |

see also embezzlement, insurance, live stock and scientific research |

|

consideration |

|

see benefits |

|

controlled foreign corporations (CFCs) |

|

attributable income of ....................... | 456 to 459A |

see also dividends and taxes |

|

co-operative company |

|

receipts of ............................... | 119 |

credit union |

|

see co-operative company |

|

currency gains |

|

see foreign exchange |

|

death |

|

see trusts |

|

debt/equity swap |

|

see shares and units |

|

defence forces |

|

allowances and benefits for service as a member of .... | 26(ea) |

depreciation |

|

excess over depreciated value at disposal of property, treatment of . |

|

pooled depreciated property, profits on the disposal, loss or destruction of |

|

development allowance |

|

partnership property acquired under a pre-27 February 1992 contract |

|

partnership which claimed a development allowance deduction, disposal of interest in |

|

directors |

|

excessive remuneration or retirement payment from company .... |

|

distributions |

|

see dividends |

|

dividends |

|

general ................................. | 44(1) |

distribution from a controlled foreign corporation ..... | 47A(1) |

foreign taxes on, grossing up of ................. | 6AC |

franked dividends, credits on ................... | 160AQT |

repayments of foreign income tax deducted from ..... | 26A |

see also liquidation |

|

drought investment allowance |

|

partnership which claimed drought investment allowance deduction, disposal of interest in |

|

elections |

|

reimbursement of expenses of .................. | 74(2), 74A(4) |

electricity connections |

|

recovery of expense of ....................... | 70A(5) |

eligible termination payments (ETPs) |

|

............................................ | 27A to 27H |

embezzlement |

|

recovery of loss from ........................ | 26(k) |

employees |

|

see shares |

|

employment |

|

allowances and benefits in relation to employment or rendering services |

|

return to work payments ...................... | 26(eb) |

see also accrued leave transfer payments, eligible termination payments and leave payments |

|

FIFs |

|

see foreign investment funds |

|

films |

|

Australian, proceeds of investment in ............. | 26AG |

foreign exchange |

|

gains .................................. | 82Y |

foreign investment funds (FIFs) |

|

attributable income of ....................... | 529 |

foreign tax paid in respect of a foreign investment fund attribution account payment |

|

see also taxes |

|

franked dividends |

|

see dividends |

|

improvements |

|

see leases |

|

imputation |

|

see dividends |

|

income equalisation deposits |

|

withdrawals from .......................... | 159GD |

industrial property |

|

consideration for disposal of ................... | 124P |

see also research & development |

|

infrastructure borrowings |

|

see interest |

|

insurance |

|

bonuses ................................. | 26(i), 26AH |

company, demutualisation of ................... | 121AT |

foreign life assurance policy ................... | 529 |

life assurance, transfer of contributions by superannuation fund or approved deposit fund to |

|

payments from a non-resident reinsurer in respect |

|

premiums in respect of Australian business received by non-resident insurers |

|

premiums paid to a non-resident for reinsurance ...... | 148 |

premiums paid to mutual insurance association ....... | 121 |

premiums payable to a non-resident for insurance of property in Australia |

|

premiums payable to a non-resident for insuring an event that can only happen in Australia |

|

premiums payable to a non-resident under an insurance contract with a resident |

|

rebates and premiums refunded to a superannuation fund trustee ... |

|

see also compensation, embezzlement and life assurance companies |

|

interest |

|

infrastructure borrowings, on ................... | 159GZZZZG |

loans raised in Australia by foreign governments, on ... | 27 |

overpaid tax, on ........................... | 26(jb) |

qualifying securities, on ...................... | 159GQ, 159GW(1) |

see also co-operative companies and leases |

|

investments |

|

non-interest bearing Commonwealth securities, gains on disposal or redemption of |

|

prizes from investment-related lotteries ............ | 26AJ |

qualifying securities, payments to partial residents made under .... |

|

qualifying securities, amount assessable to issuer of .... | 159GT(1B) |

qualifying securities, balancing adjustment on the transfer of ..... |

|

securities, variation in terms of ................. | 159GV(2) |

securities lending arrangements ................. | 26BC |

traditional securities, gains on the disposal or redemption of ..... |

|

see also films and interest |

|

leases |

|

crown leases used for primary production, assignment |

|

improvements made by lessee to land ............. | 87 |

interest component of payments under non-leveraged finance leases |

|

lessees’ payments for non-compliance with covenant to repair .... |

|

partnership leasing property under non-leveraged finance lease, new partner or contribution of capital since 14 May 1985 |

|

premiums on old leases ...................... | 84 |

premiums relating to a grant or assignment ......... | 26AB |

profit on disposal of previously leased motor vehicles .. | 26AAB |

leave payments |

|

accrued leave transfer payment ................. | 26(ec) |

annual leave, received in lieu of retirement or |

|

long service leave, received in lieu of retirement or termination ... |

|

life assurance companies |

|

consideration for transfer of equity in protection fund |

|

disposal of assets of ......................... | 116CB(3), 116CC(2), 116CD, 116GA(2), 116GB |

winding-up payments out of protection fund of ....... | 116DD |

liquidation |

|

distribution to a shareholder in winding up a company .. | 47(1) |

live stock |

|

death or destruction of ....................... | 36, 36AAA, 36AA |

departing Australia and ...................... | 36, 36AAA, 36AA |

insolvency, and ........................... | 36, 36AAA, 36AA |

profits on death or disposal of .................. | 36, 36AAA, 36AA |

see also compensation and trading stock |

|

loans |

|

fees for the procurement of .................... | 26(h) |

see also interest and shareholders |

|

long service leave |

|

see leave payments |

|

losses |

|

see compensation |

|

lotteries |

|

see investments |

|

meals |

|

see benefits |

|

mining |

|

balancing adjustment on disposal of property ........ | 330-485 |

minors |

|

see child |

|

motor vehicles |

|

see car expenses and leases |

|

mutual insurance |

|

see insurance |

|

non-cash benefits |

|

see benefits and employment |

|

offshore banking units |

|

see banking |

|

partnerships |

|

net income of, partner’s interest in ............... | 92(1) |

uncontrolled partnership income, effect of .......... | 94 |

see also development allowance, drought investment allowance and leases |

|

petroleum |

|

resource rent tax, recovery of .................. | 330-350(3) |

see also mining |

|

pooled depreciated property |

|

see depreciation |

|

premiums |

|

see insurance, leases and superannuation |

|

prizes |

|

see investments |

|

profits |

|

business partly in Australia and partly overseas ....... | 43(1) |

profit-making undertakings or the sale of property acquired for profit-making by sale |

|

see also avoidance of tax |

|

property |

|

see profits and trusts |

|

quarrying |

|

see mining |

|

rates |

|

refund of ................................ | 72(2) |

reimbursements |

|

see car expenses, dividends, elections, electricity connections, embezzlement, insurance, petroleum and taxes |

|

reinsurance |

|

see insurance |

|

research & development |

|

consideration for loss or disposal of plant or buildings used for .... |

|

return on ................................ | 73B(27A), (27C) |

transferee of property used for, effect of disposal or change of use by |

|

residual value |

|

see industrial property |

|

retirement payments |

|

see directors, leave payments and shareholders |

|

rights to income |

|

see transfers of income |

|

roads |

|

see timber |

|

royalties |

|

............................................ | 26(f) |

schemes |

|

see avoidance of tax |

|

scientific research |

|

consideration for disposal or destruction of buildings acquired for scientific research |

|

securities |

|

see investments |

|

services |

|

see co-operative companies, employment, loans and trusts |

|

shareholders |

|

excessive remuneration or retirement payment from company .... |

|

loans, payments and credits from company ......... | 108 |

see also dividends |

|

shares |

|

acquired in a debt/equity swap, profit on the disposal cancellation or redemption of |

|

bonus shares, cost of ........................ | 6BA |

buy-backs ............................... | 159GZZZJ to 159GZZZT |