Guide to Division 40

40‑1 What this Division is about

You can deduct an amount equal to the decline in value of a depreciating asset (an asset that has a limited effective life and that is reasonably expected to decline in value over the time it is used) that you hold.

That decline is generally measured by reference to the effective life of the asset.

You can also deduct amounts for certain other capital expenditure.

40‑10 Simplified outline of this Division

The key concepts about depreciating assets and certain other capital expenditure are outlined below (in bold italics).

Simplified outline of this Division |

Item | Major topic

Subordinate topics

Rules | Provisions |

1 | Rules about depreciating assets | |

1.1 | Core provisions Depreciating assets are assets with a limited effective life that are reasonably expected to decline in value. Broadly, the effective life of a depreciating asset is the period it can be used to produce income. The decline in value is based on the cost and effective life of the depreciating asset, not its actual change in value. It begins at start time, when you begin to use the asset (or when you have it installed ready for use). It continues while you use the asset (or have it installed). Usually, the owner of a depreciating asset holds the asset and can therefore claim deductions for its decline in value. Sometimes the economic owner will be different to the legal owner and the economic owner will be the holder. | Subdivision 40‑B |

1.2 | Cost The cost of a depreciating asset includes both: - expenses you incur to start holding the asset; and

- additional expenses that contribute to its present condition and location (e.g. improvements).

| Subdivision 40‑C |

1.3 | Balancing adjustments When you stop holding a depreciating asset you may have to include an amount in your assessable income, or deduct an amount under a balancing adjustment. The adjustment reconciles the decline with the actual change in value. | Subdivision 40‑D |

1.4 | Low‑value and software development pools Low‑cost assets and assets depreciated to a low value may be placed in a low value pool, which is treated as a single depreciating asset. You can also pool in‑house software expenditure in a software development pool. | Subdivision 40‑E |

1.5 | Primary production depreciating assets You can deduct amounts for capital expenditure on: - water facilities immediately; or

- horticultural plants over a period that relates to the effective life of the plant; or

- fodder storage assets immediately; or

- fencing assets immediately.

| Subdivision 40‑F |

2 | Rules about other capital expenditure | |

2.1 | Capital expenditure of primary producers and other landholders You can deduct amounts for capital expenditure on: - landcare operations immediately; or

- electricity and telephone lines over 10 income years.

| Subdivision 40‑G |

2.2 | Capital expenditure that is immediately deductible You can get an immediate deduction for certain capital expenditure on: - exploration or prospecting; and

- rehabilitation of mine and quarry sites; and

- paying petroleum taxes; and

- environmental protection activities.

| Subdivision 40‑H |

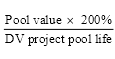

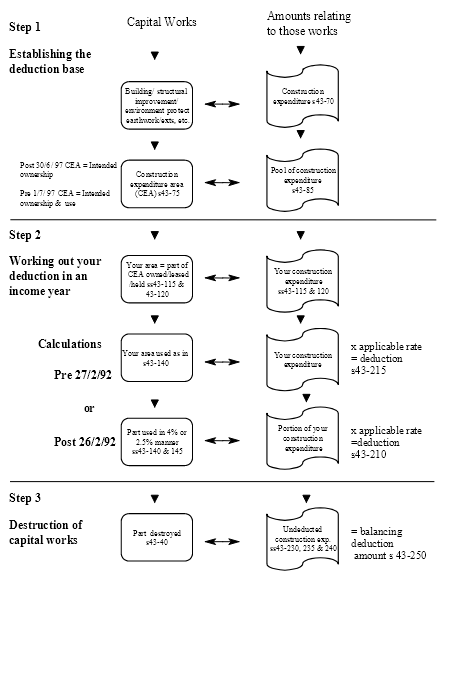

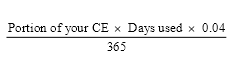

2.3 | Capital expenditure that is deductible over time You can deduct amounts for certain capital expenditure associated with projects you carry on. You deduct the amount over the life of the project using a project pool. You can also deduct amounts for certain business related costs over 5 years where the amounts are not otherwise taken into account and are not denied a deduction. | Subdivision 40‑I |

2.4 | Capital expenditure for establishing trees in carbon sink forests You can deduct amounts for capital expenditure for the establishment of trees in carbon sink forests. | Subdivision 40‑J |

Subdivision 40‑A—Objects of Division

Table of sections

40‑15 Objects of Division

40‑15 Objects of Division

The objects of this Division are:

(a) to allow you to deduct the *cost of a *depreciating asset; and

(b) to spread the deduction over a period that reflects the time for which the asset can be used to obtain benefits; and

(c) to provide deductions for certain other capital expenditure that is not otherwise deductible.

Note 1: This Division does not apply to some depreciating assets: see section 40‑45.

Note 2: The application of this Division to a life insurance company is affected by sections 320‑200 and 320‑255.

Subdivision 40‑B—Core provisions

Guide to Subdivision 40‑B

40‑20 What this Subdivision is about

The rules that apply to most depreciating assets are in this Subdivision. It explains:

• what a depreciating asset is; and

• when you start deducting amounts for depreciating assets; and

• how to work out your deductions.

It also contains rules for splitting and merging depreciating assets.

Table of sections

Operative provisions

40‑25 Deducting amounts for depreciating assets

40‑27 Further reduction of deduction for second‑hand assets in residential property

40‑30 What a depreciating asset is

40‑35 Jointly held depreciating assets

40‑40 Meaning of hold a depreciating asset

40‑45 Assets to which this Division does not apply

40‑50 Assets for which you deduct under another Subdivision

40‑53 Alterations etc. to certain depreciating assets

40‑55 Use of the “cents per kilometre” car expense deduction method

40‑60 When a depreciating asset starts to decline in value

40‑65 Choice of methods to work out the decline in value

40‑70 Diminishing value method

40‑72 Diminishing value method for post‑9 May 2006 assets

40‑75 Prime cost method

40‑80 When you can deduct the asset’s cost

40‑82 Assets costing less than $30,000—medium sized businesses—income years ending between 2 April 2019 and 30 June 2020

40‑85 Meaning of adjustable value and opening adjustable value of a depreciating asset

40‑90 Debt forgiveness

40‑95 Choice of determining effective life

40‑100 Commissioner’s determination of effective life

40‑102 Capped life of certain depreciating assets

40‑103 Effective life and remaining effective life of certain vessels

40‑105 Self‑assessing effective life

40‑110 Recalculating effective life

40‑115 Splitting a depreciating asset

40‑120 Replacement spectrum licences

40‑125 Merging depreciating assets

40‑130 Choices

40‑135 Certain anti‑avoidance provisions

40‑140 Getting tax information from associates

Operative provisions

40‑25 Deducting amounts for depreciating assets

You deduct the decline in value

(1) You can deduct an amount equal to the decline in value for an income year (as worked out under this Division) of a *depreciating asset that you *held for any time during the year.

Note 1: Sections 40‑70, 40‑72 and 40‑75 show you how to work out the decline for most depreciating assets. There is a limit on the decline: see subsections 40‑70(3), 40‑72(3) and 40‑75(7).

Note 2: Small business entities can choose to both deduct and work out the amount they can deduct under Division 328.

Note 3: Generally, only one taxpayer can deduct amounts for a depreciating asset. However, if you and another taxpayer jointly hold the asset, each of you deduct amounts for it: see section 40‑35.

Reduction of deduction

(2) You must reduce your deduction by the part of the asset’s decline in value that is attributable to your use of the asset, or your having it *installed ready for use, for a purpose other than a *taxable purpose.

Example: Ben holds a depreciating asset that he uses for private purposes for 30% of his total use in the income year.

If the asset declines by $1,000 for the year, Ben would have to reduce his deduction by $300 (30% of $1,000).

Note: You may have to make a further reduction under subsections (3) and (4) or section 40‑27.

Further reduction: leisure facilities

(3) You may have to make a further reduction for a *depreciating asset that is a *leisure facility attributable to your use of it, or your having it *installed ready for use, for a *taxable purpose.

(4) That reduction is the part of the *leisure facility’s decline in value that is attributable to your use of it, or your having it *installed ready for use, at a time when:

(a) its use did not constitute a *fringe benefit; or

(b) you did not use it or *hold it for use as mentioned in paragraph 26‑50(3)(b) (about using it in the course of your business or for your employees).

Exception: low‑value pools

(5) Subsections (2), (3) and (4) do not apply to *depreciating assets allocated to a low‑value pool.

Despite subsection (1), you can continue to deduct an amount equal to the decline in value for an income year (as worked out under this Division) of such an asset even though you do not continue to *hold that asset.

Note: See Subdivision 40‑E for low‑value pools.

Meaning of taxable purpose

(7) Subject to subsection (8), a taxable purpose is:

(a) the *purpose of producing assessable income; or

(b) the purpose of *exploration or prospecting; or

(c) the purpose of *mining site rehabilitation; or

(d) *environmental protection activities.

Note 1: Where you have had a deduction under this Division an amount may be included in your assessable income if the expenditure was financed by limited recourse debt that has terminated: see Division 243.

Note 2: When this Division notionally applies under section 355‑310 (about depreciating assets used for R&D activities), the taxable purpose is sometimes only the purpose of conducting R&D activities.

(8) If Division 250 applies to you and an asset that is a *depreciating asset:

(a) if section 250‑150 applies—you are taken not to be using the asset for a *taxable purpose to the extent of the *disallowed capital allowance percentage; or

(b) otherwise—you are taken not to be using the asset for such a purpose.

40‑27 Further reduction of deduction for second‑hand assets in residential property

(1) In addition to subsections 40‑25(2) to (4), you may have to further reduce your deduction for a *depreciating asset for the income year.

(2) Reduce your deduction by any part of the asset’s decline in value that is attributable to your use of it, or your having it *installed ready for use, for the *purpose of producing assessable income:

(a) from the use of *residential premises to provide residential accommodation; but

(b) not in the course of carrying on a *business;

if:

(c) you did not *hold the asset when it was first used, or first installed ready for use, (other than as trading stock) by any entity; or

(d) at any time during the income year or an earlier income year, the asset was used, or installed ready for use, either:

(i) in residential premises that were one of your residences at that time; or

(ii) for a purpose that was not a *taxable purpose, and in a way that was not occasional.

Note: Your deduction could be reduced to nil if the purpose to which paragraphs (a) and (b) relate is your only taxable purpose for using the asset or having the asset installed ready for use.

Exception—kind of entity

(3) Subsection (2) does not apply to you for the asset if, at any time during the income year, you are:

(a) a *corporate tax entity; or

(b) a *superannuation plan that is not a *self managed superannuation fund; or

(c) a *managed investment trust; or

(d) a public unit trust (within the meaning of section 102P of the Income Tax Assessment Act 1936); or

(e) a unit trust or partnership, if each *member of the trust or partnership is covered by a paragraph of this subsection at that time during the income year.

Exception—certain assets in new residential premises

(4) Paragraph (2)(c) does not apply to you for the asset if:

(a) the *residential premises referred to in paragraph (2)(a) (the current premises) are supplied to you as new residential premises on a particular day (the current supply day); and

(b) the asset is supplied to you as part of that supply of the current premises; and

(c) at the time you first *hold the asset as a result of that supply, the asset is used, or *installed ready for use, in:

(i) the current premises; or

(ii) any other real property in which an interest was supplied to you as part of that supply of the current premises; and

(d) at any earlier time, no entity was residing in any residential premises in which the asset was used, or installed ready for use, at that earlier time; and

(e) no amount can be deducted under this Division, or under Subdivision 328‑D, for the asset for any income year by any previous holder of the asset.

Note: An entity residing at an earlier time in other residential premises in the same complex will not cause paragraph (d) to prevent this subsection from applying.

(5) However, disregard paragraph (4)(d) for an earlier time if:

(a) the asset was used, or installed ready for use, in the current premises at that time; and

(b) both that time, and the current supply, happen during the 6‑month period starting on the day the current premises became new residential premises.

Exception—low‑value pools

(6) Subsection (2) does not apply to *depreciating assets allocated to a low‑value pool.

Note: See Subdivision 40‑E for low‑value pools.

40‑30 What a depreciating asset is

(1) A depreciating asset is an asset that has a limited *effective life and can reasonably be expected to decline in value over the time it is used, except:

(a) land; or

(b) an item of *trading stock; or

(c) an intangible asset, unless it is mentioned in subsection (2).

(2) These intangible assets are depreciating assets if they are not *trading stock:

(a) *mining, quarrying or prospecting rights;

(b) *mining, quarrying or prospecting information;

(c) items of *intellectual property;

(d) *in‑house software;

(e) *IRUs;

(f) *spectrum licences;

(h) *telecommunications site access rights.

(3) This Division applies to an improvement to land, or a fixture on land, whether the improvement or fixture is removable or not, as if it were an asset separate from the land.

Note 1: Whether such an asset is a depreciating asset depends on whether it falls within the definition in subsection (1).

Note 2: This Division does not apply to capital works for which you can deduct amounts under Division 43: see subsection 40‑45(2).

(4) Whether a particular composite item is itself a depreciating asset or whether its components are separate depreciating assets is a question of fact and degree which can only be determined in the light of all the circumstances of the particular case.

Example 1: A car is made up of many separate components, but usually the car is a depreciating asset rather than each component.

Example 2: A floating restaurant consists of many separate components (like the ship itself, stoves, fridges, furniture, crockery and cutlery), but usually these components are treated as separate depreciating assets.

(5) This Division applies to a renewal or extension of a *depreciating asset that is a right as if the renewal or extension were a continuation of the original right.

(6) This Division applies to a *mining, quarrying or prospecting right (the new right) as if it were a continuation of another mining, quarrying or prospecting right you *held if:

(a) the other right ends; and

(b) the new right and the other right relate to the same area, or any difference in area is not significant.

40‑35 Jointly held depreciating assets

(1) This Division and the provisions referred to in subsection (3) apply to a *depreciating asset (the underlying asset) that you *hold, and that is also held by one or more other entities, as if your interest in the underlying asset were itself the underlying asset.

Note: Partners do not hold partnership assets: see section 40‑40.

(2) As a result, the decline in value of the underlying asset is not itself taken into account.

Example: Buford Corp owns an office block that it leases to 2 companies, Smokey Pty Ltd and Bandit Pty Ltd. Smokey and Bandit decide to install a fountain in front of the building.

They discuss it with Buford who agrees to pay half the cost (because the fountain won’t be removable at the end of the lease). Smokey and Bandit split the rest of the cost between them.

Smokey and Bandit would each hold the asset under item 3 of the table in section 40‑40 and Buford would hold it under item 10. They would be joint holders, so each would write‑off its interest in the fountain.

(3) The provisions are:

(a) Divisions 41, 328 and 775 of this Act; and

(b) Divisions 40 and 328 of the Income Tax (Transitional Provisions) Act 1997.

40‑40 Meaning of hold a depreciating asset

Use this table to work out who holds a *depreciating asset. An entity identified in column 3 of an item in the table as not holding a depreciating asset cannot hold the asset under another item.

Identifying the holder of a depreciating asset |

Item | This kind of depreciating asset: | Is held by this entity: |

1 | A *car in respect of which a lease has been granted that was a *luxury car when the lessor first leased it | The lessee (while the lessee has the *right to use the car) and not the lessor |

2 | A *depreciating asset that is fixed to land subject to a *quasi‑ownership right (including any extension or renewal of such a right) where the owner of the right has a right to remove the asset | The owner of the quasi‑ownership right (while the right to remove exists) |

3 | An improvement to land (whether a fixture or not) subject to a *quasi‑ownership right (including any extension or renewal of such a right) made, or itself improved, by any owner of the right for the owner’s own use where the owner of the right has no right to remove the asset | The owner of the quasi‑ownership right (while it exists) |

4 | A *depreciating asset that is subject to a lease where the asset is fixed to land and the lessor has the right to recover the asset | The lessor (while the right to recover exists) |

5 | A right that an entity legally owns but which another entity (the economic owner) exercises or has a right to exercise immediately, where the economic owner has a right to become its legal owner and it is reasonable to expect that: (a) the economic owner will become its legal owner; or (b) it will be disposed of at the direction and for the benefit of the economic owner | The economic owner and not the legal owner |

6 | A *depreciating asset that an entity (the former holder) would, apart from this item, hold under this table (including by another application of this item) where a second entity (also the economic owner): (a) possesses the asset, or has a right as against the former holder to possess the asset immediately; and (b) has a right as against the former holder the exercise of which would make the economic owner the holder under any item of this table; and it is reasonable to expect that the economic owner will become its holder by exercising the right, or that the asset will be disposed of at the direction and for the benefit of the economic owner | The economic owner and not the former holder |

7 | A *depreciating asset that is a partnership asset | The partnership and not any particular partner |

8 | *Mining, quarrying or prospecting information that an entity has and that is relevant to: (a) *mining and quarrying operations carried on, or proposed to be carried on by the entity; or (b) a *business carried on by the entity that includes *exploration or prospecting for *minerals or quarry materials obtainable by such operations; whether or not it is generally available | The entity |

9 | Other *mining quarrying or prospecting information that an entity has and that is not generally available | The entity |

10 | Any *depreciating asset | The owner, or the legal owner if there is both a legal and equitable owner |

Example 1: Power Finance leases a luxury car to Kris who subleases it to Rachael. As lessee, item 1 makes Rachael the holder of the car. Power, as the legal owner, would normally hold the car under item 10.

However, item 1 makes it clear that Power, as lessor, does not hold the car. As the lessee, item 1 would normally mean that Kris held the car but, again, she is also a lessor and so is not the holder (she also doesn’t have the right to use the car during the sublease).

Example 2: Sandra sells a packing machine to Jenny under a hire purchase agreement. Jenny holds the machine under item 6 because, although she is not the legal owner until she exercises her option to purchase, she possesses the machine now and can exercise an option to become its legal owner.

Jenny is reasonably expected to exercise that option because the final payment will be well below the expected market value of the machine at the end of the agreement. Sandra, as the machine’s legal owner, would normally be its holder under item 10 but item 6 makes it clear that the legal owner is not the holder.

Note 1: Some assets may have holders under more than one item in the table.

Note 2: As well as hire purchase agreements, items 5 and 6 cover cases like assets subject to chattel mortgages, sales subject to retention of title clauses and assets subject to bare trusts.

40‑45 Assets to which this Division does not apply

Eligible work related items

(1) This Division does not apply to an asset that is an eligible work related item for the purposes of section 58X of the Fringe Benefits Tax Assessment Act 1986 where the relevant benefit provided by the employer is an expense payment benefit or a property benefit (within the meaning of that Act).

Capital works

(2) This Division does not apply to capital works for which you can deduct amounts under Division 43, or for which you could deduct amounts under that Division:

(a) but for expenditure being incurred, or capital works being started, before a particular day; or

(b) had you used the capital works for a purpose relevant to those capital works under section 43‑140.

Note: Section 43‑20 lists the capital works to which that Division applies.

Films

(5) This Division does not apply to a *depreciating asset if you or another taxpayer has deducted or can deduct amounts for it under:

(a) former Division 10BA of Part III of the Income Tax Assessment Act 1936 (about Australian films); or

(b) former Division 10B of Part III of that Act if the depreciating asset relates to a copyright in an Australian film within the meaning of that Division.

(6) This Division applies to a *depreciating asset that is copyright in a *film where a company is entitled to a *tax offset under section 376‑55 in respect of the film as if the asset’s *cost were reduced by the amount of that offset.

40‑50 Assets for which you deduct under another Subdivision

(1) You cannot deduct an amount, or work out a decline in value, for a *depreciating asset under this Subdivision if you or another taxpayer has deducted or can deduct amounts for it under Subdivision 40‑F (about primary production depreciating assets), 40‑G (about capital expenditure of primary producers and other landholders) or 40‑J (about capital expenditure for the establishment of trees in carbon sink forests).

(2) You cannot deduct an amount, or work out a decline in value, for *in‑house software under this Subdivision if you have allocated expenditure on the software to a software development pool under Subdivision 40‑E.

40‑53 Alterations etc. to certain depreciating assets

(1) These things are not the same *depreciating asset for the purposes of section 40‑50 and Subdivision 40‑F:

(a) a depreciating asset; and

(b) a repair of a capital nature, or an alteration, addition or extension, to that asset that would, if it were a separate depreciating asset, be a *water facility, *fodder storage asset or *fencing asset.

(2) These things are not the same *depreciating asset for the purposes of section 40‑50 and Subdivision 40‑G:

(a) a depreciating asset; and

(b) a repair of a capital nature, or an alteration, addition or extension, to that asset that would, if it were a separate depreciating asset, be a *landcare operation.

40‑55 Use of the “cents per kilometre” car expense deduction method

You cannot deduct any amount for the decline in value of a *car for an income year if you use the “cents per kilometre” method for the car for that year.

Note: See Subdivision 28‑C for that method.

40‑60 When a depreciating asset starts to decline in value

(1) A *depreciating asset you *hold starts to decline in value from when its *start time occurs.

(2) The start time of a *depreciating asset is when you first use it, or have it *installed ready for use, for any purpose.

Note: Previous use by a transition entity is ignored: see section 58‑70.

(3) However, there is another start time for a *depreciating asset you *hold if a *balancing adjustment event referred to in paragraph 40‑295(1)(b) occurs for the asset and you start to use the asset again. Its second start time is when you start using it again.

40‑65 Choice of methods to work out the decline in value

(1) You have a choice of 2 methods to work out the decline in value of a *depreciating asset. You must choose to use either the *diminishing value method or the *prime cost method.

Note 1: Once you make the choice for an asset, you cannot change it: see section 40‑130.

Note 2: For the diminishing value method, see sections 40‑70 and 40‑72. For the prime cost method, see section 40‑75.

Note 3: In some cases you do not have to make the choice because you can deduct the asset’s cost: see sections 40‑80 and 40‑82.

Note 4: Subdivisions 40‑BA and 40‑BB of the Income Tax (Transitional Provisions) Act 1997 may affect the operation of this section.

Exception: asset acquired from associate

(2) For a *depreciating asset that you acquire from an *associate of yours where the associate has deducted or can deduct an amount for the asset under this Division, you must use the same method that the associate was using.

Note: You can require the associate to tell you which method the associate was using: see section 40‑140.

Exception: holder changes but user same or associate of former user

(3) For a *depreciating asset that you acquire from a former *holder of the asset, you must use the same method that the former holder was using for the asset if:

(a) the former holder or another entity (each of which is the former user) was using the asset at a time before you became the holder; and

(b) while you hold the asset, the former user or an *associate of the former user uses the asset.

(4) However, you must use the *diminishing value method if:

(a) you do not know, and cannot readily find out, which method the former holder was using; or

(b) the former holder did not use a method.

Exception: low‑value pools

(5) You work out the decline in value of a *depreciating asset in a low‑value pool under Subdivision 40‑E rather than under this Subdivision.

Exception: also notionally deductible under R&D provisions

(6) If:

(a) only one of the following events has happened:

(i) you have deducted one or more amounts under this Division for an asset;

(ii) you have been entitled under section 355‑100 (about R&D) to one or more *tax offsets because you can deduct one or more amounts under section 355‑305 for an asset; but

(b) later, the other event happens for the asset;

then, for the purposes of working out the deduction for the later event, you must choose the same method that you chose for the first event.

Note 1: Deductions under section 355‑305 (about decline in value of tangible depreciating assets used for R&D activities) are worked out using a notional application of this Division.

Note 2: This subsection applies with changes if you have or could have deducted an amount under former section 73BA of the Income Tax Assessment Act 1936 for the asset (see section 40‑67 of the Income Tax (Transitional Provisions) Act 1997).

(7) If:

(a) the events in paragraph (6)(a) could both arise for the same period for an asset; and

(b) neither event has already arisen for the asset;

then you must choose the same method for the purposes of working out the deduction for each event.

40‑70 Diminishing value method

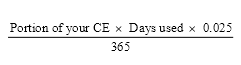

(1) You work out the decline in value of a *depreciating asset for an income year using the diminishing value method in this way:

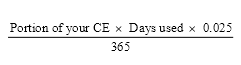

where:

base value is:

(a) for the income year in which the asset’s *start time occurs—its *cost; or

(b) for a later year—the sum of its *opening adjustable value for that year and any amount included in the second element of its cost for that year.

days held is the number of days you *held the asset in the income year from its *start time, ignoring any days in that year when you did not use the asset, or have it *installed ready for use, for any purpose.

Note 1: If you recalculate the effective life of a depreciating asset, you use that recalculated life in working out your deduction.

You can choose to recalculate effective life because of changed circumstances: see section 40‑110. That section also requires you to recalculate effective life in some cases.

Note 2: The effective life of a vessel can change in some cases: see subsection 40‑103(2).

Exception: intangibles

(2) You cannot use the *diminishing value method to work out the decline in value of:

(a) *in‑house software; or

(b) an item of *intellectual property (except copyright in a *film); or

(c) a *spectrum licence; or

(e) a *telecommunications site access right.

Limit on decline

(3) The decline in value of a *depreciating asset under this section for an income year cannot be more than the amount that is the asset’s *base value for that income year.

40‑72 Diminishing value method for post‑9 May 2006 assets

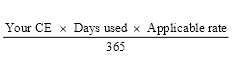

(1) You work out the decline in value of a *depreciating asset for an income year using the diminishing value method in this way if you started to *hold the asset on or after 10 May 2006:

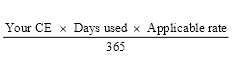

where:

days held has the same meaning as in subsection 40‑70(1).

Note: If you recalculate the effective life of a depreciating asset, you use that recalculated life in working out your deduction.

You can choose to recalculate effective life because of changed circumstances: see section 40‑110. That section also requires you to recalculate effective life in some cases.

Exception: intangibles

(2) You cannot use the *diminishing value method to work out the decline in value of:

(a) *in‑house software; or

(b) an item of *intellectual property (except copyright in a *film); or

(c) a *spectrum licence; or

(e) a *telecommunications site access right.

Limit on decline

(3) The decline in value of a *depreciating asset under this section for an income year cannot be more than the amount that is the asset’s *base value for that income year.

40‑75 Prime cost method

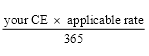

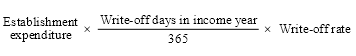

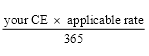

(1) You work out the decline in value of a *depreciating asset for an income year using the prime cost method in this way:

where:

where:

days held has the same meaning as in subsection 40‑70(1).

Example: Greg acquires an asset for $3,500 and first uses it on the 26th day of the income year. If the effective life of the asset is 31/3 years, the asset would decline in value in that year by:

The asset’s adjustable value at the end of the income year is:

(2) However, you must adjust the formula in subsection (1) for an income year (the change year):

(a) for which you recalculate the *depreciating asset’s *effective life; or

(b) after the year in which the asset’s start time occurs and in which an amount is included in the second element of the asset’s *cost; or

(c) for which the asset’s *opening adjustable value is reduced under section 40‑90 (about debt forgiveness); or

(d) in which the *remaining effective life of the asset is calculated under section 40‑103; or

(e) for which there is a reduction to the asset’s opening adjustable value under paragraph 40‑365(5)(b) (about involuntary disposals) where you are using the prime cost method; or

(f) for which the opening adjustable value of the asset is modified under subsection 27‑80(3A) or (4), 27‑85(3) or 27‑90(3); or

(g) for which there is a reduction in the asset’s opening adjustable value under section 775‑70; or

(h) for which there is an increase in the asset’s opening adjustable value under section 775‑75.

The adjustments apply for the change year and later years.

Note 1: For recalculating a depreciating asset’s effective life: see section 40‑110.

Note 2: You may also adjust the formula for an income year if you had undeducted core technology expenditure for the asset at the end of your last income year commencing before 1 July 2011 (see section 355‑605 of the Income Tax (Transitional Provisions) Act 1997).

Note 3: Subdivision 40‑BA or 40‑BB of the Income Tax (Transitional Provisions) Act 1997 may also require you to adjust the formula: see subsections 40‑135(3) and 40‑180(2) of that Act.

(3) The adjustments are:

(a) instead of the asset’s *cost, you use its *opening adjustable value for the change year plus the amounts (if any) included in the second element of its cost for that year; and

(b) instead of the asset’s *effective life, you use its *remaining effective life.

(4) The remaining effective life of a *depreciating asset is any period of its *effective life that is yet to elapse as at:

(a) the start of the change year; or

(b) in the case of a roll‑over under section 40‑340—the time when the *balancing adjustment event occurs for the transferor.

Note: Effective life is worked out in years and fractions of years.

(5) You must also adjust the formula in subsection (1) for an intangible *depreciating asset that:

(a) is mentioned in an item in the table in subsection 40‑95(7) (except item 5, 7 or 8); and

(b) you acquire from a former *holder of the asset.

The adjustment applies for the income year in which you acquire the asset and later income years.

(6) Instead of the asset’s *effective life under the table in subsection 40‑95(7), you use the number of years remaining in that effective life as at the start of the income year in which you acquire the asset.

Limit on decline

(7) The decline in value of a *depreciating asset under this section for an income year cannot be more than:

(a) for the income year in which the asset’s *start time occurs—its *cost; or

(b) for a later year—the sum of its *opening adjustable value for that year and any amount included in the second element of its cost for that year.

40‑80 When you can deduct the asset’s cost

Exploration or prospecting

(1) The decline in value of a *depreciating asset you *hold is the asset’s *cost if:

(a) you first use the asset for *exploration or prospecting for *minerals, or quarry materials, obtainable by *mining and quarrying operations; and

(b) when you first use the asset, you do not use it for:

(i) development drilling for *petroleum; or

(ii) operations in the course of working a mining property, quarrying property or petroleum field; and

(c) you satisfy one or more of these subparagraphs at the asset’s *start time:

(i) you carry on mining and quarrying operations;

(ii) it would be reasonable to conclude you proposed to carry on such operations;

(iii) you carry on a *business of, or a business that included, exploration or prospecting for minerals or quarry materials obtainable by such operations, and expenditure on the asset was necessarily incurred in carrying on that business; and

(d) in a case where the asset is a *mining, quarrying or prospecting right—you acquired the asset from an *Australian government agency or a *government entity; and

(e) in a case where the asset is *mining, quarrying or prospecting information:

(i) you acquired the asset from an Australian government agency or a government entity; or

(ii) the asset is a geophysical or geological data package you acquired from an entity to which subsection (1AA) applies; or

(iii) you created the asset, or contributed to the cost of its creation; or

(iv) you caused the asset to be created, or contributed to the cost of it being created, by an entity to which subsection (1AA) applies.

(1AA) This subsection applies to an entity if, at the time of the acquisition referred to in subparagraph (1)(e)(ii) or the creation referred to in subparagraph (1)(e)(iv), the entity predominantly carries on a *business of providing *mining, quarrying or prospecting information to other entities that:

(a) carry on *mining and quarrying operations; or

(b) it would be reasonable to conclude propose to carry on such operations; or

(c) carry on a business of, or a business that included, *exploration or prospecting for *minerals or quarry materials obtainable by such operations.

(1AB) If an amount is included in the second element of the *cost of a *depreciating asset, subsection (1) applies in relation to that amount only if:

(a) your first use of the asset, after the inclusion of the amount in the second element, is for *exploration or prospecting for *minerals, or quarry materials, obtainable by *mining and quarrying operations; and

(b) at the time of that first use:

(i) you satisfy paragraph (1)(b) as if that first use was your first use of the asset; and

(ii) you satisfy paragraph (1)(c) as if the time of that first use was the asset’s *start time; and

(c) if the amount relates to a *mining, quarrying or prospecting right—after the inclusion of the amount in the second element, you satisfy paragraph (1)(d) in relation to the right; and

(d) if the amount relates to *mining, quarrying or prospecting information—after the inclusion of the amount in the second element:

(i) you satisfy paragraph (1)(e) in relation to the information; or

(ii) you would satisfy that paragraph, in relation to the economic benefit that resulted in the inclusion of the amount in the second element, if that economic benefit were the asset referred to in that paragraph.

(1AC) If subsection (1) does not apply to a *depreciating asset:

(a) the fact that subsection (1) does not apply to the asset does not prevent the application of subsection (1AB) to an amount included in the second element of the *cost of the asset; but

(b) subsection (1) only affects the asset’s decline in value to the extent that the asset’s cost consists of that amount.

Depreciating assets used for certain purposes

(2) The decline in value of a *depreciating asset you start to *hold in an income year is the asset’s *cost if:

(a) that cost does not exceed $300; and

(b) you use the asset predominantly for the *purpose of producing assessable income that is not income from carrying on a *business; and

(c) the asset is not one that is part of a set of assets that you started to hold in that income year where the total cost of the set of assets exceeds $300; and

(d) the total cost of the asset and any other identical, or substantially identical, asset that you start to hold in that income year does not exceed $300.

40‑82 Assets costing less than $150,000—medium sized businesses—assets first acquired between 2 April 2019 and 31 December 2020

Year in which asset first used, or installed ready for use, for a taxable purpose

(1) The decline in value of a *depreciating asset you *hold for the income year (the current year) in which you start to use the asset, or have it *installed ready for use, for a *taxable purpose is the amount worked out under subsection (2) if:

(a) you are an entity covered by subsection (4) (about medium sized businesses) for:

(i) the current year; and

(ii) the income year in which you started to hold the asset; and

(b) you first acquired the asset:

(i) at or after 7.30 pm, by legal time in the Australian Capital Territory, on 2 April 2019; and

(ii) before 12 March 2020; and

(c) the current year ends on or after 2 April 2019; and

(d) you start to use the asset, or have it installed ready for use, for a taxable purpose before 12 March 2020; and

(e) the asset is a depreciating asset whose *cost as at the end of the current year is less than $30,000.

Note: The amount you can deduct may be reduced by other provisions, such as subsection 40‑25(2) (about taxable purpose) and section 40‑215 (about double deductions).

(2) The amount is:

(a) unless paragraph (b) applies—the asset’s *cost as at the end of the current year; or

(b) if the asset’s *start time occurred in an earlier income year—the sum of the asset’s *opening adjustable value for the current year and any amount included in the second element of its cost for the current year.

(2A) The decline in value of a *depreciating asset you *hold for the income year (the current year) in which you start to use the asset, or have it *installed ready for use, for a *taxable purpose is the amount worked out under subsection (2B) if:

(a) you are an entity covered by subsection (4) (about medium sized businesses), or by subsection (4A) (about medium sized businesses and certain assets) in relation to the asset, for:

(i) the current year; and

(ii) the income year in which you started to hold the asset; and

(b) you first acquired the asset:

(i) at or after 7.30 pm, by legal time in the Australian Capital Territory, on 2 April 2019; and

(ii) on or before 31 December 2020; and

(c) the current year ends on or after 12 March 2020; and

(d) you start to use the asset, or have it installed ready for use, for a taxable purpose:

(i) on or after 12 March 2020; and

(ii) on or before 30 June 2021; and

(e) the asset is a depreciating asset whose *cost as at the end of the earlier of:

(i) the end of the current year; and

(ii) 31 December 2020;

is less than $150,000.

Note 1: The amount you can deduct may be reduced by other provisions, such as subsection 40‑25(2) (about taxable purpose) and section 40‑215 (about double deductions).

Note 2: This subsection does not apply if Subdivision 40‑BB of the Income Tax (Transitional Provisions) Act 1997 applies: see section 40‑145 of that Act.

(2B) The amount is:

(a) unless paragraph (b) applies—the asset’s *cost as at the earlier of:

(i) the end of the current year; and

(ii) 31 December 2020; or

(b) if the asset’s *start time occurred in an earlier income year—the sum of:

(i) the asset’s *opening adjustable value for the current year; and

(ii) any amount included in the second element of the asset’s cost for the current year, other than an amount included after 31 December 2020.

Later year

(3) The decline in value of a *depreciating asset you *hold for an income year (the later year) is the first amount included in the second element of the asset’s *cost for the later year if:

(a) you are an entity covered by subsection (4) (about medium sized businesses) for the later year; and

(aa) the amount is included before 12 March 2020; and

(b) the amount included is less than $30,000; and

(c) you worked out the decline in value of the asset for an earlier income year under subsection (1); and

(d) the later year ends on or after 2 April 2019.

Note: The amount you can deduct may be reduced by other provisions, such as subsection 40‑25(2) (about taxable purpose) and section 40‑215 (about double deductions).

(3A) The decline in value of a *depreciating asset you *hold for an income year (the later year) is the first amount included in the second element of the asset’s *cost for the later year if:

(a) you are an entity covered by subsection (4) (about medium sized businesses), or by subsection (4B) (about medium sized businesses and certain amounts) in relation to the amount, for the later year; and

(b) the amount is included:

(i) on or after 12 March 2020; and

(ii) on or before 31 December 2020; and

(c) the amount included is less than $150,000; and

(d) you worked out the decline in value of the asset for an earlier income year under subsection (1) or (2A); and

(e) the later year ends on or after 12 March 2020.

Note 1: The amount you can deduct may be reduced by other provisions, such as subsection 40‑25(2) (about taxable purpose) and section 40‑215 (about double deductions).

Note 2: This subsection does not apply if Subdivision 40‑BB of the Income Tax (Transitional Provisions) Act 1997 applies: see section 40‑145 of that Act.

Medium sized business

(4) An entity is covered by this subsection for an income year if:

(a) the entity is not a *small business entity for the income year; and

(b) the entity would be a small business entity for the income year if:

(i) each reference in Subdivision 328‑C (about what is a small business entity) to $10 million were instead a reference to $50 million; and

(ii) the reference in paragraph 328‑110(5)(b) to a small business entity were instead a reference to an entity covered by this subsection.

(4A) An entity is covered by this subsection for an income year in relation to an asset mentioned in subsection (2A) if:

(a) the entity starts to use the asset, or has the asset *installed ready for use, for a *taxable purpose in the period beginning on 12 March 2020 and ending on 30 June 2021; and

(b) the entity is not a *small business entity for the income year; and

(c) the entity would be a small business entity for the income year if:

(i) each reference in Subdivision 328‑C (about what is a small business entity) to $10 million were instead a reference to $500 million; and

(ii) the reference in paragraph 328‑110(5)(b) to a small business entity were instead a reference to an entity covered by this subsection in relation to the asset.

(4B) An entity is covered by this subsection for an income year in relation to an amount included as mentioned in subsection (3A) if:

(a) the amount is so included in the period beginning on 12 March 2020 and ending on 31 December 2020; and

(b) the entity is not a *small business entity for the income year; and

(c) the entity would be a small business entity for the income year if:

(i) each reference in Subdivision 328‑C (about what is a small business entity) to $10 million were instead a reference to $500 million; and

(ii) the reference in paragraph 328‑110(5)(b) to a small business entity were instead a reference to an entity covered by this subsection in relation to the amount.

Assets you start to use, or have installed ready for use, after 30 June 2021

(5) The decline in value of a *depreciating asset you start to use, or have *installed ready for use, for a *taxable purpose after 30 June 2021 is worked out under the other provisions of this Division.

Amounts included in second element of cost after 31 December 2020

(6) The effect on the value of a *depreciating asset of an amount included in the second element of the asset’s *cost after 31 December 2020 is worked out under the other provisions of this Division.

40‑85 Meaning of adjustable value and opening adjustable value of a depreciating asset

(1) The adjustable value of a *depreciating asset at a particular time is:

(a) if you have not yet used it or had it *installed ready for use for any purpose—its *cost; or

(b) for a time in the income year in which you first use it, or have it installed ready for use, for any purpose—its cost less its decline in value up to that time; or

(c) for a time in a later income year—the sum of its *opening adjustable value for that year and any amount included in the second element of its cost for that year up to that time, less its decline in value for that year up to that time.

Note: The adjustable value of a depreciating asset may be modified by section 250‑285.

(2) The opening adjustable value of a *depreciating asset for an income year is its *adjustable value to you at the end of the previous income year.

Note: The opening adjustable value of a depreciating asset may be modified by one of these provisions:

(a) Subdivision 27‑B;

(b) subsection 40‑90(3);

(c) subsection 40‑285(4);

(d) paragraph 40‑365(5)(b);

(e) section 775‑70;

(f) section 775‑75;

(g) section 355‑605 of the Income Tax (Transitional Provisions) Act 1997.

40‑90 Debt forgiveness

(1) This section applies if an amount (the debt forgiveness amount) is applied in reduction of expenditure for a *depreciating asset in an income year under section 245‑155 or 245‑157.

(2) The asset’s *cost is reduced for that income year by the debt forgiveness amount.

(3) The asset’s *opening adjustable value for that income year is reduced by the debt forgiveness amount if that income year is later than the one in which its *start time occurs.

40‑95 Choice of determining effective life

(1) You must choose either:

(a) to use an *effective life determined by the Commissioner for a *depreciating asset under section 40‑100; or

(b) to work out the effective life of the asset yourself under section 40‑105.

Note: If you choose to use an effective life determined by the Commissioner for a depreciating asset, a capped life may apply to the asset under section 40‑102.

(2) Your choice of an *effective life determined by the Commissioner for a *depreciating asset is limited to one in force as at:

(a) the time when you entered into a contract to acquire the asset, you otherwise acquired it or you started to construct it if its *start time occurs within 5 years of that time; or

(b) for *plant that you entered into a contract to acquire, you otherwise acquired or you started to construct before 11.45 am, by legal time in the Australian Capital Territory, on 21 September 1999—the time when you entered into the contract to acquire it, otherwise acquired it or started to construct it; or

(c) otherwise—its *start time.

(3) You must make the choice for the income year in which the asset’s *start time occurs.

Note: For rules about choices: see section 40‑130.

Exception: asset acquired from associate

(4) For a *depreciating asset that you start to *hold where the former holder is an *associate of yours and the associate has deducted or can deduct an amount for the asset under this Division, you must use:

(a) if the associate was using the *diminishing value method for the asset—the same *effective life that the associate was using; or

(b) if the associate was using the *prime cost method—an effective life equal to any period of the asset’s effective life the associate was using that is yet to elapse at the time you started to hold it.

Note: You can require the associate to tell you which effective life the associate was using: see section 40‑140.

(4A) Subsection (4) does not apply to a *depreciating asset if subsection (4B) or (4C) applies to the asset.

(4B) For a *depreciating asset that you start to *hold if:

(a) the former holder is an *associate of yours; and

(b) the associate has deducted or can deduct an amount for the asset under this Division; and

(c) section 40‑102 applied to the asset immediately before you started to hold it because an item in the tables in subsections 40‑102(4) and (5) applied to it at the relevant time (the relevant time for the associate) that applied to the associate under subsection 40‑102(3); and

(d) a different item in the tables in subsections 40‑102(4) and (5) applies to the asset when you start to hold it; and

(e) the item referred to in paragraph (d) would have applied to the asset at the relevant time for the associate if the use to which the asset were put at that time were the use (the new use) to which it is put when you start to hold it;

you must use:

(f) if the associate was using the *diminishing value method for the asset—an *effective life equal to the *capped life that would have applied to the asset under subsection 40‑102(4) or (5) at the relevant time for the associate if the use to which the asset were put at that time were the new use; or

(g) if the associate was using the *prime cost method—an effective life equal to the capped life that:

(i) would have applied to the asset under subsection 40‑102(4) or (5) at the relevant time for the associate if the use to which the asset were put at that time were the new use; and

(ii) is yet to elapse at the time you start to hold it.

Note 1: If paragraph (e) is not satisfied, subsection (4C) may apply to the depreciating asset.

Note 2: You can require the associate to tell you the relevant time that applied to the associate under subsection 40‑102(3): see section 40‑140.

(4C) For a *depreciating asset that you start to *hold if:

(a) the former holder is an *associate of yours; and

(b) the associate has deducted or can deduct an amount for the asset under this Division; and

(c) section 40‑102 applied to the asset immediately before you started to hold it; and

(d) one of the following applies:

(i) no item in the tables in subsections 40‑102(4) and (5) applies to the asset when you start to hold it;

(ii) subsection (4B) would apply to the asset but for paragraph (e) of that subsection not being satisfied;

you must use:

(e) if the associate was using the *diminishing value method for the asset—the *effective life determined by the Commissioner for the asset under section 40‑100 that the associate would have used if section 40‑102 had not applied to the asset; or

(f) if the associate was using the *prime cost method—an effective life equal to any period of the effective life determined by the Commissioner for the asset under section 40‑100 that:

(i) the associate would have used if section 40‑102 had not applied to the asset; and

(ii) is yet to elapse at the time you start to hold it.

Note: You can require the associate to tell you which effective life the associate would have used if section 40‑102 had not applied to the asset: see section 40‑140.

Exception: holder changes but user same or associate of former user

(5) For a *depreciating asset that you start to *hold where:

(a) the former holder or another entity (each of which is the former user) was using the asset at a time before you became the holder; and

(b) while you hold the asset, the former user or an *associate of the former user uses the asset;

you must use:

(c) if the former holder was using the *diminishing value method for the asset—the same *effective life that the former holder was using; or

(d) if the former holder was using the *prime cost method—an effective life equal to any period of the asset’s effective life the former holder was using that is yet to elapse at the time you started to hold it.

(5A) Subsection (5) does not apply to a *depreciating asset if subsection (5B) or (5C) applies to the asset.

(5B) For a *depreciating asset that you start to *hold if:

(a) paragraphs (5)(a) and (b) apply; and

(b) section 40‑102 applied to the asset immediately before you started to hold it because an item in the tables in subsections 40‑102(4) and (5) applied to it at the relevant time (the relevant time for the former holder) that applied to the former holder under subsection 40‑102(3); and

(c) a different item in the tables in subsections 40‑102(4) and (5) applies to the asset when you start to hold it; and

(d) the item referred to in paragraph (c) would have applied to the asset at the relevant time for the former holder if the use to which the asset were put at that time were the use (the new use) to which it is put when you start to hold it;

you must use:

(e) if the former holder was using the *diminishing value method for the asset—an *effective life equal to the *capped life that would have applied to the asset under subsection 40‑102(4) or (5) at the relevant time for the former holder if the use to which the asset were put at that time were the new use; or

(f) if the former holder was using the *prime cost method—an effective life equal to the capped life that:

(i) would have applied to the asset under subsection 40‑102(4) or (5) at the relevant time for the former holder if the use to which the asset were put at that time were the new use; and

(ii) is yet to elapse at the time you start to hold it.

Note: If paragraph (d) is not satisfied, subsection (5C) may apply to the depreciating asset.

(5C) For a *depreciating asset that you start to *hold if:

(a) paragraphs (5)(a) and (b) apply; and

(b) section 40‑102 applied to the asset immediately before you started to hold it; and

(c) one of the following applies:

(i) no item in the tables in subsections 40‑102(4) and (5) applies to the asset when you start to hold it;

(ii) subsection (5B) would apply to the asset but for paragraph (d) of that subsection not being satisfied;

you must use:

(d) if the former holder was using the *diminishing value method for the asset—the *effective life determined by the Commissioner for the asset under section 40‑100 that the former holder would have used if section 40‑102 had not applied to the asset; or

(e) if the former holder was using the *prime cost method—an effective life equal to any period of the effective life determined by the Commissioner for the asset under section 40‑100 that:

(i) the former holder would have used if section 40‑102 had not applied to the asset; and

(ii) is yet to elapse at the time you start to hold it.

(6) However, you must use an *effective life determined by the Commissioner if:

(a) you do not know, and cannot readily find out, which effective life the former holder was using and, if subsection (5B) or (5C) applied to the asset, either of the following matters:

(i) the effective life the former holder would have used if section 40‑102 had not applied to the asset;

(ii) the relevant time that applied to the former holder under subsection 40‑102(3); or

(b) the former holder did not use an effective life.

Exception: intangible depreciating assets

(7) The effective life of an intangible *depreciating asset mentioned in this table is the period applicable to that asset under the table.

Effective life of certain intangible depreciating assets |

Item | For this asset: | The effective life is: |

1 | Standard patent | 20 years |

2 | Innovation patent | 8 years |

3 | Petty patent | 6 years |

4 | Registered design | 15 years |

5 | Copyright (except copyright in a *film) | The shorter of: (a) 25 years from when you acquire the copyright; or (b) the period until the copyright ends |

6 | A licence (except one relating to a copyright or *in‑house software) | The term of the licence |

7 | A licence relating to a copyright (except copyright in a *film) | The shorter of: (a) 25 years from when you become the licensee; or (b) the period until the licence ends |

8 | *In‑house software | 5 years |

9 | *Spectrum licence | The term of the licence |

14 | *Telecommunications site access right | The term of the right |

(8) The effective life of an intangible *depreciating asset that is not mentioned in the table in subsection (7) and is not an *IRU or a *mining, quarrying or prospecting right cannot be longer than the term of the asset as extended by any reasonably assured extension or renewal of that term.

(9) The effective life of an *IRU is the *effective life of the telecommunications cable over which the IRU is granted.

Exceptions: mining, quarrying or prospecting rights and mining, quarrying or prospecting information

(10) Subject to subsection (12), the effective life of:

(a) a *mining, quarrying or prospecting right; or

(b) *mining, quarrying or prospecting information;

is the period you work out yourself by estimating the period (in years, including fractions of years) set out in column 2 of this table:

Effective life of certain mining, quarrying or prospecting rights and mining, quarrying or prospecting information |

Item | Column 1

For this asset: | Column 2

Estimate the period until the end of: |

1 | A *mining, quarrying or prospecting right, or *mining, quarrying or prospecting information, relating to *mining and quarrying operations (except obtaining *petroleum or quarry materials) | The life of the mine or proposed mine to which the right or information relates or, if there is more than one, the life of the mine that has the longest estimated life |

2 | A *mining, quarrying or prospecting right, or *mining, quarrying or prospecting information, relating to *mining and quarrying operations to obtain *petroleum | The life of the petroleum field or proposed petroleum field to which the right or information relates or, if there is more than one, the life of the petroleum field that has the longest estimated life |

3 | A *mining, quarrying or prospecting right, or *mining, quarrying or prospecting information, relating to *mining and quarrying operations to obtain quarry materials | The life of the quarry or proposed quarry to which the right or information relates or, if there is more than one, the life of the quarry that has the longest estimated life |

(10A) However, if the only reason that subsection 40‑80(1) does not apply to the *mining, quarrying or prospecting right, or *mining, quarrying or prospecting information, is that the right or information does not meet the requirements of paragraph 40‑80(1)(d) or (e), the effective life of the right or information is the shorter of:

(a) the period that would, apart from this subsection, be the effective life of the information or right under subsection (10); and

(b) 15 years.

(11) You work out the period in subsection (10):

(a) as from the *start time of the *mining, quarrying or prospecting right or *mining, quarrying or prospecting information; and

(b) by reference only to the period of time over which the reserves, reasonably estimated using an appropriate accepted industry practice, are expected to be extracted from the mine, *petroleum field or quarry.

(12) The effective life of a *mining, quarrying or prospecting right, or *mining, quarrying or prospecting information, is 15 years if the right or information does not relate to:

(a) a mine or proposed mine; or

(b) a petroleum field or proposed petroleum field; or

(c) a quarry or proposed quarry.

40‑100 Commissioner’s determination of effective life

(1) The Commissioner may make a written determination specifying the effective life of *depreciating assets. The determination may specify conditions for particular depreciating assets.

(2) A determination may specify a day from which it takes effect for *depreciating assets specified in the determination.

(3) A determination may operate retrospectively to a day specified in the determination if:

(a) there was no applicable determination at that day for the *depreciating asset covered by the determination; or

(b) the determination specifies a shorter *effective life for the depreciating asset covered by the determination than was previously applicable.

Criteria for making a determination

(4) The Commissioner is to make a determination of the effective life of a *depreciating asset in accordance with subsections (5) and (6).

(5) Firstly, estimate the period (in years, including fractions of years) the asset can be used by any entity for one or more of the following purposes:

(a) a *taxable purpose;

(b) the purpose of producing *exempt income or *non‑assessable non‑exempt income;

(c) the purpose of conducting *R&D activities, assuming that this is reasonably likely.

(6) Secondly, if relevant for the asset:

(a) assume the asset will be subject to wear and tear at a rate that is reasonable for the Commissioner to assume; and

(b) assume the asset will be maintained in reasonably good order and condition; and

(c) have regard to the period within which the asset is likely to be scrapped, sold for no more than scrap value or abandoned.

However, for paragraph (c), disregard reasons attributable to the technical risk in conducting *R&D activities if it is reasonably likely that the asset will be used for such activities.

40‑102 Capped life of certain depreciating assets

(1) If this section applies to a *depreciating asset, the effective life of the asset is the period (the capped life) that applies to the asset under subsection (4) or (5) at the relevant time (which is worked out using subsection (3)).

Working out if this section applies

(2) This section applies to a *depreciating asset if:

(a) you choose, under paragraph 40‑95(1)(a), to use an *effective life determined by the Commissioner for the asset under section 40‑100; and

(b) your choice is limited to a determination in force at the time mentioned in paragraph 40‑95(2)(a) or (c); and

(c) a *capped life applies to the asset under subsection (4) or (5) at the relevant time (which is worked out using subsection (3)); and

(d) the capped life is shorter than the effective life mentioned in paragraph (a).

(3) For the purposes of this section, the relevant time is:

(a) the *start time of the *depreciating asset if:

(i) paragraph 40‑95(2)(c) applies to you; or

(ii) paragraph 40‑95(2)(a) applies to you and a *capped life does not apply to the asset under subsection (4) or (5) at the time mentioned in that paragraph; or

(iii) paragraph 40‑95(2)(a) applies to you and the capped life that applies to the asset under subsection (4) or (5) at the time mentioned in that paragraph is longer than the capped life that applies to the asset at its start time; or

(b) if paragraph (a) does not apply—the time mentioned in paragraph 40‑95(2)(a).

Capped life

(4) If the *depreciating asset corresponds exactly to the description in column 2 of the table, the capped life of the asset is the period specified in column 3 of the table.

Capped life of certain depreciating assets |

Item | Kind of depreciating asset | Period |

1 | Aeroplane used predominantly for agricultural spraying or agricultural dusting | 8 years |

2 | Aeroplane to which item 1 does not apply | 10 years |

3 | Helicopter used predominantly for mustering, agricultural spraying or agricultural dusting | 8 years |

4 | Helicopter to which item 3 does not apply | 10 years |

5 | Bus with a *gross vehicle mass of more than 3.5 tonnes | 7.5 years |

6 | Light commercial vehicle with a *gross vehicle mass of 3.5 tonnes or less and designed to carry a load of 1 tonne or more | 7.5 years |

7 | Minibus with a *gross vehicle mass of 3.5 tonnes or less and designed to carry 9 or more passengers | 7.5 years |

8 | Trailer with a *gross vehicle mass of more than 4.5 tonnes | 10 years |

9 | Truck with a *gross vehicle mass of more than 3.5 tonnes (other than a truck that is used in *mining and quarrying operations and that is not of a kind that can be registered to be driven on a public road in the place in which the truck is operated) | 7.5 years |

10 | Vessel for which you have a certificate under Part 2 of the Shipping Reform (Tax Incentives) Act 2012 | 10 years |

(4A) Item 10 of the table in subsection 40‑102(4) does not apply to a vessel if:

(a) *ordinary income that you *derive, or your *statutory income, in relation to the vessel; or

(b) ordinary income that your *associate derives, or your associate’s statutory income, in relation to the vessel;

is exempt from income tax under section 51‑100 for the income year for which you are working out the vessel’s decline in value.

(5) If the *depreciating asset is of a kind described in column 2 of the table and is used in the industry specified in column 3 of the table for the asset, the capped life of the asset is the period specified in column 4 of the table.

Capped life of certain depreciating assets used in specified industries |

Item | Kind of depreciating asset | Industry in which the asset is used | Period |

1 | Gas transmission asset | Gas supply | 20 years |

2 | Gas distribution asset | Gas supply | 20 years |

3 | Oil production asset (other than an electricity generation asset or an offshore platform) | Oil and gas extraction | 15 years |

4 | Gas production asset (other than an electricity generation asset or an offshore platform) | Oil and gas extraction | 15 years |

5 | Offshore platform | Oil and gas extraction | 20 years |

6 | Asset (other than an electricity generation asset) used to manufacture condensate, crude oil, domestic gas, liquid natural gas or liquid petroleum gas but not if the manufacture occurs in an oil refinery | Petroleum refining | 15 years |

7 | Harvester | Primary production sector | 6 2/3 years |

8 | Tractor | Primary production sector | 6 2/3 years |

40‑103 Effective life and remaining effective life of certain vessels

(1) If, at a particular time, item 10 of the table in subsection 40‑102(4):

(a) starts to apply to a vessel (whether or not that item has previously applied to the vessel); or

(b) ceases to apply to a vessel (whether or not that item subsequently applies to the vessel);

at that time the effective life of the vessel changes accordingly.

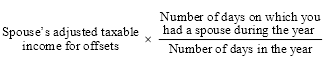

(2) If subsection (1) applies and the decline in value of the vessel is worked out using the *prime cost method, the remaining effective life of the vessel just after that time is:

where:

alternative effective life is:

(a) if that item starts to apply to the vessel at that time—what would have been the *effective life of the vessel just before that time if that item had applied to the vessel; or

(b) if that item ceases to apply to the vessel at that time—what would have been the effective life of the vessel just before that time if that item had not applied to the vessel.

unadjusted effective life is what was the *effective life of the vessel just before that time.

unadjusted remaining effective life is what was the *remaining effective life of the vessel just before that time.

Example: Assume that item 10 of the table in subsection 40‑102(4) ceases to apply to a vessel after having applied to the vessel for 7 years, and again starts to apply after another 4 years. Assume further that the effective life of a vessel of that kind has been determined under section 40‑100 to be 20 years.

The remaining effective life of the vessel just before that item ceases to apply to the vessel is 3 years. Its alternative effective life is 20 years, and its unadjusted effective life is 10 years. Its remaining effective life just after that time is therefore 6 years.

The remaining effective life of the vessel just before that item again starts to apply to the vessel is 2 years. Its alternative effective life is 10 years, and its unadjusted effective life is 20 years. Its remaining effective life just after that time is therefore 1 year.

40‑105 Self‑assessing effective life

(1) You work out the effective life of a *depreciating asset yourself in accordance with this section.

(1A) Firstly, estimate the period (in years, including fractions of years) the asset can be used by any entity for one or more of the following purposes:

(a) a *taxable purpose;

(b) the purpose of producing *exempt income or *non‑assessable non‑exempt income;

(c) the purpose of conducting *R&D activities, assuming that this is reasonably likely.

(1B) Secondly, if relevant for the asset:

(a) have regard to the wear and tear you reasonably expect from your expected circumstances of use; and

(b) assume that the asset will be maintained in reasonably good order and condition.

(2) If, in working out that period, you decide that the asset would be likely to be:

(a) scrapped; or

(b) sold for no more than scrap value or abandoned;

before the end of that period, its effective life ends at the earlier time. However, when making your decision, disregard reasons attributable to the technical risk in conducting *R&D activities if it is reasonably likely that the asset will be used for such activities.

(3) You work out the period mentioned in subsection (1A) or (2) beginning at the *start time of the *depreciating asset.

Exception: intangibles

(4) This section does not apply to the following intangible *depreciating assets:

(a) assets to which an item in the table in subsection 40‑95(7) applies;

(b) *mining, quarrying or prospecting rights;

(c) *mining, quarrying or prospecting information.

40‑110 Recalculating effective life

(1) You may choose to recalculate the *effective life of a *depreciating asset from a later income year if the effective life you have been using is no longer accurate because of changed circumstances relating to the nature of the use of the asset.

Example: Some examples of changes in circumstances that may result in your recalculating the effective life of a depreciating asset are:

• your use of the asset turns out to be more or less rigorous than you expected (or was anticipated by the Commissioner’s determination);

• there is a downturn in demand for the goods or services the asset is used to produce that will result in the asset being scrapped;

• legislation prevents the asset’s continued use;

• changes in technology make the asset redundant;

• there is an unexpected demand, or lack of success, for a film.

(2) You must recalculate a *depreciating asset’s *effective life from a later income year if:

(a) you:

(i) self‑assessed its effective life; or

(ii) are using an effective life worked out under section 40‑100 (about the Commissioner’s determination), or 40‑102 (about the capped life of certain depreciating assets), and the *prime cost method; or

(iii) are using an effective life because of subsection 40‑95(4), (4B), (4C), (5), (5B) or (5C); and

(b) its *cost is increased in that year by at least 10%.

Note 1: You may conclude that the effective life is the same.

Note 2: For the elements of the cost of a depreciating asset, see Subdivision 40‑C.

Example 1: Paul purchases a photocopier and self‑assesses its effective life at 6 years. In a later year he incurs expenditure to increase the quality of the reproductions it makes. He recalculates its effective life, but concludes that it remains the same.

Example 2: Fiona also purchases a photocopier and self‑assesses its effective life at 6 years. In a later year she incurs expenditure to incorporate a more robust paper handling system. She recalculates its effective life, and concludes that it is increased to 7 years.

(3) You must recalculate a *depreciating asset’s *effective life for the income year in which you started to *hold it if:

(a) you are using an effective life because of subsection 40‑95(4), (4B), (4C), (5), (5B) or (5C); and

(b) the asset’s *cost is increased after you started to hold it in that year by at least 10%.

(3A) Subsections (1), (2) and (3) do not apply to a *depreciating asset that is a *mining, quarrying or prospecting right or *mining, quarrying or prospecting information.

(3B) You may choose to recalculate the *effective life of a *mining, quarrying or prospecting right, or *mining, quarrying or prospecting information, from a later income year if the effective life you have been using is no longer accurate:

(a) because of changed circumstances relating to an existing or proposed mine, petroleum field or quarry to which that right or information relates; or

(b) because that right or information now relates to an existing or proposed mine, petroleum field or quarry; or

(c) because that right or information no longer relates to an existing or proposed mine, petroleum field or quarry.

(4) A recalculation under this section must be done using:

(a) if paragraph (b) does not apply—section 40‑105 (about self‑assessing effective life); or

(b) if the *depreciating asset is a *mining, quarrying or prospecting right or *mining, quarrying or prospecting information:

(i) subsections 40‑95(10) and (11) (if the right or information relates to an existing or proposed mine, petroleum field or quarry); or

(ii) subsection 40‑95(12) (if the right or information no longer relates to an existing or proposed mine, petroleum field or quarry).

Exception: intangibles

(5) This section does not apply to an intangible *depreciating asset to which an item in the table in subsection 40‑95(7) applies.

40‑115 Splitting a depreciating asset

(1) If a *depreciating asset you *hold is split into 2 or more assets, this Division applies as if you had stopped holding the original asset and started holding the assets into which it is split.

Note 1: For the cost of the split assets, see section 40‑205.

Note 2: A balancing adjustment event does not occur just because you split a depreciating asset: see section 40‑295.

(2) If you stop *holding part of a *depreciating asset, this Division applies as if, just before you stopped holding that part, you had split the original asset into the part you stopped holding and the rest of the original asset. (The rest of the original asset is then taken to be a different asset from the original asset.)