Chapter 3—Specialist liability rules

Part 3‑95—Value shifting

Division 723—Direct value shifting by creating right over non‑depreciating asset

Table of Subdivisions

723‑A Reduction in loss from realising non‑depreciating asset

723‑B Reducing reduced cost base of interests in entity that acquires non‑depreciating asset under roll‑over

Subdivision 723‑A—Reduction in loss from realising non‑depreciating asset

Table of sections

723‑1 Object

723‑10 Reduction in loss from realising non‑depreciating asset over which right has been created

723‑15 Reduction in loss from realising non‑depreciating asset at the same time as right is created over it

723‑20 Exceptions

723‑25 Realisation event that is only a partial realisation

723‑35 Multiple rights created to take advantage of the $50,000 threshold

723‑40 Application to CGT asset that is also trading stock or revenue asset

723‑50 Effects if right created over underlying asset is also trading stock or a revenue asset

723‑1 Object

The purpose of this Division is to reduce a loss that would otherwise be *realised for income tax purposes by a *realisation event happening to an asset (except a *depreciating asset), to the extent that:

(a) value has been shifted out of the asset by the owner creating in an associate a right over the asset; and

(b) the value shifted was not brought to tax when the right was created and has not since been brought to tax on a realisation of the right.

723‑10 Reduction in loss from realising non‑depreciating asset over which right has been created

(1) A loss that would, apart from this Division, be *realised for income tax purposes by a *realisation event is reduced by the amount worked out under subsections (3) and (4) if:

(a) the event happens to a *CGT asset (the underlying asset) you own that, at the time of the event (the realisation time):

(i) is not a *depreciating asset; or

(ii) is an item of your *trading stock; or

(iii) is a *revenue asset of yours; and

(b) before the realisation time:

(i) you created in an *associate of yours; or

(ii) an entity covered by subsection (2) (about previous owners of the underlying asset) created in an associate of the entity;

a right in respect of the underlying asset; and

(c) immediately before the realisation time, the right is still in existence and is owned by an associate of yours; and

(d) a decrease in the underlying asset’s *market value is reasonably attributable to the creating of the right; and

(e) creating the right involved a *CGT event:

(i) whose *capital proceeds are less than the market value of the right when created (the difference between those capital proceeds and that market value is called the shortfall on creating the right); and

(ii) that is not a CGT event that happens to some part of the underlying asset but not to the remainder of it; and

(f) the shortfall on creating the right is more than $50,000; and

(g) the market value of the underlying asset at the realisation time is less than it would have been if the right no longer existed at that time (the difference is called the deficit on realisation).

Note: If subparagraph (1)(e)(ii) applies, the cost base and reduced cost base of the underlying asset is apportioned under section 112‑30, so there is no need for this section to apply to the right.

(2) This subsection covers an entity if:

(a) the entity *acquired the underlying asset before you did; and

(b) there has been a roll‑over for each *CGT event (if any) as a result of which an entity (including you) acquired the asset after the first entity acquired it, and before the realisation time; and

(c) for each such CGT event (if any), the entity (including you) that acquired the underlying asset as a result of the event was, immediately after the event, an *associate of the entity that last acquired the asset before the event.

(3) The amount by which this section reduces the loss is the lesser of:

(a) the shortfall on creating the right; and

(b) the deficit on realisation.

However, that amount is reduced by each gain that:

(c) is *realised for income tax purposes by a *realisation event that happens to the right:

(i) before or at the realisation time for the underlying asset; and

(ii) at a time when the right is owned by an entity that is your *associate immediately before the realisation time for the underlying asset; and

(d) is not disregarded.

Note: To work out a gain realised for income tax purposes by a realisation event that happens to the right, see sections 977‑15, 977‑35, 977‑40 and 977‑55. If more than one of those sections applies to the right, see section 723‑50.

(4) For each gain that:

(a) is *realised for income tax purposes by a *realisation event that happens to the right:

(i) within 4 years after the realisation time for the underlying asset; and

(ii) at a time when the right is owned by an entity that is your *associate immediately before the realisation time for the underlying asset; and

(b) is not disregarded;

the amount worked out under subsection (3) is taken to have been reduced by the amount of that gain.

Note: This subsection may result in amendment of an assessment for the income year in which the realisation time happens.

723‑15 Reduction in loss from realising non‑depreciating asset at the same time as right is created over it

(1) A loss that would, apart from this Division, be *realised for income tax purposes by a *realisation event is reduced by the amount worked out under subsections (2) and (3) if:

(a) the event happens to a *CGT asset (the underlying asset) you own that, at the time of the event (the realisation time):

(i) is not a *depreciating asset; or

(ii) is an item of your *trading stock;

(iii) is a *revenue asset of yours; and

(b) at the realisation time, you create in an *associate of yours a right in respect of the underlying asset; and

(c) creating the right involves a *CGT event:

(i) whose *capital proceeds are less than the *market value of the right when created (the difference between those capital proceeds and that market value is called the shortfall on creating the right); and

(ii) that is not a CGT event that happens to some part of the underlying asset but not to the remainder of it; and

(d) the shortfall on creating the right is more than $50,000; and

(e) the market value of the underlying asset at the realisation time is less than it would have been if the right had not been created (the difference is called the deficit on realisation).

Note: If subparagraph (1)(c)(ii) applies, the cost base and reduced cost base of the underlying asset is apportioned under section 112‑30, so there is no need for this section to apply to the right.

(2) The amount by which this section reduces the loss is the lesser of:

(a) the shortfall on creating the right; and

(b) the deficit on realisation.

(3) For each gain that:

(a) is *realised for income tax purposes by a *realisation event that happens to the right:

(i) within 4 years after the realisation time for the underlying asset; and

(ii) at a time when the right is owned by an entity that is your *associate immediately before the realisation time for the underlying asset; and

(b) is not disregarded;

the amount worked out under subsection (2) is taken to have been reduced by the amount of that gain.

Note 1: To work out a gain realised for income tax purposes by a realisation event that happens to the right, see sections 977‑15, 977‑35, 977‑40 and 977‑55. If more than one of those sections applies to the right, see section 723‑50.

Note 2: This subsection may require amendment of an assessment for the income year in which the realisation time happens.

723‑20 Exceptions

Conservation covenant over land

(1) Section 723‑10 or 723‑15 does not reduce a loss if:

(a) the underlying asset is land; and

(b) the right referred to in paragraph 723‑10(1)(b) or 723‑15(1)(b) is a *conservation covenant over the land.

Right created on death of owner

(2) Section 723‑10 or 723‑15 does not reduce a loss if the right referred to in paragraph 723‑10(1)(b) or 723‑15(1)(b) is created by:

(a) a will or codicil; or

(b) an order of a court varying or modifying a will or codicil; or

(c) a total or partial intestacy; or

(d) an order of a court varying or modifying the application of the law about distributing the estate of someone who dies intestate.

723‑25 Realisation event that is only a partial realisation

(1) Section 723‑10 or 723‑15 applies differently if:

(a) a *realisation event happens to some part of a *CGT asset (the underlying asset) you own that, at the time of the event:

(i) is not a *depreciating asset; or

(ii) is an item of your *trading stock; or

(iii) is a *revenue asset of yours;

but not to the remainder of the underlying asset; or

(b) a realisation event consists of creating an interest in a CGT asset (also the underlying asset) you own that, at the time of the event, is covered by subparagraph (a)(i), (ii) or (iii).

(2) The section applies on the basis that:

(a) the *realisation event happens to the underlying asset; and

(b) the shortfall on creating the right referred to in paragraph 723‑10(1)(e) or 723‑15(1)(c); and

(c) the deficit on realisation referred to in paragraph 723‑10(1)(g) or 723‑15(1)(e);

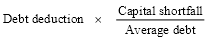

are each reduced by multiplying its amount by this fraction:

(3) For the purposes of the formula in subsection (2):

market value of part means the *market value, at the time of the *realisation event, of the part referred to in paragraph (1)(a) or the interest referred to in paragraph (1)(b), as appropriate.

market value of underlying asset means the *market value, immediately before the *realisation event, of the underlying asset.

723‑35 Multiple rights created to take advantage of the $50,000 threshold

(1) Sections 723‑10 and 723‑15 apply differently if, having regard to all relevant circumstances, it is reasonable to conclude that the sole or main reason why a right was created as a different right from one or more other rights created in respect of the same thing was so that paragraph 723‑10(1)(f) or 723‑15(1)(d) would not be satisfied for one or more of the rights mentioned in this subsection.

(2) Those sections:

(a) apply to that thing, in relation to each of the rights mentioned in subsection (1) of this section, as if paragraphs 723‑10(1)(f) and 723‑15(1)(d) were omitted; and

(b) are taken always to have so applied.

723‑40 Application to CGT asset that is also trading stock or revenue asset

If a *CGT asset you own is also an item of your *trading stock or a *revenue asset, this Division applies to the asset once in its character as a CGT asset and again in its character as trading stock or a revenue asset.

723‑50 Effects if right created over underlying asset is also trading stock or a revenue asset

(1) Subsection 723‑10(3) or (4) or 723‑15(3) applies differently if the right created in respect of the underlying asset is also *trading stock or a *revenue asset at the time of a *realisation event that happens to the right.

(2) The gain that is taken into account for the purposes of that subsection is:

(a) if the right is also *trading stock—worked out under section 977‑35 or 977‑40 (about realisation events for trading stock); or

(b) if the right is also a *revenue asset—the greater of:

(i) the gain worked out under section 977‑15 (about realisation events for CGT assets); and

(ii) the gain worked out under section 977‑55 (about realisation events for revenue assets).

Subdivision 723‑B—Reducing reduced cost base of interests in entity that acquires non‑depreciating asset under roll‑over

Table of sections

723‑105 Reduced cost base of interest reduced when interest realised at a loss

723‑110 Direct and indirect roll‑over replacement for underlying asset

723‑105 Reduced cost base of interest reduced when interest realised at a loss

(1) The *reduced cost base of a *primary equity interest, *secondary equity interest, or *indirect primary equity interest, in a company or trust is reduced just before a *realisation event that is a *CGT event happens to the interest if:

(a) apart from this Division, a loss would be *realised for income tax purposes by the CGT event; and

(b) apart from this Division, a loss would have been *realised for income tax purposes by a realisation event if the event had happened, just before the CGT event, to a *CGT asset (the underlying asset) that the company or trust then owned and that:

(i) was not then a *depreciating asset; or

(ii) was then an item of *trading stock of the company or trust; or

(iii) was then a *revenue asset of the company or trust; and

(c) the loss referred to in paragraph (b) would have been reduced under Subdivision 723‑A by an amount (the underlying asset loss reduction); and

(d) for the entity (the transferor) that owned the interest just before the CGT event, the interest was a *direct roll‑over replacement or *indirect roll‑over replacement for the underlying asset.

(2) If the interest was a *direct roll‑over replacement, its *reduced cost base is reduced by the amount worked out using this formula, unless that amount does not appropriately reflect the matters referred to in subsection (4):

(3) For the purposes of the formula in subsection (2):

RCB of interest means the interest’s *reduced cost base when the transferor *acquired it.

total of RCBs of direct roll‑over replacements means the total of the *reduced cost bases of all *direct roll‑over replacements for the underlying asset when the transferor *acquired them.

(4) If:

(a) the interest was an *indirect roll‑over replacement; or

(b) the amount worked out under subsection (2) does not appropriately reflect the matters referred to in this subsection;

the interest’s *reduced cost base is reduced by an amount that is appropriate having regard to these matters:

(c) the underlying asset loss reduction; and

(d) the quantum of the interest relative to all *direct roll‑over replacements and indirect roll‑over replacements that the transferor owns or has previously owned.

723‑110 Direct and indirect roll‑over replacement for underlying asset

(1) For an entity (the transferor) that owns a *CGT asset, the CGT asset is a direct roll‑over replacement for something (the underlying asset) that another entity owns if, and only if:

(a) a *CGT event happened to the underlying asset while the transferor owned it; and

(b) the other entity *acquired the underlying asset as a result of that CGT event; and

(c) there was a *replacement‑asset roll‑over for the CGT event; and

(d) the transferor received the CGT asset (or CGT assets including it) in respect of the CGT event as the replacement asset (or the replacement assets).

(2) For an entity (the transferor) that owns a *CGT asset, the CGT asset is an indirect roll‑over replacement for something (the underlying asset) that another entity owns if, and only if:

(a) a *CGT event happened to another CGT asset at a time when the transferor owned it and the other entity already owned the underlying asset; and

(b) for the transferor, the other CGT asset was at that time:

(i) a *direct roll‑over replacement for the underlying asset; or

(ii) an indirect roll‑over replacement for the underlying asset because of any other application or applications of this subsection; and

(c) there was a *replacement‑asset roll‑over for the CGT event; and

(d) the transferor received the first CGT asset (or CGT assets including it) in respect of the CGT event as the replacement asset (or the replacement assets).

Division 725—Direct value shifting affecting interests in companies and trusts

Table of Subdivisions

Guide to Division 725

725‑A Scope of the direct value shifting rules

725‑B What is a direct value shift

725‑C Consequences of a direct value shift

725‑D Consequences for down interest or up interest as CGT asset

725‑E Consequences for down interest or up interest as trading stock or a revenue asset

725‑F Value adjustments and taxed gains

Guide to Division 725

725‑1 What this Division is about

If, under a scheme, value is shifted from equity or loan interests in a company or trust to other equity or loan interests in the same company or trust (including interests issued at a discount), this Division:

(a) adjusts the value of those interests for income tax purposes to take account of material changes in market value that are attributable to the value shift; and

(b) treats the value shift as a partial realisation to the extent that value is shifted between interests held by different owners, and in some other cases.

However, it does so only for interests that are owned by entities involved in the value shift.

Subdivision 725‑A—Scope of the direct value shifting rules

Table of sections

725‑45 Main object

725‑50 When a direct value shift has consequences under this Division

725‑55 Controlling entity test

725‑65 Cause of the value shift

725‑70 Consequences for down interest only if there is a material decrease in its market value

725‑80 Who is an affected owner of a down interest?

725‑85 Who is an affected owner of an up interest?

725‑90 Direct value shift that will be reversed

725‑95 Direct value shift resulting from reversal

725‑45 Main object

(1) The main object of this Division is:

(a) to prevent inappropriate losses from arising on the realisation of *equity or loan interests from which value has been shifted to other equity or loan interests in the same entity; and

(b) to prevent inappropriate gains from arising on the realisation of equity or loan interests in the same entity to which the value has been shifted;

so far as those interests are owned by entities involved in the value shift.

(2) This is done by:

(a) adjusting the value of those interests for income tax purposes to take account of changes in *market value that are attributable to the value shift; and

(b) treating the value shift as a partial realisation to the extent that value is shifted:

(i) between interests held by different owners; or

(ii) in the case of interests in their character as CGT assets—from post‑CGT assets to pre‑CGT assets; or

(iii) between interests of different characters.

725‑50 When a direct value shift has consequences under this Division

A *direct value shift under a *scheme involving *equity or loan interests in an entity (the target entity) has consequences for you under this Division if, and only if:

(a) the target entity is a company or trust at some time during the *scheme period; and

(b) section 725‑55 (Controlling entity test) is satisfied; and

(c) section 725‑65 (Cause of the value shift) is satisfied; and

(d) you are an *affected owner of a *down interest, or an *affected owner of an *up interest, or both; and

(e) neither of sections 725‑90 and 725‑95 (about direct value shifts that are reversed) applies.

Note: For a down interest of which you are an affected owner, the direct value shift has consequences under this Division only if section 725‑70 (about material decrease in market value) is satisfied.

725‑55 Controlling entity test

An entity (the controller) must *control (for value shifting purposes) the target entity at some time during the period starting when the *scheme is entered into and ending when it has been carried out. (That period is the scheme period.)

For the concept of control (for value shifting purposes),

see sections 727‑355 to 727‑375.

725‑65 Cause of the value shift

(1) It must be the case that one or more of the following:

(a) the target entity;

(b) the controller;

(c) an entity that was an *associate of the controller at some time during or after the *scheme period;

(d) an *active participant in the *scheme;

(either alone or together with one or more other entities) did under the scheme the one or more things:

(e) to which the decrease in the *market value of the *down interests is reasonably attributable; and

(f) to which the increase in the market value of the *up interests, or the issue of up interests at a *discount, is reasonably attributable, or that is or include the issue of up interests at a *discount.

Active participants (if target entity is closely held)

(2) An entity (the first entity) is an active participant in the *scheme if, and only if:

(a) at some time during the *scheme period, the target entity has fewer than 300 members (in the case of a company) or fewer than 300 beneficiaries (in the case of a trust); and

(b) the first entity has actively participated in, or directly facilitated, the entering into or carrying out of the *scheme (whether or not it did so at the direction of some other entity); and

(c) the first entity:

(i) owns a *down interest at the *decrease time; or

(ii) owns an *up interest at the *increase time or has an up interest issued to it at a *discount because of the *direct value shift.

When an entity has 300 or more members or beneficiaries

(3) Section 124‑810 (under which certain companies and trusts are not regarded as having 300 or more members or beneficiaries) also applies for the purposes of this Division.

(4) In addition, this Division applies to a *non‑fixed trust as if it did not have 300 or more beneficiaries.

725‑70 Consequences for down interest only if there is a material decrease in its market value

(1) For a *down interest of which you are an *affected owner, the *direct value shift has consequences under this Division only if the sum of the decreases in the *market value of all down interests because of direct value shifts under the same *scheme as the direct value shift is at least $150,000.

Note: In working out the sum of the decreases in market value of all down interests, it will be necessary to include decreases not only in your down interests, but also in those of other affected owners and of entities that are not affected owners.

(2) However, if, having regard to all relevant circumstances, it is reasonable to conclude that the sole or main reason why a *direct value shift happened under a different scheme from one or more other direct value shifts was so that subsection (1) would not be satisfied for one or more of the direct value shifts mentioned in this subsection, subsection (1) does not apply (and is taken never to have applied) to any of the direct value shifts.

725‑80 Who is an affected owner of a down interest?

An entity is an affected owner of a *down interest if, and only if, the entity owns the down interest at the *decrease time and at least one of these paragraphs is satisfied:

(a) the entity is the controller;

(b) the entity was an *associate of the controller at some time during or after the *scheme period;

(c) the entity is an *active participant in the *scheme.

725‑85 Who is an affected owner of an up interest?

An entity is an affected owner of an *up interest if, and only if:

(a) there is at least one *affected owner of *down interests; and

(b) the entity owns the up interest at the *increase time, or the interest is an up interest because it was issued to the entity at a *discount;

and at least one of these paragraphs is satisfied:

(c) the entity is the controller;

(d) the entity was an *associate of the controller at some time during or after the *scheme period;

(e) at some time during or after the scheme period, the entity was an associate of an entity that is an affected owner of down interests because it was an associate of the controller at some time during or after that period;

(f) the entity is an *active participant in the *scheme.

725‑90 Direct value shift that will be reversed

(1) The *direct value shift does not have consequences for you under this Division if:

(a) the one or more things referred to in paragraph 725‑145(1)(b) brought about a state of affairs, but for which the direct value shift would not have happened; and

(b) as at the time referred to in that paragraph, it is more likely than not that, because of the *scheme, that state of affairs will cease to exist within 4 years after that time.

Example: Under a scheme, the voting rights attached to a class of shares in a company are changed. As a result, the market value of shares in that class decreases, and the market value of other classes of shares in the company increases. The company’s constitution provides that the change is to last for only 3 years.

(2) However, this section stops applying if the state of affairs referred to in paragraph (1)(a) still exists:

(a) at the end of those 4 years; or

(b) when a *realisation event happens to *down interests or *up interests of which you are, or any other entity is, an *affected owner;

whichever happens sooner.

(3) If this section stops applying, it is taken never to have applied to the *direct value shift.

Note: This may result in an assessment for an earlier income year having to be amended to give effect to the consequences that the direct value shift would have had for you under this Division if this section hadn’t applied.

725‑95 Direct value shift resulting from reversal

(1) A *direct value shift does not have consequences for any entity under this Division if:

(a) section 725‑90 applies, and the state of affairs referred to in paragraph 725‑90(1)(a) ceases to exist; and

(b) the direct value shift would not have happened but for that state of affairs ceasing to exist.

(2) However, if section 725‑90 stops applying, this section is taken never to have applied to the later direct value shift.

Subdivision 725‑B—What is a direct value shift

Table of sections

725‑145 When there is a direct value shift

725‑150 Issue of equity or loan interests at a discount

725‑155 Meaning of down interests, decrease time, up interests and increase time

725‑160 What is the nature of a direct value shift?

725‑165 If market value decrease or increase is only partly attributable to the scheme

725‑145 When there is a direct value shift

(1) There is a direct value shift under a *scheme involving *equity or loan interests in an entity (the target entity) if:

(a) there is a decrease in the *market value of one or more equity or loan interests in the target entity; and

(b) the decrease is reasonably attributable to one or more things done under the scheme, and occurs at or after the time when that thing, or the first of those things, is done; and

(c) either or both of subsections (2) and (3) are satisfied.

Examples of something done under a scheme are issuing new shares at a *discount, buying back shares or changing the voting rights attached to shares.

(2) One or more *equity or loan interests in the target entity must be issued at a *discount. The issue must be, or must be reasonably attributable to, the thing, or one or more of the things, referred to in paragraph (1)(b). It must also occur at or after the time referred to in that paragraph.

Example: A company runs a family business. There are 2 shares originally issued for $2 each. They are owned by husband and wife. The market value of the shares is much greater (represented by the value of the assets of the company less its liabilities). The company issues one more share for $2 to their son.

Caution is needed in such a situation. The example would result in a large CGT liability for the husband and wife under this Division, because they have shifted 1/3 of the value of their own shares to their son. No such liability would arise if the share had been issued for its market value.

(3) Or, there must be an increase in the *market value of one or more *equity or loan interests in the target entity. The increase must be reasonably attributable to the thing, or to one or more of the things, referred to in paragraph (1)(b). It must also occur at or after the time referred to in that paragraph.

725‑150 Issue of equity or loan interests at a discount

(1) An *equity or loan interest is issued at a discount if, and only if, the *market value of the interest when issued exceeds the amount of the payment that the issuing entity receives. The excess is the amount of the discount.

(2) The payment that the issuing entity receives can include property. If it does, use the *market value of the property in working out the amount of the payment.

Amounts for which bonus equities are treated as being issued

(3) If:

(a) a *primary equity interest is issued as mentioned in subsection 130‑20(1) (about bonus equities issued in relation to original equities); and

(b) subsection 130‑20(3) does not apply (about bonus equities that are a dividend or otherwise assessable income);

subsection (1) of this section applies to the interest as if the amount of the payment that the issuing entity receives were equal to the *cost base of the interest when issued (as worked out under section 130‑20).

(4) If:

(a) a *primary equity interest is issued as mentioned in subsection 6BA(1) of the Income Tax Assessment Act 1936 (about bonus shares issued in relation to original shares); and

(b) subsection 6BA(2) of that Act applies (about bonus shares that are a dividend);

subsection (1) of this section applies to the interest as if the amount of the payment that the issuing entity receives were equal to the consideration worked out under subsection 6BA(2) of that Act.

(5) If both of subsections (3) and (4) apply to the issue of the same *primary equity interest, subsection (1) of this section applies to the interest as if the amount of the payment that the issuing entity receives were equal to the greater of the amounts worked out under subsections (3) and (4).

Application of subsections (3), (4) and (5)

(6) Subsection (3) does not apply if, for the income year in which the interest is issued, the issuing entity is a public trading trust within the meaning of section 102R of the Income Tax Assessment Act 1936.

(7) Subsections (3), (4) and (5) have effect only for the purposes of working out whether a *direct value shift has happened and, if so, its consequences (if any) under this Division.

725‑155 Meaning of down interests, decrease time, up interests and increase time

(1) An *equity or loan interest in the target entity is a down interest if a decrease in its *market value is reasonably attributable to the one or more things referred to in paragraph 725‑145(1)(b), and occurs at or after the time referred to in that paragraph. The time when the decrease happens is called the decrease time for that interest.

(2) An *equity or loan interest in the target entity is an up interest if subsection 725‑145(2) or (3) is satisfied for the interest. The time when the interest is issued at a *discount, or the increase in *market value happens, is called the increase time for that interest.

725‑160 What is the nature of a direct value shift?

(1) The *direct value shift has 2 aspects.

(2) Overall, it consists of:

(a) the decreases in *market value of the down interests; and

(b) the issue at a *discount of the up interests covered by subsection 725‑145(2); and

(c) the increases in market value of the up interests covered by subsection 725‑145(3).

(3) This Division also proceeds on the basis that the *direct value shift is from each of the *down interests to each of the *up interests.

725‑165 If market value decrease or increase is only partly attributable to the scheme

If it is reasonable to conclude that an increase or decrease in *market value, or the issuing of an *equity or loan interest at a *discount, is only partly caused by the doing of the one or more things under the *scheme, this Division applies to the increase, decrease, or issue at a discount, to that extent only.

Subdivision 725‑C—Consequences of a direct value shift

Table of sections

General

725‑205 Consequences depend on character of down interests and up interests

725‑210 Consequences for down interests depend on pre‑shift gains and losses

Special cases

725‑220 Neutral direct value shifts

725‑225 Issue of bonus shares or units

725‑230 Off‑market buy‑backs

General

725‑205 Consequences depend on character of down interests and up interests

(1) The consequences for you of the *direct value shift depend on the character of the *down interests and *up interests of which you are an *affected owner.

(2) There are consequences for all your *down interests and *up interests in their character as *CGT assets. However, some of them may also be *trading stock or *revenue assets. There are additional consequences for those interests in their character as trading stock or revenue assets.

Note: For example, you may own a down interest that is a CGT asset and a revenue asset.

Sections 725‑240 to 725‑255 set out the consequences for you of a shift in value from that interest in its character as a CGT asset. The cost base of the asset will be decreased, which will affect the calculation of a capital gain when a CGT event happens to the interest.

Section 725‑320 sets out the consequences for you of a shift in value from that interest in its character as a revenue asset. The adjustment made under that section will affect the calculation of any profit on the sale of the interest.

Any overlap between the capital gain and the profit realised on the sale of the interest is then dealt with under section 118‑20.

In some instances, the direct value shift may result in a taxing event generating a gain for you in the income year in which the shift happens. That gain will be both a capital gain (because the down interest can be characterised as a CGT asset) and an increase in your assessable income (because the down interest can be characterised as a revenue asset). Again, any overlap is dealt with under section 118‑20.

725‑210 Consequences for down interests depend on pre‑shift gains and losses

(1) The consequences for a *down interest also depend on whether it has a *pre‑shift gain or a *pre‑shift loss.

(2) It has a pre‑shift gain if, immediately before the *decrease time, its *market value was greater than its *adjustable value.

(3) It has a pre‑shift loss if, immediately before the *decrease time, its *market value was equal to or less than its *adjustable value.

Special cases

725‑220 Neutral direct value shifts

(1) The consequences are different if the total decrease in *market value of your *down interests is equal to the sum of:

(a) the total increase in market value of your *up interests; and

(b) the total *discounts given to you on the issue of your up interests.

(2) In that case, this Subdivision and Subdivisions 725‑D to 725‑F apply to you as if the *direct value shift:

(a) consisted only of:

(i) the decreases in *market value of your *down interests; and

(ii) the issue at a *discount of your *up interests covered by subsection 725‑145(2); and

(iii) the increases in market value of your up interests covered by subsection 725‑145(3); and

(b) were from each of your down interests to each of your up interests.

(3) This section has effect despite section 725‑160.

725‑225 Issue of bonus shares or units

(1) The consequences are different if you are an *affected owner of *up interests (the bonus interests) that the target entity issues to you, at a *discount, under the *scheme, in relation to *down interests (the original interests) of which you are an affected owner.

Effect of treatment under subsection 130‑20(3)

(2) To the extent that the *direct value shift is to the bonus interests from original interests in relation to which the target entity issued bonus interests to which:

(a) subsection 130‑20(3) applies (because none of them is a dividend or otherwise assessable income); and

(b) item 1 of the table in that subsection applies (because the original interests are post‑CGT assets);

these paragraphs apply:

(c) the respective *cost bases and *reduced cost bases of those original interests are not reduced;

(d) the bonus interests referred to in subsection (1) do not give rise to a *taxing event generating a gain for you under the table in section 725‑245 on any of those original interests.

(3) To the extent that the *direct value shift is from the original interests to bonus interests to which subsection 130‑20(3) applies (because none of them is a dividend or otherwise assessable income) and:

(a) item 1 of the table in that subsection applies (because the original interests are post‑CGT assets); or

(b) item 2 of that table applies (because the original interests are pre‑CGT assets and an amount has been paid for the bonus interests that you were required to pay);

the respective *cost bases and *reduced cost bases of those bonus interests are not uplifted.

Effect of treatment under subsection 6BA(3) of the Income Tax Assessment Act 1936

(4) To the extent that the *direct value shift is to the bonus interests from original interests in relation to which the target entity issued bonus interests to which subsection 6BA(3) of the Income Tax Assessment Act 1936 applies (either because they are shares issued for no consideration and none of them is a dividend or because they qualify for the intercorporate dividend rebate):

(a) the respective *adjustable values of those original interests, in their character as *trading stock or *revenue assets, are not reduced; and

(b) the bonus interests referred to in subsection (1) do not give rise to a *taxing event generating a gain for you under the table in section 725‑335 on any of those original interests.

(5) To the extent that the *direct value shift is from the original interests to bonus interests to which subsection 6BA(3) of the Income Tax Assessment Act 1936 applies, the respective *adjustable values of those bonus interests of which you are an affected owner, in their character as *trading stock or *revenue assets, are not uplifted.

725‑230 Off‑market buy‑backs

(1) The consequences are different if:

(a) a decrease in the *market value of a *down interest of which you are an *affected owner is reasonably attributable to the target entity proposing to buy back that interest for less than its market value; and

(b) the target entity does buy back that down interest; and

(c) subsection 159GZZZQ(2) of the Income Tax Assessment Act 1936 treats you as having received the down interest’s market value worked out as if the buy‑back had not occurred and was never proposed to occur.

(2) The *adjustable value of the *down interest is not reduced, and there is no *taxing event generating a gain.

Note: The down interest is not dealt with here because it is already dealt with in Division 16K of Part III of the Income Tax Assessment Act 1936.

(3) Also, to the extent that the *direct value shift is from the *down interest to *up interests of which you are an *affected owner, uplifts in the *adjustable value of the up interests are worked out under either or both of:

(a) item 8 of the table in subsection 725‑250(2); and

(b) item 9 of the table in subsection 725‑335(3);

as if the down interest were one owned by another affected owner.

Subdivision 725‑D—Consequences for down interest or up interest as CGT asset

Table of sections

725‑240 CGT consequences; meaning of adjustable value

725‑245 Table of taxing events generating a gain for interests as CGT assets

725‑250 Table of consequences for adjustable values of interests as CGT assets

725‑255 Multiple CGT consequences for the same down interest or up interest

725‑240 CGT consequences; meaning of adjustable value

(1) The CGT consequences for you of a *direct value shift are of one or more of these 3 kinds:

(a) there are one or more *taxing events generating a gain for *down interests of which you are an affected owner (see subsection (2));

(b) the *cost base and *reduced cost base of down interests of which you are an *affected owner are reduced (see subsection (3));

(c) the cost base and reduced cost base of *up interests of which you are an affected owner are uplifted (see subsection (4)).

Note: If there is a taxing event generating a gain, CGT event K8 happens. See section 104‑250.

Taxing event generating a gain

(2) To work out:

(a) whether under the table in section 725‑245 there is a *taxing event generating a gain for you on a *down interest; and

(b) if so, the amount of the gain;

assume that the adjustable value from time to time of that or any other *equity or loan interest in the *target entity is its *cost base.

Note: For example, for that purpose the question whether the interest has a pre‑shift gain or a pre‑shift loss is determined on the basis that the interest’s adjustable value is its cost base.

Reduction or uplift of cost base and reduced cost base

(3) The *cost base and the *reduced cost base of a *down interest are reduced at the *decrease time to the extent that section 725‑250 provides for the *adjustable value of the interest to be reduced.

(4) The *cost base and the *reduced cost base of an *up interest are uplifted at the *increase time to the extent that section 725‑250 provides for the *adjustable value of the interest to be uplifted.

(5) However, the *cost base or *reduced cost base is uplifted only to the extent that the amount of the uplift is still reflected in the *market value of the interest when a later *CGT event happens to the interest.

(6) To work out:

(a) whether the *cost base or *reduced cost base of the interest is reduced or uplifted; and

(b) if so, by how much;

assume that:

(c) the adjustable value from time to time of that or any other *equity or loan interest in the *target entity is its cost base or reduced cost base, as appropriate; and

(d) if the interest is an *up interest because it was issued at a *discount—the adjustable value of the interest immediately before it was issued was its cost base or reduced cost base, as appropriate, when it was issued.

Note: For example, for that purpose the question whether the interest has a pre‑shift gain or a pre‑shift loss is determined on the basis that the interest’s adjustable value is its cost base or reduced cost base, as appropriate.

Reductions and uplifts also apply to pre‑CGT assets

(7) A reduction or uplift occurs regardless of whether the entity that owns the interest *acquired it before, on or after 20 September 1985.

725‑245 Table of taxing events generating a gain for interests as CGT assets

To the extent that the *direct value shift is from *down interests of which you are an *affected owner, and that are specified in an item in the table, to *up interests specified in that item, those up interests give rise to a taxing event generating a gain for you on each of those down interests. The gain is worked out under section 725‑365.

Taxing events generating a gain for down interests as CGT assets |

Item | Down interests: | Up interests: |

1 | *down interests that: (a) are owned by you; and (b) are neither your *revenue assets nor your *trading stock; and (c) have *pre‑shift gains; and (d) are *post‑CGT assets | *up interests owned by you that: (a) are neither your revenue assets nor your trading stock; and (b) are *pre‑CGT assets |

2 | *down interests that: (a) are owned by you; and (b) are neither your *revenue assets nor your *trading stock; and (c) have *pre‑shift gains | *up interests owned by you that are your trading stock or revenue assets |

3 | *down interests owned by you that: (a) are of the one kind (either your *trading stock or your *revenue assets); and (b) have *pre‑shift gains | *up interests owned by you that: (a) are of the other kind (either your revenue assets or your trading stock); or (b) are neither your *revenue assets nor your *trading stock |

4 | *down interests owned by you that have *pre‑shift gains | up interests owned by other *affected owners |

Note: If there is a taxing event generating a gain on a down interest, CGT event K8 happens: see section 104‑250. However, a capital gain you make under CGT event K8 is disregarded if the down interest:

• is your trading stock (see section 118‑25); or

• is a pre‑CGT asset (see subsection 104‑250(5)).

725‑250 Table of consequences for adjustable values of interests as CGT assets

(1) The table in subsection (2) sets out consequences of the *direct value shift for the *adjustable values of *down interests and *up interests of which you are an *affected owner, in their character as *CGT assets.

(2) To the extent that the *direct value shift is from *down interests specified in an item in the table to *up interests specified in that item:

(a) the *adjustable value of each of those down interests is decreased by the amount worked out under the section (if any) specified for the down interests in the last column of that item; and

(b) the adjustable value of each of those *up interests is uplifted by the amount worked out under the section (if any) specified for the up interests in that column.

Consequences of the direct value shift for adjustable values of CGT assets |

Item | To the extent that the direct value shift is from: | To: | The decrease or uplift is worked out under: |

1 | *down interests that: (a) are owned by you; and (b) have *pre‑shift gains; and (c) are *post‑CGT assets | *up interests owned by you that do not give rise to a *taxing event generating a gain for you on those down interests under section 725‑245 | for the down interests: section 725‑365; and for the up interests: section 725‑370 |

2 | *down interests that: (a) are owned by you; and (b) have *pre‑shift gains; and (c) are *pre‑CGT assets | *up interests owned by you that are *pre‑CGT assets | for the down interests: section 725‑365; and for the up interests: section 725‑370 |

3 | *down interests that: (a) are owned by you; and (b) have *pre‑shift gains; and (c) are *pre‑CGT assets | *up interests owned by you that are *post‑CGT assets | for the down interests: section 725‑365; and for the up interests: section 725‑375 |

4 | *down interests owned by you that have *pre‑shift gains | *up interests owned by you that give rise to a *taxing event generating a gain on those down interests under section 725‑245 | for the down interests: section 725‑365; and for the up interests: section 725‑375 |

5 | *down interests owned by you that have *pre‑shift losses | *up interests owned by you | for the down interests: section 725‑380; and for the up interests: section 725‑375 |

6 | *down interests owned by you that have *pre‑shift gains | *up interests owned by other *affected owners | for the down interests: section 725‑365 |

7 | *down interests owned by you that have *pre‑shift losses | *up interests owned by other *affected owners | for the down interests: section 725‑380 |

8 | *down interests owned by other *affected owners | *up interests owned by you | for the up interests: section 725‑375 |

9 | *down interests owned by you | *up interests owned by entities that are not *affected owners | (there are no decreases or uplifts) |

10 | *down interests owned by entities that are not *affected owners | *up interests owned by you | (there are no decreases or uplifts) |

Reducing uplift to prevent double increase in cost base etc.

(3) However, if, apart from paragraph (2)(b), an amount is included in the *cost base or *reduced cost base of an *up interest as a result of the *scheme under which the *direct value shift happens, the uplift in the *adjustable value of the interest under that paragraph is reduced by that amount.

725‑255 Multiple CGT consequences for the same down interest or up interest

(1) A *down interest or *up interest of which you are an *affected owner may be covered by 2 or more items in the table in subsection 725‑250(2).

(2) If the *cost base or *reduced cost base of the same *down interest or *up interest is decreased or uplifted under 2 or more items, it is decreased or uplifted by the total of the amounts worked out under those items.

Note: If subsection 725‑250(3) is relevant, it will affect all the uplifts worked out under all those items.

(3) If for a particular *down interest there is a *taxing event generating a gain under an item in the table in section 725‑245, that taxing event is in addition to:

(a) each taxing event generating a gain for that interest under any other item in that table; and

(b) each decrease in the *cost base or *reduced cost base of the interest under an item in the table in subsection 725‑250(2).

Subdivision 725‑E—Consequences for down interest or up interest as trading stock or a revenue asset

Table of sections

725‑310 Consequences for down interest or up interest as trading stock

725‑315 Adjustable value of trading stock

725‑320 Consequences for down interest or up interest as a revenue asset

725‑325 Adjustable value of revenue asset

725‑335 How to work out those consequences

725‑340 Multiple trading stock or revenue asset consequences for the same down interest or up interest

725‑310 Consequences for down interest or up interest as trading stock

(1) The consequences of the *direct value shift for your *trading stock are of one or more of these 3 kinds:

(a) the *adjustable values of *down interests of which you are an *affected owner are reduced (see subsection (2));

(b) the adjustable values of *up interests of which you are an affected owner are uplifted (see subsection (3));

(c) there are one or more *taxing events generating a gain for down interests of which you are an affected owner (see subsection (5)).

Effect of reduction or uplift of adjustable value

(2) If the *adjustable value of a *down interest that is your *trading stock is reduced under section 725‑335, you are treated as if:

(a) *immediately before the *decrease time, you had sold the interest to someone else (at *arm’s length and in the ordinary course of business) for its *adjustable value immediately before the decrease time; and

(b) immediately after the decrease time, you had bought the interest back for the reduced adjustable value.

(3) If the *adjustable value of an *up interest that is your *trading stock is uplifted under section 725‑335, you are treated as if:

(a) *immediately before the *increase time, you had sold the interest to someone else (at *arm’s length and in the ordinary course of business) for its *adjustable value immediately before the increase time; and

(b) immediately after the increase time, you had bought the interest back for the uplifted adjustable value.

(4) However, the increase in the cost of an *up interest because of paragraph (3)(b) is taken into account from time to time only to the extent that the amount of the increase is still reflected in the *market value of the interest.

Note: The situations where the increase in cost would be taken into account include:

• in working out your deductions for the cost of trading stock acquired during the income year in which the increase time happens; and

• the end of an income year if the interest’s closing value as trading stock is worked out on the basis of its cost; and

• the start of the income year in which the interest is disposed of, if that happens in a later income year and the interest’s closing value as trading stock at the end of the previous income year was worked out on the basis of its cost.

If the interest stops being trading stock, section 70‑110 treats you as having disposed of it.

Taxing event generating a gain

(5) For each *taxing event generating a gain under an item in the table in subsection 725‑335(3), the gain is included in your assessable income for the income year in which the *decrease time happens.

725‑315 Adjustable value of trading stock

If a *down interest or *up interest is your *trading stock, its adjustable value at a particular time is:

(a) if the interest has been trading stock of yours ever since the start of the income year in which that time occurs—its *value as trading stock at the start of the income year; or

(b) otherwise—its cost.

Note 1: If an interest has been affected by an earlier direct value shift during the same income year, it will be treated as having already been sold and repurchased (because of an earlier application of section 725‑310). As a result, the cost on repurchase becomes its adjustable value immediately before the decrease time or increase time for the later direct value shift.

Note 2: The adjustable value of an interest that is an up interest because it was issued at a discount is worked out under paragraph (b).

725‑320 Consequences for down interest or up interest as a revenue asset

(1) The consequences of the *direct value shift for your *revenue assets are of one or more of these 3 kinds:

(a) the *adjustable values of *down interests of which you are an *affected owner are reduced (see subsection (2));

(b) the adjustable values of *up interests of which you are an affected owner are uplifted (see subsection (3));

(c) one or more *taxing events generating a gain for down interests of which you are an affected owner (see subsection (5)).

Effect of reduction or uplift of adjustable value

(2) If the *adjustable value of a *down interest that is your *revenue asset is decreased under section 725‑335, you are treated as if:

(a) *immediately before the *decrease time, you had sold the interest to someone else for its *adjustable value immediately before the decrease time; and

(b) immediately afterwards, you had bought the interest back for the reduced adjustable value; and

(c) from the time when you bought it back, the interest continued to be a revenue asset, for the same reasons as it was a revenue asset before you sold it.

(3) If the *adjustable value of an *up interest that is your *revenue asset is uplifted under section 725‑335, you are treated as if:

(a) *immediately before the *increase time, you had sold the interest to someone else for its *adjustable value immediately before the increase time; and

(b) immediately afterwards, you had bought the interest back for the uplifted adjustable value; and

(c) from the time when you bought it back, the interest continued to be a revenue asset, for the same reasons as it was a revenue asset before you sold it.

(4) However, the uplift in *adjustable value is taken into account only to the extent that the amount of the uplift is still reflected in the *market value of the interest when it is disposed of or otherwise realised.

Taxing event generating a gain

(5) For each *taxing event generating a gain under an item in the table in subsection 725‑335(3), the gain is included in your assessable income for the income year in which the *decrease time happens.

725‑325 Adjustable value of revenue asset

(1) If a *down interest is your *revenue asset, its adjustable value immediately before the *decrease time is the total of the amounts that would be subtracted from the gross disposal proceeds in calculating any profit or loss on disposal of the interest if you disposed of it immediately before the decrease time.

(2) If an *up interest is your *revenue asset and it increases in *market value because of the *direct value shift, its adjustable value immediately before the *increase time is the total of the amounts that would be subtracted from the gross disposal proceeds in calculating any profit or loss on disposal of the interest if you disposed of it immediately before the increase time.

(3) If an *up interest is your *revenue asset and it is issued at a *discount, it is taken to have an adjustable value immediately before it is issued equal to the consideration paid or given by you for the interest.

Note: If an interest has been affected by an earlier direct value shift during the same income year, it will be treated as having already been sold and repurchased (because of an earlier application of section 725‑320). As a result, the cost on repurchase becomes its adjustable value immediately before the decrease time or increase time for the later direct value shift.

725‑335 How to work out those consequences

(1) This section sets out the consequences of the *direct value shift for a *down interest or *up interest as *trading stock or a *revenue asset.

(2) If you have both *trading stock and *revenue assets, items 1 and 2 of the table in subsection (3) can apply once to the trading stock and again to the revenue assets. The other items apply (if at all) to the trading stock and revenue assets together.

Decreases and uplifts in adjustable value

(3) To the extent that the *direct value shift is from *down interests specified in an item in the table to *up interests specified in that item:

(a) the *adjustable value of each of those down interests is decreased by the amount worked out under the section (if any) specified for the down interests in the last column of that item; and

(b) the adjustable value of each of those *up interests is uplifted by the amount worked out under the section (if any) specified for the up interests in that column.

Consequences for down interest or up interest as trading stock or revenue asset |

Item | To the extent that the direct value shift is from: | To: | The decrease or uplift is worked out under: |

1 | *down interests owned by you that: (a) are of the one kind (either your *trading stock or your *revenue assets); and (b) have *pre‑shift gains | *up interests owned by you that are of that same kind | for the down interests: section 725‑365; and for the up interests: section 725‑370 |

2 | *down interests owned by you that: (a) are of the one kind (either your *trading stock or your *revenue assets); and (b) have *pre‑shift gains | *up interests owned by you that are of the other kind (either your revenue assets or your trading stock) | for the down interests: section 725‑365; and for the up interests: section 725‑375 |

3 | *down interests owned by you that: (a) are your *trading stock or *revenue assets; and (b) have *pre‑shift losses | *up interests owned by you that are of that same kind or of the other kind | for the down interests: section 725‑380; and for the up interests: section 725‑375 |

4 | *down interests owned by you that: (a) are your *trading stock or *revenue assets; and (b) have *pre‑shift gains | *up interests owned by you that are neither your revenue assets nor your trading stock | for the down interests: section 725‑365 |

5 | *down interests owned by you that: (a) are your *trading stock or *revenue assets; and (b) have *pre‑shift losses | *up interests owned by you that are neither your revenue assets nor your trading stock | for the down interests: section 725‑380 |

6 | *down interests owned by you that are neither your *revenue assets nor your *trading stock | *up interests owned by you that are your trading stock or revenue assets | for the up interests: section 725‑375 |

7 | *down interests owned by you that: (a) are your *trading stock or *revenue assets; and (b) have *pre‑shift gains | up interests owned by other *affected owners | for the down interests: section 725‑365 |

8 | *down interests owned by you that: (a) are your *trading stock or *revenue assets; and (b) have *pre‑shift losses | *up interests owned by other *affected owners | for the down interests: section 725‑380 |

9 | *down interests owned by other *affected owners | *up interests owned by you that are your *trading stock or *revenue assets | for the up interests: section 725‑375 |

10 | *down interests owned by you that are your *trading stock or *revenue assets | *up interests owned by entities that are not *affected owners | (there are no decreases or uplifts) |

11 | *down interests owned by entities that are not *affected owners | *up interests owned by you that are your *trading stock or *revenue assets | (there are no decreases or uplifts) |

Reducing uplift to prevent double increase in adjustable value

(3A) However, if, apart from paragraph (3)(b), an amount is included, as a result of the *scheme under which the *direct value shift happens, in the *adjustable value of an *up interest that is your *trading stock or *revenue asset, the uplift in the adjustable value of the interest under that paragraph is reduced by that amount.

Taxing events generating a gain

(4) To the extent that the *direct value shift is from *down interests:

(a) of which you are an *affected owner; and

(b) that are specified in item 2, 4 or 7 in the table in subsection (3);

to *up interests specified in that item, those up interests give rise to a taxing event generating a gain for you under that item on each of those down interests. The gain is worked out under section 725‑365.

725‑340 Multiple trading stock or revenue asset consequences for the same down interest or up interest

(1) A *down interest or *up interest of which you are an *affected owner may be covered by 2 or more items in the table in subsection 725‑335(3).

(2) If the *adjustable value of the same *down interest or *up interest is decreased or uplifted under 2 or more items, it is decreased or uplifted by the total of the amounts worked out under those items.

Note: If subsection 725‑335(3A) is relevant, it will affect all the uplifts worked out under all those items.

(3) If for a particular *down interest there is a *taxing event generating a gain under an item, that taxing event is in addition to:

(a) each taxing event generating a gain for that interest under any other item in the table; and

(b) each decrease in the *adjustable value of the interest under that or any other item in the table.

Subdivision 725‑F—Value adjustments and taxed gains

Table of sections

725‑365 Decreases in adjustable values of down interests (with pre‑shift gains), and taxing events generating a gain

725‑370 Uplifts in adjustable values of up interests under certain table items

725‑375 Uplifts in adjustable values of up interests under other table items

725‑380 Decreases in adjustable value of down interests (with pre‑shift losses)

725‑365 Decreases in adjustable values of down interests (with pre‑shift gains), and taxing events generating a gain

Use the following method statement:

(a) to work out the amount of the gain for a *taxing event generating a gain under:

(i) section 725‑245; or

(ii) item 2, 4 or 7 of the table in subsection 725‑335(3); and

(b) to work out the decrease in *adjustable value of a *down interest under:

(i) item 1, 2, 3, 4 or 6 of the table in subsection 725‑250(2); or

(ii) item 1, 2, 4 or 7 of the table in subsection 725‑335(3).

Method statement

Step 1. Group together all *down interests that:

(a) are of the kind referred to in the relevant item; and

(b) immediately before the *decrease time, had the same *adjustable value as the down interest; and

(c) immediately before that time had the same *market value as the down interest; and

(d) sustained the same decrease in market value as the down interest because of the *direct value shift.

Step 2. Work out the value shifted from that group of *down interests to the *up interests referred to in the relevant item using the following formula:

Step 3. Work out the notional adjustable value of the value shifted from that group of *down interests to those *up interests using the formula:

Step 4. The decrease in the *adjustable value of the *down interest under the relevant item is equal to:

Step 5. For a *taxing event generating a gain under the relevant item, the amount of the gain is equal to:

725‑370 Uplifts in adjustable values of up interests under certain table items

Use the following method statement to work out the uplift in *adjustable value of an *up interest under:

(a) item 1 or 2 of the table in subsection 725‑250(2); or

(b) item 1 of the table in subsection 725‑335(3).

Method statement

Step 1. If the *market value of the *up interest increases because of the *direct value shift, group together all up interests of the kind referred to in the relevant item that:

(a) immediately before the *increase time, had the same *adjustable value as the up interest; and

(b) sustained the same increase in market value as the up interest because of the *direct value shift.

If the *up interest is issued at a *discount, group together all *up interests of the kind referred to in the relevant item that:

(c) immediately before the *increase time, had the same *adjustable value as the up interest; and

(d) because of the direct value shift, are issued at the same discount as the up interest.

Step 2. The notional adjustable value of the value shifted from the *down interests referred to in the relevant item to all the *up interests referred to in that item has already been worked out under one or more applications of step 3 of the method statement in section 725‑365.

Step 3. Use the following formula to work out how much of that notional adjustable value is attributable to the value shifted to the group of *up interests referred to in step 1 of this method statement:

Step 4. The uplift in the *adjustable value of the *up interest under the relevant item is equal to:

725‑375 Uplifts in adjustable values of up interests under other table items

Use the following method statement to work out the uplift in *adjustable value of an *up interest under:

(a) item 3, 4, 5 or 8 of the table in subsection 725‑250(2); or

(b) item 2, 3, 6 or 9 of the table in subsection 725‑335(3).

Method statement

Step 1. If the *market value of the *up interest increases because of the direct value shift, group together all *up interests of the kind referred to in the relevant item that sustained the same increase in market value as the up interest because of the direct value shift.

If the up interest is issued at a discount, group together all up interests of the kind referred to in the relevant item that are issued at a discount of the same amount as the up interest because of the direct value shift.

Step 2. The value shifted to that group of *up interests from the *down interests referred to in the relevant item is the amount worked out using the formula:

where:

sum of the group increases or discounts means (as appropriate):

(a) the sum of the increases in *market value of all *up interests in the group because of the *direct value shift; or

(b) the sum of the *discounts at which all *up interests in the group were issued because of the *direct value shift.

total value of the direct value shift means:

(a) if the sum of the decreases in *market value of all *down interests because of the *direct value shift is equal to or greater than the sum of the increases in market value of all *up interests and all *discounts given because of the shift—the sum of the decreases; or

(b) if the sum of the decreases in market value of all down interests because of the direct value shift is less than the sum of the increases in market value of all up interests and all discounts given because of the shift—the sum of the increases and discounts.

Step 3. The uplift in the *adjustable value of the *up interest under the relevant item is equal to:

725‑380 Decreases in adjustable value of down interests (with pre‑shift losses)

Use the following method statement to work out the decrease in *adjustable value of a *down interest under:

(a) item 5 or 7 of the table in subsection 725‑250(2); or

(b) item 3, 5 or 8 of the table in subsection 725‑335(3).

Method statement

Step 1. Group together all *down interests of the kind referred to in the relevant item that:

(a) immediately before the *decrease time, had the same *adjustable value as the down interest; and

(b) immediately before that time had the same *market value as the down interest; and

(c) sustained the same decrease in market value as the down interest because of the *direct value shift.

Step 2. Work out the value shifted from that group of *down interests to the *up interests referred to in the relevant item using the formula:

Step 3. The decrease in *adjustable value of the *down interest under the relevant item is equal to:

Division 727—Indirect value shifting affecting interests in companies and trusts, and arising from non‑arm’s length dealings

Table of Subdivisions

Guide to Division 727

727‑A Scope of the indirect value shifting rules

727‑B What is an indirect value shift

727‑C Exclusions

727‑D Working out the market value of economic benefits

727‑E Key concepts

727‑F Consequences of an indirect value shift

727‑G The realisation time method

727‑H The adjustable value method

727‑K Reduction of loss on equity or loan interests realised before the IVS time

727‑L Indirect value shift resulting from a direct value shift

Guide to Division 727

727‑1 What this Division is about

If there is a net shift of value between 2 related entities because of a non‑arm’s length dealing, this Division:

(a) prevents losses from arising, because of the value shift, on realisation of direct or indirect equity or loan interests in the losing entity; and

(b) within limits, prevents gains from arising, because of the value shift, on realisation of direct or indirect equity or loan interests in the gaining entity.

However, it does so only for interests that are owned by entities involved in the value shift.

Table of sections

727‑5 What is an indirect value shift?

727‑10 How does this Division deal with indirect value shifts?

727‑15 When does an indirect value shift have consequences under this Division?

727‑25 Effect of this Division on realisations at a loss that occur before the nature or extent of an indirect value shift can be fully determined

727‑5 What is an indirect value shift?

(1) An indirect value shift arises when there is a net shift of value from one entity to another.

Example: Company A transfers property to company B in return for a cash payment. If the market value of the property is $180 million but the cash payment is only $50 million, there is a net shift of value from company A to company B of $130 million.

(2) It is called indirect because the transaction will have the indirect effect of shifting value from equity or loan interests in the losing entity to equity or loan interests in the gaining entity.

This is because the net shift in value between the entities will usually decrease the market value of interests in the losing entity and increase the market value of interests in the gaining entity.

Example: Assume that company C owns all the shares in company A and company D owns all the shares in company B. The net shift of value from company A to company B will reduce the value of company C’s shares in company A and increase the value of company D’s shares in company B.

(3) It will also produce corresponding effects further up a chain of entities.

Example: Assume that company E owns all the shares in company C and company D. The net shift of value from company A to company B will also reduce the value of company E’s shares in company C and increase the value of its shares in company D.

(4) This Division is not concerned with the tax treatment of the net shift in value between the entities at the bottom of the chains. Instead, it deals with the effects on the market value of interests (both direct and indirect) in those entities.

(5) An indirect value shift distorts the relationship between the market value of an equity or loan interest and its value for income tax purposes. When the interest is realised, this can produce an inappropriate loss for income tax purposes, or an inappropriate gain.

Example: If company E sold its shares in company C, the indirect value shift could (apart from this Division) result in a loss for income tax purposes. Company E could defer the corresponding gain on its shares in company D by not selling these.

727‑10 How does this Division deal with indirect value shifts?

(1) To prevent an inappropriate loss or gain from arising on realisation of an interest, this Division reduces the amount of the loss or gain (realisation time method). However, a choice can be made to adjust the interest’s value for income tax purposes in a way that takes account of the indirect value shift (adjustable value method).

(2) This Division does not create taxing events giving rise to gains or losses.

727‑15 When does an indirect value shift have consequences under this Division?

(1) Indirect value shift is defined very broadly, but the application of this Division is limited in various ways.

(2) The losing entity must be a company or trust (except a superannuation entity). However, the gaining entity can be any kind of entity, including an individual.

(3) This Division does not apply if entities deal with each other at arm’s length, or provide economic benefits in return for full market value.

(4) The losing entity and the gaining entity must be connected by having had the same ultimate controller. In the case of closely held entities, they may instead be connected by having had a high level of common ownership.

(5) The only interests affected are those owned by entities involved in the indirect value shift or by their associates.

(6) There are a range of exclusions, such as:

(a) exclusions for minor indirect value shifts; and

(b) a series of rules designed to provide safe harbour treatment for common transactions relating to services; and

(c) anti‑overlap provisions to prevent double‑counting.

(7) Rules of thumb are included to make it easier to determine the market value of some kinds of economic benefits.

(8) To reduce compliance costs for:

(a) *small business entities; and

(b) entities that meet the CGT small business net asset threshold ($6 million);

interests owned by those entities are not affected by this Division.

727‑25 Effect of this Division on realisations at a loss that occur before the nature or extent of an indirect value shift can be fully determined

(1) To determine whether a scheme gives rise to an indirect value shift, it must be possible to identify all the economic benefits under the scheme, and the providers and recipients of those benefits.

(2) Before then, interests that might be affected by the scheme may be realised at a loss. Subdivision 727‑K contains special rules that apply if that happens.

Subdivision 727‑A—Scope of the indirect value shifting rules

Table of sections

727‑95 Main object

727‑100 When an indirect value shift has consequences under this Division

727‑105 Ultimate controller test

727‑110 Common‑ownership nexus test (if both losing and gaining entities are closely held)

727‑125 No consequences if losing entity is a superannuation entity

727‑95 Main object

The main object of this Division is:

(a) to prevent inappropriate losses from arising on the realisation of direct or indirect equity or loan interests in an entity from which there has been a net shift of value because of a dealing that is not at *arm’s length; and

(b) to prevent inappropriate gains from arising on the realisation of *direct equity interests or *indirect equity interests in the entity to which that value has been shifted;

in cases where the 2 entities are related as set out in this Division.

727‑100 When an indirect value shift has consequences under this Division

An *indirect value shift (see Subdivision 727‑B) has consequences under this Division if, and only if:

(a) the *losing entity is at the time of the indirect value shift a company or trust (except one listed in section 727‑125 (about superannuation entities)); and

(b) in relation to either or both of the following:

(i) the losing entity *providing one or more economic benefits to the gaining entity *in connection with the *scheme from which the indirect value shift results;

(ii) the gaining entity providing one or more economic benefits to the losing entity in connection with the scheme;

the 2 entities are not dealing with each other at *arm’s length; and

(c) either or both of sections 727‑105 and 727‑110 are satisfied; and

(d) no exclusion in Subdivision 727‑C applies.

Note 1: The consequences for direct and indirect interests in the losing entity or in the gaining entity are set out in Subdivision 727‑F. If those consequences are to be worked out using the realisation time method (under Subdivision 727‑G), there are further exclusions for certain 95% services indirect value shifts: see section 727‑700.

Note 2: An indirect value shift does not have consequences for interests in the losing entity or gaining entity owned immediately before the IVS time by an entity that:

• is a small business entity for each income year that includes any of the IVS period; or

• would satisfy the maximum net asset value test in section 152‑15 throughout the IVS period.

See subsection 727‑470(2).

727‑105 Ultimate controller test

It must be the case that, at some time during the *IVS period:

(a) the *losing entity and the *gaining entity have the same *ultimate controller; or