Part 3‑10—Financial transactions

Division 240—Arrangements treated as a sale and loan

Table of Subdivisions

Guide to Division 240

240‑A Application and scope of Division

240‑B The notional sale and notional loan

240‑C Amounts to be included in notional seller’s assessable income

240‑D Deductions allowable to notional buyer

240‑E Notional interest and arrangement payments

240‑F The end of the arrangement

240‑G Adjustments if total amount assessed to notional seller differs from amount of finance charge

240‑H Application of Division 16E to certain arrangements

240‑I Provisions applying to hire purchase agreements

240‑1 What this Division is about

For income tax purposes, some arrangements (such as hire purchase agreements) are recharacterised as a sale of property, combined with a loan, by the notional seller to the notional buyer, to finance the purchase price.

240‑3 How the recharacterisation affects the notional seller

Effect of notional sale

(1) The consideration for the notional sale is either the price stated as the cost or value of the property or its arm’s length value. If the notional seller is disposing of the property as trading stock, the normal consequences of disposing of trading stock follow. In particular, the notional seller will be assessed on the sale price.

(2) Where the property is not trading stock the notional seller’s assessable income will include any profit made by the notional seller on the notional sale or on the sale of the property after a notional re‑acquisition.

Effect of notional loan

(3) The notional seller’s assessable income will include notional interest over the period of the loan.

Other effects

(4) These effects displace the income tax consequences that would otherwise arise from the arrangement. For example, the actual payments to the notional seller are not included in its assessable income. Also, the notional seller loses the right to deduct amounts under Division 40 (about capital allowances).

240‑7 How the recharacterisation affects the notional buyer

Effect of notional purchase

(1) The cost of the acquisition is either the price stated as the cost or value of the property or its arm’s length value. If the notional buyer is acquiring the property as trading stock, the normal consequences of acquiring trading stock follow. In particular, the notional buyer can usually deduct the purchase price.

(2) If the property is not trading stock, the notional buyer may be able to deduct amounts for the expenditure under Division 40 (about capital allowances).

Effect of notional loan

(3) The notional buyer may be able to deduct notional interest payments over the period of the loan.

Other effects

(4) These effects displace the income tax consequences that would otherwise arise from the arrangement. For example, the notional buyer cannot deduct the actual payments to the notional seller.

Subdivision 240‑A—Application and scope of Division

Table of sections

Operative provisions

240‑10 Application of this Division

240‑15 Scope of Division

240‑10 Application of this Division

An *arrangement is treated as a notional sale and *notional loan if:

(a) the arrangement is listed in the table below; and

(b) the arrangement relates to the kind of property listed in the table; and

(c) any conditions listed in the table are satisfied.

Special provisions that apply to particular arrangements are also listed in the table.

This Division applies to: | ||||

| *Arrangements of this kind: | That relate to this kind of property: | If these conditions are satisfied: | Special provisions: |

1 | *Hire purchase agreement | Any goods | None | See Subdivision 240‑I |

This Division has effect for the purposes of this Act and for the purposes of the Income Tax Assessment Act 1936 other than:

(a) Parts 3‑1 and 3‑3 of this Act (capital gains tax); and

(b) Division 11A of Part III of the Income Tax Assessment Act 1936 (certain payments to non‑residents etc.).

Subdivision 240‑B—The notional sale and notional loan

Table of sections

Operative provisions

240‑17 Who is the notional seller and the notional buyer?

240‑20 Notional sale of property by notional seller and notional acquisition of property by notional buyer

240‑25 Notional loan by notional seller to notional buyer

240‑17 Who is the notional seller and the notional buyer?

(1) An entity is the notional seller if it is a party to the *arrangement and:

(a) actually owns the property; or

(b) is the owner of the property because of a previous operation of this Division.

(2) An entity is the notional buyer if it is a party to the *arrangement and, under the arrangement, has the *right to use the property.

Example: If the arrangement is a hire purchase agreement, the finance provider will be the notional seller and the hirer will be the notional buyer.

(1) The *notional seller is taken to have disposed of the property by way of sale to the *notional buyer, and the notional buyer is taken to have acquired it, at the start of the *arrangement.

(2) The *notional buyer is taken to own the property until:

(a) the *arrangement ends; or

(b) the notional buyer becomes the *notional seller under a later *arrangement to which this Division applies.

240‑25 Notional loan by notional seller to notional buyer

(1) On entering into the *arrangement, the *notional seller is taken to have made a loan (the notional loan) to the *notional buyer.

(2) The notional loan is for a period:

(a) starting at the start of the *arrangement; and

(b) ending on the day on which the arrangement is to cease to have effect or, if the arrangement is of indefinite duration, on the day on which it would be reasonable to conclude, having regard to the terms and conditions of the arrangement, that the arrangement will cease to have effect.

(3) The notional loan is of an amount (the notional loan principal) equal to the consideration for the sale of the property less any amount paid, or credited by the *notional seller as having been paid, by the *notional buyer to the notional seller, at or before the start of the *arrangement, for the cost of the property.

Note: Section 240‑80 affects the amount of the notional loan principal where the arrangement is an extension or renewal of another arrangement.

(4) The notional loan is subject to payment of a charge (the finance charge).

(5) The consideration for the sale of the property by the *notional seller, and the cost of the acquisition of the property by the *notional buyer, are each taken to have been:

(a) if an amount is stated to be the cost or value of the property for the purposes of the *arrangement and the notional seller and the notional buyer were dealing with each other at *arm’s length in connection with the arrangement—the amount so stated; or

(b) otherwise—the amount that could reasonably have been expected to have been paid by the notional buyer for the purchase of the property if:

(i) the notional seller had actually sold the property to the notional buyer at the start of the arrangement; and

(ii) the notional seller and the notional buyer were dealing with each other at arm’s length in connection with the sale.

(6) The *notional loan principal is taken to be repaid, and the *finance charge is taken to be paid, by the making of the payments under the *arrangement.

Subdivision 240‑C—Amounts to be included in notional seller’s assessable income

240‑30 What this Subdivision is about

This Subdivision provides for the inclusion in the notional seller’s assessable income of:

(a) amounts (notional interest) on account of the finance charge for the notional loan that the notional seller is taken to have made to the notional buyer; and

(b) any profit made by the notional seller:

(i) on the notional sale of the property to the notional buyer; or

(ii) on a sale of the property after any notional re‑acquisition of the property by the notional seller.

Table of sections

Operative provisions

240‑35 Amounts to be included in notional seller’s assessable income

240‑40 Arrangement payments not to be included in notional seller’s assessable income

240‑35 Amounts to be included in notional seller’s assessable income

Notional interest

(1) The *notional seller’s assessable income of an income year includes the *notional interest for *arrangement payment periods, and parts of arrangement payment periods, in the income year.

Profit on notional sale

(2) If the property is not *trading stock of the *notional seller and the consideration for the notional sale of the property exceeds the cost of the acquisition of the property by the notional seller, the excess is included in the notional seller’s assessable income of the income year of the notional sale.

Profit on actual sale after notional re‑acquisition

(3) If:

(a) the *notional seller is taken under this Division to have re‑acquired the property from the *notional buyer; and

(b) the notional seller afterwards sells the property; and

(c) the consideration for the sale exceeds the cost of the re‑acquisition;

the excess is included in the notional seller’s assessable income of the income year in which the sale occurred.

240‑40 Arrangement payments not to be included in notional seller’s assessable income

(1) The *arrangement payments that the *notional seller receives, or is entitled to receive, under the *arrangement:

(a) are not to be included in the *notional seller’s assessable income of any income year; but

(b) are not taken to be *exempt income of the notional seller.

(2) However, those *arrangement payments are taken into account in calculating *notional interest that is included in the *notional seller’s assessable income under section 240‑35.

(3) A loss or outgoing incurred by the *notional seller in deriving any such *arrangement payments is not taken to be a loss or outgoing incurred by the notional seller in relation to gaining or producing *exempt income.

Subdivision 240‑D—Deductions allowable to notional buyer

240‑45 What this Subdivision is about

This Subdivision provides that the notional buyer may, in certain circumstances, be entitled to deductions for the notional interest for the notional loan that the notional seller is taken to have made to the notional buyer.

Table of sections

Operative provisions

240‑50 Extent to which deductions are allowable to notional buyer

240‑55 Arrangement payments not to be allowable deductions

240‑50 Extent to which deductions are allowable to notional buyer

(1) The *notional buyer is only entitled to deduct *notional interest for an income year to the extent that the notional buyer would, apart from this Division, have been entitled to deduct *arrangement payments for that income year if no part of those payments were capital in nature.

(2) The *notional buyer is entitled to deduct *notional interest for *arrangement payment periods, and parts of arrangement payment periods, in the income year.

240‑55 Arrangement payments not to be allowable deductions

The *notional buyer is not entitled to deduct *arrangement payments that the *notional buyer makes under the *arrangement, but those payments are taken into account in calculating *notional interest that may be deducted under section 240‑50.

Subdivision 240‑E—Notional interest and arrangement payments

Table of sections

Operative provisions

240‑60 Notional interest

240‑65 Arrangement payments

240‑70 Arrangement payment periods

(1) The *notional interest for an *arrangement payment period is worked out as follows:

Calculating *notional interest

Step 1. Add the *notional interest from previous *arrangement payment periods to the *notional loan principal.

Step 2. Subtract any *arrangement payments that have already been made or that are due but that have not been made. The result is the outstanding notional loan principal as at the start of the *arrangement payment period.

Step 3. Work out the implicit interest rate. It is the rate of compound interest for the *arrangement payment period at which the *notional loan principal equals the sum of:

(a) the present value of the *arrangement payments payable by the *notional buyer under the *arrangement; and

(b) the present value of any *termination amounts.

Step 4. Multiply the outstanding *notional loan principal by the implicit interest rate. The result is the notional interest for the *arrangement payment period.

(2) If only part of an *arrangement payment period occurs during an income year, the *notional interest for that part of the arrangement payment period is so much of the notional interest for that arrangement payment period as may appropriately be related to that income year in accordance with generally accepted accounting principles.

(3) In calculating the implicit interest rate, if any of the relevant amounts are not known at the start of the *arrangement, a reasonable estimate of the amount is to be made and is to be used for the purposes of calculating the implicit interest rate for each income year of the *notional seller.

(4) If a reasonable estimate cannot be made at that time, an estimate of the amount is to be made at the end of each income year of the *notional seller for the purposes of calculating the implicit interest rate for each income year of the notional seller.

An arrangement payment is an amount that the *notional buyer is required to pay under the *arrangement but does not include:

(a) an amount in the nature of a penalty payable for failure to make a payment on time; or

(b) a *termination amount.

240‑70 Arrangement payment periods

(1) An *arrangement payment period is a period for which a payment under the *arrangement is allocated or expressed to be payable.

(2) However, if a period exceeds 6 months, the period is not an *arrangement payment period but each of the following parts of the period is a separate arrangement payment period:

(a) the part of the period beginning at the start of that period and ending 6 months later;

(b) each part of the period:

(i) beginning immediately after a part of the period that is an arrangement payment period under paragraph (a) or under a previous application of this paragraph; and

(ii) ending 6 months after the start of that later part or at the end of the period, whichever first occurs.

Subdivision 240‑F—The end of the arrangement

Table of sections

Operative provisions

240‑75 When is the end of the arrangement?

240‑78 Termination amounts

240‑80 What happens if the arrangement is extended or renewed

240‑85 What happens if an amount is paid by or on behalf of the notional buyer to acquire the property

240‑90 What happens if the notional buyer ceases to have the right to use the property

240‑75 When is the end of the arrangement?

(1) If the *arrangement is stated to cease to have effect at a particular time, it is taken for the purposes of this Division to end (even if it is extended or renewed) at the earlier of:

(a) that time; or

(b) the time at which the arrangement ceases to have effect (whether because the arrangement is terminated or for any other reason).

Note: Section 240‑80 deals with extensions and renewals.

(2) An *arrangement is taken to have ended if it is extended or renewed.

(3) If the *arrangement is of indefinite duration, it ends at the time at which the arrangement ceases to have effect even if the *arrangement is renewed.

Note: Section 240‑80 deals with extensions and renewals.

(4) An *arrangement is taken to have ended if it is reasonable to conclude, having regard to the terms and conditions of the *arrangement, that the arrangement has ceased to have effect.

(5) An *arrangement is also taken to have ended if the property has been lost or destroyed.

A termination amount is an amount payable because an *arrangement ends and includes:

(a) if, at the end of the arrangement, the *notional buyer acquires the property from the *notional seller—an amount payable to the notional seller for the acquisition; or

(b) if, at the end of the arrangement, the property is lost or destroyed—any amounts paid to the notional seller (whether by the notional buyer or another entity) as a result of the loss or destruction of the property; or

(c) otherwise—the value of the property at the end of the arrangement.

240‑80 What happens if the arrangement is extended or renewed

(1) This section sets out what happens if, after the end of the *arrangement, the *notional buyer and *notional seller extend or renew the *arrangement.

(2) This Division applies as if the original *arrangement has ended and the extended arrangement or renewed arrangement is a separate arrangement (the new arrangement).

(3) There is not, however, taken to be any disposal or acquisition as a result of the original arrangement ending or of the new arrangement starting and the *notional buyer does not cease to own the property.

(4) Also, the *notional loan principal for the new loan is:

(a) if the *arrangement as extended or renewed states an amount as the cost or value of the property for the purposes of the extension or renewal and the *notional seller and the *notional buyer were dealing with each other at *arm’s length in connection with the extension or renewal—the amount so stated; or

(b) otherwise—the amount that could reasonably have been expected to have been paid by the notional buyer for the purchase of the property if:

(i) the notional seller had actually sold the property to the notional buyer when the arrangement was extended or renewed; and

(ii) the notional seller and notional buyer were dealing with each other at arm’s length in connection with the sale.

(5) Subdivision 240‑G applies to the *notional loan for the original arrangement. For that purpose, the *notional loan principal for the new arrangement is taken to be a *termination amount paid to the *notional seller under the original arrangement.

If, at or after the end of the *arrangement, an amount is paid to the *notional seller by, or on behalf of, the *notional buyer to acquire the property, the following provisions have effect:

(a) the amount paid is not included in the notional seller’s assessable income;

(b) the notional buyer cannot deduct the payment;

(c) the notional buyer is taken to continue to own the property;

(d) the transfer to the notional buyer of legal title to the property is not taken to be a disposal of the property by the notional seller.

240‑90 What happens if the notional buyer ceases to have the right to use the property

(1) This section applies if, at the end of the *arrangement:

(a) the arrangement is not extended or renewed in the way mentioned in subsection 240‑80(1); and

(b) no amount is paid to the *notional seller by, or on behalf of, the *notional buyer to acquire the property; and

(c) the property is not lost or destroyed.

(2) The property is taken to have been disposed of by the *notional buyer by way of sale back to the *notional seller, and to have been acquired by the *notional seller, at the end of the *arrangement.

(3) The consideration for the sale of the property by the *notional buyer, and the cost of the acquisition of the property by the *notional seller, are each taken to be equal to the *market value of the property at the end of the *arrangement.

(4) Subsection (5) applies where the property is a *car and if it:

(a) had been bought from the *notional seller, when this Division first applied to an *arrangement in respect of the car, by the *notional buyer for a price equal to the *notional loan principal; and

(b) had been first used by the notional buyer for any purpose in the *financial year in which that time occurred;

the cost of the car, for the purpose of working out its decline in value for that person under Division 40, would have been limited by section 40‑230.

(a) the sum of:

(i) the amount that would have been the *adjustable value of the car at that time for the purposes of the application of that Division to the notional buyer if the notional buyer were not taken under this Division to have disposed of the car; and

(ii) any amount that is included in the notional buyer’s assessable income under section 40‑285 because the notional buyer is taken to have disposed of the car; or

(b) the cost of the acquisition of the car by the associate.

Subdivision 240‑G—Adjustments if total amount assessed to notional seller differs from amount of finance charge

240‑100 What this Subdivision is about

This Subdivision provides for adjustments if the sum of the amounts included in the notional seller’s assessable income are greater or less than the finance charge, worked out at the end of the arrangement, for the notional loan.

Table of sections

Operative provisions

240‑105 Adjustments for notional seller

240‑110 Adjustments for notional buyer

240‑105 Adjustments for notional seller

(1) This section applies at the end of the *arrangement.

(2) If the sum of:

(a) all amounts (other than *termination amounts) that were paid or payable to the *notional seller under the *arrangement; and

(b) any termination amounts paid or payable to the notional seller;

exceeds the amount worked out using the formula in subsection (4), the excess is included in the notional seller’s assessable income of the income year in which the arrangement ends.

Note: Subsection 240‑80(5) provides that the amount of a notional loan that is taken to be made by an extended or renewed arrangement is a termination amount paid under the previous arrangement.

(3) If the amount worked out using the formula in subsection (4) exceeds:

(a) all amounts (other than *termination amounts) that were paid or payable to the *notional seller under the *arrangement; and

(b) any termination amounts paid or payable to the notional seller;

the notional seller is entitled to deduct the excess in the income year in which the arrangement ends.

Note: Subsection 240‑80(5) provides that the amount of a notional loan that is taken to be made by an extended or renewed arrangement is a termination amount paid under the previous arrangement.

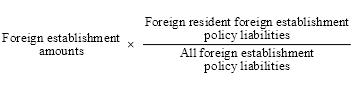

(4) The formula for the purposes of subsections (2) and (3) is:

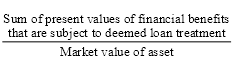

![]()

where:

assessed notional interest means the *notional interest that has been or is to be included in the *notional seller’s assessable income of any income year.

240‑110 Adjustments for notional buyer

(1) If:

(a) an amount is included in the *notional seller’s assessable income of an income year under subsection 240‑105(2); or

(b) an amount would have been so included if the notional seller had been subject to tax on assessable income;

the *notional buyer is entitled to deduct a corresponding amount in the notional buyer’s income year.

(2) If:

(a) the *notional seller is entitled to deduct an amount for an income year under subsection 240‑105(3); or

(b) the notional seller would have been so entitled if the *notional seller had been subject to tax on assessable income;

a corresponding amount is included in the notional buyer’s assessable income for the notional buyer’s income year.

(3) The *notional buyer is entitled to a deduction, and is required to include an amount in his or her assessable income only to the extent (if any) that the notional buyer would, apart from this Division, have been entitled to deduct *arrangement payments if no part of those payments were capital in nature.

Subdivision H—Application of Division 16E to certain arrangements

240‑112 Division 16E applies to certain arrangements

(1) Division 16E of Part III of the Income Tax Assessment Act 1936 applies in relation to an arrangement (the assignment arrangement) between the notional seller and another person (the holder) to transfer the right to payments (the Division 240 payments) under an arrangement that is treated as a sale and loan by this Division (the sale and loan arrangement).

(2) In applying Division 16E, the following assumptions are to be made:

(a) the assignment arrangement is the qualifying security;

(b) the notional seller is the issuer;

(c) the qualifying security is issued when the assignment arrangement is entered into;

(d) the issue price is consideration provided to the notional seller under the assignment arrangement;

(e) the Division 240 payments are payments made by the notional seller under the assignment arrangement;

(f) no part of the payments represent periodic interest.

(3) This Subdivision does not apply if the assignment arrangement gives rise to a termination of the sale and loan arrangement for the purposes of this Division.

(4) To avoid doubt, Division 6A of Part III of the Income Tax Assessment Act 1936 does not apply to an assignment arrangement to which this Subdivision applies.

Subdivision 240‑I—Provisions applying to hire purchase agreements

Table of sections

Operative provisions

240‑115 Another person, or no person taken to own property in certain cases

240‑115 Another person, or no person taken to own property in certain cases

(1) This section sets out special modifications of the effect of this Division that apply in relation to a *hire purchase agreement unless:

(a) the notional buyer would have been the owner or the *quasi‑owner of the property if the *arrangement had been a sale of the property; and

(b) it is reasonably likely that the right, obligation or contingent obligation to acquire the property will be exercised by, or in respect of, the notional buyer.

Note: An example of a contingent obligation is a put option.

(2) The modifications also apply if the *notional buyer:

(a) disposes of his or her interest in the property; or

(b) enters into a lease covered by Division 42A of Schedule 2E to the Income Tax Assessment Act 1936 under which he or she leases the property to another person.

Modifications

(3) For the purpose of the *capital allowance provisions, if, apart from the operation of this Division, an entity other than the *notional seller would own the property that is the subject of an agreement covered by this section, that entity is taken to be the owner of the property.

(4) For the purpose of the *capital allowance provisions, if, apart from the operation of this Division, the *notional seller would own the property that is the subject of an agreement covered by this section, no entity is taken to be the owner of the property.

Division 243—Limited recourse debt

Table of Subdivisions

Guide to Division 243

243‑A Circumstances in which Division operates

243‑B Working out the excessive deductions

243‑C Amounts included in assessable income and deductions

243‑D Special provisions

243‑10 What this Division is about

This Division tells you when you must include an additional amount in your assessable income at the termination of a limited recourse debt arrangement. It also tells you what the additional amount is.

Basically, the Division applies where the capital allowance deductions that have been obtained for expenditure that is funded by the debt and the deductions are excessive having regard to the amount of the debt that was repaid.

The reason for the adjustment is to ensure that, where you have not been fully at risk in relation to an amount of expenditure, you do not get a net deduction if you fail to pay that amount.

Subdivision 243‑A—Circumstances in which Division operates

Table of sections

Operative provisions

243‑15 When does this Division apply?

243‑20 What is limited recourse debt?

243‑25 When is a debt arrangement terminated?

243‑30 What is the financed property and the debt property?

243‑15 When does this Division apply?

(1) This Division applies if:

(a) *limited recourse debt has been used to wholly or partly finance or refinance expenditure; and

(b) at the time that the debt *arrangement is terminated, the debt has not been paid in full by the debtor; and

(c) the debtor can deduct an amount as a *capital allowance for the income year in which the termination occurs, or has deducted or can deduct an amount for an earlier income year, in respect of the expenditure or the *financed property.

Note: This Division does not apply to certain limited recourse debts that are used to refinance limited recourse debt to which this Division has applied (see subsection 243‑50(4)).

(2) However, unless the net *capital allowance deductions have been excessive having regard to the amount of the debt that remains unpaid (see section 243‑35), no amount is included in the debtor’s assessable income under this Division although future deductions may be reduced.

(3) In working out if the debt has been paid in full, and in working out the unpaid amount of the debt, the following amounts are to be treated as if they were not payments in respect of the debt:

(a) any reduction in the debt as a result of the *financed property being surrendered or returned to the creditor at the termination of the debt;

(b) any payment to reduce the debt that is funded directly or indirectly by *non‑arm’s length limited recourse debt or by proceeds from the disposal of the debtor’s interest in the financed property.

However, any amounts accrued that are interest, *notional interest or in the nature of interest are taken not to be unpaid.

(4) In working out if the debt has been paid in full, and in working out the unpaid amount of the debt, payments are to be attributed first to the payment of any accrued amounts that are interest, *notional interest or in the nature of interest.

(5) A *notional loan is taken to be debt that has been used to wholly or partly finance or refinance expenditure.

Note: Notional loans arise under Division 240.

243‑20 What is limited recourse debt?

(1) A limited recourse debt is an obligation imposed by law on an entity (the debtor) to pay an amount to another entity (the creditor) where the rights of the creditor as against the debtor in the event of default in payment of the debt or of interest are limited wholly or predominantly to any or all of the following:

(a) rights (including the right to money payable) in relation to any or all of the following:

(i) the *debt property or the use of the debt property;

(ii) goods produced, supplied, carried, transmitted or delivered, or services provided, by means of the debt property;

(iii) the loss or disposal of the whole or a part of the debt property or of the debtor’s interest in the debt property;

(b) rights in respect of a mortgage or other security over the debt property or other property;

(c) rights that arise out of any *arrangement relating to the financial obligations of an end‑user of the *financed property towards the debtor, and are financial obligations in relation to the financed property.

(2) An obligation imposed by law on an entity (the debtor) to pay an amount to another entity (the creditor) is also a limited recourse debt if it is reasonable to conclude that the rights of the creditor as against the debtor in the event of default in payment of the debt or of interest are capable of being limited in the way mentioned in subsection (1). In reaching this conclusion, have regard to:

(a) the assets of the debtor (other than assets that are indemnities or guarantees provided in relation to the debt);

(b) any *arrangement to which the debtor is a party;

(c) whether all of the assets of the debtor would be available for the purpose of the discharge of the debt (other than assets that are security for other debts of the debtor or any other entity);

(d) whether the debtor and creditor are dealing at *arm’s length in relation to the debt.

(3) An obligation imposed by law on an entity (the debtor) to pay an amount to another entity (the creditor) is also a limited recourse debt if there is no *debt property and it is reasonable to conclude that the rights of the creditor as against the debtor in the event of default in payment of the debt or of interest are capable of being limited. In reaching this conclusion, have regard to:

(a) the assets of the debtor (other than assets that are indemnities or guarantees provided in relation to the debt);

(b) any *arrangement to which the debtor is a party;

(c) whether all of the assets of the debtor would be available for the purpose of the discharge of the debt (other than assets that are security for other debts of the debtor or any other entity);

(d) whether the debtor and creditor are dealing at *arm’s length in relation to the debt.

(4) A *notional loan under a *hire purchase agreement is also a limited recourse debt.

Note: Notional loans arise under Division 240.

(5) However, an obligation that is covered by subsection (1) is not a limited recourse debt if the creditor’s recourse is not in practice limited due to the creditor’s rights in respect of a mortgage or other security over property of the debtor (other than the financed property) the value of which exceeds, or is likely to exceed, the amount of the debt.

(6) Also, an obligation that is covered by subsection (1), (2) or (3) is not a limited recourse debt if, having regard to all relevant circumstances, it would be unreasonable for the obligation to be treated as limited recourse debt.

(7) A *limited recourse debt is a non‑arm’s length limited recourse debt if the debtor and creditor do not deal with each other at arm’s length in relation to the debt.

243‑25 When is a debt arrangement terminated?

(1) A debt arrangement is taken to have terminated if:

(a) it is actually terminated; or

(b) the debtor’s obligation to repay the debt is waived, novated or otherwise varied so as to reduce, transfer or extinguish the debt; or

(c) an agreement is entered into to waive, novate or otherwise vary the debtor’s obligation to repay the debt so as to reduce, transfer or extinguish the debt; or

(d) the creditor ceases to have an entitlement to recover the debt from the debtor (other than as a result of an arm’s length assignment of some or all of the creditor’s rights under the debt arrangement); or

(e) the debtor ceases to be the owner or the *quasi‑owner of some or all of the *debt property because that property is surrendered to the creditor because of the debtor’s failure to pay the whole or a part of the debt; or

(f) the debtor ceases to be the owner of a beneficial interest in some or all of the debt property because the interest is surrendered to the creditor because of the debtor’s failure to pay the whole or a part of the debt; or

(g) the debt becomes a bad debt.

(2) However, a debt arrangement that is a *notional loan is not taken to have terminated merely because it has been renewed or extended.

Note: Notional loans arise under Division 240. Under that Division, they are taken to have ended if they are renewed or extended.

(3) Where a debt is terminated under paragraph (1)(b) or (c) as a result of the debt being reduced, the remaining debt is taken to be a new debt to which section 243‑15 applies.

243‑30 What is the financed property and the debt property?

(1) Property is the financed property if the expenditure referred to in paragraph 243‑15(1)(a) is on the property, is on the acquisition of the property, results in the creation of the property or is otherwise connected with the property.

(2) If the debt agreement is a *notional loan, the property that is the subject of the agreement is the financed property.

Note: Notional loans arise under Division 240.

(3) Property is the debt property if:

(a) it is the *financed property; or

(b) the property is provided as security for the debt.

Subdivision 243‑B—Working out the excessive deductions

Table of sections

Operative provisions

243‑35 Working out the excessive deductions

243‑35 Working out the excessive deductions

(1) The *capital allowance deductions have been excessive having regard to the amount of the debt that remains unpaid if the amount worked out under subsection (2) exceeds the amount worked out under subsection (4).

(2) This is how to work out the total net *capital allowance deductions:

Working out the total net capital allowance deductions

Step 1. Add up all of the debtor’s *capital allowance deductions in respect of the expenditure or the *financed property (including deductions because of balancing adjustments) for the income year in which the termination occurs or an earlier income year.

Step 2. Deduct from that any amount that is included in the assessable income of the debtor of any income year by virtue of a provision of this Act (other than this Division) as a result of the disposal of the *financed property the effect of which is to reverse a deduction covered by Step 1.

Step 3. Deduct from the result an amount equal to the sum of any amounts included in the entity’s assessable income as a result of an earlier application of this Division to the debt.

Step 4. Add to the result an amount equal to the sum of any deductions to which the entity is entitled under section 243‑45 (repayments of the original debt after termination) or 243‑50 (repayments of the replacement debt) because of payments in respect of the debt.

(3) The reference in step 2 of the method statement in subsection (2) to an amount that is included in the assessable income of a taxpayer as a result of the disposal of the *financed property includes a reference to an amount that is included under section 26AG of the Income Tax Assessment Act 1936 as a result of the disposal of the financed property.

Note: Division 20 deals with amounts included to reverse the effect of past deductions.

(4) This is how to work out the total net capital allowance deductions that would otherwise be allowable taking into account the amount of the debt that is unpaid:

Working out the total net capital allowance deductions that would otherwise be allowable

Work out the amount that would be worked out under subsection (2) if the deductions and the amounts included in assessable income had been calculated using the following assumptions:

(1) The original expenditure in respect of which deductions were calculated was reduced by the amount of the debt that was unpaid by the debtor when the debt was terminated. (In calculating the amount unpaid the following are to be disregarded:

(a) any reduction in the amount as a result of the *financed property being surrendered or returned to the creditor at the termination of the debt;

(b) any reduction in the amount to the extent that it is funded directly or indirectly by *non‑arm’s length limited recourse debt or by the consideration for the disposal of the debtor’s interest in the financed property.)

(2) Deductions for income years after the income year in which the termination occurred were also taken into account.

(3) The original expenditure in respect of which deductions were calculated was increased by any amount that is paid by the debtor as consideration for another person assuming a liability under the debt. (This assumption does not apply to the extent that the consideration is funded directly or indirectly by *non‑arm’s length limited recourse debt or by the consideration for the disposal of the debtor’s interest in the *financed property.)

(4) Step 2 were omitted from subsection (2).

Subdivision 243‑C—Amounts included in assessable income and deductions

Table of sections

Operative provisions

243‑40 Amount included in debtor’s assessable income

243‑45 Deduction for later payments in respect of debt

243‑50 Deduction for payments for replacement debt

243‑55 Effect of Division on later capital allowance deductions

243‑57 Effect of Division on later capital allowance balancing adjustments

243‑58 Adjustment where debt only partially used for expenditure

243‑40 Amount included in debtor’s assessable income

The debtor’s assessable income for the income year in which the termination occurs is to include the excess referred to in subsection 243‑35(1).

Note: Section 243‑60 applies in relation to certain partnership debts.

243‑45 Deduction for later payments in respect of debt

(1) This section applies if:

(a) an amount was included in the debtor’s assessable income under section 243‑40 or a deduction was reduced under section 243‑55; and

(b) the debtor makes a payment to the creditor, after the termination of the debt arrangement, in respect of the debt (other than an amount to the extent to which it is a payment of interest, of *notional interest or in the nature of interest).

(2) This is how to work out the amount of the deduction:

Working out the amount of the deduction

Step 1. Work out the amount that would be worked out under subsection 243‑35(2) if the debt were terminated immediately before the payment.

Step 2. Work out the amount that would have been worked out under subsection 243‑35(4) at that time if the payment had been taken into account.

Step 3. The amount of the deduction is the amount (if any) by which the amount worked out under Step 2 exceeds the amount worked out under Step 1.

(3) The amount can be deducted for the income year in which the payment is made.

Limit on deductions

(4) The total amounts deducted under this section in respect of a debt, and under section 243‑50 in respect of a replacement debt, cannot exceed the sum of:

(a) any amounts included in the debtor’s assessable income under this Division in respect of the original debt; and

(b) any amount by which deductions in respect of the original debt were reduced under section 243‑55.

243‑50 Deduction for payments for replacement debt

Payments where debt refinanced

(1) This section applies if:

(a) an amount was included in the debtor’s assessable income under section 243‑40 or a deduction was reduced under section 243‑55; and

(b) an amount funded by a *non‑arm’s length limited recourse debt (the replacement debt) was disregarded in calculations under subsection 243‑35(4); and

(c) the debtor makes a payment, after the termination of the original debt arrangement, in respect of the replacement debt (other than to the extent to which it is a payment of interest, of *notional interest or in the nature of interest).

(2) This is how to work out the amount of the deduction:

Working out the amount of the deduction

Step 1. Work out the amount that would be worked out under subsection 243‑35(2) if the replacement debt were terminated immediately before the payment.

Step 2. Work out the amount that would have been worked out under subsection 243‑35(4) at that time if the payment had been made in respect of the original debt and it had been taken into account.

Step 3. The amount of the deduction is the amount (if any) by which the amount worked out under Step 2 exceeds the amount worked out under Step 1.

(3) The amount can be deducted for the income year in which the payment is made.

Division not to apply to termination of replacement debt

(4) This Division does not apply to termination of the replacement debt referred to in paragraph (1)(b).

Limit on deductions

(5) The total amounts deducted under section 243‑45 in respect of the original debt, or under this section in respect of the replacement debt, cannot exceed the sum of:

(a) any amounts included in the debtor’s assessable income under this Division in respect of the original debt; and

(b) any amount by which deductions in respect of the original debt were reduced under section 243‑55.

243‑55 Effect of Division on later capital allowance deductions

(1) This section applies where this Division (other than section 243‑65) has applied in relation to a debt and the debtor is entitled to a *capital allowance deduction in respect of the expenditure or the *financed property in relation to a time or period after the termination of the debt.

(2) The *capital allowance deduction is reduced if the amount that would have been worked out under subsection 243‑35(2) would have exceeded the amount worked out under subsection 243‑35(4) if the following assumptions were applied in both subsections:

Assumptions to be applied

(1) That the debt was terminated at the time, or at the end of the period, referred to in subsection (1) of this section.

(2) That the amount unpaid at the time, or at the end of the period, is reduced by any amounts paid under a replacement debt.

(3) The debtor’s *capital allowance deductions in respect of the expenditure or the *financed property were increased by the amount of the capital allowance deduction referred to in subsection (1) of this section.

(3) The deduction is to be reduced by the amount of the excess.

243‑57 Effect of Division on later capital allowance balancing adjustments

(1) This section applies where this Division (other than section 243‑65) has applied in relation to a debt and an amount is later included in the assessable income of an entity by virtue of a provision of this Act (other than this Division) as a result of the disposal of the *financed property the effect of which is to reverse a deduction covered by Step 1 in subsection 243‑35(2).

(2) Any amount that would be included in the debtor’s assessable income is reduced if the amount that would have been worked out under subsection 243‑35(4) would have exceeded the amount worked out under subsection 243‑35(2) if the following assumptions were applied in both subsections:

Assumptions to be applied

(1) That the debt was terminated at the time of the disposal of the *financed property, referred to in subsection (1) of this section.

(2) The amount in Step 2 in subsection 243‑35(2) were increased by the amount that would otherwise be included in the debtor’s assessable income.

(3) The amount worked out under subsection 243‑35(4) were reduced by any amount by which:

(a) the amount arising as a result of the disposal that is taken into account for the purposes of the provision mentioned in subsection (1);

exceeds:

(b) the unpaid amount of the debt immediately before the time of the disposal of the *financed property, referred to in subsection (1).

(3) The amount is to be reduced by the amount of the excess.

243‑58 Adjustment where debt only partially used for expenditure

If the debt is only partially used to finance the expenditure, or the property, in respect of which the *capital allowance deductions referred to in Step 1 in subsection 243‑35(2) are allowed, the amount of any deduction, any reduction in a deduction or any amount included in assessable income is to be so much as is reasonable taking into account the proportion of the debt that is used for that purpose.

Subdivision 243‑D—Special provisions

Table of sections

Operative provisions

243‑60 Application of Division to partnerships

243‑65 Application where partner reduces liability

243‑70 Application of Division to companies ceasing to be 100% subsidiary

243‑75 Application of Division where debt forgiveness rules also apply

243‑60 Application of Division to partnerships

This Division applies to a partnership in respect of the partnership’s debts and in respect of debts of a partner, and references to a debtor include a reference to a partnership.

243‑65 Application where partner reduces liability

(1) This section applies to a debt in relation to a partner in a partnership if:

(a) in connection with an *arrangement, the partner’s liability to pay the debt is reduced or eliminated and the partner’s interest in the partnership ceases or is varied or transferred; and

(b) an excess would have been worked out under subsection 243‑35(1) if, at the time when the debt is reduced or eliminated, the debt had been terminated and remained unpaid and this section had not applied.

(2) If this section applies to a debt in relation to a partner in a partnership, an amount is to be included in his or her assessable income.

(3) This is how to work out the amount to be included:

Working out the amount included

Step 1. Work out which income years the partner was a member of the partnership and the partnership was entitled to a *capital allowance deduction in respect of the expenditure or the *financed property (including deductions because of balancing adjustments).

Step 2. For each of those income years, work out the proportion of net income of the partnership or the partnership loss (as the case requires) that was included in the assessable income of the partner or which the partner could deduct.

Step 3. For each of those income years, multiply the *capital allowance deductions in respect of the expenditure or the *financed property (including deductions because of balancing adjustments) of the partnership by the corresponding proportion worked out under Step 2. Sum all of the amounts.

Step 4. Divide the sum by the total of the *capital allowance deductions in respect of the expenditure or the *financed property (including deductions because of balancing adjustments) of the partnership for all of those income years.

Step 5. Work out the amount that would have been included in the partnership’s assessable income under section 243‑40 if the debt had been terminated and remained unpaid and this section had not applied.

Step 6. Multiply the amount worked out in Step 5 by the factor worked out in Step 4. The result is the amount to be included in the partner’s assessable income.

243‑70 Application of Division to companies ceasing to be 100% subsidiary

(1) This section applies to a company if:

(a) the company ceases to be a *100% subsidiary in relation to at least one other company; and

(b) at that time, the company is the debtor for a *limited recourse debt that has not been paid in full by the company; and

(c) the creditor’s rights under the debt are transferred or assigned to another entity.

(2) If this section applies, this Division applies as if the debt were terminated, and refinanced with *non‑arm’s length limited recourse debt, at the time the company ceased to be a *100% subsidiary of that other company.

243‑75 Application of Division where debt forgiveness rules also apply

(1) This section is to remove doubt about how this Division and Schedule 2C to the Income Tax Assessment Act 1936 apply where both apply to the same debt.

(2) Where both apply:

(a) this Division is to be applied first and is to be applied disregarding any operation of that Schedule; and

(b) any amounts included in assessable income under this Division are taken into account under paragraph 245‑85(1)(a) of that Schedule.

Division 247—Capital protected borrowings

247‑1 What this Division is about

Capital protection provided under a relevant capital protected borrowing to the extent that it is not provided by an explicit put option is treated (for the borrower) as if it were a put option.

An amount attributable to capital protection under any relevant capital protected borrowing is treated (for the borrower) as a payment for a put option.

Table of sections

Operative provisions

247‑5 Object of Division

247‑10 What capital protected borrowing and capital protection are

247‑15 Application of this Division

247‑20 Treating capital protection as a put option

247‑25 Number of put options

247‑30 Exercise or expiry of option

The object of this Division is to ensure that amounts for *capital protection under all relevant *capital protected borrowings are treated (for the borrower) under this Act as a payment for a put option.

247‑10 What capital protected borrowing and capital protection are

(1) An *arrangement under which a *borrowing is made, or credit is provided, is a capital protected borrowing if the borrower is wholly or partly protected against a fall in the *market value of a thing (the protected thing) to the extent that:

(a) the borrower uses the amount borrowed or credit provided to acquire the protected thing; or

(b) the borrower uses the protected thing as security for the borrowing or provision of credit.

(2) That protection is called capital protection.

247‑15 Application of this Division

(1) This Division applies to a *capital protected borrowing only if the protected thing is a beneficial interest in:

(a) a *share, a unit in a unit trust or a stapled security; or

(b) an entity that holds a beneficial interest in a share, unit in a unit trust or stapled security either directly, or indirectly through one or more interposed entities.

(2) This Division applies only to borrowers under *capital protected borrowings.

(3) This Division does not apply to a *capital protected borrowing under which a *share or stapled security is acquired under an *employee share scheme.

(4) This Division does not apply to a *capital protected borrowing entered into before 1 July 2007 (except to the extent that it is extended on or after that day) unless the *share, unit in a unit trust or stapled security is listed for quotation in the official list of an *approved stock exchange.

(5) This Division does not apply to a *capital protected borrowing entered into on or after 1 July 2007 if:

(a) the protected thing is a beneficial interest in:

(i) a *share, unit or stapled security that is not listed for quotation in the official list of an *approved stock exchange; or

(ii) an entity that holds a beneficial interest in a share, unit in a unit trust or stapled security either directly, or indirectly through one or more interposed entities, that is not so listed; and

(b) one of these conditions is satisfied:

(i) for a non‑listed share—the company is not a *widely held company;

(ii) for a non‑listed unit—the trust is not a widely held unit trust as defined in section 272‑105 in Schedule 2F to the Income Tax Assessment Act 1936;

(iii) for a non‑listed stapled security—any company involved is not a widely held company and any trust involved is not such a widely held unit trust.

247‑20 Treating capital protection as a put option

(1) This section applies to a borrower if:

(a) the borrower has an excess using the method statement in subsection (3) for a *capital protected borrowing entered into on or after 1 July 2007; or

(b) the borrower has an amount that is reasonably attributable to the *capital protection as mentioned in subsection (2) for a capital protected borrowing, or an extension of a capital protected borrowing, entered into at or after 9.30 am, by legal time in the Australian Capital Territory, on 16 April 2003 and before 1 July 2007.

(2) For paragraph (1)(b), the amount that is reasonably attributable to the *capital protection is worked out under Division 247 of the Income Tax (Transitional Provisions) Act 1997.

(3) This is the method statement.

Method statement

Step 1. Work out the total amount incurred by the borrower under or in respect of the *capital protected borrowing for the income year, ignoring amounts that are not in substance for *capital protection or interest.

Step 2. Work out the total interest that would have been incurred for the income year on a *borrowing or provision of credit of the same amount as under the *capital protected borrowing at the rate applicable under subsection (4) or (5).

Step 3. If the step 1 amount exceeds the step 2 amount, the excess is reasonably attributable to the *capital protection for the income year.

Example: Amounts that would be ignored under step 1 include amounts that are in substance the repayment of a loan or credit, the payment of an application fee or brokerage commission and the payment of stamp duty or other tax.

(4) If the *capital protected borrowing is at a fixed rate for all or part of the term of the *borrowing, use the Reserve Bank of Australia’s Indicator Rate for Personal Unsecured Loans—Variable Rate (the benchmark rate) at the time the first of the amounts referred to in step 1 of the method statement in subsection (3) was incurred during the term of the borrowing or the relevant part of the term.

(5) If the *capital protected borrowing is at a variable rate for all or part of the term of the *borrowing, use the average of the benchmark rates published by the Reserve Bank of Australia during the term of the borrowing or the relevant part of the term.

(6) If this section applies to a borrower, this Act applies as if:

(a) the borrower’s excess from the method statement in subsection (3); or

(b) the amount that is reasonably attributable to *capital protection as mentioned in paragraph (1)(b);

(reduced by any amount the borrower incurred under or in respect of the *capital protected borrowing for an explicit put option) were incurred only for a put option granted by the lender or by another entity under the *arrangement.

(1) If a *capital protected borrowing specifies more than one occasion on which the *capital protection can be invoked, this Act applies as if there were a separate put option for each of those occasions. So much of the amount to which subsection 247‑20(6) applies as is reasonably attributable to each option is taken to have been incurred for that option.

(2) However, if a borrower may invoke the *capital protection under a *capital protected borrowing at any time up to the end of a period, or only at the end of a period, for which there is capital protection, this Act applies as if there were a single put option for that period.

247‑30 Exercise or expiry of option

(1) If the *capital protection under a *capital protected borrowing is invoked:

(a) the borrower is taken to have exercised the put option; and

(b) any interest in a *share, unit in a unit trust or stapled security that is acquired by the lender or another entity under the *arrangement as a result of that capital protection being invoked is taken to have been disposed of by the borrower as a result of the exercise of the option.

(2) If the *capital protection under a *capital protected borrowing is not invoked on or before the last occasion on which it could have been, the put option is taken to have expired.

Note: If a borrower under a capital protected borrowing holds the protected things on capital account, the exercise or expiry of the put option may give rise to a capital gain or capital loss: see sections 104‑25 (CGT event C2) and 134‑1 (exercise of options).

Division 250—Assets put to tax preferred use

Table of Subdivisions

Guide to Division 250

250‑A Objects

250‑B When this Division applies to you and an asset

250‑C Denial of, or reduction in, capital allowance deductions

250‑D Deemed loan treatment of financial benefits provided for tax preferred use

250‑E Taxation of deemed loan

250‑F Treatment of asset when Division ceases to apply to the asset

250‑G Objections against determinations and decisions by the Commissioner

250‑1 What this Division is about

This Division denies or reduces certain capital allowance deductions that would otherwise be available to you in relation to an asset if the asset is put to a tax preferred use in certain circumstances.

If the capital allowance deductions are denied or reduced, certain financial benefits in relation to the tax preferred use of the asset are assessed only to the extent of a notional gain component. This component is worked out on the basis of treating the arrangements under which the asset is put to a tax preferred use, and financial benefits are provided in relation to that tax preferred use, as a loan. Subdivision 250‑E then applies to determine the amounts that are to be assessed.

Table of sections

250‑5 Main objects

The main objects of this Division are:

(a) to deny or reduce your *capital allowance deductions in respect of an asset if the asset is put to a *tax preferred use and you have insufficient economic interest in the asset; and

(b) if your capital allowance deductions are denied or reduced, to treat the *arrangement for the tax preferred use of the asset as a loan that is taxed as a financial arrangement (on a compounding accruals basis).

Subdivision 250‑B—When this Division applies to you and an asset

Table of sections

Overall test

250‑10 When this Division applies to you and an asset

250‑15 General test

250‑20 First exclusion—small business entities

250‑25 Second exclusion—financial benefits under minimum value limit

250‑30 Third exclusion—certain short term or low value arrangements

250‑35 Exceptions to section 250‑30

250‑40 Fourth exclusion—sum of present values of financial benefits less that amount otherwise assessable

250‑45 Fifth exclusion—Commissioner determination

Tax preferred use of asset

250‑50 End user of an asset

250‑55 Tax preferred end user

250‑60 Tax preferred use of an asset

250‑65 Arrangement period for tax preferred use

250‑70 New tax preferred use at end of arrangement period if tax preferred use continues

250‑75 What constitutes a separate asset for the purposes of this Division

250‑80 Treatment of particular arrangements in the same way as leases

Financial benefits in relation to tax preferred use

250‑85 Financial benefits in relation to tax preferred use of an asset

250‑90 Financial benefit provided directly or indirectly

250‑95 Expected financial benefits in relation to an asset put to tax preferred use

250‑100 Present value of financial benefit that has already been provided

Discount rate to be used in working out present values

250‑105 Discount rate to be used in working out present values

Predominant economic interest

250‑110 Predominant economic interest

250‑115 Limited recourse debt test

250‑120 Right to acquire asset test

250‑125 Effectively non‑cancellable, long term arrangement test

250‑130 Meaning of effectively non‑cancellable arrangement

250‑135 Level of expected financial benefits test

250‑140 When to retest predominant economic interest under section 250‑135

250‑10 When this Division applies to you and an asset

This Division applies to you and an asset at a particular time if:

(a) the general test in section 250‑15 is satisfied in relation to you and the asset; and

(b) none of the exclusions in sections 250‑20, 250‑25, 250‑30, 250‑40 and 250‑45 apply.

This Division applies to you and an asset at a particular time if:

(a) the asset is being *put to a tax preferred use; and

(b) the *arrangement period for the *tax preferred use of the asset is greater than 12 months; and

(c) *financial benefits in relation to the tax preferred use of the asset have been, will be or can reasonably be expected to be, *provided to you (or a *connected entity) by:

(i) a *tax preferred end user (or a connected entity); or

(ii) any *tax preferred entity (or a connected entity); or

(iii) any entity that is not an Australian resident; and

(d) disregarding this Division, you would be entitled to a *capital allowance in relation to:

(i) a decline in the value of the asset; or

(ii) expenditure in relation to the asset; and

(e) you lack a *predominant economic interest in the asset at that time.

250‑20 First exclusion—small business entities

This Division does not apply to you and an asset if:

(a) you are a *small business entity for the income year in which the *arrangement period for the *tax preferred use of the asset starts; and

(b) you choose to deduct amounts under Subdivision 328‑D for the asset for that income year.

250‑25 Second exclusion—financial benefits under minimum value limit

(1) This Division does not apply to you and an asset that is being *put to a tax preferred use under a particular *arrangement if, at the start of the *arrangement period, the total of the nominal values of all the *financial benefits that have been, or will be or can reasonably be expected to be, provided to you (or a *connected entity):

(a) by *members of the tax preferred sector; and

(b) in relation to the *tax preferred use of the asset or any other asset that is being, or is to be, put to a tax preferred use under the arrangement;

does not exceed $5 million.

(2) The amount referred to in subsection (1) is indexed annually.

Note: Subdivision 960‑M shows you how to index amounts.

250‑30 Third exclusion—certain short term or low value arrangements

Certain short term or low value arrangements generally excluded

(1) This Division does not apply to you and an asset that is being *put to a tax preferred use under a particular *arrangement if:

(a) the *arrangement period for the *tax preferred use of the asset does not exceed:

(i) 5 years if the asset is real property and the tax preferred use of the asset is a lease; or

(ii) 3 years in any other case; or

(b) at the start of the arrangement period, the total of the nominal values of all the *financial benefits that have been, will be or can reasonably be expected to be, provided to you (or a *connected entity):

(i) by *members of the tax preferred sector; and

(ii) in relation to the tax preferred use of the asset or any other asset that is being, or is to be, put to a tax preferred use under the arrangement;

does not exceed:

(iii) $50 million if the asset is real property and the tax preferred use of the asset is a lease; or

(iv) $30 million in any other case; or

(c) at the start of the arrangement period, the total of the values of all the assets that are put to a tax preferred use under the arrangement does not exceed:

(i) $40 million if the asset is real property and the tax preferred use of the asset is a lease; or

(ii) $20 million in any other case.

This subsection has effect subject to section 250‑35.

(2) The amounts referred to in paragraphs (1)(b) and (c) are indexed annually.

Note: Subdivision 960‑M shows you how to index amounts.

250‑35 Exceptions to section 250‑30

Debt interests

(1) Section 250‑30 does not apply if the *arrangement (either alone or together with any arrangement in relation to the *tax preferred use of the asset or the provision of *financial benefits in relation to the tax preferred use of the asset) is a *debt interest.

(2) In applying subsection (1), disregard subsection 974‑130(4).

Member of tax preferred sector having certain rights in relation to the asset

(3) Section 250‑30 does not apply if:

(a) a *member of the tax preferred sector has:

(i) a right, obligation or contingent obligation to purchase or acquire the asset or a legal or equitable interest in the asset; or

(ii) a right to require the transfer of the asset or a legal or equitable interest in the asset; or

(iii) a residual or reversionary interest in the asset that will arise or become exercisable at or after the end of the *arrangement period; and

(b) the consideration for the purchase, acquisition or transfer of the right, obligation or interest is not fixed as the *market value of the asset at the time of the purchase, acquisition or transfer.

To avoid doubt, this subsection does not apply to the asset merely because your interest in the asset is one that ceases to exist after the passage of a particular period of time.

Member of tax preferred sector providing financing

(4) Section 250‑30 does not apply if a *member of the tax preferred sector provides financing, or support for financing, in relation to your interest in the asset (including by way of a loan, a guarantee, an indemnity, a security, hedging or undertaking to provide *financial benefits in the event of the termination of an *arrangement).

Finance leases, non‑cancellable operating leases, service concessions and similar arrangements

(5) Section 250‑30 does not apply if an *arrangement in relation to the *tax preferred use of the asset, or the provision of *financial benefits in relation to the tax preferred use of the asset, is or involves:

(a) a finance lease; or

(b) a non‑cancellable operating lease; or

(c) a service concession or similar arrangement;

that generally accepted accounting principles, as in force at the start of the *arrangement period, require to be included as an asset or a liability in your balance sheet.

Financial benefits irregular, not based on comparable market‑based rates or not reflecting value of tax preferred use of asset

(6) Section 250‑30 does not apply if the *financial benefits that have been, or are to be provided, to you (or a *connected entity) by *members of the tax preferred sector in relation to the *tax preferred use of the asset:

(a) are not provided on a regular periodic basis (and at least annually); or

(b) are not based on comparable market‑based rates; or

(c) do not reflect the value of the tax preferred use of the asset.

Special rules if tax preferred use is a lease or hire of the asset

(7) If the *tax preferred use of the asset is a lease or hire of the asset (or the use of the asset under a lease or hire arrangement), section 250‑30 does not apply if:

(a) the asset is so specialised that the *end user could not carry out one or more of its functions effectively without the asset; and

(b) you would be unlikely to be able to re‑lease, re‑hire or resell the asset to another person who is not a *member of the tax preferred end user group.

Note: For particular arrangements that are treated as leases, see section 250‑80.

Special rules if tax preferred use is not a lease or hire of the asset

(8) If the *tax preferred use of the asset is not the lease or hire of the asset (or the use of the asset under a lease or hire arrangement), section 250‑30 does not apply if:

(a) a *member of the tax preferred sector has a right, if particular circumstances occur, to manage, or to assume control over, the asset (other than temporarily for the purpose of ensuring public health or safety, protecting the environment or continuing the supply of an essential service); or

(b) the asset is so specialised that it is unlikely that it could effectively be put to any use other than the tax preferred use; or

(c) neither you (nor a *connected entity) has effective day to day control and physical possession of the asset.

Note: For particular arrangements that are treated as leases, see section 250‑80.

(1) This Division does not apply to you and an asset that is being *put to a tax preferred use under a particular *arrangement if, when that *tax preferred use of the asset starts, the Division 250 assessable amount is less than the alternative assessable amount.

(2) For the purposes of subsection (1), the Division 250 assessable amount is the sum of the present values of all the amounts that would be likely to be included in your assessable income under this Division in relation to the *tax preferred use of the asset if this Division applied to you and the asset.

(3) This is how to work out the alternative assessable amount for the purposes of subsection (1):

Method statement

Step 1. Add up the present values of the amounts that would be included in your assessable income in relation to the *financial benefits *provided in relation to the tax preferred use of the asset during the *arrangement period if this Division did not apply to you and the asset.

Step 2. Add up the present values of the amounts that you would be able to deduct in relation to the asset, or expenditure in relation to the asset, under Division 40 or Division 43 in relation to the *arrangement period if this Division did not apply to you and the asset.

Step 3. Deduct the amount obtained in Step 2 from the amount obtained in Step 1. The result is the alternative assessable amount.

(4) To avoid doubt, the amounts referred to in subsections (2) and (3) are all the amounts that would be likely to be included in your assessable income, or deducted, for all the income years during the whole, or a part, of which the asset is *put to the tax preferred use.

(5) The point in time to be used in determining, for the purposes of this section:

(a) the present value of an amount that is included in your assessable income for an income year; or

(b) the present value of an amount that you would be able to deduct for an income year;

is the end of the income year.

250‑45 Fifth exclusion—Commissioner determination

This Division does not apply to you and an asset at a particular time if:

(a) you request the Commissioner to make a determination under this subsection; and

(b) the Commissioner determines that it is unreasonable that the Division should apply to you and the asset at that time, having regard to:

(i) the circumstances because of which this Division would apply to you and the asset; and

(ii) any other relevant circumstances.

(1) An entity (other than you) is an end user of an asset if the entity (or a *connected entity):

(a) uses, or effectively controls the use of, the asset; or

(b) will use, or effectively control the use of, the asset; or

(c) is able to use, or effectively control the use of, the asset; or

(d) will be able to use, or effectively control the use of, the asset.

(2) The control referred to in subsection (1) may be direct or indirect.

(3) For the purposes of subsection (1), disregard any temporary control of the asset that is for the purpose of ensuring public health or safety, protecting the environment or continuing the supply of an essential service.

(4) To avoid doubt, an entity is taken to be an end user of an asset if the entity (or a *connected entity) holds rights as a lessee under a lease of the asset.

Note: For particular arrangements that are treated as leases, see section 250‑80.

An *end user of an asset is a tax preferred end user if:

(a) the end user (or a *connected entity) is a *tax preferred entity; or

(b) the end user is an entity that is not an Australian resident.

250‑60 Tax preferred use of an asset

(1) An asset is put to a tax preferred use at a particular time if:

(a) an *end user (or a *connected entity) holds, at that time, rights as lessee under a lease of the asset; and

(b) either or both of the following subparagraphs is satisfied at that time:

(i) the asset is, or is to be, used by or on behalf of an end user who is a *tax preferred end user because of paragraph 250‑55(a) (tax preferred entity);

(ii) the asset is, or is to be, used wholly or principally outside Australia and an end user of the asset is a tax preferred end user because of paragraph 250‑55(b) (non‑resident).

If this subsection applies, the tax preferred use of the asset is the lease referred to in paragraph (a).

Note: For particular arrangements that are treated as leases, see section 250‑80.

(2) An asset is also put to a tax preferred use at a particular time if:

(a) at that time the asset is, or is to be, used (whether or not by you) wholly or partly in connection with:

(i) the production, supply, carriage, transmission or delivery of goods; or

(ii) the provision of services or facilities; and

(b) either or both of the following subparagraphs is satisfied at that time:

(i) some or all of the goods, services or facilities are, or are to be, produced for or supplied, carried, transmitted or delivered to or for an *end user who is a *tax preferred end user because of paragraph 250‑55(a) (tax preferred entity) but is not an *exempt foreign government agency;

(ii) the asset is, or is to be, used wholly or principally outside Australia and an end user of the asset is a tax preferred end user because of paragraph 250‑55(b) (non‑resident).

If this subsection applies, the tax preferred use of the asset is the production, supply, carriage, transmission, delivery or provision referred to in paragraph (a).

(3) To avoid doubt, the facilities referred to in subsection (2) include:

(a) hospital or medical facilities; or

(b) prison facilities; or

(c) educational facilities; or

(d) *land transport facilities; or

(e) other transport facilities; or

(f) the supply of water, gas or electricity; or

(g) housing or accommodation; or

(h) premises from which to operate a *business or other undertaking.

(4) If the asset is being *put to a tax preferred use:

(a) the members of the tax preferred end user group are:

(i) the *tax preferred end user; and

(ii) the *connected entities of the tax preferred end user; and

(b) the members of the tax preferred sector are:

(i) the tax preferred end user (and connected entities); and

(ii) any *tax preferred entity (or a connected entity); and

(iii) any entity that is not an Australian resident.

250‑65 Arrangement period for tax preferred use

Start of the arrangement period

(1) The arrangement period for a particular *tax preferred use of an asset starts when that tax preferred use of the asset starts.

End of the arrangement period

(2) Subject to subsection (3), the arrangement period for a particular *tax preferred use of an asset is taken to end on the day that is the date on which the tax preferred use of the asset may reasonably be expected, or is likely, to end.

(3) The arrangement period for the *tax preferred use of the asset ends when this Division ceases to apply to you and the asset if that happens before the day referred to in subsection (2).