Child Care Legislation Amendment Act 1996

No. 80, 1996

An Act to amend the Child Care Act 1972 and the Childcare Rebate Act 1993, and for related purposes

Child Care Legislation Amendment Act 1996

No. 80, 1996

An Act to amend the Child Care Act 1972 and the Childcare Rebate Act 1993, and for related purposes

Contents

1 Short title..................................1

2 Commencement..............................1

3 Schedule(s).................................2

Schedule 1—Amendment of the Child Care Act 1972 3

Schedule 2—Amendment of the Childcare Rebate Act 1993 4

Child Care Legislation Amendment Act 1996

No. 80, 1996

An Act to amend the Child Care Act 1972 and the Childcare Rebate Act 1993, and for related purposes

[Assented to 19 December 1996]

The Parliament of Australia enacts:

This Act may be cited as the Child Care Legislation Amendment Act 1996.

(1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) Schedule 1 commences on 1 July 1997.

Subject to section 2, each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Section 11

Repeal the section.

2 Subsection 20(6)

Omit “11(19) or”.

3 Section 24

Omit “11(19) or”.

1 Subsection 3(4)

Omit “not”, substitute “not,”.

2 Section 4

Insert:

business partner means a partner in a partnership between 2 or more persons carrying on a business of providing child care.

3 Section 4

Insert:

partner, except in the expression “business partner”, has the meaning given by subsection 5(2).

4 Section 4 (paragraph (b) of the definition of parental member)

Omit “(within the meaning of subsection 5(2))”.

5 Subsection 5(2)

Omit “purpose of paragraph (1)(b)”, substitute “purposes of this Act”.

6 Paragraph 5(4)(b)

Repeal the paragraph, substitute:

(b) members of 2 or more families are legally responsible (whether alone or jointly with a person who is, or is not, a member of either or any of those families) for the day-to-day care, welfare and development of the child.

7 At the end of section 10

Add:

(2) If a person who is not a parent of a particular child under subsection (1) has the day-to-day care of the child on a long term basis (otherwise than in the course of carrying on a business of providing care or a business of a pre-school), the Commission may determine, in writing, that the person is taken to be a parent of the child.

(3) A person may apply in writing to the Commission for a determination under this section.

(4) In making determinations under this section, the Commission must comply with any guidelines made under section 62AA in relation to the making of such determinations.

8 Subsection 11(1)

Omit “subsection (2)”, substitute “this section”.

9 After subsection 11(1)

Insert:

(1A) Subject to subsection (2), a child is a dependent child of another person if the other person is taken, by a determination in force under subsection 10(2), to be a parent of the child.

10 At the end of section 16

Add:

(4) In making determinations under this section, the Commission must comply with any guidelines made under section 62AA in relation to the making of such determinations.

11 Section 17

Repeal the section.

12 Subsections 27(1), (2) and (3)

Repeal the subsections, substitute:

(1) Subject to subsection (4):

child care means:

(a) care of a child provided:

(i) at the child’s home; or

(ii) at the home of a registered carer who is providing the care; or

(iii) at a child care centre within the meaning of section 4A of the Child Care Act 1972; or

(b) care of a child that is provided otherwise than as mentioned in paragraph (a) if there is in force a determination by the Commission stating that care of that kind provided to a child constitutes child care for the purposes of this Act.

(2) The Commission may, in writing, make determinations for the purposes of paragraph (1)(b) of the definition of child care in subsection (1).

(3) A person may apply in writing to the Commission for a determination under this section.

(4) In making determinations under this section, the Commission must comply with any guidelines made under section 62AA in relation to the making of such determinations.

13 Paragraph 36(c)

Repeal the paragraph, substitute:

(c) the claim relates to child care provided by a registered carer to:

(i) the registered carer’s own dependent children; or

(ii) if the registered carer has a partner or a business partner—dependent children of the partner or business partner; or

14 At the end of section 36

Add:

(2) Paragraph (1)(d) does not prevent childcare rebate from being payable in respect of a claim in circumstances determined by the Minister.

(3) A determination under subsection (2) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

15 After section 36

Insert:

(1) Subject to this section, the Commission is to make a decision on a claim within 14 days after the claim is made.

(2) If:

(a) the Commission considers that childcare rebate may not be payable in respect of a claim; and

(b) the Commission wishes to make further inquiries into matters relevant to the claim;

the Commission must, as soon as practicable, give notice in writing to the parental member of the family who made the claim:

(c) stating that the Commission considers that childcare rebate may not be payable in respect of the claim; and

(d) stating that the Commission wishes to make further inquiries and setting out the matters into which the Commission wishes to make those inquiries.

(3) If the Commission gives a notice under subsection (2) in respect of a claim, the Commission may defer the making of a decision on the claim until:

(a) the end of 28 days after the day on which the notice was given; or

(b) the Commission is satisfied as to whether or not childcare rebate is payable in respect of the claim;

whichever first occurs.

(4) If the Commission gives a notice under subsection (2) but has not informed the claimant in writing of its decision on the claim before the end of the period referred to in paragraph (3)(a), the Commission is taken to have made a decision that childcare rebate is payable in respect of the claim.

Note: A decision that childcare rebate is not payable in respect of a claim is reviewable under Division 3 of Part 5.

(1) If:

(a) the Commission considers that the registration of a family or of a carer may have to be cancelled; and

(b) the Commission wishes to make further inquiries into matters relevant to the possible cancellation of the registration;

the Commission may, by written notice to a parental member of the family or the carer, as the case may be, suspend the payment of childcare rebate in respect of a child of the family or a child to whom the carer is providing care, as the case may be.

(2) A suspension of the payment of childcare rebate in respect of a child that is made under subsection (1) continues until:

(a) the end of 28 days after the day on which the notice was given; or

(b) the Commission, by written notice to the parental member or carer, as the case may be, revokes the suspension; or

(c) the relevant registration is cancelled;

whichever first happens.

(3) A suspension of the payment of childcare rebate under subsection (1) is taken never to have affected the payability of childcare rebate if the period of the suspension ends under paragraph (2)(a) or (b).

16 Section 38

After “However,”, insert “except in circumstances determined by the Minister,”.

17 At the end of section 38

Add:

(2) A determination under subsection (1) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

18 Sections 45 and 46

Repeal the sections, substitute:

Rebate percentage

(1) The rebate percentage that applies in working out the childcare rebate for a week (the current week) is:

(a) 30% if a family payment notice, or family income notice, under section 46 applies to either parental member for the current week; or

(b) 20% in all other cases.

Amount of rebate—claims less than the maximum claimable amount

(2) If the claimant’s weekly child care expenditure for the current week:

(a) exceeds the minimum weekly threshold; and

(b) is less than the claimant’s maximum claimable amount for the current week;

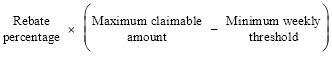

then the amount of childcare rebate payable on the claim for the current week is worked out using the formula:

Amount of rebate—claims equal to or greater than the maximum claimable amount

(3) If the claimant’s weekly child care expenditure for the current week equals or exceeds the claimant’s maximum claimable amount for the current week, then the amount of childcare rebate payable on the claim for the current week is worked out using the formula:

Reduction of rebate if other claims already made

(4) If the claimant, or another member of the claimant’s family, has previously made any other claims relating to child care provided during the current week, then the rebate calculated under subsection (1) or (2) is reduced by the amounts of childcare rebate paid or payable in respect of those other claims.

Issue of family payment notice

(1) The Secretary may issue a notice (a family payment notice) to a person stating that the person is receiving, or will receive, family payment. The notice has effect from a date specified in the notice (which may be earlier than the date on which the notice is issued).

Issue of family income notice

(2) The Secretary may issue a notice (a family income notice) to a person stating that the person satisfies the family income test. The notice has effect from a date specified in the notice (which may be earlier than the date on which the notice is issued).

Cancellation of notices by Secretary

(3) The Secretary may issue a notice to a person cancelling a family payment notice or family income notice previously issued to the person. The cancellation has effect from a date specified in the cancellation notice (which may be earlier than the date on which the cancellation notice is issued).

Note: A cancellation notice might result in an overpayment for the purposes of section 61. For example, if the cancellation has effect for a week for which childcare rebate has already been paid at the 30% rate.

Matters relevant to issue or cancellation of notices by Secretary

(4) In deciding whether to issue or cancel a family payment notice or family income notice, the only matters that the Secretary may take into account are the matters that can be taken into account under the Social Security Act 1991 in deciding whether a person should receive family payment or whether a person satisfies the family income test.

Recipient of notice to notify Commission of cancellation

(5) A person to whom a cancellation notice is issued must notify the Commission in writing of the cancellation, and its date of effect, within 14 days after receiving the cancellation notice.

Penalty: 20 penalty units.

Termination of family income notice by parental member

(6) A family income notice issued to a parental member may be terminated by either parental member by giving a written termination notice to the Commission. The termination has effect from a date specified in the termination notice (which may be earlier than the date on which the termination notice is given to the Commission).

Review of decisions relating to notices

(7) Chapter 6 of the Social Security Act 1991 applies to the following decisions as if they were specified in subsection 1240(1) of that Act:

(a) a decision not to issue a family payment notice or family income notice;

(b) a decision under subsection (3) to cancel a family payment notice or family income notice.

Manner of giving notices

(8) A notice by the Secretary to a person under this section may be included in any other notice issued or given to the person under the Social Security Act 1991.

(9) A notice by the Secretary under this section that is not included in another notice in accordance with subsection (8) may be given personally or by post.

No implied power to vary or revoke notices

(10) Subsection 33(3) of the Acts Interpretation Act 1901 does not apply to any notice issued or given under this section.

Requirement to provide information

(11) When issuing a family payment notice or family income notice, the Secretary may include a requirement that the person to whom the notice is issued must notify the Secretary, within a reasonable period specified in the notice, if:

(a) a stated event or change of circumstances occurs; or

(b) the person becomes aware that a stated event or change of circumstances is likely to occur.

The stated event or change of circumstances must be relevant to a decision of the Secretary as to whether the family payment notice or family income notice ought to be cancelled.

(12) If the Secretary has issued a family payment notice or family income notice to a person, the Secretary may issue a notice to the person under this subsection requiring the person to give the Secretary, within a reasonable period specified in the notice, a written statement about a matter that might be relevant to a decision of the Secretary as to whether the family payment notice or family income notice ought to be cancelled.

(13) A notice that contains a requirement under subsection (11) or (12) for a person to give information or a statement to the Secretary must state how the recipient is to give the information or statement. However, the notice is not invalid merely because it fails to comply with this subsection.

(14) A requirement under subsection (11) or (12) in relation to a family income notice does not apply at any time after the family income notice is terminated under subsection (6).

(15) A person must not, without reasonable excuse, refuse or fail to comply with a requirement under subsection (11) or (12) to the extent that the person is capable of complying with the notice.

Penalty: 20 penalty units.

Delegation by Secretary

(16) The Secretary may by signed instrument delegate to an officer of the Department of Social Security all or any of the powers of the Secretary under this section.

Interpretation

(17) In this section:

family income test means the family income test set out in Module C of the Family Tax Payment Rate Calculator in section 1070 of the Social Security Act 1991.

family payment means family payment under the Social Security Act 1991.

Secretary means the Secretary to the Department of Social Security.

19 After subsection 48(1)

Insert:

(1A) Anything done under this Act by the Managing Director, or by a member of the Commission’s staff in the name of the Managing Director, is taken to have been done by the Commission.

20 Paragraph 49(4)(b) (other than the note)

Repeal the paragraph, substitute:

(b) give written notice to the applicant setting out:

(i) the number so issued; and

(ii) the day on which the registration is taken to have had effect; and

(iii) the periods (if any) during which the registration is taken, because of subsection (3B), not to have had effect; and

(iv) the matters of which the applicant is required to notify the Commission under subsection 50A(1).

21 Paragraph 50(1)(a)

Repeal the paragraph, substitute:

(a) the applicant is providing, or intends within a reasonable time after making the application to provide, child care to children other than:

(i) the applicant’s own dependent children; and

(ii) if the applicant has a partner or a business partner—dependent children of the partner or business partner; and

22 After section 50

Insert:

(1) If a person who is a registered carer:

(a) has, after the person was registered and whether before or after the commencement of this section, become aware of any matter existing when the person was registered as a result of which the person was ineligible for registration; or

(b) has, whether before or after the commencement of this section, become aware of any matter occurring after the person was registered as a result of which the person is no longer eligible for registration;

the person must notify the Commission in writing of the matter as soon as practicable after:

(c) the person became aware of the matter; or

(d) the commencement of this section;

whichever is the later.

Penalty: 20 penalty units.

(2) The Commission must determine the matters of which registered carers are required to notify the Commission under subsection (1).

(3) In making determinations under subsection (2), the Commission must comply with any guidelines made under section 62AA in relation to the making of such determinations.

23 Section 53

Omit “An application may be made to the Commission for reconsideration of any of the following decisions”, substitute “The following decisions are reviewable decisions for the purposes of this Act”.

24 Before paragraph 53(a)

Insert:

(aa) a refusal to make a determination under section 10 that a person is taken to be a parent of a particular child;

25 At the end of section 53

Add:

; (j) a decision under subsection 36AB(1) to suspend payment of childcare rebate.

26 Subsection 61(4)

Omit “of the Commission”.

27 At the beginning of Part 6

Insert:

(1) If a section of this Act contains a provision declaring that the Commission must, in making determinations under that section, comply with any guidelines made under this section in relation to the making of such determinations, the Minister may make guidelines about the making of such determinations.

(2) The guidelines are disallowable instruments for the purposes of section 46A of the Acts Interpretation Act 1901.

28 Saving provision

A guideline that was in force immediately before the commencement of item 11, under section 17 of the Childcare Rebate Act 1993 as then in force, continues in force as if it had been made under section 62AA of the Childcare Rebate Act 1993.

29 Application of amendments relating to rebate percentage

The amendment made by item 18 applies to the calculation of childcare rebate for the week starting on 7 April 1997, and for all later weeks.

[Minister’s second reading speech made in—

House of Representatives on 10 October 1996

Senate on 7 November 1996]

I HEREBY CERTIFY that the above is a fair print of the Child Care Legislation Amendment Bill 1996 which originated in the House of Representatives and has been finally passed by the Senate and the House

of Representatives.

Clerk of the House of Representatives

IN THE NAME OF HER MAJESTY, I assent to this Act.

Governor-General

1996

(125/96)