SCHEDULE Section 3

AMENDMENTS OF THE HIGHER EDUCATION FUNDING ACT 1988

PART 1—ADJUSTMENTS OF FUNDING LEVELS

1. Section 3 (paragraph (b) of the definition of year to which this Chapter applies):

Omit “or the year 1996”, substitute the year 1996, the year 1997 or the year 1998”.

2. Paragraphs 17(f) (g) and (h):

Omit the paragraphs, substitute:

“(f) in the case of the year 1994—$3,520,163,000; and

(g) in the case of the year 1995—$3,652,019,000; and

(h) in the case of the year 1996—$3,781,575,000; and

(i) in the case of the year 1997—$3,834,297,000; and

(j) in the case of the year 1998—$3,844,309,000”.

3. Subsection 20(3):

Add at the end:

“; and (i) in the case of the year 1997—$73,009,000; and

(j) in the case of the year 1998—$73,009,000”.

4. Subsection 22A(5):

Add at the end:

“; and (e) for the year 1997—$211,000; and

(f) for the year 1998—$211,000”.

5. Paragraphs 23C(2)(a), (b) and (c):

Omit the paragraphs, substitute:

“(a) for the year 1994—$431,919,000; and

(b) for the year 1995—$441,397,000; and

(c) for the year 1996—$492,195,000; and

(d) for the year 1997—$476,196,000; and

(e) for the year 1998—$453,482,000”.

6. Subsection 24(3):

Add at the end:

“; and (i) in the case of the year 1997—$4,734,000; and.

(j) in the case of the year 1998—$4,734,000”.

SCHEDULE—continued

7. Paragraph 27A(6)(c):

Omit the paragraph, substitute:

“(c) for the year 1996—$36,893,000; and

(d) for the year 1997—$36,893,000; and

(e) for the year 1998—$36,893,000”.

SCHEDULE—continued

PART 2—DISCOUNT ON VOLUNTARY PAYMENTS IN RESPECT OF DEBTS

8. Subsection 106N(1):

Omit all the words from and including “less”, substitute “less any amounts by which that debt or those debts are to be reduced because of any payments made before the relevant date.”.

9. Subsection 106N(3) (definition of C):

Omit the definition, substitute:

“C is any amount, or the sum of any amounts, by which the person’s accumulated HEC debt at the earlier date is to be reduced because of any payment or payments made (otherwise than in discharge of an HEC assessment debt) on or after the earlier date and before the relevant date.”.

10. Subsection 106P(1):

Omit “If”, substitute “Subject to this Division, if”.

11. After section 106P:

Insert in Division 1 of Part 5A.3:

“106PA.(1) This section applies in relation to the repayment of any debt under this Chapter other than an HEC assessment debt.

“(2) If the amount of a debt is less than $500 but not less than $436, the debtor is taken to pay off the total debt if he or she pays $435 in respect of the debt.

“(3) If the amount of the debt is $500 or more, the debtor is taken to pay off the total debt if he or she pays in respect of the debt an amount worked out by using the formula:

“(4) Subject to subsection (5), if a person pays an amount of $500 or more in part settlement of a debt, the outstanding amount of the debt is to be reduced by the amount worked out by using the formula:

Example: If a person owes a semester debt of $1,700, and the person makes a payment of $600, the debt is to be reduced by an amount of $690 (i.e. $600 x 1.15), leaving a balance of $1,010 ($1,700 - $690) to be paid.

“(5) Subsections (2), (3) and (4) do not apply in respect of a payment in respect of a debt if, in addition to that debt, the debtor owes an HEC assessment debt to the Commonwealth.

SCHEDULE—continued

“(6) If an amount worked out by using the formula in subsection (3) or (4) is an amount made up of a number of dollars and cents, then:

(a) if the amount of cents in the amount is 50—the amount is to be rounded up to the nearest dollar; and

(b) in any other case—the amount is to be rounded up or down to the nearest dollar.”

SCHEDULE—continued

PART 3—HEC REPAYMENT INCOME

12. Subsection 100(3):

Omit “taxable income”, substitute “HEC repayment income (within the meaning of that Chapter)”.

13. Subsection 106H(1):

Insert the following definition:

“HEC repayment income of a person means:

(a) in relation to the year of income ending on 30 June 1996 or any preceding year of income—an amount equal to the taxable income of the person in respect of that year; or

(b) in relation to the year of income ending on 30 June 1997 or any subsequent year of income—the sum of:

(i) the taxable income of the person in respect of that year; and

(ii) if, in respect of that year of income, a deduction has been allowed from the assessable income of the person under section 51 of the Income Tax Assessment Act 1936 for interest on money borrowed by the person to finance rental property investments and that deduction or, if another deduction has been allowed (otherwise than for interest on money borrowed) from the assessable income of the person under that Act in respect of the rental property investments, the total of those deductions exceeds the rental income of the person—the amount of the excess.”.

14. Subsection 106Q(1):

Omit “taxable income” (wherever occurring), substitute “HEC repayment income”.

SCHEDULE—continued

PART 4—VOLUNTARY REPAYMENTS OF ACCUMULATED HEC DEBT

15. After Division 1 of Part 5A.3:

Insert:

“Division 1A—Voluntary repayments of accumulated HEC debt

Notice to Commissioner

“106PB.(1) If a person owes a debt to the Commonwealth under this Chapter, the person may, at any time, by writing in an approved form, notify the Commissioner that the person elects to make payments in reduction of his or her accumulated HEC debt when his or her HEC repayment income in respect of a year of income exceeds the prescribed amount for that year of income for the purposes of section 106PC.

“(2) A person who has made an election under subsection (1) may, at any time before the person becomes liable to pay an amount under section 106PC, revoke the election by notice in writing in an approved form to the Commissioner.

Voluntary payments in respect of accumulated HEC debt

“106PC.(1) If:

(a) a person has made an election under subsection 106PB(1) and the election has not been revoked under subsection 106PB(2); and

(b) the HEC repayment income of the person in respect of a year of income:

(i) exceeds the prescribed amount for the year of income for the purposes of this section (see subsection (3)); but

(ii) does not exceed the minimum prescribed amount for the year of income for the purposes of subsection 106Q(1); and

(c) on 1 June immediately preceding the making of an assessment in respect of the person’s income of that year of income, the person had an accumulated HEC debt;

the person is liable to pay in accordance with this Chapter to the Commonwealth in reduction of his or her relevant debt (see subsection (3)) an amount equal to so much of that relevant debt as does not exceed 2% of the person’s HEC repayment income.

“(2) On the person first becoming liable to pay an amount to the Commonwealth under subsection (1), an additional amount equal to 10% of the person’s relevant debt is taken to have been paid in reduction of that debt.

SCHEDULE—continued

“(3) In subsections (1) and (2):

relevant debt in relation to a person means:

(a) subject to paragraph (b) of this subsection—the person’s accumulated HEC debt referred to in paragraph (1)(c); or

(b) if an amount or amounts have been paid in reduction of that debt, or an amount is taken (under subsection (2)) to have been paid in reduction of that debt, or an amount or amounts have been assessed under section 106T to be payable in respect of that debt—the amount (if any) remaining after deducting from that debt the amount so paid or taken to have been paid or the sum of the amounts so paid or assessed to be payable.

“(4) A reference in paragraph (3)(b) to an amount assessed under section 106T to be payable in respect of a person’s accumulated HEC debt is, if the amount has been increased or reduced by an amendment of the relevant assessment, a reference to the increased or the reduced amount (as the case may be).

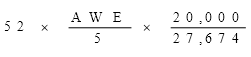

“(5) For the purposes of this section, the prescribed amount is:

(a) in the case of the year of income ending 30 June 1996—$20,000; or

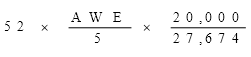

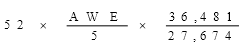

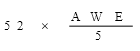

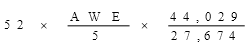

(b) in the case of a subsequent year of income—the number of whole dollars of the amount worked out by using the formula:

where:

AWE is the sum of:

(i) the average weekly earnings for all employees for the reference period in the December quarter immediately preceding that year of income, as published by the Australian Statistician; and

(ii) the average weekly earnings for all employees for the reference period in each of the 4 quarters immediately before that December quarter, as published by the Australian Statistician.

“(6) For the purposes of subsection (4), the reference period in a particular quarter in a year is the period described by the Australian Statistician as the pay period ending on or before a specified day that is the third Friday of the middle month of that quarter.

SCHEDULE—continued

“(7) The Minister must cause to be published in the Gazette:

(a) as soon as possible after the commencement of this section, the prescribed amount in respect of the year of income ending on 30 June 1996; and

(b) before the start of each following year of income, the prescribed amount in respect of that year of income.”.

16. Paragraph 106T(b):

After “section” insert “106PC or”.

SCHEDULE—continued

PART 5—ACCUMULATED HEC DEBT—NEW REPAYMENT THRESHOLDS

17. Paragraph 106Q(1)(a):

After “amount” insert “for the year of income”.

18. Subsection 106Q(1):

Omit all the words from and including “does not exceed” (first occurring), substitute “does not exceed the percentage of the person’s HEC repayment income that is applicable in accordance with the following table:

TABLE |

Item No. | Person’s HEC repayment income in respect of year of income | Percentage applicable |

1. | Not exceeding the first intermediate prescribed amount for the year of income (see subsection (4)) | 3% |

2. | Exceeding the first intermediate prescribed amount for the year of income but not exceeding the second intermediate prescribed amount for the year of income (see subsection (4)) | 3.5% |

3. | Exceeding the second intermediate prescribed amount for the year of income but not exceeding the third intermediate prescribed amount for the year of income (see subsection (4)) | 4% |

4. | Exceeding the third intermediate prescribed amount for the year of income but not exceeding the fourth intermediate prescribed amount for the year of income (see subsection (4)) | 4.5% |

5. | Exceeding the fourth intermediate prescribed amount for the year of income but not exceeding the fifth intermediate prescribed amount for the year of income (see subsection (4)) | 5% |

6. | Exceeding the fifth intermediate prescribed amount for the year of income but not exceeding the maximum prescribed amount (see subsection (4)) | 5.5% |

7. | Exceeding the maximum prescribed amount for the year of income | 6% |

SCHEDULE—continued

19. Paragraphs 106Q(4)(a), (b) and (c):

Omit the paragraphs, substitute:

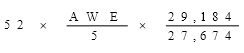

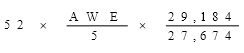

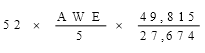

“(a) the minimum prescribed amount for a year of income is the number of whole dollars in the amount worked out by using the formula:

; and

; and

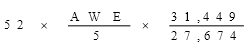

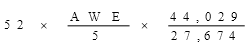

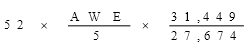

(b) the first intermediate prescribed amount for a year of income is the number of whole dollars in the amount worked out by using the formula:

; and

; and

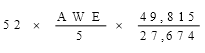

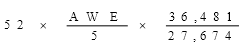

(c) the second intermediate prescribed amount for a year of income is the number of whole dollars in the amount worked out by using the formula:

; and

; and

(ca) the third intermediate prescribed amount for a year of income is the number of whole dollars in the amount worked out by using the formula:

; and

; and

(cb) the fourth intermediate prescribed amount for a year of income is the number of whole dollars in the amount worked out by using the formula:

; and

; and

(cc) the fifth intermediate prescribed amount for a year of income is the number of whole dollars in the amount worked out by using the formula:

; and

; and

(cd) the maximum prescribed amount for a year of income is the number of whole dollars in the amount worked out by using the formula:

;”

;”

SCHEDULE—continued

20. Subsection 106Q(6):

Omit the subsection, substitute:

“(6) The Minister must cause to be published in the Gazette:

(a) as soon as possible after the commencement of this section, the minimum prescribed amount, the intermediate prescribed amounts and the maximum prescribed amount, in respect of the year of income ending on 30 June 1997; and

(b) before the start of each following year of income, the minimum prescribed amount, the intermediate prescribed amounts and the maximum prescribed amount in respect of that year of income.”.

SCHEDULE—continued

PART 6—STUDENTS WHO ARE REQUIRED TO PAY FULL AMOUNT OF CONTRIBUTION

21. Subsection 41(1):

After “student” (first occurring) insert “who is not an excepted student”.

22. Paragraph 41(1)(b):

Omit “if the student is not an excepted student in relation to that course for that semester,”.

23. After subsection 41(1):

Insert:

“(2) An institution must not permit a contributing student who is an excepted student to enrol for, or undertake, a designated course of study in a semester unless the student has paid to the institution the total amount of the contribution that the institution assesses will be payable by the student in respect of the course of study in respect of that semester if the student is undertaking the course of study as a contributing student on the census date in respect of the course of study in respect of that semester.”.

24. Subsection 41(3):

Omit “subsection (1)”, substitute “subsections (1) and (2)”.

SCHEDULE—continued

PART 7—GRANTS UNDER THE HIGHER EDUCATION INNOVATION PROGRAM

25. Section 18A:

Repeal the section.

26. Paragraph 21(1)(b):

Omit all the words from and including “expenditure”, substitute: “expenditure:

(i) upon a project relating to a matter of national priority in higher education; or

(ii) that will be used to maintain or enhance innovation in, or the quality of, higher education provided by an institution.”.

Note 1: The heading to section 21 is replaced by the heading “Proposals and grants for projects of national priority etc.”.

Note 2: The heading to section 21A is replaced by the heading “Conditions on certain grants under section 21”.

27. After section 21A:

Insert:

Grants in relation to innovation in, or quality of, higher education

“21B.(1) Subject to section 23C, the Minister may determine an amount of financial assistance for an institution to which this section applies in respect of a year to which this Chapter applies if the Minister is satisfied that the assistance will be used to maintain or enhance innovation in, or the quality of, higher education provided by the institution.

“(2) The Minister may make a determination under subsection (1) subject to conditions.

“(3) If the Minister determines an amount of financial assistance for an institution in respect of a year under subsection (1), the amount payable under section 15 or 16, as the case requires, in relation to the institution in respect of the year is to be increased from 1 January in that year by the amount of the determination.”.

28. Paragraphs 23C(1)(a) and (b):

Omit the paragraphs, substitute:

“(a) the amount determined by the Minister under section 21 (Proposals and grants for projects of national priority etc.); and

(b) the amounts determined by the Minister under section 21B (Grants in relation to innovation in or the quality of higher education); and”.

SCHEDULE—continued

29. Section 119:

Omit “18A,”.

30. Section 119:

After “21,” insert “21B,".

SCHEDULE—continued

PART 8—CERTAIN HOLDERS OF SCHOLARSHIPS NOT TO BE EXEMPT STUDENTS

31. Subsection 35(7):

Omit the subsection.

SCHEDULE—continued

PART 9—CERTAIN PERSONS NOT ENTITLED TO DEFERRED CONTRIBUTIONS

32. Section 3:

Insert the following definitions:

“permanent resident has the same meaning as in the Australian Citizenship Act 1948.

permanent visa has the same meaning as in the Australian Citizenship Act 1948.”.

33. Paragraphs 41(3)(a) and (b):

Omit the paragraphs, substitute:

“(a) a student who, on the day (enrolment day) on which he or she completes enrolment for the course in respect of that semester, is a New Zealand citizen, other than a New Zealand citizen who:

(i) is also an Australian citizen; or

(ii) is the holder of a permanent visa and:

(A) does not, on enrolment day, satisfy the prescribed residency requirements; or

(B) if, on enrolment day, he or she satisfies the prescribed residency requirements—first satisfied those requirements on a day within the period of 12 months immediately preceding enrolment day; or

(b) a student (other than a New Zealand citizen) who:

(i) is a permanent resident; and

(ii) on enrolment day satisfies the prescribed residency requirements; and

(iii) first satisfied the prescribed residency requirements on a day more than one year before enrolment day; or

(c) a student (other than a New Zealand citizen) who:

(i) is a permanent resident; and

(ii) will be resident outside Australia for the duration of a course in that semester for a reason other than a requirement of the course;

but does not include a student who has been granted a certificate of Australian citizenship under section 13 of the Australian Citizenship Act 1948 and who has yet to make the pledge referred to in section 15 of that Act.”.

34. Subsection 41(4):

Omit the subsection, substitute:

SCHEDULE—continued

“(4) For the purposes of subsection (3), the prescribed residency requirements for a person on a particular day are that the person:

(a) should have been present in Australia as a permanent resident for a period of, or for periods amounting in the aggregate to, not less than one year during the period of 2 years immediately preceding that day; and

(b) should have been present in Australia as a permanent resident for a period of, or for periods amounting in the aggregate to, not less than 2 years during the period of 5 years immediately preceding that day.”.

35. Subsection 41(5):

Omit “(3)(b)(ii)”, substitute “(3)(c)(ii)”.

36. Paragraph 101(d):

Omit the paragraph, substitute:

“(d) on the day (enrolment day) on which the client completes his or her enrolment, the client is:

(i) an Australian citizen; or

(ii) a person who has been granted a certificate of Australian citizenship under section 13 of the Australian Citizenship Act 1948 and who has yet to make the pledge referred to in section 15 of that Act; or

(iii) a New Zealand citizen who is the holder of a permanent visa, is present in Australia and:

(A) does not satisfy the prescribed residency requirements; or

(B) if, on enrolment day, he or she satisfies the prescribed residency requirements—first satisfied those requirements on a day within the period of 12 months immediately preceding enrolment day; or

(iv) a person (other than a New Zealand citizen) who is a permanent resident, is present in Australia and:

(A) does not satisfy the prescribed residency requirements; or

(B) if, on enrolment day, he or she satisfies the prescribed residency requirements—first satisfied those requirements on a day within the period of 12 months immediately preceding enrolment day.”.

37. Section 101:

Add at the end:

SCHEDULE—continued

“(2) For the purposes of subsection (1), the prescribed residency requirements for a person on a particular day are that the person:

(a) should have been present in Australia as a permanent resident for a period of, or for periods amounting in the aggregate to, not less than one year during the period of 2 years immediately preceding that day; and

(b) should have been present in Australia as a permanent resident for a period of, or for periods amounting in the aggregate to, not less than 2 years during the period of 5 years immediately preceding that day.”.

38. Application:

(1) The amendments made by an item of this Part apply only in relation to a person who commences a course of study to which those amendments relate on or after 1 January 1996.

(2) In so far as the amendments made by an item of this Part relate to a person who is a permanent resident, the amendments apply only in relation to a person who becomes a permanent resident on or after 1 January 1996.

(3) In so far as the amendments made by an item of this Part relate to a person who is a New Zealand citizen, the amendments apply only in relation to a New Zealand citizen who commences a course of study after 1 January 1996.

[Minister's second reading speech made in—

House of Representatives on 28 September 1995 Senate on 23 October 1995]