Taxation Laws Amendment (FBT Cost of Compliance) Act 1995

CONTENTS

Section

1. Short title

2. Commencement

3. Schedule

SCHEDULE 1

MEAL ENTERTAINMENT AND ENTERTAINMENT FACILITIES

PART 1- AMENDMENT OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

PART 2- AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

SCHEDULE 2

CAR PARKING

PART 1- AMENDMENT OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

Division 1—Additional test to be satisfied in relation to a car parking benefit

Division 2—Valuation of car parking spaces

Division 3—Alternative methods of valuing car parking benefits

Division 4—Consequential amendments

Division 5—Application and transitional

CONTENTS—continued

PART 2—AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

Division 1—Insertion of new Division dealing with car parking

Division 2—Consequential amendments

Division 3—Transitional

SCHEDULE 3

AMENDMENTS OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986 RELATED TO EXEMPT BENEFITS

SCHEDULE 4

AMENDMENTS OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986 RELATED TO DECLARATIONS

SCHEDULE 5

OTHER AMENDMENTS OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

Taxation Laws Amendment (FBT Cost of Compliance) Act 1995

No. 145 of 1995

An Act to amend the law relating to taxation

[Assented to 12 December 1995]

The Parliament of Australia enacts:

Short title

1. This Act may be cited as the Taxation Laws Amendment (FBT Cost of Compliance) Act 1995.

Commencement

2. This Act commences on the day on which it receives the Royal Assent.

Schedules

3. The Acts specified in the Schedules to this Act are amended in accordance with the applicable items in the Schedules, and the other items in the Schedules have effect according to their terms.

______________

SCHEDULE 1 Section 3

MEAL ENTERTAINMENT AND ENTERTAINMENT FACILITIES

PART 1—AMENDMENT OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

1. After Division 9 of Part III:

Insert:

“Division 9A—Meal entertainment

“Subdivision A—Meal entertainment

Key principle

“37A.

An employer may elect that this Division will apply to the employer for an FBT year. If the employer does this, the taxable value of meal entertainment fringe benefits provided to the employer’s employees and associates of those employees by the employer will either be half the expenses incurred for the FBT year by the employer in providing meal entertainment benefits or, if the employer makes a further election, an amount worked out based on a 12 week register kept by the employer. |

Division only applies if election made

“37AA. An employer may elect that this Division applies to the employer for an FBT year.

Employee contributions to be excluded

“37AB. For the purposes of this Division any reference to expenses or expenditure in relation to meal entertainment or meal entertainment benefits excludes any contribution from an employee or an associate of an employee that is not subject to reimbursement by the employer.

Meal entertainment benefits

“37AC. Where at a particular time an employer (the provider) to whom this Division applies provides meal entertainment to another person (the recipient) the provision of the meal entertainment is taken to constitute a meal entertainment benefit provided by the provider to the recipient at that time.

Meaning of provision of meal entertainment

“37AD. A reference to the provision of meal entertainment is a reference to the provision of:

SCHEDULE 1—continued

(a) entertainment by way of food or drink; or

(b) accommodation or travel in connection with, or for the purpose of facilitating, entertainment to which paragraph (a) applies; or

(c) the payment or reimbursement of expenses incurred in providing something covered by paragraph (a) or (b);

whether or not:

(d) business discussions or business transactions occur; or

(e) in connection with the working of overtime or otherwise in connection with the performance of the duties of any office or employment; or

(f) for the purposes of promotion or advertising; or

(g) at or in connection with a seminar.

Fringe benefits only arise if employer is provider

“37AE. No meal entertainment fringe benefit arises where the employer in relation to whom the benefit would otherwise arise is not the provider of the benefit.

No other fringe benefits arise if election made

“37AF. If a meal entertainment fringe benefit arises in respect of the provision of meal entertainment, no other fringe benefit arises in relation to any person in respect of the provision of the meal entertainment.

Some benefits still arise

“37AG. To avoid doubt, sections 37AE and 37AF do not prevent a fringe benefit in relation to an employer arising under any provision of this Act where the employer is not the provider of the benefit.

“Subdivision B—50/50 split method of valuing meal entertainment

Key principle

“37B.

If an employer elects that this Division applies, then (unless the employer elects that Subdivision C applies) the taxable value of meal entertainment fringe benefits provided to the employer’s employees and associates of those employees by the employer is half the expenses incurred for the FBT year by the employer in providing meal entertainment benefits. |

SCHEDULE 1—continued

Taxable value using 50/50 split method

“37BA. If this Division applies to an employer for an FBT year then, unless the employer elects that Subdivision C applies, the total taxable value of meal entertainment fringe benefits of the employer for the FBT is 50% of the expenses incurred by the employer in providing meal entertainment for the FBT year.

Note: This means that the employer’s aggregate fringe benefits amount (see subsection 136(1)) for the FBT year will include 50% of the total expenses incurred by the employer for the provision of meal entertainment to all persons in the FBT year.

“Subdivision C—12 week register method

Key principle

“37C.

If an employer elects that this Subdivision applies, the taxable value of meal entertainment fringe benefits is to be calculated by reference to a 12 week register kept by the employer. |

Election by employer

“37CA. An employer who elects that this Division applies may elect also that this Subdivision applies to meal entertainment provided by the employer for an FBT year if the employer has a valid meal entertainment register for that year.

Taxable value using 12 week register method

“37CB.(1) If the employer elects that this Subdivision applies for an FBT year then, despite any other provision of this Act, the taxable value of meal entertainment fringe benefits for the employer for the FBT year is worked out using the formula:

![]()

Note: This means that the employer’s aggregate fringe benefits amount (see subsection 136(1)) for the FBT year will include a proportion of the expenses incurred by the employer for the provision of meal entertainment for all persons in the FBT year. The proportion is worked out on the basis of the 12 week register.

“(2) The register percentage is the percentage worked out using the formula:

SCHEDULE 1—continued

where:

total value of meal entertainment fringe benefits means the total value of meal entertainment fringe benefits that are provided by the employer in the 12 week period covered by the employer’s register.

total value of meal entertainment means the total value of meal entertainment provided by the employer during the 12 week period covered by the register.

“(3) The total meal entertainment expenditure is the total of expenses incurred by the employer in providing meal entertainment for the FBT year.

Choosing the 12 week period for a register

“37CC.(1) The register must be kept for a continuous period of at least 12 weeks throughout which meal entertainment is provided by the employer.

“(2) The period for which the register is kept must be representative of the first FBT year for which it is valid.

“(3) If the register does not meet these conditions it is not valid.

FBT years for which register is valid

12 week period in one FBT year

“37CD.(1) If the 12 week period begins and ends in the same FBT year, the register is valid for that FBT year and, subject to subsection (3), for each of the 4 FBT years immediately following that year.

12 week period over 2 FBT years

“(2) If the 12 week period begins in one FBT year and ends in another FBT year, the register is only valid for the second FBT year and, subject to subsection (3), for each of the 4 FBT years immediately following that year.

When register ceases to be valid

“(3) A register that is valid for an FBT year ceases to be valid at the end of that FBT year if the total of expenses incurred by the employer in providing meal entertainment for that FBT year is more than 20% higher than the corresponding total for the first FBT year for which the register was valid. A register also ceases to be valid for an FBT year if there is a later valid register for that FBT year.

Matters to be included in register

“37CE.(1) The register must include the details of the following:

(a) the date the employer provided meal entertainment;

SCHEDULE 1—continued

(b) for each recipient of meal entertainment—whether the recipient is an employee of the employer or an associate of the employer;

(c) the cost of the meal entertainment;

(d) the kind of meal entertainment provided;

(e) where the meal entertainment is provided;

(f) if the meal entertainment is provided on the employer’s premises—whether it is provided in an in-house dining facility within the meaning of subsection 51AE(1) of the Income Tax Assessment Act 1936.

“(2) A person responsible for making entries in the register must make the entry as soon as practicable after he or she knows the details required by subsection (1).

Fraudulent entries invalidate register

“37CF. For the purposes of this Act, a register is not valid if the register contains an entry that is false or misleading in a material particular.”.

2. Subsection 136(1) (definition of business premises):

Omit all the words after “business operations”, substitute, “of the person, but does not include:

(a) premises, or a part of premises, used as a place of residence of an employee of the person or an employee of an associate of the person; or

(b) a corporate box; or

(c) boats or planes used primarily for the purpose of providing entertainment unless the boat or plane is used in the person’s business of providing entertainment; or

(d) other premises used primarily for the purpose of providing entertainment unless the premises are used in the person’s business of providing entertainment.

In this definition, provision of entertainment has the same meaning as in section 51AE of the Income Tax Assessment Act 1936.".

3. Subsection 136(1):

Insert:

“entertainment facility leasing expenses, for a person, means expenses incurred by the person in hiring or leasing:

(a) a corporate box; or

(b) boats, or planes, for the purpose of the provision of entertainment; or

SCHEDULE 1—continued

(c) other premises, or facilities, for the purpose of the provision of entertainment;

but does not include so much of any of such expenses that is attributable to:

(d) the provision of food or beverages; or

(e) is attributable to advertising and is an allowable deduction for the person under the Income Tax Assessment Act 1936.

meal entertainment benefit means a benefit that is a meal entertainment benefit because of section 37AC.

meal entertainment fringe benefit means a fringe benefit that is a meal entertainment benefit.”.

4. Before section 153:

Insert:

Employer may elect 50/50 split method for entertainment facility leasing costs

“152B. If:

(a) the taxable value of one or more fringe benefits of an employer for an FBT year is attributable, in whole or in part, to entertainment facility leasing expenses incurred by the employer in the FBT year; and

(b) the employer elects that this section applies for the FBT year;

then:

(c) the aggregate fringe benefit amount for the employer for the FBT year is to be reduced by so much of the total taxable value of all fringe benefits as is attributable to entertainment facility leasing expenses; and

(d) the aggregate fringe benefit amount for the employer for the FBT year is to then be increased by 50% of the total of entertainment facility leasing expenses incurred by the employer in the FBT year (including expenses not taken into account under paragraph (a)).

Note: The effect of this is that the employer’s aggregate fringe benefits amount (see subsection 136(1)) for the FBT year will include 50% of the entertainment facility leasing expenses incurred by the employer for the FBT year.”.

5. Application

The amendments made by this Part apply to assessments of the fringe benefits taxable amount of an employer of the FBT year beginning on 1 April 1995 and of all later FBT years.

SCHEDULE 1—continued

PART 2—AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

6. After section 51AE:

Insert:

Meal entertainment—election under section 37AA of Fringe Benefits Tax Assessment Act 1986 to use 50/50 split method

“51AEA.( 1) If a meal entertainment fringe benefit arises for a taxpayer for an FBT year and the taxpayer elects that Division 9A of Part III of the Fringe Benefits Tax Assessment Act 1986 applies to the taxpayer for the FBT year, and has not elected that Subdivision C of that Division applies:

(a) for each expense incurred in the FBT year by the taxpayer in providing meal entertainment, a deduction equal to 50% of that expense is allowable to the taxpayer for the year of income in which it is incurred; and

(b) no other deduction under any provision of this Act is allowable to the taxpayer for the expense.

“(2) Expressions used in this section have the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

Meal entertainment—election under section 37CA of Fringe Benefits Tax Assessment Act 1986 to use the 12 week register method

“51AEB.(1) If a taxpayer has made an election under section 37CA of the Fringe Benefits Tax Assessment Act 1986:

(a) for each expense incurred in the FBT year by the taxpayer in providing meal entertainment, a deduction equal to the amount worked out using the following formula is allowable to the taxpayer for the year of income in which it is incurred:

![]()

(b) no other deduction under any provision of this Act is allowable to the taxpayer for the expense.

“(2) The register percentage is the percentage worked out using the formula:

SCHEDULE 1—continued

where:

Total deductions for register meal entertainment means the total of deductions that would (but for this section and section 51AEA) be allowable to the taxpayer for expenses incurred by the taxpayer in providing meal entertainment in the 12 week period covered by the register kept by the employer under Subdivision B of Division 9A of the Fringe Benefits Tax Assessment Act 1986.

Total register meal entertainment expenses means the total of expenses incurred by the taxpayer in providing meal entertainment during that 12 week period.

“(3) Expressions used in this section have the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

Entertainment facility—election under section 152B of Fringe Benefits Tax Assessment Act 1986 to use 50/50 split method

“51AEC.(1) If a taxpayer has made an election under section 152B of the Fringe Benefits Tax Assessment Act 1986:

(a) for each entertainment facility leasing expense incurred in the FBT year by the taxpayer, a deduction equal to 50% of that expense is allowable to the taxpayer for the year of income in which it is incurred; and

(b) no other deduction under any provision of this Act is allowable to the taxpayer for entertainment facility leasing expenses incurred in the FBT year.

“(2) Expressions used in this section have the same meaning as in the Fringe Benefits Tax Assessment Act 1986 .”.

_______________

SCHEDULE 2 Section 3

CAR PARKING

PART 1—AMENDMENT OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

Division 1—Additional test to be satisfied in relation to a car parking benefit

1. Paragraph 39A(a):

Add at the end:

“and (iii) the lowest fee charged by the operator of any such commercial parking station in the ordinary course of business to members of the public for all-day parking on the first business day of the FBT year is more than the car parking threshold;”.

2. Section 39A:

Add at the end:

“(2) For the purposes of this section:

(a) the carparking threshold for the FBT year beginning on 1 April 1995 is $5.00; and

(b) for later years the carparking threshold is the threshold for the previous FBT year as adjusted on the first business day of the later FBT year by a factor equivalent to the movement in the preceding twelve months in the All Groups Consumer Price Index number (being the weighted average of the 8 capital cities) published by the Australian Statistician.

“(3) Subject to subsection (4), if at any time, whether before or after the commencement of this Act, the Australian Statistician has published or publishes an index number in respect of a quarter in substitution for an index number previously published by the Australian Statistician in respect of that quarter, the publication of the later index number is to be disregarded for the purposes of this section.

“(4) If at any time, whether before or after the commencement of this section, the Australian Statistician has changed or changes the reference base for the Consumer Price Index, then, for the purposes of the application of this section after the change, regard is to be had only to the index numbers published in terms of the new reference base.”.

3. After section 39A:

Insert:

SCHEDULE 2—continued

Anti-avoidance—fee on first business day not representative

“39AA. For the purposes of subparagraph 39A(a)(iii), any fee charged on the first business day of an FBT year that is not representative is to be disregarded.

When fees are not representative

“39AB. A fee charged by an operator of a commercial parking station on a particular day is not representative if the fee is substantially greater or less than the average of the lowest fee charged by the operator in the ordinary course of business to members of the public for all-day parking on each of the days in whichever of the following periods is chosen by the employer:

(a) the 4 week period beginning on the day; or

(b) the 4 week period ending on the day.”.

Division 2—Valuation of car parking benefits

4. After section 39D:

Insert:

Taxable value of car parking fringe benefits—average cost method

Election

“39DA.(1) An employer may elect that this section applies to any or all of the employer’s car parking fringe benefits for a particular FBT year.

Taxable value

“(2) Subject to this Part, if an election covers a car parking fringe benefit, the taxable value of the fringe benefit is the average cost worked out under subsection (3) reduced by the recipients contribution.

Method of working out average cost

“(3) The average cost is:

where:

A is the lowest fee charged in the ordinary course of business to members of the public for all-day parking by any operator of a commercial parking station located within a 1 km radius of any of the relevant parking premises on the day on which a car parking benefit is first provided in that FBT year in relation to the employer in connection with any of those premises.

SCHEDULE 2—continued

B is the lowest fee charged in the ordinary course of business to members of the public for all-day parking by any operator of a commercial parking station located within a 1 km radius of any of the relevant parking premises on the day on which a car parking benefit is last provided in that FBT year in relation to the employer in connection with any of those premises.

relevant parking premises means the premises referred to in paragraph 39A(a).

Fees must be representative

“(4) An election is of no effect if the fees referred to in subsection (3) are not representative (see section 39AB).”.

Division 3—Alternative methods of valuing car parking benefits

5. After Subdivision B of Division 10A of Part III:

Insert in Division 10A:

“Subdivision C—Statutory formula method—spaces

The key principle

“39F.

Under this Subdivision, an employer may elect to calculate the value of certain car parking fringe benefits by using a statutory formula based on the number and value of spaces available to employees covered by the election. |

Spaces method of calculating total taxable value of car parking fringe benefits

Election

“39FA.(1) If a provider provides one or more car parking benefits in respect of one or more employees of an employer in a particular FBT year, the employer may elect that this Subdivision applies to the employer’s car parking fringe benefits for some or all of the employees for that FBT year.

Employer must specify employees covered by election

“(2) The employer must specify that the election covers:

(a) all the employees; or

(b) all employees of a particular class; or

SCHEDULE 2—continued

(c) particular employees.

Total value of car parking fringe benefits

“(3) Despite any other provision of this Act (other than section 39FB) the total taxable value of the employer’s car parking fringe benefits for employees covered by the election for the FBT year is the amount worked out using the spaces method under subsection (4).

Note: Section 39FB covers the situation where the number of spaces available to employees exceeds the number of employees.

Method

“(4) The spaces method is:

Step 1: Work out an amount using the following formula, for each space for which there is, in the FBT year, at least one car parking benefit for an employee covered by the election:

Step 2: Work out the total of all the amounts calculated under Step 1 (the total statutory benefit).

Step 3: Subtract from the total statutory benefit the sum of all relevant recipients contributions.

Note 1: Section 39FC defines daily rate amount.

Note 2: Section 39FD defines availability period.

Note 3: Section 39FE defines relevant recipients contribution.

“(5) The election is of no effect if, in working out the daily rate for a space, the fees referred to in subsection 39DA(3) are not representative (see section 39AB).

Number of spaces exceeds number of employees

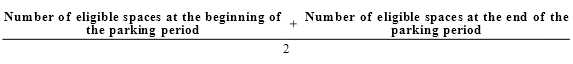

“39FB.(1) This section applies if, throughout the parking period (see subsection (5)), the average number of employees covered by the election is less than the average number of spaces (eligible spaces) for which there is an availability period.

Formula to reduce total statutory benefits

“(2) If this section applies, the total statutory benefit (see Step 2 in subsection 39FA(4)) is multiplied by the following fraction:

SCHEDULE 2—continued

Average number of employees |

Average number of eligible spaces |

“(3) The average number of employees is:

“(4) The average number of eligible spaces is:

“(5) The parking period is the period:

(a) beginning on the first day in the FBT year on which the parking of a car in any space referred to in subsection 39FA(4) gives rise to a car parking fringe benefit of the employer for an employee covered by the election; and

(b) ending on the last day in the FBT year on which the parking of a car in any space referred to in subsection 39FA(4) gives rise to a car parking fringe benefit of the employer for an employee covered by the election.

Number of employees and number of spaces must be representative

“(6) This section does not apply if the number of employees or the number of eligible spaces referred to in subsections (3) and (4) are not representative (see subsection (7)).

Meaning of not representative

“(7) A number of employees, or a number of eligible spaces, as the case requires, is not representative if the number of employees, or eligible spaces, as the case requires, is substantially greater or less than the average number throughout whichever of the following periods is chosen by the employer:

(a) the 4 week period ending on the first day of the parking period; or

(b) the 4 week period beginning on the last day of the parking period.

SCHEDULE 2—continued

Meaning of daily rate amount

“39FC. The daily rate amount for a space is the amount that would be worked out using whichever of the following methods that the taxpayer chooses:

(a) the commercial parking station method;

(b) the market value method;

(c) the average cost method;

as the taxable value of the car parking fringe benefit for the space, if there were no recipients contribution.

Meaning of availability period

“39FD. An availability period for a space begins on the first day in the FBT year on which there is a car parking benefit for the space for an employee covered by the election and ends on the last day in the FBT year on which there is a car parking benefit for the space for an employee covered by the election.

Meaning of relevant recipients contribution

“39FE. A relevant recipients contribution is a recipients contribution in respect of any car parking fringe benefit provided in respect of the employment of an employee covered by the election for the FBT year.

“Subdivision D—12 week record keeping method

The key principle

“39G.

Under this Subdivision, an employer may keep a 12 week register of car parking provided to employees. An employer who keeps such a register may elect that the total value of certain car parking fringe benefits for an FBT year for which the register is valid is to be determined in accordance with the register. |

Employer may elect to use 12 week record keeping method

“39GA.(1) An employer may elect that this Subdivision applies to the employer’s car parking fringe benefits for some or all of the employer’s employees for that FBT year if the employer has a valid register for that FBT year covering those employees.

“(2) The employer must specify that the election covers:

(a) all the employees; or

(b) all employees of a particular class; or

(c) particular employees.

SCHEDULE 2—continued

Value of fringe benefits for year

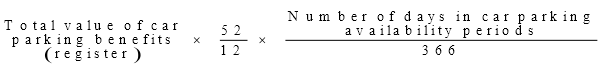

“39GB. Despite any other provision of this Act (other than this section), the total taxable value of the employer’s car parking fringe benefits for employees covered by the election for the FBT year is the amount worked out using the formula:

Meaning of total value of car parking benefits (register)

“39GC. The total value of car parking benefits (register), in relation to the FBT year, means the amount that would be the total taxable value of car parking fringe benefits for employees covered by the election for the 12 week period for which a register is kept, assuming that:

(a) the register had been kept in that FBT year; and

(b) the value of the benefits were calculated in accordance with the information in the register; and

(c) the value of the benefits were calculated using whichever of the following methods that the taxpayer chooses:

(i) the commercial parking station method;

(ii) the market value method;

(iii) the average cost method.

Meaning of car parking availability period

“39GD. The car parking availability period is the period:

(a) beginning on the first day in the FBT year on which there is a car parking benefit for an employee covered by the election; and

(b) ending on the last day in the FBT year on which there is a car parking benefit for an employee covered by the election.

Choosing the 12 week period for a register

“39GE.(1) The register must be kept for a continuous period of at least 12 weeks throughout which car parking benefits are provided to employees covered by the election.

SCHEDULE 2—continued

“(2) The period for which the register is kept must be representative of usage for the first FBT year for which it is valid.

“(3) If subsection (1) or (2) is not satisfied, the register is not valid.

FBT years for which register is valid

12 week period in one FBT year

“39GF.(1) If the 12 week period begins and ends in the one FBT year, the register is valid for that FBT year and, subject to subsections (3) and (4), for each of the 4 FBT years immediately following that year.

12 week period over 2 FBT years

“(2) If the 12 week period begins in one FBT year and ends in another FBT year, the register is only valid for the second FBT year and, subject to subsections (3) and (4), for each of the 4 years immediately following that year.

When register ceases to be valid—increase in benefits

“(3) A register that is valid for an FBT year ceases to be valid at the end of that FBT year if the number of car parking fringe benefits for the employer for employees covered by the election increases by more than 10% on any day in that FBT year.

Note: This means that if the number of car parking fringe benefits increases by more than 10%, the employer will have to keep a new register in the FBT year following the year of the increase if the employer wants to use the method in this Subdivision for that following year.

When a register ceases to be valid—later register

“(4) A register that is valid for an FBT year ceases to be valid if there is a later valid register for that FBT year that covers the same employee.

Matters to be included in register

“39GG.(1) The register must include details of the following:

(a) the date on which each car covered by subsection (4) was parked;

(b) whether the car was parked for a total that exceeds 4 hours;

(c) whether the car travelled between the place of residence of an employee covered by the election and his or her primary place of employment on that day;

(d) the place where the car was parked.

“(2) The person responsible for making entries in the register must make the entry as soon as practicable after he or she knows the details required by subsection (1).

SCHEDULE 2—continued

“(3) If subsection (1) or (2) is not satisfied, the register is not valid.

“(4) A car is covered by this subsection if:

(a) a car benefit relating to the car is provided on a day during the 12 week period to an employee covered by the election in respect of the employee’s employment; or

(b) the car is owned by, or leased to, an employee covered by the election at any time during the 12 week period; or

(c) the car is made available by another person to an employee covered by the election at any time during the 12 week period where:

(i) the other person is not the employee’s employer; and

(ii) the other person did not make the car available under an arrangement to which the employee’s employer is a party.

Fraudulent entries invalidate register

“39GH. For the purposes of this Act, a register is not valid if the register contains an entry that is false or misleading in a material particular.”.

Division 4—Consequential amendments

6. Sections 39C and 39D:

Omit “a year of tax”, substitute “an FBT year”.

7. Sections 39C and 39D:

Omit “the year of tax” (wherever occurring), substitute “the FBT year”.

8. Subsection 39D(1):

Omit “a particular year of tax”, substitute “a particular FBT year”.

9. Subsection 39E(1):

Omit “Subdivision”, substitute “Division”.

Division 5—Application and Transitional

10. Application

The amendments made by this Part apply to assessments of the fringe benefits taxable amount of an employer of the FBT year beginning on 1 April 1995 and of all later FBT years.

11. Transitional

A register is taken to have been kept under Subdivision D of Division 10A of Part III of the Fringe Benefits Tax Assessment Act 1986 if:

SCHEDULE 2—continued

(a) before the commencement of this item, an employer kept the register; and

(b) the register satisfies subsections 39GE(1) and (2) and 39GG(1) and (2) of that Act.

SCHEDULE 2—continued

PART 2—AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

Division 1—Insertion of new Division dealing with car parking

12. After Division 4 of Part III:

Insert:

“Division 4A—Car parking for certain self-employed persons, partnerships and trusts

“Subdivision A—Key principle, overview and coverage of Division

The key principle

“89A.

No deduction is allowable under this Act to a self-employed person, a partnership or a trust for certain parking expenditure unless the amount that would otherwise be deductible is reduced by the amount calculated using one of the approved valuation methods. |

Overview of Division

“89AA. The following table summarises the contents of this Division:

OVERVIEW | |

Subdivision | Coverage |

A | Key principle, overview and coverage of Division |

B | The basic requirement that the deduction must be calculated using an approved valuation method |

C | The commercial parking station method |

D | The market value method |

E | The average cost method |

F | The statutory formula (spaces) method |

G | The 12 week record keeping method |

H | Special provisions—2 anti-avoidance provisions |

J | Definitions (many terms have the same meaning as in the Fringe Benefits Tax Assessment Act 1986) |

SCHEDULE 2—continued

Deductions to which Division applies

“89AB.(1) This Division applies to any deduction that would otherwise be allowable to a taxpayer who is a natural person (including a person in the capacity of trustee) or a partnership if all of the conditions set out in this section are satisfied.

The first condition

“(2) The first condition is that the deduction (the gross deduction) would, apart from this Division, be allowable to the taxpayer under this Act in respect of expenditure to the extent to which it is incurred in respect of the provision of car parking facilities for a car on a day (the parking day) on or after 1 July 1995.

The second condition

“(3) The second condition is that, on the parking day, the taxpayer or a partner in the taxpayer (if the taxpayer is a partnership) has a primary place of self-employment and the car is used in connection with travel by the taxpayer or partner between his or her place of residence and that primary place of self-employment.

The third condition

“(4) The third condition is that:

(a) on the parking day, the car is parked on particular premises (the parking premises) for one or more daylight periods exceeding 4 hours in total; and

(b) the parking premises are at, or in the vicinity of, the primary place of self-employment; and

(c) a commercial parking station is located within a 1 km radius of the parking premises; and

(d) the lowest fee charged by the operator of any such commercial parking station in the ordinary course of business to members of the public for all-day parking on the first business day of the year of income is more than $5.00.

Note: An anti-avoidance provision applies to paragraph (4)(d)—see section 89HA.

The final condition

“(5) The final condition is that the expenditure is in respect of the provision of the parking facilities to which that parking relates.

SCHEDULE 2—continued

Regulations may exclude certain cases

“89AC. This Division does not apply to a deduction if the provision of parking facilities for the car during the period or periods to which the deduction relates is taken, under the regulations, to be excluded from this Division.

“Subdivision B—Deduction to be calculated using an approved valuation method

Deduction to be calculated using an approved valuation method

“89B.(1) If this Division applies to a gross deduction, the gross deduction is not allowable to the taxpayer, unless the taxpayer elects to use an approved valuation method in calculating the amount of the deduction.

“(2) The following are the approved valuation methods:

(a) the commercial parking station method;

(b) the market value method;

(c) the average cost method;

(d) the statutory formula (spaces);

(e) the 12 week record keeping method.

“Subdivision C—The commercial parking station method

What an election to use this method covers

“89C. A taxpayer may elect to use the commercial parking station method to cover all gross deductions for the taxpayer that relate to:

(a) a particular car; and

(b) particular parking premises; and

(c) a particular day.

Amount of deduction using this method

“89CA.(1) The amount of the deduction worked out using this method is:

Gross deduction amount - Commercial parking station amount.

“(2) The gross deduction amount is:

(a) if only one gross deduction is covered by the election—the amount of that gross deduction; or

(b) if more than one gross deduction is covered by the election—the sum of the amounts of those gross deductions.

SCHEDULE 2—continued

“(3) The commercial parking station amount is equal to the lowest fee charged by any operator of commercial parking stations within a 1 km radius of the parking premises in the ordinary course of business to members of the public for all-day parking on the parking day.

“Subdivision D—The market value method

What an election to use this method covers

“89D. A taxpayer may elect to use the market value method to cover all gross deductions for the taxpayer that relate to:

(a) a particular car; and

(b) particular parking premises; and

(c) a particular day.

Amount of deduction using this method

“89DA.(1) The amount of the deduction worked out using this method is:

Gross deduction amount - Market value amount.

“(2) The gross deduction amount is:

(a) if only one gross deduction is covered by the election—the amount of that gross deduction; or

(b) if more than one gross deduction is covered by the election—the sum of the amounts of those gross deductions.

“(3) The market value amount is the amount that the taxpayer could reasonably be expected to have been required to pay in respect of the provision of the parking facilities for the car on the parking day if:

(a) those facilities had been provided by another person; and

(b) the parties to the transaction were dealing with each other at arm’s length.

Valuer’s report needed if method is used

“89DB. An election to use the market value method in relation to one or more days in a year of income has no effect unless:

(a) a suitably qualified valuer gives to the taxpayer a report, in a form approved by the Commissioner, about the valuation of the provision of the car parking facilities; and

(b) the valuer is at arm’s length in relation to the valuation; and

(c) the taxpayer’s return for the year of income, in so far as it relates to the market value method, is based on the report.

SCHEDULE 2—continued

“Subdivision E—The average cost method

What an election to use this method covers

“89E. A taxpayer may elect to use the average cost method to cover all gross deductions for the taxpayer that relate to:

(a) a particular car; and

(b) particular parking premises; and

(c) a particular day.

Amount of deduction using this method

“89EA.(1) The amount of the deduction worked out using this method is:

Gross deduction amount - Average cost amount.

“(2) The gross deduction amount is:

(a) if only one gross deduction is covered by the election—the amount of that gross deduction; or

(b) if more than one gross deduction is covered by the election—the sum of the amounts of those gross deductions.

“(3) The average cost amount is equal to:

A + B |

2 |

where:

A is the lowest fee charged in the ordinary course of business to members of the public for all-day parking by any operator of a commercial parking station located within a 1 km radius of the parking premises on the first parking day for the taxpayer or the partner (as the case requires) for those premises in that year of income.

B is the lowest fee charged in the ordinary course of business to members of the public for all-day parking by any operator of a commercial parking station located within a 1 km radius of any of the parking premises on the last parking day for the taxpayer or the partner (as the case requires) for those premises in that year of income.

Fees must be representative if method is used

“89EB. An election to use the average cost method is of no effect if the fees referred to in subsection 89EA(3) are not representative.

SCHEDULE 2—continued

“Subdivision F—Statutory formula (spaces) method

The key principle

“89F.

Under this Subdivision, a taxpayer may elect to reduce the amount of certain deductions by an amount calculated using a statutory formula based on the number and value of spaces available to the taxpayer, or, if the taxpayer is a partnership, to partners in the taxpayer who are covered by the election. |

Spaces method of calculating total deduction for car parking expenses

Election

“89FA.(1) A taxpayer, other than a partnership, may elect to use the statutory formula (spaces) method to cover all of the gross deductions for the taxpayer for a year of income.

Election—partnerships

“(2) A partnership may elect to use the statutory formula (spaces) method to cover all of the gross deductions for the taxpayer for a year of income that relate to one or more partners in the taxpayer.

Partnership must specify partners covered by election

“(3) The partnership must specify that the election covers gross deductions that relate to:

(a) all the partners; or

(b) all partners of a particular class; or

(c) particular partners.

Total value of deductions

“(4) Despite any other provision of this Act (other than section 89FB) the total amount of deductions covered by the election for the year of income is the amount worked out using the spaces method under subsection (5).

Note: Section 89FB covers the situation where the number of spaces available to partners exceeds the number of partners.

Method

“(5) The spaces method is:

Step 1: Work out an amount using the following formula, for each space for which there is, in the year of income, at least one gross deduction for the taxpayer, or for a partner covered by the election (as the case requires):

SCHEDULE 2—continued

Step 2: Work out the total of all the amounts calculated under Step 1 (the total statutory deduction).

Step 3: Subtract the total statutory deduction from the gross deduction amount.

Note 1: Section 89FC defines daily rate amount.

Note 2: Section 89FD defines availability period.

Note 3: Subsection (6) defines gross deduction amount.

“(6) The gross deduction amount is:

(a) if only one gross deduction is covered by the election—the amount of that gross deduction; or

(b) if more than one gross deduction is covered by the election—the sum of the amounts of those gross deductions.

“(7) The election is of no effect if, in working out the daily rate for a space, the fees referred to in subsection 89EA(3) are not representative (see section 89JB).

Number of spaces exceeds number of partners

“89FB.(1) This section applies if the taxpayer is a partnership and, throughout the parking period (see subsection (5)), the average number of partners covered by the election is less than the average number of spaces (eligible spaces) for which there is an availability period.

Formula to reduce total statutory benefits

“(2) If this section applies, the total statutory deduction (see Step 2 in subsection 89FA(5)) is multiplied by the following fraction:

SCHEDULE 2—continued

“(3) The average number of partners is:

“(4) The average number of eligible spaces is:

“(5) The parking period is the period:

(a) beginning on the first day in the year of income on which the parking of a car in any space referred to in subsection 89FA(5) gives rise to a gross deduction of the taxpayer that relates to a partner covered by the election; and

(b) ending on the last day in the year of income on which the parking of a car in any space referred to in subsection 89FA(5) gives rise to a such a gross deduction.

Number of partners and number of spaces must be representative

“(6) This section does not apply if the number of partners or the number of eligible spaces referred to in subsections (3) and (4) are not representative (see subsection (7)).

Meaning of not representative

“(7) A number of partners, or a number of eligible spaces, as the case requires, is not representative if the number of partners, or eligible spaces, as the case requires, is substantially greater or less than the average number throughout whichever of the following periods is chosen by the employer:

(a) the 4 week period ending on the first day of the parking period; or

(b) the 4 week period beginning on the last day of the parking period.

Meaning of daily rate amount

“89FC. The daily rate amount for a space is the amount that would be worked out under section 89EA as the gross deduction amount for the space.

SCHEDULE 2—continued

Meaning of availability period

“89FD. An availability period for a space:

(a) begins:

(i) in the case of a taxpayer other than a partnership—on the first day in the year of income on which the parking of a car in the space gives rise to a gross deduction of the taxpayer; or

(ii) in the case of a partnership—on the first day in the year of income on which the parking of a car in the space gives rise to a gross deduction of the taxpayer that relates to a partner covered by the election; and

(b) ends on the last day in the year of income on which the parking of a car in the space gives rise to such a gross deduction.

“Subdivision G—The 12 week record keeping method

The key principle

“89G.

Under this Subdivision, a taxpayer may keep a 12 week register of car parking. A taxpayer who keeps such a register may elect that the total amount of gross deductions for years of income for which the register is valid is to be determined in accordance with the register. |

What an election to use this method covers

“89GA.(1) A taxpayer may elect to use the 12 week record keeping method to cover all gross deductions for the taxpayer for a year of income.

“(2) A partnership may, alternatively, elect to use the 12 week record keeping method to cover all gross deductions for the partnership that relate to a particular partner, or particular partners, for a year of income.

Amount of deduction using this method

“89GB. The total amount of the deductions covered by the election is:

SCHEDULE 2—continued

Meaning of allowable deductions (register)

“89GC.(1) The allowable deductions (register), in relation to a year of income, means the amount that would be the total allowable deductions for the taxpayer for the 12 week period for which a register is kept, assuming that:

(a) the register had been kept in that year of income; and

(b) the amount of the deductions were calculated in accordance with the information in the register; and

(c) the allowable deductions were calculated using whichever of the following methods that the taxpayer chooses:

(i) the commercial parking station method;

(ii) the market value method;

(iii) the average cost method.

“(2) In working out the allowable deductions (register) for a partnership, only those deductions that are attributable to the partners covered by the election are to be taken into account.

Meaning of car parking availability period

“89GD. The car parking availability period is the period:

(a) beginning on the first parking day for the taxpayer or a partner covered by the election (as the case requires) in that year of income; and

(b) ending on the last parking day for the taxpayer or a partner covered by the election (as the case requires) in that year of income.

Choosing the 12 week period for a register

“89GE.(1) The register must be kept for a continuous period of at least 12 weeks.

“(2) The period over which the register is kept must be representative of usage for the first year of income for which it is valid.

“(3) If subsection (1) or (2) is not satisfied, the register is not valid.

Years of income for which register is valid

12 week period in one year of income

“89GF.(1) If the 12 week period begins and ends in the one year of income, the register is valid for that year of income and, subject to subsections (3), (4) and (5), for each of the 4 years of income immediately following that year.

SCHEDULE 2—continued

12 week period over two years of income

“(2) If the 12 week period begins in one year of income and ends in another year of income, the register is only valid for the second year of income and, subject to subsections (3), (4) and (5), for each of the 4 years of income immediately following that year.

When register ceases to be valid

“(3) A register that is valid for a year of income ceases to be valid at the end of that year if before the end of that year of income, the Commissioner gives the taxpayer a notice advising the taxpayer that the register will cease to be valid at the end of the year of income.

Note: This means that if the Commissioner notifies the taxpayer, the taxpayer will have to keep a new register in the following year of income if the taxpayer wants to use this method.

“(4) A register kept by a taxpayer other than a partnership that is valid for a year of income ceases to be valid if there is a later valid register for that year.

“(5) A register kept by a taxpayer that is a partnership that is valid for a year of income ceases to be valid if there is a later valid register for that year of income that covers the same partners.

Matters to be included in register

“89GG.(1) The register must include the following details:

(a) the date on which each car covered by subsection (4) was parked;

(b) whether the car was parked for a total that exceeds 4 hours;

(c) whether the car was used in connection with travel by a person between his or her place of residence and his or her primary place of self-employment on that day;

(d) the place where the car was parked.

“(2) The person responsible for making entries in the register must make the entry as soon as practicable after he or she knows the details required by subsection (1).

“(3) If subsection (1) or (2) is not satisfied, the register is not valid.

“(4) A car is covered by this subsection if the car was used in connection with travel by the taxpayer, or a partner covered by the election, between his or her place of residence and his or her primary place of self-employment on any day in the 12 week period.

SCHEDULE 2—continued

Fraudulent entries invalidate register

“89GH. For the purposes of this Act, a register is not valid if the register contains an entry that is false or misleading in a material particular.

“Subdivision H—Special provisions

Anti-avoidance—commercial parking stations

“89H. If either or both of the following apply:

(a) a transaction between the operator of a commercial parking station and a customer is not at arm’s length;

(b) the operator of a commercial parking station sets the level of a fee for the sole or dominant purpose of enabling one or more taxpayers to avoid, in whole or in part, the application of this Division;

then, for the purposes of this Division:

(c) if only paragraph (a) applies—it is to be assumed that the fee is the fee that would have been payable if the operator and the customer had been dealing with each other at arm's length in relation to the transaction; and

(d) if only paragraph (b) applies—it is to be assumed that the fee is the fee that would have been payable if it had been set without that purpose in mind; and

(e) if both paragraphs (a) and (b) apply—it is to be assumed that the fee is the fee that would have been payable if:

(i) the operator and the customer had been dealing with each other at arm’s length in relation to the transaction; and

(ii) it had been set without that purpose in mind.

Anti-avoidance—fee on first business day after 31 March not representative

“89HA. For the purposes of paragraph 89AB(4)(d), any fee on the first business day after 31 March in a year that is not representative is taken to be more than $5.00.

“Subdivision J—Interpretation

When a commercial parking station is within 1 km

“89J. A commercial parking station is taken to be located within a 1 km radius of particular parking premises if, and only if, a car entrance to the commercial parking station is situated less than 1 km, by the shortest practicable route, from a car entrance to those premises.

SCHEDULE 2—continued

Daily rate equivalent for periodic parking arrangements

“89JA. If the operator of a commercial parking station provides all-day parking in the ordinary course of business to members of the public on a weekly, monthly, yearly or other periodic basis, the operator is taken to charge a fee for all-day parking on a particular day during the period equal to the amount worked out using the formula:

where:

Total fee is the total fee charged by the operator in respect of all-day parking on days in that period.

When fees are not representative

“89JB. A fee charged by an operator of a commercial parking station on a particular day is not representative if the fee is substantially greater or less than the average of the lowest fee charged by the operator in the ordinary course of business to members of the public for all-day parking on each of the days in whichever of the following periods is chosen by the taxpayer:

(a) the 4 week period beginning on the day; or

(b) the 4 week period ending on the day.

Definitions

“89JC. In this Division:

all-day parking has the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

business day has the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

car has the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

commercial parking station has the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

daylight period has the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

expenditure does not include expenditure of a capital nature.

income-producing activity, for a person, means an activity (including an investment activity) carried on for the purpose, or purposes that include the purpose, of producing:

SCHEDULE 2—continued

(a) in any case—assessable income (other than salary or wages) of the person of any year of income; or

(b) if the person is a partner in a partnership—assessable income of the partnership of any year of income; or

(c) if the person is the trustee of a trust estate—assessable income of the trust estate of any year of income.

place of residence has the same meaning as in the Fringe Benefits Tax Assessment Act 1986.

primary place of self-employment, for a person on a day, means premises where:

(a) if the person carried on income-producing activities on that day—on that day; or

(b) in any other case—on the most recent day before that day on which the person carried on income-producing activities;

those premises are or were the sole or primary place from which, or at which, the person carried on income-producing activities.

salary or wages has the same meaning as in section 221A.”.

Division 2—Consequential amendments

13. Paragraph 51AGB(1)(i):

Add at the end “and before 1 July 1995.”.

14. Subsection 262A(4AK):

After “subsection 51AGB(7)” insert “or section 89DB”.

Division 3—Transitional

15. Transitional

(1) A register is taken to have been kept under Subdivision G of Division 4A of Part III of the Income Tax Assessment Act 1936 if:

(a) before the commencement of this item, a taxpayer kept a register; and

(b) the register satisfies sections 89GE and 89GG of that Act.

(2) Regulations made for the purposes of paragraph 51AGB(1)(h) of the Income Tax Assessment Act 1936 are taken to have been made also for the purposes of section 89AC of that Act.

______________

SCHEDULE 3 Section 3

AMENDMENTS OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986 RELATED TO EXEMPT BENEFITS

1. Section 58G:

Add at the end:

“(3) If:

(a) the employer of an employee is a government body; and

(b) the employee is exclusively employed in, or in connection with, a public educational institution;

the following benefits provided in respect of the employment of the employee are exempt benefits:

(c) an eligible car parking expense payment benefit;

(d) a car parking benefit.”.

2. After section 58W:

Insert in Division 13:

Exempt benefits—provision of certain work related items

“58X.(1) Any of the following benefits provided by an employer to an employee of the employer in respect of the employee’s employment is an exempt benefit:

(a) an expense payment benefit where the recipients expenditure is in respect of an eligible work related item;

(b) a property benefit where the recipients property is an eligible work related item;

(c) a residual benefit where the recipients benefit consists of the making available of an eligible work related item.

“(2) Subject to subsections (3) and (4), each of the following is an eligible work related item:

(a) a mobile phone or a car phone;

(b) an item of protective clothing that is required for the employment of the employee;

(c) a briefcase;

(d) a calculator;

(e) a tool of trade;

(f) an item of computer software for use in the employee’s employment;

(g) an electronic diary or similar item;

(h) a notebook computer, a laptop computer or a similar portable computer.

SCHEDULE 3—continued

“(3) A mobile phone or a car phone is only an eligible work related item if the phone is primarily for use in the employee’s employment.

“(4) A notebook computer, a laptop computer or a similar portable computer is not an eligible work related item if, earlier in the FBT year, an expense payment benefit or a property benefit of the employee has arisen in relation to another notebook computer, laptop computer or similar portable computer.

Exempt benefits—membership fees and subscriptions

“58Y.(1) Either of the following benefits provided by an employer to an employee of the employer in respect of the employee’s employment is an exempt benefit:

(a) an expense payment benefit where the recipients expenditure is in respect of an eligible membership or subscription;

(b) a property benefit where the recipients property is an eligible membership or subscription.

“(2) Each of the following is an eligible membership or subscription:

(a) a subscription to a trade or professional journal;

(b) an entitlement to use a corporate credit card;

(c) an entitlement to use an airport lounge membership.

Exempt benefits—taxi travel

“58Z.(1) Any benefit arising from taxi travel by an employee is an exempt benefit if the travel:

(a) is the whole or a part of the journey directly between the employee’s place of residence and the employee’s place of work; and

(b) commences between 7.00 p.m. and 7.00 a.m.

“(2) Any benefit arising from taxi travel by an employee is an exempt benefit if the travel:

(a) is as a result of sickness of, or injury to, the employee; and

(b) is the whole or a part of the journey directly between any of the following:

(i) the employee’s place of work; or

(ii) the employee’s place of residence; or

(iii) any other place that it is necessary, or appropriate, for the employee to go as a result of the sickness or injury.”.

SCHEDULE 3—continued

3. After paragraph 65J(1)(a):

Insert:

“(aa) a non-profit scientific institution that:

(i) is engaged solely in research into the causes, prevention or cure of diseases in humans; and

(ii) is established by a law of the Commonwealth, a State or a Territory; and

(iii) is not conducted by or on behalf of the Commonwealth, a State or a Territory;”.

4. Application

(1) The amendments made by item 1 of this Schedule apply to assessments of the fringe benefits taxable amount of an employer of the FBT year beginning on 1 April 1993 and of all later FBT years.

(2) The amendments made by item 2 of this Schedule apply:

(a) in relation to expense payment fringe benefits where the recipients expenditure in relation to the benefit was incurred on or after 1 April 1995; and

(b) in relation to any other fringe benefit where the benefit is in relation to the FBT year beginning on 1 April 1995 or a later FBT year.

(3) The amendments made by item 3 of this Schedule apply to assessments of the fringe benefits taxable amount of an employer of the FBT year beginning on 1 April 1994 and of all later FBT years.

__________________

SCHEDULE 4 Section 3

AMENDMENTS OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986 RELATED TO DECLARATIONS

1. After section 20:

Insert:

Exemption—no-private-use declaration

“20A.(1) An expense payment fringe benefit that is covered by a no-private-use declaration is an exempt benefit.

“(2) An employer may make a no-private-use declaration that covers all the employer’s expense payment fringe benefits for an FBT year for which the employer will only pay or reimburse so much of the expense that is the subject of the benefit as would result in the taxable value of the benefit being nil.

“(3) The declaration must be in a form approved in writing by the Commissioner and be made by the declaration date.”.

2. After subparagraph 24(1)(e)(i):

Insert:

“(ia) covered by a recurring fringe benefit declaration (see section 152A);”.

3. After subparagraph 44(1)(c)(i):

Insert:

“(ia) covered by a recurring fringe benefit declaration (see section 152A);”.

4. After section 47:

Insert in Subdivision A of Division 12 of Part III:

Exemption—no-private-use declaration

“47A.(1) A residual fringe benefit that is covered by a no-private-use declaration is an exempt benefit.

“(2) An employer may make a no-private-use declaration that covers all the employer’s residual fringe benefits for an FBT year that are covered by a consistently enforced policy in relation to the use of the property that is the subject of the benefit that would result in the taxable value of the benefit being nil.

“(3) The declaration must be in a form approved in writing by the Commissioner and be made by the declaration date.”.

SCHEDULE 4—continued

5.After subparagraph 52(1)(c)(i):

Insert:

“(ia) covered by a recurring fringe benefit declaration (see section 152A);”.

6. Subsection 136(1) (definition of statutory evidentiary document):

Add at the end:

“and (d) a no-private-use declaration or a recurring fringe benefit declaration that covers benefits provided in the current year of tax.”.

7. After section 152:

Insert:

Recurring fringe benefit declaration

Recipient may make recurring fringe benefit declaration

“152A.(1) If a person is provided with a benefit (the declaration benefit), the person may make a recurring fringe benefit declaration in relation to the declaration benefit.

Expense payment fringe benefits covered by declaration

“(2) If the recurring fringe benefit declaration covers another benefit (the later benefit) that is an expense payment fringe benefit:

(a) the recurring fringe benefit declaration is taken to have been made under paragraph 24(1)(e) in respect of the recipients expenditure for that benefit; and

(b) the gross deduction in subparagraph 24(1)(b)(iii) in relation to the later benefit is taken to be the amount worked out using the formula:

where:

Gross expenditure (later benefit) is the gross expenditure mentioned in paragraph 24(1)(b) in relation to the later benefit.

Deductible proportion of declaration benefit is the deductible proportion of the declaration benefit as worked out under subsection (9).

Note: The gross deduction is used as component GD in the formula in paragraph 24(1)(ba).

SCHEDULE 4—continued

Property fringe benefits covered by declaration

“(3) If the recurring fringe benefit declaration covers another benefit (the later benefit) that is a property fringe benefit:

(a) the recurring fringe benefit declaration is taken to have been made under paragraph 44(1)(c) in respect of the recipients property for that benefit; and

(b) the gross deduction in subparagraph 44(1)(b)(i) in relation to the later benefit is taken to be the amount worked out using the formula:

![]()

where:

Gross expenditure (later benefit) is the gross expenditure mentioned in paragraph 44(1)(b) in relation to the later benefit.

Deductible proportion of declaration benefit is the deductible proportion of the declaration as worked out under subsection (9).

Note: The gross deduction is used as component GD in the formula in paragraph 44(1)(ba).

Residual fringe benefits covered by declaration

“(4) If the recurring fringe benefit declaration covers another benefit (the later benefit) that is a residual fringe benefit:

(a) the recurring fringe benefit declaration is taken to have been made under paragraph 52(1)(c) in respect of the recipients benefit for that benefit; and

(b) the gross deduction in subparagraph 52(1)(b)(i) in relation to the later benefit is taken to be the amount worked out using the formula:

![]()

where:

Gross expenditure (later benefit) is the gross expenditure mentioned in paragraph 52(1)(b) in relation to the later benefit.

Deductible proportion of declaration benefit is the deductible proportion of the declaration benefit as worked out under subsection (9).

Note: The gross deduction is used as component GD in the formula in paragraph 52(1)(ba).

“(5) The declaration must be in a form approved in writing by the Commissioner and be made, and given to the employer, by the declaration date for the employer for the FBT year in which the declaration benefit is provided.