Social Security Legislation Amendment

Act (No. 2) 1994

No. 109 of 1994

An Act to amend the Social Security Act 1991,

and for related purposes

[Assented to 12 July 1994]

The Parliament of Australia enacts:

PART 1—PRELIMINARY

Short title

1. This Act may be cited as the Social Security Legislation Amendment Act (No. 2) 1994.

Commencement

2.(1) This Part, Divisions 1, 5, 6 (other than subsections 40(2) and (3)) and 7 of Part 2 commence on the day on which this Act receives the Royal Assent.

(2) Division 3 of Part 2 is taken to have commenced on 20 September 1993, immediately after the commencement of Division 18 of Part 2 of the Social Security Legislation Amendment Act (No. 3) 1992.

(3) Divisions 2, 8 and 11 of Part 2, Part 3, Part 4 (other than paragraph 57(a)) commence on 1 July 1994.

(4) Division 9 of Part 2 commences on 4 July 1994.

(5) Division 4 of Part 2 commences on 1 September 1994.

(6) Subsections 40(2) and 46(1), paragraph 57(a) and Part 5 commence on 20 September 1994, immediately after the commencement of Part 3 of the Social Security (Home Child Care and Partner Allowances) Legislation Amendment Act 1994.

(7) Subsection 40(3) and Division 10 of Part 2 (other than subsection 46(1)) commence on 29 September 1994, immediately after the commencement of Part 2 of the Social Security (Home Child Care and Partner Allowances) Legislation Amendment Act 1994.

(8) Division 12 of Part 2 commences on 1 January 1995.

PART 2—AMENDMENTS OF THE SOCIAL SECURITY ACT 1991

Division 1—Principal Act

Principal Act

3. In this Part, “Principal Act” means the Social Security Act 19911.

Division 2—Disability wage supplement

General definitions

4. Section 23 of the Principal Act is amended:

(a) by inserting after paragraph (g) of the definition of “recipient notification notice” in subsection (1) the following paragraph:

“(ga) section 446 (disability wage supplement); or”;

(b) by inserting after paragraph (g) of the definition of “recipient statement notice” in subsection (1) the following paragraph:

“(ga) section 447 (disability wage supplement); or”;

(c) by inserting after paragraph (g) of the definition of “social security pension” in subsection (1) the following paragraph:

“(ga) disability wage supplement; or”;

(d) by inserting in subsection (1) the following definitions:

“ ‘Human Services Department’ means the Department dealing with matters relating to human services;

‘Human Services Secretary’ means the Secretary to the Human Services Department;”.

Qualification for disability support pension

5. Section 94 of the Principal Act is amended by inserting after subsection (1) the following subsections:

“(1A) Despite subsection (1) and subparagraph 96(1)(b)(iv), if a person claims disability support pension within 28 days of last being paid disability wage supplement, the person is qualified for the pension and section 116 does not apply to the person.

“(1B) If:

(a) a person is qualified for disability support pension under subsection (1A); and

(b) the Secretary determines under section 114 that the person’s claim is to be granted;

the person is qualified for disability support pension after the making of the determination if:

(c) the person has a physical, intellectual or psychiatric impairment; and

(d) the person’s impairment is of 20% or more under the Impairment Tables; and

(e) the person has a continuing inability to work.

Note: The Secretary may require a DSP recipient to attend a medical examination pursuant to section 105 of the Act.”.

Commencement day for disability support pension

6. Section 100 of the Principal Act is amended:

(a) by omitting from subsection (1) “Subject to subsections (2)” and substituting “Subject to subsections (1A), (2)”;

(b) by inserting after subsection (1) the following subsection:

“(1A) If a person claims disability support pension within 28 days of last being paid a disability wage supplement the person’s provisional commencement day is the day after the last payment of disability wage supplement.”.

Insertion of new Part

7. After Part 2.8 of the Principal Act the following Part is inserted:

“PART 2.9—DISABILITY WAGE SUPPLEMENT

“Division 1—Qualification for and payability of disability wage supplement

“Subdivision A—Qualification

Qualification for disability wage supplement—physical etc. impairment and continuing inability to work

“409.(1) A person who has made a claim for disability wage supplement but whose claim has not yet been determined is qualified for disability wage supplement if:

(a) the person has a physical, intellectual or psychiatric impairment; and

(b) the person’s impairment is of 20% or more under the Impairment Tables; and

(c) the person has a continuing inability to work; and

(d) the Human Services Secretary has advised the Secretary that the person is participating in the supported wage system administered by the Human Services Department, specifying the period for which the person is to participate in the system; and

(e) the person has turned 16; and

(f) the person:

(i) is an Australian resident at the time when the person first satisfies paragraph (c); or

(ii) has 10 years qualifying Australian residence; or

(iii) is born outside Australia and, at the time when the person first satisfies paragraph (c) the person:

(A) is not an Australian resident; and

(B) is a dependent child of an Australian resident;

and the person becomes an Australian resident while a dependent child of an Australian resident; and

(g) the person is in Australia.

Note 1: For ‘Australian resident’ and ‘qualifying Australian residence’ see section 7.

Note 2: For Impairment Tables see section 7A.

“(2) If the Secretary determines under section 430 that the person’s claim is to be granted, the person is qualified for disability wage supplement after the making of the determination if:

(a) the person has a physical, intellectual or psychiatric impairment; and

(b) the person’s impairment is of 20% or more under the Impairment Tables; and

(c) the person is in Australia.

Note: For Impairment Tables see section 7A.

Meaning of continuing inability

“(3) A person has a continuing inability to work if the Secretary is satisfied that:

(a) the person’s impairment is of itself sufficient to prevent the person from doing:

(i) the person’s usual work; and

(ii) work for which the person is currently skilled;

for at least 2 years; and

(b) either:

(i) the person’s impairment is of itself sufficient to prevent the person from undertaking educational or vocational training during the next 2 years; or

(ii) the person’s impairment does not prevent the person from undertaking educational or vocational training but such training is not likely to equip the person, within the next 2 years, to do work for which the person is currently unskilled.

Note: For ‘work’ see subsection (6).

“(4) In deciding whether or not a person has a continuing inability to work under subsection (3), the Secretary is not to have regard to:

(a) the availability to the person of work in the person’s locally accessible labour market (unless subsection (5) applies to the person); or

(b) the availability to the person of educational or vocational training.

“(5) For the purposes of subparagraph (3)(b)(ii), if a person has turned 55, the Secretary may, in considering whether educational or vocational training is likely to equip the person to do work, have regard to the likely availability to the person of work in the person’s locally accessible labour market.

“(6) In this section:

‘educational or vocational training’ does not include a program designed specifically for people with physical, intellectual or psychiatric impairments;

‘work’ means work:

(a) that is for at least 30 hours per week at not less than the award wages payable to a person not suffering from a physical, intellectual or psychiatric impairment; and

(b) that exists in Australia, even if not within the person’s locally accessible labour market.

Person not qualified in certain circumstances

“(7) A person is not qualified for disability wage supplement on the basis of a continuing inability to work if the person brought about the inability with a view to obtaining disability wage supplement, a disability support pension or a sickness allowance.

Note: A person who is receiving disability wage supplement may be automatically transferred to the age pension if the person becomes qualified for the age pension (see subsection 48(3)).

Qualification for disability wage supplement—permanent blindness

“410.(1) A person is qualified for disability wage supplement if:

(a) the person is permanently blind; and

(b) the Human Services Secretary has advised the Secretary that the person is participating in the supported wage system administered by the Human Services Department, specifying the period for which the person is to participate in the system; and

(c) the person has turned 16; and

(d) the person:

(i) is an Australian resident at the time when the person first satisfies paragraph (a); or

(ii) has 10 years qualifying Australian residence; or

(iii) is born outside Australia and, at the time when the person first satisfies paragraph (a), the person:

(A) is not an Australian resident; and

(B) is a dependent child of an Australian resident;

and the person becomes an Australian resident while a dependent child of an Australian resident; and

(e) the person is in Australia.

Note: For ‘Australian resident’ and ‘qualifying Australian residence’ see section 7.

Person not qualified in certain circumstances

“(2) A person is not qualified for disability wage supplement on the basis of blindness if the person brought about the blindness with a view to obtaining disability wage supplement, a disability support pension or a sickness allowance.

Note: A person who is receiving disability wage supplement may be automatically transferred to the age pension if the person becomes qualified for the age pension (see subsection 48(3)).

Temporary absence from Australia

“411.(1) For the purposes of sections 409 and 410, a person who is temporarily absent from Australia is taken to be in Australia if:

(a) the person’s work requires the person to be absent from Australia; or

(b) during the person’s absence from Australia, the person is on leave from work with pay; or

(c) the following circumstances apply:

(i) the person is on leave from work without pay;

(ii) the person will be outside Australia for a period of not more than 4 weeks;

(iii) the Secretary is satisfied that special circumstances exist which require the person to be outside Australia.

“(2) For the purposes of sections 409 and 410, if:

(a) a person who is on leave from work without pay is temporarily absent from Australia; and

(b) the person will be outside Australia for a period of more than 4 weeks; and

(c) the Secretary is satisfied that special circumstances exist which require the person to be outside Australia;

the person is taken to be in Australia during the first 4 weeks of his or her absence from Australia.

Refusal to attend interview etc. may lead to disqualification

“412.(1) A person is not qualified for disability wage supplement if:

(a) the person has lodged a claim for disability wage supplement, but the claim has not yet been determined; and

(b) the Secretary is of the opinion that the person should:

(i) contact a specified officer of the Department; or

(ii) attend an interview at a specified location; or

(iii) complete a questionnaire; or

(iv) attend a medical, psychiatric or psychological examination; and

(c) the Secretary notifies the person that the person is required to:

(i) contact that officer; or

(ii) attend that interview; or

(iii) complete that questionnaire; or

(iv) attend that examination; or

(v) if the person has undergone an examination—provide to the Secretary the medical practitioner’s report on that examination in the approved form; and

(d) the Secretary is satisfied that it is reasonable for this section to apply to the person; and

(e) the person does not take reasonable steps to comply with the Secretary’s requirements within the time specified in the notice.

“(2) A notice under paragraph (1)(c) must be in writing and must inform the person of the effect of this section.

“Subdivision B—Payability

Disability wage supplement not payable in some circumstances

“413.(1) Even though a person is qualified for disability wage supplement, disability wage supplement may not be payable to the person because:

(a) disability wage supplement has not commenced to be payable (see sections 414 and 434); or

(b) the person has not taken reasonable steps to claim or obtain compensation (see section 1164); or

(c) the person or the person’s partner is subject to a compensation preclusion period (see Division 3 of Part 3.14); or

(d) the person has not provided a tax file number for the person (see section 416) or the person’s partner (see section 417); or

(e) the person is in gaol (see Part 3.13); or

(f) the person is receiving another pension or benefit (see section 418); or

(g) the person fails to comply with a requirement that the person:

(i) contact an officer; or

(ii) attend an interview; or

(iii) complete a questionnaire; or

(iv) attend a medical, psychiatric or psychological examination;

as required by section 420.

“(2) Subject to subsection (3), disability wage supplement is not payable to a person if the rate of the person’s disability wage supplement rate is nil.

“(3) Subsection (2) does not apply to the person if the rate is nil merely because an advance pharmaceutical allowance has been paid to the person under:

(a) Part 2.23 of this Act; or

(b) Division 2 of Part VILA of the Veterans’ Entitlements Act.

Disability wage supplement generally not payable before claim or end of waiting period

“414. Disability wage supplement is not payable to a person before the person’s provisional commencement day (identified under section 415).

Provisional commencement day

General rule

“415.(1) Subject to subsections (2), (3) and (4), a person’s provisional commencement day is the day on which:

(a) the person claims disability wage supplement; or

(b) the Human Services Secretary advises the Secretary that the person is participating in the supported wage system administered by the Human Services Department;

whichever is the later.

Initial incorrect claim followed by a claim for disability wage supplement

“(2) If:

(a) a person makes a claim (the ‘initial claim’) for:

(i) a social security or service pension or a social security benefit; or

(ii) a pension, allowance, benefit or other payment under another Act, or under a program administered by the Commonwealth, that is similar in character to disability wage supplement; and

(b) on the day on which the person makes the initial claim, the person:

(i) is qualified for disability wage supplement; or

(ii) would be qualified for disability wage supplement if the Human Services Secretary had advised the Secretary as required under paragraph 409(1)(d) or 410(1)(b); and

(c) the person subsequently makes a claim for disability wage supplement; and

(d) the Secretary is satisfied that it is reasonable for this subsection to apply to the person;

the person’s provisional commencement day is:

(e) the day on which the person made the initial claim; or

(f) the day on which the Human Services Secretary advised the Secretary as required under paragraph 409(1)(d) or 410(1)(b) (as the case may be);

whichever is the later.

Early claim

“(3) If:

(a) a person lodges a claim for disability wage supplement; and

(b) the person is not, on the day on which the claim is lodged, qualified for disability wage supplement; and

(c) the person becomes qualified for disability wage supplement during the period of 6 months that starts immediately after the day on which the claim is lodged;

the person’s provisional commencement day is the first day on which the person is qualified for disability wage supplement and is an Australian resident and in Australia.

Claim resulting from a major disaster

“(4) If a person:

(a) claims a disaster relief payment; and

(b) is qualified for the payment; and

(c) as a result of the major disaster to which the payment relates, claims disability wage supplement within 14 days of claiming the disaster relief payment;

the person’s provisional commencement day is the day on which he or she was affected by the disaster.

Provision of person’s tax file number

“416.(1) Disability wage supplement is not payable to a person if:

(a) the person is requested under section 426 or 444 to give the Secretary a written statement of the person’s tax file number; and

(b) at the end of the period of 28 days after the request is made, the person has neither:

(i) given the Secretary a written statement of the person’s tax file number; nor

(ii) given the Secretary a declaration by the person in a form approved by the Secretary and satisfied either subsection (2) or (3).

“(2) The person satisfies this subsection if:

(a) the person’s declaration states that the person:

(i) has a tax file number but does not know what it is; and

(ii) has asked the Commissioner of Taxation to inform the person of the person’s tax file number; and

(b) the person has given the Secretary a document by the person that authorises the Commissioner of Taxation to tell the Secretary:

(i) whether the person has a tax file number; and

(ii) if the person has a tax file number—the tax file number; and

(c) the Commissioner of Taxation has not told the Secretary that the person has no tax file number.

“(3) The person satisfies this subsection if:

(a) the person’s declaration states that the person has applied for a tax file number; and

(b) the person has given the Secretary a document by the person that authorises the Commissioner of Taxation to tell the Secretary:

(i) if a tax file number is issued to the person—the tax file number; or

(ii) if the application is refused—that the application has been refused; or

(iii) if the application is withdrawn—that the application has been withdrawn; and

(c) the Commissioner of Taxation has not told the Secretary that the person has not applied for a tax file number; and

(d) the Commissioner of Taxation has not told the Secretary that an application by the person for a tax file number has been refused; and

(e) the application for a tax file number has not been withdrawn.

Provision of partner’s tax file number

“417.(1) Subject to subsection (4), disability wage supplement is not payable to a person if:

(a) the person is a member of a couple; and

(b) the person is requested under section 427 or 445 to give the Secretary a written statement of the tax file number of the person’s partner; and

(c) at the end of the period of 28 days after the request is made the person has neither:

(i) given the Secretary a written statement of the partner’s tax file number; nor

(ii) given the Secretary a declaration by the partner in a form approved by the Secretary and satisfied either subsection (2) or (3).

“(2) The person satisfies this subsection if:

(a) the partner’s declaration states that the partner:

(i) has a tax file number but does not know what it is; and

(ii) has asked the Commissioner of Taxation to inform the partner of the partner’s tax file number; and

(b) the person has given the Secretary a document by the partner that authorises the Commissioner of Taxation to tell the Secretary:

(i) whether the partner has a tax file number; and

(ii) if the partner has a tax file number—the tax file number; and

(c) the Commissioner of Taxation has not told the Secretary that the partner has no tax file number.

“(3) The person satisfies this subsection if:

(a) the partner’s declaration states that the partner has applied for a tax file number; and

(b) the person has given the Secretary a document by the partner that authorises the Commissioner of Taxation to tell the Secretary:

(i) if a tax file number is issued to the partner—the tax file number; or

(ii) if the application is refused—that the application has been refused; or

(iii) if the application is withdrawn—that the application has been withdrawn; and

(c) the Commissioner of Taxation has not told the Secretary that the person’s partner has not applied for a tax file number; and

(d) the Commissioner of Taxation has not told the Secretary that an application by the partner for a tax file number has been refused; and

(e) the application for a tax file number has not been withdrawn.

“(4) The Secretary may waive the request for a statement of the partner’s tax file number if the Secretary is satisfied that:

(a) the person does not know the partner’s tax file number; and

(b) the person can obtain none of the following from the partner:

(i) the partner’s tax file number;

(ii) a statement of the partner’s tax file number;

(iii) a declaration by the partner under subparagraph (1)(c)(ii).

Multiple entitlement exclusion

“418.(1) Disability wage supplement is not payable to a person if the person is already receiving a service pension.

“(2) If:

(a) a person is receiving disability wage supplement; and

(b) another social security pension or a social security benefit or service pension becomes payable to the person;

the disability wage supplement is not payable to the person.

Note 1: Another payment type will generally not become payable to the person until the person claims it.

Note 2: ‘Social security benefit’ includes job search and newstart allowances.

Note 3: For the day on which disability wage supplement ceases to be payable see section 450.

Rehabilitation and assistance programs

“419. The Secretary may request a person who is receiving disability wage supplement to undertake a program of assistance or a rehabilitation program.

Refusal to attend interview etc.

“420.(1) Disability wage supplement is not payable to a person if:

(a) the person is receiving disability wage supplement; and

(b) the Secretary is of the opinion that the person should:

(i) contact a specified officer of the Department; or

(ii) attend an interview at a specified place; or

(iii) complete a questionnaire; or

(iv) attend a medical, psychiatric or psychological examination; and

(c) the Secretary notifies the person that the person is required to:

(i) contact that officer; or

(ii) attend that interview; or

(iii) complete that questionnaire; or

(iv) attend that examination; or

(v) if the person has undergone an examination—provide to the

Secretary a report on that examination in the approved form; and

(d) the Secretary is satisfied that it is reasonable for this section to apply to the person; and

(e) the person does not take reasonable steps to comply with the Secretary’s requirements within the time specified in the notice.

Note: The person’s disability wage supplement will be cancelled or suspended by a determination of the Secretary under section 462.

“(2) A notice under paragraph (1)(c) must be in writing and must inform the person of the effect of this section.

“Division 2—Claim for disability wage supplement

Need for a claim

“421.(1) A person who wants to be granted disability wage supplement must make a proper claim for it.

Note: For ‘proper claim’ see section 422 (form), section 423 (manner of lodgment) and section 424 (residence/presence in Australia).

“(2) For the purposes of subsection (1), if:

(a) a claim for disability wage supplement is made by or on behalf of a person; and

(b) when the claim is made, the claim cannot be granted because the person is not qualified for that pension;

the claim is, subject to subsection 415(3), to be taken not to have been made.

Form of claim

“422. To be a proper claim, a claim must be made in writing and must be in accordance with a form approved by the Secretary.

Lodgment of claim

“423.(1) To be a proper claim, a claim must be lodged:

(a) at an office of the Department; or

(b) at a place approved for the purpose by the Secretary; or

(c) with a person approved for the purpose by the Secretary.

“(2) Subject to subsection (3), a place or person approved under subsection (1) must be a place or person in Australia.

“(3) The Secretary may approve a place or person outside Australia under subsection (1) for the purpose of lodgment of claims made under an international agreement.

Note: For international agreements see Part 4.1.

Claimant must be Australian resident and in Australia

“424. A claim by a person is not a proper claim unless the person is:

(a) an Australian resident; and

(b) in Australia;

on the day on which the claim is lodged.

Note 1: For ‘Australian resident’ see subsections 7(2) and (3).

Note 2: The provisions of a scheduled international agreement may permit a proper claim to be made by a person who is not an Australian resident or not in Australia (see section 1208).

Claim may be withdrawn

“425.(1) A claimant for disability wage supplement or a person on behalf of a claimant may withdraw a claim that has not been determined.

“(2) A claim that is withdrawn is taken not to have been made.

“(3) A withdrawal may be made orally or in writing.

Secretary may request claimant to give statement of claimant’s tax file number

“426.(1) If a claimant for disability wage supplement is in Australia, the Secretary may request but not compel the claimant:

(a) if the claimant has a tax file number—to give the Secretary a written statement of the claimant’s tax file number; or

(b) if the claimant does not have a tax file number:

(i) to apply to the Commissioner of Taxation for a tax file number; and

(ii) to give the Secretary a written statement of the claimant’s tax file number after the Commissioner of Taxation has issued it.

“(2) A disability wage supplement is not payable to a claimant if, at the end of the period of 28 days after a request is made:

(a) the claimant has failed to satisfy the request; and

(b) the Secretary has not exempted the claimant from having to satisfy the request.

Note: In some cases the request can be satisfied by giving the Secretary a declaration by the claimant about the claimant’s tax file number and an authority by the claimant to the Commissioner of Taxation to give the Secretary certain information about the claimant’s tax file number (see subsections 416(2) and (3)).

Secretary may request claimant to give statement of partner’s tax file number

“427.(1) If:

(a) a claimant for disability wage supplement is a member of a couple; and

(b) the claimant’s partner is in Australia;

the Secretary may request but not compel the claimant to give the Secretary a written statement of the tax file number of the claimant’s partner.

“(2) A disability wage supplement is not payable to a claimant if, at the end of the period of 28 days after a request is made:

(a) the claimant has failed to satisfy the request; and

(b) the Secretary has not exempted the claimant from having to satisfy the request.

Note 1: In some cases the request can be satisfied by giving the Secretary a declaration by the partner about the partner’s tax file number and an authority by the partner to the Commissioner of Taxation to give the Secretary certain information about the partner’s tax file number (see subsections 417(2) and (3)).

Note 2: The Secretary may waive the request in some cases (see subsection 417(4).

Secretary may require claimant or partner to take action to obtain a comparable foreign payment

“428.(1) If:

(a) a person claims disability wage supplement; and

(b) the Secretary is satisfied that the claimant would be entitled to a comparable foreign payment from a CFP country if the claimant applied for the payment;

the Secretary may give the claimant a notice that requires the claimant to take reasonable action to obtain the payment.

Note: For ‘CFP country’ see subsection 23(1).

“(2) If:

(a) a person claims disability wage supplement; and

(b) the Secretary is satisfied that the claimant’s partner would be entitled to a comparable foreign payment from a CFP country if the partner applied for the payment;

the Secretary may give the claimant a notice that requires the partner to take reasonable action to obtain the payment.

“(3) A notice under subsection (1) or (2):

(a) must be in writing; and

(b) must be given personally or by post; and

(c) must specify the period within which the reasonable action is to be taken.

“(4) The period specified under paragraph (3)(c) must end at least 14 days after the day on which the notice is given.

“(5) The Secretary may, in spite of section 430, reject a claim if:

(a) the claimant is given a notice under subsection (1) or (2); and

(b) the Secretary is satisfied that the claimant or the claimant’s partner has not taken reasonable action to obtain the comparable foreign payment within the period specified in the notice.

“(6) For the purposes of this section, a person takes reasonable action to obtain a comparable foreign payment only if the person takes reasonable action to obtain that payment at the highest rate applicable to the person.

not bold Division 3—Determination of claim

Secretary to determine claim

“429. The Secretary must, in accordance with this Act, determine the claim.

Grant of claim

“430. The Secretary is to determine that the claim is to be granted if the Secretary is satisfied that:

(a) the person is qualified for disability wage supplement; and

(b) disability wage supplement is payable.

Date of effect of determination

“431.(1) Subject to subsections (2), (3) and (4), a determination under section 430 takes effect on the day on which the determination is made or on such later day or earlier day as is specified in the determination.

Notified decision—review sought within 3 months

“(2) If:

(a) a decision (the ‘previous decision’) is made rejecting a person’s claim for disability wage supplement; and

(b) a notice is given to the person advising the person of the making of the previous decision; and

(c) the person applies to the Secretary under section 1240, within 3 months after the notice is given, for review of the previous decision; and

(d) a determination granting the claim is made as a result of the application for review;

the determination takes effect on the day on which the previous decision took effect.

Notified decision—review sought after 3 months

“(3) If:

(a) a decision (the ‘previous decision’) is made rejecting a person’s claim for disability wage supplement; and

(b) a notice is given to the person advising the person of the making of the previous decision; and

(c) the person applies to the Secretary under section 1240, more than 3 months after the notice is given, for review of the previous decision; and

(d) a determination granting the claim is made as a result of the application for review;

the determination takes effect on the day on which the person sought the review.

Decision not notified

“(4) If:

(a) a decision (the ‘previous decision’) is made rejecting a person’s claim for disability wage supplement; and

(b) no notice is given to the person advising the person of the making of the previous decision; and

(c) the person applies to the Secretary under section 1240 for review of the previous decision; and

(d) a determination granting the claim is made as a result of the application for review;

the determination takes effect on the day on which the previous decision took effect.

“Division 4—Medical examination following claim

Examination by medical practitioner

“432.(1) The Secretary must direct that a claimant for disability wage supplement be examined by a medical practitioner or practitioners unless:

(a) it is manifest that:

(i) the claimant has a physical, intellectual or psychiatric impairment of 20% or more under the Impairment Tables; and

(ii) the claimant has a continuing inability to work; or

(b) it is manifest that the claimant is permanently blind; or

(c) the claimant does not satisfy the requirements of paragraph 409(1)(e) or (f), paragraph 410(1)(c) or (d) or section 424 (residence requirements); or

(d) if disability wage supplement were granted to the claimant—the rate of his or her disability wage supplement would be nil.

Note: For ‘continuing inability to work’ see section 409.

“(2) If the claimant resides in a place that is remote from any medical practitioner, the Secretary may direct that:

(a) subsection (1) does not apply to the claimant; and

(b) the claimant is to submit to the Department a written report by a medical practitioner that relates to the impairment in respect of which the claimant is claiming disability wage supplement.

“(3) The medical practitioner who has examined the claimant because of a direction under subsection (1) is to give a certificate stating:

(a) whether, in the practitioner’s opinion, the claimant:

(i) has a physical, intellectual or psychiatric impairment; or

(ii) is permanently blind;

(as the case requires); and

(b) if the claimant does have a physical, intellectual or psychiatric impairment—what, in the practitioner’s opinion, the effect of the impairment on the claimant’s ability to work.

“(4) The medical practitioner must, if required to do so by the Secretary, include in the certificate the practitioner’s opinion of the percentage of the person’s impairment (if any) under the Impairment Tables.

“(5) A certificate under this section must be in accordance with a form approved by the Secretary.

“Division 5—Rate of disability wage supplement

How to work out the rate of a person’s disability wage supplement

“433. The rate of a person’s disability wage supplement rate is worked out by using:

(a) if the person is not permanently blind and paragraph (b) does not apply to the person—Pension Rate Calculator A at the end of section 1064 (see Part 3.2); or

(b) if the person is not permanently blind and has not turned 21—Pension Rate Calculator D at the end of section 1066A (see Part 3.4A); or

(c) if the person is permanently blind and paragraph (d) does not apply to the person—Pension Rate Calculator B at the end of section 1065 (see Part 3.3); or

(d) if the person is permanently blind and has not turned 21—Pension Rate Calculator E at the end of section 1066B (see Part 3.4B).

“Division 6—Payment of disability wage supplement

Commencement of disability wage supplement

“434. Disability wage supplement becomes payable to a person on the first day on which:

(a) the person is qualified for disability wage supplement; and

(b) no provision of this Act makes disability wage supplement not payable to the person.

Note 1: For qualification see sections 409 and 410.

Note 2: For the circumstances in which disability wage supplement is not payable see section 413.

Payment by instalments

“435.(1) Subject to section 436, a full instalment of disability wage supplement is payable to a person on each pension payday on which:

(a) the person is qualified for disability wage supplement; and

(b) disability wage supplement is payable to the person.

“(2) If a person who is qualified for disability wage supplement is outside Australia, the instalments referred to in subsection (1) are to be paid to the person on the pension paydays that the Secretary determines for the purposes of this subsection.

Effect on instalments of backdating claim

“436. If:

(a) a person claims disability wage supplement on a particular day (the ‘claim day’); and

(b) the person’s provisional commencement day is before the claim day; and

(c) there is a pension payday on or after the provisional commencement day and before the claim day;

then:

(d) no instalment of disability wage supplement is payable on that payday; and

(e) a full instalment of disability wage supplement in respect of that payday is payable on the first pension payday on or after the claim day.

Note: For ‘provisional commencement day’ see section 415.

Calculation of amount of instalment

“437.(1) The amount of an instalment of disability wage supplement is the amount worked out by dividing the amount of the annual rate of disability wage supplement by 26.

“(2) If an amount that is payable to a person on a pension payday is not a multiple of 10 cents, the amount is, subject to subsection (3), to be increased or decreased to the nearest multiple of 10 cents.

“(3) If the amount that is payable to a person on a pension payday is not a multiple of 10 cents but is a multiple of 5 cents, the amount is to be increased by 5 cents.

“(4) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of disability wage supplement; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

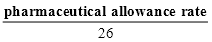

“(5) For the purposes of subsection (4), the person’s fortnightly PA rate is:

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment.

“(6) If, apart from this subsection, the amount of an instalment of disability wage supplement would be less than $1.00, the amount of the instalment is to be increased to $1.00.

Instalments to be paid to person or nominee

“438.(1) Subject to subsection (3), instalments of a person’s disability wage supplement are to be paid to that person.

“(2) The Secretary may direct that the whole or part of any of those instalments is to be paid to someone else on behalf of the person.

“(3) If the Secretary makes a direction under subsection (2), the instalments are to be paid in accordance with the direction.

Payment into bank account etc.

“439.(1) An amount that is to be paid to a person under section 438 is to be paid in the manner set out in this section.

“(2) If the person has, for the purposes of this section, nominated an account maintained by the person with a bank, credit union or building society, the amount is to be paid to the credit of that account.

“(3) The account may be an account that is maintained by the person either alone or jointly or in common with another person.

“(4) If the person has not nominated an account for the purposes of subsection (2), then, subject to subsections (5) and (7), the amount is not to be paid.

“(5) If:

(a) an amount has not been paid because of subsection (4); and

(b) the person nominates an account for the purposes of subsection (2);

the amount is to be paid under subsection (2).

“(6) The Secretary may direct that the whole or a part of the amount be paid to the person in a different way from that provided for by subsection (2).

“(7) If the Secretary gives a direction under subsection (6), the amount is to be paid in accordance with the direction.

If pension payday falls on public holiday etc.

“440. If the Secretary is satisfied that an amount of disability wage supplement that would normally be paid on a particular day cannot reasonably be paid on that day (because, for example, it is a public holiday or a bank holiday), the Secretary may direct that the amount be paid on an earlier day.

Payment of pension after death

“441.(1) If:

(a) disability wage supplement is payable to a person; and

(b) the person dies; and

(c) at the date of the person’s death the person has not received an amount of disability wage supplement payable to him or her; and

(d) another person applies to receive that amount; and

(e) the application is made:

(i) within 6 months after the death; or

(ii) within a further period allowed by the Secretary in special circumstances;

the Secretary may pay the amount to the person who, in the Secretary’s opinion, is best entitled to it.

“(2) If the Secretary pays an amount of disability wage supplement under subsection (1), the Commonwealth has no further liability to any person in respect of that amount of disability wage supplement.

“Division 7—Protection of disability wage supplement

Disability wage supplement to be absolutely inalienable

“442.(1) Subject to subsections (2) and (3) and section 1359, disability wage supplement is absolutely inalienable, whether by way of, or in consequence of, sale, assignment, charge, execution, bankruptcy or otherwise.

Payments to Commissioner of Taxation at recipient’s request

“(2) The Secretary may make deductions from the instalments of disability wage supplement payable to a person if the recipient asks the Secretary:

(a) to make the deductions; and

(b) to pay the amounts to be deducted to the Commissioner of Taxation.

Note: The Secretary must make deductions from a person’s pension, benefit or allowance if requested by the Commissioner of Taxation (see section 1359).

Deductions from instalments with recipient’s consent

“(3) The Secretary may make deductions from the instalments of disability wage supplement payable to a person if the recipient consents under section 1234A to the Secretary making the deductions.

Note: Section 1234A enables the Secretary to recover a debt from a person other than the debtor if the person is receiving a pension, benefit or allowance.

Effect of garnishee or attachment order

“443.(1) If:

(a) a person has an account with a financial institution; and

(b) instalments of disability wage supplement payable to the person (whether on the person’s own behalf or not) are being paid to the credit of that account; and

(c) a court order in the nature of a garnishee order comes into force in respect of the account;

the court order does not apply to the saved amount (if any) in the account.

“(2) The saved amount is worked out as follows:

| Method statement |

Step 1. | Work out the total amount of disability wage supplement payable to the person that has been paid to the credit of the account during the 4 week period immediately before the court order came into force. |

Step 2. | Subtract from that amount the total amount withdrawn from the account during the same 4 week period: the result is the saved amount. |

“(3) This section applies to an account whether it is maintained by a person:

(a) alone; or

(b) jointly with another person; or

(c) in common with another person.

Note: A person affected by a garnishee order may have other saved amounts if the person receives telephone allowance (see section 1061X) or pharmaceutical allowance (see section 1061EB).

“Division 8—Recipient obligations

Secretary may request recipient to give statement of recipient’s tax file number

“444.(1) If a recipient of disability wage supplement is in Australia, the Secretary may request but not compel the recipient:

(a) if the recipient is in Australia—to give the Secretary a written statement of the recipient’s tax file number; or

(b) if the recipient does not have a tax file number:

(i) to apply to the Commissioner of Taxation for a tax file number; and

(ii) to give the Secretary a written statement of the recipient’s tax file number after the Commissioner of Taxation has issued it.

“(2) A disability wage supplement is not payable to a recipient if, at the end of the period of 28 days after a request is made:

(a) the recipient has failed to satisfy the request; and

(b) the Secretary has not exempted the recipient from having to satisfy the request.

Note: In some cases the request can be satisfied by giving the Secretary a declaration by the recipient about the recipient’s tax file number and an authority by the recipient to the Commissioner of Taxation to give the Secretary certain information about the recipient’s tax file number (see subsections 416(2) and (3)).

Secretary may request recipient to give statement of partner’s tax file number

“445.(1) If:

(a) a recipient of disability wage supplement is a member of a couple; and

(b) the recipient’s partner is in Australia;

the Secretary may request but not compel the recipient to give the Secretary a written statement of the tax file number of the recipient’s partner.

“(2) A disability wage supplement is not payable to a recipient if, at the end of the period of 28 days after a request is made:

(a) the recipient has failed to satisfy the request; and

(b) the Secretary has not exempted the recipient from having to satisfy the request.

Note 1: In some cases the request can be satisfied by giving the Secretary a declaration by the partner about the partner’s tax file number and an authority by the partner to the Commissioner of Taxation to give the Secretary certain information about the partner’s tax file number (see subsections 417(2) and (3)).

Note 2: The Secretary may waive the request in some cases (see subsection 417(4)).

Secretary may require notice of the happening of an event or a change in circumstances

“446.(1) The Secretary may give a person to whom disability wage supplement is being paid a notice that requires the person to inform the Department or the Human Services Department if:

(a) a specified event or change of circumstances occurs; or

(b) the person becomes aware that a specified event or change of circumstances is likely to occur.

“(2) An event or change of circumstances is not to be specified in a notice under subsection (1) unless the occurrence of the event or change of circumstances may affect the payment of disability wage supplement.

“(3) A notice under subsection (1):

(a) must be in writing; and

(b) may be given personally or by post; and

(c) must specify how the person is to give the information to the Department or the Human Services Department; and

(d) must specify the period within which the person is to give the information; and

(e) must specify that the notice is a recipient notification notice given under this Act.

“(4) A notice under subsection (1) is not invalid merely because it fails to comply with paragraph (3)(c) or (e).

“(5) Subject to subsections (6) and (7), the period specified under paragraph (3)(d) must end at least 14 days after:

(a) the day on which the event or change of circumstances occurs; or

(b) the day on which the person becomes aware that the event or change of circumstances is likely to occur.

“(6) If a notice requires the person to inform the Department or the Human Services Department of any proposal by the person to leave Australia, subsection (5) does not apply to that requirement.

“(7) If the notice requires information about receipt of a compensation payment, the period specified under paragraph (3)(d) in relation to that information must end at least 7 days after the day on which the person becomes aware that he or she has received or is to receive a compensation payment.

“(8) A person must not, without reasonable excuse, refuse or fail to comply with a notice under subsection (1) to the extent that the person is capable of complying with the notice.

Penalty: Imprisonment for 6 months.

Note: Subsections 4B(2) and (3) of the Crimes Act 1914 allow a court to impose an appropriate fine instead of, or in addition to, a term of imprisonment.

“(9) This section extends to:

(a) acts, omissions, matters and things outside Australia whether or not in a foreign country; and

(b) all persons irrespective of their nationality or citizenship.

Secretary may require recipient to give particular information relevant to payment of disability wage supplement

“447.(1) The Secretary may give a person to whom disability wage supplement is being paid a notice that requires the person to give the Department or the Human Services Department a statement about a matter that may affect the payment of disability wage supplement to the person.

“(2) A notice under subsection (1):

(a) must be in writing; and

(b) may be given personally or by post; and

(c) must specify how the person is to give the statement to the Department or the Human Services Department; and

(d) must specify the period within which the person is to give the statement; and

(e) must specify that the notice is a recipient statement notice given under this Act.

“(3) A notice under subsection (1) is not invalid merely because it fails to comply with paragraph (2)(c) or (e).

“(4) The period specified under paragraph (2)(d) must end at least 14 days after the day on which the notice is given.

“(5) A statement given in response to a notice under subsection (1) must be in writing and in accordance with a form approved by the Secretary.

“(6) A person must not, without reasonable excuse, refuse or fail to comply with a notice under subsection (1) to the extent that the person is capable of complying with the notice.

Penalty: Imprisonment for 6 months.

Note: Subsections 4B(2) and (3) of the Crimes Act 1914 allow a court to impose an appropriate fine instead of, or in addition to, a term of imprisonment.

“(7) This section extends to:

(a) acts, omissions, matters and things outside Australia whether or not in a foreign country; and

(b) all persons irrespective of their nationality or citizenship.

Secretary may require recipient or partner to take action to obtain a comparable foreign payment

“448.(1) If the Secretary is satisfied that a recipient of disability wage supplement would be entitled to a comparable foreign payment from a CFP country if the recipient applied for the payment, the Secretary may give the recipient a notice that requires the recipient to take reasonable action to obtain the payment.

Note: For the consequences of failure to comply with the notice see section 464.

“(2) If the Secretary is satisfied that the recipient’s partner would be entitled to a comparable foreign payment from a CFP country if the partner applied for the payment, the Secretary may give the recipient a notice that requires the partner to take reasonable action to obtain the payment.

Note: For the consequences of failure to comply with the notice see section 464.

“(3) A notice under subsection (1) or (2):

(a) must be in writing; and

(b) must be given personally or by post; and

(c) must specify the period within which the action is to be taken.

“(4) The period specified under paragraph (3)(c) must end at least 14 days after the day on which the notice is given.

“(5) For the purposes of this section, a person takes reasonable action to obtain a comparable foreign payment only if the person takes reasonable action to obtain that payment at the highest rate applicable to the person.

“Division 9—Continuation, variation and termination

“Subdivision A—General

Continuing effect of determination

Entitlement determination

“449.(1) A determination that:

(a) a person’s claim for disability wage supplement is granted; or

(b) disability wage supplement is payable to a person;

continues in effect until:

(c) disability wage supplement ceases to be payable under section 450, 451, 452, 453, 454 or 455; or

(d) a further determination in relation to disability wage supplement under section 462, 463 or 464 has taken effect.

Note 1: For paragraph (a) see section 430.

Note 2: For paragraph (b) see section 466—this paragraph is relevant where the determination in question reverses an earlier cancellation or suspension.

Note 3: For paragraph (d) see also section 465.

Rate determination

“(2) A determination of the rate of disability wage supplement continues in effect until:

(a) disability wage supplement becomes payable at a lower rate under section 456, 457 or 458; or

(b) a further determination in relation to disability wage supplement under section 460 or 461 has taken effect.

Note: For paragraph (b) see also section 465.

“Subdivision B—Automatic termination and suspension

Automatic termination—transfer to new payment type

“450. If:

(a) a person is receiving disability wage supplement; and

(b) another social security pension or a social security benefit or service pension becomes payable to the person;

disability wage supplement ceases to be payable to the person immediately before the day on which the other pension or benefit becomes payable to the person.

Automatic termination—recipient complying with section 446 notification obligations

“451. If:

(a) a person who is receiving disability wage supplement is given a notice under section 446; and

(b) the notice requires the person to inform the Department or the Human Services Department of the occurrence of an event or change in circumstances within a specified period (the ‘notification period’); and

(c) the event or change in circumstances occurs; and

(d) the person informs the Department or the Human Services Department of the occurrence of the event or change in circumstances within the notification period in accordance with the notice; and

(e) because of the occurrence of the event or change in circumstances:

(i) the person ceases to be qualified for disability wage supplement; or

(ii) disability wage supplement would, apart from this section, cease to be payable to the person; and

(f) payment of disability wage supplement to the person is not cancelled before the end of the notification period;

disability wage supplement continues to be payable to the person until the end of the notification period and then ceases to be payable to the person.

Note: If the person informs the Department or the Human Services Department, within the notification period, of an event or change in circumstances that reduces the rate of the person’s disability wage supplement, there is no automatic rate reduction and a determination under section 461 must be made in order to bring the rate reduction into effect.

Automatic termination—recipient not complying with section 446 notification obligations

“452. If:

(a) a person who is receiving disability wage supplement is given a notice under section 446; and

(b) the notice requires the person to inform the Department or the Human Services Department of the occurrence of an event or change in circumstances within a specified period (the ‘notification period’); and

(c) the event or change in circumstances occurs; and

(d) the person does not inform the Department or the Human Services Department of the occurrence of the event or change in circumstances within the notification period in accordance with the notice; and

(e) because of the occurrence of the event or the change in circumstances:

(i) the person ceases to be qualified for disability wage supplement; or

(ii) disability wage supplement ceases to be payable to the person;

disability wage supplement ceases to be payable to the person immediately after the day on which the event or change in circumstances occurs.

Automatic termination—recipient receiving full award wages for 12 months

“453.(1) If:

(a) a person has been receiving disability wage supplement for at least 12 months; and

(b) for each of 52 consecutive weeks the person:

(i) has been paid for work done by the person at least the full award wages payable under the industrial award governing the terms and conditions of employment of the person; or

(ii) would have been so paid if the person had not been on leave without pay;

disability wage supplement ceases to be payable to the person immediately after the 52nd week.

“(2) In subsection (1):

‘full award wages’ means wages payable under an award to a person not suffering from any physical, intellectual or psychiatric impairment.

Automatic termination—recipient ceasing to participate in supported wage system

“454. If:

(a) a person is receiving disability wage supplement; and

(b) the person or the Human Services Secretary advises the Secretary that the person has ceased to participate in the supported wage system administered by the Human Services Department;

disability wage supplement ceases to be payable to the person immediately after the day on which the Secretary has been so advised.

Possible suspension and automatic termination—end of period of participation in supported wage system

Object of section

“455.(1) Under the supported wage system (‘System’) administered by the Human Services Department, a person may participate in the System for one or more specified periods depending on whether (towards, or within a certain time after, the end of each period) the person agrees to continue to participate in the System for a further specified period. This section deals with the payment of disability wage supplement to the person at the end of each of these periods.

Human Services Secretary to advise about continued participation

“(2) For the purposes of this section, the Human Services Secretary must:

(a) at the end of the period (‘first participation period’) specified under paragraph 409(1)(d) or 410(1)(b) as the period for which the person was to participate in the System—advise the Secretary whether the person is to continue to participate in the System for a further period specified by the Human Services Secretary; and

(b) subsequently at the end of each period (‘subsequent participation period’) for which the person has continued to participate in the System—advise the Secretary whether the person is to continue to participate in the System for a further period specified by the Human Services Secretary.

Participation period

“(3) In this section:

‘participation period’, in relation to a person who is receiving disability wage supplement, means:

(a) the first participation period within the meaning of paragraph (2)(a); or

(b) any subsequent participation period within the meaning of paragraph (2)(b).

Payment to cease at end of participation period unless otherwise provided

“(4) Except as otherwise provided in subsections (5) to (11), disability wage supplement ceases to be payable to a person at the end of a participation period.

Payment to continue if Human Services Secretary advises of continued participation before end of participation period

“(5) If, before the end of the participation period, the Human Services Secretary advises the Secretary that the person is to continue to participate in the System for a further period specified by the Human Services Secretary, disability wage supplement continues (subject to this Act) to be payable to the person after the end of the participation period.

No advice from Human Services Secretary at end of participation period—payment continued or suspended for 4 weeks

“(6) If, at the end of the participation period, the Human Services Secretary has not advised the Secretary that the person is to continue to participate in the System, then:

(a) if the Secretary has reason to believe that the person is likely to continue to participate in the System—disability wage supplement continues to be payable to the person for 4 weeks (‘extension period’) from the end of the participation period; or

(b) in any other case—the Secretary must suspend payment of disability wage supplement to the person for 4 weeks (‘short suspension period’) from the end of the participation period.

Human Services Secretary advises of continued participation within 4 weeks after end of participation period

“(7) If:

(a) disability wage supplement continues (under paragraph (6)(a)) to be payable to the person after the end of the participation period; and

(b) before the end of the extension period, the Human Services Secretary advises the Secretary that the person is to continue to participate in the System for a further period specified by the Human Services Secretary;

disability wage supplement continues (subject to this Act) to be payable to the person after the end of the extension period.

“(8) If payment of disability wage supplement to the person has been suspended under paragraph (6)(b) and, before the end of the short suspension period, the Human Services Secretary advises the Secretary that the person is to continue to participate in the System for a further period specified by the Human Services Secretary:

(a) the suspension is revoked; and

(b) disability wage supplement:

(i) is to be paid to the person in respect of the period for which the suspension had effect; and

(ii) is payable to the person from the day after the day on which the Secretary is so advised.

No advice from Human Services Secretary after 4 weeks—payment suspended for 5 months

“(9) If, at the end of the extension period or the short suspension period (as the case may be) the Human Services Secretary has not advised the Secretary that the person is to continue to participate in the System, the Secretary must suspend payment of disability wage supplement to the person for 5 months (‘long suspension period’) from the end of the extension period or the short suspension period.

Payment resumed if Human Services Secretary advises of continued participation before end of long suspension period

“(10) If, before the end of the long suspension period, the Human Services Secretary advises the Secretary that the person is to continue to participate in the System for a further period specified by the Human Services Secretary:

(a) the suspension is revoked; and

(b) disability wage supplement again becomes payable to the person from the first day of the period specified by the Human Services Secretary.

Payment to cease if no advice from Human Services Secretary at end of long suspension period

“(11) If, at the end of the long suspension period, the Human Services Secretary has not advised the Secretary that the person is to continue to participate in the System, disability wage supplement ceases to be payable to the person.

“Subdivision C—Automatic rate reduction

Automatic rate reduction—partner starting to receive pension or benefit

“456. If:

(a) a person is receiving disability wage supplement; and

(b) the person’s partner starts to receive:

(i) a social security pension or benefit; or

(ii) a service pension; and

(c) the rate of the person’s disability wage supplement is reduced because of the partner’s receipt of that pension or benefit;

disability wage supplement becomes payable to the person at the reduced rate on the day on which the partner starts to receive that pension or benefit.

Automatic rate reduction—recipient not complying with section 446 notification obligations

“457. If:

(a) a person who is receiving disability wage supplement is given a notice under section 446; and

(b) the notice requires the person to inform the Department or the Human Services Department of the occurrence of an event or change in circumstances within a specified period (the ‘notification period’); and

(c) the event or change in circumstances occurs; and

(d) the person does not inform the Department or the Human Services Department of the occurrence of the event or change in circumstances within the notification period in accordance with the notice; and

(e) because of the occurrence of the event or change in circumstances, the rate of the person’s disability wage supplement is to be reduced;

disability wage supplement becomes payable to the person at the reduced rate immediately after the day on which the event or change in circumstance occurs.

Automatic rate reduction—failure to inform Department of payment for remunerative work where earnings credit account balance available

“458. If:

(a) a person who is receiving disability wage supplement is given a notice under section 446; and

(b) the notice requires the person to inform the Department or the Human Services Department of income for remunerative work undertaken by the person; and

(c) the person fails to notify the Department or the Human Services Department of income of that kind in accordance with the notice; and

(d) the person has an earnings credit account balance for the purposes of Division 4 of Part 3.10;

disability wage supplement becomes payable to the person at the reduced rate from the first pension payday after the day on which the person’s earnings credit account balance is reduced to nil.

Changes to payments by computer following automatic termination or reduction

“459. If:

(a) a person is receiving disability wage supplement on the basis of data in a computer; and

(b) payment of disability wage supplement to the person is automatically terminated or the rate at which the person’s disability wage supplement is payable is automatically reduced by the operation of a provision of this Act; and

(c) the automatic termination or reduction is given effect to by the operation of a computer program approved by the Secretary stopping payment or reducing the rate of payment;

there is taken to be a decision by the Secretary that the automatic termination or rate reduction provision applies to the person’s disability wage supplement.

Note: The decision that is taken to have been made is a decision of an officer for the purposes of review by the Secretary (see sections 1239 and 1240) and the Social Security Appeals Tribunal (see section 1247).

“Subdivision D—Determinations

Rate increase determination

“460. If the Secretary is satisfied that the rate at which disability wage supplement is being, or has been, paid to a person is less than the rate provided for by this Act, the Secretary is to determine that the rate is to be increased to the rate specified in the determination.

Note: For the date of effect of a determination under this section see section 467.

Rate reduction determination

“461. If the Secretary is satisfied that the rate at which disability wage supplement is being, or has been, paid to a person is more than the rate provided for by this Act, the Secretary is to determine that the rate is to be reduced to the rate specified in the determination.

Note 1: A determination under this section is not necessary in a case where an automatic rate reduction is produced by section 457 or 458.

Note 2: For the date of effect of a determination under this section see section 468.

Cancellation or suspension determination

“462. If the Secretary is satisfied that disability wage supplement is being, or has been, paid to a person to whom it is not, or was not, payable under this Act, the Secretary is to determine that payment of disability wage supplement to the person is to be cancelled or suspended.

Note 1: A determination is not necessary in a case where there is an automatic termination (see Subdivision B of Division 9).

Note 2: For the date of effect of a determination under this section see section 468.

Cancellation or suspension for failure to comply with section 447, 1304 or 1305 notice

“463. If:

(a) a person who is receiving disability wage supplement is given a notice under section 447, 1304 or 1305; and

(b) the person does not comply with the requirements set out in the notice;

the Secretary may determine that payment of disability wage supplement to the person is to be cancelled or suspended.

Note 1: This section will not apply in a case where section 462 applies.

Note 2: For the date of effect of a determination under this section see section 468.

Cancellation or suspension for failure to take action to obtain a comparable foreign payment

“464.(1) If:

(a) a person receiving disability wage supplement has been given a notice under subsection 448(1); and

(b) the Secretary is satisfied that the person has not taken reasonable action to obtain comparable foreign payment within the period specified in the notice;

the Secretary may determine that payment of disability wage supplement to the person is to be cancelled or suspended.

“(2) If:

(a) a person receiving disability wage supplement has been given a notice under subsection 448(2); and

(b) the Secretary is satisfied that the person’s partner has not taken reasonable action to obtain comparable foreign payment within the period specified in the notice;

the Secretary may determine that payment of disability wage supplement to the person is to be cancelled or suspended.

“(3) For the purposes of this section, a person takes reasonable action to obtain a comparable foreign payment only if the person takes reasonable action to obtain that payment at the highest rate applicable to the person.

Changes to payments by computer

“465. If:

(a) payment of disability wage supplement to a person is based upon data in a computer; and

(b) payment of the disability wage supplement is cancelled or suspended, or the rate at which it is payable is increased or reduced, because of the operation of a computer program approved by the Secretary; and

(c) the program causes the change for a reason for which the Secretary could determine the change;

the change is taken to have been made because of a determination by the Secretary for that reason.

Note: The determination that is taken to have been made is a decision of an officer for the purposes of review by the Secretary (see sections 1239 and 1240) and the Social Security Appeals Tribunal (see section 1247).

Resumption of payment after cancellation or suspension

“466.(1) If the Secretary:

(a) cancels or suspends payment of a person’s disability wage supplement under section 462, 463 or 464; and

(b) reconsiders the decision to cancel or suspend; and

(c) becomes satisfied that because of the decision to cancel or suspend:

(i) the person did not receive disability wage supplement that was payable to the person; or

(ii) the person is not receiving disability wage supplement that is payable to the person;

the Secretary is to determine that disability wage supplement was or is payable to the person.

“(2) The reconsideration referred to in paragraph (1)(b) might be a reconsideration on an application under section 1240 for review or a reconsideration on the Secretary’s own initiative.

Note: For the date of effect of a determination under this section see section 467.

“Subdivision E—Date of effect of determination

Date of effect of favourable determination

“467.(1) The day on which a determination under section 460 or 466 (the ‘favourable determination’) takes effect is worked out in accordance with this section.

Notified decision—review sought within 3 months

“(2) If:

(a) a decision (the ‘previous decision’) is made in relation to a person’s disability wage supplement; and

(b) a notice is given to the person to whom disability wage supplement is payable advising the person of the making of the previous decision; and

(c) the person applies to the Secretary under section 1240, within 3 months after the notice is given, for review of the previous decision; and

(d) the favourable determination is made as a result of the application for review;

the determination takes effect on the day on which the previous decision took effect.

Notified decision—review sought after 3 months

“(3) If:

(a) a decision (the ‘previous decision’) is made in relation to a person’s disability wage supplement; and

(b) a notice is given to the person to whom disability wage supplement is payable advising the person of the making of the previous decision; and

(c) the person applies to the Secretary under section 1240, more than 3 months after the notice is given, for review of the previous decision; and

(d) the favourable determination is made as a result of the application for review;

the determination takes effect on the day on which the person sought the review.

Decision not notified

“(4) If:

(a) a decision (the ‘previous decision’) is made in relation to a person’s disability wage supplement; and

(b) no notice is given to the person to whom disability wage supplement is payable advising the person of the making of the previous decision; and

(c) the person applies to the Secretary under section 1240 for review of the previous decision; and

(d) the favourable determination is made as a result of the application for review;

the determination takes effect on the day on which the previous decision took effect.

Notified change of circumstances

“(5) Subject to subsections (6) and (7), if:

(a) the favourable determination is made following a person having advised the Department of a change in circumstances; and

(b) the change is not a decrease in the rate of the person’s maintenance income;

the determination takes effect on the day on which the advice was received or on the day on which the change occurred, whichever is the later.

“(6) If:

(a) the favourable determination is made following the death of the person’s partner; and

(b) the favourable determination is made because the person elects not to receive bereavement payments; and

(c) within the bereavement period:

(i) the person notifies the Department orally or in writing of the partner’s death; or

(ii) the Secretary otherwise becomes aware of the death;

the determination takes effect on the day after the day on which the partner died.

“(7) If:

(a) the favourable determination is made following the death of the person’s partner; and

(b) before the partner died, the partner:

(i) was not receiving a social security pension or a service pension; and

(ii) was not a long-term social security recipient; and

(c) within the period of 4 weeks that starts on the day after the day on which the partner dies:

(i) the person notifies the Department orally or in writing of the partner’s death; or

(ii) the Secretary otherwise becomes aware of the death;

the determination takes effect on the day on which the partner died.

Note 1: For ‘long-term social security recipient’ see subsection 23(1).

Note 2: If the person’s partner is receiving a social security pension or service pension or is a long-term social security recipient, the person is entitled to bereavement payments and this subsection does not apply to the person.

Other determinations

“(8) In any other case, the favourable determination takes effect on the day on which the determination was made or on a later day or earlier day (not being a day more than 3 months before the determination was made) specified in the determination.

Date of effect of adverse determination

General

“468.(1) The day on which a determination under section 461, 462, 463 or 464 (the ‘adverse determination’) takes effect is worked out in accordance with this section.

Note: If the adverse determination depends on a discretion or opinion and a person affected by the determination applies for review, the Secretary may continue payment pending the outcome of the review (see section 1241 (internal review) and section 1251 (review by Social Security Appeals Tribunal)).

“(2) The adverse determination takes effect on:

(a) the day on which the determination is made; or

(b) if another day is specified in the determination—on that day.

“(3) Subject to subsections (4), (5), (6), (7) and (8), the day specified under paragraph (2)(b) must be later than the day on which the determination is made.

Contravention of Act

“(4) If:

(a) the person whose disability wage supplement is affected by the adverse determination has contravened a provision of this Act (other than section 447, 1304, 1305, 1306 or 1307); and

(b) the contravention causes a delay in making the determination;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

False statement or misrepresentation—suspension or cancellation

“(5) If:

(a) a person has made a false statement or misrepresentation; and

(b) because of the false statement or misrepresentation, disability wage supplement has been paid to a person when the payment should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

False statement or misrepresentation—rate reduction

“(6) If:

(a) a person has made a false statement or misrepresentation; and

(b) because of the false statement or misrepresentation, the rate at which disability wage supplement was paid to a person was more than the rate at which it should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If: