Taxation Laws Amendment Act

(No. 2) 1994

No. 82 of 1994

An Act to amend the law relating to taxation

[Assented to 23 June 1994]

The Parliament of Australia enacts:

PART 1—PRELIMINARY

Short title

1. This Act may be cited as the Taxation Laws Amendment Act (No. 2) 1994.

Commencement

2.(1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) Divisions 1 and 13 of Part 3 are taken to have commenced on 22 October 1986.

(3) Subdivision D of Division 4 of Part 3 is taken to have commenced immediately after the commencement of Division 15 of Part 3 of the Taxation Laws Amendment Act 1993.

(4) Subdivisions A and B of Division 5 of Part 3 are taken to have commenced immediately after the commencement of the Income Tax Assessment Amendment (Foreign Investment) Act 1992.

(4) Subdivisions A and B of Division 5 of Part 3 are taken to have commenced immediately after the commencement of the Income Tax Assessment Amendment (Foreign Investment) Act 1992.

(5) Subdivisions B and C of Division 6 of Part 3 are taken to have commenced immediately after the commencement of Division 11 of Part 2 of the Taxation Laws Amendment Act (No. 3) 1992.

(6) Section 113 is taken to have commenced immediately after the commencement of the Taxation Laws Amendment Act (No. 4) 1992.

(7) Part 4 is taken to have commenced immediately after the commencement of Division 2 of Part 2 of the Taxation Laws Amendment Act (No. 6) 1992.

PART 2—AMENDMENT OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

Division 1—Principal Act

Principal Act

3. In this Part, “Principal Act” means the Fringe Benefits Tax Assessment Act 19861.

Division 2—Amendment of definitions of benchmark interest rate and statutory interest rate

Object

4. The object of this Division is to change the basis of determining the benchmark interest rate, and therefore the statutory interest rate (which is used in determining the taxable value of loan fringe benefits).

Interpretation

5. Section 136 of the Principal Act is amended:

(a) by omitting paragraph (a) of the definition of “benchmark interest rate” in subsection (1) and substituting the following paragraph:

“(a) in relation to a year of tax, means the rate of interest, known as the large bank housing lenders variable interest rate on loans for housing for owner occupation, last published by the Reserve Bank of Australia before the commencement of the year of tax; and”;

(b) by omitting paragraph (a) of the definition of “statutory interest rate” in subsection (1) and substituting the following paragraph:

“(a) in relation to a year of tax, means the benchmark interest rate in relation to the year of tax; or”.

Application

6. The amendments made by this Division apply to assessments of the fringe benefits taxable amount of an employer of the year of tax beginning on 1 April 1994 and of all later years of tax.

PART 3—AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

Division 1—Principal Act

Principal Act

7. In this Part, “Principal Act” means the Income Tax Assessment Act 19362.

Division 2—Amendments relating to accruals assessability of certain securities

Subdivision A—Object

Object

8. The object of this Division is to bring the tax treatment of variable return securities into line with that of fixed return securities.

Subdivision B—Amendments of Division 16E of Part III

Interpretation

9. Section 159GP of the Principal Act is amended:

(a) by omitting from subsection (1) the definitions of “adjusted term”, “eligible notional accrual period”, “non-varying element”, “notional accrual amount”, “notional accrual period”, “taxpayer’s yield to redemption” and “varying element”;

(b) by inserting in subsection (1) the following definitions:

“ ‘accrual amount’ has the meaning given by subsection 159GQB(1);

‘accrual period’ has the meaning given by section 159GQA;

‘eligible return’ has the meaning given by subsection (3);

‘implicit interest rate’ has the meaning given by subsection 159GQB(2);

‘taxpayer’s maximum term’, in relation to a security held by a taxpayer, means:

(a) if the security was issued to the taxpayer—the term of the security; or

(b) if the security was transferred to the taxpayer—the part of the term remaining after the transfer;”;

(c) by omitting subsections (4) and (5).

Repeal of section and substitution of new sections

10. Section 159GQ of the Principal Act is repealed and the following sections are substituted:

Tax treatment of holder of qualifying security

Accrual amounts to be worked out

“159GQ.(1) If a taxpayer holds a qualifying security for all or part of a year of income, the effect on the taxpayer’s taxable income is determined by working out the accrual amount (see section 159GQB) for each accrual period (see section 159GQA) in the year of income and then summing the accrual amounts.

Positive sum assessable

“(2) If the sum is a positive amount, the amount is included in the assessable income of the taxpayer of the year of income.

Negative sum deductible

“(3) If the sum is a negative amount, a deduction of the amount is allowable in the assessment of the taxpayer of the year of income.

Accrual period

Taxpayer’s maximum term to be divided into accrual periods

“159GQA.(1) The taxpayer’s maximum term for the qualifying security is divided into accrual periods in accordance with this section.

Whole year of income

“(2) If a year of income is wholly taken up by any of the taxpayer’s maximum term, the year of income is divided into 2 accrual periods of 6 months.

Beginning of taxpayer’s maximum term

“(3) If the taxpayer’s maximum term begins after the beginning of the year of income:

(a) if it begins less than 6 months after the beginning of the year of income—the period from the beginning of the taxpayer’s maximum term until the middle of the year of income is an accrual period and the second 6 months of the year of income is an accrual period; and

(b) in any other case—the part of the year of income taken up by the taxpayer’s maximum term is an accrual period.

End of taxpayer’s maximum term

“(4) If the taxpayer’s maximum term ends before the end of a year of income:

(a) if it ends no later than 6 months after the beginning of the year of income—the part of the year of income taken up by the taxpayer’s maximum term is an accrual period; and

(b) in any other case—the first 6 months of the year of income is an accrual period and the period from the middle of the year of income until the end of the taxpayer’s maximum term is an accrual period.

Example

“(5) For example, if the taxpayer’s year of income is a financial year and a security with a 2 year term is issued to the taxpayer on 1 April, the accrual periods will be as follows:

1st year

of income | 2nd year

of income | 3rd year

of income | |

1 Apr 1 July 1 Jan 1 July 1 Jan. 1 Apr. |

| | | | | | |

| | | | | | |

| 3 month accrual period | 6 month accrual period | 6 month accrual period | 6 month accrual period | 3 month accrual period | |

| |

Accrual amount

Formula

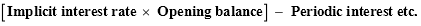

“159GQB.(1) The ‘accrual amount’ for an accrual period is worked out using the formula:

“Implicit interest rate”

“(2) In the formula in subsection (1), ‘Implicit interest rate’ means the rate of interest worked out under section 159GQC (for a fixed return security) or 159GQD (for a variable return security), properly adjusted to take account of the case where the accrual period is less than 6 months.

“Opening balance”

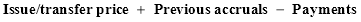

“(3) In the formula in subsection (1), ‘Opening balance’ means the amount worked out using the formula:

where:

‘Issue/transfer price’ means the issue price or transfer price, as the case requires, of the security; and

‘Previous accruals’ means:

(a) if paragraph (b) does not apply—the sum, whether positive or negative, of all accrual amounts for previous accrual periods in the taxpayer’s maximum term; or

(b) if the accrual period is the first in the taxpayer’s maximum term—nil; and

‘Payments’ means all payments (other than, of periodic interest) made or liable to be made under the security during all previous accrual periods in the taxpayer’s maximum term.

“Periodic interest etc.”

“(4) In the formula in subsection (1), ‘Periodic interest etc.’ means the sum of:

(a) all periodic interest payments made or liable to be made under the security during the accrual period, properly adjusted in the case of any payment made other than at the end of the period; and

(b) if any payments (other than of periodic interest) made or liable to be made under the security during the accrual period are made or liable to be made other than at its end—an amount to adjust properly for the making of the payments other than at the end of the period.

Implicit interest rate for fixed return security

“159GQC. For the purposes of the formula component ‘Implicit interest rate’ in subsection 159GQB(1), the rate of interest for a fixed return security in relation to a taxpayer is the rate of compound interest per period of 6 months at which:

(a) the sum of the present values of all amounts payable under the security during the taxpayer’s maximum term;

equals:

(b) the issue price or the transfer price, as the case requires, of the security.

Implicit interest rate for variable return security

Implicit interest rate to be recalculated each year etc.

“159GQD.(1) For the purposes of the formula component ‘Implicit interest rate’ in subsection 159GQB(1), the rate of interest for a variable return security must be worked out in accordance with subsection (2) separately for each year of income during the taxpayer’s maximum term. If there are 2 accrual periods of 6 months in the year of income, the rate is the same for both periods. It is possible for the rate to be negative.

Rate

“(2) The rate applicable in relation to a year of income is the rate of compound interest per period of 6 months in the calculation period (see subsection (3)) at which:

(a) the sum of the present values of all amounts payable under the security during the calculation period;

equals:

(b) the opening balance, mentioned in subsection 159GQB(1), for the accrual period that begins the calculation period.

“Calculation period”

“(3) The ‘calculation period’ means the part of the taxpayer’s maximum term that occurs after the beginning of the year of income.

Where amount payable is not known

“(4) For the purposes of paragraph (2)(a), if by the end of the year of income it is not possible to determine whether an amount will be payable, or the size of the amount that will be payable, after the end of the year of income, the determination is to be made by applying subsection (5), (7) or (11), or a combination of those subsections.

Assumption of constant level

“(5) Subject to subsection (7), if an amount payable is worked out to any extent by reference to the amount or level, at a particular time, of a rate, price, index or other thing, it is to be assumed that the rate, price, index or thing will be the same at all times after the end of the year of income as it was at the end of the year of income (or, if it was not available at the end of the year of income, at the time when it was last available in the year of income).

Examples

“(6) For the purposes of subsection (5):

(a) an example of an amount worked out wholly by reference to the amount of a rate at a particular time is an interest payment under a floating rate note. The amount payable is the product of an interest rate indicator (such as the prevailing bank bill rate) and the face or par value of the note; and

(b) an example of an amount worked out wholly by reference to the amount of a price at a particular time is a redemption payment under a commodity linked security where the amount of the payment is the product of the prevailing price of a commodity (such as gold) and the face or par value of the security.

Assumption of continuing rate of change

“(7) If an amount payable is worked out to any extent by reference to the amount of change in an index or other thing that occurs during a period, it is to be assumed that the index or other thing will continue to change at the same rate as it did:

(a) if the index or other thing was available at the end of the year of income—during the year of income; or

(b) in any other case—during the period of 12 months in respect of which the index or other thing was last available in the year of income.

Example

“(8) An example for the purposes of subsection (7) is a payment whose amount is the product of the face or par value of a security and the percentage increase in the All Groups Consumer Price Index number (the ‘CPI’) during the year ending on 30 June 1995. If the year of income for which the implicit interest rate is being worked out is the 1993-94 year of income and the CPI increases by 2% during the year ending on 31 March 1994 (the date of the last available number during the year of income), the CPI is assumed to increase by 2% during the year ending on 30 June 1995.

Disguised continuing rate of change case

“(9) For the purposes of subsection (7), if an amount payable is worked out to any extent by reference to the quotient of:

(a) the amount or level of an index or other thing at a particular time; and

(b) either:

(i) the amount or level of the index or other thing at a different time; or

(ii) another amount that, while not expressed to be the amount or level of the index or other thing at a different time, may reasonably be regarded as representing the amount or level of the index or other thing at a different time;

the amount payable is taken to be worked out to that extent by reference to the amount of change in the index or other thing that occurs during the period between the 2 times.

Example

“(10) An example for the purposes of subsection (9) is a payment under a security issued in December 1994 that is worked out by multiplying a number of dollars by the quotient of:

(a) the All Groups Consumer Price Index number in respect of the quarter ending on 31 December 1997; and

(b) the number 114.

Assume that the number in paragraph (b) is the same as the All Groups Consumer Price Index number in respect of the quarter ending on 31 December 1994. In this case, it would be reasonable to regard the number as representing the amount of the index at 31 December 1994, and therefore to apply subsection (7).

General assumption

“(11) If it is not possible to make the determination mentioned in subsection (4) in respect of the whole or part of any amount by applying subsection (5) or (7), or both, (for example, because no information about a rate, price or index was available during the year of income), the determination in respect of that whole or part is to be made on the basis of what is most likely in the circumstances.”.

Consequences of actual payments

11. Section 159GR of the Principal Act is amended:

(a) by omitting from paragraphs (1)(a) and (b) “or subsection (2) of this section”;

(b) by omitting subsection (2).

Balancing adjustments on transfer of qualifying security

12. Section 159GS of the Principal Act is amended by omitting from paragraphs (3)(c) and (d) “sections 159GQ and 159GR” and substituting “section 159GQ”.

Tax treatment of issuer of a qualifying security

13. Section 159GT of the Principal Act is amended:

(a) by omitting subsection (1) and substituting the following subsections:

“(1) Subsections (1A) and (1B) apply if a taxpayer is an issuer of a qualifying security to which this section applies during a period (the ‘issuer period’) comprising the whole or part of a year of income.

“(1A) If, on the assumptions in subsection (1C), an amount would be included in the taxpayer’s assessable income of the year of income in respect of the issuer period, then, subject to this section, the taxpayer is entitled to a deduction in his or her assessment for the year of income equal to that amount.

“(1B) If, on the assumptions in subsection (1C), a deduction would be allowable in the taxpayer’s assessment for the year of income, then an amount equal to the deduction is included in the taxpayer’s assessable income of the year of income.

“(1C) For the purposes of subsections (1A) and (1B), the assumptions are that:

(a) the security was issued to the taxpayer (rather than the taxpayer being the issuer of the security); and

(b) the taxpayer held the security during the whole of the issuer period; and

(c) the taxpayer did not transfer the security at the end of the issuer period; and

(d) sections 159GW, 159GX and 159GY were not enacted.”;

(b) by omitting from subsection (2) “(1)” and substituting “(1A)”;

(c) by omitting subsection (4).

Effect of Division in relation to non-residents

14. Section 159GW of the Principal Act is amended:

(a) by adding at the end of paragraph (1)(a) “and”;

(b) by omitting paragraph (1)(b).

Effect of Division where certain payments not assessable

15. Section 159GX of the Principal Act is amended by omitting “or 159GR”.

Effect of Division where qualifying security is trading stock

16. Section 159GY of the Principal Act is amended:

(a) by adding at the end of paragraph (a) “or”;

(b) by omitting paragraph (b).

Subdivision C—Consequential amendments

Bad debts

17. Section 63 of the Principal Act is amended by omitting from subsection (1A) “or 159GR” (wherever occurring).

Infrastructure borrowings to be non-assessable and non-deductible

18. Section 159GZZZZE of the Principal Act is amended by omitting paragraph (2)(b).

Interpretation

19. Section 221YHZA of the Principal Act is amended by omitting paragraph (2B)(b) and substituting the following paragraph:

“(b) so much of a payment that became payable at the end of the term of the investment as does not exceed:

(i) the amount that, under section 159GQ, would have been included in the investor’s assessable income for the year of income in which the end of the term occurred;

if:

(ii) any adoption of an accounting period in lieu of a year of income were ignored for the purposes of this paragraph and the application of Division 16E of Part III in relation to this paragraph.”.

Credits in respect of amounts assessed under Division 16E of Part III

20. Section 221YSA of the Principal Act is amended by omitting from paragraph (4)(a) “or 159GR”.

Subdivision D—Application

Application

21. The amendments made by this Division apply in relation to qualifying securities issued after 27 January 1994.

Division 3—Amendments to exclude accruals assessability

of certain securities

Object

22. The object of this Division is to exclude certain securities issued in a series from the application of the accruals assessability provisions of Division 16E of Part III of the Principal Act.

Interpretation

23. Section 159GP of the Principal Act is amended:

(a) by inserting after paragraph (b) of the definition of “qualifying security” in subsection (1) the following paragraph:

“(ba) that is not part of an exempt series (see subsection (9A));”;

(b) by inserting after subsection (9) the following subsections:

“(9A) For the purposes of paragraph (ba) of the definition of ‘qualifying security’ in subsection (1), if:

(a) after 16 December 1984, a person issues a security (the ‘first in the series’) that is not a qualifying security; and

(b) during the period from the end of 16 December 1984 until the issuing of the first in the series, the person did not issue any qualifying security with exactly the same payment dates, payment amounts and other terms as the first in the series; and

(c) after issuing the first in the series, the person issues another security (the ‘later security’) with exactly the same payment dates, payment amounts and other terms as the first in the series;

the later security is ‘part of an exempt series’.

“(9B) In determining for the purposes of paragraph (9A)(b) or (c) whether a security has exactly the same other terms as another security, the fact that the first-mentioned security has a different issue price than the second-mentioned security is to be disregarded.”.

Application

24. The amendments made by this Division apply to securities issued after 16 December 1984.

Division 4—Amendments relating to capital gains tax

Subdivision A—Share value shifting arrangements

Object

25. The object of this Subdivision is to remove the capital gains tax advantages of share value shifting arrangements.

Insertion of new Division

26. After Division 19A of Part IIIA of the Principal Act the following Division is inserted:

“Division 19B—Share value shifting arrangements

Object

“160ZZRI. The object of this Division is to remove the capital gains tax advantages of share value shifting arrangements.

Simplified outline

“160ZZRJ. The following diagram is a simplified outline of this Division:

Division applies if: | |

• the value of shares of a taxpayer or an associate is shifted under an arrangement involving a company and the taxpayer | |

• the taxpayer is the controller of the company at some time in the course of the arrangement | |

• the value shifted from the shares is material | |

| | |

Consequences to the extent that value shift is to pre-CGT shares: | | Consequences to the extent that value shift is to post-CGT shares: |

→ possible deemed capital gain in respect of decreased value shares | | → possible deemed capital gain in respect of decreased value shares of different person |

→ cost base reduction for decreased value shares, to take account of value shifted | |

| → cost base reduction for decreased value shares of same or different person, to take account of value shifted |

| | → if material increase in increased value shares, cost base increase for those shares, to take account of value shifted |

| | | | | |

List of definitions

“160ZZRK. The following is a list of expressions defined for the purposes of this Division and their location:

arrangement............. | subsection 160ZZRM(3) |

associate............... | subsection 160ZZRN(2) |

controller............... | subsection 160ZZRN(1) |

decreased value share...... | paragraph 160ZZRM(1)(b) |

different person share...... | paragraph 160ZZRQ(2)(a) |

entity.................. | subsection 160ZZRN(2) |

group................. | subsection 160ZZRN(2) |

increase................ | subparagraph 160ZZRM(1)(c)(ii) |

increased value share....... | paragraph 160ZZRM(1)(c) |

material decrease......... | subsection 160ZZRO(1) |

material increase.......... | subsection 160ZZRO(2) |

post-CGT share.......... | subsection 160ZZRM(6) |

pre-CGT share........... | subsection 160ZZRM(5) |

same person share......... | paragraph 160ZZRQ(6)(b) |

share.................. | subsection 160ZZRM(4) |

share value shift.......... | subsection 160ZZRMQ) |

total market value increase .. | subsection 160ZZRO(3). |

Requirements for Division to apply

“160ZZRL. In order for the operative provisions of this Division (sections 160ZZRP and 160ZZRQ) to apply, the following requirements must be satisfied:

(a) first, a share value shift must take place under an arrangement involving a company and a taxpayer (see section 160ZZRM);

(b) secondly, the taxpayer must be a controller (see subsection 160ZZRN(1)) of the company at some time during the period beginning when the arrangement is entered into and ending when it has been implemented;

(c) thirdly, there must be a material decrease (see subsection 160ZZRO(1)) in the market value of a share involved in the share value shift.

Share value shift under an arrangement

“Share value shift”

“160ZZRM.(1) A ‘share value shift’ takes place under an arrangement (see subsection (3)) involving a company and a taxpayer if:

(a) under the arrangement, the company, the taxpayer or an associate of the taxpayer, either alone or with one or more other persons, does something in relation to a share or shares (including issuing a share or shares) in the company (for example, changing voting rights attached to a share, buying-back shares or issuing new shares at a discount on their market value); and

(b) at the same time as, or after, the thing is done, one or more shares (each of which is a ‘decreased value share’) in the company (whether or not shares to which paragraph (a) applies) that are post-CGT shares held by the taxpayer or an associate of the taxpayer decrease in market value; and

(c) at the same time as, or after, the thing is done, either or both of the following happen:

(i) one or more existing shares (each of which is an ‘increased value share’) in the company (whether post-CGT shares or pre-CGT shares and whether or not shares to which paragraph (a) applies) held by:

(A) in any case—the taxpayer or an associate of the taxpayer; or

(B) if any decreased value share was held by an associate of the taxpayer—an associate of that associate;

increase in market value; or

(ii) one or more new shares (each of which is also an ‘increased value share’) in the company are issued to:

(A) in any case—the taxpayer or an associate of the taxpayer; or

(B) if any decreased value share was held by an associate of the taxpayer—an associate of that associate;

where the market value of each new share exceeds the consideration (if any) given by the taxpayer or other person for its issue (the excess is referred to in this Division as an ‘increase’ in its market value); and

(d) it is reasonable to conclude that the decrease and increase were caused by the doing of the thing mentioned in paragraph (a).

Increase or decrease partly due to arrangement

“(2) If it is reasonable to conclude that an increase or decrease in the market value of one or more shares is partly caused by the doing of the thing under the arrangement and partly caused by something else, subsection (1) applies to the decrease or increase to the extent only that it is reasonable to conclude that the decrease or increase is caused by the doing of the thing under the arrangement.

“Arrangement”

“(3) An ‘arrangement’ is:

(a) any arrangement, agreement, understanding, promise or undertaking, whether express or implied and whether or not enforceable, or intended to be enforceable, by legal proceedings; or

(b) any scheme, plan, proposal, action, course of action, or course of conduct, whether of one person or more than one person.

“Share”

“(4) The expression ‘share’ includes:

(a) an interest in a share; or

(b) a right or option (including a contingent right or option) to acquire a share or an interest in a share.

“Pre-CGT share”

“(5) A share is a ‘pre-CGT share’ if it was acquired by the shareholder before 20 September 1985.

“Post-CGT share”

“(6) A share is a ‘post-CGT share’ if it was acquired by the shareholder on or after 20 September 1985.

Controller of a company etc.

“Controller”

“160ZZRN.(1) A taxpayer is a ‘controller’ of a company if:

(a) the taxpayer has an associate-inclusive control interest in the company of not less than 50%; or

(b) both the following subparagraphs apply:

(i) the taxpayer has an associate-inclusive control interest in the company of not less than 40%;

(ii) the company is not controlled by a group of entities other than a group consisting of or including the taxpayer or any of the taxpayer’s associates; or

(c) the taxpayer controls the company, either alone or together with an associate or associates.

“Associate”, “entity” and “group”

“(2) The expressions ‘associate’, ‘entity’ and ‘group’ have the same respective meanings as in Part X.

“Associate-inclusive control interest”

“(3) Subject to the modifications in subsection (4), whether a taxpayer has an associate-inclusive control interest of not less than 50%, or not less than 40%, in a company is to be determined by applying Division 3 of Part X.

Modifications of applied provisions

“(4) The modifications are as follows:

(a) that Division 3 of Part X applies for the purpose of determining the associate-inclusive control interests in a company whether or not in the capacity of trustee;

Note: The expression ‘company’ in Part X does not include a company in the capacity of trustee.

(b) that the purpose of making the determination is one of the purposes for which subsection 349(4) is to be applied;

(c) that subsections 350(6) and (7) and 355(1) do not apply;

(d) that the reference in subsection 352(2) to a CFE is a reference to:

(i) a company of which the taxpayer or an associate is a controller; or

(ii) a partnership; or

(iii) a trust;

(e) that references in section 354 to a CFP are references to any partnership;

(f) that references in section 355 to a CFT are references to any trust.

“Material decrease”, “material increase” and “total market value increase”

“Material decrease”

“160ZZRO.(1) A decrease (the ‘current decrease’) in the market value of a share involved in a share value shift is a ‘material decrease’ if:

(a) the sum of the percentage of the current decrease and the percentages of all other decreases (if any) in the market value of the share as a result of share value shifts under the same arrangement (whether before or after the current decrease) is at least 5%; or

(b) the sum of all decreases in the market value of all shares whose market value is decreased as a result of share value shifts at any time under the same arrangement is at least $100,000.

“Material increase”

“(2) An increase (the ‘current increase’) in the market value of a share involved in a share value shift is a ‘material increase’ if:

(a) the sum of the percentage of the current increase and the percentages of all other increases (if any) in the market value of the share as a result of share value shifts under the same arrangement (whether before or after the current increase) is at least 5%; or

(b) the sum of all increases in the market value of all shares whose market value is increased as a result of share value shifts at any time under the same arrangement is at least $100,000.

“Total market value increase”

“(3) The ‘total market value increase’ in respect of an arrangement under which one or more share value shifts take place is the sum of:

(a) all increases in market value of all shares whose market value is increased as a result of the share value shifts; and

(b) all increases in market value of all other shares whose market value is increased, where it is reasonable to conclude that the doing of the thing mentioned in paragraph 160ZZRM(1)(a) in relation to any of the share value shifts caused the increase.

Consequences of value shift to pre-CGT share

Section sets out consequences

“160ZZRP.(1) If the requirements of section 160ZZRL are satisfied and a particular increased value share is a pre-CGT share, the following are the consequences.

Deemed capital gain

“(2) If:

(a) in respect of each decreased value share for which there was a material decrease in market value, this Part were applied on the following assumptions:

(i) that a part of the share had been disposed of by its holder immediately after the decrease in value of the share;

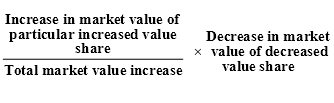

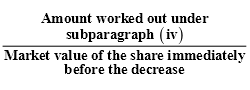

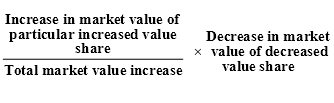

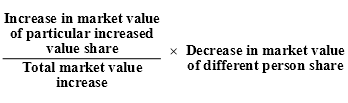

(ii) that the consideration for the disposal was an amount worked out using the formula:

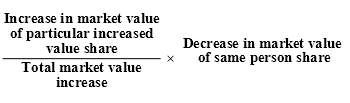

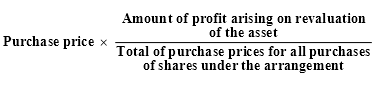

(iii) that the cost base or indexed cost base of the part was the amount worked out by multiplying the amount that would be the cost base or indexed cost base for the whole of the share if it were being disposed of at the time, by the fraction worked out using the formula:

; and

; and

(b) as a result a capital gain would accrue to the holder;

then, for the purposes of this Act, a capital gain of that amount is taken to accrue to the holder for the year of income in respect of the disposal of an asset (even though no asset was actually disposed of).

Adjustment to acquisition consideration etc. for decreased value share

“(3) Regardless of whether subsection (2) applies, for the purposes of any application of this Part to a later disposal by the holder of any decreased value share for which there was a material decrease in market value:

(a) all amounts that, under section 160ZH (which deals with cost base, indexed cost base and reduced cost base) are attributable to the share in relation to the period before the decrease in value took place;

are taken to be reduced by:

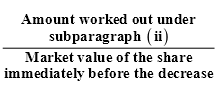

(b) the fraction worked out using the formula:

Consequences of value shift to post-CGT share

Section sets out consequences

“160ZZRQ.(1) If the requirements of section 160ZZRL are satisfied and a particular increased value share is a post-CGT share, the following are the consequences.

Deemed capital gain

“(2) If:

(a) in respect of each decreased value share (a ‘different person share’):

(i) held by a person other than the holder of the particular increased value share; and

(ii) for which there was a material decrease in market value;

this Part were applied on the following assumptions:

(iii) that a part of the different person share had been disposed of by its holder immediately after the decrease in value of the share;

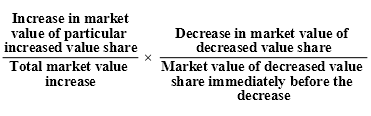

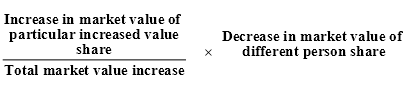

(iv) that the consideration for the disposal was an amount worked out using the formula:

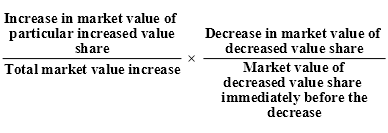

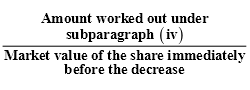

(v) that the cost base or indexed cost base of the part was the amount worked out by multiplying the amount that would be the cost base or indexed cost base for the whole of the share if it were being disposed of at the time, by the fraction worked out using the formula:

; and

(b) as a result a capital gain would accrue to the holder;

then, for the purposes of this Act, a capital gain of that amount is taken to accrue to the holder for the year of income in respect of the disposal of an asset (even though no asset was actually disposed of).

Adjustment to acquisition consideration etc. for decreased value share

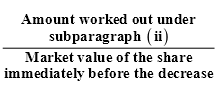

“(3) For the purpose of any application of this Part to a later disposal by the holder of any decreased value share for which there was a material decrease in market value:

(a) all amounts that, under section 160ZH (which deals with cost base, indexed cost base and reduced cost base) are attributable to any such share in relation to the period before the decrease in value took place;

are taken to be reduced by:

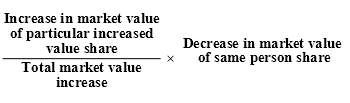

(b) the fraction worked out using the formula:

Adjustment to cost base expenditure for increased value share

“(4) If there is a material increase (see subsection 160ZZRO(2)) in the market value of the particular increased value share then, for the purposes of any application of this Part to a later disposal of the particular increased value share by the holder, the holder is taken to have incurred in relation to the share, at the time of the increase in its market value, expenditure to which paragraph 160ZH(1)(c), (2)(c) or (3)(c) applies that is equal to the sum of the amounts qualifying under subsections (5) and (6) of this section.

Deemed expenditure referable to decreased value shares of different persons

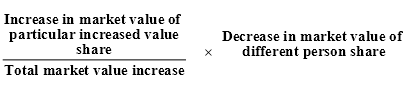

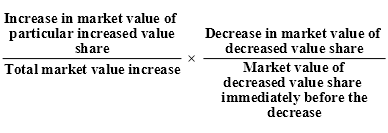

“(5) One amount qualifying for the purposes of subsection (4) is the smaller of the following:

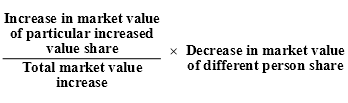

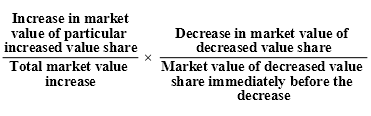

(a) the amount worked out by multiplying the increase in market value of the particular increased value share, to the extent that the increase is reflected in its market value at the time of the later disposal, by the following fraction:

(b) the sum of the amounts worked out for each different person share using the following formula:

Deemed expenditure referable to decreased value shares of same person

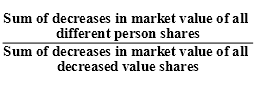

“(6) The other amount qualifying for the purposes of subsection (4) is the smallest of the following:

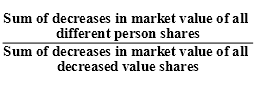

(a) the amount worked out by multiplying the increase in market value of the particular increased value share, to the extent that the increase is reflected in its market value at the time of the later disposal, by the following fraction:

1 — fraction in paragraph (5) (a)

(b) the sum of the amounts worked out for each share (a ‘same person share’):

(i) held by the person who holds the particular increased value share; and

(ii) for which there was a material decrease in market value;

using the following formula:

(c) the sum of the amounts of reductions that would result from the application of subsection (3) if that subsection applied only to same person shares.”.

Keeping of records

27. Section 160ZZU of the Principal Act is amended by omitting paragraph (1)(b) and substituting the following paragraph:

“(b) if the asset has not been disposed of:

(i) in any case—any amount that would, if the asset were disposed of, form part of the cost base to the person in respect of the asset; and

(ii) if the asset is a share whose market value has suffered a material decrease under an arrangement where the requirements of section 160ZZRL (which deals with share value shifting arrangements) are satisfied:

(A) the essential features of the arrangement; and

(B) the dates of the decreases in market value of all shares involved in share value shifts under the arrangement; and

(C) the amounts of the decreases in market value of all shares involved in share value shifts under the arrangement; and

(D) the amounts of the increases in market value of all shares involved in share value shifts under the arrangement and of any other shares covered by paragraph 160ZZRO(3)(b); and

(E) any amount that would, if the share were disposed of at the time of the decrease in market value, form part of the cost base to the person in respect of the asset; and”.

Application

28. The amendments made by this Subdivision apply to arrangements where the decrease in market value and increase in market value occur after 12 noon, by legal time in the Australian Capital Territory, on 12 January 1994.

Subdivision B—Creation or conversion of trusts

Object

29. The object of this Subdivision is to clarify the capital gains tax provisions of the Principal Act in relation to the creation of trusts and the conversion of trusts into unit trusts.

What constitutes a disposal or acquisition

30. Section 160M of the Principal Act is amended:

(a) by inserting in subsection (1A) “, subject to paragraphs (3)(a) and (aa),” after “that”;

(b) by omitting paragraph (3)(a) and substituting the following paragraphs:

“(a) the creation of a trust, by declaration or settlement, over the asset, other than where either:

(i) all of the following sub-subparagraphs apply:

(A) the person who owned the asset immediately before the creation of the trust is the sole beneficiary of the trust;

(B) that person is absolutely entitled to the asset as against the trustee or would, but for a legal disability, be so entitled;

(C) the trust is not a unit trust; or

(ii) all of the following sub-subparagraphs apply:

(A) the trust is created by the transfer of an asset to a trust from another trust;

(B) the beneficiaries of the trusts are identical;

(C) the terms of the trusts, including the interest of each beneficiary in the income and corpus of the trusts, are identical;

(aa) the conversion of a trust over an asset to a unit trust where:

(i) the trust is not an existing unit trust; and

(ii) immediately before the conversion, a person was absolutely entitled to the asset as against the trustee or would, but for a legal disability, have been so entitled;”;

(c) by inserting after subsection (3) the following subsection:

“(3A) For the purposes of paragraph (3)(a), the transfer of an asset to a trust is taken to be the creation, by settlement, of a trust over the asset.”;

(d) by inserting after subsection (4) the following subsections:

“(4A) Subsection (4B) applies if:

(a) a change in the ownership of an asset results from the application of paragraph (3)(a); and

(b) the person who owned the asset immediately before the creation of the trust is the trustee of the trust; and

(c) immediately after the change, no beneficiary is absolutely entitled to the asset as against the trustee.

“(4B) If this subsection applies, then, for the purposes of the application of this Part to any later disposal of the asset by the trustee, the cost base, indexed cost base or reduced cost base of the asset is the amount that would apply if the trustee had acquired the asset, at the time of the change in ownership resulting from the application of paragraph (3)(a), for a consideration equal to its market value at that time.”.

Disposals by bare trustees and persons enforcing securities

31. Section 160V of the Principal Act is amended by inserting after subsection (1 A) the following subsection:

“(1B) For the avoidance of doubt, nothing in subsection (1) has the effect that a change in the ownership of an asset under paragraph 160M(3)(a) or (aa) is not taken to have occurred.”.

Application

32. The amendments made by this Subdivision apply to creation of trusts, or conversions of trusts into unit trusts, after 12 noon, by legal time in the Australian Capital Territory, on 12 January 1994.

Transitional

33. The amendments made by this Subdivision are to be disregarded in determining the application of Part IIIA of the Principal Act in relation to disposals of assets at or before 12 noon, by legal time in the Australian Capital Territory, on 12 January 1994.

Subdivision C—Transfers between related companies

Object

34. The object of this Subdivision is to amend the capital gains tax provisions of the Principal Act to allow roll-over relief for transfers of assets between related companies.

Securities lending arrangements

35. Section 26BC of the Principal Act is amended by omitting “160ZZO” from the definition of “subsidiary” in subsection (1) and substituting “160G”.

Application

36. Section 160ZYK of the Principal Act is amended by omitting sub-subparagraph (b)(ii)(B) and substituting the following sub-subparagraph:

“(B) the issuing company is, or but for the issue of the rights would be, related to the company referred to in paragraph (a) when the rights are issued; and”.

Application

37. Section 160ZYR of the Principal Act is amended by omitting sub-subparagraph (b)(ii)(B) and substituting the following sub-subparagraph:

“(B) the issuing company is, or but for the issue of the options would be, related to the company referred to in paragraph (a) when the options are issued; and”.

Transfer of asset between related companies

38. Section 160ZZO of the Principal Act is amended:

(a) by omitting from paragraph (1)(b) “a group company in relation to the transferor in relation to the year of income in which the disposal took” and substituting “related to the transferor when the disposal takes”;

(b) by omitting subsections (3) to (8B) (inclusive).

Interpretation

39. Section 160ZZRA of the Principal Act is amended by omitting “160ZZO” from the definition of “subsidiary” and substituting “160G”.

When companies under common ownership

40. Section 160ZZRB of the Principal Act is amended by omitting from paragraph (a) “a group company (within the meaning of section 160ZZO) in relation” and substituting “related”.

Disposal of shares or interest in trust

41. Section 160ZZT of the Principal Act is amended by omitting from paragraph (4)(d) “a group company (within the meaning of section 160ZZO) in relation to the transferor in relation to the year of income in which the disposal took” and substituting “related to the transferor when the disposal takes”.

Keeping of records

42. Section 160ZZU of the Principal Act is amended by omitting from paragraph (3)(b) “160ZZO” (first occurring) and substituting “160ZZOA”.

Application

43.(1) The amendments made by section 35 apply in relation to disposals that occur during the 1993-94 year of income, or a later year of income, of the lender.

(2) The amendments made by section 36 apply in relation to issues of rights that occur during the 1993-94 year of income, or a later year of income, of the shareholder.

(3) The amendments made by section 37 apply in relation to issues of options that occur during the 1993-94 year of income, or a later year of income, of the shareholder.

(4) The amendments made by sections 38, 39, 40 and 41 apply in relation to disposals that occur during the 1993-94 year of income, or a later year of income, of the transferor.

(5) The amendments made by section 42 apply in relation to acquisitions that occur during the 1993-94 year of income, or a later year of income, of the transferee.

Subdivision D—Companies ceasing to be related

Object

44. The object of this Subdivision is to exclude certain company group break-ups involving sub-groups from the capital gains tax provisions of the Principal Act in relation to companies ceasing to be related after obtaining roll-over relief.

Companies ceasing to be related after section 160ZZO application

45. Section 160ZZOA of the Principal Act is amended:

(a) by inserting after paragraph (1)(c) the following word and paragraph:

“and (ca) the cessation referred to in paragraph (c) is not an eligible sub-group break-up;”;

(b) by omitting from paragraph (2)(c) “160ZZO” and substituting “160G”;

(c) by adding at the end of subsection (2) the following word and paragraphs:

“; and (e) if a company has one or more subsidiaries, the company and all of the subsidiaries of the company are a ‘sub-group’ and the company is the ‘holding company’; and

(f) a cessation referred to in paragraph (1)(c) is an ‘eligible sub-group break-up’ if:

(i) the company referred to in paragraph (1)(c) is a member of a sub-group at the time of the group roll-over disposal referred to in that paragraph; and

(ii) the transferor and the transferee referred to in section 160ZZO:

(A) if sub-subparagraph (B) does not apply—in relation to the group roll-over disposal; or

(B) if the group roll-over disposal was one of a series of group roll-over disposals—in relation to each of the group roll-over disposals in the series;

were members of the sub-group at the time of the group roll-over disposal concerned; and

(iii) if the company is the holding company of the sub-group)—immediately after the cessation, none of the shares in the company are held by the ultimate holding company or by a company that is related to the ultimate holding company; and

(iv) if the company is not the holding company of the sub-group—immediately after the cessation, none of the shares in the company or in the holding company are held by the ultimate holding company or by a company that is related to the ultimate holding company.”.

Application

46. Section 56 of the Taxation Laws Amendment Act 1993 applies in the same way to the amendments made by this Subdivision as it applied to the amendments made by Division 15 of Part 3 of that Act.

Subdivision E—Government incentive schemes

Object

47. The object of this Subdivision is to exclude from the capital gains tax provisions of the Principal Act the disposal of certain rights under prescribed government incentive schemes.

Part applies in respect of disposals of assets

48. Section 160L of the Principal Act is amended by inserting after subsection (6) the following subsections:

“(6A) This Part does not apply to a disposal (other than a disposal by way of assignment) by a taxpayer of a right to reimbursement, or to payment, under a scheme, of expenses of the taxpayer in participating in the scheme where the scheme is:

(a) established by the Commonwealth, a State or a Territory or by an authority of the Commonwealth, of a State or of a Territory; and

(b) prescribed for the purposes of this subsection under regulations applying to the time of the disposal (whether the regulations concerned are made before or after the time of the disposal).

“(6B) Nothing in section 170 prevents the amendment of an assessment for the purpose of giving effect to subsection (6A).”.

Application

49. The amendment made by this Subdivision applies in relation to disposals before, at or after the commencement of this section.

Subdivision F—Amendment of assessments

Object

50. The object of this Subdivision is to amend the Principal Act to ensure that amended assessments may be made at any time to give effect to various capital gains tax provisions.

Time of disposal and acquisition

51. Section 160U of the Principal Act is amended by adding at the end the following subsection:

“(10) Section 170 does not prevent the amendment of an assessment at any time to give effect to subsection (3) or (8) where the time of an acquisition or disposal is taken to have been before the making of the assessment.”.

Amendment of assessments

52. Section 170 of the Principal Act is amended by inserting after subsection (9C) the following subsection:

“(9D) This section does not prevent the amendment of an assessment at any time if the amendment is made, in relation to a contract that after the making of the assessment is found to be void ab initio, to ensure that Part IIIA is taken always to have applied to the contract as if the contract had never been made.”.

Application

53.(1) Subject to subsection (2), the amendments made by this Subdivision apply to assessments made at any time.

(2) The amendments made by this Subdivision do not permit the amendment of an assessment if:

(a) the amendment of the assessment would effect an increase in the liability of a taxpayer under the assessment; and

(b) as at the end of 11 January 1994, the Commissioner was prevented by section 170 of the Principal Act from amending the assessment.

Subdivision G—Taxable Australian assets

Object

54. The object of this Subdivision is to amend the capital gains tax provisions of the Principal Act to provide for the apportionment of gains or losses in relation to certain assets that are only used in Australia for a part of the time when they are owned.

Insertion of new section

55. After section 160ZA of the Principal Act the following section is inserted:

Reduction of capital gains and capital losses for certain taxable Australian assets

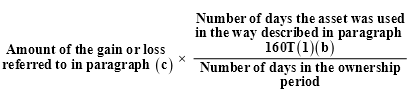

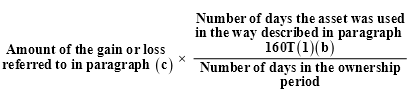

“160ZAA. If:

(a) the disposal of an asset is covered by paragraph 160T(1)(b), but not by any other paragraph of subsection 160T(1); and

(b) the taxpayer used the assets in the way described in that paragraph for only part of the period (the ‘ownership period’) starting when the taxpayer acquired the asset and ending when the taxpayer disposed of the asset; and

(c) a capital gain has accrued to the taxpayer, or the taxpayer has incurred a capital loss, in respect of the disposal;

the amount of the capital gain, or of the capital loss, (as the case may be) is taken to be:

Application

56. The amendment made by this Subdivision applies in relation to disposals of assets after 12 noon, by legal time in the Australian Capital Territory, on 12 January 1994.

Subdivision H—Transfer of group company losses

Object

57. The object of this Subdivision is to amend the capital gains tax provisions of the Principal Act in relation to the transfer of net capital losses within a company group.

Transfer of net capital loss within company group

58. Section 160ZP of the Principal Act is amended:

(a) by inserting in subsection (13) “any payments covered by subsection (12) and to” after “having regard to”;

(b) by adding at the end the following subsections:

“(14) Where:

(a) an amount has been specified by the loss company in an agreement under paragraph (7)(c); and

(b) either:

(i) a company (the ‘parent company’) that is a group company in relation to the gain company in relation to the gain year holds shares in another company that is such a group company, being shares that were acquired by the parent company after 19 September 1985; or

(ii) a company (the ‘creditor company’) that is a group company in relation to the gain company in relation to the gain year is owed a debt by another company that is such a group company in respect of a loan made to that other company, being a debt that commenced to be owed to the creditor company after 19 September 1985; and

(c) either:

(i) the other company referred to in subparagraph (b)(i) or (ii), as the case may be, is the gain company; or

(ii) the money paid to acquire the shares or the money lent, as the case may be, has indirectly, through one or more interposed companies, trusts or partnerships, been applied in the acquisition of shares in the gain company by a company that is a group company in relation to the gain company in relation to the gain year or in the making of a loan to the gain company by a company that is such a group company;

the cost base, the indexed cost base or the reduced cost base, as the case may be, to the parent company of the shares or to the creditor company of the debt is increased by such amount as is appropriate having regard to any payments covered by subsection (12) and to the direct or indirect interest of the parent company or creditor company in the gain company.

“(15) The amount of the increase under subsection (14) in the cost base, the indexed cost base or the reduced cost base, as the case may be, to the parent company of the shares, or to the creditor company of the debt, is not to exceed the increase in the market value of the shares or the debt that results from the capital loss being taken to have been incurred by the gain company.”.

Application

59. The amendments made by this Subdivision apply in relation to amounts specified in agreements made under paragraph 160ZP(7)(c) of the Principal Act where the gain year is the 1993-94 year of income, or a later year of income, of the gain company.

Subdivision I—Amendments related to winding-up

Object

60. The object of this Subdivision is to amend the capital gains tax provisions of the Principal Act to remove anomalies that are detrimental to taxpayers in relation to the disposal of assets during the winding-up of companies.

Transfers of assets between companies under common ownership

61. Section 160ZZRD of the Principal Act is amended by adding at the end the following subsection:

“(3) This Division does not apply if:

(a) the disposal is a distribution to shareholders of a company by a liquidator in the course of winding-up the company; and

(b) the company is dissolved within 3 years after the winding-up commenced, or within such further time as the Commissioner considers appropriate for the purposes of the application of this subsection in relation to the company.”.

Application

62. The amendment made by this Subdivision applies in relation to disposals of assets after 6 December 1990.

Subdivision J—Rebatable dividend adjustments

Object

63. The object of this Subdivision is to remove the capital gains tax advantages of dividend rebate arrangements.

Insertion of new section

64. After section 159GZZZM of the Principal Act the following section is inserted in Subdivision A of Division 16K of Part III:

Meaning of “rebatable dividend adjustment” for purposes of share buy-back provisions

“159GZZZMA.(1) For the purposes of this Division a ‘rebatable dividend adjustment’ arises in relation to a share (the ‘RDA share’) if:

(a) under an arrangement:

(i) a company issues one or more shares at a premium; and

(ii) the RDA share is a share in the company (whether or not one of the shares issued at a premium); and

(iii) the company buys the RDA share from the holder of the share; and

(iv) the purchase is an off-market purchase; and

(b) an amount (the ‘attributable amount’), being the whole or a part of the purchase price of the RDA share, is taken by subsection (2) to be paid out of the premiums on the shares; and

(c) assuming this section and subsection 159GZZZP(3) had not been enacted—the holder of the RDA share would have been entitled to a rebate of tax (the ‘dividend rebate’) in the holder’s assessment for a year of income under section 46 or 46A in respect of a dividend (the ‘dividend amount’) that is taken, by subsection 159GZZZP(1), to be paid by the company in relation to the purchase of the RDA share.

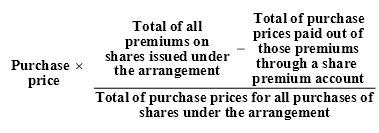

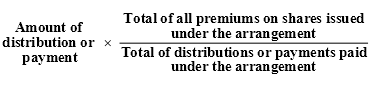

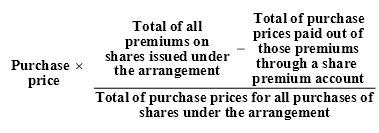

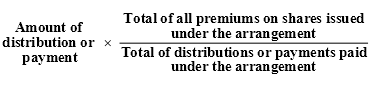

“(2) For the purposes of paragraph (1)(b), so much of the purchase price of the RDA share as does not exceed the lesser of the dividend amount and the amount worked out using the following formula is taken to be paid out of the premiums:

where:

‘Total of purchase prices paid out of those premiums through a share premium account’ means

(a) if:

(i) any amount (the ‘credited amount’) of the premiums on shares issued under the arrangement was credited to a share premium account of the company; and

(ii) any amount (the ‘share premium amount’) of the purchase price of shares under the arrangement was debited against amounts standing to the credit of that account;

so much of the share premium amount as could reasonably be attributed to the credited amount; or

(b) in any other case—nil.

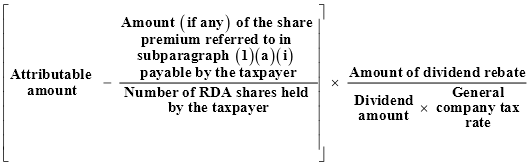

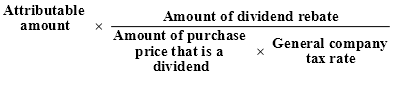

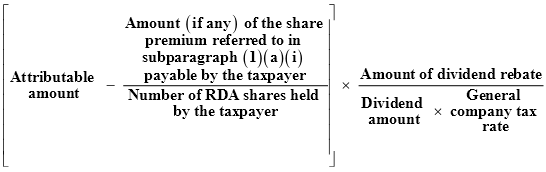

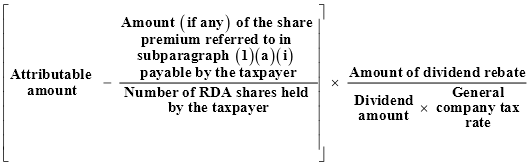

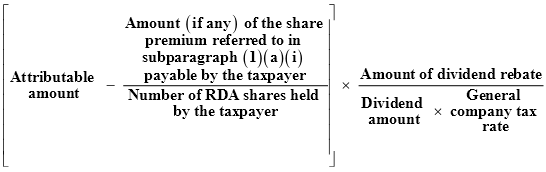

“(3) The amount of the rebatable dividend adjustment arising under subsection (1) in relation to the RDA share is:

“(4) A rebatable dividend adjustment also arises in relation to a share (the ‘RDA share’) if:

(a) under an arrangement:

(i) the RDA share is a share in the company; and

(ii) the company buys the RDA share from the holder of the share; and

(iii) the purchase is an off-market purchase; and

(b) an amount (the ‘attributable amount’), being the whole or a part of the purchase price of the RDA share, is taken by subsection (5) to be paid out of profits arising from the revaluation of an asset; and

(c) had the company disposed of the asset immediately after the revaluation, one or more of the following subparagraphs would have applied:

(i) any profit that would have arisen on the disposal of the asset would, in whole or in part, have been included in the assessable income of the company;

(ii) any loss that would have arisen from the disposal of the asset would, in whole or in part, have been allowable as a deduction to the company;

(iii) Part IIIA would, or would but for Division 17 of that Part, have applied in respect of the disposal of the asset; and

(d) the holder of the RDA share is entitled to a rebate of tax (the ‘dividend rebate’) in the holder’s assessment for a year of income under section 46 or 46A in respect of an amount (the ‘dividend amount’) being so much of the purchase price of the RDA share as is a dividend.

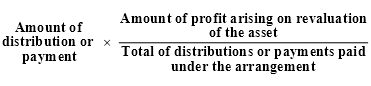

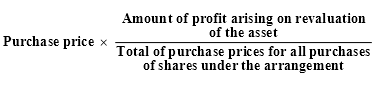

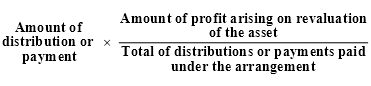

“(5) For the purposes of paragraph (4)(b), but subject to subsection (6), so much of the purchase price as does not exceed the lesser of the dividend amount and the amount worked out using the following formula is taken to be paid out of the profit arising on the revaluation of the asset:

“(6) If a share purchase is made under an arrangement covered by both paragraphs (1)(a) and (4)(a), the amount of the purchase price that would, apart from this subsection, be taken by subsection (5) to be paid out of the profit arising on the revaluation of the asset under the arrangement does not exceed the amount that remains after deducting from the dividend amount any part of the purchase price that is taken by subsection (2) to be paid out of premiums on shares issued under the arrangement.

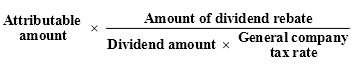

“(7) The amount of the rebatable dividend adjustment arising under subsection (4) in relation to the RDA share is:

“(8) In this section:

‘arrangement’ has the same meaning as in section 160ZZRM;

‘general company tax rate’ has the same meaning as in section 160APA.”.

Part of off-market purchase price is a dividend

65. Section 159GZZZP of the Principal Act is amended by adding at the end the following subsection:

“(3) For the purposes of paragraph (1)(b), a rebatable dividend adjustment that arises in relation to the share under subsection 159GZZZMA(1) is taken to be an amount of the purchase price in respect of the buy-back of the share which is debited against amounts standing to the credit of a share premium account of the company.”.

Consideration in respect of off-market purchase

66. Section 159GZZZQ of the Principal Act is amended:

(a) by omitting “Where” and substituting “Subject to subsection (2), where”;

(b) by adding at the end the following subsection:

“(2) For the purposes of paragraph (1)(b), if a rebatable dividend adjustment arises in relation to the share under subsection 159GZZZMA(4), the amount that the seller is taken to have received or to be entitled to receive, as consideration in respect of the sale of the share, is to be increased by the amount of the rebatable dividend adjustment.”.

Reductions of capital gains where amount otherwise assessable

67. Section 160ZA of the Principal Act is amended:

(a) by omitting from paragraph (4)(b) all the words after “this Part” and substituting “(other than an amount or amounts excluded by subsection (4A));”;

(b) by inserting after subsection (4) the following subsection:

“(4A) The following are excluded from paragraph (4)(b):

(a) in the case of any asset—any amount that has been, or will be, included in the assessable income of the taxpayer under a provision having effect where:

(i) the taxpayer recoups capital expenditure which was incurred in respect of the asset; and

(ii) a deduction has been allowed or is allowable to the taxpayer in respect of the capital expenditure; and

(b) if the asset is a share—the amount of any rebatable dividend adjustment (see section 160ZLA) in relation to the share.”;

(c) by omitting from paragraph (5)(c) all the words after “this Part” and substituting “(other than an amount or amounts excluded by subsection (5A));”;

(d) by inserting after subsection (5) the following subsection:

“(5A) The following are excluded from paragraph (5)(c):

(a) in the case of any asset—any amount that has been, or will be, included in the assessable income of the partnership under a provision having effect where:

(i) the partnership recoups capital expenditure which was incurred in respect of the asset; and

(ii) a deduction has been allowed or is allowable to the partnership in respect of the capital expenditure; and

(b) if the asset is a share—the amount of any rebatable dividend adjustment (see section 160ZLA) in relation to the share.”.

Reduction of amounts for the purposes of reduced cost base

68. Section 160ZK of the Principal Act is amended:

(a) by omitting from subsection (1) “A reference in” and substituting “Subject to subsection (1B), a reference in”;

(b) by inserting after subsection (1A) the following subsection:

“(1B) If the asset is a share, the amount worked out under subsection (1) is to be reduced by any rebatable dividend adjustment that arises in relation to the share (see subsection (5)).”;

(c) by omitting from subsection (3) “A reference in” and substituting “Subject to subsection (3B), a reference in”;

(d) by inserting after subsection (3A) the following subsection:

“(3B) If the asset is a share, the amount worked out under subsection (3) is to be reduced by any rebatable dividend adjustment that arises in relation to the share (see subsection (5)).”;

(e) by adding at the end the following subsections:

“(5) A rebatable dividend adjustment arises in relation to a share (the ‘RDA share’) if:

(a) under an arrangement, a company makes a distribution to the holder of the RDA share; and

(b) an amount (the ‘attributable amount’), being the whole or a part of the distribution, could reasonably be taken to be attributable to profits that were derived by the company before the holder acquired the RDA share; and

(c) the holder of the RDA share is entitled to a rebate of tax (the ‘dividend rebate’) in the holder’s assessment for a year of income under section 46 or 46A in respect of an amount (the ‘dividend amount’) being so much of the distribution as is a dividend; and

(d) the holder of the RDA share is, at any time during the period in which the arrangement is made or carried out, a controller of the company or an associate of a controller of the company.

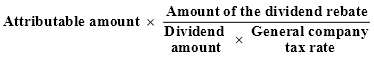

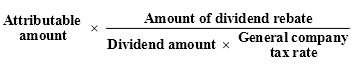

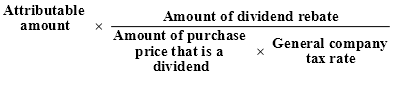

“(6) The amount of a rebatable dividend adjustment arising in relation to the share under subsection (5) is:

“(7) In this section:

‘associate’ has the same meaning as in section 160ZZRN;

‘controller’ has the same meaning as in section 160ZZRN.”.

Return of capital on shares

69. Section 160ZL of the Principal Act is amended by adding at the end the following subsection:

“(5) For the purposes of this section, a rebatable dividend adjustment that arises in relation to a share (see section 160ZLA) is taken:

(a) to be an amount that is paid by the company to the taxpayer in respect of the share and that is not a dividend; and

(b) to have been paid at the time when the distribution referred to in that section occurred.”.

Insertion of new section

70. After section 160ZL of the Principal Act the following section is inserted:

Meaning of “rebatable dividend adjustment” for purposes of sections 160ZA and 160ZL

“160ZLA.(1) For the purposes of sections 160ZA and 160ZL, a ‘rebatable dividend adjustment’ arises in relation to a share (the ‘RDA share’) if:

(a) under an arrangement:

(i) a company issues one or more shares at a premium; and

(ii) the company makes a distribution or payment to a person in the person’s capacity as holder of the RDA share; and

(iii) the person held a share in the company (whether or not the RDA share) immediately before the issue referred to in subparagraph (i); and

(iv) the distribution or payment is:

(A) for the purposes of section 160ZA—in relation to the disposal of the RDA share (whether by way of consideration for the disposal or otherwise); or

(B) for the purposes of section 160ZL—in connection with a reduction in the capital of the company; or

(C) for the purposes of section 160ZA or 160ZL—a distribution or payment to shareholders of the company by a liquidator in the course of winding-up; and

(b) an amount (the ‘attributable amount’) being the whole or a part of the distribution or payment, is taken by subsection (2) to be paid out of the premiums; and

(c) the holder of the RDA share is entitled to a rebate of tax (the ‘dividend rebate’) in the holder’s assessment for a year of income under section 46 or 46A in respect of an amount (the ‘dividend amount’) being so much of the distribution or payment as is a dividend.

“(2) For the purposes of paragraph (1)(b), so much of the distribution or payment as does not exceed the amount worked out using the following formula is taken to be paid out of the premiums:

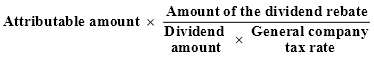

“(3) The amount of the rebatable dividend adjustment arising under subsection (1) in relation to the RDA share is:

“(4) A rebatable dividend adjustment also arises in relation to a share (the ‘RDA share’) if:

(a) under an arrangement:

(i) a company makes a distribution or payment to the person who holds the RDA share; and

(ii) the company has revalued an asset and a profit arose from that revaluation; and

(iii) the distribution or payment is:

(A) for the purposes of section 160ZA—in relation to the disposal of the RDA share (whether by way of consideration for the disposal or otherwise); or

(B) for the purposes of section 160ZL—in connection with a reduction in the capital of the company; or

(C) for the purposes of section 160ZA or 160ZL—a distribution or payment to shareholders of the company by a liquidator in the course of winding-up; and

(b) an amount (the ‘attributable amount’), being the whole or a part of the distribution or payment, is taken by subsection (5) to be paid out of profits arising from the revaluation of the asset; and

(c) had the company disposed of the asset immediately after the revaluation, one or more of the following subparagraphs would have applied:

(i) any profit that would have arisen on the disposal of the asset would, in whole or in part, have been included in the assessable income of the company;

(ii) any loss that would have arisen from the disposal of the asset would, in whole or in part, have been allowable as a deduction to the company;

(iii) Part IIIA would, or would but for Division 17 of that Part, have applied in respect of the disposal of the asset; and

(d) the holder of the RDA share is entitled to a rebate of tax (the ‘dividend rebate’) in the holder’s assessment for a year of income under section 46 or 46A in respect of an amount (the ‘dividend amount’) being so much of the distribution or payment as is a dividend.

“(5) For the purposes of paragraph (4)(b), but subject to subsection (6), so much of the distribution or payment as does not exceed the amount worked out using the following formula is taken to be paid out of the profit arising on the revaluation of the asset:

“(6) If a distribution or payment is made under an arrangement covered by both paragraphs (1)(a) and (4)(a), the amount of the distribution or payment that would, apart from this subsection, be taken by subsection (5) to be paid out of the profit arising on the revaluation of the asset under the arrangement does not exceed the amount that remains after deducting from the distribution or payment any part of it that is taken by subsection (2) to be paid out of premiums on shares issued under the arrangement.

“(7) The amount of the rebatable dividend adjustment arising under subsection (4) in relation to the RDA share is:

“(8) In this section:

‘arrangement’ has the same meaning as in section 160ZZRM;

‘general company tax rate’ has the same meaning as in section 160APA.”.

Application

71.(1) The amendments made by sections 64, 65 and 66 apply in relation to purchases after 12 noon, by legal time in the Australian Capital Territory, on 12 January 1994.

(2) The amendments made by sections 67, 69 and 70 apply in relation to distributions or payments to a taxpayer after 12 noon, by legal time in the Australian Capital Territory, on 12 January 1994.

(3) The amendments made by section 68 apply in relation to disposals of shares by a taxpayer on or after 24 March 1994.

Division 5—Amendments relating to foreign investment funds and

foreign life insurance policies

Subdivision A—Holding company exemptions involving insurance, real

property or mixed activities

Object

72. The object of this Subdivision is to provide an exemption from Part XI of the Principal Act for interests in holding companies where certain insurance, real property or mixed activities are carried on by subsidiaries.

Insertion of new section

73. After section 507 of the Principal Act the following section is inserted in Division 5 of Part XI:

Exemption for interest in foreign holding company of foreign life insurance company

Interest in holding company disregarded

“507A.(1) If:

(a) at the end of the notional accounting period of a foreign company (the ‘holding company’), the taxpayer had an interest in the holding company that consisted of shares included in a class of shares that were quoted on the stock market of an approved stock exchange; and

(b) the holding company requirements set out in subsection (2) are satisfied; and

(c) the subsidiary company requirements set out in subsection (3) are satisfied;

the interest is disregarded for the purposes of the application of the operative provision to the taxpayer in relation to the holding company in respect of that notional accounting period.

Holding company requirements

“(2) The holding company requirements are that:

(a) at the end of the notional accounting period, either:

(i) the holding company was included by an approved stock exchange in a class of companies designated by the stock exchange as engaged in the carrying on of life insurance business; or

(ii) the holding company was included by an international sectoral classification system named in regulations made for the purposes of section 499 or, until regulations are so made, by an international sectoral classification system named in Schedule 5, in a class of companies designated by the system as engaged in the carrying on of life insurance business; and

(b) throughout the notional accounting period, or the part of that period in which the taxpayer had the interest in the holding company, as the case may be, shares in the holding company that were included in the class mentioned in paragraph (1)(a) were widely held, and actively traded on a regular basis, on a stock market of an approved stock exchange.

Subsidiary company requirements

“(3) The subsidiary company requirements are that:

(a) throughout the notional accounting period (the ‘interest holding period’), or the part (also the ‘interest holding period’) of that period in which the taxpayer had the interest in the holding company, as the case may be, one or more other foreign companies were wholly-owned subsidiaries of the holding company; and

(b) if there was only one such subsidiary, that subsidiary was:

(i) throughout the interest holding period, authorised under the law of its place of residence to carry on life insurance business; and

(ii) at the test time, principally engaged in the active carrying on of life insurance business; and

(c) if there were 2 or more such subsidiaries:

(i) throughout the interest holding period, at least one subsidiary was authorised under the law of its place of residence to carry on life insurance business; and

(ii) at their test time, the principal activities of all the subsidiaries, considered together, were the active carrying on of life insurance business.

“Test time”

“(4) The ‘test time’ in relation to a subsidiary is:

(a) if the notional accounting period is one in respect of which the accounts of the subsidiary are made out—the end of that period; or

(b) if the notional accounting period is the taxpayer’s year of income—the end of the last period in respect of which the accounts of the subsidiary were made out that ended before the end of that year of income.

Single subsidiary—“principally engaged in active carrying on of life insurance business”

“(5) For the purposes of subparagraph (3)(b)(ii), a subsidiary was principally engaged in the active carrying on of life insurance business at the test time if at that time the gross value of its assets for use in carrying on life insurance business was 50% or more of the gross value of all of its assets. For this purpose, subsections 507(3) to (11) (inclusive) apply in the same way as they apply for the purpose of paragraph 507(2)(b).

More than one subsidiary—“principal activities, considered together, were active carrying on of life insurance business”

“(6) For the purposes of subparagraph (3)(c)(ii), the question whether, at their test time, the principal activities of 2 or more subsidiaries, considered together, were the active carrying on of life insurance business is determined as follows:

(a) first, work out for each subsidiary (including by applying subsections 507(3) to (11) (inclusive) in the same way as they apply for the purpose of paragraph 507(2)(b)):

(i) the gross value, at its test time, of the subsidiary’s assets for use in carrying on life insurance business; and

(ii) the gross value, at its test time, of all of the subsidiary’s assets; and

(b) secondly, work out:

(i) the sum of the gross values in subparagraph (a)(i) for all of the subsidiaries; and

(ii) the sum of the gross values in subparagraph (a)(ii) for all of the subsidiaries; and

(c) thirdly, if the sum in subparagraph (b)(i) is 50% or more of the sum in subparagraph (b)(ii), then, at their test time, the principal activities of all of the subsidiaries, considered together, were the active carrying on of life insurance business.”.

Insertion of new section

74. After section 509 of the Principal Act the following section is inserted in Division 6 of Part XI:

Exemption for interest in foreign holding company of foreign general insurance company

Interest in holding company disregarded

“509A.(1) If:

(a) at the end of the notional accounting period of a foreign company (the ‘holding company’), the taxpayer had an interest in the holding company that consisted of shares included in a class of shares that were quoted on the stock market of an approved stock exchange; and

(b) the holding company requirements set out in subsection (2) are satisfied; and

(c) the subsidiary company requirements set out in subsection (3) are satisfied;

the interest is disregarded for the purposes of the application of the operative provision to the taxpayer in relation to the holding company in respect of that notional accounting period.

Holding company requirements

“(2) The holding company requirements are that:

(a) at the end of the notional accounting period, either:

(i) the holding company was included by an approved stock exchange in a class of companies designated by the stock exchange as engaged in the carrying on of general insurance business; or