An Act relating to rehabilitation and workers’ compensation for seafarers and certain other persons, and for related purposes

Part 1—Preliminary

Division 1—Short title and commencement

1 Short title

This Act may be cited as the Seafarers Rehabilitation and Compensation Act 1992.

2 Commencement

(1) Sections 1, 2 and 3 and Part 8 commence on the day on which this Act receives the Royal Assent.

(2) Subject to subsection (3), the remaining provisions of this Act commence on a day or days to be fixed by Proclamation.

(3) If a provision referred to in subsection (2) does not commence within the period of 6 months beginning on the day on which this Act receives the Royal Assent, it commences on the first day after the end of that period.

Division 2—Definitions

3 General definitions

In this Act, unless the contrary intention appears:

AAT means the Administrative Appeals Tribunal.

adoption means adoption under a law of a State or Territory or of a foreign country.

aggravation includes acceleration or recurrence.

ailment means any physical or mental ailment, disorder, defect or morbid condition (whether of sudden onset or gradual development).

appointed member means a member referred to in paragraph 109(a), (b), (c) or (d).

approved Guide means:

(a) the document, prepared by the Authority in accordance with section 42 under the title ‘Guide to the Assessment of the Degree of Permanent Impairment’, that has been approved by the Minister and is for the time being in force; and

(b) if an instrument varying the document has been approved by the Minister—that document as so varied.

approved industry training course means an industry training course approved in writing by the Authority for the purposes of this definition.

approved program provider has the meaning given by section 48.

attendant care services, in relation to an employee, means services (other than household services, medical or surgical services or nursing care) required for the essential and regular personal care of the employee.

Australian General Shipping Register has the same meaning as in the Shipping Registration Act 1981.

Australian International Shipping Register has the same meaning as in the Shipping Registration Act 1981.

Australian Maritime Safety Authority means the Australian Maritime Safety Authority established by the Australian Maritime Safety Authority Act 1990.

authorised insurer means a general insurer or Lloyd’s underwriter under the Insurance Act 1973 or an insurer that carries on State insurance (whether or not the State insurance extends beyond the limits of the State concerned).

Authority means the Seafarers Safety, Rehabilitation and Compensation Authority established by section 103.

catastrophic injury means an injury, where the conditions specified in the legislative rules are satisfied.

Chairperson means the Chairperson of the Authority.

child: without limiting who is a child of a person for the purposes of this Act, someone is the child of a person if he or she is a child of the person within the meaning of the Family Law Act 1975.

claim means a claim under Part 5.

claimant, in relation to a time after the death of a claimant, means the claimant’s legal personal representative.

coastal trading has the same meaning as in the Coastal Trading (Revitalising Australian Shipping) Act 2012.

Comcare has the same meaning as in the Safety, Rehabilitation and Compensation Act 1988.

Comcare officer means a person referred to in subsection 88(1) of the Safety, Rehabilitation and Compensation Act 1988.

company trainee means a person (other than an industry trainee) who:

(a) although ordinarily employed or engaged as a seafarer, is not so employed or engaged but is undergoing a training course as required by his or her employer; or

(b) is undergoing a training course as required by his or her employer before becoming a seafarer.

compensation leave means any period during which an employee is absent from his or her employment due to an incapacity for work resulting from an injury in respect of which compensation is payable under section 31 or 37.

damages includes any amount paid under a compromise or settlement of a claim for damages, whether or not legal proceedings have been instituted, but does not include an amount paid in respect of costs incurred in connection with legal proceedings.

de facto partner of a person has the meaning given by the Acts Interpretation Act 1901.

default event, in relation to an employer, happens when:

(a) the employer:

(i) becomes bankrupt or insolvent; or

(ii) applies to take the benefit of any law for the relief of insolvents; or

(iii) compounds with the employer’s creditors for their benefit; or

(iv) if the employer is a body corporate—is being wound‑up; or

(v) if the employer is a body corporate—ceases to exist; or

(vi) no longer engages in trade or commerce in Australia; and

(b) the employer is unable to meet the employer’s liabilities under this Act.

dependant, in relation to a deceased employee, means a person:

(a) who is the spouse of the employee; or

(b) who is the parent, step‑parent, father‑in‑law, mother‑in‑law, grandparent, child, stepchild, grandchild, sibling or half‑sibling of the employee; or

(c) in relation to whom the employee stood in the position of a parent or who stood in the position of a parent to the employee;

being a person who was wholly or partly dependent on the employee at the date of the employee’s death.

Note: see also section 16.

dependent means dependent for economic support.

disease means:

(a) any ailment suffered by an employee; or

(b) the aggravation of any such ailment;

being an ailment or an aggravation that was contributed to in a material degree by the employee’s employment.

emergency licence has the same meaning as in the Coastal Trading (Revitalising Australian Shipping) Act 2012.

employee has the meaning given in section 4.

financial corporation means a financial corporation within the meaning of paragraph 51(xx) of the Constitution.

foreign corporation means a foreign corporation within the meaning of paragraph 51(xx) of the Constitution and includes a body that is incorporated in an external Territory.

Fund has the meaning given in section 96.

general licence has the same meaning as in the Coastal Trading (Revitalising Australian Shipping) Act 2012.

Government ship means a ship:

(a) that belongs to the Commonwealth or a State or Territory; or

(b) the beneficial interest in which is vested in the Commonwealth or a State or Territory; or

(c) that is for the time being demised or sub‑demised to, or in the exclusive possession of, the Commonwealth or a State or Territory;

and includes a ship that belongs to an arm of the Defence Force, but does not include a ship:

(d) that belongs to a trading corporation that is an authority or agency of the Commonwealth or of a State or a Territory; or

(e) the beneficial interest in which is vested in such a trading corporation; or

(f) that is for the time being demised or sub‑demised to, or in the exclusive possession of, such a trading corporation; or

(g) that is operated by seafarers supplied (directly or indirectly) by a corporation under a contract with the Commonwealth or a State or Territory.

household services, in relation to an employee, means services of a domestic nature (including cooking, house cleaning, laundry and gardening services) required for the proper running and maintenance of the employee’s household.

impairment means the loss, the loss of the use, or the damage or malfunction, of any part of the body or of the whole or part of any bodily system or function.

individual industrial agreement means an industrial agreement that applies to only one employee.

industrial instrument:

(a) includes an industrial award, determination or agreement; but

(b) does not include an individual industrial agreement.

industry trainee means a person (other than a company trainee) who:

(a) although ordinarily employed or engaged as a seafarer, is not so employed or engaged but is undergoing an approved industry training course; or

(b) is undergoing an approved industry training course before becoming a seafarer.

injury means:

(a) a disease; or

(b) an injury (other than a disease) suffered by an employee, being a physical or mental injury arising out of, or in the course of, the employee’s employment; or

(c) an aggravation of a physical or mental injury (other than a disease) suffered by an employee (whether or not that injury arose out of, or in the course of, the employee’s employment), being an aggravation that arose out of, or in the course of, that employment;

but does not include anything suffered by an employee as a result of reasonable disciplinary action taken against the employee, or failure by the employee to obtain a promotion, transfer or benefit in connection with his or her employment.

journey, in relation to a journey to which subsection 28(6), 49(6A), 50(2A), 66(4) or 83A(3) applies, includes part of that journey.

legislative rules means rules made under section 144.

loss, in relation to property used by an employee, includes destruction.

medical treatment means:

(a) medical or surgical treatment by, or under the supervision of, a legally qualified medical practitioner; or

(b) therapeutic treatment obtained at the direction of a legally qualified medical practitioner; or

(c) dental treatment by, or under the supervision of, a legally qualified dentist; or

(d) therapeutic treatment by, or under the supervision of, a physiotherapist, osteopath, masseur or chiropractor registered as such under the law of a State or Territory; or

(e) an examination, test or analysis carried out at the request or direction of a legally qualified medical practitioner or dentist, and the provision of a report in respect of it; or

(f) the supply, replacement or repair of an artificial limb or other artificial substitute or of a medical, surgical or other similar aid or appliance; or

(g) treatment and maintenance as a patient at a hospital; or

(h) nursing care, and the provision of medicines, medical and surgical supplies and curative apparatus, whether in a hospital or not.

member means a member of the Authority.

National Employment Standards has the same meaning as in the Fair Work Act 2009.

non‑economic loss, in relation to an employee who has suffered an injury resulting in a permanent impairment, means loss or damage of a non‑economic kind suffered by the employee (including pain and suffering, a loss of expectation of life or a loss of the amenities or enjoyment of life) as a result of that injury or impairment and of which the employee is aware.

normal weekly earnings means the normal weekly earnings of an employee worked out under section 13.

parent: without limiting who is a parent of a person for the purposes of this Act, someone is the parent of a person if the person is his or her child because of the definition of child in this section.

permanent means likely to continue indefinitely.

place of residence, in relation to an employee, means:

(a) the place in Australia where the employee normally resides; or

(b) a place in Australia, other than the place mentioned in paragraph (a), where the employee resides temporarily, as a matter of necessity or convenience, for the purposes of his or her employment; or

(c) any other place in Australia where the employee stays, or intends to stay, overnight, if a journey to it from the employee’s place of work does not substantially increase the risk of sustaining an injury when compared with the journey from his or her place of work to the place referred to in paragraph (a) or (b).

place of work, in relation to an employee, means any place at which the employee is required to attend for the purpose of carrying out the duties of his or her employment and:

(a) if the employee is a seafarer—includes the prescribed ship on which the seafarer is employed or engaged; and

(b) if the employee is a trainee—includes a ship on which the trainee is required to train as part of an approved industry training course.

prescribed child means:

(a) a person under 16; or

(b) a person who:

(i) is 16 or over but under 25; and

(ii) is receiving full‑time education at a school, college, university or other educational institution; and

(iii) is not ordinarily in employment or engaged in work on his or her own account.

prescribed person, in relation to an employee, means:

(a) the spouse of the employee; or

(b) any of the following who is 16 or over:

(i) the parent, step‑parent, father‑in‑law, mother‑in‑law, grandparent, child, stepchild, grandchild, sibling or half‑sibling of the employee;

(ii) a person in relation to whom the employee stands in the position of a parent or who stands in the position of a parent to the employee;

(iii) a person (other than the spouse of the employee or a person referred to in subparagraph (i) or (ii)) who is wholly or mainly dependent on the employee and has the care of a prescribed child who is wholly or mainly dependent on the employee.

Note: see also sections 16 and 17.

prescribed ship means a ship that:

(a) is either:

(i) a ship to which Part II of the Navigation Act 1912 would apply if that Act had not been repealed; or

(ii) a ship that is declared under subsection 3A(1) to be a prescribed ship; and

(b) is neither a Government ship nor a ship declared under subsection 3A(2) not to be a prescribed ship.

property used by an employee means an artificial limb or other artificial substitute, or a medical, surgical or other similar aid or appliance, used by the employee.

rehabilitation program includes medical, dental, psychiatric and hospital services (whether on an in‑patient or out‑patient basis), physical training and exercise, physiotherapy, occupational therapy and vocational training.

seafarer means a seafarer, as defined in the Navigation Act 2012, who is employed in any capacity on a prescribed ship, on the business of the ship.

seafarer berth means a berth on a prescribed ship that is normally used by a seafarer to whose employment this Act applies.

Note: Section 19 deals with the application of this Act.

spouse includes:

(a) in relation to an employee or a deceased employee—a person who is, or immediately before the employee’s death was, a de facto partner of the employee; and

(b) in relation to an employee or a deceased employee who is or was a member of the Aboriginal race of Australia or a descendant of indigenous inhabitants of the Torres Strait Islands—a person who is or was recognised as the employee’s husband or wife by the custom prevailing in the tribe or group to which the employee belongs or belonged.

stepchild: without limiting who is a stepchild of a person for the purposes of this Act, someone who is a child of a de facto partner of the person is the stepchild of the person if he or she would be the person’s stepchild except that the person is not legally married to the partner.

step‑parent: without limiting who is a step‑parent of a person for the purposes of this Act, someone who is a de facto partner of a parent of the person is the step‑parent of the person if he or she would be the person’s step‑parent except that he or she is not legally married to the person’s parent.

suitable employment, in relation to an employee who has suffered an injury in respect of which compensation is payable under this Act, means any employment (including self‑employment) for which the employee is suited having regard to:

(a) the employee’s age, experience, training, language and other skills; and

(b) the employee’s suitability for rehabilitation or vocational retraining; and

(c) if employment is available in a place that would require the employee to change his or her place of residence—whether it is reasonable to expect the employee to change his or her place of residence; and

(d) any other relevant matter.

superannuation amount, in relation to a pension received by an employee in respect of a week, or a lump sum benefit received by an employee, being a pension or benefit under a superannuation scheme, means an amount equal to:

(a) if the scheme identifies a part of the pension or lump sum as attributable to the contributions made under the scheme by the employee’s employer or any former employer—the amount of that part; or

(b) in any other case—the amount assessed by the person administering the superannuation scheme to be the part of the pension or lump sum that is so attributable.

superannuation scheme means any superannuation scheme or superannuation fund under which an employer makes contributions on behalf of his or her employees.

therapeutic treatment includes:

(a) an examination, test or analysis done for the purpose of diagnosing an injury; and

(b) treatment given for the purpose of alleviating an injury.

trading corporation means a trading corporation within the meaning of paragraph 51(xx) of the Constitution.

trainee means:

(a) a company trainee; or

(b) an industry trainee.

3A Declarations that a ship is or is not a prescribed ship

(1) The Minister may by legislative instrument declare a ship to be a prescribed ship.

(2) The Minister may by legislative instrument declare a ship not to be a prescribed ship.

4 Employees

(1) In this Act, unless the contrary intention appears:

employee means:

(a) a seafarer; or

(b) a trainee; or

(c) a person (other than a trainee) who, although ordinarily employed or engaged as a seafarer, is not so employed or engaged but is required under an award to attend at a Seafarers Engagement Centre for the purpose of registering availability for employment or engagement on a prescribed ship.

(2) For the purposes of this Act, an industry trainee or a person mentioned in paragraph (c) of the definition of employee is taken to be employed by the Fund until he or she next becomes a seafarer, and his or her employment is taken to be constituted by his or her attendance:

(a) in the case of an industry trainee—at an approved industry training course; and

(b) in the case of a person mentioned in paragraph (c) of the definition of employee—at a Seafarers Engagement Centre for the purpose of registering availability for employment or engagement on a prescribed ship.

(3) If a default event occurs in relation to the employer of a seafarer or of a company trainee, then, for the purposes of this Act, the seafarer or company trainee is taken to be employed by the Fund.

(4) If a provision of this Act applies to an employee after an employer has incurred a liability in relation to the employee under this Act, then, unless the contrary intention appears, a reference in that provision to an employee includes a reference to that person even after he or she ceases to be an employee.

(5) To avoid doubt, a reference in this Act to the employment of an employee is a reference to:

(a) if the employee is a trainee—the employee’s performance of the role of a trainee; or

(b) if the employee is a person of a kind referred to in paragraph (1)(c)—the employee’s performance of the role of a person of that kind.

5 Employees lost at sea

(1) In a claim for compensation under section 29, if it is established that a prescribed ship has not been heard of for at least 3 months, the ship is taken to have been lost with all on board immediately after the ship was last heard of.

(2) A copy of:

(a) an agreement; or

(b) a list of the employees on a prescribed ship; or

(c) another document showing changes in the employees on a prescribed ship;

which has been prepared for a legal purpose is, in the absence of proof to the contrary, sufficient proof that the employees named in the document were on board the prescribed ship at the time of the loss.

6 Injuries suffered by employees

A reference in this Act to an injury suffered by an employee is, unless the contrary intention appears, a reference to an injury suffered by the employee for which compensation is payable under this Act.

7 Injuries etc. resulting from medical treatment

For the purposes of this Act, an injury or ailment suffered by an employee as a result of medical treatment of an injury is taken to be an injury if, but only if:

(a) compensation is payable under this Act for the injury that was treated; and

(b) it was reasonable for the employee to have obtained that treatment in the circumstances.

8 Incapacity for work

A reference in this Act to an incapacity for work is a reference to an incapacity suffered by an employee as a result of an injury, being:

(a) an incapacity to engage in any work; or

(b) an incapacity to engage in work as an employee at the same rank or level at which he or she was engaged immediately before the injury happened.

9 Injury arising out of, or in the course of, employment

(1) This section does not limit the circumstances in which an injury to an employee may be treated as having arisen out of, or in the course of, his or her employment.

(2) An injury is also to be treated as having so arisen, for the purposes of this Act, if it happened:

(a) as a result of an act of violence that would not have occurred apart from the employment, or the performance by the employee of the duties or functions of his or her employment; or

(b) if the employee is a seafarer:

(i) while the employee was on board the prescribed ship on which he or she was employed or engaged; or

(ii) while the employee was temporarily absent from that ship during an ordinary recess in that employment and not at his or her place of residence; or

(c) if the employee is a trainee—while the trainee was undergoing a required course of training, or was in any other place (other than his or her place of residence) during an ordinary recess in that course of training; or

(d) if the employee is a person mentioned in paragraph (c) of the definition of employee in subsection 4(1)—while the employee was attending at a Seafarers Engagement Centre for the purpose of registering availability for employment or engagement on a prescribed ship; or

(e) while the employee:

(i) was travelling between his or her place of residence and place of work; or

(ii) was travelling between his or her place of residence and a place where he or she resides temporarily, as a matter of necessity or convenience for the purposes of his or her employment; or

(iii) was travelling between his or her place of residence and a Seafarers Engagement Centre for the purpose of registering availability for employment or engagement on a prescribed ship; or

(iv) was travelling between one of his or her places of work and another of his or her places of work; or

(v) was travelling between his or her place of work or place of residence and a place where a required course of training was being conducted; or

(vi) was travelling between his or her place of work or place of residence and any other place for the purpose of:

(A) obtaining a medical certificate for the purposes of this Act; or

(B) receiving medical treatment for an injury; or

(C) undergoing a rehabilitation program provided under this Act; or

(D) receiving a payment of compensation under this Act; or

(E) undergoing a medical examination or rehabilitation assessment in accordance with a requirement made under this Act; or

(F) receiving money due under the terms of his or her employment, being money that, under the terms of that employment or any agreement or arrangement between the employee and his or her employer, was available, or reasonably expected by the employee to be available, for collection at that place; or

(vii) was at a place for a purpose referred to in subparagraph (vi).

(2A) For the purposes of this section:

(a) a journey from a place of residence is taken to start at the boundary of the land where the place of residence is situated; and

(b) a journey to a place of residence is taken to end at that boundary.

(2B) If an employee owns or occupies a parcel of land contiguous with the land on which the employee’s residence is situated, the boundary referred to in subsection (2A) is the external boundary of all of the contiguous parcels of land if treated as a single parcel.

(3) Subparagraph (2)(e)(i), (ii), (iii), (iv), (v) or (vi) does not apply if the travel:

(a) was by a route that substantially increased the risk of sustaining an injury when compared with a more direct route; or

(b) was interrupted in a way that substantially increased the risk of sustaining an injury.

(4) Subsection (2) does not apply if an employee is injured:

(a) while at a place referred to in that subsection; or

(b) during an ordinary recess in his or her employment;

because he or she voluntarily and unreasonably submitted to an abnormal risk of injury.

(5) In this section:

required course of training means:

(a) in relation to a company trainee—a training course that the trainee was required by the employer to undergo; or

(b) in relation to an industry trainee—an approved industry training course.

10 Provisions relating to diseases

(1) If:

(a) an employee has suffered, or is suffering, from a disease, or the death of an employee results from a disease; and

(b) the disease is of a kind specified by the Minister, by legislative instrument, as a disease related to employment of a kind specified in the instrument; and

(c) the employee was, at any time before symptoms of the disease first became apparent, engaged in employment of that kind in the maritime industry;

the employment in which the employee was so engaged is taken, for the purposes of this Act, to have contributed in a material degree to the contraction of the disease, unless the contrary is established.

(2) For the purposes of this Act, if an employee contracts a disease, any employment in the maritime industry in which he or she was engaged at any time before symptoms of the disease first became apparent is taken, unless the contrary is established, to have contributed in a material degree to the contraction of the disease if the incidence of the disease among people who have engaged in such employment is significantly greater than it is among people who have engaged in other employment.

(3) For the purposes of this Act, if an employee suffers an aggravation of a disease, any employment in the maritime industry in which he or she was engaged at any time before symptoms of the aggravation first became apparent is taken, unless the contrary is established, to have contributed in a material degree to the aggravation if the incidence of the aggravation of the disease among people suffering from it who have engaged in such employment is significantly greater than it is among people suffering from the disease who have engaged in other employment.

(4) If:

(a) an employee suffers an injury (other than one resulting in a hearing impairment); and

(b) the injury is a disease or an aggravation of a disease;

the employee is taken, for the purposes of this Act, to have suffered the injury on the day when:

(c) the employee first sought medical treatment for the disease or aggravation; or

(d) the disease or aggravation resulted in the death of the employee or first resulted in his or her impairment or incapacity for work;

whichever happens first.

(5) For the purposes of this Act, the death of an employee is taken to have resulted from a disease, or an aggravation of a disease, if, apart from that disease or aggravation, as the case may be, the death of the employee would have happened at a significantly later time.

(6) For the purposes of this Act, an incapacity for work, or an impairment, of an employee is taken to have resulted from a disease, or an aggravation of a disease, if, apart from that disease or aggravation, as the case may be:

(a) the incapacity or impairment would not have occurred; or

(b) the incapacity would have started, or the impairment would have happened, at a significantly later time; or

(c) the extent of the incapacity or impairment would have been significantly less.

(7) For the purposes of this Act, a disease suffered by an employee, or an aggravation of such a disease, is not taken to be an injury to the employee if the employee has at any time, for purposes connected with his or her employment or proposed employment in the maritime industry, made a wilful and false representation that he or she did not suffer, or had not previously suffered, from that disease.

11 Hearing impairment—time when suffered

If an employee suffers a hearing impairment as a result of an injury, the employee is taken, for the purposes of this Act, to suffer the injury on the day on which the employee gives a notice of the injury under section 62.

12 Serious and wilful misconduct

For the purposes of this Act, an employee who is under the influence of alcohol or a drug (other than a drug prescribed for the employee by a legally qualified medical practitioner or dentist and used by the employee in accordance with that prescription) is taken to have engaged in serious and wilful misconduct.

13 Normal weekly earnings

(1) For the purposes of this Act, if an employee who is a seafarer suffers an injury, the employee’s normal weekly earnings are an amount equal to the amount payable weekly to the employee by way of salary under the contract of employment that applied to his or her employment immediately before the injury happened.

(2) For the purposes of this Act, if an employee who is a trainee suffers an injury, the employee’s normal weekly earnings are an amount equal to the amount that would have been payable weekly to the employee by way of salary under the industrial instrument or National Employment Standards that, apart from the injury, would have applied to his or her employment immediately after the completion of the training course.

(3) For the purposes of this Act, if an employee who is attending a Seafarers Engagement Centre suffers an injury, the employee’s normal weekly earnings are an amount equal to the amount specified in an industrial instrument for the purposes of this subsection.

(4) For the purposes of this Act, if an employee (other than an employee to whom subsection (1), (2) or (3) applies) suffers an injury, the employee’s normal weekly earnings are an amount equal to the amount that was payable weekly to the employee by way of salary under the contract of employment that applied to his or her employment immediately before the injury happened.

(5) If the amount per week payable to an employee in respect of his or her employment before the injury is increased, or would have been increased, because of the operation of an industrial instrument, the National Employment Standards or a contract of employment if the employee had continued in that employment, because the employee:

(a) reaches a particular age; or

(b) completes a particular period of service; or

(c) receives an increase in salary, by way of an increment in a range of salary that applies to the employee;

the normal weekly earnings of the employee before the injury, as worked out under the preceding subsections, must be increased by the same percentage as that by which that amount per week is increased or would have been increased, as the case may be.

(6) If the amount per week payable to employees in a class to which the employee belonged when the injury happened is later increased or reduced as a result of:

(a) the operation of a law of the Commonwealth, or of a State or Territory; or

(b) the making, alteration or operation of an industrial instrument or the National Employment Standards, or the doing of any other act or thing under such a law;

the normal weekly earnings of the employee before the injury, as worked out under the preceding subsections, must be increased or reduced by the same percentage as that by which that amount per week was so increased or reduced, as the case may be.

14 Recovery of damages

For the purposes of this Act, damages are taken to have been recovered by an employee, or by or for the benefit of a dependant of a deceased employee, when the amount of the damages was paid to, or for the benefit of, the employee or dependant, as the case may be.

15 Persons who are wholly or partly dependent

(1) For the purposes of this Act, a person is taken to have been wholly or partly dependent on an employee at the date of the employee’s death if the person would have been so dependent apart from an incapacity of the employee that resulted from an injury.

(2) For the purposes of this Act, a person who, immediately before the date of an employee’s death, lived with the employee and was:

(a) the employee’s spouse; or

(b) a prescribed child of the employee;

is taken to be a person who was wholly dependent on the employee at that date.

(3) For the purposes of this Act, other than subsection 29(5), a child of a deceased employee who was born alive after the employee’s death must be treated as if he or she had been born immediately before the employee’s death and was wholly dependent on the employee at the date of the employee’s death.

(4) In determining, for the purposes of this Act, whether a child is or was dependent on an employee, the following are not to be taken into account:

(a) family tax benefit calculated under Part 2 or 3 of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 (an individual’s Part A rate);

(b) an amount of carer allowance under the Social Security Act 1991;

(c) an amount of double orphan pension under the Social Security Act 1991.

16 Certain family relationships

For the purposes of this Act, relationships (including the relationship of being family or being relatives) are taken to include (without limitation):

(a) relationships between de facto partners; and

(b) relationships of child and parent that arise:

(i) if someone is an exnuptial or adoptive child of a person; or

(ii) because of the definitions of child and parent in section 3; and

(c) relationships traced through relationships referred to in paragraphs (a) and (b).

17 Persons caring for prescribed children

For the purposes of the definition of prescribed person in section 3, a person who has the care of a child referred to in subparagraph (b)(iii) of that definition must not be treated as not wholly or mainly maintained by the relevant employee merely because the employee pays the person remuneration for caring for the child.

Division 3—Miscellaneous preliminary provisions

18 Extent of Act

This Act extends to all places outside Australia, including the external Territories.

19 Application of Act

(1) This Act applies to the employment of employees on a prescribed ship that is engaged in trade or commerce:

(a) between Australia and places outside Australia; or

(aa) between 2 places outside Australia; or

(b) among the States; or

(c) within a Territory, between a State and a Territory or between 2 Territories.

Note: This Act does not apply if a prescribed ship is a ship registered in the Australian International Shipping Register, see paragraph 61AA(b) of the Shipping Registration Act 1981.

(1AA) This Act also applies to the employment of employees on:

(a) a vessel that is used to engage in coastal trading under a general licence; or

(b) a vessel that is used to engage in coastal trading under an emergency licence if the vessel is registered in the Australian General Shipping Register.

(1A) This Act also applies to the employment of employees on any prescribed ship that:

(a) would be an off‑shore industry vessel within the meaning of the Navigation Act 1912 if that Act had not been repealed and either:

(i) was, immediately before the repeal of that Act, covered by a declaration in force under subsection 8A(2) of that Act; or

(ii) is covered by a declaration in force under subsection (1C) of this section; or

(b) would be a trading ship within the meaning of the Navigation Act 1912 if that Act had not been repealed and either:

(i) was, immediately before the repeal of that Act, covered by a declaration in force under subsection 8AA(2) of that Act; or

(ii) is covered by a declaration in force under subsection (1C) of this section.

(1B) However, this Act does not apply because of subsection (1A) to a prescribed ship that is covered by a declaration in force under subsection (1D).

(1C) The Authority may declare in writing that this Act applies to a prescribed ship that would be an off‑shore industry vessel, or a trading ship, within the meaning of the Navigation Act 1912 if that Act had not been repealed.

(1D) The Authority may declare in writing that this Act does not apply because of subsection (1A) to a prescribed ship that would be an off‑shore industry vessel, or a trading ship, within the meaning of the Navigation Act 1912 if that Act had not been repealed.

(1E) A declaration made under subsection (1C) or (1D) is not a legislative instrument.

(2) This Act also has the effect it would have if:

(a) a reference to an employer were limited to a reference to a trading corporation formed within the limits of the Commonwealth; and

(b) a reference to an employee were limited to a reference to an employee employed by a trading corporation formed within the limits of the Commonwealth.

(3) This Act also has the effect it would have if:

(a) a reference to an employer were limited to a reference to a financial corporation formed within the limits of the Commonwealth; and

(b) a reference to an employee were limited to a reference to an employee employed by a financial corporation formed within the limits of the Commonwealth.

(4) This Act also has the effect it would have if:

(a) a reference to an employer were limited to a reference to a foreign corporation; and

(b) a reference to an employee were limited to a reference to an employee employed by a foreign corporation.

(5) Subsection (3) does not have the effect of applying this Act with respect to:

(a) State banking that does not extend beyond the limits of the State concerned; or

(b) State insurance that does not so extend.

20 Act not to apply to employees within the meaning of the Safety, Rehabilitation and Compensation Act 1988

Despite any other provision of this Act, this Act does not apply to a person who is an employee within the meaning of the Safety, Rehabilitation and Compensation Act 1988.

20A Act not to apply to exempt employment

(1) The Authority may, in writing, either generally or as otherwise provided in the exemption, exempt the employment on a particular ship of all employees, of a particular group or particular groups of employees, or of a particular employee or particular employees, from the application of:

(a) this Act; and

(b) the Seafarers Rehabilitation and Compensation Levy Act 1992; and

(c) the Seafarers Rehabilitation and Compensation Levy Collection Act 1992.

(2) An exemption is subject to any conditions set out in the exemption.

(3) If an exemption is in force in respect of a ship, those Acts (other than this section) do not apply, to the extent stated in the exemption, in relation to the employment on the ship of employees to whom the exemption applies so long as any conditions of the exemption are complied with.

(4) The Authority must not grant an exemption if the proposed exemption would be inconsistent with an obligation of Australia under an international agreement.

21 Act binds Crown etc.

(1) This Act binds the Crown in right of the Commonwealth.

(2) This Act does not permit the Crown to be prosecuted for an offence.

21A Application of Criminal Code

Chapter 2 of the Criminal Code applies to all offences against this Act.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

22 Amounts of compensation

An amount of compensation payable under a provision of this Act in respect of an injury is, unless the contrary intention appears, in addition to an amount of compensation paid or payable under any other provision of this Act in respect of that injury.

23 Indexation—Consumer Price Index

(1) In this section:

commencing day means the day on which this section commences.

index number, in relation to a quarter, means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of that quarter.

relevant amount means the amount specified in subsection 30(2), 31(9), (10) or (11), 39(9), 41(2), 43(2) or (4) or 44(1).

relevant year means the period of 12 months starting on 1 July 1992, and each later period of 12 months.

(2) Subject to subsection (3), if (whether before, on or after the commencing day) the Australian Statistician has published or publishes an index number in respect of a quarter in substitution for an index number previously published in respect of that quarter, the publication of the later index number must be disregarded for the purposes of this section.

(3) If (whether before, on or after the commencing day) the Australian Statistician has changed or changes the index reference period for the Consumer Price Index, then, for the purposes of the application of this section after the change took place or takes place, regard must only be had to the index number published in terms of the new index reference period.

(4) If the factor worked out under subsection (5) in relation to a relevant year is greater than one, this Act has effect as if for each relevant amount there were substituted, on the first day of that relevant year, an amount worked out by multiplying by that factor:

(a) if, because of one or more other applications of this section, this Act has effect as if another amount or amounts were substituted for the relevant amount—the substituted amount or the last substituted amount; or

(b) in any other case—the relevant amount.

(5) The factor worked out in relation to a relevant year is the number (calculated to 3 decimal places) worked out by dividing the index number of the December quarter immediately before the relevant year by the index number for the December quarter immediately before that first‑mentioned December quarter.

(6) If the factor worked out in relation to a relevant year would, if it were calculated to 4 decimal places, end with a number greater than 4, the factor in relation to that relevant year is taken to be the factor calculated to 3 decimal places in accordance with subsection (5) and increased by 0.001.

23A Indexation—Wage Price Index

Definitions

(1) In this section:

index number, in relation to a quarter, means:

(a) the Wage Price Index (total hourly rates of pay excluding bonuses/all sectors/all Australia/original) number published by the Australian Statistician in respect of that quarter; or

(b) if:

(i) a series of index numbers is prescribed for the purposes of this paragraph; and

(ii) the Australian Statistician publishes an index number in respect of the quarter; and

(iii) that index number belongs to the series;

that index number.

relevant amount means the amount specified in subsection 29(3), (4) or (5).

relevant year means:

(a) the financial year starting on 1 July 2009; or

(b) a later financial year.

Indexation

(2) If the indexation factor for a relevant year is greater than one, this Act has effect as if for each relevant amount there were substituted, on the first day of that relevant year, an amount calculated by multiplying by that factor:

(a) if, because of one or more other applications of this section, this Act has effect as if another amount or amounts were substituted for the relevant amount—the substituted amount or the last substituted amount; or

(b) in any other case—the relevant amount.

Indexation factor

(3) For the purposes of this section, the indexation factor for a relevant year is the number calculated, to 3 decimal places, using the formula:

where:

base December quarter means the last December quarter before the reference December quarter.

reference December quarter means the last December quarter before the relevant year.

(4) If the number calculated under subsection (3) for a relevant year would, if it were calculated to 4 decimal places, end with a number greater than 4, the number so calculated is increased by 0.001.

Other provisions

(5) Subject to subsection (6), if at any time, whether before or after the commencement of this section, the Australian Statistician has published or publishes an index number for a quarter in substitution for an index number previously published for that quarter, the publication of the later index number is to be disregarded for the purposes of this section.

(6) If at any time, whether before or after the commencement of this section, the Australian Statistician has changed or changes the reference base for:

(a) the Wage Price Index; or

(b) another index;

then, for the purposes of the application of this section after the change took place or takes place, regard is to be had only to the index number published in terms of the new reference base.

24 Liability to pay compensation

The liability of an employer to pay compensation to a person under this Act is the liability of the employer to pay the amount or amounts that the employer determines, in accordance with this Act, to be payable to the person.

25 Compensation to be paid in full

Subject to subsection 29(4) and sections 30 to 37 (inclusive), 47, 55, 58 and 139, compensation in respect of an injury must be paid in full by an employer whose employment has made a material contribution to the injury.

Part 2—Compensation

Division 1—Injuries, property loss or damage, medical expenses

26 Compensation for injuries

(1) If an employee suffers an injury that results in his or her death, incapacity for work, or impairment, compensation is payable for the injury.

(2) Compensation is not payable for an intentionally self‑inflicted injury.

(3) Compensation is not payable for an injury that is not intentionally self‑inflicted but is caused by the serious and wilful misconduct of the employee, unless the injury results in death, or serious and permanent impairment.

27 Compensation for property loss or damage

(1) If:

(a) an employee has an accident arising out of, or in the course of, his or her employment; and

(b) the accident does not cause injury to the employee but results in the loss of, or damage to, property used by the employee;

compensation of an amount equal to the expenditure reasonably incurred by the employee in the necessary replacement or repair of the property is payable to the employee.

(2) For the purposes of subsection (1), expenditure incurred by an employee in the necessary replacement or repair of property is taken to include any fees or charges paid or payable by the employee to a legally qualified medical practitioner or dentist, or other qualified person, for a consultation, examination, prescription, or other service reasonably rendered in connection with the replacement or repair.

(3) Compensation is not payable under this section if the loss or damage is caused by the serious and wilful misconduct of the employee.

28 Compensation for medical and related expenses

(1) If an employee:

(a) suffers an injury; and

(b) obtains medical treatment for the injury, being treatment that it was reasonable for the employee to obtain in the circumstances;

compensation is payable for the cost of the medical treatment, of such amount as is appropriate, having regard to the nature of the treatment.

(2) Subsection (1) applies whether or not the injury results in death, incapacity for work, or impairment.

(3) For the purposes of subsection (1), the cost of medical treatment involving the supply, replacement or repair of property used by an employee, is taken to include any fees or charges paid or payable by the employee to a legally qualified medical practitioner or dentist, or other qualified person, for a consultation, examination, prescription or other service reasonably required in connection with that supply, replacement or repair.

(4) An amount of compensation under subsection (1) is payable:

(a) to, or in accordance with the directions of, the employee; or

(b) if the employee dies before the compensation is paid and without having paid the cost referred to in subsection (1) and another person (who is not the legal personal representative of the employee) has paid that cost—to that other person; or

(c) if that cost has not been paid and the employee, or the legal personal representative of the employee, does not claim the compensation—to the person to whom the cost is payable.

(5) If an employer is liable to pay any cost referred to in subsection (1), any amount paid under subsection (4) to the person to whom that cost is payable is, to the extent of the payment, a discharge of the liability of the employer.

(6) Subject to subsection (7), if compensation in respect of the cost of medical treatment is payable under subsection (1), the employer is liable to pay to the employee an amount of compensation in respect of expenditure reasonably incurred by the employee in doing either or both of the following:

(a) making a journey, necessary for the purpose of obtaining the treatment, from the place in Australia where the employee is residing to the place where the treatment is to be obtained;

(b) remaining, for the purpose of obtaining that treatment, at a place to which the employee has made a journey for that purpose.

(6A) The amount of compensation that the employer is liable to pay in respect of the journey is:

(a) in relation to a journey by means of public transport or ambulance services—an amount equal to the expenditure reasonably incurred in undertaking that journey; or

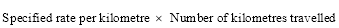

(b) in relation to a journey by means of private motor vehicle—an amount worked out using the formula:

where:

Specified rate per kilometre means such rate per kilometre as the Minister specifies, by legislative instrument, under this paragraph in respect of journeys to which this paragraph applies.

Number of kilometres travelled means the number of whole kilometres that the employer determines to have been the reasonable length of such a journey (including the return part of the journey).

(6AA) If the place where the employee is residing is not the place where the employee normally resides, the amount payable in respect of the journey is not to exceed the amount that would be payable if the journey were made from the place where the employee normally resides.

(6B) The amount of compensation that the employer is liable to pay in respect of the employee remaining at a place for the purpose of obtaining the treatment is an amount equal to the expenditure so reasonably incurred in remaining for that purpose.

(7) Compensation is not payable under subsection (6) unless:

(a) in relation to a journey to which paragraph (6A)(a) applies—the employee’s injury reasonably required the use of public transport or ambulance services (as the case may be) regardless of the distance involved; or

(b) in relation to a journey to which paragraph (6A)(b) applies—the reasonable length of such a journey exceeded 50 kilometres.

(8) The matters to be taken into account in deciding questions arising under subsections (6), (6A), (6AA), (6B) and (7) include:

(a) the place or places where appropriate medical treatment was available to the employee; and

(b) the means of transport available to the employee for the journey; and

(c) the route or routes by which the employee could have travelled; and

(d) the accommodation available to the employee.

(9) If:

(a) an employee suffers an injury; and

(b) a person has reasonably incurred expenditure in connection with the transportation of the employee, or, if the employee has died, of the employee’s body, from the place where the injury was sustained to a hospital or similar place, or to a mortuary; and

(c) an employee, or the legal personal representative of the employee, does not make a claim for compensation for that expenditure;

compensation of an amount equal to that expenditure is payable to the person who incurred the expenditure.

Division 2—Injuries resulting in death

29 Compensation for injuries resulting in death

(1) This section applies if an injury to an employee results in the employee’s death.

(2) Subject to this section and sections 28 and 30, if the employee dies without leaving dependants, compensation is not payable for the injury.

(3) If the employee dies leaving dependants some or all of whom were, at the date of the employee’s death, wholly dependent on the employee:

(a) subject to this section and to sections 28 and 30, compensation of $412,000 is payable for the injury; and

(b) that compensation is payable for the benefit of those dependants.

(4) If the employee dies without leaving dependants who were wholly dependent on the employee at the date of the employee’s death, but leaving dependants who were partly dependent on the employee at that date:

(a) subject to this section and to sections 28 and 30, compensation is payable for the injury of such amount, not exceeding $412,000, as is appropriate, having regard to any losses suffered by those dependants as a result of the cessation of the employee’s earnings; and

(b) that compensation is payable for the benefit of those dependants.

(5) If:

(a) a prescribed child was, at the date of the injury or at the date of the employee’s death, wholly or mainly dependent on the employee; or

(b) a prescribed child, being a child of the employee, was born after the employee’s death; or

(c) a prescribed child would, if the employee had not died, have been wholly or mainly dependent on the employee;

compensation is payable at the rate of $113.30 per week and that compensation is payable to, or in accordance with the directions of:

(d) if the prescribed child is 18 or over—the child; or

(e) if the prescribed child is under 18—the Authority for the benefit of the child;

from the date of the employee’s death or the date of the birth of the child, whichever is later.

(6) Compensation is not payable under subsection (5) in respect of:

(a) any period during which the child is not a prescribed child; and

(b) in the case of a child referred to in paragraph (5)(c)—any period during which, if the employee had not died, the child would not have been wholly or mainly dependent upon the employee.

(7) An amount of compensation paid or payable under this Act before the death of an employee:

(a) is not affected by subsection (2); and

(b) must not be deducted from the compensation payable under subsection (3); and

(c) must not be taken into account in determining the compensation payable under subsection (4).

(8) If an amount of compensation is payable under subsection (3) or (4) for the benefit of 2 or more dependants of the deceased employee, the employer must determine the shares of those dependants in that amount as it thinks fit, having regard to any losses suffered by those dependants as a result of the cessation of the employee’s earnings.

(9) A reference in this section to a dependant of a deceased employee is a reference to a dependant by or on behalf of whom a claim is made for compensation under this section.

(10) If claims for compensation under subsection (3) or (4) are made by or on behalf of 2 or more dependants of a deceased employee, the employer must make one determination in respect of those claims.

30 Compensation in respect of funeral expenses

(1) If an injury to an employee results in death, compensation is payable for the cost of the employee’s funeral to the person who paid the cost of the funeral or, if that cost has not been paid, to the person who carried out the funeral.

(2) The amount of compensation is such amount, not exceeding $3,500, as the employer determines is reasonable, having regard to:

(a) the charges ordinarily made for funerals in the place where the funeral was carried out; and

(b) any amount paid or payable in respect of the cost of the funeral under any other law of the Commonwealth.

(3) If an employer is liable to pay the cost of the funeral of an employee, any amount paid under this section to the person who carried out the funeral is, to the extent of the payment, a discharge of the liability of the employer.

Division 3—Injuries resulting in incapacity for work

31 Compensation for injuries resulting in incapacity

(1) This section applies to an employee who is incapacitated for work as a result of an injury, other than an employee to whom section 33, 34, 35, 36 or 37 applies.

(2) Subject to subsection (3) and this Part (other than this section), compensation for the injury is payable to the employee, for each of the first 45 weeks (whether consecutive or otherwise) during which the employee is incapacitated, of an amount worked out using the formula:

where:

Normal weekly earnings means the amount of the employee’s normal weekly earnings.

Earnings in suitable employment means the amount per week (if any) that the employee is able to earn in suitable employment.

(3) If the employee is a seafarer, the compensation payable under subsection (2) is payable for each of the first 45 weeks (whether consecutive or otherwise) after the date on which the seafarer is left on shore at, or returned to, his or her home port (as defined in the Navigation Act 2012).

(4) Subject to this Part (other than this section), compensation for the injury is payable to the employee, for each week during which the employee is incapacitated, being a week to which subsection (2) does not apply.

(5) The amount of compensation per week payable under subsection (4) to an employee is:

(a) if the employee is not employed during that week—an amount equal to 75% of his or her normal weekly earnings less the amount (if any) that he or she was able to earn during that week in suitable employment; or

(b) if the employee is employed for 25% or less of his or her normal weekly hours during that week—an amount that, when added to the amount that he or she was able to earn during that week in suitable employment, results in an amount equal to 80% of his or her normal weekly earnings; or

(c) if the employee is employed for more than 25% but not more than 50% of his or her normal weekly hours during that week—an amount that, when added to the amount that he or she was able to earn during that week in suitable employment, results in an amount equal to 85% of his or her normal weekly earnings; or

(d) if the employee is employed for more than 50% but not more than 75% of his or her normal weekly hours during that week—an amount that, when added to the amount that he or she was able to earn during that week in suitable employment, results in an amount equal to 90% of his or her normal weekly earnings; or

(e) if the employee is employed for more than 75% but less than 100% of his or her normal weekly hours during that week—an amount that, when added to the amount that he or she was able to earn during that week in suitable employment, results in an amount equal to 95% of his or her normal weekly earnings; or

(f) if the employee is employed for 100% of his or her normal weekly hours during that week—an amount that, when added to the amount that he or she was able to earn during that week in suitable employment, results in an amount equal to 100% of his or her normal weekly earnings.

(6) If:

(a) compensation is payable under subsection (4) to an employee for a week; and

(b) the employee is employed or engaged during the whole or any part of that week as a seafarer;

subsection (5) applies in relation to the employee as if he or she were covered by paragraph (5)(f).

(7) If an amount of compensation worked out under subsection (5) is more than 150% of the amount called the Average Weekly Ordinary Time Earnings of Fulltime Adults, as published from time to time by the Australian Statistician, the amount so worked out must be reduced by an amount equal to the excess.

(8) If an amount of compensation worked out under paragraph (5)(a) is less than the minimum earnings of the employee, the amount so worked out must be increased by an amount equal to the difference between that amount and the minimum earnings.

(9) For the purposes of subsection (8), the minimum earnings of an employee are taken to be:

(a) $254.46, or, if subsection (10) or (11) applies to the employee, the sum of $254.46 and the amount or amounts required to be added under whichever of those subsections applies; or

(b) an amount equal to 90% of the employee’s normal weekly earnings;

whichever is less.

(10) If there are one or more prescribed persons wholly or mainly dependent on the employee, the amount of $62.99 must be added to the amount of $254.46 specified in paragraph (9)(a).

(11) If there are one or more prescribed children (whether born before, on or after the date of the injury) wholly or mainly dependent on the employee, the amount of $31.50 for each of those children must be added to the amount of $254.46 specified in paragraph (9)(a), but an amount must not be so added for a child in relation to any period before the date of birth of that child.

(12) If a prescribed child is:

(a) a prescribed person in relation to the employee; and

(b) the only prescribed person who is wholly or mainly dependent on the employee;

subsection (11) does not apply to the child.

(13) If 2 or more prescribed children are each:

(a) a prescribed person in relation to the employee; and

(b) wholly or mainly dependent on the employee;

subsection (10) applies to one of those children and subsection (11) applies to the rest.

(14) For the purposes of this section the normal weekly hours of an employee who is not employed on a ship are:

(a) if the industrial instrument or National Employment Standards that apply to the employee specifies the normal weekly hours of an employee—those hours; or

(b) in any other case—38 hours.

32 Determination of suitable employment

An employer who determines, for the purposes of section 31, the amount per week that an employee is able to earn in suitable employment must have regard to the following:

(a) if the employee is in employment—the amount per week that the employee is earning in that employment;

(b) if, after becoming incapacitated for work, the employee received an offer of suitable employment and did not accept that offer—the amount per week that the employee would be earning in that employment if he or she were engaged in that employment;

(c) if, after becoming incapacitated for work, the employee received an offer of suitable employment and, having accepted that offer, did not engage, or continue to engage, in that employment—the amount per week that the employee would be earning in that employment if he or she were engaged in that employment;

(d) if, after becoming incapacitated for work, the employee received an offer of suitable employment on condition that the employee completed a reasonable rehabilitation or vocational retraining program and the employee did not fulfil that condition—the amount per week that the employee would be earning in that employment if he or she were engaged in that employment;

(e) if, after becoming incapacitated for work, the employee has not sought suitable employment—the amount per week that, having regard to the state of the labour‑market at the relevant time, the employee could reasonably be expected to earn in such employment if he or she were engaged in such employment;

(f) if paragraph (b), (c), (d) or (e) applies to the employee—whether the employee’s failure to accept an offer of employment, to engage, or to continue to engage, in employment, to undertake, or to complete, a rehabilitation or vocational retraining program or to seek employment, as the case may be, was, in the opinion of the employer, reasonable in all the circumstances;

(g) any other matter that the employer considers relevant.

33 Compensation for injuries resulting in incapacity where employee is in receipt of a superannuation pension

(1) This section applies to an employee who:

(a) is incapacitated for work as a result of an injury; and

(b) retires (whether voluntarily or otherwise) from his or her employment at any time after the commencement of this section; and

(c) as a result of the retirement, receives a pension under a superannuation scheme.

(2) Compensation is payable to the employee for the injury under this section for each week after the date of the retirement during which the employee is incapacitated.

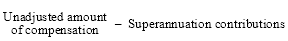

(3) The amount of compensation is an amount worked out using the formula:

where:

Unadjusted amount of compensation means the amount of compensation that would have been payable to the employee for a week if:

(a) section 31, other than subsection 31(8), had applied to the employee; and

(b) the week were a week referred to in subsection 31(4).

Superannuation amount means the superannuation amount received by the employee that week under a superannuation scheme.

Superannuation contributions means the amount of superannuation contributions that would have been required to be paid by the employee in that week if he or she were still contributing to the superannuation scheme.

34 Compensation for injuries resulting in incapacity where employee is in receipt of a lump sum benefit

(1) This section applies to an employee who:

(a) is incapacitated for work as a result of an injury; and

(b) retires (whether voluntarily or otherwise) from his or her employment at any time after the commencement of this section; and

(c) as a result of the retirement, receives a lump sum benefit under a superannuation scheme; and

(d) has not rolled‑over the lump sum benefit into another superannuation fund or an approved deposit fund.

(2) Compensation is payable to the employee for the injury under this section for each week after the date of the retirement during which the employee is incapacitated.

(3) The amount of compensation is an amount worked out using the formula:

where:

Unadjusted amount of compensation means the amount of compensation that would have been payable to the employee for a week if:

(a) section 31, other than subsection 31(8), had applied to the employee; and

(b) the week were a week referred to in subsection 31(4).

Superannuation amount means the superannuation amount received by the employee as a lump sum.

Superannuation contributions means the amount of superannuation contributions that would have been required to be paid by the employee in that week if he or she were still contributing to the superannuation scheme.

(4) In this section:

approved deposit fund has the same meaning as in the Income Tax Assessment Act 1997.

rolled‑over means paid as a roll‑over superannuation benefit (within the meaning of the Income Tax Assessment Act 1997).

superannuation fund has the same meaning as in Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act 1936 (as in force just before the commencement of Schedule 1 to the Superannuation Legislation Amendment (Simplification) Act 2007).

35 Compensation for injuries resulting in incapacity where employee rolled‑over part of a lump sum benefit

(1) This section applies to an employee who:

(a) has been incapacitated for work as a result of an injury; and

(b) retired (whether voluntarily or otherwise) from his or her employment at any time after the commencement of this section; and

(c) as a result of the retirement, receives a lump sum benefit under a superannuation scheme; and

(d) rolled‑over part of the lump sum benefit into a superannuation fund or an approved deposit fund.

(2) Compensation is payable to the employee for the injury under this section for each week after the date of the retirement during which the employee is incapacitated.

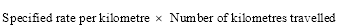

(3) The amount of compensation is an amount worked out using the formula:

where:

Unadjusted amount of compensation means the amount of compensation that would have been payable to the employee for a week if:

(a) section 31, other than subsection 31(8), had applied to the employee; and

(b) the week were a week referred to in subsection 31(4).

Amount not rolled‑over means the amount not rolled‑over or withdrawn from the superannuation fund or approved deposit fund to which the lump sum benefit was rolled‑over.

Lump sum benefit means the amount of the lump sum benefit received by the employee.

Superannuation amount means the superannuation amount received by the employee as a lump sum.

(4) In this section:

approved deposit fund has the same meaning as in section 34.

rolled‑over has the same meaning as in section 34.

superannuation fund has the same meaning as in section 34.

36 Compensation for injuries resulting in incapacity where the employee rolled‑over the whole of a lump sum benefit

(1) This section applies to an employee who:

(a) has been incapacitated for work as a result of an injury; and

(b) retired (whether voluntarily or otherwise) from his or her employment at any time after the commencement of this section; and

(c) as a result of the retirement, receives a lump sum benefit under a superannuation scheme; and

(d) rolled‑over the lump sum benefit into a superannuation fund or an approved deposit fund.

(2) Compensation is payable to the employee for the injury under this section for each week after the date of the retirement during which the employee is incapacitated.

(3) The amount of compensation is an amount worked out using the formula:

where:

Unadjusted amount of compensation means the amount of compensation that would have been payable to the employee for a week if:

(a) section 31, other than subsection 31(8), had applied to the employee; and

(b) the week were a week referred to in subsection 31(4).

Superannuation contributions means the amount of superannuation contributions that would have been required to be paid by the employee in that week if he or she were still contributing to the superannuation scheme.

(4) In this section:

approved deposit fund has the same meaning as in section 34.

rolled‑over has the same meaning as in section 34.

superannuation fund has the same meaning as in section 34.

37 Compensation where employee is maintained in a hospital

(1) If:

(a) as a result of an injury, an employee (other than an employee to whom section 33, 34, 35 or 36 applies) is maintained as a patient in a hospital, nursing home or similar place, and has been so maintained for a continuous period of not less than one year; and

(b) there are no prescribed persons or prescribed children who are dependent on the employee;

compensation is payable to the employee for the injury of the amount, for each week during which the employee is so maintained, determined by the person liable to pay the compensation, having regard to:

(c) the present and probable future needs and expenses of the employee; and

(d) the period during which the employee is likely to be such a patient.

(2) An amount determined under subsection (1) must not be less than one‑half of, nor more than, the amount per week of compensation that would have been payable to the employee under section 31 had that section applied to the employee.

38 Compensation for incapacity not payable in certain cases

(1) If an employee who has not reached 64 suffers an injury, compensation is not payable under this Division for the injury after the person reaches 65.

(2) If an employee who has reached 64 suffers an injury, compensation is not payable under this Division for the injury after the end of the period of 12 months starting on the day on which the injury happened.

(3) Compensation is not payable under section 31, 33, 34, 35 or 36 in respect of any period during which the employee is imprisoned for committing an offence.

(4) Subject to section 45, if a determination is made that an amount of compensation is payable to an employee under section 44 for an injury, compensation is not payable to the employee under section 31, 33, 34, 35 or 36 in respect of a period of incapacity for work resulting from the injury, being a period after the day on which the determination is made.

Division 4—Injuries resulting in permanent impairment

39 Compensation for injuries resulting in permanent impairment

(1) If an injury to an employee results in a permanent impairment, compensation is payable to the employee for the injury.

(2) For the purpose of determining whether an impairment is permanent, the employer must have regard to the following matters:

(a) the duration of the impairment;

(b) the likelihood of improvement in the employee’s condition;

(c) whether the employee has undertaken all reasonable rehabilitative treatment for the impairment;

(d) any other relevant matters.

(3) Subject to this section, the amount of compensation payable to the employee is an amount assessed under subsection (4) by the employer, being an amount that is not more than the maximum amount at the date of the assessment.

(4) The amount assessed must be an amount that is the same percentage of the maximum amount as the percentage determined under subsection (5).

(5) The employer under this section must determine the degree of permanent impairment of the employee resulting from an injury under the provisions of the approved Guide.

(6) The degree of permanent impairment must be expressed as a percentage.

(7) Subject to section 40, where the degree of permanent impairment of the employee, as determined under this section, is less than 10%, an amount of compensation is not payable to the employee under this section.

(8) Subsection (7) does not apply to one or more of the following:

(a) the impairment constituted by the loss, or the loss of the use, of a finger;

(b) the impairment constituted by the loss, or the loss of the use, of a toe;

(c) the impairment constituted by the loss of the sense of taste;

(d) the impairment constituted by the loss of the sense of smell.

(9) For the purposes of this section, the maximum amount is $100,778.56.

40 Interim payment of compensation

(1) If an employer:

(a) makes a determination that an employee is suffering from a permanent impairment as a result of an injury; and

(b) is satisfied that the degree of the impairment is equal to or more than 10% but has not made a final determination of the degree of impairment;

the employer must, on the written request of the employee made at any time before the final determination is made, make an interim determination of the degree of permanent impairment under section 39 and assess an amount of compensation payable to the employee.

(2) The amount assessed under subsection (1) must be an amount that is the same percentage of the maximum amount specified in subsection 39(9) as the percentage worked out in the interim determination under subsection (1) to express the degree of permanent impairment of the employee.

(3) If, after an amount of compensation has been paid to an employee following the making of an interim determination, a final determination is made of the degree of permanent impairment of the employee, there is payable to the employee an amount equal to the difference (if any) between the amount payable under section 39 on the making of the final determination and the amount paid to the employee under this section.

(4) If a final assessment is made of the degree of permanent impairment of an employee, no further amounts of compensation are payable to the employee in respect of a subsequent increase in the degree of impairment, unless the increase is 10% or more.

41 Compensation for non‑economic loss

(1) If an injury to an employee results in a permanent impairment and compensation is payable for the injury under section 39, the employer is liable to pay additional compensation in accordance with this section to the employee for any non‑economic loss suffered by the employee as a result of the injury or impairment.

(2) The amount of compensation is an amount worked out using the formula:

where:

Degree of permanent impairment means the percentage finally determined under section 39 to be the degree of permanent impairment of the employee.

Degree of non‑economic loss means the percentage determined under the approved Guide, by the employer, to be the degree of non‑economic loss suffered by the employee.

42 Approved Guide

(1) The Authority may, from time to time, prepare a written document, to be called the “Guide to the Assessment of the Degree of Permanent Impairment”, setting out:

(a) criteria by reference to which the degree of the permanent impairment of an employee resulting from an injury must be determined; and

(b) criteria by reference to which the degree of non‑economic loss suffered by an employee as a result of an injury or impairment must be determined; and