Social Security Legislation Amendment Act (No. 2) 1992

No. 229 of 1992

An Act to amend the Social Security Act 1991, and for related purposes

An Act to amend the Social Security Act 1991, and for related purposes

[Assented to 24 December 1992]

The Parliament of Australia enacts:

PART 1—PRELIMINARY

Short title etc.

1.(1) This Act may be cited as the Social Security Legislation Amendment Act (No. 2) 1992.

(2) In this Act, “Principal Act” means the Social Security Act 19911.

Commencement

2.(1) The following provisions commence on the day on which this Act receives the Royal Assent:

(a) Part 1;

(b) Divisions 1, 2, 4, 8, 12, 13, 15, 16, 17, 18, 19, 21 and 23 of Part 2;

(c) paragraphs 34(b) and (c);

(d) paragraphs 36(b) and (c);

(e) Part 3;

(f) Part 1 of Schedule 3;

(g) Part 1 of Schedule 4;

(h) Schedule 7;

(i) Schedule 8.

(2) Part 2 of Schedule 4 is taken to have commenced on 25 June 1991, immediately after the Social Security (Job Search and Newstart) Amendment Act 1991 received the Royal Assent.

(3) Part 3 of Schedule 4 is taken to have commenced on 27 June 1991, immediately after the Social Security (Rewrite) Amendment Act 1991 received the Royal Assent.

(4) Parts 2 and 5 of Schedule 3 are taken to have commenced on 1 July 1991, immediately after the commencement of the Social Security Act 1991.

(5) Part 4 of Schedule 3 is taken to have commenced on 1 July 1991, immediately after the commencement of the Social Security (Rewrite) Amendment Act 1991.

(6) Part 3 of Schedule 3 is taken to have commenced on 1 July 1991, immediately after the commencement of the Social Security (Job Search and Newstart) Amendment Act 1991.

(7) Part 4 of Schedule 4 is taken to have commenced on 9 October 1991, immediately after the Social Security (Disability and Sickness Support) Amendment Act 1991 received the Royal Assent.

(8) Part 6 of Schedule 3 and Part 5 of Schedule 4 are taken to have commenced on 12 November 1991, immediately after the commencement of Part 2 of the Social Security (Disability and Sickness Support) Amendment Act 1991.

(9) Part 6 of Schedule 4 is taken to have commenced on 12 November 1991, immediately after the commencement of Part 5 of the Social Security Legislation Amendment Act (No. 3) 1991.

(10) Part 7 of Schedule 3 is taken to have commenced on 13 December 1991 immediately after the Social Security Legislation Amendment Act (No. 4) 1991 received the Royal Assent.

(11) Division 6 of Part 2 is taken to have commenced on 1 January 1992.

(12) Part 8 of Schedule 3 is taken to have commenced on 1 January 1992, immediately after the commencement of section 48 of the Social Security Legislation Amendment Act (No. 4) 1991.

(13) Part 9 of Schedule 3 is taken to have commenced on 2 January 1992.

(14) Part 10 of Schedule 3 is taken to have commenced on 12 March 1992.

(15) Part 11 of Schedule 3 is taken to have commenced on 20 March 1992.

(16) Part 1 of Schedule 2 is taken to have commenced on 26 June 1992, immediately after the Social Security (Family Payment) Amendment Act 1992 received the Royal Assent.

(17) Part 12 of Schedule 3 is taken to have commenced on 30 June 1992, immediately after the Social Security Legislation Amendment Act 1992 received the Royal Assent.

(18) Part 7 of Schedule 4 is taken to have commenced on 29 June 1992.

(19) Part 13 of Schedule 3 and Part 8 of Schedule 4 are taken to have commenced on 1 July 1992, immediately after the commencement of sections 76, 82, 87 and 93 of the Social Security Legislation Amendment Act (No. 3) 1991.

(20) Part 14 of Schedule 3 and Part 9 of Schedule 4 are taken to have commenced on 2 November 1992, immediately after the commencement of the Social Security Amendment Act 1992.

(21) The following provisions commence, or are taken to have commenced, on 1 January 1993, immediately after the commencement of the Social Security (Family Payment) Amendment Act 1992:

(a) Division 3 of Part 2 (except paragraphs 34(b) and (c) and 36(b) and (c));

(b) Divisions 5, 7, 9 (except sections 60 to 70), 10, 11, 14, 20 and 22 of Part 2;

(c) Schedule 1;

(d) Parts 2 and 3 of Schedule 2;

(e) Schedule 5;

(f) Schedule 6.

(22) Sections 60 to 70 commence on 20 March 1993.

Application

3.(1) The first adjustment of the additional family payment child maximum basic rates under section 1199 of the Principal Act using the amendments made by this Act takes place on 1 January 1994.

(2) The amendments made by sections 11 to 26 apply to payments of arrears of periodic compensation payments:

(a) that are made on or after 1 January 1993; and

(b) that relate to periodic payments periods that commence on or after 1 January 1993.

(3) The amendments made by paragraphs 34(b) and (c) and paragraphs 36(b) and (c) apply to notices sent on or after the day on which this Act receives the Royal Assent.

(4) The amendment made by paragraph 148(b) applies to a cancellation or cessation that occurs on or after the day on which this Act receives the Royal Assent.

(5) The indexation of pharmaceutical allowance rates that occurs on 1 January 1993 (see items 31 and 32 of the CPI Indexation Table in section 1191 of the Principal Act) operates on the amounts in the Pharmaceutical Allowance Amount Tables that are being inserted in the Principal Act by Division 9 of Part 2 of this Act.

Note: this subsection means that section 1206A of the Principal Act (adjustment of certain other pharmaceutical allowance rates) will operate on the basis of the rates inserted by Division 9 of Part 2 of this Act as indexed on 1 January 1993.

PART 2—AMENDMENTS OF THE SOCIAL SECURITY ACT 1991

Division 1—Transfers from pensions to benefits

General definitions

4. Section 23 of the Principal Act is amended by omitting from subsection (6) “that immediately follows the day on which the person ceases to receive the old pension or benefit” and substituting:

“that immediately follows:

(d) if the person was receiving an old pension—the person’s last pension payday; or

(e) if the person was receiving an old benefit—the day on which the person ceases to receive the old benefit.”.

Qualification for job search allowance

5.(1) Section 513 of the Principal Act is amended by adding at the end the following subsection:

“(4) If:

(a) a person was receiving a social security pension or a service pension; and

(b) the person claims a job search allowance within 14 days of the day on which the last instalment of the person’s pension was paid; and

(c) the person becomes qualified for a job search allowance at some time during the 14 day period but after the first day of that period;

the person is taken to be qualified for a job search allowance for the whole of the 14 day period.

Note: subsection (4) operates when a person transfers from a pension to a job search allowance and the person is not qualified for a job search allowance immediately after the day on which the person’s last instalment of pension is paid. The subsection deems the person to be so qualified. As a result, the person may be paid a job search allowance for the period beginning on the day after the day on which the person’s last instalment of pension was paid. The subsection aims to ensure that there is minimal disruption to a person’s payments when a person transfers from a pension to a job search allowance.”.

(2) Subsection 513(4) of the Principal Act inserted by subsection (1) comes after subsection 513(3) of that Act inserted by paragraph 133(1)(c) of this Act.

Qualification for newstart allowance

6.(1) Section 593 of the Principal Act is amended by adding at the end the following subsection:

“(4) If:

(a) a person was receiving a social security pension or a service pension; and

(b) the person claims a newstart allowance within 14 days of the day on which the last instalment of the person’s pension was paid; and

(c) the person becomes qualified for a newstart allowance at some time during the 14 day period but after the first day of that period;

the person is taken to be qualified for a newstart allowance for the whole of the 14 day period.

Note: subsection (4) operates when a person transfers from a pension to a newstart allowance and the person is not qualified for a newstart allowance immediately after the day on which the person’s last instalment of pension is paid. The subsection deems the person to be so qualified. As a result, the person may be paid a newstart allowance for the period beginning on the day after the day on which the person’s last instalment of pension was paid. The subsection aims to ensure that there is minimal disruption to a person’s payments when a person transfers from a pension to a newstart allowance.”.

(2) Subsection 593(4) of the Principal Act inserted by subsection (1) comes after subsection 593(3) of that Act inserted by paragraph 135(1)(c) of this Act.

Qualification for sickness allowance

7. Section 666 of the Principal Act is amended by adding at the end the following subsection:

“(10) If:

(a) a person was receiving a social security pension or a service pension; and

(b) the person claims a sickness allowance within 14 days of the day on which the last instalment of the person’s pension was paid; and

(c) the person becomes qualified for a sickness allowance at some time during the 14 day period but after the first day of that period;

the person is taken to be qualified for a sickness allowance for the whole of the 14 day period.

Note: subsection (10) operates when a person transfers from a pension to a sickness allowance and the person is not qualified for a sickness allowance immediately after the day on which the person’s last instalment of pension is paid. The subsection deems the person to be so qualified. As a result, the person may be paid a sickness allowance for the period beginning on the day after the day on which the person’s last instalment of pension was paid. The subsection aims to ensure that there is minimal disruption to a person’s payments when a person transfers from a pension to a sickness allowance.”.

Qualification for special benefit

8. Section 729 of the Principal Act is amended by adding at the end the following subsection:

“(6) If:

(a) a person was receiving a social security pension or a service pension; and

(b) the person claims a special benefit within 14 days of the day on which the last instalment of the person’s pension was paid; and

(c) the person becomes qualified for a special benefit at some time during the 14 day period but after the first day of that period;

the person is taken to be qualified for a special benefit for the whole of the 14 day period.

Note: subsection (6) operates when a person transfers from a pension to a special benefit and the person is not qualified for a special benefit immediately after the day on which the person’s last instalment of pension is paid. The subsection deems the person to be so qualified. As a result, the person may be paid a special benefit for the period beginning on the day after the day on which the person’s last instalment of pension was paid. The subsection aims to ensure that there is minimal disruption to a person’s payments when a person transfers from a pension to a special benefit.”.

Division 2—Ordinary income test

Rate of job search allowance (under 18) and sickness allowance (under 18)

9. Section 1067 of the Principal Act is amended in point 1067-H11 of Benefit Rate Calculator A:

(a) by omitting from item 2 in column 2 of Table H-2 “partner not getting AUSTUDY allowance” and substituting “additional amount for partner”;

(b) by omitting from item 3 in column 2 of Table H-2 “partner getting AUSTUDY allowance” and substituting “no additional amount for partner”;

(c) by adding at the end the following Note:

“Note 2: to work out if an additional amount for the person’s partner is payable see points 1067-C1 to 1067-C6.”.

Rate of job search allowance (18 or over) and newstart allowance and sickness allowance (18 or over)

10. Section 1068 of the Principal Act is amended in point 1068-G11 of Benefit Rate Calculator B:

(a) by omitting from item 2 in column 2 of Table G-2 “partner not getting AUSTUDY allowance” and substituting “additional amount for partner”;

(b) by omitting from item 3 in column 2 of Table G-2 “partner getting AUSTUDY allowance” and substituting “no additional amount for partner”;

(c) by adding at the end the following Note:

“Note 2: to work out if an additional amount for the person’s partner is payable see points 1068-C1 to 1068-C7.”.

Division 3—Compensation recovery

Index of definitions

11. Section 3 of the Principal Act is amended by inserting in the Index the following definition:

“compensation arrears debt 23(1)”.

Compensation recovery definitions

12. Section 17 of the Principal Act is amended:

(a) by omitting from subsection (1) the definition of “periodic payments period” and substituting the following definition:

“ ‘periodic payments period’ means:

(a) in relation to a series of periodic payments—the period in respect of which the payments are, or are to be, made; and

(b) in relation to a payment of arrears of a series of periodic payments—the period in respect of which those periodic payments would have been made if they had not been made by way of an arrears payment;

Note: arrears of periodic compensation payments are normally treated as reducing, on a dollar for dollar basis, a payment under this Act that is covered by Part 3.14 because these compensation payments are not lump sum compensation payments: see subsection 17(4A) and sections 1168 and 1170.”;

(b) by adding at the end of subsection (4A) the following Note:

“Note: for the treatment of a payment of arrears of periodic compensation payments where, at the time of the event that gave rise to the compensation payments, the person was receiving a payment under this Act that is covered by Part 3.14, see points 1064-E3, 1066-E3, 1066A-F2A and 1068-G8A.”.

General definitions

13. Section 23 of the Principal Act is amended by inserting in subsection (1) the following definition:

“ ‘compensation arrears debt’ means an amount that a person is liable to pay to the Commonwealth because of an adverse determination under section 146E, 185, 234, 300, 589, 660L, 728R or 821;”.

Date of effect of adverse determination

14. Section 146E of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 or 1066A-F2A (payment of arrears of periodic compensation payments); and

(b) the pension has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the pension should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 or 1066A-F2A (payment of arrears of periodic compensation payments); and

(b) the rate at which the pension was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than the rate at which the pension should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Date of effect of adverse determination

15. Section 185 of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 (payment of arrears of periodic compensation payments); and

(b) the pension has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the pension should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 (payment of arrears of periodic compensation payments); and

(b) the rate at which the pension was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than the rate at which the pension should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Date of effect of adverse determination

16. Section 234 of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 (payment of arrears of periodic compensation payments); and

(b) the pension has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the pension should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 (payment of arrears of periodic compensation payments); and

(b) the rate at which the pension was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than the rate at which the pension should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Date of effect of adverse determination

17. Section 300 of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 or 1066-E3 (payment of arrears of periodic compensation payments); and

(b) the pension has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the pension should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 or 1066-E3 (payment of arrears of periodic compensation payments); and

(b) the rate at which the pension was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than the rate at which the pension should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Date of effect of adverse determination

18. Section 589 of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1067-H8A or 1068-G8A (payment of arrears of periodic compensation payments); and

(b) the allowance has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the allowance should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1067-H8A or 1068-G8A (payment of arrears of periodic compensation payments); and

(b) the rate at which the allowance was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than the rate at which the allowance should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Date of effect of adverse determination

19. Section 660L of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1068-G8A (payment of arrears of periodic compensation payments); and

(b) the allowance has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the allowance should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1068-G8A (payment of arrears of periodic compensation payments); and

(b) the rate at which the allowance was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than the rate at which the allowance should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Date of effect of adverse determination

20. Section 728R of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1067-H8A or 1068-G8A (payment of arrears of periodic compensation payments); and

(b) the allowance has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the allowance should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1067-H8A or 1068-G8A (payment of arrears of periodic compensation payments); and

(b) the rate at which the allowance was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than the rate at which the allowance should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Date of effect of adverse determination

21. Section 821 of the Principal Act is amended:

(a) by omitting from subsection (3) “and (6)” and substituting “, (6), (7) and (8)”;

(b) by adding at the end the following subsections:

Payment of arrears of periodic compensation payments—suspension or cancellation

“(7) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 and 1066A-F2A (payment of arrears of periodic compensation payments); and

(b) the special needs pension has been paid to the person or the person’s partner when, because of the payment of arrears of periodic compensation, the special needs pension should have been cancelled or suspended;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.

Payment of arrears of periodic compensation payments—rate reduction

“(8) If:

(a) an adverse determination is made in relation to a person because of point 1064-E3 and 1066A-F2A (payment of arrears of periodic compensation payments); and

(b) the rate at which the special needs pension was paid to the person or the person’s partner was, because of the payment of arrears of periodic compensation, more than

the rate at which the special needs pension should have been paid;

the day specified under paragraph (2)(b) may be earlier than the day on which the determination is made.”.

Rate of age, disability support, wife and carer pensions (people who are not blind)

22. Section 1064 of the Principal Act is amended in Pension Rate Calculator A by inserting after point 1064-E2 the following point:

Payment of arrears of periodic compensation payments “1064-E3. If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving disability support pension, wife pension, carer pension or sole parent pension; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive on each day in the periodic payments period an amount calculated by dividing the amount received by the number of days in the periodic payments period.

Note: for ‘periodic payments period’ see section 17.”.

Rate of sole parent pension, widowed person allowance and widow B pension

23. Section 1066 of the Principal Act is amended in Pension Rate Calculator C by inserting after point 1066-E2 the following point:

Payment of arrears of periodic compensation payments

“1066-E3. If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving sole parent pension; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive on each day in the periodic payments period an amount calculated by dividing the amount received by the number of days in the periodic payments period.

Note: for ‘periodic payments period’ see section 17.”.

Rate of disability support pension (people under 21 who are not blind)

24. Section 1066A of the Principal Act is amended in Pension Rate Calculator D by inserting after point 1066A-F2 the following point:

Payment of arrears of periodic compensation payments

“1066A-F2A. If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving disability support pension; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive on each day in the periodic payments period an amount calculated by dividing the amount received by the number of days in the periodic payments period.

Note: for ‘periodic payments period’ see section 17.”.

Rate of job search allowance (under 18) and sickness allowance (under 18)

25. Section 1067 of the Principal Act is amended in Benefit Rate Calculator A:

(a) by omitting from point 1067-H7A “point 1067-H8” and substituting “points 1067-H8 and 1067-H8A”;

(b) by inserting before point 1067-H9 the following point:

Payment of arrears of periodic compensation payments

“1067-H8A. If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving job search allowance or sickness allowance; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive in a fortnight falling within, or overlapping with, the periodic payments period, an amount calculated by:

(c) dividing the amount received by the number of days in the periodic payments period (the result is called the ‘daily rate’); and

(d) multiplying the daily rate by the number of days in the fortnight that are also within the periodic payments period.

Note: for ‘periodic payments period’ see section 17.”.

Rate of job search allowance (18 or over) and newstart allowance and sickness allowance (18 or over)

26. Section 1068 of the Principal Act is amended in Benefit Rate Calculator B:

(a) by omitting from point 1068-G7A “point 1068-G8” and substituting “points 1068-G8 and 1068-G8A”;

(b) by inserting before point 1068-G9 the following point:

Payment of arrears of periodic compensation payments

“1068-G8A. If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving job search allowance, newstart allowance or sickness allowance; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive in a fortnight falling within, or overlapping with, the periodic payments period, an amount calculated by:

(c) dividing the amount received by the number of days in the periodic payments period (the result is called the ‘daily rate’); and

(d) multiplying the daily rate by the number of days in the fortnight that are also within the periodic payments period.

Note: for ‘periodic payments period’ see section 17.”.

General effect of Part

27. Section 1163 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(a)(iii) the following subparagraph:

“(iiia) carer pension;”;

(b) by adding at the end the following subsection:

“(8) The amendments of this Part relating to carer pensions made by the Social Security Legislation Amendment Act (No. 2) 1992 affect carer pensions only if:

(a) the compensation is received on or after 1 January 1993; and

(b) the claim for the pension is made on or after 1 January 1993.”.

Secretary may require person to take action to obtain compensation

28. Section 1164 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(a)(iii) the following subparagraph:

“(iiia) carer pension; or”;

(b) by inserting after subparagraph (2)(a)(iii) the following subparagraph:

“(iiia) carer pension; or”.

Pension benefit or allowance not payable during lump sum preclusion period

29. Section 1165 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(a)(iii) the following subparagraph:

“(iiia) carer pension; or”;

(b) by omitting from the Note to subsection (1) “, (4) and” and substituting “to”;

(c) by inserting after subparagraph 2(a)(iii) the following subparagraph:

“(iiia) carer pension; or”;

(d) by inserting after subparagraph (2)(d)(iii) the following subparagraph:

“(iiia) carer pension; or”;

(e) by omitting from subparagraph (2)(e)(v) “because of caring for the person”;

(f) by omitting from the Note to subsection (2) “, (4) and” and substituting “to”.

Person may have to repay amount where both lump sum and pension, benefit or allowance payments have been received

30. Section 1166 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(b)(iii) the following subparagraph:

“(iiia) carer pension; or”;

(b) by omitting from the Note to subsection (1) “subsection 1165(3)” and substituting “subsections 1165(3) to (5)”;

(c) by omitting from column 3 of item 1 in the Recoverable Amount Table in subsection (2) “DSP” and substituting:

“CP

DSP”;

(d) by omitting from column 3 of item 2 in the Recoverable Amount Table in subsection (2) “DSP” and substituting:

“CP

DSP”;

(e) by omitting from column 3 of item 3 in the Recoverable Amount Table in subsection (2) “DSP” and substituting:

“CP

DSP”;

(f) by omitting from the Key to the Recoverable Amount Table in subsection (2) “CP = carer pension because of caring for the person” and substituting “CP = carer pension”;

(g) by adding at the end (before the Examples) the following subsection:

“(7) In subsections (5) and (6):

‘family allowance supplement’ means family allowance supplement within the meaning of the Social Security Act 1991 as in force immediately before 1 January 1993.”.

Rate reduction of certain pensions, benefits and allowances where periodic compensation payments received

31. Section 1168 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(b)(iv) the following subparagraph:

“(iva) carer pension; or”;

(b) by adding at the end of subsection (1) the following Note:

“Note 2: if a person, or a person’s partner, was, at the time of an event that gave rise to the entitlement of the person, or the person’s partner, to compensation, qualified for a pension, benefit or allowance referred to in subsection (1), the compensation is treated as ordinary income.”;

(c) by omitting from subparagraph (2)(c)(vi) “because of caring for the person”;

(d) by omitting from column 3 of item 1 in the Reduction Table in subsection (3) “DSP” and substituting:

“CP

DSP”;

(e) by omitting from column 3 of item 2 in the Reduction Table in subsection (3) “DSP” and substituting:

“CP

DSP”;

(f) by omitting from column 3 of item 3 in the Reduction Table in subsection (3) “DSP” and substituting:

“CP

DSP”;

(g) by omitting from column 3 of item 4 in the Reduction Table in subsection (3) “DSP” and substituting:

“CP

DSP”;

(h) by omitting from column 3 of item 5 in the Reduction Table in subsection (3) “DSP” and substituting:

“CP

DSP”;

(i) by omitting from the Key to the Reduction Table in subsection (3) “CP = carer pension because of caring for the person” and substituting “CP = carer pension”.

Person may have to repay amount where both periodic compensation payments and pension, benefit or allowance payments have been received

32. Section 1170 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(a)(iv) the following subparagraph:

“(iva) carer pension; or”;

(b) by inserting after paragraph (1)(c) the following Note:

“Note: if a person was, at the time of an event that gave rise to the entitlement of the person to compensation, qualified for a pension, benefit or allowance referred to in paragraph (b), the compensation is treated as ordinary income.”;

(c) by omitting from column 3 of item 1 in the Recoverable Amount Table in subsection (2) “DSP” and substituting:

“CP

DSP”;

(d) by omitting from column 3 of item 2 in the Recoverable Amount Table in subsection (2) “DSP” and substituting:

“CP

DSP”;

(e) by omitting from column 3 of item 3 in the Recoverable Amount Table in subsection (2) “DSP” and substituting:

“CP

DSP”;

(f) by omitting from the Key to the Recoverable Amount Table in subsection (2) “CP = carer pension because of caring for the person” and substituting “CP = carer pension”.

Secretary may send preliminary notice to potential compensation payer

33. Section 1172 of the Principal Act is amended by inserting after subparagraph (1)(b)(iii) the following subparagraph:

“(iiia) carer pension; or”.

Secretary may send recovery notice to compensation payer

34. Section 1174 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(b)(iii) the following subparagraph:

“(iiia) carer pension; or”;

(b) by omitting from subsection (3) “The” and substituting “Subject to subsection (6A), the”;

(c) by omitting from subparagraph (5)(b)(v) “because of caring for the person”;

(d) by omitting from subparagraph (6)(b)(v) “because of caring for the person”;

(e) by inserting after subsection (6) the following subsections:

“(6A) If:

(a) subsection (1) applies to payments of pension, benefit or allowance paid to a person for a particular period (the ‘overpayment recovery period’); and

(b) the Secretary is satisfied that family allowance supplement would have been payable to the person, or the person’s partner, for some or all of the overpayment recovery period if:

(i) the person or the person’s partner had claimed family allowance supplement for that period; and

(ii) neither the person nor the person’s partner had been receiving a social security pension or benefit during that period;

the amount specified in the notice under subsection (1) is to be reduced by the notional FAS entitlement.

“(6B) For the purposes of subsection (6A), the ‘notional FAS entitlement’ is the amount of family allowance supplement that the person or the person’s partner would, in the Secretary’s opinion, have received during the overpayment recovery period if:

(a) the person or the person’s partner had claimed family allowance supplement for that period; and

(b) neither the person nor the person’s partner had been receiving a social security pension or benefit during that period.

“(6C) In subsections (6A) and (6B):

‘family allowance supplement’ means family allowance supplement within the meaning of the Social Security Act 1991 as in force immediately before 1 January 1993.”.

Secretary may send preliminary notice to insurer

35. Section 1177 of the Principal Act is amended by inserting after subparagraph (1)(a)(iii) the following subparagraph:

“(iiia) a carer pension; or”.

Secretary may send recovery notice to insurer

36. Section 1179 of the Principal Act is amended:

(a) by inserting after subparagraph (1)(b)(iii) the following subparagraph:

“(iiia) a carer pension; or”;

(b) by omitting from subsection (3) “The” and substituting “Subject to subsection (6A), the”;

(c) by omitting from subparagraph (5)(b)(v) “because of caring for the person”;

(d) by omitting from subparagraph (6)(b)(v) “because of caring for the person”;

(e) by inserting after subsection (6) the following subsections:

“(6A) If:

(a) subsection (1) applies to payments of pension, benefit or allowance paid to a person for a particular period (the ‘overpayment recovery period’); and

(b) the Secretary is satisfied that family allowance supplement would have been payable to the person, or the person’s partner, for some or all of the overpayment recovery period if:

(i) the person or the person’s partner had claimed family allowance supplement for that period; and

(ii) neither the person nor the person’s partner had been receiving a social security pension or benefit during that period;

the amount specified in the notice under subsection (1) is to be reduced by the notional FAS entitlement.

“(6B) For the purposes of subsection (6A), the ‘notional FAS entitlement’ is the amount of family allowance supplement that the person or the person’s partner would, in the Secretary’s opinion, have received during the overpayment recovery period if:

(a) the person or the person’s partner had claimed family allowance supplement for that period; and

(b) neither the person nor the person’s partner had been receiving a social security pension or benefit during that period.

“(6C) In subsections (6A) and (6B):

‘family allowance supplement’ means family allowance supplement within the meaning of the Social Security Act 1991 as in force immediately before 1 January 1993.”.

General effect of Chapter

37. Section 1222 of the Principal Act is amended:

(a) by omitting from Note 1 to subsection (1):

“• section 1226 debts—compensation payer and insurer debts;”; and substituting:

“• section 1226 debts—compensation payer and insurer debts;

• section 1226A debts—compensation arrears debts;”;

(b) by inserting after item 7 in the Recovery Methods Table in subsection (2) the following item:

“ | 7A. | 1226A (compensation arrears debt) | Deductions legal proceedings garnishee notice | 1231, 1234A 1232 1233 | ”. |

Debts due to the Commonwealth

38. Section 1222A of the Principal Act is amended by omitting “and 1226” and substituting “, 1226 and 1226A”.

39. After section 1226 of the Principal Act the following section is inserted:

Compensation arrears debts

“1226A.(1) If a person is liable to pay a compensation arrears debt, that debt is a debt due to the Commonwealth and is recoverable by the Commonwealth by means of:

(a) if the person is receiving a pension, benefit or allowance under this Act—deductions from that person’s pension, benefit or allowance; or

(b) if section 1234A applies to another person who is receiving a pension, benefit or allowance under this Act—deductions from that other person’s pension, benefit or allowance; or

(c) legal proceedings; or

(d) garnishee notice.

Note 1: for ‘compensation arrears debt’ see subsection 23(1).

Note 2: for deductions see sections 1231 and 1234A.

Note 3: for legal proceedings see section 1232.

Note 4: for garnishee notice see section 1233.

Note 5: if the person does not pay the debt within 3 months after receiving a notice of the amount of the debt, the amount of the debt will increase under section 1229.

“(2) This section extends to:

(a) acts, omissions, matters and things outside Australia whether or not in a foreign country; and

(b) all persons irrespective of their nationality or citizenship.”.

Additional amount for late payment of debt

40. Section 1229 of the Principal Act is amended by inserting in subparagraph (1)(a)(i) “, 1226A” before “or 1227”.

Garnishee notice

41. Section 1233 of the Principal Act is amended by inserting in subsection (1) “1226A,” after “1225,”.

Division 4—Job search and newstart allowance

Persons may be treated as unemployed

42. Section 516 of the Principal Act is amended:

(a) by omitting from subsection (2) “is to” and substituting “may”;

(b) by adding at the end the following subsection:

“(3) In deciding whether to treat a person as being unemployed, the Secretary is to take into account:

(a) the nature of the activity undertaken by the person so as to comply with a requirement under subsection 522(2) (activity test); and

(b) the duration of the activity; and

(c) any other matters relating to the activity that the Secretary considers relevant.’”.

Secretary may require a person to attend the Department or CES etc.

43. Section 543 of the Principal Act is amended:

(a) by omitting subsection (2);

(b) by inserting after subsection (4) the following subsection:

“(4A) Subsection (4) does not apply to a person:

(a) who has started formal vocational training in a labour market program approved by the Employment Secretary; and

(b) who has been exempted from the application of that subsection by the Employment Secretary.

Note 1: ‘CES’ means the Commonwealth Employment Service (see section 23).

Note 2: for ‘Employment Secretary’ see section 23.”.

Persons may be treated as unemployed

44. Section 595 of the Principal Act is amended:

(a) by omitting from subsection (2) “is to” and substituting “may”;

(b) by adding at the end the following subsection:

“(3) In deciding whether to treat a person as being unemployed, the Secretary is to take into account:

(a) the nature of the activity undertaken by the person so as to comply with a requirement under subsection 601(2) (activity test) or a Newstart Activity Agreement; and

(b) the duration of the activity; and

(c) any other matters relating to the activity that the Secretary considers relevant.”.

Secretary may require a person to attend the Department or CES etc.

45. Section 627 of the Principal Act is amended:

(a) by omitting subsection (2);

(b) by inserting after subsection (4) the following subsection:

“(4A) Subsection (4) does not apply to a person:

(a) who has started formal vocational training in a labour market program approved by the Employment Secretary; and

(b) who has been exempted from the application of that subsection by the Employment Secretary.

Note 1: ‘CES’ means the Commonwealth Employment Service (see section 23).

Note 2: for ‘Employment Secretary’ see section 23.”.

Division 5—Income test for family payment

Index of definitions

46. Section 3 of the Principal Act is amended by omitting from the Index:

“exempt FP child 5(1)”.

Family relationships definitions—children

47. Section 5 of the Principal Act is amended by omitting from subsection (1) the definition of “exempt FP child”.

Rate of family payment

48. Section 1069 of the Principal Act is amended by omitting point 1069-B2.

Division 6—Assets test for family allowance

Qualification for individual family allowance

49. Section 838 of the Principal Act is amended:

(a) by omitting from subsection (1) “A” and substituting “Subject to subsection (3), a”;

(b) by adding at the end the following subsection:

“(3) Paragraph (1)(d) does not apply to a person if the person has an exempt FA child.

Note: for ‘exempt FA child’ see subsection 5(1).”.

CDA child status—family allowance requirement

50. Section 953 of the Principal Act is amended by inserting after subparagraph (b)(ii) the following subparagraph:

“(iia) paragraph 838(1)(d) (assets test); or”.

Qualification for double orphan pension

51. Section 999 of the Principal Act is amended by inserting after subparagraph (1)(a)(ii) the following subparagraph:

“(iia) paragraph 838(1)(d) (assets test); or”.

Rate of family allowance

52. Section 1069 of the Principal Act is amended by inserting after point 1069-B1 the following point:

Assets test—exempt FA children

“1069-B1A. If:

(a) the value of the person’s assets exceeds the amount referred to in paragraph 838(1)(d); and

(b) the person has an exempt FA child;

any FA child of the person who is not an exempt FA child is to be disregarded for the purposes of working out the person’s maximum basic rate under point 1069-B1.”.

Division 7—Savings provisions for certain recipients of family allowance

53. Schedule 1A of the Principal Act is amended by adding at the end the following clauses:

Family payment assets test (changes introduced on 1 January 1993)—child disability allowance

“50. If:

(a) before 1 January 1993:

(i) a person has claimed child disability allowance and family allowance for a child; and

(ii) the person is qualified for family allowance for that child because of subsection 838(3) of this Act as in force immediately before that date; and

(b) at all times on and after 1 January 1993 the person receives child disability allowance for that child;

the person does not have to satisfy paragraph 838(1)(d) of this Act as in force on and after that date in order to be qualified for family payment for that child.

Family payment assets test (changes introduced on 1 January 1993)—double orphan pension

“51. If:

(a) before 1 January 1993:

(i) a person (the ‘adult’) has claimed double orphan pension and family allowance for a young person; and

(ii) the adult is qualified for family allowance for that young

person because of subsection 838(3) of this Act as in force immediately before that date; and

(b) at all times on and after 1 January 1993 the adult receives double orphan pension for that young person;

the adult does not have to satisfy paragraph 838(1)(d) of this Act as in force on and after that date in order to be qualified for family payment for that young person.

Family payment income test (changes introduced on 1 January 1993)—child disability allowance

“52. If:

(a) before 1 January 1993:

(i) a person has claimed child disability allowance and family allowance for a child; and

(ii) the person is qualified for family allowance for that child because of paragraph 840A(1)(b) of this Act as in force immediately before that date; and

(b) at all times on and after 1 January 1993 the person receives child disability allowance for that child;

the person does not have to satisfy paragraph 838(1)(c) of this Act as in force on and after that date in order to be qualified for family payment for that child.

Family payment income test (changes introduced on 1 January 1993)—double orphan pension

“53. If:

(a) before 1 January 1993:

(i) a person (the ‘adult’) has claimed double orphan pension and family allowance for a young person; and

(ii) the adult is qualified for family allowance for that young person because of paragraph 840A(1)(b) of this Act as in force immediately before that date; and

(b) at all times on and after 1 January 1993 the adult receives double orphan pension for that young person;

the adult does not have to satisfy paragraph 838(1)(c) of this Act as in force on and after that date in order to be qualified for family payment for that young person.”.

Division 8—Education entry payment

Payment to a sole parent pensioner

54. Section 665A of the Principal Act is amended by inserting after paragraph (b) the following paragraph:

“(ba) either:

(i) the Secretary is satisfied that the person intends to enrol in a full-time or part-time course of education that is an approved course under the AUSTUDY scheme; or

(ii) the person is enrolled in such a course; and”.

General effect of Chapter

55. Section 1222 of the Principal Act is amended:

(a) by omitting from Note 1 in subsection (1):

“• section 1224A debts—pension loan scheme;”;

and substituting:

“• section 1224A debts—pension loan scheme;

• section 1224B debts—education entry payment.”;

(b) by inserting after item 5 in the Recovery Methods Table in subsection (2) the following item:

“ | 5A. | 1224B (education entry payment) | Deductions legal proceedings garnishee notice | 1231, 1234A 1232 1233 | ”. |

Debts due to the Commonwealth

56. Section 1222A of the Principal Act is amended by omitting from Note 1 “1224” and substituting “1223B, 1224, 1224B”.

57. After section 1224A of the Principal Act the following section is inserted:

Education entry payment debt

“1224B. If:

(a) an education entry payment is made to a person; and

(b) the person does not pay the enrolment fees for an approved course of education under the AUSTUDY scheme in the calendar year in respect of which the education entry payment was made;

the amount of the education entry payment so made is a debt due to the Commonwealth and is recoverable by the Commonwealth by means of:

(c) if the person is receiving a pension, benefit or allowance under this Act—deductions from that person’s pension, benefit or allowance; or

(d) if section 1234A applies to another person who is receiving a pension, benefit or allowance under this Act—deductions from that other person’s pension, benefit or allowance; or

(e) legal proceedings; or

(f) garnishee notice.

Note 1: for deductions see sections 1231 and 1234A.

Note 2: for legal proceedings see section 1232.

Note 3: for garnishee notice see section 1233.”.

Garnishee notice

58. Section 1233 of the Principal Act is amended by omitting from subsection (1) “1224A” and substituting “1224A, 1224B”.

Division 9—Pharmaceutical allowance

Pharmaceutical allowance and advance pharmaceutical allowance definitions

59. Section 19A of the Principal Act is amended:

(a) by omitting “Parts 2.22 and 2.23 of”;

(b) by adding at the end the following subsections:

“(2) If:

(a) a person is paid an instalment of social security or service pension or social security benefit on a particular day; and

(b) an amount by way of pharmaceutical allowance is to be added to the person’s maximum basic rate in working out the amount of the instalment;

the amount of pharmaceutical allowance paid to the person on that day is worked out using subsections (3), (4), (5) and (6).

“(3) If the instalment is an instalment of social security or service pension, the amount of allowance paid is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment.

“(4) If:

(a) the instalment is an instalment of social security benefit; and

(b) the instalment is for a fortnight or a period of whole fortnights;

the amount of allowance paid is:

pharmaceutical allowance rate × number of fortnights

where:

‘pharmaceutical allowance rate’ is the fortnightly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment;

‘number of fortnights’ is the number of fortnights in the period for which the instalment is paid.

“(5) If:

(a) the instalment is an instalment of social security benefit; and

(b) the instalment is for a period of less than a fortnight; the amount of the allowance paid is:

pharmaceutical allowance rate × week days in period |

10 |

where:

‘pharmaceutical allowance rate’ is the fortnightly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment;

‘week days in period’ is the number of week days in the period for which the instalment is paid.

“(6) If:

(a) the instalment is an instalment of social security benefit; and

(b) the instalment is for a period that consists of:

(i) a fortnight or a number of whole fortnights; and

(ii) a period of less than a fortnight;

the amount of allowance paid is:

pharmaceutical allowance rate | × | number of whole fortnights | × | week days in short period |

10 |

where:

‘pharmaceutical allowance rate’ is the fortnightly amount of pharmaceutical allowance added to the person’s minimum basic rate in working out the amount of the instalment;

‘number of whole fortnights’ is the number of whole fortnights in the period for which the instalment is paid;

‘week days in short period’ is the number of days in the period that is less than a fortnight.”.

Calculation of amount of instalment

60. Section 59 of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of age pension; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(3B) For the purposes of subsection (3A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment.”.

Calculation of amount of instalment

61. Section 121 of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of disability support pension; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(3B) For the purposes of subsection (3A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment.”.

Calculation of amount of instalment

62. Section 163 of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) an amount of pharmaceutical allowance is added to a woman’s maximum basic rate in working out the amount of an instalment of wife pension; and

(b) apart from this subsection, the amount of the instalment would be less than the woman’s fortnightly PA rate;

the amount of the instalment is to be increased to the woman’s fortnightly PA rate.

“(3B) For the purposes of subsection (3A), the woman’s fortnightly PA rate is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the woman’s maximum basic rate in working out the amount of the instalment.”.

Calculation of amount of instalment

63. Section 214 of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of carer pension; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(3B) For the purposes of subsection (3A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment.”.

Calculation of amount of instalment

64. Section 273 of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of sole parent pension; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(3B) For the purposes of subsection (3A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment.”.

Calculation of amount of instalment

65. Section 333 of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of widowed person allowance; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(3B) For the purposes of subsection (3A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment.”.

Calculation of amount of instalment

66. Section 380 of the Principal Act is amended by inserting after subsection (3) the following subsections:

“(3A) If:

(a) an amount of pharmaceutical allowance is added to a woman’s maximum basic rate in working out the amount of an instalment of widow B pension; and

(b) apart from this subsection, the amount of the instalment would be less than the woman’s fortnightly PA rate;

the amount of the instalment is to be increased to the woman’s fortnightly PA rate.

“(3B) For the purposes of subsection (3), the woman’s fortnightly PA rate is:

pharmaceutical allowance rate |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance added to the woman’s maximum basic rate in working out the amount of the instalment.”.

Rounding off instalment

67. Section 565 of the Principal Act is amended by inserting after subsection (2) the following subsections:

“(2A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of job search allowance; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(2B) For the purposes of subsection (2A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate × N

where:

‘pharmaceutical allowance rate’ is the fortnightly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment;

‘N’ is:

(a) if the instalment is for a number of whole fortnights—the number of fortnights; or

(b) if the instalment is for a period of less than a fortnight—equal to:

week days in period; or |

10 |

(c) if the instalment is for a period that consists of a number of whole fortnights and a period of less than a fortnight—equal to:

number of whole fortnights + week days in short period.”. |

10 |

Rounding off instalment

68. Section 648 of the Principal Act is amended by inserting after subsection (2) the following subsections:

“(2A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of newstart allowance; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(2B) For the purposes of subsection (2A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate × N

where:

‘pharmaceutical allowance rate’ is the fortnightly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment;

‘N’ is:

(a) if the instalment is for a number of whole fortnights—the number of fortnights; or

(b) if the instalment is for a period of less than a fortnight—equal to:

week days in period; or |

10 |

(c) if the instalment is for a period that consists of a number of whole fortnights and a period of less than a fortnight—equal to:

number of whole fortnights + week days in short period.”. |

10 |

Rounding off instalment

69. Section 718 of the Principal Act is amended by inserting after subsection (2) the following subsections:

“(2A) If:

(a) an amount of pharmaceutical allowance is added to a person’s maximum basic rate in working out the amount of an instalment of sickness allowance; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(2B) For the purposes of subsection (2A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate × N

where:

‘pharmaceutical allowance rate’ is the fortnightly amount of pharmaceutical allowance added to the person’s maximum basic rate in working out the amount of the instalment;

‘N’ is:

(a) if the instalment is for a number of whole fortnights—the number of fortnights; or

(b) if the instalment is for a period of less than a fortnight—equal to:

week days in period; or |

10 |

(c) if the instalment is for a period that consists of a number of whole fortnights and a period of less than a fortnight—equal to:

number of whole fortnights + week days in short period.”. |

10 |

Rounding off instalment

70. Section 751 of the Principal Act is amended by inserting after subsection (2) the following subsections:

“(2A) If:

(a) an amount of pharmaceutical allowance is taken into account in working out the amount of a person’s instalment of special benefit; and

(b) apart from this subsection, the amount of the instalment would be less than the person’s fortnightly PA rate;

the amount of the instalment is to be increased to the person’s fortnightly PA rate.

“(2B) For the purposes of subsection (2A), the person’s fortnightly PA rate is:

pharmaceutical allowance rate × N

where:

‘pharmaceutical allowance rate’ is the fortnightly amount of pharmaceutical allowance taken into account in working out the amount of the instalment;

‘N’ is:

(a) if the instalment is for a number of whole fortnights—the number of fortnights; or

(b) if the instalment is for a period of less than a fortnight—equal to:

week days in period; or |

10 |

(c) if the instalment is for a period that consists of a number of whole fortnights and a period of less than a fortnight—equal to:

number of whole fortnights + week days in short period”. |

10 |

Repeal of Part 2.22

71. Part 2.22 of the Principal Act is repealed.

72. Division 3 of Part 2.23 of the Principal Act is repealed and the following Division is substituted:

“Division 3—Amount of advance pharmaceutical allowance

Amount of advance pharmaceutical allowance

“1061JC. Subject to section 1061JD, the amount of a person’s advance pharmaceutical allowance is:

pharmaceutical allowance rate × 7 |

26 |

where:

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance that would be added to the person’s maximum basic rate if a pharmaceutical allowance advance were not being paid to the person.

Note: pharmaceutical allowance rates are to be found at:

• point 1064-C8 of Pension Rate Calculator A

• point 1065-C8 of Pension Rate Calculator B

• point 1066-C7 of Pension Rate Calculator C

• point 1066A-D8 of Pension Rate Calculator D

• point 1066B-D8 of Pension Rate Calculator E.

Annual limit

“1061JD.(1) The amount paid to a person in a calendar year by way of:

(a) pharmaceutical allowance; and

(b) advance pharmaceutical allowance;

is not to exceed the total amount of pharmaceutical allowance that would have been paid to the person during that year if the person had not received any advance pharmaceutical allowance.

Note: for the amount ‘paid’ to a person by way of pharmaceutical allowance see subsections 19A(2) to (6).

“(2) In this section:

‘advance pharmaceutical allowance’ includes advance pharmaceutical allowance under the Veterans’ Entitlements Act;

‘pharmaceutical allowance’ includes pharmaceutical allowance under the Veterans’ Entitlements Act.”.

Rate of age, disability support, wife and carer pensions (people who are not blind)

73. Pension Rate Calculator A in section 1064 is amended:

(a) by inserting after Step 1 in the Method statement in point 1064-A1 the following Step:

“Step 2. Work out the amount per year (if any) of pharmaceutical allowance using MODULE C below.”;

(b) by inserting after Module B the following Module:

“MODULE C—PHARMACEUTICAL ALLOWANCE

Qualification for pharmaceutical allowance

“1064-C1. Subject to points 1064-C2, 1064-C3, 1064-C4 and 1064-C6, an additional amount by way of pharmaceutical allowance is to be added to a person’s maximum basic rate if:

(a) the person is an Australian resident; and

(b) the person is in Australia.

No pharmaceutical allowance if person receiving pharmaceutical allowance under the Veterans’ Entitlements Act

“1064-C2. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if the person is receiving pharmaceutical allowance under the Veterans’ Entitlements Act.

No pharmaceutical allowance if partner receiving pharmaceutical allowance under the Veterans’ Entitlements Act and not a service pensioner

“1064-C3. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person is a member of a couple; and

(b) the person’s partner is receiving pharmaceutical allowance under the Veterans’ Entitlements Act; and

(c) the person’s partner is not receiving a service pension.

Note: if paragraphs (a), (b) and (c) apply to the person’s partner, the partner is receiving pharmaceutical allowance under the VEA at the higher rate (rather than the person and the person’s partner each receiving pharmaceutical allowance at the lower rate).

No pharmaceutical allowance before advance payment period ends

“1064-C4. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance under:

(i) Part 2.23 of this Act; or

(ii) Division 2 of Part VIIA of the Veterans’ Entitlements Act; and

(b) the person’s advance payment period has not ended.

Note: ‘advance payment period’ see point 1064-C5.

Advance payment period

“1064-C5. A person’s advance payment period:

(a) starts on the day on which the advance pharmaceutical allowance is paid to the person; and

(b) ends after the number of paydays worked out using the following formula have passed:

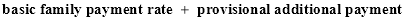

where:

‘amount of advance’ is the amount of the advance paid to the person;

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance which would be added to the person’s maximum basic rate in working out the instalment for the day on which the advance is paid if pharmaceutical allowance were to be added to the person’s maximum basic rate on that day.

No pharmaceutical allowance if annual limit reached

“1064-C6. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance during the current calendar year; and

(b) the total amount paid to the person for that year by way of:

(i) pharmaceutical allowance; and

(ii) advance pharmaceutical allowance;

equals the total amount of pharmaceutical allowance that would have been paid to the person during that year if the person had not received any advance pharmaceutical allowance.

Note 1: for the amount ‘paid’ to a person by way of pharmaceutical allowance see subsections 19A(2) to (6).

Note 2: the annual limit is affected by:

• how long during the calendar year the person was on pension or benefit;

• the rate of pharmaceutical allowance the person attracts at various times depending on the person’s family situation.

VEA payments taken into account

“1064-C7. In points 1064-C5 and 1064-C6:

‘advance pharmaceutical allowance’ includes advance pharmaceutical allowance under the Veterans’ Entitlements Act; and

‘pharmaceutical allowance’ includes pharmaceutical allowance under the Veterans’ Entitlements Act.

Amount of pharmaceutical allowance

“1064-C8. The amount of pharmaceutical allowance is the amount per year worked out using the following Table:

PHARMACEUTICAL ALLOWANCE AMOUNT TABLE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | amount per year | amount per fortnight |

1. | Not member of a couple | $135.20 | $5.20 |

2. | Partnered | $67.60 | $2.60 |

3. | Member of an illness separated or respite care couple | $135.20 | $5.20 |

4. | Partnered (partner getting service pension) | $67.60 | $2.60 |

Note: the amounts in column 3 are adjusted annually in line with CPI increases (see section 1206A).”.

Rate of age and disability support pension (blind people)

74. Pension Rate Calculator B in section 1065 is amended:

(a) by omitting Step 3 of the Method statement in point 1065-A1 and substituting the following Step:

“Step 3. Work out the amount per year (if any) of pharmaceutical allowance using MODULE C below.”;

(b) by inserting after Module B the following Module:

“MODULE C—PHARMACEUTICAL ALLOWANCE

Qualification for pharmaceutical allowance

“1065-C1. Subject to points 1065-C2, 1065-C3, 1065-C4 and 1065-C6, an additional amount by way of pharmaceutical allowance is to be added to a person’s maximum basic rate if:

(a) the person is an Australian resident; and

(b) the person is in Australia.

No pharmaceutical allowance if person receiving pharmaceutical allowance under the Veterans’ Entitlements Act

“1065-C2. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if the person is receiving pharmaceutical allowance under the Veterans’ Entitlements Act.

No pharmaceutical allowance if partner receiving pharmaceutical allowance under the Veterans’ Entitlements Act and not a service pensioner

“1065-C3. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person is a member of a couple; and

(b) the person’s partner is receiving pharmaceutical allowance under the Veterans’ Entitlements Act; and

(c) the person’s partner is not receiving a service pension.

Note: if paragraphs (a), (b) and (c) apply to the person’s partner, the partner is receiving pharmaceutical allowance under the VEA at the higher rate (rather than the person and the person’s partner each receiving pharmaceutical allowance at the lower rate).

No pharmaceutical allowance before advance payment period ends

“1065-C4. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance under:

(i) Part 2.23 of this Act; or

(ii) Division 2 of Part VIIA of the Veterans’ Entitlements Act; and

(b) the person’s advance payment period has not ended.

Note: for ‘advance payment period’ see point 1065-C5.

Advance payment period

“1065-C5. A person’s advance payment period:

(a) starts on the day on which the advance pharmaceutical allowance is paid to the person; and

(b) ends after the number of paydays worked out using the following formula have passed:

where:

‘amount of advance’ is the amount of the advance paid to the person;

‘pharmaceutical allowance rate’ is the yearly amount of pharmaceutical allowance which would be added to the person’s maximum basic rate in working out the instalment for the day on which the advance is paid if pharmaceutical allowance were to be added to the person’s maximum basic rate on that day.

No pharmaceutical allowance if annual limit reached

“1065-C6. Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance during the current calendar year; and

(b) the total amount paid to the person for that year by way of:

(i) pharmaceutical allowance; and

(ii) advance pharmaceutical allowance;

equals the total amount of pharmaceutical allowance that would have been paid to the person during that year if the person had not received any advance pharmaceutical allowance.

Note 1: for the amount ‘paid’ to a person by way of pharmaceutical allowance see subsections 19A(2) to (6).

Note 2: the annual limit is affected by:

• how long during the calendar year the person was on pension or benefit;

• the rate of pharmaceutical allowance the person attracts at various times depending on the person’s family situation.

VEA payments taken into account

“1065-C7. In points 1065-C5 and 1065-C6:

‘advance pharmaceutical allowance’ includes advance pharmaceutical allowance under the Veterans’ Entitlements Act;

‘pharmaceutical allowance’ includes pharmaceutical allowance under the Veterans’ Entitlements Act.

Amount of pharmaceutical allowance

“1065-C8. The amount of pharmaceutical allowance is the amount per year worked out using the following Table:

PHARMACEUTICAL ALLOWANCE AMOUNT TABLE |

column 1 | column 2 | column 3 | column 4 |

item | person’s family situation | amount per year | amount per fortnight |

1. | Not member of a couple | $135.20 | $5.20 |

2. | Partnered | $67.60 | $2.60 |

3. | Member of an illness separated or respite care couple | $135.20 | $5.20 |

4. | Partnered (partner getting service pension) | $67.60 | $2.60 |

Note: the amounts in column 3 are adjusted annually in line with CP1 increases (see section 1206A).”.

Rate of sole parent pension, widowed person allowance and widow B pension

75. Pension Rate Calculator C in section 1066 is amended:

(a) by inserting after Step 1 of the Method statement in point 1066-A1 the following Step:

“Step 2. Work out the amount per year (if any) of pharmaceutical allowance using MODULE C below.”;

(b) by inserting after Module B the following Module:

“MODULE C—PHARMACEUTICAL ALLOWANCE

Qualification for pharmaceutical allowance

“1066-C1. Subject to points 1066-C2, 1066-C3 and 1066-C5, an additional amount by way of pharmaceutical allowance is to be added to a person’s maximum basic rate if:

(a) the person is an Australian resident; and

(b) the person is in Australia.