Taxation Laws Amendment Act (No. 4)

No. 191 of 1992

An Act to amend the law relating to taxation

An Act to amend the law relating to taxation

[Assented to 21 December 1992]

The Parliament of Australia enacts:

PART 1—PRELIMINARY

Short title

1. This Act may be cited as the Taxation Laws Amendment Act (No. 4) 1992.

Commencement

2. This Act commences on the day on which it receives the Royal Assent.

PART 2—AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

Division 1—Principal Act

Principal Act

3. In this Part, “Principal Act” means the Income Tax Assessment Act 19361.

Division 2—Amendments relating to disability support pension and special needs disability support pension

Index of payments covered by Subdivision

4. Section 24AB of the Principal Act is amended:

(a) by omitting from the Table “24ABD” and substituting “24ABD, 24ABDAA”;

(b) by omitting from the Table “24ABR” and substituting “24ABR, 24ABRA”.

Interpretation—supplementary amounts

5. Section 24ABA of the Principal Act is amended:

(a) by omitting from the Table in subsection (1) “Age pension” and substituting:

“Age pension

Disability support pension”;

(b) by omitting from the Table in subsection (1) “Special needs age pension” and substituting:

“Special needs age pension

Special needs disability support pension”.

Disability support pension—recipients under pension age

6. Section 24ABD of the Principal Act is amended by inserting before subsection (1) the following subsection:

“(1A) This section only applies to payments to a person who is under pension age.”.

7. After section 24ABD of the Principal Act the following section is inserted:

Disability support pension—recipients pension age or over

“24ABDAA.(1) This section only applies to payments to a person who is pension age or over.

“(2) The treatment of payments of disability support pension under Part 2.3 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(3) Subsection (2) has effect subject to subsection (5) (which deals with taxpayers who derive bereavement lump sum payments under section 146H of the Social Security Act 1991).

“(4) Payments under sections 146G, 146K, 146P and 146Q of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(5) If a taxpayer derives a payment under section 146H of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24ABZB is exempt; and

(b) the balance of the sum is not exempt.

“(6) If:

(a) a taxpayer’s partner died; and

(b) the taxpayer would have been qualified for payments under a bereavement Subdivision but for an exclusion provision (taxpayer’s pension or allowance increased on partner’s death to such an extent that no bereavement payments); and

(c) the taxpayer derives payments of disability support pension under Part 2.3 of the Social Security Act 1991 on one or more of the 7 pension paydays after the death;

then those payments on that payday or each of those paydays are not treated under subsection (2) but as follows:

(d) the supplementary amounts are exempt;

(e) so much of the balance as exceeds what would have been the balance (payments less supplementary amounts) if the partner had not died is exempt;

(f) the rest of the balance is not exempt.”.

Special needs disability support pension—recipients under pension age

8. Section 24ABR of the Principal Act is amended by inserting before subsection (1) the following subsection:

“(1A) This section only applies to payments to a person who is under pension age.”.

9. After section 24ABR of the Principal Act the following section is inserted:

Special needs disability support pension—recipients pension age or over

“24ABRA.(1) This section only applies to payments to a person who is pension age or over.

“(2) The treatment of payments of special needs disability support pension under section 773 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(3) Subsection (2) has effect subject to section 24ABV (which deals with bereavement payments).

“(4) If:

(a) a taxpayer’s partner died; and

(b) the taxpayer would have been qualified for payments under a bereavement Subdivision but for an exclusion provision (taxpayer’s pension or allowance increased on partner’s death to such an extent that no bereavement payments); and

(c) the taxpayer derives payments of special needs disability support pension under section 773 of the Social Security Act 1991 on one or more of the 7 pension paydays after the death;

then those payments on that payday or each of those paydays are not treated under subsection (2) but as follows:

(d) the supplementary amounts are exempt;

(e) so much of the balance as exceeds what would have been the balance (payments less supplementary amounts) if the partner had not died is exempt;

(f) the rest of the balance is not exempt.”.

Application of amendments

10. The amendments made by this Division apply in relation to payments derived on or after 1 July 1991.

Division 3—Amendments relating to bereavement payments

Exempt bereavement payment calculator A

11. Section 24ABZB of the Principal Act is amended:

(a) by inserting after paragraph (b) in Step 2 in exempt bereavement payment calculator A the following word and paragraph:

“and (c) if immediately before the partner’s death the couple were an illness separated couple or a respite care couple—they were not such a couple;”;

(b) by omitting Step 4 in exempt bereavement payment calculator A and substituting the following Step:

“Step 4. Work out the amount of payments under the Social Security Act 1991 or Part III of the Veterans’ Entitlements Act 1986 that would have been derived by the partner on each of the relevant pension paydays if:

(a) the partner had not died; and

(b) if immediately before the partner’s death the couple were an illness separated couple or a respite care couple—they were not such a couple;

the result for each relevant pension payday is called the pension payday notional partner amount.”.

Exempt bereavement payment calculator B

12. Section 24ACX of the Principal Act is amended:

(a) by inserting after paragraph (c) in Step 2 in exempt bereavement payment calculator B the following word and paragraph:

“and (d) if immediately before the partner’s death the couple were an illness separated couple or a respite care couple—they were not such a couple;”;

(b) by omitting Step 4 in exempt bereavement payment calculator B and substituting the following Step:

“Step 4. Work out the amount of payments under the Social Security Act 1991 or Part III of the Veterans’ Entitlements Act 1986 that would have been derived by the partner on each of the relevant pension paydays if:

(a) the partner had not died; and

(b) if immediately before the partner’s death the couple were an illness separated couple or a respite care couple—they were not such a couple;

the result for each relevant pension payday is called the pension payday notional partner amount.”.

Application of amendments

13.(1) The amendments made by section 11 apply in relation to payments derived on or after 13 December 1991.

(2) The amendments made by section 12 apply in relation to payments derived on or after 1 July 1991.

Division 4—Amendments relating to offshore banking units

Officers to observe secrecy

14. Section 16 of the Principal Act is amended:

(a) by omitting from paragraph (4)(j) “or” (last occurring);

(b) by adding at the end of subsection (4) the following word and paragraph:

“; or (1) the Treasurer, for the purpose of exercising his or her powers under subsection 128AE(2A) or (2C).”;

(c) by inserting in subsection (5) “or (4)(1)” after “paragraph (4)(k)”.

15. After section 121 of the Principal Act the following Division is inserted:

“Division 9A—Offshore banking units

“Subdivision A—Object and simplified outline

Object

“121A. The object of this Division is to provide for concessional taxing, at the rate of 10%, of the offshore banking (‘OB’) income of an offshore banking unit (‘OBU’).

Simplified outline

[Scope of section]

“121B.(1) The following is a simplified outline of the Division.

[Main concepts]

“(2) Subdivision B sets out the concepts used in the Division, the most important being:

(a) ‘OB activity’ (section 121D) together with the related definition of ‘offshore person’ (section 121E) and the ‘OBU requirement’ in section 121EA; and

(b) special assessable income and allowable deduction definitions relating to OB activities (sections 121EE and 121EF).

[Operative provisions]

“(3) Subdivision C contains the operative provisions. Basically, they provide as follows:

(a) an OBU’s income from OB activities is taxed at only 10%;

(b) there is a loss of the concession where there is excessive use of non-OB money;

(c) a deduction is allowable for foreign tax on amounts derived from OB activities;

(d) income from OB activities is taken to be Australian sourced;

(e) a deemed interest penalty applies to equity provided by an OBU’s resident owner;

(f) income of OBU offshore investment trusts is exempt from tax.

“Subdivision B—Interpretation

Interpretation

“121C. In this Division:

‘adjusted assessable OB income’ has the meaning given by subsection 121EE(4);

‘adjusted total assessable income’ has the meaning given by subsection 121EE(5);

‘allowable OB deduction’ has the meaning given by subsection 121EF(2);

‘apportionable OB deduction’ has the meaning given by subsection 121EF(5);

‘assessable OB income’ has the meaning given by subsection 121EE(2);

‘associate’ has the meaning given by section 318;

‘borrow’ includes raise finance by the issue of a security;

‘eligible contract’ means a futures contract, a forward contract, an options contract, a swap contract, a cap, collar, floor or similar contract or a loan contract;

‘exclusive non-OB deduction’ has the meaning given by subsection 121EF(6);

‘exclusive OB deduction’ has the meaning given by subsection 121EF(3);

‘general OB deduction’ has the meaning given by subsection 121EF(4);

‘lend’ includes provide finance by the purchase of a security;

‘loss deduction’ has the meaning given by subsection 121EF(7);

‘non-OB money’, in relation to an OBU, means money of the OBU other than:

(a) money received by the OBU in carrying on an OB activity; or

(b) OBU resident-owner money of the OBU; or

(c) money paid to the OBU by a non-resident (other than in carrying on business in Australia at or through a permanent establishment of the non-resident) by way of subscription for, or a call on, shares in the OBU;

(an example of non-OB money being money borrowed from a resident whose lending of the money does not occur in carrying on business in a country outside Australia at or through a permanent establishment of the resident);

‘non-resident trust’ means a unit trust that is not a resident unit trust within the meaning of section 102Q;

‘OB activity’ has the meaning given by section 121D;

‘OBU’ (offshore banking unit) means an offshore banking unit within the meaning of Division 11A of Part III;

‘OBU resident-owner money’ has the meaning given by section 121EC;

‘offshore person’ has the meaning given by section 121E;

‘owner’, in relation to a company, means a person who, alone or together with an associate or associates, is the beneficial owner of all of the shares in the company;

‘related person’, in relation to an OBU, means:

(a) an associate of the OBU; or

(b) a permanent establishment referred to in paragraph 121EB(1)(b) in relation to the OBU;

‘security’ means a bond, debenture, bill of exchange, promissory note or other security or similar instrument;

trade with a person’ has the meaning given by section 121ED;

‘90-day bank bill rate’, at a particular time, means:

(a) if the Reserve Bank of Australia has published a rate described as the 90-day bank accepted bill rate in respect of a period in which the particular time occurs—that rate; or

(b) in any other case—the rate declared by regulations for the purposes of this definition to be the 90-day bank accepted bill rate in respect of a period in which the particular time occurs.

Meaning of “OB activity”

[Kinds of OB activity]

“121D.(1) Each of the following things done by an OBU is an ‘OB activity’ (offshore banking activity) of the OBU, provided that the requirement relating to the OBU in section 121EA is met:

(a) a borrowing or lending activity described in subsection (2); or

(b) a guarantee-type activity described in subsection (3); or

(c) a trading activity described in subsection (4); or

(d) an eligible contract activity described in subsection (5); or

(e) an investment activity described in subsection (6); or

(f) an advisory activity described in subsection (7); or

(g) a hedging activity described in subsection (8); or

(h) any other activity involving an offshore person, being an activity declared by regulations for the purposes of this paragraph to be an OB activity.

[Borrowing or lending activity]

“(2) For the purposes of paragraph (1)(a), a ‘borrowing or lending activity’ is:

(a) borrowing money from an offshore person where, if that person is a related person or a person to whom paragraph 121E(b) applies, the money is not Australian currency; or

(b) lending money to an offshore person where, if that person is a person to whom paragraph 121E(b) applies, the money is not Australian currency.

[Guarantee-type activity]

“(3) For the purposes of paragraph (1)(b), a ‘guarantee-type activity’ is:

(a) providing a guarantee or letter of credit to an offshore person; or

(b) underwriting a risk for an offshore person in respect of property outside Australia or an event that can only happen outside Australia; or

(c) syndicating a loan for an offshore person; or

(d) issuing a performance bond to an offshore person;

where, if the offshore person is a related person, any money payable under the guarantee, letter, underwriting, loan or bond is not Australian currency.

[Trading activity]

“(4) For the purposes of paragraph (1)(c), a ‘trading activity’ is:

(a) trading with an offshore person in:

(i) securities issued by non-residents, where the securities are denominated other than in Australian currency; or

(ii) eligible contracts, under which any amounts payable are payable by non-residents other than in Australian currency; or

(b) trading with an offshore person in:

(i) shares in non-resident companies, where the shares are denominated other than in Australian currency; or

(ii) units in non-resident trusts, where the units are denominated other than in Australian currency; or

(c) trading with an offshore person in options or rights in respect of securities, eligible contracts, shares or units referred to in paragraph (a) or (b); or

(d) trading (including on behalf of an offshore person) on the Sydney Futures Exchange in futures contracts, or options contracts, under which any money payable is not Australian currency; or

(e) trading in currency, or options or rights in respect of currency, with any person, where the currency is not Australian currency; or

(f) trading with an offshore person in gold, silver or platinum bullion, or in options or rights in respect of such bullion, where any money payable or receivable is not Australian currency.

“(5) For the purposes of paragraph (1)(d), an ‘eligible contract activity’ is entering into an eligible contract (other than a loan contract) with an offshore person under which any money payable is not Australian currency.

[Investment activity]

“(6) For the purposes of paragraph (1)(e), an ‘investment activity’ is making, as broker or agent for, or trustee for the benefit of, an offshore person to whom paragraph 121E(a) applies, an investment with an offshore person to whom that paragraph applies, or so making and managing such an investment, where:

(a) the currency in which the investment is made is not Australian currency; and

(b) if the investment involves the purchase of any thing:

(i) if the thing is a share in a company—the company is a non-resident company; or

(ii) if the thing is a unit in a unit trust—the unit trust is a non-resident trust; or

(iii) if the thing is land or a building—the land or building is not in Australia; or

(iv) in any other case—the thing is located outside Australia.

[Advisory activity]

“(7) For the purposes of paragraph (1)(f), an ‘advisory activity’ is giving investment or other financial advice to an offshore person where, if the advice is about the making of a particular investment, the investment is of a kind referred to in subsection (6). This does not exclude giving advice about a particular investment of a different kind if doing so is incidental to advising on an investment of a kind referred to in subsection (6), for example for the purpose of comparison or because the investments are commercially related.

[Hedging activities]

“(8) For the purposes of paragraph (1)(g), a ‘hedging activity’ is entering into a contract with an offshore person for the sole purpose of eliminating or reducing the risk of adverse financial consequences that might result to the OBU from:

(a) interest rate exposure of the OBU in respect of borrowing or lending activities (described in subsection (2)) of the OBU; or

(b) currency exposure of the OBU in respect of borrowing or lending activities (described in subsection (2)) of the OBU;

where, if the offshore person is a related person, any money payable under the contract is not Australian currency.

[Effect of subsection (8)]

“(9) Subsection (8) does not limit the scope of any other OB activity of the OBU (for example the trading activity mentioned in paragraph (4)(e)).

Meaning of “offshore person”

“121E. For the purposes of section 121D, a reference in that section to an offshore person, in relation to the doing of any thing by an OBU (‘the first OBU’), is a reference to:

(a) a non-resident whose involvement in the doing of the thing does not occur in carrying on business in Australia at or through a permanent establishment of that person; or

(b) a resident whose involvement in the doing of the thing occurs in carrying on business in a country outside Australia at or through a permanent establishment of the person; or

(c) another OBU (‘the second OBU’), where, if the doing of the thing involves the payment of any money (for example a loan of money) by the second OBU to the first OBU, the second OBU gives, at or before the time of the payment, a statement in writing to the first OBU to the effect that none of the money is non-OB money of the second OBU.

OBU requirement

“121EA. For a thing done by an OBU to be an OB activity, it is necessary that, when the thing is done:

(a) the OBU is a resident and the thing is not done in carrying on business in a country outside Australia at or through a permanent establishment of the OBU; or

(b) the OBU is a non-resident and the thing is done in carrying on business in Australia at or through a permanent establishment of the OBU.

Internal financial dealings of an OBU

[Permanent establishments treated as separate persons]

“121EB.(1) If an OBU consists of:

(a) one or more permanent establishments in Australia at or through which the OBU carries on what are OB activities apart from this section; and

(b) one or more other permanent establishments either in Australia or outside Australia;

then sections 121D to 121EA (inclusive) apply as if:

(c) the OBU consisted only of the permanent establishments referred to in paragraph (a); and

(d) the permanent establishments referred to in paragraph (b) were separate persons.

[Head office can be permanent establishment]

“(2) For the purpose of determining under subsection (1) whether something is a permanent establishment, it does not matter whether it is a head office or not.

Meaning of “OBU resident-owner money”

“121EC. Money is ‘OBU resident-owner money’ of an OBU if it is paid to the OBU by a resident owner of the OBU by way of a subscription for, or a call on, shares in the OBU, except if:

(a) the shares are redeemable preference shares; or

(b) the amount paid is a share premium.

Meaning of “trade with a person”

“121ED. A person (‘the trader’) is said to ‘trade with another person’ in a thing if:

(a) the trader, for the purpose of trading in the thing, acquires it on issue from the other person; or

(b) the trader, for the purpose of trading in the thing, buys it from the other person; or

(c) the trader, in trading in the thing, sells it to the other person.

Definitions relating to assessable income of an OBU [Purpose of section]

“121EE.(1) This section sets out certain definitions used in this Division that relate to the assessable income of an OBU of a year of income.

[Assessable OB income]

“(2) The ‘assessable OB income’ of an OBU is so much of the OBU’s assessable income (other than amounts included under Part IIIA) of the year of income as is:

(a) derived from OB activities of the OBU or the part of the OBU to which paragraph 121EB(1)(c) applies; or

(b) included in the assessable income because of such activities;

except to the extent that the money lent, invested or otherwise used in carrying on the activities is non-OB money of the OBU.

[Typical example of amount excluded from assessable OB income]

“(3) A typical example of an amount covered by the exception in subsection (2) is interest derived from the OB activity of lending money to an offshore person, where the money lent is non-OB money.

[Adjusted assessable OB income]

“(4) The ‘adjusted assessable OB income’ of an OBU is the OBU’s assessable OB income of the year of income reduced by the sum of the OBU’s exclusive OB deductions for interest (including a discount in the nature of interest).

[Adjusted total assessable income]

“(5) The ‘adjusted total assessable income’ of an OBU is the OBU’s assessable income of the year of income reduced by the sum of the OBU’s exclusive OB deductions, and exclusive non-OB deductions, for interest (including a discount in the nature of interest).

Definitions relating to allowable deductions of an OBU

[Purpose of section]

“121EF.(1) This section sets out certain definitions used in this Division relating to allowable deductions of an OBU in relation to a year of income.

[Allowable OB deduction]

“(2) An ‘allowable OB deduction’ is any of the following 3 kinds of allowable deduction:

(a) an exclusive OB deduction;

(b) a general OB deduction;

(c) an apportionable OB deduction.

[Exclusive OB deduction]

“(3) An ‘exclusive OB deduction’ is any deduction (other than a loss deduction) allowable from the OBU’s assessable income of the year of income that relates exclusively to assessable OB income.

[General OB deduction]

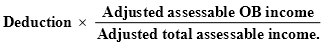

“(4) A ‘general OB deduction’ is so much of any deduction (other than a loss deduction, an apportionable deduction, an exclusive OB deduction or an exclusive non-OB deduction) allowable from the OBU’s assessable income of the year of income as is calculated using the formula:

[Apportionable OB deduction]

“(5) An ‘apportionable OB deduction’ is so much of any apportionable deduction allowable from the OBU’s assessable income of the year of income as is calculated by multiplying the deduction by the following fraction:

[Exclusive non-OB deduction]

“(6) An ‘exclusive non-OB deduction’ is any deduction (other than a loss deduction) allowable from the OBU’s assessable income of the year of income that relates exclusively to assessable income that is not assessable OB income.

[Loss deduction]

“(7) A ‘loss deduction’ is any allowable deduction under section 79E, 79F, 80, 80AAA or 80AA.

“Subdivision C—Operative provisions

Reduction of assessable OB income and allowable OB deductions [Only eligible fraction of assessable OB income is assessable]

“121EG.(1) Subject to section 121EH, the assessable income of an OBU includes only the eligible fraction of each amount of assessable OB income derived by the OBU.

[Only eligible fraction of allowable OB deductions is allowable]

“(2) Subject to section 121EH, only the eligible fraction of each allowable OB deduction of an OBU is an allowable deduction of the OBU.

[Remaining amounts not exempt income etc.]

“(3) For the purposes of this Act:

(a) any amount of assessable OB income of an OBU that, because of subsection (1), is not included in its assessable income is taken not to be exempt income of the OBU; and

(b) any part of an allowable OB deduction of an OBU that, because of subsection (2), is not an allowable deduction of the OBU is taken not to be an expense or outgoing incurred in deriving exempt income of the OBU.

[Meaning of “eligible fraction”]

“(4) In this section:

‘eligible fraction’ means 10 divided by the number of percent in the general company tax rate (within the meaning of section 160APA).

Loss of special treatment where excessive use of non-OB money

“121EH. If:

(a) the subsection 121EE(2) exception in respect of the lending, investing or other use of non-OB money of an OBU in carrying on activities did not apply to exclude amounts from its assessable OB income; and

(b) as a result, more than 10% of what would then be the OBU’s assessable OB income of any year of income would be attributable to that lending, investing or other use of non-OB money;

then:

(c) subsection 121EG(1) (which limits the OBU’s assessable income) does not apply to the OBU’s assessable OB income of the year of income; and

(d) subsection 121EG(2) (which limits the OBU’s allowable deductions) does not apply to so much of each allowable OB deduction of the OBU for the year of income as is calculated using the formula:

(where each amount is worked out ignoring the assumption in paragraph (a)).

Deduction for foreign tax on amounts included in assessable OB income

“121E1. Foreign tax paid during a year of income by an OBU on amounts included in the OBU’s assessable OB income of any year of income is an allowable deduction for the year of income in which it is paid.

Source of income derived from OB activities

“121EJ. For the purposes of this Act, income of an OBU that is derived from OB activites of the OBU is taken to be derived from a source in Australia.

Deemed interest on 90% of certain OBU resident-owner money

[Deemed interest]

“121EK.(1) If:

(a) an owner of an OBU pays an amount of money to the OBU and, because of section 121EC, the amount becomes OBU resident-owner money of the OBU; and

(b) the OBU uses, or holds ready for use, the whole or part of the amount (which whole or part is called ‘the OB use amount’) in carrying on any of its OB activities during the whole or part of any year of income (which whole or part is called ‘the OB use period’);

then the assessable income of the owner of the year of income includes deemed interest as described in subsection (2).

[Amount of deemed interest]

“(2) The deemed interest is:

(a) applied to 90% of the OB use amount; and

(b) applied on a daily-rests basis for the OB use period at a rate that is 2% above the 90-day bank bill rate from time to time during that period.

[Deduction for deemed interest]

“(3) A deduction is allowable from the OBU’s assessable income, equal to the amount included in the owner’s assessable income, for the year of income. The deduction is taken to be an exclusive OB deduction for interest.

Exemption of income etc. of OBU offshore investment trusts

“121EL. If:

(a) an OBU is a trustee, or is the central manager and controller, of a trust estate; and

(b) the only persons who benefit, or are capable (whether by the exercise of a power of appointment or otherwise) of benefiting, under the trust are non-residents; and

(c) the terms of the trust are to the effect that income, profits or capital gains of the trust estate may only come from investment activities of a kind to which subsection 121D(6) applies;

then:

(d) any income of the trust estate derived from such investment activities is exempt from income tax; and

(e) no capital gain accrues to, and no capital loss is incurred by, the trust estate under Part IIIA in respect of the disposal of any asset in the course of, or in connection with, such investment activities.”.

Interpretation provisions relating to offshore banking units

16. Section 128AE of the Principal Act is amended:

(a) by omitting from subsection (1) the definition of “offshore banking unit” and substituting the following definition:

“ ‘offshore banking unit’ has the meaning given by this section;”;

(b) by omitting from subsection (1) the definition of “offshore borrowing” and substituting the following definition:

“ ‘offshore borrowing’ means:

(a) a borrowing in any currency, by a person who is or has been an offshore banking unit, from a non-resident who is not a related person (within the meaning of Division 9A); or

(b) a borrowing in a currency other than Australian currency, by a person who is or has been an offshore banking unit, from a resident or a related person (within the meaning of Division 9A);”;

(c) by omitting from subsection (1) the definition of “offshore loan”;

(d) by inserting in subsection (1) the following definitions:

“ ‘borrow’ includes raise finance by the issue of a security;

‘lend’ includes provide finance by the purchase of a security;

‘OB activity’ has the same meaning as in section 121D;

‘security’ means a bond, debenture, bill of exchange, promissory note or other security or similar instrument;”;

(e) by adding at the end of paragraph (2)(a) “or”;

(f) by inserting after paragraph (2)(b) the following paragraph:

“(ba) a company in which all of the shares are beneficially owned by an offshore banking unit (other than one to which paragraph (c) applies); or”;

(g) by inserting after subsection (2) the following subsections:

“(2A) If a person who is an offshore banking unit for the purposes of this Division:

(a) is convicted of an offence against section 8L, 8N, 8P, 8Q, 8T or 8U of the Taxation Administration Act 1953; or

(b) incurs a tax liability, within the meaning of that Act, by way of a penalty equal to 90% of an amount;

the Treasurer may declare, by notice published in the Gazette, that the person is no longer an offshore banking unit for the purposes of this Division.

“(2B) If the Treasurer makes such a declaration in respect of a company that is an offshore banking unit only because of paragraph (2)(ba), the offshore banking unit mentioned in that

paragraph, and in any previous application of that paragraph that was necessary for it to apply to the company, is no longer an offshore banking unit from the time when the declaration comes into force.

“(2C) If a person who is an offshore banking unit ceases to be a person of a kind mentioned in any of paragraphs (2)(a), (b), (ba) and (c), the Treasurer must declare, by notice published in the Gazette, that the person is no longer an offshore banking unit for the purposes of this Division.

“(2D) Except as mentioned in subsection (2A), (2B) or (2C), a person does not cease to be an offshore banking unit for the purposes of this Division.”;

(h) by inserting in subsection (3) “, (2A) or (2C)” after “(2)”;

(i) by omitting from paragraph (5)(a) “an offshore loan of tax exempt loan money” and substituting “a loan of tax exempt loan money where the loan is an OB activity or would be if the person were an OBU”;

(j) by omitting subsection (6);

(k) by omitting from subsection (9) “(other than by way of an offshore loan” and substituting “(other than by way of payment in carrying on an OB activity, or what would be an OB activity if the person were an OBU,”;

(l) by omitting from paragraph (9)(a) “an offshore loan” and substituting “payment in carrying on an OB activity (or what would be an OB activity if the person were an OBU)”;

(m) by adding at the end the following subsection:

“(13) If an offshore banking unit consists of:

(a) one or more permanent establishments in Australia at or through which the offshore banking unit carries on what are OB activities within the meaning of Division 9A; and

(b) one or more other permanent establishments either in Australia or outside Australia;

then this section and section 128NB apply as if:

(c) the offshore banking unit consisted only of the permanent establishments referred to in paragraph (a); and

(d) the permanent establishments referred to in paragraph (b) were separate persons.”.

Special tax payable in respect of certain dealings by current and former offshore banking units

17. Section 128NB of the Principal Act is amended by omitting from paragraph (1)(a) “an offshore loan” and substituting “payment in carrying on an OB activity or what would be an OB activity if the person were an OBU”.

Keeping of records

18. Section 262A of the Principal Act is amended by inserting after subsection (1) the following subsection:

“(1A) Without limiting subsection (1), if the person is an OBU (within the meaning of Division 9A of Part III), the person must, subject to this section, maintain the same accounting records in respect of, and separately account for, money used in its OB activities (within the meaning of that Division) as it would if it were a bank conducting banking activities with another person.”.

Application of amendments

[Meaning of “amended Act”]

19.(1) In this section:

“amended Act” means the Principal Act as amended by this Division.

[Section 121EG]

(2) Section 121EG of the amended Act applies to assessable income derived, and allowable deductions in respect of losses or outgoings incurred, after 30 June 1992.

[Section 121EI]

(3) Section 121EI of the amended Act applies to foreign tax paid after 30 June 1992.

[Section 121EJ]

(4) Section 121EJ of the amended Act applies to income derived after 30 June 1992.

[Section 121EK]

(5) Section 121EK of the amended Act applies to deemed interest in respect of any period beginning after 30 June 1992, regardless of when the money referred to in that section was paid, used or held ready for use.

[Section 121EL]

(6) Section 121EL of the amended Act applies to income derived, and gains or losses in respect of the disposal of assets, after 30 June 1992.

[Sections 16, 128AE and 262A]

(7) The amendments made by sections 14, 16 and 18 apply to the doing of things after the commencement of those sections.

Transitional—1 July to commencement

[Modified text to apply for transitional period]

20.(1) In applying section 19 in relation to things done or happening during the period beginning on 1 July 1992 and ending at the commencement of this section, the Principal Act as amended by this Division is to be modified as set out in this section.

[Paragraph 121B(3)(e)]

(2) Paragraph 121B(3)(e) is to be amended by omitting “resident”.

[Non-OB money]

(3) The definition of “non-OB money” in section 121C is to be replaced with the following definition:

“ ‘non-OB money’, in relation to an OBU, means money that is not:

(a) derived from OB activities of the OBU; or

(b) money that would be OBU owner money of the OBU if paragraphs 121EC(b) and (c) were disregarded;”.

[Related person]

(4) The definition of “related person” in section 121C is to be amended by omitting paragraph (a) and substituting the following paragraph:

“(a) an owner of the OBU; or”.

[Paragraph 121D(3)(b)]

(5) Paragraph 121D(3)(b) is to be amended by omitting “in respect of property outside Australia or an event that can only happen outside Australia”.

[Paragraph 121D(4)(f)]

(6) Paragraph 121D(4)(f) is to be amended by omitting “, silver or platinum bullion, or in options or rights in respect of such bullion, where any money payable or receivable is not Australian currency” and substituting “bullion”.

[Paragraphs 121D(8)(a) and (b)]

(7) Paragraphs 121D(8)(a) and (b) are to be amended by omitting “borrowing or lending activities (described in subsection (2))” and substituting “other OB activities”.

[Paragraph 121E(c)]

(8) Paragraph 121E(c) is to be replaced with the following paragraph:

“(c) an OBU.”.

[Section 121EC]

(9) Section 121EC is to be replaced with the following section:

“121EC. Money is ‘OBU owner money’ of an OBU if:

(a) the money is made available for use in OB activities of the OBU by an owner of the OBU, whether by way of a loan, gift, share subscription or otherwise; and

(b) according to the accounts of the owner, the money was borrowed by the owner; and

(c) any interest payable by the owner on the money is an allowable deduction from the assessable income of the owner.”.

[Subsection 121EK(1)]

(10) Subsection 121EK(1) is to be amended by omitting “pays an amount of money to the OBU and, because of section 121EC, the amount becomes OBU resident-owner” and substituting “makes money available as mentioned in paragraph 121EC(a) so that, in accordance with that section, it is OBU owner”.

Division 5—Amendment relating to rebates in respect of Textile, Clothing and Footwear Special Allowance

Rebate in respect of certain pensions, benefits etc.

21. Section 160AAA of the Principal Act is amended by adding at the end of the definition of “rebatable benefit” in subsection (1) the following word and paragraph:

“or (e) paid by way of Textile, Clothing and Footwear Special Allowance;”.

Application of amendment

22. The amendment made by this Division applies to payments made on or after 26 September 1991.

Division 6—Amendments relating to capital gains tax

Assets to which Part applies

23. Section 160A of the Principal Act is amended:

(a) by omitting paragraph (a) and substituting the following paragraphs:

“(a) any of the following:

(i) an option;

(ii) a debt;

(iii) a chose in action;

(iv) any other right;

whether legal or equitable and whether or not a form of property;

(aa) goodwill or any other form of incorporeal property;”;

(b) by omitting paragraph (c).

Part applies in respect of disposals of assets

24. Section 160L of the Principal Act is amended by inserting in subsection (1) “or not situated anywhere” after “Australia or elsewhere”.

What constitutes a disposal or acquisition

25. Section 160M of the Principal Act is amended:

(a) by omitting paragraphs (5)(b) and (c) and substituting the following paragraphs:

“(b) if:

(i) a person constructs or creates an asset; and

(ii) on its construction or creation, the asset is not vested in another person;

the person constructing or creating the asset is taken to have acquired, and to have commenced to own, the asset at the time applicable under subsection 160U(5); and

(c) if:

(i) a person constructs or creates an asset that is a form of corporeal property; and

(ii) on its construction or creation, the asset is vested in another person;

the other person is taken to have acquired, and to have commenced to own, the asset at the time applicable under subparagraph 160U(6)(a)(i) or (b)(i).”;

(b) by omitting subsection (6) and substituting the following subsections:

“(6) Subject to this Part (other than subsection (7) of this section), if:

(a) a person creates an asset that is not a form of corporeal property; and

(b) on its creation, the asset is vested in another person; then subsections (6A) and (6B) apply.

“(6A) If subsection (6) applies:

(a) the person creating the asset is taken to have acquired, and to have commenced to own, the asset at the time applicable under subparagraph 160U(6)(a)(ii) or (b)(ii); and

(b) the person creating the asset is later taken to have disposed of the asset to the other person mentioned in paragraph (6)(b) of this section at the time applicable under subparagraph 160U(6)(a)(iii) or (b)(iii); and

(c) the person so taken to dispose of the asset is taken not to have paid or given any consideration, or incurred any costs or expenditure, referred to in any of paragraphs 160ZH(1)(a) to (d) (inclusive), (2)(a) to (d) (inclusive) and (3)(a) to (d) (inclusive) in respect of the asset; and

(d) paragraph 160ZD(2)(a) does not apply to that disposal of the asset.

“(6B) Also, if subsection (6) applies:

(a) the other person mentioned in paragraph (6)(b) is taken to have acquired the asset from the person creating it, and to have commenced to own it, at the time applicable under subparagraph 160U(6)(a)(i) or (b)(i); and

(b) paragraph 160ZH(9)(a) does not apply to that acquisition of the asset.

“(6C) Subsection (6) applies to the creation of an asset:

(a) whether or not the asset is created out of, over or otherwise in connection with, an existing asset; and

(b) whether or not the person creating the asset owned or disposed of anything at the moment of creation of the asset.

“(6D) In subsections (5) and (6):

‘vest’, in relation to an asset, means:

(a) in the case of an asset that is not a right—confer ownership of the asset on a person; or

(b) in the case of an asset that is a right—create the right in a person (whether or not conferring ownership of the asset on the person).”;

(c) by omitting paragraph (7)(a) and substituting the following paragraph:

“(a) either:

(i) an act or transaction has taken place in relation to an asset, whether or not affecting the asset; or

(ii) an event affecting an asset has occurred; where, in a subparagraph (i) case in which the asset was affected or in any subparagraph (ii) case, it does not matter whether the asset was affected adversely or beneficially, or neither adversely nor beneficially; and”;

(d) by omitting from paragraph (7)(b) “a person” and substituting “the person who owned the asset at the time of the act, transaction or event”;

(e) by omitting from subparagraph (7)(b)(i) “for forfeiture or surrender of the right or”;

(f) by adding at the end of subsection (7) the following word and paragraph:

“; and (e) the person is taken to have acquired and owned the asset immediately before the disposal.”;

(g) by omitting subsection (7A) and substituting the following subsections:

“(7A) Subsection (7), as in force before it was amended by the Taxation Laws Amendment Act (No. 4) 1992, is taken not to have applied in relation to:

(a) an act or transaction that took place in relation to an asset during the period that commenced on 20 September 1985 and ended on 22 May 1986; or

(b) an event affecting an asset that occurred during that period;

if the requirement set out in subsection (7B) is met.

“(7B) For the purposes of subsection (7A), the requirement is:

(a) if the person who received, or was entitled to receive, the amount of money or other consideration referred to in paragraph (7)(b) owned the asset when the act or transaction took place, or the event occurred—that the person acquired the asset before 20 September 1985; or

(b) in any other case—that the person who owned the asset when the act or transaction took place, or the event occurred, acquired the asset before 23 May 1986.”.

26. After section 160M of the Principal Act the following section is inserted:

Certain asset creation cases not to constitute an acquisition or disposal

[Certain debts]

“160MA.(1) If a person creates a debt by borrowing money or obtaining credit from another person, neither subsection 160M(6) nor subsection 160M(7) applies to the creation of the debt, but the other person is taken to acquire the debt for the purposes of this Part.

[Right to require Part IIIA disposal]

“(2) If:

(a) a person creates a right in another person to require the first person to do any thing; and

(b) the doing of the thing will constitute the disposal of an asset for the purposes of this Part;

then neither subsection 160M(6) nor subsection 160M(7) applies to the creation of the right.

[Interpretive provision relating to paragraph (2)(b)]

“(3) In applying paragraph (2)(b), the exclusion from the definition of ‘asset’ in section 160A of motor vehicles of a kind mentioned in paragraph 82AF(2)(a), and interests in such motor vehicles, is to be ignored.”.

Disposal of taxable Australian assets

27. Section 160T of the Principal Act is amended:

(a) by omitting from paragraph (j) “or” (last occurring);

(b) by adding at the end the following paragraphs and subsection:

“(1) the following conditions are satisfied:

(i) there is a disposal of the asset because paragraph 160M(6A)(b) applies; and

(ii) the asset is not a taxable Australian asset under another paragraph of this section; and

(iii) the consideration in respect of the disposal of the asset was derived from a source in Australia or if there had been such consideration it would have been derived from such a source; or

(m) the following conditions are satisfied:

(i) there is a disposal of the asset because subsection 160M(7) applies; and

(ii) the asset referred to in paragraph 160M(7)(a) is a taxable Australian asset under another paragraph of this section.

“(2) If the consideration referred to in subparagraph (1)(l)(iii) is not of an income nature, then for the purpose of determining under that subparagraph whether the consideration was or would have been derived from a source in Australia, it is taken to be of an income nature.”.

Time of disposal and acquisition

28. Section 160U of the Principal Act is amended by omitting subsections (5) and (6) and substituting the following subsections:

“(5) If paragraph 160M(5)(b) applies to the construction or creation of the asset, the asset is taken to have been acquired as mentioned in that paragraph when the construction of the asset commenced or when the work on, or work that resulted in, the creation of the asset commenced.

“(6) If paragraph 160M(5)(c), 160M(6A)(a) or (b) or 160M(6B)(a) applies to the construction or creation of the asset:

(a) if the asset was constructed or created under a contract—the asset is taken:

(i) in a paragraph 160M(5)(c) or 160M(6B)(a) case—to have been acquired as mentioned in that paragraph at the time of making of the contract; and

(ii) in a paragraph 160M(6A)(a) case—to have been acquired as mentioned in that paragraph immediately before the time of making of the contract; and

(iii) in a paragraph 160M(6A)(b) case—to have been disposed of as mentioned in that paragraph at the time of making of the contract; and

(b) in any other case—the asset is taken:

(i) in a paragraph 160M(5)(c) or 160M(6B)(a) case—to have been acquired as mentioned in that paragraph at the time of the vesting referred to in paragraph 160M(5)(c) or in paragraph 160M(6)(b), as the case requires; and

(ii) in a paragraph 160M(6A)(a) case—to have been acquired as mentioned in that paragraph immediately before the time of the vesting referred to in paragraph 160M(6)(b); and

(iii) in a paragraph 160M(6A)(b) case—to have been disposed of as mentioned in that paragraph at the time of the vesting referred to in paragraph 160M(6)(b).

“(6A) Where:

(a) a provision of this Part, other than a provision of section 160M (‘the relevant section 160M provision’) referred to in subsection (5) or (6) of this section, applies to the construction or creation of an asset to deem there to have been an acquisition or disposal of the asset; and

(b) because the relevant section 160M provision does not apply, neither subsection (5) nor subsection (6) of this section applies; and

(c) the provision of this Part does not state the time at which the acquisition or disposal is taken to have occurred;

then the acquisition or disposal is taken to have occurred at the time that would have been applicable under subsection (5) or (6) of this section if the relevant section 160M provision had applied.”.

Exemption of certain gains and losses

29. Section 160ZB of the Principal Act is amended by inserting in subsections (2) and (3) “or competition” after “game” (wherever occurring).

Cost base, indexed cost base and reduced cost base

30. Section 160ZH of the Principal Act is amended:

(a) by omitting from subsection (7) “Subject to subsection” and substituting “Subject to subsections (7A) and”;

(b) by inserting after subsection (7) the following subsections:

“(7A) Subject to subsection (8), if the disposal of an asset is taken to have occurred under paragraph 160M(6A)(b) because of the application of subsection 160M(6) in relation to the creation of the asset, a reference in subsection (1), (2) or (3) of this section to the incidental costs to a taxpayer of the disposal of the asset is a reference to expenditure described in subsection (7B).

“(7B) For the purposes of subsection (7A), the expenditure is any expenditure incurred by the taxpayer to the extent to which it was incurred in connection with the creation of the asset, being:

(a) fees, commission or remuneration for the professional services of a surveyor, valuer, auctioneer, accountant, broker, agent, consultant or legal adviser; or

(b) costs of registration of any instrument, including stamp duty or other similar duty; or

(c) costs of advertising to find a buyer; or

(d) costs in relation to the making of any valuation or apportionment under or for the purposes of this Part in respect of the creation of the asset;

but excluding any expenditure incurred by way of fees or commission for professional advice that:

(e) concerns the operation of this Act; and

(f) was not provided by a recognised professional tax adviser (within the meaning of section 69).”;

(c) by inserting in subsection (8) “, or (7B)(a), (b), (c) or (d),” after “or (d)”.

Application of amendments

31.(1) Subject to this section, the amendments made by this Division (other than paragraph 25(g)) apply to the construction or creation of assets after 25 June 1992.

(2) The amendments made by paragraphs 25(c), (d), (e) and (f) apply to acts or transactions taking place, or events occurring, after 25 June 1992.

(3) The amendment made by section 29 applies to participation in competitions after 25 June 1992.

(4) Paragraph 160T(1)(m) of the Principal Act as amended by this Division applies to acts or transactions taking place, or events occurring, after 25 June 1992.

Division 7—Amendment of assessments

Amendment of assessments

32. Section 170 of the Principal Act does not prevent the amendment of an assessment made before the commencement of this section for the purpose of giving effect to this Act.

PART 3—AMENDMENTS RELATING TO TAX PENALTIES

Late payment penalties etc.

33.(1) Each of the following provisions is amended by omitting “20%” and substituting “16%”:

Fringe Benefits Tax Assessment Act 1986

subsection 93(1)

subsection 93(2)

subsection 112(4)

Income Tax Assessment Act 1936

subsection 128C(3)

subsection 221AY(2)

subsection 221AY(3)

subsection 221AZE(3)

subsection 221EAA(1)

subsection 221EAA(2)

subparagraph 221F(12)(b)(i)

sub-subparagraph 221 F(12)(b)(ii)(B)

paragraph 221G(4A)(c)

subparagraph 221 G(4A)(d)(ii)

subsection 221YDB(1AA)

subsection 221YDB(1ABA)

paragraph 221YHH(1)(b)

subsection 221YHH(2)

subparagraph 221YHJ(1)(b)(i)

sub-subparagraph 221YHJ(1)(b)(ii)(B)

paragraph 221YHZC(3)(b)

subparagraph 221YHZD(2)(b)(i)

sub-subparagraph 221YHZD(2)(b)(ii)(B)

paragraph 221YN(4)(b)

paragraph 221ZC(4)(b)

paragraph 221ZD(1)(b)

paragraph 221ZO(1)(b)

paragraph 221ZP(b)

Sales Tax Assessment Act (No. 1) 1930

subsection 29(1)

Sales Tax Assessment Act 1992

subsection 68(1).

(2) The amendments made by this section apply in relation to the calculation of a penalty payable in respect of so much of a period as occurs on or after 1 October 1992.

Transitional—sections 160ARW and 207 of the Income Tax Assessment Act 1936

34.(1) This section applies to sections 160ARW and 207 of the Income Tax Assessment Act 1936, in so far as those sections continue to apply in spite of the amendments made by the Taxation Laws Amendment (Self Assessment) Act 1992.

(2) Those sections have effect, in relation to the calculation of a penalty payable in respect of so much of a period as occurs on or after 1 October 1992, as if a reference in those sections to 20% were a reference to 16%.

Provisional tax penalties—under-estimation of income or over-estimation of PAYE deductions

35.(1) Each of the following provisions is amended by omitting “20%” and substituting “16%”:

subsection 221YDB(1) of the Income Tax Assessment Act 1936;

subsection 221YDB(1AAA) of the Income Tax Assessment Act 1936.

(2) The amendments made by this section apply in relation to provisional tax payable for the 1992-93 year of income and for all subsequent years of income.

NOTE

NOTE

1. No 27, 1936, as amended. For previous amendments, see No. 88, 1936; No. 5, 1937; No. 46, 1938; No. 30, 1939; Nos. 17 and 65, 1940; Nos. 58 and 69, 1941; Nos. 22 and 50, 1942; No. 10, 1943; Nos. 3 and 28, 1944; Nos. 4 and 37, 1945; No. 6, 1946; Nos. 11 and 63, 1947; No. 44, 1948; No. 66, 1949; No. 48, 1950; No. 44, 1951; Nos. 4, 28 and 90, 1952; Nos. 1, 28, 45 and 81, 1953; No. 43, 1954; Nos. 18 and 62, 1955; Nos. 25, 30 and 101, 1956; Nos. 39 and 65, 1957; No. 55, 1958; Nos. 12, 70 and 85, 1959; Nos. 17, 18, 58 and 108, 1960; Nos. 17, 27 and 94, 1961; Nos. 39 and 98, 1962; Nos. 34 and 69, 1963; Nos. 46, 68, 110 and 115, 1964; Nos. 33, 103 and 143, 1965; Nos. 50 and 83, 1966; Nos. 19, 38, 76 and 85, 1967; Nos. 4, 70, 87 and 148, 1968; Nos. 18, 93 and 101, 1969; No. 87, 1970; Nos. 6, 54 and 93, 1971; Nos. 5, 46, 47, 65 and 85, 1972; Nos. 51, 52, 53, 164 and 165, 1973; No. 216, 1973 (as amended by No. 20, 1974); Nos. 26 and 126, 1974; Nos. 80 and 117, 1975; Nos. 50, 53, 56, 98, 143, 165 and 205, 1976; Nos. 57, 126 and 127, 1977; Nos. 36, 57, 87, 90, 123, 171 and 172, 1978; Nos. 12, 19, 27, 43, 62, 146, 147 and 149, 1979; Nos. 19, 24, 57, 58, 124, 133, 134 and 159, 1980; Nos. 61, 92, 108, 109, 110, 111, 154 and 175, 1981; Nos. 29, 38, 39, 76, 80, 106 and 123, 1982; Nos. 14, 25, 39, 49, 51, 54 and 103, 1983; Nos. 14, 42, 47, 63, 76, 115, 124, 165 and 174, 1984; No. 123, 1984 (as amended by No. 65, 1985); Nos. 47, 49, 104, 123, 168 and 174, 1985; No. 173, 1985 (as amended by No. 49, 1986); Nos. 41, 46, 48, 51, 109, 112 and 154, 1986; No. 49, 1986 (as amended by No. 141, 1987); No. 52, 1986 (as amended by No. 141, 1987); No. 90, 1986 (as amended by No. 141, 1987); Nos. 23, 58, 61, 120, 145 and 163, 1987; No. 62, 1987 (as

NOTE—continued

amended by No. 108, 1987); No. 108, 1987 (as amended by No. 138, 1987); No. 138, 1987 (as amended by No. 11, 1988); No. 139, 1987 (as amended by Nos. 11 and 78, 1988); Nos. 8, 11, 59, 75, 78, 80, 87, 95, 97, 127 and 153, 1988; Nos. 2, 11, 56, 70, 73, 105, 107, 129, 163 and 167, 1989; No. 97, 1989 (as amended by No. 105, 1989); Nos. 20, 35, 45, 57, 58, 60, 61, 87, 119 and 135, 1990; Nos. 4, 5, 6, 48, 55, 100, 203, 208 and 216, 1991; and Nos. 3 and 35, 1992.

[Minister’s second reading speech made in—

House of Representatives on 25 June 1992

Senate on 12 November 1992]

![]()

![]() An Act to amend the law relating to taxation

An Act to amend the law relating to taxation