An Act relating to the establishment and administration of the Superannuation Guarantee Scheme, and for related purposes

Part 1—Preliminary

1 Short title [see Note 1]

This Act may be cited as the Superannuation Guarantee (Administration) Act 1992.

2 Commencement

This Act commences on 1 July 1992.

3 Act binds Crown etc.

(1) This Act binds the Crown in right of the Commonwealth, each State, the Australian Capital Territory and the Northern Territory.

(2) Nothing in this Act permits the Crown to be prosecuted for an offence.

4 Extension to Territories

This Act:

(a) extends to the Territory of Cocos (Keeling) Islands and the Territory of Christmas Island; and

(b) has effect as if those Territories were part of Australia.

4A Extension to Joint Petroleum Development Area

This Act:

(a) extends to the Joint Petroleum Development Area (within the meaning of the Petroleum (Timor Sea Treaty) Act 2003); and

(b) has effect as if that Area were part of Australia.

5 Application of Act to Commonwealth

(1) The Commonwealth, Commonwealth Departments and untaxable Commonwealth authorities are not liable to pay superannuation guarantee charge.

(2) However, subject to this Act and to such modifications as are prescribed, this Act applies in all other respects, in respect of any matter or thing in respect of the employment of a Commonwealth employee, as if:

(a) the employee were employed by the responsible Department and not by the Commonwealth; and

(b) the responsible Department were a company and each other Department, and each authority of the Commonwealth, were a company related to the responsible Department; and

(c) the responsible Department were a government body.

(2A) In addition, subject to such modifications as are prescribed, this Act applies in relation to an untaxable Commonwealth authority in the same way as it applies in relation to a Commonwealth Department.

(2B) The Finance Minister may give such directions in writing as are necessary or convenient to be given for carrying out or giving effect to this section and, in particular, may give directions in relation to the transfer of money within an account, or between accounts, operated by the Commonwealth or a Commonwealth entity.

(2C) Directions under subsection (2B) have effect, and must be complied with, notwithstanding any other law of the Commonwealth.

(3) Part 8 has effect as if any superannuation guarantee charge for a quarter in respect of a superannuation guarantee shortfall of the Commonwealth had been paid on:

(a) for a quarter beginning on 1 January—28 May in the next quarter; and

(b) for a quarter beginning on 1 April—28 August in the next quarter; and

(c) for a quarter beginning on 1 July—28 November in the next quarter; and

(d) for a quarter beginning on 1 October—28 February in the next quarter.

(4) Subsection 14ZX(4), section 14ZZ and Divisions 4 and 5 of Part IVC of the Taxation Administration Act 1953 do not apply to the Commonwealth, Commonwealth Departments or untaxable Commonwealth authorities.

(5) In this section:

Commonwealth Department means:

(a) a Department of State; or

(b) a Department of the Parliament established under the Parliamentary Service Act 1999; or

(c) a branch or part of the Australian Public Service in relation to which a person has, under an Act, the powers of, or exercisable by, the Secretary of a Department of the Australian Public Service.

Commonwealth entity means:

(a) an Agency (within the meaning of the Financial Management and Accountability Act 1997); or

(b) a Commonwealth authority (within the meaning of the Commonwealth Authorities and Companies Act 1997);

that cannot be made liable to taxation by a Commonwealth law.

Finance Department means the Department administered by the Finance Minister.

Finance Minister means the Minister administering the Financial Management and Accountability Act 1997.

responsible Department, in relation to the employment of a Commonwealth employee, means:

(a) where the remuneration in respect of that employment is or was paid wholly or principally out of money appropriated under an annual Appropriation Act—the Commonwealth Department in respect of which the money was appropriated; and

(b) where the remuneration in respect of that employment is or was paid wholly or principally out of money appropriated under an Act other than an annual Appropriation Act:

(i) if the employee performs or performed the duties of that employment in, or in respect of, a Commonwealth Department—that Commonwealth Department; or

(ii) in any other case—the Department of State administered by the Minister who administers the Act under which that money was appropriated, insofar as the Act appropriated that money; and

(c) where the remuneration in respect of that employment is or was paid wholly or principally out of money appropriated by the Constitution—the Finance Department.

untaxable Commonwealth authority means an authority of the Commonwealth that cannot, by a law of the Commonwealth, be made liable to taxation by the Commonwealth.

5A Application of Act to Commonwealth authorities

(1) In this section:

Commonwealth authority means an authority or body that is established by or under a law of the Commonwealth.

(2) If:

(a) a law, or a provision of a law, passed before the commencement of this section purports to exempt a Commonwealth authority from liability to pay:

(i) taxes under the laws of the Commonwealth; or

(ii) certain taxes under the laws of the Commonwealth; and

(b) apart from this subsection, the exemption would apply to superannuation guarantee charge;

that law or provision is taken not to have exempted, or not to exempt, that authority from liability to pay the charge.

(3) If:

(a) a law, or a provision of a law, passed after the commencement of this section purports to exempt a Commonwealth authority from liability to pay:

(i) taxes under the laws of the Commonwealth; or

(ii) certain taxes under the laws of the Commonwealth; and

(b) apart from this subsection, the exemption would apply to superannuation guarantee charge;

the law or provision is not taken to have exempted, or to exempt, the authority from liability to pay the charge unless the law or provision expressly exempts the authority from liability to pay the charge.

5B Jurisdiction etc. of Fair Work Australia not affected

(1) To avoid doubt, but subject to subsection (2), nothing in this Act or in the Superannuation Guarantee Charge Act 1992 affects:

(a) the jurisdiction, functions or powers of Fair Work Australia; or

(b) the operation of the Fair Work Act 2009, the Fair Work (Registered Organisations) Act 2009, or the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 in any other way.

(2) Subsection (1) does not apply to any express reference in the Fair Work Act 2009, the Fair Work (Registered Organisations) Act 2009, or the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 to this Act or to the Superannuation Guarantee Charge Act 1992.

5C Application of the Criminal Code

Chapter 2 of the Criminal Code applies to all offences against this Act.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Part 2—Explanation of terms used in the Act

6 Interpretation—general

(1) In this Act, unless the contrary intention appears:

actuary means a Fellow or Accredited Member of The Institute of Actuaries of Australia.

administration component, in relation to an employer and a quarter, means the amount worked out according to section 32.

approved clearing house has the meaning given by subsection 79A(3).

approved deposit fund has the same meaning as in the Superannuation Industry (Supervision) Act 1993.

approved form has the meaning given by section 388‑50 in Schedule 1 to the Taxation Administration Act 1953.

arrangement, for the purposes of section 30, means:

(a) an agreement, arrangement, understanding, promise or undertaking, whether express or implied, and whether or not enforceable, or intended to be enforceable, by legal proceedings; or

(b) any scheme, plan, proposal, action, course of action or course of conduct.

assessment means:

(a) the ascertainment of an employer’s superannuation guarantee shortfall for a quarter and of the superannuation guarantee charge payable on the shortfall; or

(b) the ascertainment of additional superannuation guarantee charge payable under Part 7.

authorised officer means a person appointed or engaged under the Public Service Act 1999 who has been authorised in writing by the Commissioner for the purposes of the provision in which the expression appears.

Commissioner means the Commissioner of Taxation.

Commonwealth employee means an employee of the Commonwealth.

Commonwealth industrial award means:

(a) an industrial award or determination made under a law of the Commonwealth; or

(b) an industrial agreement approved or registered under such a law; or

(c) a notional agreement preserving State awards; or

(d) a preserved State agreement.

complying approved deposit fund has the meaning given by section 7A.

complying superannuation fund has the meaning given by section 7.

complying superannuation scheme has the meaning given by section 7.

CSS means the scheme known as the Commonwealth Superannuation Scheme.

data processing device means any article or material from which information is capable of being reproduced with or without the aid of any other article or device.

defined benefit member means a member entitled on retirement to be paid a benefit defined, wholly or in part, by reference to either or both of the following:

(a) the amount of the member’s salary:

(i) at the date of the member’s retirement or an earlier date; or

(ii) averaged over a period before retirement;

(b) a specified amount.

defined benefit superannuation scheme has the meaning given by section 6A.

Deputy Commissioner means a Deputy Commissioner of Taxation.

general interest charge means the charge worked out under Part IIA of the Taxation Administration Act 1953.

government body means:

(a) the Commonwealth or a State or Territory; or

(b) a Commonwealth, State or Territory authority.

indexation factor, in relation to a year, has the meaning given by section 9.

individual superannuation guarantee shortfall, has the meaning given by section 19.

industrial award means a Commonwealth industrial award, a State industrial award or a Territory industrial award.

liability to the Commonwealth means a liability to the Commonwealth arising under an Act of which the Commissioner has the general administration.

lodge means lodge with the Commissioner.

nominal interest component, in relation to an employer and a quarter, has the meaning given by section 31.

occupational superannuation arrangement, in relation to the employment of a person, means an agreement that imposes an obligation on the person’s employer to contribute to a superannuation fund for the benefit of the person.

offence against this Act includes an offence relating to this Act against:

(a) the Crimes Act 1914; or

(b) the Taxation Administration Act 1953.

ordinary time earnings, in relation to an employee, means:

(a) the total of:

(i) earnings in respect of ordinary hours of work other than earnings consisting of a lump sum payment of any of the following kinds made to the employee on the termination of his or her employment:

(A) a payment in lieu of unused sick leave;

(B) an unused annual leave payment, or unused long service leave payment, within the meaning of the Income Tax Assessment Act 1997; and

(ii) earnings consisting of over‑award payments, shift‑loading or commission; or

(b) if the total ascertained in accordance with paragraph (a) would be greater than the maximum contribution base for the quarter—the maximum contribution base.

part‑time employee means a person who is employed to work not more than 30 hours per week.

penalty charge, in respect of superannuation guarantee charge and a quarter, means:

(a) general interest charge in respect of non‑payment of the superannuation guarantee charge; or

(b) additional superannuation guarantee charge that is payable under section 59 and calculated by reference to the superannuation guarantee charge.

proceeding under this Act includes:

(a) a proceeding for an offence against this Act; or

(b) a proceeding under the Taxation Administration Act 1953 relating to this Act.

PSS means the Public Sector Superannuation Scheme within the meaning of the Superannuation Act 1990.

PSSAP means the Public Sector Superannuation Accumulation Plan within the meaning of the Superannuation Act 2005.

public sector scheme means a scheme of superannuation established:

(a) by or under a law of the Commonwealth or of a State or Territory; or

(b) under the authority of:

(i) the Commonwealth or the government of a State or Territory; or

(ii) a municipal corporation, another local governing body or a public authority constituted by or under a law of the Commonwealth or of a State or Territory.

quarter means a period of 3 months beginning on 1 January, 1 April, 1 July or 1 October.

resident of Australia has the meaning given by section 8.

RSA has the same meaning as in the Retirement Savings Accounts Act 1997.

RSA provider has the same meaning as in the Retirement Savings Accounts Act 1997.

Second Commissioner means a Second Commissioner of Taxation.

State industrial award means:

(a) an industrial award or determination made under a law of a State; or

(b) an industrial agreement approved or registered under such a law.

superannuation fund has the same meaning as in the Superannuation Industry (Supervision) Act 1993.

superannuation guarantee charge means charge imposed by the Superannuation Guarantee Charge Act 1992.

superannuation guarantee shortfall has the meaning given by section 17.

superannuation guarantee statement means a superannuation guarantee statement under section 33.

superannuation scheme means:

(a) a defined benefit superannuation scheme whether or not embodied in the governing rules of a superannuation fund; or

(b) any other scheme embodied in the governing rules of a superannuation fund.

Territory industrial award means:

(a) an industrial award or determination made under a law of a Territory; or

(b) an industrial agreement approved or registered under such a law.

trustee, in relation to a superannuation scheme, means:

(a) if:

(i) the scheme is embodied in the governing rules of a fund; and

(ii) there is a trustee of the fund;

the trustee of the fund; or

(b) in any other case—the person who manages the scheme.

trustee, except in relation to a superannuation fund or superannuation scheme, includes:

(a) a person appointed or constituted trustee by:

(i) act of parties; or

(ii) order or declaration of a court; or

(iii) operation of law; and

(b) an executor, administrator or other personal representative of a deceased person; and

(c) a guardian or committee; and

(d) a receiver or receiver and manager; and

(e) a liquidator of a company; and

(f) a person:

(i) having or taking upon himself or herself the administration or control of any real or personal property affected by any express or implied trust; or

(ii) acting in any fiduciary capacity; or

(iii) having the possession, control or management of any real or personal property of a person under any legal or other disability.

unfunded public sector scheme means a public sector scheme that is a defined benefit superannuation scheme:

(a) in respect of which no fund is established for the purposes of the scheme; or

(b) under which all or some of the amounts that will be required for the payment of benefits are not paid into the fund established for the purposes of the scheme or are not paid until the members become entitled to receive the benefits.

year means financial year.

(2) For the purposes of this Act, a reference to a contribution made by an employer for the benefit of an employee includes a reference to a contribution made on behalf of the employer.

(3) For the purposes of this Act, a reference to salary or wages paid by an employer to an employee includes a reference to a payment made on behalf of the employer.

6A Interpretation: defined benefit superannuation scheme

(1) Subject to subsection (2), a defined benefit superannuation scheme is a scheme under which:

(a) one or more members of the scheme are entitled, on retirement, to be paid a benefit defined, wholly or in part, by reference to either or both of the following:

(i) the amount of the member’s annual salary:

(A) at the date of the member’s retirement; or

(B) at a date before retirement; or

(C) averaged over a period of employment before retirement;

(ii) a specified amount; and

(b) if the scheme is not a public sector scheme—some or all of the contributions under the scheme (out of which, together with earnings on those contributions, the benefits are to be paid) are not paid into a fund, or accumulated in a fund, in respect of any individual member but are paid into and accumulated in a fund in the form of an aggregate amount.

(2) A scheme embodied in the governing rules of a superannuation fund (other than a scheme of the kind referred to in subsection (1)) is a defined benefit superannuation scheme if a conversion notice has effect in relation to the fund or scheme.

(3) If the conversion notice is expressed to take effect on a day before the day on which the notice is given, the scheme in question is taken to have been a defined benefit superannuation scheme from the day on which the notice is expressed to take effect.

(4) Subsection (3) has effect regardless of the making of any assessment, or the payment of any superannuation guarantee charge, in respect of a quarter that ended after the conversion notice took effect.

6B Interpretation: conversion notice

(1) A conversion notice is a written notice by the trustee of a superannuation fund given to the Commissioner stating that the fund, or a particular superannuation scheme embodied in the governing rules of the fund, is to be treated as a defined benefit superannuation scheme for the purposes of this Act.

(2) Subject to subsection (4), a conversion notice takes effect in relation to the fund or scheme on the day specified in the notice. Subject to subsection (4), the trustee may, by written notice (revocation notice) given to the Commissioner, revoke the conversion notice.

(3) A conversion notice may be expressed to take effect on a day that is not earlier than:

(a) if the notice is given before 15 May in a quarter starting on 1 April—1 January in the previous quarter; or

(b) if the notice is given before 15 August in a quarter starting on 1 July—1 April in the previous quarter; or

(c) if the notice is given before 15 November in a quarter starting on 1 October—1 July in the previous quarter; or

(d) if the notice is given before 15 February in a quarter starting on 1 January—1 October in the previous quarter; or

(e) in any other case—the first day of the quarter in which the notice is given.

(4) A conversion notice or a revocation notice will not be effective unless, before it is given, the trustee gives each employer contributing to the fund or scheme for the benefit of employees written notice of:

(a) the trustee’s intention to give the notice; and

(b) the proposed date of effect of the notice.

(5) If an employer begins contributing to a superannuation fund or a superannuation scheme for the benefit of employees at a time when a conversion notice has effect in relation to the fund or scheme, the trustee must give the employer written notice of:

(a) the giving of the conversion notice; and

(b) the date of effect of the notice;

within 30 days of the receipt by the trustee of the employer’s first contribution.

(6) A notice under this section may be given by post.

7 Interpretation: complying superannuation fund or scheme

A superannuation fund or scheme is a complying superannuation fund or scheme (as the case may be) in relation to a period for the purposes of this Act if it is a complying superannuation fund in relation to that period for the purposes of the Income Tax Assessment Act 1997.

7A Interpretation: complying approved deposit fund

An approved deposit fund is a complying approved deposit fund at a particular time for the purposes of this Act if it is a complying approved deposit fund in relation to the year of income in which that time occurred for the purposes of the Income Tax Assessment Act 1997.

8 Interpretation: resident of Australia

A person is a resident of Australia for the purposes of this Act at any time when the person is a resident of Australia for the purposes of the Income Tax Assessment Act 1936.

9 Interpretation: indexation factor

(1) The indexation factor for a year is whichever is the greater of the following:

(a) 1;

(b) the number calculated (to 3 decimal places) by dividing the AWOTE amount for the March quarter in the preceding year by the AWOTE amount for the March quarter in the year preceding that year.

Note: The March quarter is a quarter beginning on 1 January.

(2) The AWOTE amount for a quarter is the estimate of the full‑time adult average weekly ordinary time earnings for persons in Australia for the middle month of the quarter published by the Australian Statistician in relation to the month.

(3) If the Australian Statistician publishes an estimate of full‑time adult average weekly ordinary time earnings for persons in Australia for a period for which such an estimate was previously published by the Australian Statistician, the publication of the later estimate is to be disregarded for the purposes of this section.

(4) If the number calculated for the purposes of paragraph (1)(b) in relation to a year would, if calculated to 4 decimal places, end with a numeral higher than 4, the number is to be taken to be the number calculated to 3 decimal places and increased by 0.001.

10 Interpretation: benefit certificate

(1) A benefit certificate is a certificate by an actuary relating to one or more specified defined benefit superannuation schemes and specifying the rate, expressed as a percentage, that is, in the opinion of the actuary, the notional employer contribution rate, in relation to a specified class of employees (being members of the scheme or schemes, as the case may be), of an employer who is a contributor under the scheme or schemes (as the case may be) for the benefit of an employee in that class.

(2) The notional employer contribution rate, in relation to a class of employees specified in a benefit certificate relating to one or more defined benefit superannuation schemes, is the contribution rate required to meet the expected long‑term cost, to an employer who contributes to the scheme or schemes for the benefit of employees in the class, of the minimum benefits accruing in respect of all employees in the class from the date of effect of the benefit certificate onwards.

(3) A benefit certificate has effect from the date specified in the certificate until:

(a) a superannuation scheme to which it relates is amended in a way that affects, or may affect, the level or method of calculation of benefits provided under the scheme for the class of employees specified in the certificate; or

(b) another benefit certificate is issued in relation to the same class of employees and the same scheme or schemes; or

(c) a period of 5 years from the date of issue expires; or

(d) in the case of a certificate that relates to a scheme that is a defined benefit superannuation scheme because of the operation of subsection 6A(2)—the conversion notice under section 6B is revoked;

whichever occurs first.

(4) A benefit certificate may be expressed to have effect from:

(a) a day that is no earlier than:

(i) if the certificate is issued before 15 May in a quarter starting on 1 April, or before a later day in that quarter allowed by the Commissioner—1 January in the previous quarter; or

(ii) if the certificate is issued before 15 August in a quarter starting on 1 July, or before a later day in that quarter allowed by the Commissioner—1 April in the previous quarter; or

(iii) if the certificate is issued before 15 November in a quarter starting on 1 October, or before a later day in that quarter allowed by the Commissioner—1 July in the previous quarter; or

(iv) if the certificate is issued before 15 February in a quarter starting on 1 January, or before a later day in that quarter allowed by the Commissioner—1 October in the previous quarter; or

(v) in any other case—the first day of the quarter in which the certificate is issued; and

(b) a day that is no later than the day on which the certificate is issued.

(6) The regulations may make provision regarding:

(a) the issue and form of benefit certificates; and

(b) the way in which the expected long‑term cost to an employer of benefits accruing to all employees is to be calculated under subsection (2); and

(c) the manner in which the contribution rate is to be expressed under subsection (2); and

(d) the way in which minimum benefits accruing to all employees are to be calculated under subsection (2).

11 Interpretation—salary or wages

(1) In this Act, salary or wages includes:

(a) commission; and

(b) payment for the performance of duties as a member of the executive body (whether described as the board of directors or otherwise) of a body corporate; and

(ba) payments under a contract referred to in subsection 12(3) that are made in respect of the labour of the person working under the contract; and

(c) remuneration of a member of the Parliament of the Commonwealth or a State or the Legislative Assembly of a Territory; and

(d) payments to a person for work referred to in subsection 12(8); and

(e) remuneration of a person referred to in subsection 12(9) or (10).

(2) Remuneration under a contract for the employment of a person, for not more than 30 hours per week, in work that is wholly or principally of a domestic or private nature is not to be taken into account as salary or wages for the purposes of this Act.

(3) Fringe benefits within the meaning of the Fringe Benefits Tax Assessment Act 1986 are not salary or wages for the purposes of this Act.

12 Interpretation: employee, employer

(1) Subject to this section, in this Act, employee and employer have their ordinary meaning. However, for the purposes of this Act, subsections (2) to (11):

(a) expand the meaning of those terms; and

(b) make particular provision to avoid doubt as to the status of certain persons.

(2) A person who is entitled to payment for the performance of duties as a member of the executive body (whether described as the board of directors or otherwise) of a body corporate is, in relation to those duties, an employee of the body corporate.

(3) If a person works under a contract that is wholly or principally for the labour of the person, the person is an employee of the other party to the contract.

(4) A member of the Parliament of the Commonwealth is an employee of the Commonwealth.

(5) A member of the Parliament of a State is an employee of the State.

(6) A member of the Legislative Assembly for the Australian Capital Territory is an employee of the Australian Capital Territory.

(7) A member of the Legislative Assembly of the Northern Territory is an employee of the Northern Territory.

(8) The following are employees for the purposes of this Act:

(a) a person who is paid to perform or present, or to participate in the performance or presentation of, any music, play, dance, entertainment, sport, display or promotional activity or any similar activity involving the exercise of intellectual, artistic, musical, physical or other personal skills is an employee of the person liable to make the payment;

(b) a person who is paid to provide services in connection with an activity referred to in paragraph (a) is an employee of the person liable to make the payment;

(c) a person who is paid to perform services in, or in connection with, the making of any film, tape or disc or of any television or radio broadcast is an employee of the person liable to make the payment.

(9) A person who:

(a) holds, or performs the duties of, an appointment, office or position under the Constitution or under a law of the Commonwealth, of a State or of a Territory; or

(b) is otherwise in the service of the Commonwealth, of a State or of a Territory (including service as a member of the Defence Force or as a member of a police force);

is an employee of the Commonwealth, the State or the Territory, as the case requires. However, this rule does not apply to a person in the capacity of the holder of an office as a member of a local government council.

(9A) Subject to subsection (10), a person who holds office as a member of a local government council is not an employee of the council.

(10) A person covered by paragraph 12‑45(1)(e) in Schedule 1 to the Taxation Administration Act 1953 (about members of local governing bodies subject to PAYG withholding) is an employee of the body mentioned in that paragraph.

(11) A person who is paid to do work wholly or principally of a domestic or private nature for not more than 30 hours per week is not regarded as an employee in relation to that work.

12A Interpretation: references to industrial instruments

(1) In this Act, the following expressions have the same meanings as in the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009:

(a) AWA;

(b) collective agreement;

(c) ITEA;

(d) notional agreement preserving State awards;

(e) old IR agreement;

(f) pre‑reform AWA;

(g) pre‑reform certified agreement;

(h) preserved State agreement;

(i) Division 2B State instrument.

Note: For an instrument referred to in this subsection, see item 4 of Schedule 2 to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009.

(2) In this Act, enterprise agreement has the same meaning as in the Fair Work Act 2009.

(3) In this Act, workplace determination means a workplace determination made under the Fair Work Act 2009 or the Workplace Relations Act 1996.

15 Interpretation: maximum contribution base

(1) The maximum contribution base for a quarter in the 2001‑02 year is $27,510.

(3) The maximum contribution base for a quarter in any later year is the amount worked out using the formula:

(4) Amounts calculated under subsection (3) must be rounded to the nearest 10 dollar multiple (rounding 5 dollars upwards).

Part 3—Liability of employers other than the Commonwealth and tax‑exempt Commonwealth authorities to pay superannuation guarantee charge

15B Application of Part to former employees

This Part applies to salary or wages paid to, and contributions for the benefit of, a former employee as if the former employee were an employee of the person who was the former employee’s employer.

15C Certificates of coverage for international social security agreements

(1) This section applies if a scheduled international social security agreement (within the meaning of section 5 of the Social Security (International Agreements) Act 1999) prevents double coverage of the compulsory retirement savings arrangements under the laws of the parties to the agreement.

(2) An entity mentioned in subsection (3) may apply in writing to the Commissioner for a certificate under subsection (4) covering the employment of a particular employee.

(3) For the purposes of subsection (2), the entity must be:

(a) if the employee’s employer is not a resident of Australia—a related entity (within the meaning of the agreement) of the employer; or

(b) otherwise—the employee’s employer.

(4) The Commissioner may give the entity that made the application a certificate under this subsection if the Commissioner is satisfied that doing so is in accordance with the agreement mentioned in subsection (1).

(5) The certificate must:

(a) state the name of the employer and the employee; and

(b) state the time at which, or the circumstances in which, the certificate stops covering the employment; and

(c) contain any other information that the Commissioner considers relevant.

(6) The Commissioner may revoke or vary a certificate under subsection (4), if doing so would be in accordance with the administrative arrangements to the agreement mentioned in subsection (1) that are agreed between the parties to the agreement.

(7) A person who is dissatisfied with a decision of the Commissioner under subsection (4) or (6) may object against the decision in the manner set out in Part IVC of the Taxation Administration Act 1953.

(8) If the entity that made the application is not the employee’s employer, this Part (apart from this section) applies to salary or wages relating to employment covered by the certificate that are paid to the employee as if the entity that made the application were the employee’s employer.

16 Charge payable by employer

Superannuation guarantee charge imposed on an employer’s superannuation guarantee shortfall for a quarter is payable by the employer.

17 Superannuation guarantee shortfall

If an employer has one or more individual superannuation guarantee shortfalls for a quarter, the employer has a superannuation guarantee shortfall for the quarter worked out by adding together:

(a) the total of the employer’s individual superannuation guarantee shortfalls for the quarter; and

(b) the employer’s nominal interest component for the quarter; and

(c) the employer’s administration component for the quarter.

19 Individual superannuation guarantee shortfalls

(1) An employer’s individual superannuation guarantee shortfall for an employee for a quarter is the amount worked out using the formula:

where:

charge percentage, for an employer for a quarter, means:

(a) the number specified in subsection (2) (unless paragraph (b) applies); or

(b) if the number specified in subsection (2) is reduced in respect of the employee by either or both sections 22 and 23—the number as reduced.

(2) The charge percentage is 9.

Note: This might be reduced under section 22 or 23.

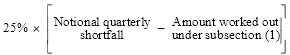

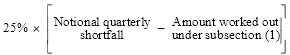

(2A) If an employer makes one or more contributions (the no choice contributions) to an RSA or a complying superannuation fund other than a defined benefit superannuation scheme, for the benefit of an employee during a quarter and the contributions are not made in compliance with the choice of fund requirements, the employer’s individual superannuation guarantee shortfall for the employee for the quarter is increased by the amount worked out in accordance with the formula:

where:

notional quarterly shortfall is the amount that would have been worked out under subsection (1) if the no choice contributions had not been made.

Note 1: See also subsection (2E) and section 19A.

Note 2: Part 3A sets out the choice of fund requirements.

(2B) If:

(a) a reduction of the charge percentage for an employee for a quarter is made under subsection 22(2) in respect of a defined benefit superannuation scheme; and

(b) there is at least one relevant day in the quarter where, if contributions (the notional contributions) had been made to the scheme by the employer for the benefit of the employee on the day, the notional contributions would have been made not in compliance with the choice of fund requirements; and

(c) section 20 (which deals with certain cases where no contributions are required) does not apply to the employer in respect of the employee in respect of the scheme for the quarter;

the employer’s individual superannuation guarantee shortfall for the employee for the quarter is increased by the amount worked out in accordance with the formula:

where:

notional quarterly shortfall is the amount that would have been worked out under subsection (1) if no reduction were made under subsection 22(2) in respect of the scheme.

number of breach of condition days is the number of relevant days in the quarter on which, if a contribution had been made to the scheme by the employer for the benefit of the employee, those contributions would have been made not in compliance with the choice of fund requirements.

Note 1: See also subsection (2E) and section 19A.

Note 2: Part 3A sets out the choice of fund requirements.

(2C) The following days in a quarter are relevant days for the purposes of subsection (2B):

(a) if the value of B in the formula in subsection 22(2) for the quarter is 1—every day in the quarter; or

(b) in any other case—every day in the quarter that is in the shorter of the scheme membership period or the certificate period referred to in subsection 22(2).

(2D) A reference in subsections (2A) and (2B) to an employer’s individual superannuation guarantee shortfall being increased includes a reference to the shortfall being increased from nil.

(2E) The Commissioner may, after taking account, wherever appropriate, of the operation of section 19A, reduce (including to nil) the amount of an increase in an employer’s individual superannuation guarantee shortfall for an employee for a quarter under subsection (2A) or (2B).

Note: The Commissioner must have regard to written guidelines when deciding whether or not to make a decision under this subsection: see section 21.

(3) If the total salary or wages paid by an employer to an employee in a quarter exceeds the maximum contribution base for the quarter, the total salary or wages to be taken into account for the purposes of the application of subsection (1) in relation to the quarter is the amount equal to the maximum contribution base.

19A Limit on shortfall increases arising from failure to comply with choice of fund requirements

(1) Subject to subsections (2) and (3), if the total of the amounts worked out for an employee for a quarter under subsections 19(2A) and (2B) exceeds $500, the total is taken to be $500.

(2) If:

(a) the total (the previous amount) of the amounts worked out for an employee under subsections 19(2A) and (2B) for previous quarters within an employer’s notice period for an employee does not exceed $500; and

(b) the current quarter is within the same employer’s notice period for the employee; and

(c) the total of the amounts worked out under subsections 19(2A) and (2B) for the employee for the current quarter and the previous quarters within the employer’s notice period for the employee exceeds $500;

then, the total of the amounts worked out under subsections 19(2A) and (2B) for the employee for the current quarter is taken to be the amount by which $500 exceeds the previous amount.

(3) If a quarter (the later quarter) in an employer’s notice period for an employee follows a quarter within that notice period:

(a) to which subsection (1) applied; or

(b) to which paragraph (2)(c) applied;

in respect of the employee, the total of the amounts worked out for the employee under subsections 19(2A) and (2B) for the later quarter is taken to be nil.

(4) An employer’s notice period for an employee:

(a) begins on:

(i) in the case of the first employer’s notice period for the employee—the later of 1 July 2005 and the day on which the employee is first employed by the employer; or

(ii) in any other case—when the immediately preceding employer’s notice period for the employee ends; and

(b) ends on the day the Commissioner gives the employer written notice that the employer’s notice period for the employee has ended.

20 Scheme in surplus or member has accrued maximum benefit

(1) This section applies to an employer in respect of an employee in respect of a defined benefit superannuation scheme for a quarter if the employee is a defined benefit member of the scheme and either subsection (2) or (3) is satisfied.

Scheme in surplus

(2) This subsection is satisfied if:

(a) the employee was a defined benefit member of the fund immediately before 1 July 2005 and has not ceased to be such a member since that time and before the start of the quarter; and

(b) an actuary has provided a certificate in accordance with regulations under the Superannuation Industry (Supervision) Act 1993 stating that the employer is not required to make contributions for the quarter and there has been such a certificate covering all times since 1 July 2005; and

(c) an actuary has provided a certificate stating that, in the actuary’s opinion, at all times from 1 July 2005 until the end of the quarter, there is a high probability that the assets of the scheme are, and will be, equal to or greater than 110% of the greater of the scheme’s liabilities in respect of vested benefits and the scheme’s accrued actuarial liabilities.

The certificate under paragraph (c) must have been provided no earlier than 15 months before the end of the quarter.

Member has accrued maximum benefit

(3) This subsection is satisfied if, after the start of the quarter, the defined benefit that has accrued to the employee will not increase other than:

(a) as a result of increases in the employee’s salary or remuneration; or

(b) by reference to accruals of investment earnings; or

(c) by reference to indexation based on, or calculated by reference to, a relevant price index or wages index; or

(d) in any other way prescribed for the purposes of this paragraph.

Meaning of scheme’s accrued actuarial liabilities and scheme’s liabilities in respect of vested benefits

(4) In this section:

scheme’s accrued actuarial liabilities, at a particular time, means the total value, as certified by an actuary, of the future benefit entitlements of members of the scheme in respect of membership up to that time based on assumptions about future economic conditions and the future of matters affecting membership of the scheme, being assumptions made in accordance with applicable professional actuarial standards (if any).

scheme’s liabilities in respect of vested benefits, at a particular time, means the total value of the benefits payable from the scheme to which the members of the scheme would be entitled if they all voluntarily terminated their service with their employers at that time.

21 Guidelines for reducing an increase in an individual superannuation guarantee shortfall

(1) The Commissioner must develop written guidelines that he or she must have regard to when deciding whether or not to make a decision under subsection 19(2E).

Note: Subsection 19(2E) allows the Commissioner to reduce (including to nil) the amount of an increase in an individual superannuation guarantee shortfall under subsection 19(2A) or (2B).

(2) The guidelines are to be made available for inspection on the internet.

22 Reduction of charge percentage where contribution made to defined benefit superannuation scheme

(1) This section applies only in relation to defined benefit superannuation schemes.

(2) If:

(a) a benefit certificate in relation to one or more complying superannuation schemes has effect for the whole or part of a quarter; and

(b) a scheme in relation to which the certificate has effect is operating for the benefit of a person as an employee of an employer; and

(c) the certificate specifies a figure as the notional employer contribution rate in relation to a class of employees (being a class that includes the employee referred to in paragraph (b)) as members of the scheme or schemes (as the case may be);

the charge percentage for the employer, as specified in subsection 19(2), in respect of an employee in the class for the quarter, is reduced, in addition to any other such reduction made under this section or section 23, by the amount worked out using the formula:

where:

A is the figure referred to in paragraph (c).

B is:

(A) 1; or

(B) if, in relation to the quarter, the employment period is greater than the scheme membership period or the certificate period—either the fraction that represents the scheme membership period as a proportion of the employment period or the fraction that represents the certificate period as a proportion of the employment period or, if one fraction is smaller than the other, the smaller fraction.

(3) For the purposes of subsection (2):

the employment period means the period, or the aggregate of the periods, in the quarter for which the employee is employed by the employer.

the scheme membership period means the period, or the aggregate of the periods, in the quarter for which the employee is a member of the superannuation scheme.

the certificate period means the period, or the aggregate of the periods, in the quarter for which the benefit certificate has effect in relation to the scheme.

(4) The charge percentage for an employer for a quarter cannot be reduced below 0.

(5) For the purposes of a calculation under this section in relation to an employer and an employee:

(a) a period of leave of absence without pay granted by the employer to the employee is not to be taken into account as a period for which the employee is employed by the employer; and

(b) a benefit certificate is taken not to have effect in relation to the employee in respect of such a period.

23 Reduction of charge percentage if contribution made to RSA or to fund other than defined benefit superannuation scheme

(1) This section applies only in relation to RSAs and to superannuation funds other than defined benefit superannuation schemes.

Reduction of charge percentage where contributions are made by employer

(2) If, in a quarter, an employer contributes for the benefit of an employee to a complying superannuation fund or an RSA, then the charge percentage for the employer (as specified in subsection 19(2)) for the employee for the quarter is reduced by the number worked out using the formula:

where:

contribution is the number of dollars in the amount of the contribution.

ordinary time earnings is the number of dollars in the ordinary time earnings of the employee for the quarter in respect of the employer.

Example: If the contribution is $60 and the ordinary time earnings are $1,000 then the charge percentage is reduced by 6. If there are no other contributions, and no reduction under section 22, then the charge percentage will be 3 (instead of 9).

(3) A reduction under subsection (2) in respect of a contribution is in addition to:

(a) any other reduction under that subsection in respect of any other contribution; and

(b) any reduction under section 22.

Some contributions made after a quarter ends may be taken into account in the quarter

(6) A contribution to a complying superannuation fund or an RSA made by an employer for the benefit of an employee may be taken into account under this section as having been made in a quarter if it is in fact made within the period of 28 days after the end of the quarter.

Certain contributions made before a quarter may be taken into account in the quarter

(7) A contribution to a complying superannuation fund or an RSA made by an employer for the benefit of an employee may be taken into account under this section as if it had been made during a particular quarter if the contribution is made not more than 12 months before the beginning of the quarter.

Contributions taken into account for a quarter not to be taken into account for any other quarter

(8) A contribution to a superannuation fund or an RSA made by an employer for the benefit of an employee that is taken into account under this section in relation to a quarter is not to be taken into account under this section in relation to any other quarter.

[Contribution made when conversion notice has effect not to be taken into account under this section]

(8A) A contribution to a superannuation fund or superannuation scheme made by an employer for the benefit of an employee at a time when a conversion notice has effect in relation to the fund or scheme is not at any time to be taken into account under this section.

[Contributions to estate of deceased employee]

(9A) If:

(a) an employee has died; and

(b) the employer would, if the employee had not died, have made a contribution to a complying superannuation fund or RSA for the benefit of the employee; and

(c) the employer pays to the legal personal representative of the employee an amount equal to the amount of the contribution that would have been paid;

the amount paid is taken for the purposes of this section to have been a contribution made by the employer to a complying superannuation fund or RSA for the benefit of the employee.

[Charge percentage not to be less than 0]

(10) The charge percentage for an employer for a quarter cannot be reduced below 0.

[Reduction of notional earnings base if amount excluded from employee’s salary or wages]

(11) If an employee’s notional earnings base includes an amount of the employee’s salary or wages that, because of section 27 or 28, is not taken into account for the purpose of making a calculation under section 19, the employee’s notional earnings base for the purposes of this section is taken to be reduced by that amount.

[Reduction of ordinary time earnings if amount excluded from employee’s salary or wages]

(12) If, because of section 27 or 28, an amount of an employee’s salary or wages is not taken into account for the purpose of making a calculation under section 19, the employee’s ordinary time earnings for the purposes of this section are taken to be reduced by that amount.

(13) Subject to subsection (15), if:

(a) an employer makes a deposit under the Small Superannuation Accounts Act 1995 in respect of an employee before 1 July 2006; and

(b) the deposit form that accompanied the deposit, in so far as the form relates to the deposit, did not contain a declaration that is false or misleading;

this section has effect as if the deposit were a contribution made by the employer for the benefit of the employee to a complying superannuation fund.

(14) Subsection (13) has effect despite section 9 of the Small Superannuation Accounts Act 1995.

(15) If:

(a) an employer makes a deposit under the Small Superannuation Accounts Act 1995 in respect of an employee; and

(b) the employer receives a payment under Part 8 of that Act by way of a refund of the deposit;

this section has effect as if the deposit had never been made.

(16) In subsections (13) and (15):

deposit has the same meaning as in the Small Superannuation Accounts Act 1995.

deposit form has the same meaning as in the Small Superannuation Accounts Act 1995.

23A Offsetting late payments against charge

(1) A contribution to a complying superannuation fund or an RSA made by an employer for the benefit of an employee is offset under subsection (3) if:

(a) the contribution is made:

(i) after the end of the period of 28 days after the end of a quarter; and

(ii) before the employer’s original assessment for that quarter is made; and

(b) the employer elects, in the approved form, that the contribution be offset.

(2) The election must be made:

(a) in a statement having effect under section 35 as the employer’s assessment for the quarter; or

(b) within 4 years after the employer’s original assessment for the quarter is made.

The election cannot be revoked.

(3) The contribution is offset, at the time the employer’s original assessment for the quarter is made, against the employer’s liability to pay superannuation guarantee charge to the extent that the liability relates to:

(a) that part of the employer’s nominal interest component for the quarter that relates to the employee; or

(b) the employer’s individual superannuation guarantee shortfall for the employee for the quarter.

(4) The contribution is offset against that part of the employer’s nominal interest component for the quarter that relates to the employee before any remainder is offset against the employer’s individual superannuation guarantee shortfall for the employee for the quarter.

(4A) If the election happens after the employer’s assessment for the quarter is made, then, for the offset to take effect, the assessment must be amended accordingly under section 37.

(5) A contribution to a superannuation fund or an RSA made by an employer for the benefit of an employee that is taken into account under this section in relation to a quarter is not to be taken into account:

(a) under this section in relation to any other quarter; or

(b) under section 22 or 23.

23B Contributions through an approved clearing house

For the purposes of sections 23 and 23A:

(a) treat an employer that, at a particular time, pays an amount to an approved clearing house for the benefit of an employee as having made a contribution of the same amount to a complying superannuation fund or an RSA for the benefit of the employee at that time, if the approved clearing house accepts the payment; and

(b) disregard any contribution that the approved clearing house makes to a complying superannuation fund or an RSA as a result of the payment.

24 Certain benefit certificates presumed to be certificates in relation to complying superannuation scheme

(1) Subject to subsection (4), a benefit certificate that has effect in relation to a superannuation scheme (being a scheme to which an employer has contributed for the benefit of an employee) for the whole or a part of a quarter is, for the purposes of section 22, conclusively presumed, in relation to the employer, to be a certificate that has effect in relation to a complying superannuation scheme for the whole, or that part, as the case may be, of the quarter if:

(a) within 30 days of the starting day in relation to that certificate, the employer obtains a written statement, provided by or on behalf of the trustee of the scheme, that the scheme:

(i) is a resident regulated superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993; and

(ii) is not subject to a direction under section 63 of the Superannuation Industry (Supervision) Act 1993; and

(iii) has not been subject to such a direction at any time since the beginning of the day on which the benefit certificate is expressed to take effect; or

(b) in an earlier quarter, the employer has obtained a statement of the kind referred to in paragraph (a).

(2) Subject to subsection (4), a benefit certificate that has effect in relation to a superannuation scheme (being a scheme to which an employer has contributed for the benefit of an employee) for the whole or a part of a quarter is, if the employer obtains a statement of the kind referred to in paragraph (1)(a):

(a) within the quarter; but

(b) later than 30 days after the starting day in relation to that certificate;

for the purposes of section 22, conclusively presumed, in relation to the employer, to be a certificate that has effect in relation to a complying superannuation scheme for the period commencing on the day on which the employer obtains the statement and ending on the last day of the quarter.

(4) A presumption relating to a benefit certificate under subsection (1) or (2) is not, in relation to an employer and a superannuation scheme, effective in respect of any period for which the scheme is not a resident regulated superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993 or is operating in contravention of a regulatory provision, as defined in section 38A of that Act if, in that period:

(a) the employer:

(i) is the trustee or manager of the scheme; or

(ii) has an association, within the meaning of section 318 of the Income Tax Assessment Act 1936, with the trustee or the manager of the scheme; and

(b) the employer has reasonable grounds for believing that the scheme is not a resident regulated superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993 or is operating in contravention of a regulatory provision, as defined in section 38A of that Act.

(4A) Section 39 of the Superannuation Industry (Supervision) Act 1993 applies for the purposes of subsection (4) of this section in a corresponding way to the way in which it applies for the purposes of Division 2 of Part 5 of that Act.

(5) In this section:

starting day means:

(a) in relation to a benefit certificate that has effect in relation to a superannuation scheme for the whole of a quarter—the first day of the quarter; or

(b) in relation to a benefit certificate that has effect in relation to a superannuation scheme for a part of a quarter—the first day in the quarter for which the benefit certificate has effect.

25 Certain contributions presumed to be contributions to complying superannuation fund

(1) Subject to subsection (2), a contribution by an employer for the benefit of an employee to a superannuation fund is conclusively presumed to be a contribution to a complying superannuation fund for the purposes of section 23 if, at or before the time the contribution is made, the employer has obtained a written statement, provided by or on behalf of the trustee of the fund, that the fund:

(a) is a resident regulated superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993; and

(b) is not subject to a direction under section 63 of that Act.

(2) Subsection (1) does not apply to a contribution to a superannuation fund if, at the time the contribution is made:

(a) the employer:

(i) is the trustee or the manager of the fund; or

(ii) has an association, within the meaning of section 318 of the Income Tax Assessment Act 1936, with the trustee or the manager of the fund; and

(b) the employer has reasonable grounds for believing that the fund is not a resident regulated superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993 or is operating in contravention of a regulatory provision, as defined in section 38A of that Act.

(3) Section 39 of the Superannuation Industry (Supervision) Act 1993 applies for the purposes of subsection (2) of this section in a corresponding way to the way in which it applies for the purposes of Division 2 of Part 5 of that Act.

26 Certain periods not to count as periods of employment

(1) Any period in respect of which excluded salary or wages are paid by an employer to an employee is not, for the purposes of section 22 or 23, to be taken into account as a period for which the employee is employed by the employer.

(2) For the purposes of subsection (1), excluded salary or wages are salary or wages that, under section 27 or 28, are not to be taken into account for the purpose of making a calculation under section 19.

27 Salary or wages: general exclusions

(1) The following salary or wages are not to be taken into account for the purpose of making a calculation under section 19:

(a) salary or wages paid to an employee who is 70 or over;

(b) salary or wages paid to an employee who is not a resident of Australia for work done outside Australia (except to the extent that the salary or wages relate to employment covered by a certificate under section 15C);

(c) salary or wages paid by an employer who is not a resident of Australia to an employee who is a resident of Australia for work done outside Australia;

(ca) salary or wages paid by an employer to an employee who is not a resident of Australia for work done in the Joint Petroleum Development Area (within the meaning of the Petroleum (Timor Sea Treaty) Act 2003);

(d) salary or wages paid to an employee who is a prescribed employee for the purposes of this paragraph;

(e) salary or wages prescribed for the purposes of this paragraph.

(2) If an employer pays an employee less than $450 by way of salary or wages in a calendar month, the salary or wages so paid are not to be taken into account for the purpose of making a calculation, in relation to the employer and the employee, under section 19.

28 Salary or wages: excluded earnings of young persons

Salary or wages paid to a part‑time employee who is under 18 are not to be taken into account for the purpose of making a calculation under section 19.

29 Salary or wages: excluded earnings of members of Reserves

If an employee receives income that is exempt from income tax under item 1.4 of the table in section 51‑5 of the Income Tax Assessment Act 1997, that income is not to be taken into account for the purposes of this Act.

30 Arrangements to avoid payment of superannuation guarantee charge

If:

(a) an employer makes an arrangement; and

(b) as a result of the arrangement the employer’s superannuation guarantee shortfall for a quarter is reduced; and

(c) in the Commissioner’s opinion the arrangement was made solely or principally for the purpose of avoiding payment of superannuation guarantee charge otherwise than in accordance with this Act;

the employer is liable to pay for the quarter an amount of superannuation guarantee charge equal to the amount that, in the Commissioner’s opinion, the employer would have been liable to pay if the arrangement had not been made.

31 Nominal interest component

The nominal interest component in relation to an employer for a quarter is the amount that would accrue by way of interest on the total of the employer’s individual superannuation guarantee shortfalls for the quarter if interest were calculated at the rate applicable under the regulations for the purposes of this subsection from the beginning of the quarter in question until the date on which superannuation guarantee charge in relation to the total would be payable under this Act.

32 Administration component

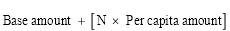

An employer’s administration component for a quarter is the amount worked out using the formula:

where:

base amount is the amount (if any) prescribed in the regulations.

N is the number of employees in respect of whom the employer has an individual superannuation guarantee shortfall for the quarter.

Per capita amount is $20 or such other amount as is from time to time prescribed.

Part 3A—Choice of fund requirements

Division 1—Overview of Part

32A Purpose of Part

This Part sets out the circumstances in which contributions are made in compliance with the choice of fund requirements. This is important because an employer’s individual superannuation guarantee shortfall for an employee for a quarter may be increased where contributions do not comply.

32B Structure of Part

The structure of this Part is as follows:

Structure of Part |

Division | Topic |

Division 1 | Overview of Part |

Division 2 | Which contributions satisfy the choice of fund requirements? |

Division 3 | Eligible choice funds |

Division 4 | Choosing a fund |

Division 6 | Standard choice forms |

Division 8 | Miscellaneous |

Division 2—Which contributions satisfy the choice of fund requirements?

32C Contributions that satisfy the choice of fund requirements

Contributions to certain funds

(1) A contribution to a fund by an employer for the benefit of an employee is made in compliance with the choice of fund requirements if the contribution is made to a fund that, at the time that the contribution is made, is:

(a) a chosen fund for the employee (see Division 4); or

(b) if the employee is not a Commonwealth employee who is a member of the CSS or the PSS—an unfunded public sector scheme.

Contributions to other funds

(2) A contribution to a fund by an employer for the benefit of an employee is made in compliance with the choice of fund requirements if, at the time the contribution is made:

(a) there is no chosen fund for the employee; and

(b) the fund is an eligible choice fund for the employer; and

(ba) the fund either:

(i) is specified under section 32P in the standard choice form provided as the fund to which the employer will contribute for the benefit of the employee if the employee does not make a choice or will be so specified within the time specified in section 32N for the provision of a standard choice form to the employee; or

(ii) if the employer has not contributed, and cannot contribute, to a fund (the first employer fund) that was so specified or that was purportedly so specified—will be so specified within 28 days of the employer becoming aware that the employer cannot contribute to the first employer fund; and

(c) the fund complies with the requirements (if any) set out in the regulations in relation to offering insurance in respect of death.

(2A) Subsection (2) does not apply if the employer is required under section 32N to give the employee a standard choice form and the employer does not do this by the time specified in the subsection concerned. However, this subsection ceases to apply from the time that the employer gives the standard choice form to the employee.

Contributions through an approved clearing house

(2B) A contribution to a fund by an employer for the benefit of an employee is made in compliance with the choice of fund requirements if:

(a) section 79A (which is about a contribution through an approved clearing house) applies to the contribution; and

(b) the employee gives the employer written notice to the effect that the employee wants a fund to be a chosen fund for the employee in accordance with Division 4 of Part 3A (Choosing a fund); and

Note: Under section 32G (Limit on funds that may be chosen), the fund chosen by the employee must be an eligible choice fund and must be a fund to which the employer can make contributions.

(c) the employer passes onto the approved clearing house mentioned in section 79A the information that the employee included in the written notice, and any other prescribed information:

(i) within 21 days after the employee gives the notice to the employer; and

(ii) before or at the time the contribution is made; and

(d) the approved clearing house accepts the information.

Contributions to the CSS

(3) A contribution to a fund by an employer for the benefit of an employee at a particular time is also made in compliance with the choice of fund requirements if the contribution is made to the CSS. However, this subsection does not apply if the law of the Commonwealth under which the contribution is made has been prescribed in relation to that time under regulations made for the purpose of this subsection.

Contributions to the PSS

(4) A contribution to a fund by an employer for the benefit of an employee at a particular time is also made in compliance with the choice of fund requirements if the contribution is made to the PSS. However, this subsection does not apply if the law of the Commonwealth under which the contribution is made has been prescribed in relation to that time under regulations made for the purpose of this subsection.

Contributions to PSSAP

(4A) A contribution to a fund by an employer for the benefit of an employee at a particular time is also made in compliance with the choice of fund requirements if the contribution is made to PSSAP. This subsection ceases to have effect on 1 July 2006.

Contributions under the Superannuation (Productivity Benefit) Act 1988

(5) A contribution to a fund by an employer for the benefit of an employee at a particular time is also made in compliance with the choice of fund requirements if the contribution is made under the Superannuation (Productivity Benefit) Act 1988. However, this subsection does not apply if that Act has been prescribed in relation to that time under regulations made for the purpose of this subsection.

Contributions under certain agreements and workplace determinations

(6) A contribution to a fund by an employer for the benefit of an employee is also made in compliance with the choice of fund requirements if the contribution, or a part of the contribution, is made under, or in accordance with:

(a) a pre‑reform certified agreement; or

(b) an AWA; or

(c) a pre‑reform AWA; or

(d) a collective agreement; or

(e) an old IR agreement; or

(f) an ITEA; or

(g) a workplace determination; or

(h) an enterprise agreement.

Note: A number of the expressions used in this subsection are defined in section 12A by reference to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 or the Fair Work Act 2009.

Contributions under notional agreements preserving State awards

(6A) A contribution to a fund by an employer for the benefit of an employee is also made in compliance with the choice of fund requirements if the contribution, or a part of the contribution, is made:

(a) under, or in accordance with, a notional agreement preserving State awards; and

(b) in respect of salary or wages paid before 1 July 2006.

Note: A number of the expressions used in this subsection are defined in section 12A by reference to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 or the Fair Work Act 2009.

Contributions under preserved State agreements

(6B) A contribution to a fund by an employer for the benefit of an employee is also made in compliance with the choice of fund requirements if the contribution, or a part of the contribution, is made under, or in accordance with, a preserved State agreement.

Note: A number of the expressions used in this subsection are defined in section 12A by reference to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 or the Fair Work Act 2009.

Contributions under Division 2B State instruments

(7) A contribution to a fund by an employer for the benefit of an employee is also made in compliance with the choice of fund requirements if the contribution, or a part of the contribution, is made under, or in accordance with, a Division 2B State instrument.

Note: The expression Division 2B State instrument is defined in section 12A by reference to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009.

Contributions under State awards

(8) A contribution to a fund by an employer for the benefit of an employee is also made in compliance with the choice of fund requirements if the contribution, or a part of the contribution, is made under, or in accordance with, a State industrial award.

Contributions under prescribed legislation

(9) A contribution to a fund by an employer for the benefit of an employee at a particular time is also made in compliance with the choice of fund requirements if the contribution is made under a law of the Commonwealth, of a State or of a Territory and the law is prescribed in relation to that time under regulations made for the purpose of this subsection.

Contributions made after employees cease employment

(10) If:

(a) an employee ceases to be employed by an employer; and

(b) after the employment ceases, the employer makes a contribution to a fund for the benefit of the employee and in respect of the employment;

then, for the purposes of this section, the contribution is taken to have been made immediately before the employment ceases.

Note: This section is used in determining if an individual superannuation guarantee shortfall is increased under subsection 19(2A) or (2B). Where subsection 19(2B) is relevant, the contributions referred to in this section are the notional contributions referred to in paragraph 19(2B)(b).

32CA Certain contributions taken not to satisfy the choice of fund requirements

Despite section 32C, a contribution to a fund by an employer for the benefit of an employee is taken not to comply with the choice of fund requirements if the employer imposes a direct cost or charge on the employee as a consequence of having to contribute to that fund.

Division 3—Eligible choice funds

32D What funds are eligible choice funds?

A fund is an eligible choice fund for an employer at a particular time if:

(a) it is a complying superannuation fund at that time; or

(b) it is a complying superannuation scheme at that time; or

(c) it is an RSA; or

(ca) if the time is a time before 1 July 2006—it is the account that is continued in existence under section 8 of the Small Superannuation Accounts Act 1995 as the Superannuation Holding Accounts Special Account; or

(d) at that time, a benefit certificate in relation to the fund is conclusively presumed under section 24, in relation to the employer, to be a certificate in relation to a complying superannuation scheme; or

(e) contributions made by the employer to the fund at that time are conclusively presumed under section 25 to be contributions to a complying superannuation fund.

32E Meaning of funds—includes RSAs and schemes

(1) In this Part:

fund means:

(a) a superannuation fund; and

(b) a superannuation scheme; and

(c) an RSA;

and, until immediately before 1 July 2006, includes the account that is continued in existence under section 8 of the Small Superannuation Accounts Act 1995 as the Superannuation Holding Accounts Special Account.

(2) For the purposes of this Part, the holder of an RSA is taken to be a member.

Division 4—Choosing a fund

32F What is a chosen fund

(1) If an employee wants a fund to be a chosen fund for the employee, the employee must give the employer written notice to that effect.

Note: A fund can only be a chosen fund if the employer is able to make contributions to the fund for the benefit of the employee (see subsection 32G(2)).

(1A) If:

(a) an employer has offered an employee a choice of fund before 1 July 2005; and

(b) the employee has chosen a fund in accordance with the choice of funds that is offered; and

(c) the limitations on that choice are consistent with section 32G or, if the choice was made before the commencement of that section, would have been consistent with section 32G if the section had been in force at the time the choice was made;

then, for the purposes of this Part, any fund chosen by the employee is taken to be the chosen fund for the employee with effect from:

(d) 1 July 2005; or

(e) a date that is 2 months after the fund is so chosen (unless the employer determines an earlier time after 1 July 2005 but within that 2 months);

whichever last occurs.

(2) The fund becomes a chosen fund for the employee 2 months after the employee gives the notice to the employer or at such earlier time after the notice is given as the employer determines.

(3) A fund (the selected fund) cannot become a chosen fund for an employee under this section if:

(a) immediately before the employee gave the notice to the employer, the employee was a defined benefit member of a defined benefit superannuation scheme; and

(b) even if the selected fund were to become a chosen fund for the employee, the employee would be entitled, on the employee’s retirement, resignation or retrenchment, to the same amount of benefit from the defined benefit superannuation scheme as the employee would be entitled if the selected fund were not a chosen fund for the employee.

32FA Employer may refuse to accept certain chosen funds

(1) An employer may refuse to accept the fund chosen by an employee under section 32F if the employee does not provide, together with the notice under that section:

(a) a written statement setting out:

(i) contact details for the fund; and

(ii) any other prescribed information; and

(b) written evidence that the fund will accept contributions made by the employer for the benefit of the employee.

(2) An employer may refuse to accept the fund chosen by an employee under section 32F if the employee has chosen another fund within the previous 12 months.

32G Limit on funds that may be chosen

(1) The fund chosen by the employee must be an eligible choice fund for the employer at the time that the choice is made.

(2) The fund chosen by the employee must be a fund to which the employer can make contributions for the benefit of the employee at the time that the choice is made.

32H When fund ceases to be a chosen fund

(1) A fund (the old fund) ceases to be a chosen fund for an employee if:

(a) there is another fund that is a chosen fund for the employee; and

(b) the employee has not given the employer a written notice stating that the old fund continues to be a chosen fund for the employee.

(2) A fund also ceases to be a chosen fund if the employee requests the employer, under subsection 32N(3), to give him or her a standard choice form and the employer does not do this by the time specified in that subsection.

(3) A fund also ceases to be a chosen fund if it is impossible for the employer to contribute on behalf of the employee to the chosen fund. This may occur immediately after the fund becomes a chosen fund for the employee.

Example: The chosen fund is closed to new members or ceases to accept further contributions.

(4) A fund also ceases to be a chosen fund if the fund ceases to be an eligible choice fund for the employer. This may occur immediately after the fund becomes a chosen fund for the employee.

Division 6—Standard choice forms