An Act to provide for a new long service leave funding scheme in the black coal mining industry, and for other purposes

Part 1—Preliminary

1 Short title [see Note 1]

This Act may be cited as the Coal Mining Industry (Long Service Leave Funding) Act 1992.

2 Commencement [see Note 1]

(1) Sections 1 and 2 commence on the day on which this Act receives the Royal Assent.

(2) Subject to subsection (3), sections 35 and 44 to 49 commence on a day or days to be fixed by Proclamation.

(3) If a section mentioned in subsection (2) does not commence under that subsection within the period of 12 months beginning on the day on which this Act receives the Royal Assent, it commences on the first day after the end of that period.

(4) Subject to subsection (5), the remaining provisions of this Act commence on a day or days to be fixed by Proclamation.

(5) If a provision mentioned in subsection (4) does not commence under that subsection within the period of 6 months beginning on the day on which this Act receives the Royal Assent, it commences on the first day after the end of that period.

3 Object

The main object of this Act is to provide for a new long service leave funding scheme in the black coal mining industry by:

(a) establishing a Coal Mining Industry (Long Service Leave Funding) Corporation; and

(b) requiring the Corporation to establish and maintain a Coal Mining Industry (Long Service Leave) Fund and to make payments out of the Fund to employers in the industry to reimburse them for long service leave payments made to eligible employees; and

(c) appropriating money for the purposes of the Fund in respect of the amounts of payroll levy paid by employers under the Coal Mining Industry (Long Service Leave) Payroll Levy Collection Act 1992.

4 Interpretation

(1) In this Act, unless the contrary intention appears:

bank includes, but is not limited to, a body corporate that is an ADI (authorised deposit‑taking institution) for the purposes of the Banking Act 1959.

black coal mining industry has the same meaning as in the Black Coal Mining Industry Award 2010 as in force on 1 January 2010.

Board means the Board of Directors of the Corporation.

Chairperson means Chairperson of the Board.

Corporation means the corporation established by section 6.

Deputy Chairperson means Deputy Chairperson of the Board.

Director means a member of the Board.

eligible employee means:

(a) an employee who is employed in the black coal mining industry by an employer engaged in the black coal mining industry, whose duties are directly connected with the day to day operation of a black coal mine; or

(b) an employee who is employed in the black coal mining industry, whose duties are carried out at or about a place where black coal is mined and are directly connected with the day to day operation of a black coal mine; or

(c) an employee permanently employed with a mine rescue service for the purposes of the black coal mining industry; or

(d) a prescribed person who is employed in the black coal mining industry;

but does not include a person declared by the regulations not to be an eligible employee for the purposes of this Act.

Note: For prescription or declaration by class, see subsection 13(3) of the Legislative Instruments Act 2003.

employee means a national system employee as defined in section 13 of the Fair Work Act 2009.

employee‑representative Director means a Director referred to in subsection 13(4), (5) or (6).

employer means a national system employer as defined in section 14 of the Fair Work Act 2009.

employer‑representative Director means a Director referred to in subsection 13(2) or (3).

Finance Minister means the Minister administering the Financial Management and Accountability Act 1997.

Fund means the Coal Mining Industry (Long Service Leave) Fund maintained by the Corporation under section 40.

industrial authority means the Coal Industry Tribunal, Fair Work Australia, the New South Wales Industrial Commission, the New South Wales Industrial Relations Commission, the Industrial Relations Commission of Queensland, the Western Australian Coal Industry Tribunal, the Western Australian Industrial Relations Commission or the Tasmanian Industrial Commission or any predecessor of, or successor to, any of those Tribunals or Commissions.

National Employment Standards has the same meaning as in the Fair Work Act 2009.

payroll levy means the levy imposed by the Payroll Levy Act and includes any amount of additional levy paid under section 7 of the Payroll Levy Collection Act.

Payroll Levy Act means the Coal Mining Industry (Long Service Leave) Payroll Levy Act 1992.

Payroll Levy Collection Act means the Coal Mining Industry (Long Service Leave) Payroll Levy Collection Act 1992.

previous Fund means the Coal Mining Industry Long Service Leave Fund established under the States Grants (Coal Mining Industry Long Service Leave) Act 1949.

relevant industrial instrument means:

(a) an award made by, or registered with, an industrial authority; or

(b) a determination made by, or registered with, an industrial authority; or

(c) an order given by, or registered with, an industrial authority; or

(d) an agreement approved by, or registered with, an industrial authority;

that confers on employees in the black coal mining industry to whom the award, determination, order or agreement applies an entitlement to long service leave in circumstances set out in the award, determination, order or agreement, being an entitlement that continues to exist and accrue so long as the employees continue to be employed by any employer in that industry.

(2) A regulation is not to be made prescribing a person for the purposes of paragraph (d) of the definition of eligible employee in subsection (1) unless the prescribing of that person for those purposes has been recommended to the Minister by the Board.

5 Act to bind Crown

This Act binds the Crown in each of its capacities.

Part 2—Establishment, functions and powers of Corporation

6 Establishment of Corporation

(1) A corporation, to be known as the Coal Mining Industry (Long Service Leave Funding) Corporation, is established.

(2) The Corporation:

(a) is a body corporate; and

(b) is to have a seal; and

(c) may sue and be sued in its corporate name.

Note: The Commonwealth Authorities and Companies Act 1997 applies to the Corporation. That Act deals with matters relating to Commonwealth authorities, including reporting and accountability, banking and investment, and conduct of officers.

(3) The seal of the Corporation is to be kept in such custody as the Board directs, and must not be used except as authorised by the Board.

(4) All courts, judges and persons acting judicially are to take judicial notice of the seal of the Corporation appearing on a document and are to presume that the document was duly sealed.

7 Functions of Corporation

The functions of the Corporation are:

(a) to establish and maintain the Fund; and

(b) to make payments into and out of the Fund, and invest the Fund, in accordance with this Act and the Payroll Levy Collection Act; and

(c) to advise the Minister as to the rates of payroll levy that should be imposed on employers; and

(d) to monitor payments of the payroll levy and keep the Minister informed of any failure by an employer to pay the payroll levy; and

(e) to advise the Minister generally on the operation of this Act, the Payroll Levy Act and the Payroll Levy Collection Act; and

(f) such other functions as are conferred on the Corporation by the Payroll Levy Collection Act.

8 Powers of Corporation

(1) The Corporation has power to do all things that are necessary or convenient to be done for, or in connection with, the performance of its functions and, in particular, may:

(a) acquire, hold and dispose of real or personal property; and

(b) enter into contracts; and

(c) occupy, use and control any land or building owned or leased by the Commonwealth and made available for the purposes of the Corporation; and

(d) appoint agents and attorneys; and

(e) do anything incidental to any of its powers.

(2) The power of the Corporation to enter into contracts includes the power to enter into a contract with a person under which that person will administer the Fund on behalf of the Board.

(3) Except with the written consent of the Minister, the Corporation must not enter into a contract under which, or as a result of which, the Corporation would or might be liable to pay, in respect of any one transaction, any commission, brokerage or fee exceeding $100,000 or, if a higher amount is prescribed, that higher amount.

(4) Without derogating from the obligation of the Corporation to comply with subsection (3), the validity of a contract is not affected merely because the contract was entered into in contravention of that subsection.

Part 3—Board of Directors of the Corporation

Division 1—Constitution of the Board

9 The Board

There is to be a Board of Directors of the Corporation.

10 Board to manage affairs of Corporation

Subject to section 8, the Board is to manage the affairs of the Corporation and administer the Fund.

11 Guidelines for managing affairs of Corporation

(1) This section does not apply to the investment of the Fund.

(2) The Board must prepare guidelines for the management of the affairs of the Corporation and submit them to the Minister for approval.

(3) The Minister may approve the guidelines or refer them back to the Board for revision in accordance with the directions of the Minister.

(4) If the guidelines are referred back to the Board, the Board must revise the guidelines and submit the revised guidelines to the Minister for approval.

(5) Subsection (3) applies to revised guidelines submitted under subsection (4) as it applies to guidelines submitted under subsection (2).

12 Constitution of the Board

(1) The Board consists of 6 Directors.

(2) The performance of a function or the exercise of a power by the Corporation or the Board is not affected by:

(a) a vacancy in the office of Chairperson or Deputy Chairperson; or

(b) any vacancy in the membership of the Board.

13 Appointment of Directors

(1) The Directors are to be appointed by the Minister and hold office on a part‑time basis.

(2) Two of the Directors are to be appointed to represent the companies engaged in black coal mining in New South Wales, Queensland or Tasmania.

(3) One Director is to be appointed to represent companies engaged in black coal mining in Western Australia.

(4) One Director is to be appointed to represent the United Mine Workers Division of the Construction, Forestry and Mining Employees Union.

(5) One Director is to be appointed to represent the following organisations:

(a) the Electrical Trades Union of Australia;

(b) the Federated Engine Drivers’ and Firemen’s Association of Australia;

(c) the Metals and Engineering Workers’ Union.

(6) One Director is to be appointed to represent the following organisations:

(a) the Australian Collieries Staff Association;

(b) the Colliery Officials Association of New South Wales;

(c) the New South Wales Mine Managers Association.

(7) If the United Mine Workers Division of the Construction, Forestry and Mining Employees Union changes its name or merges with another Division of that Union, the reference in subsection (4) to the first‑mentioned Division is taken to be a reference to that Division under its new name or to the other Division, as the case requires.

(8) If an organisation referred to in subsection (4), (5) or (6):

(a) changes its name; or

(b) merges with another organisation; or

(c) is succeeded by another organisation;

the reference in that subsection to the first‑mentioned organisation is taken to be a reference to that organisation under its new name or to the other organisation, as the case requires.

(9) A person to be appointed as a Director as mentioned in subsection (2), (3), (4), (5) or (6) is to be a person who the Minister considers, after consulting the bodies or organisations that the person is to represent, is suitable to represent those bodies or organisations, as the case may be.

14 Appointment of Chairperson and Deputy Chairperson

(1) One of the Directors is to be appointed to be the Chairperson of the Board and another of them to be the Deputy Chairperson of the Board.

(2) The first appointment of the Chairperson and the first appointment of the Deputy Chairperson are to be made by the Minister.

(3) Subsequent appointments are to be made by the Board.

(4) Subject to subsection (5), a Director appointed to be the Chairperson or Deputy Chairperson is to be so appointed for such period not exceeding 2 years as is set out in the instrument of his or her appointment.

(5) In making an appointment under subsection (1) and in fixing the period of such an appointment, the Minister or the Board, as the case may be, must try to ensure, as far as is reasonably practicable, that:

(a) the Chairperson and the Deputy Chairperson are appointed from different categories of Directors; and

(b) the offices of Chairperson and Deputy Chairperson are rotated every 2 years between the two categories of Directors.

(6) For the purposes of subsection (5), employee‑representative Directors constitute one category of Directors and employer‑representative Directors constitute another category of Directors.

Division 2—Meetings of the Board

15 Convening of meetings

(1) The Board is to hold such meetings as are necessary for the efficient performance of its functions.

(2) The Chairperson:

(a) may, at any time, convene a meeting of the Board; and

(b) must, on receipt of a written request from the Minister or at least one Director, convene a meeting of the Board.

16 Presiding at meetings

(1) The Chairperson is to preside at all meetings at which he or she is present.

(2) In the absence of the Chairperson:

(a) if the Deputy Chairperson is present—the Deputy Chairperson is to preside; or

(b) otherwise—the Directors present are to elect one of their number to preside.

17 Quorum

(1) At a meeting, 4 Directors (including at least 2 employee‑representative Directors and 2 employer‑representative Directors) constitute a quorum.

(2) If, as a result of the operation of section 22, it will not or may not be possible to constitute a quorum at a particular meeting as required by subsection (1) of this section, a quorum at that meeting is constituted by such number of Directors (whether or not including any employee‑representative Directors or employer‑representative Directors) as the Minister, acting on a written recommendation of the Chairperson or, in the absence of the Chairperson, of the Deputy Chairperson, determines.

18 Voting at meetings

At a meeting:

(a) all questions are to be decided by a two‑thirds majority of votes of the Directors present and voting, being a majority that includes 2 employee‑representative directors and 2 employer‑representative directors; and

(b) the Director presiding has a deliberative vote but, in the event of an equality of votes, does not have a casting vote.

19 Conduct of meetings

The Board may, subject to this Division, regulate proceedings at its meetings as it considers appropriate.

20 Resolutions without meetings

(1) If a two‑thirds majority of the Directors (being a majority that includes 2 employee‑representative Directors and 2 employer‑representative Directors) sign a document containing a statement that they are in favour of a resolution in terms set out in the document, a resolution in those terms is taken to have been passed at a duly constituted meeting of the Board held on the day the document was signed, or, if the Directors signed the document on different days, on the last of those days.

(2) For the purposes of subsection (1), 2 or more separate documents containing statements in identical terms each of which is signed by one or more Directors are together taken to constitute one document containing a statement in those terms signed by those Directors on the respective days on which they signed the separate documents.

(3) A Director must not sign a document containing a statement in favour of a resolution if the resolution concerns a matter in which the Director has a material personal interest.

21 Records relating to meetings

The Board is to keep minutes of its meetings and records of resolutions taken to have been passed in accordance with section 20.

Division 3—Provisions relating to Directors

23 Term of appointment

A Director is to be appointed for a period not exceeding 2 years, but is eligible for re‑appointment.

24 Remuneration and allowances

(1) A Director is to be paid such remuneration as is determined by the Remuneration Tribunal or, if no determination is in operation, such remuneration as is prescribed.

(2) A Director is to be paid such allowances as are prescribed.

(3) This section has effect subject to the Remuneration Tribunal Act 1973.

25 Leave of absence

(1) The Minister may grant leave of absence to the Chairperson on such terms and conditions as to remuneration or otherwise as the Minister considers appropriate.

(2) The Chairperson may grant leave of absence to another Director on such terms and conditions as to remuneration or otherwise as the Chairperson considers appropriate.

26 Resignation

(1) A Director may resign by writing signed by the Director and delivered to the Minister.

(2) The Chairperson or Deputy Chairperson may resign from the office of Chairperson or Deputy Chairperson by writing signed by him or her and delivered to the Minister but a resignation from such an office does not affect his or her appointment as a Director.

27 Outside employment

A Director must not engage in any paid employment that, in the Minister’s opinion, conflicts with the proper performance of the Director’s functions.

28 Termination of appointment

(1) The Minister may terminate a Director’s appointment for misbehaviour or physical or mental incapacity.

(2) The Minister may terminate a Director’s appointment if:

(a) the bodies or organisations that the Director was appointed to represent request the Minister in writing to terminate the appointment; or

(b) the Director becomes bankrupt, applies to take the benefit of any law for the relief of bankrupt or insolvent debtors, compounds with creditors or makes an assignment of remuneration for their benefit; or

(c) the Director fails, without reasonable excuse, to comply with an obligation imposed by subsection 20(3) or section 27 of this Act or section 27F or 27J of the Commonwealth Authorities and Companies Act 1997.

29 Terms and conditions of appointment not provided for by Act

A Director holds office on such terms and conditions (if any) in relation to matters not provided for by this Act as are determined, in writing, by the Minister.

31 Acting Chairperson and acting Deputy Chairperson

(1) If:

(a) there is a vacancy in the office of Chairperson, whether or not an appointment has previously been made to the office; or

(b) the Chairperson is absent from duty or from Australia or is, for any other reason, unable to perform the duties of his or her office;

the Deputy Chairperson is to act as Chairperson.

Note: For rules that apply to persons acting as the Chairperson, see section 33A of the Acts Interpretation Act 1901.

(2) The Minister may appoint a Director to act as Deputy Chairperson:

(a) during a vacancy in the office of Deputy Chairperson, whether or not an appointment has previously been made to that office; or

(b) during any period, or during all periods, when the Deputy Chairperson is absent from duty or from Australia, is acting as Chairperson or is, for any other reason, unable to perform the duties of his or her office.

Note: For rules that apply to acting appointments, see section 33A of the Acts Interpretation Act 1901.

(3) The Minister may determine the terms and conditions, other than terms and conditions relating to remuneration and allowances, applying to a person acting as Chairperson or as Deputy Chairperson.

(4) A person acting as Chairperson or as Deputy Chairperson is to be paid the same remuneration and allowances as are payable to the Chairperson or the Deputy Chairperson, as the case requires.

32 Acting Director

(1) If a Director (the absent Director) is, or is expected to be, absent from duty or from Australia, or for any other reason unable to perform his or her duties as Director, the Minister may appoint a person to act as Director, during the period of the absence or inability, to represent the bodies or organisations that the absent Director was appointed to represent.

Note: For rules that apply to acting appointments, see section 33A of the Acts Interpretation Act 1901.

(2) A person to be appointed to act as a Director as mentioned in subsection (1) is to be a person who the Minister considers, after consulting the bodies or organisations that the absent Director was appointed to represent, is suitable to represent those bodies or organisations.

Part 4—Staff of the Corporation

33 Employees

(1) The Corporation may engage such employees as are necessary for the performance of its functions and the exercise of its powers.

(2) The terms and conditions of employment are to be determined by the Board.

34 Consultants

(1) The Corporation may engage persons who have suitable qualifications and experience as consultants to the Corporation.

(2) The terms and conditions of engagement are to be determined by the Board.

Part 5—Finance

35 Transfer of previous Fund to Corporation

(1) Upon the commencement of this section, the amount in the Trust Fund standing to the credit of the previous Fund is payable to the Corporation, and the Finance Minister must arrange for the payment to be made as soon as practicable after that commencement.

(2) Upon the making of the payment, the States Grants (Coal Mining Industry Long Service Leave) Act 1949 is, by force of this subsection, repealed.

(3) The Minister must cause notice of the repeal to be published in the Gazette.

(4) Any assets in which money that formed part of the previous Fund is invested at the commencement of this section vest in the Corporation by force of this subsection and form part of the Fund.

(5) Without limiting the generality of subsection (4), any money that, if the previous Fund continued in existence, would be, or would become, payable to the previous Fund is, or becomes, payable to the Fund.

36 Payments to Corporation

(1) Subject to subsection (2), there are payable out of the Consolidated Revenue Fund to the Corporation amounts equal to amounts of payroll levy paid under the Payroll Levy Collection Act.

(2) The amounts that, but for this subsection, would be payable out of the Consolidated Revenue Fund to the Corporation under subsection (1) are reduced by such amount or amounts as are determined by the Minister to represent the expenses incurred by the Commonwealth in procuring the enactment, and in connection with the administration, of this Act, the Payroll Levy Act and the Payroll Levy Collection Act.

(3) The Finance Minister may give directions as to the amounts and times of payments to the Corporation under this section.

(4) The Consolidated Revenue Fund is appropriated for the purposes of this section.

37 Borrowing

(1) Subject to this section, the Corporation may, with the written approval of the Minister and not otherwise, borrow money on terms and conditions specified in, or consistent with, the approval.

(2) The approval of the Minister is not required for a borrowing if the sum of:

(a) the amount to be borrowed; and

(b) any amounts previously borrowed by the Corporation for the same purpose as the first‑mentioned borrowing;

does not exceed $50,000 or, if a higher amount is prescribed, that higher amount.

(3) Money may be borrowed wholly or partly in foreign currency.

(4) Without derogating from the obligation of the Corporation to comply with this section, the validity of a borrowing is not affected merely because the borrowing was made in contravention of this section.

38 Corporation may give security

The Corporation may give security over the whole or any part of its assets for the performance of any obligation incurred under section 37.

39 Application to the Corporation of the Commonwealth Authorities and Companies Act

(2) Subsection 18(3) of the Commonwealth Authorities and Companies Act 1997 does not apply to the Corporation.

(4) Money standing to the credit of the Fund is money of the Corporation for the purposes of the Commonwealth Authorities and Companies Act 1997 as that Act applies to the Corporation.

(5) Transactions and affairs relating to the Fund are transactions and affairs of the Corporation for the purposes of the Commonwealth Authorities and Companies Act 1997 as that Act applies to the Corporation.

Part 6—The Coal Mining Industry (Long Service Leave) Fund

40 Establishment of the Fund

(1) The Corporation must establish and maintain in its books of account a fund to be known as the Coal Mining Industry (Long Service Leave) Fund.

(2) All money received by the Corporation other than payments made by employers in respect of payroll levy is to be paid into, and is taken to be part of, the Fund.

(3) Payment of money into a bank account maintained by the Corporation constitutes payment into the Fund.

41 Application of the Fund

The Fund is to be applied only in making payments that are required or permitted by this Act or the Payroll Levy Collection Act to be made out of the Fund.

42 Investment of the Fund

(1) The Minister may, by written notice to the Board, set out principles or guidelines to be followed in respect of the investment of the Fund.

(2) As soon as practicable after the commencement of this section the Board must prepare a plan for the investment of the Fund.

(3) The Board must revise the plan prepared under subsection (2), or that plan as previously revised under this subsection, not later than 12 months after the plan was prepared or last revised, as the case may be.

(4) Any plan for the investment of the Fund must:

(a) conform with any principles or guidelines referred to in subsection (1); and

(b) subject to those principles or guidelines, be directed towards maximising the return on the money invested consistently with prudent financial management practices.

(5) As soon as practicable after the Board has prepared, or revised, a plan for the investment of the Fund the Board must send a copy of the plan, or of the revised plan, to the Minister.

(6) If the Minister is of the opinion that a plan or revised plan prepared under this section does not comply with subsection (4), the Minister may return the plan to the Board for reconsideration in accordance with any directions given by the Minister.

(7) Where a plan is so returned by the Minister, the Board must revise the plan in accordance with the Minister’s directions and send a copy of the revised plan to the Minister.

(8) Any asset in which money included in the Fund is invested forms part of the Fund.

43 Sufficiency of the Fund

(1) The Board must seek to obtain, within 6 months after the date of commencement of the Payroll Levy Act (the commencing date), advice from an actuary as to:

(a) the amount that it is estimated will be the liability of employers at that date to make payments to eligible employees in respect of long service leave that will have accrued at that date; and

(b) the rate of the payroll levy that, having regard to the amount to be transferred to the Fund under section 35, needs to be imposed to ensure that:

(i) the Fund will be sufficient on and after that date to discharge the liability of employers to make payments to eligible employees in respect of long service leave accruing on and after that date; and

(ii) the Fund will be sufficient at the end of the period of 10 years after that date to discharge so much of the liability of employers to make payments referred to in paragraph (a) as is not discharged before the end of that period.

(2) The Board must seek to obtain, within 6 months before each review date, advice from an actuary as to:

(a) whether the rate of payroll levy imposed when the advice is given would be adequate to ensure that:

(i) the Fund will be sufficient on and after that review date to discharge the liability of employers to make payments to eligible employees in respect of long service leave that accrued or will accrue on or after the commencing date; and

(ii) the Fund will be sufficient at the end of the period of 10 years after the commencing date to discharge so much of the liability of employers to make payments to eligible employees in respect of long service leave that accrued before the commencing date as is not discharged before the end of that period; and

(b) if not, the rate that would be so adequate.

(3) The dates that are 3 years, 5 years and 7 years, respectively, after the commencing date are review dates for the purposes of subsection (2).

(4) The Board must seek to obtain, within 6 months before the end of the period of 10 years after the commencing date, advice from an actuary as to:

(a) whether the Fund will be sufficient at the end of that period to discharge so much of the liability of employers to make payments to eligible employees in respect of long service leave that will have accrued at the end of that period as had not been discharged before the end of that period and, if not, the amount of any deficiency; and

(b) the rate of payroll levy that would need to be imposed to ensure that the Fund will be sufficient:

(i) to discharge the liability of employers to make payments to eligible employees in respect of long service leave accruing after the end of that period; and

(ii) to meet any deficiency referred to in paragraph (a).

(5) When the Board obtains advice from an actuary in respect of any matters referred to in this section, the Board must notify the Minister of the terms of the advice and make a recommendation to the Minister as to whether the rate of payroll levy needs to be changed and, if so, the rate that should be imposed.

(6) If the Board forms the opinion, having regard to any advice obtained by it under this section, that the Fund is likely within the ensuing 12 months to be sufficient to discharge the liability of employers to make payments to eligible employees in respect of long service leave, the Board must give to the Minister a written report stating that it has formed that opinion and setting out the reasons for that opinion.

(7) If at any time the Board considers that the amount standing to the credit of the Fund exceeds the amount required to be retained in the Fund to make any payments that will need to be made out of the Fund, the Board may distribute the excess among such persons who have paid payroll levy, and in such amounts, as the Board considers equitable.

Part 7—Payments out of the Fund

44 Reimbursement of employers in respect of payments for long service leave

(1) When, after the commencement of this section, an employer makes a payment to an eligible employee in respect of the employee’s entitlement to long service leave, there is payable to the employer out of the Fund an amount equal to whichever is the lesser of the following amounts:

(a) the amount of the payment;

(b) the maximum reimbursable amount.

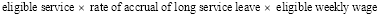

(2) For the purposes of subsection (1), the maximum reimbursable amount in respect of an eligible employee is the amount worked out in accordance with the formula:

where:

eligible service means:

(a) if the payment is being made to the employee on the termination of his or her employment as an eligible employee—the number of years (including any fraction of a year) in respect of which the employee is entitled to be paid for accrued long service leave; or

(b) otherwise—the number of years (including any fraction of a year) in the period of long service leave that the employee is taking pursuant to his or her entitlement to long service leave.

rate of accrual of long service leave means the number of weeks of long service leave to which the eligible employee is entitled for each year of employment in respect of which the employee is entitled to be paid for, or to take, long service leave.

eligible weekly wage means the sum of:

(a) the amount per week of the employee’s eligible wages within the meaning of the Payroll Levy Collection Act immediately before he or she was paid for, or commenced to take, the long service leave (excluding any production‑related bonuses that were included in that amount); and

(b) if any production‑related bonuses were paid to the employee in respect of his or her employment during the period of 52 weeks immediately before he or she was paid for, or commenced to take, the long service leave—the total of those bonuses divided by 52.

(3) A reference in this section to an employee’s entitlement to long service leave, or to an employee’s entitlement to be paid for, or to take, long service leave, is a reference to the employee’s entitlement under any of the following:

(a) section 113 of the Fair Work Act 2009;

(b) a relevant industrial instrument;

(c) a contract of employment.

Note: Schedule 2 to the Coal Mining Industry (Long Service Leave Funding) Amendment Act 2009 extends the operation of section 113 of the Fair Work Act 2009.

45 Reimbursement of employers in respect of certain past payments for long service leave

If, during the period that commenced on 9 April 1990 and ended immediately before the commencement of this section, an employer made, to an employee who was employed in the black coal mining industry under a relevant industrial instrument, a payment in respect of the employee’s entitlement to long service leave, being a payment that was made otherwise than under that instrument, an amount equal to the amount of the payment is payable to the employer out of the Fund.

46 Reimbursement of employer if employee ceases to be eligible employee

If:

(a) an employee ceases to be an eligible employee; and

(b) the employee does not, upon ceasing to be an eligible employee, take all the long service leave to which he or she is entitled or receive payment in respect of the whole of his or her entitlement to long service leave; and

(c) the employer by whom the employee was employed immediately before ceasing to be an eligible employee:

(i) continues to be liable to make a payment to the employee in respect of that entitlement; or

(ii) if another employer of the employee is liable to make a payment to the employee in respect of that entitlement—is liable to reimburse the other employer in respect of the other employer’s liability; and

(d) the employer first mentioned in paragraph (c) requires the Corporation to make a payment to that employer under this section in respect of the employee;

there is payable to that employer out of the Fund an amount equal to:

(e) if the employee did not, upon ceasing to be an eligible employee, take any long service leave or receive any payment in respect of his or her entitlement to long service leave—the maximum reimbursable amount that would have been applicable to the employer in respect of the employee under section 44 if the employee had taken the whole of the long service leave to which he or she was entitled; or

(f) if the employee took part of that long service leave or received payment in respect of part of that entitlement to long service leave—the amount that would be calculated under paragraph (e) if that paragraph were applicable less any amount paid or payable to the employer out of the Fund under section 44 in respect of the long service leave so taken or the payment so received by the employee.

47 Reimbursement of overpayment of payroll levy

If an employer makes an overpayment of payroll levy, an amount equal to the overpayment is payable to the employer out of the Fund.

48 Payments to employees if employer being wound up

(1) If the Board is satisfied that:

(a) an employer is required to make a payment to an eligible employee; and

(b) if the payment were made, an amount (the relevant amount) equal to the payment would be payable to the employer out of the Fund under section 44; and

(c) the employer has not made the payment; and

(d) the employer is in the course of being wound up;

the following provisions of this section have effect.

(2) An amount equal to the relevant amount is payable to the employee out of the Fund.

(3) The making of the payment referred to in subsection (2) discharges the liability of the employer to make the payment referred to in paragraph (1)(a).

48A Payments to former Oakdale employees

(1) Each former Oakdale employee is entitled to be paid, out of the Fund, an amount equal to the employee’s termination entitlement, reduced by:

(a) any amount that the employee has received from Oakdale in respect of the employee’s termination entitlement; and

(b) any amount that the employee has received as a beneficiary of the Trust.

(2) Payment is not to be made to an employee unless the employee has entered into a written agreement with the Corporation:

(a) assigning to the Corporation the employee’s rights to be paid any amount (by a person other than the Corporation) in respect of the employee’s termination entitlement; and

(b) agreeing to pay to the Corporation:

(i) any amount that the employee later receives from Oakdale in respect of the employee’s termination entitlement; and

(ii) any amount that the employee later receives as a beneficiary of the Trust.

(3) Regulations may be made requiring the Corporation to give information statements to employees in respect of payments under this section.

(4) In this section:

former Oakdale employee means a person whose employment by Oakdale was terminated on or after 25 May 1999.

Oakdale means Oakdale Collieries Pty Limited (ACN 066 839 585).

termination entitlement means the amount owing by Oakdale to the employee, immediately after the termination time, in respect of the employee’s employment by Oakdale.

termination time means the time when the employee’s employment by Oakdale was terminated.

Trust means the Oakdale Collieries Employee Entitlements Trust that was established by a deed of trust made on 9 July 1999.

48B Payments in respect of former employees of companies being wound up etc.

(1) A person is a qualifying employee for the purposes of this section if all the following conditions are met:

(a) the person’s employment with an employer (the former employer) has been terminated on or before 31 December 1999;

(b) immediately before the termination, the person was an eligible employee;

(c) a liquidator, provisional liquidator or administrator of the former employer has been appointed under the Corporations Act 2001 on or after 1 January 1999;

(d) the former employer is not Oakdale Collieries Pty Limited (ACN 066 839 585).

(2) A qualifying employee is entitled to be paid, out of the Fund, an amount equal to the employee’s termination entitlement, reduced by any amount that the employee has received in respect of the employee’s termination entitlement.

(3) Payment is not to be made to an employee unless the employee has entered into a written agreement with the Corporation:

(a) assigning to the Corporation the employee’s rights to be paid any amount (by a person other than the Corporation) in respect of the employee’s termination entitlement; and

(b) agreeing to pay to the Corporation any amount that the employee later receives in respect of the employee’s termination entitlement.

(4) Regulations may be made requiring the Corporation to give information statements to employees in respect of payments under this section.

(5) In this section:

termination entitlement means the amount owing by the former employer to the employee, immediately after the termination time, in respect of the employee’s employment by the former employer.

termination time means the time when the employee’s employment by the former employer was terminated.

49 Board may determine claims for payment

When a question arises as to whether an amount is payable to a person out of the Fund, the Board may determine any matter of fact relevant to that question.

Part 8—Miscellaneous

50 Delegation

(1) The Corporation may, by writing under its seal, delegate to:

(a) a Director; or

(b) a person employed by the Corporation; or

(c) a person engaged by the Corporation under a contract; or

(d) a person employed by a person referred to in paragraph (c);

any of the Corporation’s powers and functions under this Act or the Payroll Levy Collection Act.

(2) The Board may, by signed writing, delegate to:

(a) a Director; or

(b) a person employed by the Corporation; or

(c) a person engaged by the Corporation under a contract; or

(d) a person employed by a person referred to in paragraph (c);

any of the Board’s powers under this Act or the Payroll Levy Collection Act other than the power to revoke or vary a decision made by the Board.

(3) The Minister may, by signed writing, delegate to a person performing the duties of an office in the Department, the Minister’s powers under this Act other than the Minister’s powers under section 13, 14, 31 or 32.

51 Expenses of Corporation

Subject to section 53, the expenses incurred by the Corporation are to be paid out of the Fund.

52 Remuneration and allowances of Directors

Subject to section 53, the remuneration and allowances of Directors are to be paid out of the Fund.

53 Transitional

(1) Until the date of commencement of section 35, any amount that, apart from this section, would be payable out of the Fund under section 51 or 52 is payable out of the previous Fund.

(2) If an amount that was payable out of the previous Fund is not paid before that date, that amount is payable out of the Fund.

54 Regulations

The Governor‑General may make regulations prescribing matters:

(a) required or permitted by this Act to be prescribed; or

(b) necessary or convenient to be prescribed for carrying out or giving effect to this Act.

55 Review of Act

The Minister is to arrange for the carrying out of an independent review of the operation of this Act as soon as possible after the Minister receives a report from the Board under subsection 43(6).