Taxation Laws Amendment Act (No. 2) 1991

No. 100 of 1991

TABLE OF PROVISIONS

PART 1—PRELIMINARY

Section

- Short title

- Commencement

PART 2—AMENDMENT OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

3. Principal Act

4. Indexation factor for valuation purposes—non-remote housing

5. Repeal of sections 65b and 65c

6. Insertion of new section:

65caa. Reduction of taxable value of fringe benefits in relation to 1991-92 year of tax—Cocos (Keeling) Islands

7. Assessment on assumption

8. Remote area holiday transport

9. Christmas Island and Cocos (Keeling) Islands

10. Consequential amendments—repeal of sections 65b and 65c of the Principal Act

11. Consequential amendments—Cocos (Keeling) Islands

12. Application of amendments

13. Amendment of assessments

PART 3—AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

14. Principal Act

15. Interpretation

16. Exemptions

TABLE OF PROVISIONS—continued

Section

17. Repeal of section 23ad

18. Exemption of certain income derived in respect of approved overseas projects

19. Exemption of income earned in overseas employment

20. Insertion of new Division:

Division 1aa—Exemption from income tax—payments under the

Social Security Act 1991 and the Veterans’ Entitlements Act 1986, and similar payments

Subdivision A—Preliminary

24a. Interpretation—meaning of ‘exempt’ and ‘not exempt’

24aa. Interpretation—payments derived when due

24aaa. Index of payments covered by Division

Subdivision B—Exemption from income tax—payments under

the Social Security Act 1991

24ab. Index of payments covered by Subdivision

24aba. Interpretation—supplementary amounts

24abb. Interpretation—expressions used in the Social Security Act 1991

24abc. Age pension

24abd. Invalid pension

24abe. Wife pension

24abf. Carer pension

24abg. Sole parent pension

24abh. Widowed person allowance

24abi. Widow B pension

24abj. Sheltered employment allowance

24abk. Rehabilitation allowance

24abl. Unemployment benefit

24abm. Job search allowance

24abn. Employment entry payment

24abo. Sickness benefit

24abp. Special benefit

24abq. Special needs age pension

24abr. Special needs invalid pension

24abs. Special needs wife pension

24abt. Special needs sole parent pension

24abu. Special needs widow B pension

24abv. Bereavement payments—special needs pensions

24abw. Family allowance

24abx. Family allowance supplement

24aby. Child disability allowance

24abz. Double orphan pension

24abza. Mobility allowance

24abzb. Exempt bereavement payment calculator A

Subdivision C—Exemption from income tax—payments under

the Veterans’ Entitlements Act 1986

24ac. Index of payments covered by Subdivision

24aca. Interpretation—supplementary amounts

24acb. Interpretation—expressions used in the Veterans’ Entitlements Act 1986

24acc. Interpretation—meaning of ‘pension age’

24acd. Section 13 pension

24ace. Age service pension

24acf. Invalidity service pension

24acg. Wife service pension

24ach. Carer service pension

24aci. Section 70 pension

TABLE OF PROVISIONS—continued

Section

24acj. Clothing allowance

24ack. Attendant allowance

24acl. Section 98a bereavement payment

24acm. Section 99 funeral benefit

24acn. Section 100 funeral benefit

24aco. Decoration allowance

24acp. Victoria Cross allowance

24acq. Recreation transport allowance

24acr. Vehicle Assistance Scheme

24acs. Special assistance

24act. Temporary incapacity allowance

24acu. Loss of earnings allowance

24acv. Travelling expenses

24acw. Pharmaceutical supplement

24acx. Exempt bereavement payment calculator B

Subdivision D—Exemption from income tax—payments under

the Seamen’s War Pensions and Allowances Act 1940

24ad. Seamen’s war pensions and allowances

24ada. Bereavement payments

Subdivision E—Exemption from income tax—payments by virtue

of the Veterans’ Entitlements (Transitional Provisions and

Consequential Amendments) Act 1986

24ae. Payments by virtue of the Veterans’ Entitlements (Transitional Provisions and Consequential Amendments) Act 1986

Subdivision F—Exemption from income tax—payments of

allowances under Part III of the Disability Services Act 1986

24af. Allowances under Part III

Subdivision G—Exemption from income tax—payments of

domiciliary nursing care benefit under Part Vb of the National Health Act 1953

24ag. Domiciliary nursing care benefit

Subdivision H—Exemption from income tax—similar Australian and United Kingdom veterans’ payments

24ah. Similar Australian and United Kingdom veterans’ payments

Subdivision I—Exemption from income tax—wounds and disability pensions

24ai. Wounds and disability pensions

Subdivision J—Occupational superannuation payments not covered

24aj. Occupational superannuation payments not covered by this Division

21. Application of Division—1985-86 to 1990-91

22. Insertion of new section:

24bb. Application of Division—1991-92 and subsequent years

23. Insertion of new section:

24p. Transitional capital gains tax provisions for certain Cocos (Keeling) Islands assets

TABLE OF PROVISIONS—continued

Section

24. Amounts received on retirement or termination of employment in lieu of long service leave

25. Securities lending arrangements

26. Interpretation

27. Insertion of new section:

43a. Subdivision has effect subject to section 160aqua (transfer of shareholder status for tax purposes)

28. Distribution benefits—CFCs

29. Bad debts of money-lenders not allowable deductions where attributable to listed country branches

30. Deduction of expenditure on prevention of land degradation

31. Gifts, pensions etc.

32. Rebates for residents of isolated areas

33. Interpretation

34. Payment of interest by taxpayer on distributions from certain non-resident trust estates

35. Persons to whom Division applies

36. Disposal, loss, destruction or termination of use of property

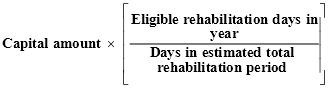

37. Insertion of new section:

122ka. Application of section 122k before 1 July 1991—subsequent use of property for rehabilitation

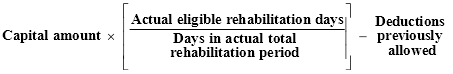

38. Disposal, loss, destruction or termination of use of property

39. Insertion of new section:

124ama. Application of section 124am before 1 July 1991—subsequent use of property for rehabilitation

40. Insertion of new Division:

Division 10ab—Rehabilitation and Restoration of Mining,

Quarrying and Petroleum Sites

124b. Interpretation

124ba. Deduction of expenditure on rehabilitation-related activities

124bb. Rehabilitation-related activity

124bc. No deduction for certain expenditure

124bd. No deduction where expenditure is recouped

124be. Transactions between persons not at arm’s length

124bf. Property used for rehabilitation-related activities taken to be used for the purpose of producing assessable income

41. Foreign debt

42. Foreign equity

43. Section 128f debenture amounts

44. Adjustment of foreign equity in certain cases involving resident holding companies of financial institutions

45. Insertion of new section:

159gzlb. Transition to wholly-owned banking group—resident company group and adjustment of foreign equity

46. Rebates for dependents

47. Housekeeper

48. Interpretation

49. Rebate in respect of certain pensions, benefits etc.

50. Insertion of new section:

160ace. Rebate for certain Cocos (Keeling) Islands income—1991-92

51. Credits in respect of foreign tax

52. Interpretation

53. Insertion of new Division:

Division 6a—Transfer of Shareholder Status for Tax Purposes

160aqua. Transfer of shareholder status for tax purposes—cum-dividend stock exchange sales and securities lending arrangements

TABLE OF PROVISIONS—continued

Section

160aqub. Securities dealer to give dividend statement to other party— cum-dividend sale

160aquc. No securities dealer—party to cum-dividend sale contract to give dividend statement to other party

160aqud. Borrower under a securities lending arrangement to give dividend statement to lender

54. General application of Part in relation to corporate trust estates

55. Penalty for setting out incorrect amounts in dividend statements

56. Deemed assessment

57. Quotation of tax file number in employment declaration

58. Effect of incorrect quotation of tax file number

59. Explanation of terms: investment, investor, investment body

60. Insertion of new sections:

202dda. Quotation of investment body remitter number to be alternative to quoting tax file number

202ddb. Quotation of tax file number in connection with indirectly held investment

61. Investments held jointly

62. Persons receiving certain pensions etc.—employment

63. Persons receiving certain pensions etc.—investments

64. Non-residents

65. When income tax becomes due and payable

66. Interpretation

67. Certain employees to be subject to provisional tax

68. Uplifted provisional tax amount

69. Provisional tax on estimated income

70. Interpretation

71. Duty of payer to pay deducted amount to Commissioner

72. Credits in respect of deducted amounts

73. Interpretation

74. Medicare levy

75. Prescribed persons

76. Insertion of new section:

399a. Modified application of bad debt provisions

77. Reduction of section 456 assessability where item subject to foreign accruals tax

78. Assessability in respect of certain dividends paid by a CFC

79. Insertion of new section:

462a. Keeping of records—section 457

80. Insertion of new section:

464a. Keeping of records—section 459a

81. Offence of failing to keep records

82. Circumstances where records not required to be kept—reasonable excuse etc.

83. Application of amendments

84. Amendment of assessments

PART 4—AMENDMENT OF THE INCOME TAX RATES ACT 1986

85. Principal Act

86. Interpretation

87. Interpretation

88. Application of amendments

PART 5—AMENDMENT OF THE MEDICARE LEVY ACT 1986

89. Principal Act

90. Amount of levy—person who has spouse or dependants

91. Application of amendments

TABLE OF PROVISIONS—continued

Section

PART 6—AMENDMENT OF THE TAXATION ADMINISTRATION ACT 1953

92. Principal Act

93. Interpretation

SCHEDULE 1

AMENDMENTS OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986 CONSEQUENTIAL ON THE REPEAL OF SECTIONS 65b AND 65c OF THAT ACT

SCHEDULE 2

CONSEQUENTIAL AMENDMENTS OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986 RELATING TO THE COCOS (KEELING) ISLANDS

Taxation Laws Amendment Act (No. 2) 1991

No. 100 of 1991

An Act to amend the law relating to taxation

An Act to amend the law relating to taxation

[Assented to 27 June 1991]

The Parliament of Australia enacts:

PART 1—PRELIMINARY

Short title

1. This Act may be cited as the Taxation Laws Amendment Act (No. 2) 1991.

Commencement

2. (1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) Sections 4, 6, 8, 9 and 11 commence on the day after the day on which this Act receives the Royal Assent.

(3) Section 29 commences, or is taken to have commenced, immediately after the commencement of section 14 of the Taxation Laws Amendment Act 1991.

(4) Paragraph 33 (a) is taken to have commenced at the same time as section 59 of the Taxation Laws Amendment Act (No. 2) 1990.

(5) Paragraphs 33 (c) and (d) are taken to have commenced at the same time as section 31 of the Taxation Laws Amendment Act (No. 3) 1989.

(6) Section 77 commences, or is taken to have commenced, immediately after the commencement of section 76 of the Taxation Laws Amendment Act 1991.

(7) Section 78 is taken to have commenced immediately after the commencement of the Taxation Laws Amendment (Foreign Income) Act 1990.

PART 2—AMENDMENT OF THE FRINGE BENEFITS TAX ASSESSMENT ACT 1986

Principal Act

3. In this Part, “Principal Act” means the Fringe Benefits Tax Assessment Act 19861.

Indexation factor for valuation purposes—non-remote housing

4. Section 28 of the Principal Act is amended by inserting in paragraph (5) (b) “and the Territory of Cocos (Keeling) Islands” after “Christmas Island”.

Repeal of sections 65b and 65c

5. Sections 65b and 65c of the Principal Act are repealed.

6. Before section 65ca of the Principal Act the following section is inserted in Division 14 of Part III:

Reduction of taxable value of fringe benefits in relation to 1991-92 year of tax—Cocos (Keeling) Islands

“65caa. (1) Where:

(a) a fringe benefit (not being a car fringe benefit) in relation to an employer in relation to the year of tax commencing on 1 April 1991 relates to a particular employee; and

(b) on or after 1 July 1991, the employee derived salary or wages from Cocos (Keeling) Islands service, being salary or wages paid by the employer; and

(c) the fringe benefit was provided in respect of that Cocos (Keeling) Islands service; and

(d) except in the case of a loan fringe benefit, a housing fringe benefit or a period residual fringe benefit—the benefit was provided on or after 1 July 1991; and

(e) in the case of a loan fringe benefit, a housing fringe benefit or a period residual fringe benefit—the whole or a part (which whole or part is in this subsection called the ‘reducible portion’) of the taxable value of the fringe benefit is attributable to the obligation to repay the whole or any part of the loan, the subsistence of the housing right or the provision of the residual benefit, as the case may be, on or after 1 July 1991;

the amount that, but for this subsection and sections 62, 64 and 65, would be the taxable value or, if paragraph (e) applies, the reducible portion of taxable value, of that fringe benefit in relation to the year of tax is to be reduced by 50%.

“(2) Where:

(a) one or more car fringe benefits (in this subsection called the ‘eligible car fringe benefits’) in relation to an employee, in relation to an employer, in relation to the year of tax commencing on 1 April 1991 relate to a particular car; and

(b) on or after 1 July 1991, the employee derived salary or wages from Cocos (Keeling) Islands service, being salary or wages paid by the employer; and

(c) the eligible car fringe benefits were provided on or after 1 July 1991 in respect of that Cocos (Keeling) Islands service;

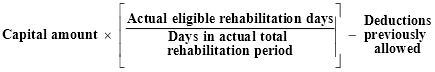

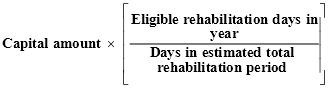

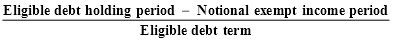

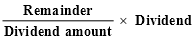

the amount that, but for this subsection and sections 62, 64 and 65, would be the taxable value, or the sum of the taxable values, as the case requires, of the car fringe benefits in relation to the employer in relation to the year of tax that relate to the car is to be reduced by the amount calculated using the formula:

where:

‘Taxable value’ means so much of the taxable value or the sum of the taxable values as is attributable to the eligible car fringe benefits.

“(3) A reference in this section to Cocos (Keeling) Islands service is a reference to service as an employee where:

(a) salary or wages are payable in respect of the service; and

(b) if:

(i) section 24bb of the Income Tax Assessment Act 1936 had not been enacted; and

(ii) section 24ba of that Act had applied in relation to the year of income in which the salary or wages were derived;

the salary or wages would have been exempt income under section 24g of that Act.”.

Assessment on assumption

7. Section 124a of the Principal Act is amended by omitting from paragraph (1) (b) “the whole or a part of.

Remote area holiday transport

8. Section 143 of the Principal Act is amended by adding at the end of paragraph (4) (d) “and the Territory of Cocos (Keeling) Islands”.

Christmas Island and Cocos (Keeling) Islands

9. Section 157 of the Principal Act is amended:

(a) by adding at the end of subsection (1) “and to the Territory of Cocos (Keeling) Islands”;

(b) by inserting in subsection (2) “or the Territory of Cocos (Keeling) Islands” after “Christmas Island”.

Consequential amendments—repeal of sections 65b and 65c of the Principal Act

10. The Principal Act is amended as set out in Schedule 1.

Consequential amendments—Cocos (Keeling) Islands

11. The Principal Act is amended as set out in Schedule 2.

Application of amendments

12. (1) In this section:

“amended Act” means the Principal Act as amended by this Act.

(2) The repeal of sections 65b and 65c of the Principal Act effected by this Part and the amendments made by sections 7 and 10 apply in relation to eligible foreign remuneration, or foreign earnings, derived on or after 1 July 1990 and:

(a) except in the case of a loan fringe benefit, a housing fringe benefit or a period residual fringe benefit—in relation to a benefit provided on or after 1 July 1990; or

(b) in the case of a loan fringe benefit, a housing fringe benefit or a period residual fringe benefit—in relation to the obligation to repay the whole or any part of the loan, the subsistence of the housing right or the provision of the residual benefit, as the case may be, on or after 1 July 1990.

(3) Subject to this section, the amendments made by sections 4, 6, 8, 9 and 11 apply to assessments of the fringe benefits taxable amount of an employer of the year of tax commencing on 1 April 1991 and of each subsequent year of tax.

(4) In spite of anything in the amended Act, the amended Act applies in relation to the Territory of Cocos (Keeling) Islands as if that Territory had become an internal Territory on 1 July 1991.

Amendment of assessments

13. Section 74 of the Principal Act does not prevent the amendment of an assessment made before the commencement of this section for the purpose of giving effect to this Act.

PART 3—AMENDMENT OF THE INCOME TAX ASSESSMENT ACT 1936

Principal Act

14. In this Part, “Principal Act” means the Income Tax Assessment Act 19362.

Interpretation

15. Section 6 of the Principal Act is amended by inserting in subsection (1) the following definition:

“‘Timor Gap treaty’ means the Treaty defined by subsection 5 (1) of the Petroleum (Australia-Indonesia Zone of Cooperation) Act 1990;”.

Exemptions

16. Section 23 of the Principal Act is amended by omitting paragraph (jca).

Repeal of section 23ad

17. Section 23ad of the Principal Act is repealed.

Exemption of certain income derived in respect of approved overseas projects

18. Section 23af of the Principal Act is amended:

(a) by omitting from subsection (1) “365” and substituting “91”;

(b) by omitting subsection (2);

(c) by omitting from paragraph (15) (b) “subsection (1) or (2)” and substituting “this section”;

(d) by omitting subsections (17a) and (17b) and substituting the following subsections:

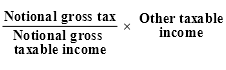

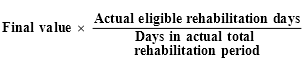

“(17a) If the income of a taxpayer of a year of income consists of an amount that is exempt from tax under this section (in this section called the ‘exempt amount’) and other income, the amount of tax (if any) payable in respect of the other income is calculated using the formula:

where:

‘Notional gross tax’ means the number of whole dollars in the

amount of income tax that would be assessed under this Act in respect of the taxpayer’s taxable income of the year of income if:

(a) the exempt amount were not exempt income; and

(b) the taxpayer were not entitled to any rebate of tax;

Notional gross taxable income’ means the number of whole dollars in the amount that would have been the taxpayer’s taxable income of the year of income if the exempt amount were not exempt income;

‘Other taxable income’ means the amount (if any) remaining after deducting from so much of the other income as is assessable income:

(d) any deductions allowable to the taxpayer in relation to the year of income that relate exclusively to that assessable income; and

(e) so much of any other deductions (other than apportionable deductions) allowable to the taxpayer in relation to the year of income as, in the opinion of the Commissioner, may appropriately be related to that assessable income; and

(f) the amount calculated using the formula in subsection (17b).

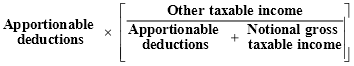

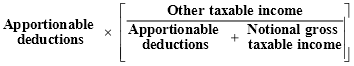

“(17b) The formula referred to in paragraph (17a) (f) is:

where:

‘Apportionable deductions’ means the number of whole dollars in the apportionable deductions allowable to the taxpayer in relation to the year of income;

‘Other taxable income’ means the amount that, apart from paragraph (17a) (f), would be represented by the component ‘Other taxable income’ in subsection (17a);

‘Notional gross taxable income’ means the number of whole dollars in the amount that would have been the taxpayer’s taxable income of the year of income if the exempt amount were not exempt income.”.

Exemption of income earned in overseas employment

19. Section 23ag of the Principal Act is amended:

(a) by omitting from subsection (1) “365” and substituting “91”;

(b) by omitting subsections (2), (3), (4) and (5) and substituting the following subsections:

“(2) An amount of foreign earnings derived in a foreign country is not exempt from tax under this section if the amount is exempt from income tax in the foreign country only because of any of the following:

(a) a law of the foreign country giving effect to a double tax agreement;

(b) a double tax agreement;

(c) provisions of a law of the foreign country under which income covered by any of the following categories is generally exempt from income tax:

(i) income derived in the capacity of an employee;

(ii) income from personal services;

(iii) similar income;

(d) the law of the foreign country does not provide for the imposition of income tax on one or more of the categories of income mentioned in paragraph (c);

(e) a law of the foreign country corresponding to the International Organizations (Privileges and Immunities) Act 1963 or to the regulations under that Act;

(f) an international agreement to which Australia is a party and that deals with:

(i) diplomatic or consular privileges and immunities;

or

(ii) privileges and immunities in relation to persons connected with international organisations;

(g) a law of the foreign country giving effect to an agreement covered by paragraph (f).

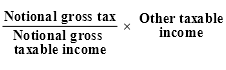

“(3) If the income of a taxpayer of a year of income consists of an amount that is exempt from tax under this section (in this section called the ‘exempt amount’) and other income, the amount of tax (if any) payable in respect of the other income is calculated using the formula:

where:

‘Notional gross tax’ means the number of whole dollars in the amount of income tax that would be assessed under this Act in respect of the taxpayer’s taxable income of the year of income if:

(a) the exempt amount were not exempt income; and

(b) the taxpayer were not entitled to any rebate of tax;

‘Notional gross taxable income’ means the number of whole

dollars in the amount that would have been the taxpayer’s taxable income of the year of income if the exempt amount were not exempt income;

‘Other taxable income’ means the amount (if any) remaining after deducting from so much of the other income as is assessable income:

(d) any deductions allowable to the taxpayer in relation to the year of income that relate exclusively to that assessable income; and

(e) so much of any other deductions (other than apportionable deductions) allowable to the taxpayer in relation to the year of income as, in the opinion of the Commissioner, may appropriately be related to that assessable income; and

(f) the amount calculated using the formula in subsection (4).

“(4) The formula referred to in paragraph (3) (f) is:

where:

‘Apportionable deductions’ means the number of whole dollars in the apportionable deductions allowable to the taxpayer in relation to the year of income;

‘Other taxable income’ means the amount that, apart from paragraph (3) (f), would be represented by the component ‘Other taxable income’ in subsection (3);

‘Notional gross taxable income’ means the number of whole dollars in the amount that would have been the taxpayer’s taxable income of the year of income if the exempt amount were not exempt income.”;

(c) by omitting subsection (6h);

(d) by inserting in subsection (7) the following definitions:

“‘double tax agreement’ means:

(a) double tax agreement within the meaning of Part X; or

(b) the Timor Gap treaty;

‘income tax’, in relation to a foreign country:

(a) in all cases—does not include a municipal income tax; and

(b) in the case of a federal foreign country—does not include a State income tax;”.

20. After section 24 of the Principal Act the following Division is inserted:

“Division 1AA—Exemption from income tax—payments under the Social Security Act 1991 and the Veterans’ Entitlements Act 1986, and similar payments

“Subdivision A—Preliminary

Interpretation—meaning of ‘exempt’ and ‘not exempt’

24a. In this Division:

‘exempt’ means exempt from income tax;

‘not exempt’ means not exempt from income tax under this Division.

Interpretation—payments derived when due

“24aa. (1) For the purposes of the application of this Division to a payment derived by a taxpayer, the payment is taken to have been derived on the day on which the payment became due.

“(2) For the purposes of the application of this Division to a payment that would have been derived by a taxpayer in particular circumstances, the payment is taken to have been derived on the day on which the payment would have become due in those circumstances.

Index of payments covered by Division

“24aaa. The following is an index of payments covered by this Division:

Type of payment | Subdivision | Sections |

Payments under the Social Security Act 1991 | Subdivision B | 24ab-24abzb |

Payments under the Veterans’ Entitlements Act 1986 | Subdivision C | 24ac-24acx |

Payments under the Seamen’s War Pensions and Allowances Act 1940 | Subdivision D | 24ad-24ada |

Payments by virtue of the Veterans’ Entitlements (Transitional Provisions and Consequential Amendments) Act 1986 | Subdivision E | 24ae |

Allowances under Part III of the Disability Services Act 1986 | Subdivision F | 24af |

Payments of domiciliary nursing care benefit under Part Vb of the National Health Act 1953 | Subdivision G | 24ag |

Similar Australian and United Kingdom veterans’ payments | Subdivision H | 24ah |

Wounds and disability pensions | Subdivision I | 24ai |

“Subdivision B—Exemption from income tax—payments under the Social Security Act 1991

Index of payments covered by Subdivision

“24ab. The following is an index of payments under the Social Security Act 1991 covered by this Subdivision:

Type of payment | Section |

Age pension | 24abc |

Carer pension | 24abf |

Child disability allowance | 24aby |

Double orphan pension | 24abz |

Employment entry payment | 24abn |

Family allowance | 24abw |

Family allowance supplement | 24abx |

Invalid pension | 24abd |

Job search allowance | 24abm |

Mobility allowance | 24abza |

Rehabilitation allowance | 24abk |

Sheltered employment allowance | 24abj |

Sickness benefit | 24abo |

Sole parent pension | 24abg |

Special benefit | 24abp |

Special needs age pension | 24abq |

Special needs invalid pension | 24abr |

Special needs sole parent pension | 24abt |

Special needs widow B pension | 24abu |

Special needs wife pension | 24abs |

Unemployment benefit | 24abl |

Widow B pension | 24abi |

Widowed person allowance | 24abh |

Wife pension | 24abe |

Interpretation—supplementary amounts

“24aba. (1) For the purpose of applying this Subdivision to a payment derived by a taxpayer, the supplementary amounts are as follows:

Type of payment | Supplementary amounts |

Age pension Wife pension Carer pension Sole parent pension Widowed person allowance | (a) so much of the payment as was included in the payment because the taxpayer or the partner of the taxpayer paid rent; |

Widow B pension Special needs age pension Special needs wife pension Special needs sole parent pension Special needs widow B pension | (b) so much of the payment as represents an increase in the rate of the pension that is calculated by reference to another person or other persons; |

| (c) so much of the payment as was included in the payment by way of remote area allowance. |

Unemployment benefit Job search allowance Sickness benefit Special benefit | (a) so much of the payment as was included in the payment because the taxpayer or the partner of the taxpayer paid rent; |

| (b) if the payment was made to or in respect of a taxpayer who had a dependent child or children or who was making regular contributions towards the maintenance of a child or children—so much of the payment as is attributable to the child or children; |

| (c) so much of the payment as was included in the payment by way of remote area allowance. |

“(2) A reference in subsection (1) to a partner, child or other person includes a reference to a deceased partner, deceased child or deceased other person.

“(3) For the purposes of this section, a payment under section 186 of the Social Security Act 1991 is taken to be a payment of a wife pension.

Interpretation—expressions used in the Social Security Act 1991

“24abb. (1) Expressions used in this Subdivision that are also used in the Social Security Act 1991 have the same respective meanings as in that Act.

“(2) Expressions used in a section in this Subdivision that relates to payments under a particular provision of the Social Security Act

1991 that are also used in that provision have the same respective meanings as in that provision.

Age pension

“24abc. (1) The treatment of payments of age pension under Part 2.2 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 84 of the Social Security Act 1991).

“(3) Payments under sections 83, 86, 90 and 91 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 84 of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

Invalid pension

“24abd. (1) Payments of invalid pension under Part 2.3 of the Social Security Act 1991 are exempt.

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 137 of the Social Security Act 1991).

“(3) Payments under sections 136, 139, 143 and 144 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 137 of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

Wife pension

“24abe. (1) The treatment of payments of wife pension under Part 2.4 of the Social Security Act 1991 is as follows:

Item | Category | Supplementary amounts | Balance of payment |

1 | Taxpayer not under pension age | Exempt | Not exempt |

2 | Partner not under pension age | Exempt | Not exempt |

3 | Both taxpayer and partner under pension age | Exempt | Exempt |

4 | (a) Taxpayer under pension age; and (b) Partner deceased | Exempt | Exempt |

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 190 of the Social Security Act 1991).

“(3) Payments under sections 189, 191 and 195 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 190 of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

“(5) For the purposes of this section, a payment under section 186 of the Social Security Act 1991 is taken to be a payment of a wife pension.

Carer pension

“24abf. (1) The treatment of payments of carer pension under Part 2.5 of the Social Security Act 1991 is as follows:

Item | Category | | |

1 | Taxpayer not under pension age | Exempt | Not exempt |

2 | Severely handicapped pensioner not under pension age | Exempt | Not exempt |

3 | Both taxpayer and severely handicapped pensioner under pension age | Exempt | Exempt |

4 | (a) Taxpayer under pension age; and (b) Severely handicapped pensioner deceased | Exempt | Exempt |

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 239 of the Social Security Act 1991).

“(3) Payments under sections 238, 241, 245 and 246 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 239 of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

Sole parent pension

“24abg. (1) The treatment of payments of sole parent pension under Part 2.6 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 305 of the Social Security Act 1991).

“(3) Payments under sections 304, 307, 311 and 312 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 305 of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

Widowed person allowance

“24abh. (1) The treatment of payments of widowed person allowance under Part 2.7 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Payments under sections 358 and 359 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

Widow B pension

“24abi. (1) The treatment of payments of widow B pension under Part 2.8 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Payments under sections 406 and 407 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

Sheltered employment allowance

“24abj. (1) Payments of sheltered employment allowance under Part 2.9 of the Social Security Act 1991 are exempt.

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 451 of the Social Security Act 1991).

“(3) Payments under sections 450, 453, 457 and 458 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 451 of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

Rehabilitation allowance

“24abk. (1) Payments of rehabilitation allowance under Part 2.10 of the Social Security Act 1991 are exempt.

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 503 of the Social Security Act 1991).

“(3) Payments under sections 502, 505, 509 and 510 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 503 of the Social Security Act. 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

Unemployment benefit

“24abl. (1) The treatment of payments of unemployment benefit under Part 2.11 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Payments under section 588 of the Social Security Act 1991 (which deals with bereavement payments) are exempt.

Job search allowance

“24abm. (1) The treatment of payments of job search allowance under Part 2.12 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Payments under section 660 of the Social Security Act 1991 (which deals with bereavement payments) are exempt.

Employment entry payment

“24abn. Payments of employment entry payment under Part 2.13 of the Social Security Act 1991 are exempt.

Sickness benefit

“24abo. (1) The treatment of payments of sickness benefit under Part 2.14 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Payments under section 728 of the Social Security Act 1991 (which deals with bereavement payments) are exempt.

Special benefit

“24abp. (1) The treatment of payments of special benefit under Part 2.15 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Payments under section 771 of the Social Security Act 1991 (which deals with bereavement payments) are exempt.

Special needs age pension

“24abq. (1) The treatment of payments of special needs age pension under section 772 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Subsection (1) has effect subject to section 24abv (which deals with bereavement payments).

Special needs invalid pension

“24abr. (1) Payments of special needs invalid pension under section 773 of the Social Security Act 1991 are exempt.

“(2) Subsection (1) has effect subject to section 24abv (which deals with bereavement payments).

Special needs wife pension

“24abs. (1) The treatment of payments of special needs wife pension under section 774 of the Social Security Act 1991 is as follows:

Item | Category | Supplementary amounts | Balance of payment |

1 | Taxpayer not under pension age | Exempt | Not exempt |

2 | Partner not under pension age | Exempt | Not exempt |

3 | Both taxpayer and partner under pension age | Exempt | Exempt |

4 | (a) Taxpayer under pension age; and | Exempt | Exempt |

“(2) Subsection (1) has effect subject to section 24abv (which deals with bereavement payments).

Special needs sole parent pension

“24abt. The treatment of payments of special needs sole parent pension under section 775 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

Special needs widow B pension

“24abu. The treatment of payments of special needs widow B pension under section 778 of the Social Security Act 1991 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

Bereavement payments—special needs pensions

“24abv. (1) Payments under sections 823, 826 and 830 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

“(2) If a taxpayer derives a payment under section 824 of the Social Security Act 1991:

(a) so much of the sum of that payment and other payments under the Social Security Act 1991 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator A in section 24abzb is exempt; and

(b) the balance of the sum is not exempt.

Family allowance

“24abw. (1) Payments of family allowance under Part 2.17 of the Social Security Act 1991 are exempt.

“(2) Payments under sections 889 and 890 of the Social Security Act 1991 (which deal with bereavement payments) are exempt.

Family allowance supplement

“24abx. (1) Payments of family allowance supplement under Part 2.18 of the Social Security Act 1991 are exempt.

“(2) Payments under section 951 of the Social Security Act 1991 (which deals with bereavement payments) are exempt.

Child disability allowance

“24aby. (1) Payments of child disability allowance under Part 2.19 of the Social Security Act 1991 are exempt.

“(2) Payments under section 992 of the Social Security Act 1991 (which deals with bereavement payments) are exempt.

Double orphan pension

“24abz. (1) Payments of double orphan pension under Part 2.20 of the Social Security Act 1991 are exempt.

“(2) Payments under section 1034 of the Social Security Act 1991 (which deals with bereavement payments) are exempt.

Mobility allowance

“24abza. Payments of mobility allowance under Part 2.21 of the Social Security Act 1991 are exempt.

Exempt bereavement payment calculator A

“24abzb. The exempt bereavement payment calculator A is as follows:

EXEMPT BEREAVEMENT PAYMENT CALCULATOR A This is how to work out the tax-free amount: Step 1. Work out the pension paydays that are in the bereavement lump sum period: the result is called the relevant pension paydays. Step 2. Work out the amount of payments under the Social Security Act 1991 that would have been derived by the taxpayer on each of the relevant pension paydays and which would have been exempt if: (a) the partner had not died; and (b) the partner had been under pension age; the result for each relevant pension payday is called the pension payday exempt notional taxpayer amount. Step 3. Sum the pension payday exempt notional taxpayer amounts: the result is called the exempt notional taxpayer amount. Step 4. Work out the amount of payments under the Social Security Act 1991 or Part III of the Veterans’ Entitlements Act 1986 that would have been derived by the partner on each of the relevant pension paydays if the partner had not died: the result for each relevant pension payday is called the pension payday notional partner amount. Step 5. Sum the pension payday notional partner amounts: the result is called the notional partner amount. Step 6.__Sum the exempt notional taxpayer amount and the notional partner amount: the result is the tax-free amount. |

“Subdivision C—Exemption from income tax—payments under the Veterans’ Entitlements Act 1986

Index of payments covered by Subdivision

“24ac. The following is an index of payments under the Veterans’ Entitlements Act 1986 covered by this Subdivision:

Type of payment | Section |

Age service pension | 24ace |

Attendant allowance | 24ack |

Carer service pension | 24ach |

Clothing allowance | 24acj |

Decoration allowance | 24aco |

Invalidity service pension | 24acf |

Loss of earnings allowance | 24acu |

Pharmaceutical supplement | 24acw |

Recreation transport allowance | 24acq |

Section 13 pension | 24acd |

Section 70 pension | 24aci |

Section 98a bereavement payment | 24acl |

Section 99 funeral benefit | 24acm |

Section 100 funeral benefit | 24acn |

Special assistance | 24acs |

Temporary incapacity allowance | 24act |

Travelling expenses | 24acv |

Vehicle Assistance Scheme | 24acr |

Victoria Cross allowance | 24acp |

Wife service pension | 24acg |

Interpretation—supplementary amounts

“24aca. (1) For the purpose of applying this Subdivision to a payment derived by a taxpayer, the supplementary amounts are as follows:

(a) so much of the payment as was included in the payment because the taxpayer or the partner of the taxpayer paid rent; and

(b) so much of the payment as represents an increase in the rate of the pension concerned that is calculated by reference to another person or other persons; and

(c) so much of the payment as was included in the payment by way of remote area allowance.

“(2) A reference in subsection (1) to a partner or other person includes a reference to a deceased partner or deceased other person.

Interpretation—expressions used in the Veterans’ Entitlements Act 1986

“24acb. (1) Expressions (other than ‘pension age’) used in this Subdivision that are also used in the Veterans’ Entitlements Act 1986 have the same respective meanings as in that Act.

“(2) Expressions (other than ‘pension age’) used in a section in this Subdivision that relates to payments under a particular provision of the Veterans’ Entitlements Act 1986 that are also used in that provision have the same respective meanings as in that provision.

Interpretation—meaning of ‘pension age’

“24acc. A reference in this Subdivision to pension age is a reference to:

(a) in the case of a woman—the age of 60 years; or

(b) in the case of a man—the age of 65 years.

Section 13 pension

“24acd. Payments of pension under section 13 of the Veterans’ Entitlements Act 1986 are exempt.

Age service pension

“24ace. (1) The treatment of payments of age service pension under Division 3 of Part III of the Veterans’ Entitlements Act 1986 is as follows:

(a) the supplementary amount is exempt;

(b) the balance is not exempt.

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 36r of the Veterans’ Entitlements Act 1986).

“(3) Payments under sections 36Q, 36T, 36x and 36y of the Veterans’ Entitlements Act 1986 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 36r of the Veterans’ Entitlements Act 1986:

(a) so much of the sum of that payment and other payments under Part III of the Veterans’ Entitlements Act 1986 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator B in section 24acx is exempt; and

(b) the balance of the sum is not exempt.

Invalidity service pension

“24acf. (1) The treatment of payments of invalidity service pension under Division 4 of Part III of the Veterans’ Entitlements Act 1986 is as follows:

Item | Category | | Balance of payment |

1 | Taxpayer not under pension age | Exempt | Not exempt |

2 | Taxpayer under pension age | Exempt | Exempt |

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 37r of the Veterans’ Entitlements Act 1986).

“(3) Payments under sections 37q, 37t, 37x and 37y of the Veterans’ Entitlements Act 1986 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 37r of the Veterans’ Entitlements Act 1986:

(a) so much of the sum of that payment and other payments under Part III of the Veterans’ Entitlements Act 1986 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator B in section 24acx is exempt; and

(b) the balance of the sum is not exempt.

Wife service pension

“24acg. (1) The treatment of payments of wife service pension under Division 5 of Part III of the Veterans’ Entitlements Act 1986 is as follows:

Item | Category | Supplementary amounts | Balance of payment |

1 | Taxpayer not under pension age | Exempt | Not exempt |

2 | Veteran not under pension age | Exempt | Not exempt |

3 | (a) Both taxpayer and veteran under pension age; and (b) Veteran receiving invalidity service pension | Exempt | Exempt |

4 | (a) Both taxpayer and veteran under pension age; and (b) Veteran not receiving invalidity service pension | Exempt | Not exempt |

5 | (a) Taxpayer under pension age; and (b) Veteran deceased; and (c) Veteran was receiving an invalidity service pension immediately before death | Exempt | Exempt |

6 | (a) Taxpayer under pension age; and (b) Veteran deceased; and (c) Veteran was not receiving an invalidity service pension immediately before death | Exempt | Not exempt |

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 38r of the Veterans’ Entitlements Act 1986).

“(3) Payments under sections 38q, 38s, 38w and 38x of the Veterans’ Entitlements Act 1986 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 38r of the Veterans’ Entitlements Act 1986:

(a) so much of the sum of that payment and other payments under Part III of the Veterans’ Entitlements Act 1986 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free

amount calculated using the exempt bereavement payment calculator B in section 24acx is exempt; and

(b) the balance of the sum is not exempt.

Carer service pension

“24ach. (1) The treatment of payments of carer service pension under Division 6 of Part III of the Veterans’ Entitlements Act 1986 is as follows:

Item | Category | Supplementary amounts | Balance of payment |

1 | Taxpayer not under pension age | Exempt | Not exempt |

2 | Veteran not under pension age | Exempt | Not exempt |

3 | (a) Both taxpayer and veteran under pension age; and (b) Veteran receiving invalidity service pension | Exempt | Exempt |

4 | (a) Both taxpayer and veteran under pension age; and (b) Veteran not receiving invalidity service pension | Exempt | Not exempt |

5 | (a) Taxpayer under pension age; and (b) Veteran deceased; and (c) Veteran was receiving an invalidity service pension immediately before death | Exempt | Exempt |

6 | (a) Taxpayer under pension age; and (b) Veteran deceased; and (c) Veteran was not receiving an invalidity service pension immediately before death | Exempt | Not exempt |

“(2) Subsection (1) has effect subject to subsection (4) (which deals with taxpayers who derive bereavement lump sum payments under section 39t of the Veterans’ Entitlements Act 1986).

“(3) Payments under sections 39s, 39v, 39z and 39za of the Veterans’ Entitlements Act 1986 (which deal with bereavement payments) are exempt.

“(4) If a taxpayer derives a payment under section 39t of the Veterans’ Entitlements Act 1986:

(a) so much of the sum of that payment and other payments under Part III of the Veterans’ Entitlements Act 1986 derived by the taxpayer on pension paydays that occurred during the bereavement lump sum period as does not exceed the tax-free amount calculated using the exempt bereavement payment calculator B in section 24acx is exempt; and

(b) the balance of the sum is not exempt.

Section 70 pension

“24aci. Payments of pension under section 70 of the Veterans’ Entitlements Act 1986 are exempt.

Clothing allowance

“24acj. Payments of clothing allowance under section 97 of the Veterans’ Entitlements Act 1986 are exempt.

Attendant allowance

“24ack. Payments of attendant allowance under section 98 of the Veterans’ Entitlements Act 1986 are exempt.

Section 98a bereavement payment

“24acl. Payments under section 98a of the Veterans’ Entitlements Act 1986 are exempt.

Section 99 funeral benefit

“24acm. Payments under section 99 of the Veterans’ Entitlements Act 1986 are exempt.

Section 100 funeral benefit

“24acn. Payments under section 100 of the Veterans’ Entitlements Act 1986 are exempt.

Decoration allowance

“24aco. Payments of decoration allowance under section 102 of the Veterans’ Entitlements Act 1986 are exempt.

Victoria Cross allowance

“24acp. Payments of Victoria Cross allowance under section 103 of the Veterans’ Entitlements Act 1986 are exempt.

Recreation transport allowance

“24acq. Payments of recreation transport allowance under section 104 of the Veterans’ Entitlements Act 1986 are exempt.

Vehicle Assistance Scheme

“24acr. Payments under the Vehicle Assistance Scheme established under section 105 of the Veterans’ Entitlements Act 1986 are exempt.

Special assistance

“24acs. Payments of special assistance under section 106 of the Veterans’ Entitlements Act 1986 are exempt.

Temporary incapacity allowance

“24act. Payments of temporary incapacity allowance under section 107 of the Veterans’ Entitlements Act 1986 are exempt.

Loss of earnings allowance

“24acu. Payments of loss of earnings allowance under section 108 of the Veterans’ Entitlements Act 1986 are exempt.

Travelling expenses

“24acv. Payments of travelling expenses under section 110 of the Veterans’ Entitlements Act 1986 are exempt.

Pharmaceutical supplement

“24acw. Payments under Part VIIa of the Veterans’ Entitlements Act 1986 are exempt.

Exempt bereavement payment calculator B

“24acx. The exempt bereavement payment calculator B is as follows:

EXEMPT BEREAVEMENT PAYMENT CALCULATOR B This is how to work out the tax-free amount: Method statement Step 1. Work out the pension paydays that are in the bereavement lump sum period: the result is called the relevant pension paydays. Step 2. Work out the amount of payments under Part III of the Veterans’ Entitlements Act 1986 that would have been derived by the taxpayer on each of the relevant pension paydays and which would have been exempt if: (a) the partner had not died; and (b) the partner had been under pension age; and (c) the partner had continued to receive the pension or allowance that the partner was receiving immediately before the partner died; the result for each relevant pension payday is called the pension payday exempt notional taxpayer amount. Step 3. Sum the pension payday exempt notional taxpayer amounts: the result is called the exempt notional taxpayer amount. Step 4. Work out the amount of payments under the Social Security Act 1991 or Part III of the Veterans’ Entitlements Act 1986 that would have been derived by the partner on each of the relevant pension paydays if the partner had not died: the result for each relevant pension payday is called the pension payday notional partner amount. Step 5. Sum the pension payday notional partner amounts: the result is called the notional partner amount. Step 6. Sum the exempt notional taxpayer amount and the notional partner amount: the result is the tax-free amount. |

“Subdivision D—Exemption from income tax—payments under the

Seamen’s War Pensions and Allowances Act 1940

Seamen’s war pensions and allowances

“24ad. Payments of amounts under the Seamen’s War Pensions and Allowances Act 1940 are exempt if the payments are of a like nature to payments under the Veterans’ Entitlements Act 1986 that are exempt under Subdivision C.

Bereavement payments

“24aca. Payments under section 24b of the Seamen’s War Pensions and Allowances Act 1940 are exempt.

“Subdivision E—Exemption from income tax—payments by virtue of the

Veterans’ Entitlements (Transitional Provisions and Consequential

Amendments) Act 1986

Payments by virtue of the Veterans’ Entitlements (Transitional Provisions and Consequential Amendments) Act 1986

“24ae. (1) The treatment of a payment made in accordance with Table A in Schedule 3 to the Repatriation Act 1920 (including that Table as applying by virtue of the Repatriation (Far East Strategic Reserve) Act 1956, the Repatriation (Special Overseas Service) Act 1962 or the Interim Forces Benefits Act 1947), as in force by virtue of subsection 4 (6) of the Veterans’ Entitlements (Transitional Provisions and Consequential Amendments) Act 1986, to the extent that the payment:

(a) is payable because the taxpayer is either:

(i) the mother of a deceased member of the Forces (being a woman who is a widow or is divorced or has been deserted by her husband) within the meaning of the Act concerned or the relevant Part of that Act; or

(ii) a parent of a deceased member of the Forces (other than a woman who is a widow or is divorced or who has been deserted by her husband) within the meaning of the Act concerned or the relevant Part of that Act, being a parent who:

(a) in the case of a woman—is not under the age of 60 years; or

(b)in the case of a man—is not under the age of 65 years; and

(b) is payable in the circumstances constituting a prescribed case for the purposes of that Table; and

(c) exceeds the amount that would have been assessed if the requirement in that Table to have regard to the maximum rate of age pension under subsection 33 (1) of the Social Security Act 1947 were disregarded;

is as follows:

(d) so much of the payment as was included in the payment because the taxpayer or the spouse of the taxpayer paid rent is exempt;

(e) so much of the payment, being a payment of a pension, allowance or benefit, as represents an increase in the rate of that pension, allowance or benefit that is calculated by reference to another person or other persons is exempt;

(f) so much of the payment as was included in the payment by way of remote area allowance is exempt;

(g) the balance of the payment is not exempt.

“(2) Other payments payable by virtue of subsection 4 (6) of the Veterans’ Entitlements (Transitional Provisions and Consequential Amendments) Act 1986 are exempt.

“Subdivision F—Exemption from income tax—payments of allowance

under Part III of the Disability Services Act 1986

Allowances under Part III

“24af. Payments of allowances under Part III of the Disability Services Act 1986 are exempt.

“Subdivision G—Exemption from income tax—payments of domiciliary nursing care benefit under Part Vb of the National Health Act 1953

Domiciliary nursing care benefit

“24ag. Payments of domiciliary nursing care benefit under Part Vb of the National Health Act 1953 are exempt.

“Subdivision H—Exemption from income tax—similar Australian and

United Kingdom veterans’ payments

Similar Australian and United Kingdom veterans’ payments

“24ah. Payments of pensions and allowances, and other payments, made by the Government of Australia or the Government of the United Kingdom, are exempt if they are of a similar nature to payments that are exempt under Subdivision C, D or E.

“Subdivision I—Exemption from income tax—wounds and disability pensions

Wounds and disability pensions

“24ai. Payments are exempt if:

(a) the payments are of wounds and disability pensions of the kinds specified in subsection 315 (2) of the Income and Corporation Taxes Act 1988 of the United Kingdom; and

(b) the payments are not of a similar nature to payments that are not exempt under other Subdivisions of this Division.

“Subdivision J—Occupational superannuation payments not covered by this Division

Occupational superannuation payments not covered by this Division

“24aj. (1) The following payments are not covered by this Division:

(a) any payment made under the Superannuation Act 1922;

(b) any payment of a pension or benefit to which subsection 8 (1) of the Superannuation Act 1948 applies;

(c) any payment of a pension made in accordance with section 9 or 14 of the Superannuation Act (No. 2) 1956;

(d) any payment of a pension made under section 10 of the Superannuation (Pension Increases) Act 1971;

(e) any payment made under the Superannuation Act 1976;

(f) any payment made under the Defence Forces Retirement Benefits Act 1948;

(g) any payment made under the Defence Forces Retirement and Death Benefits Act 1973;

(h) any payment made under the Parliamentary Contributory Superannuation Act 1948;

(i) any payment made under the Papua New Guinea (Staffing Assistance) Act 1973;

(j) any payment made under a scheme established by or under the Superannuation Act 1990;

(k) any payment made under a scheme established by or under the Military Superannuation and Benefits Act 1991.

“(2) Subsection (1) has effect in spite of anything contained in any other provision of this Division.”.

Application of Division—1985-86 to 1990-91

21. Section 24ba of the Principal Act is amended by inserting “preceding the year of income commencing on 1 July 1991” after “all subsequent years of income”.

22. After section 24ba of the Principal Act the following section is inserted:

Application of Division—1991-92 and subsequent years

“24bb. This Division applies to assessments in respect of income of the 1991-92 year of income and of all subsequent years of income as if:

(a) the definition of ‘prescribed Territory’ in subsection 24b (1) were omitted and the following definition were substituted:

‘ “prescribed Territory” means Norfolk Island.’; and

(b) subsection 24l (5) were omitted and the following subsection were substituted:

‘(5) In subsections (1), (3), (4), (4a), (4b) and (4c), “Australia”, “resident” and “non-resident” have the meanings that those expressions would have if subsection 7a (2) did not refer to Norfolk Island.’.”.

23. After section 24n of the Principal Act the following section is inserted:

Transitional capital gains tax provisions for certain Cocos (Keeling) Islands assets

“24P. (1) Subject to an election under subsection (5), this section applies to an asset held by a taxpayer where all of the following conditions are satisfied:

(a) the asset was owned by the taxpayer at the end of 30 June 1991;

(b) if the asset had been disposed of by the taxpayer on 1 July 1991, Part IIIa would, or would, apart from section 160zzf and Divisions 5a, 7a and 17 of that Part, have applied in respect of that disposal;

(i) the asset had been disposed of by the taxpayer on 1 July 1991; and

(ii) profits or gains of a capital nature had been derived by the taxpayer in respect of that disposal; and

(iii) section 24bb had not been enacted; and

(iv) section 24ba had applied in relation to the year of income in which disposal occurred;

the profits or gains would have been exempt income under this Division.

“(2) For the purposes of Part IIIa:

(a) except for the purposes of determining the cost base to the taxpayer of the asset—the asset is taken to have been acquired by the taxpayer on 30 June 1991; and

(b) the taxpayer is taken to have paid or given as consideration in respect of the acquisition of the asset an amount equal to the market value of the asset as at the end of 30 June 1991; and

(c) the taxpayer is taken to have paid or given that consideration on 30 June 1991.

“(3) Paragraphs 160zzu(l) (a) and (b) do not apply in relation to the taxpayer in relation to the asset.

“(4) If a provision of Part IIIa provides that, if a disposal of an asset occurs within 12 months after the day (in this subsection called the ‘acquisition day’) on which the asset was acquired by a taxpayer, a reference in another provision of that Part to the indexed cost base to the taxpayer in respect of the asset is to be construed as a reference to the cost base to the taxpayer in respect of the asset, paragraph (2) (a) of this section does not apply for the purposes of determining the acquisition day for the purposes of the first-mentioned provision.

“(5) If, as at the date on which a taxpayer disposes of an asset, the taxpayer has complied with section 160zzu in relation to the asset, the

taxpayer may elect that this section does not apply in relation to the asset.

“(6) An election for the purposes of subsection (5) must be lodged with the Commissioner on or before the date of lodgment of the taxpayer’s return of income for the year of income in which the disposal occurred or within such further period as the Commissioner allows.

“(7) An expression used in this section and in Part IIIa has the same meaning in this section as it has in that Part.”.

Amounts received on retirement or termination of employment in lieu of long service leave

24. Section 26ad of the Principal Act is amended by adding at the end the following subsection:

“(13) Where:

(a) apart from this subsection, an amount would be included in the assessable income of a taxpayer in respect of an amount to which this section applies (in this subsection called the ‘lump sum amount’); and

(b) apart from section 24bb, no amount, or a lesser amount, would be included in the assessable income of the taxpayer in respect of the lump sum amount;

this section has effect in relation to the lump sum amount as if:

(c) references in the preceding provisions of this section (other than subsection (12)) to 15 August 1978 were references to 30 June 1991; and

(d) subsection (5) were omitted.”.

Securities lending arrangements

25. Section 26bc of the Principal Act is amended:

(a) by omitting “listed” from paragraph (a) of the definition of “eligible security” in subsection (1) and substituting “public”;

(b) by inserting in subsection (1) the following definitions:

“‘distribution’ includes:

(a) interest; or

(b) a dividend; or

(c) a share issued by a company to a shareholder in the company where the share is issued:

(i) as a bonus share; or

(ii) in the circumstances mentioned in subsection 6ba (1); or

(d) an amount credited by the trustee of a unit trust to a unit holder as a unit holder; or

(e) a unit issued by the trustee of a unit trust in the

circumstances that would be covered by section 160zyc if paragraph (d) of that section had not been enacted;

‘public company’ means:

(a) a listed company; or

(b) a mutual life assurance company (within the meaning of section 110); or

(c) a company in which a government or an authority of a government has a controlling interest; or

(d) a company that is a subsidiary of a company covered by paragraph (a), (b) or (c);

‘subsidiary’ has the same meaning as in section 160zzo.”;

(c) by omitting from subparagraph (3) (a) (ii) “not being later than 3 months” and substituting “being less than 12 months”;

(d) by omitting paragraph (3) (c) and substituting the following paragraph:

“(c) if any of the following events occurred during the period (in this section called the ‘borrowing period’) commencing at the original disposal time and ending at the re-acquisition time:

(i) the making or payment of a distribution (whether in property or money) in respect of the borrowed security;

(ii) the issue, by the company, trustee, government or government authority concerned, of a right or option in respect of the borrowed security;

(iii) if the borrowed security is a right or option:

(a) the giving of a direction by the lender to the borrower to exercise the right or option; or

(b) the giving of a direction by the lender to the borrower to exercise an identical right or option;

then (even if the event occurred after. the borrowed security was disposed of by the borrower to a third party), the lender receives from the borrower, under the agreement:

(iv) if subparagraph (i) applies:

(a) the distribution; or

(b) if the distribution is in property—identical property; or

(c) a payment (in this section called the ‘compensatory payment’) equal to the value to the lender of the distribution; or

(v) if subparagraph (ii) applies:

(a) the right or option; or

(b) an identical right or option; or

(c) a payment (in this section also called the ‘compensatory payment’) equal to the value to the lender of the right or option; or

(vi) if subparagraph (iii) applies:

(a) the shares, units, bonds, debentures or financial instruments that resulted from exercising the right or option; or

(b) shares, units, bonds, debentures or financial instruments that are identical to those that resulted from, or that would have resulted from, exercising the right or option; or

(c) a payment (in this section also called the ‘compensatory payment’) equal to the value to the lender of the shares, units, bonds, debentures or financial instruments that resulted from, or would have resulted from, exercising the right or option; and”;

(e) by inserting after subsection (3) the following subsection:

“(3a) For the purposes of paragraph (3) (c), if, apart from this subsection, either of the following events occurred after the commencement of the borrowing period:

(a) the making or payment of a distribution (whether in property or money) in respect of the borrowed security;

(b) the issue, by the company, trustee, government or government authority concerned, of a right or option in respect of the borrowed security;

(even if the event occurred after the borrowed security was disposed of by the borrower to a third party), the event is taken to have occurred during the borrowing period if, and only if, (assuming that the borrower had held the borrowed security at all times during the borrowing period) the entitlement to the distribution or issue would have been attributable to the borrower’s holding of the borrowed security at a particular time during the borrowing period.”;

(f) by inserting after subsection (4) the following subsections:

“(4a) If the lender receives a compensatory payment covered by sub-subparagraph (3) (c) (v) (c), then, in determining whether an amount is included in the assessable income of the lender under a provision of this Act other than Part IIIa, the lender is to be treated as if:

(a) the lender had held the borrowed security at all relevant times during the borrowing period; and

(b) the right or option had been issued directly to the lender in respect of the borrowed security; and

(c) the the lender had disposed of the right or option immediately after its issue for a consideration equal to the compensatory payment.

“(4b) If the lender receives a compensatory payment covered by sub-subparagraph (3) (c) (vi) (c), then, in determining whether an amount is included in the assessable income of the lender under a provision of this Act other than Part IIIA, the lender is to be treated as if:

(a) the lender had held the right or option at all relevant times during the borrowing period; and

(b) the lender had exercised the right or option; and

(c) the lender had immediately disposed of the shares, units, bonds, debentures or financial instruments that resulted from exercising the right or option for a consideration equal to the compensatory payment.”;

(g) by omitting from subparagraph (6) (b) (i) all the words after “of that Part” and substituting the following word and sub-subparagraphs:

“if:

(a) the lender had disposed of the borrowed security immediately before the acquisition of the replacement security; and

(b) that Part had applied in respect of the disposal of the borrowed security by the lender; or”;

(h) by omitting subsection (7) and substituting the following subsection:

“(7) If, in the case of a borrowed security to which paragraph (6) (b) applies, the replacement security was disposed of by the lender (otherwise than under a transaction covered by subsection (3)):

(a) if the disposal of the replacement security occurred within 12 months after the earliest day on which a paired security in relation to the replacement security was acquired by the lender (otherwise than under a transaction covered by subsection (3))—the reference in paragraph (6) (b) to the indexed cost base to the lender of the borrowed security is to be read as a reference to the cost base to the lender of the paired security; or

(b) if the disposal of the replacement security occurred not less than 12 months after the earliest day on which a paired security in relation to the replacement security was acquired by the lender (otherwise than under a transaction covered by subsection (3))—subsection

160z (3) does not apply to the disposal of the replacement security.”;

(i) by inserting after subsection (9) the following subsections:

“(9a) Subject to subsection 160zh (6), a reference in subsection 160zh (1), (2) or (3) to the incidental costs to the borrower of the acquisition of an eligible security covered by sub-subparagraph (3) (a) (ii) (b) includes a reference to a compensatory payment incurred by the borrower.

“(9b) For the purposes of the application of Part IIIa to a right or option received by the lender as mentioned in subparagraph (3) (c) (v), the borrower and lender are to be treated as if the eligible security in respect of which the right or option was issued had been held by the lender at the time of the acquisition of the right or option.

“(9c) For the purposes of the application of Part IIIa to a share, unit, bond, debenture or financial instrument received by the lender as mentioned in subparagraph (3) (c) (vi), the borrower and the lender are to be treated as if:

(a) the share, unit, bond, debenture or financial instrument had been received as the result of the exercise of the borrowed security; and

(b) the borrowed security had been held by the lender at the time of the exercise; and

(c) the lender had exercised the borrowed security; and

(d) the lender had exercised the borrowed security at the time the direction concerned was given; and

(e) the amount of the contribution (if any) made by the lender to the borrower in respect of the carrying out of the direction were an amount paid as consideration by the lender in respect of the exercise.

“(9d) If a distribution covered by subparagraph (3) (c) (i) consists of one or more shares issued by a company to the borrower or to a third party in the circumstances mentioned in subsection 6ba (1), then, for the purposes of the application of Part IIIA to a share (in this subsection called the ‘notional bonus share’) received by the lender in relation to the distribution in the circumstances mentioned in sub-subparagraph (3) (c) (iv) (a) or (b), the borrower and the lender are to be treated as if:

(a) the company had issued the notional bonus share to the lender instead of the borrower or the third party, as the case requires; and

(b) the notional bonus share had been issued in the circumstances mentioned in subsection 6ba (1); and

(c) the notional bonus share had been issued in respect of the borrowed security; and

(d) the lender had held the borrowed security at the time the notional bonus share was issued.

“(9e) If a distribution covered by subparagraph (3) (c) (i) consists of one or more units issued by the trustee of a unit trust to the borrower or to a third party in the circumstances covered by section 160zyc, then, for .the purposes of the application of Part IIIa to a unit (in this subsection called the ‘notional bonus unit’) received by the lender in relation to the distribution in the circumstances mentioned in sub-subparagraph (3) (c) (iv) (a) or (b), the borrower and the lender are to be treated as if:

(a) the trustee had issued the notional bonus unit to the lender instead of the borrower or the third party, as the case requires; and

(b) the notional bonus unit had been issued in the circumstances covered by section 160zyc; and

(c) the notional bonus unit had been issued in respect of the borrowed security; and

(d) the lender had held the borrowed security at the time the notional bonus unit was issued.

“(9f) If the lender receives a compensatory payment covered by sub-subparagraph (3) (c) (v) (c), then, for the purposes of the application of Part IIIa to the lender, the lender is to be treated as if: