Chapter 3—General provisions relating to payability and rates

Part 3.6—Benefit Rate Calculator B

1068 Rate of widow allowance, jobseeker payment (18 or over), partner allowance, and mature age allowance under Part 2.12B

(1) The rate of:

(a) jobseeker payment; or

(c) partner allowance; or

(ca) mature age allowance under Part 2.12B; or

(d) widow allowance;

is to be calculated in accordance with the Rate Calculator at the end of this section.

Note: Module A of the Rate Calculator establishes the overall rate calculation process and the remaining Modules provide for the calculation of the component amounts used in the overall rate calculation.

(2) If:

(a) a person has a relationship with another person, whether of the same sex or a different sex (other person); and

(b) the relationship between them is a de facto relationship in the Secretary’s opinion (formed after the Secretary has had regard to all the circumstances of the relationship, including, in particular, the matters referred to in paragraphs 4(3)(a) to (e) and subsection 4(3A));

(c) the other person is under the age of consent applicable in the State or Territory in which the person is living;

the person’s benefit rate is not to exceed the rate at which it would be payable to the person if the other person were the person’s partner.

Note: This provision has the effect of taking into account the ordinary income and assets of the partner in applying the ordinary income test and assets test respectively.

Rate of benefit limited for certain armed services widows

(3) If:

(a) an armed services widow is receiving a pension under Part II or IV of the Veterans’ Entitlements Act at a rate determined under or by reference to subsection 30(1) of that Act; and

(b) the widow has been receiving a payment referred to in paragraph (a) continuously since before 1 November 1986; and

(c) before 1 November 1986 the widow was also receiving a social security benefit;

the rate of benefit payable to the widow is not to be increased:

(d) if, immediately before 1 November 1986, the widow was receiving a social security benefit at a rate less than $124.90 per fortnight—to a rate greater than $124.90 per fortnight; or

(e) if, immediately before 1 November 1986, the widow was receiving a social security benefit at a rate equal to or greater than $124.90 per fortnight—to a rate greater than the rate at which it was payable immediately before 1 November 1986.

Note 1: A benefit is not payable to a widow who starts to get a payment referred to in subsection (3) after 1 November 1986—see sections 408CF, 614, 660YCF and 771HI.

Note 2: For armed services widow see subsection 4(1).

Benefit Rate Calculator B

Module A—Overall rate calculation process

Method of calculating rate

1068‑A1 The rate of benefit is a daily rate. That rate is worked out by dividing the fortnightly rate calculated according to this Rate Calculator by 14.

Method statement

Step 1. Work out the person’s maximum basic rate using MODULE B below.

Step 1A. Work out the pension supplement amount (if any) using Module BA below.

Step 1B. Work out the energy supplement (if any) using Module C below.

Step 2. Work out the amount per fortnight (if any) of pharmaceutical allowance using MODULE D below.

Step 3. Work out the applicable amount per fortnight (if any) for rent assistance in accordance with paragraph 1070A(a).

Step 4. Add up the amounts obtained in Steps 1 to 4: the result is called the maximum payment rate.

Step 5. Apply the income test using MODULE G below to work out the income reduction.

Step 6. Take the income reduction away from the maximum payment rate: the result is called the provisional fortnightly payment rate.

Step 7. The rate of benefit is the amount obtained by:

(a) subtracting from the provisional fortnightly payment rate any special employment advance deduction (see Part 3.16B); and

(b) if there is any amount remaining, subtracting from that amount any advance payment deduction (see Part 3.16A); and

(c) except where the person is a CDEP Scheme participant in respect of the whole or a part of the period for which the rate of benefit is being worked out, adding any amount payable by way of remote area allowance (see Module J).

Note 1: If a person’s rate is reduced under step 6, the order in which the reduction is to be made against the components of the maximum payment rate is laid down by section 1210.

Note 2: In some circumstances a person may also be qualified for a pharmaceutical allowance under Part 2.22.

Note 3: An amount of remote area allowance is to be added under paragraph (c) of step 7 only if the conditions in point 1068‑J1 are satisfied.

Module B—Maximum basic rate

Maximum basic rate

1068‑B1 The maximum basic rate of a person other than a person who is a CDEP Scheme participant in respect of the whole or a part of the period for which the maximum basic rate is being worked out is worked out using Table B. Work out the person’s family situation and whether the person has a dependent child or not. The maximum basic rate is the corresponding amount in the rate column. The maximum basic rate of a person who is a CDEP Scheme participant in respect of the whole or a part of the period for which the maximum basic rate is being worked out is nil (see sections 408CG, 614A, 660YCH and 771HK).

Table B—Maximum basic rates |

Column 1 | Column 2 | Column 3 Rate |

Item | Person’s family situation | Column 3A Person with dependent child | Column 3B Person without dependent child |

4A. | Not member of couple and person: (a) receives jobseeker payment or widow allowance; and (b) has not turned 60 | $326.10 | $301.50 |

4B. | Not member of couple and person: (a) receives jobseeker payment or widow allowance; and (b) has turned 60; and (c) has not been receiving one, or a combination, of social security pension, social security benefit or job search allowance or service pension, income support supplement or veteran payment for a continuous period of at least 9 months | $326.10 | $301.50 |

5. | Not member of couple and person: (a) has turned 60; and (b) has been receiving one, or a combination, of social security pension, social security benefit or job search allowance or service pension or income support supplement for a continuous period of at least 9 months | $326.10 | $326.10 |

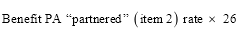

7. | Partnered | $272.00 | $272.00 |

9. | Member of illness separated couple | $326.10 | $326.10 |

11. | Partnered (partner in gaol) | $326.10 | $326.10 |

Note 1: For member of couple, partnered, illness separated couple and partnered (partner in gaol) see section 4.

Note 2: For dependent child see section 5.

Note 5: The rates in column 3 are indexed 6 monthly in line with CPI increases (see sections 1191 to 1194).

Note 7: Some dependent children will not be taken into account in working out a person’s maximum basic rate (see point 1068‑B2).

Note 8: Some recipients of jobseeker payment have a maximum basic rate based on the maximum basic rate under the Pension PP (Single) Rate Calculator (see point 1068‑B5).

Certain children who are not young persons are to be treated as dependent children

1068‑B1A If:

(a) a person is not a member of a couple; and

(b) the person has at least one natural child, adopted child or relationship child who has turned 16 but has not turned 18; and

(c) either:

(i) a social security benefit is payable to the child; or

(ii) if the person is receiving jobseeker payment—a disability support pension is payable to the child; and

(d) the child is substantially dependent on the person;

the person’s maximum basic rate is worked out as if the person had a dependent child.

Certain children treated as dependent children if in recipient’s care for at least minimum period

1068‑B1B The maximum basic rate for a person receiving jobseeker payment is worked out as if the person had a dependent child if:

(a) either:

(i) the person is legally responsible (whether alone or jointly with another person) for the day‑to‑day care, welfare and development of a child under 16; or

(ii) under a family law order, registered parenting plan or parenting plan that is in force, a child under 16 is supposed to live or spend time with the person; and

(b) the child is in the person’s care for at least 14% of:

(i) the instalment period in relation to which the maximum basic rate is being worked out; or

(ii) if the Secretary, under point 1068‑B1C, determines another period for the person for the purposes of this subparagraph—that other period; and

(c) none of subsections 5(3), (6) and (7) prevents the child from being a dependent child of the person; and

(d) the person is not a member of a couple.

Note: For family law order, registered parenting plan and parenting plan see subsection 23(1).

1068‑B1C The Secretary may, in writing, determine a period of either 14 days or 28 days for the purposes of subparagraph 1068‑B1B(b)(ii). In making the determination, the Secretary must have regard to the guidelines (if any) determined under point 1068‑B1E.

1068‑B1D A determination made under point 1068‑B1C is not a legislative instrument.

1068‑B1E The Secretary may, by legislative instrument, determine guidelines to be complied with when making a determination under point 1068‑B1C.

Certain dependent children to be disregarded

1068‑B2 For the purposes of items 4A and 4B of Table B in point 1068‑B1, if:

(a) a person has a dependent child; and

(b) the child has turned 18; and

(c) the child is a prescribed student child;

the child is to be disregarded in working out the person’s maximum basic rate under that point.

Note: For prescribed student child see section 5.

1068‑B3 On 20 March 1994 the amounts specified in items 3, 4, 4A and 4B in column 3B of Table B in point 1068‑B1 are increased by $6.00. The increase is to be made after the indexation of the amounts on that day has occurred.

1068‑B4 The amounts in items 3, 4, 4A and 4B in columns 3A and 3B of Table B in point 1068‑B1 are to be indexed on 20 September 1993 and 20 March 1994 under section 1192 as if Part 2 of the Social Security Amendment Act (No. 2) 1993 had commenced on 1 September 1993.

Maximum basic rate for certain jobseeker payment recipients

1068‑B5 Despite point 1068‑B1, if a person:

(a) is not a member of a couple; and

(b) receives jobseeker payment; and

(c) is not required to satisfy the activity test because of a determination in relation to the person under subsection 602C(3) or (3A);

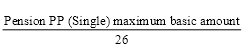

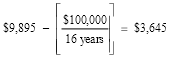

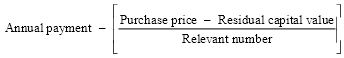

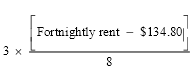

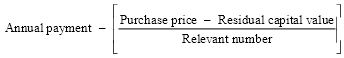

the person’s maximum basic rate is the amount worked out as follows:

where:

pension PP (Single) maximum basic amount is the sum of:

(a) the amount that would have been the person’s maximum basic rate under Module B of the Pension PP (Single) Rate Calculator if the person was receiving parenting payment; and

(b) the amount that would have been the person’s pension supplement under Module BA of the Pension PP (Single) Rate Calculator if the person was receiving parenting payment.

Note: A person’s maximum basic rate under Module B of the Pension PP (Single) Rate Calculator is indexed 6 monthly in line with increases in Male Total Average Weekly Earnings (see section 1195).

Module BA—Pension supplement

Pension supplement

1068‑BA1 A pension supplement amount is to be added to the person’s maximum basic rate if the person is residing in Australia, has reached pension age and:

(a) is in Australia; or

(b) is temporarily absent from Australia and has been so for a continuous period not exceeding 6 weeks.

1068‑BA2 The person’s pension supplement amount is:

(a) if an election by the person under subsection 1061VA(1) is in force—the amount worked out under point 1068‑BA4; and

(b) otherwise—the amount worked out under point 1068‑BA3.

Amount if no election in force

1068‑BA3 The person’s pension supplement amount is the amount worked out by:

(a) applying the applicable percentage in the following table to the combined couple rate of pension supplement; and

(b) dividing the result by 26; and

(c) if:

(i) the person is not partnered; and

(ii) the amount resulting from paragraph (b) is not a multiple of 10 cents;

rounding the amount up or down to the nearest multiple of 10 cents (rounding up if the amount is not a multiple of 10 cents but is a multiple of 5 cents).

Item | Person’s family situation | Use this % |

1 | Not member of couple | 66.33% |

2 | Partnered | 50% |

3 | Member of illness separated couple | 66.33% |

4 | Member of respite care couple | 66.33% |

5 | Partnered (partner in gaol) | 66.33% |

Note: For combined couple rate of pension supplement, see subsection 20A(1).

Amount if election in force

1068‑BA4 The person’s pension supplement amount is the amount worked out as follows:

(a) work out the amount for the person under point 1068‑BA3 as if the election were not in force;

(b) from that amount, subtract 1/26 of the person’s minimum pension supplement amount.

Module C—Energy supplement

1068‑C1 An energy supplement is to be added to the person’s (the recipient’s) maximum basic rate if the recipient is residing in Australia and:

(a) is in Australia; or

(b) is temporarily absent from Australia and has been so for a continuous period not exceeding 6 weeks.

However, this Module does not apply if quarterly energy supplement is payable to the recipient.

Note: Section 918 may affect the addition of the energy supplement.

Recipient has reached pension age

1068‑C2 If the recipient has reached pension age and is not covered by point 1068‑B5, the recipient’s energy supplement is the amount worked out using the following table:

Energy supplement |

Item | Recipient’s family situation | Amount of energy supplement |

1 | Not a member of a couple | $14.10 |

2 | Partnered | $10.60 |

3 | Member of an illness separated couple | $14.10 |

4 | Member of a respite care couple | $14.10 |

5 | Partnered (partner in gaol) | $14.10 |

Recipient has not reached pension age

1068‑C3 If the recipient has not reached pension age and is not covered by point 1068‑B5, the recipient’s energy supplement is the amount worked out using the following table:

Energy supplement |

Item | Recipient’s family situation for maximum basic rate | Amount of energy supplement |

1 | If the recipient’s maximum basic rate is worked out under column 3A of item 4A, 4B, 5, 9 or 11 of the table in point 1068‑B1 | $9.50 |

2 | If the recipient’s maximum basic rate is worked out under column 3A of item 7 of the table in point 1068‑B1 | $7.90 |

3 | If the recipient’s maximum basic rate is worked out under column 3B of item 4A or 4B of the table in point 1068‑B1 | $8.80 |

4 | If the recipient’s maximum basic rate is worked out under column 3B of item 5, 9 or 11 of the table in point 1068‑B1 | $9.50 |

5 | If the recipient’s maximum basic rate is worked out under column 3B of item 7 of the table in point 1068‑B1 | $7.90 |

Recipient covered by point 1068‑B5

1068‑C4 If the recipient is covered by point 1068‑B5, the recipient’s energy supplement is $12.00.

Module D—Pharmaceutical allowance

Qualification for pharmaceutical allowance

1068‑D1 Subject to points 1068‑D3A, 1068‑D4, 1068‑D5, 1068‑D6 and 1068‑D8, an additional amount by way of pharmaceutical allowance is to be added to a person’s maximum basic rate if:

(c) one of the following subparagraphs applies:

(ia) the person is receiving mature age allowance under Part 2.12B;

(ii) the person is receiving widow allowance, jobseeker payment or partner allowance and point 1068‑D2, 1068‑D2A, 1068‑D2B or 1068‑D3 applies to the person.

Incapacity for work—jobseeker payment

1068‑D2 This point applies to a person if the person is receiving jobseeker payment and the person is, under Subdivision BA of Division 1 of Part 2.12, exempt from the activity test.

Incapacity for work—widow allowance and partner allowance recipients

1068‑D2A This point applies to a person who is receiving widow allowance or partner allowance if the person is incapacitated for work.

Jobseeker payment recipients who have a partial capacity to work or are principal carers

1068‑D2B This point applies to a person who is receiving jobseeker payment if the person:

(a) has a partial capacity to work; or

(b) is the principal carer of at least one child and is not a member of a couple.

Note 1: For partial capacity to work see section 16B.

Note 2: For principal carer see subsections 5(15) to (24).

Long term recipients over 60

1068‑D3 This point applies to a person if the person:

(a) has turned 60; and

(b) has been receiving income support payments in respect of a continuous period of at least 9 months (whether or not the kind of payment received has changed over the period and whether the period or any part of it occurred before or after the commencement of this paragraph).

Note 1: For income support payment see subsection 23(1).

Note 2: For the determination of the continuous period in respect of which a person received income support payments see section 38B.

No pharmaceutical allowance if person receiving pension supplement

1068‑D3A Pharmaceutical allowance is not to be added to a person’s maximum basic rate if a pension supplement amount has been added to that rate.

No pharmaceutical allowance if person receiving certain supplements under other Acts

1068‑D4 Pharmaceutical allowance is not to be added to a person’s maximum basic rate if the person is receiving:

(a) veterans supplement under section 118A of the Veterans’ Entitlements Act; or

(b) MRCA supplement under section 300 of the Military Rehabilitation and Compensation Act; or

(c) pharmaceutical supplement under Part 3A of the Australian Participants in British Nuclear Tests and British Commonwealth Occupation Force (Treatment) Act 2006; or

(d) pharmaceutical supplement under Part 4 of the Treatment Benefits (Special Access) Act 2019.

No pharmaceutical allowance if partner receiving certain supplements under other Acts

1068‑D5 Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person is a member of a couple; and

(b) the person’s partner is receiving:

(i) veterans supplement under section 118A of the Veterans’ Entitlements Act; or

(ii) MRCA supplement under section 300 of the Military Rehabilitation and Compensation Act; or

(iii) pharmaceutical supplement under Part 3A of the Australian Participants in British Nuclear Tests and British Commonwealth Occupation Force (Treatment) Act 2006; or

(iv) pharmaceutical supplement under Part 4 of the Treatment Benefits (Special Access) Act 2019; and

(c) the person’s partner is not receiving a service pension or a veteran payment.

No pharmaceutical allowance before advance payment period ends

1068‑D6 Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance under Part 2.23 of this Act; and

(b) the person’s advance payment period has not ended.

Note: For advance payment period see point 1068‑D7.

Advance payment period

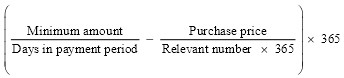

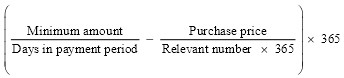

1068‑D7 A person’s advance payment period:

(a) starts on the day on which the advance pharmaceutical allowance is paid to the person; and

(b) ends after the number of paydays worked out using the following formula have passed:

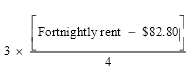

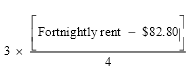

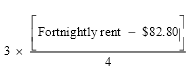

where:

amount of advance is the amount of the advance paid to the person;

pharmaceutical allowance rate is the fortnightly amount of pharmaceutical allowance which would be added to the person’s maximum basic rate in working out the social security benefit instalment for the day on which the advance is paid if a social security benefit were payable to the person and pharmaceutical allowance were to be added to the person’s maximum basic rate on that day.

Note: The person may have come on social security benefit after having been a pension recipient and have received an advance while a pension recipient.

No pharmaceutical allowance if annual limit reached

1068‑D8 Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance during the current calendar year; and

(b) the total amount paid to the person for that year by way of:

(i) pharmaceutical allowance; and

(ii) advance pharmaceutical allowance;

equals the total amount of pharmaceutical allowance that would have been paid to the person during that year if the person had not received any advance pharmaceutical allowance.

Note 1: For the amount paid to a person by way of pharmaceutical allowance see subsections 19A(2) to (6).

Note 2: The annual limit is affected by:

• how long during the calendar year the person was on pension or benefit;

• the rate of pharmaceutical allowance the person attracts at various times depending on the person’s family situation.

Amount of pharmaceutical allowance

1068‑D10 The amount of pharmaceutical allowance is the amount per fortnight worked out using the following Table:

Pharmaceutical allowance amount table |

Column 1 Item | Column 2 Person’s family situation | Column 3 Amount per fortnight |

1. | Not member of couple | $5.20 |

2. | Partnered | $2.60 |

4. | Member of illness separated couple | $5.20 |

5. | Member of respite care couple | $5.20 |

6. | Partnered (partner getting service pension) | $2.60 |

7. | Partnered (partner in gaol) | $5.20 |

Note 1: For member of couple, partnered, illness separated couple, respite care couple and partnered (partner in gaol) see section 4.

Note 2: The amounts in column 3 are indexed or adjusted annually in line with CPI increases (see sections 1191 to 1194 and 1206A).

Module G—Income test

Effect of ordinary income on maximum payment rate

1068‑G1 This is how to work out the effect of a person’s ordinary income, and the ordinary income of a partner of the person, on the person’s maximum payment rate:

Method statement

Step 1. Work out the amount of the person’s ordinary income on a fortnightly basis.

Note: For the treatment of amounts received from friendly societies, see point 1068‑G4.

Step 2. If the person is a member of a couple, work out the partner income free area using point 1068‑G9.

Note: The partner income free area is the maximum amount of ordinary income the person’s partner may have without affecting the person’s benefit.

Step 3. Use paragraphs 1068‑G10(a), (b) and (c) to work out whether the person has a partner income excess.

Step 4. If the requirements of paragraphs 1068‑G10(a), (b) and (c) are not satisfied then the person’s partner income excess is nil.

Step 5. If the requirements of paragraphs 1068‑G10(a), (b) and (c) are satisfied, the person’s partner income excess is the partner’s ordinary income less the partner income free area.

Step 6. Use the person’s partner income excess to work out the person’s partner income reduction using point 1068‑G11.

Step 7. Work out whether the person’s ordinary income exceeds the person’s ordinary income free area under point 1068‑G12.

Note: A person’s ordinary income free area is the maximum amount of ordinary income the person may have without affecting the person’s benefit rate.

Step 8. If the person’s ordinary income does not exceed the person’s ordinary income free area, the person’s ordinary income excess is nil.

Step 9. If the person’s ordinary income exceeds the person’s ordinary income free area, the person’s ordinary income excess is the person’s ordinary income less the person’s ordinary income free area.

Step 10. Use the person’s ordinary income excess to work out the person’s ordinary income reduction using points 1068‑G14, 1068‑G15, 1068‑G16 and 1068‑G17.

Step 11. Add the person’s partner income reduction and ordinary income reduction: the result is the person’s income reduction referred to in Step 5 of point 1068‑A1.

Note 1: For ordinary income see section 8.

Note 2: See point 1068‑A1 (Steps 6 to 9) for the significance of the person’s income reduction.

Note 3: The application of the ordinary income test is affected by provisions concerning:

• the general concept of ordinary income (sections 1072 and 1073);

• business income (sections 1074 and 1075);

• income from financial assets (including income streams (short term) and certain income streams (long term)) (Division 1B of Part 3.10);

• income from income streams not covered by Division 1B of Part 3.10 (Division 1C of Part 3.10);

• disposal of income (sections 1106 to 1111).

Ordinary income of members of certain couples

1068‑G2 Subject to point 1068‑G3, if a person is a member of a couple and the person’s partner is receiving a social security pension, a service pension, income support supplement or a veteran payment, the person’s ordinary income is taken to be one half of the sum of:

(a) the amount that would be the person’s ordinary income if he or she were not a member of a couple; and

(b) the amount that would be the ordinary income of the person’s partner if the partner were not a member of a couple.

Friendly society amounts

1068‑G4 The ordinary income of a person to whom, or to whose partner, jobseeker payment is payable and who, or whose partner, under Subdivision BA of Division 1 of Part 2.12, is not required to satisfy the activity test is not to include any amount received by the person or partner from an approved friendly society in respect of the incapacity because of which the person or partner is not required to satisfy the activity test.

Board and lodging

1068‑G6 A person’s ordinary income is not to include a payment to the person for board or lodging provided by the person to a parent, child, brother or sister of the person.

Lump sum payments arising from termination of employment

1068‑G7 Subject to points 1068‑G7AF to 1068‑G7AR (inclusive), if:

(a) a person’s employment has been terminated; and

(b) as a result the person is entitled to a lump sum payment from the person’s former employer;

the person is taken to have received the lump sum payment on the day on which the person’s employment was terminated.

Directed termination payments excluded

1068‑G7AF If:

(a) a person’s employment has been terminated; and

(b) as a result the person is entitled to a lump sum payment from the person’s former employer; and

(c) the payment, or part of the payment, is a directed termination payment within the meaning of section 82‑10F of the Income Tax (Transitional Provisions) Act 1997;

the payment, or that part, is to be disregarded in working out the ordinary income of the person for the purposes of Module G of section 1068.

Certain leave payments taken to be ordinary income—employment continuing

1068‑G7AG If:

(a) a person is employed; and

(b) the person is on leave for a period; and

(c) the person is or was entitled to receive a leave payment (whether as a lump sum payment, as a payment that is one of a series of regular payments or otherwise) in respect of a part or all of a leave period;

the person is taken to have received ordinary income for a period (the income maintenance period) equal to the leave period to which the leave payment entitlement relates.

Certain termination payments taken to be ordinary income

1068‑G7AH If:

(a) a person’s employment has been terminated; and

(b) the person receives a termination payment (whether as a lump sum payment, as a payment that is one of a series of regular payments or otherwise);

the person is taken to have received ordinary income for a period (the income maintenance period) equal to the period to which the payment relates.

Exception to points 1068‑G7AG and 1068‑G7AH

1068‑G7AI Point 1068‑G7AG or 1068‑G7AH does not apply in relation to a person’s entitlement referred to in paragraph 1068‑G7AG(c) or in relation to a person’s termination payment referred to in paragraph 1068‑G7AH(b) if:

(a) the person makes a claim for jobseeker payment on or after the commencement of this point; and

(b) the person makes the claim after the death of the person’s partner on or after the commencement of this point; and

(c) if the person is a man or a woman who was not pregnant when her partner died—the person makes the claim in the period of 14 weeks starting on the day of the death of the partner; and

(d) if the person is a woman who was pregnant when her partner died—the person makes the claim:

(i) in the period of 14 weeks starting on the day of the death of the partner; or

(ii) in the period starting on the day of the death of the partner and ending when the child is born or the woman otherwise stops being pregnant;

whichever ends later; and

(e) the entitlement referred to in paragraph 1068‑G7AG(c) arose, or the termination payment referred to in paragraph 1068‑G7AH(b) was paid, in the period applicable under paragraph (c) or (d) of this point.

More than one termination payment on a day

1068‑G7AJ If:

(a) the person is covered by point 1068‑G7AH; and

(b) the person receives more than one termination payment on a day;

the income maintenance period is worked out by adding the periods to which the payments relate.

Start of income maintenance period—employment continuing

1068‑G7AK If the person is covered by point 1068‑G7AG, the income maintenance period starts on the first day of the leave period to which the leave payment entitlement relates.

Start of income maintenance period—employment terminated

1068‑G7AKA Subject to point 1068‑G7AKC, if the person is covered by point 1068‑G7AH, the income maintenance period starts, subject to point 1068‑G7AKB, on the day the person is paid the termination payment.

Commencement of income maintenance period where there is a second termination payment

1068‑G7AKB If a person who is covered by point 1068‑G7AH is subject to an income maintenance period (the first period) and the person is paid another termination payment during that period (the second leave payment), the income maintenance period for the second termination payment commences the day after the end of the first period.

Start of income maintenance period where liquid assets test waiting period applies

1068‑G7AKC If a person to whom point 1068‑G7AKA applies is subject to a liquid assets test waiting period, the income maintenance period is taken to have started on the day on which the liquid assets test waiting period started.

Leave payments or termination payments in respect of periods longer than a fortnight

1068‑G7AL If:

(a) a person receives a leave payment or termination payment; and

(b) the payment is in respect of a period greater than a fortnight;

the person is taken to receive in a payment fortnight or part of a payment fortnight an amount calculated by:

(c) dividing the amount received by the number of days in the period to which the payment relates (the daily rate); and

(d) multiplying the daily rate by the number of days in the payment fortnight that are also in the period.

1068‑G7AM If the Secretary is satisfied that a person is in severe financial hardship because the person has incurred unavoidable or reasonable expenditure while an income maintenance period applies to the person, the Secretary may determine that the whole, or any part, of the period does not apply to the person.

Note 1: For in severe financial hardship see subsection 19C(2) (person who is not a member of a couple) and 19C(3) (person who is a member of a couple).

Note 2: For unavoidable or reasonable expenditure see subsection 19C(4).

Note 3: If an income maintenance period applies to a person, then, during that period:

(a) the payment or allowance claimed may not be payable to the person; or

(b) the amount of the payment or allowance payable to the person may be reduced.

When a person receives a leave payment or a termination payment

1068‑G7AN For the purposes of points 1068‑G7AF to 1068‑G7AM (inclusive), a person (the first person) is taken to receive a leave payment or termination payment if the payment is made to another person:

(a) at the direction of the first person or a court; or

(b) on behalf of the first person; or

(c) for the benefit of the first person; or

(d) the first person waives or assigns the first person’s right to receive the payment.

Single payment in respect of different kinds of termination payments

1068‑G7AP If a person who is covered by point 1068‑G7AH receives a single payment in respect of different kinds of termination payments, then, for the purposes of the application of points 1068‑G7AG to 1068‑G7AN (inclusive), each part of the payment that is in respect of a different kind of termination payment is taken to be a separate payment and the income maintenance period in respect of the single payment is worked out by adding the periods to which the separate payments relate.

Definitions

1068‑G7AQ In points 1068‑G7AG to 1068‑G7AP (inclusive):

payment fortnight means a fortnight in respect of which a jobseeker payment is paid, or would be paid, apart from the application of an income maintenance period, to a person.

period to which the payment relates means:

(a) if the payment is a leave payment—the leave period to which the payment relates; or

(b) if the payment is a termination payment and is calculated as an amount equivalent to an amount of ordinary income that the person would (but for the termination) have received from the employment that was terminated—the period for which the person would have received that amount of ordinary income; or

(c) if the payment is a termination payment and paragraph (b) does not apply—the period of weeks (rounded down to the nearest whole number) in respect of which the person would have received ordinary income, from the employment that was terminated, of an amount equal to the amount of the termination payment if:

(i) the person’s employment had continued; and

(ii) the person received ordinary income from the employment at the rate per week at which the person usually received ordinary income from the employment prior to the termination.

redundancy payment includes a payment in lieu of notice, but does not include a directed termination payment within the meaning of section 82‑10F of the Income Tax (Transitional Provisions) Act 1997.

termination payment includes:

(a) a redundancy payment; and

(b) a leave payment relating to a person’s employment that has been terminated; and

(c) any other payment that is connected with the termination of a person’s employment.

1068‑G7AR In points 1068‑G7AG to 1068‑G7AQ (inclusive):

leave payment includes a payment in respect of sick leave, annual leave, maternity leave and long service leave, but does not include:

(a) an instalment of parental leave pay; or

(b) dad and partner pay.

Ordinary income generally taken into account when first earned, derived or received

1068‑G7A Subject to points 1068‑G7B, 1068‑G7C, 1068‑G8 and 1068‑G8A and section 1073, ordinary income is to be taken into account in the fortnight in which it is first earned, derived or received.

Claimant or recipient receives lump sum amount for remunerative work

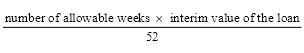

1068‑G7B If a person whose claim for a payment or an allowance has been granted receives a lump sum amount after the claim was made that:

(a) is paid to him or her in relation to remunerative work; and

(b) is not a payment to which point 1068‑G8 applies; and

(c) is not an exempt lump sum;

the person is, for the purposes of this Module, taken to receive one fifty‑second of that amount as ordinary income during each week in the 12 months commencing on the day on which the person becomes entitled to receive that amount.

Partner of claimant or recipient receives lump sum amount for remunerative work

1068‑G7C If:

(a) a person whose claim for a payment or an allowance has been granted is a member of a couple; and

(b) after the person has made the claim, the person’s partner receives a lump sum amount that:

(i) is paid to him or her in relation to remunerative work; and

(ii) is not a payment to which point 1068‑G8 applies; and

(iii) is not an exempt lump sum;

the partner is, for the purposes of this Module, taken to receive one fifty‑second of that amount as ordinary income during each week in the 12 months commencing on the day on which the partner becomes entitled to receive that amount.

Reference to payment or allowance

1068‑G7D A reference in point 1068‑G7B or 1068‑G7C to a payment or an allowance is a reference to a payment or an allowance the rate of which is calculated under this Rate Calculator.

Operation of points 1068‑G7B and 1068‑G7C

1068‑G7E Points 1068‑G7B and 1068‑G7C have effect even if the person who has made the claim:

(a) has to serve an ordinary waiting period or a liquid assets test waiting period in respect of the payment or allowance claimed; or

(b) is subject to an income maintenance period in respect of the payment or allowance claimed; or

(c) is subject to a seasonal work preclusion period;

during the period of 12 months referred to in those points.

Ordinary income received at intervals longer than one fortnight

1068‑G8 Subject to points 1068‑G7AF to 1068‑G7AR (inclusive), if:

(a) a person receives a number of ordinary income payments; and

(b) each payment is in respect of a period (in this point called the work period) that is greater than a fortnight; and

(c) there is reasonable predictability or regularity as to the timing of the payments; and

(d) there is reasonable predictability as to the quantum of the payments;

the person is taken to receive in a fortnight falling within, or overlapping with, a work period an amount calculated by:

(e) dividing the amount received by the number of days in the work period (the result is called the daily rate); and

(f) multiplying the daily rate by the number of days in the fortnight that are also within the work period.

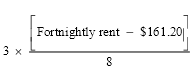

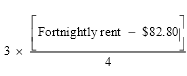

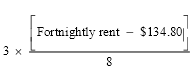

EXAMPLE OF HOW ORDINARY INCOME RECEIVED AT INTERVALS LONGER THAN A FORTNIGHT IS ALLOCATED TO FORTNIGHTLY PERIODS

Facts: Fred receives $600 each 25 days from remunerative work. The social security benefit becomes payable to Fred such that the first 25 days of his earnings that are counted as ordinary income for the purposes of the ordinary income test are spread over 3 social security benefit payment fortnights as follows:

• 5 days of the first fortnight;

• all of the second fortnight;

• 6 days of the third fortnight.

In this example, it is assumed that Fred remains qualified for the social security benefit during the three fortnights and that nothing prevents it from being payable to him. The problem is then to work out what proportion of Fred’s earnings to allocate to each fortnight for ordinary income testing purposes.

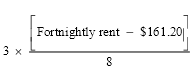

Application: To work out the amount that Fred is taken to receive in the first fortnight first divide the total amount received for the 25 day work period ($600) by the number of days in the work period (25). This gives a daily rate. The daily rate is:

Then multiply the daily rate ($24) by the number of days in the fortnight that are also within the work period. The result is:

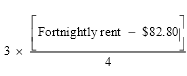

For the second fortnight the calculation is:

For the third fortnight the calculation is:

plus

Note that the amount of $192 added for the third fortnight comes from the given fact that Fred receives $600 each 25 days. So, for as long as there is reasonable predictability as to the timing and quantum of Fred’s ordinary income from remunerative work where receipt is at intervals longer than a fortnight, then this provision should be used to allocate that income to fortnightly periods for the purposes of the ordinary income test.

Payment of arrears of periodic compensation payments

1068‑G8A If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving jobseeker payment; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive in a fortnight falling within, or overlapping with, the periodic payments period, an amount calculated by:

(c) dividing the amount received by the number of days in the periodic payments period (the result is called the daily rate); and

(d) multiplying the daily rate by the number of days in the fortnight that are also within the periodic payments period.

Note: For periodic payments period see section 17.

Partner income free area

1068‑G9 The partner income free area for a person is:

(a) if the person’s partner is not receiving a social security benefit and has not turned 22—the amount of income of the partner (rounded up to the nearest dollar) beyond which youth allowance would not be payable to the partner if the partner were qualified for a youth allowance and were not undertaking full‑time study (see section 541B); or

(b) if the person’s partner is not receiving a social security benefit and has turned 22—the amount of income of the partner (rounded up to the nearest dollar) beyond which jobseeker payment would not be payable to the partner if the partner were qualified for a jobseeker payment; or

(c) if the person’s partner is receiving a social security benefit—the amount of income of the partner (rounded up to the nearest dollar) beyond which that benefit would not be payable to the partner.

1068‑G9A For the purposes of paragraph 1068‑G9(a), disregard steps 2, 2A and 3 of the method statement in point 1067G‑A1.

1068‑G9B For the purposes of paragraph 1068‑G9(b), disregard steps 2 and 3 of the method statement in point 1068‑A1.

Partner income excess

1068‑G10 If:

(a) a person is a member of a couple; and

(b) the person’s partner is not receiving a social security pension, a service pension, income support supplement or a veteran payment; and

(c) the partner’s ordinary income exceeds the partner income free area for the partner;

then:

(d) the person has a partner income excess; and

(e) the person’s partner income excess is the amount by which the partner’s ordinary income exceeds the partner income free area.

Partner income reduction

1068‑G11 If a person has a partner income excess, the person’s partner income reduction is an amount equal to 60% of the part of the partner’s ordinary income that exceeds the partner income free area.

Example:

Facts: Susan’s partner Colin has an ordinary income of $800. Assume that the partner income free area under point 1068‑G9 is $640.

Application: Colin’s ordinary income exceeds the partner income free area. He therefore has a partner income excess under point 1068‑G10 of:

Susan’s partner income reduction under point 1068‑G11 is therefore:

Ordinary income free area

1068‑G12 A person’s ordinary income free area is $100.

Note 1: The amount specified is indexed in line with CPI increases (see sections 1190 to 1194).

Note 2: The income free area is used in the ordinary income test in relation to fortnightly income.

Ordinary income excess

1068‑G13 If a person’s ordinary income exceeds the person’s ordinary income free area:

(a) the person has an ordinary income excess; and

(b) the person’s ordinary income excess is the amount by which the person’s ordinary income exceeds the person’s ordinary income free area.

Ordinary income reduction—general

1068‑G14 Subject to point 1068‑G17, if a person has an ordinary income excess, the person’s ordinary income reduction is the sum of:

(a) the person’s lower range reduction (see point 1068‑G15); and

(b) the person’s upper range reduction (if any) (see point 1068‑G16).

Lower range reduction

1068‑G15 The person’s lower range reduction is an amount equal to 50% of the part of the person’s ordinary income excess that does not exceed $150.

Upper range reduction

1068‑G16 The person’s upper range reduction is an amount equal to 60% of the part (if any) of the person’s ordinary income excess that exceeds $150.

Ordinary income reduction for certain recipients of jobseeker payment

1068‑G17 If:

(a) a person has an ordinary income excess; and

(b) the person is receiving jobseeker payment; and

(c) the person is not a member of a couple; and

(d) the person is the principal carer of a child;

the person’s ordinary income reduction is an amount equal to 40% of the person’s ordinary income excess.

Module J—Remote area allowance

Remote area allowance—person physically in remote area

1068‑J1 An amount by way of remote area allowance is to be added to a person’s rate if:

(aa) any of the following subparagraphs applies:

(i) apart from this point, the person’s rate would be greater than nil;

(ii) apart from this point, the person’s rate would be nil merely because an advance pharmaceutical allowance has been paid to the person under Part 2.23 of this Act;

(iii) apart from this point, the person’s rate would be nil merely because an election by the person under subsection 1061VA(1) is in force;

(iv) apart from this point, the person’s rate would be nil merely because of both of the matters mentioned in subparagraphs (ii) and (iii); and

(a) the person’s usual place of residence is situated in the remote area; and

(b) the person is physically present in the remote area.

Note 1: For remote area see subsection 14(1).

Note 2: A person may be considered to be physically present in a remote area during temporary absences—see subsection 14(2).

Rate of remote area allowance

1068‑J3 The rate of remote area allowance payable to a person is worked out using Table J. Work out which family situation in the Table applies to the person. The rate of remote area allowance is the corresponding amount in column 3 plus an additional corresponding amount in column 4 for each FTB child, and regular care child, of the person.

Table J Remote area allowance |

Column 1 Item | Column 2 Person’s family situation | Column 3 Basic allowance | Column 4 Additional allowance for each FTB child and regular care child |

1. | Not member of couple | $18.20 | $7.30 |

2. | Partnered | $15.60 | $7.30 |

3. | Member of illness separated couple | $18.20 | $7.30 |

5. | Partnered (partner in gaol) | $18.20 | $7.30 |

Meaning of remote area allowance

1068‑J4 In Table J, remote area allowance means:

(a) an amount added to a person’s social security pension or benefit by way of remote area allowance; or

(b) a remote area allowance payable under point SCH6‑G1 of the VEA.

In remote area

1068‑J5 For the purposes of Table J in point 1068‑J3, a person is in the remote area if:

(a) the person’s usual place of residence is in the remote area; and

(b) the person is physically present in the remote area.

Special rule where partner has an FTB or regular care child but is not receiving a pension

1068‑J7 If:

(a) a person who is a member of a couple is qualified for an amount by way of additional allowance; and

(b) the person’s partner is not receiving a pension or benefit; and

(c) the person’s partner has an FTB child or a regular care child;

the child is taken, for the purposes of this Module, to be an FTB child, or a regular care child, (as the case requires) of the person.

Special rule where partner has an FTB or regular care child but is not receiving additional allowance for the child

1068‑J8 If:

(a) a person who is a member of a couple is qualified for an amount by way of remote area allowance; and

(b) the person’s partner has an FTB child or a regular care child; and

(c) the person’s partner is not receiving additional allowance for the child;

the child is taken, for the purposes of this Module, to be an FTB child, or a regular care child, (as the case requires) of the person.

Special rule dealing with the death of an FTB or regular care child

1068‑J9 If an FTB child, or a regular care child, of a person dies, this Module has effect, for a period of 14 weeks after the death of the child, as if the child had not died.

Note: This point does not prevent this Module having the effect it would have had if the child would otherwise have ceased to be an FTB child, or a regular care child, during that 14 weeks.

Part 3.6A—Parenting Payment Rate Calculator

1068A Rate of parenting payment—pension PP (single)

(1) If a person is not a member of a couple, the person’s rate of parenting payment is the pension PP (single) rate.

(2) The pension PP (single) rate is worked out in accordance with the rate calculator at the end of this section.

Note: For rate of a person who is a member of a couple see section 1068B.

(3) If:

(a) a person has a relationship with another person, whether of the same sex or a different sex (the other person); and

(b) the relationship between them is a de facto relationship in the Secretary’s opinion (formed after the Secretary has had regard to all the circumstances of the relationship, including, in particular, the matters referred to in paragraphs 4(3)(a) to (e) and subsection 4(3A)); and

(c) either or both of them are under the age of consent applicable in the State or Territory in which they are living;

the person’s pension PP (single) rate is not to exceed the benefit PP (partnered) rate which would be payable to the person if the other person were the person’s partner.

Pension PP (Single) Rate Calculator

Module A—Overall rate calculation process

Method of calculating rate

1068A‑A1 The rate of pension PP (single) is a daily rate. That rate is worked out by dividing the annual rate calculated according to this Rate Calculator by 364 (fortnightly rates are provided for information only).

Method statement

Step 1. Work out the person’s maximum basic rate using Module B below.

Step 1A. Work out the amount of pension supplement using Module BA below.

Step 1B. Work out the energy supplement (if any) using Module BB below.

Step 2. Work out the amount per year (if any) of pharmaceutical allowance using Module C below.

Step 3. Work out the amount per year (if any) for rent assistance in accordance with paragraph 1070A(b).

Step 4. Add up the amounts obtained in Steps 1, 1A, 1B, 2 and 3: the result is called the maximum payment rate.

Step 5. Apply the ordinary income test using Module E below to work out the income reduction.

Step 6. Take the income reduction away from the maximum payment rate: the result is called the provisional annual payment rate.

Step 7. The rate of pension PP (single) is the amount obtained by:

(a) subtracting from the provisional annual payment rate any special employment advance deduction (see Part 3.16B); and

(b) if there is any amount remaining, subtracting from that amount any advance payment deduction (see Part 3.16A); and

(c) adding any amount payable by way of remote area allowance (see Module F).

Note 1: If a person’s rate is reduced under Step 6, the order in which the reduction is to be made against the components of the maximum payment rate is laid down by section 1210.

Note 2: In some circumstances a person may also be qualified for a pharmaceutical allowance under Part 2.22.

Note 3: An amount of remote area allowance is to be added under Step 7 only if the person’s provisional payment rate under Step 6 is greater than nil.

Module B—Maximum basic rate

Maximum basic rate

1068A‑B1 A person’s maximum basic rate is $9,042.80 per year ($347.80 per fortnight).

Note: The maximum basic rate is indexed 6 monthly in line with CPI increases (see sections 1191 to 1194).

Module BA—Pension supplement

Pension supplement

1068A‑BA1 A pension supplement amount is to be added to the person’s maximum basic rate.

Residents of pension age who are in Australia etc.

1068A‑BA2 If the person is residing in Australia, has reached pension age and:

(a) is in Australia; or

(b) is temporarily absent from Australia and has been so for a continuous period not exceeding 6 weeks;

the person’s pension supplement amount is:

(c) if an election by the person under subsection 1061VA(1) is in force—the amount worked out under point 1068A‑BA4; and

(d) otherwise—the amount worked out under point 1068A‑BA3.

Residents of pension age in Australia etc.—no election in force

1068A‑BA3 The person’s pension supplement amount is the amount worked out by:

(a) working out 66.33% of the combined couple rate of pension supplement; and

(b) if the result is not a multiple of $2.60, rounding the result up or down to the nearest multiple of $2.60 (rounding up if the result is not a multiple of $2.60 but is a multiple of $1.30).

Note: For combined couple rate of pension supplement, see subsection 20A(1).

Residents of pension age in Australia etc.—election in force

1068A‑BA4 The person’s pension supplement amount is the amount worked out as follows:

(a) work out the amount for the person under point 1068A‑BA3 as if the election were not in force;

(b) from that amount, subtract the person’s minimum pension supplement amount.

Other persons

1068A‑BA5 If the person is not covered by point 1068A‑BA2, the person’s pension supplement amount is the person’s pension supplement basic amount.

Module BB—Energy supplement

1068A‑BB1 An energy supplement is to be added to the person’s (the recipient’s) maximum basic rate if the recipient is residing in Australia and:

(a) is in Australia; or

(b) is temporarily absent from Australia and has been so for a continuous period not exceeding 6 weeks.

However, this Module does not apply if quarterly energy supplement is payable to the recipient.

Note: Section 918 may affect the addition of the energy supplement.

Recipient has reached pension age

1068A‑BB2 If the recipient has reached pension age, the recipient’s energy supplement is $366.60.

Recipient has not reached pension age

1068A‑BB3 If the recipient has not reached pension age, the recipient’s energy supplement is $312.00.

Module C—Pharmaceutical allowance

Qualification for pharmaceutical allowance

1068A‑C1 Subject to points 1068A‑C1A, 1068A‑C2, 1068A‑C3 and 1068A‑C5, an additional amount by way of pharmaceutical allowance is to be added to a person’s maximum basic rate if the person is an Australian resident.

No pharmaceutical allowance if person has reached pension age

1068A‑C1A Pharmaceutical allowance is not to be added to a person’s maximum basic rate if the person has reached pension age.

No pharmaceutical allowance if person receiving certain supplements under other Acts

1068A‑C2 Pharmaceutical allowance is not to be added to a person’s maximum basic rate if the person is receiving:

(a) veterans supplement under section 118A of the Veterans’ Entitlements Act; or

(b) MRCA supplement under section 300 of the Military Rehabilitation and Compensation Act; or

(c) pharmaceutical supplement under Part 3A of the Australian Participants in British Nuclear Tests and British Commonwealth Occupation Force (Treatment) Act 2006; or

(d) pharmaceutical supplement under Part 4 of the Treatment Benefits (Special Access) Act 2019.

No pharmaceutical allowance before advance payment period ends

1068A‑C3 Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance under Part 2.23 of this Act; and

(b) the person’s advance payment period has not ended.

Note: For advance payment period see point 1068A‑C4.

Advance payment period

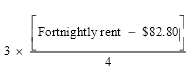

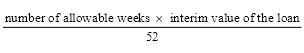

1068A‑C4(1) A person’s advance payment period starts on the day on which the advance pharmaceutical allowance is paid to the person.

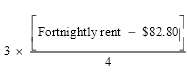

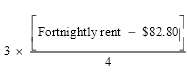

(2) The period ends after the number of paydays worked out using the following formula have passed:

where:

amount of advance is the amount of the advance paid to the person.

pharmaceutical allowance rate is the yearly amount of pharmaceutical allowance which would be added to the person’s maximum basic rate in working out the person’s rate of pension PP (single) on the day on which the advance is paid if pharmaceutical allowance were to be added to the person’s maximum basic rate on that day.

No pharmaceutical allowance if annual limit reached

1068A‑C5 Pharmaceutical allowance is not to be added to a person’s maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance during the current calendar year; and

(b) the total amount paid to the person for that year by way of:

(i) pharmaceutical allowance; and

(ii) advance pharmaceutical allowance;

equals the total amount of pharmaceutical allowance that would have been paid to the person during that year if the person had not received any advance pharmaceutical allowance.

Note 1: For the amount paid to a person by way of pharmaceutical allowance see subsections 19A(2) to (7).

Note 2: The annual limit is affected by the following:

(a) how long during the calendar year the person was on pension or benefit;

(b) the rate of pharmaceutical allowance the person attracts at various times depending on the person’s family situation.

Amount of pharmaceutical allowance

1068A‑C7 The amount of pharmaceutical allowance is $140.40 per year ($5.40 per fortnight).

Note: The annual amount is adjusted annually in line with CPI increases (see section 1206A).

Module E—Ordinary income test

Effect of income on maximum payment rate

1068A‑E1 This is how to work out the effect of a person’s ordinary income on the person’s maximum payment rate:

Method statement

Step 1. Work out the amount of the person’s ordinary income on a yearly basis.

Step 2. Work out the person’s ordinary income free area (see points 1068A‑E14 to 1068A‑E18 below).

Note: A person’s ordinary income free area is the amount of ordinary income that the person can have without any deduction being made from the person’s maximum payment rate.

Step 3. Work out whether the person’s ordinary income exceeds the person’s ordinary income free area.

Step 4. If the person’s ordinary income does not exceed the person’s ordinary income free area, the person’s ordinary income excess is nil.

Step 5. If the person’s ordinary income exceeds the person’s ordinary income free area, the person’s ordinary income excess is the person’s ordinary income less the person’s ordinary income free area.

Step 6. Use the person’s ordinary income excess to work out the person’s reduction for ordinary income using points 1068A‑E19 and 1068A‑E20 below.

Note 1: See point 1068A‑A1 (Steps 5 and 6) for the significance of the person’s reduction for ordinary income.

Note 2: The application of the ordinary income test is affected by provisions concerning the following:

(a) the general concept of ordinary income (sections 1072 and 1073);

(b) business income (sections 1074 and 1075);

(c) income from financial assets (including income streams (short term) and certain income streams (long term)) (Division 1B of Part 3.10);

(d) income from income streams not covered by Division 1B of Part 3.10 (Division 1C of Part 3.10);

(e) disposal of income (sections 1106 to 1111).

Directed termination payments excluded

1068A‑E2 If:

(a) a person’s employment has been terminated; and

(b) as a result the person is entitled to a lump sum payment from the person’s former employer; and

(c) the payment, or part of the payment, is a directed termination payment within the meaning of section 82‑10F of the Income Tax (Transitional Provisions) Act 1997;

the payment, or that part, is to be disregarded in working out the ordinary income of the person for the purposes of this Module.

Certain leave payments taken to be ordinary income—employment continuing

1068A‑E3 If:

(a) a person is employed; and

(b) the person is on leave for a period; and

(c) the person is or was entitled to receive a leave payment (whether as a lump sum payment, as a payment that is one of a series of regular payments or otherwise) in respect of a part or all of the leave period;

the person is taken to have received ordinary income for a period (the income maintenance period) equal to the leave period to which the leave payment entitlement relates.

Certain termination payments taken to be ordinary income

1068A‑E4 If:

(a) a person’s employment has been terminated; and

(b) the person receives a termination payment (whether as a lump sum payment, as a payment that is one of a series of regular payments or otherwise);

the person is taken to have received ordinary income for a period (the income maintenance period) equal to the period to which the payment relates.

More than one termination payment on a day

1068A‑E5 If:

(a) the person is covered by point 1068A‑E4; and

(b) the person receives more than one termination payment on a day;

the income maintenance period is worked out by adding the periods to which the payments relate.

Start of income maintenance period—employment continuing

1068A‑E6 If the person is covered by point 1068A‑E3, the income maintenance period starts on the first day of the leave period to which the leave payment entitlement relates.

Start of income maintenance period—employment terminated

1068A‑E7 If the person is covered by point 1068A‑E4, the income maintenance period starts, subject to point 1068A‑E8, on the day the person is paid the termination payment.

Commencement of income maintenance period where there is a second termination payment

1068A‑E8 If a person who is covered by point 1068A‑E4 is subject to an income maintenance period (the first period) and the person is paid another termination payment during that period (the second leave payment), the income maintenance period for the second termination payment commences on the day after the end of the first period.

1068A‑E9 If the Secretary is satisfied that a person is in severe financial hardship because the person has incurred unavoidable or reasonable expenditure while an income maintenance period applies to the person, the Secretary may determine that the whole, or any part, of the period does not apply to the person.

Note 1: For in severe financial hardship see subsection 19C(2) (person who is not a member of a couple).

Note 2: For unavoidable or reasonable expenditure see subsection 19C(4).

Note 3: If an income maintenance period applies to a person, then, during that period:

(a) the pension PP (single) claimed may not be payable to the person; or

(b) the amount of the pension PP (single) payable to the person may be reduced.

When a person receives a leave payment or a termination payment

1068A‑E10 For the purposes of points 1068A‑E2 to 1068A‑E9 (inclusive), a person (the first person) is taken to receive a leave payment or termination payment if the payment is made to another person:

(a) at the direction of the first person or a court; or

(b) on behalf of the first person; or

(c) for the benefit of the first person; or

the first person waives or assigns the first person’s right to receive the payment.

Single payment in respect of different kinds of termination payments

1068A‑E11 If a person who is covered by point 1068A‑E4 receives a single payment in respect of different kinds of termination payments, then, for the purposes of the application of points 1068A‑E3 to 1068A‑E10 (inclusive), each part of the payment that is in respect of a different kind of termination payment is taken to be a separate payment and the income maintenance period in respect of the single payment is worked out by adding the periods to which the separate payments relate.

Definitions

1068A‑E12 In points 1068A‑E3 to 1068A‑E12 (inclusive):

leave payment includes a payment in respect of sick leave, annual leave, maternity leave and long service leave, but does not include:

(a) an instalment of parental leave pay; or

(b) dad and partner pay.

period to which the payment relates means:

(a) if the payment is a leave payment—the leave period to which the payment relates; or

(b) if the payment is a termination payment and is calculated as an amount equivalent to an amount of ordinary income that the person would (but for the termination) have received from the employment that was terminated—the period for which the person would have received that amount of ordinary income; or

(c) if the payment is a termination payment and paragraph (b) does not apply—the period of weeks (rounded down to the nearest whole number) in respect of which the person would have received ordinary income, from the employment that was terminated, of an amount equal to the amount of the termination payment if:

(i) the person’s employment had continued; and

(ii) the person received ordinary income from the employment at the rate per week at which the person usually received ordinary income from the employment prior to the termination.

redundancy payment includes a payment in lieu of notice, but does not include a directed termination payment within the meaning of section 82‑10F of the Income Tax (Transitional Provisions) Act 1997.

termination payment includes:

(a) a redundancy payment; and

(b) a leave payment relating to a person’s employment that has been terminated; and

(c) any other payment that is connected with the termination of a person’s employment.

Payment of arrears of periodic compensation payments

1068A‑E13 If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving a compensation affected payment; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive, on each day in the periodic payments period, an amount calculated by dividing the amount received by the number of days in the periodic payments period.

Note: For compensation affected payment and periodic payments period see section 17.

How to calculate a person’s ordinary income free area

1068A‑E14 A person’s ordinary income free area is worked out using Table E. The ordinary income free area is the amount in Column 2 plus the additional amount in Column 4 for each dependent child of the person.

Table E—Ordinary income free area |

Column 1 Item | Column 2 Basic free area per year | Column 3 Basic free area per fortnight | Column 4 Additional free area per year | Column 5 Additional free area per fortnight |

1 | $2,600 | $100 | $639.60 | $24.60 |

Note 1: For dependent child see section 5 and point 1068A‑E21.

Note 2: The basic free area per year is indexed annually in line with CPI increases (see sections 1191 to 1194).

No additional free area for certain prescribed student children

1068A‑E15 No additional free area is to be added for a dependent child who:

(a) has turned 18; and

(b) is a prescribed student child;

unless the person whose rate is being calculated receives carer allowance for the child.

Reduction of additional free area for dependent children

1068A‑E16 The additional free area for a dependent child is reduced by the annual amount of any payment received by the person for or in respect of that particular child. The payments referred to in point 1068A‑E17 do not result in a reduction.

Payments that do not reduce additional free area

1068A‑E17 No reduction is to be made under point 1068A‑E16 for a payment:

(a) under this Act; or

(b) of maintenance income; or

(c) under the Veterans’ Entitlements Act; or

(d) under an Aboriginal study assistance scheme; or

(e) under the Assistance for Isolated Children Scheme.

Note: For Aboriginal study assistance scheme see subsection 23(1).

Examples of payments reducing additional free area

1068A‑E18 Examples of the kinds of payments that result in a reduction under point 1068A‑E16 are:

(a) amounts received from State authorities or registered public benevolent institutions in respect of the boarding out of the child; or

(b) amounts of superannuation or compensation paid in respect of the child; or

(c) amounts (other than amounts covered by point 1068A‑E17) paid in respect of the child under educational schemes; or

(d) foster care allowance payments made by a State welfare authority.

Ordinary income excess

1068A‑E19 A person’s ordinary income excess is the person’s ordinary income less the person’s ordinary income free area.

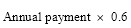

Reduction for ordinary income

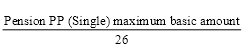

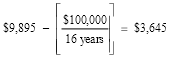

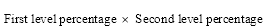

1068A‑E20 A person’s reduction for ordinary income is:

1068A‑E21 In this Module:

dependent child, in relation to a person, includes any child of the person who is under 18 and is receiving a youth allowance.

Module F—Remote area allowance

Remote area allowance

1068A‑F1 An amount by way of remote area allowance is to be added to a person’s rate if:

(a) any of the following subparagraphs applies:

(i) apart from this point, the person’s rate would be greater than nil;

(ii) apart from this point, the person’s rate would be nil merely because an advance pharmaceutical allowance has been paid to the person under Part 2.23 of this Act;

(iii) apart from this point, the person’s rate would be nil merely because an election by the person under subsection 1061VA(1) is in force;

(iv) apart from this point, the person’s rate would be nil merely because of both of the matters mentioned in subparagraphs (ii) and (iii); and

(b) the person’s usual place of residence is situated in a remote area; and

(c) the person is physically present in the remote area.

Note: For remote area and physically present in the remote area see section 14.

Rate of remote area allowance

1068A‑F2 The rate of remote area allowance payable to a person is worked out using Table F. The rate of remote area allowance is the amount in Column 2 plus the additional corresponding amount in Column 4 for each FTB child, and each regular care child, of the person.

Table F—Remote area allowance |

Column 1 Item | Column 2 Basic allowance per year | Column 3 Basic allowance per fortnight | Column 4 Additional allowance per year | Column 5 Additional allowance per fortnight |

1 | $473.20 | $18.20 | $189.80 | $7.30 |

1068B Rate of parenting payment—PP (partnered)

(1) If a person is a member of a couple, the person’s rate of parenting payment is the benefit PP (partnered) rate.

(2) The benefit PP (partnered) rate is worked out in accordance with the rate calculator at the end of this section.

Note: For member of a couple see section 4.

Benefit PP (Partnered) Rate Calculator

Module A—Overall rate calculation process

Method of calculating rate—general

1068B‑A1 The rate of benefit PP (partnered) is a daily rate. That rate is worked out by dividing the fortnightly rate calculated according to this Rate Calculator by 14. There are 2 ways of working out the fortnightly rate:

(a) one for a person who is not a partner of a non‑independent YA recipient (see point 1068B‑A2); and

(b) one for a person who is a partner of a non‑independent YA recipient (see point 1068B‑A3).

Note: For partner of a non‑independent YA recipient see subsection 23(1).

Method of calculating rate for person who is not a partner of a non‑independent YA recipient

1068B‑A2 If a person is not the partner of a non‑independent YA recipient, the fortnightly rate of benefit PP (partnered) for the person is worked out as follows:

Method statement

Step 1. Work out the person’s maximum basic rate using Module C below.

Step 2. Work out the amount per fortnight (if any) of rent assistance in accordance with paragraph 1070A(a).

Step 2A. Work out the pension supplement amount (if any) using Module DA below.

Step 2B. Work out the energy supplement (if any) using Module DB below.

Step 3. Work out the amount per fortnight (if any) of pharmaceutical allowance using Module E below.

Step 4. Add up the amounts obtained in steps 1 to 3: the result is called the maximum payment rate.

Step 5. Apply the income test using Module D below to work out the person’s income reduction.

Step 6. Take the income reduction away from the maximum payment rate: the result is called the provisional payment rate.

Step 7. The rate of benefit PP (partnered) is the difference between:

(a) the provisional payment rate; and

(b) any advance payment deduction (see Part 3.16A);

plus, except where the person is a CDEP Scheme participant in respect of the whole or part of the period for which the rate of payment is being worked out, any amount by way of remote area allowance that, under Module G, is to be added to the person’s rate of benefit PP (partnered).

Note 1: For partner of a non‑independent YA recipient see subsection 23(1).

Note 2: If a person’s rate is reduced under step 6, the order in which the reduction is to be made against the components of the maximum payment rate is laid down by section 1210 (maximum basic rate first, then rent assistance).

Method of calculating rate for partner of a non‑independent YA recipient

1068B‑A3 If a person is the partner of a non‑independent YA recipient, the fortnightly rate of benefit PP (partnered) for the person is worked out as follows:

Method statement

Step 1. Work out the person’s maximum basic rate using Module C below.

Step 2. Work out the amount per fortnight (if any) of rent assistance in accordance with paragraph 1070A(a).

Step 2A. Work out the pension supplement amount (if any) using Module DA below.

Step 2B. Work out the energy supplement (if any) using Module DB below.

Step 3. Work out the amount per fortnight (if any) of pharmaceutical allowance using Module E below.

Step 4. Add up the amounts obtained in steps 1 to 3: the result is called the maximum payment rate.

Step 5. Apply the income test using Module E of the Rate Calculator in section 1068A to work out the person’s income reduction.

Step 6. Take the income reduction away from the maximum payment rate: the rate is called the provisional payment rate.

Step 7. The rate of benefit is the difference between:

(a) the provisional payment rate; and

(b) any advance payment deduction (see Part 3.16A);

plus, except where the person is a CDEP Scheme participant in respect of the whole or part of the period for which the rate of payment is being worked out, any amount by way of remote area allowance that, under Module G, is to be added to the person’s rate of benefit PP (partnered).

Note 1: For partner of a non‑independent YA recipient see subsection 23(1).

Note 2: If a person’s rate is reduced under step 6, the order in which the reduction is to be made against the components of the maximum payment rate is laid down by section 1210 (maximum basic rate first, then rent assistance).

Module C—Maximum basic rate

Maximum basic rate

1068B‑C2 If a person is not a CDEP Scheme participant in respect of the whole or part of the period for which the rate of payment is being worked out, the person’s maximum basic rate is worked out using Table C. Work out the person’s family situation. The maximum basic rate is the corresponding amount in Column 3.

Table C—Maximum basic rates |

Column 1 Item | Column 2 Person’s family situation | Column 3 Rate |

1 | Person not covered by item 2, 3 or 4 | $290.10 |

2 | Member of illness separated couple | $347.80 |

3 | Member of respite care couple | $347.80 |

4 | Partnered (partner in gaol) | $347.80 |

Note 1: For illness separated couple, respite care couple and partnered (partner in gaol) see section 4.

Note 2: The rates are indexed 6 monthly in line with CPI increases (see sections 1191 to 1194).

Maximum basic rate—CDEP Scheme participant

1068B‑C3 The maximum basic rate of a person who is a CDEP Scheme participant in respect of the whole or a part of the period for which the maximum basic rate is being worked out is nil (see section 500W).

Module D—Income test

Effect of income on maximum payment rate

1068B‑D1 This is how to work out the effect of a person’s ordinary income, and the ordinary income of the person’s partner, on the person’s maximum payment rate:

Method statement

Step 1. Work out the amount of the person’s ordinary income on a fortnightly basis.

Note: The amount of the person’s ordinary income is affected by points 1068B‑D2 to 1068B‑D21.

Step 2. Work out the partner income free area using point 1068B‑D22.

Note: The partner income free area is the maximum amount of ordinary income the person’s partner can have without affecting the person’s rate.

Step 3. Use point 1068B‑D23 to work out the person’s partner income excess.

Step 4. Use the person’s partner income excess to work out the person’s partner income reduction using point 1068B‑D24.

Step 5. Work out whether the person’s ordinary income exceeds the person’s ordinary income free area (see point 1068B‑D27).