Part 3.12A—Provisions for Seniors Health Card taxable income test

Division 1—Purpose of this Part

1157A Purpose of Part

1157A(1) Division 2 of this Part describes the kind of benefits that can be assessable fringe benefits. Division 3 to 7 tell you how to work out the value of the assessable fringe benefits received by a person in a tax year. Division 8 deals with foreign currency conversions.

These provisions are necessary for the purposes of the Seniors Health Card Taxable Income Test Calculator.

Note 1: For assessable fringe benefit see section 10A.

Note 2: A fringe benefit is one that is provided by an employer to an employee in respect of the employee’s employment (see section 10A).

1157A(2) Section 10A contains many of the definitions that are relevant to the provisions of this Part.

Division 2—Benefits that may be assessable fringe benefits

1157B Benefits received in or outside Australia

This Part applies to a fringe benefit whether the benefit is received in or outside Australia.

1157C Car benefits

1157C(1) A person (the employee) receives a car benefit if:

(a) a car held by another person (the provider):

(i) is applied to a private use by the employee or an associate of the employee; or

(ii) is taken under subsection (2), (3) or (4) to be available for the private use of the employee or an associate of the employee; and

(b) either:

(i) the provider is the employer, or an associate of the employer, of the employee; or

(ii) the car is applied or available in that way under an arrangement between:

(A) the provider or another person; and

(B) the employer or an associate of the employer.

1157C(2) A car is taken, for the purposes of subsection (1), to be available at a particular time for the private use of the employee or an associate of the employee if:

(a) the car is held by a person who is:

(i) the employer; or

(ii) an associate of the employer; or

(iii) some other person with whom, or in respect of whom, the employer or associate has an arrangement relating to the use or availability of the car; and

(b) the car is garaged or kept at or near a place of residence of the employee or of an associate of the employee.

1157C(3) A car is taken, for the purposes of subsection (1), to be available at a particular time for the private use of the employee or an associate of the employee if:

(a) the car is held by a person who is:

(i) the employer; or

(ii) an associate of the employer; or

(iii) some other person with whom, or in respect of whom, the employer or associate has an arrangement relating to the use or availability of the car; and

(b) the car is not at business premises of:

(i) the employer; or

(ii) an associate of the employer; or

(iii) some other person with whom, or in respect of whom, the employer or associate has an arrangement relating to the use or availability of the car; and

(c) either:

(i) the employee is entitled to apply the car to a private use at that time; or

(ii) the employee is not performing the duties of his or her employment at that time and has custody or control of the car; or

(iii) an associate of the employee is entitled to use the car at that time; or

(iv) an associate of the employee has custody or control of the car at that time.

1157C(4) For the purposes of subsection (3), if a prohibition on the use of a car, or on the application of a car for a private use, by a person is not consistently enforced, the person is taken to be entitled to use the car, or to apply the car to a private use, despite the prohibition.

1157C(5) For the purposes of this section, a car that is let on hire to a person under a hire‑purchase agreement is taken:

(a) to have been purchased by the person at the time when the person first took the car on hire; and

(b) to have been owned by the person at all material times.

1157C(6) A reference in this Part to a car held by a person (the provider) does not include a reference to:

(a) a taxi let on hire to the provider; or

(b) a car let on hire to the provider under an agreement of a kind that is ordinarily entered into by persons taking cars on hire intermittently as occasion requires on an hourly, daily, weekly or other short‑term basis.

1157C(7) Paragraph (6)(b) does not apply if the car has been or may reasonably be expected to be on hire under successive agreements of a kind that result in substantial continuity of the hiring of the car.

1157D Exempt car benefits

1157D(1) Except in so far as section 1157C provides that the application or availability of a car held by a person is a car benefit, the application or availability of a car held by a person is exempt.

1157D(2) A car benefit provided in respect of the employment of the employee is exempt if:

(a) the car is:

(i) a taxi, panel van or utility truck; or

(ii) any other road vehicle designed to carry a load of less than 1 tonne (other than a vehicle designed for the principal purpose of carrying passengers); and

(b) the only private use of the car at a time when the benefit was provided was:

(i) work‑related travel of the employee; and

(ii) other minor, infrequent and irregular private use by the employee or an associate of the employee.

1157D(3) A car benefit provided in respect of the employment of the employee is exempt if the car was unregistered at all times when the car was held by the person who provided the car.

1157E School fees benefits

Payment to recipient

1157E(1) If:

(a) a person (the provider) pays an amount to another person (the recipient); and

(b) the amount is for fees for:

(i) tuition at primary or secondary level provided by a school; or

(ii) books or equipment provided by the school in relation to that tuition; and

(c) the tuition, books or equipment is provided to:

(i) a dependent child of the recipient or the recipient’s partner; or

(ii) a person who would be a dependent child of the recipient or the recipient’s partner if the person was not receiving a newstart allowance, a sickness allowance or a youth allowance;

the payment constitutes a school fees benefit provided by the provider to the recipient.

Note: For school see section 10A.

Payment to or on behalf of the school

1157E(2) If:

(a) a person (the provider) pays an amount to or on behalf of a school; and

(b) the amount is for fees for:

(i) tuition at primary or secondary level provided by the school; or

(ii) books or equipment provided by the school in relation to that tuition; and

(c) the tuition, books or equipment is provided to:

(i) a dependent child of a person (the recipient) or the recipient’s partner; or

(ii) a person who would be a dependent child of the recipient or the recipient’s partner if the person was not receiving a newstart allowance or a sickness allowance;

the payment constitutes a school fees benefit provided by the provider to the recipient.

Note: For school see section 10A.

Boarding fees

1157E(3) For the purposes of subsections (1) and (2), if:

(a) a school is providing tuition at primary or secondary level to a dependent child of a person; and

(b) the child is boarding at the school;

the fees that are payable for the child to board at the school are taken to be fees for the tuition provided by the school to the child.

1157F Health insurance benefits

Payment to recipient

1157F(1) If:

(a) a person (the provider) pays an amount to another person (the recipient); and

(b) the amount is for the cost of health insurance; and

(c) the health insurance covers:

(i) the recipient; or

(ii) the recipient’s partner; or

(iii) a dependent child of the recipient or the recipient’s partner; or

(iv) a person who would be a dependent child of the recipient or the recipient’s partner if the person was not receiving a newstart allowance, a sickness allowance or a youth allowance;

the payment constitutes a health insurance benefit provided by the provider to the recipient.

Payment to the health insurance fund

1157F(2) If:

(a) a person (the provider) pays an amount to a health insurance fund; and

(b) the amount is for the cost of health insurance; and

(c) the health insurance covers:

(i) a person (the recipient); or

(ii) the recipient’s partner; or

(iii) a dependent child of the recipient or the recipient’s partner; or

(iv) a person who would be a dependent child of the recipient or the recipient’s partner if the person was not receiving a newstart allowance or a sickness allowance;

the payment constitutes a health insurance benefit provided by the provider to the recipient.

1157G Loan benefits

1157G(1) Subject to subsection (1A), if a person (the provider) makes a loan to another person (the recipient), the making of the loan constitutes a loan benefit provided by the provider to the recipient.

1157G(1A) The making of the loan does not constitute a loan benefit provided by the provider to the recipient if:

(a) the provider is the Defence Force, or a body one of the objects or functions of which is making loans to employees of the Defence Force; and

(b) the recipient is an employee of the Defence Force.

Late payment of debt

1157G(2) For the purposes of this section, if:

(a) a person (the debtor) is under an obligation to pay or repay an amount (the principal amount) to another person (the creditor); and

(b) the principal amount is not the whole or a part of the amount of a loan; and

(c) after the due date for payment or repayment of the principal amount, the whole or part of the principal amount remains unpaid;

the following provisions have effect:

(d) the creditor is taken, immediately after the due date, to have made a loan (the deemed loan) of the principal amount to the debtor;

(e) at any time when the debtor is under an obligation to repay any part of the principal amount, the debtor is taken to be under an obligation to repay that part of the deemed loan;

(f) the deemed loan is taken to have been made:

(i) if interest accrues on so much of the principal amount as remains from time to time unpaid—at the rate of interest at which that interest accrues; or

(ii) in any other case—at a nil rate of interest.

1157G(3) Subject to subsection (4), a loan is a deferred interest loan if interest is payable on the loan at a rate that exceeds nil.

1157G(4) A loan is not a deferred interest loan if:

(a) the whole of the interest is due for payment within 6 months after the loan is made; or

(b) all of the following conditions are satisfied:

(i) interest on the loan is payable by instalments;

(ii) the intervals between instalments do not exceed 6 months;

(iii) the first instalment is due for payment within 6 months after the loan is made.

1157G(5) For the purposes of this section, if a person (the provider) makes a deferred interest loan (the principal loan) to another person (the recipient), the following provisions apply:

(a) the provider is taken, at the end of:

(i) the period of 6 months starting on the day on which the principal loan was made; and

(ii) each subsequent period of 6 months;

to have made a loan (the deemed loan) to the recipient;

(b) the amount of the loan is taken to be equal to the amount by which the interest (the accrued interest) that has accrued on the principal loan in respect of the period exceeds the amount (if any) paid in respect of the accrued interest before the end of the period;

(c) if any part of the accrued interest becomes payable or is paid after the time when the deemed loan is taken to have been made, the deemed loan is to be reduced accordingly;

(d) the deemed loan is taken to have been made at a nil rate of interest.

1157G(6) Paragraph (5)(a) only applies to a period of 6 months if the recipient is under an obligation during the whole of the period to repay the whole or a part of the principal loan.

1157G(7) For the purposes of this Part, if no interest is payable in respect of a loan, a nil rate of interest is taken to be payable in respect of the loan.

1157H Exempt loan benefit

1157H(3) The making of a loan is exempt if:

(a) the loan consists of an advance by the employer to the employee; and

(b) the loan is made for the sole purpose of enabling the employee to meet expenses incurred in performing the duties of his or her employment; and

(c) the amount of the loan is not substantially greater than the amount of those expenses that could reasonably be expected to be incurred by the employee; and

(d) the employee is required:

(i) to account to the employer for expenses met from the loan; and

(ii) to repay (whether by set‑off or otherwise) any amount not so accounted for.

1157H(4) The making of a loan is exempt if:

(a) the loan consists of an advance by the employer to the employee; and

(b) the sole purpose of the making of the loan is to enable the employee to pay any of the following amounts payable by the employee in respect of accommodation:

(i) a rental bond;

(ii) a security deposit in respect of electricity, gas or telephone services;

(iii) any similar amount; and

(c) the employee is required to repay (whether by set‑off or otherwise) the loan amount of the advance.

1157I Housing benefits

1157I(1) The subsistence of a housing right granted by a person (the provider) to another person (the recipient) constitutes a housing benefit provided by the provider to the recipient.

1157I(2) The payment of money or other valuable consideration by an employer directly or indirectly to an employee (other than an employee of the Defence Force) to enable or assist the employee to meet costs associated with a loan to which subsection (4) applies constitutes a housing benefit provided by the employer to the employee.

Note: For employee and employer see section 10A.

1157I(3) The payment of money or other valuable consideration by an employer directly or indirectly to an employee of the Defence Force to meet costs associated with a loan to which subsection (4) applies does not constitute a housing benefit provided by the employer to the employee.

1157I(4) This subsection applies to a loan made to, or used by, a person (whether in his or her own right or jointly with his or her partner) wholly:

(a) to enable the person to acquire a prescribed interest in land on which a dwelling or a building containing a dwelling was subsequently to be constructed; or

(b) to enable the person to acquire a prescribed interest in land and construct, or complete the construction of, a dwelling or a building containing a dwelling on the land; or

(c) to enable the person to construct, or complete the construction of, a dwelling or a building containing a dwelling on land in which the person held a prescribed interest; or

(d) to enable the person to acquire a prescribed interest in land on which there was a dwelling or a building containing a dwelling; or

(e) to enable the person to acquire a prescribed interest in a stratum unit in relation to a dwelling; or

(f) to enable the person to extend a building that:

(i) is a dwelling or contains a dwelling; and

(ii) is constructed on land in which the person held a prescribed interest;

by adding a room or part of a room to the building or part of the building containing the dwelling, as the case may be; or

(g) if the person held a prescribed interest in a stratum unit in relation to a dwelling—to enable the person to extend the dwelling by adding a room or part of a room to the dwelling; or

(h) to enable the person to repay a loan that was made to, and used by, the person wholly for a purpose mentioned in paragraph (a) to (g).

Note 1: For dwelling see subsection 10A(7).

Note 2: For prescribed interest see subsections 10A(10) to (14).

Note 3: For stratum units see subsection 10A(8).

1157I(5) The payment of money or other valuable consideration by an employer directly or indirectly to an employee to enable or assist the employee to meet costs associated with enjoying a housing right constitutes a housing benefit provided by the employer to the employee.

Note: For employee, employer and housing right see section 10A.

1157I(6) For the avoidance of doubt, subsection (5) does not apply to payments to which subsection (2) or (3) applies.

1157J Exempt housing benefits—live‑in residential care workers

1157J(1) If, during a period:

(a) the employer of an employee is:

(i) a government body; or

(ii) a religious institution; or

(iii) a non‑profit company;

whose activities consist of, or include, caring for mature persons or disadvantaged persons; and

(b) the duties of the employee’s employment consist of, or consist principally of, caring for mature or disadvantaged persons; and

(c) in the performance of those duties, the employee lives, together with mature persons or disadvantaged persons, in residential premises of the employer; and

(d) the fact that the employee lives in those premises is directly related to the provision, in the course of the performance of the duties of the employee’s employment, of care to the mature persons or disadvantaged persons living in those premises;

any benefit arising from the provision, during that period, of that accommodation to the employee or to the employee and a partner or dependent child of the employee who resides in those premises with the employee is exempt.

1157J(2) In this section:

residential premises means a house or hostel used exclusively for the provision of residential accommodation to:

(a) mature persons or disadvantaged persons and dependent children of mature persons or disadvantaged persons; and

(b) persons the duties of whose employment consist of, or consist principally of, caring for persons referred to in paragraph (a); and

(c) partners and children of persons referred to in paragraph (b).

1157JA Expense benefits

1157JA(1) A person (the employee) receives an expense benefit if an amount is paid to, or on behalf of, the employee or a person connected with the employee by:

(a) an employer of the employee; or

(b) an associate of the employer; or

(c) a person (the arranger), other than the employer or an associate of the employer, under an arrangement between:

(i) the employer or an associate of the employer; and

(ii) the arranger or another person;

and is so paid in connection with an expense or expenses of a private nature that have been, or will or may be, incurred by the employee or person connected with the employee.

1157JA(2) The following are persons connected with the employee:

(a) a partner of the employee;

(b) a dependent child of the employee or of the employee’s partner;

(c) a person who would be a dependent child of the employee or of the employee’s partner if the person was not receiving a newstart allowance or a sickness allowance.

1157JB Exempt expense benefit

An amount paid as mentioned in subsection 1157JA(1) is exempt if:

(a) the amount is paid to reimburse expenses incurred in connection with the employee’s employment; or

(b) the employee requires the amount to be applied in paying expenses related to the employee’s employment.

1157JC Financial investment benefit

1157JC(1) A person (the employee) receives a financial investment benefit if:

(a) an employer of the employee; or

(b) an associate of the employer; or

(c) a person (the arranger), other than the employer or an associate of the employer, under an arrangement between:

(i) the employer or an associate of the employer; or

(ii) the arranger or another person;

pays for, or reimburses the cost of, the acquisition of a financial investment by the employee or a person connected with the employee.

1157JC(2) The making by a person, for the benefit of another person, of contributions to a superannuation fund or an ATO small superannuation account does not constitute payment for the acquisition of a financial investment by the other person.

1157JC(3) The following are persons connected with the employee:

(a) a partner of the employee;

(b) a dependent child of the employee or of the employee’s partner;

(c) a person who would be a dependent child of the employee or of the employee’s partner if the person was not receiving a newstart allowance or a sickness allowance.

Division 3—Value of car fringe benefits

1157K Method of valuing car fringe benefits

1157K(1) Subject to subsection (2), the value of a car fringe benefit is to be worked out in accordance with section 1157L.

1157K(2) If a determination is in force under section 1157M, the value of a car fringe benefit is to be worked out in accordance with the determination.

1157L Value of car fringe benefits

1157L(1) This is how to work out the value of a car fringe benefit:

Method statement

Step 1. Work out the engine capacity of the car and go to the relevant Part of the Car Fringe Benefits Value Table.

Step 2. Work out how old the car is and go to the appropriate row in the Table.

Step 3. Work out how many complete months in the appropriate tax year the person had or will have the car fringe benefit and go to the appropriate column in the Table: the number where that row and column intersect is the value of the car fringe benefit.

Note: If the person is a member of a couple, the value of the car fringe benefit is to be halved in certain circumstances (see subsection (3)).

1157L(2) The following Table is to be used in working out the value of a car fringe benefit:

CAR FRINGE BENEFITS VALUE TABLE | ||||||||||||||||||||||||||||||||

PART A—Car engine size up to 1600cc | ||||||||||||||||||||||||||||||||

| car age |

| ||||||||||||||||||||||||||||||

item | (years) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |||||||||||||||||||

1. | 1 | 93.8 | 188 | 281 | 375 | 469 | 563 | 656 | 750 | 844 | 938 | 1031 | 1125 | |||||||||||||||||||

2. | 2 | 83.6 | 168 | 252 | 336 | 420 | 504 | 588 | 672 | 756 | 840 | 923.8 | 1008 | |||||||||||||||||||

3. | 3 | 74.2 | 148 | 223 | 297 | 371 | 445 | 520 | 594 | 668 | 742 | 816.4 | 890.6 | |||||||||||||||||||

4. | 4 | 64.5 | 129 | 193 | 258 | 322 | 387 | 451 | 516 | 580 | 645 | 709 | 773.4 | |||||||||||||||||||

5. | 5 | 54.7 | 109 | 164 | 219 | 273 | 328 | 383 | 438 | 492 | 547 | 601.6 | 656.3 | |||||||||||||||||||

6. | 6 | 44.9 | 89.8 | 135 | 180 | 225 | 270 | 314 | 359 | 404 | 449 | 494.1 | 539.1 | |||||||||||||||||||

7. | 7 | 35.2 | 70.3 | 105 | 141 | 176 | 211 | 246 | 281 | 316 | 352 | 386.7 | 421.9 | |||||||||||||||||||

8. | 8 | 25.4 | 50.8 | 76.2 | 102 | 127 | 152 | 178 | 203 | 229 | 254 | 279.3 | 304.7 | |||||||||||||||||||

9. | 9 | 15.6 | 31.3 | 46.9 | 62.5 | 78.1 | 93.8 | 109 | 125 | 141 | 156 | 171.9 | 187.5 | |||||||||||||||||||

10. | 10+ | 5.86 | 11.7 | 17.6 | 23.4 | 29.3 | 35.2 | 41 | 46.9 | 52.7 | 58.6 | 64.45 | 70.31 | |||||||||||||||||||

| ||||||||||||||||||||||||||||||||

PART B—Car engine size 1601cc to 2850cc | ||||||||||||||||||||||||||||||||

11. | 1 | 229 | 458 | 688 | 917 | 1146 | 1375 | 1604 | 1833 | 2063 | 2292 | 2521 | 2750 | |||||||||||||||||||

12. | 2 | 210 | 422 | 633 | 844 | 1055 | 1266 | 1477 | 1688 | 1898 | 2109 | 2320 | 2531 | |||||||||||||||||||

13. | 3 | 193 | 385 | 578 | 771 | 964 | 1156 | 1349 | 1442 | 1734 | 1927 | 2120 | 2313 | |||||||||||||||||||

14. | 4 | 174 | 349 | 523 | 698 | 872 | 1047 | 1221 | 1396 | 1570 | 1745 | 1919 | 2094 | |||||||||||||||||||

15. | 5 | 156 | 313 | 469 | 625 | 781 | 938 | 1094 | 1250 | 1406 | 1563 | 1719 | 1875 | |||||||||||||||||||

16. | 6 | 138 | 276 | 414 | 552 | 690 | 828 | 966 | 1104 | 1242 | 1380 | 1518 | 1656 | |||||||||||||||||||

17. | 7 | 120 | 240 | 359 | 479 | 599 | 719 | 839 | 958 | 1078 | 1198 | 1318 | 1438 | |||||||||||||||||||

18. | 8 | 102 | 203 | 305 | 406 | 508 | 609 | 711 | 813 | 914 | 1016 | 1117 | 1219 | |||||||||||||||||||

19. | 9 | 83.3 | 167 | 250 | 333 | 417 | 500 | 583 | 667 | 750 | 833 | 916.7 | 1000 | |||||||||||||||||||

20 | 10+ | 65.1 | 130 | 195 | 260 | 326 | 391 | 456 | 521 | 586 | 651 | 716.1 | 781.3 | |||||||||||||||||||

| ||||||||||||||||||||||||||||||||

PART C—Car engine size more than 2850cc | ||||||||||||||||||||||||||||||||

21. | 1 | 354 | 708 | 1063 | 1417 | 1771 | 2125 | 2479 | 2833 | 3188 | 3542 | 3896 | 4250 | |||||||||||||||||||

22. | 2 | 327 | 656 | 984 | 1313 | 1641 | 1969 | 2297 | 2625 | 2953 | 3281 | 3609 | 3938 | |||||||||||||||||||

23. | 3 | 302 | 604 | 906 | 1208 | 1510 | 1813 | 2115 | 2417 | 2719 | 3021 | 3323 | 3625 | |||||||||||||||||||

24. | 4 | 276 | 552 | 828 | 1104 | 1380 | 1656 | 1932 | 2208 | 2484 | 2760 | 3036 | 3313 | |||||||||||||||||||

25. | 5 | 250 | 500 | 750 | 1000 | 1250 | 1500 | 1750 | 2000 | 2250 | 2500 | 2750 | 3000 | |||||||||||||||||||

26. | 6 | 224 | 448 | 672 | 896 | 1120 | 1344 | 1568 | 1792 | 2016 | 2240 | 2464 | 2688 | |||||||||||||||||||

27. | 7 | 198 | 396 | 594 | 792 | 990 | 1188 | 1385 | 1583 | 1781 | 1979 | 2177 | 2375 | |||||||||||||||||||

28. | 8 | 172 | 344 | 516 | 688 | 859 | 1031 | 1203 | 1375 | 1547 | 1719 | 1891 | 2063 | |||||||||||||||||||

29. | 9 | 146 | 292 | 438 | 583 | 729 | 875 | 1021 | 1167 | 1313 | 1458 | 1604 | 1750 | |||||||||||||||||||

30. | 10+ | 120 | 240 | 359 | 479 | 599 | 719 | 839 | 958 | 1078 | 1198 | 1318 | 1438 | |||||||||||||||||||

1157L(3) If:

(a) the person is a member of a couple; and

(b) the person’s partner receives a car fringe benefit in the appropriate tax year; and

(c) the person’s and the partner’s car fringe benefits relate to the same car;

the value of the car fringe benefit is to be halved.

1157M Minister may determine alternative method of valuing car fringe benefits

1157M(1) The Minister may determine an alternative method for valuing car fringe benefits.

1157M(2) A determination under subsection (1) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

1157M(3) A determination in subsection (1):

(a) starts to have effect on the day on which it is notified in the Gazette; and

(b) ceases to have effect at the end of 6 months after the day on which it is notified in the Gazette if it has not been revoked before then.

Division 4—Value of school fees fringe benefits

1157N Value of school fees fringe benefits

The value of a school fees fringe benefit is the amount of the payment that constitutes the school fees benefit.

Division 5—Value of health insurance fringe benefits

1157O Value of health insurance fringe benefits

The value of a health insurance fringe benefit is the amount of the payment that constitutes the health insurance benefit.

Division 6—Value of loan fringe benefits

1157P Method of valuing loan fringe benefits

1157P(1) Subject to subsection (2), the value of a loan fringe benefit is to be worked out in accordance with section 1157Q.

1157P(2) If a determination is in force under section 1157R, the value of a loan fringe benefit is to be worked out in accordance with the determination.

1157Q Value of loan fringe benefits

1157Q(1) This is how to work out the value of a loan fringe benefit:

Method statement

Step 1. Work out whether the loan is a housing loan or another type of loan.

Note: For housing loan see subsection 10A(9).

Step 2. Work out the notional rate of interest for the loan using subsection (2), (3) or (4).

Step 3. Work out the actual rate of interest for the loan in the appropriate tax year using subsection (5).

Step 4. Work out whether the actual rate of interest exceeds the notional rate of interest.

Step 5. If the actual rate of interest is equal to or exceeds the notional rate of interest, the value of the loan fringe benefit is nil.

Note: If the value of the loan fringe benefit is nil, you do not have to go any further in the Method statement.

Step 6. If the actual rate of interest is less than the notional rate of interest, take the actual rate of interest away from the notional rate of interest.

Step 7. Work out the amount of the loan (both the principal and interest) that is outstanding in the appropriate tax year using subsection (6).

Step 8. Multiply the rate of interest obtained in Step 6 and the amount obtained in Step 7: the result is the interim value of the loan.

Step 9. Work out how many complete weeks in the appropriate tax year the person had or will have the loan: the result is the number of allowable weeks.

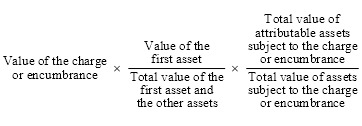

Step 10. Apply the formula:

Step 11. The amount obtained by applying the formula in Step 10 is the value of the loan fringe benefit.

Note: If the person is a member of a couple, the value of the loan fringe benefit is to be halved in certain circumstances (see subsection (7)).

1157Q(2) The notional rate of interest for the tax year ending 30 June 1993 is:

(a) 10% for a housing loan; and

(b) 13.5% for any other loan.

1157Q(3) The notional rate of interest for the tax years ending 30 June 1994 and 30 June 1995 is:

(a) 6.95% for a housing loan; and

(b) 11.75% for any other loan.

1157Q(4) The notional rate of interest for any subsequent tax year is the market rate of interest for 1 April in the preceding tax year.

1157Q(4A) For the purposes of subsection (4):

market rate of interest, for a particular day, means:

(a) for a housing loan—the lowest variable rate of interest for a housing loan; or

(b) for any other loan—the lowest variable rate of interest for any other loan;

that is available on that day from a bank which is one of 4 banks specified in a written determination made by the Minister.

1157Q(4B) A determination under subsection (4A) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

1157Q(5) The actual rate of interest for the loan is:

(a) if the loan starts after 1 July in the appropriate tax year—the rate of interest that is payable under the loan on the day on which the loan starts; and

(b) in any other case—the rate of interest that is payable under the loan on 1 July in the appropriate tax year.

1157Q(6) The amount of the loan that is outstanding is:

(a) if the loan starts after 1 July in the appropriate tax year—the amount that is outstanding on the day on which the loan starts; and

(b) in any other case—the amount that is outstanding on 1 July in the appropriate tax year.

1157Q(7) If:

(a) the person is a member of a couple; and

(b) the person’s partner receives a loan fringe benefit in the appropriate tax year; and

(c) the person’s and the partner’s loan fringe benefits relate to the same loan;

the value of the loan fringe benefit obtained in Step 11 of the Method statement is to be halved.

1157R Minister may determine alternative method of valuing loan fringe benefits

1157R(1) The Minister may determine an alternative method for valuing loan fringe benefits.

1157R(2) A determination under subsection (1) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

1157R(3) A determination in subsection (1):

(a) starts to have effect on the day on which it is notified in the Gazette; and

(b) ceases to have effect at the end of 6 months after the day on which it is notified in the Gazette if it has not been revoked before then.

Division 7—Value of housing fringe benefits

Subdivision A—Grants of housing rights

1157S Methods of valuing housing fringe benefits—grants of housing rights

1157S(1) Subject to subsection (3), the value of a housing fringe benefit to which subsection 1157I(1) applies that is provided to a person who is not an employee of the Defence Force is to be worked out in accordance with section 1157T.

1157S(2) Subject to subsection (3), the value of a housing fringe benefit to which subsection 1157I(1) applies that is provided to an employee of the Defence Force is to be worked out in accordance with section 1157TA.

1157S(3) If:

(a) a determination is in force under section 1157U; and

(b) the determination applies to housing fringe benefits to which subsection 1157I(1) applies;

the value of a housing fringe benefit to which subsection 1157I(1) applies is to be worked out in accordance with the determination.

1157T Value of grants of housing rights—general

1157T(1) This is how to work out the value of a housing fringe benefit to which subsection 1157I(1) applies that is provided to a person who is not an employee of the Defence Force:

Method statement

Step 1. Work out the location of the unit of accommodation and go to the appropriate row of the Housing Fringe Benefits Value Table.

Step 2. Work out the type of accommodation and go to the appropriate column in the Table: the number where the row and column intersect is the weekly market rent of the unit of accommodation.

Note: If the person is a member of a couple, the weekly market rent is to be halved in certain circumstances (see subsection (4)).

Step 3. Work out how many complete weeks in the appropriate tax year the unit of accommodation was or will be available to the person.

Step 4. Multiply the weekly market rent of the unit of accommodation and the number of weeks obtained in Step 3: the result is the provisional value of the housing fringe benefit.

Step 5. Work out the allowable rent for the unit of accommodation in the appropriate tax year using subsection (3).

Note: If the person is a member of a couple, the allowable rent is to be halved in certain circumstances (see subsection (4)).

Step 6. Take the allowable rent away from the provisional value of the housing fringe benefit: the result is the value of the housing fringe benefit.

1157T(2) The following Table is to be used in working out the value of a housing fringe benefit to which subsection 1157I(1) applies that is provided to a person who is not an employee of the Defence Force:

Housing fringe benefits value table | |||||

Location | Type of accommodation | ||||

House, flat or home unit | Any other unit of | ||||

3 or more bedrooms | 1‑2 bedrooms | accommodation | |||

Metropolitan | 140 | 120 | 85 | ||

Non‑metropolitan | 100 | 90 | 70 | ||

Special housing | 80 | 80 | 25 | ||

Outside Australia | 140 | 120 | 85 | ||

Note 1: For unit of accommodation, metropolitan location, non‑metropolitan location and special housing location see section 10A.

Note 2: A housing fringe benefit that is received outside Australia is to be valued (see section 1157B).

Note 3: For Australia see subsection 23(1).

1157T(3) The allowable rent is the amount of rent that the Secretary is satisfied is payable for the unit of accommodation in the appropriate tax year by:

(a) if the person is not a member of a couple—the person; or

(b) if the person is a member of a couple—the person and the person’s partner.

1157T(4) If:

(a) the person is a member of a couple; and

(b) the person’s partner receives a housing fringe benefit in the appropriate tax year; and

(c) the person’s and the partner’s housing fringe benefits relate to the same unit of accommodation;

the weekly market rent obtained in Step 2 of the Method statement and the allowable rent obtained in Step 5 of the Method statement are both to be halved.

1157TA Value of grants of housing rights—employees of the Defence Force

1157TA(1) This is how to work out the value of a housing fringe benefit to which subsection 1157I(1) applies that is provided to an employee of the Defence Force:

Method statement

Step 1. Work out the type of accommodation and go to the appropriate column in the Housing Fringe Benefits Value Table (Defence Force Employees): the number in the appropriate column is the weekly market rent of the unit of accommodation.

Note: If the person is a member of a couple, the weekly market rent is to be halved in certain circumstances (see subsection (4)).

Step 2. Work out how many complete weeks in the appropriate tax year the unit of accommodation was or will be available to the person.

Step 3. Multiply the weekly market rent of the unit of accommodation and the number of weeks obtained in Step 2: the result is the provisional value of the housing fringe benefit.

Step 4. Work out the allowable rent for the unit of accommodation in the appropriate tax year using subsection (3).

Note: If a person is a member of a couple, the allowable rent is to be halved in certain circumstances (see subsection (4)).

Step 5. Take the allowable rent away from the provisional value of the housing fringe benefit: the result is the value of the housing fringe benefit.

Note: For employee see section 10A.

1157TA(2) The following Table is to be used in working out the value of a housing fringe benefit to which subsection 1157I(1) applies that is provided to an employee of the Defence Force:

Housing Fringe Benefits Value Table (Defence Force Employees) | ||

Type of accommodation | ||

House, flat or home unit | Any other unit of accommodation | |

3 or more bedrooms | 1‑2 bedrooms | |

80 | 80 | 25 |

Note 1: For employee see section 10A.

Note 2: For unit of accommodation see section 10A.

Note 3: A housing fringe benefit that is received outside Australia is to be valued (see section 1157B).

Note 4: For Australia see subsection 23(1).

1157TA(3) The allowable rent is the amount of rent that the Secretary is satisfied is payable for the unit of accommodation in the appropriate tax year by:

(a) if the person is not a member of a couple—the person; or

(b) if the person is a member of a couple—the person and the person’s partner.

1157TA(4) If:

(a) the person is a member of a couple; and

(b) the person’s partner receives a housing fringe benefit in the appropriate tax year; and

(c) the person’s and the partner’s housing fringe benefits relate to the same unit of accommodation;

the weekly market rent obtained in Step 1 of the Method statement and the allowable rent obtained in Step 4 of the Method statement are both to be halved.

Subdivision B—Payments associated with loans

1157TB Method of valuing housing fringe benefits—payments associated with loans

1157TB(1) Subject to subsection (2), the value of a housing fringe benefit to which subsection 1157I(2) applies is to be worked out in accordance with section 1157TC.

1157TB(2) If:

(a) a determination is in force under section 1157U; and

(b) the determination applies to housing fringe benefits to which subsection 1157I(2) applies;

the value of a housing fringe benefit to which subsection 1157I(2) applies is to be worked out in accordance with the determination.

1157TC Value of payments associated with loans

The value of a housing fringe benefit to which subsection 1157I(2) applies is the amount of the payment that constitutes the housing benefit.

Subdivision C—Payments associated with enjoying housing rights

1157TD Methods of valuing housing fringe benefits—payments associated with enjoying housing rights

1157TD(1) Subject to subsection (3), the value of a housing fringe benefit to which subsection 1157I(4) applies that is provided to a person who is not an employee of the Defence Force is to be worked out in accordance with section 1157TE.

1157TD(2) Subject to subsection (3), the value of a housing fringe benefit to which subsection 1157I(4) applies that is provided to an employee of the Defence Force is to be worked out in accordance with section 1157TF.

1157TD(3) If:

(a) a determination is in force under section 1157U; and

(b) the determination applies to housing fringe benefits to which subsection 1157I(4) applies;

the value of a housing fringe benefit to which subsection 1157I(4) applies is to be worked out in accordance with the determination.

1157TE Value of payments associated with enjoying housing rights—general

1157TE(1) This is how to work out the value of a housing fringe benefit to which subsection 1157I(4) applies that is provided to a person who is not an employee of the Defence Force:

Method statement

Step 1. Work out the location of the unit of accommodation and go to the appropriate row of the Housing Fringe Benefits Value Table.

Step 2. Work out the type of accommodation and go to the appropriate column in the Table: the number where the row and column intersect is the weekly market rent of the unit of accommodation.

Note: If the person is a member of a couple, the weekly market rent is to be halved in certain circumstances (see subsection (4)).

Step 3. Work out how many complete weeks in the appropriate tax year the unit of accommodation was or will be available to the person.

Step 4. Multiply the weekly market rent of the unit of accommodation and the number of weeks obtained in Step 3: the result is the provisional value of the housing fringe benefit.

Step 5. Work out the allowable rent for the unit of accommodation in the appropriate tax year using subsection (3).

Note: If a person is a member of a couple, the allowable rent is to be halved in certain circumstances (see subsection (4)).

Step 6. Work out the amount the employer paid or will pay by way of the housing fringe benefits in respect of the unit of accommodation in the appropriate tax year: the result is the employer subsidy.

Step 7. Work out the amount (if any) by which the allowable rent exceeds the employer subsidy: the result is the employee contribution.

Note: If the employer subsidy equals or exceeds the allowable rent, the employee contribution is nil.

Step 8. Take the employee contribution away from the provisional value of the housing fringe benefit: the result is the value of the housing fringe benefit.

1157TE(2) The following Table is to be used in working out the value of a housing fringe benefit to which subsection 1157I(4) applies that is provided to a person who is not an employee of the Defence Force:

Housing fringe benefits value table | ||||

Location | Type of accommodation | |||

House, flat or home unit | Any other unit of | |||

3 or more bedrooms | 1‑2 bedrooms | accommodation | ||

Metropolitan | 140 | 120 | 85 | |

Non‑metropolitan | 100 | 90 | 70 | |

Special housing | 80 | 80 | 25 | |

Outside Australia | 140 | 120 | 85 | |

Note 1: For unit of accommodation, metropolitan location, non‑metropolitan location and special housing location see section 10A.

Note 2: A housing fringe benefit that is received outside Australia is to be valued (see section 1157B).

Note 3: For Australia see subsection 23(1).

1157TE(3) The allowable rent is the amount of rent that the Secretary is satisfied is payable for the unit of accommodation in the appropriate tax year by:

(a) if the person is not a member of a couple—the person; or

(b) if the person is a member of a couple—the person and the person’s partner.

1157TE(4) If:

(a) the person is a member of a couple; and

(b) the person’s partner receives a housing fringe benefit in the appropriate tax year; and

(c) the person’s and the partner’s housing fringe benefits relate to the same unit of accommodation;

the weekly market rent obtained in Step 2 of the Method statement and the allowable rent obtained in Step 5 of the Method statement are both to be halved.

1157TF Value of payments associated with enjoying housing rights—employees of the Defence Force

1157TF(1) This is how to work out the value of a housing fringe benefit to which subsection 1157I(4) applies that is provided to an employee of the Defence Force:

Method statement

Step 1. Work out the type of accommodation and go to the appropriate column in the Housing Fringe Benefits Value Table (Defence Force Employees): the number in the appropriate column is the weekly market rent of the unit of accommodation.

Note: If the person is a member of a couple, the weekly market rent is to be halved in certain circumstances (see subsection (4)).

Step 2. Work out how many complete weeks in the appropriate tax year the unit of accommodation was or will be available to the person.

Step 3. Multiply the weekly market rent of the unit of accommodation and the number of weeks obtained in Step 2: the result is the provisional value of the housing fringe benefit.

Step 4. Work out the allowable rent for the unit of accommodation in the appropriate tax year using subsection (3).

Note: If a person is a member of a couple, the allowable rent is to be halved in certain circumstances (see subsection (4)).

Step 5. Work out the amount the employer paid or will pay by way of the housing fringe benefits in respect of the unit of accommodation in the appropriate tax year: the result is the employer subsidy.

Step 6. Work out the amount (if any) by which the allowable rent exceeds the employer subsidy: the result is the employee contribution.

Note: If the employer subsidy equals or exceeds the allowable rent, the employee contribution is nil.

Step 7. Take the employee contribution away from the provisional value of the housing fringe benefit: the result is the value of the housing fringe benefit.

1157TF(2) The following Table is to be used in working out the value of a housing fringe benefit to which subsection 1157I(4) applies that is provided to an employee of the Defence Force:

Housing Fringe Benefits Value Table (Defence Force Employees) | ||

Type of accommodation | ||

House, flat or home unit | Any other unit of accommodation | |

3 or more bedrooms | 1‑2 bedrooms | |

80 | 80 | 25 |

Note 1: For employee see section 10A.

Note 2: For unit of accommodation see section 10A.

Note 3: A housing fringe benefit that is received outside Australia is to be valued (see section 1157B).

Note 4: For Australia see subsection 23(1).

1157TF(3) The allowable rent is the amount of rent that the Secretary is satisfied is payable for the unit of accommodation in the appropriate tax year by:

(a) if the person is not a member of a couple—the person; or

(b) if the person is a member of a couple—the person and the person’s partner.

1157TF(4) If:

(a) the person is a member of a couple; and

(b) the person’s partner receives a housing fringe benefit in the appropriate tax year; and

(c) the person’s and the partner’s housing fringe benefits relate to the same unit of accommodation;

the weekly market rent obtained in Step 1 of the Method statement and the allowable rent obtained in Step 4 of the Method statement are both to be halved.

Subdivision D—Alternative methods of valuing housing fringe benefits

1157U Minister may determine alternative method of valuing housing fringe benefits

1157U(1) The Minister may determine an alternative method for valuing housing fringe benefits.

1157U(1A) A determination under subsection (1) may apply to all housing fringe benefits or only to specified kinds of housing fringe benefits.

1157U(2) A determination under subsection (1) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

1157U(3) A determination in subsection (1):

(a) starts to have effect on the day on which it is notified in the Gazette; and

(b) ceases to have effect at the end of 6 months after the day on which it is notified in the Gazette if it has not been revoked before then.

Division 8—Value of expense fringe benefit

1157UA Value of expense fringe benefits

The value of an expense fringe benefit is the amount of the payment that constitutes the expense benefit.

Division 9—Value of financial investment fringe benefit

1157UB Value of financial investment fringe benefit

The value of a financial investment fringe benefit is the value of the financial investment benefit that constitutes the financial investment fringe benefit when the financial investment benefit is received.

Division 8—Foreign currency rates

1157V Foreign currency rates

1157V(1) If:

(a) it is necessary, for the purposes of this Part, to work out an amount or value of a fringe benefit; and

(b) the amount or value of the benefit is expressed in a foreign currency;

the amount or value in Australian currency is to be worked out using the market exchange rate for 1 July in the appropriate tax year.

1157V(2)If there is no market exchange rate for 1 July in the appropriate tax year (for example, because of a national public holiday), the market exchange rate to be used is the market exchange rate that applied on the last working day immediately before that 1 July.

1157V(3) For the purposes of this section, the market exchange rate of a foreign currency is the on‑demand airmail buying rate for that currency available at the Commonwealth Bank of Australia.

Part 3.13—Imprisonment

1158 Some social security payments not payable during period in gaol or in psychiatric confinement following criminal charge

An instalment of a social security pension, a social security benefit, a parenting payment or a pensioner education supplement is not payable to a person in respect of a day on which the person is:

(a) in gaol; or

(b) undergoing psychiatric confinement because the person has been charged with an offence.

Note 1: For in gaol see subsection 23(5).

Note 2: For psychiatric confinement see subsections 23(8) and (9).

1159 Payment may be redirected to dependent partner or child

1159(1) If:

(a) a social security pension (other than pension PP (single)) is not payable to a person on a pension payday because of section 1158; and

(b) the person’s partner is dependent on the person;

the Secretary may authorise the payment of all or some of the instalment that would otherwise have been payable to the person to be paid to:

(c) the partner; or

(d) someone else for the benefit of the partner.

1159(2) If:

(a) a social security pension (other than pension PP (single)) is not payable to a person on a pension payday because of section 1158; and

(b) a young person is dependent on the person;

the Secretary may authorise the payment of all or some of the instalment that would otherwise have been payable to the person to be paid to:

(c) the young person; or

(d) someone else for the benefit of the young person.

Part 3.14—Compensation recovery

Division 1—General

1160 General effect of Part

1160(1) This Part operates in certain specified circumstances to do one or more of the following:

(a) reduce a person’s compensation affected payment;

(b) render a person’s compensation affected payment not payable;

(c) require the repayment of some or all of a person’s compensation affected payment;

because of the receipt of compensation by the person or the person’s partner.

1160(2) This Part applies whether or not there is any connection between the circumstances that give rise to the person’s qualification for the compensation affected payment and the circumstances that give rise to the receipt of compensation by the person or the person’s partner.

1161 Application of Part

1161(1) Subject to subsections (2) to (7), payments of a compensation affected payment are affected under this Part if:

(a) whether the compensation was received before or after the commencement of this Part, the compensation affected payment is:

(i) a newstart allowance in relation to which, under Subdivision BA of Division 1 of Part 2.12, the recipient of the allowance is not required to satisfy the activity test; or

(ii) a sickness allowance; or

(iii) a sickness benefit under the 1947 Act; or

(iv) a rehabilitation allowance under the 1947 Act payable in place of sickness benefit under the 1947 Act; or

(b) in the case of any other kind of compensation affected payment, the compensation was received on or after 1 May 1987 and the claim for the compensation affected payment was made on or after 1 May 1987.

1161(2) This Part applies to a pension PP (single) if:

(a) the compensation was received on or after 20 March 1992; and

(b) the claim for the pension was made on or after 20 March 1992.

1161(3) This Part applies to carer payment if:

(a) the compensation was received on or after 1 January 1993; and

(b) the claim for the carer payment was made on or after 1 January 1993.

1161(4) This Part applies to a mature age allowance or mature age partner allowance if:

(a) the compensation was received on or after 20 March 1994; and

(b) the claim for the allowance was made on or after 20 March 1994.

1161(5) This Part applies to partner allowance if:

(a) the compensation was received on or after 20 September 1994; and

(b) the claim for the allowance was made on or after 20 September 1994.

1161(6) This Part applies to age pension if:

(a) the compensation was received on or after 20 March 1997; and

(b) the person’s provisional commencement day or start day for the age pension is on or after 20 March 1997.

1161(7) In spite of subsection (1), Division 4 does not apply to:

(a) a disability support wife pension; or

(b) a special needs disability support wife pension;

received by a person if:

(c) the compensation was received by the person on or after 1 May 1987 but before 1 January 1994; and

(d) the claim for the pension was made on or after 1 May 1987 but before 1 January 1994.

1162 Part to bind Crown

This Part binds the Crown in right of the Commonwealth, of each of the States, of the Australian Capital Territory, of the Northern Territory and of Norfolk Island.

1163 Interpretation

1163(1) In a provision of this Part (other than section 1164), a reference to the payment or receipt of periodic compensation payments includes a reference to the payment or receipt, as the case may be, of arrears of periodic compensation payments.

1163(2) A reference in this Part to periodic compensation payments is a reference to:

(a) a periodic compensation payment; or

(b) if 2 or more periodic compensation payments relate to the same period, those payments.

1163(3) In this Part, a reference to a person’s partner receiving or claiming a compensation affected payment includes a reference to the partner receiving or claiming a compensation affected pension within the meaning of the Veterans’ Entitlements Act.

1164 Certain lump sums to be treated as though they were received as periodic compensation payments

If:

(a) a person was entitled to periodic compensation payments under a law of a State or Territory; and

(b) the person’s entitlement to the periodic payments was converted under the law of the State or Territory into an entitlement to a lump sum; and

(c) the lump sum was calculated by reference to a period;

this Part applies to the person as if:

(d) the person had not received:

(i) the lump sum; or

(ii) if the lump sum was to be paid in instalments—any of the instalments; and

(e) the person had received in each fortnight during the period a periodic compensation payment equal to:

![]()

where:

lump sum amount is the amount of the lump sum referred to in paragraph (b);

number of fortnights in the period is the number of whole fortnights in the period referred to in paragraph (c).

1165 Effect of certain State and Territory laws

If:

(a) a law of a State or Territory provides for the payment of compensation; and

(b) the law includes a provision to the effect that a person’s compensation under the law is to be or may be reduced or cancelled if the person is qualified for or receives payments under this Act;

this Act applies as if the person had received under the law the compensation that the person would have received under the law if the provision referred to in paragraph (b) had not been enacted.

Division 2—Enforcement of compensation rights

1166 Secretary may require person to take action to obtain compensation

1166(1) If:

(a) a person receives or claims a compensation affected payment; and

(b) the person or the person’s partner is, or, in the Secretary’s opinion, may be, entitled to compensation; and

(c) the person or the partner:

(i) has taken no action to claim or obtain the compensation; or

(ii) has taken no action that the Secretary considers reasonable to claim or obtain the compensation;

the Secretary may require the person or the partner to take the action specified by the Secretary.

1166(2) The action specified by the Secretary is to be the action that the Secretary considers reasonable to enable the person to claim or obtain the compensation.

1166(3) Even though a person has entered into an agreement to give up the person’s right to compensation, the Secretary may form the opinion that the person may be entitled to compensation if the Secretary is satisfied that the agreement is void, ineffective or unenforceable.

1166(4) For the purposes of subsection (3), a person enters into an agreement to give up the person’s right to compensation if the person:

(a) enters into an agreement to waive the person’s right to compensation; or

(b) enters into an agreement to withdraw the person’s claim for compensation.

1167 Failure to comply with a requirement to take action to obtain compensation

1167(1) If the Secretary, under section 1166, requires a person who receives or claims a compensation affected payment to take action to claim or obtain compensation, the compensation affected payment is not payable to the person or is not to be granted, as the case may be, unless the person complies with the requirement.

1167(2) If the Secretary requires the partner of a person who receives or claims a compensation affected payment to take action to claim or obtain compensation, the compensation affected payment is not payable to the person or is not to be granted, as the case may be, unless the partner complies with the requirement.

Division 3—Receipt of compensation

1168 Application

A provision of this Division that refers to a person receiving or claiming a compensation affected payment and receiving a lump sum compensation payment has effect regardless of whether the lump sum compensation payment was received before or after the person received or claimed the compensation affected payment.

1169 Compensation affected payment not payable during lump sum preclusion period

1169(1) If:

(a) a person receives or claims a compensation affected payment; and

(b) the person receives a lump sum compensation payment;

the compensation affected payment is not payable to the person in relation to any day or days in the lump sum preclusion period.

1169(2) In this section:

lump sum compensation payment does not include a lump sum payment:

(a) to which section 1164 applies; or

(b) that relates only to arrears of periodic compensation payments.

1170 Lump sum preclusion period

1170(1) Subject to subsection (2), if a person receives both periodic compensation payments and a lump sum compensation payment, the lump sum preclusion period is the period that:

(a) begins on the day following the last day of the periodic payments period or, where there is more than one periodic payments period, the day following the last day of the last periodic payments period; and

(b) ends at the end of the number of weeks worked out under subsections (4) and (5).

1170(2) If a person chooses to receive part of an entitlement to periodic compensation payments in the form of a lump sum, the lump sum preclusion period is the period that:

(a) begins on the first day on which the person’s periodic compensation payment is a reduced payment because of that choice; and

(b) ends at the end of the number of weeks worked out under subsections (4) and (5).

` 1170(3) If neither of subsections (1) and (2) applies, the lump sum preclusion period is the period that:

(a) begins on the day on which the loss of earnings or loss of capacity to earn began; and

(b) ends at the end of the number of weeks worked out under subsections (4) and (5).

1170(4) The number of weeks in the lump sum preclusion period in relation to a person is the number worked out using the formula:

1170(5) If the number worked out under subsection (4) is not a whole number, the number is to be rounded down to the nearest whole number.

1171 Deemed lump sum payment arising from separate payments

1171(1) If:

(a) a person receives 2 or more lump sum payments in relation to the same event that gave rise to an entitlement of the person to compensation (the multiple payments); and

(b) at least one of the multiple payments is made wholly or partly in respect of lost earnings or lost capacity to earn;

the following paragraphs have effect for the purposes of this Act and the Administration Act:

(c) the person is taken to have received one lump sum compensation payment (the single payment) of an amount equal to the sum of the multiple payments;

(d) the single payment is taken to have been received by the person:

(i) on the day on which he or she received the last of the multiple payments; or

(ii) if the multiple payments were all received on the same day, on that day.

1171(2) A payment is not a lump sum payment for the purposes of paragraph (1)(a) if it relates exclusively to arrears of periodic compensation.

1172 Lump sum compensation not counted as ordinary income

If an amount of a compensation affected payment is not payable to a person under section 1169 because the person has received a lump sum compensation payment, that lump sum compensation payment is not to be regarded as ordinary income of either the person or the person’s partner (if any) for the purposes of a provision of this Act, other than point 1071A‑4.

1173 Effect of periodic compensation payments on rate of person’s compensation affected payment

1173(1) If:

(a) a person receives periodic compensation payments; and

(b) the person was not, at the time of the event that gave rise to the entitlement of the person to the compensation, qualified for, and receiving, a compensation affected payment; and

(c) the person receives or claims a compensation affected payment in relation to a day or days in the periodic payments period;

the rate of the person’s compensation affected payment in relation to that day or those days is reduced in accordance with subsection (2).

1173(2) The person’s daily rate of compensation affected payment is reduced by the amount of the person’s daily rate of periodic compensation.

1173(3) The reference in subsection (2) to a daily rate of periodic compensation is a reference to the amount worked out by dividing the total amount of the periodic compensation payments referred to in paragraph (1)(a) by the number of days in the periodic payments period.

1173(4) If:

(a) a person receives periodic compensation payments; and

(b) at the time of the event that gave rise to the entitlement of the person to compensation, the person was qualified for, and was receiving, a compensation affected payment; and

(c) the person receives or claims a compensation affected payment in relation to a day or days in the periodic payments period;

the periodic compensation payments are to be treated as ordinary income of the person for the purposes of this Act.

1174 Effect of periodic compensation payments on rate of partner’s compensation affected payment

1174(1) If:

(a) a person receives periodic compensation payments; and

(b) the person is a member of a couple; and

(c) the person was not, at the time of the event that gave rise to the entitlement of the person to the compensation, qualified for, and receiving, a compensation affected payment; and

(d) the person is qualified for a compensation affected payment in relation to a day or days in the periodic payments period but, solely because of the operation of this Part, does not, or would not, receive the payment; and

(e) the person’s partner receives or claims a compensation affected payment in relation to a day or days in the periodic payments period;

the amount (if any) by which the daily rate of periodic compensation payable to the person exceeds the daily rate of the compensation affected payment for which the person is qualified in relation to a day or days in the periodic payments period (the excess amount) is to be treated as ordinary income of the person’s partner for the purpose of the calculation of the amount of the compensation affected payment referred to in paragraph (e).

1174(2) The reference in subsection (1) to a daily rate of periodic compensation is a reference to the amount worked out by dividing the total amount of the periodic compensation payments referred to in paragraph (1)(a) by the number of days in the periodic payments period.

1174(3) For the purposes of subsection (1):

(a) the amount that would, apart from this section, be the amount of the partner’s ordinary income in relation to the day or days referred to in paragraph (1)(e) is to be increased by the excess amount; and

(b) the increased amount is to be taken to be the amount of the partner’s ordinary income in relation to that day or those days, as the case may be.

1175 Rate reduction under both income/assets test and this Part

If the rate of a person’s compensation affected payment is reduced under this Part, the reduction applies to the person’s rate as reduced under the ordinary income test Module or the assets test Module of the relevant Rate Calculator.

1176 Periodic compensation not counted as ordinary income

If an instalment of a compensation affected payment payable to a person is reduced under section 1173 because of the receipt of periodic compensation payments, those payments are not to be regarded as ordinary income of the person for the purposes of a provision of this Act, other than point 1071A‑4.

Division 4—Recoverable amounts

Subdivision A—Preliminary

1177 Interpretation

If:

(a) a person is liable to make a compensation payment to another person; or

(b) an authority of a State or Territory has determined that it will make a compensation payment to another person, whether or not it is liable to make the payment;

then, for the purposes of this Division, in relation to the person to whom the compensation is payable or is to be paid, the following paragraphs have effect:

(c) a reference to the lump sum preclusion period is a reference to the period that would represent the lump sum preclusion period if the compensation were paid in accordance with the liability or determination;

(d) a reference to the periodic payments period is a reference to the period that would represent the periodic payments period if the compensation were paid in accordance with the liability or determination.

Subdivision B—Recovery from recipient of compensation affected payment

1178 Repayment of amount where both lump sum and payments of compensation affected payment have been received

1178(1) If:

(a) a person receives a lump sum compensation payment; and

(b) the person receives payments of a compensation affected payment in relation to a day or days in the lump sum preclusion period;

the Secretary may, by written notice to the person, determine that the person is liable to pay to the Commonwealth the amount specified in the notice.

1178(2) The amount to be specified in the notice is the recoverable amount under section 1179.

1179 The section 1178 recoverable amount

The recoverable amount under this section is equal to the smaller of the following amounts:

(a) the compensation part of the lump sum compensation payment;

(b) the sum of the payments of the compensation affected payment made to the person in relation to a day or days in the lump sum preclusion period.

1180 Repayment where both periodic compensation payments and payments of compensation affected payment have been received

1180(1) If:

(a) a person receives periodic compensation payments; and

(b) the person was not, at the time of the event that gave rise to the entitlement of the person to the compensation, qualified for, and receiving, a compensation affected payment; and

(c) the person receives payments of a compensation affected payment in relation to a day or days in the periodic payments period; and

(d) the payments referred to in paragraph (c) have not been reduced to nil as a result of the operation of section 1173;

the Secretary may, by written notice to the person, determine that the person is liable to pay to the Commonwealth the amount specified in the notice.

1180(2) The amount to be specified in a notice for the purpose of subsection (1) is the recoverable amount under section 1181.

1181 The section 1180 recoverable amount

1181(1) Subject to subsection (2), the recoverable amount under this section is equal to the smaller of the following amounts:

(a) the sum of the periodic compensation payments;

(b) the difference between:

(i) the sum of the compensation affected payments made to the person in relation to a day or days in the periodic payments period; and

(ii) the sum of the compensation affected payments that would have been made to the person in relation to any such day or days had those payments been made at the rate to which the payments were reduced as a result of the operation of section 1173.

1181(2) If:

(a) a person is a member of a couple; and

(b) the person’s partner receives a compensation affected payment in relation to a day or days in the periodic payments period;

the recoverable amount under this section is equal to the smaller of the following amounts:

(c) the sum of the periodic compensation payments;

(d) the difference between:

(i) the sum of the compensation affected payments made to the person and the person’s partner in relation to a day or days in the periodic payments period; and

(ii) the sum of the compensation affected payments that would have been made to the person and the person’s partner in relation to any such day or days had those payments been made at the rates to which the payments were reduced as a result of the operation of sections 1173 and 1174.

Subdivision C—Recovery from compensation payers and insurers

1182 Secretary may send preliminary notice to potential compensation payer or insurer

1182(1) If:

(a) a person (the claimant) makes a claim against another person (the potential compensation payer) for compensation; and

(b) the claimant claims a compensation affected payment in relation to a day or days in the periodic payments period or the lump sum preclusion period, as the case may be;

the Secretary may give written notice to the potential compensation payer that the Secretary may wish to recover an amount from the potential compensation payer.

1182(2) If:

(a) a person (the claimant) makes a claim against a person (the potential compensation payer) for compensation; and

(b) the claimant claims a compensation affected payment for a day or days in the periodic payments period or the lump sum preclusion period, as the case may be; and

(c) an insurer, under a contract of insurance, may be liable to indemnify the potential compensation payer against any liability arising from the claim for compensation;

the Secretary may give written notice to the insurer that the Secretary may wish to recover an amount from the insurer.

1182(3) A notice must contain:

(a) a statement of the potential compensation payer’s or insurer’s obligation under section 1183; and

(b) a statement of the effect of section 1184D so far as it relates to the notice.

1183 Potential compensation payer or insurer must notify Secretary of liability

1183(1) If a person (the potential compensation payer):

(a) is given a notice under subsection 1182(1) in relation to a person; and

(b) whether before or after receiving the notice, the potential compensation payer becomes liable to pay compensation to the person;

the potential compensation payer must give written notice to the Secretary of the liability within 7 days after:

(c) becoming liable; or

(d) receiving the notice;

whichever happens later.

Penalty: Imprisonment for 12 months.

1183(2) If an insurer:

(a) is given a notice under subsection 1182(2) in relation to a claim by a person; and

(b) whether before or after receiving the notice, the insurer becomes liable to indemnify the potential compensation payer, either wholly or partly, in relation to the claim;

the insurer must give written notice to the Secretary of the liability within 7 days after:

(c) becoming liable; or

(d) receiving the notice;

whichever happens later.

Penalty: Imprisonment for 12 months.

1183(3) Strict liability applies to:

(a) an element of an offence against subsection (1) that a notice is a notice under subsection 1182(1); and

(b) an element of an offence against subsection (2) that a notice is a notice under subsection 1182(2).

1184 Secretary may send recovery notice to compensation payer or insurer

1184(1) If:

(a) a person (the compensation payer):

(i) is liable to pay compensation to a person (a claimant); or

(ii) where the compensation payer is an authority of a State or Territory, has determined that a payment by way of compensation is to be made to a claimant; and

(b) the claimant has received a compensation affected payment in relation to a day or days in the periodic payments period or the lump sum preclusion period, as the case may be;

the Secretary may give written notice to the compensation payer that the Secretary proposes to recover from the compensation payer the amount specified in the notice.

1184(2) If:

(a) an insurer is liable, under a contract of insurance, to indemnify a compensation payer against any liability arising from a person’s claim for compensation; and

(b) the person has received a compensation affected payment in relation to a day or days in the periodic payments period or the lump sum preclusion period, as the case may be;

the Secretary may give written notice to the insurer that the Secretary proposes to recover from the insurer the amount specified in the notice.

1184(3) If a compensation payer or insurer is given notice under subsection (1) or (2), as the case may be, the compensation payer or insurer is liable to pay to the Commonwealth the amount specified in the notice.

1184(4) The amount to be specified in the notice is the recoverable amount under section 1184A.

1184(5) A notice under this section must contain a statement of the effect of section 1184D so far as it relates to such a notice.

1184(6) This section applies to an amount payable by way of compensation in spite of any law of a State or Territory (however expressed) under which the compensation is inalienable.

1184A The section 1184 recoverable amount

1184A(1) If a person receives compensation affected payments in relation to a day or days in a lump sum preclusion period, the recoverable amount under this section is equal to the smallest of the following amounts:

(a) the sum of all compensation affected payments made to the person that relate to a day or days in a lump sum preclusion period;

(b) the compensation part of the lump sum payment;

(c) in the case of a compensation payer—the maximum amount that the compensation payer is liable to pay to the person in relation to the matter at any time after receiving:

(i) a notice under section 1182 in relation to the matter; or

(ii) if the compensation payer has not received a notice under section 1182—the notice under section 1184 in relation to the matter;

(d) in the case of an insurer—the maximum amount for which the insurer is liable to indemnify the compensation payer in relation to the matter at any time after receiving:

(i) a notice under section 1182 in relation to the matter; or

(ii) if the insurer has not received a notice under section 1182—the notice under section 1184 in relation to the matter.

1184A(2) Subject to subsection (4), if:

(a) a person receives compensation affected payments in relation to a day or days in a periodic payments period; and

(b) either:

(i) the person is not a member of a couple; or

(ii) the person’s partner neither receives nor claims a compensation affected payment in relation to any day in the periodic payments period;

the recoverable amount under this section is equal to the smallest of the following amounts:

(c) the difference between:

(i) the sum of all compensation affected payments made to the person that relate to a day or days in a periodic payments period; and

(ii) the sum of all compensation affected payments that would have been made to the person in relation to any such day or days had those payments been reduced in accordance with section 1173;

(d) the sum of the amounts of the periodic compensation payments;

(e) in the case of a compensation payer—the maximum amount that the compensation payer is liable to pay to the person in relation to the matter at any time after receiving:

(i) a notice under section 1182 in relation to the matter; or