An Act to make provision for determining the financial support payable by parents for their children, and for other purposes

Part 1—Preliminary

1 Short title [see Note 1]

This Act may be cited as the Child Support (Assessment) Act 1989.

2 Commencement [see Note 1]

(1) Subject to subsection (2), this Act commences on a day to be fixed by Proclamation.

(2) If this Act does not commence under subsection (1) within the period of 6 months beginning on the day on which it receives the Royal Assent, it commences on the first day after the end of that period.

3 Duty of parents to maintain their children

(1) The parents of a child have the primary duty to maintain the child.

(2) Without limiting subsection (1), the duty of a parent to maintain a child:

(a) is not of lower priority than the duty of the parent to maintain any other child or another person; and

(b) has priority over all commitments of the parent other than commitments necessary to enable the parent to support:

(i) himself or herself; and

(ii) any other child or another person that the parent has a duty to maintain; and

(c) is not affected by:

(i) the duty of any other person to maintain the child; or

(ii) any entitlement of the child or another person to an income tested pension, allowance or benefit.

4 Objects of Act

(1) The principal object of this Act is to ensure that children receive a proper level of financial support from their parents.

(2) Particular objects of this Act include ensuring:

(a) that the level of financial support to be provided by parents for their children is determined according to their capacity to provide financial support and, in particular, that parents with a like capacity to provide financial support for their children should provide like amounts of financial support; and

(b) that the level of financial support to be provided by parents for their children should be determined in accordance with the costs of the children; and

(c) that persons who provide ongoing daily care for children should be able to have the level of financial support to be provided for the children readily determined without the need to resort to court proceedings; and

(d) that children share in changes in the standard of living of both their parents, whether or not they are living with both or either of them; and

(e) that Australia is in a position to give effect to its obligations under international agreements or arrangements relating to maintenance obligations arising from family relationship, parentage or marriage.

(3) It is the intention of the Parliament that this Act should be construed, to the greatest extent consistent with the attainment of its objects:

(a) to permit parents to make private arrangements for the financial support of their children; and

(b) to limit interferences with the privacy of persons.

4A Application of the Criminal Code

Chapter 2 of the Criminal Code applies to all offences against this Act.

5 Interpretation—definitions

(1) In this Act, unless the contrary intention appears:

AAT means the Administrative Appeals Tribunal.

adjusted taxable income has the meaning given by section 43 and subsections 61(1) and 63(1).

administrative assessment means assessment (other than assessment for the purposes of a notional assessment) under Part 5.

annualised MTAWE figure has the meaning given by section 5A.

annual rate includes an annual rate of nil.

applicable Rules of Court has the same meaning as in the Family Law Act 1975.

applicable YTD income amount has the meaning given by subsections 63AF(1) and (2).

application day has the meaning given by subsection 54B(2).

application period has the meaning given by:

(a) for an election made under subsection 60(1)—subsection 61(1A); and

(b) for an election made under subsection 62A(1)—subsection 63(2).

ATI indexation factor has the meaning given by subsection 58AA(1).

binding child support agreement has the meaning given by section 80C.

care arrangement has the same meaning as in the Family Assistance Act.

care period has the meaning given by paragraph 49(1)(a), subparagraph 49(1)(b)(ii), paragraph 50(1)(a) or subparagraph 50(1)(b)(ii).

carer entitled to child support, in relation to a child, means:

(a) in the case of an administrative assessment—a parent, or non‑parent carer, of the child who, under the administrative assessment, is entitled to be paid child support in relation to the child; and

(b) in the case of a child support agreement—has the meaning given by subsection 93(1).

change of care day for a responsible person for a child means:

(a) if a determination of the responsible person’s percentage of care for the child has been revoked under Subdivision C of Division 4 of Part 5—the first day on which the care of the child that was actually taking place ceased to correspond with the responsible person’s percentage of care for the child under the determination; or

(b) otherwise—the first day on which the care of the child that was actually taking place ceased to correspond with the responsible person’s extent of care under a care arrangement that applies in relation to the child.

child eligible for administrative assessment means a child in relation to whom an application may, under section 24, be made to the Registrar for administrative assessment of child support.

child support means financial support under this Act, including financial support under this Act by way of lump sum payment or by way of transfer or settlement of property.

child support agreement has the meaning given by section 81.

child support case, in relation to a child, is the administrative assessments for child support for all children who are children of both of the parents of the child.

child support income has the meaning given by section 41.

child support percentage has the meaning given by section 55D.

child support period has the meaning given by subsection 7A(1).

child support terminating event has the meaning given by section 12.

child support year means:

(a) the period starting on the commencing day and ending on the next 30 June; or

(b) a subsequent financial year.

claimant, in relation to family tax benefit, means a person who has made a claim for the benefit, if the claim has not been determined.

combined child support income has the meaning given by section 42.

commencing day means the day on which this Act commences.

cost percentage has the meaning given by section 55C.

costs of a child has the meaning given by section 55H or 55HA (as the case requires).

Costs of the Children Table means the table in clause 1 of Schedule 1 to this Act.

court exercising jurisdiction under this Act does not include a court exercising jurisdiction in proceedings under paragraph 79(a).

court having jurisdiction under this Act does not include a court that has jurisdiction under this Act only in relation to the recovery of amounts of child support.

determined ATI has the meaning given by paragraph 64AB(2)(a).

eligible carer has the meaning given by section 7B.

eligible child has the meaning given by Part 3 (Children who may be covered by Act).

estimated ATI amount has the meaning given by subsections 64A(3) and 64AD(3).

Family Assistance Act means the A New Tax System (Family Assistance) Act 1999.

Family Assistance Administration Act means the A New Tax System (Family Assistance) (Administration) Act 1999.

family assistance care determination has the meaning given by paragraph 54K(1)(b).

Family Assistance Secretary means the Secretary of the Department administered by the Minister who administers Division 1 of Part 3 of the Family Assistance Act.

Family Law Act 1975 includes regulations under that Act.

family tax benefit has the meaning given by the Family Assistance Act.

final, in relation to a decision of a court, has the meaning given by section 144.

full‑time secondary education, in relation to a child, means education that is determined by the secondary school at which the child is receiving the education to be full‑time secondary education.

income amount order means:

(a) a determination under Part 6A (departure determinations), or an order under Division 4 of Part 7 (departure orders), that:

(i) varies the annual rate of child support payable by a parent for a child or for all the children in a child support case by setting that annual rate; or

(ii) varies the adjusted taxable income, or the child support income, of a parent by setting that adjusted taxable income or child support income by setting that adjusted taxable income or child support income; or

(b) provisions of a child support agreement that has been accepted by the Registrar that have effect, for the purposes of Part 5, as if they were such an order made by consent.

income component amounts has the meaning given by subsection 60(2).

income election means an election made under subsection 60(1) or 62A(1).

income percentage has the meaning given by section 55B.

income support payment has the meaning given by subsection 66(9).

Income Tax Assessment Act means the Income Tax Assessment Act 1936 or the Income Tax Assessment Act 1997.

income tested pension, allowance or benefit has the same meaning as in the Family Law Act 1975.

index number for a quarter has the meaning given by subsection 153A(2).

interim period has the meaning given by subsection 54C(2).

last day, in relation to a child’s secondary school year, means:

(a) if the child is not required to sit an examination—the day determined by the secondary school to be the last day of classes for the school year; and

(b) if the child is required to sit an examination—the later of:

(i) the day determined by the secondary school to be the last day of the period of examinations for the child’s year level; and

(ii) the day determined by the secondary school to be the last day of classes for the school year.

last relevant year of income in relation to a child support period means the last year of income that ended before the start of the period.

Note: For example, in working out Philippe’s last relevant year of income for the child support period that began on 1 January 2008, the last relevant year of income is 2006‑07.

liable parent, in relation to a child, means:

(a) in the case of an administrative assessment—a parent by whom child support is payable for the child under the administrative assessment; and

(b) in the case of a child support agreement—has the meaning given by subsection 93(1).

limited child support agreement has the meaning given by section 80E.

lump sum payment provisions has the meaning given by paragraph 84(1)(e).

member of a couple means:

(a) a person who is legally married to another person and is not living separately and apart from the other person on a permanent or indefinite basis; or

(b) a person who is living with another person as the partner of the other person on a genuine domestic basis although not legally married to the other person; or

(c) a person whose relationship with another person (whether of the same sex or a different sex) is registered under a law of a State or Territory prescribed for the purposes of section 2E of the Acts Interpretation Act 1901 as a kind of relationship prescribed for the purposes of that section, and is not living separately and apart from the other person on a permanent or indefinite basis.

minimum annual rate of child support in respect of a child support period has the meaning given by subsection 66(5).

multi‑case allowance has the meaning given by section 47.

multi‑case cap has the meaning given by section 55E.

multi‑case child costs has the meaning given by step 3 of the method statement in section 47.

non‑parent carer of a child means an eligible carer of the child who is not a parent of the child.

non‑periodic payment provisions has the meaning given by paragraph 84(1)(d).

notional assessment has the meaning given by section 146E.

otherwise than in the form of periodic amounts, in relation to child support, means child support that is not paid as periodic amounts, and includes child support paid in the form of:

(a) a lump sum payment; and

(b) a transfer or settlement of property.

Note: Periodic amount is defined in section 4 of the Registration and Collection Act.

overseas income, in relation to a parent, means income determined under Subdivision BA of Division 7 of Part 5 to be the overseas income of that parent.

parent:

(a) when used in relation to a child who has been adopted—means an adoptive parent of the child; and

(b) when used in relation to a child born because of the carrying out of an artificial conception procedure—means a person who is a parent of the child under section 60H of the Family Law Act 1975; and

(c) when used in relation to a child born because of a surrogacy arrangement—includes a person who is a parent of the child under section 60HB of the Family Law Act 1975.

parenting plan has the meaning given by section 63C of the Family Law Act 1975.

partial year income amount has the meaning given by:

(a) for an election made under subsection 60(1) to which subsection 60(3) applies—step 2 of the method statement in subsection 60(4); and

(b) for an election made under subsection 62A(1)—step 2 of the method statement in that subsection.

partner, in relation to a person who is a member of a couple, means the other member of the couple.

pension PP (single) maximum basic amount is the sum of:

(a) the amount that would have been a person’s maximum basic rate under Module B of the Pension PP (Single) Rate Calculator if the person was receiving parenting payment under the Social Security Act 1991; and

(b) the amount that would have been the person’s pension supplement under Module BA of the Pension PP (Single) Rate Calculator if the person was receiving parenting payment under that Act.

percentage of care, in relation to a responsible person for a child, means the responsible person’s percentage of care for the child that is determined by the Registrar under Subdivision B of Division 4 of Part 5.

provisional notional assessment means a provisional notional assessment made under section 146B.

reduced care of a child has the meaning given by section 54.

Registrar means the Child Support Registrar.

Registration and Collection Act means the Child Support (Registration and Collection) Act 1988.

regular care has the meaning given by subsection (2).

related Federal Magistrates Rules has the same meaning as in the Family Law Act 1975.

relative has a meaning affected by subsection (4).

relevant dependent child, in relation to a parent, means a child or step‑child of the parent, but only if:

(a) the parent has at least shared care of the child or step‑child during the relevant care period; and

(b) either:

(i) the child or step‑child is under 18; or

(ii) if the child or step‑child is not under 18—a child support terminating event has not happened under subsection 151D(1) in relation to the child; and

(c) the child or step‑child is not a member of a couple; and

(d) in the case of a step‑child:

(i) an order is in force under section 66M of the Family Law Act 1975 in relation to the parent and the step‑child; or

(ii) the parent has the duty, under section 124 of the Family Court Act 1997 of Western Australia, of maintaining the step‑child; and

(e) in the case of a child—the parent is not assessed in respect of the costs of the child (except for the purposes of step 4 of the method statement in section 46).

relevant dependent child amount has the meaning given by section 46.

relevant September quarter has the meaning given by subsection 5A(2).

remaining period has the meaning given by:

(a) for an election made under subsection 60(1) to which subsection 60(3) applies—step 1 of the method statement in subsection 60(4); and

(b) for an election made under subsection 62A(1)—step 1 of the method statement in that subsection.

reportable fringe benefits total for a year of income for a person who is an employee (for the purposes of the Fringe Benefits Tax Assessment Act 1986, whether it applies of its own force or because of the Fringe Benefits Tax (Application to the Commonwealth) Act 1986) means the employee’s reportable fringe benefits total (as defined in the Fringe Benefits Tax Assessment Act 1986) for the year of income.

resident of Australia has the meaning given by section 10.

responsible person for a child means a parent or non‑parent carer of the child.

secondary school means a school, technical and further education institution or any other educational institution at which full‑time secondary education is provided.

self‑support amount has the meaning given by section 45.

separated has the meaning given by section 9.

shared care has the meaning given by subsection (3).

standard Rules of Court has the same meaning as in the Family Law Act 1975.

start day for an income election means the day specified in the notice of the income election under subsection 60(8) or 62A(5) as the start day for the income election.

target foreign income has the meaning given by section 5B.

taxable income has the meaning given by sections 56 and 57.

tax free pension or benefit means any of the following pensions or benefits:

(a) a disability support pension under Part 2.3 of the Social Security Act 1991;

(b) a wife pension under Part 2.4 of the Social Security Act 1991;

(c) a carer payment under Part 2.5 of the Social Security Act 1991;

(d) an invalidity service pension under Division 4 of Part III of the Veterans’ Entitlements Act 1986;

(e) a partner service pension under Division 5 of Part III of the Veterans’ Entitlements Act 1986;

(f) income support supplement under Part IIIA of the Veterans’ Entitlements Act 1986;

(g) Defence Force Income Support Allowance under Part VIIAB of the Veterans’ Entitlements Act 1986;

to the extent to which the payment:

(h) is exempt from income tax; and

(i) is not a payment by way of bereavement payment, pharmaceutical allowance, rent assistance, language, literacy and numeracy supplement or remote area allowance; and

(j) if the payment is a payment under the Social Security Act 1991—does not include tax‑exempt pension supplement (within the meaning of subsection 20A(6) of that Act); and

(k) if the payment is a payment under the Veterans’ Entitlements Act 1986—does not include tax‑exempt pension supplement (within the meaning of subsection 5GA(5) of that Act).

termination agreement has the meaning given by section 80D.

this Act includes the regulations.

underestimated an income amount has the meaning given by subsections 64AF(2) and (3).

year of income, in relation to a person, means:

(a) a year of income (within the meaning of the Income Tax Assessment Act 1936); or

(b) an income year (within the meaning of the Income Tax Assessment Act 1997).

Definitions of regular care and shared care

(2) A person has regular care of a child if the person’s percentage of care for the child during a care period is at least 14% but less than 35%.

(3) A person has shared care of a child if the person’s percentage of care for the child during a care period is at least 35% but not more than 65%.

Relatives

(4) For the purposes of section 26A and subparagraph 150(4E)(b)(ii), the relatives of a person are taken to include the following (without limitation):

(a) a partner of the person;

(b) someone who is a parent of the person, or someone of whom the person is a parent, because of the definition of parent in this section;

(c) anyone else who would be a relative of the person if someone mentioned in paragraph (a) or (b) is taken to be a relative of the person.

5A Definition of annualised MTAWE figure

(1) The annualised MTAWE figure for a relevant September quarter means the figure that is 52 times the amount set out for the reference period in the quarter under the headings “Average Weekly Earnings—Trend—Males—All Employees Total Earnings” in a document published by the Australian Statistician entitled “Average Weekly Earnings, Australia”.

(2) The relevant September quarter, in relation to a child support period, means the quarter ending on 30 September of the last calendar year ending before the child support period begins.

(3) If at any time (whether before or after the commencement of this section), the Australian Statistician publishes the amount referred to in subsection (1):

(a) under differently described headings (the new headings); or

(b) in a document entitled otherwise than as described in subsection (1) (the new document);

then the annualised MTAWE figure is to be calculated in accordance with subsection (1) as if the references to:

(c) “Average Weekly Earnings—Trend—Males—All Employees Total Earnings”; or

(d) “Average Weekly Earnings, Australia”;

were references to the new headings and/or the new document, as the case requires.

(4) For the purposes of this section, the reference period in a particular quarter is the period described by the Australian Statistician as the pay period ending on or before a specified day that is the third Friday of the middle month of that quarter.

(5) If:

(a) the Australian Statistician publishes the amount (the later amount) referred to in subsection (1) for a relevant September quarter; and

(b) the later amount is published in substitution for such an amount for that quarter that was previously published by the Australian Statistician;

the publication of the later amount is to be disregarded for the purposes of this Act.

5B Definition of target foreign income

(1) A parent’s target foreign income for a year of income is:

(a) the amount of the parent’s foreign income (as defined in section 10A of the Social Security Act 1991) for the year of income that is neither:

(i) taxable income; nor

(ii) received in the form of a fringe benefit (as defined in the Fringe Benefits Tax Assessment Act 1986, as it applies of its own force or because of the Fringe Benefits Tax (Application to the Commonwealth) Act 1986) in relation to the parent as an employee (as defined in the Fringe Benefits Tax Assessment Act 1986) and a year of tax; and

(b) any amount of income that is not covered by paragraph (a) that is exempt from tax under section 23AF or 23AG of the Income Tax Assessment Act 1936, reduced (but not below nil) by the total amount of losses and outgoings (except capital losses and outgoings) incurred by the parent in deriving that exempt income.

(1A) In working out a parent’s target foreign income under subsection (1), exclude any overseas income that was determined for the purpose of working out the parent’s adjusted taxable income.

(2) If it is necessary, for the purposes of this Act, to work out an amount of foreign income expressed in a foreign currency received in a year of income, the amount in Australian currency is to be worked out using the market exchange rate for 1 July in that year of income.

(3) If there is no market exchange rate for 1 July in the year of income (for example, because of a national public holiday), the market exchange rate to be used is the market exchange rate that applied on the last working day immediately before that 1 July.

(4) For the purposes of this section, the appropriate market exchange rate on a particular day for a foreign currency is:

(a) if there is an on‑demand airmail buying rate for the currency available at the Commonwealth Bank of Australia at the start of business in Sydney on that day and the Secretary determines that it is appropriate to use that rate—that rate; or

(b) in any other case:

(i) if there is another rate of exchange for the currency, or there are other rates of exchange for the currency, available at the Commonwealth Bank of Australia at the start of business in Sydney on that day and the Secretary determines that it is appropriate to use the other rate or one of the other rates—the rate so determined; or

(ii) otherwise—a rate of exchange for the currency available from another source at the start of business in Sydney on that day that the Secretary determines it is appropriate to use.

6 Interpretation—expressions used in Registration and Collection Act

Unless the contrary intention appears, expressions used in this Act, and in the Registration and Collection Act, have the same respective meanings as in that Act.

7 Interpretation—expressions used in Part VII of Family Law Act

Unless the contrary intention appears, expressions used in this Act, and in Part VII of the Family Law Act 1975, have the same respective meanings as in that Part.

7A Meaning of child support period

What is a child support period?

(1) A child support period is a period that:

(a) starts at a time described in subsection (2); and

(b) ends at the time described in subsection (3) that occurs soonest after the start of the period.

Note: Subsections (5) to (8) provide some examples of child support periods. The examples are not exhaustive: see section 15AD of the Acts Interpretation Act 1901.

When does a child support period start?

(2) Each of the following times is the start of a child support period:

(a) the beginning of the day on which an application for an administrative assessment of the child support payable for a child is properly made under Part 4;

(b) the beginning of the day mentioned in paragraph 93(1)(g) (child support payable under a child support agreement accepted by Registrar);

(c) the start of the first day for which a child support agreement described in section 34B is to affect the rate of child support payable for a child;

(d) immediately after the end of the preceding child support period that relates to child support payable for the child (whether it was a period starting as described in paragraph (a), (b) or (c) or this paragraph).

Note: Despite paragraph (2)(a), a child support period might not start if a non‑parent carer applies for an administrative assessment of child support during a child support period (see section 40B).

End of the child support period

(3) The child support period ends at whichever of the following times occurs soonest after the start of the period:

(a) the time 15 months after the period started;

(b) the end of the calendar month during which the Registrar makes an assessment relating to the annual rate of child support payable for the child as required by section 34A (assessment when new tax figure is available);

(c) the time immediately before the day mentioned in paragraph 93(1)(g) (child support payable under a child support agreement accepted by Registrar);

(d) the end of the day immediately before the first day for which a child support agreement described in section 34B is to affect the rate of child support payable for the child.

Examples

(4) Subsections (5), (6), (7) and (8) merely give a series of examples of the operation of the rules in subsections (1), (2) and (3). The examples involve Mary and Peter. Mary cares for their child and, on 8 June 2000, makes an application under Part 4 and receives a child support assessment for Peter to pay her child support for the child.

Example—initial child support period resulting from application under Part 4

(5) On 20 October 2000, the Registrar makes a new administrative assessment based on an assessment under the income tax law of Peter’s taxable income for the 1999‑2000 year of income (as required by section 34A). The first child support period starts on 8 June 2000 and ends at the end of 31 October 2000, and the second starts on 1 November 2000.

Example—end of child support period if new taxable income not available within 15 months

(6) If no assessment of the taxable income of Mary or Peter for the 1999‑2000 or the 2000‑2001 year of income had been made under the income tax law before the end of 7 September 2001, the first child support period would start on 8 June 2000 and end at the end of 7 September 2001 (15 months after it started).

Example—child support agreement ends existing child support period and starts a new one

(7) If Mary and Peter make a child support agreement to influence the annual rate of child support on and after 15 September 2000:

(a) the child support period that started on 8 June 2000 ends at the end of 14 September 2000; and

(b) a new child support period starts on 15 September 2000.

Example—child support period for child support agreement setting child support rate lasts 15 months

(8) If the child support agreement set the rate of child support payable for the next 2 years (so section 34A did not require the Registrar to make an administrative assessment on 20 October 2000 as described in subsection (5)), the child support period that started on 15 September 2000 would end 15 months later at the end of 14 December 2001 (unless Mary and Peter made another child support agreement to affect the rate of child support payable for a day before 15 December 2001).

7B Meaning of eligible carer

(1) In this Act, eligible carer, in relation to a child, means a person who has at least shared care of the child.

(2) Despite subsection (1), if:

(a) a person cares for a child; and

(b) the person is neither a parent nor a legal guardian of the child; and

(c) a parent or legal guardian of the child has indicated that he or she does not consent to the person caring for the child;

then the person is not an eligible carer in relation to the child unless it would be unreasonable in the circumstances for a parent or legal guardian of the child to care for the child.

(3) For the purposes of subsection (2), it is unreasonable for a parent or legal guardian to care for a child if:

(a) the Registrar is satisfied that there has been extreme family breakdown; or

(b) the Registrar is satisfied that there is a serious risk to the child’s physical or mental wellbeing from violence or sexual abuse in the home of the parent or legal guardian concerned.

9 Interpretation—meaning of separated

For the purposes of this Act, the parents of a child are to be taken to have separated in circumstances in which the parties to a marriage are, under the Family Law Act 1975, taken to have separated.

10 Interpretation—meaning of resident of Australia

For the purposes of this Act, a person is a resident of Australia on a day if on that day the person is a resident of Australia for the purposes of the Income Tax Assessment Act 1936 otherwise than because of subsection 7A(2) of that Act.

12 Interpretation—happening of child support terminating events

(1) A child support terminating event happens in relation to a child if:

(a) the child dies; or

(b) the child ceases to be an eligible child under regulations made under subsection 22(1); or

(c) the child turns 18; or

(d) the child is adopted; or

(e) the child becomes a member of a couple; or

(f) none of the following subparagraphs applies any longer in relation to the child:

(i) the child is present in Australia;

(ii) the child is an Australian citizen;

(iii) the child is ordinarily resident in Australia; or

(g) the circumstances described in subsection 30AA(1) of the Registration and Collection Act apply in relation to the child.

Note: Paragraph (1)(c) may be affected by section 151C (which deals with continuing administrative assessments and child support agreements beyond a child’s 18th birthday in certain situations).

(2) A child support terminating event happens in relation to a person who is a carer entitled to child support in relation to a child if the person dies.

(2AA) A child support terminating event happens in relation to a child if:

(a) both of the parents of the child are not eligible carers of the child; and

(b) there are no non‑parent carers entitled to be paid child support in relation to the child.

(2A) A child support terminating event happens in relation to a person who is a carer entitled to child support in relation to a child if:

(a) an international maintenance arrangement applies in respect of the person and the child; and

(b) the person is a resident of a reciprocating jurisdiction; and

(c) the person ceases to be a resident of the reciprocating jurisdiction; and

(d) the person does not, immediately after so ceasing, become a resident of another reciprocating jurisdiction or of Australia.

(3) A child support terminating event happens in relation to a person who is a liable parent in relation to a child if:

(a) the person dies; or

(b) the person ceases to be a resident of Australia.

(3A) A child support terminating event happens in relation to a person who is a liable parent in relation to a child if:

(a) an international maintenance arrangement applies in respect of the person and the child; and

(b) the person is a resident of a reciprocating jurisdiction; and

(c) the person ceases to be a resident of the reciprocating jurisdiction; and

(d) the person does not, immediately after so ceasing, become a resident of another reciprocating jurisdiction or of Australia.

(3B) A child support terminating event happens in relation to a person who is a liable parent in relation to a child if:

(a) an international maintenance arrangement applies in respect of the person and the child; and

(b) the person is a resident of a reciprocating jurisdiction; and

(c) the reciprocating jurisdiction becomes specified in regulations made for the purposes of section 30A as a reciprocating jurisdiction for a resident of which an application for:

(i) an administrative assessment of child support for a child; or

(ii) acceptance of a child support agreement;

may not be accepted.

(4) A child support terminating event happens in relation to a child and the persons who are respectively a carer entitled to child support and a liable parent in relation to the child if:

(a) either of the following subparagraphs applies in relation to the child and those persons:

(i) the carer entitled to child support elects by a notice that complies with section 151 (Election by carer entitled to child support to end administrative assessment) that the liability of the liable parent to pay or provide child support for the child to the carer entitled to child support is to end from a specified day;

(ii) the Registrar accepts a child support agreement made in relation to the child between the carer entitled to child support and the liable parent, and the agreement includes provisions under which the liability of the liable parent to pay or provide child support for the child to the carer entitled to child support is to end from a specified day; and

(b) the specified day arrives.

(4A) Subject to subsection (4B):

(a) if an international maintenance arrangement applies in respect of a child—a circumstance set out in paragraph (1)(f) is not a child support terminating event in relation to the child; and

(b) if an international maintenance arrangement applies in respect of a person who is a liable parent in respect of a child—a circumstance set out in paragraph (3)(b) is not a child support terminating event in relation to the person.

(4B) Subsection (4A) does not apply if:

(a) where one only of the carer entitled to child support in relation to a child and the liable parent in relation to the child is a resident of Australia—that carer or that liable parent ceases to be a resident of Australia; or

(b) where both the carer entitled to child support in relation to a child and the liable parent in relation to the child are residents of Australia—that carer and that liable parent both cease to be residents of Australia.

(5) A child support terminating event happens in relation to a child and the child’s parents if the parents become members of the same couple for a period of 6 months or more.

13 Extension and application of Act in relation to maintenance of exnuptial children

Extension of Act to States (except Western Australia)

(1) Subject to subsections (4) and (5), this Act so far as it relates to the maintenance of exnuptial children extends to New South Wales, Victoria, Queensland, South Australia and Tasmania.

Extension of Act to Western Australia

(2) If:

(a) the Parliament of Western Australia refers to the Parliament of the Commonwealth the matter of the maintenance of exnuptial children or matters that include that matter; or

(b) Western Australia adopts this Act in so far as it relates to the maintenance of exnuptial children;

then, subject to subsections (4), (5), (5A) and (5B), this Act in so far as it relates to the maintenance of exnuptial children also extends to Western Australia.

Application of Act to Territories

(3) This Act so far as it relates to the maintenance of exnuptial children applies in and in relation to the Territories.

Limitations on extension of Act to States

(4) This Act extends to a State because of subsection (1) or (2) only for so long as there is in force:

(a) an Act of the Parliament of the State by which there is referred to the Parliament of the Commonwealth:

(i) the matter of the maintenance of exnuptial children; or

(ii) matters that include that matter; or

(b) a law of the State adopting this Act so far as it applies in relation to the maintenance of exnuptial children.

Note: See subsections (5A) and (5B) for the extension of this Act to Western Australia if the Act is amended in relation to the maintenance of exnuptial children.

(5) This Act extends to a State at any time because of subsection (1) or paragraph (2)(a) only so far as it makes provision with respect to:

(a) the matters that are at that time referred to the Parliament of the Commonwealth by the Parliament of the State; or

(b) matters incidental to the execution of any power vested by the Constitution in the Parliament of the Commonwealth in relation to those matters.

(5A) The Parliament of the Commonwealth intends that this Act, so far as it is amended by one or more other Acts in relation to the maintenance of exnuptial children, not extend to Western Australia, unless and until one of the following events occurs:

(a) the Parliament of Western Australia refers to the Parliament of the Commonwealth the matter of the maintenance of exnuptial children or matters that include that matter;

(b) Western Australia adopts this Act, as so amended.

(5B) The Parliament of the Commonwealth also intends that, unless and until one of those events occurs, this Act continue to extend to Western Australia in relation to the maintenance of exnuptial children as if those amendments had not been made.

Note: If this Act is amended by one or more other Acts in relation to the maintenance of exnuptial children, unless and until one of the events mentioned in subsection (5A) occurs, there are effectively 2 versions of this Act that apply in Australia. This Act, as amended, applies:

(a) in all States and Territories in relation to children of marriages; and

(b) in all States and Territories, except Western Australia, in relation to exnuptial children.

This Act continues to apply in Western Australia in relation to exnuptial children as if those amendments had not been made.

(6) Nothing in this section affects the operation of the provisions of this Act to the extent that they give effect to an international maintenance arrangement.

14 Additional application of Act in relation to maintenance of children of marriages

(1) Without prejudice to its effect apart from this section, this Act so far as it relates to the maintenance of children also has effect as provided by this section.

(2) This Act so far as it relates to the maintenance of children has, because of this section, the effect that it would have if:

(a) each reference to a child were, by express provision, confined to a child of a marriage; and

(b) each reference to the parents of the child were, by express provision, confined to the parties to the marriage;

and has that effect only so far as it makes provision with respect to the rights and duties of the parties to the marriage in relation to the child, including, for example, provision with respect to the rights and duties of the parties in relation to the maintenance of the child.

(3) Nothing in this section affects the operation of the provisions of this Act to the extent that they give effect to an international maintenance arrangement.

15 Corresponding State laws

(1) If the Minister is satisfied that a law of a State makes adequate and appropriate provision for determining the financial support payable for children, the Minister may, by Gazette notice, declare the law to be a corresponding State law.

(2) If the Minister becomes satisfied that the State law no longer makes adequate and appropriate provision for determining the financial support payable for children, the Minister may, by Gazette notice, revoke the declaration of the law as a corresponding State law.

(3) It is the intention of the Parliament that the Registrar should have and be subject to the powers, functions, rights, liabilities and duties conferred or imposed on the Registrar by a corresponding State law that are additional to those conferred or imposed by this Act.

16 Act to bind Crown

(1) This Act binds the Crown in right of the Commonwealth, of each of the States, of the Australian Capital Territory, of the Northern Territory and of Norfolk Island.

(2) Nothing in this Act permits the Crown to be prosecuted for an offence.

Part 2—Counselling

17 Court counselling facilities to be made available

(1) A parent of an eligible child, or an eligible carer of an eligible child who is not a parent of the child, may seek the assistance of the counselling facilities of the Family Court or a Family Court of a State.

(2) The Principal Director of Court Counselling of the Family Court or an appropriate officer of the Family Court of the State must, as far as practicable, make the counselling facilities available.

Part 3—Children who may be covered by Act

18 Act applies only in relation to eligible children

This Act applies only in relation to children who are eligible children.

19 Children born on or after commencing day are eligible children

A child born on or after the commencing day is an eligible child.

20 Children of parents who separate on or after commencing day are eligible children

(1) Where:

(a) the parents of a child born before the commencing day have cohabited; and

(b) the parents separate on or after the commencing day;

the child is an eligible child.

(2) Subsection (1) applies in relation to the child whether or not the parents:

(a) are or were at any time legally married; or

(b) have separated on an earlier occasion; or

(c) have resumed cohabitation.

21 Children with a brother or sister who is an eligible child are eligible children

Where:

(a) a child would, apart from this section, not be an eligible child; and

(b) another child is born to the parents of the first‑mentioned child on or after the commencing day;

the first‑mentioned child is an eligible child.

22 Exclusion of certain children from coverage of Act

(1) The regulations may provide that children who are under the care (however described) of a person under a child welfare law are not eligible children.

(2) Sections 19, 20 and 21 have effect subject to any regulations made under subsection (1).

Part 4—Applications to Registrar for administrative assessment of child support

Division 1—Application requirements

23 Application requirements generally

An application for administrative assessment of child support is properly made if it complies with the following provisions:

(a) section 24 (Children in relation to whom applications may be made);

(b) section 25 (Persons who may apply—parents);

(c) section 25A (Persons who may apply—non‑parent carers);

(d) Section 27 (Formal requirements for applications).

24 Children in relation to whom applications may be made

(1) Application may be made to the Registrar for administrative assessment of child support for a child only if:

(a) the child is:

(i) an eligible child; and

(ii) under 18 years of age; and

(iii) not a member of a couple; and

(b) except in a circumstance referred to in subsection (2), either or both of the following subparagraphs applies or apply in relation to the child:

(i) the child is present in Australia on the day on which the application is made;

(ii) the child is an Australian citizen, or ordinarily resident in Australia, on that day.

(2) Paragraph (1)(b) does not apply to an application for administrative assessment of child support if:

(a) all of the following apply:

(i) the application is made under section 25 for a parent to be assessed in respect of the costs of the child;

(ii) the parent of the child is a resident of a reciprocating jurisdiction;

(iii) the Registrar has not determined under section 29A that child support is reasonably likely to be payable by the parent; or

(b) both of the following apply:

(i) the application is made under section 25A by a non‑parent carer;

(ii) the non‑parent carer is a resident of a reciprocating jurisdiction.

25 Persons who may apply—parents

A parent (the applicant) of a child may apply to the Registrar under this section for administrative assessment of child support for the child if:

(a) the applicant applies for both parents to be assessed in respect of the costs of the child; and

(b) the applicant is not living with the other parent as his or her partner on a genuine domestic basis (whether or not legally married to the other parent); and

(c) the applicant complies with any applicable requirements of section 26 (dealing with joint care situations) and section 26A (dealing with children cared for under child welfare laws); and

(d) if either parent of the child is not a resident of Australia on the day on which the application is made—the application meets the requirements of sections 29A and 29B.

25A Persons who may apply—non‑parent carers

A person who is not a parent of a child (the applicant) may apply to the Registrar under this section for administrative assessment of child support for the child if:

(a) the applicant is an eligible carer of the child; and

(b) one of the following also applies:

(i) the applicant applies for both parents to be assessed in respect of the costs of the child;

(ii) if one parent of the child is neither a resident of Australia nor a resident of a reciprocating jurisdiction—the applicant applies for the other parent to be assessed in respect of the costs of the child;

(iii) if the Registrar is satisfied that there are special circumstances—the applicant applies for the other parent to be assessed in respect of the costs of the child;

(iv) if one parent of the child is dead—the applicant applies for the other parent to be assessed in respect of the costs of the child; and

(c) the applicant is not living with either parent as the partner of that parent on a genuine domestic basis (whether or not legally married to that parent); and

(d) the applicant complies with any applicable requirements of section 26 (dealing with joint care situations) and section 26A (dealing with children cared for under child welfare laws); and

(e) if a parent of the child who is to be assessed in respect of the costs of the child is not a resident of Australia on the day on which the application is made—the application meets the requirements of sections 29A and 29B.

26 Requirements of applications where there are joint carers

If 2 or more persons (joint carers) jointly have care of a child, then only one of the joint carers may apply for administrative assessment of child support for the child. If one of those joint carers is a parent of the child, the joint carer who applies must be that parent.

26A Requirements of application if child is cared for under child welfare law

If a non‑parent carer has care (however described) of a child under a child welfare law, the non‑parent carer may apply for child support for the child only if the non‑parent carer is a relative of the child.

27 Application for administrative assessment

An application for administrative assessment of child support must be made to the Registrar in the manner specified by the Registrar.

Note: Section 150A provides for the Registrar to specify the manner in which an application may be made.

28 Application for child support for 2 or more children made in same form

If application is made in the same form for administrative assessment of child support for 2 or more children, the form may be treated as if it contained separate applications made for administrative assessment for each of the children.

Note: This provision applies even if the children are in different child support cases.

Division 2—Decision on application

29 How decision is to be made

(1) Subject to this section, in determining whether an application for administrative assessment of child support complies with sections 24, 25 and 25A, the Registrar may act on the basis of the application and the documents accompanying the application, and is not required to conduct any inquiries or investigations into the matter.

(2) The Registrar is to be satisfied that a person is a parent of a child only if the Registrar is satisfied:

(a) that the person is or was a party to a marriage and the child was born to the person, or the other party to the marriage, during the marriage; or

(b) that the person’s name is entered in a register of births or parentage information, kept under the law of the Commonwealth or of a State, Territory or prescribed overseas jurisdiction, as a parent of the child; or

(c) that, whether before or after the commencement of this Act, a federal court, a court of a State or Territory or a court of a prescribed overseas jurisdiction has:

(i) found expressly that the person is a parent of the child; or

(ii) made a finding that it could not have made unless the person was a parent of the child;

and the finding has not been altered, set aside or reversed; or

(d) that, whether before or after the commencement of this Act, the person has, under the law of the Commonwealth or of a State, Territory or prescribed overseas jurisdiction, executed an instrument acknowledging that the person is a parent of the child, and the instrument has not been annulled or otherwise set aside; or

(e) that the child has been adopted by the person; or

(f) that the person is a man and the child was born to a woman within 44 weeks after a purported marriage to which the man and the woman were parties was annulled; or

(g) that the person is a man who was a party to a marriage to a woman and:

(i) the parties to the marriage separated; and

(ii) after the parties to the marriage separated, they resumed cohabitation on one occasion; and

(iii) within 3 months after the resumption of cohabitation, they again separated and afterwards lived separately and apart; and

(iv) the child was born to the woman within 44 weeks after the period of cohabitation but after the dissolution of the marriage; or

(h) that the person is a man and:

(i) the child was born to a woman who cohabited with the man at any time during the period beginning 44 weeks and ending 20 weeks before the birth; and

(ii) no marriage between the man and the woman subsisted during any part of the period of cohabitation; or

(i) that the person is a parent of the child under section 60H or section 60HB of the Family Law Act 1975.

(3) If:

(a) 2 or more paragraphs of subsection (2) are relevant to a particular application; and

(b) those paragraphs, or some of them, conflict with each other;

the paragraph that appears to the Registrar to be the more or most likely to be the correct presumption prevails.

29A Person by whom child support is payable must be Australian resident or resident of reciprocating jurisdiction

(1) This section applies if:

(a) an application is made under section 25 or 25A for a parent to be assessed in respect of the costs of the child; and

(b) the parent is not a resident of Australia on the day on which the application is made.

(2) The Registrar must determine whether child support is reasonably likely to be payable by the parent.

(3) If the Registrar determines that child support is reasonably likely to be payable by the parent, the application is taken to have been properly made only if:

(a) subsection 24(2) does not apply in relation to the child (payee of child support resident in reciprocating jurisdiction); and

(b) the parent is a resident of a reciprocating jurisdiction on the day on which the application is made.

Note: If an application is not properly made, the Registrar must refuse the application under section 30.

29B Applications by residents of reciprocating jurisdictions

(1) If a person applying under section 25 or 25A is a resident of a reciprocating jurisdiction, the application must be made:

(a) by the person and given to the Registrar by an overseas authority of the reciprocating jurisdiction; or

(b) if an overseas authority of the reciprocating jurisdiction believes that child support is reasonably likely to be payable to the person in respect of a child—by the overseas authority on behalf of the person; or

(c) if the person believes that child support is reasonably likely to be payable by him or her to another person in respect of a child—directly to the Registrar by the person.

(2) If an application is made by an overseas authority of a reciprocating jurisdiction on behalf of a person, the regulations may prescribe actions the overseas authority may take for the person.

(3) If an application is made by a person and given to the Registrar by an overseas authority of a reciprocating jurisdiction, the regulations may prescribe actions the overseas authority may take for the person with the person’s consent.

30 Decision on application

(1) If the Registrar is satisfied that an application has been properly made for administrative assessment of child support for a child, the Registrar must accept the application.

(2) If the Registrar is not so satisfied, the Registrar may refuse to accept the application.

(3) This section is subject to sections 30A and 30B.

30A No administrative assessment or acceptance of agreement if contrary to international maintenance arrangement

(1) An application for:

(a) an administrative assessment of child support for a child; or

(b) acceptance of a child support agreement;

is taken not to have been properly made by a parent by whom, under a determination made under section 29A, child support is reasonably likely to be payable and who is a resident of a reciprocating jurisdiction specified in regulations made for the purposes of this section.

(2) A reciprocating jurisdiction may be specified in regulations made for the purposes of this section if the acceptance of an application for:

(a) an administrative assessment of child support for a child; or

(b) a child support agreement;

in relation to a parent by whom, under a determination made under section 29A, child support is reasonably likely to be payable who is a resident of the jurisdiction would not be permitted by the law of the jurisdiction.

(3) This section has effect despite subsection 29A(3).

30B Registrar may refuse application for administrative assessment if overseas liability already registered

If:

(a) a registered maintenance liability of a kind mentioned in section 18A of the Registration and Collection Act relates to a particular child, a liable parent and a carer entitled to child support; and

(b) after the registration of the liability, an application is made for an administrative assessment of child support in relation to the child, the liable parent and the carer entitled to child support; and

(c) either the liable parent or the carer entitled to child support is a resident of a reciprocating jurisdiction;

then the Registrar may determine that the application is taken not to have been properly made.

31 Requirement to assess child support on acceptance of application

(1) If the Registrar accepts an application for administrative assessment of child support for a child, the Registrar must, as quickly as possible:

(a) either:

(i) if the application is made under section 25—assess both parents in respect of the costs of the child under Part 5; or

(ii) if the application is made under section 25A (non‑parent carer applications)—assess both parents, or the relevant parent, (as the case requires) in respect of the costs of the child under Part 5; and

(b) assess under Part 5 the annual rate of child support payable by a parent for the child for the days in the child support period that starts:

(i) if child support is payable by a parent who is a resident of a reciprocating jurisdiction—on the first day on which all prior requirements (if any) under the applicable international maintenance arrangement, and under the laws of the reciprocating jurisdiction, have been complied with; and

(ii) otherwise—on the day on which the application is made.

Example: Some reciprocating jurisdictions require that notice be given about the making and substance of the application for administrative assessment of child support and how the person may object to the application, or require that a person have an opportunity to be heard before making a decision on an application.

Note: Part 4A deals with assessments for later child support periods.

(2) Child support is payable until the day immediately before the day on which a child support terminating event happens in relation to the child, the carer entitled to child support, the liable parent or all 3 of them.

32 Withdrawal of application by applicant

(1) Where:

(a) a person has made an application to the Registrar for administrative assessment of child support for a child; and

(b) the Registrar has not accepted, or refused to accept, the application;

the person may, by notice given to the Registrar, withdraw the application.

(2) The notice must be given in the manner specified by the Registrar.

Note: Section 150A provides for the Registrar to specify the manner in which a notice may be given.

(4) Where a notice that complies with subsections (2) is given to the Registrar in relation to an application for administrative assessment, the application is to be taken not to have been made.

Division 3—Notice of decision

33 Notice to be given to unsuccessful applicant

(1) If the Registrar refuses to accept an application for administrative assessment of child support for a child, the Registrar must immediately notify the applicant in writing.

Refusals on ground that Registrar not satisfied that person a parent

(3) If one of the reasons the Registrar refused to accept the application was because the Registrar was not satisfied under section 29 that a person who was to be assessed in respect of the costs of the child is a parent of the child, the notice must include, or be accompanied by:

(a) a statement that the Registrar was not satisfied under section 29 that the person is a parent of the child; and

(b) a statement to the effect that an application may be made to a court having jurisdiction under this Act for a declaration under section 106A that the person should be assessed in respect of the costs of a child because the person is a parent of the child.

Refusals on other grounds

(4) If subsection (3) does not apply, the notice must include, or be accompanied by, a statement to the effect that:

(a) the applicant may, subject to the Registration and Collection Act, object to the decision (the original decision); and

(b) the applicant may, if aggrieved by a later decision on an objection to the original decision (no matter who lodges the objection), subject to that Act, apply to the SSAT for review of the later decision.

Validity of decisions

(5) A contravention of subsection (3) or (4) in relation to a decision does not affect the validity of the decision.

34 Giving notice of successful application

(1) If the Registrar accepts an application for administrative assessment of child support for a child, the Registrar must notify the applicant and any parent who is to be assessed in respect of the costs of the child.

(2) The notice must include, or be accompanied by, a statement to the effect that:

(a) an application may be made to a court having jurisdiction under this Act for a declaration under section 107 that a person should not be assessed in respect of the costs of the child because the person is not a parent of the child; and

(b) in any case:

(i) the applicant or a parent who is to be assessed in respect of the costs of the child, may, subject to the Registration and Collection Act, object to the decision (the original decision) (other than because a person is not a parent of the child); and

(ii) the applicant or a parent who is to be assessed in respect of the costs of the child, if aggrieved by a later decision on an objection in relation to the original decision (no matter who lodges the objection), may, subject to that Act, apply to the SSAT for review of the later decision.

Part 4A—Assessments of child support for later child support periods

34A Registrar must make assessment when new tax figure is available

Application of section

(1) This section requires the Registrar to assess the annual rate of child support payable in some cases if:

(a) child support is payable by a liable parent for a child for a day in a child support period (the earlier period); and

(b) during the earlier period, an assessment (the tax assessment) is made under an Income Tax Assessment Act of the taxable income, or any other component of the adjusted taxable income, of the liable parent or the other parent, for the latest year of income (the last year) that ended after the start of the earlier period.

Registrar must make assessment using new tax figures

(2) As soon as practicable after the tax assessment is made, the Registrar must assess the annual rate of child support payable for the child for days in a child support period starting on the first day of the next calendar month (after the calendar month in which the Registrar makes the assessment).

When new assessment is not required

(3) This section does not require the Registrar to make an assessment if:

(a) the Registrar calculates that the tax assessment for the last year could not affect the annual rate of child support payable for the child for a day in a child support period; or

(b) the annual rate of child support payable for the child for the first day of the next calendar month is to be worked out without reference to the actual taxable income of the parent mentioned in paragraph (1)(b) because of:

(i) a child support agreement between the parents of the child; or

(ii) a determination under Part 6A (departure determination); or

(iii) an order made by a court under this Act or the Registration and Collection Act; or

(c) the earlier period will end before the end of the earliest calendar month in which it is practicable for the Registrar to make the assessment mentioned in subsection (2).

Note: In the case of paragraph (3)(c), the Registrar must use the information from the tax assessment to make an assessment for the period starting immediately after the end of the earlier period (unless the information is not relevant to an assessment, because of an agreement, determination or order) (see section 34C).

34B Administrative assessment for child support period started by new agreement when support already payable

(1) The Registrar must assess the annual rate of child support payable for a child for a day in a child support period if:

(a) the Registrar accepts a child support agreement made in relation to the child; and

(b) child support is already payable by a parent for the child under an administrative assessment; and

(c) the agreement is to affect the annual rate of child support payable for the child.

The Registrar must assess the annual rate immediately after accepting the agreement.

Note 1: Section 95 explains how the provisions of the agreement affect the assessment.

Note 2: If the Registrar makes an assessment under this section, the Registrar must make a provisional notional assessment under section 146B.

(2) The child support period starts:

(a) if:

(i) the application for acceptance of the agreement was made to the Registrar within 28 days after the day on which the agreement was signed; and

(ii) the agreement states that child support is to be payable from a specified day; and

(iii) the day specified is not earlier than the day on which child support first became payable under the administrative assessment;

on the specified day; or

(b) if:

(i) the application for acceptance of the agreement was made to the Registrar within 28 days after the day on which the agreement was signed; and

(ii) the agreement states that child support is to be payable from a specified day; and

(iii) the day specified is earlier than the day on which child support first became payable under the administrative assessment;

on the day on which child support first became payable under the administrative assessment; or

(c) if:

(i) the application for acceptance of the agreement was made to the Registrar within 28 days after the day on which the agreement was signed; and

(ii) the agreement does not specify a day from which child support is to be payable;

on the day on which the agreement was signed; or

(d) otherwise—on the day on which the application was made to the Registrar for acceptance of the agreement.

(3) However, if the applicant for acceptance of the agreement is a resident of a reciprocating jurisdiction, subsection (2) applies as if the references in subparagraphs (2)(a)(i), (b)(i) and (c)(i) were references to 90 days instead of 28 days.

34C Administrative assessments for child support periods not started by application or new agreement

The Registrar must assess under this Act the annual rate of child support payable for a child for days in a child support period either before, or as soon as practicable after, the start of the period unless:

(a) the period starts when the application is made under Part 4; or

(b) the period starts on a day mentioned in paragraph 93(1)(g); or

(c) an assessment of the child support payable for the child for days in the period has already been made as required by section 34A; or

(d) the period starts on the first day for which a child support agreement described in subsection 34B(1) is to affect the annual rate of child support payable for the child.

Note 1: Section 31 requires the Registrar to make an assessment of child support payable as quickly as possible after accepting an application under Part 4.

Note 2: Subsection 93(2) requires the Registrar to make an assessment of child support payable as soon as practicable after accepting certain child support agreements.

Note 3: If a child support agreement has effect for the purposes of the child support period, it will affect the assessment (see section 95).

Part 5—Administrative assessment of child support

Division 1—Preliminary

35A Simplified outline

The following is a simplified outline of this Part:

• This Part includes the formulas used for assessing the annual rate of child support payable by a parent for a child for a day in a child support period (other than in cases where that rate is worked out in accordance with a child support agreement, a Registrar’s determination under Part 6A or a court order).

• The Costs of the Children Table published by the Secretary each year (based on the table in Schedule 1 to this Act) sets out the costs to parents of raising children in various age ranges.

• Those costs are to be met by both parents (by paying child support or by caring for their children) according to each parent’s capacity to meet the costs.

• To determine each parent’s capacity to meet those costs, the parents are assessed in respect of the costs of the child.

• Generally, both parents’ income is taken into account in determining each parent’s capacity to meet the costs of their children.

• The formulas also allow child support payable to non‑parent carers of children to be worked out.

Division 2—The formulas

Subdivision A—Preliminary

35B Simplified outline

The following is a simplified outline of this Division:

• The Costs of the Children Table published by the Secretary each year (based on the table in Schedule 1 to this Act) sets out the costs to parents of raising children in various age ranges.

• These costs are to be met by both parents (by paying child support or by caring for their children) according to each parent’s capacity to meet the costs.

• To determine each parent’s capacity to meet the costs, the parents are assessed in respect of the costs of the child.

• Formulas 1 and 2 apply if both parents’ incomes are taken into account in determining each parent’s capacity to meet the costs of their children, and each parent only has one child support case.

• Formulas 3 and 4 apply if both parents’ incomes are taken into account in determining each parent’s capacity to meet the costs of their children, and at least one of the parents has multiple child support cases.

• Formulas 5 and 6 apply if only one parent’s income is taken into account in determining the parent’s capacity to meet the costs of his or her children (such as because the other parent is not a resident of Australia).

• Formulas 2, 4, 5 and 6 also allow child support payable to non‑parent carers of children to be worked out.

• In some cases, the annual rate of child support payable by a parent is assessed under Subdivision B of Division 8 (low income parents and minimum annual rates of child support).

35C Application of Part to determine annual rate of child support

This Part applies in relation to the assessment of child support payable by a parent for a child, subject to:

(a) any determination made by the Registrar under Part 6A (departure determinations); and

(b) any order made by a court under Division 4 of Part 7 (departure orders); and

(c) any provisions of a child support agreement that have effect, for the purposes of this Part, as if they were such an order made by consent.

Subdivision B—Working out annual rates of child support using incomes of both parents in single child support case

35D Application of Subdivision

(1) The annual rate of child support payable for a child for a day in a child support period is assessed under this Subdivision if:

(a) both parents of the child are to be assessed in respect of the costs of the child; and

(b) both parents are to be assessed only in respect of the costs of:

(i) that child; and

(ii) any other child in the child support case that relates to that child.

(2) Subsection (1) does not apply if at least one of the parents is liable to pay child support for a child under an administrative assessment under the law of a reciprocating jurisdiction.

35 Formula 1: Method statement using incomes of both parents in single child support case with no non‑parent carer

This is how to work out the annual rate of child support payable for a child for a day in a child support period if no non‑parent carer has a percentage of care for the child for the day.

Method statement

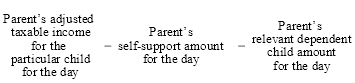

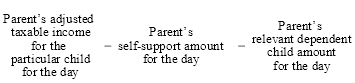

Step 1. Work out each parent’s child support income for the child for the day (see section 41).

Step 2. Work out the parents’ combined child support income for the child for the day (see section 42).

Step 3. Work out each parent’s income percentage for the child for the day (see section 55B).

Step 4. Work out each parent’s percentage of care for the child for the day (see Subdivision B of Division 4 of Part 5).

Step 5. Work out each parent’s cost percentage for the child for the day (see section 55C).

Step 6. Work out each parent’s child support percentage for the child for the day (see section 55D).

Step 7. Work out the costs of the child for the day under sections 55G and 55H.

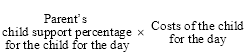

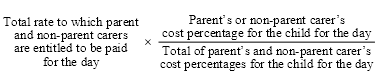

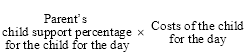

Step 8. If a parent has a positive child support percentage under step 6, the annual rate of child support payable by the parent for the child for the day is worked out using the formula:

Note: If a parent’s percentage of care for a child is more than 65%, the parent’s annual rate of child support for the child is nil (see section 40C).

36 Formula 2: Working out annual rates of child support using incomes of both parents in single child support case with a non‑parent carer

(1) This is how to work out the annual rate of child support payable for a child for a day in a child support period if one or more non‑parent carers have a percentage of care for the child for the day.

(2) Follow steps 1 to 8 of the method statement in section 35 for each parent (disregarding subsection 55D(2) (negative child support percentages)).

Annual rate payable by parent

(3) If a parent’s (the first parent’s) child support percentage under step 6 of the method statement in section 35 is positive, then the annual rate of child support payable by the first parent for the child for the day is the annual rate of child support for the child worked out under step 8 of the method statement.

Annual rate payable only to non‑parent carers

(4) If:

(a) the second parent’s child support percentage is also positive; or

(b) the second parent’s child support percentage is nil or negative, and the second parent does not have at least shared care of the child during the relevant care period;

then, subject to section 40B, the first parent must pay the annual rate of child support that is payable by the first parent for the child under subsection (3) to the non‑parent carer or carers in accordance with section 40A.

Note 1: If both parents have a positive child support percentage, then the non‑parent carer or carers are entitled to be paid the total of the 2 annual rates of child support that are payable by the parents for the child.

Note 2: Under section 40B, a non‑parent carer of a child is not entitled to be paid child support unless he or she applies under section 25A in relation to the child.

Annual rate payable to parent and non‑parent carer

(5) If the second parent’s child support percentage is negative, and the second parent has at least shared care of the child during the relevant care period, then:

(a) the first parent must pay to the second parent the annual rate of child support for the child worked out under step 8 of the method statement using the second parent’s negative child support percentage (expressed as a positive); and

(b) subject to section 40B, the first parent must pay to the non‑parent carer an annual rate of child support for the child that is the difference between:

(i) the annual rate of child support payable by the first parent for the child under subsection (3); and

(ii) the rate referred to in paragraph (a) of this subsection.

Subdivision C—Working out annual rates of child support using incomes of both parents in multiple child support cases

36A Application of Subdivision

(1) The annual rate of child support payable for a child for a day in a child support period is assessed under this Subdivision if:

(a) both parents of the child are to be assessed in respect of the costs of that child; and

(b) at least one of the parents of the child is to be assessed in respect of the costs of another child in another child support case.

(2) For the purposes of paragraph (1)(b), a parent is taken to be assessed in respect of the costs of another child in another child support case if the parent is liable to pay child support for that child under an administrative assessment under the law of a reciprocating jurisdiction.

37 Formula 3: Method statement using incomes of both parents in multiple child support cases with no non‑parent carer

This is how to work out the annual rate of child support payable for a child for a day in a child support period if no non‑parent carer has a percentage of care for the child for the day.

Method statement

Step 1. Follow steps 1 to 6 in the method statement in section 35 for each parent.

Step 1A. Work out the costs of the child for the day under section 55HA.

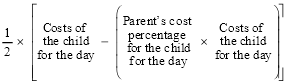

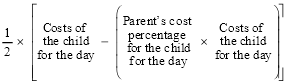

Step 1B. If a parent has a positive child support percentage under step 6 of the method statement in section 35, work out the following rate:

Step 2. Work out each parent’s multi‑case cap (if any) for the child for the day (see section 55E).

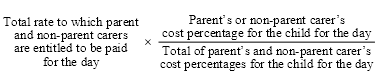

Step 3. If a parent has a positive child support percentage under step 6 of the method statement in section 35, the annual rate of child support payable by the parent for the child for the day is the lower of:

(a) the rate worked out under step 1B of the method statement in this section; and

(b) the parent’s multi‑case cap (if any) for the child for the day.